ThinkCareBelieve: Where Are The Missing Children?

Austin, Texas, Oct. 25, 2024 (GLOBE NEWSWIRE) — EMBARGOED FOR IMMEDIATE RELEASE

Article: https://thinkcarebelieve.blog/2024/10/25/where-are-the-children/

Austin, Texas– President Trump delivered remarks to the press on border security and migrant crime. There are currently 325,000 children missing after coming through the U.S. southern border that were placed with sponsors here in the United States, a number which is growing. When Department of Human Services went to check on them and assigned them follow up appointments, they were nowhere to be found. Americans are asking what has happened to these children. Their arrival into the United States is associated with the sharp influx of illegal immigrants coming into the United States from policy changes by President Biden and Vice President Kamala Harris when they took office in January 2020.

President Trump’s Presser today: https://www.youtube.com/live/NHpF4Oat0UQ

This is a problem that all of us are going to need to face together. We cannot continue to ignore what is happening to these children. Every minute that goes by, children are being harmed and abused and worse… and it is our U.S. tax dollars that are funding it.

ThinkCareBelieve’s Article

ThinkCareBelieve’s article includes testimony from two Department of Human Services whistleblowers who testified in front of the Senate about their instructions not to vet sponsors and what happened when the children were gone upon follow-up checks. They describe what is happening from the children’s point of view and how they discovered that MS-13 gang members are involved. The article covers explanations from retired Immigrations and Customs Enforcement Director, Tom Homan and how President Trump was asked to do everything he can to find the children once elected. Also included is a first hand report from Dr. Phil upon return from his visit to the border to discuss the situation with Border Control Officers.

President Trump has announced that he will level strict penalties on child and human traffickers and those committing violent migrant crime, including enacting the Alien Enemies Act of 1798, which gives the power to target and dismantle every criminal network on American soil and deport immigrant criminals back to their native country, and if they come back, it’s automatically 10 years in jail. President Trump stands with the families of victims of violent migrant crime. He is calling for the death penalty for anyone that kills an American or law enforcement officer.

The Border Patrol Union has officially endorsed President Trump for his support and understanding of the problems. They are entirely grateful to President Trump for his work in what has become a major crisis for America. The article also covers remarks from Sound of Freedom Movie Director Alejandro Monteverde who has a message for Border Czar, Kamala Harris.

ThinkCareBelieve is an outlook. ThinkCareBelieve will do its best to accentuate the possibilities for positive outcomes. To find the commonalities between diverse groups and bring the focus on common needs to work together toward shared goals. Activism is an important aspect of ThinkCareBelieve, because public participation and awareness to issues needing exposure to light leads to justice. Improved transparency in government can lead to changes in policy and procedure resulting in more fluid communication between the public and the government that serves them. America needs hope right now, and Americans need to be more involved in their government.

###

CONTACT: Joanne COMPANY: ThinkCareBelieve EMAIL: joanne@thinkcarebelieve.blog WEB: thinkcarebelieve.blog

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rivian Automotive's Options: A Look at What the Big Money is Thinking

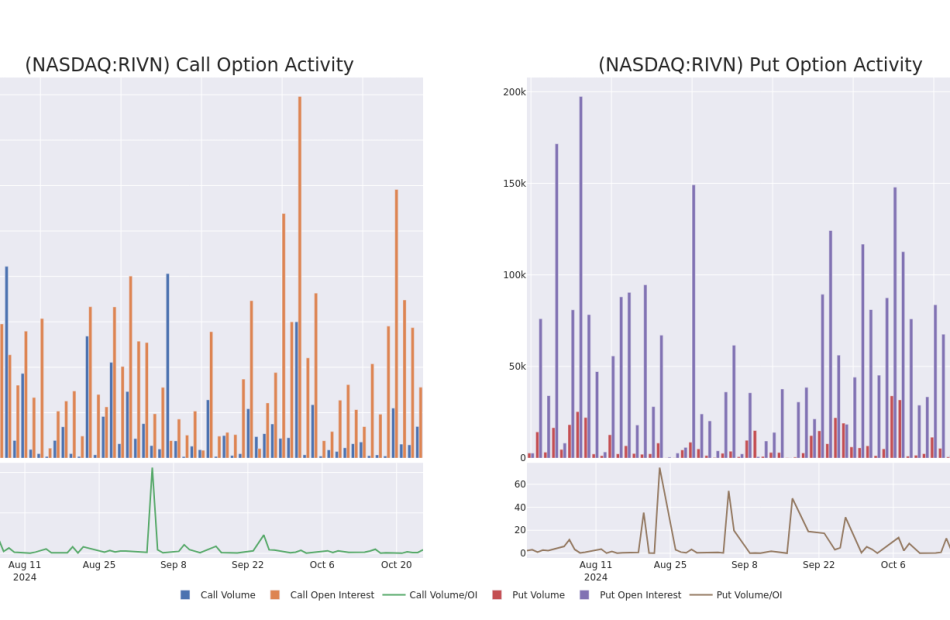

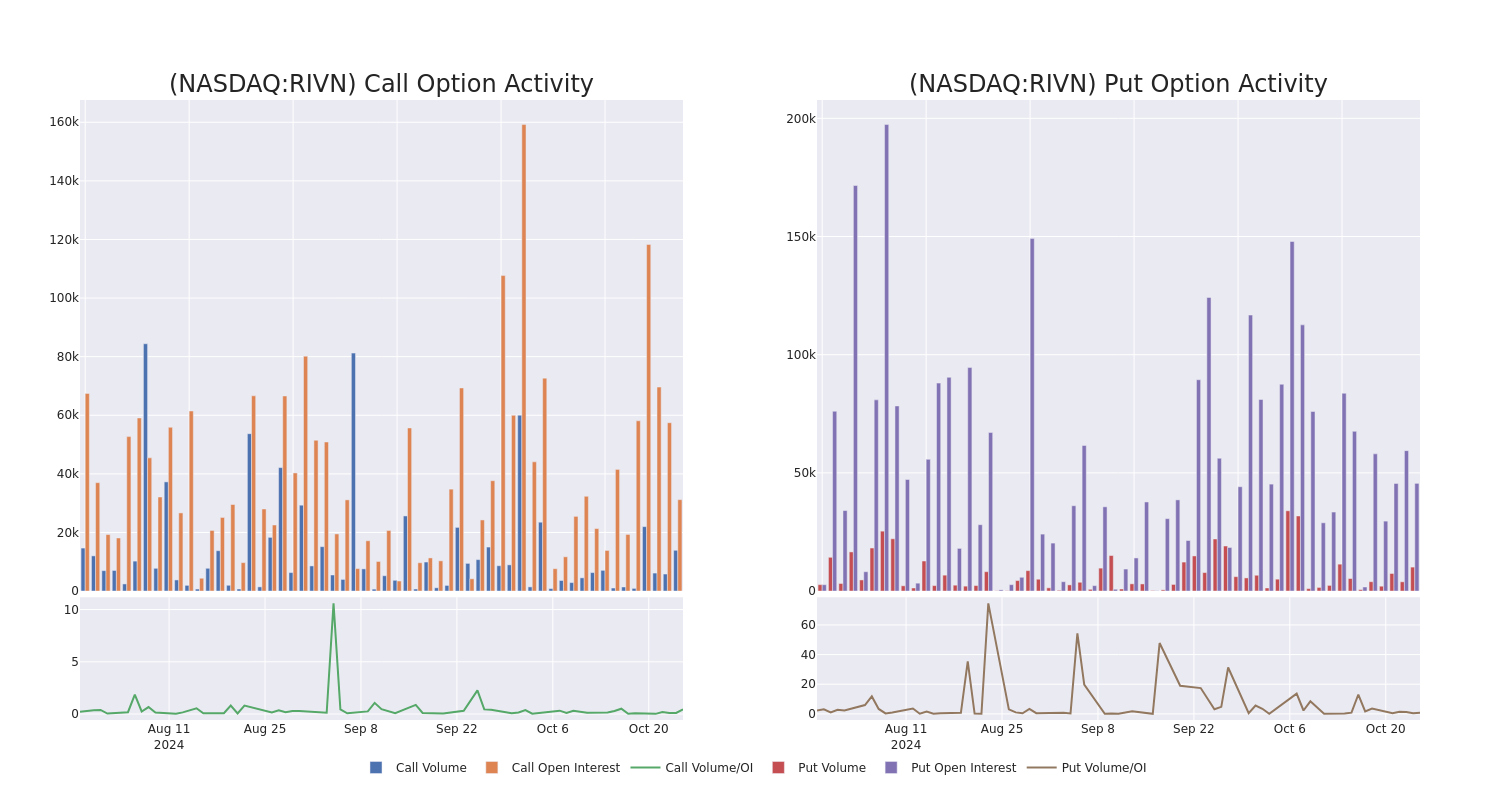

Financial giants have made a conspicuous bearish move on Rivian Automotive. Our analysis of options history for Rivian Automotive RIVN revealed 14 unusual trades.

Delving into the details, we found 0% of traders were bullish, while 92% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $570,961, and 6 were calls, valued at $301,896.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $2.0 to $17.5 for Rivian Automotive over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rivian Automotive’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rivian Automotive’s whale trades within a strike price range from $2.0 to $17.5 in the last 30 days.

Rivian Automotive 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | PUT | SWEEP | BEARISH | 01/15/27 | $7.15 | $7.1 | $7.15 | $15.00 | $278.8K | 11.6K | 983 |

| RIVN | CALL | SWEEP | BEARISH | 01/15/27 | $3.65 | $3.6 | $3.6 | $15.00 | $85.6K | 2.8K | 707 |

| RIVN | CALL | SWEEP | BEARISH | 01/15/27 | $3.65 | $3.6 | $3.6 | $15.00 | $79.2K | 2.8K | 967 |

| RIVN | PUT | SWEEP | BEARISH | 01/15/27 | $7.15 | $7.1 | $7.15 | $15.00 | $71.5K | 11.6K | 1.1K |

| RIVN | PUT | SWEEP | BEARISH | 01/15/27 | $7.15 | $7.05 | $7.15 | $15.00 | $60.7K | 11.6K | 1.7K |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

Having examined the options trading patterns of Rivian Automotive, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Rivian Automotive’s Current Market Status

- With a volume of 19,528,288, the price of RIVN is up 0.38% at $10.47.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

Expert Opinions on Rivian Automotive

5 market experts have recently issued ratings for this stock, with a consensus target price of $13.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Rivian Automotive, maintaining a target price of $11.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $19.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Underweight rating on Rivian Automotive with a target price of $12.

* An analyst from Barclays has decided to maintain their Equal-Weight rating on Rivian Automotive, which currently sits at a price target of $13.

* An analyst from Truist Securities persists with their Hold rating on Rivian Automotive, maintaining a target price of $12.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rivian Automotive with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rory Harvey At General Motors Capitalizes: Options Exercised, Resulting In $114K

Rory Harvey, Executive Vice President at General Motors GM, reported a large exercise of company stock options on October 24, according to a new SEC filing.

What Happened: A notable Form 4 filing on Thursday with the U.S. Securities and Exchange Commission revealed that Harvey, Executive Vice President at General Motors, exercised stock options for 9,307 shares of GM, resulting in a transaction value of $114,732.

The Friday morning market activity shows General Motors shares up by 0.12%, trading at $52.78. This implies a total value of $114,732 for Harvey’s 9,307 shares.

Discovering General Motors: A Closer Look

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023’s share was 16.5%. GM’s Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company’s captive finance arm in October 2010 via the purchase of AmeriCredit.

General Motors: Delving into Financials

Revenue Growth: Over the 3 months period, General Motors showcased positive performance, achieving a revenue growth rate of 10.48% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 13.12%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): General Motors’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 2.71.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.8, caution is advised due to increased financial risk.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 5.63 is lower than the industry average, implying a discounted valuation for General Motors’s stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.34, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 6.05 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of General Motors’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Dividend-Paying Financial Stocks That Could Make You a Millionaire

Financial stocks aren’t usually very exciting, but that doesn’t mean they can’t be highly rewarding. And if you are looking to become a millionaire, you should have some exposure to them in your portfolio. Here are three options — W.P. Carey (NYSE: WPC), Toronto-Dominion Bank (NYSE: TD), and Visa (NYSE: V) — that cover a lot of investment ground and pay you well to own them thanks to their dividends.

There’s a problem with W.P. Carey that may keep a lot of investors away: a dividend cut. That’s the cynical view of a complex situation.

A more appropriate take, perhaps, is that management hit the reset button so this real estate investment trust (REIT) could work from a stronger foundation. Essentially, it ripped the bandage off and exited the troubled office sector in one quick move instead of letting the exposure to this property segment slowly dwindle to nothing. But with office space accounting for 16% of rents prior to the divestiture, that couldn’t happen without a dividend reset.

You know it was a reset because the dividend was immediately back to the cadence of quarterly increases that existed before the cut. Meanwhile, W.P. Carey’s office exit has left it with a record level of liquidity to invest in new properties.

Or, to put it another way, this REIT is ready to start growing again. And you can collect a fat 5.9% yield backed by a growing dividend if you buy it today.

Toronto-Dominion Bank, more commonly known as TD Bank, has admitted that it allowed its U.S. bank system to be used by money launderers. It has upgraded its internal controls, paid a roughly $3 billion fine, and now lives under an asset cap in the United States that will require it to reposition its balance sheet in this country.

More notably, all of this means that U.S. growth will be slow to nonexistent for a little while until TD Bank earns back regulators’ trust. That’s not a great outcome, but it is all a part of TD Bank taking responsibility for its mistake.

However, it has the cash to pay the fine (it sold a portion of its stake in Charles Schwab to come up with the money), and the U.S. banking operation is only one part of the company’s business.

It’s also the second largest bank in Canada, and that business is unaffected by the U.S. problems. This is not a life-or-death situation; it is a very low-risk turnaround for a company that has paid a dividend every year for well over 100 years.

And you get to collect a 5.2% yield while you wait for the bank to muddle through this headwind. That will likely be worth it, even for more conservative dividend investors.

FEDERAL HOME LOAN BANK OF BOSTON ANNOUNCES 2024 THIRD QUARTER RESULTS, DECLARES DIVIDEND

BOSTON, Oct. 25, 2024 /PRNewswire/ — The Federal Home Loan Bank of Boston announced its preliminary, unaudited third quarter results for 2024, reporting net income of $60.4 million for the quarter. The Bank expects to file its quarterly report on Form 10-Q for the quarter ending September 30, 2024, with the U.S. Securities and Exchange Commission next month.

The Bank’s board of directors has declared a dividend equal to an annual yield of 8.36%, the daily average of the Secured Overnight Financing Rate for the third quarter of 2024 plus 300 basis points. The dividend, based on average stock outstanding for the third quarter of 2024, will be paid on November 4, 2024. As always, dividends remain at the discretion of the board.

“FHLBank Boston’s solid financial performance continues to support a broad range of liquidity and funding solutions for our members, along with existing programs and initiatives that improve housing affordability and increase community development throughout New England,” said President and CEO Timothy J. Barrett. “We were pleased to recently launch the CDFI Advance focused on helping Community Development Financial Institutions and the Permanent Rate Buydown product designed to make homeownership more attainable for lower-income households through interest-rate reductions of up to 2 percentage points.”

Third Quarter 2024 Operating Highlights

The Bank’s overall results of operations are influenced by the economy, interest rates and members’ demand for advances. During the third quarter of 2024, the Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by 50 basis points, to between 475 and 500 basis points. During the quarter, the yield curve remained inverted as intermediate- and long-term interest rates decreased substantially reflecting a weaker economic outlook.

The Bank recently launched the Permanent Rate Buydown product for mortgage loans purchased from participating financial institutions that is designed to make homeownership more attainable for lower income households. The product enables our bank and credit union members that utilize the Mortgage Partnership Finance® (MPF®) Program to reduce interest rates paid by income-eligible borrowers by up to 2 percentage points.

Net income for the three months ended September 30, 2024, was $60.4 million, compared with net income of $70.1 million for the same period of 2023, primarily the result of a decrease in net interest income after reduction of credit losses of $14.3 million, offset by an increase in other income of $3.4 million. These results led to a $6.7 million statutory contribution to the Bank’s Affordable Housing Program for the quarter. In addition, the Bank made a voluntary contribution of $507,000 to the Affordable Housing Program and a $4.6 million contribution to our discretionary housing and community investment programs(5) for the quarter ended September 30, 2024.

Net interest income after reduction of credit losses for the three months ended September 30, 2024, was $89.8 million, compared with $104.1 million for the same period in 2023. The $14.3 million decrease in net interest income after provision for credit losses was primarily driven by a $13.5 million increase in mortgage-backed security net amortization, and a $9.4 million unfavorable variance in net unrealized gains and losses on fair value hedge ineffectiveness, both attributable to a decrease in intermediate- and long-term interest rates during the quarter ended September 30, 2024, compared to an increase in intermediate- and long-term interest rates during the same period in 2023. The decrease in net interest income after reduction of credit losses was partially offset by increases of $3.4 billion, $2.5 billion, and $572.9 million in our average advances, mortgage-backed securities, and mortgage loan portfolios, respectively.

Net interest spread was 0.19% for the three months ended September 30, 2024, a decrease of eight basis points from the same period in 2023, and net interest margin was 0.52%, a decrease of 13 basis points from the three months ended September 30, 2023. The decrease in net interest spread and margin was primarily attributable to the substantial decrease in intermediate- and long-term interest rates.

September 30, 2024 Balance-Sheet Highlights

Total assets increased $5.3 billion, or 7.8%, to $72.4 billion at September 30, 2024, up from $67.1 billion at year-end 2023. Total investments were $26.1 billion at September 30, 2024, an increase of $5.0 billion from $21.2 billion at the prior year end, driven primarily by growth in short-term investments and mortgage-backed securities. Mortgage loans totaled $3.5 billion at September 30, 2024, an increase of $484.2 million from year-end 2023 as mortgage sales to the Bank increased. Advances totaled $42.0 billion at September 30, 2024, a modest increase of $48.2 million from year-end 2023.

Total capital at September 30, 2024, was $3.8 billion, an increase of $268.7 million from $3.5 billion at year-end 2023. During 2024, capital stock increased by $119.0 million, primarily attributable to the increase in advances. Total retained earnings grew to $1.9 billion during 2024, an increase of $82.8 million, or 4.6%, from December 31, 2023. Of this amount, restricted retained earnings(3) totaled $492.8 million at September 30, 2024. Accumulated other comprehensive loss totaled $227.7 million at September 30, 2024, an improvement of $66.9 million from accumulated other comprehensive loss as of December 31, 2023.

The Bank was in compliance with all regulatory capital ratios at September 30, 2024, and in the most recent information available was classified “adequately capitalized” by its regulator, the Federal Housing Finance Agency, based on the Bank’s financial information at June 30, 2024.(1)

About the Bank

The Federal Home Loan Bank of Boston is a cooperatively owned wholesale bank for housing finance in the six New England states. Its mission is to provide highly reliable wholesale funding and liquidity to its member financial institutions in New England. The Bank also develops and delivers competitively priced financial products, services, and expertise that support housing finance, community development, and economic growth, including programs targeted to lower-income households.

|

Contact: |

|

Adam Coldwell |

|

617-292-9774 |

|

adam.coldwell@fhlbboston.com |

“Mortgage Partnership Finance,” and “MPF,” are registered trademarks of the Federal Home Loan Bank of Chicago.

|

Federal Home Loan Bank of Boston Balance Sheet Highlights (Dollars in thousands) (Unaudited) |

||||||

|

9/30/2024 |

6/30/2024 |

12/31/2023 |

||||

|

ASSETS |

||||||

|

Cash and due from banks |

$ 50,242 |

$ 50,096 |

$ 53,412 |

|||

|

Advances |

42,006,806 |

42,294,369 |

41,958,583 |

|||

|

Investments (2) |

26,137,824 |

22,436,579 |

21,167,632 |

|||

|

Mortgage loans held for portfolio, net |

3,543,560 |

3,345,541 |

3,059,331 |

|||

|

Other assets |

658,409 |

642,793 |

903,316 |

|||

|

Total assets |

$ 72,396,841 |

$ 68,769,378 |

$ 67,142,274 |

|||

|

LIABILITIES |

||||||

|

Consolidated obligations, net |

$ 67,279,657 |

$ 63,692,005 |

$ 62,249,289 |

|||

|

Deposits |

765,831 |

891,137 |

922,879 |

|||

|

Other liabilities |

543,995 |

504,270 |

431,492 |

|||

|

CAPITAL |

||||||

|

Class B capital stock |

2,161,471 |

2,094,276 |

2,042,453 |

|||

|

Retained earnings – unrestricted |

1,380,713 |

1,375,438 |

1,339,546 |

|||

|

Retained earnings – restricted (3) |

492,833 |

480,759 |

451,154 |

|||

|

Total retained earnings |

1,873,546 |

1,856,197 |

1,790,700 |

|||

|

Accumulated other comprehensive loss |

(227,659) |

(268,507) |

(294,539) |

|||

|

Total capital |

3,807,358 |

3,681,966 |

3,538,614 |

|||

|

Total liabilities and capital |

$ 72,396,841 |

$ 68,769,378 |

$ 67,142,274 |

|||

|

Total regulatory capital-to-assets ratio |

5.6 % |

5.8 % |

5.7 % |

|||

|

Ratio of market value of equity (MVE) to par value of capital stock (4) |

171 % |

168 % |

170 % |

|||

|

Income Statement Highlights (Dollars in thousands) (Unaudited) |

||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||

|

9/30/2024 |

6/30/2024 |

9/30/2023 |

9/30/2024 |

9/30/2023 |

||||||

|

Total interest income |

$ 911,873 |

$ 933,331 |

$ 851,503 |

$ 2,736,507 |

$ 2,591,521 |

|||||

|

Total interest expense |

822,086 |

825,076 |

747,374 |

2,428,623 |

2,295,844 |

|||||

|

Net interest income |

89,787 |

108,255 |

104,129 |

307,884 |

295,677 |

|||||

|

Net interest income after provision for credit losses |

89,791 |

108,655 |

104,137 |

307,688 |

295,592 |

|||||

|

Other income |

5,483 |

3,212 |

2,067 |

11,303 |

10,071 |

|||||

|

Operating expense |

19,652 |

19,316 |

18,679 |

58,648 |

54,514 |

|||||

|

Federal Housing Finance Agency and Office of Finance |

2,366 |

2,323 |

2,765 |

6,952 |

8,138 |

|||||

|

AHP voluntary contribution |

507 |

1,345 |

— |

1,852 |

2,000 |

|||||

|

Discretionary housing and community investment programs (5) |

4,567 |

9,802 |

6,105 |

16,673 |

9,357 |

|||||

|

Other expense |

1,093 |

1,092 |

790 |

3,278 |

2,917 |

|||||

|

AHP assessment |

6,720 |

7,809 |

7,798 |

23,193 |

22,915 |

|||||

|

Net income |

$ 60,369 |

$ 70,180 |

$ 70,067 |

$ 208,395 |

$ 205,822 |

|||||

|

Performance Ratios: (6) |

||||||||||

|

Return on average assets |

0.34 % |

0.40 % |

0.43 % |

0.40 % |

0.39 % |

|||||

|

Return on average equity (7) |

6.57 % |

7.75 % |

8.27 % |

7.74 % |

7.74 % |

|||||

|

Net interest spread |

0.19 % |

0.28 % |

0.27 % |

0.25 % |

0.23 % |

|||||

|

Net interest margin |

0.52 % |

0.63 % |

0.65 % |

0.60 % |

0.57 % |

|||||

(1) For additional information on the Bank’s capital requirements, see Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Capital in the Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 15, 2024 (the 2023 Annual Report).

(2) Investments include available-for-sale securities, held-to-maturity securities, trading securities, interest-bearing deposits, securities purchased under agreements to resell, and federal funds sold.

(3) The Bank’s capital plan and a joint capital enhancement agreement among all Federal Home Loan Banks require the Bank to allocate a certain amount, generally not less than 20% of each of quarterly net income and adjustments to prior net income, to a restricted retained earnings account until a total required allocation is met. Amounts in the restricted retained earnings account are unavailable to be paid as dividends, which may be paid from current net income and unrestricted retained earnings. For additional information, see Item 5 — Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities in the 2023 Annual Report.

(4) MVE equals the difference between the theoretical market value of assets and the theoretical market value of liabilities, and the ratio of MVE to par value of Bank capital stock can be an indicator of future net income to the extent that it demonstrates the impact of prior interest-rate movements on the capacity of the current balance sheet to generate net interest income. However, this ratio does not always provide an accurate indication of future net income. Accordingly, investors should not place undue reliance on this ratio and are encouraged to read the Bank’s discussion of MVE, including discussion of the limitations of MVE as a metric, in Item 7A — Quantitative and Qualitative Disclosures About Market Risk — Measurement of Market and Interest Rate Risk in the 2023 Annual Report.

(5) We have certain discretionary subsidized advance and grant programs, including our Jobs for New England (JNE), Housing Our Workforce (HOW), and Lift Up Homeownership programs. For additional information see Item 1 — Business — Targeted Housing and Community Investment Programs in the 2023 Annual Report. In 2024, the Bank also launched the Permanent Rate Buydown product which enables our participating financial institutions that utilize the MPF Program to reduce interest rates paid by income-eligible borrowers by up to 2 percentage points, and a subsidized advance program targeting certified, non-depository community development financial institutions (CDFIs) to support the development of affordable housing, job creation/small business growth and the expansion of community facilities in distressed communities throughout New England.

(6) Yields for quarterly periods are annualized.

(7) Return on average equity is net income divided by the total of the average daily balance of outstanding Class B capital stock, accumulated other comprehensive loss, and total retained earnings.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This release, including the unaudited balance sheet highlights and income statement highlights, uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, which include statements with respect to the Bank’s plans, objectives, projections, estimates, or predictions. These statements are based on the Bank’s expectations as of the date hereof. The words “preliminary,” “expectations,” “anticipates,” “will,” and similar statements and their plural and negative forms are used in this notification to identify some, but not all, of such forward-looking statements. For example, statements about future declarations of dividends and expectations for advances balances, mortgage-loan investments, and net income are forward-looking statements, among other forward-looking statements herein.

The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the application of accounting standards relating to, among other things, the amortization and accretion of premiums and discounts on financial assets, financial liabilities, and certain fair value gains and losses; hedge accounting of derivatives and underlying financial instruments; the fair values of financial instruments, including investment securities and derivatives; the allowance for credit losses on investment securities and mortgage loans; instability in the credit and debt markets; economic conditions (including the United States’ credit rating and its effect on the Bank); changes in demand for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system; changes in interest rates; volatility of market prices, rates, and indices that could affect the value of financial instruments; the Bank’s ability to execute its business model and pay future dividends; and prepayment speeds on mortgage assets. In addition, the Bank reserves the right to change its plans for any programs for any reason, including but not limited to, legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements or could impact the extent to which a particular plan, objective, projection, estimate or prediction is realized, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.

![]() View original content:https://www.prnewswire.com/news-releases/federal-home-loan-bank-of-boston-announces-2024-third-quarter-results-declares-dividend-302287749.html

View original content:https://www.prnewswire.com/news-releases/federal-home-loan-bank-of-boston-announces-2024-third-quarter-results-declares-dividend-302287749.html

SOURCE Federal Home Loan Bank of Boston

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

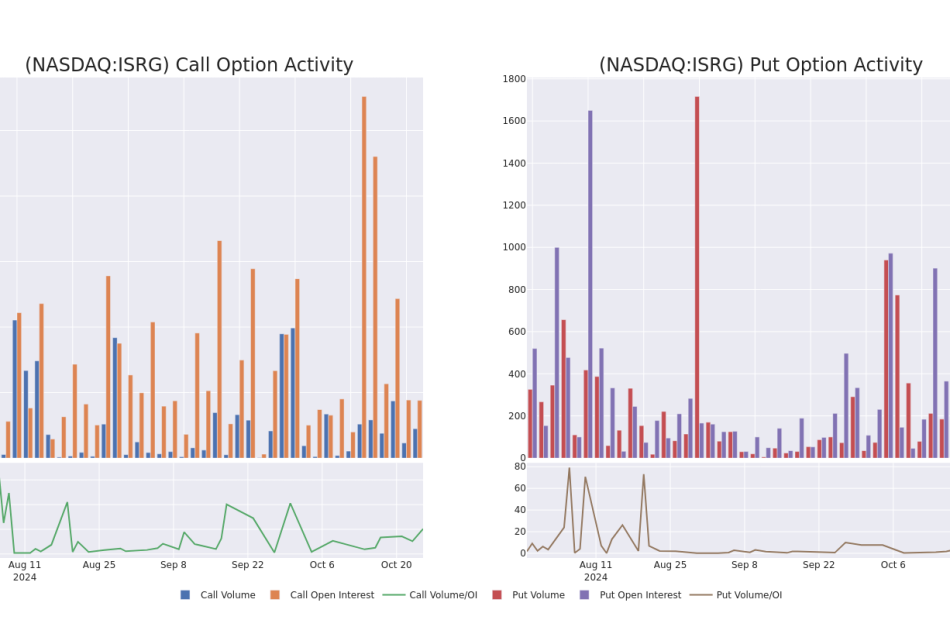

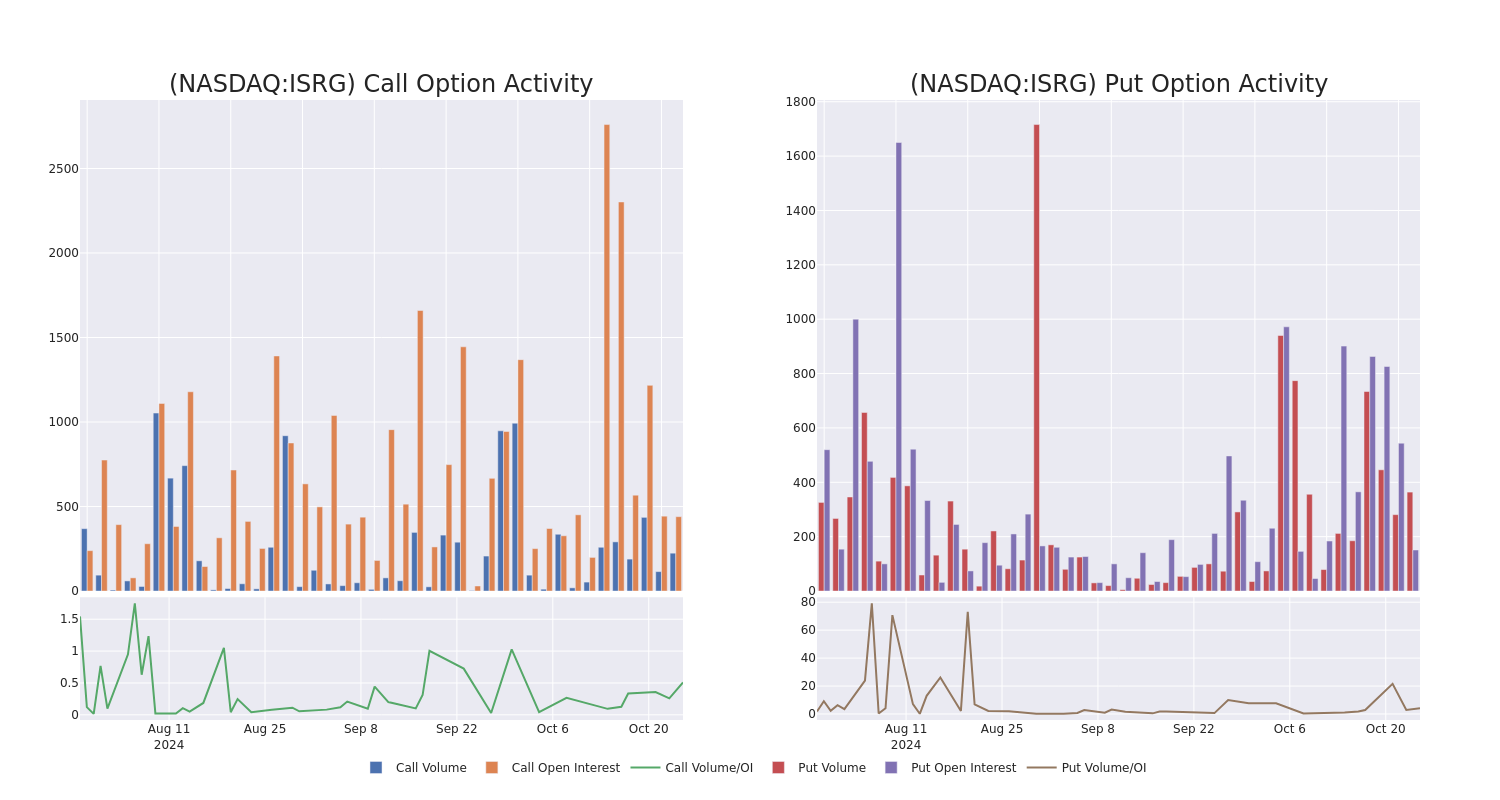

Market Whales and Their Recent Bets on ISRG Options

Financial giants have made a conspicuous bearish move on Intuitive Surgical. Our analysis of options history for Intuitive Surgical ISRG revealed 8 unusual trades.

Delving into the details, we found 12% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $426,801, and 6 were calls, valued at $285,918.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $350.0 to $520.0 for Intuitive Surgical over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Intuitive Surgical options trades today is 147.75 with a total volume of 588.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuitive Surgical’s big money trades within a strike price range of $350.0 to $520.0 over the last 30 days.

Intuitive Surgical 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | PUT | SWEEP | BULLISH | 01/17/25 | $8.3 | $7.9 | $7.9 | $465.00 | $253.5K | 94 | 322 |

| ISRG | PUT | SWEEP | NEUTRAL | 01/16/26 | $47.1 | $46.7 | $46.9 | $500.00 | $173.2K | 57 | 42 |

| ISRG | CALL | SWEEP | BEARISH | 01/17/25 | $168.7 | $167.6 | $168.6 | $350.00 | $67.4K | 348 | 8 |

| ISRG | CALL | TRADE | NEUTRAL | 03/21/25 | $37.3 | $36.7 | $37.0 | $520.00 | $55.5K | 92 | 15 |

| ISRG | CALL | SWEEP | BEARISH | 01/17/25 | $170.5 | $168.6 | $168.6 | $350.00 | $50.5K | 348 | 3 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Present Market Standing of Intuitive Surgical

- With a volume of 979,283, the price of ISRG is down -0.07% at $511.27.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 88 days.

What The Experts Say On Intuitive Surgical

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $543.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from RBC Capital persists with their Outperform rating on Intuitive Surgical, maintaining a target price of $525.

* An analyst from Truist Securities has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $570.

* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Intuitive Surgical with a target price of $565.

* An analyst from Raymond James persists with their Outperform rating on Intuitive Surgical, maintaining a target price of $540.

* An analyst from BTIG has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $518.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuitive Surgical with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Refrigerants Market Estimated to Reach $9.0 billion by 2028 Globally, at a CAGR of 6.4%, says MarketsandMarkets™

Delray Beach, FL, Oct. 25, 2024 (GLOBE NEWSWIRE) — The Refrigerants Market is projected to grow from USD 6.3 billion in 2022 to USD 9.0 billion by 2028, at a CAGR of 6.4% during the forecast period, as per the recent study by MarketsandMarkets. Refrigerants are used to generate a cooling effect in the air conditioning and refrigeration systems industry. They are used in equipment such as freezers, refrigerators, air conditioners, and heating units. Based on their chemical composition, the commonly used refrigerants are HCFCs, HFCs, HFOs, HCs, ammonia, carbon dioxide, and water. In general, refrigerants find application in domestic, commercial, and industrial refrigeration; chillers; window, split, variable refrigerant flow, and other types of air conditioning systems; and mobile air conditioning.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1082

Browse in-depth TOC on “Refrigerants Market”

331 – Market Data Tables

54 – Figures

285 – Pages

List of Key Players in Refrigerants Market:

- Arkema S.A. (France)

- Daikin Industries Ltd. (Japan)

- Honeywell International Inc. (US)

- The Chemours Company (US)

- The Linde Group (Dublin)

- Air Liquide (France)

Drivers, Restraints, Opportunities and Challenges in Refrigerants Market:

- Driver: Growing pharmaceutical industry

- Restraint: Flammability and toxicity issues

- Opportunity: Increasing demand for natural refrigerants

- Challenge: Illegal trade of refrigerants

Key Findings of the Study:

- Based on type, HFC & Blends was the largest segment for refrigerants market, in terms of value, in 2022.

- Based on applications, refrigeration system was the largest segment for refrigerants market, in terms of value, in 2022.

- Asia Pacific accounted for the largest market share for refrigerants market, in terms of value, in 2022

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=1082

The global refrigerants market is segmented based on type into HFC & blends, HFO, isobutane, propane, ammonia, carbon dioxide, and others (HCFC, air, water, propene, and isopentane). HFC & blends is estimated to be the largest type of refrigerants in 2022. Increasing commercial infrastructure in developing and developed economies, along with increasing bans on the HCFC usage, will drive the market for HFC & blends refrigerants. The demand for HCFCs is declining globally due to environmental concerns, with scheduled phasing out in different regions. The declining market share of HCFCs will be captured by other refrigerants such as HFO, ammonia, and carbon dioxide.

Based on application, the refrigerants market is segmented into refrigeration system, air conditioning system, chillers, and MAC. Refrigeration system dominated the global refrigerants market, in terms of value, in 2022. Within the refrigeration system, industrial refrigeration accounted for the largest market share due to the high-volume usage of refrigerants in the segment. The air conditioning system accounted for the second-largest market share, in terms of value, in 2022. Factors such as the growing population, rapid urbanization, higher spending income, and increasing quality of lifestyle are driving the refrigerants market for this segment. Rapid developments in industrial infrastructure, increasing construction of commercial spaces, and urbanization are expected to drive the demand for refrigerants in these segments during the forecast period.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=1082

Based on region, Asia Pacific is estimated to be the largest market for refrigerants in 2022 due to the increasing population in the region, improving economic conditions such as rising GDP & disposable incomes, and a booming consumer appliances sector. The market growth in this region is also fueled by the growth in the manufacturing sector, increase in spending on private & public infrastructure development, and rapid urbanization.

Browse Adjacent Markets: Mining, Minerals and Metals Market Research Reports & Consulting

Related Reports:

- Flooring Market – Global Forecast to 2028

- Specialty Chemicals Market – Global Forecast to 2028

- Personal Protective Equipment Market – Global Forecast to 2028

- Industrial Gases Market – Global Forecast to 2028

- Industrial Lubricants Market – Global Forecast to 2029

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alibaba Agrees To $433.5M Settlement In Shareholder Class Action Lawsuit

In a recent development, Alibaba Group BABA has decided to settle a class-action lawsuit filed by its shareholders for $433.5 million. The lawsuit alleged that the company had made misleading statements about its exclusivity practices.

What Happened: The e-commerce behemoth, based in China, denied all allegations of fault, liability, wrongdoing, or damages, reported The Wall Street Journal on Wednesday. The company stated in a regulatory filing that it opted for the settlement to evade further litigation costs and disruptions.

The lawsuit was filed in the U.S. District Court in the Southern District of New York in March 2023. It accused Alibaba of violating federal securities laws by making numerous false statements about its antitrust and exclusivity practices. This allegedly led to an artificial inflation of its stock price, causing financial losses to investors.

See Also: Iranian Hackers Leak Stolen Emails From Trump’s 2024 Campaign Ahead Of Nov. 5 Election: Report

The legal action was initiated against Alibaba, along with certain directors and officers, representing all investors who purchased or otherwise acquired the company’s American depositary shares between July 9, 2020, and Dec. 23, 2020.

Why It Matters: The lawsuit alleged that Alibaba enforced exclusivity practices that “required or coerced merchants to sell exclusively on Alibaba platforms,” and penalized merchants who sold on competitors’ platforms. The company allegedly continued these practices even after promising to stop them in an agreement signed in July 2020 with the State Administration for Market Regulation, which enforces China’s e-commerce and antimonopoly laws.

The settlement, however, is still subject to several conditions, including court approval.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.