1 Reason I Haven't Bought Plug Power and Probably Never Will

I think hydrogen has the potential to be a game-changing fuel source. It could help supply the global economy with the emissions-free fuel it needs to help reach net-zero emissions by 2050. The fuel represents a massive opportunity that could be worth trillions of dollars in the coming years.

Given the immense potential of hydrogen, I’ve looked into various ways to invest in the emerging fuel source, including Plug Power (NASDAQ: PLUG). However, I haven’t invested in Plug Power and will probably never buy shares. Here’s the main reason why.

Plug Power has been around for a very long time. The company formed in 1997 and went public two years later. Despite being public for a quarter-century, Plug Power has never fully matured into a profitable and growing company.

Through the first six months of this year, Plug Power generated only $145 million in revenue. Instead of growing, its sales have fallen more than 50% over the past year, and its losses continue to pile up. Plug Power posted a net loss of $558 million during the first six months of 2024. That’s up from a nearly $443 million net loss across the same period of 2023.

That’s just the company’s operating losses. Plug Power is digging itself farther into a financial hole by investing heavily in building out its green hydrogen ecosystem. The purchase of property, plant, and equipment totaled another $194 million in the first half of the year. As a result, the company is burning through cash. Its cash balance was down to $1 billion at the end of June, falling from $1.5 billion in June of 2023.

The company has been covering its losses by issuing new shares. Those stock sales have massively increased its outstanding shares:

That has significantly diluted existing investors, which has weighed heavily on the stock price. Plug Power has lost an astounding 98.5% of its value since its IPO.

Plug Power is still several years away from turning the corner on profitability. While analysts expect Plug Power’s revenue to more than double by 2026 to over $2 billion, they still anticipate it will post a $250 million operating loss that year. That’s if everything goes according to plan, which hasn’t been the case for Plug Power in the past. It’s likely, then, that the company will need to continue issuing more stock to plug the gap between its revenue and losses. Future stock sales could continue to weigh on the share price.

Burnham Holdings, Inc. Announces Third Quarter 2024 Financial Results

LANCASTER, Pa., Oct. 24, 2024 /PRNewswire/ — Burnham Holdings, Inc. BURCA (“BHI”, the “Company”, “we” or “our”) today reported its consolidated financial results for the third quarter of 2024. Where noted, prior periods presented have been restated for a voluntary change in accounting principle related to our last-in, first-out (LIFO) inventory valuation as disclosed in our 2023 Annual Report.

- Net sales were $64.7 million for the third quarter of 2024, an increase of $5.0 million, or 8.3%, versus the third quarter of 2023. Year to date net sales were $176.1 million compared to $171.4 for the first nine months of 2023.

- Gross profit margin was 19.3% and 20.5% for the third quarters of 2024 and 2023, respectively. Year to date gross profit margins were 21.6% for 2024 versus 22.0% for 2023. Product mix and temporary inefficiencies from unplanned downtime adversely impacted third quarter 2024 gross profit margins.

- Selling, general, and administrative expenses (SG&A) were higher by $1.4 million and $2.0 million for the third quarter 2024 and the first nine months of 2024, respectively, versus the same periods last year. The primary driver in the increase in SG&A expenses was an adjustment to reserves related to uninsured litigation settlements and fees. Excluding these impacts, adjusted SG&A as a percentage of sales in the third quarter of 2024 was 15.6% compared to 17.1% for the third quarter of 2023.

- Adjusted EBITDA was $12.8 million, or 7.3%, for the nine months of 2024 versus $12.0 million, or 7.0%, for the first nine months of 2023. Adjusted EBITDA excludes the impact of the reserve adjustments noted above.

- Adjusted net income, excluding reserve adjustments, for the third quarter of 2024 was $1.7 million versus net income of $0.8 million for the third quarter of 2023.

- Adjusted diluted earnings per share were $0.37 and $0.17 for the third quarters of 2024 and 2023, respectively. For the first nine months of 2024 and 2023, adjusted diluted earnings per share were $1.18 and $1.03, respectively. Adjusted diluted earnings per share excludes $0.25 per share related to the reserve adjustments noted above for both the three months and nine months ended September 29, 2024.

For the third quarter of 2024, sales of residential products were higher by 2.2% versus the same period in 2023, while sales of commercial products were up 20.8% in 2024 versus 2023. For the nine months of 2024, residential sales were lower by 5.1% versus the prior year while commercial sales were higher by 13.0% versus the nine months of 2023. Thermal InMotion continues to expand BHI’s capabilities into previously unserved segments of the HVAC industry, and we are pleased with the results. The service and rentals businesses contributed $1.8 million of net sales in the third quarter of 2024 and $6.3 million for the nine months of 2024. Overall, we continue to believe order flow and our current backlogs are in line with seasonal operating patterns.

Average debt levels of the Company’s revolving credit facility for the third quarter of 2024 were approximately $10.6 million lower than the third quarter of 2023. On a year over year basis, the average debt levels on the revolving credit facility were approximately $9.6 million lower. We continue to evaluate our working capital needs, including inventory levels, to ensure we can appropriately meet production volumes and fund future growth initiatives.

About Burnham Holdings, Inc.: BHI is the parent company of multiple subsidiaries that are leading domestic manufacturers of boilers, furnaces and related HVAC products and accessories for residential, commercial, and industrial applications. BHI is listed on the OTC Exchange under the ticker symbol “BURCA”. For more information, please visit www.burnhamholdings.com.

Non-GAAP Financial Information: This press release contains certain non-GAAP financial measures, including adjusted SG&A, EBITDA, Adjusted EBITDA, Adjusted Net Income and adjusted diluted earnings per share. These non-GAAP financial measures do not provide investors with an accurate measure of, and should not be used as a substitute for, the comparable financial measures as determined in accordance with accounting principles generally accepted in the United States (“GAAP”). The Company believes these non-GAAP financial measures, when read in conjunction with the comparable GAAP financial measures, give investors a useful tool to assess and understand the Company’s overall financial performance, because they exclude items of income or expense that the Company believes are not reflective of its ongoing operating performance, allowing for a better period-to-period comparison of operations of the Company. The Company acknowledges that there are many items that impact a company’s reported results, and the adjustments reflected in these non-GAAP measures are not intended to present all items that may have impacted these results. In addition, these non-GAAP measures are not necessarily comparable to similarly titled measures used by other companies.

|

Burnham Holdings, Inc. |

|||||||||

|

Consolidated Statements of Income |

|||||||||

|

(In thousands, except per share amounts) |

|||||||||

|

(Unaudited) |

|||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||

|

September 29, |

October 1, |

September 29, |

October 1, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||||

|

Net sales |

$ 64,689 |

$ 59,705 |

$ 176,083 |

$ 171,406 |

|||||

|

Cost of goods sold |

52,217 |

47,489 |

138,035 |

133,613 |

|||||

|

Gross profit |

12,472 |

12,216 |

38,048 |

37,793 |

|||||

|

Selling, general and administrative expenses |

11,605 |

10,182 |

32,115 |

30,164 |

|||||

|

Operating income |

867 |

2,034 |

5,933 |

7,629 |

|||||

|

Other (expense) / income: |

|||||||||

|

Non-service related pension credit |

124 |

137 |

374 |

412 |

|||||

|

Interest and investment gain |

423 |

(222) |

912 |

267 |

|||||

|

Interest expense |

(697) |

(921) |

(1,526) |

(2,107) |

|||||

|

Other expense |

(150) |

(1,006) |

(240) |

(1,428) |

|||||

|

Income before income taxes |

717 |

1,028 |

5,693 |

6,201 |

|||||

|

Income tax expense |

165 |

236 |

1,309 |

1,426 |

|||||

|

Net income |

$ 552 |

$ 792 |

$ 4,384 |

$ 4,775 |

|||||

|

Earnings per share: |

|||||||||

|

Basic |

$ 0.12 |

$ 0.17 |

$ 0.94 |

$ 1.03 |

|||||

|

Diluted |

$ 0.12 |

$ 0.17 |

$ 0.93 |

$ 1.03 |

|||||

|

Cash dividends per share |

$ 0.23 |

$ 0.22 |

$ 0.69 |

$ 0.66 |

|||||

|

Burnham Holdings, Inc. |

||||||||

|

Consolidated Balance Sheets |

||||||||

|

(In thousands) |

||||||||

|

(Unaudited) |

(Unaudited) |

|||||||

|

September 29, |

December 31, |

October 1, |

||||||

|

ASSETS |

2024 |

2023 |

2023 |

|||||

|

Current Assets |

||||||||

|

Cash and cash equivalents |

$ 6,280 |

$ 5,880 |

$ 6,638 |

|||||

|

Trade accounts receivable, net |

29,573 |

31,023 |

27,704 |

|||||

|

Inventories, net |

70,158 |

58,017 |

72,043 |

|||||

|

Costs in Excess of Billings |

1,425 |

621 |

544 |

|||||

|

Prepaid expenses and other current assets |

3,038 |

1,954 |

3,130 |

|||||

|

Total Current Assets |

110,474 |

97,495 |

110,059 |

|||||

|

Property, plant and equipment, net |

70,040 |

64,437 |

63,728 |

|||||

|

Lease assets |

6,410 |

4,119 |

4,171 |

|||||

|

Other long-term assets |

18,592 |

18,620 |

17,831 |

|||||

|

Total Assets |

$ 205,516 |

$ 184,671 |

$ 195,789 |

|||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

||||||||

|

Current Liabilities |

||||||||

|

Accounts payable & accrued expenses |

$ 29,663 |

$ 35,365 |

$ 26,620 |

|||||

|

Billings in excess of costs |

3,497 |

137 |

– |

|||||

|

Current portion of: |

||||||||

|

Long-term liabilities |

71 |

1,171 |

1,252 |

|||||

|

Lease liabilities |

1,175 |

1,051 |

1,036 |

|||||

|

Long-term debt |

184 |

184 |

– |

|||||

|

Total Current Liabilities |

34,590 |

37,908 |

28,908 |

|||||

|

Long-term debt |

48,390 |

27,232 |

53,713 |

|||||

|

Lease liabilities |

5,235 |

3,068 |

3,135 |

|||||

|

Other long-term liabilities |

5,847 |

5,933 |

6,726 |

|||||

|

Deferred income taxes |

9,039 |

9,095 |

8,423 |

|||||

|

Shareholders’ Equity |

||||||||

|

Preferred Stock |

530 |

530 |

530 |

|||||

|

Class A Common Stock |

3,633 |

3,633 |

3,630 |

|||||

|

Class B Convertible Common Stock |

1,311 |

1,311 |

1,314 |

|||||

|

Additional paid-in capital |

10,625 |

11,769 |

11,549 |

|||||

|

Retained earnings |

122,397 |

121,291 |

117,667 |

|||||

|

Accumulated other comprehensive loss |

(25,023) |

(24,668) |

(27,331) |

|||||

|

Treasury stock, at cost |

(11,058) |

(12,431) |

(12,475) |

|||||

|

Total Shareholders’ Equity |

102,415 |

101,435 |

94,884 |

|||||

|

Total Liabilities and Shareholders’ Equity |

$ 205,516 |

$ 184,671 |

$ 195,789 |

|||||

|

Burnham Holdings, Inc. |

||||

|

Consolidated Statements of Cash Flows |

||||

|

(In thousands) |

||||

|

(Unaudited) |

||||

|

Nine Months Ended |

||||

|

September 29, |

October 1, |

|||

|

2024 |

2023 |

|||

|

Cash flows from operating activities: |

||||

|

Net income |

$ 4,384 |

$ 4,775 |

||

|

Adjustments to reconcile net income to net cash related |

||||

|

to operating activities: |

||||

|

Depreciation and amortization |

4,031 |

3,730 |

||

|

Deferred income taxes |

50 |

162 |

||

|

Provision for long-term employee benefits |

(375) |

(375) |

||

|

Share-based compensation expense |

300 |

482 |

||

|

Other reserves and allowances |

(33) |

977 |

||

|

Changes in current assets and liabilities, net of acquisition: |

||||

|

Decrease in accounts receivable, net |

947 |

1,491 |

||

|

Increase in inventories, net |

(12,141) |

(10,495) |

||

|

Decrease / (increase) in other current assets |

1,954 |

(891) |

||

|

Decrease in accounts payable and accrued expenses |

(6,889) |

(7,681) |

||

|

Net cash used by operating activities |

(7,772) |

(7,825) |

||

|

Cash flows from investing activities: |

||||

|

Capital expenditures |

(9,638) |

(7,614) |

||

|

Purchase of CSI |

– |

(1,750) |

||

|

Other investing activities |

– |

(8) |

||

|

Net cash used by investing activities |

(9,638) |

(9,372) |

||

|

Cash flows from financing activities: |

||||

|

Net proceeds from revolver |

21,251 |

19,992 |

||

|

Repayment of term loan |

(92) |

– |

||

|

Share-based compensation activity |

(71) |

(44) |

||

|

Dividends paid |

(3,278) |

(3,107) |

||

|

Net cash provided by financing activities |

17,810 |

16,841 |

||

|

Net increase (decrease) in cash and cash equivalents |

$ 400 |

$ (356) |

||

|

Cash and cash equivalents, beginning of period |

$ 5,880 |

$ 6,994 |

||

|

Net increase (decrease) in cash and cash equivalents |

400 |

(356) |

||

|

Cash and cash equivalents, end of period |

$ 6,280 |

$ 6,638 |

||

|

Burnham Holdings, Inc. |

||||||||||||||||

|

Consolidated Statements of Shareholders’ Equity |

||||||||||||||||

|

(In thousands) |

||||||||||||||||

|

(Unaudited) |

||||||||||||||||

|

Class B |

Accumulated |

|||||||||||||||

|

Class A |

Convertible |

Additional |

Other |

Treasury |

||||||||||||

|

Preferred |

Common |

Common |

Paid-in |

Retained |

Comprehensive |

Stock, |

Shareholders’ |

|||||||||

|

Stock |

Stock |

Stock |

Capital |

Earnings |

Loss |

at Cost |

Equity |

|||||||||

|

Balance at December 31, 2023 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 11,769 |

$ 121,291 |

$ (24,668) |

$ (12,431) |

$ 101,435 |

||||||||

|

Net income |

– |

– |

– |

– |

2,991 |

– |

– |

2,991 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

253 |

– |

253 |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,065) |

– |

– |

(1,065) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

100 |

– |

– |

– |

100 |

||||||||

|

Balance at March 31, 2024 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 11,869 |

$ 123,217 |

$ (24,415) |

$ (12,431) |

$ 103,714 |

||||||||

|

Net income |

– |

– |

– |

– |

841 |

– |

– |

841 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

(27) |

– |

(27) |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Preferred stock – 6% |

– |

– |

– |

– |

(9) |

– |

– |

(9) |

||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,132) |

– |

– |

(1,132) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

100 |

– |

– |

– |

100 |

||||||||

|

Issuance of vested shares |

– |

– |

– |

(1,444) |

– |

– |

1,373 |

(71) |

||||||||

|

Balance at June 30, 2024 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 10,525 |

$ 122,917 |

$ (24,442) |

$ (11,058) |

$ 103,416 |

||||||||

|

Net income |

– |

– |

– |

– |

552 |

– |

– |

552 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

(581) |

– |

(581) |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,072) |

– |

– |

(1,072) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

100 |

– |

– |

– |

100 |

||||||||

|

Balance at September 29, 2024 |

$ 530 |

$ 3,633 |

$ 1,311 |

$ 10,625 |

$ 122,397 |

$ (25,023) |

$ (11,058) |

$ 102,415 |

||||||||

|

Class B |

Accumulated |

|||||||||||||||

|

Class A |

Convertible |

Additional |

Other |

Treasury |

||||||||||||

|

Preferred |

Common |

Common |

Paid-in |

Retained |

Comprehensive |

Stock, |

Shareholders’ |

|||||||||

|

Stock |

Stock |

Stock |

Capital |

Earnings |

Loss |

at Cost |

Equity |

|||||||||

|

Balance at December 31, 2022 (as restated) |

$ 530 |

$ 3,626 |

$ 1,318 |

$ 11,928 |

$ 115,999 |

$ (27,549) |

$ (13,292) |

$ 92,560 |

||||||||

|

Net income |

– |

– |

– |

– |

2,969 |

– |

– |

2,969 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

(296) |

– |

(296) |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,012) |

– |

– |

(1,012) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

75 |

– |

– |

– |

75 |

||||||||

|

Balance at April 2, 2023 |

$ 530 |

$ 3,626 |

$ 1,318 |

$ 12,003 |

$ 117,956 |

$ (27,845) |

$ (13,292) |

$ 94,296 |

||||||||

|

Net income |

– |

– |

– |

– |

1,014 |

– |

– |

1,014 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

316 |

– |

316 |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Preferred stock – 6% |

– |

– |

– |

– |

(9) |

– |

– |

(9) |

||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,068) |

– |

– |

(1,068) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

357 |

– |

– |

– |

357 |

||||||||

|

Issuance of vested shares |

– |

– |

– |

(861) |

– |

– |

817 |

(44) |

||||||||

|

Balance at July 2, 2023 |

$ 530 |

$ 3,626 |

$ 1,318 |

$ 11,499 |

$ 117,893 |

$ (27,529) |

$ (12,475) |

$ 94,862 |

||||||||

|

Net income |

– |

– |

– |

– |

792 |

– |

– |

792 |

||||||||

|

Other comprehensive income, |

||||||||||||||||

|

net of tax |

– |

– |

– |

– |

– |

198 |

– |

198 |

||||||||

|

Cash dividends declared: |

||||||||||||||||

|

Common stock – ($0.88 per share) |

– |

– |

– |

– |

(1,018) |

– |

– |

(1,018) |

||||||||

|

Share-based compensation: |

||||||||||||||||

|

Expense recognition |

– |

– |

– |

50 |

– |

– |

– |

50 |

||||||||

|

Conversion of common stock |

– |

4 |

(4) |

– |

– |

– |

– |

– |

||||||||

|

Balance at October 1, 2023 |

$ 530 |

$ 3,630 |

$ 1,314 |

$ 11,549 |

$ 117,667 |

$ (27,331) |

$ (12,475) |

$ 94,884 |

||||||||

|

Burnham Holdings, Inc. |

||||||||||||

|

Non-GAAP Reconciliations |

||||||||||||

|

(In thousands, except per share amounts) |

||||||||||||

|

(Unaudited) |

||||||||||||

|

Three Months Ended, |

Nine Months Ended, |

|||||||||||

|

September 29, |

September 29, |

|||||||||||

|

2024 |

2024 |

|||||||||||

|

GAAP |

Adjustments |

Adjusted |

GAAP |

Adjustments |

Adjusted |

|||||||

|

Selling, general and administrative expenses |

$ 11,605 |

$ (1,536) |

$ 10,069 |

$ 32,115 |

$ (1,536) |

$ 30,579 |

||||||

|

Net sales |

$ 64,689 |

$ – |

$ 64,689 |

$ 176,083 |

$ – |

$ 176,083 |

||||||

|

SG&A as percent of sales |

17.9 % |

15.6 % |

18.2 % |

17.4 % |

||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 29, |

October 1, |

September 29, |

October 1, |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

Net sales |

$ 64,689 |

$ 59,705 |

$ 176,083 |

$ 171,406 |

||||||||

|

Net income |

$ 552 |

$ 792 |

$ 4,384 |

$ 4,775 |

||||||||

|

Exclude: |

||||||||||||

|

Income tax expense |

165 |

236 |

1,309 |

1,426 |

||||||||

|

Interest expense |

697 |

921 |

1,526 |

2,107 |

||||||||

|

Depreciation and amortization |

1,322 |

1,219 |

4,031 |

3,730 |

||||||||

|

EBITDA |

$ 2,736 |

$ 3,168 |

$ 11,250 |

$ 12,038 |

||||||||

|

EBITDA as a percent of net sales |

4.2 % |

5.3 % |

6.4 % |

7.0 % |

||||||||

|

EBITDA |

$ 2,736 |

$ 3,168 |

$ 11,250 |

$ 12,038 |

||||||||

|

Adjustments |

1,536 |

– |

1,536 |

– |

||||||||

|

Adjusted EBITDA |

$ 4,272 |

$ 3,168 |

$ 12,786 |

$ 12,038 |

||||||||

|

Adjusted EBITDA as a percent of net sales |

6.6 % |

5.3 % |

7.3 % |

7.0 % |

||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 29, |

October 1, |

September 29, |

October 1, |

|||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

Net income |

$ 552 |

$ 792 |

$ 4,384 |

$ 4,775 |

||||||||

|

Adjustments, net of tax |

1,183 |

– |

1,183 |

– |

||||||||

|

Adjusted net income |

$ 1,735 |

$ 792 |

$ 5,567 |

$ 4,775 |

||||||||

|

Diluted weighted-average shares outstanding |

4,718 |

4,629 |

4,713 |

4,618 |

||||||||

|

Diluted earnings per share |

$ 0.12 |

$ 0.17 |

$ 0.93 |

$ 1.03 |

||||||||

|

Adjusted diluted earnings per share |

$ 0.37 |

$ 0.17 |

$ 1.18 |

$ 1.03 |

||||||||

![]() View original content:https://www.prnewswire.com/news-releases/burnham-holdings-inc-announces-third-quarter-2024-financial-results-302286151.html

View original content:https://www.prnewswire.com/news-releases/burnham-holdings-inc-announces-third-quarter-2024-financial-results-302286151.html

SOURCE Burnham Holdings, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

$1000 Invested In Motorola Solns 15 Years Ago Would Be Worth This Much Today

Motorola Solns MSI has outperformed the market over the past 15 years by 6.66% on an annualized basis producing an average annual return of 18.82%. Currently, Motorola Solns has a market capitalization of $77.93 billion.

Buying $1000 In MSI: If an investor had bought $1000 of MSI stock 15 years ago, it would be worth $13,020.86 today based on a price of $467.08 for MSI at the time of writing.

Motorola Solns’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Soft Tissue Repair Market Size to Worth USD 12.78 Billion by 2034 With 5.6% CAGR | Fact.MR Report

Rockville, MD, Oct. 24, 2024 (GLOBE NEWSWIRE) — According to a new industry report released by Fact.MR, the global soft tissue repair market size is expected to reach a size of US$ 7.39 billion in 2024 and further expand at 5.6% CAGR, to reach a value of US$ 12.78 billion by the end of 2034.

Because of the increasing aging population, demand for orthopedic procedures is increasing at a significant pace, offering lucrative prospects for soft tissue repair solution providers. Chronic conditions like diabetes-related gangrene, osteoarthritis, and peripheral vascular disease are boosting the demand for orthopedic procedures, including amputations. Consequently, there is a surge in overall sales within the soft tissue repair market.

Increased investment in soft tissue repair research and development fuels market expansion, fostering the introduction of novel products and technological advancements. This market is experiencing substantial growth, offering substantial opportunities for the healthcare sector.

For More Insights into the Market, Download a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10115

Key Takeaways from Market Study

- The market is forecasted to expand at a CAGR of 6% from 2024 to 2034.

- Sales of soft tissue repair products in the United States are placed to reach US$ 3.05 billion in 2024.

- Brazil is set to occupy 6% market share in East Asia in 2024.

- The market in Canada is estimated to reach a value of US$ 511 million in 2024.

- The North American market is forecasted to expand at a CAGR of 9% from 2024 to 2034.

“Development of products for soft tissue repair has resulted from the growing preference for minimally invasive procedures. Increasing prevalence of sports-related injuries is an additional factor driving market growth,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Soft Tissue Repair Market:

Smith & Nephew Plc.; Medtronic Plc.; Arthrex, Inc.; Medprin Biotech; Zimmer Biomet; Stryker Corporation; Baxter International, Inc.; Stryker; Medtronic; Acera Surgical Inc.; Arthrex Inc.; Integra LifeSciences; Acelity L.P. Inc.; Aroa Biosurgery Limited; Becton, Dickinson and Company; Conmed.

Rising Awareness of Injury Prevention and Rehabilitation in United Kingdom

The United Kingdom is a key player in the soft tissue repair market due to its extensive healthcare system and active population. Due to the increasing awareness of the importance of sports injury prevention and rehabilitation, the country is seeing notable advancements in this field. Prominent healthcare providers and medical equipment manufacturers also benefit the UK market. These companies continually bring innovative soft tissue repair products and methods to the market, which helps it grow. Due to its commitment to healthcare research and development, which fosters the development of cutting-edge soft tissue repair technologies, the United Kingdom is a major player in the global market.

Soft Tissue Repair Industry News:

- Theradaptive, a biopharmaceutical company leading the way in regenerative treatments, and 3D Systems, a prominent developer of additive manufacturing technology, signed a partnership designating 3D Systems as Theradaptive’s 3D printing partner. The main goal of the firms was to offer a new method of promoting bone and tissue growth by using medical devices from 3D Systems and unique Theradaptive material binding variants.

- In December 2022, Stryker debuted the Citrefix suture anchor system, designed specifically for foot and ankle surgery. The invention features a disposable suture anchor system and a resorbable biomimetic anchor body, in contrast to traditional anchor systems.

- In May 2022, Paragon 28 Inc. released the Grappler Suture Anchor System, which significantly eased the challenges related to ligament restoration and soft tissue tensioning in acute foot and ankle surgeries.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10115

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the soft tissue repair market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the soft tissue repair market based on product type (synthetic, allograft, xenograft, alloplast), application (breast reconstruction, hernia, dermatology, orthopedics, dental problems, vaginal sling), and end user (hospitals, ambulatory surgical centers, clinics) across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Soft Tissue Allografts Market Analysis by Cartilage Allografts, Tendon Allografts, Meniscus Allografts, Dental Allografts, and Others for Hospitals, Aesthetic Centers, and Others from 2023 to 2033

Soft Tissue Anchor Market Study by Absorbable and Non-Absorbable Metallic Suture Anchors, Bio-absorbable Suture Anchors, PEEK Sutures, All Suture, and Bio-composite Suture Anchors from 2024 to 2034

Tissue Processing System Market Study by Small Volume Tissue Processors, Medium Volume Tissue Processors, Rapid High Volume Tissue Processors from 2024 to 2034

Tissue Glue and Bio-adhesive Sealant Market Study by Protein-based, Collagen-based, Thrombin-based, Fibrin, and Gelatin-based Sealants from 2024 to 2034

Hemostasis and Tissue Sealing Agents Market Analysis By Product (Topical Hemostats, Adhesive & Tissue Sealants), By End User (Hospitals, Ambulatory Surgery Centers, Home Care Settings, Others), & By Region – 2024 to 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aventon Companies Breaks Ground on Aventon Holly Hill

Aventon Holly Hill is Aventon’s Newest Community in the Orlando Metro Region

ORLANDO, Fla., Oct. 24, 2024 /PRNewswire/ — Aventon Companies, a prominent multifamily developer and general contractor with active projects throughout the Mid-Atlantic and Southeast, announces that construction has begun on its newest Orlando area development Aventon Holy Hill. The three-story, garden-style community will open in the second half of 2025.

With Aventon Holly Hill marking Aventon Companies’ sixth project in the Orlando submarket, it remains committed to the flourishing metro area. One, two and three-bedroom options will comprise 288 units spread across 14.5 acres. Each apartment will be outfitted with the firm’s signature best-in-class finishes and attention to detail. With a focus on creating a sense of community, shared amenities will include a business lounge, fitness center, game room, resort-style pool, and an on-site pet spa. The community’s prime location on U.S. Route 27 also offers easy commuting access to major area employers within the Orlando Commercial Corridor and to local attractions like Disney World.

“Data indicates that Orlando is one of the fastest growing areas in the entire country with over 1,500 new residents added to the population every week,” said Sean Flanagan, Senior Development Director for Aventon Companies. “Aventon Holly Hill is designed to fulfill the growing desire for luxury living in the heart of it all.”

The overall design of Aventon Holly Hill was created by Watts Leaf Architects, with interiors curated by Studio 5 Interiors. The property will be located at the intersection of Holly Hill Grove Road and U.S. Route 27 in the city of Davenport. Since 2019, Aventon Companies has assembled an impressive $2 billion portfolio of ground-up developments bringing nearly 9,000 Aventon-branded apartment homes to Florida, Georgia, the Carolinas, and the Mid-Atlantic.

About Aventon Companies

Aventon Companies acquires, develops, constructs, and asset manages multifamily communities in Florida, Georgia, the Carolinas and the Mid-Atlantic with regional offices in West Palm Beach, FL, Tampa, FL, Orlando, FL, Raleigh, NC and Bethesda, MD. To learn more, visit www.aventoncompanies.com.

Media Contact:

Kristen Skladd

586-222-2423

kristen@andersoncollaborative.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aventon-companies-breaks-ground-on-aventon-holly-hill-302285397.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aventon-companies-breaks-ground-on-aventon-holly-hill-302285397.html

SOURCE Aventon Companies

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Meta Platforms Stock Ahead Of Q3 Earnings?

Meta Platforms Inc META shares are up nearly 25% over the past quarter. The company is gearing up to report earnings again next week. Here’s a look at what you need to know ahead of the report.

What To Know: Meta is scheduled to report third-quarter financial results after the market close on Oct. 30. The company is expected to report earnings of $5.24 per share and revenue of $40.253 billion, according to estimates from Benzinga Pro.

Meta has exceeded analyst estimates on the top and bottom lines in six consecutive quarters heading into the third-quarter print.

Last quarter, Meta beat analyst estimates as revenue jumped 11% year-over-year and daily actives climbed 7%. The company noted at the time that Meta AI was on track to be the most used AI assistant in the world by the end of the year.

“We had a good quarter. We continue to see strong engagement across our apps and we have the most exciting roadmap I’ve seen in a while with Llama 2, Threads, Reels, new AI products in the pipeline, and the launch of Quest 3 this fall,” CEO Mark Zuckerberg said in the second-quarter earnings release.

Check This Out: Meta’s Reels Monetization and AI Innovations Drive Top AI Pick: Analyst

Several analysts have already released positive updates ahead of earnings next week. BofA Securities maintained a Buy rating and price target of $630 earlier this week, calling Meta a top AI pick. The analyst firm expects Meta’s quarterly results to exceed consensus estimates.

Jefferies also maintained a Buy rating on Meta this week and lifted the price target from $600 to $675. Other recent analyst changes include a price target increase to $675 by TD Cowen, an Overweight reiteration from Cantor Fitzgerald and a price target bump to $650 from Mizuho.

Mizuho analyst James Lee maintained an Outperform rating on the stock heading into earnings as he anticipates a beat-and-raise quarter from the tech giant next week.

Ad agency checks showed that ad spending is ahead of consensus estimates and at the high-end of Meta’s guidance for 20% growth year-over-year, the analyst said.

“Although the stock is a crowded trade into the print, we believe it is the only big tech internet name that could beat and raise with substantial optionality in messaging and Gen-AI for creative,” Lee said.

Meta will hold a conference call at 5 p.m. ET next Wednesday to discuss the company’s quarterly performance with analysts and investors.

META Price Action: Meta shares are up approximately 60% year-to-date heading into the report. The stock was up 0.54% at $566.74 the time of publication Thursday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Outstanding Dividend Stocks That Are Too Cheap to Ignore

When dividend-paying companies go on sale, their yields increase, which can make them juicy passive income opportunities. But a dividend is only as good as the company paying it; meaning if you’re going to invest in a beaten-down dividend-paying company, it has to be able to overcome whatever challenges it is going through.

United Parcel Service (NYSE: UPS) and Devon Energy (NYSE: DVN) are far from firing on all cylinders, but both companies have what it takes to find their footing. Meanwhile, the stock of Kinder Morgan (NYSE: KMI) just hit an eight-year high and could still be a great value.

Here’s what makes all three dividend stocks great buys now, according to these Motley Fool contributors.

Daniel Foelber (United Parcel Service): UPS has a 22.2 price-to-earnings ratio (P/E) and a dividend yield of 4.8%. So right off the bat, it stands out as an intriguing high-yield value stock. But when a well-known industry leader has a depressed valuation or inflated yield, it is usually for good reasons.

UPS has seen a significant reduction in its sales growth and profitability in the past couple of years. As you can see in the following chart, it enjoyed a surge in sales and margins during the pandemic, but now the business is arguably worse off than it was pre-pandemic. Past success means little to investors, who tend to care more about where a company is headed than where it has been.

In March, UPS outlined a three-year plan to get back on course, with an emphasis on increasing delivery volumes in 2024 and operating margins in 2025 and 2026. It has made some progress on that plan, with higher delivery volumes in the second quarter, but it needs to sustain that momentum to impress investors.

The good news is that UPS remains highly committed to its dividend, although raises may be small for the foreseeable future until the company can show meaningful earnings growth, and thus justify a higher payout. But at a 4.8% yield, it is already offering income investors something to like, making it a worthwhile dividend stock to consider buying now.

Scott Levine (Devon Energy): For those looking to procure steady passive income, it can be incredibly exciting to find a compelling dividend stock.

But to find one sitting in the bargain bin? That’s the icing on the cake — and it’s an opportunity that is available with Devon Energy, which offers a juicy forward dividend yield of 4.9%. Currently, shares of this leading oil stock trade at 3.8 times operating cash flow, representing a discount to the five-year average cash flow multiple of 4.

Looking At Bank of America's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on Bank of America. Our analysis of options history for Bank of America BAC revealed 37 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 25 were puts, with a value of $1,600,134, and 12 were calls, valued at $408,606.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $48.0 for Bank of America during the past quarter.

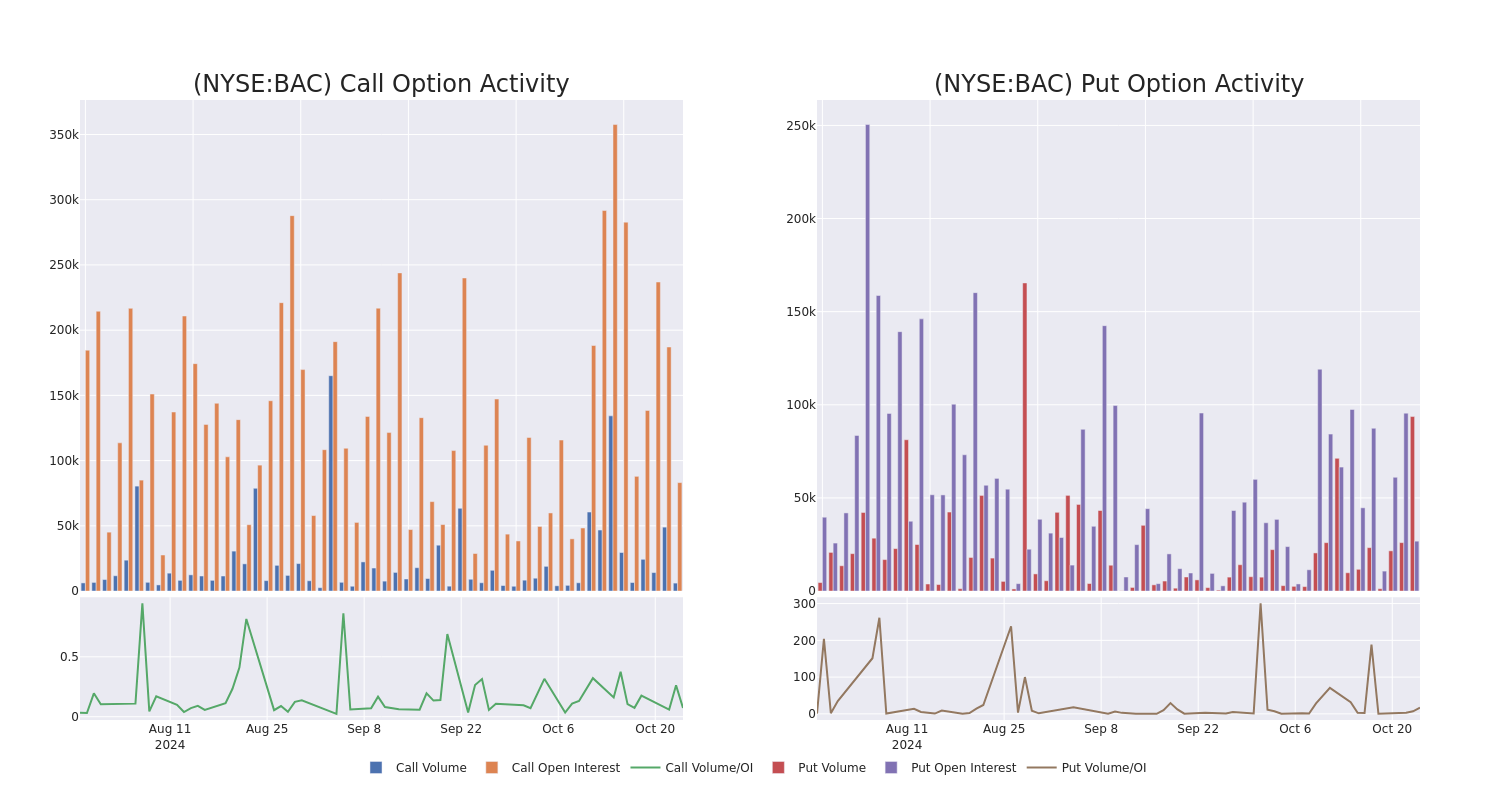

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Bank of America options trades today is 9159.25 with a total volume of 99,774.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Bank of America’s big money trades within a strike price range of $20.0 to $48.0 over the last 30 days.

Bank of America Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.42 | $2.4 | $2.4 | $43.00 | $79.9K | 5.4K | 4.0K |

| BAC | CALL | SWEEP | BEARISH | 12/20/24 | $22.5 | $22.4 | $22.43 | $20.00 | $76.2K | 15 | 0 |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.37 | $2.34 | $2.34 | $43.00 | $76.0K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.35 | $2.33 | $2.33 | $43.00 | $73.3K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.43 | $2.41 | $2.41 | $43.00 | $72.3K | 5.4K | 3.7K |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

In light of the recent options history for Bank of America, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Bank of America

- Trading volume stands at 15,957,725, with BAC’s price down by -0.09%, positioned at $42.3.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 84 days.

Expert Opinions on Bank of America

5 market experts have recently issued ratings for this stock, with a consensus target price of $48.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Bank of America, which currently sits at a price target of $48.

* An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $46.

* An analyst from Morgan Stanley persists with their Overweight rating on Bank of America, maintaining a target price of $47.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on Bank of America, maintaining a target price of $50.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Bank of America with a target price of $50.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of America options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.