Mohamed El-Erian Flags Japan's 'Striking' Inflation Paradox As Shigeru Ishiba's Ruling LDP Loses Majority — Yen Tumbles To 3-Month Low Against Dollar

A surprising voter focus on inflation in Japan’s general election, alongside global economic concerns, has sparked comments from Mohamed El-Erian, Chief Economic Advisor at Allianz about shifting economic paradigms in traditionally low-inflation economies.

What Happened: El-Erian highlighted an unexpected economic paradox in Japan, where voters cited cost-of-living concerns as a major issue despite the country’s historically low inflation rates compared to other G7 nations.

“The contrast is quite striking,” El-Erian wrote on X. He attributed this phenomenon to “multi-decade price conditioning and stagnant wages” in Japan.

The election resulted in Prime Minister Shigeru Ishiba‘s Liberal Democratic Party and its coalition partner Komeito securing only 209 of 465 lower house seats – their worst showing since 2009 and a significant drop from their previous 279 seats.

Why It Matters: This outcome has immediate economic implications, with the yen touching a three-month low of 153.30 against the dollar on Monday.

Market analysts suggest this political shift could slow the pace of future interest rate hikes in Japan. The yen’s weakness extended to the euro, reaching 165.36, marking another three-month low, Reuters reported.

The Nikkei 225 is trading at 38,555.44, up 1.69% after the yen slid against the U.S. dollar on Monday. The Japanese index is up 15.82% year-to-date.

In July, the Bank of Japan increased its key interest rate from a range of zero to approximately 0.1% up to 0.25% in an effort to curb the yen’s decline against the U.S. dollar.

The Japanese election results mirror growing global concerns about inflation and living costs, particularly relevant as the United States approaches its own election cycle where economic issues are expected to play a central role.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shaquille O'Neal Says He's Got 40 Cars, 5 Houses But Doesn't 'Know Why.' His Advice Is To 'Just Save. Don't Even Touch It'

One of the most well-known figures in sports and business, Shaquille O’Neal, has talked about his spending patterns and the lessons he’s learned from them. On a recent podcast, Shaq revealed in passing that he owns as many as five houses and forty cars. Furthermore, he claims he doesn’t truly know why, saying, “I have 40 cars and I don’t know why. And I got five houses, I don’t know why.”

Don’t Miss:

Shaq’s advice was surprisingly straightforward and practical despite his enormous presence – save your money. “Just save. Don’t even touch it,” he advised when discussing what he’d do differently from a financial perspective. This advice comes from someone who has lived long but also learned the value of financial caution.

Shaq said that his numerous residences and collection of expensive vehicles don’t always make practical sense. Although he admitted that he could afford them, he claimed that it would have helped him to have been more frugal when he was younger.

See Also: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Besides, this isn’t the first time he said you should save more. In a recent interview with CNBC, Shaq said, “It’s not about how much you make; it’s about how much you keep.” He further explained, “Save 75% of your earnings and put it away. Use the other 25% as you please.”

One of the key lessons Shaq shared during the podcast was learning from losing. He was honest about how failure shaped his success, saying, “Before you succeed, you must first learn to fail.” Whenever he lost a game, he analyzed his mistakes and made sure not to repeat them. “Every time we lost, I said to myself, ‘Not going to do that again.’ Once I started winning,” Shaq said, “I knew what it took to keep winning.”

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Shaq’s personal experiences have shaped his financial outlook. Like some other NBA players, he earned hundreds of millions during his NBA career, but he wasn’t always financially savvy. When he was younger, he made a few major mistakes, such as spending $1 million within hours of signing his first big contract. But as time passed, he learned how important it was to be disciplined with his money.

At the end of the podcast, Shaq was asked whether he thinks about his mortality. He answered, “No,” before continuing, “I’m amazed that children know who I am. I’m amazed that people in Mexico know who I am and hopefully that lasts forever, but if it doesn’t, I understand.”

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

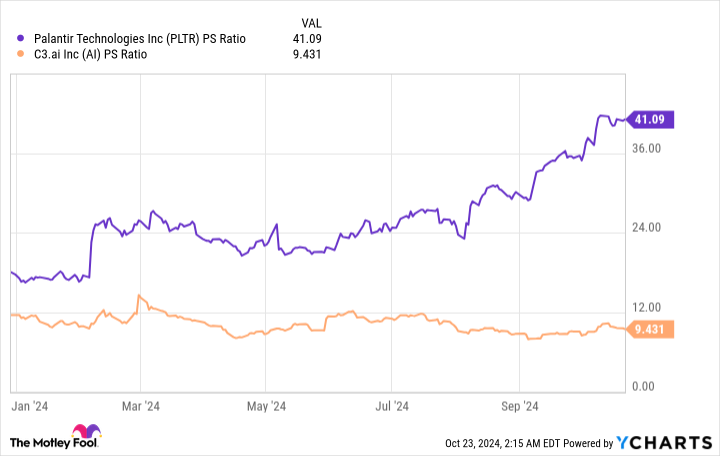

Better Artificial Intelligence Stock: Palantir vs. C3.ai

Artificial intelligence (AI) holds incredible potential to change industries. Some have likened AI to the biggest transformational technology since the internet.

Plenty of companies are trying to capitalize on AI’s secular trend. Two are Palantir Technologies (NYSE: PLTR) and C3.ai (NYSE: AI). The former uses AI to derive insights from data, and the latter provides organizations with turnkey and custom AI software.

The AI market is expected to expand rapidly from a projected $184 billion this year to $827 billion by 2030. Given this growth, is Palantir or C3.ai the better AI investment for the long haul? Here’s a look at each to reach a conclusion.

Palantir has been helping the U.S. government analyze data since 2003, but it just released its artificial intelligence platform (AIP) in 2023. With its inception, AIP helped to spur the expansion of Palantir’s non-government business.

In the second quarter, Palantir experienced 33% year-over-year sales growth to $307 million in its commercial division. This contributed to the firm’s Q2 revenue reaching $678 million, a 27% jump up from the previous year.

Not only is Palantir’s revenue growing, but its financial health is also excellent. It exited Q2 with a net income of $135.6 million, up from $27.9 million in 2023. It also boasted Q2 adjusted free cash flow (FCF) of $149 million, an increase from the prior year’s $96 million.

AIP successfully attracted commercial customers because the platform enables businesses to go from an AI concept to real-world implementation in as little as a few days. This ability is no small feat, and according to Palantir’s CTO, Shyam Sankar, “therein lies our entire opportunity in the market.”

As a follow-up to AIP’s success, Palantir introduced a new product built on AIP called Warp Speed. This solution is meant to address bottlenecks in the manufacturing industry by leveraging AI to improve supply chains and an organization’s manufacturing processes.

If Palantir can successfully tackle this massive market, which represented nearly $3 trillion in U.S. gross domestic product (GDP) last year, it could fundamentally transform its fortunes.

C3.ai began in 2009 as an energy management company and transitioned to AI software in 2019. Its energy industry roots enabled the firm to form a joint venture with energy giant Baker Hughes to deliver AI tech to the oil and gas sector. This allowed C3.ai to capture customers such as Shell and ExxonMobil.

C3.ai’s software platform can address various situations where AI can help a business, such as fraud detection for banks. The company generated 84% of its revenue from subscriptions in its 2025 fiscal first quarter, which ended July 31. The remainder came from services such as training and customer support.

Boeing Plans Over $15 Billion Capital Hike as Soon as Monday

(Bloomberg) — Boeing Co. is planning to launch a capital raise as early as Monday, according to people familiar with the matter, in an offering that would help the beleaguered airplane maker boost its liquidity.

Most Read from Bloomberg

The company is set to raise more than $15 billion from the fundraising, one of the people said, adding that the amount could still rise depending on demand. Boeing’s advisers have been lining up potential investors for the offering, according to people familiar with the matter, who asked not to be identified as the information isn’t public.

The transaction is likely to include shares as well as debt that can be converted into equity, the people said.

The company on Oct. 23 received clearance from the US Securities and Exchange Commission to sell as much as $25 billion of equity and debt, a move that could help Boeing avoid having its credit rating downgraded to junk.

Deliberations are ongoing and details of the offering, such as timing, could still change, the people said. A Boeing representative declined to comment.

A $15 billion share sale would be the largest equity offering since SoftBank Group Corp. sold part of its stake in T-Mobile US Inc. in 2020, data compiled by Bloomberg show.

Boeing needs the capital infusion to maintain its investment-grade rating and fund its eventual recovery from a crippling strike, now in its seventh week. The company is on pace to use around $4 billion in cash during the fourth quarter, which would bring its free-cash outflow to around $14 billion for the year. The planemaker expects to continue burning cash through the first half of next year as it restarts its airplane factories, including the assembly lines for its cash-cow 737 Max jetliner.

Boeing factory workers voted last week to reject the company’s latest contract offer, which included a wage increase of 35% spread over four years. The company plans to cut its workforce by about 10%, with reductions potentially including executives, managers and employees, Chief Executive Officer Kelly Ortberg said in a memo to employees Oct. 11.

Boeing was weighing raising at least $10 billion by selling new stock and was working with advisers to explore its options, Bloomberg News reported earlier this month. Bank of America Corp. analyst Ronald Epstein on Oct. 23 estimated the company would raise between $18 billion and $20 billion.

Boeing plans to launch effort to raise over $15 billion in capital as early as Monday, source says

By David Shepardson

(Reuters) – Boeing is set to launch as early as Monday its plan to raise more than $15 billion in capital, a source briefed on the matter told Reuters.

Reuters first reported on Oct. 16 that the planemaker was closing in on a plan to raise around $15 billion with common shares and a mandatory convertible bond as it sought to bolster finances worsened by a crippling ongoing strike.

The new capital is set to come from a mix of the sale of stock and convertible preferred shares, the source added, saying the total amount raised could rise based on demand.

Boeing declined to comment on Sunday.

Bloomberg News reported the expected timing of Monday’s capital raise earlier.

Last week, machinists voted nearly two to one to reject Boeing’s latest offer seeking to end the strike that has halted 737 MAX production.

The company said earlier this month in regulatory filings that it could raise as much as $25 billion in stock and debt with its investment-grade credit rating at risk.

The aerospace giant has been dealing with increased regulatory scrutiny, production curbs and a loss of confidence from customers since a door panel blew off a 737 MAX plane in midair in early January.

Boeing has been burning through cash all year and last week announced a new $6 billion quarterly loss. Earlier this month, Boeing said it had secured a $10 billion credit agreement with major lenders: Bank of America, Citibank, Goldman Sachs and JPMorgan.

Boeing said earlier this month it would cut 17,000 jobs – 10% of its global workforce – and delay first deliveries of its 777X jet by a year.

The top three credit rating agencies – S&P, Moody’s and Fitch – have said they will cut Boeing’s ratings to junk if it raised new debt without retiring some $11 billion of debt maturing through Feb. 1, 2026.

(Reporting by David Shepardson; Editing by Christopher Cushing)

Stock market today: Asian shares rise and the yen dips after Japan's ruling party loses majority

TOKYO (AP) — Asian shares rose Monday, as the yen dipped in the midst of political uncertainty after Japan’s ruling party lost its majority in Parliament’s lower house in weekend elections.

In currency trading, the U.S. dollar rose to 153.76 Japanese yen from 152.24 yen. It was trading at 140-yen levels last month. The euro cost $1.0796, down form $1.0803.

The weak yen is a boon for Japan’s giant exporters like Toyota Motor Corp., whose stock gained 3.7% in Tokyo trading. Nintendo Co. gained 2.6%, while Sony Corp. rose nearly 2.0%.

Japan’s ruling Liberal Democratic Party is still the top party, but several members failed to win reelection in Sunday’s vote after a scandal involving unreported campaign funding.

All told, the ruling coalition with junior partner Komeito secured 215 seats, down sharply from the majority of 279 it previously held, according to Japanese media. A change of government is not expected but the LDP may need a third coalition partner.

Tokyo stocks rose. Analysts say the ruling party defeat had been greatly expected and factored into markets from before.

Japan’s benchmark Nikkei 225 surged 1.6% in morning trading to 38,527.52. Australia’s S&P/ASX 200 gained nearly 0.1% to 8,217.80. South Korea’s Kospi edged up 0.6% to 2,598.73. Hong Kong’s Hang Seng added 0.1% to 20,614.74, while the Shanghai Composite rose 0.3% to 3,310.63.

On Wall Street, U.S. stock indexes finished last week, drifting to a mixed finish, giving the market its first losing week since early September.

The S&P 500 closed little changed after having been up 0.9% earlier in the day. The Dow Jones Industrial Average fell 0.6% and also posted its first weekly loss after six straight gains. The Nasdaq composite rose 0.6%.

Company earnings reports, which have been mostly solid, continue to be a key focus for investors. More than a third of the companies in the S&P 500 index have reported their latest quarterly financial results. Most of the results have beat analysts’ forecasts. Companies from around the world are scheduled to report earnings in coming weeks.

Treasury yields ended last week broadly higher. The yield on the 10-year Treasury rose to 4.24% Friday from 4.21% late Thursday.

Yields have generally climbed following reports showing the U.S. economy remains stronger than expected. Wall Street will have more updates next week on consumer confidence, jobs and inflation.

The Fed raised its benchmark interest rate to its highest level in two decades in an effort to tame inflation back to 2%, without sinking the economy into a recession.

Yen Falls, Japan’s Stocks Rise as Traders Weigh Election Impact

(Bloomberg) — The yen extended losses to 1% while Japanese stocks climbed Monday as investors mulled the implications of the Liberal Democratic Party and its coalition partner losing their majority.

Most Read from Bloomberg

The slide in the currency as far as 153.88 against the dollar came after four straight weekly declines. That’s again raised the risk that authorities may wade back into the market to protect the yen as traders factor in when the Bank of Japan is likely to raise interest rates again given the political uncertainty.

“This result is definitely a concern for many investors, because we have no clear picture about who’s going to be leading the country,” said Hebe Chen, a market analyst at IG Markets Ltd. “The LDP is in a very difficult position and there’s no one option that can be easily settled.”

The yen has depreciated 7% against the dollar this month, and is the worst performer among its Group-of-10 peers.

The tech-heavy Nikkei 225 Stock Average and the broader Topix index both opened slightly lower before quickly turning to gains of more than 1%.

While political instability is typically negative for equities, there is still a possibility that Prime Minister Shigeru Ishiba can secure enough support to stay on. Currency declines also tend to support the stock market.

“This is an unexpected reaction,” said Shuji Hosoi, senior strategist at Daiwa Securities Co. “While the political risk may be increasing, there may be expectation that the Ishiba administration won’t become a lame duck immediately.”

Support for the LDP and its partner Komeito fell short of the 233 seats needed for a majority in the lower house, according to a tally by public broadcaster NHK. Surveys by other media pointed to similar results.

In the fixed-income market, the yield on benchmark 10-year government bonds rose 1.5 basis points to 0.96%. The LDP may team up with a party that has pledged to cut consumption and income taxes and is likely to pursue expansionary fiscal policies, said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management Co.

Much of the currency’s weakness reflects the ultra-low level of interest rates in Japan relative to the US and other major economies. This wide gulf is unlikely to change significantly anytime soon, with the BOJ widely expected to keep its policy interest rate unchanged at a meeting that concludes Thursday.

Michael Saylor's Proposal To Microsoft CEO Satya Nadella: 'If You Want To Make The Next Trillion Dollars For Shareholders, Call Me'

MicroStrategy (NASDAQ:MSTR) executive chairman Michael Saylor humorously reached out to Microsoft (NASDAQ:MSFT) CEO Satya Nadella, suggesting he can help with the company’s Bitcoin (CRYPTO: BTC) strategy.

What Happened: In a post on X on Friday, Saylor advised Nadella that if he’s interested in creating the next trillion-dollar opportunity, he should reach out. This comes as Microsoft, per an SEC filing, prepares to discuss a possible Bitcoin investment at its December shareholder meeting.

MicroStrategy, despite being much smaller, has outperformed Microsoft by 313% largely due to its Bitcoin holdings. The company’s total bitcoin holdings as of Oct. 20 stand at 252,220, worth $9.91 billion.

Microsoft’s second-largest shareholder, BlackRock (NYSE:BLK), has already shown confidence in Bitcoin, offering its clients a Bitcoin ETF.

Why It Matters: Saylor’s message highlights MicroStrategy’s strong performance amid its heavy Bitcoin investments, with the company’s stock up 444% over the past year, including a 244% YTD increase.

Investor confidence in MicroStrategy recently grew as BlackRock raised its stake in the company to 5.2%, making MicroStrategy a key entry point for institutional Bitcoin exposure.

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Michael Saylor’s Proposal To Microsoft CEO Satya Nadella: ‘If You Want To Make The Next Trillion Dollars For Shareholders, Call Me’ originally appeared on Benzinga.com