Higher Prices Energized Coca Cola's Q3 Financials

On Wednesday, The Coca Cola Company KO surpassed Wall Street estimates on both revenue and earnings fronts as higher prices managed to offset a rather sluggish demand for its beverages in the face of increasingly price-sensitive consumers.

Third Quarter Highlights

Adjusted net sales were roughly flat compared to last year, amounting to $11.95 billion, surpassing LSEG’s consensus estimate of $11.60 billion. However, when acquisitions, divestitures and currency are excluded, organic revenue actually rose 9%.

Net income attributable to shareholders went did go down to $2.85 billion, or 66 cents per share while adjusted earnings amounted to 77 cents per share, topping LSEG’s consensus estimate of 74 cents per share.

But, the reality is that North America consumers have been snacking and and drinking less, even its rival PepsiCo Inc PEP noticed it while also dealing with the fallout from Quaker Foods recalls. Pepsi said volume for its North American beverage business fell 3% in its third quarter. Overall, PepsiCo reported disappointing third quarter sales and also trimmed its growth outlook.

With a weakened international demand, Coca Cola reported its unit case volume fell by 1%. China and Turkey’s declines were specifically named out.

Unit case volume fell 2% in both Europe, Middle East and Africa as well as Asia-Pacific regions. In North America, it was flat, as the weakened demand for water, sports, coffee and tea products offset growth in its namesake soda, juice, dairy, plant-based beverages and sparkling flavors. However, premium products with higher price tags like seltzers have performed well.

Global volume for sparkling soft drinks, like Sprite, and for its namesake soda were both flat, while juice, dairy and plant-based beverages division reported a 3% volume drop, with water, sports, coffee and tea segment’s volume shrinking by 4% which was mainly triggered by a 6% drop in bottled water’s volume.

Coca Cola executives stated that pricing rose 10% with a more normalized pricing on the horizon going into 2025.

A Reaffirmed Full Year Outlook

Coca Cola guided for 2024 organic revenue growth of roughly 10% which is the high end of the range between 9% and 10% it had previously provided, while also reiterating its earnings per share growth projection between 5% and 6%.

While Coca Cola will provide a full-year outlook for the upcoming year with the release of 2024’s fourth quarter earnings report, it already revealed it is expecting currency to hurt its 2025 results, with headwinds for comparable revenue being in low-single digits and for earnings per share being in mid-single digits.

As for the fourth quarter, Coca Cola warned that earnings per share percentage growth will include a 10% currency headwind in addition to headwinds from acquisitions, divestitures and structural changes that will be about 3% to 4%.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Will Tesla's Giant Move Help NASDAQ Break Out?

To gain an edge, this is what you need to know today.

Nasdaq Breakout?

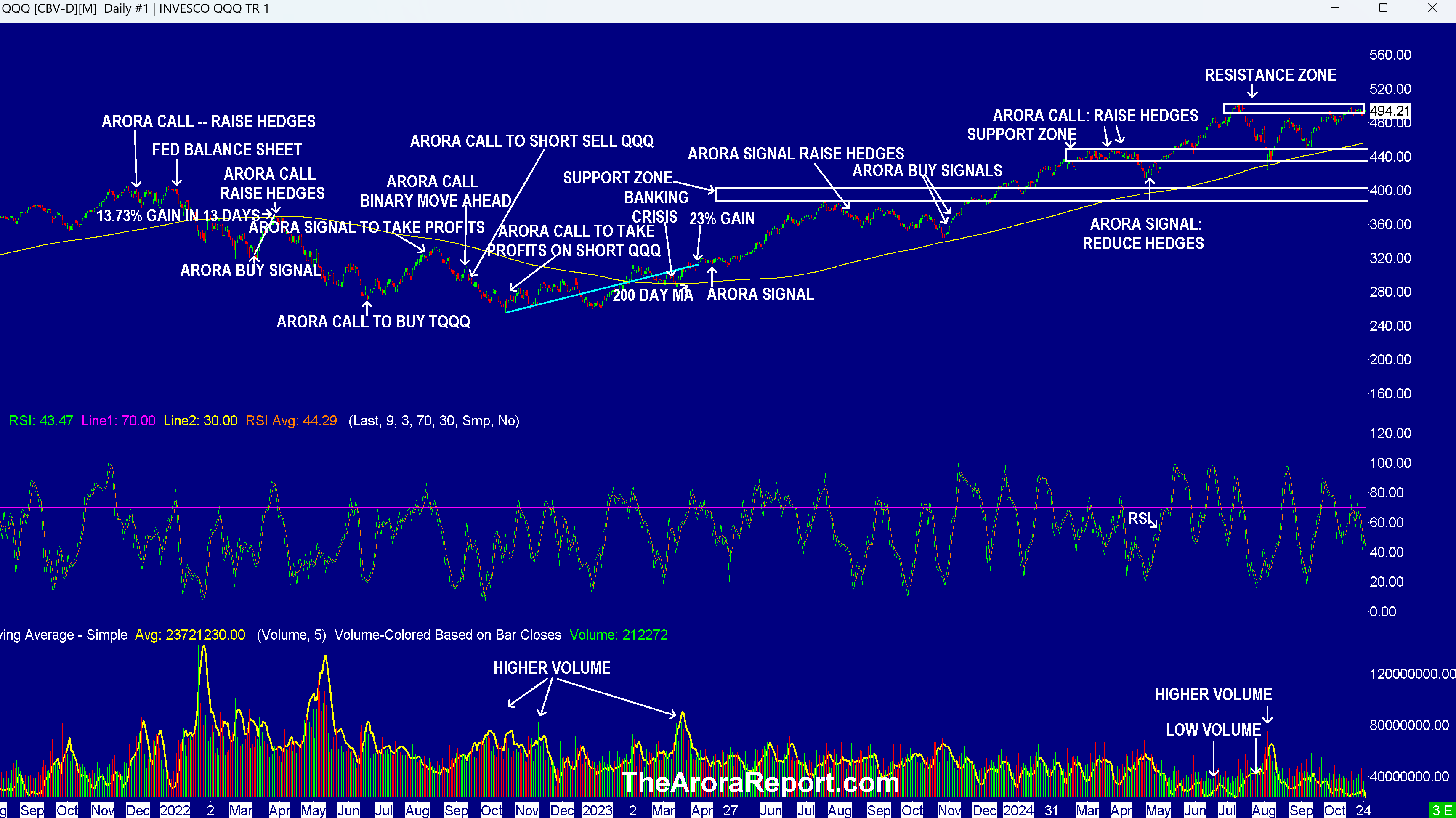

Please click here for a chart of Invesco QQQ Trust Series 1 QQQ.

Note the following:

- The chart shows QQQ is in the resistance zone.

- The chart shows that QQQ moved up on giant Tesla Inc TSLA earnings. Please see yesterday’s Morning Capsule for details on Tesla earnings. After earnings, Tesla added a giant gain of $150B to its market capitalization.

- Bulls are hoping that giant Tesla earnings combined with a potential short squeeze today will cause QQQ to breakout above the resistance zone.

- Prudent investors should note that while S&P 500 has broken out, Nasdaq 100 has not. Lately, tech stocks have lagged. This is a reminder that it is important to diversify beyond tech stocks.

- RSI on the chart shows that QQQ is a long way from being overbought, and thus it will be easier to push it higher.

- In The Arora Report analysis, next week there are important big tech earnings. These earnings will determine how QQQ behaves.

- This morning more buying is coming into the stock market after the release of durable goods orders.

- Durable Orders came at -0.8% vs. -0.9% consensus.

- Durable Orders Ex-Transport came at 0.4% vs. -0.1% consensus.

- University of Michigan consumer sentiment will be released at 10am ET. This data may be market moving. Consumer sentiment is important because the consumer is 70% of the U.S. economy.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band. The protection band is one of the large number of unique edges that are available to members of The Arora Report.

Japan

A general election will be held in Japan this Sunday. There is a risk of the ruling party losing control of parliament. In The Arora Report analysis, if the ruling party loses control of parliament, there is a fair probability that it will be negative for the yen and Japanese stocks.

Europe

The European Central Bank’s (ECB) Chief Economist is out saying that inflation in Europe is expected to reach the central bank’s target in 2025.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Amazon.com, Inc. AMZN, Alphabet Inc Class C GOOG, Meta Platforms Inc META, Microsoft Corp MSFT, and NVIDIA Corp NVDA.

In the early trade, money flows are neutral in TSLA.

In the early trade, money flows are negative in Apple Inc AAPL.

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust Series 1 (QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust GLD. The most popular ETF for silver is iShares Silver Trust SLV. The most popular ETF for oil is United States Oil ETF USO.

Bitcoin

Bitcoin BTC/USD is range bound.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fidus Investment Corporation Schedules Third Quarter 2024 Earnings Release and Conference Call

EVANSTON, Ill., Oct. 25, 2024 (GLOBE NEWSWIRE) — Fidus Investment Corporation FDUS (“Fidus” or the “Company”) today announced that it will report its third quarter 2024 financial results on Thursday, October 31, 2024 after the close of the financial markets.

Management will host a conference call to discuss the operating and financial results at 9:00am ET on Friday, November 1, 2024. To participate in the conference call, please dial (844) 808-7136 approximately 10 minutes prior to the call. International callers should dial (412) 317-0534. Please ask to be joined into the Fidus Investment Corporation call.

A live webcast of the conference call will be available at https://investor.fdus.com/news-events/events-presentations. Please access the website 15 minutes prior to the start of the call to download and install any necessary audio software.

A webcast replay of the conference call will be available two hours after the call on the investor relations section of the Company’s website.

ABOUT FIDUS INVESTMENT CORPORATION

Fidus Investment Corporation provides customized debt and equity financing solutions to lower middle-market companies, which management generally defines as U.S. based companies with revenues between $10 million and $150 million. The Company’s investment objective is to provide attractive risk-adjusted returns by generating both current income from debt investments and capital appreciation from equity related investments. Fidus seeks to partner with business owners, management teams and financial sponsors by providing customized financing for change of ownership transactions, recapitalizations, strategic acquisitions, business expansion and other growth initiatives.

Fidus is an externally managed, closed-end, non-diversified management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940, as amended. In addition, for tax purposes, Fidus has elected to be treated as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended. Fidus was formed in February 2011 to continue and expand the business of Fidus Mezzanine Capital, L.P., which commenced operations in May 2007 and is licensed by the U.S. Small Business Administration as a Small Business Investment Company (SBIC).

FORWARD-LOOKING STATEMENTS

This press release may contain certain forward-looking statements which are based upon current expectations and are inherently uncertain, including, but not limited to, statements about the future performance and financial condition of the Company, the prospects of our existing and prospective portfolio companies, the financial condition and ability of our existing and prospective portfolio companies to achieve their objectives, and the timing, form and amount of any distributions or supplemental dividends in the future. Any such statements, other than statements of historical fact, are likely to be affected by other unknowable future events and conditions, including elements of the future that are or are not under the Company’s control, and that the Company may or may not have considered, such as changes in the financial and lending markets and the impact of interest rate volatility, including the decommissioning of LIBOR and rising interest rates; accordingly, such statements cannot be guarantees or assurances of any aspect of future performance. Actual developments and results are highly likely to vary materially from these estimates and projections of the future as a result of a number of factors related to changes in the markets in which the Company invests, changes in the financial, capital, and lending markets, and other factors described from time to time in the Company’s filings with the Securities and Exchange Commission. Such statements speak only as of the time when made, and are based on information available to the Company as of the date hereof and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update any such statement now or in the future, except as required by applicable law.

| Company Contact: | Investor Relations Contact: |

| Shelby E. Sherard | LHA Investor Relations |

| Chief Financial Officer | Jody Burfening |

| Fidus Investment Corporation | (212) 838-3777 |

| (847) 859-3938 | JBurfening@lhai.com |

| SSherard@fidusinv.com |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Another bad quarter for NYCB shows CRE problems are not yet behind banks

Regional lender New York Community Bancorp (NYCB) offered a new reminder Friday that commercial real estate problems are not totally in the rear-view mirror of US banks.

The Hicksville, N.Y.-based regional lender posted higher loan loss provisions and loan write-offs in the third quarter than Wall Street expected. It also reported its fourth consecutive quarterly loss, of $280 million, and delayed its goal of turning profitable by a year to 2026.

Its stock fell 8.3% Friday. As of Friday’s close, it has fallen 65.6% since the beginning of the year.

NYCB is a big lender to office buildings and rent-regulated apartment complexes, especially in New York City. With $114 billion in assets, it is one of the country’s 30 largest banks.

Its stock began plummeting in January after the bank set aside more money for real estate loan losses related in part to those apartment complexes in the New York City area.

NYCB was able to calm the market with an emergency equity infusion from a group that included former Treasury Secretary Steven Mnuchin. A new team began cutting the bank’s exposure to commercial real estate while selling businesses, cutting costs, and laying off employees.

Earlier this year, the bank pledged as part of its turnaround it would turn a profit or break even in 2025.

But on Friday, the bank pushed that forecast to 2026 while also lowering what it estimates it will earn in that breakthrough year.

“The company is making a seismic change, and that commercial bank is going to be better in 2026 and 2027 from a profit and structure and franchise value perspective,” Janney analyst Chris Marinac told Yahoo Finance. “It’s simply going to be more expensive for them to make the transition in 2025.”

NYCB is not the only bank still working its way through commercial real estate burdens.

Wells Fargo (WFC) CEO Charlie Scharf said on Thursday that his bank may lose $2 billion to $3 billion on its commercial real estate office loan portfolio and that the problems are expected to play out over the next three to four years.

“We’re going to lose $2 to $3 billion, it’s a lot of money,” Scharf said at an event in Washington Thursday. “On the other hand, we’ve reserved for all of it.”

Two weeks ago, Wells Fargo disclosed that it had an allowance of $2.42 billion for future credit losses.

Scharf said concerns about commercial real estate are waning, however, as interest rates start to come back down, and that most of the problems are concentrated among office buildings that are emptier than they were pre-pandemic

Israel Strikes Iranian Military Targets In Major Retaliation: IDF

Israel on Friday initiated strikes against Iranian military targets. This move comes as a response to Tehran’s attacks on Israel, marking a significant escalation in Middle East tensions.

What Happened: The Israel Defense Forces (IDF) confirmed on X that they were executing precise strikes on military targets in Iran.

This action is a direct retaliation to Iran’s ballistic missile attack on Israel on Oct. 1, during which approximately 200 missiles were launched at Israel. This marked Iran’s second direct attack on Israel within a six-month period.

“In response to months of continuous attacks from the regime in Iran against the State of Israel – right now the Israel Defense Forces is conducting precise strikes on military targets in Iran,” The IDF said.

Israel asserts that it has the right and obligation to respond to attacks from Tehran and its proxies, which have included missile strikes launched from Iranian soil.

See Also: Peter Schiff Warns Investors Against Keeping $20K In Cash: ‘One Of The Riskiest Bets You Can Make’

Iran’s state TV reported several powerful explosions in the capital, Tehran, and the nearby city of Karaj. According to unnamed Iranian intelligence officials, these explosions are speculated to have been the result of the activation of Iran’s air defense system, according to Reuters.

The U.S. was informed of Israel’s strikes but was not involved in the operation. The U.S. is working to prevent further escalation of the conflict, the report said.

Why It Matters: The recent escalation follows Iran’s missile attack on Israel on Oct. 1, which was in response to the killing of Hassan Nasrallah, the leader of Iran-backed Hezbollah. The U.S. had warned of an imminent attack in the region, leading to increased tensions.

Israeli Prime Minister Benjamin Netanyahu had promised retaliation for the missile attack, while Iran warned of “vast destruction” if Israel retaliated. The U.S. has been pushing for a cease-fire as Israel continues its military offensive in Gaza and Lebanon.

Meanwhile, the extent of the damage in Iran remains unclear.

The United States Oil Fund, LP USO rose by 1.2% in after-hours trading, with oil prices climbing 9% since Sept. 10 as traders factor in global political risks. Historically, oil prices have surged briefly in response to similar events, only to fall back once it’s evident that physical supply remains unaffected.

This attack unfolded after major global markets had closed.

Read Next: Elon Musk Apologizes To ‘Long Suffering’ Deposit Holders Of New Tesla Roadster

Image via Shutterstock

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Nikola Stock Is Jumping This Week

Electric truck maker Nikola (NASDAQ: NKLA) continues to work to grow its business, and it announced some new progress this week. That led to a jump in the stock price. As of early Friday morning, Nikola shares were 10.5% above last Friday’s closing price, according to data provided by S&P Global Market Intelligence.

However, that bump higher still didn’t do much to offset the huge decline the stock has had this year. Nikola shares have dropped by about 84% year to date, even as the company begins to accelerate sales of its hydrogen fuel cell electric trucks.

Yet this week’s news of an agreement between Nikola, global beverage company Diageo, and logistics provider DHL Supply Chain to deploy two new Nikola hydrogen trucks in Illinois is still notable progress for the electric truckmaker. DHL Supply Chain is a division of DHL Group, and a longtime logistics contract partner for Diageo’s North American operations.

The two Nikola hydrogen fuel cell trucks joining the DHL Supply Chain fleet may not sound like enough to be impactful for the company or the stock. Nikola sold 72 new trucks to its wholesale distributors in the second quarter alone. But these two trucks represent its entry into a new geographic region. Nikola has mostly focused early sales on the West Coast, and near Southern California ports specifically. Its niche product requires hydrogen supply and fueling infrastructure, so holding to a contained market geography made sense.

Now it will have the first two hydrogen fuel cell trucks in service in the state of Illinois. It will also include a modular refueler on the Diageo campus in Plainfield, Illinois, the company said. So this deal is more meaningful to Nikola than it may look on the surface. And investors seemed to acknowledge that this week.

We should hear more about the company’s expansion plans when it reports third-quarter results next week on Thursday, Oct. 31.

Before you buy stock in Nikola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nikola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $860,447!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Paul Mueller Company Announces Its Third Quarter Earnings of 2024

SPRINGFIELD, Mo., Oct. 25, 2024 (GLOBE NEWSWIRE) — Paul Mueller Company MUEL (the “Company”) announces its third-quarter earnings of 2024.

| PAUL MUELLER COMPANY | |||||||||||||||||||||||

| NINE-MONTH REPORT | |||||||||||||||||||||||

| Unaudited | |||||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | Twelve Months Ended | |||||||||||||||||||||

| September 30 | September 30 | September 30 | |||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||

| Net Sales | $ | 62,085 | $ | 57,088 | $ | 178,111 | $ | 173,370 | $ | 233,897 | $ | 232,372 | |||||||||||

| Cost of Sales | 41,028 | 38,948 | 121,459 | 119,881 | 160,203 | 169,963 | |||||||||||||||||

| Gross Profit | $ | 21,057 | $ | 18,140 | $ | 56,652 | $ | 53,489 | $ | 73,694 | $ | 62,409 | |||||||||||

| Selling, General and Administrative Expense | 12,238 | 11,245 | 34,013 | 36,546 | 85,736 | 41,225 | |||||||||||||||||

| Operating Income (Loss) | $ | 8,819 | $ | 6,895 | $ | 22,639 | $ | 16,943 | $ | (12,042 | ) | $ | 21,184 | ||||||||||

| Interest Expense 1 | (83 | ) | (82 | ) | (256 | ) | (259 | ) | (347 | ) | (346 | ) | |||||||||||

| Other Income 1 | 840 | 477 | 1,885 | 1,810 | 2,741 | 2,749 | |||||||||||||||||

| Income (Loss) before Provision (Benefit) for Income Taxes | $ | 9,576 | $ | 7,290 | $ | 24,268 | $ | 18,494 | $ | (9,648 | ) | $ | 23,587 | ||||||||||

| Provision (Benefit) for Income Taxes | 2,297 | 1,786 | 5,736 | 4,510 | (4,306 | ) | 5,703 | ||||||||||||||||

| Net Income (Loss) | $ | 7,279 | $ | 5,504 | $ | 18,532 | $ | 13,984 | $ | (5,342 | ) | $ | 17,884 | ||||||||||

| Earnings (Loss) per Common Share – Basic and Diluted | $ | 7.77 | $ | 5.07 | $ | 18.79 | $ | 12.88 | $ | (5.28 | ) | $ | 16.47 | ||||||||||

| 1. The elimination of intercompany interest was incorrect in the 2nd Quarter release causing interest income and interest expense to be overstated by the same amount, however, net income was still correct. For this financial presentation, the error was corrected as of June 30th so the three-month, nine-month and twelve-month interest income and expense would be presented correctly. | |||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | |||||||||

| Nine Months Ended | |||||||||

| September 30 | |||||||||

| 2024 | 2023 | ||||||||

| Net Income | $ | 18,532 | $ | 13,984 | |||||

| Other Comprehensive Income (Loss), Net of Tax: | |||||||||

| Foreign Currency Translation Adjustment | 526 | (275 | ) | ||||||

| Comprehensive Income | $ | 19,058 | $ | 13,709 | |||||

| CONSOLIDATED BALANCE SHEETS | |||||||||

| September 30 | December 31 | ||||||||

| 2024 | 2023 | ||||||||

| Cash and Cash Equivalents 2 | $ | 16,030 | $ | 5,894 | |||||

| Marketable Securities 2 | 15,070 | 28,031 | |||||||

| Accounts Receivable | 31,363 | 25,166 | |||||||

| Inventories (FIFO) | 45,450 | 45,910 | |||||||

| LIFO Reserve | (21,461 | ) | (21,774 | ) | |||||

| Inventories (LIFO) | 23,989 | 24,136 | |||||||

| Current Net Investments in Sales-Type Leases | 35 | 27 | |||||||

| Other Current Assets | 6,262 | 3,537 | |||||||

| Current Assets | $ | 92,749 | $ | 86,791 | |||||

| Net Property, Plant, and Equipment | 45,890 | 42,011 | |||||||

| Right of Use Assets | 2,271 | 2,421 | |||||||

| Other Assets | 2,409 | 2,590 | |||||||

| Long-Term Net Investments in Sales-Type Leases | 604 | 456 | |||||||

| Total Assets | $ | 143,923 | $ | 134,269 | |||||

| Accounts Payable | $ | 13,003 | $ | 11,041 | |||||

| Current Maturities and Short-Term Debt | 648 | 640 | |||||||

| Current Lease Liabilities | 344 | 402 | |||||||

| Advance Billings | 22,696 | 27,383 | |||||||

| Pension Liabilities | 32 | 32 | |||||||

| Other Current Liabilities | 25,989 | 19,599 | |||||||

| Current Liabilities | $ | 62,712 | $ | 59,097 | |||||

| Long-Term Debt | 8,500 | 8,880 | |||||||

| Long-Term Pension Liabilities | 209 | 233 | |||||||

| Other Long-Term Liabilities | 1,677 | 1,768 | |||||||

| Lease Liabilities | 759 | 775 | |||||||

| Total Liabilities | $ | 73,857 | $ | 70,753 | |||||

| Shareholders’ Investment | 70,066 | 63,516 | |||||||

| Total Liabilities and Shareholders’ Investment | $ | 143,923 | $ | 134,269 | |||||

| 2. Has been restated to move money market accounts out of marketable securities into cash equivalents. | |||||||||

| SELECTED FINANCIAL DATA | |||||||||

| September 30 | December 31 | ||||||||

| 2024 | 2023 | ||||||||

| Book Value per Common Share | $ | 74.79 | $ | 58.50 | |||||

| Total Shares Outstanding | 936,837 | 1,085,711 | |||||||

| Backlog | $ | 171,505 | $ | 97,350 | |||||

| CONSOLIDATED STATEMENT OF SHAREHOLDERS’ INVESTMENT | ||||||||||||||||||||||||

| Accumulated Other Comprehensive Income (Loss) | ||||||||||||||||||||||||

| Common Stock | Paid-in Surplus | Treasury Stock | ||||||||||||||||||||||

| Retained Earnings | Total | |||||||||||||||||||||||

| Balance, December 31, 2023 | $ | 1,508 | $ | 9,708 | $ | 67,181 | $ | (10,787 | ) | $ | (4,094 | ) | $ | 63,516 | ||||||||||

| Add (Deduct): | ||||||||||||||||||||||||

| Net Income | 18,532 | 18,532 | ||||||||||||||||||||||

| Other Comprehensive Income (Loss), Net of Tax | 526 | 526 | ||||||||||||||||||||||

| Dividends, $.45 per Common Share | (594 | ) | (594 | ) | ||||||||||||||||||||

| Treasury Stock Acquisition | (11,910 | ) | (11,910 | ) | ||||||||||||||||||||

| Other | (4 | ) | (4 | ) | ||||||||||||||||||||

| Balance, September 30, 2024 | $ | 1,508 | $ | 9,708 | $ | 85,115 | $ | (22,697 | ) | $ | (3,568 | ) | $ | 70,066 | ||||||||||

| CONSOLIDATED STATEMENT OF CASH FLOWS | |||||||||||

| Nine Months Ended September 30, 2024 |

Nine Months Ended September 30, 2023 |

||||||||||

| Operating Activities: | |||||||||||

| Net Income | $ | 18,532 | $ | 13,984 | |||||||

| Adjustment to Reconcile Net Income to Net Cash Provided by Operating Activities: | |||||||||||

| Pension Contributions (Greater) Less than Expense | (25 | ) | (1,586 | ) | |||||||

| Bad Debt Expense (Recovery) | – | 112 | |||||||||

| Depreciation & Amortization | 5,177 | 4,718 | |||||||||

| (Gain) on Sales of Equipment | (104 | ) | (48 | ) | |||||||

| (Gain) on Disposal of Equipment | (389 | ) | – | ||||||||

| Change in Assets and Liabilities | |||||||||||

| (Inc) in Accts and Notes Receivable | (6,197 | ) | (3,658 | ) | |||||||

| (Inc) in Cost in Excess of Estimated Earnings and Billings | – | (109 | ) | ||||||||

| Dec (Inc) in Inventories | 738 | (1,985 | ) | ||||||||

| (Inc) in Prepayments | (2,724 | ) | (456 | ) | |||||||

| (Inc) in Net Investment in Sales-type leases | (353 | ) | (80 | ) | |||||||

| Dec in Other LT Assets | 1,036 | 373 | |||||||||

| Inc (Dec) in Accounts Payable | 1,962 | (148 | ) | ||||||||

| (Dec) Inc in Accrued Income Tax | (1,063 | ) | 3,519 | ||||||||

| Inc in Other Accrued Expenses | 1,606 | 5,515 | |||||||||

| (Dec) in Advanced Billings | (4,686 | ) | (4,737 | ) | |||||||

| Inc(Dec) in Billings in Excess of Costs and Estimated Earnings | 5,842 | (7,073 | ) | ||||||||

| Inc in Lease Liability for Operating | 169 | – | |||||||||

| Inc in Lease Liability for Financing | – | 130 | |||||||||

| Principal payments of Lease Liability for Operating | (188 | ) | (163 | ) | |||||||

| (Dec) in Long Term Deferred Tax Liabilities | (85 | ) | – | ||||||||

| (Dec) Inc in Other Long-Term Liabilities | (119 | ) | 197 | ||||||||

| Net Cash Provided by Operating Activities | $ | 19,129 | $ | 8,505 | |||||||

| Investing Activities | |||||||||||

| Intangibles | – | (62 | ) | ||||||||

| Purchases of Marketable Securities 2 | (16,442 | ) | (23,464 | ) | |||||||

| Proceeds from Sales of Marketable Securities 2 | 29,403 | 18,130 | |||||||||

| Proceeds from Sales of Equipment | 131 | 83 | |||||||||

| Additions to Property, Plant, and Equipment | (8,637 | ) | (4,351 | ) | |||||||

| Net Cash (Required) for Investing Activities | $ | 4,455 | $ | (9,664 | ) | ||||||

| Financing Activities | |||||||||||

| Principal payments of Lease Liability for Financing | (149 | ) | (146 | ) | |||||||

| (Repayment) of Short-Term Borrowings, Net | (1,637 | ) | – | ||||||||

| Proceeds of Short-Term Borrowings, Net | 1,637 | – | |||||||||

| (Repayment) of Long-Term Debt | (1,152 | ) | (479 | ) | |||||||

| Dividends Paid | (594 | ) | (489 | ) | |||||||

| Treasury Stock Acquisitions | (11,910 | ) | – | ||||||||

| Net Cash Provided by (Required for) Financing Activities | $ | (13,805 | ) | $ | (1,114 | ) | |||||

| Effect of Exchange Rate Changes | 357 | 290 | |||||||||

| Net Increase in Cash and Cash Equivalents 2 | $ | 10,136 | $ | (1,983 | ) | ||||||

| Cash and Cash Equivalents at Beginning of Year 2 | 5,894 | 3,468 | |||||||||

| Cash and Cash Equivalents at End of Quarter 2 | $ | 16,030 | $ | 1,485 | |||||||

| 2. Has been restated to move money market accounts out of marketable securities into cash equivalents. | |||||||||||

PAUL MUELLER COMPANY

SUMMARIZED NOTES TO THE FINANCIAL STATEMENTS

(In thousands)

| A. | The chart below depicts the net revenue on a consolidating basis for the three months ended September 30. |

| Three Months Ended September 30 | |||||||||

| Revenue | 2024 | 2023 | |||||||

| Domestic | $ | 52,560 | $ | 46,044 | |||||

| Mueller BV | $ | 10,087 | $ | 11,366 | |||||

| Eliminations | $ | (562 | ) | $ | (322 | ) | |||

| Net Revenue | $ | 62,085 | $ | 57,088 | |||||

The chart below depicts the net revenue on a consolidating basis for the nine months ended September 30.

| Nine Months Ended September 30 | |||||||||

| Revenue | 2024 | 2023 | |||||||

| Domestic | $ | 144,267 | $ | 139,924 | |||||

| Mueller BV | $ | 35,076 | $ | 34,743 | |||||

| Eliminations | $ | (1,232 | ) | $ | (1,297 | ) | |||

| Net Revenue | $ | 178,111 | $ | 173,370 | |||||

The chart below depicts the net revenue on a consolidating basis for the twelve months ended September 30.

| Twelve Months Ended September 30 | |||||||||

| Revenue | 2024 | 2023 | |||||||

| Domestic | $ | 187,349 | $ | 187,222 | |||||

| Mueller BV | $ | 48,043 | $ | 46,745 | |||||

| Eliminations | $ | (1,495 | ) | $ | (1,595 | ) | |||

| Net Revenue | $ | 233,897 | $ | 232,372 | |||||

The chart below depicts the net income (loss) on a consolidating basis for the three months ended September 30.

| Three Months Ended September 30 | |||||||||

| Net Income | 2024 | 2023 | |||||||

| Domestic | $ | 7,365 | $ | 5,078 | |||||

| Mueller BV | $ | (84 | ) | $ | 426 | ||||

| Eliminations | $ | (2 | ) | $ | – | ||||

| Net Income (Loss) | $ | 7,279 | $ | 5,504 | |||||

The chart below depicts the net income on a consolidating basis for the nine months ended September 30.

| Nine Months Ended September 30 | |||||||||

| Net Income | 2024 | 2023 | |||||||

| Domestic | $ | 17,440 | $ | 14,233 | |||||

| Mueller BV | $ | 1,064 | $ | (234 | ) | ||||

| Eliminations | $ | 28 | $ | (15 | ) | ||||

| Net Income (Loss) | $ | 18,532 | $ | 13,984 | |||||

The chart below depicts the net income on a consolidating basis for the twelve months ended September 30.

| Twelve Months Ended September 30 | |||||||||

| Net Income | 2024 | 2023 | |||||||

| Domestic | $ | (8,121 | ) | $ | 18,092 | ||||

| Mueller BV | $ | 2,775 | $ | (182 | ) | ||||

| Eliminations | $ | 4 | $ | (26 | ) | ||||

| Net Income (Loss) | $ | (5,342 | ) | $ | 17,884 | ||||

| B. | September 30, 2024 backlog is $171.5 million compared to $97.4 million at September 30, 2023. The majority of this backlog is in the U.S. where the backlog is $165.3 million at September 30, 2024 compared to $90.3 million at September 30, 2023. The $75.0 million increase in U.S. backlog is primarily from the pharmaceutical divisions. In the Netherlands, the backlog is $6.9 million on September 30, 2024 versus $9.7 million on September 30, 2023. |

| C. | Compared to last year, revenue is up $5.0 million (8.8%) on a three-month basis; up $4.7 million (2.7%) on a nine-month basis; and flat for the trailing twelve months. In the U.S., revenues show a similar pattern with increased revenue from the pharmaceutical and food and beverage divisions driving the increase. In the Netherlands business continues to improve with revenue down for the quarter but up on the 9-month and 12-month timeframes. |

| Net Income is up $1.8 million for three-months; $4.5 million for nine months but down $23.2 million before removing the pension settlement charges incurred in December 2023. In the Netherlands, earnings continue to improve following the business restructuring in the spring of 2023. Efficiencies achieved from the restructuring along with strategic price increases have led to the improved earnings. | |

| We manage our business in the U.S. looking at earnings before tax (EBT) and excluding the effects of LIFO and non-reoccurring events such as the pension settlement. This non-GAAP adjusted EBT (as shown in the table on the next page) shows improved results from a strong 2023 performance in all three timeframes. This improvement comes primarily from the pharmaceutical and food and beverage divisions. | |

| Results Ending September 30th | ||||||||||||||||

| Three Months Ended September 30 | Nine Months Ended September 30 | Twelve Months Ended September 30 | ||||||||||||||

| (In Thousands) | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||

| Domestic Net Income | $ | 7,365 | $ | 5,078 | $ | 17,440 | $ | 14,233 | $ | (8,121 | ) | $ | 18,092 | |||

| Income Tax Expense | $ | 2,321 | $ | 1,595 | $ | 5,391 | $ | 4,468 | $ | (3,834 | ) | $ | 5,634 | |||

| Domestic EBT – GAAP | $ | 9,686 | $ | 6,673 | $ | 22,831 | $ | 18,701 | $ | (11,955 | ) | $ | 23,726 | |||

| LIFO Adjustment | $ | 151 | $ | 302 | $ | (312 | ) | $ | 541 | $ | (770 | ) | $ | 925 | ||

| Pension Adjustment | $ | – | $ | – | $ | – | $ | – | $ | 41,774 | $ | – | ||||

| Domestic EBT – Non-GAAP | $ | 9,837 | $ | 6,975 | $ | 22,519 | $ | 19,242 | $ | 29,049 | $ | 24,651 | ||||

| D. | Due to recent record backlogs, on July 26, 2024, the Company announced a facility expansion of just over 100,000 square feet at a cost of $22 million. On August 26, 2024, the Company had a ground-breaking ceremony with the Missouri governor, Mike Parsons, and other dignitaries present. On October 16, 2024, site preparation began. Building completion date is scheduled for the end of 2025. |

| E. | The consolidated financials are affected by the euro to dollar exchange rate when consolidating Mueller B.V., the Dutch subsidiary. The month-end euro to dollar exchange rate was 1.06 at September 2023; 1.10 at December 2023 and 1.12 for September 2024, respectively. |

This press release contains forward-looking statements that provide current expectations of future events based on certain assumptions. All statements regarding future performance growth, conditions, or developments are forward-looking statements. Actual future results may differ materially from those described in the forward-looking statements due to a variety of factors, including, but not limited to, the factors described in the Company’s Annual Report under “Safe Harbor for Forward-Looking Statements”, which is available at paulmueller.com. The Company expressly disclaims any obligation or undertaking to update these forward-looking statements to reflect any future events or circumstances.

The accounting policies related to this report and additional management discussion and analysis are provided in the 2023 annual report, available at www.paulmueller.com.

Contact Info:

Ken Jeffries (417) 575-9000

kjeffries@paulmueller.com

https://paulmueller.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir Stock Today: Two Options Trades To Play On The Long Side

Palantir Technologies (PLTR) has been a solid mover in 2024. And with an IBD Composite Rating of 99, let’s position two option plays to consider in Palantir stock.

↑

X

Anne-Marie Baiynd: Feel At Home Trading On The Range

Both can be taken simultaneously. The first will be a short put spread to lean into the overall bullish structure of the chart. In the second trade, we will share a long call butterfly with a twist.

Palantir stock stands No. 1 overall within the enterprise software industry group, according to IBD Stock Checkup. So, it stands to reason that the chart is likely to show traders pressing ever higher, with new buyers coming into Palantir during the dips over the next quarter.

Earnings are scheduled for Nov. 4. So, we can wait to take this trade in Palantir stock after earnings. Or we could position before the results to potentially catch a move.

The key thing to watch? Simply your risk exposure.

Palantir Stock Action

The chart is extended in the near term. Plus, we approach what might be a fair bit of market volatility into the election cycle. My suspicion? Any dips get likely bought. But the breakout near the price point of 30 in Palantir stock is sharply lower than the current price near 44.

When we position with short spreads into earnings, we must consider our position size. Implied volatility within the option chains will spike into the Nov. 4 earnings news. If shocks come, we will get penalized. And if the release is very close to the options’ expiration dates, we take on more risk. No significant movement in Palantir stock will result in the bull put spread losing much of its value. This benefits traders.

When we position with long butterflies into earnings, we must consider our position size. Butterflies carry great rewards but lower probabilities of success.

When shocks come, we are well rewarded. When the moves are undersized, we are not penalized heavily so long as our sizes are small. No significant movement will result in the butterfly losing much of its value. As I often say, we assume that we don’t know the pure direction. But we can estimate the magnitude of the move using the ATR (average true range, as measured on the weekly chart) and the implied moves that market makers have priced into the move over the weeks and months ahead.

Trade Structure

The short put spread allows us to sell premium by selling an out-of-the-money put and buying another with a lower strike to protect or hedge any extraordinary price action. Set it up this way:

- Sell to open 1 PLTR Dec. 20-expiring 35 put

- Buy to open 1 PLTR Dec. 20 30 put

The short put spread above will deliver a credit of 81 cents, or $81 per share of a 100-shares contract, based on recent trading. This amount also serves as the maximum profit. Maximum loss for the position is calculated by subtracting the distance between the strikes and then the premium collected. That is, we get $35-$30 = $5 – 0.81= $4.19, or $419 per set of options.

You might ask, “Why would I take a position that has 4x on the losing side versus the profit?” The answer: This spread has a five-time likelihood of expiring worthless, thus giving the trader the overall edge if this trade is done many times over.

Long Call Butterfly

A long call butterfly is positioned so the ‘long wing’ of the trade gives us a likelihood of returns, while using the short wing to finance part of the trade.

This long call butterfly holds a single long call spread (a bullish position) and two short call spreads (a bearish position) that share the middle strike. Please notice the side that holds the short call spread is tighter so that the risk is bounded; there is no need for additional margin.

- Buy to open 1 PLTR Dec. 20 50 call

- Sell to open 3 PLTR Dec. 20 60 calls

- Buy to open 2 PLTR Dec. 20 65 calls

The call butterfly above will cost 86 cents per set of contracts, based on recent trading in Palantir stock. This makes $86 the maximum potential loss. It also means max gain comes out to $9.14, or $914 ($60 – $50 – $0.86 x 100) before commissions. Total profits will begin to erode if Palantir stock stays above 60.

Our maximum exposure is the cost of the butterfly, and it is also the max risk of the position. The break-even price stands at 50.86.

Stock hunting using fundamental and price strength within the IBD methodology is where I firmly plant myself under the backdrop of the current economic backdrop. I use technical analysis to find ideal buying opportunities in conjunction with the tools for strength seen on IBD.

Catch Anne-Marie Baiynd On The Oct. 25 IBD Live Episode

Understanding Long Butterfly Spreads

The goal of taking long butterflies like the one above is to take advantage of higher implied volatility as the undercurrent of markets shift to participate in an outsized move in either direction.

This trade could be placed both before and after earnings, though the movements may not be as amplified. Traders may try to push Palantir stock past 50 before it retraces near 35, a level of support.

As a side note, 45 serves as a resistance level, which occurred five months after its IPO at $7.25 a share on Sept. 30, 2020.

Palantir Stock: The Exit Strategy

Let’s consider three choices to exit the trade. One, sell the butterfly in Palantir stock once it gets to an acceptable profit margin for you. I customarily look for 100%-300% profit in these setups. Two, sell the bull put spread once it gets to an acceptable profit margin for you, normally 50% for me. Three, sell the spreads once it hits your loss threshold as determined by personal risk. This will happen with extreme movement. I customarily look at about 65%. Depending on my size, I will choose 50%.

And finally, sell the entire position with both the bull put spreads and the butterfly spreads into the week before expiration, if all is going well and you have decided to hold the trade to closer to the end of expiration.

Final point: I have had many a trade go sideways taking it down to the wire and not capturing gains, so I do not advise this.

Anne-Marie Baiynd is a 20-year veteran trader of stocks, options and futures and is the author of “The Trading Book: A Complete Solution to Mastering Technical Systems and Trading Psychology.” She holds no positions in the investments she writes about for IBD. You can find her on X at @AnneMarieTrades

YOU MIGHT ALSO LIKE:

Find The Best Growth Stocks Via This Highly Stringent Screen

Want More Options Trading Strategies? Go Here