Not Guilty Plea From Ex-Abercrombie CEO Jeffries – Faces $10M Bond And House Arrest

Former Abercrombie & Fitch Company ANF CEO Mike Jeffries has entered a plea of not guilty to allegations of sex trafficking and interstate prostitution.

Attorneys submitted the plea on Jeffries’ behalf in a New York federal court located on Long Island, reported BBC. He sat alongside them, clad in a sharp navy blue suit, his face revealing no emotion.

Jeffries faced indictment on Wednesday for 16 federal charges involving sex trafficking and international prostitution, with allegations suggesting he utilized a network of employees, contractors, and security personnel, while leading the retailer, reported CNN.

Jeffries, who joined Abercrombie & Fitch in 1992 and led the company to its dramatic rise, stepped down in 2014 after declining performance, including 11 consecutive quarters of negative comparable-store sales.

Read Next: Trump To Joe Rogan: ‘Biggest Mistake’ Was Trusting ‘Bad’ And ‘Disloyal’ People

According to Benzinga Pro, ANF stock has gained over 15% in the past six months. Investors can gain exposure to the stock via Two Roads Shared Trust Conductor Global Equity Value ETF CGV and Alpha Architect U.S. Quantitative Value ETF QVAL.

According to a report from ABC News, Jeffries’ partner Matthew Smith and a third man, Jim Jacobson, were also arrested in the investigation into possible sexual exploitation and abuse of young men.

Jacobson also entered a not guilty plea immediately after the former CEO. Meanwhile, Smith is set to make his courtroom debut in New York at a later date, BBC added.

The FBI opened an investigation into the former A&F CEO last year after a BBC report uncovered multiple men alleging that Jeffries and Smith sexually abused them at events hosted in their New York homes and hotels worldwide.

However, Jeffries will be placed under house arrest, permitted to leave his residences in New York and Florida only for medical appointments, meetings with his lawyers, and religious gatherings.

Meanwhile, the company will report its third quarter results on Tuesday, November 26, 2024. The street view for adjusted earnings per share is pegged at $2.36, while the analyst consensus estimate for quarterly revenues stands at $1.18 billion.

Read Next

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 High-Yield Dividend Stocks (and 1 ETF) You Can Buy and Hold for a Decade

You can build a portfolio one stock at a time, which is a great way to invest. Or you can save time and effort and use exchange-traded funds (ETFs) to quickly build a portfolio. A well-structured high-yield dividend ETF you should consider is the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD). But there are some noticeable missing pieces in the ETF, which is why you might want to buy both it and high-yield stocks Realty Income (NYSE: O) and W.P. Carey (NYSE: WPC). Here’s a look at all three.

The Schwab U.S. Dividend Equity ETF is a passively managed exchange-traded fund (ETF) that uses a unique screening approach to build its portfolio. It starts by screening for companies that have increased their dividend for 10 or more consecutive years, eliminating real estate investment trusts (REITs) from consideration (more on this in a second). Then a composite score is created for all the remaining stocks. The score includes cash flow to total debt, return on equity, dividend yield, and five-year dividend growth rate. The 100 highest-rated stocks get into the ETF.

What is basically going on here is that the Schwab U.S. Dividend Equity ETF is trying to create a portfolio that balances company quality, company growth, and dividend yield. You get all this for a fairly tiny expense ratio of 0.06%. While the close to 3.5% dividend yield may not sound huge, it is nearly three times higher than what you’d get from an S&P 500 index (SNPINDEX: ^GSPC) tracking ETF.

The Schwab U.S. Dividend Equity ETF is a fairly compelling core holding for dividend investors. Since the portfolio gets updated annually, you can also rest assured that you’re always going to own the kind of stocks you expect. Yet there are some glaring holes in the ETF’s portfolio.

For example, since it focuses on companies with more rapid dividend growth, the utility sector isn’t well represented in the Schwab U.S. Dividend Equity ETF. Utilities, which are a common holding for income investors, make up less than 1% of the portfolio. But, more importantly, REITs, a sector known for offering high yields, are excluded. So you can easily cherry-pick high-yield utility and REIT stocks to complement this ETF. To fill in the most obvious blank spot, two solid REIT options are Realty Income and W.P. Carey, which yield 5% and 6%, respectively.

Both of these companies are large net lease REITs, which means that their tenants are responsible for most of the operating costs of the properties they occupy. Although any single property is high-risk, across a large portfolio, the risks are fairly low. Realty Income is the largest net lease REIT, followed by W.P. Carey. Portfolio size isn’t an issue for either of them.

This Is What Whales Are Betting On Texas Instruments

Investors with a lot of money to spend have taken a bearish stance on Texas Instruments TXN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TXN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 22 uncommon options trades for Texas Instruments.

This isn’t normal.

The overall sentiment of these big-money traders is split between 40% bullish and 50%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $487,536, and 16 are calls, for a total amount of $655,379.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $195.0 to $230.0 for Texas Instruments over the last 3 months.

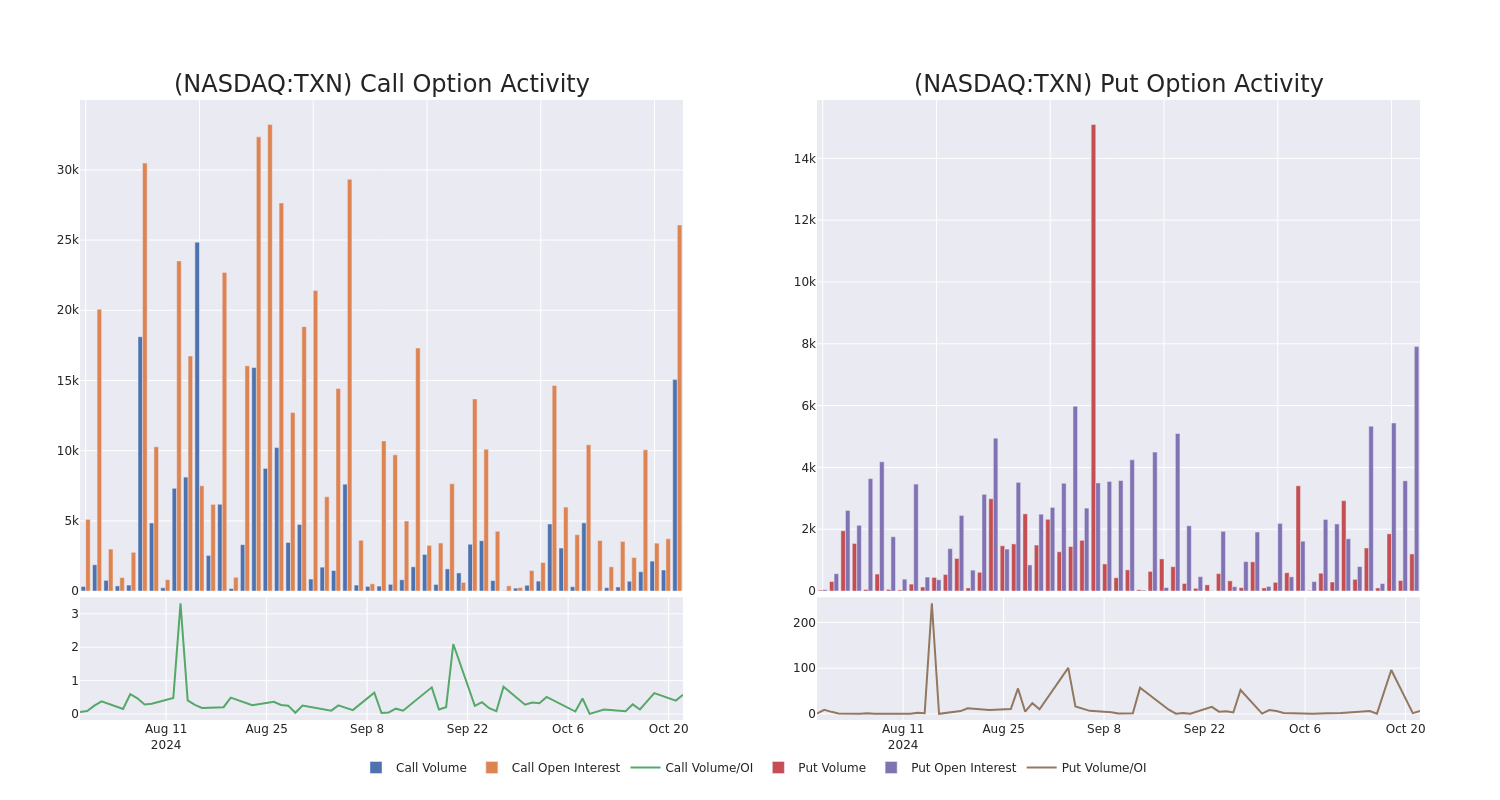

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Texas Instruments’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Texas Instruments’s whale trades within a strike price range from $195.0 to $230.0 in the last 30 days.

Texas Instruments 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | PUT | SWEEP | BULLISH | 10/17/25 | $33.8 | $33.65 | $33.65 | $230.00 | $296.1K | 0 | 204 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $4.0 | $3.85 | $4.0 | $205.00 | $82.8K | 3.0K | 603 |

| TXN | PUT | TRADE | BEARISH | 10/17/25 | $34.1 | $32.65 | $33.8 | $230.00 | $67.6K | 0 | 204 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $5.15 | $4.95 | $5.15 | $205.00 | $59.2K | 3.0K | 121 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $3.85 | $3.6 | $3.65 | $205.00 | $58.4K | 3.0K | 905 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Current Position of Texas Instruments

- Currently trading with a volume of 5,099,021, the TXN’s price is up by 0.15%, now at $206.93.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 88 days.

What Analysts Are Saying About Texas Instruments

In the last month, 5 experts released ratings on this stock with an average target price of $233.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Texas Instruments, targeting a price of $250.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Texas Instruments with a target price of $200.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Texas Instruments, targeting a price of $190.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Texas Instruments, targeting a price of $298.

* Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $230.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Texas Instruments, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: With $218k in My IRA at 67, Should I Start Withdrawals to Avoid Bigger RMDs?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

I’m turning 68 shortly and plan to wait to claim my Social Security at age 70 to maximize the monthly benefit. I also plan to retire at the end of the year, if not sooner (so in three months or less). Does withdrawing from my traditional IRAs (current balance is $215,000) to reduce the income tax on my RMDs outweigh the benefit of keeping those withdrawals invested and growing tax-deferred? My understanding is that if I withdraw amounts up to my standard deduction, then those amounts would be tax-free.

– Austen

Retirement withdrawals, Social Security benefits, required minimum distribution (RMDs), taxes … there are a lot of moving parts when it comes to making decisions about your retirement income. Reducing the amount of money that’s subject to RMDs can help minimize your taxes once they kick in. This may also help avoid taxes on your Social Security benefits.

If you don’t need the money now, but want to reduce RMDs later, one of the best moves might be converting a portion of your IRA to a Roth IRA each year. That can help reduce future required withdrawals and allow your money to grow tax-free, though there can be tax consequences for certain withdrawals. (A financial advisor can help guide you through the Roth conversion process and potentially avoid unwanted tax consequences.)

Delaying Social Security benefits until age 70 makes sense for certain people. That’s when you can receive the largest possible monthly payment. You can start collecting Social Security retirement benefits at age 62, but the monthly amount will be reduced by 30%.

For example, if your full retirement benefit would be $2,000, your payment at age 62 would be only $1,400. However, waiting until age 70 would give you a maximum monthly benefit of $2,480.

Still, there are some circumstances in which starting sooner can be more beneficial, such as:

• You need the money to make ends meet

• You’re in poor health or have a shorter life expectancy

• You’re completely done working

• Your spouse has been a higher earner and will delay their benefits

Remember, there’s no right answer that works for everyone, and you should do what makes the most sense for your family. (And if you need help planning for Social Security, consider working with a financial advisor.)

Once you turn age 73, you have to start taking required minimum distributions – known as “RMDs” – from all of your traditional retirement accounts, including IRAs and 401(k)s. Your RMD is calculated based on your age, life expectancy and account balance according to IRS Uniform Lifetime Table. If you have multiple IRAs, you’ll need to figure out the RMDs for each separately.

48-Year-Old Earning $2,200 Per Month in Dividends With $378,000 Portfolio Reveals His Portfolio: Top 9 Stocks and ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Should you invest in growth stocks for capital gains through stock price appreciation or in dividend stocks for steady, reliable income? There’s no one-size-fits-all answer, but patient investors are crushing it with income strategies, earning substantial returns through regular dividends.

About two months ago, a dividend investor shared his success story and income report on r/Dividends – a community of over 600,000 members on Reddit. The investor, 48, said he was collecting about $2,200 per month in dividend income with a portfolio worth $378,351. This gives the portfolio a strong dividend yield of over 7%.

Don’t Miss Out:

The investor was asked about his expectations of capital growth from his portfolio. Here was his response:

“I expect it to grow between 5-7% annually without reinvesting dividends. Yes, I am reinvesting dividends. With dividends reinvested, I expect it to grow 8-10% annually.”

Based on the screenshots shared by the investor publicly, let’s examine some of the biggest holdings of this high-yield dividend portfolio.

Vanguard 500 Index Fund Admiral Shares

Vanguard 500 Index Fund Admiral Shares (MUTF: VFIAX) was one of the Redditor’s biggest positions, earning $2,200 per month in dividends. His portfolio screenshots showed that VFIAX accounted for about 34.5% of the entire portfolio. This fund tracks the S&P 500 Index, with about 79% of the portfolio comprising large-cap stocks. The fund yields 1.3% and pays quarterly dividends.

Fidelity Total Bond K6 Fund

Fidelity Total Bond K6 Fund (FTKFX) invests in U.S. government securities, investment-grade corporate bonds, mortgage-backed securities and other debt instruments. The fund suits investors looking for safer, fixed-income investments rather than stocks. FTKFX has a dividend yield of about 4.5% and pays monthly. About 32% of the investor’s total portfolio making $2,200 per month was invested in FTKFX.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!.

Billionaires Are Buying This Cryptocurrency That Could Soar 200% Over the Next 12 Months, According to an Investment Firm

After trading down or sideways for much of the past seven months, Bitcoin (CRYPTO: BTC) may finally be ready for a major breakout. The investment firm Bernstein has just released a report detailing all the reasons it thinks Bitcoin could hit a new all-time high of $200,000 by the end of 2025.

Based on Bitcoin’s current price of about $68,000, that would represent nearly a 200% gain. As a result, billionaire investors appear to be rushing to buy the cryptocurrency right now. The most notable of these include hedge fund managers and tech entrepreneurs, and all seem to believe that Bitcoin is poised for a major rally after the 2024 presidential election. So, could they be right?

Michael Saylor, executive chairman of MicroStrategy (NASDAQ: MSTR), is arguably the most prominent of the billionaire bulls. At a Bitcoin conference in Nashville, Tennessee, this past summer, he predicted that the digital coin could hit a price of $13 million by the year 2045. And he continues to buy aggressively for MicroStrategy, to the point where the company now holds more than 1% of all Bitcoin in the world.

Other tech billionaires are also jumping into Bitcoin, including Mark Cuban and Jack Dorsey, head of Block. So are top Silicon Valley venture capitalists, some of whom are now getting involved in the 2024 presidential election. As a sign of their bullish outlook for crypto, Dorsey recently predicted that the crypto could hit a price of $1 million by 2030.

Lastly, there are the billionaire hedge fund managers who are loading up on the new spot Bitcoin exchange-traded funds (ETFs). Based on 13F data from the Securities and Exchange Commission, it’s possible to piece together which funds are buying it, as well as how much they own.

One of the biggest names to watch is Millennium Management, led by the billionaire Israel Englander, who loaded up on $2 billion worth of Bitcoin ETFs at the start of the year. All told, there are now more than 600 investment firms that have significant holdings of the Bitcoin ETFs.

Based on the above, it might be easy to conclude that these billionaires are primarily buying Bitcoin because they expect its price to increase significantly over the short run. In the crypto industry, this is known as “Number Go Up.” You buy Bitcoin because you hope that its price will go up, and you don’t worry about why.

But that is likely painting too simplistic a picture of billionaire buying activity. As part of its $200,000 price prediction for Bitcoin, Bernstein laid out a number of compelling reasons to buy it.

MDJM LTD Received Nasdaq Notification Letter Regarding Bid Price Deficiency

LETHAM, Scotland, Oct. 25, 2024 /PRNewswire/ — MDJM LTD MDJH (the “Company” or “MDJM”), an integrated global culture-driven asset management company, today announced that the Company received a letter (the “Notification Letter”) from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) on October 23, 2024, notifying the Company that it is not in compliance with the minimum bid price requirement set forth in the Nasdaq Listing Rules for continued listing on the Nasdaq.

Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of US$1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. Based on the closing bid price of the Company’s ordinary shares for the 30 consecutive business days from September 11, 2024 to October 22, 2024, the Company no longer meets the minimum bid price requirement.

The Notification Letter does not impact the Company’s listing on the Nasdaq Capital Market at this time. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided 180 calendar days, or until April 21, 2025, to regain compliance with Nasdaq Listing Rule 5550(a)(2). If at any time during such 180-day period the closing bid price of the Company’s ordinary shares is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company written confirmation of compliance.

If the Company does not regain compliance during such 180-day period, the Company may be eligible for an additional 180 calendar days, provided that the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq except for Nasdaq Listing Rule 5550(a)(2), and provides Nasdaq with a written notice of its intention to cure this deficiency during the second compliance period, by effecting a reverse stock split, if necessary.

About MDJM LTD

MDJM LTD is a global culture-driven asset management company focused on transforming historical properties into cultural hubs that blend modern digital technology with rich historical value. The Company is actively expanding its operations in the UK, where it is developing projects such as Fernie Castle in Scotland and the Robin Hill Property in England. These properties are being remodeled into multi-functional cultural venues that will feature fine dining, hospitality services, art exhibitions, and cultural exchange events. As part of its broader strategy, MDJM is positioning itself as a hub for artisan exchanges, art shows, and sales, leveraging its historical properties as platforms for promoting Eastern and Western cultural exchanges. This initiative reflects the Company’s commitment to furthering its global market expansion and enhancing its cultural business footprint. For more information regarding the Company, please visit http://ir.mdjmjh.com.

Forward-Looking Statements

This announcement may contain forward-looking statements. All statements other than statements of historical fact in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s annual report on Form 20-F and its other filings with the U.S. Securities and Exchange Commission.

Investor Contact:

Sherry Zheng

Weitian Group LLC

Email: shunyu.zheng@weitian-ir.com

Phone: +1 718-213-7386

![]() View original content:https://www.prnewswire.com/news-releases/mdjm-ltd-received-nasdaq-notification-letter-regarding-bid-price-deficiency-302287548.html

View original content:https://www.prnewswire.com/news-releases/mdjm-ltd-received-nasdaq-notification-letter-regarding-bid-price-deficiency-302287548.html

SOURCE MDJM LTD

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Canfor Pulp reports results for the third quarter of 2024

VANCOUVER, BC, Oct. 25, 2024 /CNW/ – Canfor Pulp Products Inc. (“The Company” or “CPPI”) CFX today reported its third quarter of 2024 results:

Overview.

- Q3 2024 operating loss of $209 million, includes a $211 million asset write-down and impairment charge in the pulp segment resulting from further deterioration in economic fibre availability following recent British Columbia Interior sawmill closure announcements.

- After taking into consideration one-time items, Q3 2024 operating income of $2 million compared to similarly adjusted operating loss of $6 million in Q2 2024.

- Modest improvement in NBSK pulp unit sales realizations driven by steady North American pulp pricing through most of the third quarter and favourable timing lag in shipments, despite weak demand in China and notable increase in pulp producer inventory levels.

- Orderly wind down of one production line at Northwood NBSK pulp mill completed in August.

Financial results.

The following table summarizes select financial information for CPPI for the comparative periods:

|

(millions of Canadian dollars, except per share amounts) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

||||||||

|

Sales |

$ |

193.2 |

$ |

220.0 |

$ |

635.5 |

$ |

188.8 |

$ |

681.6 |

|||

|

Reported operating income (loss) before amortization, asset write-down and impairment |

$ |

18.8 |

$ |

11.0 |

$ |

31.0 |

$ |

(27.7) |

$ |

(43.6) |

|||

|

Reported operating loss |

$ |

(209.3) |

$ |

(5.6) |

$ |

(230.6) |

$ |

(49.3) |

$ |

(112.4) |

|||

|

Adjusted operating income (loss) before amortization, asset write-down and impairment1 |

$ |

18.8 |

$ |

11.0 |

$ |

31.0 |

$ |

(29.7) |

$ |

(35.1) |

|||

|

Adjusted operating income (loss)1 |

$ |

1.7 |

$ |

(5.6) |

$ |

(19.6) |

$ |

(51.3) |

$ |

(103.9) |

|||

|

Net loss |

$ |

(156.1) |

$ |

(6.3) |

$ |

(164.8) |

$ |

(35.7) |

$ |

(82.9) |

|||

|

Net loss per share, basic and diluted |

$ |

(2.39) |

$ |

(0.10) |

$ |

(2.53) |

$ |

(0.55) |

$ |

(1.27) |

|||

|

Adjusted net loss1 |

$ |

(2.1) |

$ |

(6.3) |

$ |

(10.8) |

$ |

(35.7) |

$ |

(82.9) |

|||

|

Adjusted net loss per share, basic and diluted1 |

$ |

(0.03) |

$ |

(0.10) |

$ |

(0.17) |

$ |

(0.55) |

$ |

(1.27) |

|||

|

1. Adjusted results referenced throughout this news release are defined as non-IFRS financial measures. For further details, refer to the “Non-IFRS financial measures” section of this document. |

For the third quarter of 2024, the Company reported an operating loss of $209.3 million, including an asset write-down and impairment charge totaling $211.0 million within its pulp segment.

In recent years, the Company, like other pulp producers in central and northern British Columbia (“BC”), has experienced a significant reduction in the supply of sawmill residual chips driven by extensive temporary and permanent sawmill curtailments and closures in the region. In response to these fibre constraints, the Company has taken several actions including securing additional fibre supply, prioritizing discretionary capital spending to maximize fibre utilization and recovery, as well as making rationalization decisions with respect to the Company’s operating footprint. Notably, the Company permanently closed the pulp line at its Prince George pulp and paper mill in early 2023, and more recently, completed the wind down of one production line at the Company’s Northwood Northern Bleached Softwood Kraft (“NBSK”) pulp mill (“Northwood”) in August. Collectively, these curtailments reduce the Company’s annual market kraft pulp production by approximately 580,000 tonnes.

During the third quarter of 2024, these fibre challenges were further exacerbated by additional sawmill closure announcements in the BC Interior, which were in response to weak lumber market conditions, upcoming increases in US tariffs on lumber exports and various regulatory complexities. As a result, the reduction in fibre supply as well as the ongoing uncertainty surrounding economic fibre availability continue to impact the Company and consequently, an asset write-down and impairment charge of $211.0 million was recognized in the third quarter of 2024, as a reduction to the carrying value of the Company’s pulp segment assets.

After adjusting for the asset write-down and impairment charge, the Company’s operating income for the third quarter of 2024 was $1.7 million, a $7.3 million improvement compared to the second quarter of 2024. Despite some moderation in US-dollar pulp list prices to China during the current quarter, the Company’s results largely reflected modestly higher NBSK pulp unit sales realizations, offset in part by reduced pulp production and shipment volumes in the period following the successful wind down of one production line at Northwood in August 2024.

Commenting on the Company’s third quarter of 2024 results, CPPI’s President and Chief Executive Officer, Kevin Edgson, said, “The Company continues to face persistent challenges accessing economic fibre, the results of which led to another curtailment of our operations this quarter. These decisions weigh heavily on our results, as well as our employees, their families and the local communities. Despite these challenges, our business realized improved adjusted operating earnings this quarter, and we executed a safe, smooth and efficient wind down of one line at Northwood.”

Third quarter highlights.

Global softwood pulp market fundamentals experienced downward pressure throughout the third quarter of 2024 primarily driven by weak demand from China, as well as the introduction of additional global hardwood capacity. These factors, when combined with the traditional seasonal summer slowdown in global demand, led to a moderation in purchasing activity and prices during the current period. As a result, NBSK US-dollar pulp list prices to China, the world’s largest consumer of pulp, declined in the quarter to a low of US$750 per tonne in August, before stabilizing through the balance of the period, ending September at US$754 per tonne. For the current quarter overall, US-dollar NBSK pulp list prices to China averaged US$771 per tonne, down US$40 per tonne, or 5%, from the prior quarter. Other global regions, including North America, experienced a delayed impact on price moderation, as prices remained steady for most of the third quarter, with slight declines seen towards the end of the period. As a result of these market conditions, particularly in China, global softwood pulp producer inventories experienced a notable increase in the current period to well above the balanced range, ending August at 50 days of supply, an increase of 12 days compared to June 2024.

Pulp production was 125,000 tonnes for the third quarter of 2024, down 5,000 tonnes, or 4%, from the second quarter of 2024, principally reflecting the wind down of one pulp line at the Company’s Northwood pulp mill, which was completed safely and efficiently in August 2024 (approximately 50,000 tonnes).

The Company’s paper segment experienced an operating loss of $0.8 million in the current quarter, compared to operating income of $1.9 million in the previous quarter. This decline was largely driven by reduced paper production and shipments in the current period, primarily as a result of minor mechanical failures at the paper machine.

Outlook.

Looking forward, global softwood pulp market conditions are anticipated to experience a slight improvement through the fourth quarter of 2024, as demand from the Chinese market is forecast to gradually recover and as elevated inventory levels slowly begin to normalize following the end of the seasonally slower summer months.

Results in the fourth quarter of 2024 will reflect the full wind down of one production line at the Company’s Northwood pulp mill, including the impact on pulp production (a reduction of approximately 300,000 tonnes of market kraft pulp annually), shipments and costs. Looking forward, the Company remains focused on optimizing its operating footprint, enhancing operational reliability and closely managing manufacturing and fibre costs.

In addition, the Company will continue to evaluate operating conditions and adjust operating rates at its pulp mills to align with economically viable fibre supply. These factors could also affect the Company’s operating plan, liquidity, cash flows and the valuation of long-lived assets.

Demand for bleached kraft paper is projected to weaken somewhat through the fourth quarter of 2024 with a modest slowdown in kraft paper demand anticipated.

No major maintenance outages are planned for the fourth quarter of 2024.

Additional information and conference call.

A conference call to discuss the third quarter’s financial and operating results will be held on Monday, October 28, 2024, at 8:00 AM Pacific time. To participate in the call, please dial Toll-Free 1-888-510-2154. For instant replay access until November 11, 2024, please dial Toll-Free 1-888-660-6345 and enter participant pass code 89443#.

The conference call will be webcast live and will be available at www.canfor.com. This news release, the attached financial statements and a presentation used during the conference call can be accessed via the Company’s website at www.canfor.com/investor-relations/webcasts.

Non-IFRS financial measures.

Throughout this press release, reference is made to certain non-IFRS financial measures which are used to evaluate the Company’s performance but are not generally accepted under IFRS and may not be directly comparable with similarly titled measures used by other companies. The following table provides a reconciliation of these non-IFRS financial measures to figures reported in the Company’s condensed consolidated interim financial statements:

|

(millions of Canadian dollars) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

|||||||

|

Reported operating loss |

$ |

(209.3) |

$ |

(5.6) |

$ |

(230.6) |

$ |

(49.3) |

$ |

(112.4) |

||

|

Asset write-down and impairment |

$ |

211.0 |

$ |

– |

$ |

211.0 |

$ |

– |

$ |

– |

||

|

Inventory write-down (recovery) |

$ |

– |

$ |

– |

$ |

– |

$ |

(2.0) |

$ |

8.5 |

||

|

Adjusted operating income (loss) |

$ |

1.7 |

$ |

(5.6) |

$ |

(19.6) |

$ |

(51.3) |

$ |

(103.9) |

||

|

Amortization |

$ |

17.1 |

$ |

16.6 |

$ |

50.6 |

$ |

21.6 |

$ |

68.8 |

||

|

Adjusted operating income (loss) before amortization, asset write-down |

$ |

18.8 |

$ |

11.0 |

$ |

31.0 |

$ |

(29.7) |

$ |

(35.1) |

||

|

(millions of Canadian dollars) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

||||||

|

Net loss |

$ |

(156.1) |

$ |

(6.3) |

$ |

(164.8) |

$ |

(35.7) |

$ |

(82.9) |

|

|

Asset write-down and impairment, net of tax |

$ |

154.0 |

$ |

– |

$ |

154.0 |

$ |

– |

$ |

– |

|

|

Adjusted net loss |

$ |

(2.1) |

$ |

(6.3) |

$ |

(10.8) |

$ |

(35.7) |

$ |

(82.9) |

|

Forward-looking statements.

Certain statements in this press release constitute “forward-looking statements” which involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. Words such as “expects”, “anticipates”, “projects”, “intends”, “plans”, “will”, “believes”, “seeks”, “estimates”, “should”, “may”, “could”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are based on Management’s current expectations and beliefs and actual events or results may differ materially. There are many factors that could cause such actual events or results expressed or implied by such forward-looking statements to differ materially from any future results expressed or implied by such statements. Forward-looking statements are based on current expectations and Canfor assumes no obligation to update such information to reflect later events or developments, except as required by law.

About Canfor Pulp Products Inc.

Canfor Pulp Products Inc. (“Canfor Pulp” or “CPPI”) is a leading global supplier of pulp and paper products with operations in the northern interior of British Columbia (“BC”). Canfor Pulp operates two mills in Prince George, BC with a total capacity of 780,000 tonnes of Premium Reinforcing Northern Bleached Softwood Kraft (“NBSK”) pulp and 140,000 tonnes of kraft paper. CPPI shares are traded on the Toronto Stock Exchange under the symbol CFX. For more information visit canfor.com.

SOURCE Canfor Pulp Products Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c9231.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c9231.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.