M&A Frenzy And Deflation Post-Election: Which Companies Are Ready To Win Big In Florida's Cannabis Market

With Florida’s recreational cannabis vote looming, Pablo Zuanic of Zuanic & Associates anticipates a high-stakes shakeup in the state’s cannabis market. His latest analysis reveals a volatile mix of market deflation, rapid retail expansion and an active M&A landscape as key companies position themselves to capitalize on post-election shifts.

For operators ready to seize these dynamics, the coming months following the on November 5 elections could bring significant growth opportunities…or intensified competition.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Market Deflation As Sales Drop Despite Volume Growth

According to Zuanic, Florida’s medical marijuana (MMJ) market is experiencing a deflationary trend. Q3 2024 sales were reported at $418 million—a 13% year-over-year drop, despite a 13% growth in flower volume and 6% in non-flower products reported by the Office of Medical Marijuana Use (OMMU).

This volume-sales disconnect points to a 23% year-over-year price decline, reflecting a more competitive landscape. “Price declines show that Florida’s cannabis market faces intense pressures,” Zuanic noted.

Expanded Retail With Varying Store Productivity

The state’s dispensary count reached 690 in October, up from 615 in 2023. Trulieve TCNNF leads with 155 stores, followed by Verano VRNOF (79) and AYR AYRWF (67).

Yet, store productivity differs significantly: Trulieve averages 4.06 ounces of flower and 9.71 million mg of non-flower sales per store quarterly, well above the industry average excluding Trulieve. Meanwhile, Verano and Curaleaf CURLF post lower figures, lagging notably in both flower and non-flower productivity per store.

Diverging Operator Growth And Market Dynamics

Florida’s operators have followed diverse growth paths. Smaller players like Sunburn and Green Dragon have seen remarkable growth – 903% and 605% increases in flower volumes over two years, respectively.

In non-flower sales, Green Dragon expanded by 1,500%, while Sanctuary grew by 576%.

Conversely, Cannabist CBSTF and iAnthus ITHUF reported declines in volume, with flower sales dropping 22% and 36%, respectively. “These disparities reveal how strategies differ between new and established players,” Zuanic observed.

M&A Landscape: Potential Buyers, Sellers, Strategic Realignments

Florida’s cannabis sector is primed for M&A activity, with some operators facing financial challenges and others expanding strategically.

Zuanic identifies AYR and iAnthus as likely sellers, citing “stretched balance sheets” that could position them as acquisition targets. Cannabist has already sold its Florida assets to a joint venture between MINT Cannabist and Shango.

For potential buyers, Green Thumb GTBIF, Curaleaf and Cresco are well-capitalized to acquire distressed or underperforming assets in the state.

SNDL‘s SNDL recent acquisition of Surterra suggests it will maintain its Florida operations, while Sunburn’s owner, who previously sold a business to Cresco CRLBF before re-entering through MedMen‘s Florida assets, may continue expanding or divest strategically.

“If recreational sales are legalized, M&A could further accelerate as financial pressures reshape the market,” Zuanic noted.

Projected Upside

If recreational cannabis is legalized, Zuanic projects the market could triple, reaching $6 billion. Cansortium could see an estimated 700% increase in market cap, with iAnthus and AYR potentially gaining 360% and 270%, respectively.

His methodology applies a 30% EBITDA margin and an 8x EV/EBITDA multiple to estimate value creation in a recreational market scenario. While the potential upside is promising, Zuanic advises caution, noting uncertainties around future regulations.

Changes in licensing or lobbying efforts from hemp advocates could impact the market’s growth trajectory. “Florida presents substantial opportunities, but investors should remain vigilant,” Zuanic concluded.

Read Next: Why Cannabis Investors Should Make This Bold Move Before Florida’s Vote: What To Buy And Sell Now

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should Investors Buy IBM Stock for its Quantum Potential?

IBM — International Business Machines Corporation — (IBM) stock has surged in 2024, outpacing the rest of the market and beating many of its sector peers. Investors appear buoyed by the company’s potential in artificial intelligence (AI), but this “potential” isn’t currently reflected in earnings forecasts. Quantum computing represents another area of great potential, and one where IBM has invested heavily. However, I feel it’s too early to invest in IBM for quantum potential, especially given the stock’s valuation. I’m neutral on this rather expensive stock.

IBM, founded in 1911, is a multinational technology corporation headquartered in Armonk, New York. Its positioning in the information technology segment predates pretty much all of its big tech peers, showcasing decades of leadership in hardware and enterprise solutions.

In light of this history, the company’s stock has risen significantly over the past 12 months—over 70% at the time of writing—largely fueled by excitement around artificial intelligence (AI), as investors have ploughed into stocks with exposure or potential exposure to AI.

However, IBM’s performance had broadly impressed investors until the Q3 results released on October 23. For example, IBM’s recurring revenue, represented by an Annual Recurring Revenue (ARR) of $14.1 billion, grew by 9% year-over-year in Q2, outpacing overall revenue growth of 4%. Meanwhile, the company’s software segment saw an 8% increase in revenue to $6.7 billion, indicating potential for future growth as it becomes a larger part of overall sales.

Moreover, these prospects are compounded by the hybrid cloud market, which is expected to grow significantly, with a compound annual growth rate of 12.4% from 2025 to 2033. Yet, despite these positive indicators, IBM’s stock surge appears more driven by AI hype than by substantial changes in its fundamental business performance.

Personally, I’m concerned that IBM’s exposure to AI might be overstated. While IBM has reported growth in its generative AI business, with a book of business reaching over $2 billion since the launch of watsonx, this figure is small compared to its total trailing twelve-month revenue of $62.36 billion. The company’s AI-related revenues represent a fraction of its overall business.

Moreover, revenue growth certainly isn’t groundbreaking. The 9% ARR year-over-year growth in Q2 was followed by just 1% growth in total revenue in Q3. This suggests that IBM is not yet positioned as a true software-centric company that could justify a higher valuation based solely on AI capabilities.

Verizon Just Gave Good News to Income Investors Who Love Its Ultra-High Dividend Yield

Many investors didn’t like Verizon Communications‘ (NYSE: VZ) third-quarter update on Tuesday. That’s obvious from Verizon stock sinking around 5% after the telecommunications giant reported its Q3 results.

But some investors should be pleased with Verizon’s latest update. Why? The company just gave good news to income investors who love its ultra-high dividend yield of nearly 6.5%.

Verizon announced Q3 revenue of $33.3 billion, flat year over year and slightly under the consensus estimate of $33.5 billion. It posted adjusted earnings per share of $1.19. Although this result was down from adjusted earnings per share of $1.22 in the prior-year period, it narrowly topped the average analysts’ estimate of $1.18 per share.

Wall Street analysts also focused on other figures in Verizon’s Q3 update. For example, the company reported total fixed wireless net additions of 363,000, bringing its subscriber base to nearly 4.2 million. This growth enabled Verizon to reach its fixed wireless subscriber target of 4 million to 5 million, 15 months ahead of schedule.

However, those aren’t the numbers that matter to income investors. Instead, they are more concerned with the financial metrics that make a difference in Verizon’s dividends continuing to flow and grow. And Verizon provided reasons to be confident about its dividend program in its Q3 update.

CEO Hans Erik Vestberg said in the Q3 earnings call that Verizon delivered the highest earnings before interest, taxes, depreciation, and amortization (EBITDA) in the company’s history. CFO Tony Skiadas noted that Verizon is on track to reach or exceed the midpoint of its guidance range for full-year adjusted EBITDA.

Skiadas added, “That strong EBITDA led to free cash flow of $14.5 billion year to date, and that’s consistent with the prior year.” He pointed out that the year-to-date free cash flow included an additional $2.5 billion in cash taxes.

Verizon’s leaders also expressed a strong commitment to the dividend program in the Q3 earnings call. Skiadas reiterated that the company’s top two capital allocation priorities are investing in the business and funding the quarterly dividend.

In September, Verizon announced it was increased the dividend for the 18th consecutive year. Skiadas said, “[O]ur goal is to put the board in a position for further dividend increases.”

How is the telecommunications company delivering on this goal? Vestberg highlighted the pending acquisition of Frontier Communications, which he said would expand Verizon’s total addressable market. He also maintained that Verizon’s broadband, mobility, and other services should enable the company to grow its EBITDA and cash flow.

Investors Behind Territorial Proposal Advance Offer with Detailed Disclosure to Board

Confidentially Provide Information Detailing Financial Wherewithal, Regulatory Experience and Oversubscribed Investor Interest

Reduce Minimum Tender Requirement from 70% to 51%

Call on Board to Recognize that Offer is “Reasonably Likely to Lead to a Superior Proposal”

Remind Shareholders That Board Has Failed to Justify Territorial’s Sale to Hope

Urge Territorial Shareholders to Vote AGAINST Hope Sale Again at the Adjourned Special Meeting of Stockholders on November 6, 2024

HONOLULU, Oct. 25, 2024 /PRNewswire/ — Investors behind a proposal submitted on August 26 to the Board of Directors (the “Board”) of Territorial Bancorp Inc. (“Territorial” or the “Company”) TBNK have disclosed information about themselves in an addendum sent to Territorial’s outside counsel today (the “Addendum”). The investors have offered repeatedly since late August to engage with the Board and advance their proposal toward a binding agreement that they believe will be better for all Territorial stakeholders.

The Addendum offers additional details about the seven seasoned bank investors backing the proposal, whose individual expressions of interest in acquiring Territorial shares total $134 million. That is $26 million more than the amount required to tender for 100% of Territorial’s shares at a price of $12.50 per share and nearly $80 million more than the amount required to tender for 51% of Territorial’s shares, a new reduced minimum threshold the investors have committed to in the Addendum.

The investors collectively manage $3.4 billion in investor capital and comprise a mix of funds, family offices and private investors who have executed hundreds of transactions like this. Two of the investors have opted to remain anonymous due to the Board’s history of aggressive and misleading public statements – detailed information about them is nevertheless provided in the Addendum.

“Territorial has perpetuated a false narrative about the relative risks of these two transactions. Territorial’s shareholders and Board should be comforted by the strong, oversubscribed interest in this transaction among the seven experienced investors who are backing this proposal,” said Jason Blumberg, Managing Member of Blue Hill Advisors. “Our proposal clearly exceeds the threshold of ‘reasonably likely to lead to a Superior Proposal,’ and the Board should engage immediately.”

Thus far, however, the investors have been stymied by the Board’s refusal to engage on any level. The Board has declined every overture, citing Territorial’s merger agreement with Hope which prohibits engagement until the Board determines that a proposal is “reasonably likely to lead to a Superior Offer.” 1 The investors firmly believe they have always cleared the “reasonably likely” hurdle and opted to send the Addendum to put to rest any questions about the viability of their offer.

The investors are now calling on the Board to uphold its fiduciary duty to shareholders and explore a potentially superior proposal that values Territorial at a 25% premium to the current value of the consideration shareholders would receive in a sale to Hope2. The Board should stop provoking the investors with ludicrous demands – for example, suggesting that Blue Hill Advisors, one of the investors behind the proposal, should make a sight-unseen “legally binding ‘hell or highwater’ commitment” 3 – and instead engage quickly.

Mr. Blumberg further commented, “The Superior Proposal criteria in the merger agreement clearly exist so that a competing bidder with a potentially superior offer can exchange the confidential information needed to move from a preliminary offer to a definitive, binding agreement, all while the Hope transaction proceeds in parallel. The criteria don’t just allow for, but explicitly anticipate, routine contingencies like due diligence that are inherent in any initial offer. There is no risk to Territorial shareholders since the Hope transaction can clearly proceed in parallel while the investors perform due diligence and move to a superior, final offer.”

Mr. Blumberg continued, “Territorial has adopted a confounding position, unsupported by the merger agreement, under which the preliminary offer must be fully baked, devoid of any contingencies including due diligence and with financing that is already committed before the Board will even consider engaging. Territorial’s unjustifiable position has created a roadblock that makes it impossible for us to deliver the certainty they claim to want.”

The investors maintain that Territorial shareholders are left with little choice but to continue opposing the Hope merger until the Board comes to the table or the deal is terminated, freeing Territorial’s Board to pursue a better deal. The investors have consistently maintained that virtually any deal would be better than a sale to Hope that (1) was struck near Territorial’s all-time-low share price, (2) values Territorial at the second lowest bank sale multiple on record and (3) deprives shareholders of any chance to recover the nearly 70% in value destroyed over the last five years. The improving interest rate outlook and M&A environment for banks only bolster the investors’ confidence that Territorial can and should do better.

Mr. Blumberg concluded, “Territorial shareholders should continue voting AGAINST the sale to Hope to force the Board to the table. The special meeting can be postponed one more time if Territorial cannot achieve the requisite shareholder support on November 6. The Board can use the extra time between now and the next meeting to give the investors access to information to finalize this superior proposal.”

More information on the investor proposal can be found at www.NewTerritorial.com and in a presentation titled, “A Better Deal for Territorial”.

Territorial shareholders are encouraged to contact Blue Hill Advisors for more information or to contact Territorial’s Board to express their support for this proposal. Shareholders who have already voted FOR the Hope merger but who wish to change their vote can still do so before the November 6 special meeting of Territorial stockholders by following the instructions for changing votes as described in the prospectus that Hope filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 22, 2024.

Contacts

For Media:

Breitenbush Partner

Andrew Wilson, 773-425-4991

awilson@breitenbushpartners.com

For Investors:

Blue Hill Advisors

Jason Blumberg, 917-733-0381

jason@bluehilladv.com

About Blue Hill Advisors

Blue Hill Advisors is an advisor to and investor in regional and community banks. The firm looks for opportunities that it believes have been substantially mispriced by the market and seeks to build long-term value through active management.

FORWARD-LOOKING STATEMENTS

Certain statements and information contained in this communication may be forward looking in nature and may constitute forward-looking statements. Forward-looking statements include all statements that are not historical facts and can typically be identified by words such as “may”, “will “, “expect”, “could”, “should”, “intend”, “commit”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, “intend”, or similar terminology, including by way of example and without limitation plans, intentions and expectations regarding the proposal to acquire Territorial and the anticipated results, benefits, synergies, costs, timing and other expectations of the benefits of a potential transaction.

Forward-looking statements are related to future, not past, events and are not guarantees of future performance. These statements are based on current expectations and projections about future events and, by their nature, address matters that are, to different degrees, uncertain and are subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future, and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in such statements as a result of a variety of factors, including, among other things, the ability of Territorial, on the one hand, and Blue Hill Advisors and certain other investors (collectively, the “Investors“), on the other hand, to agree on terms for the proposed transaction and, in the event a definitive transaction agreement is executed, the ability of the parties to obtain any necessary shareholder and regulatory approvals and financing, to satisfy any other conditions to the closing of the transaction and to consummate the proposed transaction on a timely basis, as well as changes in general economic, financial and market conditions and other changes in business conditions, changes in regulations, and many other factors, most of which are outside of the control of the Investors. The Investors expressly disclaim and do not assume any liability in connection with any inaccuracies in any of these forward-looking statements or in connection with any use by any party of such forward-looking statements. Any forward-looking statements contained in this communication speaks only as of the date of this communication.

The Investors undertake no obligation to update or revise its outlook or forward-looking statements, whether as a result of new developments or otherwise. Names, organizations and company names referred to may be the trademarks of their respective owners. This communication does not represent investment advice, a solicitation, a recommendation, an invitation, an offer for the purchase or sale of financial products and/or of any kind of financial services as contemplated by the laws in any country or state.

NO OFFER OR SOLICITATION

This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal that Investors have made for a transaction with Territorial. In furtherance of this proposal and subject to future developments, Investors or certain affiliated entities (and, if a negotiated transaction is agreed to, Territorial) may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document Investors or any of their affiliates and/or Territorial may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF TERRITORIAL ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT, TENDER OFFER STATEMENT, PROSPECTUS AND/OR OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of Territorial, as applicable. Investors and security holders of Territorial will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC through the web site maintained by the SEC at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC.

1 https://www.sec.gov/Archives/edgar/data/1447051/000110465924055737/tm2412965d1_ex2-1.htm

2 Based on Hope’s closing stock price on the Nasdaq on 10/25/24.

3 https://www.nasdaq.com/press-release/blue-hill-doubles-down-cloak-secrecy-and-unanswered-questions-2024-10-09

![]() View original content:https://www.prnewswire.com/news-releases/investors-behind-territorial-proposal-advance-offer-with-detailed-disclosure-to-board-302287791.html

View original content:https://www.prnewswire.com/news-releases/investors-behind-territorial-proposal-advance-offer-with-detailed-disclosure-to-board-302287791.html

SOURCE Blue Hill Advisors

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Voters Are Responding To Rising Home Prices – Could Kamala Harris Benefit On Election Day? Expert Says Yes

Home prices are a factor in the upcoming presidential election, with new research suggesting the housing market’s performance could influence voter behavior in key battleground states.

Nationally, home prices have surged 47% over the past four years through July of this year, according to data from the S&P CoreLogic Case-Shiller Home Price Index cited by Realtor.com. While the increase has created affordability challenges for first-time buyers, academic research indicates it might boost Vice President Kamala Harris’ electoral prospects.

Don’t Miss:

A recent study examining the relationship between housing prices and presidential elections found that counties seeing stronger home price gains tend to support the incumbent party’s candidate. The research, led by Eren Cifci, assistant professor of finance at Austin Peay State University, analyzed six presidential elections from 2000 to 2020.

“In our study, we found that when an incumbent party candidate runs for reelection, voters respond more strongly to increases in their home values and tend to favor the incumbent party,” Cifci said to Realtor. “We also found evidence that voters tend to favor the incumbent party even if a different candidate from the incumbent party runs for the election.”

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

The findings carry particular weight given the current housing landscape. Freddie Mac estimates a national shortage of at least 1.5 million housing units, contributing to the price surge both campaigns addressed in their policy platforms.

The Trump campaign has targeted Democratic policies as responsible for housing affordability issues while Harris has outlined plans to increase starter home availability.

Homeowners, who represent nearly 66% of housing units nationwide, could impact the election outcome. This demographic typically shows higher voter registration and turnout rates than renters. The study found that counties with superior home price gains four years before an election were more likely to vote to support the incumbent party’s candidate.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

“Particularly in such a close race, even small factors can have a significant impact on the outcome,” Cifci said. His research holds special relevance for swing states, where margins of victory often come down to a few thousand votes.

However, Cifci maintains measured expectations about the study’s predictive power. “There are multiple dynamics at play and several unique aspects of this election. I think it is hard to say with certainty how each factor will influence voter behavior.”

The housing market’s influence on voter behavior follows a pattern similar to the stock market’s traditional impact on incumbent support.

While Harris might not benefit as strongly as an incumbent president would, the research suggests rising home values could still work in her favor, particularly in closely contested counties.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Not Guilty Plea From Ex-Abercrombie CEO Jeffries – Faces $10M Bond And House Arrest

Former Abercrombie & Fitch Company ANF CEO Mike Jeffries has entered a plea of not guilty to allegations of sex trafficking and interstate prostitution.

Attorneys submitted the plea on Jeffries’ behalf in a New York federal court located on Long Island, reported BBC. He sat alongside them, clad in a sharp navy blue suit, his face revealing no emotion.

Jeffries faced indictment on Wednesday for 16 federal charges involving sex trafficking and international prostitution, with allegations suggesting he utilized a network of employees, contractors, and security personnel, while leading the retailer, reported CNN.

Jeffries, who joined Abercrombie & Fitch in 1992 and led the company to its dramatic rise, stepped down in 2014 after declining performance, including 11 consecutive quarters of negative comparable-store sales.

Read Next: Trump To Joe Rogan: ‘Biggest Mistake’ Was Trusting ‘Bad’ And ‘Disloyal’ People

According to Benzinga Pro, ANF stock has gained over 15% in the past six months. Investors can gain exposure to the stock via Two Roads Shared Trust Conductor Global Equity Value ETF CGV and Alpha Architect U.S. Quantitative Value ETF QVAL.

According to a report from ABC News, Jeffries’ partner Matthew Smith and a third man, Jim Jacobson, were also arrested in the investigation into possible sexual exploitation and abuse of young men.

Jacobson also entered a not guilty plea immediately after the former CEO. Meanwhile, Smith is set to make his courtroom debut in New York at a later date, BBC added.

The FBI opened an investigation into the former A&F CEO last year after a BBC report uncovered multiple men alleging that Jeffries and Smith sexually abused them at events hosted in their New York homes and hotels worldwide.

However, Jeffries will be placed under house arrest, permitted to leave his residences in New York and Florida only for medical appointments, meetings with his lawyers, and religious gatherings.

Meanwhile, the company will report its third quarter results on Tuesday, November 26, 2024. The street view for adjusted earnings per share is pegged at $2.36, while the analyst consensus estimate for quarterly revenues stands at $1.18 billion.

Read Next

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 High-Yield Dividend Stocks (and 1 ETF) You Can Buy and Hold for a Decade

You can build a portfolio one stock at a time, which is a great way to invest. Or you can save time and effort and use exchange-traded funds (ETFs) to quickly build a portfolio. A well-structured high-yield dividend ETF you should consider is the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD). But there are some noticeable missing pieces in the ETF, which is why you might want to buy both it and high-yield stocks Realty Income (NYSE: O) and W.P. Carey (NYSE: WPC). Here’s a look at all three.

The Schwab U.S. Dividend Equity ETF is a passively managed exchange-traded fund (ETF) that uses a unique screening approach to build its portfolio. It starts by screening for companies that have increased their dividend for 10 or more consecutive years, eliminating real estate investment trusts (REITs) from consideration (more on this in a second). Then a composite score is created for all the remaining stocks. The score includes cash flow to total debt, return on equity, dividend yield, and five-year dividend growth rate. The 100 highest-rated stocks get into the ETF.

What is basically going on here is that the Schwab U.S. Dividend Equity ETF is trying to create a portfolio that balances company quality, company growth, and dividend yield. You get all this for a fairly tiny expense ratio of 0.06%. While the close to 3.5% dividend yield may not sound huge, it is nearly three times higher than what you’d get from an S&P 500 index (SNPINDEX: ^GSPC) tracking ETF.

The Schwab U.S. Dividend Equity ETF is a fairly compelling core holding for dividend investors. Since the portfolio gets updated annually, you can also rest assured that you’re always going to own the kind of stocks you expect. Yet there are some glaring holes in the ETF’s portfolio.

For example, since it focuses on companies with more rapid dividend growth, the utility sector isn’t well represented in the Schwab U.S. Dividend Equity ETF. Utilities, which are a common holding for income investors, make up less than 1% of the portfolio. But, more importantly, REITs, a sector known for offering high yields, are excluded. So you can easily cherry-pick high-yield utility and REIT stocks to complement this ETF. To fill in the most obvious blank spot, two solid REIT options are Realty Income and W.P. Carey, which yield 5% and 6%, respectively.

Both of these companies are large net lease REITs, which means that their tenants are responsible for most of the operating costs of the properties they occupy. Although any single property is high-risk, across a large portfolio, the risks are fairly low. Realty Income is the largest net lease REIT, followed by W.P. Carey. Portfolio size isn’t an issue for either of them.

This Is What Whales Are Betting On Texas Instruments

Investors with a lot of money to spend have taken a bearish stance on Texas Instruments TXN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TXN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 22 uncommon options trades for Texas Instruments.

This isn’t normal.

The overall sentiment of these big-money traders is split between 40% bullish and 50%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $487,536, and 16 are calls, for a total amount of $655,379.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $195.0 to $230.0 for Texas Instruments over the last 3 months.

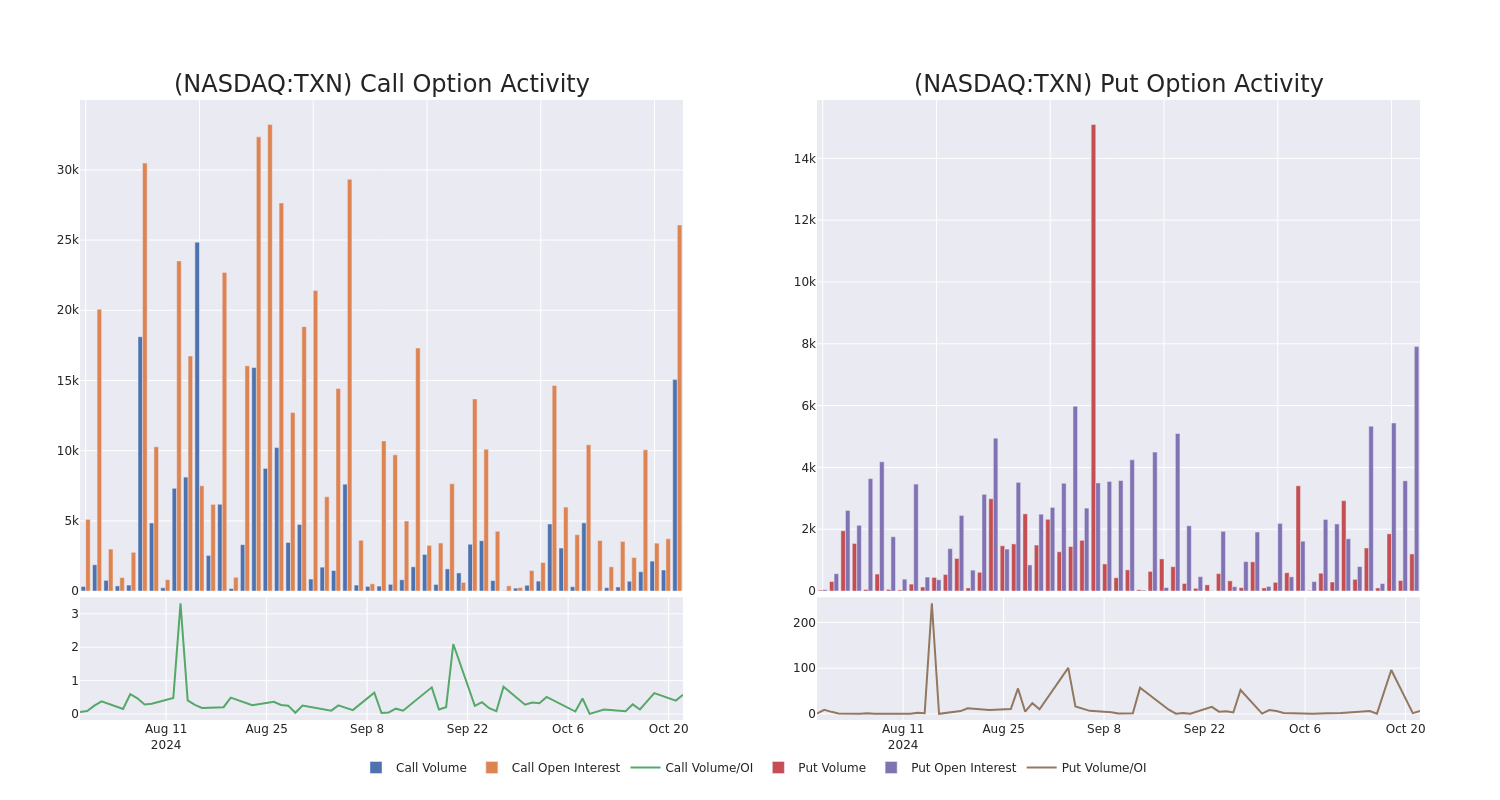

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Texas Instruments’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Texas Instruments’s whale trades within a strike price range from $195.0 to $230.0 in the last 30 days.

Texas Instruments 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | PUT | SWEEP | BULLISH | 10/17/25 | $33.8 | $33.65 | $33.65 | $230.00 | $296.1K | 0 | 204 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $4.0 | $3.85 | $4.0 | $205.00 | $82.8K | 3.0K | 603 |

| TXN | PUT | TRADE | BEARISH | 10/17/25 | $34.1 | $32.65 | $33.8 | $230.00 | $67.6K | 0 | 204 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $5.15 | $4.95 | $5.15 | $205.00 | $59.2K | 3.0K | 121 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $3.85 | $3.6 | $3.65 | $205.00 | $58.4K | 3.0K | 905 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Current Position of Texas Instruments

- Currently trading with a volume of 5,099,021, the TXN’s price is up by 0.15%, now at $206.93.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 88 days.

What Analysts Are Saying About Texas Instruments

In the last month, 5 experts released ratings on this stock with an average target price of $233.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Texas Instruments, targeting a price of $250.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Texas Instruments with a target price of $200.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Texas Instruments, targeting a price of $190.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Texas Instruments, targeting a price of $298.

* Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $230.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Texas Instruments, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.