Apple Q4 Earnings Preview: Goldman Sachs Analyst Anticipates Big Earnings Beat, Resilient iPhone 16 Demand

A Goldman Sachs analyst has forecasted stronger-than-expected fourth-quarter results for Apple Inc AAPL ahead of its Oct. 31 release.

The Apple Analyst: Analyst Michael Ng reiterated a Buy rating on Apple and maintained its price target at $275.

Earnings Preview: Ng is bullish on Apple’s potential to beat earnings expectations in the short term. For the quarter, the analyst projects earnings-per-share of $1.61, higher than Wall Street’s consensus of $1.57. Ng also projects revenue of $94.5 billion, higher than the consensus $93.6 billion.

iPhone Takeaways: Ng cited the continued demand for older models of the iPhone as a plus. He also mentioned the demand for the newly released iPhone 16 as perhaps better than initially thought.

“iPhone 16 demand has been relatively stable year-over-year and better-than-feared given more cautious data points around shorter lead-times relative to year-ago and production cuts,” the analyst said.

Also Read: Nvidia Back On Top: Edges Out Apple As AI Demand Drives Market Surge

Apple Intelligence Takeaways: Ng sees Apple’s foray into artificial intelligence as a “long-term demand driver.” Apple has opted for a slow rollout of Apple Intelligence.

“We believe that as more features exclusive to 15 Pro/Pro Max and the 16-series get released, users should be driven to upgrade their iPhones,” Ng said.

Services Takeaways: Apple’s strength in its services segment serves as justification for Ng’s bullishness on the company.

The analyst acknowledged that product revenue growth has slowed but insisted that the market is underestimating the continued viability of the Apple ecosystem.

“Apple’s installed base growth, secular growth in services, and new product innovation should more than offset cyclical headwinds to product revenue, such as a reduced iPhone unit demand due to a lengthening replacement cycle and reduced consumer demand for the PC & tablet category,” Ng said.

The analyst also believes that Apple TV+’s apparent decision to shorten theatrical release windows in favor of a quicker rollout to streaming is driving subscriptions.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dogecoin Falls More Than 3% In 24 hours

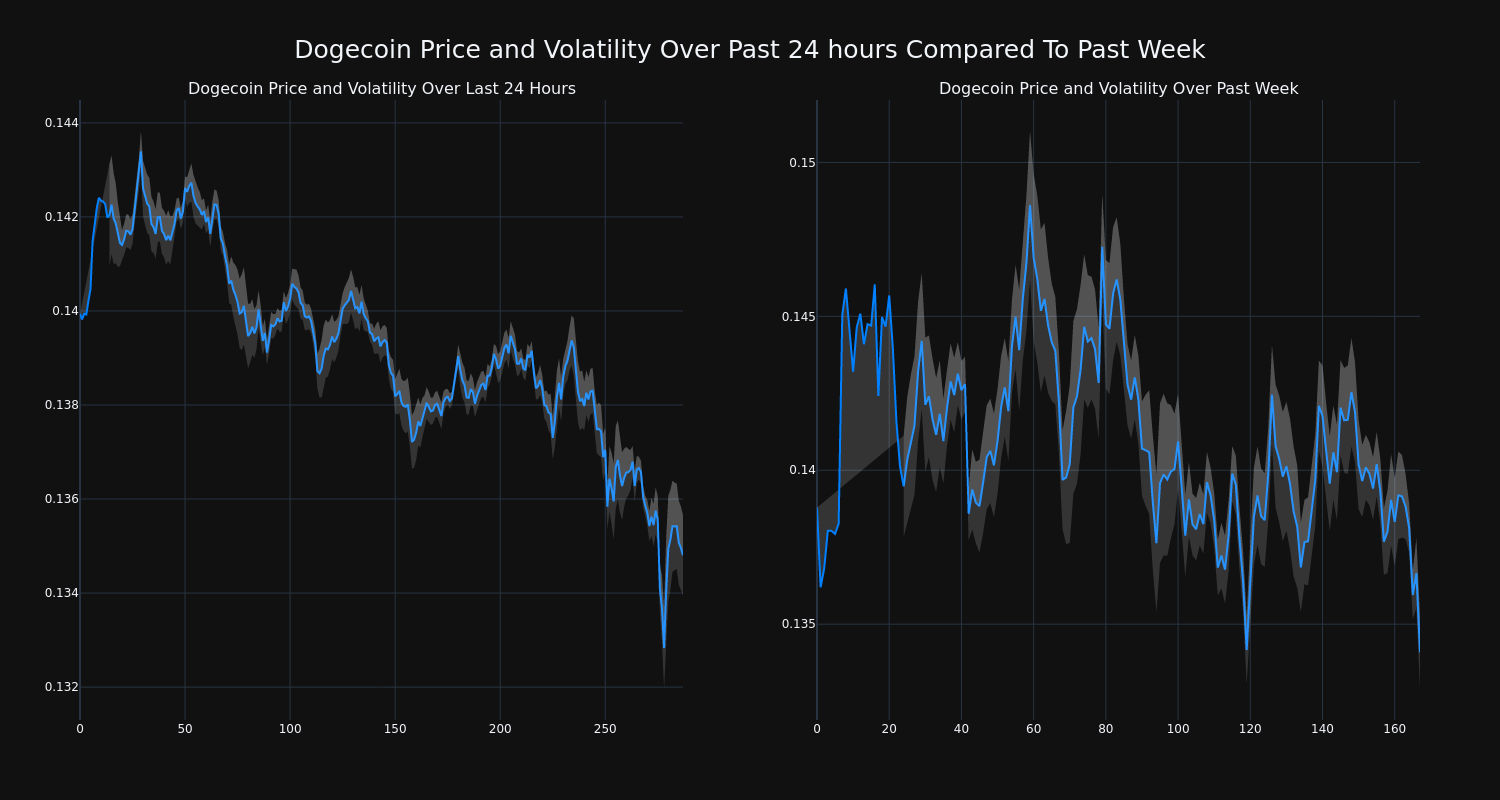

Over the past 24 hours, Dogecoin’s DOGE/USD price has fallen 3.94% to $0.13. This continues its negative trend over the past week where it has experienced a 3.0% loss, moving from $0.14 to its current price.

The chart below compares the price movement and volatility for Dogecoin over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

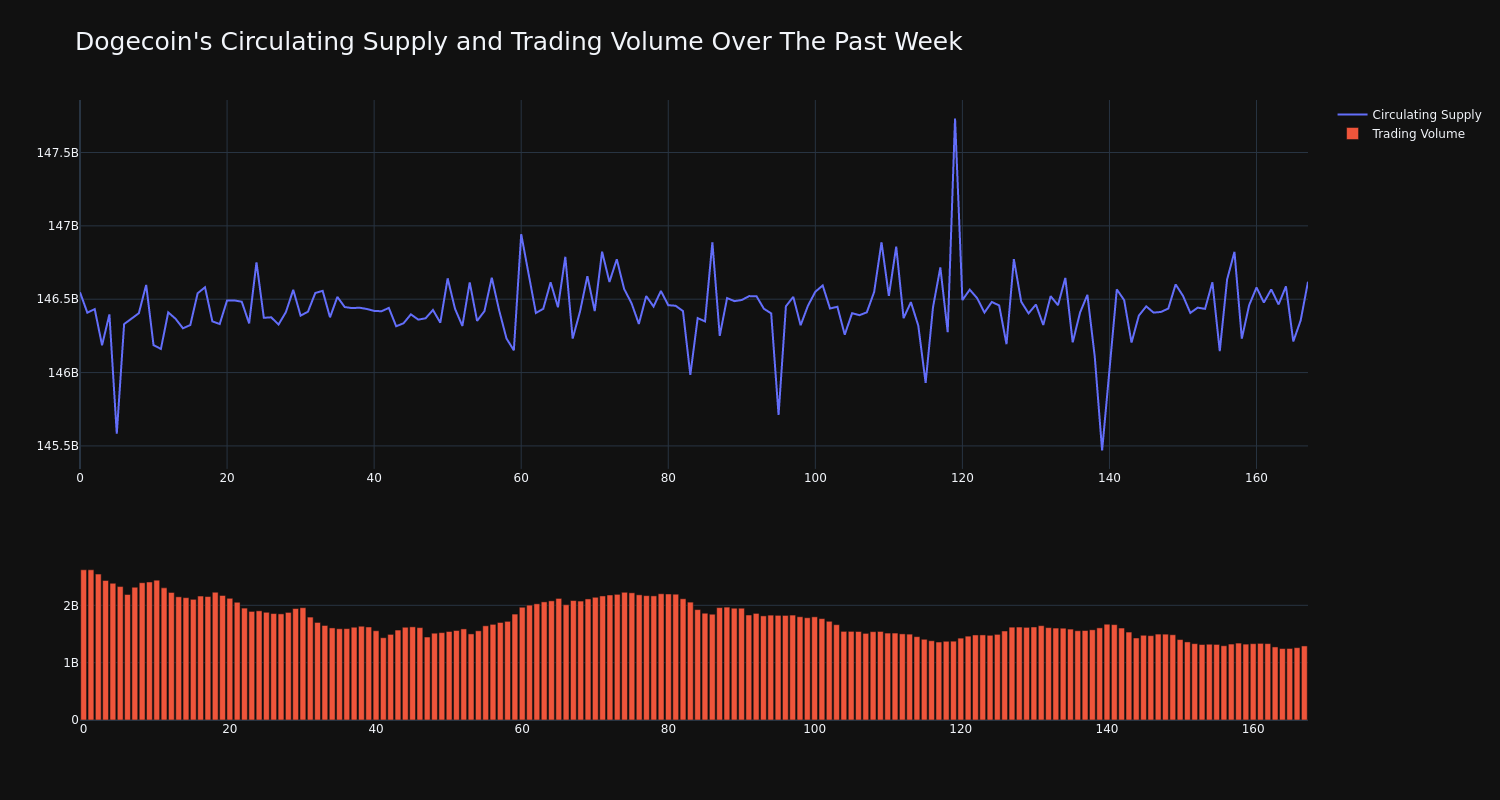

The trading volume for the coin has tumbled 51.0% over the past week while the circulating supply of the coin has risen 0.05%. This brings the circulating supply to 146.46 billion. According to our data, the current market cap ranking for DOGE is #9 at $19.71 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mercedes car earnings plunge as China shuns luxury

By Andrey Sychev

(Reuters) -Mercedes-Benz will step up cost cuts after earnings halved in the third quarter hit by tepid demand and fierce competition in China, it said on Friday.

The luxury carmaker cut its full-year profit margin target twice during the third quarter, joining a growing number of European rivals blaming a weakening Chinese car market for falling profits and margins.

Union Investment, which according to LSEG is among the 30 top investors in Mercedes, called on the management to amend its strategy as it sees no market for 2 million luxury cars any longer.

“We are clearly in favour of adjusting the strategy and adapting it to the new market conditions and the new competition from China,” said portfolio manager Moritz Kronenberger.

Mercedes refuses to participate in the price war in China and prefers to stick to its “value over volume” strategy, hoping that a massive new model rollout will help to revive sales next year.

The “value over volume” approach can be successful if demand and capacity are roughly equal, Kronenberger said, adding that currently this is not the case for the automaker.

“Chinese demand is currently focused on affordable electric cars. And Mercedes has nothing to offer here,” he said.

Mercedes shares were down 1.6% at 1246 GMT, dragging down peers BMW and Volkswagen.

The stock has lost around 8% year to date, underperforming Germany’s benchmark DAX index but still faring better than Volkswagen, BMW, and Porsche AG.

The pan-European autos index is down 10% year-to-date, the worst-performing sector in Europe this year.

PROFITABILITY DROPS

Mercedes’ car division’s adjusted return on sales fell to 4.7% in the third quarter from 12.4% last year, its worst profitability since the pandemic, while earnings in the unit more than halved, worse than expected by analysts.

“The Q3 results do not meet our ambitions,” CFO Harald Wilhelm said in a statement, adding that the group will step up cost cuts.

Wilhelm declined to provide more details about the cost cuts, but warned that “it will be tighter and tougher for sure”.

Europe’s biggest automaker, Volkswagen is considering plant closures in Germany for the first time.

Stifel analyst Daniel Schwarz noted substantial progress already made by Mercedes in reducing fixed costs since 2019 but there were “fewer low-hanging fruits”, especially when compared to Volkswagen.

In 2020, Mercedes launched a plan to reduce costs by 20% between 2019 and 2025, 15-16% of which was already achieved, according to the finance chief.

ELAN LEGAL NEWS: Elanco Animal Health Sued for Securities Fraud after Stock Drops 21%; Investors are Urged to Contact BFA Law before December 6 Court Deadline (NYSE:ELAN)

NEW YORK, Oct. 25, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Elanco Animal Health Incorporated ELAN and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in Elanco, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated.

Investors have until December 6, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Elanco Animal Health Incorporated securities. The case is pending in the U.S. District Court of Maryland and is captioned Barpar v. Elanco Animal Health Incorporated, et al., No. 24-cv-02912.

What is the Lawsuit About?

The complaint alleges that Elanco develops products to treat diseases in animals. Two of the most important treatments in the company’s development pipeline are currently being reviewed by the U.S. Food and Drug Administration (“FDA”). The treatments are named Zenrelia, a drug for a type of dermatitis in dogs, and Credelio Quattro, which is a broad spectrum oral parasiticide covering fleas, ticks and internal parasites.

With respect to these treatments, the company stated that the FDA “has all data necessary to complete its review. All technical sections, including the label, are expected to be approved before the end of June [2024].” However, on June 27, 2024, Elanco announced that it expected the FDA would not approve either drug in June 2024 and that Zenrelia would come with a boxed warning on safety.

As a result of the news, Elanco’s stock price declined over 21%, from $17.97 per share on June 26, 2024 to $14.27 per share on June 27, 2024. BFA Law is investigating whether Elanco and certain of its executives made materially false and/or misleading statements to investors related to the FDA’s approval of its drugs.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated.

What Can You Do?

If you invested in Elanco Animal Health Incorporated ELAN you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Diös Fastigheter's Interim Report Jan-Sep 2024

ÖSTERSUND, Sweden, Oct. 25, 2024 /PRNewswire/ — The market is shifting from a place of financial uncertainty to providing opportunities for growth and greater profitability. We see stronger economic growth ahead as indicated by the large acquisitions we have completed, and the number of new contracts signed. Income from property management per share increased by 17 per cent and net leasing is still strong, amounting to SEK 8 million this quarter and totalling SEK 20 million for the period. Lower interest rates, an improved economy and strong underlying growth in our market bode well for the future.

Third quarter 2024

- Income amounted to SEK 622 million (621)

- Net letting was SEK 8 million (-1)

- The operating surplus increased by 3 per cent to SEK 462 million (449)

- Income from property management increased by 17 per cent to SEK 258 million (221)

- Unrealised changes in the value of properties amounted to SEK 24 million (-203) and of derivatives to SEK -237 million (97)

- Profit after tax amounted to SEK -11 million (88)

- Earnings per share amounted to SEK -0.08 (0.62)

Period Jan-Sep 2024

- Income increased by 2 per cent and amounted to SEK 1,895 million (1,858)

- Net letting amounted to SEK 20 million (18)

- The operating surplus increased by 3 per cent to SEK 1,315 million (1,271)

- Income from property management increased by 4 to SEK 698 million (673)

- Unrealised changes in the value of properties amounted to SEK 40 million (-897) and of derivatives to SEK -112 million (24)

- Profit after tax amounted to SEK 365 million (-163)

- Earnings per share amounted to SEK 2.58 (-1.15)

– “We are convinced that we are well-positioned based on our market’s growth potential and the opportunities created by the green transition. We believe that the demand for modern offices in prime locations remains strong and is driving rent levels upwards,” says Knut Rost, CEO, Diös.

Presentation of the report

Today at 08:30 CEST, CEO Knut Rost and CFO Rolf Larsson will present the report via a web conference call. The presentation is in English. More information about the conference call is available at: investors.dios.se

This information is information that Diös Fastigheter AB is obliged to make public pursuant to the EU Market Abuse Regulation (EU no 596/2014) the Securities Markets Act. The information was submitted for publication, through the agency of the contact person set out above, at 07:00 CEST on 25 October 2024.

For further information please contact:

Knut Rost, CEO, Diös

Phone: +46(0)10-470 95 01

E-mail: knut.rost@dios.se

Rolf Larsson, CFO, Diös

Phone: +46(0)10-470 95 03

E-mail: rolf.larsson@dios.se

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/dios-fastigheter/r/dios-fastigheter-s-interim-report-jan-sep-2024,c4056551

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/dios-fastigheters-interim-report-jan-sep-2024-302286996.html

View original content:https://www.prnewswire.com/news-releases/dios-fastigheters-interim-report-jan-sep-2024-302286996.html

SOURCE Diös Fastigheter

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hydration Containers Market Size to Hit USD 19.6 billion by 2031, Projected a 6.1% CAGR – Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 25, 2024 (GLOBE NEWSWIRE) — The global hydration containers market (수화 용기 시장) is estimated to flourish at a CAGR of 6.1% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for hydration containers is estimated to reach US$ 19.6 billion by the end of 2031.

Consumers increasingly seek personalized hydration solutions, driving demand for customizable containers that reflect individual preferences and lifestyles. Collaborations with social media influencers and celebrities play a significant role in shaping consumer preferences and driving product adoption, particularly among younger demographics.

The rise of corporate wellness initiatives prompts organizations to invest in branded hydration containers for employees, creating a new avenue for market growth. Cultural norms and traditions influence hydration habits, leading to demand for containers designed specifically to cater to cultural preferences and rituals.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=37952

Evolving regulations regarding single-use plastics and packaging waste drive innovation in sustainable packaging solutions, impacting the choice of materials and design features in hydration containers.

Key Findings of the Market Report

- Polymer dominates the hydration containers market, offering versatility, durability, and lightweight properties, meeting consumer demands for portable and eco-friendly hydration solutions.

- The 21 to 40 oz. capacity segment dominates the hydration containers market, offering a balance between portability and ample hydration volume.

- Water bottles dominate the hydration containers market, offering convenience and versatility for on-the-go hydration needs, catering to diverse consumer preferences.

Hydration Containers Market Growth Drivers & Trends

- Increasing consumer awareness about environmental impact drives demand for eco-friendly hydration containers made from recycled materials or with reusable features.

- Active lifestyles and fitness routines propel the demand for durable and portable hydration solutions tailored to on-the-go hydration needs.

- Innovative designs incorporating insulation technologies and smart features enhance product performance and user experience, driving market growth.

- Growing emphasis on hydration as a key component of wellness fuels demand for hydration containers with health-focused features such as fruit infusers and hydration tracking capabilities.

- The proliferation of online shopping platforms facilitates easy access to a wide range of hydration containers, contributing to market expansion and consumer convenience.

Global Hydration Containers Market: Regional Profile

- In North America, led by the United States and Canada, the market thrives on a culture of outdoor recreation and fitness, driving demand for durable, insulated containers from brands like Hydro Flask and Yeti. Innovative features and premium materials appeal to consumers seeking high-quality hydration solutions, while sustainability initiatives drive growth in eco-friendly options.

- Europe boasts a diverse market landscape, with countries like Germany and the United Kingdom driving innovation and demand for stylish yet functional hydration containers. Brands like CamelBak and SIGG cater to outdoor enthusiasts and urban dwellers alike, offering products that combine performance with aesthetics.

- In the Asia Pacific region, particularly in countries like China and Japan, rising health awareness and urbanization fuel demand for hydration containers. Local players such as Tupperware Brands Corporation and Lock & Lock Co., Ltd. compete alongside international brands by offering affordable and innovative solutions tailored to regional preferences.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=37952

Hydration Containers Market: Competitive Landscape

The hydration containers market is fiercely competitive, with several key players vying for market share. Industry giants like Yeti Holdings Inc., Hydro Flask, and CamelBak Products LLC dominate the market with their extensive product portfolios and strong brand recognition. Emerging players such as Klean Kanteen Inc. and Contigo are rapidly gaining traction by offering innovative designs and eco-friendly solutions.

Regional players also contribute significantly, catering to local preferences and niche markets. With consumers increasingly prioritizing sustainability, durability, and functionality, competition continues to intensify, driving companies to innovate and differentiate to maintain their competitive edge in the dynamic hydration containers market.

Some prominent players are as follows:

- Cool Gear International, LLC

- CAMELBAK PRODUCTS, LLC

- Brita SE

- Klean Kanteen Inc.

- Hydro Flask

- S’well Corporation

- Tupperware Brands Corporation

- Nalge Nunc International Corp. (Thermo Fisher Scientific Inc.)

- Contigo

- AQUASANA INC.

- Bulletin Brands Inc.

- Thermos L.L.C.

- O2COOL LLC

- Nathan Sports Inc.

- SIGG Switzerland AG

- Emsa GmbH

- Ee-Lian Enterprise (M) Sdn. Bhd.

- ZHE JIANG HAERS VACUUM CONTAINERS CO. LTD.

- Lock & Lock Co. Ltd.

- Bubba Brands Inc.

Product Portfolio

- Brita SE offers a diverse product portfolio of water filtration systems, pitchers, bottles, and filters. Their innovative solutions provide clean, great-tasting water for households and on-the-go hydration needs, promoting sustainability and wellness for consumers worldwide.

- Klean Kanteen Inc. specializes in eco-friendly stainless steel water bottles, tumblers, and containers designed for active lifestyles. With a focus on durability, versatility, and sustainability, their products encourage hydration while minimizing environmental impact.

- Hydro Flask is renowned for its insulated stainless steel bottles, tumblers, and containers, keeping beverages hot or cold for extended periods. Combining functionality with style, their products cater to outdoor enthusiasts, athletes, and everyday adventurers seeking reliable hydration solutions.

Hydration Containers Market: Key Segments

By Material Type

By Capacity

- Up to 20 Oz

- 21 to 40 Oz

- 41 to 60 Oz

- Above 60 Oz

By Product Type

- Water Bottles

- Cans

- Mugs

- Mason Jars

- Tumblers

- Shakers

- Infusers

By Distribution Network

- Hypermarkets

- Supermarkets

- Convenience Stores

- Specialty Stores

- Others

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East & Africa

- Japan

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=37952<ype=S

More Trending Reports by Transparency Market Research –

Dual-Ovenable Trays & Containers Market (سوق الصواني والحاويات المزدوجة القابلة للفرن) – The global dual-ovenable trays & containers market is projected to flourish at a CAGR of 3.7% from 2023 to 2031. As per the report published by TMR, a valuation of US$ 2.4 Bn is anticipated for the market in 2031.

Sugarcane Containers Market (サトウキビコンテナ市場) – The global sugarcane containers market is projected to grow at a CAGR of 6.7% from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the Unstoppable Stock That Could Join Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Taiwan Semiconductor in the $1 Trillion Club by 2030.

One of the biggest secular tailwinds of the past several years has been that of artificial intelligence (AI). Lest there be any question, a quick scan of the top-ranking companies by market cap helps to dispel any remaining doubts. In fact, nearly all the companies in the $1 trillion club have one thing in common — they are each developing, deploying, or manufacturing products on the cutting edge of AI.

Apple has a long history of integrating sophisticated algorithms to give its state-of-the-art products an edge. Nvidia graphics processing units (GPUs) provide the technology that makes generative AI possible. Microsoft joined forces with OpenAI to spur the evolution of ChatGPT. Alphabet, Amazon, and Meta Platforms have all developed top-shelf generative AI models that are bringing the technology to the masses. Taiwan Semiconductor Manufacturing is the foundry that produces the vast majority of the most advanced chips used for AI.

With a market cap of just $483 billion, it might seem premature to nominate Oracle (NYSE: ORCL) for membership in this prestigious fraternity. However, the company’s recent business performance and management’s forecast suggest that the accelerating demand for generative AI could drive additional growth for years to come.

Oracle has previously reported that 98% of Global Fortune 500 companies use some combination of its database, cloud, and enterprise software. This puts the company in a prime position to help new and potential customers interested in adopting AI.

This has helped fuel robust overall growth. During Oracle’s fiscal 2025 first quarter (ended Aug 31), revenue grew 7% year over year to $13.3 billion, while its operating income growth accelerated to 21% — but that’s just the beginning.

Oracle continues to experience a surge of new business, and CEO Safra Catz pointed out a growing trend of customers opting for “larger and longer contracts as they see firsthand how Oracle Cloud services are benefiting their businesses.” This trend is fueling the company’s remaining performance obligation (RPO) — or contracts not yet included in revenue — which surged 53% year over year to $99 billion. When RPO is growing faster than revenue, it points to a robust pipeline of revenue growth, which bodes well for the future.

As a result, the company expects its fiscal 2025 revenue to accelerate in each successive quarter, ultimately growing by double-digits for the year. In the second quarter, Oracle expects its revenue growth rate to climb to 8% at the midpoint of its guidance, fueled by cloud revenue growth of 24%. This will drive adjusted earnings per share (EPS) growth of 8%.

Insider Decision: Michael Bokan Offloads $1.09M Worth Of Micron Technology Stock

Disclosed on October 23, Michael Bokan, SVP at Micron Technology MU, executed a substantial insider sell as per the latest SEC filing.

What Happened: Bokan’s decision to sell 10,000 shares of Micron Technology was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $1,090,300.

The latest update on Thursday morning shows Micron Technology shares up by 1.75%, trading at $106.89.

Delving into Micron Technology’s Background

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Financial Insights: Micron Technology

Revenue Growth: Micron Technology displayed positive results in 3 months. As of 31 August, 2024, the company achieved a solid revenue growth rate of approximately 93.27%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company shows a low gross margin of 35.32%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Micron Technology’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.8.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.31.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 150.07, Micron Technology’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 4.68, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Micron Technology’s EV/EBITDA ratio at 12.77 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Navigating the World of Insider Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Micron Technology’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.