Unpacking the Latest Options Trading Trends in Joby Aviation

Financial giants have made a conspicuous bullish move on Joby Aviation. Our analysis of options history for Joby Aviation JOBY revealed 15 unusual trades.

Delving into the details, we found 80% of traders were bullish, while 13% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $263,540, and 7 were calls, valued at $360,161.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $4.0 to $12.0 for Joby Aviation over the recent three months.

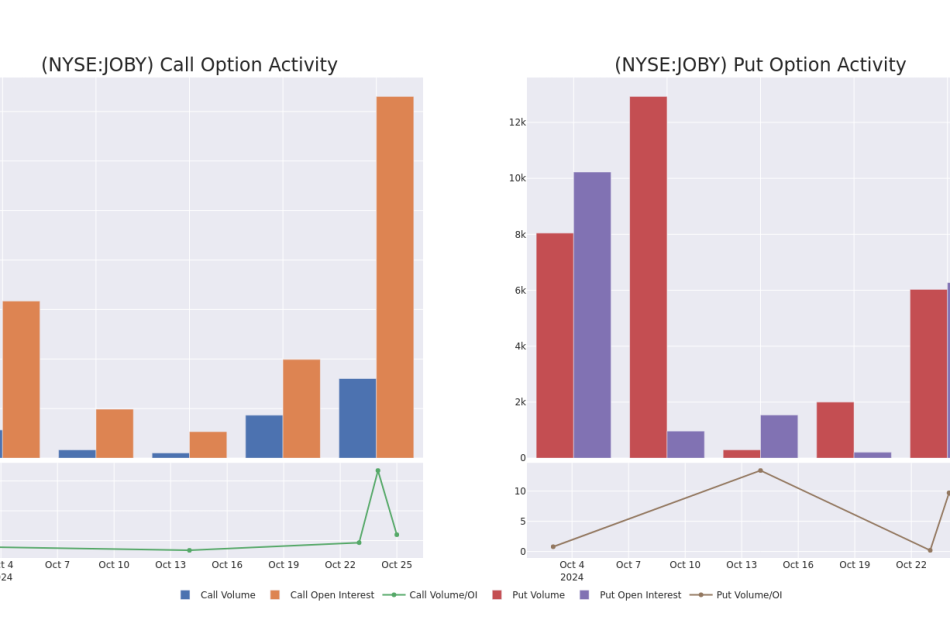

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Joby Aviation’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Joby Aviation’s significant trades, within a strike price range of $4.0 to $12.0, over the past month.

Joby Aviation Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $1.5 | $1.45 | $1.5 | $4.00 | $75.0K | 1.5K | 1.0K |

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $1.5 | $1.45 | $1.5 | $4.00 | $75.0K | 1.5K | 518 |

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $0.65 | $0.6 | $0.65 | $5.50 | $65.1K | 12.0K | 2.1K |

| JOBY | PUT | SWEEP | BULLISH | 11/15/24 | $1.05 | $0.95 | $0.96 | $6.00 | $48.0K | 1.7K | 514 |

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $0.65 | $0.6 | $0.65 | $5.50 | $45.5K | 12.0K | 1.1K |

About Joby Aviation

Joby Aviation Inc is a transportation company developing electric air taxis for commercial passenger service.

After a thorough review of the options trading surrounding Joby Aviation, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Joby Aviation’s Current Market Status

- With a volume of 73,682,452, the price of JOBY is down -15.4% at $5.11.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 12 days.

What The Experts Say On Joby Aviation

3 market experts have recently issued ratings for this stock, with a consensus target price of $9.833333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $10.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Joby Aviation with a target price of $10.

* An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $9.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Joby Aviation, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Peek at Provident Finl Hldgs's Future Earnings

Provident Finl Hldgs PROV is gearing up to announce its quarterly earnings on Monday, 2024-10-28. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Provident Finl Hldgs will report an earnings per share (EPS) of $0.24.

Provident Finl Hldgs bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Overview of Past Earnings

Last quarter the company beat EPS by $0.05, which was followed by a 6.47% drop in the share price the next day.

Here’s a look at Provident Finl Hldgs’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.23 | 0.23 | 0.25 | 0.28 |

| EPS Actual | 0.28 | 0.22 | 0.31 | 0.25 |

| Price Change % | -6.0% | 5.0% | 0.0% | -4.0% |

Provident Finl Hldgs Share Price Analysis

Shares of Provident Finl Hldgs were trading at $15.6 as of October 24. Over the last 52-week period, shares are up 29.17%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for Provident Finl Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia And Other Chip Stocks Rise On Analyst Comments. These Are The Top Picks.

Artificial intelligence chip stocks rose Friday amid encouraging reports from Wall Street analysts. Nvidia (NVDA) stock was among the gainers.

BofA Securities analyst Vivek Arya pounded the table for a portfolio of AI chip stocks, citing a “generational capex cycle in generative AI infrastructure.”

↑

X

S&P 500 Giants Report Earnings. Will Megacap Results Sustain The Tech Rally?

The data center market “remains one of few bright spots” in third-quarter semiconductor earnings reports, he said.

The four major U.S. hyperscale cloud computing companies — Alphabet‘s (GOOGL) Google, Amazon (AMZN), Meta Platforms (META) and Microsoft (MSFT) — likely will continue to spend heavily on AI data center gear, he said. And that, in turn, bodes well for AI chipmakers.

AI beneficiaries among chip stocks are Nvidia, Broadcom (AVGO), Marvell Technology (MRVL), Micron Technology (MU) and Advanced Micro Devices (AMD), Arya said. His “top picks” are Nvidia and Broadcom.

On the stock market today, Nvidia stock rose 0.8% to close at 141.54. Broadcom advanced 1% to 173. Marvell was up most of the day but ended the regular session down 0.4% to 81.61. Micron climbed 1% to 107.91. And AMD improved 1.8% to 156.23.

Nvidia Stock Is On Six IBD Lists

Cloud capital expenditures in the third quarter rose an estimated 54% year over year to $62 billion worldwide, Arya said. For the full year, cloud capex is tracking to $237 billion, up 46%.

For 2025, global cloud capex is forecast to rise 15% to $272 billion, Arya said.

Elsewhere on Wall Street, Piper Sandler analyst Harsh Kumar called AMD his “top large-cap pick” among chip stocks. He rates AMD stock as overweight, or buy, with a price target of 200.

He sees AMD closing a competitive gap with AI chip leader Nvidia through its planned purchase of ZT Systems. Meanwhile, momentum is building for AMD’s AI accelerators, Kumar said.

In the AI chip market, Kumar also has positive ratings for Nvidia, Broadcom and Micron.

AI chip stocks are well represented on IBD stock lists.

Nvidia stock is on six IBD lists: IBD 50, Leaderboard, Sector Leaders, Stock Spotlight, SwingTrader and Tech Leaders.

Broadcom is on two IBD lists: Big Cap 20 and Tech Leaders. And AMD is on the Tech Leaders list.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Apple Stock Downgraded To Sell Ahead Of Earnings. Here’s Why.

AI Data Centers Are Driving Business For These Tech Infrastructure Stocks

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens

Bosses are engaging in ‘subtle sabotage’ and giving their employees ‘office housework’. Here’s how to spot workplace gaslighting

An investigation into the working conditions of legal counsel at major companies found a troubling increase in the rate of bullying that could be compared to domestic abuse.

A new study by The Eagle Club, a network of senior female lawyers and C-suite execs, and the law firm Mishcon de Reya, found a pattern of bullying taking place among general counsel staff at high-profile companies, leading to huge levels of anxiety and depression.

Some employees identified overt hostility from their bosses in the form of shouting, throwing items, or sending aggressive emails and WhatsApp messages.

The most common, however, was the use of “subtle sabotage,” essentially microaggressions that made employees feel undermined and created an environment that was similar to domestic abuse.

“The slipperiest form of bullying is the most subtle and wide-ranging,” the authors wrote.

Subtle sabotage can take many forms and manifests itself in different ways among the employees who formed the Eagle Club’s research.

Micromanagement is a key pillar of this form of coercion, with bosses erratically calling their employees to check in and ensure they always feel like they’re being watched.

Isolation was another major trait of subtle sabotage, with employees citing how they had been left out of “boys club” WhatsApp groups or were kept out of specific email chains.

A prevalent aspect of this pattern of behavior involved gaslighting, with employers playing down their actions to their employees to convince them it wasn’t problematic.

“These slippery behaviors that result in targets feeling gaslit have overlap with behaviors that are now in domestic relationships being defined as coercive control,” the authors wrote.

“Whether domestic or professional, this destabilizes the target and can delay or preclude them from seeking help,” the authors wrote. “In many of our interviews, where people were still not sure whether to call behaviors bullying or not, this is the pervasive effects of gaslighting still affecting them.”

A boss holding the threat of dismissal over an employee unless they obey their commands, engaging in lying and deceit to other co-workers, and setting an employee up to fail by calling them out in meetings, are other forms of “subtle sabotage” identified by researchers as damaging experiences experienced by in-house legal counsel.

The research, which focuses on legal workers, showed workers in the profession were more likely to bear the brunt of this type of bullying because they would often provide advice that was contrary to the goals of the company.

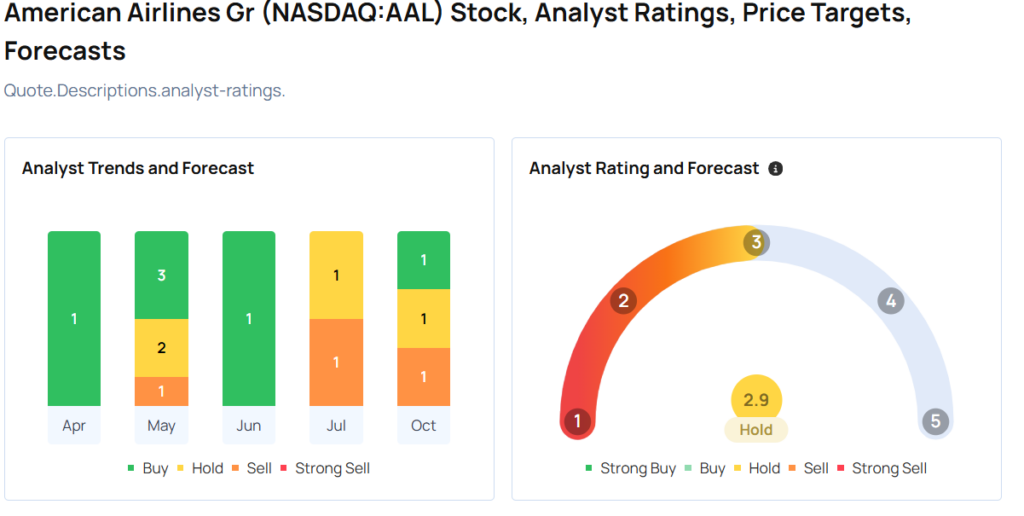

American Airlines Analysts Boost Their Forecasts After Better-Than-Expected Earnings

American Airlines Group Inc. AAL reported upbeat third-quarter financial results and updated its 2024 EPS outlook on Thursday.

The airline reported third-quarter total operating revenue growth of 1.2% year-over-year to $13.647 billion, beating the consensus of $13.471 billion. The adjusted operating margin stood at 4.7% compared to 5.4% a year ago. AAL reported adjusted EPS of 30 cents, down from 38 cents a year ago but above the consensus of 15 cents.

For 2024, American Airlines now expects an adjusted EPS of $1.35 – $1.60 (prior $0.70 – $1.30) versus the consensus of $1.21. It expects a 2024 operating margin of 4.5% to 5.5%

AAL shares gained 2.2% to trade at $13.06 on Friday.

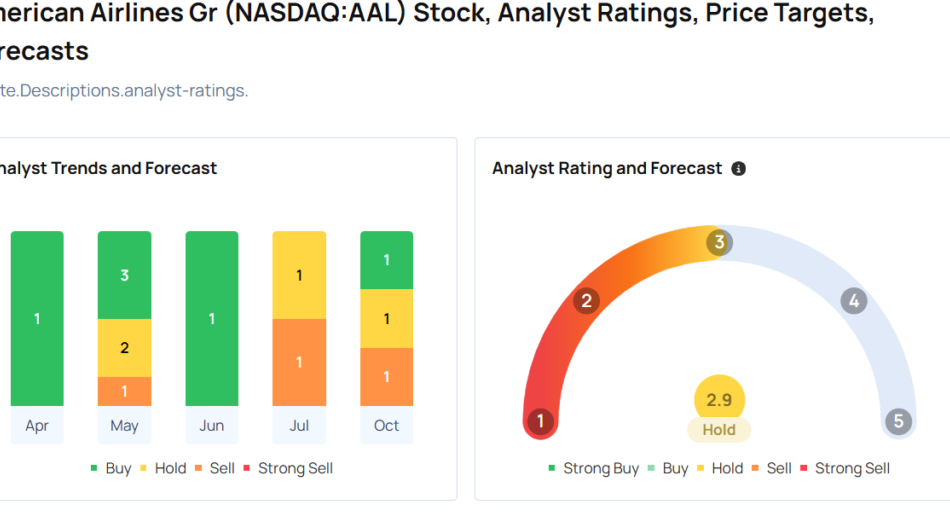

These analysts made changes to their price targets on AAL following earnings announcement.

- JP Morgan analyst Jamie Baker maintained American Airlines with an Overweight and raised the price target from $15 to $20.

- B of A Securities analyst Andrew Didora maintained American Airlines with an Underperform and raised the price target from $9 to $10.

- TD Cowen analyst Thomas Fitzgerald maintained American Airlines with a Hold and raised the price target from $9 to $10.

Considering buying AAL stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

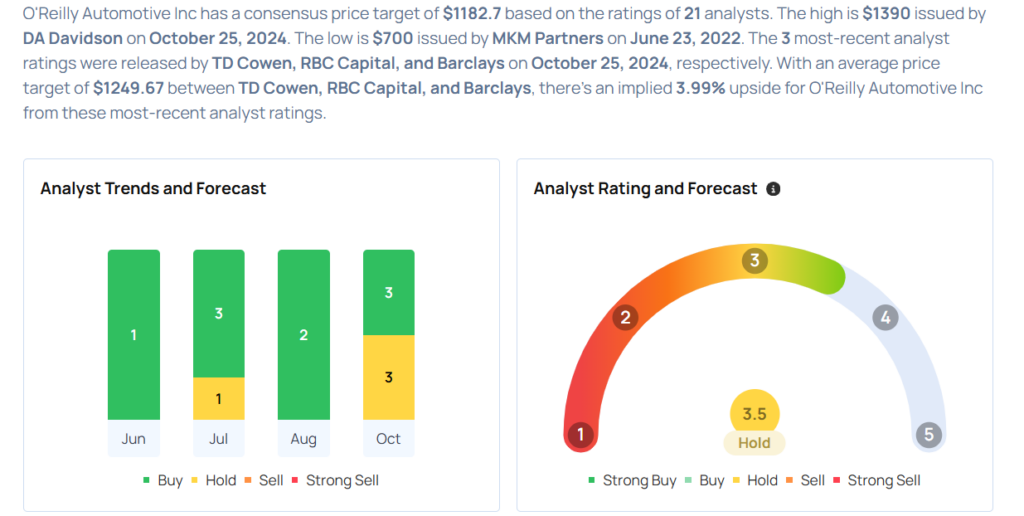

These Analysts Increase Their Forecasts On O'Reilly Automotive After Q3 Results

O’Reilly Automotive, Inc. ORLY reported third-quarter financial results and issued FY24 EPS guidance below estimates, after the closing bell on Wednesday.

O’Reilly Automotive reported quarterly earnings of $11.41 per share which missed the analyst consensus estimate of $11.61 per share. The company reported quarterly sales of $4.36 billion which missed the analyst consensus estimate of $4.43 billion.

The company said it sees FY24 total revenue of $16.6 billion to $16.8 billion, versus estimates of $16.75 billion. The company projects diluted EPS of $40.60 to $41.10 versus expectations of $41.14.

O’Reilly shares gained 0.1% to trade at $1,200.67 on Friday.

These analysts made changes to their price targets on O’Reilly following earnings announcement.

- Truist Securities analyst Scot Ciccarelli maintained O’Reilly Automotive with a Buy and raised the price target from $1,290 to $1,313.

- DA Davidson analyst Michael Baker maintained the stock with a Buy and raised the price target from $1,275 to $1,390.

- Barclays analyst Seth Sigman maintained O’Reilly with an Equal-Weight and increased the price target from $986 to $1,088.

- RBC Capital analyst Steven Shemesh maintained the stock with an Outperform and boosted the price target from $1,115 to $1,286.

- TD Cowen analyst Max Rakhlenko maintained O’Reilly with a Buy and raised the price target from $1,300 to $1,375.

Considering buying ORLY stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Versus Systems Inc. Names Luis Goldner as Chief Executive Officer

VANCOUVER, British Columbia, Oct. 25, 2024 (GLOBE NEWSWIRE) — Versus Systems Inc. VS (the “Company”) announces the appointment of Luis Goldner as Chief Executive Officer, effective immediately. Mr. Goldner succeeds Curtis Wolfe, who served as interim CEO and provided invaluable guidance during the transitional period. Mr. Goldner is a member of the Board of Directors of Versus Systems. Mr. Goldner also serves as a member of the Board of Directors of ASPIS Cyber Technologies, Inc., an affiliate of the largest shareholder of Versus Systems.

Mr. Goldner brings extensive experience to Versus Systems, having previously served as Chief Executive Officer of Intralot do Brazil, a publicly-listed global leader in the gaming sector, and Chief Executive Officer of Trust Impressores, a subsidiary of Oberthur Group, a leader in high-security printing, specializing in the production of banknotes, security paper, credit cards, secured documents and their associated services.

Mr. Goldner also served as Chief Operating Officer and as a Member of the Board of Directors of ICARO Media Group, Inc., a provider of AI-powered media technology for telecommunications and media broadcast companies.

With over 16 years in executive management experience in the private and public sectors, Mr. Goldner was instrumental in establishing Smart Card technology in Brazil and growing Intralot do Brazil into one of the country’s leading lottery operators.

“I am excited to take on this role at Versus Systems,” said Mr. Goldner. “I look forward to collaborating with our talented team to drive innovation and create value for our stakeholders.”

About Versus Systems

Versus Systems, Inc. has developed a proprietary in-game prizing and promotions engine that allows game developers and publishers to offer real-world rewards inside their games. Players can choose from a variety of rewards that match their interests, including merchandise, events, and digital goods. Versus Systems is headquartered in Los Angeles, California.

For more information, please visit www.versussystems.com.

For media inquiries, please contact:

Cody Slach

Gateway Group, Inc.

949-574-3860

IR@versussystems.com or

Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this news release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, outlook, expectations or intentions regarding the future. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. You should not place undue reliance on forward-looking statements and it is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Readers should refer to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q, the Company’s annual reports on Form 10-K, and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov and the Company’s interim and annual filings and other disclosure documents filed in Canada from time-to-time under the Company’s profile on SEDAR+ at https://www.sedarplus.ca.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NEWSTAR Announces New NoDa and East Charlotte Single-Family Rental Communities in Charlotte, North Carolina

ATLANTA, Oct. 24, 2024 /PRNewswire/ — NEWSTAR announced property transactions today in Charlotte, North Carolina planned for development of two new single-family rental communities to be operated under NEWSTAR’s Stella Homes brand. NEWSTAR is partnering on the projects with Red Cedar Homes, a leading Southeast homebuilder and land developer.

Once complete, these communities will feature 72 three-story townhomes with attached garages and market-leading finishes including Hardiplank exterior facades, Stone Plastic Composite (“SPC”) flooring, Quartz countertops, framed mirrors, walk-in showers, and sodded and fenced-in yards. Finished homes will offer three bedrooms across 1,700 – 1,800 square feet of heated living area.

“These new rental subdivisions in NoDa and East Charlotte expand NEWSTAR’s Charlotte portfolio to 345 current or future homes across six active developments, with several more in the pipeline,” said Boone DuPree, Chief Executive Officer for NEWSTAR. “Charlotte continues to be a top performer in terms of population and job growth, and we are positioning our communities, under the Stella Homes brand, to offer best-in-class family housing alternatives to traditional apartment and for-sale options. Our recently delivered Hadley Crossing community is proof of concept, reaching 98% leased within 8 months of final certificate of occupancy, and commanding some of the highest rents in the Charlotte market.”

“We are excited to continue a great relationship with NEWSTAR by adding these two new communities to our collective portfolio,” said Jon Grabowski, CEO of Red Cedar Capital Partners. “Red Cedar looks forward to delivering these high-end neighborhoods in our home market.”

Construction loan financing and joint-venture equity was arranged by Patterson Real Estate Advisory Group. Ameris Bank is the construction lender.

Clearing and sitework is expected to begin this quarter with homes delivering starting in the fourth quarter of 2025.

For more information, please contact info@newstar-am.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/newstar-announces-new-noda-and-east-charlotte-single-family-rental-communities-in-charlotte-north-carolina-302286601.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/newstar-announces-new-noda-and-east-charlotte-single-family-rental-communities-in-charlotte-north-carolina-302286601.html

SOURCE NewStar Asset Management

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.