Cathie Wood and Warren Buffett Both Own This Dirt-Cheap Artificial Intelligence (AI) Stock. Time to Buy?

Cathie Wood and Warren Buffett share few investment traits. Buffett helped build Berkshire Hathaway into one of the world’s most successful investment firms by owning mostly blue-chip stocks to generate steady cash flow. By comparison, Wood’s Ark Invest navigates the capital markets through a series of high-risk, high-reward opportunities in emerging market themes such as artificial intelligence (AI) or biotechnology.

Nevertheless, Berkshire and Ark Invest both own positions in “Magnificent Seven” member Amazon (NASDAQ: AMZN). While it’s not a major position for either investor, I think there are several reasons why both Wood and Buffett are attracted to such a stock.

Below, I’ll detail what catalysts Amazon has and why I see the stock as an absolute bargain right now.

One of the things that makes Amazon so unique is its multifaceted platform. While the company relies on its e-commerce marketplace and cloud computing enterprise for the majority of its growth, Amazon also has success from its Prime subscription service, entertainment and streaming, and even advertising.

The table below breaks down Amazon’s revenue growth across its reportable segments through the first six months of 2024:

|

Category |

Six Months Ended June 30, 2023 (in millions) |

Six Months Ended June 30, 2024 (in millions) |

Change |

|---|---|---|---|

|

Online stores |

$104,062 |

$110,062 |

6% |

|

Physical stores |

$9,919 |

$10,408 |

5% |

|

Third-party seller services |

$62,152 |

$70,797 |

14% |

|

Advertising services |

$20,192 |

$24,595 |

22% |

|

Subscription services |

$19,551 |

$21,588 |

10% |

|

AWS |

$43,494 |

$51,318 |

18% |

|

Other |

$2,371 |

$2,522 |

6% |

|

Consolidated |

$261,741 |

$291,290 |

11% |

Data source: Amazon.

The high-level takeaway is that Amazon is witnessing growth across its entire platform. But looking deeper, there are some more important takeaways.

Despite a troubled macroeconomy over the last couple of years, Amazon is still managing to generate growth its e-commerce and physical storefronts, as well as Prime subscriptions. I think this trend underscores the resiliency of the consumer, even in an inflationary environment. Moreover, I see the Federal Reserve’s recent interest rate tapering as a tailwind that could spark even further acceleration for Amazon’s online shopping empire.

Another great takeaway is that the company’s cloud computing business, Amazon Web Services (AWS), is growing by double-digit percentage points and accelerating materially compared to 2023. What’s even more important is that operating income from AWS — Amazon’s biggest profit machine — returned to positive growth year over year compared to last year.

SPAR Group 10% Owner Sold $106K In Company Stock

Revealing a significant insider sell on October 23, Robert G Brown, 10% Owner at SPAR Group SGRP, as per the latest SEC filing.

What Happened: Brown’s decision to sell 43,834 shares of SPAR Group was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $106,078.

At Thursday morning, SPAR Group shares are up by 0.83%, trading at $2.43.

Discovering SPAR Group: A Closer Look

SPAR Group Inc is a supplier of merchandising and other marketing services. It also provides range of services to retailers, consumer goods manufacturers and distributors around the globe. The company divides its operations into three reportable regional segments: Americas, which is comprised of United States, Canada, Brazil and Mexico; Asia-Pacific (APAC), which is comprised of Japan, China, and India; and Europe, Middle East and Africa (EMEA), which is comprised of South Africa. It generates maximum revenue from Americas.

SPAR Group: Delving into Financials

Revenue Challenges: SPAR Group’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -13.11%. This indicates a decrease in top-line earnings. When compared to others in the Communication Services sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 19.19%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): SPAR Group’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 0.15.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.73, caution is advised due to increased financial risk.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: The P/E ratio of 4.55 is lower than the industry average, implying a discounted valuation for SPAR Group’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.23 is lower than the industry average, implying a discounted valuation for SPAR Group’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 2.51, SPAR Group could be considered undervalued.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of SPAR Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

My 3 Favorite Stocks to Buy Right Now

Many of my friends like to ask me what my favorite stocks are. Ideally, my portfolio should contain a healthy mix of growth stocks and dividend stocks. This is because I want to structure the portfolio in a way that gives me passive income while helping me to compound my wealth over the long term. Call it the best of both worlds if you will, but I believe that having such a mix helps me to achieve diversification while also providing sufficient exposure to both growth and income stocks.

You can do the same for your portfolio, too, if you seek a mix of growth and income. Dividend stocks should include businesses that generate consistent free cash flow and have a long history of paying out dividends. Growth stocks, on the other hand, need to possess sustainable catalysts that can ensure the business can grow its revenue and net income for the long term.

Here are three favorite stocks that you can consider buying for your investment portfolio.

Lennox International (NYSE: LII) is a market leader in energy-efficient, climate-control solutions. Some of its products include heat pumps, furnaces, air conditioners, chillers, and indoor air-quality systems. The company has demonstrated steady growth in its top and bottom lines over the past three years.

Revenue grew from $4.2 billion in 2021 to $5 billion in 2023 with net income climbing from $464 million to $590.1 million over the same period. The business also generated an average-annual free cash flow of $365 million, showcasing Lennox’s ability to generate dependable free cash flow that can be used to pay out dividends.

The climate-control specialist has dutifully paid out quarterly dividends since 2000 and most recently increased its quarterly dividend by 4.5% year over year to $1.15 per share back in May.

The company has continued its strong financial streak in the first half of 2024. Sales inched up just 1.5% year over year to $2.5 billion, but operating income climbed 16.4% to $486.9 million. Lennox’s net income stood at $370.2 million, 17.4% higher than the net income of $315.2 million a year ago. Free cash flow came in at $99 million for the first half of this year, more than triple of what was generated in the previous-corresponding period.

Lennox also reaffirmed its full-year revenue guidance of 7% year-over-year growth and revised its earnings-per-share (EPS) guidance upwards. The company now expects EPS to come in between $19.50 to $20.25, up from the previous range of $19 to $20.

Management has updated its set of long-term targets for 2026 with an increase in targeted revenue to a range of $5.4 billion to $6 billion, up from between $5 billion to $5.5 billion previously. The company also expects to convert around 90% of its net income to free cash flow, thus continuing its track record of healthy free-cash-flow generation.

$1000 Invested In Texas Pacific Land 5 Years Ago Would Be Worth This Much Today

Texas Pacific Land TPL has outperformed the market over the past 5 years by 29.39% on an annualized basis producing an average annual return of 43.2%. Currently, Texas Pacific Land has a market capitalization of $25.23 billion.

Buying $1000 In TPL: If an investor had bought $1000 of TPL stock 5 years ago, it would be worth $6,021.99 today based on a price of $1098.01 for TPL at the time of writing.

Texas Pacific Land’s Performance Over Last 5 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Listener With $1.5 Million Retirement And $12K Monthly Income Asks If She Should Get A Prenup – Suze Orman Says 'I Wouldn't Get Married'

In a recent episode of the Women & Money podcast, a listener named PBS asked Suze Orman a question many people face later in life: should she consider getting a prenuptial agreement before tying the knot with her partner?

PBS is a single mother with two adult children, ages 24 and 18, who lives with her partner. She earns over $12,000 a month and has assets totaling about $3 million, including her home, retirement savings and a rental property. Her partner, however, earns about $3,900 per month, creating a significant income gap that has led her to think deeper about the financial implications of marriage.

Don’t Miss:

Orman didn’t hold back. “I would just stay living with him,” she said. “I’m not sure that I would marry him. There’s really no advantage for you to marry him.”

Orman pointed out that PBS could still protect her partner in the event of her passing without getting married. Tools like trusts, transfer-on-death accounts or naming him a beneficiary of her assets are all options Orman said could secure his future without the legal complexities of marriage.

Diving deeper into the complexities of prenups, Orman stated these can get messy because both parties need legal representation to guarantee that the prenuptial will hold up in court.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Her advice wasn’t solely based on finances, though. Orman felt there might be something more to the listener’s question. “The real question is that you have hesitation or you wouldn’t have written to us and you’re nervous about marrying him,” Orman said. She advised PBS to avoid marriage altogether if she felt any sense of nervousness or uncertainty about their financial future.

Orman’s wife and co-host, KT, chimed in with an observation that adds another layer to this conversation. She speculated that PBS’s adult children might be more nervous about their mother’s situation than PBS herself. “They see the writing on the wall,” KT remarked, possibly referring to concerns about how their mother’s financial decisions could impact their inheritance or future financial stability.

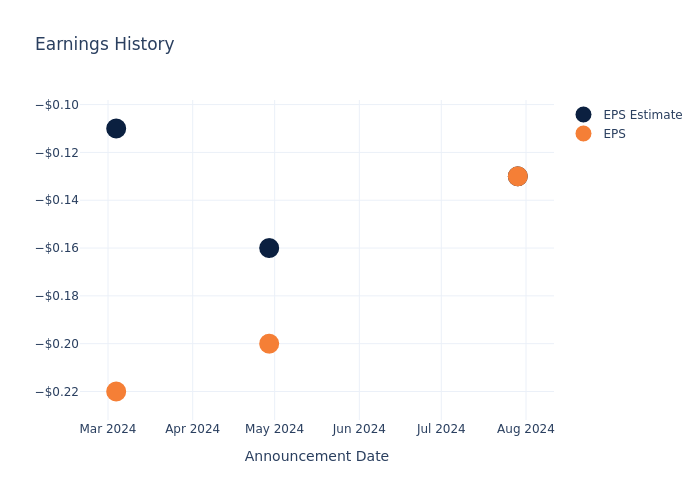

Uncovering Potential: Inspirato's Earnings Preview

Inspirato ISPO is preparing to release its quarterly earnings on Monday, 2024-10-28. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Inspirato to report an earnings per share (EPS) of $-1.33.

Investors in Inspirato are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Here’s a look at Inspirato’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -3.66 | -3.33 | ||

| EPS Actual | -4.03 | -0.18 | -3.20 | -3.90 |

| Price Change % | -7.000000000000001% | 1.0% | -7.000000000000001% | -8.0% |

To track all earnings releases for Inspirato visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For Ekso Bionics Holdings

Ekso Bionics Holdings EKSO is preparing to release its quarterly earnings on Monday, 2024-10-28. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ekso Bionics Holdings to report an earnings per share (EPS) of $-0.10.

The market awaits Ekso Bionics Holdings’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

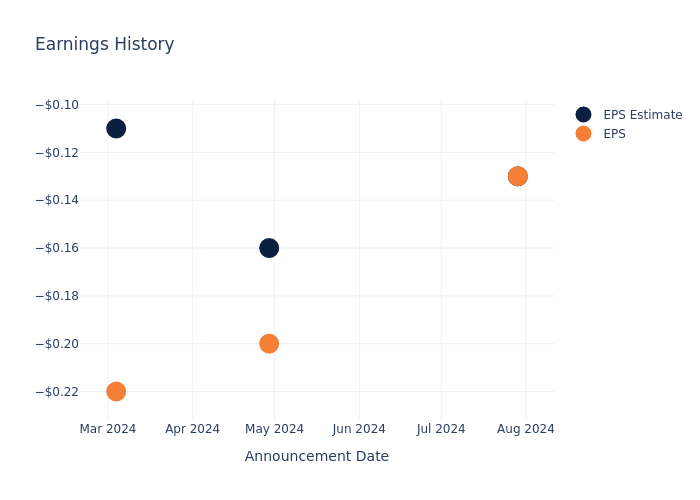

Earnings History Snapshot

Last quarter the company missed EPS by $0.00, which was followed by a 28.62% drop in the share price the next day.

Here’s a look at Ekso Bionics Holdings’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.13 | -0.16 | -0.11 | -0.31 |

| EPS Actual | -0.13 | -0.20 | -0.22 | -0.24 |

| Price Change % | -28.999999999999996% | -4.0% | -25.0% | 6.0% |

Stock Performance

Shares of Ekso Bionics Holdings were trading at $1.02 as of October 24. Over the last 52-week period, shares are up 3.42%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for Ekso Bionics Holdings visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

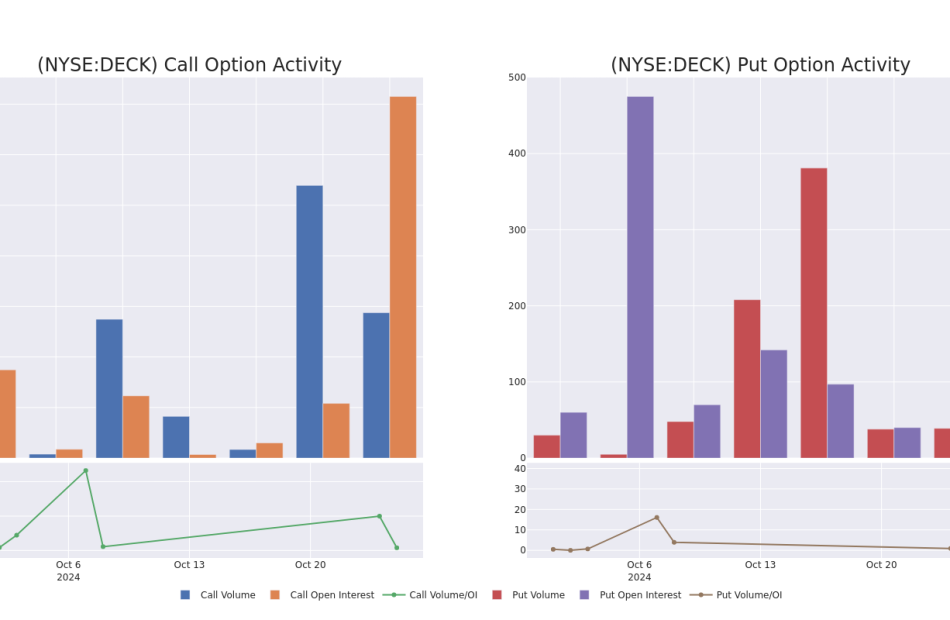

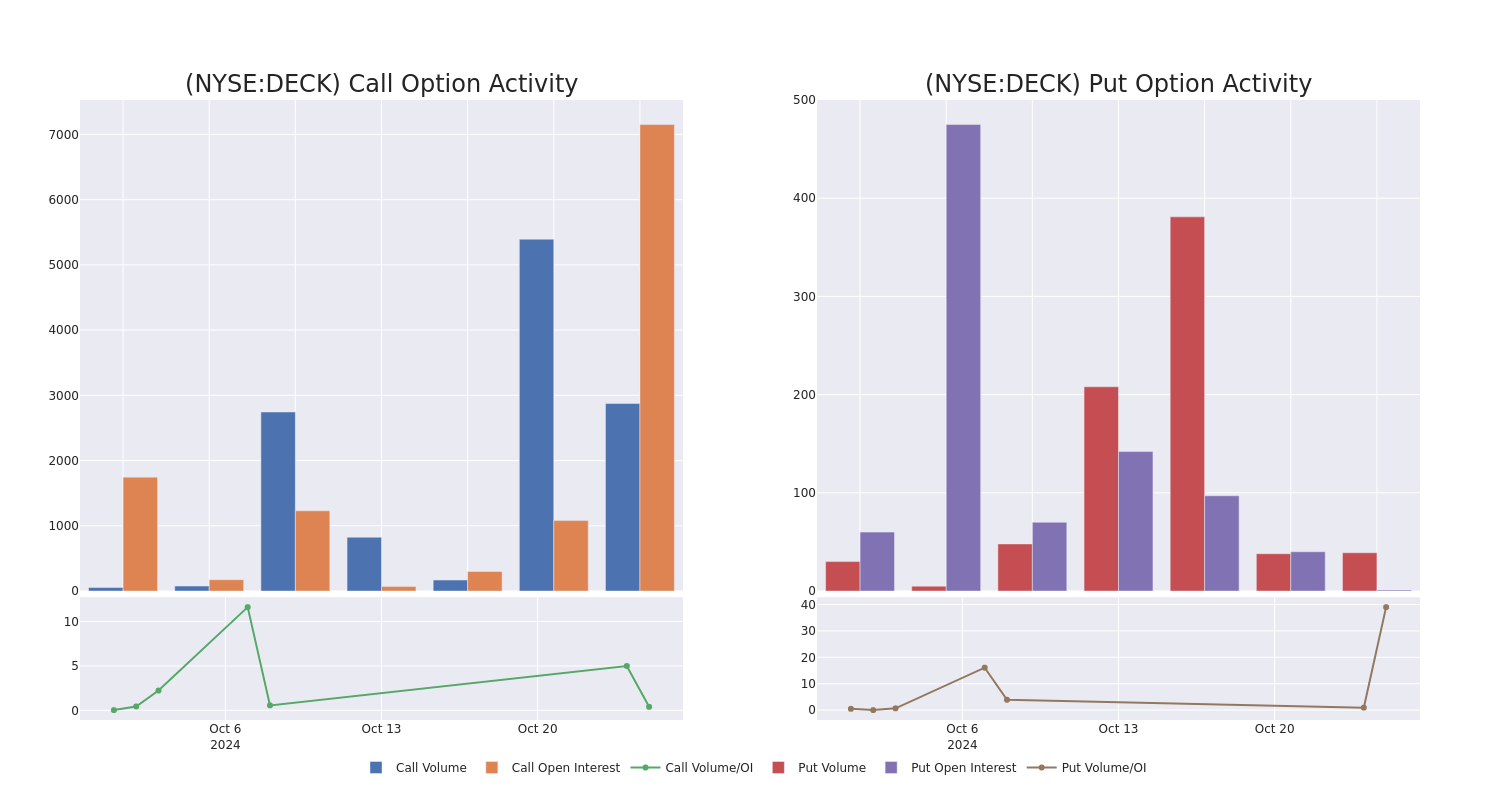

Smart Money Is Betting Big In DECK Options

Investors with a lot of money to spend have taken a bearish stance on Deckers Outdoor DECK.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DECK, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 11 options trades for Deckers Outdoor.

This isn’t normal.

The overall sentiment of these big-money traders is split between 9% bullish and 45%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $28,267, and 10, calls, for a total amount of $811,197.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $152.5 to $175.0 for Deckers Outdoor over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Deckers Outdoor options trades today is 715.2 with a total volume of 2,913.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Deckers Outdoor’s big money trades within a strike price range of $152.5 to $175.0 over the last 30 days.

Deckers Outdoor Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | CALL | TRADE | BEARISH | 12/20/24 | $10.2 | $10.0 | $10.0 | $171.67 | $200.0K | 524 | 206 |

| DECK | CALL | SWEEP | BEARISH | 10/25/24 | $17.6 | $15.6 | $15.82 | $152.50 | $157.1K | 608 | 265 |

| DECK | CALL | TRADE | BULLISH | 11/01/24 | $1.5 | $1.3 | $1.55 | $175.00 | $155.0K | 2.3K | 1.5K |

| DECK | CALL | TRADE | NEUTRAL | 11/29/24 | $7.9 | $6.7 | $7.3 | $170.00 | $73.0K | 2 | 71 |

| DECK | CALL | SWEEP | BEARISH | 03/21/25 | $28.2 | $23.2 | $23.1 | $155.00 | $69.3K | 54 | 4 |

About Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Majority of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Majority of its sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. It has structured their reporting around six segments which inlcudes the wholesale operations of specific brands like UGG, HOKA, Teva, Sanuk, and Other brands, alongside a segment focused on direct-to-consumer (DTC) operations.

Present Market Standing of Deckers Outdoor

- With a trading volume of 6,759,703, the price of DECK is up by 10.46%, reaching $167.94.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 97 days from now.

What The Experts Say On Deckers Outdoor

In the last month, 5 experts released ratings on this stock with an average target price of $185.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Stifel has decided to maintain their Hold rating on Deckers Outdoor, which currently sits at a price target of $181.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Deckers Outdoor with a target price of $195.

* An analyst from Keybanc has decided to maintain their Overweight rating on Deckers Outdoor, which currently sits at a price target of $190.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Deckers Outdoor with a target price of $178.

* Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Deckers Outdoor, targeting a price of $183.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deckers Outdoor options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.