Newly Revised Regulations of the Guangzhou Economic and Technological Development Zone to Take Effect on November 1, 2024

GUANGZHOU, China, Oct. 25, 2024 (GLOBE NEWSWIRE) — This year marks the 40th anniversary of the establishment of the Guangzhou Development Zone. The revised Regulations of the Guangzhou Economic and Technological Development Zone (hereinafter referred to as the “Regulations”) will officially come into effect on November 1, 2024. The revised Regulations comprise 34 articles in seven chapters, providing comprehensive guidelines on the management system, development and construction, industrial growth, open cooperation, and service guarantees for the Guangzhou Development Zone. These regulations offer robust legal support for a new round of reform explorations in the zone.

The revised Regulations emphasize the delegation of powers, clarifying that the Management Committee of the Guangzhou Development Zone shall exercise management authority at the municipal level. This signifies that the zone will enjoy greater policy advantages and autonomy in areas such as project introduction, land development, and administrative approvals in the future.

Another notable feature of this revision is its focus on high-quality development. The Regulations explicitly enumerate 20 key industries for development, including biomanufacturing, low-altitude economy, artificial intelligence, and digital industries, with provisions for dynamic adjustments. The Management Committee of the Guangzhou Development Zone is required to formulate policies supporting the transformation and upgrading of traditional industries and to promote advanced manufacturing and strategic emerging industries. Continuous optimization of industrial park functions, cultivation of advanced manufacturing clusters, enhancement of financial support, development of innovation and entrepreneurship service platforms, and increased efforts in the application of technological achievements and their conversion will also be prioritized.

Nowadays, the Guangzhou Development Zone has established three major industrial clusters, each valued at over 10 billion yuan, characterized by high-end equipment, biotechnology, and integrated circuits. Additionally, five industrial clusters, each exceeding 100 billion yuan, are represented by automobiles, new displays, green energy, new materials, and health and beauty products. The zone is also taking the lead in the low-altitude economy and artificial intelligence sectors, aiming for a new trillion-yuan market.

The Guangzhou Development Zone was born out of reform and has thrived through openness. As a key gateway for Guangzhou’s external openness, foreign investment has always been a pivotal topic since the zone’s establishment. In 2023, the actual foreign investment utilized by the Guangzhou Development Zone surpassed 3 billion US dollars for the first time, accounting for 44.4% of the city’s total foreign investment. The zone has maintained its position as the top economic development zone in the country for five consecutive years.

In this revision of the Regulations, “openness” remains a prominent development keyword for the Guangzhou Development Zone. The zone aims not only to attract high-quality investments but also to adhere to a strategy of high-quality outbound engagement. By pursuing both “bringing in” and “going global” strategies with equal emphasis, the zone seeks to expand its new development landscape and fully leverage its role as an open platform.

Source: Management Committee of the Guangzhou Development Zone

Contact person: Ms. Li, Tel: 86-10-63074558.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Venterra Named to Great Place To Work® 2024 Best Workplaces for Women List

HOUSTON, Oct. 24, 2024 /PRNewswire/ — Great Place to Work® and Fortune magazine have selected Venterra as one of the 2024 Best Workplaces™ for Women. This is Venterra’s second time being named to this prestigious list.

To determine the Best Workplaces for Women, Great Place To Work® analyzed the survey responses of nearly 600,000 women who work for Great Place To Work Certified™ companies that were eligible for the list. To be considered, a company must employ at least 50 women, have at least 20% of non-executive managers who are women, and at least one female C-suite executive.

Understanding that diversity drives innovation and creativity, Venterra is committed to fostering a diverse and inclusive environment where individuals of all genders and backgrounds feel valued and empowered to bring their unique perspectives to the table. By embracing a wide range of experiences and viewpoints, their goal is to build a stronger, more dynamic team in an environment as a Great Place to Work® for all.

“We are honored to be recognized as one of the Best Workplaces for Women for a second time. This accolade reflects our commitment to fostering an inclusive and supportive environment where women can thrive and all colleagues have equal opportunities for success,” said Venterra CEO, John Foresi. “This recognition reflects our ongoing efforts to champion diversity and inclusion, which are essential to driving innovation and excellence at Venterra. By empowering our team members and driving positive change within the company, we continue to build a workplace where everyone can succeed,” said Andrew Stewart, Venterra Chairman.

The Best Workplaces for Women list is highly competitive. Survey responses reflect a comprehensive picture of the workplace experience. Honorees were selected based on their ability to offer positive outcomes for women regardless of job role, race, sexual orientation, work status, or other demographic identifier.

Great Place To Work analyzed the gender balance of each workplace compared with Bureau of Labor Statistics industry data. Companies were also assessed on how representation changes as women rise from front-line positions to the board of directors.

“The things that create a great workplace for women are the same basic needs that every employee has,” says Michael C. Bush, CEO of Great Place To Work. “The best workplaces have closed the experience gap, providing access and opportunity to all regardless of an employee’s gender or background.”

“Fortune congratulates the companies that made the cut for the Best Workplaces for Women,” says Fortune Editor-in-Chief Alyson Shontell. “Based on survey responses of so many women nationwide, these companies clearly demonstrate they have created workplaces where many feel valued, supported, and encouraged to do their best work.”

Venterra’s unique culture has been honored by the Great Place To Work® Institute with a variety of awards in the past. Their recent recognitions from the organization include overall 2024 Best Workplaces, 2024 PEOPLE® Companies that Care, Best Workplaces for Giving Back, and Best Workplaces in Canada. View all of Venterra’s previous awards from the Great Place To Work® Institute and learn more about their latest survey results from their U.S. company profile and Canadian company profile.

About Venterra:

Venterra Realty is a growing developer, owner, and operator of multifamily apartments with approximately 90 mixed-use and multifamily communities across 21 major US cities. Over 42,000 people and more than 18,000 pets call Venterra “home”! The Venterra Team is focused on achieving excellence in serving its three major stakeholders: residents, employees, and investors. Venterra has enjoyed tremendous growth and financial success over its 23-year history, with approximately $5.5 billion USD of assets under management. This success has been achieved through the exceptional commitment and dedication of Venterra’s approximately 900 team members. Find out more about Venterra Realty and its award-winning company culture at Venterra.com.

About the Fortune Best Workplaces for Women

Great Place To Work selected the 2024 Fortune Best Workplaces for Women List by analyzing the survey responses of nearly 600,000 employees who work for Great Place To Work Certified™ companies that also meet the criteria for this list. To be eligible, a company must employ at least 50 women, have least 20% of non-executive managers who are women, and have at least one female C-suite executive. Company rankings are derived from 60 employee experience questions within the Great Place To Work Trust Index™ Survey. Read the full methodology.

About Great Place To Work

As the global authority on workplace culture, Great Place To Work brings 30 years of groundbreaking research and data to help every place become a great place to work for all. Its proprietary platform and Great Place To Work Model help companies evaluate the experience of every employee, with exemplary workplaces becoming Great Place To Work Certified and receiving recognition on a coveted Best Workplaces™ List.

About Fortune

Fortune upholds a legacy of award-winning writing and trusted reporting for executives who want to make business better. Independently owned, with a global perspective and digital agility, Fortune tells the stories of a new generation of innovators, builders, and risk takers. Online and in print, Fortune measures corporate performance through rigorous benchmarks and holds companies accountable. Fortune creates communities by convening true thought leaders and iconoclasts — those who shape industry, commerce, and society – through powerful and prestigious lists, events, and conferences, such as the iconic Fortune 500, the CEO Initiative, and Most Powerful Women. For more information, visit fortune.com.

Contact: Allie Lewnes, Communications Manager & Brand Specialist

Venterramedia@venterraliving.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/venterra-named-to-great-place-to-work-2024-best-workplaces-for-women-list-302286608.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/venterra-named-to-great-place-to-work-2024-best-workplaces-for-women-list-302286608.html

SOURCE Venterra Realty

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ManpowerGroup Recent Insider Activity

It was revealed in a recent SEC filing that John McGinnis, EVP at ManpowerGroup MAN made a noteworthy insider purchase on October 24,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that McGinnis purchased 8,000 shares of ManpowerGroup. The total transaction amounted to $498,240.

As of Thursday morning, ManpowerGroup shares are up by 3.55%, currently priced at $64.49.

Get to Know ManpowerGroup Better

ManpowerGroup Inc. is engaged in providing workforce solutions and services. The company provides services that includes Recruitment and Assessment, Upskilling, Reskilling, Training and Development, Career Management, Outsourcing, and Workforce Consulting. The reportable segments of the company are Staffing and Interim, Outcome-Based Solutions and Consulting, Permanent Recruitment, and Others. The Staffing and Interim segment derives maximum of the company’s revenue. The company derives maximum geographical revenue from Southern European region.

Financial Milestones: ManpowerGroup’s Journey

Revenue Growth: ManpowerGroup’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 0.21%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company shows a low gross margin of 17.26%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): ManpowerGroup’s EPS is below the industry average. The company faced challenges with a current EPS of 0.48. This suggests a potential decline in earnings.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.61.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: ManpowerGroup’s current Price to Earnings (P/E) ratio of 71.59 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.17 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 11.71 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Deciphering Transaction Codes in Insider Filings

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of ManpowerGroup’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Definity Financial Corporation to announce Third Quarter 2024 results on November 7, 2024 and hold its earnings conference call the following day

WATERLOO, ON, Oct. 24, 2024 /CNW/ – Definity Financial Corporation DFY will release its third quarter 2024 results after the market close on Thursday, November 7, 2024, which will be made available at www.definity.com/investors.

A live webcast and conference call are scheduled for Friday, November 8 at 11:00 a.m. (ET) where Rowan Saunders, President and Chief Executive Officer, Philip Mather, Executive Vice-President and Chief Financial Officer; Paul MacDonald, Executive Vice-President, Personal Insurance & Digital Channels; and Fabian Richenberger, Executive Vice-President, Commercial Insurance & Insurance Operations, will discuss the results, followed by a question-and-answer period with analysts.

The conference call is available by dialing 437-900-0527 or 1-888-510-2154 (toll-free in North America). Please call ten minutes before the start of the call. To join the conference call without operator assistance, you may register and enter your phone number at https://emportal.ink/4eIXHv8 to receive an instant automated call back.

The archived webcast will be available at www.definity.com/investors/events-and-presentations following the call. A replay of the call will also be available on November 8, 2024 at 2:00 p.m. (ET) until midnight on November 15, 2024. To listen to the replay, call 289-819-1450 or 1-888-660-6345 (toll-free in North America), passcode 76564.

About Definity Financial Corporation

Definity Financial Corporation (“Definity”, which includes its subsidiaries where the context so requires) is one of the leading property and casualty insurers in Canada, with approximately $4.3 billion in gross written premiums1 for the 12 months ended June 30, 2024 and over $3.0 billion in equity attributable to common shareholders as at June 30, 2024.

1 “Gross written premiums” is a supplementary financial measure composed of the total premiums for sale of insurance during a specified period including premiums assumed.

SOURCE Definity Financial Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/24/c7928.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/24/c7928.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can MariMed's $7.7M Illinois Cannabis Expansion Turn The Tide In A $496M Market?

In Zuanic & Associates‘ latest equity report, senior analyst Pablo Zuanic analyzes MariMed‘s MRMD performance across its core markets, with Illinois (IL) accounting for 40-45% of the company’s sales.

Despite overall market stagnation, MariMed aims to boost growth through capacity expansion, including a new 14,000 sq ft cultivation site expected to begin sales by early 2025.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Q3

In Q3, Illinois’ cannabis sales reached $496 million, with 86% from recreational use. However, per capita spending remains at $160, lower than in states like Arizona ($178) and Michigan ($320). Retail flower prices fell 10% year-over-year to $8.87 per gram, and per-store revenue dropped from $17 million to $8.8 million annually.

“The Illinois market remains attractive due to high wholesale prices, but growth challenges persist, particularly for retailers without cultivation operations,” Zuanic said. Despite these challenges, MariMed’s in-house brands, launched in January 2024, performed well, generating $7.7 million in Q3, with vape sales leading at $4.9 million. Competitors like Green Thumb Industries GTBIF, Curaleaf CURLF, and Cresco Labs CRLBF also maintain strong positions in the Illinois market.

Read Also: Almost Every Major Cannabis Company Could See Positive Cash Flow If 280E Is Removed In 2025

MariMed’s Playbook: Maryland, Massachusetts, Ohio

MariMed’s operations in Maryland continue to expand, contributing $292 million in Q3, an 8% year-over-year increase. Per capita consumption reached $192, exceeding figures in Illinois, New Jersey, and Connecticut. Maryland’s retail flower prices averaged $8.62 per gram, providing better margins for retailers compared to Illinois.

Conversely, Massachusetts faced deflationary pressures, with retail flower prices falling 18% year-over-year to $4.85 per gram. This led to a 17% decline in MariMed’s branded sales in Q3, even though the market grew by 1%.

In Maryland, MariMed’s Betty’s brand led the edibles segment with an 11.3% market share, while in Massachusetts, branded products like Nature’s Heritage flower saw a sales decline. “The state regulator has issued 101 store licenses. Average annualized revenue per store of $11.6Mn is among the best in the US, and now above that of Illinois. We calculate gross margins at >46%, so this means >$5.3Mn gross profit per store. Companies with vertical operations like MariMed are in a strong position to benefit both from grower margins as well as retailer margins,” Zuanic wrote. Meanwhile, competitors such as Trulieve TCNNF continue to expand their footprint across Maryland’s market.

Ohio’s recreational market is experiencing different pricing dynamics. Flower prices increased from $5.84 per gram in Q4 2023 to $8.62 per gram in Q3 2024, contrasting with price drops in Illinois and Massachusetts, underscoring the varied maturation of cannabis markets across states.

Valuation And Stock Performance

MariMed’s valuation continues to be a focal point, trading at 1x CY24 sales compared to the multi-state operator (MSO) average of 1.9x. According to Zuanic, over the past year, MariMed’s stock underperformed (-52%) relative to the MSOS ETF (+21%).

However, in the last month, MariMed gained +4%, while the MSOS ETF rose +18%. Zuanic notes, “We believe the discount is overdone,” emphasizing the company’s strong balance sheet and growth potential.

Read Next: EXCLUSIVE: Tilray CEO Irwin Simon On Why US Cannabis Rescheduling Won’t Change A Billion-Dollar Play

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NAV CANADA announces year-end financial results

OTTAWA, ON, Oct. 24, 2024 /CNW/ – NAV CANADA today released its financial results for the year ended August 31, 2024.

The Company saw air traffic levels for fiscal 2024, as measured in weighted charging units(1), increase by 6.4% on a year-over-year basis. The Company’s revenue for fiscal 2024 was $1,800 million, compared to $1,778 million in fiscal 2023.

The Company had free cash flow(2) of $162 million in fiscal 2024 as compared to free cash flow of $350 million in fiscal 2023. The decrease in free cash flow in fiscal 2024 is driven primarily by higher payments to employees and suppliers and higher capital expenditures as compared to fiscal 2023.

“Over the past year, NAV CANADA has demonstrated improved operational performance, a testament to the resilience and dedication of our teams. We have been actively focusing on cost management and refining our modernization strategies, which has led to notable improvements across various areas such as advancement in technology initiatives, infrastructure renewal, recruitment, and training. Our commitment to delivering value to our customers remains unwavering, and we are proud to have partnered to increase our operational workforce to support their needs,” said Raymond Bohn, President and CEO, NAV CANADA. “These efforts collectively position us for continued growth and success in the coming year.”

Operating expenses for fiscal 2024 were $1,638 million as compared to $1,493 million in fiscal 2023, primarily due to higher compensation costs driven by an increase in both staffing and wage levels.

Net other income and expenses for fiscal 2024 was a net expense of $80 million as compared to a net expense of $124 million in fiscal 2023. The higher expense in fiscal 2023 is mainly due to the reduction in the fair value of the Company’s investment in preferred interests of Aireon LLC recorded in fiscal 2023.

The Company had a net income (before net movement in regulatory deferral accounts including rate stabilization) of $81 million in fiscal 2024 as compared to a net income of $161 million in fiscal 2023.

The Company is subject to legislation that regulates its approach to setting customer service charges. The timing of the recognition of certain revenue and expenses recovered through customer service charges is recorded through movements in regulatory deferral accounts. The net movement in regulatory deferral accounts for fiscal 2024 was an expense of $81 million as compared to an expense of $161 million in fiscal 2023. This change in regulatory deferrals is primarily due to a decrease in favourable rate stabilization adjustments of $65 million and a $15 million net increase in adjustments required to align the accounting recognition of certain transactions to the periods in which they will be considered for rate setting. As at August 31, 2024, the rate stabilization account had a balance of $175 million to be recovered from customers through future customer service charges.

Associated Links

The Company’s Financial Statements, Management’s Discussion and Analysis and Annual Information Form for the year ended August 31, 2024 can be found at:

Financial Statements

Management’s Discussion and Analysis

Annual Information Form

About NAV CANADA

NAV CANADA is a private, not-for-profit company, established in 1996, providing air traffic control, airport advisory services, weather briefings and aeronautical information services for more than 18 million square kilometres of Canadian domestic and international airspace.

The Company is internationally recognized for its safety record, and technology innovation.

|

(1) Weighted charging units represent a traffic measure that reflects the number of billable flights, aircraft size and distance flown in Canadian airspace and is the basis for movement-based service charges, which comprise the vast majority of the Company’s revenue. |

|

|

(2) Free cash flow is a non-GAAP financial measure used by the Company to enhance the overall understanding of its financial and operating performance. Non-GAAP financial measures do not have any standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company defines free cash flow as cash generated from operations, less capital expenditures (net of government grants received), investments in regulatory assets, investments in Aireon LLC and equity related investments and principal payment of lease liabilities. Management places importance on this indicator as it assists in measuring the impact of its investment program on the Company’s financial resources and provides users with a more stable indication of the Company’s ability to meet its debt obligations and continue to invest in the air navigation system. |

This press release contains certain forward-looking statements that are subject to important risks and uncertainties. Actual results may differ materially from the results indicated in these statements for a number of reasons. NAV CANADA disclaims any intention to update any forward-looking statements.

SOURCE NAV CANADA

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/24/c3470.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/24/c3470.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

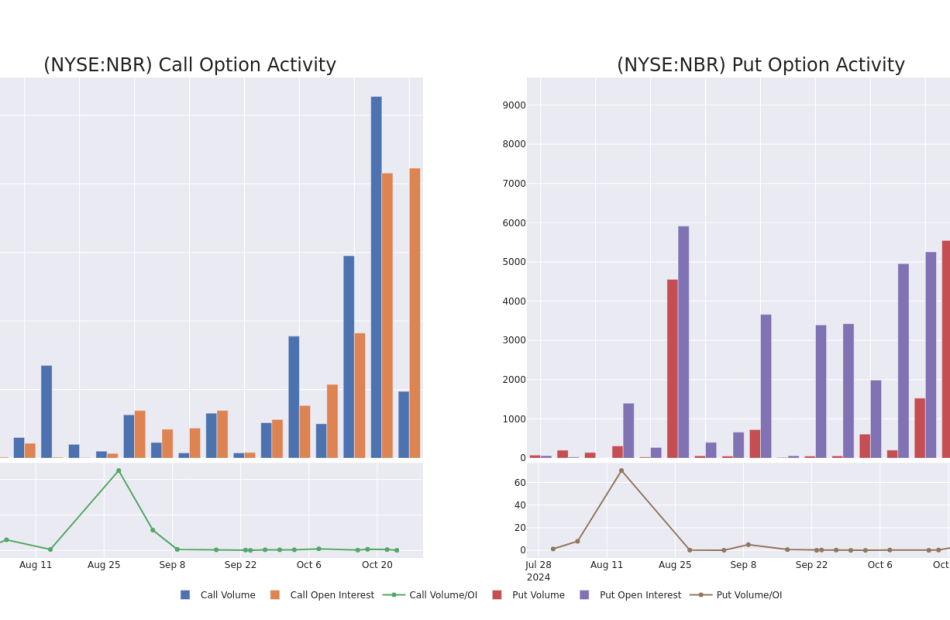

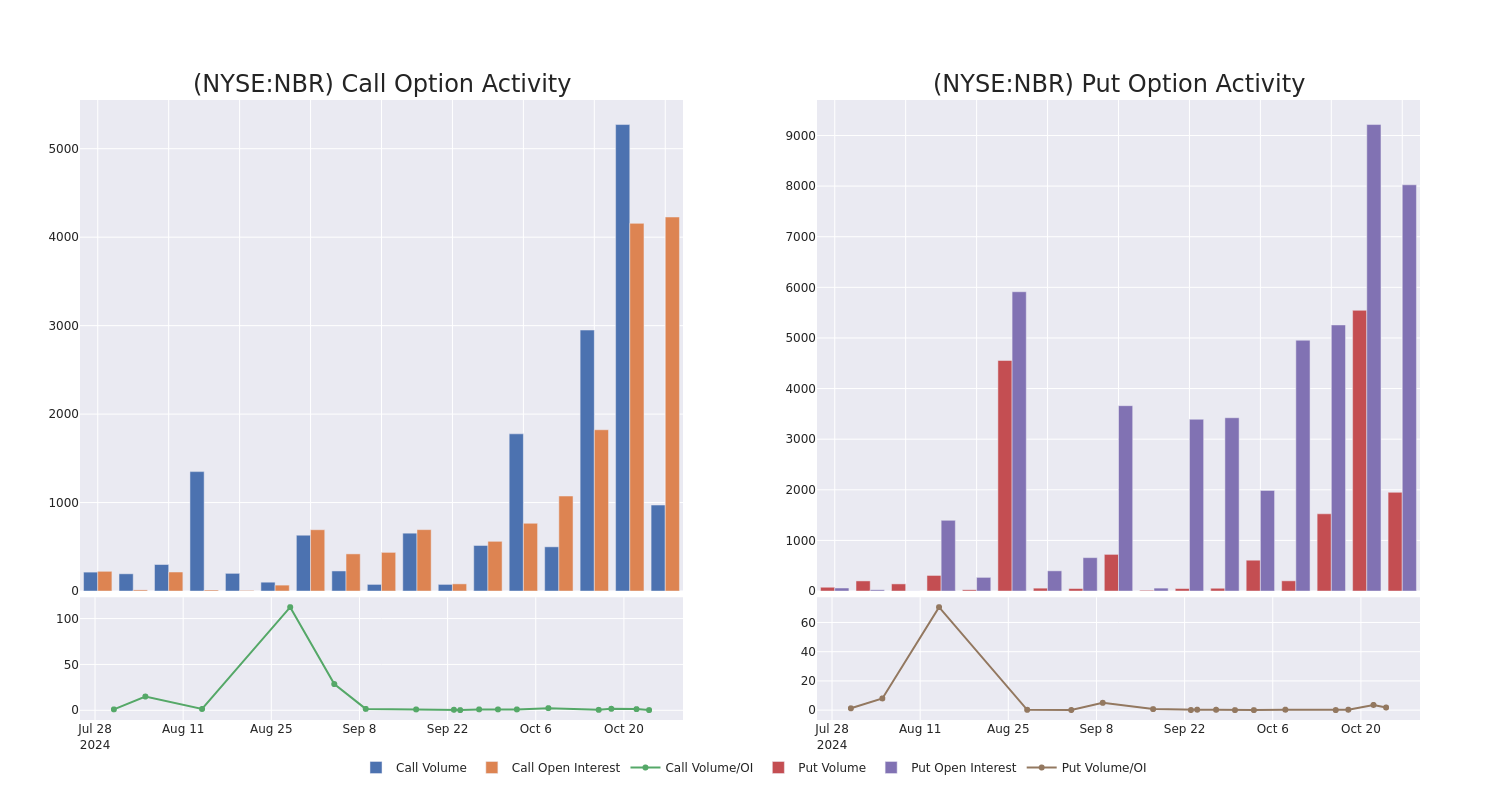

Nabors Industries's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Nabors Industries NBR, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NBR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for Nabors Industries. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 41% bearish. Among these notable options, 7 are puts, totaling $310,700, and 5 are calls, amounting to $177,650.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $90.0 for Nabors Industries over the last 3 months.

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Nabors Industries’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nabors Industries’s whale activity within a strike price range from $55.0 to $90.0 in the last 30 days.

Nabors Industries Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NBR | PUT | TRADE | BULLISH | 01/17/25 | $12.4 | $11.9 | $12.1 | $75.00 | $121.0K | 7.4K | 228 |

| NBR | CALL | TRADE | NEUTRAL | 11/15/24 | $2.1 | $1.65 | $1.9 | $80.00 | $38.0K | 2.4K | 200 |

| NBR | PUT | TRADE | BULLISH | 04/17/25 | $7.9 | $7.4 | $7.6 | $60.00 | $38.0K | 276 | 180 |

| NBR | CALL | TRADE | BEARISH | 04/17/25 | $7.3 | $7.0 | $7.03 | $90.00 | $35.1K | 1.2K | 131 |

| NBR | CALL | TRADE | BEARISH | 12/20/24 | $3.7 | $3.5 | $3.5 | $85.00 | $35.0K | 540 | 215 |

About Nabors Industries

Nabors Industries Ltd owns and operates land-based drilling rig fleets and is a provider of offshore platform rigs in the United States and international markets. It also provides performance tools, directional drilling services, tubular running services, and innovative technologies. It has operations in over 15 countries, 291 actively marketed rigs for land-based drilling operations and 28 actively marketed rigs for offshore platform drilling operations in the United States and multiple international markets. The company has five reportable segments: U.S. Drilling, Canada Drilling, International Drilling, Drilling Solutions, and Rig Technologies. The key revenue of the company is generated from International Drilling.

Having examined the options trading patterns of Nabors Industries, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Nabors Industries

- Trading volume stands at 428,872, with NBR’s price up by 3.96%, positioned at $72.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 103 days.

What The Experts Say On Nabors Industries

4 market experts have recently issued ratings for this stock, with a consensus target price of $88.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Susquehanna persists with their Neutral rating on Nabors Industries, maintaining a target price of $77.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Nabors Industries with a target price of $88.

* An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $102.

* An analyst from Evercore ISI Group persists with their In-Line rating on Nabors Industries, maintaining a target price of $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nabors Industries options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The First of Long Island Corporation Reports Earnings for the Third Quarter of 2024

MELVILLE, N.Y., Oct. 24, 2024 (GLOBE NEWSWIRE) — The First of Long Island Corporation FLIC the “Company” or the “Corporation”))), the parent of The First National Bank of Long Island (the “Bank”), reported earnings for the three and nine months ended September 30, 2024.

President and Chief Executive Officer Chris Becker commented on the Company’s results: “We are encouraged by a second consecutive linked quarter showing improvements in key financial metrics. After an increase in the net interest margin of one basis point in the second quarter of 2024 from the first quarter of 2024, the margin increased nine basis points in the third quarter of 2024 when compared to second quarter of 2024. We are optimistic the trend will continue during the fourth quarter of this year. Excluding merger and branch consolidation expenses, our noninterest expense remains well controlled and in line with expectations. Finally, our credit quality results remained strong.”

Analysis of Earnings – Nine Months Ended September 30, 2024

Net income and earnings per share (“EPS”) for the nine months ended September 30, 2024, were $13.8 million and $0.61, respectively, as compared to $20.2 million and $0.89, respectively, in the same period of 2023. Adjusted net income and EPS for the current nine-month period, which exclude merger and branch consolidation expenses, were $14.8 million and $0.66, respectively (see “Non-GAAP Reconciliation” table at the end of this release). The principal drivers of the change in adjusted net income were a decline in net interest income of $11.7 million, or 17.5%, and a provision for credit losses of $740,000 as compared to a provision reversal of $1.2 million in the prior period, partially offset by a loss on sales of securities of $3.5 million in the first quarter of 2023, an increase in remaining noninterest income of $1.4 million, and decreases in noninterest expense of $1.2 million and income tax expense of $2.2 million. The nine months ended 2024 produced a return on average assets (“ROA”) of 0.44%, a return on average equity (“ROE”) of 4.88%, an efficiency ratio of 76.39%, and a net interest margin of 1.83%. Excluding merger and branch consolidation expenses, adjusted ROA and ROE were 0.47% and 5.23%, respectively, and the adjusted efficiency ratio was 74.21% (see “Non-GAAP Reconciliation” table at the end of this release).

Net interest income declined when comparing the first nine months of 2024 and 2023 due to an increase in interest expense of $23.4 million that was only partially offset by a $11.7 million increase in interest income. The cost of interest-bearing liabilities increased 109 basis points while the yield on interest-earning assets increased 38 basis points when comparing the nine-month periods. The Bank’s balance sheet remains liability sensitive, however the pace of repricing of average interest-earning assets began outpacing the repricing of average interest-bearing liabilities in the third quarter.

The Bank recorded a provision for credit losses of $740,000 for the nine months ended 2024, compared to a provision reversal of $1.2 million in the same period of 2023. The allowance for credit losses declined when compared to year-end 2023 largely due to declines in historical loss rates and reserves on individually evaluated loans, partially offset by a deterioration in current and forecasted economic conditions, including adjustments for rent stabilization status of multifamily properties. The reserve coverage ratio remained stable at 0.88% of total loans at September 30, 2024 as compared to 0.88% at June 30, 2024 and 0.89% at December 31, 2023. Past due loans and nonaccrual loans were at $346,000 and $2.9 million, respectively, on September 30, 2024. Overall credit quality of the loan and investment portfolios remains strong.

Noninterest income, excluding the loss on sales of securities of $3.5 million in the 2023 period, increased $1.4 million, or 19.1%, when comparing the first nine months of 2024 and 2023. Recurring components of noninterest income including bank-owned life insurance (“BOLI”) and service charges on deposit accounts had increases of 8.0% and 13.4%, respectively. Other noninterest income increased 33.2% and included increases of $469,000 in merchant card services, $232,000 in back-to-back swap fees, and $181,000 in pension income, which were partially offset by a gain on disposition of premises and fixed assets of $240,000 in 2023.

Noninterest expense increased $254,000, or 0.5%, for the nine months of 2024, as compared to the same period in 2023. Excluding merger and branch consolidation expenses, adjusted noninterest expense decreased by $1.2 million (See “Non-GAAP Reconciliation” table at the end of this release). Reductions in occupancy and equipment expense of $685,000 and telecommunication expense of $383,000 drove the decline in adjusted noninterest expense. The decrease in occupancy and equipment expense was largely due to the ongoing branch optimization strategy, which resulted in the closing of various locations. Telecom expense decreased mainly due to efficiencies associated with system upgrades.

Income tax expense decreased $2.7 million, and the effective tax rate declined to (0.3)% for the nine months ended 2024 as compared to 11.6% for the same period in prior year. The decline in the effective tax rate is mainly due to an increase in the percentage of pre-tax income derived from the Bank’s real estate investment trust reducing the state and local income tax due. The decrease in income tax expense reflects the lower effective tax rate and a decline in pre-tax income.

Analysis of Earnings – Third Quarter 2024 Versus Third Quarter 2023

Net income for the third quarter of 2024 decreased $2.2 million as compared to the third quarter of last year. Adjusted net income for the third quarter decreased by $1.2 million (see “Non-GAAP Reconciliation” table at the end of this release). The change in adjusted net income is mainly attributable to a $2.8 million decline in net interest income for substantially the same reasons discussed above with respect to the nine-month periods along with a $341,000 increase in the provision for credit losses. Partially offsetting the decreases, was an increase in noninterest income of $966,000 for substantially the same reasons discussed above with respect to the nine-month periods. The quarter produced a ROA of 0.44%, a ROE of 4.77%, an efficiency ratio of 79.09%, and a net interest margin of 1.89%. On an adjusted basis, ROA and ROE were 0.53% and 5.79%, respectively, and the efficiency ratio was 72.69% (see “Non-GAAP Reconciliation” table at the end of this release).

Analysis of Earnings –Third Quarter 2024 Versus Second Quarter 2024

Net income for the third quarter of 2024 decreased $199,000 compared to the second quarter of 2024. Adjusted net income for the third quarter increased by $782,000 (see “Non-GAAP Reconciliation” table at the end of this release). The increase in adjusted net income was partially due to an increase in net interest income of $169,000, a decrease in the provision for credit losses of $400,000, and an increase in back-to-back swap fees of $232,000.

Net interest income increased due to an increase in net interest margin. The increase in the net interest margin to 1.89% in the third quarter of 2024 from 1.80% in the second quarter of 2024 was largely due to the repricing of wholesale funding at lower costs largely offsetting the increase in cost of other interest-bearing liabilities while the yield on interest-earning assets continued to rise. Additionally, average interest-bearing deposits decreased $35.8 million and average higher cost borrowings decreased $65.6 million.

The decrease in income tax expense was substantially due to the same reasons discussed above with respect to the nine-month periods.

Liquidity

Total average deposits declined by $89.6 million, or 2.6%, when comparing the nine-month periods of 2024 and 2023. On September 30, 2024, overnight advances and other borrowings were down by $70.0 million and $27.5 million, respectively, from year-end 2023. The Bank had $582.8 million in collateralized borrowing lines with the Federal Home Loan Bank of New York and the Federal Reserve Bank, as well as a $20 million unsecured line of credit with a correspondent bank. We also had $312.9 million in unencumbered cash and securities. In total, we had approximately $915.7 million of available liquidity on September 30, 2024. At September 30, 2024, uninsured deposits were 45.9% of total deposits.

Capital

The Corporation’s capital position remains strong with a leverage ratio of approximately 10.13% on September 30, 2024. Book value per share was $17.25 on September 30, 2024, versus $16.83 on December 31, 2023. The accumulated other comprehensive loss component of stockholders’ equity is mainly comprised of a net unrealized loss in the available-for-sale securities portfolio due to higher market interest rates. The Company declared its quarterly cash dividend of $0.21 per share during the quarter. There were no share repurchases during the quarter. The Board and management continue to evaluate the quarterly dividend to provide the best opportunity to maximize shareholder value.

Forward Looking Information

This earnings release contains various “forward-looking statements” within the meaning of that term as set forth in Rule 175 of the Securities Act of 1933 and Rule 3b-6 of the Securities Exchange Act of 1934. Such statements are generally contained in sentences including the words “may” or “expect” or “could” or “should” or “would” or “believe” or “anticipate”. The Corporation cautions that these forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Factors that could cause future results to vary from current management expectations include, but are not limited to, changing economic conditions; legislative and regulatory changes; monetary and fiscal policies of the federal government; changes in interest rates; deposit flows and the cost of funds; demand for loan products; competition; changes in management’s business strategies; changes in accounting principles, policies or guidelines; changes in real estate values; and other factors discussed in the “risk factors” section of the Corporation’s filings with the Securities and Exchange Commission (“SEC”). The forward-looking statements are made as of the date of this press release, and the Corporation assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

For more detailed financial information please see the Corporation’s quarterly report on Form 10-Q for the quarter ended September 30, 2024. The Form 10-Q will be available through the Bank’s website at www.fnbli.com on or about October 28, 2024, when it is anticipated to be electronically filed with the SEC. Our SEC filings are also available on the SEC’s website at www.sec.gov.

| CONSOLIDATED BALANCE SHEETS (Unaudited) |

|||||||

| 9/30/2024 | 12/31/2023 | ||||||

| (dollars in thousands) | |||||||

| Assets: | |||||||

| Cash and cash equivalents | $ | 78,568 | $ | 60,887 | |||

| Investment securities available-for-sale, at fair value | 659,696 | 695,877 | |||||

| Loans: | |||||||

| Commercial and industrial | 146,440 | 116,163 | |||||

| Secured by real estate: | |||||||

| Commercial mortgages | 1,950,008 | 1,919,714 | |||||

| Residential mortgages | 1,103,937 | 1,166,887 | |||||

| Home equity lines | 36,962 | 44,070 | |||||

| Consumer and other | 1,150 | 1,230 | |||||

| 3,238,497 | 3,248,064 | ||||||

| Allowance for credit losses | (28,647 | ) | (28,992 | ) | |||

| 3,209,850 | 3,219,072 | ||||||

| Restricted stock, at cost | 28,191 | 32,659 | |||||

| Bank premises and equipment, net | 30,180 | 31,414 | |||||

| Right-of-use asset – operating leases | 20,359 | 22,588 | |||||

| Bank-owned life insurance | 116,192 | 114,045 | |||||

| Pension plan assets, net | 10,421 | 10,740 | |||||

| Deferred income tax benefit | 27,779 | 28,996 | |||||

| Other assets | 20,243 | 19,622 | |||||

| $ | 4,201,479 | $ | 4,235,900 | ||||

| Liabilities: | |||||||

| Deposits: | |||||||

| Checking | $ | 1,121,871 | $ | 1,133,184 | |||

| Savings, NOW and money market | 1,594,317 | 1,546,369 | |||||

| Time | 610,876 | 591,433 | |||||

| 3,327,064 | 3,270,986 | ||||||

| Overnight advances | — | 70,000 | |||||

| Other borrowings | 445,000 | 472,500 | |||||

| Operating lease liability | 22,876 | 24,940 | |||||

| Accrued expenses and other liabilities | 17,958 | 17,328 | |||||

| 3,812,898 | 3,855,754 | ||||||

| Stockholders’ Equity: | |||||||

| Common stock, par value $0.10 per share: | |||||||

| Authorized, 80,000,000 shares; | |||||||

| Issued and outstanding, 22,532,080 and 22,590,942 shares | 2,253 | 2,259 | |||||

| Surplus | 79,157 | 79,728 | |||||

| Retained earnings | 355,541 | 355,887 | |||||

| 436,951 | 437,874 | ||||||

| Accumulated other comprehensive loss, net of tax | (48,370 | ) | (57,728 | ) | |||

| 388,581 | 380,146 | ||||||

| $ | 4,201,479 | $ | 4,235,900 | ||||

| CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|||||||||||||||

| Nine Months Ended | Three Months Ended | ||||||||||||||

| 9/30/2024 | 9/30/2023 | 9/30/2024 | 9/30/2023 | ||||||||||||

| (dollars in thousands) | |||||||||||||||

| Interest and dividend income: | |||||||||||||||

| Loans | $ | 102,679 | $ | 94,706 | $ | 35,026 | $ | 32,818 | |||||||

| Investment securities: | |||||||||||||||

| Taxable | 20,701 | 15,877 | 6,229 | 6,594 | |||||||||||

| Nontaxable | 2,872 | 3,976 | 955 | 1,004 | |||||||||||

| 126,252 | 114,559 | 42,210 | 40,416 | ||||||||||||

| Interest expense: | |||||||||||||||

| Savings, NOW and money market deposits | 33,637 | 22,188 | 12,117 | 8,802 | |||||||||||

| Time deposits | 20,748 | 13,086 | 6,712 | 5,785 | |||||||||||

| Overnight advances | 392 | 596 | 125 | 50 | |||||||||||

| Other borrowings | 16,283 | 11,782 | 4,656 | 4,347 | |||||||||||

| 71,060 | 47,652 | 23,610 | 18,984 | ||||||||||||

| Net interest income | 55,192 | 66,907 | 18,600 | 21,432 | |||||||||||

| Provision (credit) for credit losses | 740 | (1,227 | ) | 170 | (171 | ) | |||||||||

| Net interest income after provision (credit) for credit losses | 54,452 | 68,134 | 18,430 | 21,603 | |||||||||||

| Noninterest income: | |||||||||||||||

| Bank-owned life insurance | 2,573 | 2,383 | 876 | 809 | |||||||||||

| Service charges on deposit accounts | 2,543 | 2,243 | 842 | 703 | |||||||||||

| Net loss on sales of securities | — | (3,489 | ) | — | — | ||||||||||

| Other | 3,732 | 2,802 | 1,492 | 732 | |||||||||||

| 8,848 | 3,939 | 3,210 | 2,244 | ||||||||||||

| Noninterest expense: | |||||||||||||||

| Salaries and employee benefits | 29,169 | 29,268 | 9,695 | 9,649 | |||||||||||

| Occupancy and equipment | 9,289 | 9,974 | 2,965 | 3,253 | |||||||||||

| Merger expenses | 866 | — | 866 | — | |||||||||||

| Branch consolidation expenses | 547 | — | 547 | — | |||||||||||

| Other | 9,635 | 10,010 | 3,378 | 3,262 | |||||||||||

| 49,506 | 49,252 | 17,451 | 16,164 | ||||||||||||

| Income before income taxes | 13,794 | 22,821 | 4,189 | 7,683 | |||||||||||

| Income tax (credit) expense | (38 | ) | 2,641 | (410 | ) | 883 | |||||||||

| Net income | $ | 13,832 | $ | 20,180 | $ | 4,599 | $ | 6,800 | |||||||

| Share and Per Share Data: | |||||||||||||||

| Weighted Average Common Shares | 22,520,026 | 22,538,520 | 22,529,051 | 22,569,716 | |||||||||||

| Dilutive restricted stock units | 87,716 | 69,010 | 138,272 | 86,914 | |||||||||||

| Dilutive weighted average common shares | 22,607,742 | 22,607,530 | 22,667,323 | 22,656,630 | |||||||||||

| Basic EPS | $ | 0.61 | $ | 0.90 | $ | 0.20 | $ | 0.30 | |||||||

| Diluted EPS | 0.61 | 0.89 | 0.20 | 0.30 | |||||||||||

| Cash Dividends Declared per share | 0.63 | 0.63 | 0.21 | 0.21 | |||||||||||

| FINANCIAL RATIOS | |||||||||||||||

| (Unaudited) | |||||||||||||||

| ROA | 0.44 | % | 0.64 | % | 0.44 | % | 0.63 | % | |||||||

| ROE | 4.88 | 7.29 | 4.77 | 7.34 | |||||||||||

| Net Interest Margin | 1.83 | 2.21 | 1.89 | 2.13 | |||||||||||

| Dividend Payout Ratio | 103.28 | 70.79 | 105.00 | 70.00 | |||||||||||

| Efficiency Ratio | 76.39 | 65.33 | 79.09 | 67.51 | |||||||||||

| PROBLEM AND POTENTIAL PROBLEM LOANS AND ASSETS (Unaudited) |

|||||||

| 9/30/2024 | 12/31/2023 | ||||||

| (dollars in thousands) | |||||||

| Loans including modifications to borrowers experiencing financial difficulty: | |||||||

| Modified and performing according to their modified terms | $ | 424 | $ | 431 | |||

| Past due 30 through 89 days | 346 | 3,086 | |||||

| Past due 90 days or more and still accruing | — | — | |||||

| Nonaccrual | 2,899 | 1,053 | |||||

| 3,669 | 4,570 | ||||||

| Other real estate owned | — | — | |||||

| $ | 3,669 | $ | 4,570 | ||||

| Allowance for credit losses | $ | 28,647 | $ | 28,992 | |||

| Allowance for credit losses as a percentage of total loans | 0.88 | % | 0.89 | % | |||

| Allowance for credit losses as a multiple of nonaccrual loans | 9.9 | x | 27.5 | x | |||

| AVERAGE BALANCE SHEET, INTEREST RATES AND INTEREST DIFFERENTIAL (Unaudited) |

||||||||||||||||||||||||

| Nine Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||

| Average | Interest/ | Average | Average | Interest/ | Average | |||||||||||||||||||

| (dollars in thousands) | Balance | Dividends | Rate | Balance | Dividends | Rate | ||||||||||||||||||

| Assets: | ||||||||||||||||||||||||

| Interest-earning bank balances | $ | 66,593 | $ | 2,724 | 5.46 | % | $ | 52,163 | $ | 1,969 | 5.05 | % | ||||||||||||

| Investment securities: | ||||||||||||||||||||||||

| Taxable (1) | 620,721 | 17,977 | 3.86 | 564,857 | 13,908 | 3.28 | ||||||||||||||||||

| Nontaxable (1) (2) | 152,758 | 3,636 | 3.17 | 209,566 | 5,033 | 3.20 | ||||||||||||||||||

| Loans (1) (2) | 3,236,794 | 102,679 | 4.23 | 3,266,184 | 94,708 | 3.87 | ||||||||||||||||||

| Total interest-earning assets | 4,076,866 | 127,016 | 4.15 | 4,092,770 | 115,618 | 3.77 | ||||||||||||||||||

| Allowance for credit losses | (28,590 | ) | (30,531 | ) | ||||||||||||||||||||

| Net interest-earning assets | 4,048,276 | 4,062,239 | ||||||||||||||||||||||

| Cash and due from banks | 32,844 | 31,410 | ||||||||||||||||||||||

| Premises and equipment, net | 30,979 | 32,107 | ||||||||||||||||||||||

| Other assets | 122,671 | 115,167 | ||||||||||||||||||||||

| $ | 4,234,770 | $ | 4,240,923 | |||||||||||||||||||||

| Liabilities and Stockholders’ Equity: | ||||||||||||||||||||||||

| Savings, NOW & money market deposits | $ | 1,589,154 | 33,637 | 2.83 | $ | 1,668,506 | 22,188 | 1.78 | ||||||||||||||||

| Time deposits | 625,553 | 20,748 | 4.43 | 536,529 | 13,086 | 3.26 | ||||||||||||||||||

| Total interest-bearing deposits | 2,214,707 | 54,385 | 3.28 | 2,205,035 | 35,274 | 2.14 | ||||||||||||||||||

| Overnight advances | 9,303 | 392 | 5.63 | 14,993 | 596 | 5.31 | ||||||||||||||||||

| Other borrowings | 457,053 | 16,283 | 4.76 | 377,053 | 11,782 | 4.18 | ||||||||||||||||||

| Total interest-bearing liabilities | 2,681,063 | 71,060 | 3.54 | 2,597,081 | 47,652 | 2.45 | ||||||||||||||||||

| Checking deposits | 1,136,738 | 1,236,001 | ||||||||||||||||||||||

| Other liabilities | 38,354 | 37,736 | ||||||||||||||||||||||

| 3,856,155 | 3,870,818 | |||||||||||||||||||||||

| Stockholders’ equity | 378,615 | 370,105 | ||||||||||||||||||||||

| $ | 4,234,770 | $ | 4,240,923 | |||||||||||||||||||||

| Net interest income (2) | $ | 55,956 | $ | 67,966 | ||||||||||||||||||||

| Net interest spread (2) | 0.61 | % | 1.32 | % | ||||||||||||||||||||

| Net interest margin (2) | 1.83 | % | 2.21 | % | ||||||||||||||||||||

| (1) | The average balances of loans include nonaccrual loans. The average balances of investment securities exclude unrealized gains and losses on available-for-sale securities. | |

| (2) | Tax-equivalent basis. Interest income on a tax-equivalent basis includes the additional amount of interest income that would have been earned if the Corporation’s investment in tax-exempt loans and investment securities had been made in loans and investment securities subject to federal income taxes yielding the same after-tax income. The tax-equivalent amount of $1.00 of nontaxable income was $1.27 for each period presented using the statutory federal income tax rate of 21%. | |

| AVERAGE BALANCE SHEET, INTEREST RATES AND INTEREST DIFFERENTIAL (Unaudited) |

||||||||||||||||||||||||

| Three Months Ended September 30, | ||||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||||

| Average | Interest/ | Average | Average | Interest/ | Average | |||||||||||||||||||

| (dollars in thousands) | Balance | Dividends | Rate | Balance | Dividends | Rate | ||||||||||||||||||

| Assets: | ||||||||||||||||||||||||

| Interest-earning bank balances | $ | 33,463 | $ | 453 | 5.39 | % | $ | 66,474 | $ | 902 | 5.38 | % | ||||||||||||

| Investment securities: | ||||||||||||||||||||||||

| Taxable (1) | 602,446 | 5,776 | 3.84 | 625,827 | 5,692 | 3.64 | ||||||||||||||||||

| Nontaxable (1) (2) | 152,278 | 1,209 | 3.18 | 161,423 | 1,271 | 3.15 | ||||||||||||||||||

| Loans (1) | 3,237,138 | 35,026 | 4.33 | 3,257,256 | 32,818 | 4.03 | ||||||||||||||||||

| Total interest-earning assets | 4,025,325 | 42,464 | 4.22 | 4,110,980 | 40,683 | 3.96 | ||||||||||||||||||

| Allowance for credit losses | (28,495 | ) | (29,981 | ) | ||||||||||||||||||||

| Net interest-earning assets | 3,996,830 | 4,080,999 | ||||||||||||||||||||||

| Cash and due from banks | 33,028 | 33,420 | ||||||||||||||||||||||

| Premises and equipment, net | 30,754 | 32,268 | ||||||||||||||||||||||

| Other assets | 126,428 | 113,084 | ||||||||||||||||||||||

| $ | 4,187,040 | $ | 4,259,771 | |||||||||||||||||||||

| Liabilities and Stockholders’ Equity: | ||||||||||||||||||||||||

| Savings, NOW & money market deposits | $ | 1,614,294 | 12,117 | 2.99 | $ | 1,655,032 | 8,802 | 2.11 | ||||||||||||||||

| Time deposits | 600,873 | 6,712 | 4.44 | 587,814 | 5,785 | 3.90 | ||||||||||||||||||

| Total interest-bearing deposits | 2,215,167 | 18,829 | 3.38 | 2,242,846 | 14,587 | 2.58 | ||||||||||||||||||

| Overnight advances | 8,793 | 125 | 5.66 | 3,478 | 50 | 5.70 | ||||||||||||||||||

| Other borrowings | 396,739 | 4,656 | 4.67 | 382,500 | 4,347 | 4.51 | ||||||||||||||||||

| Total interest-bearing liabilities | 2,620,699 | 23,610 | 3.58 | 2,628,824 | 18,984 | 2.87 | ||||||||||||||||||

| Checking deposits | 1,146,274 | 1,225,052 | ||||||||||||||||||||||

| Other liabilities | 36,805 | 38,123 | ||||||||||||||||||||||

| 3,803,778 | 3,891,999 | |||||||||||||||||||||||

| Stockholders’ equity | 383,262 | 367,772 | ||||||||||||||||||||||

| $ | 4,187,040 | $ | 4,259,771 | |||||||||||||||||||||

| Net interest income (2) | $ | 18,854 | $ | 21,699 | ||||||||||||||||||||

| Net interest spread (2) | 0.64 | % | 1.09 | % | ||||||||||||||||||||

| Net interest margin (2) | 1.89 | % | 2.13 | % | ||||||||||||||||||||

| (1) | The average balances of loans include nonaccrual loans. The average balances of investment securities exclude unrealized gains and losses on available-for-sale securities. | |

| (2) | Tax-equivalent basis. Interest income on a tax-equivalent basis includes the additional amount of interest income that would have been earned if the Corporation’s investment in tax-exempt investment securities had been made in investment securities subject to federal income taxes yielding the same after-tax income. The tax-equivalent amount of $1.00 of nontaxable income was $1.27 for each period presented using the statutory federal income tax rate of 21%. | |

NON-GAAP RECONCILIATION

(Unaudited)

The following tables provide supplemental non-GAAP financial measures which management uses internally to help understand, manage, and evaluate our business performance and to help make operating decisions. These supplemental financial measures are not measurements of financial performance under generally accepted accounting principles in the United States (“GAAP”) and, as a result may not be comparable to similarly titled measures of other companies. The Corporation believes that these non-GAAP financial measures are useful to investors and analysts in comparing our performance across reporting periods on a consistent basis. The Corporation also believes the use of these non-GAAP financial measures can facilitate comparison of our operating results to those of our competitors. The following non-GAAP financial measures exclude merger related and branch consolidation expenses:

| Nine Months Ended | Three Months Ended | ||||||||||||||

| 9/30/2024 | 9/30/2023 | 9/30/2024 | 9/30/2023 | ||||||||||||

| (dollars in thousands, except per share data) | |||||||||||||||

| Reconciliation of adjusted net income: | |||||||||||||||

| Net income | $ | 13,832 | $ | 20,180 | $ | 4,599 | $ | 6,800 | |||||||

| Adjustments to net income: | |||||||||||||||

| Merger expenses | 866 | — | 866 | — | |||||||||||

| Branch consolidation expenses | 547 | — | 547 | — | |||||||||||

| Income tax effect of adjustments (1) | (432 | ) | — | (432 | ) | — | |||||||||

| Adjusted net income | $ | 14,813 | $ | 20,180 | $ | 5,580 | $ | 6,800 | |||||||

| Diluted EPS | |||||||||||||||

| Net income | $ | 13,832 | $ | 20,180 | $ | 4,599 | $ | 6,800 | |||||||

| Adjusted net income | 14,813 | 20,180 | 5,580 | 6,800 | |||||||||||

| Dilutive weighted average common shares | 22,607,742 | 22,607,530 | 22,667,323 | 22,656,630 | |||||||||||

| Diluted EPS | $ | 0.61 | $ | 0.89 | $ | 0.20 | $ | 0.30 | |||||||

| Adjusted Diluted EPS | 0.66 | 0.89 | 0.25 | 0.30 | |||||||||||

| ROA and ROE | |||||||||||||||

| Net income | $ | 13,832 | $ | 20,180 | $ | 4,599 | $ | 6,800 | |||||||

| Adjusted net income | 14,813 | 20,180 | 5,580 | 6,800 | |||||||||||

| Average Total Assets | $ | 4,234,770 | $ | 4,240,923 | $ | 4,187,040 | $ | 4,259,771 | |||||||

| Average Total Equity | 378,615 | 370,105 | 383,262 | 367,772 | |||||||||||

| ROA | 0.44 | % | 0.64 | % | 0.44 | % | 0.63 | % | |||||||

| Adjusted ROA | 0.47 | 0.64 | 0.53 | 0.63 | |||||||||||

| ROE | 4.88 | % | 7.29 | % | 4.77 | % | 7.34 | % | |||||||

| Adjusted ROE | 5.23 | 7.29 | 5.79 | 7.34 | |||||||||||

| Efficiency Ratio | |||||||||||||||

| Noninterest expense | $ | 49,506 | $ | 49,252 | $ | 17,451 | $ | 16,164 | |||||||

| Adjustments to noninterest expense: | |||||||||||||||

| Merger expenses | (866 | ) | — | (866 | ) | — | |||||||||

| Branch consolidation expenses | (547 | ) | — | (547 | ) | — | |||||||||

| Adjusted noninterest expense | $ | 48,093 | $ | 49,252 | $ | 16,038 | $ | 16,164 | |||||||

| Net interest income | $ | 55,956 | 67,966 | 18,854 | 21,699 | ||||||||||

| Noninterest income | 8,848 | 3,939 | 3,210 | 2,244 | |||||||||||

| Total revenue | $ | 64,804 | $ | 71,905 | $ | 22,064 | $ | 23,943 | |||||||

| Efficiency Ratio | 76.39 | % | 65.33 | % | 79.09 | % | 67.51 | % | |||||||

| Adjusted Efficiency Ratio | 74.21 | 65.33 | 72.69 | 67.51 | |||||||||||

(1) Adjustments to net income are taxed at the Corporation’s approximate statutory rate.

For More Information Contact:

Janet Verneuille, SEVP and CFO

(516) 671-4900, Ext. 7462

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.