First Solar's Options: A Look at What the Big Money is Thinking

Financial giants have made a conspicuous bearish move on First Solar. Our analysis of options history for First Solar FSLR revealed 21 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $2,392,752, and 13 were calls, valued at $1,524,988.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $105.0 and $240.0 for First Solar, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for First Solar options trades today is 717.67 with a total volume of 2,830.00.

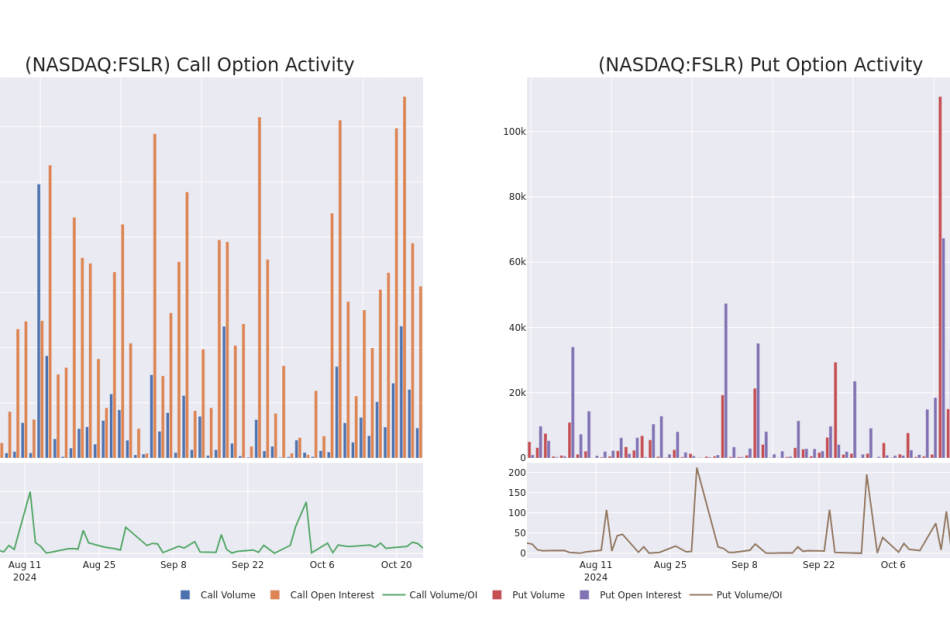

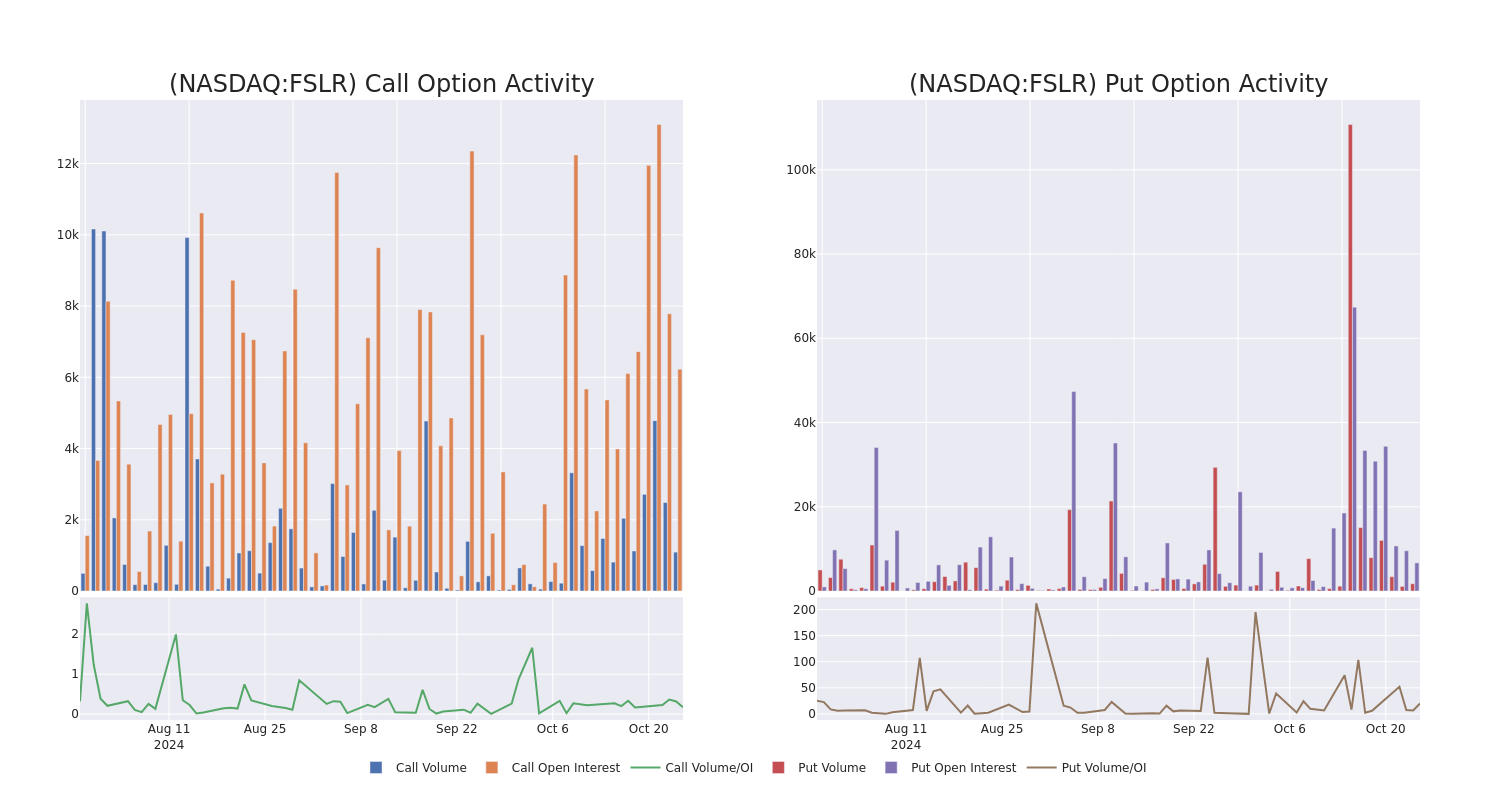

In the following chart, we are able to follow the development of volume and open interest of call and put options for First Solar’s big money trades within a strike price range of $105.0 to $240.0 over the last 30 days.

First Solar Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FSLR | PUT | SWEEP | BULLISH | 01/17/25 | $12.15 | $11.65 | $11.9 | $175.00 | $1.4M | 2.9K | 800 |

| FSLR | CALL | TRADE | BEARISH | 12/20/24 | $14.3 | $14.0 | $14.0 | $220.00 | $910.0K | 511 | 656 |

| FSLR | PUT | TRADE | BULLISH | 01/17/25 | $12.25 | $11.9 | $11.9 | $175.00 | $476.0K | 2.9K | 400 |

| FSLR | PUT | TRADE | BEARISH | 11/01/24 | $10.8 | $9.95 | $10.8 | $200.00 | $162.0K | 503 | 0 |

| FSLR | PUT | SWEEP | BULLISH | 06/20/25 | $8.45 | $8.3 | $8.3 | $135.00 | $146.0K | 861 | 177 |

About First Solar

First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company’s solar modules use cadmium telluride to convert sunlight into electricity. This is commonly called thin-film technology. First Solar is the world’s largest thin-film solar module manufacturer. It has production lines in Vietnam, Malaysia, the United States, and India.

In light of the recent options history for First Solar, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

First Solar’s Current Market Status

- Currently trading with a volume of 1,866,540, the FSLR’s price is up by 1.25%, now at $198.5.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 4 days.

Professional Analyst Ratings for First Solar

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $284.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Roth MKM has decided to maintain their Buy rating on First Solar, which currently sits at a price target of $280.

* Showing optimism, an analyst from Citigroup upgrades its rating to Buy with a revised price target of $254.

* Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on First Solar with a target price of $266.

* Reflecting concerns, an analyst from Truist Securities lowers its rating to Buy with a new price target of $300.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on First Solar with a target price of $321.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest First Solar options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy Nvidia Before Nov. 20? Here's What History Says.

Nvidia (NASDAQ: NVDA) has established itself as a successful investment over time, climbing more than 2,700% over the past five years. And momentum has strengthened as this top chip designer reported quarter after quarter of triple-digit earnings growth. This is thanks to the dominance Nvidia has built in the artificial intelligence (AI) chip market, with the company now holding about 80% share.

And Nvidia isn’t only winning in AI chips but in the entire AI market, which is forecast to grow from $200 billion today to $1 trillion by the end of the decade. This is because Nvidia offers a wide variety of products and services to suit any company developing an AI platform. Speaking on a BG2 podcast earlier this month, CEO Jensen Huang referred to the company as the “on ramp” to the AI world.

Next up for Nvidia is the company’s third-quarter earnings report, scheduled for Nov. 20. Investors will focus on earnings figures, the ability of Nvidia to meet its gross margin goal, and comments about an important upcoming product launch. Should you buy Nvidia stock before this key report? Let’s take a look at what history has to say.

First, let’s consider what investors are expecting from the tech giant. Nvidia has forecast double-digit revenue growth, slower than the recent triple-digit growth. But it’s important to keep in mind that comparison quarters are getting tougher, with Nvidia’s last third quarter already bringing in more revenue than the company made in an entire year just a few years ago — back in fiscal 2021. So double-digit growth should still be considered extremely strong performance at this stage of the Nvidia story.

The company, which last quarter reported gross margin of 75%, aims to maintain the greater than 70% margin level. It’s forecast gross margin in the mid-70% range for the third quarter and the full year. This level of profitability along with double-digit revenue growth should reinforce investors’ confidence in this top tech player.

Finally, investors will be looking for comments about the upcoming launch of Nvidia’s Blackwell architecture and best-performing chip ever. So far, so good — with Nvidia’s Huang saying on the latest earnings call that demand surpassed supply and that should continue into next year.

Now, let’s consider how Nvidia’s stock may react to the Nov. 20 earnings report. And one way to do that is to look at historical trends for Nvidia following these reports. Looking back at the past eight quarters, Nvidia stock rose on six of those occasions in the one-month period following the report. And four of those times, the stock posted double-digit gains.

‘Load Up,’ Says J.P. Morgan About These 3 Nuclear Power Stocks

After five years of closure, the Three Mile Island nuclear power plant is set to reopen. Known for the infamous 1979 partial meltdown that cemented its place in the annals of anti-nuclear activism, the plant is now being revived due to a shift in economic and energy trends.

At the core of the nuclear industry’s resurgence is the rising demand for electricity. The rapid expansion of power-hungry AI-driven data centers, combined with government initiatives promoting a transition from fossil fuels to electric power, has made it essential to boost electricity generation – and nuclear energy is once again becoming a key player in this landscape.

Watching the electric utility stocks for J.P. Morgan, analyst Jeremy Tonet writes of the sector’s growing shift toward nuclear, “We see structural tailwinds, including manufacturing onshoring, broader electrification trends (transportation, heating, and more), as well data center development underpinning a paradigm shift in power demand. We do not see competitive market supply growth matching this demand, enabling IPPs to capture outsized margins for an extended period of time,” Tonet explained. “More specifically, we see burgeoning hyperscaler demand growth focused on firm, carbon-free power, transforming nuclear power into a unique, scarce offering that will command a substantial premium.”

Following from this, Tonet goes on to recommend three nuclear power stocks for investors to buy – now, as the industry is beginning to power up. According to the data from TipRanks, these are all Buy-rated equities that have seen recent strong share appreciation – yet Tonet sees more upside ahead. Here are the details.

We’ll start with Talen Energy, a major independent power and infrastructure company on the North American scene. Talen was founded in 2015, and in its near-decade of business, which has already included bankruptcy in 2022 and restructuring the following year, has expanded to reach a market cap of $9 billion. The company focuses on delivering power generation that is both safe and reliable, providing investors with the most value for every megawatt of energy produced.

Talen’s power generation portfolio includes all of the major assets behind the U.S. electric grid: natural gas, coal, oil, and nuclear. The firm’s operations are built around its Susquehanna nuclear power plant, the nation’s sixth-largest operating nuclear power facility. Talen’s total portfolio has operations in five states—Maryland, Pennsylvania, New Jersey, Massachusetts, and Montana—and has a total of 10.7 gigawatts of power generation. Of that total, 2.2 gigawatts, or more than 20%, comes from the Susquehanna plant.

Canfor reports results for the third quarter of 2024

VANCOUVER, BC, Oct. 25, 2024 /CNW/ – Canfor Corporation (“The Company” or “Canfor”) CFP today reported its third quarter of 2024 results:

Overview.

- Q3 2024 operating loss of $560 million, including a $311 million asset write-down and impairment charge as well as other one-time items1; shareholder net loss of $350 million, or $2.96 per share.

- After taking into consideration adjusting and one-time items1, Q3 2024 operating loss of $139 million, compared to a similarly adjusted operating loss of $135 million in Q2 2024.

- Persistent pressure on North American lumber markets and pricing, especially in US South; positive results from Alberta and Europe.

- Ongoing North American lumber market weakness, high duties and persistent challenges accessing economic fibre led to the announcement of sawmill closures in British Columbia and, as a result, an asset write-down and impairment charge of $100 million in the lumber segment.

- Proceeds of $314 million received in relation to duty deposits loan agreement.

- Modest improvement in NBSK pulp unit sales realizations driven by steady North American pulp pricing through most of the third quarter and favourable timing lag in shipments, despite weak demand in China; fibre-driven asset write-down and impairment charge of $211 million in the pulp segment.

Financial results.

The following table summarizes select financial information for the Company for the comparative periods:

|

(millions of Canadian dollars, except per share amounts) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

|||||||||||

|

Sales |

$ |

1,202.9 |

$ |

1,381.5 |

$ |

3,967.1 |

$ |

1,312.3 |

$ |

4,143.7 |

||||||

|

Reported operating income (loss) before amortization, asset write-downs and impairments |

$ |

(144.4) |

$ |

(98.3) |

$ |

(222.9) |

$ |

42.6 |

$ |

(22.1) |

||||||

|

Reported operating loss |

$ |

(559.7) |

$ |

(250.8) |

$ |

(896.3) |

$ |

(65.1) |

$ |

(340.3) |

||||||

|

Net loss2 |

$ |

(350.1) |

$ |

(191.1) |

$ |

(605.7) |

$ |

(23.1) |

$ |

(209.0) |

||||||

|

Net loss per share, basic and diluted2 |

$ |

(2.96) |

$ |

(1.61) |

$ |

(5.11) |

$ |

(0.19) |

$ |

(1.74) |

||||||

|

1. Adjusted operating loss as well as adjusting and one-time items referenced throughout this news release are defined as non-IFRS financial measures. For further details, refer to the table on page 2 of the news release and the “Non-IFRS financial measures” section of the news release. 2. Attributable to equity shareholders of the Company. |

|||||||||||||||||

For the third quarter of 2024, the Company reported an operating loss of $559.7 million, compared to an operating loss of $250.8 million in the second quarter of 2024.

During the current period, the Company’s British Columbia (“BC”) operations continued to encounter operational challenges, including limited access to economic fibre, weak lumber market conditions, rising operating costs, increased export tariffs to the United States (“US”), as well as various regulatory complexities. After a thorough review of these operational constraints, the Company made the difficult decision to permanently close its Plateau and Fort St. John operations located in northern BC, following an orderly wind down in the fourth quarter of 2024. In connection with these closures, in the third quarter of 2024 the Company recognized an asset write-down and impairment charge of $100.3 million to reduce the carrying value of its lumber segment assets, as well as $38.6 million in restructuring costs.

Recognizing the impact of these recent closures, along with the fibre effects of previously announced reductions and curtailments across the industry in the BC Interior, Canfor Pulp Products Inc. (“CPPI”) recorded an asset write-down and impairment charge of $211.0 million in the same period, as a reduction to the carrying value of its pulp segment assets.

Commenting on the Company’s third quarter results, Canfor’s President and Chief Executive Officer, Don Kayne, said, “This was another extremely challenging quarter for our lumber business. While Alberta and Europe delivered positive results, our North American operations continued to face a persistently weak pricing environment. In BC, this depressed pricing was exacerbated by a complex operating environment, high costs, rising US tariffs and ongoing difficulties in reliably accessing sufficient economic fibre. These conditions have resulted in unsustainable financial losses from our BC operations. As a result, we made the very difficult decision to close both our Plateau and Fort St. John operations in northern BC by the end of 2024. We sincerely regret the impact these decisions have on our employees, their families, contractors, and the businesses that support our operations and the local community.”

“For our pulp business,” added Kayne, “we also continue to face persistent fibre-related constraints, however, during the current quarter, our business had improved adjusted operating results, benefiting from an uplift in pulp unit sales realizations.”

Third quarter adjusting and one-time items.

After taking account of the aforementioned asset write-down and impairment charges as well as other one-time items, combined totaling $420.8 million, as outlined in the table below, the Company’s operating loss for the third quarter of 2024 was $138.9 million, compared to a similarly adjusted operating loss of $135.2 million in the prior quarter. These results primarily reflected lower lumber segment results, partly offset by improved pulp and paper segment earnings.

|

(millions of Canadian dollars) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

|||||||

|

Reported operating loss |

$ |

(559.7) |

$ |

(250.8) |

$ |

(896.3) |

$ |

(65.1) |

$ |

(340.3) |

||

|

Asset write-down and impairment – lumber segment |

$ |

100.3 |

$ |

31.6 |

$ |

131.9 |

$ |

– |

$ |

– |

||

|

Asset write-down and impairment – pulp segment |

$ |

211.0 |

$ |

– |

$ |

211.0 |

$ |

– |

$ |

– |

||

|

Inventory write-down (recovery), net4 |

$ |

(14.8) |

$ |

51.4 |

$ |

6.4 |

$ |

(20.8) |

$ |

(16.1) |

||

|

Adjusted operating loss3 |

$ |

(263.2) |

$ |

(167.8) |

$ |

(547.0) |

$ |

(85.9) |

$ |

(356.4) |

||

|

One-time items – lumber segment3: |

||||||||||||

|

Restructuring and closure costs5 |

$ |

36.5 |

$ |

32.6 |

$ |

69.1 |

$ |

1.1 |

$ |

12.2 |

||

|

Gain on sale of assets, net6 |

$ |

(34.9) |

$ |

– |

$ |

(34.9) |

$ |

– |

$ |

– |

||

|

Duty expense (recovery) related to finalized rates7 |

$ |

67.2 |

$ |

– |

$ |

67.2 |

$ |

(43.3) |

$ |

(43.3) |

||

|

Duty expense related to fair value measurement8 |

$ |

53.4 |

$ |

– |

$ |

53.4 |

$ |

– |

$ |

– |

||

|

One-time items – corporate restructuring costs3,5 |

$ |

2.1 |

$ |

– |

$ |

2.1 |

$ |

– |

$ |

– |

||

|

Adjusted operating loss before one-time items3 |

$ |

(138.9) |

$ |

(135.2) |

$ |

(390.1) |

$ |

(128.1) |

$ |

(387.5) |

||

|

Amortization |

$ |

104.0 |

$ |

120.9 |

$ |

330.5 |

$ |

107.7 |

$ |

318.2 |

||

|

Adjusted operating loss before amortization and one-time items3 |

$ |

(34.9) |

$ |

(14.3) |

$ |

(59.6) |

$ |

(20.4) |

$ |

(69.3) |

||

|

3. Adjusted operating loss as well as adjusting and one-time items referenced throughout this news release are defined as non-IFRS financial measures. For further details, refer to the “Non-IFRS financial measures” section of this news release. |

|

4. For the lumber segment, a $14.8 million net reversal of a previously recognized inventory write-down was recorded in Q3 2024 (Q2 2024 – $51.4 million net inventory write-down expense, Q3 2023 – $18.8 million net reversal of a previously recognized inventory write-down). For the pulp and paper segment, no inventory valuation adjustment was recognized in Q3 2024 and Q2 2024 (Q3 2023 – $2.0 million net reversal of a previously recognized inventory write-down). |

|

5. Restructuring and closure costs of $38.6 million ($36.5 million in the lumber segment and $2.1 million in the unallocated segment), largely comprised of severance, were recognized in Q3 2024 related to the permanent closures of Plateau and Fort St. John (Q2 2024 – restructuring and closure costs of $32.6 million related to Polar and Houston; Q3 2023 – restructuring and closure costs of $1.1 million related to Houston). |

|

6. On September 9, 2024, the Company completed the sale of its remaining Mackenzie sawmill assets and associated forest tenure to the McLeod Lake Indian Band and Tsay Keh Dene Nation for total proceeds of $66.5 million. As a result of this transaction, as well as other asset sales in the current period, a net gain on sale of $34.9 million was recognized in Q3 2024. |

|

7. A duty expense of $67.2 million (US$48.6 million) was recognized in Q3 2024 following the finalization of countervailing (“CVD”) and anti-dumping duty (“ADD”) rates applicable to the fifth period of review (“POR5”) (Q3 2023 – a net duty recovery of $43.3 million related to final rates for the fourth period of review (“POR4”)). |

|

8. In Q3 2024, the Company refined its estimate of the fair value measurement of net duty deposits recoverable. In accordance with IFRS Accounting Standards, this change in accounting estimate was applied on a prospective basis. |

Third quarter lumber segment highlights.

For the lumber segment, the operating loss was $336.2 million for the third quarter of 2024, compared to the previous quarter’s operating loss of $230.5 million. After taking account of adjustments and other one-time items totaling $207.7 million for the lumber segment in the current period, as noted in the table above, the operating loss was $128.5 million, compared to a similarly adjusted operating loss of $114.9 million in the prior quarter.

These results reflected the ongoing weakness in North American lumber markets and pricing in the current quarter, particularly in the US South. These conditions were accompanied by lower lumber production and shipment volumes, driven by continued curtailments in BC, a full quarter impact of the April 2024 closure of Polar, as well as market and capital project related downtime in the US South. Although earnings from Europe were positive in the quarter, overall results reflected the Company’s regular summer downtime.

Despite modestly improving fundamentals, North American lumber markets remained under pressure during the third quarter of 2024. Affordability constraints continued to impact both the repair and remodeling and housing sectors, leading to a decline in US residential construction activity in the current quarter. While some supply pressures in the region resulted in pricing improvements towards the end of the third quarter, weakened demand ultimately contributed to an overall decline in certain North American benchmark prices compared to the previous quarter.

Offshore lumber demand and pricing in Asia remained relatively stable during the third quarter of 2024. In China, the real estate market continued to face challenges despite the government’s ongoing efforts to rejuvenate the economy. However, a slight reduction in inventories in the region contributed to small price increases in the current quarter. In Japan, rising demand in the multi-family rental housing market helped to offset declines in the single-family sector, leading to relatively flat pricing quarter-over-quarter.

In Europe, the ongoing impact of low levels of residential and commercial construction throughout the current quarter was coupled with weakness in the do-it-yourself sector, resulting in continued pricing pressure in the region.

Lumber segment outlook.

Looking ahead, demand in the North American lumber market is anticipated to remain under pressure for the balance of 2024. Residential housing and do-it-yourself activity are likely to continue to be constrained largely due to ongoing affordability concerns despite some initial relief provided by lower interest rates. On the supply side, however, the gradual effects of industry-wide sawmill curtailments and closures, coupled with the decline in European imports into the North American market, have resulted in some modest pricing improvements early in the fourth quarter. This slow improvement is projected to continue through the balance of the year.

Offshore lumber demand and pricing in China is forecast to remain under pressure in the fourth quarter of 2024 predominately due to persistent challenges in the real estate market. In contrast, Japan’s multi-family rental and non-residential markets are anticipated to continue to strengthen and result in some modest upward pricing trends for the rest of the year.

European lumber pricing and demand are projected to remain relatively flat through the fourth quarter of 2024. Increased inventory levels in the United Kingdom are forecast to lead to some pricing declines in the near-term; however, this reduction is anticipated to be offset by overall supply constraints in other European regions.

In BC, despite the Company’s recent announced changes with regards to its operating footprint, it is anticipated that this region will continue to face challenging operating conditions especially with respect to the availability of economically viable fibre and high duties on lumber shipments to the US.

Third quarter pulp and paper segment highlights.

For the pulp and paper segment, the operating loss was $209.3 million, including an asset write-down and impairment charge totaling $211.0 million for the third quarter of 2024. After adjusting for the asset write-down and impairment charge, CPPI’s operating income for the third quarter of 2024 was $1.7 million, a $7.3 million improvement compared to the second quarter of 2024.

Despite some moderation in US-dollar pulp list prices to China during the current quarter, these results largely reflected modestly higher Northern Bleached Softwood Kraft (“NBSK”) pulp unit sales realizations, offset in part by reduced pulp production and shipment volumes in the period following the successful wind down of one production line at Northwood NBSK pulp mill (“Northwood”) in August 2024.

Global softwood pulp market fundamentals experienced downward pressure throughout the third quarter of 2024 primarily driven by weak demand from China, as well as the introduction of additional global hardwood capacity. These factors, when combined with the traditional seasonal summer slowdown in global demand, led to a moderation in purchasing activity and prices during the current period. As a result, NBSK US-dollar pulp list prices to China, the world’s largest consumer of pulp, declined in the quarter to a low of US$750 per tonne in August, before stabilizing through the balance of the period, ending September at US$754 per tonne. For the current quarter overall, US-dollar NBSK pulp list prices to China averaged US$771 per tonne, down US$40 per tonne, or 5%, from the prior quarter. Other global regions, including North America, experienced a delayed impact on price moderation, as prices remained steady for most of the third quarter, with slight declines seen towards the end of the period. As a result of these market conditions, particularly in China, global softwood pulp producer inventories experienced a notable increase in the current period to well above the balanced range, ending August at 50 days of supply, an increase of 12 days compared to June 2024.

Pulp and paper segment outlook.

Looking forward, global softwood pulp market conditions are anticipated to experience a slight improvement through the fourth quarter of 2024, as demand from the Chinese market is forecast to gradually recover and as elevated inventory levels slowly begin to normalize following the end of the seasonally slower summer months.

Results in the fourth quarter of 2024 will reflect the full wind down of one production line at Northwood, including the impact on pulp production (a reduction of approximately 300,000 tonnes of market kraft pulp annually), shipments and costs. Looking forward, CPPI remains focused on optimizing its operating footprint, enhancing operational reliability and closely managing manufacturing and fibre costs.

In addition, CPPI will continue to evaluate operating conditions and adjust operating rates at its pulp mills to align with economically viable fibre supply. These factors could also affect CPPI’s operating plan, liquidity, cash flows and the valuation of long-lived assets.

Additional information and conference call.

A conference call to discuss the third quarter’s financial and operating results will be held on Monday, October 28, 2024, at 8:00 AM Pacific time. To participate in the call, please dial Toll-Free 1-888-510-2154. For instant replay access until November 11, 2024, please dial Toll-Free 1-888-660-6345 and enter participant pass code 89443#.

The conference call will be webcast live and will be available at www.canfor.com. This news release, the attached financial statements and a presentation used during the conference call can be accessed via the Company’s website at www.canfor.com/investor-relations/webcasts.

Non-IFRS financial measures.

Throughout this press release, reference is made to certain non-IFRS financial measures which are used to evaluate the Company’s performance but are not generally accepted under IFRS Accounting Standards and may not be directly comparable with similarly titled measures used by other companies.

Forward-looking statements.

Certain statements in this press release constitute “forward-looking statements” which involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. Words such as “expects”, “anticipates”, “projects”, “intends”, “plans”, “will”, “believes”, “seeks”, “estimates”, “should”, “may”, “could”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are based on Management’s current expectations and beliefs and actual events or results may differ materially. There are many factors that could cause such actual events or results expressed or implied by such forward-looking statements to differ materially from any future results expressed or implied by such statements. Forward-looking statements are based on current expectations and Canfor assumes no obligation to update such information to reflect later events or developments, except as required by law.

About Canfor Corporation.

Canfor is a global leader in the manufacturing of high-value low-carbon forest products including dimension and specialty lumber, engineered wood products, pulp and paper, wood pellets and green energy. Proudly headquartered in Vancouver, British Columbia, Canfor produces renewable products from sustainably managed forests, at more than 50 facilities across its diversified operating platform in Canada, the United States and Europe. The Company has a 70% stake in Vida AB, Sweden’s largest privately owned sawmill company and also owns a 54.8% interest in Canfor Pulp Products Inc. Canfor shares are traded on the Toronto Stock Exchange under the symbol CFP. For more information visit canfor.com.

SOURCE Canfor Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c0645.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c0645.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaires Have Been Buying These 3 Top Artificial Intelligence (AI) Stocks. Should You Follow Suit?

Investors looking for investment ideas often turn to billionaires’ investment ideas. This can make sense, as one often gets to billionaire status by making wise investing decisions.

One problem with this approach is that a billionaire may have different investing goals than an average investor looking to accumulate wealth over their lifetime. Instead of seeking long-term gains, a billionaire may buy a stock as a short-term trade. We don’t know what billionaires are going to do ahead of time, and we likely won’t know why they make the investing decisions they do. So while it makes sense to see which stocks the super-wealthy like, average investors have to go the extra step and confirm that a stock suits their investment needs.

Let’s dig in on three stocks that billionaires have bought shares of recently.

Admittedly, Amazon (NASDAQ: AMZN) is more of a known quantity to investors of all wealth levels. Its online retail and cloud computing leadership has made it a favorite among consumers and investors alike.

Although its online sales business has not been a growth center, it has benefited from subscription sales, third-party seller services, and advertising. Additionally, amid strong growth in cloud computing and AI, its AWS arm continues to drive most of Amazon’s operating income.

Although net sales rose by only 11% yearly in the first half of 2024, a continued recovery from 2022 weakness took profits higher by 141% over the same period.

Moreover, while its 45 P/E ratio may not sound cheap, it is far below the stock’s average 87 earnings multiple over the last five years.

That may have helped draw several billionaire investors into the stock in the second quarter of 2024. Ken Griffin, Ray Dalio, and Paul Tudor Jones are just some of the billionaires who added positions during that quarter.

With numerous business lines and $89 billion in liquidity, Amazon is among the safest individual stocks to own, likely making it an excellent choice for average investors.

Another noteworthy “stock” choice of billionaires is an exchange-traded fund (ETF) that owns the 100 nonfinancial stocks on the Nasdaq-100 index. The Invesco QQQ Trust (NASDAQ: QQQ) tends to attract investors at all interest levels since individual components tend to have little influence.

Although it contains 100 stocks, its weighting tends to vary. Its top holding, Apple, constitutes just under 9% of the fund as of this writing. Also, the top 10 stocks, all but one of which is a tech stock, make up just over 50% of its assets.

The Ultimate Biotech Stock to Buy With $50 Right Now

If I had to buy one share of any biotech with no price restriction, I’d naturally gravitate toward the most successful companies in the industry. However, the exercise becomes more complicated if you stipulate a limit of $50 per share; most of the prominent biotech stocks are trading well above that amount.

Those around that level are, disproportionately, relatively small and risky companies whose prospects don’t look all that strong. Still, at least one biotech company whose shares are below $50 looks like a great buy: CRISPR Therapeutics (NASDAQ: CRSP).

CRISPR Therapeutics simply hasn’t been a favorite among investors in the past three-and-a-half years. Its stock is down by 77% since mid-January 2021:

At least two factors have led to CRISPR Therapeutics’ poor performance.

First, the company isn’t profitable. That’s pretty normal for a mid-cap biotech, but with rising interest rates, investors wanted to put their money into safer, profitable investments. Plenty of profitable companies have been moving in the wrong direction over the past few years.

Second, CRISPR focuses on gene editing. Although the technology has the potential to unlock treatments for diseases we previously couldn’t cure, it has one major drawback. Ex vivo gene-editing medicines are complex to administer — the process takes a while and can only be done in specialized treatment centers.

Basic finance tells us that the more we lengthen the timing of future cash flow we’ll receive for an asset, the less it’s worth today, all else being equal. The process involved in administering the kinds of therapies developed by CRISPR Therapeutics lengthens the timing of their future cash flow compared to simple oral pills.

Many investors see significant risks in investing in the company because of its gene-editing focus. Case in point: Bluebird Bio is a biotech company with three approved gene-editing treatments, but its stock continues to perform terribly. Revenue isn’t coming fast enough for investors to change their opinion of Bluebird. Is the same fate awaiting CRISPR Therapeutics?

The challenge for CRISPR Therapeutics is threefold. First, it needs to develop successful therapies; that’s hard enough, but especially so in gene editing. Second, the biotech has to fund commercialization efforts until the revenue from its treatments covers — and exceeds — the associated expenses. Third, it has to pour more money into research and development to create newer medicines.

Could These Stocks Be in Trouble If Trump Wins in November?

Everyone knows that elections always have winners and losers. However, the list isn’t limited only to political candidates and their supporters. Stocks can be affected by election results, too.

UBS recently evaluated the potential impact of former President Donald Trump’s proposed tariffs. The investment bank says it expects that U.S. stocks will fall “by around 10%” if Trump is elected and implements his steep across-the-board tariffs.

But some industries could be hit harder than others. Could these three stocks be in trouble if Trump wins in November?

Retail was the first sector identified by UBS as potentially experiencing the biggest effect from Trump’s proposed tariffs. Many retailers import a high percentage of the products they sell, and tariffs are basically a sales tax on these products.

Retailers have two options, neither of which is good. They can absorb the higher costs. Or they can pass the higher costs along to their customers, which could cause the customers to reduce their spending.

Target (NYSE: TGT) could especially feel the sting of Trump’s tariffs. The company ranks as one of the largest U.S. retailers. A large portion of the products it sells are imported, and China is its biggest source of merchandise. That’s problematic because Trump has singled out the country for high tariffs of at least 60%.

What might Target do if Trump wins and implements his tariffs? The company stated in its latest 10-K regulatory filing that additional tariffs could cause it to raise prices and/or look for alternative vendors. It added, “Any of these actions could adversely affect our reputation and results of operations.”

Perhaps the greatest concern for Target in a higher-tariff environment is that its customers could decide to shop elsewhere. Some of its competitors, notably including Walmart, already often offer lower prices than Target.

Auto manufacturing was the second industry singled out by UBS as being especially jeopardized by Trump’s proposed tariffs. Carmakers with operations in Mexico could be hurt more than others because the former president has threatened to impose a 2,000% tariff on vehicles made in the country.

General Motors (NYSE: GM) is one of the Big Three U.S. automakers. Roughly 12% of the company’s long-lived assets (notably including plants and equipment) are in Mexico, the only country that represents more than 10% other than the U.S. The percentage of those long-lived assets in Mexico has increased in recent years.

Could GM shift production to the U.S. to minimize the harm of the tariffs? Yes, but that’s easier said than done. The company would have to spend a lot of money to build new factories in the U.S. This process would also take time.

‘I don’t trust my financial guy.’ I’m 67 and trying to live on $2.2K-a-month Social Security. I have $500K with an adviser, who charges 2%, but last year the return was 26%. What’s my move?

Question: “I’m 67 years old living – or trying to – live on $2,200 Social Security a month. I don’t trust my financial guy. I rolled over a roughly $500,000 IRA to him without really digesting how much his 2% AUM fee would add up to. He invested in about six different funds, Class A, which cost me a lot up front. He charges 2% to add additional money. My return was 26%, but I know year to year that will vary.

He keeps bugging me for additional funds for an individual account (which I currently have in a 5% CD coming due in March). I need to get out of this situation but am woefully not very knowledgeable about investing. Even though I likely wouldn’t make a 26% return, can I roll those funds into an online Vanguard or Fidelity account? Should I let a robo investor do its thing? What if they don’t accept my funds? Do I need to hire a new financial adviser to help me and if so, what kind?”

Have an issue with your financial adviser or looking for a new one? Email picks@marketwatch.com.

Answer: At the highest level, if you don’t trust your adviser, get out – and that may be especially true in this case, as his fee is very high. “Right off the bat, a 2% AUM fee is quite high, regardless of whether the adviser is just managing your portfolio or providing comprehensive financial planning services. To put you in loaded mutual funds, from which he or she benefits directly on top of that, is outrageous in my opinion,” says certified financial planner Bruce Primeau at Avantax. Typically an AUM fee is roughly 1%, and can sometimes be negotiated down from there.

What’s more, the load you paid for the funds is a sunk cost, says Primeau. “In other words, you won’t get that back should you decide to leave your adviser and sell those funds. My recommendation is to find an adviser that is a fiduciary for you – and not the company they work for – who will look to minimize your fees and invest your portfolio more tax effectively,” says Primeau. Basically, if you’re working with someone who tacks on a sales charge or commission, they’re not a fiduciary because there’s an obvious conflict of interest that could interfere with what’s actually best for you.