DJT stock skyrockets following Donald Trump's inflammatory MSG rally as election looms

Trump Media & Technology Group stock (DJT) extended its five-week surge on Monday, rising as much as 20% following Donald Trump’s highly criticized rally at Manhattan’s Madison Square Garden (MSG) over the weekend as investors bet on improved chances the former president wins the November election.

At current levels, the stock is trading at its highest level since mid-July, with shares up about 235% from their September lows.

Other Trump-related stocks moved in tandem with DJT. Mobile-advertising software company Phunware (PHUN), which has ties to the former president, edged more than 3% higher on Monday, while conservative-leaning video platform Rumble (RUM) climbed more than 6%.

Trump’s rally sparked backlash from both sides of the political aisle after comedian Tony Hinchcliffe made inflammatory jokes about Latinos and the Black community, while anti-immigration comments also dominated headlines.

The surge in DJT stock is unlikely to continue beyond the short term. One current investor warned that if Trump loses the election next week, shares of DJT could plunge to $0.

“It’s a binary bet on the election,” Matthew Tuttle, CEO of investment fund Tuttle Capital Management, told Yahoo Finance’s Catalyst show on Monday.

Tuttle, who currently owns put options on the stock, said the trajectory of shares hinges on “a buy the rumor, sell the fact” trading strategy.

“I would imagine that the day after him winning, you’d see this come down,” he surmised. “If he loses, I think it goes to zero.”

Shares in the company, the home of the Republican nominee’s social media platform Truth Social, have seen a recent rise as both domestic and overseas betting markets shift in favor of a Trump victory, with prediction sites like Polymarket, PredictIt, and Kalshi all showing Trump’s presidential chances ahead of those of Democratic nominee and current Vice President Kamala Harris.

National polls, however, show both candidates in an incredibly tight race, especially in key battleground states like Pennsylvania and Michigan, which are likely to decide the fate of the election.

The recovery in shares comes after the stock traded at its lowest level since the company’s debut following the expiration of its highly publicized lockup period last month. Shares had also been under pressure, as previous polling around early September saw Harris edging slightly ahead of the former president.

Trump’s recent campaign momentum, which recently included a stop at a local Pennsylvania McDonald’s, follows an appearance by Elon Musk at his rally in Butler, Pa., earlier this month. It was the same location where the former president survived an assassination attempt in July.

Automotive Headliner (OE) Market Size Forecasted to Achieve USD 19.83 Billion by 2031 with 4.5% CAGR, Led by Advanced Interior Technologies – Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 28, 2024 (GLOBE NEWSWIRE) — The forecasted market valuation of the global automotive headliner (OE) market (自動車用ヘッドライナー(OE)市場) by the end of 2031 is US$ 19.83 billion. The advancement of the market is subject to a CAGR of 4.5%. The previous market valuation measured by 2021 was US$ 12.77 billion. This market growth is subjected to various driving forces.

The differentiation of products in terms of their capacities has become possible on OEM platforms. The life of existing automobile platforms has also been extended, increasing the demand for relevant products. Due to this, the dependency on OEMs increases, which creates a significant driving force for the market under consideration.

Consumers’ incomes have been increasing recently. This increased disposable income allows them to buy premium cars and other products. Subsequently, the demand for allied products like automotive headliners also increases. This increased demand for the product drives the market directly. Such a heavy force for the subject market proves to be the reason for the market’s growth during the forecasted period.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=39719

High-performance thermoplastics have gained popularity in the consumer market due to their durability. Consequently, this market segment has grown exponentially and is forecasted to grow substantially. It fuels the development of the subject market.

Like the thermoplastic market segment, the fabric material market segment is also expected to grow. This helps the market increase as the cost of raw materials for automotive headliners reduces. As a result, significant market forces were observed for the subject market.

Key Players-

- Adient plc.

- Atlas Roofing Corporation

- Freudenberg Performance Materials

- Grupo Antolin

- Harodite Industries

- Howa-Tramico

- IAC Group

- Industrialesusd S.p.A.

- Lear Corporation

- Motus Integrated Technologies

- SMS Auto Fabrics

- Sage Automotive Interiors

- Toray Plastics (America), Inc.

- Toyota Boshoku Corporation

- UGN Inc.

Key Findings from the Market Report

- The global automotive headliner (OE) market can be segmented based on many factors. Based on the headliner substrate, the thermoplastic market segment increases the heat-dampening effect. Consequently, it generates more demand within the market.

- Based on the material, cars and trucks often use fabric headliners. The requirement for material is less, as compared to other materials, which adds value to the market segment.

- Hatchback category vehicles form an important market segment, which requires headlines on a mass level.

- With the help of conventional technology, headliner fabric is produced, which is still a demanded market segment.

Regional Profile

- The rise in the automobile sector within Asia Pacific is the main reason for the market growth in the region mentioned above. It has been forecasted that Asia Pacific will hold about 39.12% of the market. Thus, it is one of the significant contributors to the market.

- European countries like Germany have excellent technological infrastructure and engineering expertise. This fuels the growth of the automobile sector within these countries. Therefore, Europe is another significant contributor to the subject market.

- Due to the technological development in North America, similar to Europe, it is also one of the key contributors to the market that fuels its growth.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=39719

Key Developments in the Automotive Headliner Market

- In September 2017, Adient plc. acquired Futuris Group. It helped the said business in diversifying its area of operation.

- Grupo Antolin installed a new plant in Alabama, USA, in April 2018. This helped the organization to boost its production of automotive parts.

- Motus Integrated Technologies acquired Janesville Fiber Solutions in August 2019. Due to this strategic move, the enterprise expansion was possible.

Competitive Landscape

Various competitors within the market have cluttered the market.

- Adient plc. is one of these competitors famous for manufacturing commercial vehicle seats. It also produces foam seats for vehicles.

- Freudenberg Performance Materials operates in a diverse market of the textile sector, where it produces different knitted fabrics, foams, composites, etc.

- Harodite Industries operates mainly in the textile industry. However, it is known for its headliners and various other allied products.

Market Segmentation

Headliner Substrate

Material Type

- Fabric

- Foam-backed

- Suede Foam-backed

- Perforated Vinyl

- Synthetic-backed cloth

- Composite

Technology

Vehicle Type

- Hatchback

- Sedan

- Utility Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=39719<ype=S

More Trending Reports by Transparency Market Research –

- EV Chargers Market – The global EV chargers market (EV充電器市場) is projected to advance at a CAGR of 19.4% from 2022 to 2031.

- Autonomous Trains Market – The global autonomous trains market (自動運転列車市場) is projected to expand at a CAGR of 15.2% during the forecast period from 2022 to 2031.

- Traffic Equipment Market – The global traffic equipment market (交通機器市場) is estimated to grow at a CAGR of 5.6% from 2024 to 2034.

- Vehicle Periodic Maintenance Market – The global vehicle periodic maintenance market (自動車定期メンテナンス市場) is estimated to grow at a CAGR of 3.9% from 2024 to 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is S&P 500 Headed For A Lost Decade? Analysts Say 'We May Have Forgotten About Dividends'

The idea of a “lost decade” for S&P 500 returns in the next 10 years has gained traction after a bearish report from Goldman Sachs earlier in October, which predicted very subdued annual returns for U.S. stocks over the next decade and possible underperformance against other asset classes.

This view, however, has sparked strong pushback from other prominent Wall Street voices, including analysts at Bank of America and veteran investor Ed Yardeni.

Goldman Sachs’ Grim Outlook: Just 3% Annual Returns Ahead

Goldman Sachs recently forecasted that the S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, will deliver an annualized nominal total return of just 3% over the next 10 years, placing this return scenario in the 7th percentile of historical outcomes since 1930. Adjusted for inflation, the real return would hover around 1% per year.

According to Goldman, the S&P 500 has a 72% probability of underperforming bonds and a 33% chance of lagging inflation through 2034.

David J. Kostin, chief U.S. equity strategist at Goldman Sachs, highlighted that extreme market concentration is a key factor weighing down their long-term outlook. Currently, the U.S. stock market is more concentrated in a few mega-cap tech names than at any point in the last century, which Kostin suggests could limit the broader market’s returns in the coming years.

Bank of America: A Case For Equal-Weighted Stocks And Dividend Reinvestment

While Bank of America’s equity analyst Savita Subramanian acknowledged on Monday that the S&P 500 is “statistically expensive,” she indicated potential upside in the equal-weighted version of the index, tracked by the Invesco S&P 500 Equal Weight ETF RSP.

The equal-weighted S&P 500 currently trades at a “historic discount” to the traditional, cap-weighted index and could offer more attractive returns over the next decade, according to Subramanian.

Subramanian suggests that dividends could provide an overlooked source of gains for investors.

“We may have forgotten about dividends because they did little for total returns in the past decade,” she said.

She highlighted that dividends historically contributed 40% of total returns before the period of low-interest rates prior to the pandemic.

If dividend contributions revert to historical levels, Subramanian projects that the equal-weighted S&P 500 could deliver an 8.3% total return annually, thanks in part to dividend growth from mature tech giants in the “Magnificent 7” that are now initiating dividend programs.

Ed Yardeni: Optimism For Earnings Growth And The “Roaring 2020s”

Veteran Wall Street strategist Ed Yardeni openly challenged Goldman’s downbeat S&P 500 long-term forecast.

In a note published on Monday, Yardeni wrote, “We don’t agree with [Goldman’s recent depressing long-term prediction for S&P 500 returns.”

Yardeni is forecasting annual earnings growth of at least 6% over the next decade, consistent with the S&P 500’s long-term historical average of 6.5%.

Yardeni also disputed Goldman’s concerns about market concentration. While tech and communication services companies now account for roughly 40% of the S&P 500—similar to their share during the dot-com bubble—he indicated that today’s tech giants are financially stronger and more resilient than those in 2000.

While a “lost decade” for stocks isn’t unprecedented—the S&P 500 remained flat for 10 years after peaking in April 2000, amid the dot-com crash and the Great Financial Crisis—the investor highlighted that S&P 500 dividends still rose by 41% during that period.

If the conditions for a “Roaring 2020s” scenario take hold—marked by a productivity-driven economic boom fueled by technological advancements, with real GDP growth stabilizing around 3% annually and inflation at 2%—Yardeni forecasts an average annual total return of 11% for the S&P 500 over the next decade.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

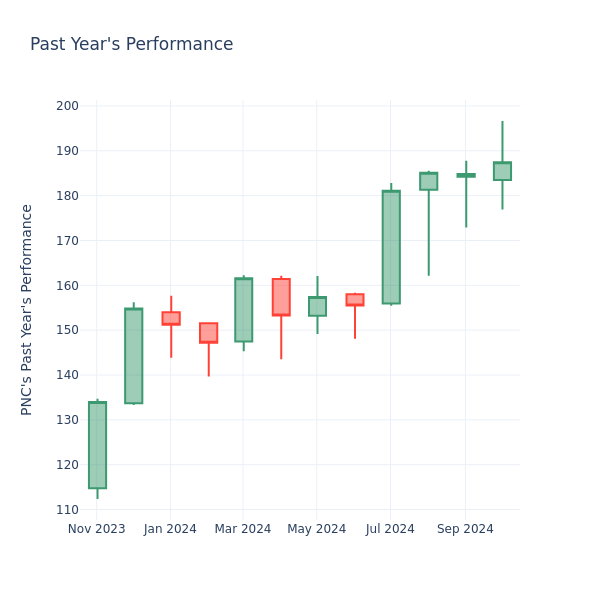

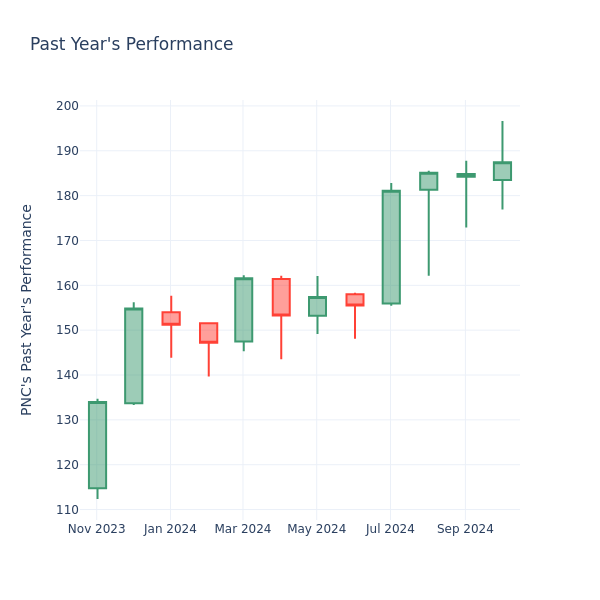

P/E Ratio Insights for PNC Finl Servs Gr

In the current session, the stock is trading at $187.43, after a 0.87% increase. Over the past month, PNC Finl Servs Gr Inc. PNC stock increased by 4.19%, and in the past year, by 63.74%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

PNC Finl Servs Gr P/E Compared to Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of 13.38 in the Banks industry, PNC Finl Servs Gr Inc. has a higher P/E ratio of 15.71. Shareholders might be inclined to think that PNC Finl Servs Gr Inc. might perform better than its industry group. It’s also possible that the stock is overvalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Google earnings are coming tomorrow. Here's what Wall Street expects

Google (GOOGL) parent Alphabet is set to report third-quarter earnings on Tuesday, after beating second-quarter earnings expectations on artificial intelligence momentum.

The tech giant is expected to report revenues of around $86.4 billion for the third quarter, according to analyst estimates compiled by FactSet (FDS). Google’s U.S. revenues are expected to be $40.6 billion, and its “rest of the world” revenues are expected at $45 billion. The company is expected to report earnings per share, or EPS, of $1.84, according to FactSet.

In the second quarter, Google reported revenues of nearly $85 billion, outdoing Wall Street’s expectations by around $640 million. Google’s revenue was up 14% year over year, and its Cloud division surpassed $10 billion in quarterly revenues for the first time, Google president Ruth Porat said. Google Cloud also exceeded $1 billion in operating profit for the first time.

“Our strong performance this quarter highlights ongoing strength in Search and momentum in Cloud,” Google chief executive Sundar Pichai said in a statement at the time. “We are innovating at every layer of the AI stack. Our longstanding infrastructure leadership and in-house research teams position us well as technology evolves and as we pursue the many opportunities ahead.”

In recent months, Google has reportedly made progress on software for AI models that resembles humanlike reasoning abilities. The company has long focused on “reasoning” capabilities in large language models (LLMs), including with its work on chain-of-thought prompting.

With this technique, which people told Bloomberg Google is using, LLMs can solve multistep problems using a “series of intermediate reasoning steps,” similar to the way a human would. OpenAI unveiled its “reasoning” model series, OpenAI o1, in September.

Google is also working on improving its Gemini chatbot’s “reasoning” abilities. In July, Google made its fastest, most cost-efficient model, 1.5 Flash, available in the unpaid version of Gemini.

Google’s shares were up around 0.7% during Monday morning trading. The tech giant’s stock is up20.5% so far this year.

GE Aerospace Partners with Waygate Technologies To Elevate Engine Inspections With AI

GE Aerospace GE and Waygate Technologies disclosed the joint development of a new AI-assisted commercial engine borescope solution.

This innovative tool will be available to Waygate Technologies’ customers and introduced to GE Aerospace’s maintenance, repair, and overhaul (MRO) network later this year.

This milestone marks the successful completion of their first development program under the Joint Technology Development Agreement established in May 2023.

In their initial program, GE Aerospace and Waygate Technologies aimed to improve machine vision-based assisted defect recognition (ADR) systems using AI for commercial aviation engine borescope inspections.

The focus was specifically on High Pressure Compressor (HPC) inspections, which are among the most critical and time-consuming tasks in the engine’s Maintenance, Repair, and Overhaul (MRO) process.

The new solution leverages advanced AI techniques to improve detection rates by about 34% and reduce false alerts by over 13% compared to the previous model.

This AI upgrade will be available in an upcoming software update for the Mentor Visual iQ+ video borescope later this year.

Nicole Jenkins, Chief MRO Engineer, GE Aerospace, said, “Collaborating with Waygate Technologies, we have successfully combined our industry domain knowledge and digital expertise to integrate new AI techniques with the right data to improve the detection capabilities of commercial engine borescope inspections.”

“This joint development illustrates a bigger effort to give our inspection engineers more advanced tools using AI, computer vision, and automation to help them work productively and meet the needs of our customers. We believe this AI-assisted borescope system will help significantly reduce the time it takes to perform HPC inspections, while delivering high accuracy at the same time.”

Investors can gain exposure to GE via IShares U.S. Aerospace & Defense ETF ITA and TCW Transform Systems ETF NETZ.

Price Action: GE shares are down 1.74% at $175.99 at the last check Monday.

Read Next:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VERV DEADLINE TOMORROW: ROSEN, A LEADING LAW FIRM, Encourages Verve Therapeutics, Inc. Investors with Losses in Excess of $100K to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – VERV

NEW YORK, Oct. 27, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Verve Therapeutics, Inc. VERV between August 9, 2022 and April 1, 2024, both dates inclusive (the “Class Period”), of the important October 28, 2024 lead plaintiff deadline in the securities class action first filed by the firm.

SO WHAT: If you purchased Verve Therapeutics securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Verve Therapeutics class action, go to https://rosenlegal.com/submit-form/?case_id=28262 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than October 28, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose, among other things, that: (1) defendants did not fully disclose the circumstances under which the Heart-1 Phase 1b clinical trial (the “Heart-1 Trial”) of VERVE-101 would be halted (VERVE-101 is an investigational gene editing medicine designed to be a single course treatment that permanently turns off the PCSK9 gene in the liver to reduce disease-driving low-density lipoprotein cholesterol (LDL-C)); (2) defendants overstated the potential benefits of its proprietary lipid nanoparticle (LNP) delivery system; and (3) as a result, defendants’ statements about its business, operations, and prospects, were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Verve Therapeutics class action, go to https://rosenlegal.com/submit-form/?case_id=28262 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm or on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40thFloor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spark Real Estate Software Expands Product Offering with Strategic Acquisition of Juniper Homeowner Care

The acquisition expands Spark’s value proposition beyond the marketing & sales enablement of New Development homes.

VANCOUVER, BC, Oct. 24, 2024 /CNW/ – Spark Real Estate Software is pleased to announce the acquisition of Juniper, a modern homeowner care and warranty service platform for residential developers. The acquisition of Juniper extends the Spark offering beyond the sales and marketing timeline, and into completion, warranty management and homeowner care, covering more of the real estate development journey.

“We have been working alongside Juniper’s Founder, Chris Miller, for many years, with a number of mutual customers,” said Cody Curley, President and Co-Founder of Spark. “We had a shared vision in that we see huge opportunities to transform the New Development real estate industry through technology and create incredible experiences for builders and homebuyers – that at its core is what drives us both. Their product begins where ours ends and when enough people tell you to combine the two companies, it’s time to start listening. It just made perfect sense.”

Since launching in 2019, Juniper has grown rapidly to provide homeowner care for more than 12,000 units and 60 projects from Canada’s top developers.

“The acquisition will provide a more seamless experience for homeowners as well as Spark customers. Spark is doubling down on its commitment to offer the most advanced platform for New Development management, encompassing marketing, sales, and customer care. This addition of Juniper further emphasizes the compounding benefit of having all of the tools developers need to access in one place.”

Chris Miller is an experienced operator and entrepreneur with over 25 years of building and launching numerous digital products and 10 years of working within the proptech space.

“The post purchase, completion and warranty stage is often an overlooked part of the presale customer journey,” says Miller. “Juniper provides the tools for developers to deliver a superior customer experience in order to mitigate areas of risk and enhance their brand reputation. Our goal is to make the final part of the process the best one.”

Spark and Juniper will continue to focus on delivering superior tools that meet the evolving needs of the real estate industry.

SOURCE Spark

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c8564.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c8564.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.