Comfort Systems (NYSE:FIX) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops

HVAC and electrical contractor Comfort Systems USA (NYSE:FIX) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 31.5% year on year to $1.81 billion. Its GAAP profit of $4.09 per share was 2.4% above analysts’ consensus estimates.

Brian Lane, Comfort Systems USA’s President and Chief Executive Officer, said, “We are happy to report record earnings and cash flow this quarter, as our employees continue to achieve unmatched execution for our customers. Recently acquired companies exceeded our high expectations, and each of our operating segments excelled in every respect. Quarterly per share earnings were 40% ahead of the same quarter last year, and through nine months our per share earnings were 60% higher than in the same period last year. Cash flow surpassed any previous quarter, and that extraordinary cash flow is both a great base for continued investment and a definite signal of strong underlying trends in our execution, customer relationships, and prospects.”

Having historically grown through organic means as well as acquisitions of numerous peers and competitors, Comfort Systems USA (NYSE:FIX) provides mechanical and electrical contracting services.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams – for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Movano Health Announces Reverse Stock Split

Shares Expected to Begin Trading on Split-Adjusted Basis on October 29, 2024

PLEASANTON, Calif., Oct. 25, 2024 /PRNewswire/ — Movano Health MOVE announced today that it will implement a 1-for-15 reverse stock split of the issued shares of its common stock (the “Reverse Stock Split”), effective at 12:01 a.m. Eastern time on October 29, 2024. The Company’s common stock is expected to begin trading on a split-adjusted basis when the market opens on Tuesday, October 29, 2024, and will continue to trade on The Nasdaq Capital Market under the symbol “MOVE.” The new CUSIP number for the common stock will be 62459M 206.

The Reverse Stock Split is intended to increase the bid price of the common stock to enable the Company to regain compliance with the minimum bid price requirement for continued listing on The Nasdaq Capital Market. The Company’s stockholders authorized the reverse stock split at the Company’s annual meeting of stockholders held on July 9, 2024, with the final ratio subsequently determined by the Company’s Board of Directors.

As a result of the Reverse Stock Split, every 15 shares of the Company’s pre-split common stock issued and outstanding will be automatically reclassified into one new share of the Company’s common stock. This will reduce the number of shares outstanding from approximately 99.5 million shares to approximately 6.6 million shares. The number of authorized shares of the Company’s common stock will remain unchanged. Stockholders who would otherwise be entitled to receive a fractional share will instead automatically have their fractional interests rounded up to the next whole share, after aggregating all the fractional interests of a holder resulting from the Reverse Stock Split. Proportionate adjustments will be made to the exercise prices and the number of shares underlying the Company’s equity plans and grants thereunder, as applicable. The Reverse Stock Split will not affect the par value of the common stock.

The combination of, and reduction in, the issued shares of common stock as a result of the Reverse Stock Split will occur automatically at the effective time of the Reverse Stock Split without any additional action on the part of the Company’s stockholders. The Company’s transfer agent, Pacific Stock Transfer Company, is acting as the exchange agent for the Reverse Stock Split and will send stockholders of record holding their shares electronically in book-entry form a transaction notice indicating the number of shares of common stock held after the Reverse Stock Split. Stockholders who hold their shares through a broker, bank, or other nominee will have their positions adjusted to reflect the Reverse Stock Split, subject to their broker, bank, or other nominee’s particular processes, and are not expected to be required to take any action in connection with the Reverse Stock Split.

Additional information regarding the Reverse Stock Split can be found in the Company’s definitive proxy statement for the annual meeting of stockholders of the Company held on July 9, 2024, which was filed with the U.S. Securities and Exchange Commission on May 28, 2024, a copy of which is available at www.sec.gov and on the Company’s website.

About Movano Health

Founded in 2018, Movano Inc. MOVE dba Movano Health, maker of the Evie Ring (www.eviering.com), is developing a suite of purpose-driven healthcare solutions to bring medical-grade data to the forefront of wearables. Featuring modern and flexible form factors, Movano Health’s devices offer an innovative approach to delivering trusted data to both customers and enterprises, capturing a comprehensive picture of an individual’s health data and uniquely translating it into personalized and intelligent insights.

Movano Health’s proprietary technologies and wearable medical device solutions will soon enable the use of data as a tool to proactively monitor and manage health outcomes across a number of patient populations that exist in healthcare. For more information on Movano Health, visit https://movanohealth.com/.

Forward Looking Statements

This press release contains forward-looking statements concerning our expectations, anticipations, intentions, beliefs, or strategies regarding the future. These forward-looking statements are based on assumptions that we have made as of the date hereof and are subject to known and unknown risks and uncertainties that could cause actual results, conditions, and events to differ materially from those anticipated. Therefore, you should not place undue reliance on forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding plans with respect to the timing and impact of the Reverse Stock Split, the commercial launches of the Evie Ring and EvieMED Ring; our expectations regarding potential commercial opportunities; planned cost-cutting initiatives; anticipated FDA clearance decisions with respect to our products; expected future operating results; product development and features, product releases, clinical trials and regulatory initiatives; our strategies, positioning and expectations for future events or performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, and in our other reports filed with the Securities and Exchange Commission, including under the caption “Risk Factors.” Any forward-looking statement in this release speaks only as of the date of this release. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/movano-health-announces-reverse-stock-split-302286792.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/movano-health-announces-reverse-stock-split-302286792.html

SOURCE Movano

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intel to invest more than $28 billion to build two chip factories in Ohio

(Reuters) -Intel will invest more than $28 billion to construct two new chip factories in Ohio, the company said on Friday, in a latest step to build out its contract manufacturing business and better compete with Taiwan Semiconductor Manufacturing Co.

Shares of the troubled chip firm rose nearly 2% in early trading. The stock has slumped more than 55% this year.

Intel’s foundry business is central to CEO Pat Gelsinger’s turnaround strategy, as the once-chipmaking king attempts to claw back the technological edge that it lost to TSMC, the world’s largest contract chipmaker.

The big investment comes more than a month after Intel signed a multibillion-dollar deal with Amazon to build custom AI chips for the e-commerce giant’s cloud services unit. The deal was seen as a major stamp of approval to Intel’s money-losing foundry business.

The Santa Clara, California-based company said on Friday the initial phase of the project is expected to create 3,000 Intel jobs.

The chipmaker has had a tumultuous year as it suspended its dividend, slashed workforce and saw sudden resignation of a high-profile board member, while the slump in its share price threatened its place in the Dow Jones index.

(Reporting by Deborah Sophia in Bengaluru; Editing by Shilpi Majumdar)

Michael Burry Is Betting the House on Chinese Stocks and This Billionaire Investor Is Too. Should You Follow Them?

Even if you’re just a casual investor, there’s a good chance you’re familiar with Michael Burry. He’s the contrarian hedge fund manager made famous by The Big Short, the Michael Lewis book-turned-movie that chronicled the investors who saw the 2008 collapse of the financial system early and bet accordingly.

Burry’s Scion Capital Management made $725 million for his investors by betting against mortgage-backed securities back then, and he pocketed $100 million for himself.

The hedge fund manager has since been closely followed by investors, and though he doesn’t frequently give interviews, anyone can track his moves each quarter through Scion’s 13F filings with the SEC. Burry’s recent purchases show that he’s squarely lining up behind another contrarian bet.

The Scion Capital manager now has approximately 46% of his portfolio in a trio of Chinese tech stocks. Alibaba (NYSE: BABA) made up 21.3% of his portfolio as of the end of the second quarter, followed by Baidu (NASDAQ: BIDU) at 12.4%, and JD.com (NASDAQ: JD) at 12.3%. Burry started buying those stocks in Q4 2022.

The past few weeks notwithstanding, it’s hard to find a more unloved sector than China in recent years. As you can see from the chart below, the iShares MSCI China ETF, a top China ETF, has badly underperformed the S&P 500.

The gains over the last few weeks are related to Beijing’s move to loosen lending rates and restrictions, a sign that Burry’s patience could be paying off.

He’s not alone. Billionaire fund manager David Tepper, who runs Appaloosa Management, has also been stocking up on Chinese stocks. Tepper’s top holding is also Alibaba, representing 12.2% of his holdings, and Pinduoduo parent PDD Holdings (NASDAQ: PDD) makes up another 4.2%. He also owns Baidu, the Kraneshares CSI China ETF (NYSEMKT: KWEB), JD.com, and KE Holdings (NYSE: BEKE), which represent a combined 6.6% of his portfolio.

All totaled, nearly a quarter of Tepper’s holdings are Chinese stocks, and he first started buying the sector, starting with Alibaba, in Q2 2022.

Should you follow these top investors into China? Let’s take a look at one reason to buy Chinese stocks and one reason not to.

Plenty of top investors seem to think the U.S. stock market, as represented by the S&P 500, is overvalued. Even Warren Buffett, one of the biggest cheerleaders for U.S. stocks in history, has been a net seller this year, instead piling into Treasuries.

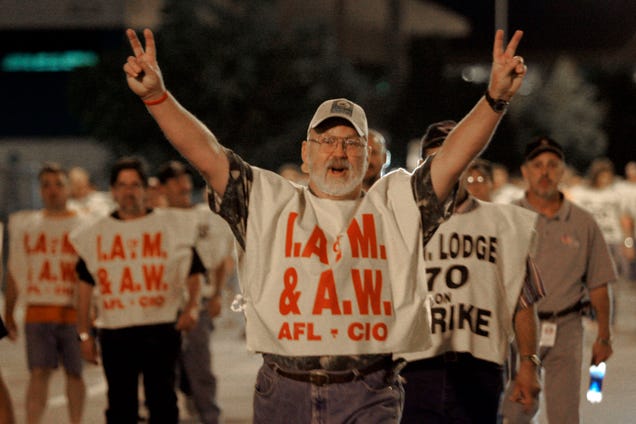

Boeing union to striking workers: 'Bullying' each other over strike votes is 'vile'

The union representing workers on strike against troubled aerospace firm Boeing (BA) on Thursday reminded its members that they need to stick together in order to get what they want.

Sixty-four percent of workers represented by International Association of Machinists and Aerospace Workers (IAM) local 751 on Wednesday voted against Boeing’s latest deal, which offered a 35% raise but failed to meet the workers’ broader demands. Two key sticking points have been the size of the raise — the IAM has been seeking a 40% wage increase — and the restoration of Boeing’s pension, which was cut as a benefit for new employees a decade ago.

Machinists have been divided over the contract, with some arguing that they should be “grateful” for the deal and “vote accordingly,” while others want to stick out for that pension benefit,” The Seattle Times reported.

Rachel Sarzynski, a team lead on Boeing’s 777, told the Times that “some people are desperate” and just want to get back to work and get paid again. Union members have received $250 per week from the strike fund after the walkouts entered its third week — a major pay cut for many employees. Sarzynski added that Boeing’s latest offer has “absolutely divided people.”

The IAM on Thursday evening seemed to acknowledged that divide, reminding its members that no one “deserves to be bullied or disrespected” because of how they voted on the deal. “Bullying” fellow members, the union added, is “unacceptable and vile.”

“Each one of us made a choice, using our voice, deciding what was right for our families. That power to choose, the right to choose, is at the core of everything we stand for,” the IAM said in a statement. “Respect. Fairness. A future that we decide, not one handed down to us from corporate boardrooms. “

As for the strike negotiations, the latest offer came partially after an intervention from Acting Secretary of Labor Julie Su, which pushed both sides to return to the bargaining table.

Boeing in a statement said it was “disappointed” by Wednesday’s results; its CEO had told investors this week the company is “feverishly” working toward a solution. The IAM has said it will work to return to the negotiating table.

The strike has added to Boeing’s litany of problems, which were renewed this year after a piece of fuselage fell off a plane in January. The Federal Aviation Administration (FAA) imposed a continuing production rate cap so Boeing could address quality-control issues, which meant that the company has been sending billions of dollars in cash out the door for a while without the lost income.

The strike paused work on many of the plane models making up Boeing’s order backlog. Now, it has plans to lay off 10% of its workforce and raise tens of billions of dollars in cash to fortify its coffers amid lost revenue, but securing that funding was in part tied to ending the strike.

The company’s much-needed investment-grade credit rating hangs on by a thread, and losing it would make the path to recovery steeper and more expensive should Boeing need to borrow more money along the way. Fitch Ratings said last week that Boeing’s cash-raising actions “support liquidity amidst continued operational challenges” — but only if Boeing can reach an agreement for its machinists to be back on the job by the end of the year.

—Melvin Backman contributed to this article

Five US Banks Face Billions In Losses As Silver's Price Spike Hits Short Sellers Hard: Report

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Silver prices have experienced a significant increase, rising over 6% to exceed $33.6 per ounce. This unexpected surge has put five U.S. banks at risk of substantial financial losses due to their large short positions in the metal.

What Happened: The recent spike in silver prices has led to potential losses for these banks, estimated at billions of dollars, according to a report by The Silver Academy.

The Commodities Futures Trading Commission (CFTC) reports that open interest in silver futures contracts has reached 141,580 contracts, each representing 5,000 ounces.

Don’t Miss:

This amounts to approximately 707.9 million ounces, nearly equaling a year’s global silver production. With silver prices increasing by $1.84 per ounce, these short positions are now estimated to be underwater by $1.3 billion.

“This behavior undermines market integrity and could have far-reaching consequences for both the financial sector and industries that depend on stable silver prices,” said The Silver Academy.

The concentration of these short positions among just five U.S. banks has raised concerns among industry analysts. Critics argue that this level of short-selling artificially depresses silver prices, despite strong industrial demand from sectors like electric vehicles and solar panels.

“Silver is viewed as the relatively cheap sibling to gold, and as gold continues to reach fresh record highs and copper hits a 2 1/2 month high, traders took it through resistance at $32.50,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S, according to a report by Bloomberg.

Concerns about market integrity and potential supply shortages have emerged, with some fearing a sharp price increase could force banks to buy back large quantities of silver, leading to significant losses.

Why It Matters: The surge in silver prices comes amid a backdrop of increasing investor interest in precious metals. Robert Kiyosaki, a renowned investor, predicted a potential stock market crash and emphasized the importance of investing in gold, silver, and Bitcoin. His remarks highlight a growing trend of investors seeking defensive assets in uncertain market conditions.

Colgate-Palmolive Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Colgate-Palmolive Company CL will release earnings results for its third quarter, before the opening bell on Friday, Oct. 25.

Analysts expect the New York-based company to report quarterly earnings at 88 cents per share, compared to 86 cents per share in the year-ago period. Colgate-Palmolive projects to report revenue of $5 billion for the quarter, according to data from Benzinga Pro.

On Sept. 12, the company’s board declared a quarterly cash dividend of 50 cents per common share.

Colgate-Palmolive shares gained 0.8% to close at $99.74 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Andrea Teixeira maintained an Overweight rating and raised the price target from $113 to $114 on Oct. 11. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Chris Carey downgraded the stock from Equal-Weight to Underweight with a price target of $100 on Sept. 16. This analyst has an accuracy rate of 66%.

- Deutsche Bank analyst Steve Powers downgraded the stock from Buy to Hold and raised the price target from $107 to $109 on Sept. 9. This analyst has an accuracy rate of 68%.

- TD Cowen analyst Robert Moskow maintained a Buy rating and raised the price target from $110 to $115 on July 30. This analyst has an accuracy rate of 67%.

- Morgan Stanley analyst Dara Mohsenian maintained an Overweight rating and raised the price target from $103 to $111 on July 29. This analyst has an accuracy rate of 72%.

Considering buying CL stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.