This Is What Whales Are Betting On Tapestry

Whales with a lot of money to spend have taken a noticeably bullish stance on Tapestry.

Looking at options history for Tapestry TPR we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $401,000 and 11, calls, for a total amount of $540,543.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $42.5 to $60.0 for Tapestry over the recent three months.

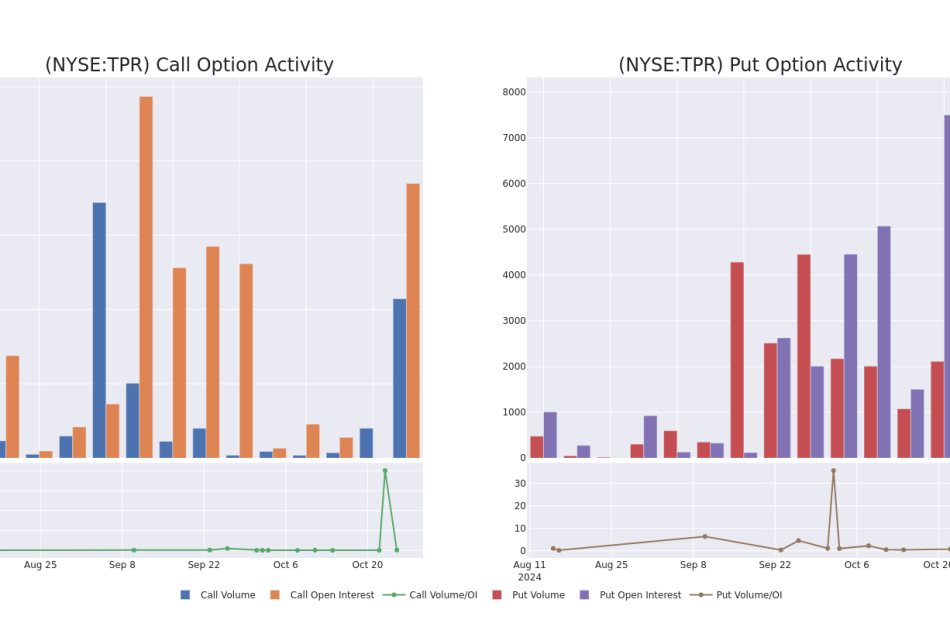

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Tapestry’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Tapestry’s whale trades within a strike price range from $42.5 to $60.0 in the last 30 days.

Tapestry 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TPR | PUT | TRADE | BULLISH | 01/17/25 | $0.9 | $0.75 | $0.8 | $42.50 | $252.0K | 6.4K | 3.1K |

| TPR | PUT | TRADE | BULLISH | 01/17/25 | $0.9 | $0.8 | $0.8 | $42.50 | $104.0K | 6.4K | 4.4K |

| TPR | CALL | SWEEP | BEARISH | 05/16/25 | $2.65 | $2.55 | $2.55 | $60.00 | $91.0K | 1.0K | 2.5K |

| TPR | CALL | TRADE | BEARISH | 05/16/25 | $2.85 | $2.4 | $2.5 | $60.00 | $84.5K | 1.0K | 1.4K |

| TPR | CALL | TRADE | BEARISH | 05/16/25 | $2.4 | $2.1 | $2.15 | $60.00 | $70.5K | 1.0K | 628 |

About Tapestry

Coach, Kate Spade, and Stuart Weitzman are Tapestry’s fashion and accessory brands. The firm’s products are sold through about 1,400 company-operated stores, wholesale channels, and e-commerce in North America (64% of fiscal 2024 sales), Europe, Asia (29% of fiscal 2024 sales), and elsewhere. Coach (76% of fiscal 2024 sales) is best known for affordable luxury leather products. Kate Spade (20% of fiscal 2023 sales) is known for colorful patterns and graphics. Women’s handbags and accessories produced 69% of Tapestry’s sales in fiscal 2024. Stuart Weitzman (4% of sales) generates virtually all its revenue from women’s footwear. In August 2023, Tapestry agreed to acquire rival Capri and its three brands, Michael Kors, Versace, and Jimmy Choo.

Tapestry’s Current Market Status

- With a volume of 17,218,462, the price of TPR is up 13.72% at $50.57.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 13 days.

Expert Opinions on Tapestry

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $59.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Tapestry, targeting a price of $66.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Tapestry with a target price of $52.

* An analyst from B of A Securities has decided to maintain their Buy rating on Tapestry, which currently sits at a price target of $60.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Tapestry, targeting a price of $65.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Tapestry, targeting a price of $55.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Tapestry options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ford boss ‘doesn’t want to give up’ Chinese electric car

The boss of American car giant Ford has admitted he “doesn’t want to give up” an electric vehicle (EV) made by one of his Chinese rivals after driving it for six months.

Jim Farley, who has been Ford’s chief executive since 2000, said he had arranged for his own Xiaomi SU7 to be shipped back from Shanghai to Chicago after trips to China.

In an interview with the Electrify Everything Show, presented by former Red Dwarf actor Robert Llewellyn, Mr Farley said: “Everyone’s talking about the Apple car, but the Xiaomi car – which now exists, and it’s fantastic – they sell 10,000, 20,000 a month.

“They’re sold out for six months. Wow. You know, that is an industry juggernaut.

“I don’t like talking about the competition so much, but I drive the Xiaomi – we flew one from Shanghai to Chicago and I’ve been driving it for six months now and I don’t want to give it up.”

Commenting on his unusual admission, the chief executive added: “I’m fine to [say that] because I think this was all something that I processed, we processed as a team.

“And we were not naive to [do that].”

He described experiencing “epiphanies” on his China visits, after seeing and trying out high-tech cars now being produced by the likes of electronics giant Xiaomi, as well as other rivals such as BYD, Neo, SAIC and Geely.

In China, EV sales have now accounted for more than half of all new cars sales for several months in a row.

The success of electric cars in the Communist country has partly been attributed to plans put in place by the Government more than a decade ago to dominate all aspects of the technology’s supply chain, as well as state subsidies.

China’s rise in the EV market has rattled more traditional rivals in America and Europe, with major manufacturers such as Volkswagen, Renault, General Motors and Ford now scrambling to catch up.

Mr Farley pointed to this, as well as the sheer size of the Chinese market, as reasons for why China now “dominated” EV production.

“Companies like BYD, they were very small when they started their journey,” he told the podcast.

“They’re now much bigger than Tesla – they’re the biggest in the world … And you know, they have [intellectual property] that the rest of the world has not developed. It’s not the old days, where someone would copy a Western technology – the opposite is true.

“That happened a decade ago and now everyone’s seeing it on the street in front of their house. But it didn’t happen overnight. The market was big enough for the last six or seven years, where none of those companies needed to export.

Apple wins $250 US jury verdict in patent case over Masimo smartwatches

By Blake Brittain

(Reuters) -Apple convinced a federal jury on Friday that early versions of health monitoring tech company Masimo’s smartwatches infringe two of its design patents as part of a broader intellectual property dispute between the companies.

The jury, in Delaware, agreed with Apple that previous iterations of Masimo’s W1 and Freedom watches and chargers willfully violated Apple’s patent rights in smartwatch designs.

But the jury awarded the tech giant, which is worth about $3.5 trillion, just $250 in damages – the statutory minimum for infringement in the United States.

Apple’s attorneys told the court the “ultimate purpose” of its lawsuit was not money, but to win an injunction against sales of Masimo’s smartwatches after an infringement ruling.

On that front, jury also determined that Masimo’s current watches did not infringe Apple patents covering inventions that the tech giant had accused Masimo of copying.

Masimo said in a statement it appreciated the jury’s verdict “in favor of Masimo and against Apple on nearly all issues,” and that the decision only applied to a “discontinued module and charger.”

“Apple primarily sought an injunction against Masimo’s current products, and the jury’s verdict is a victory for Masimo on that issue,” Masimo said.

Apple said in a statement that it was “glad the jury’s decision today will protect the innovations we advance on behalf of our customers.”

Irvine, California-based Masimo accused Apple of hiring away its employees and stealing its pulse oximetry technology after discussing a potential collaboration.

Masimo convinced the U.S. International Trade Commission last year to block imports of Apple’s Series 9 and Ultra 2 smartwatches after the commission found their technology for reading blood oxygen levels infringed Masimo’s patents.

Apple has appealed the decision and resumed selling the watches after removing the technology. The tech giant countersued Masimo for patent infringement in 2022, alleging Masimo copied Apple Watch features to use in its smartwatches.

Apple also accused Masimo of using lawsuits at the ITC and in California to “make way for Masimo’s own watch.”

Masimo said Apple’s patent lawsuit was “retaliatory” and “an attempt to avoid the court in which the parties have been litigating their dispute.”

(Reporting by Blake Brittain in Washington; Editing by Leslie Adler, Rosalba O’Brien and Lincoln Feast.)

GOP Sweep Would Ignite Animal Spirits, $12 Billion Adviser Says

(Bloomberg) — Investors should be prepared for US market volatility and lower long-term returns on stocks whether Donald Trump or Kamala Harris wins the Nov. 5 presidential election, money managers said at a Bloomberg event in Los Angeles.

Most Read from Bloomberg

Todd Morgan, chairman of Bel Air Investment Advisors, which manages $11.5 billion for high-net-worth investors, said the current investment climate resembles the Roaring ’20s, with a strong economy and societal change in the wake of a pandemic.

If Harris is elected and Democrats take control of both the White House and Congress, they are likely to raise taxes, which could lead to a selloff before the year ends, Morgan said. A Trump win and Republican sweep could ignite “animal spirits,” fueling a broad market rally, but Morgan warned that such a scenario could increase the deficit and drive up inflation.

“As long as we have a divided Congress between Democrats and Republicans, we’re all going to be OK,” said Morgan, who co-hosted the panel on Wednesday called “Where to Put Your Money Post-Election” with Bloomberg’s US Economist Stuart Paul.

A survey of swing-state voters released Wednesday by Bloomberg News/Morning Consult found the race too close to call. Polls list the economy as a top voter concern again this election cycle, with the candidates’ potential impact on investments a key consideration.

The S&P 500 Index has gained roughly 50% since President Joe Biden was inaugurated in January 2021, similar to gains during an equivalent period of Trump’s presidential term. Stocks are unlikely to sustain the performance as investors turn to other assets, including bonds, for better returns, Goldman Sachs strategists predicted this week.

Stocks and other assets have soared to unprecedented valuations, which makes high returns less likely in coming years no matter who wins the election, according to Katie Koch, chief executive officer of TCW Group Inc.

Koch, who’s LA-based firm oversees about $200 billion, cited Warren Buffett’s former partner, the late Charlie Munger, who advocated investors keep some powder dry for the right opportunity.

“Having some liquidity to lean in and take advantage of a dislocation is probably wise,“ Koch said. “Something that we are thinking a lot about in our portfolios is having dry powder and really being cautious about everything being priced for perfection.”

First Capital, Inc. Reports Quarterly Earnings

CORYDON, Ind., Oct. 25, 2024 (GLOBE NEWSWIRE) — First Capital, Inc. (the “Company”) FCAP, the holding company for First Harrison Bank (the “Bank”), today reported net income of $2.9 million, or $0.87 per diluted share, for the quarter ended September 30, 2024, compared to net income of $3.1 million, or $0.94 per diluted share, for the quarter ended September 30, 2023.

Results of Operations for the Three Months Ended September 30, 2024 and 2023

Net interest income after provision for credit losses increased $415,000 for the quarter ended September 30, 2024 as compared to the same period in 2023. Interest income increased $2.0 million when comparing the periods due to an increase in the average yield on interest-earning assets from 3.96% for the third quarter of 2023 to 4.53% for the third quarter of 2024. The average balance of interest-earning assets increased from $1.13 billion for the quarter ended September 30, 2023 to $1.17 billion at September 30, 2024. The increase in the yield was primarily due to an increase in the yield on loans to 6.09% for the third quarter of 2024 compared to 5.74% for the same period in 2023. In addition, the Company’s lower yielding securities continue to mature with proceeds being reinvested in higher yielding loans or federal funds sold. When compared to the quarter ended September 30, 2023, the average balance of the Company’s securities decreased $59.0 million, while the Company’s average loans and federal funds sold balances increased $40.6 million and $58.0 million, respectively, during the quarter ended September 30, 2024. Interest expense increased $1.5 million when comparing the periods due to an increase in the average cost of interest-bearing liabilities from 1.30% for the third quarter of 2023 to 1.87% for the third quarter of 2024, in addition to an increase in the average balance of interest-bearing liabilities from $813.2 million for the third quarter of 2023 to $875.8 million for the third quarter of 2024. The Company had no outstanding advances from the Federal Home Loan Bank (“FHLB”) during the quarter ended September 30, 2024 compared to $3.3 million with an average rate of 6.03% during the quarter ended September 30, 2023. The Company had average outstanding borrowings under the Federal Reserve Bank’s Bank Term Funding Program (“BTFP”) of $33.6 million and $13.0 million with an average rate of 4.89% and 5.02% during the quarters ended September 30, 2024 and 2023, respectively. As a result of the changes in interest-earning assets and interest-bearing liabilities, the net interest margin increased from 3.02% for the quarter ended September 30, 2023 to 3.12% for the same period in 2024.

Based on management’s analysis of the Allowance for Credit Losses (“ACL”) on loans and unfunded loan commitments, the provision for credit losses increased from $290,000 for the quarter ended September 30, 2023 to $463,000 for the quarter ended September 30, 2024. The increase was due to loan growth during the period, the increase in nonperforming assets during the quarter described later in this release, as well as management’s consideration of macroeconomic uncertainty. The Bank recognized net charge-offs of $64,000 and $19,000 for the quarters ended September 30, 2024 and 2023, respectively.

Noninterest income decreased $147,000 for the quarter ended September 30, 2024 as compared to the same period in 2023. The Company recognized a $196,000 loss on equity securities for the quarter ended September 30, 2024 compared to a loss of $131,000 for the same quarter in 2023. The Company did not sell any securities during the quarter ended September 30, 2024. The Company recognized a net $63,000 gain on sale of securities during the quarter ended September 30, 2023. During the quarter ended September 30, 2023, the Company sold securities available for sale with a market value of $9.4 million and an amortized cost basis of $9.5 million resulting in a net loss of $94,000. The net loss was more than offset by the $157,000 gain on sale of the Company’s VISA Class B stock in September 2023. In addition, other income decreased $54,000 during the quarter. These were partially offset by increases of $17,000 and $13,000 in ATM and debit card fees and service charges on deposit accounts, respectively.

Noninterest expense increased $543,000 for the quarter ended September 30, 2024 as compared to the same period in 2023, due primarily to increases in professional fees and compensation and benefits of $213,000 and $160,000, respectively. The increase in professional fees is primarily due to increased costs associated with the Company’s annual audit and fees being accrued for the Company’s ongoing core contract negotiations. The increase in compensation and benefits is due to standard increases in salary and wages as well as increases in the cost of Company-provided health insurance benefits. In addition, data processing, advertising, and occupancy and equipment expenses increased $51,000, $45,000, and $41,000, respectively.

Income tax expense decreased $35,000 for the third quarter of 2024 as compared to the third quarter of 2023 primarily due to a decrease in the Company’s taxable income. The effective tax rate for the quarter ended September 30, 2024 was 15.6% compared to 15.4% for the same period in 2023.

Results of Operations for the Nine Months Ended September 30, 2024 and 2023

For the nine months ended September 30, 2024, the Company reported net income of $8.7 million, or $2.59 per diluted share, compared to net income of $9.7 million, or $2.89 per diluted share, for the same period in 2023.

Net interest income after provision for credit losses increased $72,000 for the nine months ended September 30, 2024 compared to the same period in 2023. Interest income increased $5.3 million when comparing the two periods due to an increase in the average yield on interest-earning assets from 3.80% for the nine months ended September 30, 2023 to 4.37% for the same period in 2024. The increase in the yield was primarily due to an increase in the yield on loans to 5.99% for the first nine months of 2024 compared to 5.57% for the same period in 2023. In addition, the Company’s lower yielding securities continue to mature with proceeds being reinvested in higher yielding loans or federal funds sold. When compared to the nine months ended September 30, 2023, the average balance of the Company’s securities decreased $49.7 million, while the Company’s average loans and federal funds sold balances increased $50.8 million and $15.5 million, respectively, during the nine months ended September 30, 2024. Interest expense increased $5.0 million as the average cost of interest-bearing liabilities increased from 0.98% for the nine months ended September 30, 2023 to 1.72% for the same period in 2024, in addition to an increase in the average balance of interest-bearing liabilities from $805.1 million for the first nine months of 2023 to $846.8 million for the same period of 2024. The Company had average outstanding advances from the FHLB of $2.3 million and $2.6 million with an average rate of 5.69% and 5.49% during the nine months ended September 30, 2024 and 2023, respectively. The Company had average outstanding borrowings under the Federal Reserve Bank’s BTFP of $33.1 million and $6.4 million with an average rate of 4.84% and 5.03% during the nine months ended September 30, 2024 and 2023, respectively. As a result of the changes in interest-earning assets and interest-bearing liabilities, the net interest margin decreased from 3.10% for the nine months ended September 30, 2023 to 3.09% for the nine months ended September 30, 2024.

Based on management’s analysis of the ACL on loans and unfunded loan commitments, the provision for credit losses increased from $833,000 for the nine months ended September 30, 2023 to $1.1 million for the nine months ended September 30, 2024. The increase was due to loan growth during the period, the increase in nonperforming assets described later in this release, as well as management’s consideration of macroeconomic uncertainty. The Bank recognized net charge-offs of $149,000 for the nine months ended September 30, 2024 compared to $380,000 for the same period in 2023.

Noninterest income decreased $79,000 for the nine months ended September 30, 2024 as compared to the nine months ended September 30, 2023 primarily due to the Company recognizing a $270,000 loss on equity securities during the nine months ended September 30, 2024 compared to an $86,000 loss during the same period in 2023. This was partially offset by increases of $77,000 and $30,000 from gains on sale of loans and service charges on deposit accounts, respectively.

Noninterest expenses increased $1.2 million for the nine months ended September 30, 2024 as compared to the same period in 2023. This was primarily due to increases in professional fees, compensation and benefits, data processing, and other expenses of $424,000, $374,000, $130,000, and $179,000, respectively, when comparing the two periods. The increase in professional fees is primarily due to increased costs associated with the Company’s annual audit and fees being accrued for the Company’s ongoing core contract negotiations. The increase in compensation and benefits is due to standard increases in salary and wages as well as increases in the cost of Company-provided health insurance benefits. The increase in data processing expense is primarily due to increased debit card interchange fees. Increases in other expenses included a $77,000 increase in the Company’s support of local communities through sponsorships and donations, $26,000 in increased dues and subscriptions and $24,000 of additional FDIC insurance assessments for the nine months ended September 30, 2024 compared to the same period of 2023.

Income tax expense decreased $238,000 for the nine months ended September 30, 2024 as compared to the same period in 2023 resulting in an effective tax rate of 15.0% for the nine months ended September 30, 2024, compared to 15.4% for the same period in 2023.

Comparison of Financial Condition at September 30, 2024 and December 31, 2023

Total assets were $1.19 billion and $1.16 billion at September 30, 2024 and December 31, 2023, respectively. Net loans receivable and total cash and cash equivalents increased $16.2 million and $51.3 million from December 31, 2023 to September 30, 2024, respectively, while securities available for sale decreased $28.8 million, during the same period. Deposits were $1.03 billion at December 31, 2023 and September 30, 2024. The Bank had $33.6 million in borrowings outstanding through the Federal Reserve Bank’s BTFP at September 30, 2024 compared to $21.5 million at December 31, 2023. Nonperforming assets (consisting of nonaccrual loans, accruing loans 90 days or more past due, and foreclosed real estate) increased from $1.8 million at December 31, 2023 to $4.5 million at September 30, 2024. The increase was primarily due to the nonaccrual classification of two commercial loan relationships totaling $2.6 million. Loans in the relationship are secured by a variety of real estate and business assets.

The Bank currently has 18 offices in the Indiana communities of Corydon, Edwardsville, Greenville, Floyds Knobs, Palmyra, New Albany, New Salisbury, Jeffersonville, Salem, Lanesville and Charlestown and the Kentucky communities of Shepherdsville, Mt. Washington and Lebanon Junction.

Access to First Harrison Bank accounts, including online banking and electronic bill payments, is available through the Bank’s website at www.firstharrison.com. For more information and financial data about the Company, please visit Investor Relations at the Bank’s aforementioned website. The Bank can also be followed on Facebook.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “could” and “should,” and other words of similar meaning. Forward-looking statements are not historical facts nor guarantees of future performance; rather, they are statements based on the Company’s current beliefs, assumptions, and expectations regarding its business strategies and their intended results and its future performance.

Numerous risks and uncertainties could cause or contribute to the Company’s actual results, performance and achievements to be materially different from those expressed or implied by these forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; competition; the ability of the Company to execute its business plan; legislative and regulatory changes; the quality and composition of the loan and investment portfolios; loan demand; deposit flows; changes in accounting principles and guidelines; and other factors disclosed periodically in the Company’s filings with the Securities and Exchange Commission.

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this press release, the Company’s reports, or made elsewhere from time to time by the Company or on its behalf. These forward-looking statements are made only as of the date of this press release, and the Company assumes no obligation to update any forward-looking statements after the date of this press release.

Contact:

Joshua Stevens

Chief Financial Officer

812-738-1570

| FIRST CAPITAL, INC. AND SUBSIDIARIES | |||||||||||||||

| Consolidated Financial Highlights (Unaudited) | |||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, | September 30, | ||||||||||||||

| OPERATING DATA | 2024 | 2023 | 2024 | 2023 | |||||||||||

| (Dollars in thousands, except per share data) | |||||||||||||||

| Total interest income | $ | 13,224 | $ | 11,179 | $ | 37,279 | $ | 31,966 | |||||||

| Total interest expense | 4,099 | 2,642 | 10,897 | 5,926 | |||||||||||

| Net interest income | 9,125 | 8,537 | 26,382 | 26,040 | |||||||||||

| Provision for credit losses | 463 | 290 | 1,103 | 833 | |||||||||||

| Net interest income after provision for credit losses | 8,662 | 8,247 | 25,279 | 25,207 | |||||||||||

| Total non-interest income | 1,800 | 1,947 | 5,722 | 5,801 | |||||||||||

| Total non-interest expense | 7,024 | 6,481 | 20,781 | 19,548 | |||||||||||

| Income before income taxes | 3,438 | 3,713 | 10,220 | 11,460 | |||||||||||

| Income tax expense | 537 | 572 | 1,532 | 1,770 | |||||||||||

| Net income | 2,901 | 3,141 | 8,688 | 9,690 | |||||||||||

| Less net income attributable to the noncontrolling interest | 3 | 3 | 10 | 10 | |||||||||||

| Net income attributable to First Capital, Inc. | $ | 2,898 | $ | 3,138 | $ | 8,678 | $ | 9,680 | |||||||

| Net income per share attributable to First Capital, Inc. common shareholders: | |||||||||||||||

| Basic | $ | 0.87 | $ | 0.94 | $ | 2.59 | $ | 2.89 | |||||||

| Diluted | $ | 0.87 | $ | 0.94 | $ | 2.59 | $ | 2.89 | |||||||

| Weighted average common shares outstanding: | |||||||||||||||

| Basic | 3,347,236 | 3,345,869 | 3,345,863 | 3,347,823 | |||||||||||

| Diluted | 3,347,236 | 3,345,869 | 3,345,863 | 3,347,823 | |||||||||||

| OTHER FINANCIAL DATA | |||||||||||||||

| Cash dividends per share | $ | 0.29 | $ | 0.27 | $ | 0.83 | $ | 0.81 | |||||||

| Return on average assets (annualized) (1) | 0.97 | % | 1.09 | % | 0.99 | % | 1.13 | % | |||||||

| Return on average equity (annualized) (1) | 10.48 | % | 13.53 | % | 10.84 | % | 14.14 | % | |||||||

| Net interest margin | 3.12 | % | 3.02 | % | 3.09 | % | 3.10 | % | |||||||

| Interest rate spread | 2.66 | % | 2.66 | % | 2.65 | % | 2.82 | % | |||||||

| Net overhead expense as a percentage of average assets (annualized) (1) | 2.35 | % | 2.25 | % | 2.38 | % | 2.28 | % | |||||||

| September 30, | December 31, | ||||||||||||||

| BALANCE SHEET INFORMATION | 2024 | 2023 | |||||||||||||

| Cash and cash equivalents | $ | 89,939 | $ | 38,670 | |||||||||||

| Interest-bearing time deposits | 2,695 | 3,920 | |||||||||||||

| Investment securities | 415,469 | 444,271 | |||||||||||||

| Gross loans | 639,566 | 622,414 | |||||||||||||

| Allowance for credit losses | 8,959 | 8,005 | |||||||||||||

| Earning assets | 1,119,791 | 1,083,898 | |||||||||||||

| Total assets | 1,189,295 | 1,157,880 | |||||||||||||

| Deposits | 1,030,249 | 1,025,211 | |||||||||||||

| Borrowed funds | 33,625 | 21,500 | |||||||||||||

| Stockholders’ equity, net of noncontrolling interest | 116,775 | 105,233 | |||||||||||||

| Allowance for credit losses as a percent of gross loans | 1.40 | % | 1.29 | % | |||||||||||

| Non-performing assets: | |||||||||||||||

| Nonaccrual loans | 4,483 | 1,751 | |||||||||||||

| Accruing loans past due 90 days | – | – | |||||||||||||

| Foreclosed real estate | – | – | |||||||||||||

| Regulatory capital ratios (Bank only): | |||||||||||||||

| Community Bank Leverage Ratio (2) | 10.25 | % | 9.92 | % | |||||||||||

| (1) See reconciliation of GAAP and non-GAAP financial measures for additional information relating to the calculation of this item. | |||||||||||||||

| (2) Effective March 31, 2020, the Bank opted in to the Community Bank Leverage Ratio (CBLR) framework. As such, the other regulatory ratios are no longer provided. | |||||||||||||||

| RECONCILIATION OF GAAP AND NON-GAAP FINANCIAL MEASURES (UNAUDITED): | |||||||||||||||

| This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes that these non-GAAP financial measures allow for better comparability with prior periods, as well as with peers in the industry who provide a similar presentation, and provide a further understanding of the Company’s ongoing operations. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. The following table summarizes the non-GAAP financial measures derived from amounts reported in the Company’s consolidated financial statements and reconciles those non-GAAP financial measures with the comparable GAAP financial measures. | |||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||

| September 30, | September 30, | ||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||

| Return on average assets before annualization | 0.24 | % | 0.27 | % | 0.75 | % | 0.85 | % | |||||||

| Annualization factor | 4.00 | 4.00 | 1.33 | 1.33 | |||||||||||

| Annualized return on average assets | 0.97 | % | 1.09 | % | 0.99 | % | 1.13 | % | |||||||

| Return on average equity before annualization | 2.62 | % | 3.38 | % | 8.13 | % | 10.60 | % | |||||||

| Annualization factor | 4.00 | 4.00 | 1.33 | 1.33 | |||||||||||

| Annualized return on average equity | 10.48 | % | 13.53 | % | 10.84 | % | 14.14 | % | |||||||

| Net overhead expense as a % of average assets before annualization | 0.59 | % | 0.56 | % | 1.78 | % | 1.71 | % | |||||||

| Annualization factor | 4.00 | 4.00 | 1.33 | 1.33 | |||||||||||

| Annualized net overhead expense as a % of average assets | 2.35 | % | 2.25 | % | 2.38 | % | 2.28 | % | |||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why the S&P 500 will drop 5% in the coming weeks, technical analyst says

-

US stocks will drop 5% in the coming weeks, BTIG’s Jonathan Krinsky said.

-

The swings being seen in the dollar and bond market have historically preceded stock sell-offs, he said.

-

Krinsky also sees the market as set up for a “sell the news” event related to the election.

US stocks are facing an overdue drawdown that could come in a matter of weeks, BTIG’s Jonathan Krinsky said.

In an interview with CNBC, the firm’s chief market technician predicted that the S&P 500 will slump 5% either heading into the presidential election, or in the days after.

“In the coming weeks, you’re going to get that shakeout,” he said.

Krinsky cited volatile moves in the dollar (to its strongest level since July) and Treasury bonds (10-year Treasury above 4.2%) as core catalysts for an impending pullback. The stock market has been placid by comparison, but Krinsky doesn’t expect that to last.

According to Krinsky, such moves in the currency and bond markets have historically preceded significant pullbacks in the S&P 500. Similar volatility in the fall of 2022 and 2023 caused the index to drop 19% and 11%, he cited.

“It just seems like the equity volatility isn’t really matching the macro at this point,” Krinsky noted. As of Friday, the S&P continues to churn higher.

Krinsky also said the upcoming election could serve as a “sell the news” event for investors, as the stock market has been unusually strong during September and October, a period that normally sees seasonal weakness.

“I think this year the market is in some ways pre-trading,” the market technician said, noting that investors appear to be betting around rising sentiment that Donald Trump will win. “And so I think the set-up is a little different here.”

This means that weakness is likely ahead, whoever the next president is: “If he wins, I think it’s been pre-traded. And if Harris wins, there could be some disappointment there, given what the market’s pricing in right now.”

Read the original article on Business Insider

Vale (VALE) Q3 2024 Earnings Call Transcript

Vale (NYSE: VALE)

Q3 2024 Earnings Call

Oct 25, 2024, 1:00 p.m. ET

Good morning, ladies and gentlemen. Welcome to Vale’s third-quarter 2024 earnings call. This conference is being recorded, and the replay will be available on our website at vale.com. The presentation is also available for download in English and Portuguese from our website.

[Operator instructions] We would like to advise that forward-looking statements may be provided in this presentation, including Vale’s expectations about future events or results, encompassing those matters listed in the respective presentation. We caution you that forward-looking statements are not guarantees of future performance, and involve risks and uncertainties. To obtain information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission, the Brazil Comissao de Valores MobiliArios, and in particular, the factors discussed under forward-looking statements and risks factors in Vale’s annual report on Form 20-F.

With us today are Mr. Gustavo Pimenta, CEO; Mr. Murilo Muller, acting executive vice president of finance and investor relations; Mr. Rogerio Nogueira, acting executive vice president, Iron Ore Solutions; Mr.

Carlos Medeiros, executive vice president of operations; Mr. Shaun Usmar, CEO of Vale Base Metals; and Mr. Alexandre D’Ambrosio, executive vice president of corporate and external affairs. Now, I will turn the conference over to Mr.

E Gustavo Pimenta. Sir, you may now begin.

Hello, everyone, and welcome to Vale’s third-quarter 2024 conference call. I’m pleased to present Vale’s result for the first time as the company’s CEO. Before I start, I would like to take a moment to thank Eduardo Bartolomeo for his tenure as CEO of Vale in the last five years. Eduardo led Vale through one of the most difficult periods of our history.

It drove a series of significant changes within the company, and today, we are in a much stronger position, being safer, more stable, and better prepared for an even greater future. So on behalf of the entire Vale team, we thank you, Eduardo, for that. I also want to express my gratitude to the board of directors for their trust and confidence. It is an honor for me to lead this great company.

ThinkCareBelieve: Where Are The Missing Children?

Austin, Texas, Oct. 25, 2024 (GLOBE NEWSWIRE) — EMBARGOED FOR IMMEDIATE RELEASE

Article: https://thinkcarebelieve.blog/2024/10/25/where-are-the-children/

Austin, Texas– President Trump delivered remarks to the press on border security and migrant crime. There are currently 325,000 children missing after coming through the U.S. southern border that were placed with sponsors here in the United States, a number which is growing. When Department of Human Services went to check on them and assigned them follow up appointments, they were nowhere to be found. Americans are asking what has happened to these children. Their arrival into the United States is associated with the sharp influx of illegal immigrants coming into the United States from policy changes by President Biden and Vice President Kamala Harris when they took office in January 2020.

President Trump’s Presser today: https://www.youtube.com/live/NHpF4Oat0UQ

This is a problem that all of us are going to need to face together. We cannot continue to ignore what is happening to these children. Every minute that goes by, children are being harmed and abused and worse… and it is our U.S. tax dollars that are funding it.

ThinkCareBelieve’s Article

ThinkCareBelieve’s article includes testimony from two Department of Human Services whistleblowers who testified in front of the Senate about their instructions not to vet sponsors and what happened when the children were gone upon follow-up checks. They describe what is happening from the children’s point of view and how they discovered that MS-13 gang members are involved. The article covers explanations from retired Immigrations and Customs Enforcement Director, Tom Homan and how President Trump was asked to do everything he can to find the children once elected. Also included is a first hand report from Dr. Phil upon return from his visit to the border to discuss the situation with Border Control Officers.

President Trump has announced that he will level strict penalties on child and human traffickers and those committing violent migrant crime, including enacting the Alien Enemies Act of 1798, which gives the power to target and dismantle every criminal network on American soil and deport immigrant criminals back to their native country, and if they come back, it’s automatically 10 years in jail. President Trump stands with the families of victims of violent migrant crime. He is calling for the death penalty for anyone that kills an American or law enforcement officer.

The Border Patrol Union has officially endorsed President Trump for his support and understanding of the problems. They are entirely grateful to President Trump for his work in what has become a major crisis for America. The article also covers remarks from Sound of Freedom Movie Director Alejandro Monteverde who has a message for Border Czar, Kamala Harris.

ThinkCareBelieve is an outlook. ThinkCareBelieve will do its best to accentuate the possibilities for positive outcomes. To find the commonalities between diverse groups and bring the focus on common needs to work together toward shared goals. Activism is an important aspect of ThinkCareBelieve, because public participation and awareness to issues needing exposure to light leads to justice. Improved transparency in government can lead to changes in policy and procedure resulting in more fluid communication between the public and the government that serves them. America needs hope right now, and Americans need to be more involved in their government.

###

CONTACT: Joanne COMPANY: ThinkCareBelieve EMAIL: joanne@thinkcarebelieve.blog WEB: thinkcarebelieve.blog

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.