LG Energy Solution Releases 2024 Third-Quarter Results

- LG Energy Solution posts KRW 6.8778 trillion in consolidated revenue and KRW 448.3 billion in operating profit

- The company secures large-scale supply agreements leveraging new form factors and chemistries

- The company to effectively address EV/ESS market needs, with the long-term focus on operational efficiency, R&D, and business portfolio expansion

SEOUL, South Korea, Oct. 27, 2024 /PRNewswire/ — LG Energy Solution (KRX: 373220) today announced its third quarter earnings, along with its quarterly progress reports and action plans for EV and energy storage system (ESS) battery businesses.

The company posted consolidated revenue of KRW 6.8778 trillion, a 11.6 percent increase quarter-on-quarter and 16.4 percent decrease year-on-year. The operating profit was KRW 448.3 billion, a 129.5 percent increase quarter-on-quarter and 38.7 percent decrease year-on-year. The operating profit includes the estimated IRA tax credit amount of KRW 466 billion. Excluding the IRA tax credit, the company would have recorded quarterly operating loss of KRW 17.7 billion.

“Expanded sales to major European automakers and increased production at our joint venture facilities in North America and Indonesia, as well as substantial ESS revenue growth from grid-scale projects, improved the overall revenue compared to the previous quarter,” said Chang Sil Lee, CFO of LG Energy Solution.

“We also saw quarter-on-quarter improvements in the operating profit excluding IRA tax credit effect on the back of improved utilization rate led by shipment increase in both EV and ESS batteries, as well as reduced unit cost burden in line with metal price stabilization,” Lee said.

- Recent Progress: Large-Scale Supply Agreements for New Form Factors and Chemistries

LG Energy Solution successfully secured large-scale orders from top global automakers for its new form factors and chemistries totaling 160GWh, further advancing its goal of leading global innovation in EV batteries.

The major supply agreements include a contract for 50GWh of cylindrical batteries with a major automaker to power EVs sold in North America. With the deal, the company has expanded its customer portfolio for cylindrical EV batteries from primarily EV start-ups to established automakers, and secured stronger market presence in North America through local production capability.

For pouch-type NCM[1] EV batteries, LG Energy Solution secured supply agreements totaling 109GWh for commercial vehicles sold in Europe, leveraging the chemistry’s technological competitiveness characterized by high-power and long-life cycle. These agreements are also expected to contribute to improving the Poland facility’s production efficiency once the production starts after the second-half of 2026.

- Action Plans for EV and ESS Battery Businesses

For EV battery business, as customers are increasingly interested in applying more diversified battery chemistries and form factors tailored to different EV segment, LG Energy Solution will offer various chemistry choices to customers, such as LFP and High Voltage Mid-Ni to support all EV segments. On the same note, the company will further diversify its product form factors by starting mass production of its 46-Series cylindrical batteries.

To address increasing needs of cost innovation for core EV components, the company will continue to advance its materials and process technologies. For battery materials, it will apply industry-leading material technologies such as single crystal cathode and silicon contents in anode. Also, it will focus on developing dry electrode technology to achieve higher energy density and cost innovation, with the goal of applying it to mass production in 2028.

In addition, responding to rising importance of EV safety, LG Energy Solution is developing multiple solutions to reinforce its product safety, including advanced thermal propagation (TP) prevention technology for pouch-type batteries. The company also completed the development of optimized cooling module structure for cylindrical batteries.

For ESS battery business where strong demand momentum is expected, especially in power grid, LG Energy Solution will actively respond to long-term, large-volume projects in North America, leveraging its stable production know-how and local supply capability, creating opportunities to generate stable revenue. To enhance competitiveness, the company also plans to launch high capacity LFP ESS batteries, along with advanced energy management and system integration (SI) software. To maximize the benefits from policies supporting local manufacturing, the company will start ESS battery production in the U.S. next year and also consider converting EV production lines to ESS in response to the European market demand.

In the mid to long term, LG Energy Solution’s key strategic initiatives will be: proactively adjusting operation, reinforcing R&D investment, and expanding business portfolio.

1) Proactively adjusting operation: Scale down capacity expansion and adjust ramp-up speed to maximize utilization rates of existing lines

2) Reinforcing R&D investment: Secure differentiated material and process technologies, accelerate R&D for optimized chemistry and form factor solutions, develop next-generation batteries such as bipolar semi-solid batteries and sulfide-based solid-state batteries

3) Expanding business portfolio: Establish a closed-loop recycling system on a regional basis, expand BaaS[2]/EaaS[3] businesses, explore new market opportunities for other applications beyond EVs

“While we expect unprecedented shifts in external environments, we will be nimble in responding to these changes through our comprehensive business strategy,” said David Kim, CEO of LG Energy Solution. “Capitalizing on our unmatched product portfolio, we will enhance the values we’re providing to our customers, thereby securing solid leadership in the global battery market.”

|

[1] NCM: nickel, cobalt, manganese |

|

[2] BaaS: battery-as-a-service |

|

[3] EaaS: energy-as-a-service |

About LG Energy Solution

LG Energy Solution (KRX: 373220), a split-off from LG Chem, is a leading global manufacturer of lithium-ion batteries for electric vehicles, mobility, IT, and energy storage systems. With 30 years of experience in revolutionary battery technology and extensive research and development (R&D), the company is the top battery-related patent holder in the world with over 58,000 patents. Its robust global network, which spans North America, Europe, and Asia, includes battery manufacturing facilities established through joint ventures with major automakers. Committed to building sustainable battery ecosystem, LG Energy Solution aims to achieve carbon neutrality across its value chain by 2050, while embodying the value of shared growth and promoting diverse and inclusive corporate culture. To learn more about LG Energy Solution’s ideas and innovations, visit https://news.lgensol.com.

![]() View original content:https://www.prnewswire.com/news-releases/lg-energy-solution-releases-2024-third-quarter-results-302288127.html

View original content:https://www.prnewswire.com/news-releases/lg-energy-solution-releases-2024-third-quarter-results-302288127.html

SOURCE LG Energy Solution

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Cybertruck Customers Must DIY Off-Road Light Bar Installation As Employees Are 'By Law' Barred From Assisting

Tesla Inc. TSLA has been found to be offering a Cybertruck accessory that its employees are not legally allowed to install.

What Happened: The accessory in question is an off-road light bar, an LED light fixture positioned above the front windshield that comes with the Foundation Series “Cyberbeast” version of Tesla’s electric truck.

The light bar can illuminate up to 525 yards and was not included with the Cybertruck when it was initially launched last year. It is expected to be delivered in 2025.

However, Tesla has informed its customers that its employees are not legally permitted to install the necessary electronics for the light bar. Customers who wish to equip their vehicles with this accessory will have to set it up themselves.

Notably, some customers have already received the product but have been required to install it themselves. Tesla provided one customer with the necessary parts and the contact details of a nearby mechanic who could complete the installation.

“Tesla by law cannot install the lightbar electronics and configure the vehicle for lightbar control,” the manual says, adding that Tesla staff “are not permitted to connect or assist with the connection of the Cybertruck off road lightbar harness to the roof accessory jumper harness connector.”

Why It Matters: This news comes on the heels of Tesla’s announcement that the Cybertruck’s battery can be used with the Powerwall to power homes starting in 2025. This development is part of Tesla’s broader strategy to make the Cybertruck an integral part of its customers’ lives, not just as a vehicle but also as a power source.

Despite these innovative features, Tesla’s Cybertruck has faced some regulatory challenges. In 2021, the company’s plans to build the Cybertruck without side mirrors were thwarted by federal regulations, leading CEO Elon Musk to promise “easy to remove” side mirrors.

Despite these challenges, Tesla’s Cybertruck has been met with significant demand, and the company has been working to meet this demand by expanding its production capacity.

The Cybertruck’s innovative features and strong market demand have contributed to Tesla’s continued dominance in the U.S. EV market, with three of the top five best-selling EVs in the third quarter of 2024 being Tesla models.

Read Next:

Photo: courtesy of Tesla

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Philips delivers strong margin improvement; flat comparable sales due to further deteriorated demand in China; growth in rest of world

October 28, 2024

Third-quarter highlights

- Group sales amounted to EUR 4.4 billion, with flat comparable sales growth

- Income from operations was EUR 337 million

- Adjusted EBITA margin increased by 160 basis points from 10.2% to 11.8% of sales

- Operating cashflow of EUR 192 million, with a free cashflow of EUR 22 million

- Comparable order intake decreased by 2%, due to decline in China

- Outlook for full-year 2024 revised to reflect deteriorated demand in China: comparable sales growth within an updated range 0.5%-1.5%, Adjusted EBITA margin at around 11.5%, the upper end of current range; free cashflow at around EUR 0.9 billion, at lower end of current range

Roy Jakobs, CEO of Royal Philips:

“In the quarter, demand from hospitals and consumers in China further deteriorated, while we continue to see solid growth in other regions. We have adjusted our full-year sales outlook to reflect the continued impact from China.

Strong improvement in profitability was driven by progress on our execution priorities, productivity measures and the improved margins of our AI-driven, industry-leading innovations.

Within a challenging macro environment, we remain focused on successfully executing our three-year plan to fully capture growth and margin expansion opportunities. With patient safety as our number one priority, we are committed to delivering better care for more people.”

Group and segment performance

Group comparable sales were flat on the back of 11% growth in Q3 2023 and deterioration in demand in China. We delivered growth in all other regions and from an increase in royalty income. China remains a fundamentally attractive growth market for Philips in the long term, with market conditions expected to remain uncertain.

Adjusted EBITA margin improved 160 basis points from 10.2% to 11.8%, driven by a strong step-up in gross margin from innovations, productivity actions and higher royalty income. Free cash flow was EUR 22 million in the quarter, driven by higher earnings, offset by working capital outflows.

Comparable order intake in the quarter declined 2% due to China, with solid order intake growth in Diagnosis & Treatment, particularly in the US. Year-to-date comparable order intake grew 1%, including China.

Diagnosis & Treatment comparable sales decreased 1%, on the back of 14% growth in Q3 2023, with solid growth outside of China. Adjusted EBITA margin was 12.6%.

Connected Care comparable sales were flat, with growth in Enterprise Informatics and Sleep & Respiratory Care offset by a low- single-digit decline in Monitoring, on the back of high-teens growth in Q3 2023. Adjusted EBITA margin improved from 3.7% to 7.3%.

Personal Health comparable sales decreased 5% due to a double-digit decline in China, more than offsetting a robust performance elsewhere. Adjusted EBITA margin was 16.5%.

Productivity

Our productivity initiatives are on track and delivered savings of EUR 188 million in Q3: operating model savings of EUR 54 million, procurement savings of EUR 58 million, and other programs savings of EUR 76 million. Since 2023, productivity initiatives delivered savings of over EUR 1.5 billion.

Outlook

The significant deterioration in China demand leads to an updated comparable sales growth outlook range of 0.5-1.5% for the full year 2024. Comparable sales growth outside of China remains within the 3-5% range. Adjusted EBITA margin is expected to be around 11.5%, the upper end of the range, with free cashflow at around EUR 0.9 billion, at the lower end of the range.

Within an ongoing challenging macro environment, Philips remains focused on successfully executing its three-year plan to drive operational improvement and create value with sustainable impact. The uncertainties signaled in earlier quarters have intensified in China and are expected to continue.

The outlook excludes the potential impact of the ongoing Philips Respironics-related legal proceedings, including the investigation by the US Department of Justice.

Customer, innovation and ESG highlights

- Philips expanded its next-generation cardiovascular ultrasound platform with FDA clearance of two additional AI algorithms to enhance structural heart disease examinations as part of the global rollout of this technology.

- Philips secured FDA approval for its new LumiGuide Navigation Wire, which uses fiber optic technology to reduce radiation for both patients and physicians during minimally invasive surgery.

- Carilion Clinic in the US will expand cardiac care access through 11 specialized Philips interventional suites that allow physicians to treat patients with complex cardiovascular conditions closer to home using platforms including the Azurion Image Guided Therapy System and EPIQ CVx cardiology ultrasound system with AI capabilities.

- NYU Langone Health in the US successfully implemented Philips’ digital pathology solutions as part of an eight-year partnership, enabling patients to be diagnosed faster using real-time digital images instead of microscopes.

- Siloam Hospital Group, Indonesia’s largest private hospital network serving close to 4 million patients a year, is partnering with Philips for digital health and AI transformation. The collaboration aims to improve healthcare access and enhance clinical outcomes, delivering better care for more people in one of the fastest-growing G20 nations.

- Supporting China in expanding access to care in a new private hospital in Zhangzhou serving half a million patients each year, Philips will be the sole provider of MR, image-guided therapy and ultrasound technologies, enabling high-quality care for patients.

- Philips launched the AI-powered Avent Premium Connected Baby Monitor, which offers cry translation and SenseIQ technology to track sleep, breathing, and movements, giving parents peace of mind.

- Philips is collaborating with customers worldwide to help them assess and mitigate their carbon footprints, including Jackson Health System in the US, Rennes University Hospital in France, and Champalimaud Foundation in Portugal.

Click here to view the release online

For further information, please contact:

Elco van Groningen

Philips External Relations

Tel.: +31 6 8103 9584

E-mail: elco.van.groningen@philips.com

Ben Zwirs

Philips External Relations

Tel.: +31 6 1521 3446

E-mail: ben.zwirs@philips.com

Dorin Danu

Philips Investor Relations

Tel.: +31 20 59 77055

E-mail: dorin.danu@philips.com

About Royal Philips

Royal Philips PHGPHIA)) is a leading health technology company focused on improving people’s health and well-being through meaningful innovation. Philips’ patient- and people-centric innovation leverages advanced technology and deep clinical and consumer insights to deliver personal health solutions for consumers and professional health solutions for healthcare providers and their patients in the hospital and the home.

Headquartered in the Netherlands, the company is a leader in diagnostic imaging, ultrasound, image-guided therapy, monitoring and enterprise informatics, as well as in personal health. Philips generated 2023 sales of EUR 18.2 billion and employs approximately 69,300 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about strategy, estimates of sales growth, future Adjusted EBITA *) , future restructuring and acquisition related charges and other costs, future developments in Philips’ organic business and the completion of acquisitions and divestments. Forward-looking statements can be identified generally as those containing words such as “anticipates”, “assumes”, “believes”, “estimates”, “expects”, “should”, “will”, “will likely result”, “forecast”, “outlook”, “projects”, “may” or similar expressions. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

These factors include but are not limited to: Philips’ ability to gain leadership in health informatics in response to developments in the health technology industry; Philips’ ability to keep pace with the changing health technology environment; macro-economic and geopolitical changes; integration of acquisitions and their delivery on business plans and value creation expectations; securing and maintaining Philips’ intellectual property rights, and unauthorized use of third-party intellectual property rights; Philips’ ability to meet expectations with respect to ESG-related matters; failure of products and services to meet quality or security standards, adversely affecting patient safety and customer operations; breaches of cybersecurity; challenges in simplifying our organization and our ways of working; the resilience of our supply chain; attracting and retaining personnel; challenges in driving operational excellence and speed in bringing innovations to market; compliance with regulations and standards including quality, product safety and (cyber) security; compliance with business conduct rules and regulations including privacy and upcoming ESG disclosure and due diligence requirements; treasury and financing risks; tax risks; reliability of internal controls, financial reporting and management process; and global inflation. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see also the Risk management chapter included in the Annual Report 2023. Reference is also made to section Risk management in the Philips semi-annual report 2024.

Third-party market share data

Statements regarding market share contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, as well as industry and dealer panels, in combination with management estimates. Where information is not yet available to Philips, market share statements may also be based on estimates and projections prepared by management and/or based on outside sources of information. Management’s estimates of rankings are based on order intake or sales, depending on the business.

Market Abuse Regulation

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Use of non-IFRS information

In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-IFRS financial measures. These non-IFRS financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Further information on non-IFRS measures can be found in the Annual Report 2023.

Presentation

All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2023. Prior-period amounts have been reclassified to conform to the current-period presentation; this includes immaterial organizational changes.

Effective Q1 2024, Philips has revised the order intake policy to reflect the full contract value for software contracts that start generating revenue within an 18-month horizon, instead of only the next 18-months-to-revenue horizon. This change has been implemented to better align with the specific business model of our software businesses, simplify the order intake process, and better align with peers. Prior-period comparable order intake percentages have been restated accordingly. This revision has not resulted in any material changes to the order intake percentages for the periods presented.

Per share calculations have been adjusted retrospectively for all periods presented to reflect the issuance of shares in the second quarter of 2024 in connection with the 2023 share dividend.

*) Non-IFRS financial measure. Refer to Reconciliation of non-IFRS information.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Coinbase CEO Brian Armstrong Credits Balaji Srinivasan For Early Foresight On Role Of New Media And Prediction Markets In Trump-Harris Battle

Brian Armstrong, CEO of the U.S.’s largest cryptocurrency exchange, Coinbase, acknowledged the significant role of new media in shaping election outcomes, crediting the company’s former tech head Balaji Srinivasan for his early foresight.

What Happened: On Sunday, Armstrong took to X to express his views on the changing media landscape and its impact on elections.

“This seems like the first election where new media has fully flipped traditional media. Long form podcasts, X/social, prediction markets, etc. deciding this election,” the cryptocurrency mogul wrote.

Armstrong added that Balaji Srinivasan, a renowned Silicon Valley investor and Coinbase’s former Chief Technology Officer, was the first to identify this trend around 7-8 years ago.

Why It Matters: Armstrong’s tweet comes in the wake of the growing popularity of prediction markets this election, which were betting in favor of Donald Trump to win the election. These stood in contrast to national opinion polls, which showed a neck-and-neck fight between Trump and Kamala Harris.

The ‘long form podcasts’ mention could refer to Trump’s three-hour episode with popular podcaster Joe Rogan that aired Friday night.

Armstrong has strongly put his weight behind pro-cryptocurrency candidates in the upcoming Senate elections, backing GOP nominees David McCormick and John Deaton for the Pennsylvania and Massachusetts seats, respectively.

The Coinbase boss had previously said that cryptocurrency is a non-partisan issue, with advocates from both sides of the political spectrum championing its cause.

Global bank Standard Chartered has predicted that Bitcoin BTC/USD could hit $73,000 by the time of the U.S. presidential election on Nov. 5.

Image via Flickr/ TechCrunch

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

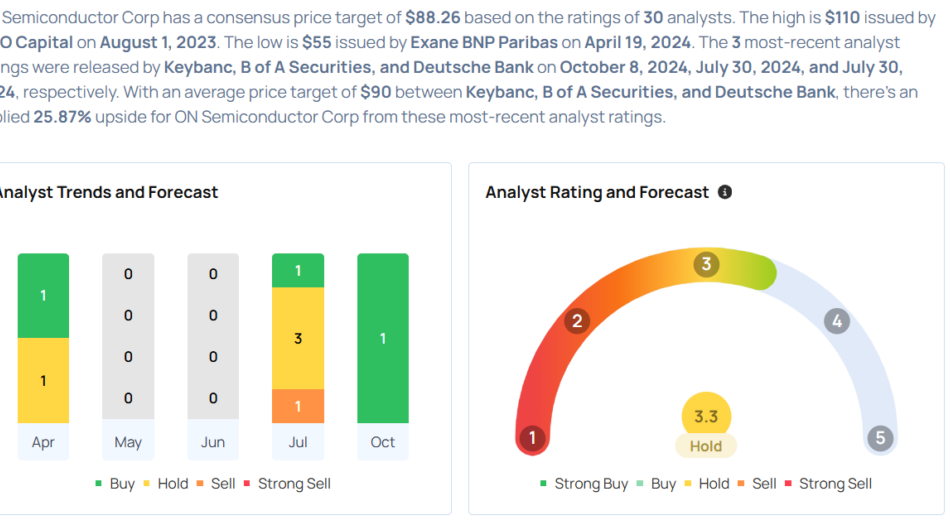

Top Wall Street Forecasters Revamp ON Semiconductor Price Expectations Ahead Of Q3 Earnings

ON Semiconductor Corporation ON will release earnings results for its third quarter, before the opening bell on Monday, Oct. 28.

Analysts expect the Scottsdale, Arizona-based company to report quarterly earnings at 97 cents per share, down from $1.39 per share in the year-ago period. ON Semiconductor projects to report revenue of $1.75 billion for the quarter, compared to $2.18 billion a year earlier, according to data from Benzinga Pro.

On July 29, ON Semiconductor reported better-than-expected second-quarter financial results.

ON Semiconductor shares gained 1.7% to close at $71.25 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Keybanc analyst John Vinh maintained an Overweight rating and cut the price target from $95 to $90 on Oct. 8. This analyst has an accuracy rate of 76%.

- B of A Securities analyst Vivek Arya maintained a Buy rating and raised the price target from $80 to $90 on July 30. This analyst has an accuracy rate of 82%.

- Deutsche Bank analyst Ross Seymore maintained a Buy rating and raised the price target from $85 to $90 on July 30. This analyst has an accuracy rate of 83%.

- Rosenblatt analyst Kevin Cassidy maintained a Neutral rating and raised the price target from $70 to $75 on July 30. This analyst has an accuracy rate of 73%.

- Truist Securities analyst William Stein maintained a Buy rating and raised the price target from $85 to $97 on July 30. This analyst has an accuracy rate of 86%.

Considering buying ON stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ON Semiconductor, Ford And 3 Stocks To Watch Heading Into Monday

With U.S. stock futures trading higher this morning on Monday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects ON Semiconductor Corporation ON to report quarterly earnings at 97 cents per share on revenue of $1.75 billion before the opening bell, according to data from Benzinga Pro. ON Semiconductor shares gained 0.3% to $71.44 in after-hours trading.

- Analysts are expecting Waste Management, Inc. WM to post quarterly earnings at 89 cents per share on revenue of $5.00 billion. The company will release earnings after the markets close. Waste Management shares fell 1% to close at $206.80 on Friday.

- Hawaiian Electric Industries, Inc. HE shares rose in after-hours trading after Citadel’s Ken Griffin reported a 5.4% passive stake in the company. Hawaiian Electric shares gained 5% to $10.24 in the after-hours trading session.

Check out our premarket coverage here

- Before the markets open, CenterPoint Energy, Inc. CNP is projected to report quarterly earnings at 32 cents per share on revenue of $1.93 billion. CenterPoint Energy shares gained 1.4% to $29.72 in after-hours trading.

- Analysts expect Ford Motor Company F to report quarterly earnings at 47 cents per share on revenue of $41.88 billion after the closing bell. Ford shares gained 0.4% to $11.11 in after-hours trading.

Check This Out:

Photo courtesy: ON Semiconductor

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq Surges To Fresh Highs As Nvidia, Meta And Amazon Surge: Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed a decline in the overall market sentiment, while the index remained in the “Greed” zone on Friday.

U.S. stocks settled mixed on Friday, with the Nasdaq Composite surging to an all-time high during the session.

Tech stocks provided a boost to the market ahead of their upcoming quarterly earnings. Shares of Nvidia Corp. NVDA, Meta Platforms Inc. META, and Amazon AMAZN settled higher on Friday.

Both the Dow Jones and S&P 500 ended a six-week winning streak, falling around 1% and 2.7%, respectively. The Nasdaq recorded gains for the seventh straight week, gaining nearly 0.2% last week.

Shares of HCA Healthcare, Inc. HCA fell around 9% on Friday after the company reported weaker-than-expected third-quarter financial results. Colgate-Palmolive CL shares fell around 4% after the company reported third-quarter earnings.

On the economic data front, the University of Michigan consumer sentiment for the U.S. rose to 70.5 in October compared to a preliminary reading of 68.9. U.S. durable goods orders fell by 0.8% to $284.8 billion in September compared to a revised 0.8% fall in August.

Most sectors on the S&P 500 closed on a negative note, with financials, real estate, and utilities stocks recording the biggest losses on Friday. However, information technology and communication services stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 260 points to 42,114.40 on Friday. The S&P 500 fell 0.03% to 5,808.12, while the Nasdaq Composite climbed 0.56% at 18,518.61 during Friday’s session.

Investors are awaiting earnings results from ON Semiconductor Corporation ON, Waste Management, Inc. WM, and Ford Motor Company F today.

What is CNN Business Fear & Greed Index?

At a current reading of 58.9, the index remained in the “Greed” zone on Friday, versus a prior reading of 61.5.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ahead Of 'Mag 7' Earnings Season, Michael Saylor Celebrates Bitcoin Proxy MicroStrategy's Record-Breaking Trading Volume, Says King Crypto Makes 'Magnificent 8'

MicroStrategy Inc. MSTR ended Friday as the sixth-most traded stock on Wall Street, prompting founder and CEO Michael Saylor to celebrate by coining the term “Magnificent 8.”

What happened: On Sunday, Saylor took to X, drawing attention to the Bitcoin BTC/USD development company’s latest feat.

MicroStrategy recorded volumes of $5.8 billion on Friday, trailing only tech behemoths such as Tesla Inc. TSLA, Nvidia Corp. NVDA, Apple Inc. AAPL, Microsoft Corp. MSFT, and Meta Platforms Inc. META.

Moreover, MicroStrategy’s volume was higher than Amazon.com Inc. AMZN and Alphabet Inc. GOOG GOOGL, the other two members of the “Magnificent 7.”

As is well known, the term “Magnificent 7” refers to a group of seven high-performing and influential U.S. companies. These seven stocks alone have a combined market capitalization of $16.5 trillion.

Saylor’s coinage of the term “Magnificent 8” was meant to reflect the growing stature of MicroStrategy, which outperformed the “Magnificent 7” companies with a 238% year-to-date (YTD) gain.

Five of these seven tech behemoths were set to disclose third-quarter earnings later this week, with Tesla reporting its numbers last week and Nvidia scheduled to reveal financials in November.

Why It Matters: The spike in volumes comes amid MicroStrategy’s Bitcoin playbook, which has sparked interest from firms with far greater valuations.

Last week, Microsoft shareholders proposed investments in Bitcoin, citing MicroStrategy as an example whose shares outperformed the tech giant in 2024.

MicroStrategy adopted Bitcoin as its primary reserve asset in 2020, becoming the first publicly listed company to pursue this strategy. The company doubled up on its Bitcoin purchases and today holds over $17 billion in Bitcoin on its books, according to bitcointreasuries.net.

Price Action: At the time of writing, Bitcoin was exchanging hands at $68,289.13, up 2.06% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy closed 0.66% lower at $234.34 on Friday.

Read Next:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.