Insider Decision: Steven H Collis Exercises Options At Cencora For $3.12M

A large exercise of company stock options by Steven H Collis, Executive Chairman at Cencora COR was disclosed in a new SEC filing on October 23, as part of an insider exercise.

What Happened: Collis, Executive Chairman at Cencora, exercised stock options for 21,509 shares of COR stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The exercise price of the options was $89.58 per share.

The latest update on Thursday morning shows Cencora shares down by 0.0%, trading at $234.52. At this price, Collis’s 21,509 shares are worth $3,117,514.

Get to Know Cencora Better

Cencora is one of three domestic leading pharmaceutical wholesalers. It sources and distributes branded, generic, and specialty pharmaceutical products to pharmacies (retail chains, independent, and mail order), hospital networks, and healthcare providers. It and McKesson and Cardinal Health constitute over 90% of the us pharmaceutical wholesale industry. Cencora also provides commercialization services for manufacturers of pharmaceuticals and medical devices, global specialty drug logistics (World Courier), and animal health product distribution (MWI Animal Health). Cencora expanded its international presence in 2021 by purchasing Alliance Healthcare, one of the leading drug wholesalers in Europe.

Key Indicators: Cencora’s Financial Health

Positive Revenue Trend: Examining Cencora’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.9% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Interpreting Earnings Metrics:

-

Gross Margin: With a low gross margin of 3.25%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Cencora’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 2.44.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 5.11, caution is advised due to increased financial risk.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 25.44 is lower than the industry average, implying a discounted valuation for Cencora’s stock.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.17 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Cencora’s EV/EBITDA ratio stands at 12.75, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cencora’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Colemanite Market Size/Share Worth USD 2.36 Billion by 2033 at a 4.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

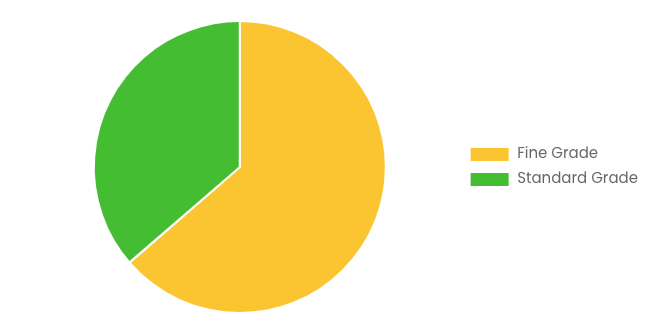

Austin, TX, USA, Oct. 24, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Colemanite Market Size, Trends and Insights By Type (Primary Boron, Sub primary Boron), By Form (Fine Grade, Standard Grade), By Application (Steel Industry, Plastics Industry, Glass Fiber, Other Applications), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

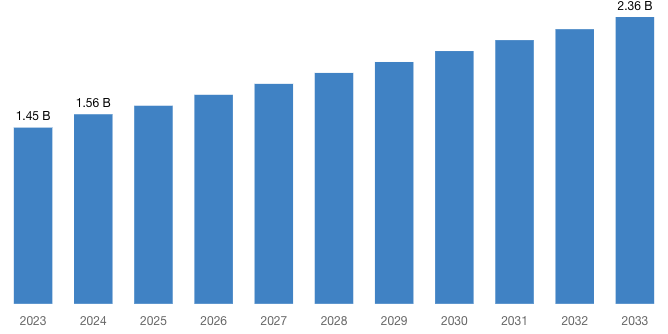

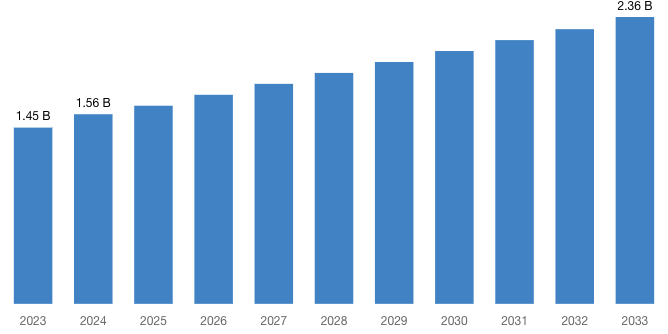

“According to the latest research study, the demand of global Colemanite Market size & share was valued at approximately USD 1.45 Billion in 2023 and is expected to reach USD 1.56 Billion in 2024 and is expected to reach a value of around USD 2.36 Billion by 2033, at a compound annual growth rate (CAGR) of about 4.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Colemanite Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53192

Colemanite Market: Growth Factors and Dynamics

- Rising Demand for Borates: The expanding use of borates in industries such as glass, ceramics, agriculture, and detergents fuels the demand for colemanite, a crucial source of boron. Borates enhance the durability and heat resistance of glass and ceramics and play a vital role in agricultural fertilizers.

- Technological Advancements: Innovations in mining and processing technologies are increasing the efficiency and environmental sustainability of colemanite extraction and refining. These advancements help companies meet strict regulatory requirements and reduce operational costs, boosting colemanite’s competitiveness in the market.

- Sustainable Mining Practices: There is a growing emphasis on sustainable mining practices driven by environmental regulations and corporate social responsibility. Companies are investing in cleaner and more efficient mining techniques to minimize their environmental impact and ensure long-term resource availability.

- Economic Growth in Emerging Markets: Rapid industrialization and urbanization in emerging economies are increasing the demand for borates used in construction materials, household products, and agriculture. This economic growth leads to higher consumption of colemanite-based products.

- Expansion of Production Capacities: Major players in the colemanite market are expanding their production capacities to meet rising global demand. This includes initiating new mining projects, expanding existing facilities, and forming strategic partnerships to improve supply chain capabilities.

Request a Customized Copy of the Colemanite Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=53192

Colemanite Market: Partnership and Acquisitions

- In May 2023, BHP Billiton completed a $9.6 billion acquisition of OZ Minerals, a gold and copper producer, to enhance its presence in the critical metals sector, crucial for the clean energy and electric vehicle industries.

- In 2023, American Pacific Borates Limited (ABR) has actively expanded its operations and market reach through strategic acquisitions and partnerships, focusing on boosting its production capacities to meet growing demand

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1.56 Billion |

| Projected Market Size in 2033 | USD 2.36 Billion |

| Market Size in 2023 | USD 1.45 Billion |

| CAGR Growth Rate | 4.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Form, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Colemanite report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Colemanite report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Colemanite Market Report @ https://www.custommarketinsights.com/report/colemanite-market/

Colemanite Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Colemanite Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disrupted Supply Chains: The pandemic caused significant disruptions in global supply chains due to lockdowns, restrictions on movement, and workforce shortages. This led to delays in the extraction, processing, and transportation of colemanite.

- Reduced Production: Many mining operations faced temporary shutdowns or reduced capacity due to health regulations and safety concerns. This directly affected colemanite production volumes.

- Decreased Demand: The economic downturn and reduced industrial activities during the pandemic led to a decline in demand for colemanite. Industries such as ceramics, glass, and agriculture, which are major consumers of colemanite, experienced a slowdown, impacting overall market demand.

- Logistical Challenges: Restrictions on international trade and transportation created logistical challenges, further complicating the supply and distribution of colemanite across different regions.

- Price Volatility: Supply chain disruptions and fluctuating demand contributed to price volatility in the colemanite market. Uncertainty in production and supply influenced market prices.

- Recovery and Adaptation: As the situation stabilized, industries adapted to new norms with enhanced safety measures, digitalization of operations, and diversification of supply sources. This helped in the gradual recovery and stabilization of the colemanite market.

- Increased Focus on Sustainability: The pandemic highlighted the importance of sustainable and resilient supply chains. There is a growing emphasis on sustainable mining practices and the adoption of eco-friendly technologies in the colemanite market.

In conclusion, while the COVID-19 pandemic posed significant challenges, it also accelerated the need for innovation and sustainability within the colemanite market, shaping its future trajectory.

Request a Customized Copy of the Colemanite Market Report @ https://www.custommarketinsights.com/report/colemanite-market/

Key questions answered in this report:

- What is the size of the Colemanite market and what is its expected growth rate?

- What are the primary driving factors that push the Colemanite market forward?

- What are the Colemanite Industry’s top companies?

- What are the different categories that the Colemanite Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Colemanite market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Colemanite Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/colemanite-market/

Colemanite Market – Regional Analysis

The Colemanite Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: the market is driven by factors such as robust industrial infrastructure, technological advancements, and stringent regulatory standards. The region’s strong presence in industries like steel, plastics, and glass fiber contributes to the demand for colemanite as a fluxing agent, flame retardant, and glass fiber additive, respectively. Additionally, increasing investments in infrastructure development, particularly in the construction sector, further bolster the demand for colemanite-based products.

- Europe: the colemanite market is propelled by factors such as a well-established manufacturing base, emphasis on sustainability, and growing applications in emerging industries. The region’s focus on environmental regulations drives the adoption of colemanite as a sustainable and eco-friendly material in various applications, including agriculture, ceramics, and pharmaceuticals. Moreover, the automotive industry’s demand for lightweight materials and the construction sector’s need for energy-efficient solutions contribute to the growth of colemanite-based products in the region.

- Asia-Pacific: rapid industrialization, urbanization, and infrastructure development are key drivers of the colemanite market. The region’s burgeoning steel, plastics, and construction industries fuel the demand for colemanite as a fluxing agent, flame retardant, and construction material, respectively. Additionally, the growing population and rising disposable incomes drive the demand for consumer goods, further boosting the consumption of colemanite-based products in applications such as plastics and ceramics.

- LAMEA: In LAMEA regions, factors such as increasing construction activities, agricultural expansion, and growing industrialization drive the Colemanite market. The region’s vast agricultural lands create a significant demand for boron-based fertilizers derived from colemanite. Moreover, the construction sector’s focus on sustainable building materials and the automotive industry’s demand for lightweight components contribute to the growth of colemanite-based products in the region.

Request a Customized Copy of the Colemanite Market Report @ https://www.custommarketinsights.com/report/colemanite-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Colemanite Market Size, Trends and Insights By Type (Primary Boron, Sub primary Boron), By Form (Fine Grade, Standard Grade), By Application (Steel Industry, Plastics Industry, Glass Fiber, Other Applications), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/colemanite-market/

List of the prominent players in the Colemanite Market:

- Eti Maden

- Rio Tinto Borates

- American Borate Company

- Boron Specialist

- Minera Santa Rita SRL

- Boron Molecular Pty Ltd

- Sociedad Industrial Tierra S.A.

- Quiborax

- Inkabor

- Orocobre Limited

- Erin Ventures Inc.

- Gulf Resources Inc.

- Mitsui & Co. Ltd.

- RUSAL

- Balkan Mining and Minerals Ltd.

- Others

Click Here to Access a Free Sample Report of the Global Colemanite Market @ https://www.custommarketinsights.com/report/colemanite-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Aromatherapy Essential Oils Market: Aromatherapy Essential Oils Market Size, Trends and Insights By Product Type (Essential Oils, Carrier Oils, Blended Oils, Others), By Application (Relaxation and Stress Management, Skin and Hair Care, Pain Relief and Anti-inflammatory, Others), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets and Hypermarkets, Others), By End-Use (Household Consumers, Spa and Wellness Centers, Medical and Healthcare Facilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Synthetic Ethanol Market: Synthetic Ethanol Market Size, Trends and Insights By Feedstock (Starch, Sugar, Cellulose Based, Others), By Application (Fuel & Fuel Additives, Industrial Solvents, Beverages, Disinfectant, Personal Care, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Building Insulation Market: US Building Insulation Market Size, Trends and Insights By Type (Mineral Wool, Glass Wool, Stone Wool, Foamed Plastics, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Polyurethane (PU), Polyisocyanurate (PIR), Other, Fiberglass, Cellulose, Aerogels, Others), By Application (Floor Basement, Wall, Roof Ceiling), By End User (Residential, Non-Residential, Industrial, Commercial, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Acoustic Ceiling Tiles Market: Acoustic Ceiling Tiles Market Size, Trends and Insights By Type (Mineral Wool Ceiling Tiles, Metal Ceiling Tiles, Gypsum Ceiling Tiles, Wood Ceiling Tiles, Others), By Application (Commercial Buildings, Educational Institutions, Healthcare Facilities, Industrial Settings, Others), By End User (Architects and Interior Designers, Building Contractors, Facility Managers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

North America Spoolable Pipe Market: North America Spoolable Pipe Market Size, Trends and Insights By Product Type (Flexible Spoolable Pipe, Rigid Spoolable Pipe), By Reinforcement Type (Fiber Reinforcement, Glass Reinforcement, Carbon Reinforcement, Other Reinforcement, Steel Reinforcement, Hybrid Reinforcement), By Application (Onshore, Production and Gathering Lines, Injection Pipes, Disposal Lines, Others, Offshore, Flowlines, Jumpers, Others, Downhole, Water, Others), By End User (Oil & Gas, Municipalities, Mining, Chemical & Petrochemical, Food Processing, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Building Insulation Market: Europe Building Insulation Market Size, Trends and Insights By Type (Mineral Wool, Glass Wool, Stone Wool, Foamed Plastics, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Polyurethane (PU), Polyisocyanurate (PIR), Other, Fiberglass, Cellulose, Aerogels, Others), By Application (Floor Basement, Wall, Roof Ceiling), By End User (Residential, Non-Residential, Industrial, Commercial, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Commercial Flooring Market: US Commercial Flooring Market Size, Trends and Insights By Product Type (Carpet, Vinyl, Tile, Laminate, Wood, Stone), By Application (Healthcare, Education, Retail, Office, Hospitality, Industrial), By Material (Synthetic, Natural), By End Use (Renovation, New Construction), By Sales Channel (Direct, Distributors, Online), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Aerosol Disinfectants Market: Aerosol Disinfectants Market Size, Trends and Insights By Product Category (Plain, Scented), By Sale Channels (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Others), By Application (Residential, Commercial, Industrial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Colemanite Market is segmented as follows:

By Type

- Primary Boron

- Sub primary Boron

By Form

By Application

- Steel Industry

- Plastics Industry

- Glass Fiber

- Other Applications

Click Here to Get a Free Sample Report of the Global Colemanite Market @ https://www.custommarketinsights.com/report/colemanite-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Colemanite Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Colemanite Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Colemanite Market? What Was the Capacity, Production Value, Cost and PROFIT of the Colemanite Market?

- What Is the Current Market Status of the Colemanite Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Colemanite Market by Considering Applications and Types?

- What Are Projections of the Global Colemanite Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Colemanite Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Colemanite Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Colemanite Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Colemanite Industry?

Click Here to Access a Free Sample Report of the Global Colemanite Market @ https://www.custommarketinsights.com/report/colemanite-market/

Reasons to Purchase Colemanite Market Report

- Colemanite Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Colemanite Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Colemanite Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Colemanite Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Colemanite market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Colemanite Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/colemanite-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Colemanite market analysis.

- The competitive environment of current and potential participants in the Colemanite market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Colemanite market should find this report useful. The research will be useful to all market participants in the Colemanite industry.

- Managers in the Colemanite sector are interested in publishing up-to-date and projected data about the worldwide Colemanite market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Colemanite products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Colemanite Market Report @ https://www.custommarketinsights.com/report/colemanite-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Colemanite Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/colemanite-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Miners Crippled by Costs Risk Losing Out on Bullion’s Boom

(Bloomberg) — Gold prices are at record highs. But disappointing results at the world’s largest miner of the yellow metal signals companies may be struggling to capitalize on sizzling demand.

Most Read from Bloomberg

Newmont Corp. shares plunged the most in more than 25 years, tumbling 15% after the Denver-based company posted earnings, revenue and profit margins that fell short of analysts’ estimates in the third quarter, dragged down by higher costs for labor, diesel and other operating expenses. Top rivals Barrick Gold Corp. and Agnico Eagle Mines Ltd. also saw their shares drop.

Analysts had high hopes for the industry, with gold among the best-performing commodities this year, surging more than 30% on the outlook for lower interest rates and geopolitical turmoil. But Newmont’s results revealed that big gold producers are still wrestling with inflationary pressures, especially regarding labor costs, that have lasted longer than expected.

“There’s a potential read-through here, assuming Newmont’s takeaways are accurate, that this is a risk factor for the industry,” said Josh Wolfson, a mining analyst with Royal Bank of Canada.

Newmont earned 80 cents a share, well short of the average estimate of 89 cents among analysts surveyed by Bloomberg. Revenue of $4.61 billion also trailed estimates, as did its gross profit margin, which slipped below 50%.

The company said it spent more to dig up the precious metal at its mines in Australia, Canada, Peru and Papua New Guinea than in the previous quarter. Capital expenses rose 10% due to expansion projects in Australia and Argentina, while some of the company’s highest expenses came from major assets it picked up through last year’s $15 billion takeover of Newcrest Mining Ltd.

Some of those cost issues are specific to the company, and not necessarily indicative of a broader industry trend. Newmont is undertaking costly maintenance work at its Lihir mine in Papua New Guinea — a notoriously complex operation in a remote region — and it spent more to re-start its Cerro Negro mine in Argentina after operations were paused due to the deaths of two workers in April.

But the company’s growing costs for workers could signal trouble across the industry.

“It’s the labor costs where we’re seeing that escalation,” Chief Executive Officer Tom Palmer told analysts in a conference call Thursday.

Massive Insider Trade At Kinder Morgan

On October 23, a recent SEC filing unveiled that C. Park Shaper, Director at Kinder Morgan KMI made an insider sell.

What Happened: Shaper’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday unveiled the sale of 900,000 shares of Kinder Morgan. The total transaction value is $22,263,481.

As of Thursday morning, Kinder Morgan shares are up by 0.59%, currently priced at $24.91.

Discovering Kinder Morgan: A Closer Look

Kinder Morgan is one of the largest midstream energy firms in North America, with an interest in or an operator on about 82,000 miles in pipelines and 139 storage terminals. The company is active in the transportation, storage, and processing of natural gas, crude oil, refined products, natural gas liquids, and carbon dioxide. The majority of Kinder Morgan’s cash flows stem from fee-based contracts for handling, moving, and storing fossil fuel products.

Understanding the Numbers: Kinder Morgan’s Finances

Revenue Growth: Kinder Morgan’s revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 3.56%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Energy sector.

Key Profitability Indicators:

-

Gross Margin: With a high gross margin of 56.45%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Kinder Morgan’s EPS reflects a decline, falling below the industry average with a current EPS of 0.28.

Debt Management: Kinder Morgan’s debt-to-equity ratio is below the industry average. With a ratio of 1.05, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 21.92 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 3.63 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Kinder Morgan’s EV/EBITDA ratio stands at 13.1, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: Above industry benchmarks, the company’s market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Kinder Morgan’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Breaking Update: Nicholas M. Westfall Engages In Options Exercise At Chemed

A large exercise of company stock options by Nicholas M. Westfall, Executive Vice President at Chemed CHE was disclosed in a new SEC filing on October 23, as part of an insider exercise.

What Happened: In an insider options sale disclosed in a Form 4 filing on Wednesday with the U.S. Securities and Exchange Commission, Westfall, Executive Vice President at Chemed, exercised stock options for 0 shares of CHE. The transaction value amounted to $0.

As of Thursday morning, Chemed shares are up by 0.27%, with a current price of $594.75. This implies that Westfall’s 0 shares have a value of $0.

Delving into Chemed’s Background

Chemed Corp operates subsidiaries in two main segments: VITAS and Roto-Rooter. The VITAS segment generates the majority of the firm’s revenue. It provides hospice and palliative care services to patients with terminal illnesses through a network of physicians, registered nurses, home health aides, social workers, and volunteers. The vast majority of the segment’s revenue is received from the Medicare and Medicaid reimbursement programs. The Roto-Rooter segment provides plumbing, drain cleaning, water restoration, and related services to residential and commercial customers. Chemed generates the majority of its revenue from business in the United States.

Chemed’s Financial Performance

Revenue Growth: Chemed displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 7.6%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: The company maintains a high gross margin of 34.59%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Chemed’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 4.7.

Debt Management: Chemed’s debt-to-equity ratio is below the industry average at 0.12, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: Chemed’s P/E ratio of 30.06 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 3.88, Chemed’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 19.54, Chemed presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Understanding Crucial Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Chemed’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prospects of a Trump win and huge tariffs spark worst sell-off for emerging market stocks in 10 months

-

Emerging markets stocks are set for their worst monthly decline since January.

-

The slump comes as investors price in higher odds of a Trump win in the upcoming US election.

-

Trump has pledged to drastically raise import tariffs to as high as 20%, and up to 60% for China.

It’s been a tough month for emerging market stocks as the odds of a Donald Trump election win rise — and with it, the odds that his proposed tariff plan will actually see the light of day.

Emerging market stocks are headed for their worst monthly decline since January, with the MSCI Emerging Markets Index falling for a fourth day on Thursday for a 3.1% decline this month.

A select few EM stocks have taken the biggest hits, with Samsung, Alibaba, Tencent, and Meituan accounting for more than half of the index’s fall.

The decline comes as the market prices in higher odds of a win for former President Donald Trump with just two weeks until the election.

On crypto betting market Polymarket, Trump’s odds of winning soared as high as to 66% on Tuesday, their highest since President Joe Biden was still in the race in July. Odds are now slightly lower at 62%.

Polls, meanwhile, are much closer, with the most recent national polling average compiled by RealClearPolitics showing Harris at 48.7% versus 48.5% for Trump.

Trump has proposed raising tariffs on imports from all countries to as high as 20% and has said imports from China would be subject to a 60% tariff.

Investors’ fears of a damaging trade war aren’t unfounded. In 2018, Trump’s trade war with China led to a significant underperformance compared to US stocks, and strategists say the election’s outcome is again pushing investors away from EM shares as uncertainty builds.

“US elections have become a key driver of uncertainty as risk positioning is clearly fluctuating to a more cautious stance. In our recent client interactions, we have sensed global EM investors’ appetite to increase risk budgets over the next weeks may have been significantly reduced,” analysts from Citi wrote in a note last week.

The strategists note that the latest sentiment is a sharp contrast from a month ago, when investors were pricing in higher odds of a Harris win.

“There has been a significant change in investor sentiment, and investors’ risk budgets have likely been changing as a function of that.”

Other factors, like rising geopolitical tensions in the Middle East and a bond market sell-off, are also driving investors away from riskier assets. Investors are also expressing disappointment in China’s stimulus measures, which initially fueled a rally in EM stocks last month.

Read the original article on Business Insider

Ask an Advisor: We're 65, Have $1 Million, and Want to Live on $90K a Year. Is That Feasible?

My wife and I are both 65 years old. She will retire this year and I’ll work until I’m 67. We’ll get about $42,000 in Social Security and have about $1 million in savings. Can we live on $90,000 per year?

-Terry

$90,000 per year is going to be pushing the upper limit of what I’d be comfortable with as a general rule. Whether it will work for you, however, is highly individualized. I’ll give you an overview of some of the things you’ll want to look into before deciding if you are comfortable with spending $90,000 per year. (And if you need more help planning for retirement, consider working with a financial advisor.)

Does Your Expense Number Include Taxes?

Will the $90,000 you expect to spend each year cover your annual tax bill or is that how much money you plan to spend after taxes? The answer to this question is vital. If it’s the latter, you’ll need to withdraw even more of your savings each year, further stressing the longevity of your portfolio.

Whether your savings are held in a tax-deferred, Roth or taxable account matters. I assume your money is mostly tax-deferred, meaning it’s held in 401(k)s and IRAs. You’ll have to account for income taxes that you’ll owe when you start withdrawing that money. If a considerable portion of your assets is in Roth accounts, your distributions are tax-free, which will simply the process. (And if you want more help managing your retirement savings, consider matching with a financial advisor.)

What’s Your Investment Plan and Risk Tolerance?

You need to invest according to your own risk tolerance. But if your portfolio is too conservative or aggressive it will place additional strain on your savings.

-

If you and your wife are especially conservative that will likely inhibit your ability to keep up with that level of spending over time.

-

If you’re too aggressive, you may expose yourself to too much volatility, which can also wreck a retiree’s portfolio once withdrawals start.

The 60/40 portfolio has historically been so popular with retirees because it leaves them with enough equity to benefit from the long-term growth that’s often required for a decades-long retirement without too much volatility. It’s not right for everybody, but the point is that if your entire balance is in CDs, for example, your money likely won’t grow fast enough. The opposite is true for a 100% stock portfolio. It’s too volatile and one or two bad market years, especially early on, could be catastrophic. (A financial advisor can help you find the right mix of stocks, bonds and other investments for your risk tolerance.)

Here's How Much $100 Invested In Stryker 10 Years Ago Would Be Worth Today

Stryker SYK has outperformed the market over the past 10 years by 4.01% on an annualized basis producing an average annual return of 15.33%. Currently, Stryker has a market capitalization of $137.55 billion.

Buying $100 In SYK: If an investor had bought $100 of SYK stock 10 years ago, it would be worth $418.78 today based on a price of $360.95 for SYK at the time of writing.

Stryker’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.