Should You Buy This Millionaire-Maker Stock Instead of Nvidia?

Nvidia has turned out to be an outstanding investment in the past decade, as shares of the company have shot up a whopping 32,600% during this period and outpaced the 207% gains clocked by the S&P 500 index.

So, an investment of just $3,500 made in shares of Nvidia a decade ago is now worth just over a million dollars.

Nvidia, therefore, has turned out to be a millionaire-maker stock over the past 10 years, assuming someone put $3,500 into its shares at that time and never sold. However, as the chart above shows, the majority of Nvidia’s gains have come in the past couple of years when the artificial intelligence (AI) craze gripped the globe.

Nvidia has been at the forefront of the AI revolution thanks to its graphics processing units (GPUs), which have been instrumental in training AI models and are now being deployed for AI inference. The good part is that Nvidia can keep growing at a healthy pace in the future as well thanks to the lucrative opportunity present in the AI chip market, a space where it is the dominant player right now.

But at the same time, investors looking to buy Nvidia stock right now will have to pay a hefty 65 times earnings and 36 times sales. While Nvidia could justify that valuation with its stunning growth, investors looking for an alternative that’s trading at relatively cheaper levels would do well to take a closer look at Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly known as TSMC.

The Taiwan-based foundry giant plays a critical role in the global-semiconductor market and could be an ideal pick for investors looking to construct a million-dollar portfolio. Let’s look at the reasons why.

TSMC is the world’s largest-semiconductor foundry. Its fabrication plants are used by top chipmakers such as Nvidia, AMD, Broadcom, Qualcomm, and many others to manufacture chips. Additionally, consumer-electronics giant Apple is TSMC’s largest customer, while the likes of Sony also turn to the Taiwanese company for their chip manufacturing.

It is worth noting that TSMC ended 2023 with an impressive base of 528 customers, manufacturing close to 12,000 products for multiple-end markets, such as smartphones, the Internet of Things (IoT), high-performance computing, consumer electronics, and automotive. Given that AI is driving solid growth across all these end markets, it is not surprising to see why TSMC has been growing at an incredible pace of late.

The company released third-quarter 2024 results on Oct. 17, reporting a 36% year-over-year increase in revenue to $23.5 billion. That exceeded the higher end of the company’s $23.2 billion guidance. Even better, TSMC’s net profit shot up 54% year over year to $10.1 billion, easily clearing the consensus estimate. The stronger growth in the company’s earnings can be attributed to an increase of 4.2 percentage points in its net-profit margin.

Texas Smoke Shop Owners Sue DEA Over 'Intimidation And Bullying' Tactics In Raid Of Legal Retail Store

A legal dispute has erupted in Allen, Texas, where cannabis shop owners and their advocates are taking a stand against local and federal law enforcement, claiming their rights were violated during recent police raids.

This lawsuit, filed by attorney David Sergi on Oct. 24, represents Sabhie Khan, a manager of Allen Smoke and Vape, and members of the Hemp Industry Leaders of Texas, following an August raid led by the Allen Police Department with the support of the U.S. Drug Enforcement Administration (DEA).

See Also: $8B Market On The Brink: Texas Senator Calls It ‘Uncontrollable,’ Proposes Erasing Hemp

Sergi condemned the raids as “fishing expeditions,” saying “the DEA attempted to intimidate and bully these family businesses selling legal hemp,” Lonestar Live reported.

He contends that law enforcement’s actions crossed a line, disregarding Texas’s hemp regulations and constitutional protections. Under Texas law, cannabis products with 0.3% delta-9 THC or less qualify as hemp, making them lawful within the state.

Raids And Arrests Spark Lawsuit

The incident that sparked the lawsuit occurred on Aug. 27, when Allen Police, collaborating with federal agencies, searched several shops, arresting Khan. The lawsuit alleges he was charged with a second-degree felony for “manufacturing a controlled substance” despite the seized products meeting Texas’s legal definition of hemp.

According to Sergi, Khan, who is 70, was jailed for two days, “shackled in a jail cell without bond,” despite his business being in compliance with state hemp laws. Sergi criticized the enforcement agencies’ handling of Khan’s case, saying they treated him “like the kingpin of a drug cartel, despite hemp being legal.”

The plaintiffs argue that their Fourth, Fifth, Eighth, and 14th Amendment rights were breached in the process, naming the city of Allen, the Allen Police Department, Police Chief Steve Dye, Collin County Sheriff Jim Skinner and the DEA in the lawsuit. These amendments offer protections against unreasonable searches, self-incrimination, and cruel punishment, as well as guaranteeing due process.

Legal Battles And Disputed Testing Methods

The trouble began in May when Allen police allegedly sent notices to several CBD and vape shops, accusing them of selling “illegal THC products.” The lawsuit claims the DEA followed suit in June, issuing subpoenas to Khan and other business owners, demanding sensitive personal and business data.

A federal judge issued a temporary stay on these subpoenas in July, questioning their legitimacy. However, the lawsuit alleges that the DEA sidestepped this judicial halt by engaging the Allen Police Department, who executed search warrants under allegedly flawed “questionable laboratory testing methods and standards” that could not differentiate between delta-9 THC and other legal cannabinoids in the products.

Sergi contends that these actions led to the seizure of approximately $8,000 to $10,000 worth of “legal inventory,” with much of it being delta-8, THCa, and THCP products, all of which had certificates of analysis, a legal requirement for hemp products in Texas.

Additionally, officers allegedly confiscated computers, phones and storage devices from Khan’s shop, significantly impacting his business operations.

Calls For Legal Protections And Industry Standards

Khan and his fellow plaintiffs are not only seeking the immediate return of seized inventory and compensation for damages but are also requesting a permanent injunction to protect their businesses from future “unlawful actions.”

The lawsuit demands that any future testing on hemp products employ high-performance liquid chromatography (HPLC) to ensure compliance with Texas’s legal standards, especially concerning the preservation of THCa, which Texas law treats differently from delta-9 THC.

The Allen Police Department has yet to issue a public response, citing “pending litigation.” The outcome of this lawsuit could significantly impact Texas’s hemp industry, as Khan and other business owners advocate for greater legal clarity and protections, insisting on their right to operate without undue interference from law enforcement.

Read Next:

Cover image made with AI.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The owner of Versace and Jimmy Choo just lost half its value in 24 hours—and Wall Street ended its 6-week winning streak

Wall Street said goodbye to its six-week winning streak at market close on Friday, as Treasury yields climbed and investors wrestled with high valuations amid mixed earnings. One of the biggest losers Friday was Capri Holdings Ltd., which lost nearly half its value after a federal judge blocked its acquisition by Tapestry.

-

S&P 500: 5,808.12 ⬇️ down 0.03%

-

Nasdaq Composite: 18,518.61 ⬆️ up 0.56%

-

Dow Jones Industrial Average: 42,114.40 ⬇️ down 0.61%

-

STOXX Europe 600: 518.81 ⬇️ down 0.033%

-

CSI 300: 3,956.42 ⬆️ up 0.70%

-

Nikkei 225: 37,913.92 ⬇️ down 0.60%

-

Bitcoin: $66,748.76 ⬇️ down 2.08%

U.S.: Nasdaq climbs on strong tech stocks while Dow and S&P slip on mixed outlook

The S&P 500 edged down 0.03%, and the Dow Jones Industrial Average also lost ground, down 0.61%. Only the Nasdaq Composite rose, up 0.56%, driven by strong performances in tech stocks. Capital One surged over 6% after beating third-quarter earnings expectations, while Deckers Outdoor soared more than 10% following a raised annual forecast. But luxury brand owner Capri Holdings, the owner of Jimmy Choo, Versace, and Michael Kors, was down more than 48%, adding fresh uncertainty to the company’s outlook. Rising Treasury yields also weighed on sentiment, with the 10-year yield increasing to 4.24%, making equities a tougher sell.

For the week, the S&P 500 lost 1% and the Dow fell 2.7% as blue chips also ended a six-week win streak. The Nasdaq notched a 0.2% weekly gain.

Europe: Shares fall as weak earnings drag markets

European stocks closed lower Friday after several companies missed earnings expectations. The Stoxx Europe 600 declined by 0.033%, as German automaker Mercedes-Benz dropped nearly 4% following disappointing quarterly results. France’s Remy Cointreau also slipped around 1% after revising down its guidance due to weaker demand in China. Despite SAP’s strong performance earlier this week, European sentiment remained cautious, with Britain’s FTSE 100 losing 0.25%.

China: Gains as focus shifts to U.S. election

Chinese markets edged higher, with the CSI 300 rising 0.70%, as investors watched the tight U.S. election race and digested limited domestic news. The People’s Bank of China held its medium-term lending rate at 2%, following last month’s substantial rate cut, which helped support market sentiment. Hong Kong’s Hang Seng also rose modestly by 0.49%, as investors remained hopeful for stable policy conditions.

Japan: Stocks slip ahead of weekend election

Japan’s Nikkei 225 fell 0.60% as investors remained cautious ahead of Sunday’s elections. The Liberal Democratic Party’s majority status remains uncertain, casting doubt on future economic policies. Core inflation slowed to 1.8%, its lowest level in five months, fueling hopes that Japan’s central bank might avoid raising interest rates. In a mostly red market, Mazda Motor was a rare bright spot, climbing 1.56%.

This story was originally featured on Fortune.com

Zelensky Sounds Alarm On Potential North Korean Involvement In Ukraine

The President of Ukraine, Vladimir Zelensky, has raised concerns over the potential deployment of North Korean soldiers to Ukraine by Russia.

What Happened: In a post on X on Friday, Zelensky disclosed that intelligence indicates the first group of North Korean troops could be dispatched by Russia to battle zones as early as October 27–28. He characterized this development as a “clear escalation by Russia.”

The Pentagon had previously confirmed the presence of DPRK military personnel in Russia. Sabrina Singh, Deputy Pentagon Press Secretary, in a press briefing on Thursday, expressed that Russia’s decision to involve North Korea “really highlights Russia’s desperation.”

Singh approximates that there are currently 3,000 North Korean soldiers in Russia, a figure that Ukraine cautions could surge to up to 12,000. Zelensky called for a “principled and strong response from global leaders” to North Korea’s potential involvement in combat.

Also Read: North Korean Forces Aiding Russia In Ukraine War Effort

Earlier this week, National Security Communications Adviser John Kirby declared that if North Korean troops are deployed to fight in Ukraine, they would be considered “fair game” by the Ukrainian military.

Why It Matters: This development comes amidst escalating tensions in the region. The potential involvement of North Korean troops in the Ukraine conflict signifies a new phase in the geopolitical dynamics, potentially drawing in more global powers into the fray.

The international community’s response to this development could significantly influence the course of the conflict.

Read Next

Kim Jong Un Threatens Nuclear Retaliation Against South Korea If Attacked

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NYSE To Extend Arca Exchange Trading To 22 Hours Per Day

The New York Stock Exchange, part of Intercontinental Exchange, Inc. ICE, announced on Friday plans to extend weekday trading on its NYSE Arca equities exchange to 22 hours a day.

The Details: The extended trading is subject to regulatory approval and would take place from 1:30 a.m. to 11:30 p.m. ET on all weekdays, excluding holidays. The NYSE said it will also seek support for extended trading from the U.S. securities information processors.

Read Next: Friday’s Top 5 Trending Stocks: What’s The Scoop On Tesla, SoFi, Joby?

“The NYSE’s initiative to extend U.S. equity trading to 22 hours a day, 5 days a week underscores the strength of our U.S. capital markets and growing demand for our listed securities around the world,” said Kevin Tyrrell, Head of Markets, New York Stock Exchange.

“As the steward of the U.S. capital markets, the NYSE is pleased to lead the way in enabling exchange-based trading for our U.S.-listed companies and funds to investors in time zones across the globe,” Tyrrell added.

Why It Matters: NYSE’s Arca exchange is the world’s leading exchange-traded fund (ETF) exchange in terms of volume and listings, listing 62.9% of the total ETFs in the United States. The Arca exchange currently operates from 4 a.m. to 8 p.m. ET.

Online brokerage firm, Robinhood Markets, Inc. HOOD began offering 24 hour trading of select stocks and ETFs in 2023, using Blue Ocean Alternative Trading Systems (BOATS) to execute overnight trading orders. Around-the-clock trading has become one of the firm’s most popular features, according to the company, which now offers 226 stocks and ETFs for 24 hour trading.

ICE Price Action: According to Benzinga Pro, Intercontinental Exchange shares ended Friday’s session down 0.95% at $165.31.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Elon Musk "Superhuman"? Here's Why Nvidia's Jensen Huang Thinks So After the Tesla Chief's $2.5 Billion Feat

Few people elicit as strong a reaction as Elon Musk. The outspoken Tesla founder is fond of making bold claims and huge promises — promises that he doesn’t always keep, much to the chagrin of Tesla investors. Add to that his social media activity, and he is often a divisive figure.

One thing that can’t be denied is that Musk has vision. That — and a massive net worth — make him capable of marshaling huge resources to accomplish incredible tasks. Look no further than the recent successful rocket booster “capture” executed by his company, SpaceX. And while that truly is an incredible feat, Musk recently pulled off something else that left Nvidia (NASDAQ: NVDA) CEO, Jensen Huang, thoroughly impressed.

While X, Tesla, and SpaceX dominate the headlines, Musk’s artificial intelligence (AI) startup, xAI, recently built what could be the most powerful AI-training supercomputer around. Dubbed “Colossus,” the supercomputer will be used to train Grok, a large language model (LLM) and the company’s answer to ChatGPT. The LLM will be available to paying X customers initially, but many believe Grok will eventually power Tesla’s humanoid robots. Sounds like science fiction, no? It’s not.

Here’s the thing, xAI built the facility in a matter of months, but it installed 100,000 Nvidia H100s in just 19 days. The Nvidia chief was recently interviewed about the installation, and it was clear this was something he’d never seen, calling it “superhuman” and “unbelievable.” Why? According to Huang, it’s a process that would normally take years.

Musk isn’t done, however. He plans to install another 50,000 H200s in the next few months, roughly doubling its current power. Although nothing official has been announced, I wouldn’t be surprised if he is first in line for Nvidia’s yet-to-be-released B200s. xAI has spent a few billion on the project thus far and at $25,000 a pop, an estimated $2.5 billion of that was spent just on the H100 chips themselves.

While Musk and xAI’s feat is undeniably impressive, I would take Huang’s statements with a grain of salt. CEOs of companies that do billions of dollars of business together tend to be quite complimentary of each other, and like Musk, Huang doesn’t shy away from bold claims.

The whole project shows the incredible lengths to which companies will go to win the AI arms race — companies with billions to burn. During the last round of quarterly earnings, CEOs from the largest companies in tech reiterated that losing was not an option, and they will keep spending whatever it takes to win. Alphabet CEO Sundar Pichai put it bluntly, “The risk of underinvesting is dramatically greater than the risk of overinvesting for us.” That’s why the company expects to spend roughly $50 billion this year in capital expenditures, up from $31 billion the year before, with much of it going toward AI infrastructure and Nvidia chips.

TOP RANKED ROSEN LAW FIRM Encourages Coinbase Global, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – COIN

NEW YORK, Oct. 26, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Coinbase Global, Inc. COIN between April 14, 2021 and July 25, 2024, both dates inclusive (the “Class Period”), of the important November 12, 2024 lead plaintiff deadline in the securities class action first filed by the Firm.

SO WHAT: If you purchased Coinbase securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Coinbase class action, go to https://rosenlegal.com/submit-form/?case_id=28116 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 12, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, defendants throughout the Class Period made materially false and/or misleading statements and/or failed to disclose that: (1) in 2020, the United Kingdom’s Financial Conduct Authority (“FCA”) had deemed efforts by Coinbase’s British unit, CB Payments Limited (“CBPL”), to prevent criminals from using its platform, to be inadequate; (2) as a result, the FCA reached an agreement with CBPL, which put requirements in place that were designed to prevent high risk customers from using CBPL’s platform; (3) CBPL then breached that agreement, which resulted in 13,416 high risk individuals receiving services; (4) the foregoing resulted in an undisclosed heightened regulatory risk; and (5) as a result, defendants statements about its business, operations and prospects were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Coinbase class action, go to https://rosenlegal.com/submit-form/?case_id=28116 call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm or on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Agnico Eagle Mines Options Trading: A Deep Dive into Market Sentiment

Investors with a lot of money to spend have taken a bearish stance on Agnico Eagle Mines AEM.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AEM, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 8 options trades for Agnico Eagle Mines.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $43,400, and 7, calls, for a total amount of $661,568.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $70.0 and $90.0 for Agnico Eagle Mines, spanning the last three months.

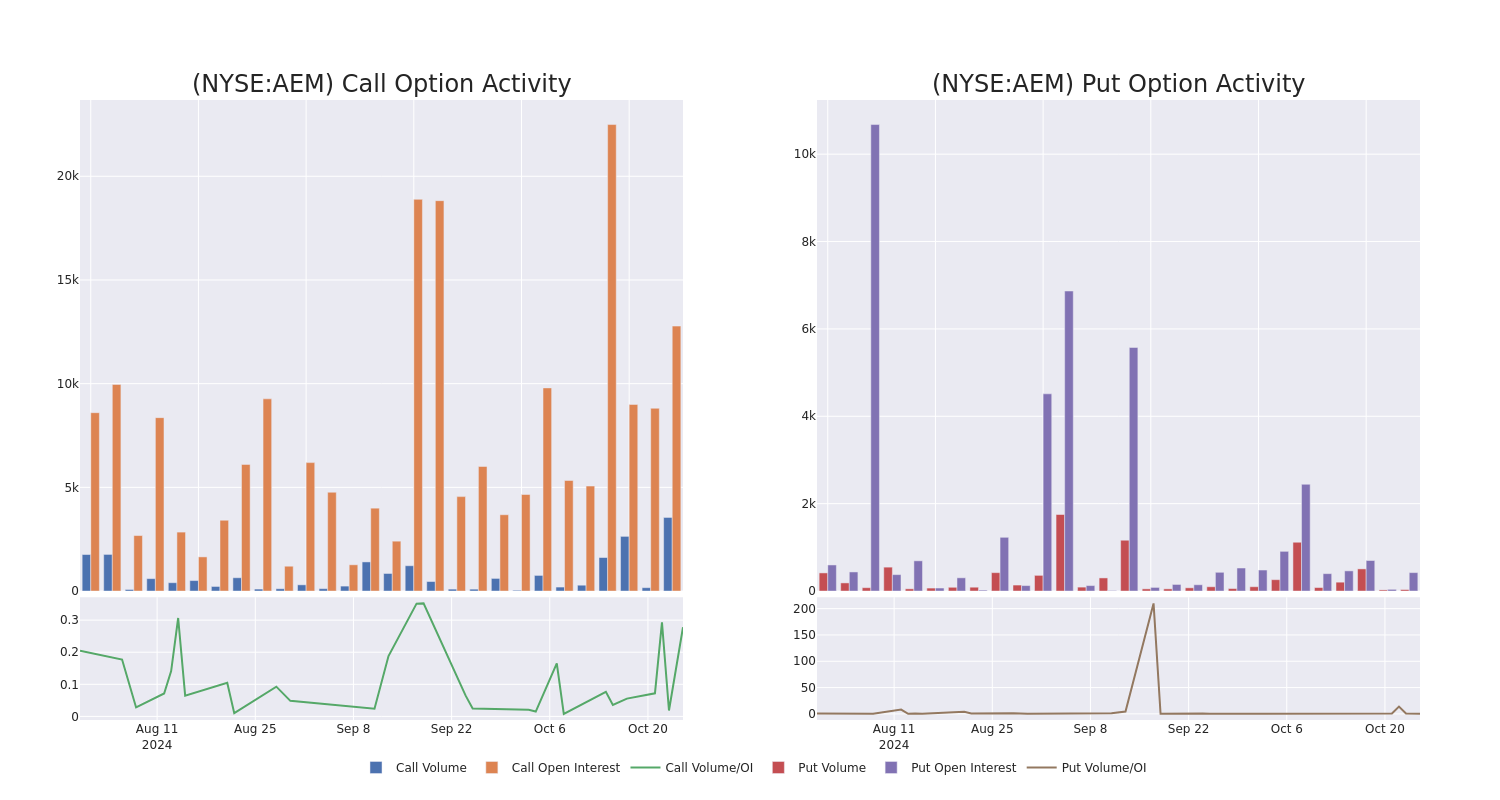

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Agnico Eagle Mines stands at 2639.8, with a total volume reaching 3,583.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Agnico Eagle Mines, situated within the strike price corridor from $70.0 to $90.0, throughout the last 30 days.

Agnico Eagle Mines Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | CALL | TRADE | BEARISH | 01/17/25 | $4.6 | $4.5 | $4.5 | $90.00 | $405.0K | 8.6K | 1.6K |

| AEM | CALL | SWEEP | BULLISH | 10/17/25 | $13.2 | $13.0 | $13.2 | $85.00 | $69.9K | 100 | 55 |

| AEM | CALL | TRADE | BEARISH | 11/15/24 | $2.35 | $2.25 | $2.28 | $90.00 | $45.5K | 3.9K | 225 |

| AEM | CALL | TRADE | NEUTRAL | 01/17/25 | $4.6 | $4.4 | $4.5 | $90.00 | $45.0K | 8.6K | 610 |

| AEM | PUT | SWEEP | BULLISH | 12/20/24 | $3.7 | $3.5 | $3.5 | $85.00 | $43.4K | 422 | 34 |

About Agnico Eagle Mines

Agnico Eagle is a gold miner with mines in Canada, Mexico, Finland, and Australia. Agnico operated just one mine, LaRonde, as recently as 2008 before bringing its other mines online in rapid succession in the following years. It merged with Kirkland Lake Gold in 2022, acquiring the Detour Lake and Macassa mines in Canada along with the high-grade, low-cost Fosterville mine in Australia. It produced more than 3.4 million gold ounces in 2023 and had about 15 years of gold reserves at end 2023. Agnico Eagle is focused on increasing gold production in lower-risk jurisdictions and bought the remaining 50% of its Canadian Malartic mine along with the Wasamac project and other assets from Yamana Gold in 2023.

Having examined the options trading patterns of Agnico Eagle Mines, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Agnico Eagle Mines

- Currently trading with a volume of 2,327,317, the AEM’s price is down by -1.23%, now at $86.85.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 5 days.

Expert Opinions on Agnico Eagle Mines

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $85.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Jefferies has decided to maintain their Hold rating on Agnico Eagle Mines, which currently sits at a price target of $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Agnico Eagle Mines options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.