Marc Benioff Warns Microsoft's Copilot 'Spills Corporate Data,' Emphasizes Security Gaps Ahead Of Salesforce Agentforce Launch

Salesforce Inc. CRM CEO Marc Benioff criticized Microsoft Corp. MSFT for its artificial intelligence tools, claiming that they are overhyped and underperforming.

What Happened: Benioff took aim at Microsoft’s Copilot AI tool, describing it as overhyped and ineffective, in an interview with Business Insider. This criticism comes in the wake of Microsoft’s announcement of new Dynamics 365 AI agents, which directly compete with Salesforce’s Agentforce product, a CRM lead.

Benioff’s comments were not a coincidence. The day before the interview, Microsoft introduced 10 new AI agents for its CRM offering, Dynamics 365. This announcement came just days before the release of Salesforce’s own AI agent product, Agentforce, which is set to be generally available on Friday.

Benioff stated, “Microsoft has really disappointed so many of our customers. They’ve really done it by delivering a level of hype around their AI solutions.”

He also criticized the accuracy of Copilot, stating that it “spills corporate data,” and referred to it as “Clippy 2.0,” a nod to an infamous 1990s Microsoft Office digital assistant.

Benioff emphasized the success of Salesforce’s AI solutions and the company’s continued lead in the CRM market. Despite Microsoft’s recent gains in CRM market share, Benioff remains confident in Salesforce’s position.

See Also: ‘Nvidia, Own It, Don’t Trade It:’ Jim Cramer Questions Short-Sellers As Stock Hits New Highs

Why It Matters: The rivalry between Salesforce and Microsoft has intensified with the introduction of AI-driven technologies.

Recently, Benioff criticized Microsoft’s rebranding of Copilot to “agents,” calling it a sign of “panic mode” due to Microsoft’s lack of data and security models, which he claims leads to inaccuracies and data leaks. Benioff praised Salesforce’s Agentforce for its integration of data, workflows, and security into a unified platform.

Microsoft’s announcement during its “AI Tour” in London highlighted the ability of businesses to develop autonomous AI agents, aiming to streamline enterprise functions. This move is part of Microsoft’s Copilot Studio platform, which allows organizations to customize AI-driven agents.

Analysts have noted that Salesforce’s Agentforce platform is on par with Microsoft’s offerings, with Piper Sandler upgrading Salesforce’s rating and raising its price target.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Savings Financial Group, Inc. Reports Financial Results for the Fiscal Year Ended September 30, 2024

JEFFERSONVILLE, Ind., Oct. 24, 2024 (GLOBE NEWSWIRE) — First Savings Financial Group, Inc. FSFG (the “Company”), the holding company for First Savings Bank (the “Bank”), today reported net income of $13.6 million, or $1.98 per diluted share, for the year ended September 30, 2024, compared to net income of $8.2 million, or $1.19 per diluted share, for the year ended September 30, 2023. The core banking segment reported net income of $16.9 million, or $2.47 per diluted share for the year ended September 30, 2024, compared to $14.9 million, or $2.18 per diluted share for the year ended September 30, 2023.

Commenting on the Company’s performance, Larry W. Myers, President and CEO, stated “Fiscal 2024 was, in many ways, a year of rebuilding, repositioning and refinement. A summary of these enhancement actions is provided below. While we’re not entirely pleased with the financial performance in fiscal 2024, we are confident that the Company is well positioned to better perform in fiscal 2025 and the years thereafter regardless of the economic environment. For fiscal 2025 we’ll remain focused on core banking; strong asset quality; selective high-quality lending; core deposit growth; increased SBA lending volume; continued improvement of liquidity, capital and interest rate sensitivity positions; and strategic opportunities. We believe the efforts of fiscal 2024 along with the focus for fiscal 2025 will deliver enhanced shareholder value. Additionally, we’ll continue to evaluate options and strategies that we believe will further position the Company for future success and deliver shareholder value.”

Net interest income decreased $3.5 million, or 5.7%, to $58.1 million for the year ended September 30, 2024 as compared to the prior year. The tax equivalent net interest margin for the year ended September 30, 2024 was 2.68% as compared to 3.10% for the prior year. The decrease in net interest income was due to a $22.3 million increase in interest expense, partially offset by an $18.8 million increase in interest income. A table of average balance sheets, including average asset yields and average liability costs, is included at the end of this release.

The Company recognized a provision for credit losses for loans of $3.5 million, a credit for unfunded lending commitments of $421,000, and a provision for credit losses for securities of $21,000 for the year ended September 30, 2024, compared to a provision for loan losses of $2.6 million only for the prior year. The provision for credit losses for loans increased primarily due to loan growth and the effects of adopting the Current Expected Credit Loss (CECL) methodology during the year ended September 30, 2024. The Company recognized net charge-offs totaling $527,000 during the year, of which $104,000 was related to unguaranteed portions of SBA loans, compared to net charge-offs of $1.1 million during the prior year, of which $872,000 was related to unguaranteed portions of SBA loans. Nonperforming loans, which consist of nonaccrual loans and loans over 90 days past due and still accruing interest, increased $3.0 million from $13.9 million at September 30, 2023 to $16.9 million at September 30, 2024.

Noninterest income decreased $12.8 million for the year ended September 30, 2024 as compared to the prior year. The decrease was due primarily to a $14.1 million decrease in mortgage banking income due to the cessation of national mortgage banking operations in the quarter ended December 31, 2023.

Noninterest expense decreased $23.2 million for the year ended September 30, 2024 as compared to the prior year. The decrease was due primarily to decreases in compensation and benefits, data processing expense and other operating expenses of $12.0 million, $2.2 million and $7.8 million, respectively. The decrease in compensation and benefits expense was due primarily to a reduction in staffing related to the cessation of national mortgage banking operations in the quarter ended December 31, 2023. The decrease in data processing expense was due primarily to expenses recognized in the prior year related to the implementation of the new core operating system in August 2023. The decrease in other operating expense was due primarily to a $1.9 decrease in net loss on captive insurance operations due to the dissolution of the captive insurance company in September 2023; a decrease in loss contingency accrual for SBA-guaranteed loans of $754,000 in 2024 compared to an increase of $1.5 million in 2023; a decrease in the loss contingency accrual for restitution to mortgage borrowers of $283,000 in 2024 compared to an increase of $609,000 in 2023; and a decrease of $853,000 in loan expense for 2024 as compared to 2023 due primarily to lower mortgage loan originations related to the cessation of national mortgage banking operations in the quarter ended December 31, 2023.

The Company recognized income tax expense of $1.0 million for the year ended September 30, 2024 compared to tax expense of $10,000 for the prior year. The increase is primarily due to higher taxable income in the 2024 period. The effective tax rate for 2024 was 7.0%, which was an increase from the effective tax rate of 0.1% in 2023. The effective tax rate is well below the statutory tax rate primarily due to the recognition of investment tax credits related to solar projects in both the 2024 and 2023 periods.

The Company reported net income of $3.7 million, or $0.53 per diluted share, for the three months ended September 30, 2024, compared to a net loss of $747,000, or $0.11 per diluted share, for the three months ended September 30, 2023. The core banking segment reported net income of $4.1 million, or $0.60 per diluted share, for the three months ended September 30, 2024, compared to $2.3 million, or $0.33 per diluted share, for the three months ended September 30, 2023.

Net interest income decreased $459,000, or 3.0%, to $15.1 million for the three months ended September 30, 2024 as compared to the same period in 2023. The tax equivalent net interest margin was 2.72% for the three months ended September 30, 2024 as compared to 3.03% for the same period in 2023. The decrease in net interest income was due to a $4.5 million increase in interest expense, partially offset by a $4.1 million increase in interest income. A table of average balance sheets, including average asset yields and average liability costs, is included at the end of this release.

The Company recognized a provision for credit losses for loans of $1.8 million, a credit for unfunded lending commitments of $262,000, and a credit for credit losses for securities of $86,000 for the three months ended September 30, 2024, compared to a provision for loan losses of $815,000 only for the same period in 2023. The provision for credit losses for loans increased primarily due to loan growth and the effects of adopting the Current Expected Credit Loss (CECL) methodology during the year ended September 30, 2024. The Company recognized net charge-offs totaling $304,000 during the 2024 period, of which $120,000 was related to unguaranteed portions of SBA loans, compared to net charge-offs of $753,000 during the 2023 period, of which $609,000 was related to unguaranteed portions of SBA loans.

Noninterest income decreased $2.6 million for the three months ended September 30, 2024 as compared to the same period in 2023. The decrease was due primarily to a $3.0 million decrease in mortgage banking income due to the cessation of national mortgage banking operations in the quarter ended December 31, 2023.

Noninterest expense decreased $9.0 million for the three months ended September 30, 2024 as compared to the same period in 2023. The decrease was due primarily to decreases in compensation and benefits expense, data processing expense, and other operating expenses of $4.5 million, $1.5 million and $3.5 million, respectively. The decrease in compensation and benefits expense was due primarily to a reduction in staffing related to the cessation of national mortgage banking operations in the quarter ended December 31, 2023. The decrease in data processing expense was due primarily to expenses recognized in the prior year period related to the implementation of the new core operating system in August 2023. The decrease in other operating expense was due primarily to a $978,000 decrease in the net loss on captive insurance operations due to the dissolution of the captive insurance company in September 2023; a decrease in loss contingency accrual for SBA-guaranteed loans of $14,000 in 2024 compared to an increase of $1.0 million in 2023; and a decrease of $270,000 in loan expense for 2024 as compared to 2023 due primarily to lower mortgage loan originations related to the cessation of the national mortgage banking operations in the quarter ended December 31, 2023.

The Company recognized income tax expense of $145,000 for the three months ended September 30, 2024 compared to income tax benefit of $737,000 for the same period in 2023. The increase was primarily due to higher taxable income in the 2024 period.

Total assets increased $161.5 million, from $2.29 billion at September 30, 2023 to $2.45 billion at September 30, 2024. Net loans held for investment increased $193.6 million during the year ended September 30, 2024 due primarily to growth in residential real estate, residential construction, and commercial real estate loans. Loans held for sale decreased by $20.1 million from $45.9 million at September 30, 2023 to $25.7 million, primarily due to the winddown of the national mortgage banking operations. Residential mortgage loan servicing rights decreased $59.8 million during the year ended September 30, 2024, due to the sale of the entire residential mortgage loan servicing rights portfolio during the year.

Total liabilities increased $135.4 million due primarily to increases in total deposits of $199.1 million, which included an increase in brokered deposits of $70.8 million, partially offset by a decrease in FHLB borrowings of $61.5 million. As of September 30, 2024, deposits exceeding the FDIC insurance limit of $250,000 per insured account were 30.1% of total deposits and 13.7% of total deposits when excluding public funds insured by the Indiana Public Deposit Insurance Fund.

Common stockholders’ equity increased $26.1 million, from $151.0 million at September 30, 2023 to $177.1 million at September 30, 2024, due primarily to a $18.4 million decrease in accumulated other comprehensive loss and an increase in retained net income of $7.0 million. The decrease in accumulated other comprehensive loss was due primarily to decreasing long term market interest rates during the year ended September 30, 2024, which resulted in an increase in the fair value of securities available for sale. At September 30, 2024 and September 30, 2023, the Bank was considered “well-capitalized” under applicable regulatory capital guidelines.

First Savings Bank is an entrepreneurial community bank headquartered in Jeffersonville, Indiana, which is directly across the Ohio River from Louisville, Kentucky, and operates fifteen depository branches within Southern Indiana. The Bank also has two national lending programs, including single-tenant net lease commercial real estate and SBA lending, with offices located predominately in the Midwest. The Bank is a recognized leader, both in its local communities and nationally for its lending programs. The employees of First Savings Bank strive daily to achieve the organization’s vision, We Expect To Be The BEST community BANK, which fuels our success. The Company’s common shares trade on The NASDAQ Stock Market under the symbol “FSFG.”

This release may contain forward-looking statements within the meaning of the federal securities laws. These statements are not historical facts; rather, they are statements based on the Company’s current expectations regarding its business strategies and their intended results and its future performance. Forward-looking statements are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions.

Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause or contribute to the Company’s actual results, performance and achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, changes in general economic conditions; changes in market interest rates; changes in monetary and fiscal policies of the federal government; legislative and regulatory changes; and other factors disclosed periodically in the Company’s filings with the Securities and Exchange Commission.

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on its behalf. Except as may be required by applicable law or regulation, the Company assumes no obligation to update any forward-looking statements.

Contact:

Tony A. Schoen, CPA

Chief Financial Officer

812-283-0724

Bitcoin Gains, Ethereum, Dogecoin Muted Amid Tesla-Powered Stocks Rally: Analyst Highlights 'Most Bullish Outcome' For King Crypto In The Short Term

Bitcoin traded in the green Thursday after Tesla Inc.’s TSLA searing rally lifted stocks out of losses.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Bitcoin BTC/USD | +1.13% | $67,956.29 |

| Ethereum ETH/USD |

-0.66% | $2,525.51 |

| Dogecoin DOGE/USD | -1.46% | $0.14 |

What Happened: Bitcoin sailed to an intraday high of $68,693 during U.S. evening hours before dipping below $68,000 on profit-taking.

The world’s largest cryptocurrency took a sharp U-turn after clinching $69,000 earlier this week. Its October gains stood at 7% as of this writing, well below the historical average of 21.57%.

Ethereum failed to rise, wobbling in the $2,500 range throughout the day.

Total cryptocurrency liquidations breached $104 million in the last 24 hours, with long liquidations accounting for half of them.

Bitcoin’s Open Interest rose marginally by 0.05% in the 24 hours. Interestingly, most institutional investors and top traders on Binance bet against the cryptocurrency, as per the Long/Shorts Ratio.

Market sentiment remained in the “Greed” zone, according to the Cryptocurrency Fear & Greed Index, implying a bullish sentiment

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Cat In A Dogs World (MEW) | +18.18% | $0.01125 |

| Pyth Network (PYTH) | +10.91% | $0.3869 |

| Raydium (RAY) | +8.94% | $2.93 |

The global cryptocurrency stood at $2.33 trillion, increasing by 2.05% in the last 24 hours.

Stocks made a strong comeback Thursday The S&P 500 rose 0.21% to end at 5,809.86, snapping a three-day losing streak. The tech-focused Nasdaq Composite gained 0.76% to close at 18,415.49.

On the flip side, the Dow Jones Industrial Average recorded its fourth straight day of losses, closing 0.33% lower at 42,374.36.

The rally was bolstered by a massive 22% jump in shares of electric vehicle giant Tesla after it reported higher-than-expected third-quarter earnings. Thursday marked the company’s best day since 2013.

Additionally, the benchmark 10-year Treasury yield dropped below 4.20%, a reversal from the three-month highs earlier this week.

See More: Best Cryptocurrency Scanners

Analyst Notes: Popular cryptocurrency analyst and trader Rekt Capital said that a weekly close above $67,900 would be the most bullish outcome for Bitcoin under present conditions.

The analyst repeated his previous stance of a “successful retest.”

A widely followed cryptocurrency trader known by the moniker Nihilus disputed predictions of a new Bitcoin low, instead predicting a retreat before a climb to new highs.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Edwards Lifesciences

Whales with a lot of money to spend have taken a noticeably bullish stance on Edwards Lifesciences.

Looking at options history for Edwards Lifesciences EW we detected 14 trades.

If we consider the specifics of each trade, it is accurate to state that 42% of the investors opened trades with bullish expectations and 42% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $169,256 and 10, calls, for a total amount of $439,821.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $80.0 for Edwards Lifesciences, spanning the last three months.

Analyzing Volume & Open Interest

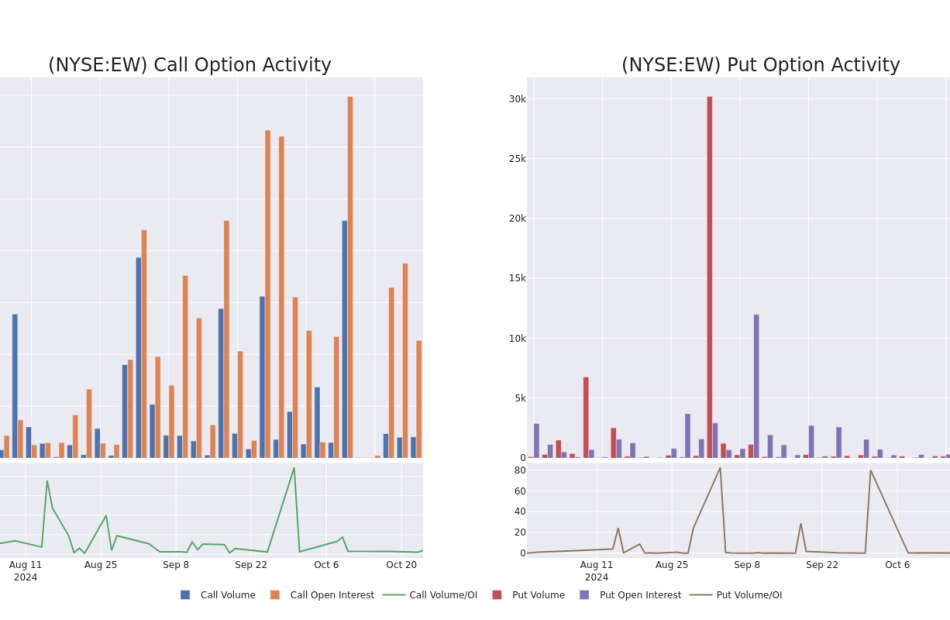

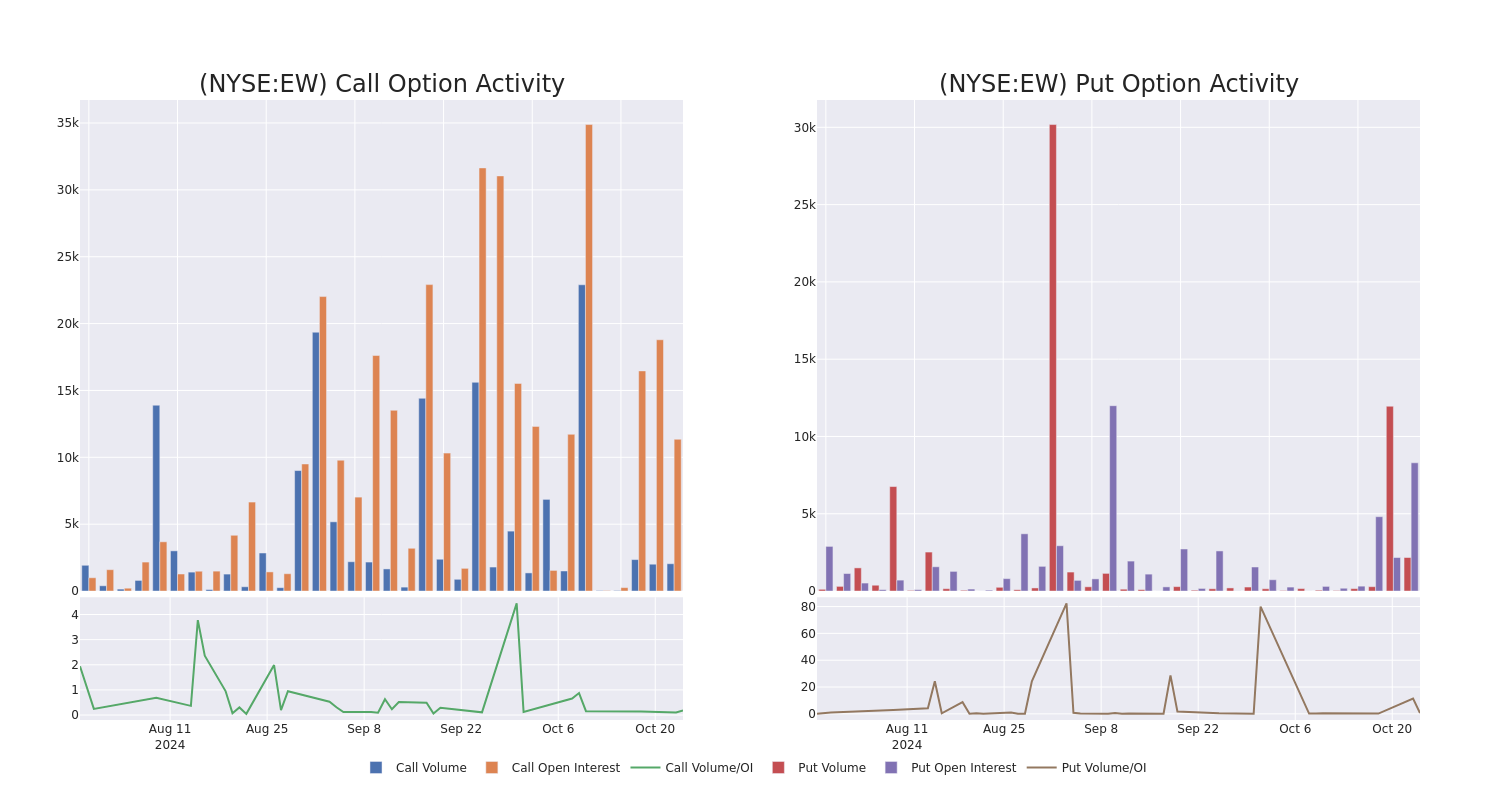

In today’s trading context, the average open interest for options of Edwards Lifesciences stands at 1511.31, with a total volume reaching 4,213.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Edwards Lifesciences, situated within the strike price corridor from $60.0 to $80.0, throughout the last 30 days.

Edwards Lifesciences 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EW | CALL | TRADE | BEARISH | 11/15/24 | $2.05 | $1.8 | $1.8 | $77.50 | $147.0K | 3.5K | 1.2K |

| EW | PUT | TRADE | BULLISH | 11/15/24 | $1.6 | $1.45 | $1.45 | $65.00 | $72.5K | 4.9K | 708 |

| EW | CALL | SWEEP | BEARISH | 01/17/25 | $7.4 | $7.2 | $7.2 | $67.50 | $41.7K | 310 | 83 |

| EW | CALL | SWEEP | BULLISH | 12/20/24 | $2.5 | $2.45 | $2.45 | $77.50 | $37.7K | 147 | 154 |

| EW | PUT | TRADE | BULLISH | 01/17/25 | $2.45 | $0.9 | $1.35 | $60.00 | $33.7K | 1.1K | 250 |

About Edwards Lifesciences

Spun off from Baxter International in 2000, Edwards Lifesciences designs, manufactures, and markets a range of medical devices and equipment for advanced stages of structural heart disease. It has established itself as a leader across key products, including surgical tissue heart valves, transcatheter valve technologies, surgical clips, and catheters. The firm derives about 55% of its total sales from outside the US.

Present Market Standing of Edwards Lifesciences

- With a trading volume of 6,662,255, the price of EW is up by 4.82%, reaching $74.01.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

What Analysts Are Saying About Edwards Lifesciences

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $71.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Edwards Lifesciences, targeting a price of $77.

* An analyst from Evercore ISI Group persists with their In-Line rating on Edwards Lifesciences, maintaining a target price of $70.

* Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Equal-Weight with a new price target of $70.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Edwards Lifesciences, targeting a price of $75.

* An analyst from Canaccord Genuity has decided to maintain their Hold rating on Edwards Lifesciences, which currently sits at a price target of $66.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Edwards Lifesciences with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The 'Ethereum Killer' Lives Up To Its Name: Solana Outperforms ETH by 19% Over A Week, But Can The Second-Largest Coin Stage A Comeback?

Ethereum and Solana have plotted drastically divergent trajectories over the past week or so, causing investors eager to shift capital away from Bitcoin BTC/USD to sit up and take notice.

What happened: Solana, often touted as the “Ethereum Killer,” spiked over 13% in the last seven days, faring among the top weekly gainers. In contrast, Ethereum, with a much bigger market capitalization, slipped 4.63% in the said period.

In fact, in ETH’s terms, SOL was currently sitting at an all-time high, according to data from CoinMarketCap, reflecting a gain of 57% year-to-date. Over the last week, SOL was up over 19% against ETH.

| Cryptocurrency | 7-Day Gains +/- | Price (Recorded at 12:30 p.m. EDT) |

| Solana SOL/USD | +13.65% | $173.33 |

| Ethereum ETH/USD | -4.63% | $2,497.52 |

The divergence comes at a time when Bitcoin, the market bellwether, was flirting with the $70,000 level in a bid to break out to new all-time highs.

According to Trading View, Solana’s Relative Strength Index (RSI) showed a reading of 67.80, indicating a neutral sentiment, having just returned from the overbought territory.

Additionally, the Moving Average Convergence Divergence (MACD) indicator was positive, flashing a ‘Buy’ signal.

On the other hand, Ethereum’s MACD indicator flashed a ‘Sell’ signal, while its RSI remained in the neutral zone.

However, despite the underperformance, analysts were not writing off Ethereum just yet.

Widely followed cryptocurrency-associated X handle Wolf spotted an ascending triangle pattern for the asset, which tends to be bullish as it indicates the continuation of an upward trend.

Another popular analyst, with the pseudonym Basel, said that Ethereum is “severely undervalued” in the long term.

He added that most of the L2 networks are built atop Ethereum and won’t be able to function in its absence.

Photo by Avi Rozen on Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Binance Blockchain Week 2024: UXUY Unveils NFC Cards – Tap2Earn Onsite to Receive BNB Chain Ecosystem Airdrops

Dubai, Oct. 25, 2024 (GLOBE NEWSWIRE) — Binance will host its Binance Blockchain Week 2024 from October 30 to October 31 at the Coca-Cola Arena in Dubai, UAE, under the theme “Momentum.”

The conference will focus on key topics such as technology, regulation, community, and the social impact of blockchain. Notable speakers include Binance founder Changpeng Zhao (CZ), Binance CEO Richard Teng, Dubai Future Foundation CEO HE Khalfan Belhoul, and Circle CEO Jeremy Allaire, among other thought leaders.

This year’s theme, “Momentum,” emphasizes the importance of harnessing the driving forces of the crypto industry to overcome current challenges and achieve future milestones. Attendees will engage in deep discussions about how “Momentum” will shape the future of Web3.

BNB Chain Ecosystem Airdrop

During the event, UXUY, a multi-chain infrastructure incubated and invested in by Binance Labs, will release limited edition NFC cards. Attendees can tap the NFC card with their phones to instantly create a UXUY Telegram wallet and receive a random airdrop from the BNB Chain ecosystem, including BNB, FDUSD, and other popular tokens. This interactive feature adds fun and engagement to the event, giving users the exciting experience of Tap2Earn in a live setting.

The UXUY Telegram Wallet is the first decentralized multi-chain wallet on Telegram, developed and operated by UXUY. It supports 21 blockchains, including BNB Chain, Bitcoin Lightning Network, Base, Solana, and TRON, with nearly 1.5 million users. UXUY’s mission is to bring 900 million users into the multi-chain crypto world.

UXUY is actively integrating BNB Chain DApps, such as PancakeSwap, Four.Meme, and KiloEx, achieving over 1.2 million on-chain interactions. This significantly lowers the barrier for Telegram’s 900 million users to access BNB Chain, continuously unlocking its immense potential.

Exclusive Access to Cutting-Edge Crypto Technology

This year’s Binance Blockchain Week not only brings together top leaders in the crypto industry but also introduces the eagerly awaited Innovation Stage. Attendees will gain first-hand insights into the latest advancements in cutting-edge platforms, tools, DeFi, NFTs, and other emerging trends, staying ahead of the curve. The Innovation Stage will also provide personalized, interactive experiences for engaged participants through live demos and keynote presentations, enriching the event’s content and format.

Jordan, co-founder of UXUY, will deliver a compelling talk on the Innovation Stage, sharing insights into UXUY’s pioneering work within the Telegram ecosystem.

Stay tuned for more details

Leading up to the event, visit the Binance Blockchain Week 2024 official website for the latest updates, ticket information, and more.

About BNB Chain

BNB Chain is a community-driven blockchain ecosystem that is breaking down barriers to Web3 adoption. It consists of the following components:

BNB Smart Chain (BSC): A secure DeFi hub with the lowest gas fees among all EVM-compatible L1s, serving as the governance chain of the ecosystem.

opBNB: A scalable L2 that offers the lowest gas fees and fast processing speeds among all L2s.

BNB Greenfield: Fulfills the ecosystem’s decentralized storage needs and allows users to create their own data marketplace.

About UXUY

UXUY, incubated and invested in by Binance Labs, is a next-generation decentralized multi-chain infrastructure that has launched its app and bot products across iOS, Android, and the Telegram ecosystem.

UXUY Wallet (@UXUYbot) is the first self-custody multi-chain wallet on Telegram, supporting various blockchains, including Bitcoin Lightning Network, BNB Chain, Base, TON, Arbitrum, TRON, and more. UXUY has created the first decentralized multi-chain wallet and DApp center based on Telegram, with over 1.5 million users. The goal of UXUY Wallet is to bring 900 million users into the multi-chain crypto ecosystem.

Jordan L Co-founder, UXUY E: jordan@uxuy.com T: https://t.me/zeroxjordan

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Digital Realty Reports Third Quarter 2024 Results

AUSTIN, Texas, Oct. 24, 2024 /PRNewswire/ — Digital Realty DLR, the largest global provider of cloud- and carrier-neutral data center, colocation, and interconnection solutions, announced today financial results for the third quarter of 2024. All per share results are presented on a fully diluted basis.

Highlights

- Reported net income available to common stockholders of $0.09 per share in 3Q24, compared to $2.31 in 3Q23

- Reported FFO per share of $1.55 in 3Q24, compared to $1.55 in 3Q23

- Reported Core FFO per share of $1.67 in 3Q24, compared to $1.62 in 3Q23

- Reported rental rate increases on renewal leases of 15.2% on a cash basis in 3Q24

- Signed total bookings during 3Q24 that are expected to generate $521 million of annualized GAAP rental revenue, including a $50 million contribution from the 0–1 megawatt category and $16 million contribution from interconnection

- Reported backlog of $859 million of annualized GAAP base rent at the end of 3Q24

- Raised 2024 Core FFO per share outlook to $6.65 – $6.75

Financial Results

Digital Realty reported revenues of $1.4 billion in the third quarter of 2024, a 5% increase from the previous quarter and a 2% increase from the same quarter last year.

The company delivered net income of $40 million in the third quarter of 2024, and net income available to common stockholders of $41 million, or $0.09 per diluted share, compared to $0.20 per diluted share in the previous quarter and $2.31 per diluted share in the same quarter last year.

Digital Realty generated Adjusted EBITDA of $758 million in the third quarter of 2024, a 4% increase from the previous quarter and a 11% increase over the same quarter last year.

The company reported Funds From Operations (FFO) of $520 million in the third quarter of 2024, or $1.55 per share, compared to $1.57 per share in the previous quarter and $1.55 per share in the same quarter last year.

Excluding certain items that do not represent core expenses or revenue streams, Digital Realty delivered Core FFO per share of $1.67 in the third quarter of 2024, compared to $1.65 per share in the previous quarter and $1.62 per share in the same quarter last year. Digital Realty delivered Constant-Currency Core FFO per share of $1.66 for the third quarter of 2024 and $4.99 per share for the nine-month period ended September 30, 2024.

“In the third quarter, Digital Realty posted over $520 million of new leasing, more than double the record set in the first quarter. Record leasing across both the greater-than-a-megawatt and 0-1 MW plus interconnection segments drove the backlog up nearly 60% above our prior record,” said Digital Realty President & Chief Executive Officer Andy Power. “Our backlog now represents over 20% of annualized in-place data center revenue, enhancing our visibility and positioning Digital Realty for accelerating longer-term growth.”

Leasing Activity

In the third quarter, Digital Realty signed total bookings that are expected to generate $521 million of annualized GAAP rental revenue, including a $50 million contribution from the 0–1 megawatt category and a $16 million contribution from interconnection.

The weighted-average lag between new leases signed during the third quarter of 2024 and the contractual commencement date was 15 months. The backlog of signed-but-not-commenced leases at quarter-end increased to $859 million of annualized GAAP base rent at Digital Realty’s share.

In addition to new leases signed, Digital Realty also signed renewal leases representing $258 million of annualized cash rental revenue during the quarter. Rental rates on renewal leases signed during the third quarter of 2024 increased 15.2% on a cash basis and 27.5% on a GAAP basis.

1

New leases signed during the third quarter of 2024 are summarized by region and product as follows:

|

Annualized GAAP |

|||||||||||||

|

Base Rent |

Square Feet |

GAAP Base Rent |

GAAP Base Rent |

||||||||||

|

Americas |

(in thousands) |

(in thousands) |

per Square Foot |

Megawatts |

per Kilowatt |

||||||||

|

0-1 MW |

$23,394 |

83 |

$282 |

7.5 |

$262 |

||||||||

|

> 1 MW |

425,641 |

1,102 |

386 |

158.8 |

223 |

||||||||

|

Other (1) |

4,684 |

66 |

71 |

— |

— |

||||||||

|

Total |

$453,719 |

1,251 |

$363 |

166.2 |

$225 |

||||||||

|

EMEA (2) |

|||||||||||||

|

0-1 MW |

$20,406 |

66 |

$308 |

7.5 |

$228 |

||||||||

|

> 1 MW |

17,339 |

80 |

217 |

9.0 |

161 |

||||||||

|

Other (1) |

168 |

5 |

35 |

— |

— |

||||||||

|

Total |

$37,913 |

151 |

$252 |

16.5 |

$191 |

||||||||

|

Asia Pacific (2) |

|||||||||||||

|

0-1 MW |

$6,563 |

20 |

$324 |

1.7 |

$315 |

||||||||

|

> 1 MW |

6,764 |

55 |

124 |

4.4 |

129 |

||||||||

|

Other (1) |

216 |

2 |

87 |

— |

— |

||||||||

|

Total |

$13,543 |

77 |

$175 |

6.1 |

$182 |

||||||||

|

All Regions (2) |

|||||||||||||

|

0-1 MW |

$50,363 |

169 |

$297 |

16.6 |

$252 |

||||||||

|

> 1 MW |

449,744 |

1,236 |

364 |

172.1 |

218 |

||||||||

|

Other (1) |

5,068 |

73 |

69 |

— |

— |

||||||||

|

Total |

$505,174 |

1,479 |

$342 |

188.8 |

$221 |

||||||||

|

Interconnection |

$15,702 |

N/A |

N/A |

N/A |

N/A |

||||||||

|

Grand Total |

$520,876 |

1,479 |

$342 |

188.8 |

$221 |

||||||||

|

Note: Totals may not foot due to rounding differences. |

|

|

(1) |

Other includes Powered Base Building® shell capacity as well as storage and office space within fully improved data center facilities. |

|

(2) |

Based on quarterly average exchange rates during the three months ended September 30, 2024. |

Investment Activity

As previously disclosed, in July, Digital Realty closed on the acquisition of two data centers with a combined IT load of 15 megawatts in the Slough Trading Estate for $200 million, marking the Company’s entry into the west London, UK submarket.

During the quarter, Digital Realty acquired the land and shell of one of its existing data centers in Schiphol Rijk, Amsterdam for €43 million, or approximately $48 million. The site comprises approximately 15 megawatts of fully leased capacity and was previously operated pursuant to an operating lease.

Subsequent to quarter end, Digital Realty closed on the acquisition of a 6.7-acre parcel in Richardson, Texas, adjacent to Digital Realty’s existing campus, for approximately $15 million to support the development of more than 80 megawatts of incremental IT capacity.

2

Balance Sheet

Digital Realty had approximately $17.0 billion of total debt outstanding as of September 30, 2024, comprised of $16.2 billion of unsecured debt and approximately $0.8 billion of secured debt and other. At the end of the third quarter of 2024, net debt-to-Adjusted EBITDA was 5.4x, debt-plus-preferred-to-total enterprise value was 24.5% and fixed charge coverage was 4.1x.

Digital Realty completed the following financing transactions during the third quarter:

- In July, the company repaid £250 million ($316 million) in aggregate principal amount of its 2.75% senior notes;

- In September, the company issued €850 million aggregate principal amount of 3.875% notes due 2033. Net proceeds were approximately €843 million ($933 million);

- In September, the company repaid €375 million ($415 million) on the Euro term loan;

- In late September, the company amended, extended, and upsized both its existing global revolving credit facility from $3.75 billion to $4.2 billion and its existing Japanese yen-denominated revolving credit facility from ¥33.3 billion (approximately $232 million) to ¥42.5 billion (approximately $297 million); and

- The company also sold 5.2 million shares of common stock under its At-The-Market (ATM) equity issuance program at a weighted average price of $156.19 per share, for net proceeds of approximately $806 million.

Subsequent to quarter end, the company sold an additional 0.4 million shares of common stock under its ATM program at a weighted average price of $160.81 per share, for net proceeds of approximately $62 million.

3

2024 Outlook

Digital Realty raised its 2024 Core FFO per share and Constant-Currency Core FFO per share outlook to $6.65 – $6.75. The assumptions underlying the outlook are summarized in the following table.

|

As of |

As of |

As of |

As of |

||||||

|

Top-Line and Cost Structure |

February 15, 2024 |

May 2, 2024 |

July 25, 2024 |

October 24, 2024 |

|||||

|

Total revenue |

$5.550 – $5.650 billion |

$5.550 – $5.650 billion |

$5.550 – $5.650 billion |

$5.550 – $5.600 billion |

|||||

|

Net non-cash rent adjustments (1) |

($35 – $40 million) |

($35 – $40 million) |

($35 – $40 million) |

($25 – $30 million) |

|||||

|

Adjusted EBITDA |

$2.800 – $2.900 billion |

$2.800 – $2.900 billion |

$2.800 – $2.900 billion |

$2.925 – $2.975 billion |

|||||

|

G&A |

$450 – $460 million |

$450 – $460 million |

$450 – $460 million |

$455 – $460 million |

|||||

|

Internal Growth |

|||||||||

|

Rental rates on renewal leases |

|||||||||

|

Cash basis |

4.0% – 6.0% |

5.0% – 7.0% |

5.0% – 7.0% |

8.0% – 10.0% |

|||||

|

GAAP basis |

6.0% – 8.0% |

7.0% – 9.0% |

7.0% – 9.0% |

12.0% – 14.0% |

|||||

|

Year-end portfolio occupancy |

+100 – 200 bps |

+100 – 200 bps |

+100 – 200 bps |

+150 – 200 bps |

|||||

|

“Same-Capital” cash NOI growth (2) |

2.0% – 3.0% |

2.5% – 3.5% |

2.5% – 3.5% |

2.75% – 3.25% |

|||||

|

Foreign Exchange Rates |

|||||||||

|

U.S. Dollar / Pound Sterling |

$1.25 – $1.30 |

$1.25 – $1.30 |

$1.25 – $1.30 |

$1.25 – $1.30 |

|||||

|

U.S. Dollar / Euro |

$1.05 – $1.10 |

$1.05 – $1.10 |

$1.05 – $1.10 |

$1.05 – $1.10 |

|||||

|

External Growth |

|||||||||

|

Dispositions / Joint Venture Capital |

|||||||||

|

Dollar volume |

$1,000 – $1,500 million |

$1,000 – $1,500 million |

$1,000 – $1,500 million |

$1,000 – $1,500 million |

|||||

|

Cap rate |

6.0% – 8.0% |

6.0% – 8.0% |

6.0% – 8.0% |

6.0% – 8.0% |

|||||

|

Development |

|||||||||

|

CapEx (Net of Partner Contributions) (3) |

$2,000 – $2,500 million |

$2,000 – $2,500 million |

$2,000 – $2,500 million |

$2,200 – $2,400 million |

|||||

|

Average stabilized yields |

10.0%+ |

10.0%+ |

10.0%+ |

10.0%+ |

|||||

|

Enhancements and other non-recurring CapEx (4) |

$15 – $20 million |

$15 – $20 million |

$15 – $20 million |

$25 – $30 million |

|||||

|

Recurring CapEx + capitalized leasing costs (5) |

$260 – $275 million |

$260 – $275 million |

$260 – $275 million |

$260 – $275 million |

|||||

|

Balance Sheet |

|||||||||

|

Long-term debt issuance |

|||||||||

|

Dollar amount |

$0 – $1,000 million |

$0 – $1,000 million |

$0 – $1,000 million |

$933 million |

|||||

|

Pricing |

5.0% – 5.5% |

5.0% – 5.5% |

5.0% – 5.5% |

3.875 % |

|||||

|

Timing |

Mid-Year |

Mid-Year |

Mid-Year |

Sep-24 |

|||||

|

Net income per diluted share |

$1.80 – $1.95 |

$1.80 – $1.95 |

$1.40 – $1.55 |

$1.40 – $1.50 |

|||||

|

Real estate depreciation and (gain) / loss on sale |

$4.40 – $4.40 |

$4.40 – $4.40 |

$4.75 – $4.75 |

$4.75 – $4.75 |

|||||

|

Funds From Operations / share (NAREIT-Defined) |

$6.20 – $6.35 |

$6.20 – $6.35 |

$6.15 – $6.30 |

$6.15 – $6.25 |

|||||

|

Non-core expenses and revenue streams |

$0.40 – $0.40 |

$0.40 – $0.40 |

$0.45 – $0.45 |

$0.50 – $0.50 |

|||||

|

Core Funds From Operations / share |

$6.60 – $6.75 |

$6.60 – $6.75 |

$6.60 – $6.75 |

$6.65 – $6.75 |

|||||

|

Foreign currency translation adjustments |

$0.00 – $0.00 |

$0.00 – $0.00 |

$0.00 – $0.00 |

$0.00 – $0.00 |

|||||

|

Constant-Currency Core Funds From Operations / share |

$6.60 – $6.75 |

$6.60 – $6.75 |

$6.60 – $6.75 |

$6.65 – $6.75 |

|

(1) |

Net non-cash rent adjustments represent the sum of straight-line rental revenue and straight-line rental expense, as well as the amortization of above- and below-market leases (i.e., ASC 805 adjustments). |

|

(2) |

The “Same-Capital” pool includes properties owned as of December 31, 2022 with less than 5% of total rentable square feet under development. It excludes properties that were undergoing, or were expected to undergo, development activities in 2023-2024, properties classified as held for sale, and properties sold or contributed to joint ventures for all periods presented. |

|

(3) |

Excludes land acquisitions and includes Digital Realty’s share of JV contributions. Figure is net of JV partner contributions. |

|

(4) |

Other non-recurring CapEx represents costs incurred to enhance the capacity or marketability of operating properties, such as network fiber initiatives and software development costs. |

|

(5) |

Recurring CapEx represents non-incremental improvements required to maintain current revenues, including second-generation tenant improvements and leasing commissions. |

|

Note: The Company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis, where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. Please see Non-GAAP Financial Measures in this document for further discussion. |

|

4

Non-GAAP Financial Measures

This document contains non-GAAP financial measures, including FFO, Core FFO, Adjusted FFO, Net Operating Income (NOI), “Same-Capital” Cash NOI and Adjusted EBITDA. A reconciliation from U.S. GAAP net income available to common stockholders to FFO, a reconciliation from FFO to Core FFO, a reconciliation from Core FFO to Adjusted FFO, reconciliation from NOI to Cash NOI, and definitions of FFO, Core FFO, Adjusted FFO, NOI and “Same-Capital” Cash NOI are included as an attachment to this document. A reconciliation from U.S. GAAP net income available to common stockholders to Adjusted EBITDA, a definition of Adjusted EBITDA and definitions of net debt-to-Adjusted EBITDA, debt-plus-preferred-to-total enterprise value, cash NOI, and fixed charge coverage ratio are included as an attachment to this document.

The Company does not provide a reconciliation for non-GAAP estimates on a forward-looking basis, where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and/or amount of various items that would impact net income attributable to common stockholders per diluted share, which is the most directly comparable forward-looking GAAP financial measure. This includes, for example, external growth factors, such as dispositions, and balance sheet items such as debt issuances, that have not yet occurred, are out of the Company’s control and/or cannot be reasonably predicted. For the same reasons, the Company is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures.

Investor Conference Call

Prior to Digital Realty’s investor conference call at 5:00 p.m. ET / 4:00 p.m. CT on October 24, 2024, a presentation will be posted to the Investors section of the company’s website at https://investor.digitalrealty.com. The presentation is designed to accompany the discussion of the company’s third quarter 2024 financial results and operating performance. The conference call will feature President & Chief Executive Officer Andy Power and Chief Financial Officer Matt Mercier.

To participate in the live call, investors are invited to dial +1 (888) 317-6003 (for domestic callers) or +1 (412) 317-6061 (for international callers) and reference the conference ID# 0345410 at least five minutes prior to start time. A live webcast of the call will be available via the Investors section of Digital Realty’s website at https://investor.digitalrealty.com.

Telephone and webcast replays will be available after the call until November 24, 2024. The telephone replay can be accessed by dialing +1 (877) 344-7529 (for domestic callers) or +1 (412) 317-0088 (for international callers) and providing the conference ID# 4823548. The webcast replay can be accessed on Digital Realty’s website.

About Digital Realty

Digital Realty brings companies and data together by delivering the full spectrum of data center, colocation, and interconnection solutions. PlatformDIGITAL®, the company’s global data center platform, provides customers with a secure data meeting place and a proven Pervasive Datacenter Architecture (PDx®) solution methodology for powering innovation and efficiently managing Data Gravity challenges. Digital Realty gives its customers access to the connected data communities that matter to them with a global data center footprint of 300+ facilities in 50+ metros across 25+ countries on six continents. To learn more about Digital Realty, please visit digitalrealty.com or follow us on LinkedIn and X.

Contact Information

Matt Mercier

Chief Financial Officer

Digital Realty

(415) 874-2803

Jordan Sadler / Jim Huseby

Investor Relations

Digital Realty

(415) 275-5344

5

|

Consolidated Quarterly Statements of Operations |

Third Quarter 2024 |

|||||||||||||||||||||||

|

Unaudited and in Thousands, Except Per Share Data |

||||||||||||||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

||||||||||||||||||

|

Rental revenues |

$956,351 |

$912,994 |

$894,409 |

$885,694 |

$886,960 |

$2,763,753 |

$2,627,233 |

|||||||||||||||||

|

Tenant reimbursements – Utilities |

305,097 |

274,505 |

276,357 |

316,634 |

335,477 |

855,959 |

983,041 |

|||||||||||||||||

|

Tenant reimbursements – Other |

39,624 |

41,964 |

38,434 |

46,418 |

64,876 |

120,021 |

151,218 |

|||||||||||||||||

|

Interconnection & other |

112,655 |

109,505 |

108,071 |

106,413 |

107,305 |

330,231 |

313,521 |

|||||||||||||||||

|

Fee income |

12,907 |

15,656 |

13,010 |

14,330 |

7,819 |

41,572 |

30,596 |

|||||||||||||||||

|

Other |

4,581 |

2,125 |

862 |

144 |

— |

7,568 |

1,819 |

|||||||||||||||||

|

Total Operating Revenues |

$1,431,214 |

$1,356,749 |

$1,331,143 |

$1,369,633 |

$1,402,437 |

$4,119,106 |

$4,107,428 |

|||||||||||||||||

|

Utilities |

$356,063 |

$315,248 |

$324,571 |

$366,083 |

$384,455 |

$995,882 |

$1,105,753 |

|||||||||||||||||

|

Rental property operating |

249,796 |

237,653 |

224,369 |

237,118 |

223,089 |

711,817 |

672,717 |

|||||||||||||||||

|

Property taxes |

45,633 |

49,620 |

41,156 |

40,161 |

72,279 |

136,408 |

159,420 |

|||||||||||||||||

|

Insurance |

4,869 |

4,755 |

2,694 |

3,794 |

4,289 |

12,318 |

13,029 |

|||||||||||||||||

|

Depreciation & amortization |

459,997 |

425,343 |

431,102 |

420,475 |

420,613 |

1,316,442 |

1,274,379 |

|||||||||||||||||

|

General & administration |

115,120 |

119,511 |

114,419 |

109,235 |

108,039 |

349,051 |

321,769 |

|||||||||||||||||

|

Severance, equity acceleration and legal expenses |

2,481 |

884 |

791 |

7,565 |

2,682 |

4,156 |

10,489 |

|||||||||||||||||

|

Transaction and integration expenses |

24,194 |

26,072 |

31,839 |

40,226 |

14,465 |

82,105 |

44,496 |

|||||||||||||||||

|

Provision for impairment |

— |

168,303 |

— |

5,363 |

113,000 |

168,303 |

113,000 |

|||||||||||||||||

|

Other expenses |

4,774 |

(529) |

10,836 |

5,580 |

1,295 |

15,080 |

1,949 |

|||||||||||||||||

|

Total Operating Expenses |

$1,262,928 |

$1,346,860 |

$1,181,776 |

$1,235,598 |

$1,344,206 |

$3,791,564 |

$3,717,001 |

|||||||||||||||||

|

Operating Income |

$168,286 |

$9,889 |

$149,367 |

$134,035 |

$58,231 |

$327,542 |

$390,426 |

|||||||||||||||||

|

Equity in earnings / (loss) of unconsolidated joint ventures |

(26,486) |

(41,443) |

(16,008) |

(29,955) |

(19,793) |

(83,936) |

164 |

|||||||||||||||||

|

Gain / (loss) on sale of investments |

(556) |

173,709 |

277,787 |

(103) |

810,688 |

450,940 |

900,634 |

|||||||||||||||||

|

Interest and other income / (expense), net |

37,756 |

62,261 |

9,709 |

50,269 |

24,812 |

109,726 |

18,162 |

|||||||||||||||||

|

Interest (expense) |

(123,803) |

(114,756) |

(109,535) |

(113,638) |

(110,767) |

(348,095) |

(324,103) |

|||||||||||||||||

|

Income tax benefit / (expense) |

(12,427) |

(14,992) |

(22,413) |

(20,724) |

(17,228) |

(49,832) |

(54,855) |

|||||||||||||||||

|

Loss on debt extinguishment and modifications |

(2,636) |

— |

(1,070) |

— |

— |

(3,706) |

— |

|||||||||||||||||

|

Net Income |

$40,134 |

$74,668 |

$287,837 |

$19,884 |

$745,941 |

$402,639 |

$930,427 |

|||||||||||||||||

|

Net (income) / loss attributable to noncontrolling interests |

11,059 |

5,552 |

(6,329) |

8,419 |

(12,320) |

10,282 |

(9,893) |

|||||||||||||||||

|

Net Income Attributable to Digital Realty Trust, Inc. |

$51,193 |

$80,220 |

$281,508 |

$28,304 |

$733,621 |

$412,921 |

$920,534 |

|||||||||||||||||

|

Preferred stock dividends |

(10,181) |

(10,181) |

(10,181) |

(10,181) |

(10,181) |

(30,544) |

(30,544) |

|||||||||||||||||

|

Net Income / (Loss) Available to Common Stockholders |

$41,012 |

$70,039 |

$271,327 |

$18,122 |

$723,440 |

$382,377 |

$889,990 |

|||||||||||||||||

|

Weighted-average shares outstanding – basic |

327,977 |

319,537 |

312,292 |

305,781 |

301,827 |

319,965 |

296,184 |

|||||||||||||||||

|

Weighted-average shares outstanding – diluted |

336,249 |

327,946 |

320,798 |

314,995 |

311,341 |

328,641 |

306,735 |

|||||||||||||||||

|

Weighted-average fully diluted shares and units |

342,374 |

334,186 |

326,975 |

321,173 |

317,539 |

334,830 |

312,867 |

|||||||||||||||||

|

Net income / (loss) per share – basic |

$0.13 |

$0.22 |

$0.87 |

$0.06 |

$2.40 |

$1.20 |

$3.00 |

|||||||||||||||||

|

Net income / (loss) per share – diluted |

$0.09 |

$0.20 |

$0.82 |

$0.03 |

$2.31 |

$1.10 |

$2.87 |

|||||||||||||||||

6

|

Funds From Operations and Core Funds From Operations |

Third Quarter 2024 |

|||||||||||||||||||||||

|

Unaudited and in Thousands, Except Per Share Data |

||||||||||||||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

Reconciliation of Net Income to Funds From Operations (FFO) |

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

|||||||||||||||||

|

Net Income / (Loss) Available to Common Stockholders |

$41,012 |

$70,039 |

$271,327 |

$18,122 |

$723,440 |

$382,378 |

$889,990 |

|||||||||||||||||

|

Adjustments: |

||||||||||||||||||||||||

|

Non-controlling interest in operating partnership |

1,000 |

1,500 |

6,200 |

410 |

16,300 |

8,700 |

20,300 |

|||||||||||||||||

|

Real estate related depreciation & amortization (1) |

449,086 |

414,920 |

420,591 |

410,167 |

410,836 |

1,284,597 |

1,247,072 |

|||||||||||||||||

|

Reconciling items related to non-controlling interests |

(19,746) |

(17,317) |

(8,017) |

(15,377) |

(14,569) |

(45,081) |

(42,101) |

|||||||||||||||||

|

Unconsolidated JV real estate related depreciation & amortization |

48,474 |

47,117 |

47,877 |

64,833 |

43,215 |

143,468 |

112,320 |

|||||||||||||||||

|

(Gain) / loss on real estate transactions |

556 |

(173,709) |

(286,704) |

103 |

(810,688) |

(459,857) |

(908,459) |

|||||||||||||||||

|

Provision for impairment |

— |

168,303 |

— |

5,363 |

113,000 |

168,303 |

113,000 |

|||||||||||||||||

|

Funds From Operations |

$520,382 |

$510,852 |

$451,273 |

$483,621 |

$481,535 |

$1,482,507 |

$1,432,124 |

|||||||||||||||||

|

Weighted-average shares and units outstanding – basic |

334,103 |

325,777 |

318,469 |

311,960 |

308,024 |

326,154 |

302,316 |

|||||||||||||||||

|

Weighted-average shares and units outstanding – diluted (2) (3) |

342,374 |

334,186 |

326,975 |

321,173 |

317,539 |

334,830 |

312,867 |

|||||||||||||||||

|

Funds From Operations per share – basic |

$1.56 |

$1.57 |

$1.42 |

$1.55 |

$1.56 |

$4.55 |

$4.74 |

|||||||||||||||||

|

Funds From Operations per share – diluted (2) (3) |

$1.55 |

$1.57 |

$1.41 |

$1.53 |

$1.55 |

$4.52 |

$4.68 |

|||||||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

Reconciliation of FFO to Core FFO |

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

|||||||||||||||||

|

Funds From Operations |

$520,382 |

$510,852 |

$451,273 |

$483,621 |

$481,535 |

$1,482,507 |

$1,432,124 |

|||||||||||||||||

|

Other non-core revenue adjustments (4) |

(4,583) |

(33,818) |

3,525 |

(146) |

(27) |

(34,876) |

26,540 |

|||||||||||||||||

|

Transaction and integration expenses |

24,194 |

26,072 |

31,839 |

40,226 |

14,465 |

82,105 |

44,496 |

|||||||||||||||||

|

Loss on debt extinguishment and modifications |

2,636 |

— |

1,070 |

— |

— |

3,706 |

— |

|||||||||||||||||

|

Severance, equity acceleration and legal expenses (5) |

2,481 |

884 |

791 |

7,565 |

2,682 |

4,156 |

10,489 |

|||||||||||||||||

|

(Gain) / Loss on FX and derivatives revaluation |

1,513 |

32,222 |

33,602 |

(24,804) |

451 |

67,337 |

(14,195) |

|||||||||||||||||

|

Other non-core expense adjustments (6) |

11,120 |

2,271 |

10,052 |

1,956 |

1,295 |

23,443 |

1,949 |

|||||||||||||||||

|

Core Funds From Operations |

$557,744 |

$538,482 |

$532,153 |

$508,417 |

$500,402 |

$1,628,378 |

$1,501,403 |

|||||||||||||||||

|

Weighted-average shares and units outstanding – diluted (2) (3) |

334,476 |

326,181 |

319,138 |

312,356 |

308,539 |

326,545 |

302,740 |

|||||||||||||||||

|

Core Funds From Operations per share – diluted (2) |

$1.67 |

$1.65 |

$1.67 |

$1.63 |

$1.62 |

$4.99 |

$4.96 |

|||||||||||||||||

|

(1) Real Estate Related Depreciation & Amortization |

Three Months Ended |

Nine Months Ended |

||||||||||||||||||||||

|

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

||||||||||||||||||

|

Depreciation & amortization per income statement |

$459,997 |

$425,343 |

$431,102 |

$420,475 |

$420,613 |

$1,316,442 |

$1,274,384 |

|||||||||||||||||

|

Non-real estate depreciation |

(10,911) |

(10,424) |

(10,511) |

(10,308) |

(9,777) |

(31,845) |

(27,312) |

|||||||||||||||||

|

Real Estate Related Depreciation & Amortization |

$449,086 |

$414,920 |

$420,591 |

$410,167 |

$410,836 |

$1,284,597 |

$1,247,072 |

|||||||||||||||||

|

(2) |

Certain of Teraco’s minority indirect shareholders have the right to put their shares in an upstream parent company of Teraco to Digital Realty in exchange for cash or the equivalent value of shares of Digital Realty common stock, or a combination thereof. US GAAP requires Digital Realty to assume the put right is settled in shares for purposes of calculating diluted EPS. This same approach was utilized to calculate FFO/share. The potential future dilutive impact associated with this put right will be excluded from Core FFO and AFFO until settlement occurs – causing diluted share count to be higher for FFO than for Core FFO and AFFO. When calculating diluted FFO, Teraco related minority interest is added back to the FFO numerator as the denominator assumes all shares have been put back to Digital Realty. |

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||

|

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

||||||||||||||||

|

Teraco noncontrolling share of FFO |

$9,828 |

$12,453 |

$9,768 |

$7,135 |

$11,537 |

$32,049 |

$32,251 |

|||||||||||||||

|

Teraco related minority interest |

$9,828 |

$12,453 |

$9,768 |

$7,135 |

$11,537 |

$32,049 |

$32,251 |

|||||||||||||||

|

(3) |

For all periods presented, we have excluded the effect of dilutive series J, series K and series L preferred stock, as applicable, that may be converted into common stock upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series J, series K and series L preferred stock, as applicable, which we consider highly improbable. See above for calculations of FFO and the share count detail section that follows the reconciliation of Core FFO to AFFO for calculations of weighted average common stock and units outstanding. For definitions and discussion of FFO and Core FFO, see the Definitions section. |

|

(4) |

Includes deferred rent adjustments related to a customer bankruptcy, joint venture development fees included in gains, lease termination fees and gain on sale of equity investment included in other income. |

|

(5) |

Relates to severance and other charges related to the departure of company executives and integration-related severance. |

|

(6) |

Includes write-offs associated with bankrupt or terminated customers, non-recurring legal expenses and adjustments to reflect our proportionate share of transaction costs associated with noncontrolling interests. |

7

|

Adjusted Funds From Operations (AFFO) |

Third Quarter 2024 |

|||||||||||||||||||||||

|

Unaudited and in Thousands, Except Per Share Data |

||||||||||||||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

Reconciliation of Core FFO to AFFO |

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

|||||||||||||||||

|

Core FFO available to common stockholders and unitholders |

$557,744 |

$538,482 |

$532,153 |

$508,417 |

$500,402 |

$1,628,378 |

$1,501,403 |

|||||||||||||||||

|

Adjustments: |

||||||||||||||||||||||||

|

Non-real estate depreciation |

10,911 |

10,424 |

10,511 |

10,308 |

9,777 |

31,845 |

27,312 |

|||||||||||||||||

|

Amortization of deferred financing costs |

4,853 |

5,072 |

5,576 |

5,744 |

5,776 |

15,501 |

15,832 |

|||||||||||||||||

|

Amortization of debt discount/premium |

1,329 |

1,321 |

1,832 |

973 |

1,360 |

4,481 |

4,000 |

|||||||||||||||||

|

Non-cash stock-based compensation expense |

15,026 |

14,464 |

12,592 |

9,226 |

14,062 |

42,083 |

41,012 |

|||||||||||||||||

|

Straight-line rental revenue |

(17,581) |

334 |

9,976 |

(21,992) |

(14,080) |

(7,271) |

(46,424) |

|||||||||||||||||

|

Straight-line rental expense |

1,690 |

782 |

1,111 |

(4,999) |

1,427 |

3,583 |

1,432 |

|||||||||||||||||

|

Above- and below-market rent amortization |

(742) |

(1,691) |

(854) |

(856) |

(1,127) |

(3,287) |

(3,548) |

|||||||||||||||||

|

Deferred tax (benefit) / expense |

(9,366) |

(9,982) |

(3,437) |

33,448 |

(8,539) |

(22,786) |

(16,995) |

|||||||||||||||||

|

Leasing compensation & internal lease commissions |

10,918 |

10,519 |

13,291 |

9,848 |

12,515 |

34,728 |

35,193 |

|||||||||||||||||

|

Recurring capital expenditures (1) |

(67,308) |

(60,483) |

(47,676) |

(142,808) |

(90,251) |

(175,467) |

(184,214) |

|||||||||||||||||

|

AFFO available to common stockholders and unitholders (2) |

$507,474 |

$509,241 |

$535,073 |

$407,306 |

$431,322 |

$1,551,788 |

$1,375,001 |

|||||||||||||||||

|

Weighted-average shares and units outstanding – basic |

334,103 |

325,777 |

318,469 |

311,960 |

308,024 |

326,154 |

302,316 |

|||||||||||||||||

|

Weighted-average shares and units outstanding – diluted (3) |

334,476 |

326,181 |

319,138 |

312,356 |

308,539 |

326,545 |

302,740 |

|||||||||||||||||

|

AFFO per share – diluted (3) |

$1.52 |

$1.56 |

$1.68 |

$1.30 |

$1.40 |

$4.75 |

$4.54 |

|||||||||||||||||

|

Dividends per share and common unit |

$1.22 |

$1.22 |

$1.22 |

$1.22 |

$1.22 |

$3.66 |

$3.66 |

|||||||||||||||||

|

Diluted AFFO Payout Ratio |

80.4 % |

78.1 % |

72.8 % |

93.6 % |

87.3 % |

77.0 % |

80.6 % |

|||||||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||||||||||||||

|

Share Count Detail |

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

30-Sep-24 |

30-Sep-23 |

|||||||||||||||||

|

Weighted Average Common Stock and Units Outstanding |

334,103 |

325,777 |

318,469 |

311,960 |

308,024 |

326,154 |

302,316 |

|||||||||||||||||

|

Add: Effect of dilutive securities |

373 |

404 |

669 |

396 |

515 |

391 |

424 |

|||||||||||||||||

|

Weighted Avg. Common Stock and Units Outstanding – diluted |

334,476 |

326,181 |

319,138 |

312,356 |

308,539 |

326,545 |

302,740 |

|||||||||||||||||

|

(1) |

Recurring capital expenditures represent non-incremental building improvements required to maintain current revenues, including second-generation tenant improvements and external leasing commissions. Recurring capital expenditures do not include acquisition costs contemplated when underwriting the purchase of a building, costs which are incurred to bring a building up to Digital Realty’s operating standards, or internal leasing commissions. |

|

(2) |

For a definition and discussion of AFFO, see the Definitions section. For a reconciliation of net income available to common stockholders to FFO and Core FFO, see above. |

|

(3) |

For all periods presented, we have excluded the effect of dilutive series J, series K and series L preferred stock, as applicable, that may be converted into common stock upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series J, series K and series L preferred stock, as applicable, which we consider highly improbable. See above for calculations of FFO and for calculations of weighted average common stock and units outstanding. |

8

|

Consolidated Balance Sheets |

Third Quarter 2024 |

||||||||||||||||

|

Unaudited and in Thousands, Except Per Share Data |

|||||||||||||||||

|

30-Sep-24 |

30-Jun-24 |

31-Mar-24 |

31-Dec-23 |

30-Sep-23 |

|||||||||||||

|

Assets |

|||||||||||||||||

|

Investments in real estate: |

|||||||||||||||||

|

Real estate |

$28,808,770 |

$27,470,635 |

$27,122,796 |

$27,306,369 |

$25,887,031 |

||||||||||||

|

Construction in progress |

5,175,054 |

4,676,012 |

4,496,840 |

4,635,215 |

5,020,464 |

||||||||||||

|

Land held for future development |

23,392 |

93,938 |

114,240 |

118,190 |

179,959 |

||||||||||||

|

Investments in Real Estate |

$34,007,216 |

$32,240,584 |

$31,733,877 |

$32,059,773 |

$31,087,453 |

||||||||||||

|

Accumulated depreciation and amortization |

(8,777,002) |

(8,303,070) |

(7,976,093) |

(7,823,685) |

(7,489,193) |

||||||||||||

|

Net Investments in Properties |

$25,230,214 |

$23,937,514 |

$23,757,784 |

$24,236,089 |

$23,598,260 |

||||||||||||

|

Investment in unconsolidated joint ventures |

2,456,448 |

2,332,698 |

2,365,821 |

2,295,889 |

2,180,313 |

||||||||||||

|

Net Investments in Real Estate |

$27,686,662 |

$26,270,212 |

$26,123,605 |

$26,531,977 |

$25,778,573 |

||||||||||||

|

Operating lease right-of-use assets, net |

$1,228,507 |

$1,211,003 |

$1,233,410 |

$1,414,256 |

$1,274,410 |

||||||||||||

|

Cash and cash equivalents |

2,175,605 |

2,282,062 |

1,193,784 |

1,625,495 |

1,062,050 |

||||||||||||

|

Accounts and other receivables, net (1) |

1,274,460 |

1,222,403 |

1,217,276 |

1,278,110 |

1,325,725 |

||||||||||||

|

Deferred rent, net |

641,778 |

613,749 |

611,670 |

624,427 |

586,418 |

||||||||||||

|

Goodwill |

9,395,233 |

9,128,811 |

9,105,026 |

9,239,871 |

8,998,074 |

||||||||||||

|

Customer relationship value, deferred leasing costs & other intangibles, net |

2,367,467 |

2,315,143 |

2,359,380 |

2,500,237 |

2,506,198 |

||||||||||||

|

Assets held for sale |

— |

— |

287,064 |

478,503 |

— |

||||||||||||

|

Other assets |

525,679 |

563,500 |

501,875 |

420,382 |

401,068 |

||||||||||||

|

Total Assets |

$45,295,392 |

$43,606,883 |

$42,633,089 |

$44,113,257 |

$41,932,515 |

||||||||||||

|

Liabilities and Equity |

|||||||||||||||||

|

Global unsecured revolving credit facilities, net |

$1,786,921 |

$1,848,167 |

$1,901,126 |

$1,812,287 |

$1,698,780 |

||||||||||||

|

Unsecured term loans, net |

913,733 |

1,297,893 |

1,303,263 |

1,560,305 |

1,524,663 |

||||||||||||

|

Unsecured senior notes, net of discount |

13,528,061 |

12,507,551 |

13,190,202 |

13,422,342 |

13,072,102 |

||||||||||||

|

Secured and other debt, net of discount |

757,831 |

686,135 |

625,750 |

630,973 |

574,231 |

||||||||||||

|

Operating lease liabilities |

1,343,903 |

1,336,839 |

1,357,751 |

1,542,094 |

1,404,510 |

||||||||||||

|

Accounts payable and other accrued liabilities |

2,140,764 |

1,973,798 |

1,870,344 |

2,168,983 |

2,147,103 |

||||||||||||

|

Deferred tax liabilities, net |

1,223,771 |

1,132,090 |

1,121,224 |

1,151,096 |

1,088,724 |

||||||||||||

|

Accrued dividends and distributions |

— |

— |

— |

387,988 |

— |

||||||||||||

|

Security deposits and prepaid rents |

423,797 |

416,705 |

413,225 |

401,867 |

385,521 |

||||||||||||

|

Obligations associated with assets held for sale |

— |

— |

9,981 |

39,001 |

— |

||||||||||||

|

Total Liabilities |

$22,118,781 |

$21,199,178 |

$21,792,866 |

$23,116,936 |

$21,895,634 |

||||||||||||

|

Redeemable non-controlling interests |

1,465,636 |

1,399,889 |

1,350,736 |

1,394,814 |

1,360,308 |

||||||||||||

|

Equity |

|||||||||||||||||

|

Preferred Stock: $0.01 par value per share, 110,000 shares authorized: |

|||||||||||||||||

|

Series J Cumulative Redeemable Preferred Stock (2) |

$193,540 |

$193,540 |

$193,540 |

$193,540 |

$193,540 |

||||||||||||

|

Series K Cumulative Redeemable Preferred Stock (3) |

203,264 |

203,264 |

203,264 |

203,264 |

203,264 |

||||||||||||

|

Series L Cumulative Redeemable Preferred Stock (4) |

334,886 |

334,886 |

334,886 |

334,886 |

334,886 |

||||||||||||

|

Common Stock: $0.01 par value per share, 392,000 shares authorized (5) |

3,285 |

3,231 |

3,097 |

3,088 |

3,002 |

||||||||||||

|

Additional paid-in capital |

27,229,143 |

26,388,393 |

24,508,683 |

24,396,797 |

23,239,088 |

||||||||||||

|

Dividends in excess of earnings |

(6,060,642) |

(5,701,096) |

(5,373,529) |

(5,262,648) |

(4,900,757) |

||||||||||||

|

Accumulated other comprehensive (loss), net |

(657,364) |

(884,715) |

(850,091) |

(751,393) |

(882,996) |

||||||||||||

|

Total Stockholders’ Equity |

$21,246,112 |

$20,537,503 |

$19,019,850 |

$19,117,535 |

$18,190,026 |

||||||||||||

|

Noncontrolling Interests |

|||||||||||||||||

|

Noncontrolling interest in operating partnership |

$427,930 |

$434,253 |

$438,422 |

$438,081 |

$441,366 |

||||||||||||

|

Noncontrolling interest in consolidated joint ventures |

36,933 |

36,060 |

31,215 |

45,892 |

45,182 |

||||||||||||

|

Total Noncontrolling Interests |

$464,863 |

$470,313 |

$469,637 |

$483,972 |

$486,547 |

||||||||||||

|

Total Equity |

$21,710,975 |

$21,007,816 |

$19,489,487 |

$19,601,507 |

$18,676,573 |

||||||||||||

|

Total Liabilities and Equity |

$45,295,392 |

$43,606,883 |

$42,633,089 |

$44,113,257 |

$41,932,515 |

||||||||||||

|

(1) |

Net of allowance for doubtful accounts of $56,353 and $46,643 as of September 30, 2024 and September 30, 2023, respectively. |

|

(2) |