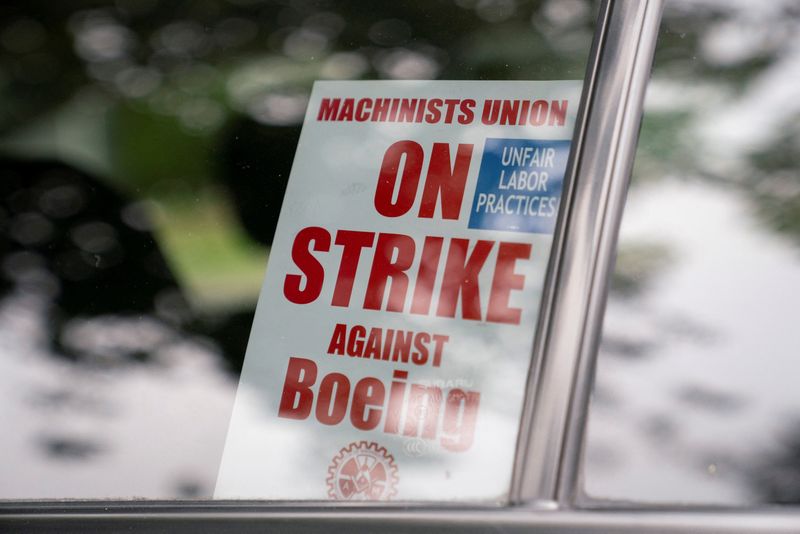

Boeing shares fall after workers reject latest offer

By Abhijith Ganapavaram, Anandita Mehrotra and Tim Hepher

(Reuters) -Striking workers’ rejection of Boeing’s latest contract offer hit shares across the U.S. aerospace sector on Thursday, raising doubts about the company’s efforts to stabilize its finances and restore its battered image.

Some 64% of the planemaker’s U.S. West Coast factory workers rejected the offer late on Wednesday, leaving assembly lines idle for nearly all of Boeing’s commercial jets, including the 737 MAX, the backbone of its balance sheet.

Boeing shares fell over 2% and the company’s leading suppliers also came under pressure, led by Spirit AeroSystems, which lost almost 4% after warning of layoffs and more furloughs.

“The Boeing circumstances are obviously very challenging. We all saw the results of the vote yesterday night, which is unfortunate,” Honeywell CEO Vimal Kapur said on a call with analysts. The company is a major supplier of cockpit instruments and other parts.

The offer included a 35% general wage increase over four years but no defined benefit pension plan, which was one of the striking machinists’ main demands.

Deadlock over the pension plan, which was withdrawn following a deal to keep jobs in Washington state a decade ago, raised immediate concerns over the duration of strike as rating agencies monitor Boeing for a possible downgrade to junk status.

“A longer strike delays Boeing’s recovery and increases financial pressure on the company and its (credit) rating,” said Ben Tsocanos, aerospace director at S&P Global Ratings.

“The rejection raises the risk of a protracted strike if the obstacle is reinstatement of a pension. We believe the company is not likely to agree to a pension because of the cost.”

Others said the stoppage leaves the U.S. planemaker with dwindling options as it bleeds cash.

“Boeing is going to have to settle it and just make a higher offer, because they are just not in a position to duke it out,” said Agency Partners analyst Nick Cunningham.

“This rejection adds further uncertainty, costs and recovery delays as the strike approaches day 40. We anticipate further concessions of wages will be required for a deal to pass,” Bank of America analyst Ron Epstein said in a note.

With the clock ticking on a potential Boeing downgrade, the company’s first major strike in 16 years has sent Wall Street combing through online forums and worker demographic data to predict how the strike over pensions and pay will unfold.

Wells Fargo analyst Matthew Akers said raising the wage offer to meet the union’s demand of 40% could end the dispute, noting that members were divided online on the pension issue.

Pet Food Ingredients Market Poised for Growth: Premiumization and Rising Pet Ownership Drive Demand

Delray Beach, FL, Oct. 24, 2024 (GLOBE NEWSWIRE) — The global pet food ingredients market is set for significant growth, projected to expand from USD 34.2 billion in 2023 to USD 47.4 billion by 2028, at a compound annual growth rate (CAGR) of 6.8%. Several factors, including the rising demand for premium and specialty pet foods and the increase in pet ownership, particularly in urban areas, are fueling this upward trend. As more individuals embrace pets as part of their households, the demand for high-quality, diverse, and innovative pet food ingredients continues to rise.

Rising Pet Ownership and Expenditure: Fueling Market Growth

The growing trend of pet ownership, especially in urban settings, is contributing directly to the surge in demand for pet food ingredients. More households, particularly in cities, are welcoming pets, and owners are increasingly viewing them as integral family members. This emotional connection leads to higher expenditure on pet care, especially on premium products. Pet owners are now more inclined to invest in pet food that incorporates high-quality ingredients, further boosting market growth.

Increased expenditure on pet food is a key factor driving the market forward. With a rising focus on pet health, owners are opting for diverse and high-nutritional ingredients, from premium meats to novel plant-based products. This willingness to invest in their pets’ health encourages manufacturers to innovate and provide a variety of high-end ingredients that cater to the evolving demands of modern pet owners.

Report Coverage & Details

| Report Metric | Details |

| Revenue prediction in 2028 | USD 47.4 billion |

| Growth Rate | CAGR of 6.8% from 2023-2028 |

| Forecast period considered | 2023–2028 |

| Segments Covered | By Ingredient, Source, Form, and Region |

| Regions covered | North America, Europe, South America, Asia Pacific, and RoW |

Unlock further insights—request your PDF copy!

Deboned Meat Accounted for the Largest Pet Food Ingredients Market Share

One of the major drivers of the pet food ingredients market is the trend of premiumization. Pet owners are increasingly willing to spend more on high-quality and specialty pet foods, seeking products that cater to their pets’ health and nutritional needs. This shift in consumer behavior is driven by growing awareness of pet health, nutrition, and well-being. As a result, manufacturers are investing in new ingredient formulations, exploring innovative sources that not only enhance the nutritional value of pet foods but also improve taste and digestibility.

For instance, deboned meat products, particularly deboned beef, are becoming highly popular due to their superior protein content and digestibility. These products offer essential amino acids that support muscle development and general health in pets, making them a preferred choice for pet owners seeking premium nutrition for their animals. The rise in pet allergies has also led to increased demand for single-source proteins like deboned beef, which addresses concerns about food sensitivities in pets.

Cats: Leading the Growth in Pet Food Ingredients

While dogs have long been the dominant pet category, cats are now growing at the highest rate in the pet food ingredients market. Rising cat ownership, particularly in urban areas, is driving demand for specialized and high-quality cat food components. As more families adopt cats, there is a greater emphasis on providing optimal nutrition to ensure their well-being.

Cat owners are looking for natural, nutrient-rich ingredients that cater to their pets’ dietary needs. This growing awareness of feline health is spurring manufacturers to develop premium cat food options, often mirroring human dietary trends. Ingredients rich in critical nutrients, such as proteins, vitamins, and minerals, are becoming the norm in the rapidly expanding cat food segment.

North America: Dominating the Market

North American pet food ingredients market is expected to dominate the industry during the forecast period. The region’s well-established pet food industry, supported by numerous manufacturers and distributors, ensures efficient production and sourcing of a diverse range of ingredients. The advent of e-commerce platforms has further boosted the accessibility of pet food, allowing pet owners to easily purchase high-quality and specialized products.

The demand for meat and meat products in North America continues to soar due to their superior nutritional profile. These products serve as excellent sources of amino acids, fatty acids, and essential vitamins and minerals that promote pet health, boosting the immune system and supporting overall growth. Additionally, meat products enhance the palatability of pet foods, making them a favored choice among pet owners in the region.

The pet food ingredients industry growth is driven by the rising trend of premiumization, increased pet ownership, and higher pet care expenditure. As pet owners continue to prioritize their pets’ health and well-being, the demand for diverse, high-quality, and innovative ingredients will only grow. North America is expected to maintain its dominance in the market, supported by its well-developed infrastructure and consumer preference for premium pet food products.

Let Us Help You Understand the Future: Key Takeaways from Our Research Reports!

- What are the Emerging Opportunities and Hidden Challenges Shaping the Pet Food Ingredients Market?”

- “Where Will Your Next Revenue Streams Come From?”

- “Who Will Be Your Key Customer and What Will Drive Their Loyalty?”

- “How Can You Protect Your Market Share or Outpace Competitors?”

- “Evaluate Potential Partners with a Strategic Scorecard

Top Pet Food Ingredients Leaders: Innovating for Healthier Pets

- BASF SE (Germany)

- Darling Ingredients Inc (US)

- Cargill, Incorporated (US)

- Ingredion (US)

- DSM (Netherlands)

- Omega Protein Corporation (US)

- ADM (US)

- Kemin Industries, Inc (US)

- Chr. Hansen Holding A/S (Denmark)

- Roquette Frères (France)

- The Scoular Company (US)

- Symrise (Germany)

- Mowi (Norway)

- Lallemand Inc. (Canada)

Download a sample report or Speak to our Analysts to gain deeper insights into the pet food ingredients market, including:

- Market size and forecast.

- Growth potential.

- Emerging trends and innovations in the pet food space.

- Competitive landscape and key players.

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fourth Avenue Capital breaks ground on 240 apartments in Liberty Lake, WA

SEATTLE, Oct. 24, 2024 /PRNewswire/ — Garden-Style Community to Add 240 Apartment Homes to Liberty Lake’s Meadowwood Technology Campus.

Fourth Avenue Capital has commenced construction on Signal Point Apartment Homes, a luxury suburban apartment community within the mixed-use Meadowwood Technology Campus in Liberty Lake, WA.

This new development will feature 240 apartment homes, complemented by an expansive resident clubhouse, gym, and leasing center. Set in a tranquil, park-like environment, Signal Point is just minutes from the town center, with easy access to major highways. The first move-ins are projected for mid-2025.

“Liberty Lake continues to be one of the most sought-after markets in the Spokane metro area,” said Chris Rossman, Managing Partner of Fourth Avenue Capital. “Its excellent schools, small-town charm, and abundant recreational opportunities make it an ideal location for Signal Point.”

Located at 24085 E Mission Ave, Signal Point is perfectly situated to take advantage of Liberty Lake’s many amenities. As part of the Meadowwood Technology Campus, residents will enjoy access to a wide range of services and amenities within the master-planned community. Nearby recreational spots such as Liberty Lake, Liberty Lake Golf Course, Meadowwood Golf Course, and Rocky Hill Park are all within a mile and a half of the property.

“Our goal was to blend top-tier suburban living amenities with the natural beauty of the area,” Rossman added. “Signal Point will offer residents the modern conveniences they expect, while providing the open spaces and outdoor features of a garden-style community.”

Signal Point will offer a mix of one-, two-, and three-bedroom apartment homes, ranging from 733 to 1,318 square feet. Each unit will be outfitted with high-end finishes, including quartz countertops, stainless steel appliances, under-cabinet lighting, wood-style flooring, and oversized windows. Many homes will also include walk-in closets and extra storage space.

The community will be rich in amenities, including an oversized clubhouse with entertainment areas, social spaces, and private workstations. Fitness enthusiasts will appreciate the full-size gym, equipped with cardio machines, free weights, and CrossFit options, all overlooking the pool area and lawn, where residents can extend their workouts outdoors. Additional outdoor amenities include a spacious living area with a dining section and fireplace, a pool and spa, barbecue grills, lounging spaces, and a dog park.

Signal Point is designed to offer the perfect blend of modern luxury and suburban comfort, making it a standout option for those seeking a high-quality living experience in Liberty Lake.

About Fourth Avenue Capital

Fourth Avenue Capital is a real estate investment, development, and operating company headquartered in Seattle and Spokane, Washington focused on middle market multifamily assets in the Pacific Northwest. FAC has acquired over 1,000 units/ beds to date and a development pipeline exceeding 500 units and $150MM cost. FAC’s existing assets under management total more than $300M.

Fourth Avenue Capital plans to expand its portfolio through strategic acquisitions, leveraging strong relationships with industry partners and its ability to identify attractive investment opportunities. By aligning investor interests and implementing sustainable practices, the company aims to create lasting value while making a positive impact on the communities it serves.

For more information about Fourth Avenue Capital, please visit www.fourthavecapital.com

Media Contact:

Fourth Avenue Capital

investors@fourthavecapital.com

www.fourthavecapital.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fourth-avenue-capital-breaks-ground-on-240-apartments-in-liberty-lake-wa-302285151.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fourth-avenue-capital-breaks-ground-on-240-apartments-in-liberty-lake-wa-302285151.html

SOURCE Fourth Avenue Capital

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Redwood's Fall 2024 Sustainability in Logistics Report: 97% of Companies Considering a Digital Solution to Deliver on Scope 3 Decarbonization goals

—Research indicates that decarbonization efforts bring companies

$200M in annual net benefits—

CHICAGO, Oct. 24, 2024 (GLOBE NEWSWIRE) — Redwood’s Fall 2024 Sustainability in Logistics Report, informed by recent Gartner and Boston Consulting Group research, as well as Redwood’s recent Sustainability in Logistics event, has indicated significant momentum for companies’ investment in decarbonization and sustainability practices.

The Gartner Market Guide for Logistics Carbon Accounting and Management Solutions, featuring Redwood as a Representative Vendor, reported that: “The adoption of logistics carbon accounting and management solutions (LCAMSs), which enables evaluation of logistics greenhouse gas (GHG) sustainability performance, is accelerating. According to a study conducted by the Scope 3 Peer Group, 97% of responding organizations consider the use of a digital solution to help them deliver on their company’s Scope 3 decarbonization goals to be very or extremely important.”

At the Redwood Sustainability in Logistics event, UNVR’s Travis Vedral, Sr. Director Transportation Strategy, identified three core pillars for the transportation industry that can be acted upon today without significant tech investment. Those include minimizing miles, implementing efficient equipment, and targeted training of staff so they understand the role they play in turning the tide.

“For an effective sustainability plan to come to fruition, you have to start with an effective team centered around research, collaboration and education,” added Vedral. “UNVR’s research as well as market research indicates that tech investment is seen as a barrier to entry, especially in transportation. However, any company can act now without having to implement any new technology. The only thing they must be willing to invest in is internal assessment and research.”

In addition, results from the Boston Consulting Group’s fourth annual Carbon Emissions Survey, announced Sept. 17, revealed that decarbonization efforts bring companies $200M in annual net benefits. From the report:

“Climate leaders in our survey have realized significant value from their decarbonization efforts, including financial benefits equal to more than 7% of their revenues—for an average net benefit of $200 million a year. To achieve these financial benefits, leading companies are stepping beyond foundational actions, such as measuring and reporting emissions, and adopting more advanced actions—including using AI in their climate efforts and calculating product-level emissions—to support their decarbonization journeys.”

Redwood offers companies at any step in their sustainability journey a solution in Redwood Hyperion, which delivers logistics carbon visibility for all shipments moved with Redwood’s brokerage, or using shipment data sourced through Redwood’s proprietary integration platform, RedwoodConnect® which integrates directly with customers’ Transportation Management System (TMS), Supply Chain Management (SCM) or Enterprise Resource Planning (ERP).

“The evolution of decarbonization and sustainability efforts in 2024 is intertwined with Scope 3 regulations, creating new challenges and opportunities,” added Nate Greensphan, Director of Product, Redwood. “While tech investment isn’t necessary to get started on a sustainability journey, it can certainly help to kickstart the process and is essential for companies that have more evolved plans. We are the only 4PL – or 3PL- provider included in the Market Guide offering these digital sustainability solutions to the transportation industry and shippers at large.”

As a leading 4PL provider, Redwood is uniquely positioned to assist shippers as they strive to meet these upcoming challenges. Redwood Hyperion automates detailed load-by-load emissions calculations, provides supply chain emissions metrics & analytics, and supports carbon neutral initiatives by facilitating carbon credit purchases toward verified projects.

Redwood Hyperion calculates carbon emissions through sourced shipment data including weight, distance, mode and vehicle type, which is then cleansed, normalized and calculated to freight-based emissions using GLEC-supplied emission factors for all mode types. Reports can be viewed or downloaded from Hyperion or the data can be extracted into any internal tool for further analysis or utilization.

Additional resources:

About Redwood Logistics

Redwood Logistics, a leading logistics platform company and modern 4PL headquartered in Chicago, has provided solutions for moving and managing freight for more than 21 years. The company’s diverse portfolio includes digital freight brokerage and flexible freight management all wrapped into a revolutionary logistics and technology strategy, a modern 4PL. Redwood’s 4PL strategy utilizes an open platform for digital logistics that empowers shippers to seamlessly mix-and-match partners, technologies and solutions into their own unique digital supply chain fingerprint. Redwood connects a wide range of customers to the power of supply chain management, technology and the industry’s brightest minds. For more information, visit www.redwoodlogistics.com.

Media Contact:

Tyler Thornton

LeadCoverage

tyler@leadcoverage.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want $300 in Dividends Every Month? Invest $20,000 in Each of These 3 Stocks

Recurring dividend income can help boost your savings, help pay bills, and/or potentially even allow you to retire early. There’s a significant incentive for building up a strong portfolio of high-yielding dividend stocks as the payoff could be huge in the long run.

And while most dividend stocks only pay you every three months, you can create a stream of recurring monthly income by investing in at least three of them that pay at different times within the quarter. If you invest $20,000 into Verizon Communications (NYSE: VZ), Organon & Co. (NYSE: OGN), and Bank of Nova Scotia (NYSE: BNS), you can build up a diverse portfolio while collecting $300 in dividends in every month of the year.

Investing in a top telecom provider like Verizon can be a great move for dividend investors. These businesses tend to generate a steady stream of revenue from their subscribers. While customers may switch back and forth between telecom companies, the bigger players know what levels to push to ensure long-term stability in their operations. Verizon is definitely no exception to that.

While there may be short-term volatility on occasion, historically, this has made for a fairly sound business to invest in. In each of the past three years, the company has generated more than $130 billion in revenue, and its operating profits are normally more than 20% of its top line.

Last month, Verizon increased its dividend for the 18th consecutive year. And with the increase, the stock is now yielding 6.2%. On a $20,000 investment, you’d be collecting a quarterly dividend of $310 every time the company makes a payment — February, May, August, and November.

Organon is a healthcare company that focuses on women’s health. It spun off from Merck in 2021, and since then it has been operating on its own.

Like Verizon, it too has made for a stable business to invest in, with annual revenue normally above $6 billion. Its operating margins are also fairly strong at more than 20%. This year the company expects revenue to come in within a range of $6.2 billion and $6.5 billion.

While Organon doesn’t have a long track record of paying dividends, that is already a key reason investors may want to hold this stock in their portfolios. At 6.4%, it offers a yield that is close to five times the S&P 500 average of around 1.3%.

With its current yield, investing $20,000 into the stock would produce approximately $320 every quarter. Organon typically makes dividend payments every March, June, September, and December.

Analyst Report: General Motors Company

Summary

General Motors, one of the world’s largest automakers, traces its roots back to 1908. GM and its strategic partners produce cars and trucks in 31 countries and sell and service these vehicles through the following brands: Buick, Cadillac, Chevrolet, FAW, GMC, Daewoo, Holden, Jiefang, Opel, Vauxhall, and Wuling. GM’s largest national market is China, followed by the United States, Brazil, Germany, the United K

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

This Sam Altman-Backed Nuclear Stock Just Doubled in a Week. Is It Too Late to Buy?

Move over, AI stocks. Nuclear stocks are becoming the next big thing.

Investors have caught on to tech powerhouses like Nvidia that are capitalizing on demand for artificial intelligence (AI) chip components, but the data centers running AI applications like ChatGPT require tremendous amounts of power, and the big question facing investors now is which companies are going to power these “AI factories.”

That’s the main reason why utilities have been one of the hottest stock market sectors this year, up 28% at recent prices, and Vistra, an unregulated power company, is the top stock on the S&P 500, with gains of 227% through Wednesday’s close.

In particular, investors have sharpened their focus on nuclear stocks in the last few weeks as a number of new deals have shown that big tech companies are counting on nuclear power as a source of clean energy to power the AI revolution. Microsoft recently signed an agreement with Constellation Energy to restart the Three Mile Island nuclear plant in Pennsylvania. Alphabet ordered several small nuclear reactors from Kairos Power, and Amazon just signed several agreements for nuclear power.

One little-known nuclear stock capitalizing on the surge is Oklo (NYSE: OKLO), a developer of fission-power plants and a provider of nuclear fuel recycling services. It also has plenty of AI credibility, as OpenAI CEO Sam Altman has been the chairman of the board since 2015, shortly after its founding in 2013.

In the five-day span ending Oct. 21, Oklo shares jumped an incredible 115%, surging in nearly every session during that period, as the chart below shows.

In fact, even after a pullback on Wednesday, the stock was still trading for twice its closing price on Oct. 11.

So why is Oklo suddenly surging? Let’s take a look at the scorching-hot nuclear stock first, and then we’ll discuss whether it’s a buy.

There hasn’t been much company-specific news out on Oklo over the past week. The Department of Energy approved its Conceptual Safety Design Report for a fuel-fabrication facility in Idaho. However, that’s more of a routine development for the stock.

Instead, the jump in Oklo was driven by the broader interest in the sector sparked by the moves by Amazon and Alphabet, though no company has specifically contracted with Oklo. The reaction is based on the general interest in nuclear energy. Peers like Nuscale Power jumped 34% during that period, and Nano Nuclear Energy was up 39%.

Part of the gains in Oklo shares are likely related to Sam Altman, who owns roughly 6% of the company. Oklo went public in May through a special purpose acquisition company (SPAC) created by Altman, and its performance had been mediocre before last week’s breakout.

Flow Chemistry Market Expected to Register CAGR of 7.1% by 2031: SkyQuest Technology

Westford, US, Oct. 24, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Global Flow Chemistry Market size will reach a value of USD 3.32 Billion by 2031, with a CAGR of 7.1% during the forecast period (2024-2031). The global flow chemistry market is witnessing an enormous transformation and growth with the increased demand for sustainable and efficient production processes by the chemical and pharmaceutical industries. Benefits have been more widely compared with batch operations in a continuous flow chemistry, also known as microreactor technology, including improved control over the reaction, safety, waste generation, and efficiency.

Flow chemistry, for instance, provides appropriate control over reaction parameters such as temperature, pressure, and residence time to enhance even the quality of products and their yields. In the future, the global market will experience rapid growth due to increasing attention towards process optimization, sustainability, and cost efficiency.

Request Sample of the Report: https://www.skyquestt.com/sample-request/flow-chemistry-market

North America Led the Market Due to Growing Investments in R&D of Flow Chemistry

Due to the presence of major players in North America, it led the market to grow significantly in the region. Some of the prime drivers for the industrial growth in the region are the increase in the investments in the research and development of flow chemistry, particularly continuous processes, and expansion in the chemicals and pharmaceuticals manufacturing sector. The US market stands atop in North America as of 2023, with over 75% revenue share. The demand for flow chemistry products during the foreseeable projection period is expected to be led by the increasing domestic production and manufacturing capacity of the US.

Flow Chemistry Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.61 Billion |

| Estimated Value by 2031 | USD 3.32 Billion |

| Growth Rate | Poised to grow at a CAGR of 7.1% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Flow Chemistry and its Growing Applications |

| Key Market Opportunities | Green Chemistry Initiatives |

| Key Market Drivers | Increasing Demand for Efficient and Sustainable Manufacturing |

Get Customized Reports with your Requirements: https://www.skyquestt.com/speak-with-analyst/flow-chemistry-market

CSTR Dominance Due to Its Rising Applications in Wastewater and Water Applications

The continuous stirred tank reactors (CSTR) segment in 2023 had the market leader, which captured roughly over 36.4% of overall revenue. This comes as no surprise given its wide applications, ease to construct, efficient temperature control, cost-effectiveness, and flexibility in handling two-phase lines. Increasing applications of CSTRs in wastewater treatment and water processing are also envisaged to be among the future growth drivers for this industry. The increasing demand for efficient and reliable mixing solutions from the industries will further augment the demand for the technology.

Pharmaceutical Applications Segment is Expected to Grow Due to Need for Increasing Time of Drug Launch

Market contribution toward flow chemistry pharmaceutical application is expected to contribute significantly in terms of CAGR during the forecast period. The forward movement driving this is the need to accelerate the time of drug launch and the ever-increasing demand for process development in drug development. Flow chemistry can make the synthesis of pharmaceutical molecules fast and efficient and help researchers try lots of different formulation combinations and optimize reaction conditions. The process enables continuous processing, thereby increasing scalability and reducing waste. Large prospects exist in the pharmaceutical industry to increase flow chemistry systems immensely with its searches towards an enhancement of their R&D capacity and to meet regulatory requirements.

Is this report aligned with your requirements? Buy Now: https://www.skyquestt.com/buy-now/flow-chemistry-market

Flow Chemistry Market Drivers

- Increasing Demand for Efficient and Sustainable Manufacturing

- Safety Improvements

- Integration with Automation

Flow Chemistry Market Restraints

- High Initial Investment

- Complexity of Equipment

- Limited Market Awareness

Flow Chemistry Market Key Players

- Am Technology

- Asahi Glassplant Inc.

- METTLER TOLEDO

- Vapourtec Ltd.

- ThalesNano Inc.

- H.E.L. Group

- Uniqsis Ltd.

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

Key Questions Covered in the Flow Chemistry Market Report

- What are the factors driving the growth of the global flow chemistry market?

- Which is the fastest-growing sub-segment within the application category?

- Till 2031, what will be the growth rate of the market?

This report provides the following insights:

Analysis of key drivers (safety improvements, integration with automation), restraints (high initial investment, complexity of equipment), opportunities (green chemistry initiatives, emerging markets), and challenges (skill gap, economic factors) influencing the growth of the flow chemistry market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the flow chemistry market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the flow chemistry market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Ammonia Market: Global Opportunity Analysis and Forecast, 2024-2031

Bioplastics Market: Global Opportunity Analysis and Forecast, 2024-2031

Waste Management Market: Global Opportunity Analysis and Forecast, 2024-2031

Pharmaceutical Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

Beverage Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.