CrowdStrike, Carahsoft Struck Deal to Sell Software IRS Didn’t Buy

(Bloomberg) — Last fall, George Kurtz, the chief executive officer of CrowdStrike Holdings, Inc., gave investors a quarterly financial update that sent shares soaring. Among the details Kurtz highlighted was a major deal to sell cybersecurity tools for use by the US government.“Identity threat protection wins in the quarter included an eight-figure total deal value win in the federal government,” Kurtz said on the earnings call after markets closed on Nov. 28, 2023.Kurtz was referring to a $32 million order from Carahsoft Technology Corp., which serves as a middleman between technology companies and government agencies, that arrived on the last day of CrowdStrike’s fiscal third quarter. It was for identity threat protection software intended for the US Internal Revenue Service, according to documents from both companies.

But the IRS never bought the software, according to records reviewed by Bloomberg News and people with knowledge of the situation.

Still, Carahsoft has been making on-time payments on the $32 million to CrowdStrike, according to the cybersecurity firm. When asked for comment by Bloomberg News, both companies explained that they had a “non-cancellable order” between them. They declined to say why that deal was struck without a purchase in place from the IRS. Shares of CrowdStrike fell as much as 2.7% after Bloomberg News reported about the deal.

Some legal and accounting experts, who reviewed the arrangement at Bloomberg’s request, said it raises red flags that merit scrutiny from regulators. The deal also raised concerns within CrowdStrike — according to people familiar with the matter and the company itself – and many specifics of the transaction remain unclear.

Depending on how CrowdStrike accounted for the deal in financial statements — the company didn’t explain those details — it was big enough that it could have made the difference between the company beating or missing Wall Street projections for the period. The day after CrowdStrike reported results for the record quarter, its shares rose 10%.

Jeremy Fielding, a spokesperson representing CrowdStrike, dismissed employees’ concerns as baseless and the order’s timing as insignificant. The Austin, Texas-based cybersecurity firm closes deals “throughout the quarter, starting the first day and often through the last day,” he said.

Roof Repair Specialist Supports Boy Scout Eagle Project to Renovate Valley Forge Trail Camp Roofs

BURBANK, Calif., Oct. 25, 2024 /PRNewswire/ — Roof Repair Specialist, a leading roofing company in Southern California, is pleased to announce its contribution to a community-driven project led by Boy Scout Nick, who is working towards his Eagle rank. Nick took on the significant task of renovating several aging roofs at the Valley Forge Trail Camp, including the bathroom stall and sheds, as part of his Eagle project.

The Valley Forge Trail Camp, a beloved spot for hikers and campers in the Angeles National Forest, had structures in need of roof repairs due to years of wear and exposure to the elements. Recognizing the importance of preserving this local camping facility, Nick chose this project as a way to give back to the community and support the camp’s long-term maintenance.

Nick approached Roof Repair Specialist to request a donation of roofing materials, and the company was more than willing to lend a hand. Understanding the significance of Nick’s Eagle project and the impact it would have on the camp, Roof Repair Specialist provided high-quality shingles and other necessary materials. The company also shared expert guidance on the process of shingle installation to help ensure the project’s success.

The renovation work required dedication and perseverance, and Nick rose to the occasion. With a focus on doing the job correctly and enhancing the durability of the camp’s facilities, he installed the new shingles on the bathroom stall and sheds, transforming the look and functionality of these structures. The improvements brought a fresh appearance to the buildings and will help to protect them from future weather damage.

“We’re honored to support young leaders like Nick who take on meaningful projects that positively impact the community,” said Andre Afsharian, owner at Roof Repair Specialist. “As local roofers in Los Angeles, we understand the importance of maintaining local landmarks like Valley Forge Trail Camp, and we’re proud to help make these renovations possible. Nick’s hard work and determination are truly commendable, and we’re excited to see him continue on his journey to becoming an Eagle Scout.”

The project stands as a testament to the value of community collaboration and the drive of young leaders to make a difference. Roof Repair Specialist remains committed to supporting local initiatives and empowering individuals who aim to improve their communities through service.

For more information about Roof Repair Specialist and their community involvement, visit https://www.roofrepairspecialist.com.

About Roof Repair Specialist

Roof Repair Specialist is a family-owned roofing company based in Burbank, CA, serving Southern California with expert roofing services. With a focus on quality and customer satisfaction, the company provides repair, maintenance, and installation services for residential and commercial clients. Roof Repair Specialist is dedicated to giving back to the community through partnerships and initiatives that enhance local neighborhoods.

![]() View original content:https://www.prnewswire.com/news-releases/roof-repair-specialist-supports-boy-scout-eagle-project-to-renovate-valley-forge-trail-camp-roofs-302287564.html

View original content:https://www.prnewswire.com/news-releases/roof-repair-specialist-supports-boy-scout-eagle-project-to-renovate-valley-forge-trail-camp-roofs-302287564.html

SOURCE Roof Repair Specialist

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia Stock Could Soar Another 38%, According to 1 Wall Street Firm

Nvidia (NASDAQ: NVDA) has been in scintillating form on the stock market in 2024, reaching gains of nearly 180% as of this writing. This is due to the robust growth that the company has been clocking in recent quarters on account of the strong demand for its graphics cards deployed in artificial intelligence (AI) servers.

The stock’s median 12-month price target of $150 — as per 64 analysts who cover Nvidia — indicates that there isn’t much upside on offer as it points toward gains of just 9% from current levels. However, Bank of America recently raised their price target on Nvidia from $165 to $190, which would translate into a 38% gain from current levels.

Let’s see why that was the case and check if this high-flying semiconductor stock could rise above consensus estimates and deliver stronger gains going forward.

Bank of America analysts have raised their price target on Nvidia because of the company’s dominant position in the AI chip market. They believe that the chipmaker could continue commanding an estimated 80% to 85% share of this space, which puts the company in a terrific position to capitalize on a $400 billion market opportunity.

Bank of America’s bullishness also stems from the arrival of Nvidia’s new generation of Blackwell processors, as well as a terrific earnings report from key supplier TSMC and Nvidia CEO Jensen Huang’s claim that the demand for its upcoming Blackwell cards is “insane.” It is worth noting that Nvidia management pointed out on the company’s August earnings-conference call that it is on track to sell several billion dollars’ worth of Blackwell processors in the fourth quarter of the current fiscal year.

More importantly, the demand for Blackwell chips is expected to be higher than their supply in 2025. That won’t be surprising as multiple cloud-computing giants are in line to deploy Nvidia’s Blackwell processors. In March this year, Nvidia management pointed out that Amazon Web Services, Dell Technologies, Google, Meta, Microsoft, OpenAI, Oracle, Tesla, and xAI are among the many companies expected to adopt the Blackwell platform.

That’s not surprising considering the huge leap in performance that Nvidia’s Blackwell platform is expected to deliver as compared to the prior-generation Hopper chips. More specifically, Nvidia is promising a 4 times increase in AI training performance and a 30 times jump in AI inference as compared to Hopper. Even better, Nvidia claims that Blackwell can train large language models (LLMs) at “up to 25x less cost and energy consumption than its predecessor.”

Trump’s Impossible Tax Cut

The New York Times today devotes a little over 1,100 words by reporter Andrew Duehren to examining a policy idea floated vaguely by former President Donald Trump: eliminating federal income taxes and replacing the lost revenue via tariffs.

Under a headline that reads “Trump Flirts With the Ultimate Tax Cut: No Income Taxes at All,” Duehren notes — as we did the other day — that Trump has spoken approvingly of the economic and tariff policies of the 1890s and Republican President William McKinley, and has floated or expressed openness to the idea of returning to such policies, when there was no federal income tax.

“Mr. Trump has not provided specific details of how that would work, and it is unclear if he wants to eliminate all federal taxes, including corporate income taxes and payroll taxes, or only end the individual income tax,” Duehren points out. “Either way, both liberal and conservative experts have dismissed his idea as mathematically impossible and economically destructive. Even if Republicans control Congress, lawmakers are unlikely to dismantle the income tax system.”

Duehren adds that the federal income tax system arose after the high tariffs of the 1890s that funded the federal government were criticized by Democrats of that era as a burden on poor Americans. It was meant to have the rich pay more, addressing concerns about inequality, and to help fund a larger federal government.

The result: “Tariffs dwindled as a source of federal revenue while income taxes expanded,” Duehren writes. “Today, tariffs make up just 2 percent of federal revenue, while income and payroll taxes make up about 94 percent. Overall, the tax system is progressive: In 2020, the top 20 percent of earners in the United States paid about 80 percent of all federal taxes, according to the Congressional Budget Office.”

It would now be essentially impossible to replace all income tax revenue with money from tariffs given that the U.S. imports about $3 trillion worth of goods a year, but the Treasury took in some $4.2 trillion in income taxes and payroll taxes in fiscal year 2024 — and astronomically high tariffs could lead to damaging trade wars that dry up global trade with the United States, producing little tariff revenue.

The bottom line: Trump hasn’t detailed how this idea might work — because it wouldn’t.

ASHFORD HOSPITALITY TRUST COMPLETES REVERSE STOCK SPLIT

DALLAS, Oct. 25, 2024 /PRNewswire/ — Ashford Hospitality Trust, Inc. AHT (“Ashford Trust” or the “Company”) announced today that it completed a reverse split of the Company’s common stock at a ratio of 1-for-10.

After the close of business on October 25, 2024, the effective date of the reverse stock split, each share of the Company’s issued and outstanding common stock and equivalents was converted into 1/10th of a share of the Company’s common stock. As a result of the reverse split, the number of outstanding shares of common stock was reduced from approximately 55.2 million shares to approximately 5.5 million shares. The reverse stock split will affect all stockholders proportionally and will not affect any stockholder’s ownership percentage of shares of the Company’s common stock, except for minor changes resulting from the payment of cash for fractional shares.

As of market open on October 28, 2024, the Company’s common stock will commence trading on a split-adjusted basis on the New York Stock Exchange (the “NYSE”). The common stock will continue to trade on the NYSE under the symbol “AHT” but will trade under a new CUSIP number.

Ashford Trust’s stockholders should contact their broker or Ashford Trust’s transfer agent, Computershare, at (800) 546-5141, for any necessary assistance relating to the reverse stock split.

On October 25, 2024, the Company also completed a reverse split of the partnership units of Ashford Hospitality Limited Partnership, the Company’s operating partnership (“Ashford Trust OP”), at a ratio of 1-for-10. As a result of such reverse split, the number of outstanding partnership units of Ashford Trust OP was reduced from approximately 2.1 million units to approximately 200,000 units.

Ashford Trust is a real estate investment trust (REIT) focused on investing predominantly in upper upscale, full-service hotels.

Forward-Looking Statements

Certain statements and assumptions in this press release contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Additionally, statements regarding the following subjects are forward-looking by their nature: our business and investment strategy; anticipated or expected purchases, sales or dispositions of assets; our projected operating results; completion of any pending transactions; our plan to pay off strategic financing; our ability to restructure existing property-level indebtedness; our ability to secure additional financing to enable us to operate our business; our understanding of our competition; projected capital expenditures; the impact of technology on our operations and business; the risk that the notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; and the Company’s ability to regain compliance with the NYSE continued listing standards. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. These and other risk factors are more fully discussed in the Company’s filings with the SEC.

The forward-looking statements included in this press release are only made as of the date of this press release. Investors should not place undue reliance on these forward-looking statements. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations or otherwise except to the extent required by law.

![]() View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-completes-reverse-stock-split-302287703.html

View original content:https://www.prnewswire.com/news-releases/ashford-hospitality-trust-completes-reverse-stock-split-302287703.html

SOURCE Ashford Hospitality Trust, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Tariffs Are Inflationary': IMF Deputy Chief Rejects Trump's Trade Policies As Elections Loom

With less than two weeks until the U.S. presidential election, economic policy is once again a focal point, especially as concerns around tariffs and inflation resurface.

Gita Gopinath, deputy managing director of the International Monetary Fund (IMF), issued a warning about economic risks associated with tariffs, underscoring how they can drive up prices and potentially harm growth.

In a clear message that appears to counter former President Donald Trump‘s pro-tariff stance, Gopinath cautioned, “What we do know is that tariffs are inflationary.”

In an interview with Bloomberg on Thursday, Gopinath emphasized tariffs have a proven track record of raising prices for both businesses and consumers.

“Tariffs put pressure on prices — that’s usually what we see in the data looking at past episodes of tariffs that have been put in place,” she said.

Her remarks are particularly timely, as inflation remains a persistent concern in the U.S., even as the Federal Reserve works to bring it down.

The U.S. economy has been grappling with elevated inflation since the COVID-19 pandemic, and while inflation is now trending downward, prices remain much higher than pre-pandemic levels.

“The price level now is much higher than it was a couple of years ago,” Gopinath stated, explaining why inflation is still a top issue for many American households.

The IMF believes additional tariffs could reverse recent progress in controlling inflation. When tariffs are imposed on imported goods, production costs are raised and prices often increase down the supply chain. The impact is particularly severe for sectors that rely heavily on imported components, such as electronics, automotive and machinery industries.

Tariffs could have significant detrimental consequences for both sides of the Atlantic. “An increase in tariffs on Europe would push down European growth versus the U.S. and push up U.S. inflation versus Europe,” according to George Cole, an analyst at Goldman Sachs.

Tariffs could add new challenges to the Federal Reserve’s fight against inflation, creating upward pressure on prices and potentially forcing the Fed to consider even tighter monetary policy.

This risk comes as Goldman Sachs highlights another emerging trend: U.S. Treasury yields have surged sharply in recent weeks, mirroring the rise in Donald Trump’s election odds. Higher yields reflect investor concerns about inflationary pressures and future fiscal policy.

The race between Trump and Harris remains razor-thin in most polls, underscoring a polarized electorate. Betting markets reveal a clearer lean toward Trump, with implied odds showing him at 60.02% chance of winning, compared to Harris’s 39.98%.

Meanwhile, the U.S. dollar is gaining momentum. The U.S. Dollar Index (DXY), as tracked by the Invesco DB USD Index Bullish Fund ETF UUP, has climbed for four consecutive weeks, reaching its highest level since late July.

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Exploring NBT Bancorp's Earnings Expectations

NBT Bancorp NBTB is preparing to release its quarterly earnings on Monday, 2024-10-28. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect NBT Bancorp to report an earnings per share (EPS) of $0.77.

Investors in NBT Bancorp are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

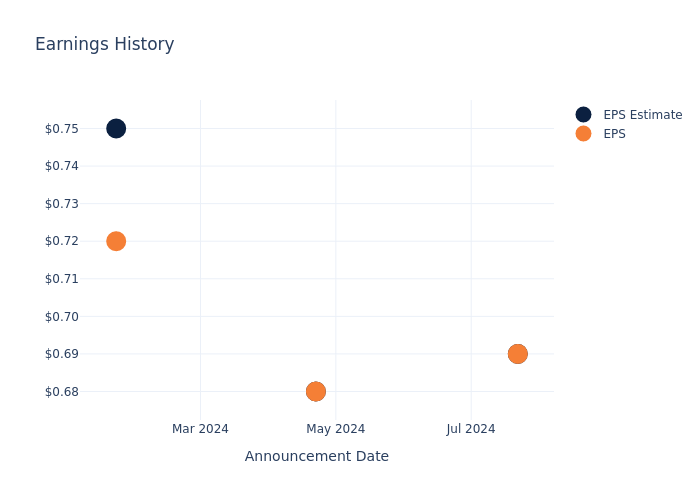

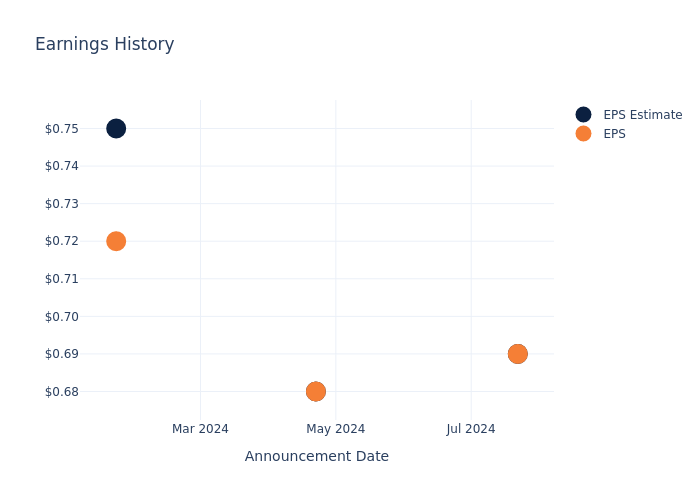

Historical Earnings Performance

In the previous earnings release, the company missed EPS by $0.00, leading to a 8.11% increase in the share price the following trading session.

Here’s a look at NBT Bancorp’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.69 | 0.68 | 0.75 | 0.70 |

| EPS Actual | 0.69 | 0.68 | 0.72 | 0.84 |

| Price Change % | 8.0% | 4.0% | -3.0% | 8.0% |

Stock Performance

Shares of NBT Bancorp were trading at $44.43 as of October 24. Over the last 52-week period, shares are up 30.09%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for NBT Bancorp visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

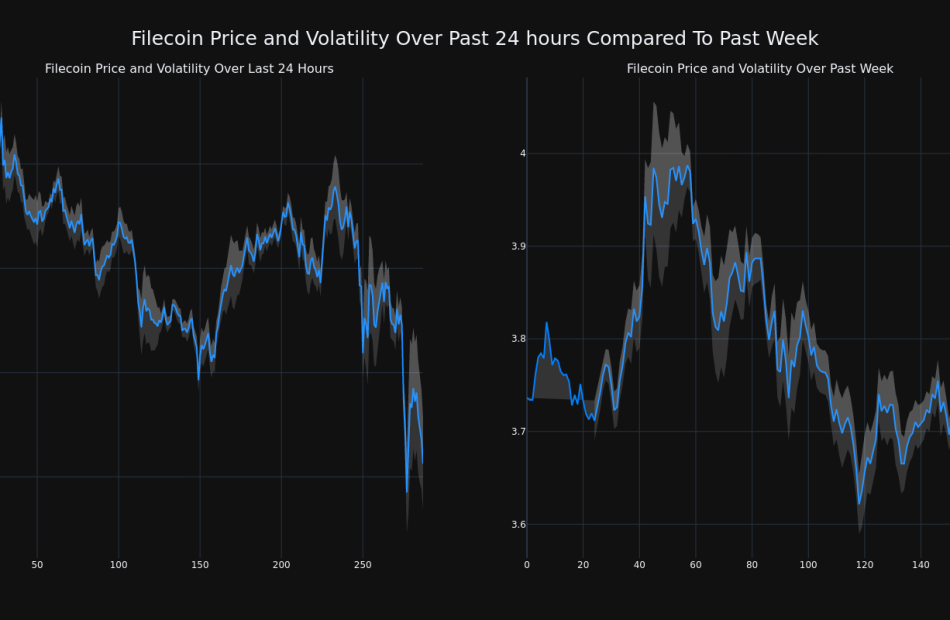

Cryptocurrency Filecoin Down More Than 3% Within 24 hours

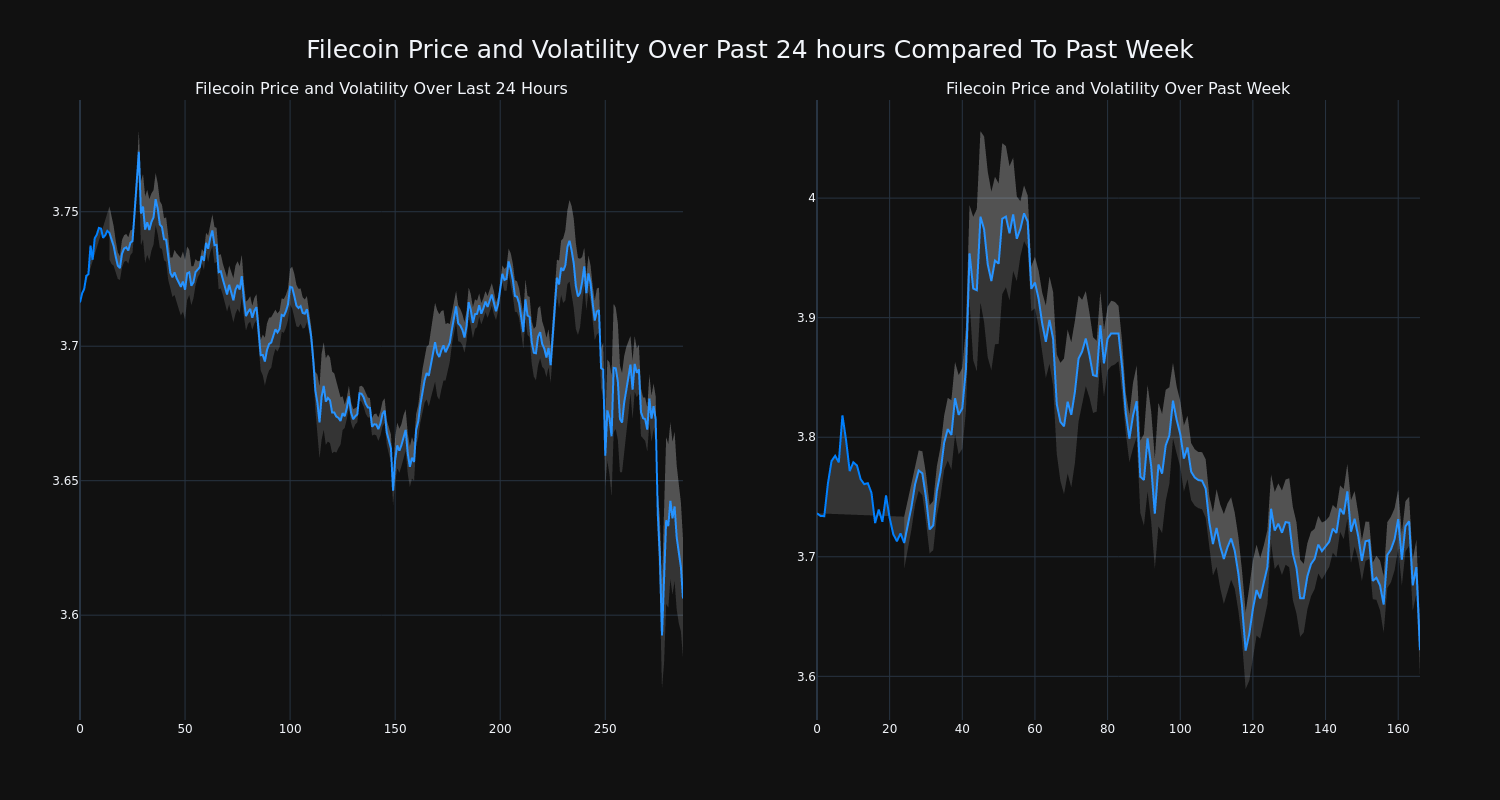

Over the past 24 hours, Filecoin’s FIL/USD price has fallen 3.03% to $3.61. This continues its negative trend over the past week where it has experienced a 3.0% loss, moving from $3.74 to its current price.

The chart below compares the price movement and volatility for Filecoin over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

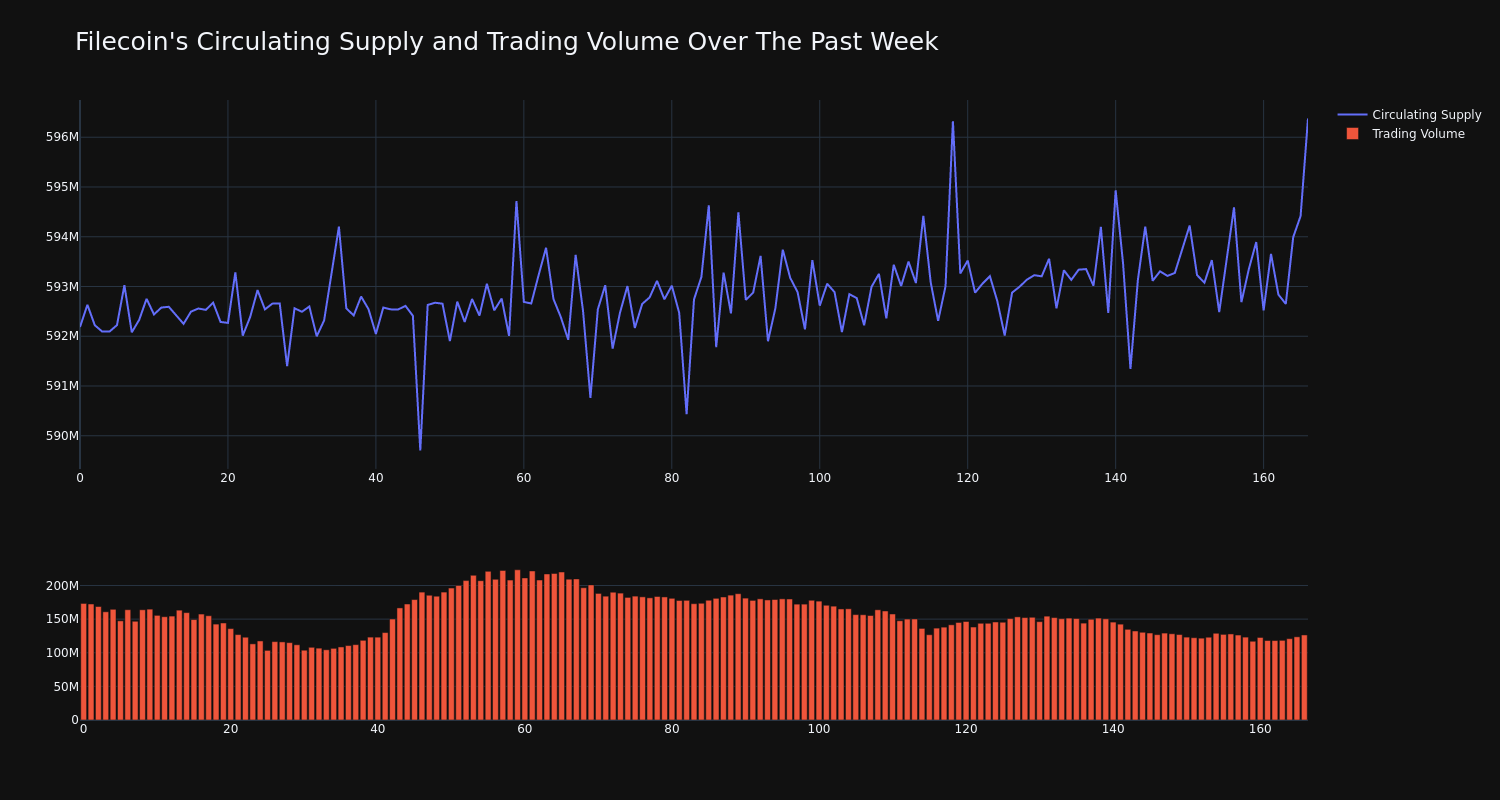

The trading volume for the coin has fallen 27.0% over the past week which is opposite, directionally, with the overall circulating supply of the coin, which has increased 0.71%. This brings the circulating supply to 593.63 million, which makes up an estimated 30.29% of its max supply of 1.96 billion. According to our data, the current market cap ranking for FIL is #46 at $2.15 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.