Bosses are engaging in ‘subtle sabotage’ and giving their employees ‘office housework’. Here’s how to spot workplace gaslighting

An investigation into the working conditions of legal counsel at major companies found a troubling increase in the rate of bullying that could be compared to domestic abuse.

A new study by The Eagle Club, a network of senior female lawyers and C-suite execs, and the law firm Mishcon de Reya, found a pattern of bullying taking place among general counsel staff at high-profile companies, leading to huge levels of anxiety and depression.

Some employees identified overt hostility from their bosses in the form of shouting, throwing items, or sending aggressive emails and WhatsApp messages.

The most common, however, was the use of “subtle sabotage,” essentially microaggressions that made employees feel undermined and created an environment that was similar to domestic abuse.

“The slipperiest form of bullying is the most subtle and wide-ranging,” the authors wrote.

Subtle sabotage can take many forms and manifests itself in different ways among the employees who formed the Eagle Club’s research.

Micromanagement is a key pillar of this form of coercion, with bosses erratically calling their employees to check in and ensure they always feel like they’re being watched.

Isolation was another major trait of subtle sabotage, with employees citing how they had been left out of “boys club” WhatsApp groups or were kept out of specific email chains.

A prevalent aspect of this pattern of behavior involved gaslighting, with employers playing down their actions to their employees to convince them it wasn’t problematic.

“These slippery behaviors that result in targets feeling gaslit have overlap with behaviors that are now in domestic relationships being defined as coercive control,” the authors wrote.

“Whether domestic or professional, this destabilizes the target and can delay or preclude them from seeking help,” the authors wrote. “In many of our interviews, where people were still not sure whether to call behaviors bullying or not, this is the pervasive effects of gaslighting still affecting them.”

A boss holding the threat of dismissal over an employee unless they obey their commands, engaging in lying and deceit to other co-workers, and setting an employee up to fail by calling them out in meetings, are other forms of “subtle sabotage” identified by researchers as damaging experiences experienced by in-house legal counsel.

The research, which focuses on legal workers, showed workers in the profession were more likely to bear the brunt of this type of bullying because they would often provide advice that was contrary to the goals of the company.

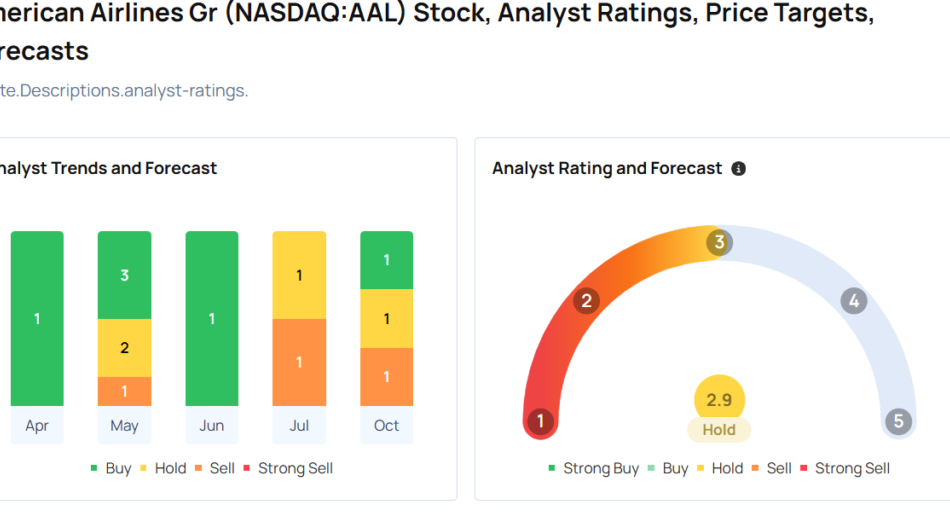

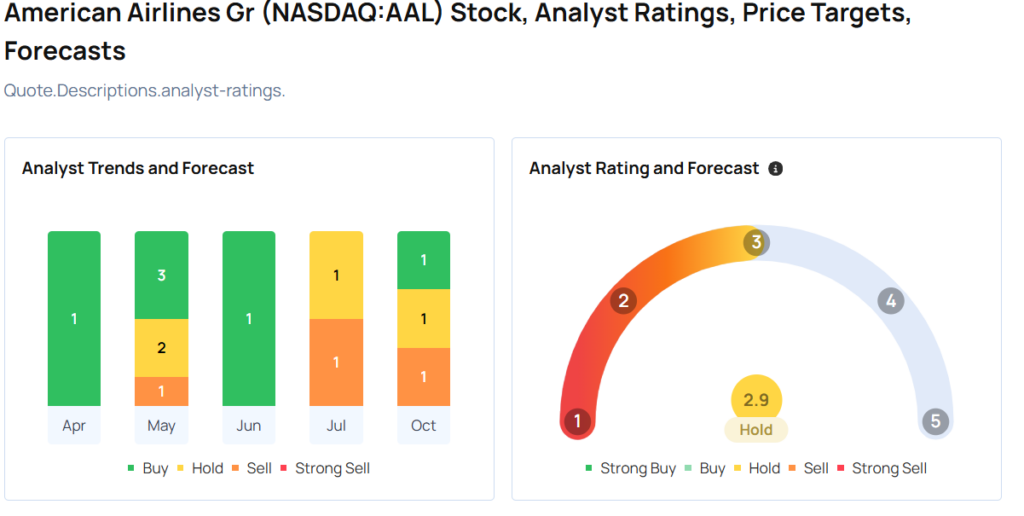

American Airlines Analysts Boost Their Forecasts After Better-Than-Expected Earnings

American Airlines Group Inc. AAL reported upbeat third-quarter financial results and updated its 2024 EPS outlook on Thursday.

The airline reported third-quarter total operating revenue growth of 1.2% year-over-year to $13.647 billion, beating the consensus of $13.471 billion. The adjusted operating margin stood at 4.7% compared to 5.4% a year ago. AAL reported adjusted EPS of 30 cents, down from 38 cents a year ago but above the consensus of 15 cents.

For 2024, American Airlines now expects an adjusted EPS of $1.35 – $1.60 (prior $0.70 – $1.30) versus the consensus of $1.21. It expects a 2024 operating margin of 4.5% to 5.5%

AAL shares gained 2.2% to trade at $13.06 on Friday.

These analysts made changes to their price targets on AAL following earnings announcement.

- JP Morgan analyst Jamie Baker maintained American Airlines with an Overweight and raised the price target from $15 to $20.

- B of A Securities analyst Andrew Didora maintained American Airlines with an Underperform and raised the price target from $9 to $10.

- TD Cowen analyst Thomas Fitzgerald maintained American Airlines with a Hold and raised the price target from $9 to $10.

Considering buying AAL stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

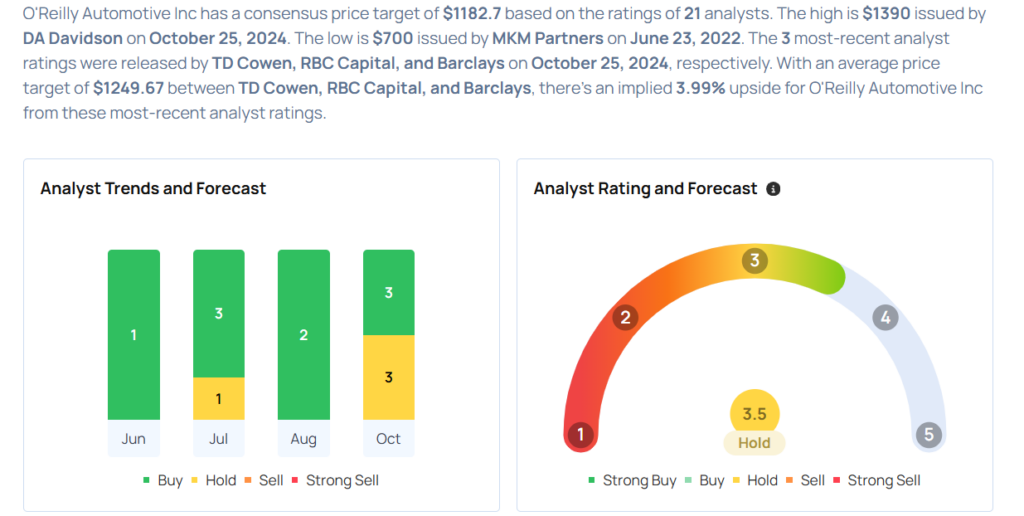

These Analysts Increase Their Forecasts On O'Reilly Automotive After Q3 Results

O’Reilly Automotive, Inc. ORLY reported third-quarter financial results and issued FY24 EPS guidance below estimates, after the closing bell on Wednesday.

O’Reilly Automotive reported quarterly earnings of $11.41 per share which missed the analyst consensus estimate of $11.61 per share. The company reported quarterly sales of $4.36 billion which missed the analyst consensus estimate of $4.43 billion.

The company said it sees FY24 total revenue of $16.6 billion to $16.8 billion, versus estimates of $16.75 billion. The company projects diluted EPS of $40.60 to $41.10 versus expectations of $41.14.

O’Reilly shares gained 0.1% to trade at $1,200.67 on Friday.

These analysts made changes to their price targets on O’Reilly following earnings announcement.

- Truist Securities analyst Scot Ciccarelli maintained O’Reilly Automotive with a Buy and raised the price target from $1,290 to $1,313.

- DA Davidson analyst Michael Baker maintained the stock with a Buy and raised the price target from $1,275 to $1,390.

- Barclays analyst Seth Sigman maintained O’Reilly with an Equal-Weight and increased the price target from $986 to $1,088.

- RBC Capital analyst Steven Shemesh maintained the stock with an Outperform and boosted the price target from $1,115 to $1,286.

- TD Cowen analyst Max Rakhlenko maintained O’Reilly with a Buy and raised the price target from $1,300 to $1,375.

Considering buying ORLY stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Versus Systems Inc. Names Luis Goldner as Chief Executive Officer

VANCOUVER, British Columbia, Oct. 25, 2024 (GLOBE NEWSWIRE) — Versus Systems Inc. VS (the “Company”) announces the appointment of Luis Goldner as Chief Executive Officer, effective immediately. Mr. Goldner succeeds Curtis Wolfe, who served as interim CEO and provided invaluable guidance during the transitional period. Mr. Goldner is a member of the Board of Directors of Versus Systems. Mr. Goldner also serves as a member of the Board of Directors of ASPIS Cyber Technologies, Inc., an affiliate of the largest shareholder of Versus Systems.

Mr. Goldner brings extensive experience to Versus Systems, having previously served as Chief Executive Officer of Intralot do Brazil, a publicly-listed global leader in the gaming sector, and Chief Executive Officer of Trust Impressores, a subsidiary of Oberthur Group, a leader in high-security printing, specializing in the production of banknotes, security paper, credit cards, secured documents and their associated services.

Mr. Goldner also served as Chief Operating Officer and as a Member of the Board of Directors of ICARO Media Group, Inc., a provider of AI-powered media technology for telecommunications and media broadcast companies.

With over 16 years in executive management experience in the private and public sectors, Mr. Goldner was instrumental in establishing Smart Card technology in Brazil and growing Intralot do Brazil into one of the country’s leading lottery operators.

“I am excited to take on this role at Versus Systems,” said Mr. Goldner. “I look forward to collaborating with our talented team to drive innovation and create value for our stakeholders.”

About Versus Systems

Versus Systems, Inc. has developed a proprietary in-game prizing and promotions engine that allows game developers and publishers to offer real-world rewards inside their games. Players can choose from a variety of rewards that match their interests, including merchandise, events, and digital goods. Versus Systems is headquartered in Los Angeles, California.

For more information, please visit www.versussystems.com.

For media inquiries, please contact:

Cody Slach

Gateway Group, Inc.

949-574-3860

IR@versussystems.com or

Forward-Looking Statements

This news release contains “forward-looking statements”. Statements in this news release which are not purely historical are forward-looking statements and include any statements regarding beliefs, plans, outlook, expectations or intentions regarding the future. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. You should not place undue reliance on forward-looking statements and it is important to note that actual outcomes and the Company’s actual results could differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Readers should refer to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q, the Company’s annual reports on Form 10-K, and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov and the Company’s interim and annual filings and other disclosure documents filed in Canada from time-to-time under the Company’s profile on SEDAR+ at https://www.sedarplus.ca.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NEWSTAR Announces New NoDa and East Charlotte Single-Family Rental Communities in Charlotte, North Carolina

ATLANTA, Oct. 24, 2024 /PRNewswire/ — NEWSTAR announced property transactions today in Charlotte, North Carolina planned for development of two new single-family rental communities to be operated under NEWSTAR’s Stella Homes brand. NEWSTAR is partnering on the projects with Red Cedar Homes, a leading Southeast homebuilder and land developer.

Once complete, these communities will feature 72 three-story townhomes with attached garages and market-leading finishes including Hardiplank exterior facades, Stone Plastic Composite (“SPC”) flooring, Quartz countertops, framed mirrors, walk-in showers, and sodded and fenced-in yards. Finished homes will offer three bedrooms across 1,700 – 1,800 square feet of heated living area.

“These new rental subdivisions in NoDa and East Charlotte expand NEWSTAR’s Charlotte portfolio to 345 current or future homes across six active developments, with several more in the pipeline,” said Boone DuPree, Chief Executive Officer for NEWSTAR. “Charlotte continues to be a top performer in terms of population and job growth, and we are positioning our communities, under the Stella Homes brand, to offer best-in-class family housing alternatives to traditional apartment and for-sale options. Our recently delivered Hadley Crossing community is proof of concept, reaching 98% leased within 8 months of final certificate of occupancy, and commanding some of the highest rents in the Charlotte market.”

“We are excited to continue a great relationship with NEWSTAR by adding these two new communities to our collective portfolio,” said Jon Grabowski, CEO of Red Cedar Capital Partners. “Red Cedar looks forward to delivering these high-end neighborhoods in our home market.”

Construction loan financing and joint-venture equity was arranged by Patterson Real Estate Advisory Group. Ameris Bank is the construction lender.

Clearing and sitework is expected to begin this quarter with homes delivering starting in the fourth quarter of 2025.

For more information, please contact info@newstar-am.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/newstar-announces-new-noda-and-east-charlotte-single-family-rental-communities-in-charlotte-north-carolina-302286601.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/newstar-announces-new-noda-and-east-charlotte-single-family-rental-communities-in-charlotte-north-carolina-302286601.html

SOURCE NewStar Asset Management

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

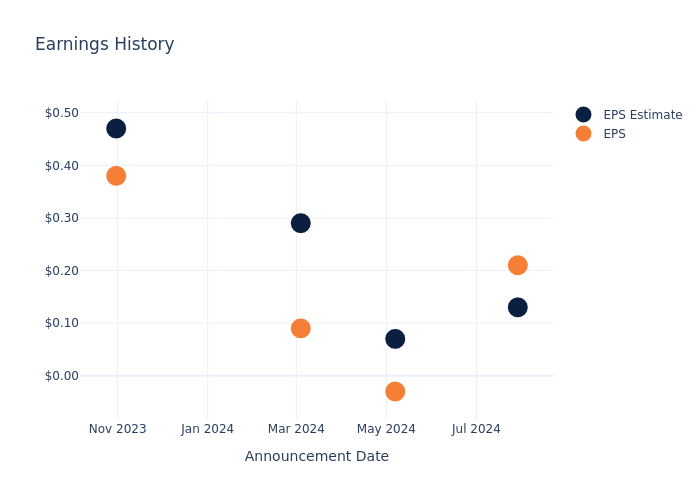

Earnings Outlook For Ranger Energy Services

Ranger Energy Services RNGR is gearing up to announce its quarterly earnings on Monday, 2024-10-28. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Ranger Energy Services will report an earnings per share (EPS) of $0.29.

Ranger Energy Services bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Historical Earnings Performance

Last quarter the company beat EPS by $0.08, which was followed by a 13.54% increase in the share price the next day.

Here’s a look at Ranger Energy Services’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.13 | 0.07 | 0.29 | 0.47 |

| EPS Actual | 0.21 | -0.03 | 0.09 | 0.38 |

| Price Change % | 14.000000000000002% | 2.0% | 7.000000000000001% | 1.0% |

Market Performance of Ranger Energy Services’s Stock

Shares of Ranger Energy Services were trading at $12.28 as of October 24. Over the last 52-week period, shares are down 5.97%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analysts’ Take on Ranger Energy Services

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ranger Energy Services.

Analysts have provided Ranger Energy Services with 1 ratings, resulting in a consensus rating of Neutral. The average one-year price target stands at $13.0, suggesting a potential 5.86% upside.

Comparing Ratings with Peers

This comparison focuses on the analyst ratings and average 1-year price targets of Oil States International, Natural Gas Services Gr and DMC Glb, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- Oil States International received a Neutral consensus from analysts, with an average 1-year price target of $6.5, implying a potential 47.07% downside.

- The prevailing sentiment among analysts is an Buy trajectory for Natural Gas Services Gr, with an average 1-year price target of $27.0, implying a potential 119.87% upside.

- Analysts currently favor an Buy trajectory for DMC Glb, with an average 1-year price target of $19.0, suggesting a potential 54.72% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary outlines pivotal metrics for Oil States International, Natural Gas Services Gr and DMC Glb, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ranger Energy Services | Neutral | -15.38% | $13.90M | 1.80% |

| Oil States International | Neutral | 1.56% | $29.65M | 0.18% |

| Natural Gas Services Gr | Buy | 42.79% | $13.30M | 1.75% |

| DMC Glb | Buy | -9.27% | $46.41M | 1.14% |

Key Takeaway:

Ranger Energy Services ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit and Return on Equity.

Discovering Ranger Energy Services: A Closer Look

Ranger Energy Services Inc is a provider of onshore high specification (high-spec) well service rigs, wireline services, and additional processing solutions and ancillary services in the United States. It offers a range of well site services to U.S. exploration and production (E&P) companies that are fundamental to establishing and enhancing the flow of oil and natural gas throughout the productive life of a well. The segments of the group are High Specification Rigs, Wireline Services and Processing Solutions and Ancillary Services, of which key revenue is derived from High Specification Rigs segment.

Ranger Energy Services’s Economic Impact: An Analysis

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Ranger Energy Services’s revenue growth over a period of 3 months has faced challenges. As of 30 June, 2024, the company experienced a revenue decline of approximately -15.38%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 3.4%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Ranger Energy Services’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 1.8% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ranger Energy Services’s ROA stands out, surpassing industry averages. With an impressive ROA of 1.31%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.09.

To track all earnings releases for Ranger Energy Services visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

All Once Again Warned: Unregulated Cannabis Vapes Contain Dangerous Pesticides, Study Says

In a reminder of the dangers of the unregulated cannabis market, a new study from RPC Labs in New Brunswick, Canada, has revealed alarmingly high levels of chemical contaminants in illicit cannabis vape cartridges.

This study, which looked at products seized by law enforcement earlier this year, found that 93% of the tested unregulated vapes contained pesticide levels far above Health Canada limits, reported Stratscann.

Dangerous Pesticide Levels In Illicit Vapes

The study tested a variety of illicit cannabis products, including vapes, shatter, hash, flower and edibles, showing a consistent pattern of lower-than-advertised THC levels. In some cases, THC was 86% lower than claimed on the packaging.

One striking example was a gummy advertised to contain 50 mg of THC but tested at just 6.81 mg.

What sets this study apart is its focus on vape cartridges, an increasingly popular product in the illicit market. Out of the 27 illicit samples tested, only two were found to be free of detectable pesticides. Shockingly, one vape cartridge contained 22 different pesticides, with some found 3,000 times over the legal limit.

Read Also: ‘Just Smoke The Weed’: Why This Physician In California Urges Against Cannabis Vaping

Regulated Vs Unregulated

Main author Andrien Rackov addressed the importance of understanding the dangers posed by unlicensed products:

“The more studies done over time, the clearer the picture becomes. And this picture is disturbing.”

While these products showed alarming levels of contamination, the study also tested 10 legal vape products, all of which were compliant with Health Canada standards.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

All in all, consumers using unregulated cannabis products might not only be getting far less THC than advertised—they are also being exposed to potentially harmful chemicals.

This sharp contrast highlights the importance of purchasing from the legal market, where products undergo rigorous testing.

This study serves as a stark warning: we are once again reminded of the serious risks associated with unregulated cannabis products.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

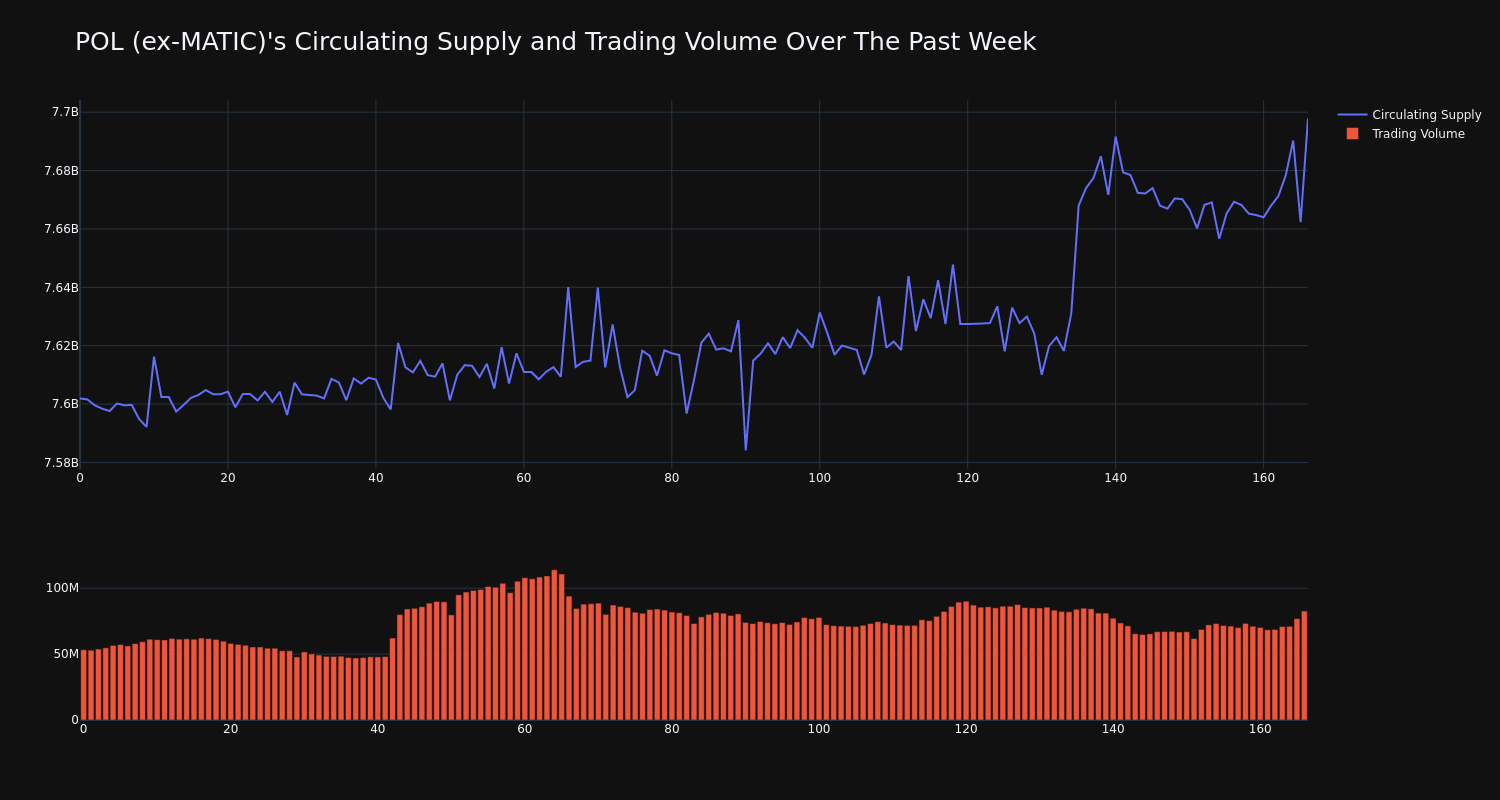

Cryptocurrency POL (ex-MATIC) Decreases More Than 7% Within 24 hours

Over the past 24 hours, POL (ex-MATIC)’s POL/USD price has fallen 7.21% to $0.33. This continues its negative trend over the past week where it has experienced a 9.0% loss, moving from $0.37 to its current price.

The chart below compares the price movement and volatility for POL (ex-MATIC) over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has increased 55.0% over the past week while the overall circulating supply of the coin has increased 1.26% to over 7.67 billion. The current market cap ranking for POL is #42 at $2.54 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.