Trump Says Robert Kennedy Jr. Can Run Wild On Health And Food: 'I'm Going To Let Him Go Wild On The Medicines'

Former President Donald Trump has pledged to give Robert F. Kennedy Jr. full authority over health, food, and medicine issues if he secures a second term.

What Happened: Trump revealed his plans on Sunday, expressing his intent to allow Kennedy to have free reign over health, food, and medicine-related matters, with the exception of oil, which he referred to as “liquid gold,” reported The Hill.

“I’m going to let him go wild on health. I’m going to let him go wild on the food. I’m going to let him go wild on the medicines,” said Trump at his Madison Square Garden rally in New York.

“The only thing I don’t think I’m going to let him even get near is the liquid gold that we have under our feet.”

Kennedy, who earlier withdrew from an independent White House run and endorsed Trump, has been spearheading a Trump campaign initiative named “Make America Healthy Again.” The former presidential contender holds contentious views on vaccines. He has also been outspoken about the spread of processed foods and additives.

Medical professionals have raised concerns about Kennedy’s potential influence in a future Trump administration. While Kennedy denies being anti-vaccine, he has been associated with spreading controversial claims about vaccines.

See Also: Could Trump Be First Republican To Win Popular Vote In 20 Years? Here’s What This Analyst Predicts

Why It Matters: The relationship between Trump and Kennedy has been developing over the past year. In July, Kennedy was reported to be in discussions with Trump about endorsing his campaign and potentially taking up a senior role in a second Trump administration, as per a Benzinga report.

Later in August, Kennedy suspended his own presidential campaign and endorsed Trump. The ex-president subsequently welcomed Kennedy at a campaign rally in Arizona, praising him as an “incredible champion” and predicting his significant influence on the campaign.

Kennedy Jr. revealed that Trump asked him to assist in reforming key health agencies, such as the Centers for Disease Control and Prevention, Food and Drug Administration, and National Institutes of Health, if he wins a second term. Trump’s campaign, however, described discussions on specific roles as “premature.”

However, Kennedy’s endorsement of Trump has been met with strong disapproval from his siblings, who view it as a “betrayal” of their family values.

Image via Shutterstock

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NAACP Co-Founder's 1875 DC Townhouse – Site Of Frederick Douglass' Wedding – Listed For $1.8M

A piece of American history is changing hands in Washington, D.C.’s Dupont Circle neighborhood.

The 1875 town house where civil rights pioneer Frederick Douglass married his second wife, Helen Pitts, in 1884 has found a buyer just days after hitting the market at $1.8 million, according to a report by Realtor.com.

Don’t Miss:

The three-bedroom, two-and-a-half-bath property spans 2,458 square feet and carries deep historical significance. The town house was owned by Francis James Grimké, a prominent clergyman and co-founder of the NAACP, who hosted Douglass’s intimate wedding ceremony in the home’s parlor room.

“We just went under contract this morning. We had two offers,” Meredith Margolis of Compass, who listed the property, told Realtor.

While the property’s connection to Douglass’s wedding is well documented, Margolis said Grimké never lived in the residence. “It was just the site for the wedding because there’s no record for him living in the house,” she explains.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

The current owners, who purchased the property in 1999, have carefully balanced preserving historical elements and incorporating modern amenities. According to the report, the kitchen features new granite countertops and a breakfast nook with a bay window, while the original wood flooring and traditional layout remain intact.

One bedroom has been converted into a library and family room with a balcony overlooking the backyard. The spacious dining room preserves the home’s heritage as a gathering space.

An adjacent alley, likely dating back to the horse-and-buggy era, provides access to the rear of the property.

The town house stands among Dupont Circle’s earliest residences, predating most of the neighborhood’s post-1900 construction. Its location offers urban convenience with historical charm; it is within walking distance to the Metro Red Line, Michelin-starred restaurants and local shops.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

“It has a lot of original, traditional details of a townhome in historical Washington, D.C.,” says Margolis, who lives in the neighborhood with co-listing agent Jennifer Touchette. “Dupont Circle is one of the few neighborhoods that allow you to have an urban experience with all of the conveniences that you need … Plus, you’re surrounded by history and a really nice setting, which is why I chose to raise my kids here.”

It marks the first time in over two decades that the property has been available for purchase.

A bit of history: Douglass was one of the most influential figures in American history, best known for his leadership in the abolitionist movement and his fight for equality.

Born into slavery, Douglass escaped and became a powerful orator, writer and activist, according to the Library of Congress. His autobiographies, including Narrative of the Life of Frederick Douglass, an American Slave, brought the horrors of slavery to the public’s attention.

He also served as a trusted advisor to President Abraham Lincoln during the Civil War, advocating for the enlistment of Black soldiers. Later in life, Douglass became a diplomat and was appointed U.S. Marshal for the District of Columbia.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PBOC activates open market outright reverse repo operations facility

By Joe Cash

BEIJING (Reuters) – China’s central bank launched a new lending tool on Monday to inject more liquidity into the market and support credit flow in the banking system ahead of the expiration of trillions of yuan in loans at the end of the year.

The People’s Bank of China said in a statement it had activated the open market outright reverse repo operations facility to “maintain a reasonable abundance of liquidity in the banking system and further enrich the central bank’s policy toolbox”.

Some 2.9 trillion yuan ($406.6 billion) in medium-term loans are due to mature between now and the end of December, which would make it harder for banks to finance investment and revive flagging growth in the world’s second-largest economy.

Despite taking effect on Monday, the PBOC did not mention the new tool in its open market operations statement.

In a separate statement announcing the new facility, the PBOC said it would use it to trade with primary dealers in OMO on a monthly basis.

The announcement said the new tool would have a tenor of less than one year, longer than those for regular reverse repo operations, which typically have tenors of seven, 14 or 28 days, are conducted daily and normally require collateral.

“It looks like a technical optimisation, part of an effort by the central bank to make its monetary policy framework more functional and to better regulate liquidity provision,” said Xu Tianchen, senior economist at the Economist Intelligence Unit.

“This type of repo is far more common in the European Union and the United States, so it’s a step to modernise the PBOC’s policy toolbox and bring it more in line with them,” he added.

Beijing is counting on massive financial stimulus announced in September to kick-start lending and investment, as a sharp property market downturn and frail consumer confidence weigh on investor confidence.

The PBOC, which has steadily reduced interest rates and injected liquidity, is under pressure to do more to ensure the economy grows at the government’s target of around 5% this year.

State-owned Shanghai Securities News said in an article published shortly after the PBOC notice that the new tool would cover three- and six-month tenors and aid liquidity adjustments over the next year, citing people close to the central bank.

“The central bank’s choice to launch this new tool at this time is also expected to be a better hedge against the concentrated expiry of medium-term lending facility before the end of the year,” the article added.

Mohamed El-Erian Flags Japan's 'Striking' Inflation Paradox As Shigeru Ishiba's Ruling LDP Loses Majority — Yen Tumbles To 3-Month Low Against Dollar

A surprising voter focus on inflation in Japan’s general election, alongside global economic concerns, has sparked comments from Mohamed El-Erian, Chief Economic Advisor at Allianz about shifting economic paradigms in traditionally low-inflation economies.

What Happened: El-Erian highlighted an unexpected economic paradox in Japan, where voters cited cost-of-living concerns as a major issue despite the country’s historically low inflation rates compared to other G7 nations.

“The contrast is quite striking,” El-Erian wrote on X. He attributed this phenomenon to “multi-decade price conditioning and stagnant wages” in Japan.

The election resulted in Prime Minister Shigeru Ishiba‘s Liberal Democratic Party and its coalition partner Komeito securing only 209 of 465 lower house seats – their worst showing since 2009 and a significant drop from their previous 279 seats.

Why It Matters: This outcome has immediate economic implications, with the yen touching a three-month low of 153.30 against the dollar on Monday.

Market analysts suggest this political shift could slow the pace of future interest rate hikes in Japan. The yen’s weakness extended to the euro, reaching 165.36, marking another three-month low, Reuters reported.

The Nikkei 225 is trading at 38,555.44, up 1.69% after the yen slid against the U.S. dollar on Monday. The Japanese index is up 15.82% year-to-date.

In July, the Bank of Japan increased its key interest rate from a range of zero to approximately 0.1% up to 0.25% in an effort to curb the yen’s decline against the U.S. dollar.

The Japanese election results mirror growing global concerns about inflation and living costs, particularly relevant as the United States approaches its own election cycle where economic issues are expected to play a central role.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shaquille O'Neal Says He's Got 40 Cars, 5 Houses But Doesn't 'Know Why.' His Advice Is To 'Just Save. Don't Even Touch It'

One of the most well-known figures in sports and business, Shaquille O’Neal, has talked about his spending patterns and the lessons he’s learned from them. On a recent podcast, Shaq revealed in passing that he owns as many as five houses and forty cars. Furthermore, he claims he doesn’t truly know why, saying, “I have 40 cars and I don’t know why. And I got five houses, I don’t know why.”

Don’t Miss:

Shaq’s advice was surprisingly straightforward and practical despite his enormous presence – save your money. “Just save. Don’t even touch it,” he advised when discussing what he’d do differently from a financial perspective. This advice comes from someone who has lived long but also learned the value of financial caution.

Shaq said that his numerous residences and collection of expensive vehicles don’t always make practical sense. Although he admitted that he could afford them, he claimed that it would have helped him to have been more frugal when he was younger.

See Also: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Besides, this isn’t the first time he said you should save more. In a recent interview with CNBC, Shaq said, “It’s not about how much you make; it’s about how much you keep.” He further explained, “Save 75% of your earnings and put it away. Use the other 25% as you please.”

One of the key lessons Shaq shared during the podcast was learning from losing. He was honest about how failure shaped his success, saying, “Before you succeed, you must first learn to fail.” Whenever he lost a game, he analyzed his mistakes and made sure not to repeat them. “Every time we lost, I said to myself, ‘Not going to do that again.’ Once I started winning,” Shaq said, “I knew what it took to keep winning.”

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Shaq’s personal experiences have shaped his financial outlook. Like some other NBA players, he earned hundreds of millions during his NBA career, but he wasn’t always financially savvy. When he was younger, he made a few major mistakes, such as spending $1 million within hours of signing his first big contract. But as time passed, he learned how important it was to be disciplined with his money.

At the end of the podcast, Shaq was asked whether he thinks about his mortality. He answered, “No,” before continuing, “I’m amazed that children know who I am. I’m amazed that people in Mexico know who I am and hopefully that lasts forever, but if it doesn’t, I understand.”

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

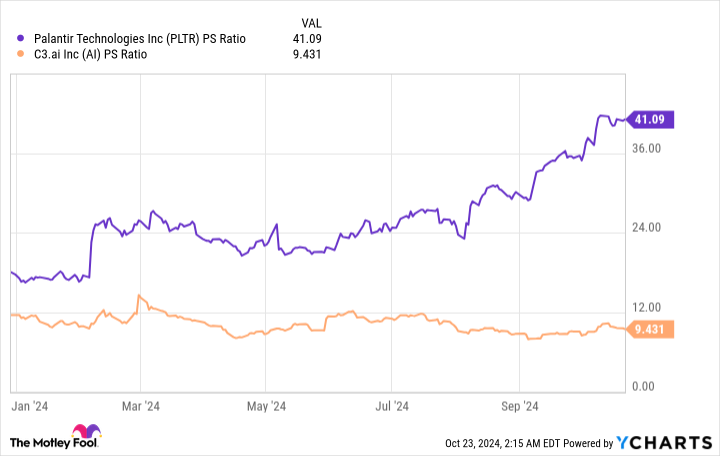

Better Artificial Intelligence Stock: Palantir vs. C3.ai

Artificial intelligence (AI) holds incredible potential to change industries. Some have likened AI to the biggest transformational technology since the internet.

Plenty of companies are trying to capitalize on AI’s secular trend. Two are Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI). The former uses AI to derive insights from data, and the latter provides organizations with turnkey and custom AI software.

The AI market is expected to expand rapidly from a projected $184 billion this year to $827 billion by 2030. Given this growth, is Palantir or C3.ai the better AI investment for the long haul? Here’s a look at each to reach a conclusion.

Palantir has been helping the U.S. government analyze data since 2003, but it just released its artificial intelligence platform (AIP) in 2023. With its inception, AIP helped to spur the expansion of Palantir’s non-government business.

In the second quarter, Palantir experienced 33% year-over-year sales growth to $307 million in its commercial division. This contributed to the firm’s Q2 revenue reaching $678 million, a 27% jump up from the previous year.

Not only is Palantir’s revenue growing, but its financial health is also excellent. It exited Q2 with a net income of $135.6 million, up from $27.9 million in 2023. It also boasted Q2 adjusted free cash flow (FCF) of $149 million, an increase from the prior year’s $96 million.

AIP successfully attracted commercial customers because the platform enables businesses to go from an AI concept to real-world implementation in as little as a few days. This ability is no small feat, and according to Palantir’s CTO, Shyam Sankar, “therein lies our entire opportunity in the market.”

As a follow-up to AIP’s success, Palantir introduced a new product built on AIP called Warp Speed. This solution is meant to address bottlenecks in the manufacturing industry by leveraging AI to improve supply chains and an organization’s manufacturing processes.

If Palantir can successfully tackle this massive market, which represented nearly $3 trillion in U.S. gross domestic product (GDP) last year, it could fundamentally transform its fortunes.

C3.ai began in 2009 as an energy management company and transitioned to AI software in 2019. Its energy industry roots enabled the firm to form a joint venture with energy giant Baker Hughes to deliver AI tech to the oil and gas sector. This allowed C3.ai to capture customers such as Shell and ExxonMobil.

C3.ai’s software platform can address various situations where AI can help a business, such as fraud detection for banks. The company generated 84% of its revenue from subscriptions in its 2025 fiscal first quarter, which ended July 31. The remainder came from services such as training and customer support.

Boeing Plans Over $15 Billion Capital Hike as Soon as Monday

(Bloomberg) — Boeing Co. is planning to launch a capital raise as early as Monday, according to people familiar with the matter, in an offering that would help the beleaguered airplane maker boost its liquidity.

Most Read from Bloomberg

The company is set to raise more than $15 billion from the fundraising, one of the people said, adding that the amount could still rise depending on demand. Boeing’s advisers have been lining up potential investors for the offering, according to people familiar with the matter, who asked not to be identified as the information isn’t public.

The transaction is likely to include shares as well as debt that can be converted into equity, the people said.

The company on Oct. 23 received clearance from the US Securities and Exchange Commission to sell as much as $25 billion of equity and debt, a move that could help Boeing avoid having its credit rating downgraded to junk.

Deliberations are ongoing and details of the offering, such as timing, could still change, the people said. A Boeing representative declined to comment.

A $15 billion share sale would be the largest equity offering since SoftBank Group Corp. sold part of its stake in T-Mobile US Inc. in 2020, data compiled by Bloomberg show.

Boeing needs the capital infusion to maintain its investment-grade rating and fund its eventual recovery from a crippling strike, now in its seventh week. The company is on pace to use around $4 billion in cash during the fourth quarter, which would bring its free-cash outflow to around $14 billion for the year. The planemaker expects to continue burning cash through the first half of next year as it restarts its airplane factories, including the assembly lines for its cash-cow 737 Max jetliner.

Boeing factory workers voted last week to reject the company’s latest contract offer, which included a wage increase of 35% spread over four years. The company plans to cut its workforce by about 10%, with reductions potentially including executives, managers and employees, Chief Executive Officer Kelly Ortberg said in a memo to employees Oct. 11.

Boeing was weighing raising at least $10 billion by selling new stock and was working with advisers to explore its options, Bloomberg News reported earlier this month. Bank of America Corp. analyst Ronald Epstein on Oct. 23 estimated the company would raise between $18 billion and $20 billion.

Boeing plans to launch effort to raise over $15 billion in capital as early as Monday, source says

By David Shepardson

(Reuters) – Boeing is set to launch as early as Monday its plan to raise more than $15 billion in capital, a source briefed on the matter told Reuters.

Reuters first reported on Oct. 16 that the planemaker was closing in on a plan to raise around $15 billion with common shares and a mandatory convertible bond as it sought to bolster finances worsened by a crippling ongoing strike.

The new capital is set to come from a mix of the sale of stock and convertible preferred shares, the source added, saying the total amount raised could rise based on demand.

Boeing declined to comment on Sunday.

Bloomberg News reported the expected timing of Monday’s capital raise earlier.

Last week, machinists voted nearly two to one to reject Boeing’s latest offer seeking to end the strike that has halted 737 MAX production.

The company said earlier this month in regulatory filings that it could raise as much as $25 billion in stock and debt with its investment-grade credit rating at risk.

The aerospace giant has been dealing with increased regulatory scrutiny, production curbs and a loss of confidence from customers since a door panel blew off a 737 MAX plane in midair in early January.

Boeing has been burning through cash all year and last week announced a new $6 billion quarterly loss. Earlier this month, Boeing said it had secured a $10 billion credit agreement with major lenders: Bank of America, Citibank, Goldman Sachs and JPMorgan.

Boeing said earlier this month it would cut 17,000 jobs – 10% of its global workforce – and delay first deliveries of its 777X jet by a year.

The top three credit rating agencies – S&P, Moody’s and Fitch – have said they will cut Boeing’s ratings to junk if it raised new debt without retiring some $11 billion of debt maturing through Feb. 1, 2026.

(Reporting by David Shepardson; Editing by Christopher Cushing)