BlueOne Card Inc., Announces Definitive Agreement to Acquire Millennium EBS, Inc. in a $12 Million Deal

LOS ANGELES, Oct. 25, 2024 (GLOBE NEWSWIRE) — BlueOne Card, Inc. BCRD (“BlueOne Card,” the “Company”), a leading fintech provider of payment hub solutions and prepaid debit cards, today announced that it has entered into a definitive agreement to acquire equity interest of 60% in Millennium EBS, Inc. The transaction is valued at $12 million. This acquisition positions BlueOne Card to emerge as a prominent payment hub and prepaid debit card provider, significantly expanding its reach and capabilities globally in the fintech sector.

The acquisition includes ownership of the Millennium EBS Payment Hub, an advanced payment orchestration and modernization platform that efficiently manages payments across multiple networks. This strategic move will enhance BlueOne Card’s ability to deliver a unified payment hub platform for small and medium-sized financial institutions worldwide.

- Revenue Growth: The combined company anticipates potential revenue growth up to $10 million in revenue over the next year, driven by the new integrated Payment Hub platform.

- Stock Transaction: Millennium EBS shareholders will receive approximately 17% equity ownership stake in BlueOne Card, while BlueOne will own a 60% stake in Millennium EBS.

- Synergies: The acquisition is expected to create substantial synergies by integrating Millennium EBS’s advanced payment orchestration platform with BlueOne Card’s established international platform, accelerating both domestic and global growth.

- Future Outlook: The Company aims to work towards meeting NASDAQ listing requirements by Q4 2026, subject to market conditions and other factors.

Significance of the Acquisition

The Millennium EBS Payment Hub has successfully enabled a major banking institution in Sri Lanka to transition to ISO20022 standards and is now in use, showcasing its role as the ultimate solution for banks seeking scalability, compliance, and secure financial messaging. The platform integrates diverse payment systems into a cohesive framework, offering seamless multi-channel payment processing. This acquisition shifts BlueOne Card’s position from a planned leasing agreement to full ownership, enabling us to provide payment services directly to banks and generate significant revenue from financial institutions that utilize our platform.

Strategic Goals

- Empowering Financial Institutions: By acquiring Millennium EBS, BlueOne Card is positioned to support small and medium-sized banks worldwide in modernizing their payment operations. The platform will streamline payment processing across channels such as Swift, RTGS, ACH, FedNow, and Fedwire, offering banks an efficient path to meeting ISO 20022 compliance requirements.

- Expanding Remittance Services: The acquisition enables BlueOne Card to establish a robust remittance platform, allowing users to send money globally without needing a traditional bank account. This new service will generate revenue on each transaction, with convenient options for loading money at locations such as Walmart and 7-Eleven.

- Driving Operational Efficiency: Full ownership of the Millennium EBS Payment Hub allows BlueOne Card to integrate and optimize payment processes, enhancing operational efficiency for banks. By offering this comprehensive solution, the Company aims to meet the evolving demands of the financial sector while capitalizing on new revenue streams.

BlueOne Card’s acquisition of Millennium EBS is a significant step forward in our mission to transform payment solutions for financial institutions and individuals around the globe. This strategic move positions us to deliver comprehensive payment services while maximizing growth opportunities in the expanding digital payments market.

“This acquisition represents a pivotal move in our long-term vision of becoming a global leader in financial technology,” said Jame Koh, Chairman and CEO of BlueOne Card.

About Millennium EBS

Millennium EBS is a progressive player in the payment hub market, offering Millennium Payment Hub, a comprehensive platform designed to modernize payment processes across multiple channels including Swift, RTGS, ACH, FedNow, and Fedwire. The payment hub platform streamlines financial operations for institutions by integrating various payment systems into a unified solution, leveraging extensive payment technology and software expertise. With support for real-time transaction processing and built-in compliance management (KYC & AML), Millennium Payment Hub enhances operational efficiency and reduces regulatory risks. Millennium EBS is currently targeting small to medium-sized financial institutions seeking to meet ISO 20022 migration deadlines for Fedwire and Swift.

For more information,

visit: www.millenniumebs.com

About BlueOne Card

Founded in 2007 and incorporated in Nevada, BlueOne Card® is a leading provider of innovative payout solutions and prepaid card services, dedicated to transforming the way consumers and corporations manage their money. Our advanced prepaid debit cards facilitate seamless Card-to-Card cross-border real-time global money transfers, making financial transactions simpler and more efficient than ever. With unique security features such as lock and unlock access and dynamic CVV technology, our BlueOne Prepaid Debit Card ensures that users can enjoy peace of mind in every transaction. Backed by FDIC insurance and zero liability, our cards offer a safer, more reliable alternative to cash. At BlueOne Card, we are committed to empowering the unbanked workforce and addressing their payment and money transfer needs.

For more information,

visit: www.blueonecard.com or contact info@blueonecard.com

1-800-210-9755

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

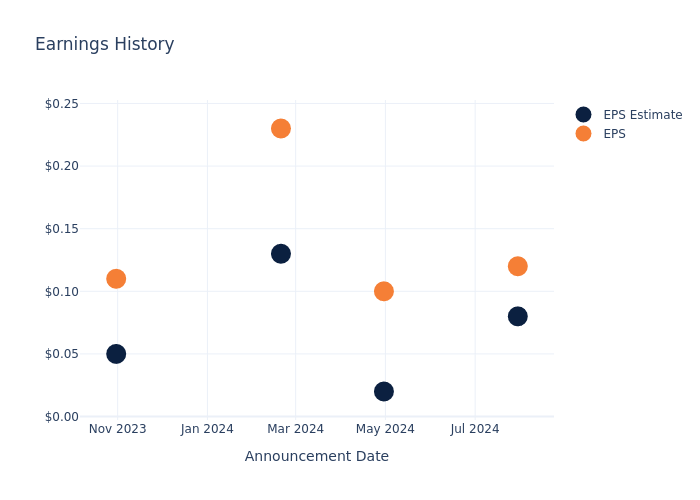

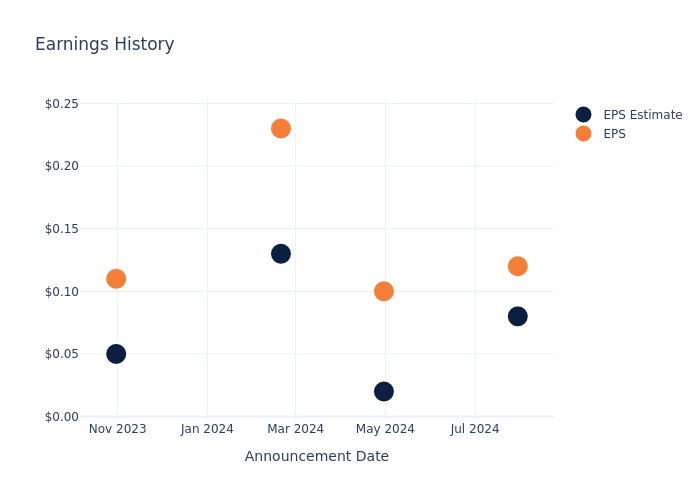

Quad/Graphics's Earnings Outlook

Quad/Graphics QUAD will release its quarterly earnings report on Monday, 2024-10-28. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Quad/Graphics to report an earnings per share (EPS) of $0.23.

Anticipation surrounds Quad/Graphics’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Historical Earnings Performance

Last quarter the company beat EPS by $0.04, which was followed by a 18.39% drop in the share price the next day.

Here’s a look at Quad/Graphics’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.08 | 0.02 | 0.13 | 0.05 |

| EPS Actual | 0.12 | 0.10 | 0.23 | 0.11 |

| Price Change % | -18.0% | 1.0% | -9.0% | -13.0% |

Tracking Quad/Graphics’s Stock Performance

Shares of Quad/Graphics were trading at $5.46 as of October 24. Over the last 52-week period, shares are up 2.82%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Quad/Graphics

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Quad/Graphics.

Analysts have given Quad/Graphics a total of 5 ratings, with the consensus rating being Buy. The average one-year price target is $7.96, indicating a potential 45.79% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of and Quad/Graphics, three prominent industry players, offering insights into their relative performance expectations and market positioning.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for and Quad/Graphics are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Quad/Graphics | Buy | -9.80% | $140.30M | -3.33% |

Key Takeaway:

Quad/Graphics is positioned at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. In terms of Return on Equity, Quad/Graphics is also at the bottom compared to its peers. The consensus rating for Quad/Graphics is ‘Buy’.

All You Need to Know About Quad/Graphics

Quad/Graphics Inc provides print and marketing services to help customers market their products, services, and contents. The company operates in the commercial segment of the printing industry. It operates through three divisions. The United States print and related services segment consists of the company’s American operations. Besides the complete set of print and marketing solutions, this segment also manufactures ink. The international segment includes the company’s printing business in Europe and Latin America. The corporate segment is engaged in the general and administrative activities as well as associated costs. The company almost generates all its revenue from the American domestic market.

A Deep Dive into Quad/Graphics’s Financials

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: Quad/Graphics’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -9.8%. This indicates a decrease in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of -0.44%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Quad/Graphics’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -3.33%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Quad/Graphics’s ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.2%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 8.1, Quad/Graphics faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Quad/Graphics visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Firefly Neuroscience Announces Inducement Grant Under Nasdaq Listing Rule 5635(c)(4)

TORONTO, Oct. 25, 2024 (GLOBE NEWSWIRE) — Firefly Neuroscience, Inc. (“Firefly,” or the “Company”) AIFF, an Artificial Intelligence (“AI”) company developing innovative solutions that improve brain health outcomes for patients with neurological and mental disorders, today announced that the Board of Directors of Firefly granted 557,885 restricted shares (the “Shares”) as an inducement grant to David Johnson, the Company’s Executive Chairman, pursuant to that certain Employment Agreement (the “Agreement”), by and between the Company and Mr. Johnson. The Shares were granted in accordance with Nasdaq Listing Rule 5635(c)(4) and are subject to the terms and conditions of the Agreement and the Company’s 2024 Long-Term Incentive Plan.

The Shares will vest as follows: one-half of the Shares shall vest on each of the sixth and twelfth month anniversaries of the grant date. provided that Mr. Johnson has not incurred a termination of service prior to the applicable vesting date.

About Firefly

Firefly AIFF is an Artificial Intelligence (“AI”) company developing innovative solutions that improve brain health outcomes for patients with neurological and mental disorders. Firefly’s FDA-510(k) cleared Brain Network Analytics (BNA™) technology revolutionizes diagnostic and treatment monitoring methods for conditions such as depression, dementia, anxiety disorders, concussions, and ADHD. Over the past 15 years, Firefly has built a comprehensive database of brain wave tests, securing patent protection, and achieving FDA clearance. The Company is now launching BNA™ commercially, targeting pharmaceutical companies engaged in drug research and clinical trials, as well as medical practitioners for clinical use.

Brain Network Analytics was developed using artificial intelligence and machine learning on Firefly’s extensive proprietary database of standardized, high-definition longitudinal electroencephalograms (EEGs) of over 17,000 patients representing twelve disorders, as well as clinically normal patients. BNA™, in conjunction with an FDA-cleared EEG system, can provide clinicians with comprehensive insights into brain function. These insights can enhance a clinician’s ability to accurately diagnose mental and cognitive disorders and to evaluate what therapy and/or drug is best suited to optimize a patient’s outcome.

Please visit https://fireflyneuro.com/ for more information.

Forward-Looking Statements

Certain statements in this press release and the information incorporated herein by reference may constitute “forward-looking statements” for purposes of the federal securities laws concerning Firefly. These forward-looking statements include express or implied statements relating to Firefly’s management teams’ expectations, hopes, beliefs, intentions, or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting Firefly will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond Firefly’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: risks related to development and commercialization of BNA™ technology; risks related to Firefly’s ability to recognize the anticipated benefits of the merger (the “Merger”) with WaveDancer, Inc. (“WaveDancer”); risks related to Firefly’s ability to correctly estimate its operating expenses and expenses associated with the Merger and other events and unanticipated spending and costs that could reduce Firefly’s cash resources; the ability of Firefly to protect its intellectual property rights; competitive responses to the business combination; unexpected costs, charges or expenses resulting from the Merger; potential adverse reactions or changes to business relationships resulting from the completion of the Merger; legislative, regulatory, political and economic developments; and those factors described under the heading “Risk Factors” in the in the registration statement on Form S-4 filed by WaveDancer with the Securities and Exchange Commission on January 22, 2024, as amended, and declared effective on February 6, 2024. Should one or more of these risks or uncertainties materialize, or should any of Firefly’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. It is not possible to predict or identify all such risks. Forward-looking statements included in this press release only speak as of the date they are made, and Firefly does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Firefly Neuroscience Investor Contacts

KCSA Strategic Communications

Valter Pinto / Jack Perkins

(212) 896-1254

Firefly@KCSA.com

Firefly Neuroscience Media Contact

KCSA Strategic Communications

Raquel Cona, Vice President

(516) 779-2630

Rcona@KCSA.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Says Apple, Meta, Amazon And Other Tech Earnings Present A 'Huge Opportunity,' But Advises To 'Wait To Process The Numbers…Before You Pull The Trigger'

Investors are bracing for a flurry of earnings reports from some of the biggest names in the tech industry. Alphabet Inc. GOOGL GOOG, Meta Platforms Inc. META, Apple Inc. AAPL, Microsoft Corporation MSFT, and Amazon.com Inc. AMZN are all set to disclose their financial performance.

What Happened: On Friday, CNBC’s Jim Cramer advised investors to stay calm in anticipation of these major earnings reports. Cramer also highlighted the importance of the nonfarm payroll report due next Friday, suggesting that a weak hiring result could lead the Federal Reserve to continue its rate reduction.

“Huge opportunity,” he said.

However, Cramer stressed the need for patience, urging investors to “wait to process the numbers and listen to the conference calls before you pull the trigger.” He pointed out that the initial market reaction has been off the mark nearly 50% of the time since the start of this earnings season.

The week’s earnings reports will commence with Ford Motor Company’s F disclosure on Monday. Cramer expressed optimism for a clean quarter from the automaker, devoid of warranty cost issues and minimal losses on electric vehicles.

Why It Matters: On Tuesday, McDonald’s Corporation MCD will release its earnings report. Cramer expects a detailed update on the recent E. coli outbreak linked to the fast-food chain’s Quarter Pounders, which, according to the Centers for Disease Control and Prevention, has resulted in 75 cases across 13 states.

Cramer concluded by emphasizing the importance of Friday’s nonfarm payroll report, suggesting that continued strong employment could deter a November interest rate cut. Despite some investors’ tendency to sell, Cramer proposed that fed rate cut cycles are times to buy.

The upcoming earnings reports from these tech giants and other major companies have been a point of interest for investors. The tech sector has been rallying as investors position themselves ahead of these pivotal earnings releases.

Read Next: Nate Silver’s ‘Gut’ Says Trump Will Win, But Kamala Harris ‘Could Beat Her Polls’

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Trump Has An Enemies List, I Have A To-Do List,' Says Kamala Harris — Cannabis Legalization Is On It

Vice President Kamala Harris released her “to-do list” and legalizing recreational cannabis took sixth place, right after restoring reproductive freedom.

“Trump has an enemies list. I have a to-do list,” wrote Harris on X, referring to former President Donald Trump who has talked about turning the military on the “enemy within” and jailing reporters who don’t identify their sources, among other things not befitting a democracy.

NPR reported Trump made more than 100 threats to prosecute or punish people who oppose him.

Harris has committed to making marijuana legalization “the law of the land,” framing it as part of a broader effort to address systemic inequities. Her campaign has said that federal cannabis reform would “break down unjust legal barriers” impacting Black men and other marginalized communities by standardizing legal cultivation, distribution and personal use across states.

“I just feel strongly, people should not be going to jail for smoking weed. And we know historically what that has meant and who has gone to jail,” Harris said recently on “All the Smoke,” podcast in an interview with former NBA players Matt Barnes and Stephen Jackson.

Harris was referring to the racial disparity in cannabis possession arrests. On average, Black people are 3.6 times more likely to be arrested on marijuana charges, according to data collected by the American Civil Liberties Union (ACLU).

“I just think we have come to a point where we have to understand that we need to legalize it and stop criminalizing this behavior,” Harris said, adding “This is not a new position for me. I have felt for a long time we need to legalize.”

Shortly after the podcast, Harris reiterated her pledge to legalize recreational marijuana, protect cryptocurrency assets and give one million loans to Black entrepreneurs in an effort to galvanize Black voters.

Trump has also come out in support of Florida’s cannabis legalization initiative, Amendment 3, and has indicated he would reschedule marijuana if elected president.

Read Next:

Photos: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Genesis Land Development Corp. Appoints Senior Vice President & General Counsel

CALGARY, AB, Oct. 25, 2024 /CNW/ – Genesis Land Development Corp. GDC (“Genesis”) is pleased to announce the appointment of Travis McArthur, JD as Senior Vice President & General Counsel effective November 1, 2024.

Reporting to Iain Stewart, CEO, Mr. McArthur will join the company’s executive leadership team responsible for all legal matters and play an important role in land acquisition, land development, financings, land sales and homebuilding operations.

Mr. McArthur brings extensive legal and real estate expertise to Genesis. With over 12 years of private practice experience acting for developers, homebuilders, financial institutions, surety companies, and private lenders, he will be a great addition to the team.

“Genesis has more than doubled its asset base over the last three years. Mr. McArthur brings important skillsets and leadership needed to continue Genesis’ growth. I am very excited to have Travis join our team and am looking forward to his contributions to Genesis” commented Mr. Stewart.

About Genesis

Genesis is an integrated land developer and residential home builder operating in the Calgary Metropolitan Area (“CMA”) holding a portfolio of well-located, entitled and unentitled primarily residential lands and serviced lots in the CMA.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain statements which constitute forward-looking statements or information (“forward-looking statements”) within the meaning of applicable securities legislation, including Canadian Securities Administrators’ National Instrument 51-102 ‘Continuous Disclosure Obligations’, concerning the business and operations of Genesis. Forward-looking statements in this news release include, but are not limited to, matters relating to future growth. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “scheduled”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements are based on material factors or assumptions made by us with respect to, among other things, opportunities that may or may not be pursued by us; changes in the real estate industry; fluctuations in the Canadian and Alberta economy; changes in the number of lots sold and homes delivered per year; and changes in laws or regulations or the interpretation or application of those laws and regulations. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control.

Although Genesis believes that the anticipated future results, performance or achievements expressed or implied by forward-looking statements are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements because they involve assumptions, known and unknown risks, uncertainties and other factors many of which are beyond the Corporation’s control, which may cause the actual results, performance or achievements of Genesis to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements. Accordingly, Genesis cannot give any assurance that its expectations will in fact occur and cautions that actual results may differ materially from those in the forward-looking statements.

Factors that could cause actual results to differ materially from those set forth in the forward-looking statements include, but are not limited to: the impact of contractual arrangements and incurred obligations on future operations and liquidity; local real estate conditions, including the development of properties in close proximity to Genesis’ properties; the uncertainties of real estate development and acquisition activity; fluctuations in interest rates; ability to access and raise capital on favourable terms; not realizing on the anticipated benefits from transactions or not realizing on such anticipated benefits within the expected time frame; the cyclicality of the oil and gas industry; changes in the Canadian US dollar exchange rate; labour matters; governmental regulations; general economic and financial conditions; stock market volatility; and other risks and factors described from time to time in the documents filed by Genesis with the securities regulators in Canada available at www.sedar.com, including in the Corporation’s MD&A under the heading “Risks and Uncertainties” and the Corporation’s annual information form under the heading “Risk Factors”.

The forward-looking statements contained in this news release are made as of the date of this news release and, except as required by applicable law, Genesis does not undertake any obligation to publicly update or to revise any of the forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE Genesis Land Development Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c8651.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c8651.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

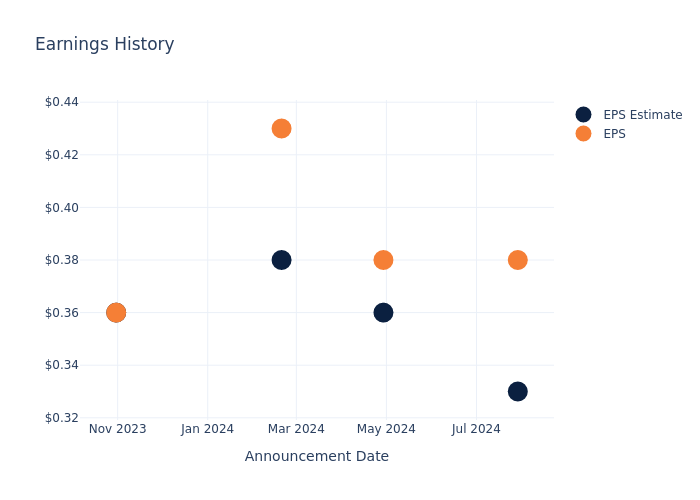

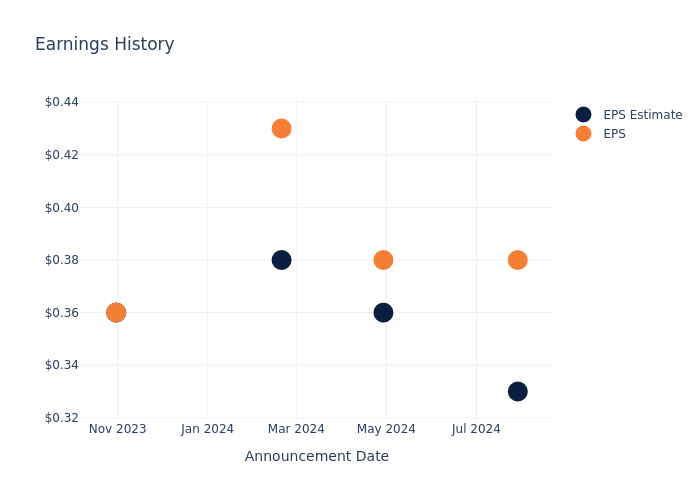

A Preview Of Seven Hills Realty Trust's Earnings

Seven Hills Realty Trust SEVN is preparing to release its quarterly earnings on Monday, 2024-10-28. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Seven Hills Realty Trust to report an earnings per share (EPS) of $0.37.

Investors in Seven Hills Realty Trust are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Earnings History Snapshot

Last quarter the company beat EPS by $0.05, which was followed by a 1.05% increase in the share price the next day.

Here’s a look at Seven Hills Realty Trust’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.33 | 0.36 | 0.38 | 0.36 |

| EPS Actual | 0.38 | 0.38 | 0.43 | 0.36 |

| Price Change % | 1.0% | 3.0% | 6.0% | 1.0% |

Performance of Seven Hills Realty Trust Shares

Shares of Seven Hills Realty Trust were trading at $14.29 as of October 24. Over the last 52-week period, shares are up 40.06%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.