SUMMIT HOTEL PROPERTIES DECLARES THIRD QUARTER 2024 DIVIDENDS

AUSTIN, Texas, Oct. 24, 2024 /PRNewswire/ — Summit Hotel Properties, Inc. INN (the “Company”), announced today that its Board of Directors has authorized, and the Company has declared, a cash dividend for the third quarter ended September 30, 2024, of $0.08 per share of common stock of the Company and per common unit of limited partnership interest in Summit Hotel OP, LP, the Company’s operating partnership. The Company’s third quarter common dividend represents an annualized dividend yield of 5.2 percent based on the closing price of shares of the common stock on October 23, 2024.

The Board of Directors has also authorized, and the Company has declared, a cash dividend of $0.390625 per share of the Company’s 6.25% Series E Cumulative Redeemable Preferred Stock for the dividend period ending on November 30, 2024, and a cash dividend of $0.3671875 per share of the Company’s 5.875% Series F Cumulative Redeemable Preferred Stock for the dividend period ending on November 30, 2024.

Additionally, the Board of Directors has authorized a cash distribution, and the Company has declared on behalf of the operating partnership, distributions of $0.328125 per unit pertaining to the operating partnership’s unregistered 5.25% Series Z Cumulative Perpetual Preferred Units for the distribution period ending on November 30, 2024.

The dividends are payable on November 29, 2024, to holders of record as of November 15, 2024.

About Summit Hotel Properties

Summit Hotel Properties, Inc. is a publicly-traded real estate investment trust focused on owning premium-branded lodging properties with efficient operating models primarily in the Upscale segment of the lodging industry. As of September 30, 2024, the Company’s portfolio consisted of 96 assets, 54 of which are wholly owned, with a total of 14,255 guestrooms located in 24 states.

For additional information, please visit the Company’s website, www.shpreit.com, and follow the Company on X at @SummitHotel_INN.

Forward Looking Statements

This press release contains statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Act of 1934, as amended, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” “forecast,” “continue,” “plan,” “likely,” “would” or other similar words or expressions. These forward-looking statements relate to the payment of dividends. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections or other forward-looking information. These forward-looking statements are subject to various risks and uncertainties, not all of which are known to the Company and many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, supply and demand in the hotel industry and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/summit-hotel-properties-declares-third-quarter-2024-dividends-302286620.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/summit-hotel-properties-declares-third-quarter-2024-dividends-302286620.html

SOURCE Summit Hotel Properties, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple (AAPL) Q4 Earnings: Is Now the Right Time to Buy the Stock?

Apple (AAPL) is set to report its Fiscal Q4 earnings on Thursday, October 31, after the closing bell, aiming to maintain its recent bullish momentum. However, I’m more cautious this time. While I remain a long-term Apple bull, analysts have raised their estimates for FQ4 over the past three months, adding pressure on the company to meet these heightened expectations. As a result, I’m uncertain if now is the best time to buy, despite my long-term optimism.

In addition to this, the stock’s stretched valuation after its recent rally could further increase the pressure for strong performance, leaving little room for any slip-ups in guidance. The narrative surrounding the AI supercycle, still in its early stages, also adds a layer of short-term volatility.

Although I have a more cautious outlook on Apple stock ahead of its FQ4 earnings, the previous quarter was quite strong, with the company exceeding expectations on both earnings and revenue. Apple reported an EPS of $1.40, beating the consensus estimate of $1.34, and posted revenues of $85.8 billion, surpassing the $84.4 billion forecast. This marked the sixth consecutive quarter that the firm exceeded earnings estimates, highlighting Apple’s consistent performance

Two key takeaways from the quarter were Apple’s performance in China and its approach to capital expenditures (CapEx). First, despite a 6.5% year-over-year decline in China sales, the results were better than expected, especially given that the iPhone dropped out of the top five in market share, slipping to 14% from 16% a year ago.

Second, while many Big Tech companies have been significantly increasing their AI-related spending, Apple has taken a more conservative approach. The company is likely to maintain its CapEx in the $10–$11 billion range annually. In fact, over the past twelve months, CapEx has decreased by 28% compared to the same period last year—far below the $50–$70 billion being spent by some of its peers.

Apple’s conservative approach has resonated well with the market. Unlike its peers, Apple’s AI strategy focuses on improving existing products to better monetize its vast user base rather than building data centers. This cautious spending led to strong cash flow, with $29 billion in operating cash flow in the June quarter—a record. With $153 billion in cash and $101 billion in debt, Apple is well-positioned to reward shareholders, returning over $32.7 billion last quarter through share buybacks and a $0.25 dividend.

Boeing Reports $6B Q3 Loss: 'This Is The Bottom,' Says Analyst

Troubled aerospace giant Boeing Co. BA reported a $6 billion third-quarter loss on Wednesday, the company’s largest since 2020, amid an ongoing labor strike and a company-wide turnaround effort. Analysts weighed in on the company’s issues and what is next for Boeing.

The Details: BofA Securities analyst Ronald Epstein pointed to Boeing stock’s muted reaction to the company’s earnings report as capturing investor sentiments of “1) This is the bottom and 2) There are plenty more skeletons in the closet for Kelly [Ortberg] to find.”

The research firm said the most critical first step to make Boeing “great again” is ending the labor strike. The firm estimates the strike is costing Boeing approximately $50 million a day due to the halt in production and said a strike lasting 58 days would result in a financial impact of nearly $3 billion to the company.

BofA analysts also see shoring up the balance sheet as key to Boeing’s return to glory and now expects the company to raise between $18 billion and $20 billion through its recent mixed shelf offering.

Boeing reported it is considering divesting non-core assets which BofA views as a good step towards the company reducing debt and strengthening its balance sheet.

“We see this as a positive not only for offsetting cash-burn but for Boeing to refocus while transforming,” the analyst wrote.

BofA Securities maintained its Neutral rating and $170 price target on Boeing shares.

Read Next: Bank Of America CEO Cautions Fed Not To ‘Go Too Fast Or Too Slow’ On Interest Rate Cuts

RBC Capital Markets analyst Ken Herbert pointed to Boeing’s 2025 negative free cash flow forecast as the focus of the earnings call. The RBC analyst adjusted the firm’s estimate to approximately negative $8 billion in 2025 and negative $2.6 billion in 2026 as Boeing indicated a return to positive free cash flow in the second half of 2026.

Herbert noted CEO Ortberg’s initial public comments were “very cautious” during Boeing’s earnings call and expressed concerns that investors were looking for more clarity and specific timelines for a return to pre-strike production levels. However, the analyst said he remains optimistic Ortberg can right the ship at Boeing.

RBC Capital reiterated its Outperform rating and $200 price target on Boeing.

BA Price Action: According to Benzinga Pro, Boeing shares ended Thursday’s session 1.18% lower at $155.20.

Read Also:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marc Benioff Warns Microsoft's Copilot 'Spills Corporate Data,' Emphasizes Security Gaps Ahead Of Salesforce Agentforce Launch

Salesforce Inc. CRM CEO Marc Benioff criticized Microsoft Corp. MSFT for its artificial intelligence tools, claiming that they are overhyped and underperforming.

What Happened: Benioff took aim at Microsoft’s Copilot AI tool, describing it as overhyped and ineffective, in an interview with Business Insider. This criticism comes in the wake of Microsoft’s announcement of new Dynamics 365 AI agents, which directly compete with Salesforce’s Agentforce product, a CRM lead.

Benioff’s comments were not a coincidence. The day before the interview, Microsoft introduced 10 new AI agents for its CRM offering, Dynamics 365. This announcement came just days before the release of Salesforce’s own AI agent product, Agentforce, which is set to be generally available on Friday.

Benioff stated, “Microsoft has really disappointed so many of our customers. They’ve really done it by delivering a level of hype around their AI solutions.”

He also criticized the accuracy of Copilot, stating that it “spills corporate data,” and referred to it as “Clippy 2.0,” a nod to an infamous 1990s Microsoft Office digital assistant.

Benioff emphasized the success of Salesforce’s AI solutions and the company’s continued lead in the CRM market. Despite Microsoft’s recent gains in CRM market share, Benioff remains confident in Salesforce’s position.

See Also: ‘Nvidia, Own It, Don’t Trade It:’ Jim Cramer Questions Short-Sellers As Stock Hits New Highs

Why It Matters: The rivalry between Salesforce and Microsoft has intensified with the introduction of AI-driven technologies.

Recently, Benioff criticized Microsoft’s rebranding of Copilot to “agents,” calling it a sign of “panic mode” due to Microsoft’s lack of data and security models, which he claims leads to inaccuracies and data leaks. Benioff praised Salesforce’s Agentforce for its integration of data, workflows, and security into a unified platform.

Microsoft’s announcement during its “AI Tour” in London highlighted the ability of businesses to develop autonomous AI agents, aiming to streamline enterprise functions. This move is part of Microsoft’s Copilot Studio platform, which allows organizations to customize AI-driven agents.

Analysts have noted that Salesforce’s Agentforce platform is on par with Microsoft’s offerings, with Piper Sandler upgrading Salesforce’s rating and raising its price target.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Savings Financial Group, Inc. Reports Financial Results for the Fiscal Year Ended September 30, 2024

JEFFERSONVILLE, Ind., Oct. 24, 2024 (GLOBE NEWSWIRE) — First Savings Financial Group, Inc. FSFG (the “Company”), the holding company for First Savings Bank (the “Bank”), today reported net income of $13.6 million, or $1.98 per diluted share, for the year ended September 30, 2024, compared to net income of $8.2 million, or $1.19 per diluted share, for the year ended September 30, 2023. The core banking segment reported net income of $16.9 million, or $2.47 per diluted share for the year ended September 30, 2024, compared to $14.9 million, or $2.18 per diluted share for the year ended September 30, 2023.

Commenting on the Company’s performance, Larry W. Myers, President and CEO, stated “Fiscal 2024 was, in many ways, a year of rebuilding, repositioning and refinement. A summary of these enhancement actions is provided below. While we’re not entirely pleased with the financial performance in fiscal 2024, we are confident that the Company is well positioned to better perform in fiscal 2025 and the years thereafter regardless of the economic environment. For fiscal 2025 we’ll remain focused on core banking; strong asset quality; selective high-quality lending; core deposit growth; increased SBA lending volume; continued improvement of liquidity, capital and interest rate sensitivity positions; and strategic opportunities. We believe the efforts of fiscal 2024 along with the focus for fiscal 2025 will deliver enhanced shareholder value. Additionally, we’ll continue to evaluate options and strategies that we believe will further position the Company for future success and deliver shareholder value.”

Net interest income decreased $3.5 million, or 5.7%, to $58.1 million for the year ended September 30, 2024 as compared to the prior year. The tax equivalent net interest margin for the year ended September 30, 2024 was 2.68% as compared to 3.10% for the prior year. The decrease in net interest income was due to a $22.3 million increase in interest expense, partially offset by an $18.8 million increase in interest income. A table of average balance sheets, including average asset yields and average liability costs, is included at the end of this release.

The Company recognized a provision for credit losses for loans of $3.5 million, a credit for unfunded lending commitments of $421,000, and a provision for credit losses for securities of $21,000 for the year ended September 30, 2024, compared to a provision for loan losses of $2.6 million only for the prior year. The provision for credit losses for loans increased primarily due to loan growth and the effects of adopting the Current Expected Credit Loss (CECL) methodology during the year ended September 30, 2024. The Company recognized net charge-offs totaling $527,000 during the year, of which $104,000 was related to unguaranteed portions of SBA loans, compared to net charge-offs of $1.1 million during the prior year, of which $872,000 was related to unguaranteed portions of SBA loans. Nonperforming loans, which consist of nonaccrual loans and loans over 90 days past due and still accruing interest, increased $3.0 million from $13.9 million at September 30, 2023 to $16.9 million at September 30, 2024.

Noninterest income decreased $12.8 million for the year ended September 30, 2024 as compared to the prior year. The decrease was due primarily to a $14.1 million decrease in mortgage banking income due to the cessation of national mortgage banking operations in the quarter ended December 31, 2023.

Noninterest expense decreased $23.2 million for the year ended September 30, 2024 as compared to the prior year. The decrease was due primarily to decreases in compensation and benefits, data processing expense and other operating expenses of $12.0 million, $2.2 million and $7.8 million, respectively. The decrease in compensation and benefits expense was due primarily to a reduction in staffing related to the cessation of national mortgage banking operations in the quarter ended December 31, 2023. The decrease in data processing expense was due primarily to expenses recognized in the prior year related to the implementation of the new core operating system in August 2023. The decrease in other operating expense was due primarily to a $1.9 decrease in net loss on captive insurance operations due to the dissolution of the captive insurance company in September 2023; a decrease in loss contingency accrual for SBA-guaranteed loans of $754,000 in 2024 compared to an increase of $1.5 million in 2023; a decrease in the loss contingency accrual for restitution to mortgage borrowers of $283,000 in 2024 compared to an increase of $609,000 in 2023; and a decrease of $853,000 in loan expense for 2024 as compared to 2023 due primarily to lower mortgage loan originations related to the cessation of national mortgage banking operations in the quarter ended December 31, 2023.

The Company recognized income tax expense of $1.0 million for the year ended September 30, 2024 compared to tax expense of $10,000 for the prior year. The increase is primarily due to higher taxable income in the 2024 period. The effective tax rate for 2024 was 7.0%, which was an increase from the effective tax rate of 0.1% in 2023. The effective tax rate is well below the statutory tax rate primarily due to the recognition of investment tax credits related to solar projects in both the 2024 and 2023 periods.

The Company reported net income of $3.7 million, or $0.53 per diluted share, for the three months ended September 30, 2024, compared to a net loss of $747,000, or $0.11 per diluted share, for the three months ended September 30, 2023. The core banking segment reported net income of $4.1 million, or $0.60 per diluted share, for the three months ended September 30, 2024, compared to $2.3 million, or $0.33 per diluted share, for the three months ended September 30, 2023.

Net interest income decreased $459,000, or 3.0%, to $15.1 million for the three months ended September 30, 2024 as compared to the same period in 2023. The tax equivalent net interest margin was 2.72% for the three months ended September 30, 2024 as compared to 3.03% for the same period in 2023. The decrease in net interest income was due to a $4.5 million increase in interest expense, partially offset by a $4.1 million increase in interest income. A table of average balance sheets, including average asset yields and average liability costs, is included at the end of this release.

The Company recognized a provision for credit losses for loans of $1.8 million, a credit for unfunded lending commitments of $262,000, and a credit for credit losses for securities of $86,000 for the three months ended September 30, 2024, compared to a provision for loan losses of $815,000 only for the same period in 2023. The provision for credit losses for loans increased primarily due to loan growth and the effects of adopting the Current Expected Credit Loss (CECL) methodology during the year ended September 30, 2024. The Company recognized net charge-offs totaling $304,000 during the 2024 period, of which $120,000 was related to unguaranteed portions of SBA loans, compared to net charge-offs of $753,000 during the 2023 period, of which $609,000 was related to unguaranteed portions of SBA loans.

Noninterest income decreased $2.6 million for the three months ended September 30, 2024 as compared to the same period in 2023. The decrease was due primarily to a $3.0 million decrease in mortgage banking income due to the cessation of national mortgage banking operations in the quarter ended December 31, 2023.

Noninterest expense decreased $9.0 million for the three months ended September 30, 2024 as compared to the same period in 2023. The decrease was due primarily to decreases in compensation and benefits expense, data processing expense, and other operating expenses of $4.5 million, $1.5 million and $3.5 million, respectively. The decrease in compensation and benefits expense was due primarily to a reduction in staffing related to the cessation of national mortgage banking operations in the quarter ended December 31, 2023. The decrease in data processing expense was due primarily to expenses recognized in the prior year period related to the implementation of the new core operating system in August 2023. The decrease in other operating expense was due primarily to a $978,000 decrease in the net loss on captive insurance operations due to the dissolution of the captive insurance company in September 2023; a decrease in loss contingency accrual for SBA-guaranteed loans of $14,000 in 2024 compared to an increase of $1.0 million in 2023; and a decrease of $270,000 in loan expense for 2024 as compared to 2023 due primarily to lower mortgage loan originations related to the cessation of the national mortgage banking operations in the quarter ended December 31, 2023.

The Company recognized income tax expense of $145,000 for the three months ended September 30, 2024 compared to income tax benefit of $737,000 for the same period in 2023. The increase was primarily due to higher taxable income in the 2024 period.

Total assets increased $161.5 million, from $2.29 billion at September 30, 2023 to $2.45 billion at September 30, 2024. Net loans held for investment increased $193.6 million during the year ended September 30, 2024 due primarily to growth in residential real estate, residential construction, and commercial real estate loans. Loans held for sale decreased by $20.1 million from $45.9 million at September 30, 2023 to $25.7 million, primarily due to the winddown of the national mortgage banking operations. Residential mortgage loan servicing rights decreased $59.8 million during the year ended September 30, 2024, due to the sale of the entire residential mortgage loan servicing rights portfolio during the year.

Total liabilities increased $135.4 million due primarily to increases in total deposits of $199.1 million, which included an increase in brokered deposits of $70.8 million, partially offset by a decrease in FHLB borrowings of $61.5 million. As of September 30, 2024, deposits exceeding the FDIC insurance limit of $250,000 per insured account were 30.1% of total deposits and 13.7% of total deposits when excluding public funds insured by the Indiana Public Deposit Insurance Fund.

Common stockholders’ equity increased $26.1 million, from $151.0 million at September 30, 2023 to $177.1 million at September 30, 2024, due primarily to a $18.4 million decrease in accumulated other comprehensive loss and an increase in retained net income of $7.0 million. The decrease in accumulated other comprehensive loss was due primarily to decreasing long term market interest rates during the year ended September 30, 2024, which resulted in an increase in the fair value of securities available for sale. At September 30, 2024 and September 30, 2023, the Bank was considered “well-capitalized” under applicable regulatory capital guidelines.

First Savings Bank is an entrepreneurial community bank headquartered in Jeffersonville, Indiana, which is directly across the Ohio River from Louisville, Kentucky, and operates fifteen depository branches within Southern Indiana. The Bank also has two national lending programs, including single-tenant net lease commercial real estate and SBA lending, with offices located predominately in the Midwest. The Bank is a recognized leader, both in its local communities and nationally for its lending programs. The employees of First Savings Bank strive daily to achieve the organization’s vision, We Expect To Be The BEST community BANK, which fuels our success. The Company’s common shares trade on The NASDAQ Stock Market under the symbol “FSFG.”

This release may contain forward-looking statements within the meaning of the federal securities laws. These statements are not historical facts; rather, they are statements based on the Company’s current expectations regarding its business strategies and their intended results and its future performance. Forward-looking statements are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions.

Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause or contribute to the Company’s actual results, performance and achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, changes in general economic conditions; changes in market interest rates; changes in monetary and fiscal policies of the federal government; legislative and regulatory changes; and other factors disclosed periodically in the Company’s filings with the Securities and Exchange Commission.

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on its behalf. Except as may be required by applicable law or regulation, the Company assumes no obligation to update any forward-looking statements.

Contact:

Tony A. Schoen, CPA

Chief Financial Officer

812-283-0724

Bitcoin Gains, Ethereum, Dogecoin Muted Amid Tesla-Powered Stocks Rally: Analyst Highlights 'Most Bullish Outcome' For King Crypto In The Short Term

Bitcoin traded in the green Thursday after Tesla Inc.’s TSLA searing rally lifted stocks out of losses.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Bitcoin BTC/USD | +1.13% | $67,956.29 |

| Ethereum ETH/USD |

-0.66% | $2,525.51 |

| Dogecoin DOGE/USD | -1.46% | $0.14 |

What Happened: Bitcoin sailed to an intraday high of $68,693 during U.S. evening hours before dipping below $68,000 on profit-taking.

The world’s largest cryptocurrency took a sharp U-turn after clinching $69,000 earlier this week. Its October gains stood at 7% as of this writing, well below the historical average of 21.57%.

Ethereum failed to rise, wobbling in the $2,500 range throughout the day.

Total cryptocurrency liquidations breached $104 million in the last 24 hours, with long liquidations accounting for half of them.

Bitcoin’s Open Interest rose marginally by 0.05% in the 24 hours. Interestingly, most institutional investors and top traders on Binance bet against the cryptocurrency, as per the Long/Shorts Ratio.

Market sentiment remained in the “Greed” zone, according to the Cryptocurrency Fear & Greed Index, implying a bullish sentiment

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Cat In A Dogs World (MEW) | +18.18% | $0.01125 |

| Pyth Network (PYTH) | +10.91% | $0.3869 |

| Raydium (RAY) | +8.94% | $2.93 |

The global cryptocurrency stood at $2.33 trillion, increasing by 2.05% in the last 24 hours.

Stocks made a strong comeback Thursday The S&P 500 rose 0.21% to end at 5,809.86, snapping a three-day losing streak. The tech-focused Nasdaq Composite gained 0.76% to close at 18,415.49.

On the flip side, the Dow Jones Industrial Average recorded its fourth straight day of losses, closing 0.33% lower at 42,374.36.

The rally was bolstered by a massive 22% jump in shares of electric vehicle giant Tesla after it reported higher-than-expected third-quarter earnings. Thursday marked the company’s best day since 2013.

Additionally, the benchmark 10-year Treasury yield dropped below 4.20%, a reversal from the three-month highs earlier this week.

See More: Best Cryptocurrency Scanners

Analyst Notes: Popular cryptocurrency analyst and trader Rekt Capital said that a weekly close above $67,900 would be the most bullish outcome for Bitcoin under present conditions.

The analyst repeated his previous stance of a “successful retest.”

A widely followed cryptocurrency trader known by the moniker Nihilus disputed predictions of a new Bitcoin low, instead predicting a retreat before a climb to new highs.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Edwards Lifesciences

Whales with a lot of money to spend have taken a noticeably bullish stance on Edwards Lifesciences.

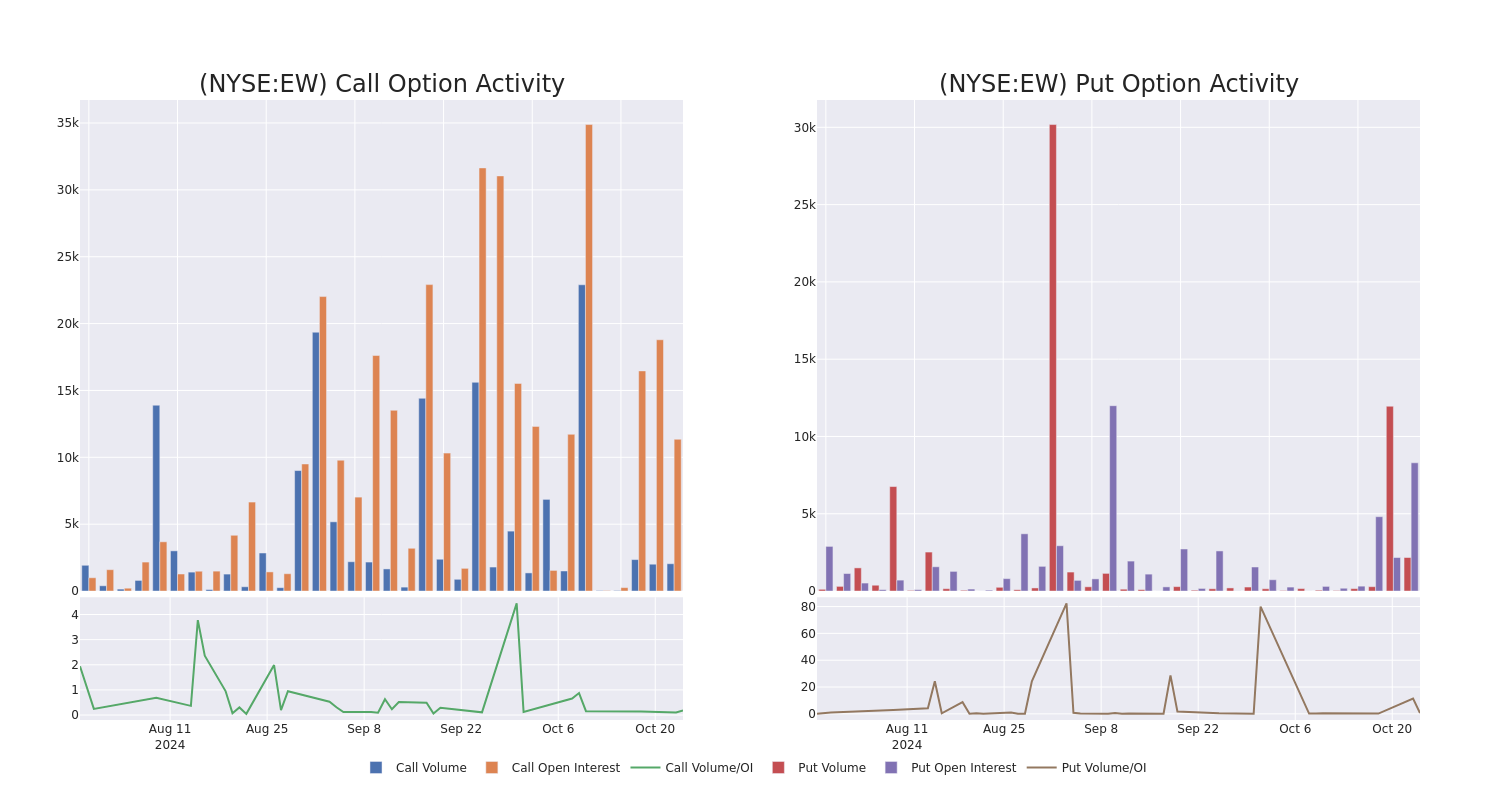

Looking at options history for Edwards Lifesciences EW we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $169,256 and 10, calls, for a total amount of $439,821.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $80.0 for Edwards Lifesciences, spanning the last three months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Edwards Lifesciences stands at 1511.31, with a total volume reaching 4,213.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Edwards Lifesciences, situated within the strike price corridor from $60.0 to $80.0, throughout the last 30 days.

Edwards Lifesciences 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | CALL | TRADE | BEARISH | 11/15/24 | $2.05 | $1.8 | $1.8 | $77.50 | $147.0K | 3.5K | 1.2K |

| EW | PUT | TRADE | BULLISH | 11/15/24 | $1.6 | $1.45 | $1.45 | $65.00 | $72.5K | 4.9K | 708 |

| EW | CALL | SWEEP | BEARISH | 01/17/25 | $7.4 | $7.2 | $7.2 | $67.50 | $41.7K | 310 | 83 |

| EW | CALL | SWEEP | BULLISH | 12/20/24 | $2.5 | $2.45 | $2.45 | $77.50 | $37.7K | 147 | 154 |

| EW | PUT | TRADE | BULLISH | 01/17/25 | $2.45 | $0.9 | $1.35 | $60.00 | $33.7K | 1.1K | 250 |

About Edwards Lifesciences

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

Present Market Standing of Edwards Lifesciences

- With a trading volume of 6,662,255, the price of EW is up by 4.82%, reaching $74.01.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

What Analysts Are Saying About Edwards Lifesciences

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $71.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Edwards Lifesciences, targeting a price of $77.

* An analyst from Evercore ISI Group persists with their In-Line rating on Edwards Lifesciences, maintaining a target price of $70.

* Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Equal-Weight with a new price target of $70.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Edwards Lifesciences, targeting a price of $75.

* An analyst from Canaccord Genuity has decided to maintain their Hold rating on Edwards Lifesciences, which currently sits at a price target of $66.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Edwards Lifesciences with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The 'Ethereum Killer' Lives Up To Its Name: Solana Outperforms ETH by 19% Over A Week, But Can The Second-Largest Coin Stage A Comeback?

Ethereum and Solana have plotted drastically divergent trajectories over the past week or so, causing investors eager to shift capital away from Bitcoin BTC/USD to sit up and take notice.

What happened: Solana, often touted as the “Ethereum Killer,” spiked over 13% in the last seven days, faring among the top weekly gainers. In contrast, Ethereum, with a much bigger market capitalization, slipped 4.63% in the said period.

In fact, in ETH’s terms, SOL was currently sitting at an all-time high, according to data from CoinMarketCap, reflecting a gain of 57% year-to-date. Over the last week, SOL was up over 19% against ETH.

| Cryptocurrency | 7-Day Gains +/- | Price (Recorded at 12:30 p.m. EDT) |

| Solana SOL/USD | +13.65% | $173.33 |

| Ethereum ETH/USD | -4.63% | $2,497.52 |

The divergence comes at a time when Bitcoin, the market bellwether, was flirting with the $70,000 level in a bid to break out to new all-time highs.

According to Trading View, Solana’s Relative Strength Index (RSI) showed a reading of 67.80, indicating a neutral sentiment, having just returned from the overbought territory.

Additionally, the Moving Average Convergence Divergence (MACD) indicator was positive, flashing a ‘Buy’ signal.

On the other hand, Ethereum’s MACD indicator flashed a ‘Sell’ signal, while its RSI remained in the neutral zone.

However, despite the underperformance, analysts were not writing off Ethereum just yet.

Widely followed cryptocurrency-associated X handle Wolf spotted an ascending triangle pattern for the asset, which tends to be bullish as it indicates the continuation of an upward trend.

Another popular analyst, with the pseudonym Basel, said that Ethereum is “severely undervalued” in the long term.

He added that most of the L2 networks are built atop Ethereum and won’t be able to function in its absence.

Photo by Avi Rozen on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.