Dycom Industries, Inc. Announces Fiscal 2025 Third Quarter Results

Third Quarter Highlights

- Contract revenues increased 12.0% to $1.272 billion

- Non-GAAP Adjusted EBITDA increased to $170.7 million, or 13.4% of contract revenues

- Non-GAAP Adjusted Net Income increased to $79.2 million, or $2.68 per common share diluted

PALM BEACH GARDENS, Fla., Nov. 20, 2024 (GLOBE NEWSWIRE) — Dycom Industries, Inc. DY announced today its results for the third quarter ended October 26, 2024. Contract revenues increased 12.0% to $1.272 billion for the quarter ended October 26, 2024, compared to $1.136 billion in the year ago quarter. On an organic basis, contract revenues increased 7.6% after excluding revenues from acquired businesses that were not owned for the entirety of both the current and prior year quarters, revenues from storm restoration services in the current quarter, and revenue from a change order and project closeout in the prior year quarter.

Non-GAAP Adjusted EBITDA increased to $170.7 million, or 13.4% of contract revenues, for the quarter ended October 26, 2024, compared to $143.2 million, or 12.9% of contract revenues, in the year ago quarter. Non-GAAP Adjusted EBITDA for the quarter ended October 28, 2023 excludes $23.6 million, or 1.8% of contract revenues, of incremental benefit in EBITDA from the impacts of a change order and the closeout of several projects reported in the prior year quarter.

On a GAAP basis, net income was $69.8 million, or $2.37 per common share diluted, for the quarter ended October 26, 2024, compared to $83.7 million, or $2.82 per common share diluted, in the prior year quarter. Non-GAAP Adjusted Net Income increased to $79.2 million, or $2.68 per common share diluted for the quarter ended October 26, 2024, compared to $66.3 million, or $2.23 per common share diluted, in the prior year quarter. Non-GAAP Adjusted Net Income for the quarter ended October 28, 2023 excludes $17.5 million, or $0.59 per common share diluted, of after-tax benefit from the impacts of a change order and the closeout of several projects reported in the prior year quarter.

Year-to-Date Highlights

Contract revenues increased 12.2% to $3.617 billion for the nine months ended October 26, 2024, compared to $3.223 billion in the year ago period. On an organic basis, contract revenues increased 6.4% after excluding revenues from acquired businesses that were not owned for the entirety of both the current and prior year periods, revenues from storm restoration services in the current period, and revenue from a change order and project closeout in the prior year period.

Non-GAAP Adjusted EBITDA increased to $460.0 million, or 12.7% of contract revenues, for the nine months ended October 26, 2024, compared to $387.5 million, or 12.1% of contract revenues, in the year ago period. Non-GAAP Adjusted EBITDA for the nine months ended October 28, 2023 excludes $23.6 million, or 0.7% of contract revenues, of incremental benefit in EBITDA from the impacts of a change order and the closeout of several projects reported in the prior year period.

On a GAAP basis, net income increased to $200.7 million, or $6.81 per common share diluted, for the nine months ended October 26, 2024, compared to $195.5 million, or $6.58 per common share diluted, in the year ago period. Non-GAAP Adjusted Net Income increased to $214.2 million, or $7.26 per common share diluted for the nine months ended October 26, 2024, compared to $178.0 million, or $5.99 per common share diluted, in the year ago period. Non-GAAP Adjusted Net Income for the nine months ended October 28, 2023 excludes $17.5 million, or $0.59 per common share diluted, of after-tax benefit from the impacts of a change order and the closeout of several projects reported in the prior year period.

During the nine months ended October 26, 2024, the Company purchased 210,000 shares of its own common stock in open market transactions for $29.8 million at an average price of $141.84 per share.

Outlook

For the quarter ending January 25, 2025, the Company expects total contract revenues to increase mid- to high single digit as a percentage of contract revenues, compared to $952.5 million for the quarter ended January 27, 2024. Included in the expectation for the quarter ending January 25, 2025 is approximately $35 million of revenues from acquired businesses not owned for the entirety of both the current and prior year quarters. For comparison purposes, there were no acquired revenues from these businesses in the quarter ended January 27, 2024. Non-GAAP Adjusted EBITDA as a percentage of contract revenues for the quarter ending January 25, 2025 is expected to increase approximately 25 basis points, compared to 9.8% in the quarter ended January 27, 2024.

For additional information regarding the Company’s outlook, please see the presentation materials available on the Company’s website posted in connection with the conference call discussed below.

Use of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, the Company may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. See Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Financial Measures in the press release tables that follow.

Conference Call Information and Other Selected Data

The Company will host a conference call to discuss fiscal 2025 third quarter results on Wednesday, November 20, 2024 at 9:00 a.m. ET. Interested parties may participate in the question and answer session of the conference call by registering at https://register.vevent.com/register/BI23ce626113c940d8b42fa7eec38956e3. Upon registration, participants will receive a dial-in number and unique PIN to access the call. Participants are encouraged to join approximately ten minutes prior to the scheduled start time.

For all other attendees, a live listen-only audio webcast of the call, including an accompanying slide presentation, can be accessed directly at https://edge.media-server.com/mmc/p/uah4hfjv. A replay of the live webcast and the related materials will be available on the Company’s Investor Center website at https://dycomind.com/investors for approximately 120 days following the event.

About Dycom Industries, Inc.

Dycom is a leading provider of specialty contracting services to the telecommunications infrastructure and utility industries throughout the United States. These services include program management; planning; engineering and design; aerial, underground, and wireless construction; maintenance; and fulfillment services. Additionally, Dycom provides underground facility locating services for various utilities, including telecommunications providers, and other construction and maintenance services for electric and gas utilities.

Forward Looking Information

This press release contains forward-looking statements within the meaning of the 1995 Private Securities Litigation Reform Act. These forward-looking statements include those related to the outlook for the quarter ending January 25, 2025, including, but not limited to, those statements found under the “Outlook” section of this press release. Forward-looking statements are based on management’s expectations, estimates and projections, are made solely as of the date these statements are made, and are subject to both known and unknown risks and uncertainties that may cause the actual results and occurrences discussed in these forward-looking statements to differ materially from those referenced or implied in the forward-looking statements contained in this press release. The most significant of these known risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) and include future economic conditions and trends including the potential impacts of an inflationary economic environment, changes to customer capital budgets and spending priorities, the availability and cost of materials, equipment and labor necessary to perform our work, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, the future impact of any acquisitions or dispositions, adjustments and cancellations of the Company’s projects, the impact to the Company’s backlog from project cancellations or postponements, the impacts of pandemics and public health emergencies, the impact of varying climate and weather conditions, the anticipated outcome of other contingent events, including litigation or regulatory actions involving the Company, the adequacy of our liquidity, the availability of financing to address our financials needs, the Company’s ability to generate sufficient cash to service its indebtedness, the impact of restrictions imposed by the Company’s credit agreement, and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update its forward-looking statements.

For more information, contact:

Callie Tomasso, Vice President Investor Relations

Email: investorrelations@dycomind.com

Phone: (561) 627-7171

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES | |||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||

| (Dollars in thousands) | |||||

| Unaudited | |||||

| October 26, 2024 | January 27, 2024 | ||||

| ASSETS | |||||

| Current assets: | |||||

| Cash and equivalents | $ | 15,269 | $ | 101,086 | |

| Accounts receivable, net | 1,661,293 | 1,243,256 | |||

| Contract assets | 60,963 | 52,211 | |||

| Inventories | 115,973 | 108,565 | |||

| Income tax receivable | — | 2,665 | |||

| Other current assets | 43,321 | 42,253 | |||

| Total current assets | 1,896,819 | 1,550,036 | |||

| Property and equipment, net | 514,858 | 444,909 | |||

| Operating lease right-of-use assets | 107,924 | 76,348 | |||

| Goodwill and other intangible assets, net | 560,043 | 420,945 | |||

| Other assets | 35,051 | 24,647 | |||

| Total assets | $ | 3,114,695 | $ | 2,516,885 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||

| Current liabilities: | |||||

| Accounts payable | $ | 241,007 | $ | 222,121 | |

| Current portion of debt | 5,000 | 17,500 | |||

| Contract liabilities | 58,885 | 39,122 | |||

| Accrued insurance claims | 49,614 | 44,466 | |||

| Operating lease liabilities | 34,752 | 32,015 | |||

| Income taxes payable | 23,557 | 3,861 | |||

| Other accrued liabilities | 195,660 | 147,219 | |||

| Total current liabilities | 608,475 | 506,304 | |||

| Long-term debt | 1,092,789 | 791,415 | |||

| Accrued insurance claims – non-current | 51,227 | 49,447 | |||

| Operating lease liabilities – non-current | 72,946 | 44,110 | |||

| Deferred tax liabilities, net – non-current | 31,682 | 49,562 | |||

| Other liabilities | 23,898 | 21,391 | |||

| Total liabilities | 1,881,017 | 1,462,229 | |||

| Total stockholders’ equity | 1,233,678 | 1,054,656 | |||

| Total liabilities and stockholders’ equity | $ | 3,114,695 | $ | 2,516,885 | |

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES | |||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||

| (Dollars in thousands, except share amounts) | |||||||||||||||

| Unaudited | |||||||||||||||

| Quarter | Quarter | Nine Months | Nine Months | ||||||||||||

| Ended | Ended | Ended | Ended | ||||||||||||

| October 26, 2024 | October 28, 2023 |

October 26, 2024 |

October 28, 2023 |

||||||||||||

| Contract revenues | $ | 1,272,007 | $ | 1,136,110 | $ | 3,617,489 | $ | 3,223,119 | |||||||

| Costs of earned revenues, excluding depreciation and amortization | 1,007,412 | 886,662 | 2,881,930 | 2,570,437 | |||||||||||

| General and administrative1 | 110,777 | 87,511 | 304,915 | 254,699 | |||||||||||

| Depreciation and amortization | 52,001 | 42,522 | 143,778 | 117,786 | |||||||||||

| Total | 1,170,190 | 1,016,695 | 3,330,623 | 2,942,922 | |||||||||||

| Interest expense, net | (17,451 | ) | (13,952 | ) | (44,941 | ) | (37,601 | ) | |||||||

| Loss on debt extinguishment2 | — | — | (965 | ) | — | ||||||||||

| Other income, net | 6,926 | 6,906 | 22,595 | 17,628 | |||||||||||

| Income before income taxes | 91,292 | 112,369 | 263,555 | 260,224 | |||||||||||

| Provision for income taxes3 | 21,503 | 28,633 | 62,812 | 64,719 | |||||||||||

| Net income | $ | 69,789 | $ | 83,736 | $ | 200,743 | $ | 195,505 | |||||||

| Earnings per common share: | |||||||||||||||

| Basic earnings per common share | $ | 2.39 | $ | 2.85 | $ | 6.89 | $ | 6.66 | |||||||

| Diluted earnings per common share | $ | 2.37 | $ | 2.82 | $ | 6.81 | $ | 6.58 | |||||||

| Shares used in computing earnings per common share: | |||||||||||||||

| Basic | 29,154,262 | 29,334,798 | 29,121,475 | 29,344,064 | |||||||||||

| Diluted | 29,481,003 | 29,689,316 | 29,489,808 | 29,710,603 | |||||||||||

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES | |||||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO COMPARABLE GAAP FINANCIAL MEASURES |

|||||||||||||||

| (Dollars in thousands) | |||||||||||||||

| Unaudited | |||||||||||||||

| CONTRACT REVENUES, NON-GAAP ORGANIC CONTRACT REVENUES, AND GROWTH % | |||||||||||||||

| Quarter | Quarter | Nine Months | Nine Months | ||||||||||||

| Ended | Ended | Ended | Ended | ||||||||||||

| October 26, 2024 | October 28, 2023 | October 26, 2024 | October 28, 2023 | ||||||||||||

| Contract Revenues – GAAP | $ | 1,272,007 | $ | 1,136,110 | $ | 3,617,489 | $ | 3,223,119 | |||||||

| Contract Revenues – GAAP Growth % | 12.0 | % | 12.2 | % | |||||||||||

| Contract Revenues – GAAP | $ | 1,272,007 | $ | 1,136,110 | $ | 3,617,489 | $ | 3,223,119 | |||||||

| Revenues from acquired businesses, excluding storm restoration services4 | (80,117 | ) | (45,225 | ) | (217,267 | ) | (45,225 | ) | |||||||

| Revenues from storm restoration services | (46,312 | ) | — | (46,312 | ) | — | |||||||||

| Impacts of a change order and closeout of several projects6 | — | (26,539 | ) | — | (26,539 | ) | |||||||||

| Non-GAAP Organic Contract Revenues | $ | 1,145,578 | $ | 1,064,346 | $ | 3,353,910 | $ | 3,151,355 | |||||||

| Non-GAAP Organic Contract Revenues Growth % | 7.6 | % | 6.4 | % | |||||||||||

| NET INCOME AND NON-GAAP ADJUSTED EBITDA | |||||||||||||||

| Quarter | Quarter | Nine Months | Nine Months | ||||||||||||

| Ended | Ended | Ended | Ended | ||||||||||||

| October 26, 2024 | October 28, 2023 | October 26, 2024 | October 28, 2023 | ||||||||||||

| Reconciliation of net income to Non-GAAP Adjusted EBITDA: | |||||||||||||||

| Net income | $ | 69,789 | $ | 83,736 | $ | 200,743 | $ | 195,505 | |||||||

| Interest expense, net | 17,451 | 13,952 | 44,941 | 37,601 | |||||||||||

| Provision for income taxes | 21,503 | 28,633 | 62,812 | 64,719 | |||||||||||

| Depreciation and amortization | 52,001 | 42,522 | 143,778 | 117,786 | |||||||||||

| Earnings Before Interest, Taxes, Depreciation & Amortization (“EBITDA”) | 160,744 | 168,843 | 452,274 | 415,611 | |||||||||||

| Gain on sale of fixed assets | (8,202 | ) | (8,357 | ) | (28,765 | ) | (23,730 | ) | |||||||

| Stock-based compensation expense | 14,024 | 6,298 | 31,329 | 19,240 | |||||||||||

| Loss on debt extinguishment2 | — | — | 965 | — | |||||||||||

| Acquisition integration costs5 | 4,163 | — | 4,163 | — | |||||||||||

| Non-GAAP Adjusted EBITDA | $ | 170,729 | $ | 166,784 | $ | 459,966 | $ | 411,121 | |||||||

| Non-GAAP Adjusted EBITDA % of contract revenues | 13.4 | % | 14.7 | % | 12.7 | % | 12.8 | % | |||||||

| Non-GAAP Adjusted EBITDA, excluding impacts of a change order and closeout of several projects6 | $ | 170,729 | $ | 143,163 | $ | 459,966 | $ | 387,500 | |||||||

| Contract revenues, excluding impacts of a change order and closeout of several projects6 | $ | 1,272,007 | $ | 1,109,571 | $ | 3,617,489 | $ | 3,196,580 | |||||||

| Non-GAAP Adjusted EBITDA % of contract revenues, excluding impacts of a change order and closeout of several projects6 | 13.4 | % | 12.9 | % | 12.7 | % | 12.1 | % | |||||||

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES | |||||||||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO COMPARABLE GAAP FINANCIAL MEASURES (CONTINUED) |

|||||||||||||

| (Dollars in thousands, except share amounts) | |||||||||||||

| Unaudited | |||||||||||||

| NET INCOME, NON-GAAP ADJUSTED NET INCOME, DILUTED EARNINGS PER COMMON SHARE, AND NON-GAAP ADJUSTED DILUTED EARNINGS PER COMMON SHARE | |||||||||||||

| Quarter | Quarter | Nine Months | Nine Months | ||||||||||

| Ended | Ended | Ended | Ended | ||||||||||

| October 26, 2024 | October 28, 2023 | October 26, 2024 | October 28, 2023 | ||||||||||

| Reconciliation of net income to Non-GAAP Adjusted Net Income: | |||||||||||||

| Net income | $ | 69,789 | $ | 83,736 | $ | 200,743 | $ | 195,505 | |||||

| Pre-Tax Adjustments: | |||||||||||||

| Stock-based compensation modification7 | 7,066 | — | 9,297 | — | |||||||||

| Acquisition integration costs5 | 4,163 | — | 4,163 | — | |||||||||

| Loss on debt extinguishment2 | — | — | 965 | — | |||||||||

| Tax Adjustments: | |||||||||||||

| Tax impact of pre-tax adjustments | (1,868 | ) | — | (969 | ) | — | |||||||

| Total adjustments, net of tax | 9,361 | — | 13,456 | — | |||||||||

| Non-GAAP Adjusted Net Income | $ | 79,150 | $ | 83,736 | $ | 214,199 | $ | 195,505 | |||||

| Non-GAAP Adjusted Net Income, excluding impacts of a change order and closeout of several projects6 | $ | 79,150 | $ | 66,256 | $ | 214,199 | $ | 178,025 | |||||

| Reconciliation of diluted earnings per common share to Non-GAAP Adjusted Diluted Earnings per Common Share: | |||||||||||||

| GAAP diluted earnings per common share | $ | 2.37 | $ | 2.82 | $ | 6.81 | $ | 6.58 | |||||

| Total adjustments, net of tax | 0.31 | — | 0.45 | — | |||||||||

| Non-GAAP Adjusted Diluted Earnings per Common Share | $ | 2.68 | $ | 2.82 | $ | 7.26 | $ | 6.58 | |||||

| Non-GAAP Adjusted Diluted Earnings per Common Share, excluding impacts of a change order and closeout of several projects6 | $ | 2.68 | $ | 2.23 | $ | 7.26 | $ | 5.99 | |||||

| Shares used in computing Non-GAAP Adjusted Diluted Earnings per Common Share | 29,481,003 | 29,689,316 | 29,489,808 | 29,710,603 | |||||||||

| Amounts in table above may not add due to rounding. | |||||||||||||

| DYCOM INDUSTRIES, INC. AND SUBSIDIARIES RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO COMPARABLE GAAP FINANCIAL MEASURES (CONTINUED) |

Explanation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). In the Company’s quarterly results releases, trend schedules, conference calls, slide presentations, and webcasts, it may use or discuss Non-GAAP financial measures, as defined by Regulation G of the Securities and Exchange Commission. The Company believes that the presentation of certain Non-GAAP financial measures in these materials provides information that is useful to investors because it allows for a more direct comparison of the Company’s performance for the period reported with the Company’s performance in prior periods. The Company cautions that Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Management defines the Non-GAAP financial measures used as follows:

- Non-GAAP Organic Contract Revenues – contract revenues from businesses that are included for the entirety of both the current and prior year periods, excluding contract revenues from storm restoration services and certain non-recurring items. Non-GAAP Organic Contract Revenue change percentage is calculated as the change in Non-GAAP Organic Contract Revenues from the comparable prior year period divided by the comparable prior year period Non-GAAP Organic Contract Revenues. Management believes Non-GAAP Organic Contract Revenues is a helpful measure for comparing the Company’s revenue performance with prior periods.

- Non-GAAP Adjusted EBITDA – net income before interest, taxes, depreciation and amortization, gain on sale of fixed assets, stock-based compensation expense, and certain non-recurring items. Management believes Non-GAAP Adjusted EBITDA is a helpful measure for comparing the Company’s operating performance with prior periods as well as with the performance of other companies with different capital structures or tax rates.

- Non-GAAP Adjusted Net Income – GAAP net income before certain non-recurring items and the related tax impact. Management believes Non-GAAP Adjusted Net Income is a helpful measure for comparing the Company’s operating performance with prior periods.

- Non-GAAP Adjusted Diluted Earnings per Common Share – Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding.

Management excludes or adjusts each of the items identified below from Non-GAAP Adjusted EBITDA, Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share:

- Stock-based compensation modification – During the quarter ended July 27, 2024, the Company announced its CEO succession plan and transition. In connection with this transition, the Company incurred stock-based compensation modification expense. The Company excludes the impact of the modification because the Company believes it is not indicative of its underlying results or ongoing operations.

- Loss on debt extinguishment – Loss on debt extinguishment includes the write-off of deferred financing fees in connection with the amendment of the Company’s credit agreement during the quarter ended July 27, 2024. Management believes excluding the loss on debt extinguishment from the Company’s Non-GAAP financial measures assists investors’ overall understanding of the Company’s current financial performance and provides management with a consistent measure for assessing the current and historical financial results.

- Acquisition integration costs – The Company incurred costs of approximately $4.2 million in connection with the integration of a business acquired during the quarter ended October 26, 2024. The exclusion of the acquisition integration costs from the Company’s Non-GAAP financial measures provides management with a consistent measure for assessing financial results.

- Tax impact of pre-tax adjustments – The tax impact of pre-tax adjustments reflects the Company’s estimated tax impact of specific adjustments and the effective tax rate used for financial planning for the applicable period.

Notes

1 Includes stock-based compensation expense of $14.0 million and $6.3 million for the quarters ended October 26, 2024 and October 28, 2023, respectively, and $31.3 million and $19.2 million for the nine months ended October 26, 2024 and October 28, 2023, respectively.

2 During the nine months ended October 26, 2024, the Company recognized a loss on debt extinguishment of approximately $1.0 million in connection with the amendment of its credit agreement.

3 Provision for income taxes includes benefits resulting from the vesting and exercise of share-based awards of approximately $3.9 million and less than $0.1 million for the quarters ended October 26, 2024 and October 28, 2023, respectively, and approximately $9.9 million and $2.9 million for the nine months ended October 26, 2024 and October 28, 2023, respectively.

4 Amounts represent contract revenues from acquired businesses that were not owned for the entirety of both the current and prior year periods, excluding contract revenues from storm restoration services, when applicable.

5 The Company incurred costs of approximately $4.2 million in connection with the integration of a business acquired during the quarter ended October 26, 2024.

6 The impacts of a change order and the closeout of several projects increased contract revenues by $26.5 million for the quarter and nine months ended October 28, 2023. After the impacts of certain other costs, these items contributed $23.6 million to Adjusted EBITDA for the quarter and nine months ended October 28, 2023. As a result, reported Adjusted EBITDA was increased by 1.8% and 0.7% as a percentage of contract revenues, for the quarter and nine months ended October 28, 2023, respectively. On an after-tax basis, these items contributed approximately $17.5 million to reported net income, or $0.59 per common share diluted for the quarter and nine months ended October 28, 2023.

7 In connection with the Company’s CEO succession plan and transition announced in June 2024, the Company will incur approximately $11.4 million of stock-based compensation modification expense through the current CEO’s retirement date of November 30, 2024 related to previously issued equity awards. Of this total, approximately $7.1 million and $9.3 million was recognized during the quarter and nine months ended October 26, 2024, respectively.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NBA Legend Shaq Agrees To Pay $11M In Astrals NFT Lawsuit

NBA legend Shaquille O’Neal, known popularly as Shaq, has consented to a $11 million settlement in a class-action lawsuit tied to his promotion of the Astrals non-fungible token (NFT) project.

What Happened: After a year of legal wrangling, O’Neal agreed to the compensation to have the lawsuit dismissed, The Block reported Tuesday.

At the center of the lawsuit is a collection of 10,000 NFT 3D avatars based on Solana SOL/USD and a decentralized autonomous organization for incubating innovative projects.

Why It Matters: The suit alleged that O’Neal, who was the face of Astrals, used his celebrity influence to encourage investors to purchase the NFTs. The lawsuit further claimed that O’Neal abandoned the project following the collapse of the cryptocurrency exchange FTX, causing a significant drop in the value of the NFTs.

The plaintiffs claimed that O’Neal was aware of potential regulatory concerns surrounding the selling of unregistered securities but still promoted them to expand his cryptocurrency business.

Earlier in August, the U.S. District Court for the Southern District of Florida, Miami Division, dismissed the claim that O’Neal was a “control person,” but upheld the allegation that Astrals sold “unregistered securities.”

Price Action: The floor price of Astrals NFT rose 115% in the last 24 hours to 0.153 SOL, or $36.39 at current market prices, as per NFT marketplace Magic Eden.

The NFT market recorded an 85% jump in sales volume for the week ending Nov. 17, as per the NFT market tracking platform CryptoSlam, coinciding with the gains in Bitcoin BTC/USD and the broader cryptocurrency market.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Target CEO 'guiding for some conservatism' as the retailer misses earnings estimates ahead of the holidays

A few months after suggesting a sales turnaround is afoot, Target (TGT) has offered up an earnings day misfire from start to finish.

On Wednesday, the retail giant badly missed third quarter Wall Street profit forecasts, slashed full-year guidance after raising it the previous quarter, and took a cautious stance on holiday sales and profit.

Its shares sank 16% in premarket trading on the heels of the release of its quarterly results.

By contrast, its rival Walmart (WMT) beat expectations again — significantly — with its quarterly same-store sales performance, online sales growth, and overall narrative to investors. Target has been slashing prices on food and other everyday essentials this year in a bid to compete.

On a call with reporters, Target execs offered up little explanation for the U-turn in results, except to note that consumers are spending “cautiously” in more discretionary departments such as home goods. The company also felt the brunt of unplanned costs in its supply chain as it added more inventory than it sold in the quarter — never a recipe for success for a retailer.

Target’s veteran chairman and CEO Brian Cornell told Yahoo Finance it has the “appropriate approach” for the holiday season but is “guiding for some conservatism.”

Read more: What’s Macy’s CEO Tony Spring said about holidays at Yahoo Finance’s Invest conference

Cornell added the holiday shopping season is off to a “really good start” but acknowledged the biggest days are ahead of it. Walmart CFO John David Rainey told Yahoo Finance on Tuesday it has seen a brisk start to the holiday shopping season.

Target stock was up 9% year to date ahead of the results, lagging the S&P 500’s 24% advance. Walmart’s stock was up a cool 64% on the year.

“The stock seems constrained in the near term given the uncertainty of the holiday, in which Target faces headwinds from a promotionally/event-driven consumer and likely acutely benefitted, relative to other retailers, from the beneficial calendar a year ago (now a headwind), along with tariffs,” JPMorgan analyst Christopher Horvers wrote in a client note.

Horvers added, “Like they do so very often for retailers, comparable sales and gross margin matter, with the former a relatively low bar and the latter a high bar. Given uncertainty and share losses, we see Target as unlikely to roll forward to 2026 valuation anytime soon.”

Here’s what Target reported for the third quarter, compared to Wall Street analyst estimates compiled by Bloomberg:

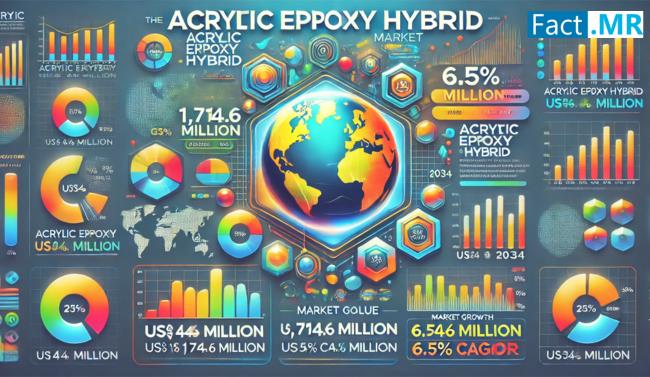

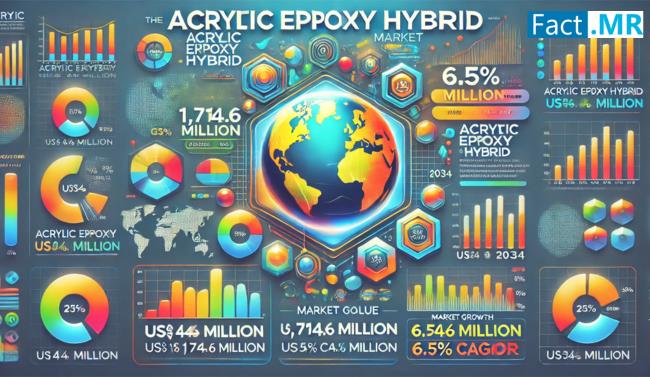

Acrylic Epoxy Hybrid Market is Predicted to Reach US$ 1,714.6 Million by 2034, Expanding at a CAGR of 6.5% | Fact.MR

Rockville, MD, Nov. 20, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global acrylic epoxy hybrid market was valued at US$ 913.4 million in 2024 and is projected to grow at a CAGR of 6.5% to end up at US$ 1,714.6 million by 2034.

Acrylic epoxy hybrid market is one of the fastest-growing markets presently, due to increasing demand emanating from various end-use sectors, especially construction, automotive, and industrial coatings. The state-of-the-art coating technology combines superior durability and chemical resistance associated with epoxy and the acrylics’ weather resistance and aesthetic appeal, thus offering a multi-dimensional product to meet a wide range of market demands. The construction sector remains the most prominent end-user of acrylic epoxy hybrids, as these coatings are used to protect concrete, apply that is applied to flooring, and finished buildings. The market dynamics are also influenced by growing environmental regulations and changing consumer preferences for eco-friendly coating solutions. Such factors have persuaded manufacturers to introduce innovations by formulating low-VOC and water-based acrylic epoxy hybrids, which enjoy significant acceptance in relatively more developed markets. The Asia-Pacific region leads in market growth, while China and India are the main growth drivers due to rapid industrialization and large-scale infrastructure development projects.

Advances in technology in the polymer science field have enabled value formulations with improved adhesion, faster curing times, and other performance characteristics. This, in turn, has expanded the applications of acrylic epoxy hybrids in specialized industries such as marine coatings and aerospace. The market also continues to benefit from an increase in renovation and refurbishment projects in developed economies, where such coatings are preferred for their durability and attractiveness.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10453

Key Takeaways from Market Study

Key Takeaways from Market Study

- The global acrylic epoxy hybrid market is projected to grow at 6.5% CAGR and reach US$ 1,714.6 million by 2034

- The market created an opportunity of US$ 801.2 million between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 34.9% in 2024

- Acrylic modified epoxy segment is estimated to grow at a CAGR of 6.6% creating an absolute $ opportunity of US$ 442.1 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 499.9 million collectively

“Anchoring performance with sustainability, the ingredients have gained success in the marketplace. All investors should pay attention to the emerging opportunities brought on by sustainable formulation and Asia-Pacific expansion-even with possible challenges such as raw material costs.” says a Fact.MR analyst.

Leading Players Driving Innovation in the Acrylic Epoxy Hybrid Market:

BASF SE; Dow Chemical Company; Huntsman Corporation; Covestro AG; AkzoNobel N.V.; PPG Industries, Inc.; Sherwin-Williams Company; RPM International Inc.; Jotun Group; Eastman Chemical Company; Other Prominent Players

“Quality Performance Standards and Innovation Are Priorities in US Industries”

The acrylic epoxy hybrid market in the US is expected to reach a value of US$ 229.5 million in 2024 and grow at a compound annual growth rate (CAGR) of 6.5% until 2034, creating an absolute potential of US$ 201.8 million.

This is explained by elements that fit the US industrial environment, where important sectors are sensitive to quality and innovation. Because the automotive and construction industries need materials that can endure extreme conditions, acrylic epoxy hybrids are useful in terms of adhesion, flexibility, and durability. Producers are therefore compelled to employ cutting-edge hybrid solutions due to strict quality and ecological restrictions. Due of stringent quality control in the US, businesses are compelled to use acrylic epoxy hybrids in order to comply with legal and industrial requirements. This tendency is accelerated by the emphasis on sustainability, as producers create environmentally friendly formulas that satisfy customer preferences and legal requirements.

Manufacturers can provide customized solutions that increase the adoption rate of acrylic epoxy hybrid thanks to the United States’ strengths in hybrid formulation R&D. The United States is one of the top markets for these acrylic epoxy hybrids because to strict regulations, high quality standards, and a thriving innovation ecosystem.

Acrylic Epoxy Hybrid Market Industry News:

- In Aug 2024, BASF SE introduced a new eco-friendly acrylic epoxy hybrid targeting industrial coatings with low VOC emissions

- In July 2022, DIC Corporation Acquired Guangdong TOD New Materials Co., Ltd., enhancing its presence in the Asian coating resin market

- In Sep 2023, Huntsman International LLC Developed a fast-curing acrylic epoxy hybrid with improved corrosion resistance for marine applications

- In Nov 2021, Solvay Released a waterborne emulsifier specifically for acrylic epoxy hybrids to meet sustainability requirements in industrial coatings

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10453

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global acrylic epoxy hybrid market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights on the basis of tType (acrylic modified epoxy, epoxy modified acrylic), formulation type (waterborne, solvent-borne, powder coatings), application (coatings, sealants, encapsulation materials, adhesives), end-user industry (automotive industry, construction industry, manufacturing, electronics and electrical, oil and gas, consumer goods) across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Checkout More Related Studies Published by Fact.MR Research:

global epoxy hardener market is estimated to be valued at US$ 3.8 billion in 2023 and it is expected to grow at a CAGR of 5.0% to reach US$ 6.1 billion by the end of 2033.

epoxy curing agents market stands at US$ 4.7 billion as of 2022 and is projected to rake in revenue worth US$ 9.53 billion by the end of 2032. Demand for epoxy curing agents is slated to increase at a CAGR of 7.4% from 2022 to 2032.

global epoxy resin market size is forecasted to reach US$ 26.45 billion by 2034, up from US$ 13.57 billion in 2024. This increase amounts to a projected CAGR of 6.9% from 2024 to 2034.

global glass reinforced epoxy (GRE) pipes market is valued at US$ 2.62 Bn in 2022, and is forecast to reach US$ 4.45 Bn by 2032, expanding at a CAGR of 5.4% during the 2022-2032 time period.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Target Corporation Reports Third Quarter Earnings

MINNEAPOLIS, Nov. 20, 2024 /PRNewswire/ —

- Third quarter comparable sales increased 0.3 percent, driven by strong traffic and digital performance.

- Guest traffic grew 2.4 percent over the prior year.

- Digital comparable sales grew 10.8 percent reflecting nearly 20 percent growth in same-day delivery powered by Target Circle 360™ and double digit growth in Drive Up.

- Beauty comparable sales grew more than 6 percent. Food & Beverage and Essentials categories grew low-single digits compared to the prior year.

- Third quarter gross margin rate was down 0.2 percentage points to the prior year. Year-to-date, gross margin rate has expanded by a full percentage point compared to last year.

- Third quarter GAAP and Adjusted EPS of $1.85 was down 11.9 percent compared with last year.

For additional media materials, please visit:

https://corporate.target.com/news-features/article/2024/11/q3-2024-earnings

Target Corporation TGT today announced its third quarter 2024 financial results, reflecting comparable sales growth driven entirely by traffic and strength in the digital channel.

The Company reported third quarter GAAP and Adjusted earnings per share1 (EPS) of $1.85, compared with $2.10 in 2023. The attached tables provide a reconciliation of non-GAAP to GAAP measures. All earnings per share figures refer to diluted EPS.

|

1Adjusted EPS, a non-GAAP financial measure, excludes the impact of certain discretely managed items, when applicable. See the tables of this release for additional information. |

“I’m proud of our team’s efforts to navigate through a volatile operating environment during the third quarter. We saw several strengths across the business, including a 2.4 percent increase in traffic, nearly 11 percent growth in the digital channel, and continued growth in beauty and frequency categories. At the same time, we encountered some unique challenges and cost pressures that impacted our bottom-line performance,” said Brian Cornell, chair and chief executive officer of Target Corporation. “Looking ahead, our team is energized and ready to deliver the unique combination of newness and value that holiday shoppers can only find at Target, and we remain confident in the underlying strength and fundamentals of our business, and our ability to deliver on our longer-term financial goals.”

Guidance

For the fourth quarter, the Company expects approximately flat comparable sales and GAAP and Adjusted EPS of $1.85 to $2.45, translating to a full year expected GAAP and Adjusted EPS range of $8.30 to $8.90.

Operating Results

Comparable sales increased 0.3 percent in the third quarter, reflecting a comparable store sales decline of 1.9 percent and a comparable digital sales increase of 10.8 percent. Total revenue of $25.7 billion in the third quarter was 1.1 percent higher than last year, reflecting a total sales increase of 0.9 percent and an 11.5 percent increase in other revenue. Third quarter operating income of $1.2 billion was 11.2 percent lower than last year.

Third quarter operating income margin rate was 4.6 percent in 2024, compared with 5.2 percent in 2023. Third quarter gross margin rate was 27.2 percent, compared with 27.4 percent in 2023, reflecting higher digital fulfillment and supply chain costs due to the cost of managing higher inventory levels, increased digital sales volume, and new supply chain facilities coming online, partially offset by lower book to physical inventory adjustments and the net impact of merchandising activities as compared to the prior year. Third quarter SG&A expense rate was 21.4 percent in 2024, compared with 20.9 percent in 2023, reflecting the combined impact of higher costs, including higher team member pay and benefits and higher general liability expenses, partially offset by disciplined cost management.

Interest Expense and Taxes

The Company’s third quarter 2024 net interest expense was $105 million, compared with $107 million last year.

Third quarter 2024 effective income tax rate was 21.7 percent, compared with the prior year rate of 21.3 percent, reflecting lower discrete benefits in the current year.

Capital Deployment and Return on Invested Capital

The Company paid dividends of $516 million in the third quarter, compared with $507 million last year, reflecting a 1.8 percent increase in the dividend per share.

The Company repurchased $354 million of its shares in the third quarter, retiring 2.4 million shares of common stock at an average price of $147.43. As of the end of the quarter, the Company had approximately $9.2 billion of remaining capacity under the repurchase program approved by Target’s Board of Directors in August 2021.

For the trailing twelve months through third quarter 2024, after-tax return on invested capital (ROIC) was 15.9 percent, compared with 13.9 percent for the trailing twelve months through third quarter 2023. The increase in ROIC reflects higher operating income, partially offset by higher average invested capital. The tables in this release provide additional information about the Company’s ROIC calculation.

Webcast Details

Target will webcast its third quarter earnings conference call at 7:00 a.m. CT today. Investors and the media are invited to listen to the meeting at Corporate.Target.com/Investors (click on “Q3 2024 Target Corporation Earnings Conference Call” under “Events & Presentations”). A replay of the webcast will be provided when available. The replay number is 1-800-513-1169.

Miscellaneous

Statements in this release regarding the Company’s future financial performance, including its fiscal 2024 fourth quarter and full-year guidance, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties which could cause the Company’s results to differ materially. The most important risks and uncertainties are described in Item 1A of the Company’s Form 10-K for the fiscal year ended February 3, 2024. Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update any forward-looking statement.

About Target

Minneapolis-based Target Corporation TGT serves guests at nearly 2,000 stores and at Target.com, with the purpose of helping all families discover the joy of everyday life. Since 1946, Target has given 5% of its profit to communities, which today equals millions of dollars a week. Additional company information can be found by visiting the corporate website (corporate.target.com) and press center.

|

TARGET CORPORATION |

||||||||||||

|

Consolidated Statements of Operations |

||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

(millions, except per share data) (unaudited) |

November 2, |

October 28, |

Change |

November 2, |

October 28, |

Change |

||||||

|

Sales |

$ 25,228 |

$ 25,004 |

0.9 % |

$ 74,392 |

$ 74,336 |

0.1 % |

||||||

|

Other revenue |

440 |

394 |

11.5 |

1,259 |

1,157 |

8.8 |

||||||

|

Total revenue |

25,668 |

25,398 |

1.1 |

75,651 |

75,493 |

0.2 |

||||||

|

Cost of sales |

18,375 |

18,149 |

1.2 |

53,623 |

54,333 |

(1.3) |

||||||

|

Selling, general and administrative expenses |

5,486 |

5,316 |

3.2 |

16,046 |

15,525 |

3.4 |

||||||

|

Depreciation and amortization (exclusive of |

639 |

616 |

3.6 |

1,883 |

1,793 |

5.0 |

||||||

|

Operating income |

1,168 |

1,317 |

(11.2) |

4,099 |

3,842 |

6.7 |

||||||

|

Net interest expense |

105 |

107 |

(1.5) |

321 |

395 |

(18.7) |

||||||

|

Net other income |

(28) |

(25) |

11.0 |

(77) |

(64) |

19.0 |

||||||

|

Earnings before income taxes |

1,091 |

1,235 |

(11.6) |

3,855 |

3,511 |

9.8 |

||||||

|

Provision for income taxes |

237 |

264 |

(9.9) |

867 |

755 |

14.9 |

||||||

|

Net earnings |

$ 854 |

$ 971 |

(12.1) % |

$ 2,988 |

$ 2,756 |

8.4 % |

||||||

|

Basic earnings per share |

$ 1.86 |

$ 2.10 |

(11.8) % |

$ 6.47 |

$ 5.97 |

8.3 % |

||||||

|

Diluted earnings per share |

$ 1.85 |

$ 2.10 |

(11.9) % |

$ 6.45 |

$ 5.96 |

8.3 % |

||||||

|

Weighted average common shares outstanding |

||||||||||||

|

Basic |

460.1 |

461.6 |

(0.3) % |

461.6 |

461.4 |

0.1 % |

||||||

|

Diluted |

461.5 |

462.6 |

(0.2) % |

462.9 |

462.7 |

0.1 % |

||||||

|

Antidilutive shares |

0.5 |

3.0 |

0.5 |

2.6 |

||||||||

|

Dividends declared per share |

$ 1.12 |

$ 1.10 |

1.8 % |

$ 3.34 |

$ 3.28 |

1.8 % |

||||||

|

TARGET CORPORATION |

||||||

|

Consolidated Statements of Financial Position |

||||||

|

(millions, except footnotes) (unaudited) |

November 2, 2024 |

February 3, 2024 |

October 28, 2023 |

|||

|

Assets |

||||||

|

Cash and cash equivalents |

$ 3,433 |

$ 3,805 |

$ 1,910 |

|||

|

Inventory |

15,165 |

11,886 |

14,731 |

|||

|

Other current assets |

1,956 |

1,807 |

1,958 |

|||

|

Total current assets |

20,554 |

17,498 |

18,599 |

|||

|

Property and equipment |

||||||

|

Land |

6,666 |

6,547 |

6,520 |

|||

|

Buildings and improvements |

38,666 |

37,066 |

36,627 |

|||

|

Fixtures and equipment |

8,840 |

8,765 |

8,490 |

|||

|

Computer hardware and software |

3,549 |

3,428 |

3,312 |

|||

|

Construction-in-progress |

758 |

1,703 |

2,000 |

|||

|

Accumulated depreciation |

(25,548) |

(24,413) |

(23,781) |

|||

|

Property and equipment, net |

32,931 |

33,096 |

33,168 |

|||

|

Operating lease assets |

3,513 |

3,362 |

3,086 |

|||

|

Other noncurrent assets |

1,533 |

1,400 |

1,376 |

|||

|

Total assets |

$ 58,531 |

$ 55,356 |

$ 56,229 |

|||

|

Liabilities and shareholders’ investment |

||||||

|

Accounts payable |

$ 14,419 |

$ 12,098 |

$ 14,291 |

|||

|

Accrued and other current liabilities |

5,738 |

6,090 |

6,099 |

|||

|

Current portion of long-term debt and other borrowings |

1,635 |

1,116 |

1,112 |

|||

|

Total current liabilities |

21,792 |

19,304 |

21,502 |

|||

|

Long-term debt and other borrowings |

14,346 |

14,922 |

14,883 |

|||

|

Noncurrent operating lease liabilities |

3,418 |

3,279 |

3,031 |

|||

|

Deferred income taxes |

2,419 |

2,480 |

2,447 |

|||

|

Other noncurrent liabilities |

2,067 |

1,939 |

1,852 |

|||

|

Total noncurrent liabilities |

22,250 |

22,620 |

22,213 |

|||

|

Shareholders’ investment |

||||||

|

Common stock |

38 |

38 |

38 |

|||

|

Additional paid-in capital |

6,916 |

6,761 |

6,681 |

|||

|

Retained earnings |

8,009 |

7,093 |

6,225 |

|||

|

Accumulated other comprehensive loss |

(474) |

(460) |

(430) |

|||

|

Total shareholders’ investment |

14,489 |

13,432 |

12,514 |

|||

|

Total liabilities and shareholders’ investment |

$ 58,531 |

$ 55,356 |

$ 56,229 |

|||

|

Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 459,244,995, 461,675,441, and 461,651,176 shares issued and outstanding as of November 2, 2024, February 3, 2024, and October 28, 2023, respectively. |

|

Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding during any period presented. |

|

TARGET CORPORATION |

||||

|

Consolidated Statements of Cash Flows |

||||

|

Nine Months Ended |

||||

|

(millions) (unaudited) |

November 2, 2024 |

October 28, 2023 |

||

|

Operating activities |

||||

|

Net earnings |

$ 2,988 |

$ 2,756 |

||

|

Adjustments to reconcile net earnings to cash provided by operating activities: |

||||

|

Depreciation and amortization |

2,215 |

2,072 |

||

|

Share-based compensation expense |

229 |

176 |

||

|

Deferred income taxes |

(58) |

252 |

||

|

Noncash (gains) / losses and other, net |

(1) |

101 |

||

|

Changes in operating accounts: |

||||

|

Inventory |

(3,279) |

(1,232) |

||

|

Other assets |

(265) |

(208) |

||

|

Accounts payable |

2,362 |

887 |

||

|

Accrued and other liabilities |

(113) |

528 |

||

|

Cash provided by operating activities |

4,078 |

5,332 |

||

|

Investing activities |

||||

|

Expenditures for property and equipment |

(1,968) |

(3,952) |

||

|

Proceeds from disposal of property and equipment |

2 |

24 |

||

|

Other investments |

24 |

18 |

||

|

Cash required for investing activities |

(1,942) |

(3,910) |

||

|

Financing activities |

||||

|

Additions to long-term debt |

741 |

— |

||

|

Reductions of long-term debt |

(1,112) |

(114) |

||

|

Dividends paid |

(1,533) |

(1,503) |

||

|

Repurchase of stock |

(506) |

— |

||

|

Shares withheld for taxes on share-based compensation |

(98) |

(124) |

||

|

Cash required for financing activities |

(2,508) |

(1,741) |

||

|

Net decrease in cash and cash equivalents |

(372) |

(319) |

||

|

Cash and cash equivalents at beginning of period |

3,805 |

2,229 |

||

|

Cash and cash equivalents at end of period |

$ 3,433 |

$ 1,910 |

||

|

TARGET CORPORATION |

||||||||

|

Operating Results |

||||||||

|

Rate Analysis |

Three Months Ended |

Nine Months Ended |

||||||

|

(unaudited) |

November 2, 2024 |

October 28, 2023 |

November 2, 2024 |

October 28, 2023 |

||||

|

Gross margin rate |

27.2 % |

27.4 % |

27.9 % |

26.9 % |

||||

|

SG&A expense rate |

21.4 |

20.9 |

21.2 |

20.6 |

||||

|

Depreciation and amortization expense rate (exclusive of |

2.5 |

2.4 |

2.5 |

2.4 |

||||

|

Operating income margin rate |

4.6 |

5.2 |

5.4 |

5.1 |

||||

|

Note: Gross margin rate is calculated as gross margin (sales less cost of sales) divided by sales. All other rates are calculated by dividing the applicable amount by total revenue. Other revenue includes $148 million and $433 million of profit-sharing income under our credit card program agreement for the three and nine months ended November 2, 2024, respectively, and $165 million and $508 million for the three and nine months ended October 28, 2023, respectively. |

|

Comparable Sales |

Three Months Ended |

Nine Months Ended |

||||||

|

(unaudited) |

November 2, 2024 |

October 28, 2023 |

November 2, 2024 |

October 28, 2023 |

||||

|

Comparable sales change |

0.3 % |

(4.9) % |

(0.5) % |

(3.5) % |

||||

|

Drivers of change in comparable sales |

||||||||

|

Number of transactions (traffic) |

2.4 |

(4.1) |

1.1 |

(2.7) |

||||

|

Average transaction amount |

(2.0) |

(0.8) |

(1.6) |

(0.8) |

||||

|

Comparable Sales by Channel |

Three Months Ended |

Nine Months Ended |

||||||

|

(unaudited) |

November 2, 2024 |

October 28, 2023 |

November 2, 2024 |

October 28, 2023 |

||||

|

Stores originated comparable sales change |

(1.9) % |

(4.6) % |

(2.0) % |

(2.8) % |

||||

|

Digitally originated comparable sales change |

10.8 |

(6.0) |

6.9 |

(6.7) |

||||

|

Sales by Channel |

Three Months Ended |

Nine Months Ended |

||||||

|

(unaudited) |

November 2, 2024 |

October 28, 2023 |

November 2, 2024 |

October 28, 2023 |

||||

|

Stores originated |

81.5 % |

83.2 % |

81.8 % |

82.9 % |

||||

|

Digitally originated |

18.5 |

16.8 |

18.2 |

17.1 |

||||

|

Total |

100 % |

100 % |

100 % |

100 % |

||||

|

Sales by Fulfillment Channel |

Three Months Ended |

Nine Months Ended |

||||||

|

(unaudited) |

November 2, 2024 |

October 28, 2023 |

November 2, 2024 |

October 28, 2023 |

||||

|

Stores |

97.7 % |

97.7 % |

97.8 % |

97.5 % |

||||

|

Other |

2.3 |

2.3 |

2.2 |

2.5 |

||||

|

Total |

100 % |

100 % |

100 % |

100 % |

||||

|

Note: Sales fulfilled by stores include in-store purchases and digitally originated sales fulfilled by shipping merchandise from stores to guests, Order Pickup, Drive Up, and Shipt. |

|

Target Circle Card Penetration |

Three Months Ended |

Nine Months Ended |

||||||

|

(unaudited) |

November 2, 2024 |

October 28, 2023 |

November 2, 2024 |

October 28, 2023 |

||||

|

Total Target Circle Card Penetration |

17.7 % |

18.3 % |

17.8 % |

18.6 % |

||||

|

Number of Stores and Retail Square Feet |

Number of Stores |

Retail Square Feet (a) |

||||||||||

|

(unaudited) |

November 2, |

February 3, |

October 28, |

November 2, |

February 3, |

October 28, |

||||||

|

170,000 or more sq. ft. |

273 |

273 |

273 |

48,824 |

48,824 |

48,824 |

||||||

|

50,000 to 169,999 sq. ft. |

1,559 |

1,542 |

1,542 |

195,050 |

192,908 |

192,877 |

||||||

|

49,999 or less sq. ft. |

146 |

141 |

141 |

4,404 |

4,207 |

4,207 |

||||||

|

Total |

1,978 |

1,956 |

1,956 |

248,278 |

245,939 |

245,908 |

||||||

|

(a) |

In thousands; reflects total square feet less office, supply chain facilities, and vacant space. |

TARGET CORPORATION

Reconciliation of Non-GAAP Financial Measures

To provide additional transparency, we disclose non-GAAP adjusted diluted earnings per share (Adjusted EPS). When applicable, this metric excludes certain discretely managed items. However, there are no adjustments in any period presented. We believe this information is useful in providing period-to-period comparisons of the results of our operations. This measure is not in accordance with, or an alternative to, U.S. GAAP. The most comparable GAAP measure is diluted earnings per share. Adjusted EPS should not be considered in isolation or as a substitution for analysis of our results as reported in accordance with GAAP. Other companies may calculate Adjusted EPS differently, limiting the usefulness of the measure for comparisons with other companies.

|

Reconciliation of Non-GAAP Adjusted EPS |

Three Months Ended |

Nine Months Ended |

||||||||||

|

November 2, 2024 |

October 28, 2023 |

Change |

November 2, 2024 |

October 28, 2023 |

Change |

|||||||

|

GAAP and adjusted diluted earnings per share |

$ 1.85 |

$ 2.10 |

(11.9) % |

$ 6.45 |

$ 5.96 |

8.3 % |

||||||

|

Reconciliation of Non-GAAP Adjusted EPS Guidance |

Guidance |

||||

|

(per share) (unaudited) |

Q4 2024 |

Full Year 2024 |

|||

|

GAAP diluted earnings per share guidance |

$1.85 – $2.45 |

$8.30 – $8.90 |

|||

|

Estimated adjustments |

|||||

|

Other (a) |

$ — |

$ — |

|||

|

Adjusted diluted earnings per share guidance |

$1.85 – $2.45 |

$8.30 – $8.90 |

|||

|

(a) |

Fourth quarter and full-year 2024 GAAP EPS may include the impact of certain discrete items, which will be excluded in calculating Adjusted EPS. The guidance does not currently reflect any such discrete items. In the past, these items have included losses on the early retirement of debt and certain other items that are discretely managed. |

Earnings before interest expense and income taxes (EBIT) and earnings before interest expense, income taxes, depreciation and amortization (EBITDA) are non-GAAP financial measures. We believe these measures provide meaningful information about our operational efficiency compared with our competitors by excluding the impact of differences in tax jurisdictions and structures, debt levels, and, for EBITDA, capital investment. These measures are not in accordance with, or an alternative to, GAAP. The most comparable GAAP measure is net earnings. EBIT and EBITDA should not be considered in isolation or as a substitution for analysis of our results as reported in accordance with GAAP. Other companies may calculate EBIT and EBITDA differently, limiting the usefulness of the measures for comparisons with other companies.

|

EBIT and EBITDA |

Three Months Ended |

Nine Months Ended |

||||||||||

|

(dollars in millions) (unaudited) |

November 2, 2024 |

October 28, 2023 |

Change |

November 2, 2024 |

October 28, 2023 |

Change |

||||||

|

Net earnings |

$ 854 |

$ 971 |

(12.1) % |

$ 2,988 |

$ 2,756 |

8.4 % |

||||||

|

+ Provision for income taxes |

237 |

264 |

(9.9) |

867 |

755 |

14.9 |

||||||

|

+ Net interest expense |

105 |

107 |

(1.5) |

321 |

395 |

(18.7) |

||||||

|

EBIT |

$ 1,196 |

$ 1,342 |

(10.8) % |

$ 4,176 |

$ 3,906 |

6.9 % |

||||||

|

+ Total depreciation and amortization (a) |

754 |

722 |

4.2 |

2,215 |

2,072 |

6.8 |

||||||

|

EBITDA |

$ 1,950 |

$ 2,064 |

(5.5) % |

$ 6,391 |

$ 5,978 |

6.9 % |

||||||

|

(a) |

Represents total depreciation and amortization, including amounts classified within Depreciation and Amortization and within Cost of Sales. |

We have also disclosed after-tax ROIC, which is a ratio based on GAAP information, with the exception of the add-back of operating lease interest to operating income. We believe this metric is useful in assessing the effectiveness of our capital allocation over time. Other companies may calculate ROIC differently, limiting the usefulness of the measure for comparisons with other companies.

|

After-Tax Return on Invested Capital |

||||||

|

(dollars in millions) (unaudited) |

||||||

|

Trailing Twelve Months |

||||||

|

Numerator |

November 2, 2024 (a) |

October 28, 2023 |

||||

|

Operating income |

$ 5,964 |

$ 5,001 |

||||

|

+ Net other income |

105 |

79 |

||||

|

EBIT |

6,069 |

5,080 |

||||

|

+ Operating lease interest (b) |

157 |

106 |

||||

|

– Income taxes (c) |

1,403 |

1,050 |

||||

|

Net operating profit after taxes |

$ 4,823 |

$ 4,136 |

||||

|

Denominator |

November 2, 2024 |

October 28, 2023 |

October 29, 2022 |

|||

|

Current portion of long-term debt and other borrowings |

$ 1,635 |

$ 1,112 |

$ 2,207 |

|||

|

+ Noncurrent portion of long-term debt |

14,346 |

14,883 |

14,237 |

|||

|

+ Shareholders’ investment |

14,489 |

12,514 |

11,019 |

|||

|

+ Operating lease liabilities (d) |

3,765 |

3,351 |

2,879 |

|||

|

– Cash and cash equivalents |

3,433 |

1,910 |

954 |

|||

|

Invested capital |

$ 30,802 |

$ 29,950 |

$ 29,388 |

|||

|

Average invested capital (e) |

$ 30,376 |

$ 29,670 |

||||

|

After-tax return on invested capital |

15.9 % |

13.9 % |

||||

|

(a) |

The trailing twelve months ended November 2, 2024, consisted of 53 weeks compared with 52 weeks in the prior-year period. |

|

(b) |

Represents the add-back to operating income driven by the hypothetical interest expense we would incur if the property under our operating leases were owned or accounted for as finance leases. Calculated using the discount rate for each lease and recorded as a component of rent expense within Operating Income. Operating lease interest is added back to Operating Income in the ROIC calculation to control for differences in capital structure between us and our competitors. |

|

(c) |

Calculated using the effective tax rates, which were 22.5 percent and 20.3 percent for the trailing twelve months ended November 2, 2024, and October 28, 2023, respectively. For the twelve months ended November 2, 2024, and October 28, 2023, includes tax effect of $1.4 billion and $1.0 billion, respectively, related to EBIT, and $35 million and $22 million, respectively, related to operating lease interest. |

|

(d) |

Total short-term and long-term operating lease liabilities included within Accrued and Other Current Liabilities and Noncurrent Operating Lease Liabilities, respectively. |

|

(e) |

Average based on the invested capital at the end of the current period and the invested capital at the end of the comparable prior period. |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/target-corporation-reports-third-quarter-earnings-302310629.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/target-corporation-reports-third-quarter-earnings-302310629.html

SOURCE Target Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer Shares Soar 32% As It Avoids Getting Booted Off Nasdaq, But Analysts Are Not Convinced: Here's What's Coming Next For SMCI

Shares of Super Micro Computer Inc SMCI closed 31.24% higher in trade on Tuesday at $28.27 apiece. This happened after it announced the appointment of BDO USA as its Independent Auditor and also filed a compliance plan with Nasdaq, according to its press release.

The aforementioned update has prevented the company shares from being delisted from Nasdaq, however, company insiders loaded up on the shares of SMCI before this update. Furthermore, despite the rise in shares, analysts tracking the company have mostly downgraded the stock.

What Happened: Super Micro Computer shares have waded through a flurry in 2024 since it has been riddled with several troubles. It missed filing the Form 10-K with the SEC, the annual financial report for the company’s year ending June 30.

It was followed by the release of the short-seller Hindenburg’s report on Aug. 27 stating that the company was involved in accounting manipulation along with the allegations of self-dealing and evading sanctions.

Ernst & Young resigned as the auditor of the company on Oct. 30 and it delayed filing the Form 10-Q with the SEC for the first quarter of fiscal 2025, ending Sept. 30.

Also read: Why Super Micro’s Future May Hinge On Nvidia Earnings, Nasdaq Deadline

Why It Matters: The stock was nearly 64% up at $28.27 per share from its 52-week low of $17.25 apiece. But still down 77% from its 52-week high at $122.90 apiece. On a year-to-date basis, the stock was down by nearly 1%.

The relative strength index at 45.26 implies that the stock is not overbought or oversold. The recent trade by company insiders, as per Benzinga Pro shows that they bought the stocks before announcing the appointment of the new Independent Auditor between Nov. 1 to Nov. 12.

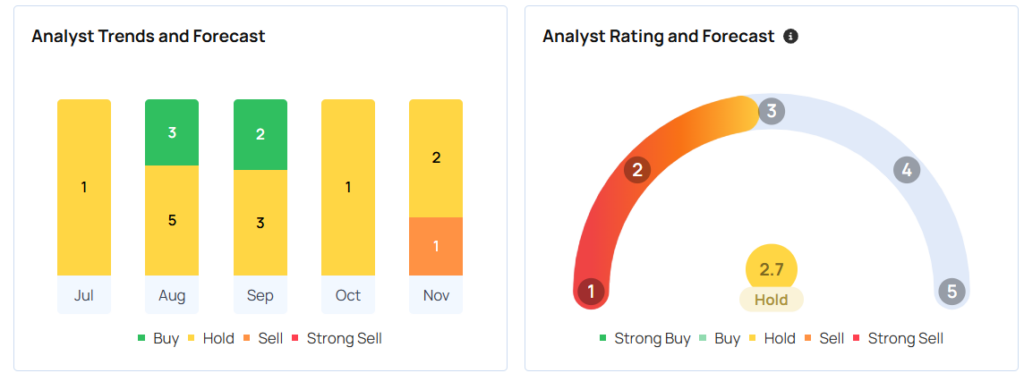

Analyst Snapshot

Many brokerages have lowered their ratings and target prices on SMCI. According to MarketBeat, Bank of America downgraded it to a ‘neutral’ rating and decreased their target price to $70.00 per share and Rosenblatt Securities reissued a ‘buy’ rating and set a $130.00 target price, in August.

Barclays lowered their price to $42.00 apiece and set an ‘equal weight’ rating in October. JPMorgan Chase & Co. lowered a “neutral” rating to an “underweight” and set a price target of $23.00 per share in November.

According to Benzinga Pro, based on an average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush, there’s an implied -2.65% downside for Super Micro Computer Inc. from these most recent analyst ratings. The consensus rating forecast on Benzinga, suggests a score of 2.7 out of 5 points, which implies holding the stock.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marine Lubricants Market to Hit USD 7.53 billion by 2031, at a CAGR 4.17% | Exclusive Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Nov. 20, 2024 (GLOBE NEWSWIRE) — The global marine lubricants market (해양 윤활유 시장) was projected to attain US$ 4.08 billion in 2020. It is anticipated to garner a 4.17% CAGR from 2021 to 2031 and by 2031, the market is likely to attain US$ 7.53 billion by 2031.

Due to the rising demand to increase the output efficiency of machine parts, the global market for marine lubricants is growing significantly in size and worth. The increase in demand for group II and group III base oils prompts producers to create more base oil, which has a significant impact on this market.

On the other hand, the scarcity of bright stock material has prompted the development of alternatives. This is anticipated to slow the growth of this market in the near future. A supply shortfall is also predicted to hamper this market in the coming years.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1096

Key Findings of the Market Report

- Marine lubricants are a type of lubricant designed to fulfill the performance requirements of marine boats for optimal operation.

- These lubricants assist to reduce wear and tear throughout vessels.

- The increased use of marine lubricants in cargo ships, drillships, inflatable boats, passenger ships, outboard motorboats, and other applications is expected to provide great development potential.

- The rising demand for bio-lubricants will significantly increase business potential.

- Many people are becoming more inclined to use environmentally friendly fuels, which will enhance growth opportunities.

- The rise in disposable money has resulted in an increase in marine journeys and tourism.

Market Trends for Marine Lubricants

- In terms of product type, producers in the global marine lubricants market are increasing production of bio-based, mineral, and synthetic oils. Mineral oil consumption is far larger than the other two, and this trend is expected to continue in the future decade. Synthetic oil is also gaining traction globally owing to the cost savings it provides, and it is projected to emerge as the most appealing category in the market in the future years.

- Companies within the marine lubricants industry operate in both onshore and offshore applications. The offshore sector has led the market since there has been increased activity in offshore waterways such as ocean fish farming as well as transportation. The situation is expected to persist in the coming years as naval fleets operate more widely throughout the world.

Global Market for Marine Lubricants: Regional Outlook

- Asia Pacific emerged as the leading regional market for marine lubricants in 2020, accounting for more than 51% of the market. Due to the high demand for marine lubricants in this region, the trend is projected to continue in the coming years. Another key factor driving the growth of the Asia Pacific marine lubricant market is the abundance of ports in the region, particularly in China and the ASEAN nations.

- Several economies, including China, Japan, India, Singapore, Indonesia, the Philippines, and Australia, are expected to make substantial contributions to the region’s expanding need for marine lubricants in the coming years.

- Europe is another major geographic market for marine lubricants. The United Kingdom, Russia, and Germany are the major contributors to this market; the United Kingdom has taken the lead. Europe has a larger number of ships using inland waterways than other areas due to the presence of extensive inland waterways in nations such as Germany, France, Belgium, the Netherlands, and Russia. This is expected to enhance Europe’s marine lubricant business in the next years.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1096

Global Marine Lubricants Market: Key Players

Ongoing technical advances in the industry are likely to generate profitable growth opportunities for manufacturers. The increase in spending in research and development activities by industry players is expected to boost the worldwide market.

Research and development is becoming increasingly important in predicting shifting oil prices, which are set by OPEC (Organization of Petroleum Exporting Countries) and other organizations. Mergers and acquisitions play an important role in the growth of the marine lubricants business. The following companies are well-known participants in the global marine lubricants market:

- Lukoil Marine Lubricants Ltd.

- BP Marine

- Royal Dutch Shell

- ExxonMobil Corporation

- Total Lubmarine

- Castrol

- Chevron Corporation

Some key developments by the players in this market are:

- In 2023, Lukoil is exploring entering new oil and gas projects in the Republic of Congo as an operator, following a meeting with Congolese Minister of Hydrocarbons Bruno Jean-Richard Itoua. Lukoil is already involved in the Marine XII project, which is run by the Italian corporation Eni.

Global Marine Lubricants Market Segmentation

Product Type

- Mineral Oil Marine Lubricants

- Synthetic Marine Lubricants

- Bio-based Marine Lubricants

Application

- Engine Oil Marine Lubricants

- Hydraulic Oil Marine Lubricants

- Grease

- Others (Turbine Oils, Gear Oils, Compressor Oils, and Heat Transfer Fluids)

Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=1096<ype=S

Explore Trending Report by Transparency Market Research-

Conductive Inks Market (導電性インク市場) – The global conductive inks market size was more than US$ 3.1 Bn in 2022 and is projected to cross value of US$ 4.9 Bn by 2031. Market forecast estimates the global industry to grow at a CAGR of 5.0% between 2023 and 2031.

Deliming Agent Market (سوق وكيل التخليص) – The global industry was valued at US$ 8.2 Bn in 2022. It is estimated to grow at a CAGR of 6.7% from 2023 to 2031 and reach US$ 14.7 Bn by the end of 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

As Spirit Airlines Files For Bankruptcy Experts Weigh Potential Impact On Flight Prices: 'This Is Not A Black And White Situation'

Industry experts are divided about the potential impact on airfare prices after Spirit Airlines SAVE filed for bankruptcy.