This Sam Altman-Backed Nuclear Stock Just Doubled in a Week. Is It Too Late to Buy?

Move over, AI stocks. Nuclear stocks are becoming the next big thing.

Investors have caught on to tech powerhouses like Nvidia that are capitalizing on demand for artificial intelligence (AI) chip components, but the data centers running AI applications like ChatGPT require tremendous amounts of power, and the big question facing investors now is which companies are going to power these “AI factories.”

That’s the main reason why utilities have been one of the hottest stock market sectors this year, up 28% at recent prices, and Vistra, an unregulated power company, is the top stock on the S&P 500, with gains of 227% through Wednesday’s close.

In particular, investors have sharpened their focus on nuclear stocks in the last few weeks as a number of new deals have shown that big tech companies are counting on nuclear power as a source of clean energy to power the AI revolution. Microsoft recently signed an agreement with Constellation Energy to restart the Three Mile Island nuclear plant in Pennsylvania. Alphabet ordered several small nuclear reactors from Kairos Power, and Amazon just signed several agreements for nuclear power.

One little-known nuclear stock capitalizing on the surge is Oklo (NYSE: OKLO), a developer of fission-power plants and a provider of nuclear fuel recycling services. It also has plenty of AI credibility, as OpenAI CEO Sam Altman has been the chairman of the board since 2015, shortly after its founding in 2013.

In the five-day span ending Oct. 21, Oklo shares jumped an incredible 115%, surging in nearly every session during that period, as the chart below shows.

In fact, even after a pullback on Wednesday, the stock was still trading for twice its closing price on Oct. 11.

So why is Oklo suddenly surging? Let’s take a look at the scorching-hot nuclear stock first, and then we’ll discuss whether it’s a buy.

There hasn’t been much company-specific news out on Oklo over the past week. The Department of Energy approved its Conceptual Safety Design Report for a fuel-fabrication facility in Idaho. However, that’s more of a routine development for the stock.

Instead, the jump in Oklo was driven by the broader interest in the sector sparked by the moves by Amazon and Alphabet, though no company has specifically contracted with Oklo. The reaction is based on the general interest in nuclear energy. Peers like Nuscale Power jumped 34% during that period, and Nano Nuclear Energy was up 39%.

Part of the gains in Oklo shares are likely related to Sam Altman, who owns roughly 6% of the company. Oklo went public in May through a special purpose acquisition company (SPAC) created by Altman, and its performance had been mediocre before last week’s breakout.

Flow Chemistry Market Expected to Register CAGR of 7.1% by 2031: SkyQuest Technology

Westford, US, Oct. 24, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Global Flow Chemistry Market size will reach a value of USD 3.32 Billion by 2031, with a CAGR of 7.1% during the forecast period (2024-2031). The global flow chemistry market is witnessing an enormous transformation and growth with the increased demand for sustainable and efficient production processes by the chemical and pharmaceutical industries. Benefits have been more widely compared with batch operations in a continuous flow chemistry, also known as microreactor technology, including improved control over the reaction, safety, waste generation, and efficiency.

Flow chemistry, for instance, provides appropriate control over reaction parameters such as temperature, pressure, and residence time to enhance even the quality of products and their yields. In the future, the global market will experience rapid growth due to increasing attention towards process optimization, sustainability, and cost efficiency.

Request Sample of the Report: https://www.skyquestt.com/sample-request/flow-chemistry-market

North America Led the Market Due to Growing Investments in R&D of Flow Chemistry

Due to the presence of major players in North America, it led the market to grow significantly in the region. Some of the prime drivers for the industrial growth in the region are the increase in the investments in the research and development of flow chemistry, particularly continuous processes, and expansion in the chemicals and pharmaceuticals manufacturing sector. The US market stands atop in North America as of 2023, with over 75% revenue share. The demand for flow chemistry products during the foreseeable projection period is expected to be led by the increasing domestic production and manufacturing capacity of the US.

Flow Chemistry Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.61 Billion |

| Estimated Value by 2031 | USD 3.32 Billion |

| Growth Rate | Poised to grow at a CAGR of 7.1% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Flow Chemistry and its Growing Applications |

| Key Market Opportunities | Green Chemistry Initiatives |

| Key Market Drivers | Increasing Demand for Efficient and Sustainable Manufacturing |

Get Customized Reports with your Requirements: https://www.skyquestt.com/speak-with-analyst/flow-chemistry-market

CSTR Dominance Due to Its Rising Applications in Wastewater and Water Applications

The continuous stirred tank reactors (CSTR) segment in 2023 had the market leader, which captured roughly over 36.4% of overall revenue. This comes as no surprise given its wide applications, ease to construct, efficient temperature control, cost-effectiveness, and flexibility in handling two-phase lines. Increasing applications of CSTRs in wastewater treatment and water processing are also envisaged to be among the future growth drivers for this industry. The increasing demand for efficient and reliable mixing solutions from the industries will further augment the demand for the technology.

Pharmaceutical Applications Segment is Expected to Grow Due to Need for Increasing Time of Drug Launch

Market contribution toward flow chemistry pharmaceutical application is expected to contribute significantly in terms of CAGR during the forecast period. The forward movement driving this is the need to accelerate the time of drug launch and the ever-increasing demand for process development in drug development. Flow chemistry can make the synthesis of pharmaceutical molecules fast and efficient and help researchers try lots of different formulation combinations and optimize reaction conditions. The process enables continuous processing, thereby increasing scalability and reducing waste. Large prospects exist in the pharmaceutical industry to increase flow chemistry systems immensely with its searches towards an enhancement of their R&D capacity and to meet regulatory requirements.

Is this report aligned with your requirements? Buy Now: https://www.skyquestt.com/buy-now/flow-chemistry-market

Flow Chemistry Market Drivers

- Increasing Demand for Efficient and Sustainable Manufacturing

- Safety Improvements

- Integration with Automation

Flow Chemistry Market Restraints

- High Initial Investment

- Complexity of Equipment

- Limited Market Awareness

Flow Chemistry Market Key Players

- Am Technology

- Asahi Glassplant Inc.

- METTLER TOLEDO

- Vapourtec Ltd.

- ThalesNano Inc.

- H.E.L. Group

- Uniqsis Ltd.

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

Key Questions Covered in the Flow Chemistry Market Report

- What are the factors driving the growth of the global flow chemistry market?

- Which is the fastest-growing sub-segment within the application category?

- Till 2031, what will be the growth rate of the market?

This report provides the following insights:

Analysis of key drivers (safety improvements, integration with automation), restraints (high initial investment, complexity of equipment), opportunities (green chemistry initiatives, emerging markets), and challenges (skill gap, economic factors) influencing the growth of the flow chemistry market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the flow chemistry market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the flow chemistry market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Ammonia Market: Global Opportunity Analysis and Forecast, 2024-2031

Bioplastics Market: Global Opportunity Analysis and Forecast, 2024-2031

Waste Management Market: Global Opportunity Analysis and Forecast, 2024-2031

Pharmaceutical Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

Beverage Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Propylene Glycol Methyl Ether Acetate Market is Projected to Reach US$ 2.08 Billion by 2034 | Fact.MR Report

Rockville, MD , Oct. 24, 2024 (GLOBE NEWSWIRE) — Methyl ether acetates play a vital role in the electronics industry, covering both polar and non-polar substances. The global Propylene Glycol Methyl Ether Acetate Market is valued at US$ 980.6 million in 2024 with projections for expansion at a CAGR of 7.8% from 2024 to 2034.

PMA/PGMA is widely used in several industrial materials such as paints, printing inks, and polymers such as nitrocellulose, acrylic acid, and epoxy resin, serving as coloring agents too. Applications include photoresist removal, stripping agents, TFT-LCD photo-resistance diluents, and IC detergents.

Propylene glycol methyl ether acetate functions well as a solvent in battery management ICs and electronic chips due to its non-corrosive nature. Its market share has risen due to its cost-effectiveness and versatility. Manufacturers are recognizing its potential through intense research, thus driving its popularity and cushioning market growth. This chemical is favored for its ability to act as a colorless solvent in various environments, both aqueous and organic.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9982

Key Takeaways from Market Study:

- The global propylene glycol methyl ether acetate market is projected to expand at a CAGR of 7.8% through 2034.

- Global sales of PGMEA are estimated at US$ 980.6 million in 2024.

- The market is forecasted to reach US$ 2.08 billion by 2034-end.

- The North American market is forecasted to expand at a CAGR of 7.9% through 2034.

- Metal finishing accounts for 23.3% market share in 2024.

- East Asia is projected to account for 38.4% of the global market share by 2034.

“Propylene glycol methyl ether acetate is a versatile industrial solvent, valued for its low toxicity, strong solubility, and diverse applications across various sectors. The non-corrosive nature of PGMEA is driving its widespread use in electronics manufacturing,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Propylene Glycol Methyl Ether Acetate Market:

Chang Chun Group, Shiny Chemical Industrial Company Ltd, KH Neochem Co., Dow Chemical Company, Eastman Chemical Company, Royal Dutch Shell Plc, Yancheng Super Chemical, LyondellBasell

Market Competition:

Prominent players in the propylene glycol methyl ether acetate market, like Chang Chun Group, Shiny Chemical Industrial Company Ltd., and KH Neochem Co., have established themselves through geographical expansions and collaborations with counterparts. Industry participants are focusing on comprehending the challenges posed by these acetates and converting those challenges into lucrative possibilities.

Country-wise Evaluation:

The United States has an extensive road network and well-designed skyscrapers as part of its well-developed infrastructure. Because of its coating qualities, propylene glycol methyl ether acetate is employed in building. It facilitates construction for field workers by effectively diluting a variety of components, including sand, concrete, and cement blocks.

In addition to infrastructure, the nation is home to well-known industrial facilities that bring in large sums of money. Because of its exceptional capabilities, a large number of these industries are investing in the propylene glycol methyl ether acetate market. PGMEA suppliers now have a chance to take control of the US market and develop their presence.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9982

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the propylene glycol methyl ether acetate market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on application (solvents, cleaners, electronics, metal finishing, pesticides) and purity (99.5%, 99.9%), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA).

Key Segments of Propylene Glycol Methyl Ether Acetate Market Research:

- By Application :

- Solvents

- Cleaners

- Electronics

- Metal Finishing

- Pesticides

- By Purity :

Checkout More Related Studies Published by Fact.MR Research:

Propylene Glycol Market: The global propylene glycol market size has been valued at US$ 4.66 billion in 2024, as revealed in the recently updated research study by Fact.MR. Worldwide sales of propylene glycol are analyzed to rise at a CAGR of 4.2% and reach US$ 7.03 billion by the end of 2034.

Dipropylene Glycol N-Propyl Ether Market: The global dipropylene glycol n-propyl ether market is projected to evolve at an impressive CAGR of 9% and touch a valuation of US$ 9.5 million by 2033, up from US$ 4 million in 2023.

Propylene Glycol Ether Market: The global propylene glycol ether market size is forecasted to increase from a valuation of US$ 2.03 billion in 2024 to US$ 2.75 billion by 2034-end, expanding at a CAGR of 3.1% over the study period of 2024 to 2034.

Methyl Tertiary-Butyl Ether Market: The global methyl tertiary-butyl ether market has been forecasted to reach US$ 25.06 billion by the end of 2034, up from a value of US$ 15.98 billion in 2024. Worldwide demand for methyl tertiary-butyl ether (MTBE) is evaluated to increase at a CAGR of 4.6% from 2024 to 2034.

Mono Methyl Ether of Hydroquinone (MEHQ) Market: The utilization of MEHQ in dermatology can be the leading driver for its significant growth in the market. MEHQ is usually added as an inhibitor to acrylonitrile in the monomer and needs to be regulated to avoid spontaneous polymerization.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Set To Open Higher As Tesla's Strong Profit Margins Win Over Wall Street: Wharton Economist Says 'Under-Loved' Bull Market Could See 'Significant Upside'

Investors could see some respite on Wall Street as the index futures point to a positive start on Thursday after three straight days of losses. EV giant Tesla Inc. TSLA blew past expectations in terms of margins and earnings per share (EPS), although it missed revenue expectations.

Dow Jones experienced its worst session in over a month, while megacap stocks like Nvidia Corp. NVDA and Apple Inc. AAPL fell by over 2%. Amid this, Nvidia supplier SK Hynix reported a record quarterly profit on the back of a boom in artificial intelligence.

Boeing Co. BA reported a loss in its third quarter, while AT&T T posted better-than-expected earnings.

Tesla will be among the stocks in focus today. Dow Inc. DOW, American Airlines Group Inc. AAL, United Parcel Service Inc. UPS, Honeywell International Inc. HON, Northrop Grumman Corp. NOC, and Southwest Airlines Co. LUV are scheduled to announce their earnings today.

Investors will also keep a close eye on Boeing after its machinists rejected a 35% wage hike deal and extended their ongoing strike against the company. Workers were dissatisfied with the pension plan and wanted a bigger hike to deal with a rise in the cost of living.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.75% |

| S&P 500 | 0.40% |

| Dow Jones | -0.11% |

| R2K | 0.43% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY rose 0.42% to $580.42 and the Invesco QQQ ETF QQQ surged 0.77% to $492.14, according to Benzinga Pro data.

Cues From Last Session:

Along with the Dow, the Nasdaq Composite recorded its third straight session in the red, dragged down by tech stocks.

Most sectors on the S&P 500 closed on a negative note, with consumer discretionary, information technology, and communication services stocks recording the biggest losses on Wednesday. However, real estate and utilities stocks bucked the overall market trend, closing the session higher.

Rising treasury yields and the possible outcome of the Nov. 5 presidential election results played on the minds of investors.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -1.60% | 18,276.65 |

| S&P 500 | -0.92% | 5,797.42 |

| Dow Jones | -0.96% | 42,514.95 |

| Russell 2000 | -0.79% | 2,213.84 |

Insights From Analysts:

Following six consecutive weeks of gains, the markets have remained gloomy this week, with tech stocks offering some respite amid sideways movements in most other sectors.

Benchmark US 10-year treasury yields remain in focus, which rose to their highest mark since July.

On the economic data front, U.S. existing home sales declined 1% from the previous month to an annualized rate of 3.84 million in September.

The International Monetary Fund, though, expects U.S. growth to remain strong. According to its latest World Economic Outlook report, the IMF revised its projected U.S. GDP growth rate to 2.8%, up from its previous projection of 2.6%.

“On the equity front, corporate earnings are strong and with the VIX (the CBOE’s volatility index) still elevated around 20, this is not the backdrop for the start of a bear market,” explained WisdomTree and Wharton School economist Jeremy Siegel.

“The current under-loved bull market could see significant upside. While I’m not predicting a ‘melt-up,’ it is important to acknowledge the market’s upward momentum could continue as fundamentals remain supportive,” Siegel added.

See Also: Best Futures Trading Software

Upcoming Economic Data:

- Data on initial jobless claims is scheduled to be released at 8:30 a.m. ET.

- Cleveland Fed President Beth Hammack is scheduled to speak at 8:45 a.m. ET.

- New home sales data is scheduled to be released at 10 a.m. ET.

Stocks In Focus:

- Tesla will stay in focus after beating margin and EPS estimates in its third-quarter earnings.

- IBM IBM missed third-quarter revenue estimates on account of a drag in consulting revenue.

- AT&T added over 403,000 new monthly subscribers in the third quarter, reporting $30.2 billion in revenue.

Commodities, Bonds And Global Equity Markets:

Crude oil futures rose in the early New York session, surging over 1.5% as data showed a rise in spot demand.

The 10-year Treasury note yield fell marginally to 4.192%.

Asian markets were mixed on Thursday, with Chinese markets edging lower while Japan’s Nikkei 225 rose.

European stocks moved past tentativeness in early trading, surging after a gloomy week so far.

Read Next:

Image generated using AI tools

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

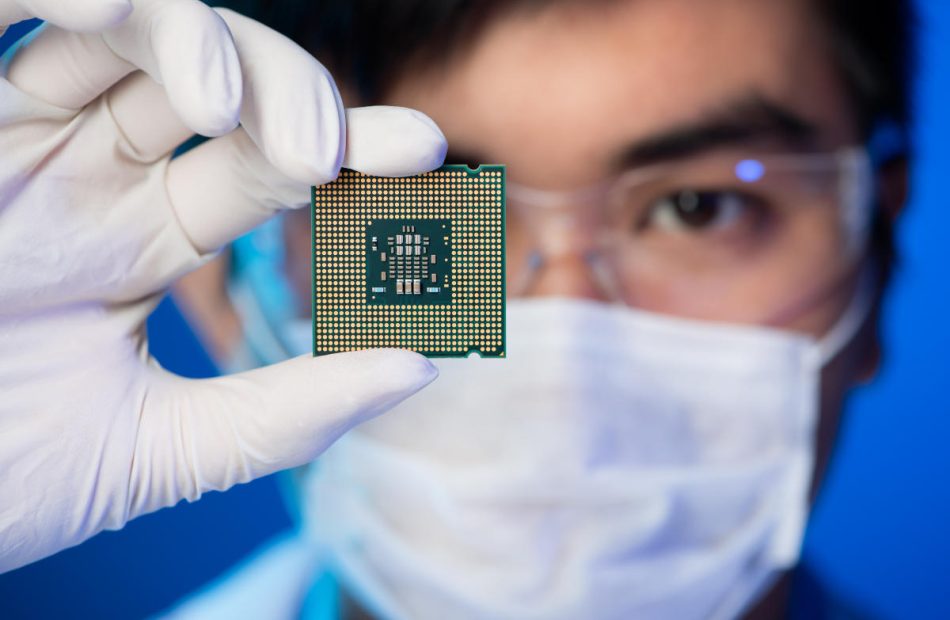

1 Incredibly Cheap Semiconductor Stock That Could Start Soaring After Nov. 4 (Hint: It's Not Nvidia)

Nvidia stock has been in stellar form on the market over the past couple of years thanks to the proliferation of artificial intelligence (AI), as the robust demand for the company’s graphics cards that are deployed in data centers has led to outstanding growth in its revenue and earnings.

Nvidia’s dominant position in the AI chip market explains why its shares have shot up a whopping 1,000% in the past two years. The good part is that Nvidia seems to be in a solid position to sustain its AI-powered growth, driven by the arrival of a new generation of chips that are likely to help it extend its technological lead over rivals.

But at the same time, investors should note that there are other AI chip stocks that are taking advantage of the growing adoption of AI in other areas. Cirrus Logic (NASDAQ: CRUS) is one such company. Known for supplying smartphone chips to Apple (NASDAQ: AAPL), Cirrus stock stitched impressive gains of 43% so far in 2024.

The company is set to release its fiscal 2025 second-quarter earnings on Nov. 4, and there is a good chance that its rally could get a nice boost. Let’s look at the reasons why.

Apple has a massive influence on Cirrus Logic’s business. That’s because the tech giant accounts for 88% of Cirrus’ top line. More specifically, Apple taps Cirrus for the latter’s audio chips and power amplifier chips. For instance, Apple’s latest iPhone 16 lineup boasts a number of chips from Cirrus Logic.

A teardown of the iPhone 16 Pro suggests that Cirrus is supplying three audio chips and one power management module to Apple. The plain iPhone 16 models, on the other hand, have at least three Cirrus Logic audio chips in them. Now, reliance on a single customer for such a big chunk of the business isn’t ideal, as Cirrus’ business could come crashing down if Apple decides to build chips in-house or moves to a different supplier.

However, both companies have been in a tight relationship for a very long time. More importantly, Cirrus has been gaining more business from Apple, as it was earlier known for supplying only audio chips to the iPhone maker. Cirrus’ diversification beyond its core audio market into high-performance mixed-signal offerings such as camera controllers, haptics, and power management tools allowed it to win more business with its largest client.

KeyBanc analysts believe that Cirrus could also supply camera parts to Apple for its latest iPhone generation, while the addition of the new camera control button suggests that the chipmaker could also supply the haptics driver to its largest customer. The good news for Cirrus Logic investors is that Apple’s iPhone 16 lineup seems to have gotten off to a nice start as far as sales are concerned.

Analyst Report: Regions Financial Corp.

Summary

Based in Birmingham, Alabama, Regions Financial provides a range of retail and commercial banking, residential mortgage lending, and asset management services. The company has 1,300 banking offices and ov

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Market Digest: CMA, DGX, NEE, RF, SAP, GM

Summary

Sector Breadth a Positive Heading into Year-End The S&P 500 closed on October 18, logging its sixth consecutive winning week. During that mid-October week, the three major averages – the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite – all set new all-time highs. That’s a rare example of the blue-chip index, the broad market, and growth stocks all moving in concert. One reason the major indices are moving broadly in lockstep follows from analysis of S&P sector performance. The growth leadership that characterized most of 2023 and the 2024 first half gave way to non-traditional leaders in 3Q24; these included rate-sensitive, cyclical, and defensive sectors. All but one sector was positive in 3Q24, but the various sectors had highly varied performances. The tag-team approach to sector leadership across the nine months has contributed to well-balanced year-to-date performance. All sectors are positive for 2024, and all but one sector was up in double-digit percentages for the year to date as of 9/30/24. Sector Performance for 1H24 In the first quarter of 2024, investors saw signs that leadership in the market might be shifting. During the quarter, the S&P 500 delivered capital appreciation of 10.2%. Five sectors either outperformed the broad market or finished within a percentage point of the S&P 500. Two were the traditional growth leaders: Communication Services finished up 11.9%, and the Information Technology sector appreciated 10.0%. The best two sectors, however, were not the traditional leaders. Energy and Financial both finished on March 31 with 12.0% gains. Another sector, Industrial, was a tick behind Financial, with a 9.9% gain. Healthcare and Materials both had solid third quarters, with gains of about 8% and 7%, respectively. In a sign of things to come, Utilities – out of favor particularly during the Fed’s rate-hiking campaign of 2022-2023 – logged a roughly 6% first-quarter gain. Stock sectors with above-market income tend to outperform the broad market in periods of declining interest rates. Although the Fed stood pat during 1Q24, the market was already buzzing about the potential for rate cuts later in the year. The only negative sector in the quarter was Real Estate, down 3%. While Utility stocks tend to move in lockstep, Real Estate equities in different niches are subject to different cyclical and secular forces, such as the pandemic-driven collapse in commercial office occupancy. In the second quarter of 2024, the broad market advance was much more subdued, with the S&P 500 rising less than 4% after its 10%-plus surge in 1Q24. Growth leadership reasserted itself in the second quarter. With buzzwords like ‘Mag 7’ and ‘Gen AI’ resonating in the background, Information Technology led the market with an 11.4% gain. Communication Services also topped the broad market with a 4.9% gain. While growth was back, the shift toward beneficiaries of declining interest rates further accelerated as the likelihood of the first Fed rate cut drew nearer. The Utility sector appreciated 4% in 2024. Possibly because of those secular factors cited above, Real Estate continued to struggle and declined about 2% in the quarter. Multiple other sectors were negative in 2Q24, including Industrial and Materials (both down about 5%), Energy (down 3%), and Financial and Healthcare (both down about 1%). For the full first half of 2024, growth sectors won; but participation widened across the broad market, and only one sector (Real Estate) was down. In the first half of 2024, the S&P 500 appreciated 14.5%. Just two sectors did better than the market in the first half: Information Technology, up 22.6%; and Communication Services, up 17.4%. The two other double-digit winners in the first half were Financial, up 11%; and Utilities, up about 10%. The paired leadership of the third- and fourth-place sectors may seem counter-intuitive. If rates are about to come down, wouldn’t that hurt net interest margins at banks? While that is true, banks have many other fee-based businesses, including investment banking, capital markets financing, and consumer loans, that benefit in a declining rate environment. Besides the negative showing from Real Estate, five other sectors posted single-digit gains in 1H24: Energy (up 9%), Healthcare (up 7%), Consumer Staples (up 6%), Industrials (up 4%), and Materials (up 1%). Those latter two sectors are at least partly sensitive to demand from China, which as of mid-year remained mired in its slump. Sector Performance for 3Q24 Investors at mid-year 2024, assessing the clear growth leadership at the sector level, may have thought that 2024 would shape up as a replay of 2023: a narrowly led market defined by AI fever. Instead, non-traditional sectors grabbed the leadership reins in 3Q24. Why did the market pivot away from growth and toward defensive, rate-sensitive, and cyclical in 3Q24? Seasoned investors always want to take money off the table before some kind of sentiment shift turns paper profits into a wisp of smoke. That explains the rotation away from growth. As for the rotation toward other sectors, signs that China was becoming serious about stimulating its economy stirred interest in the commodities complex, as did the worsening situation in the Middle East. And midway through September, the Federal Reserve cut interest rates for the first time in over four years. In the third quarter of 2024, the broad market advanced 7.4%, splitting the difference between first- and second-quarter gains. With the first Fed rate cuts no longer imminent but now a reality, momentum shifted clearly to income sectors. Real Estate made up for its late start and led the S&P 500 in 3Q24 with a 17.2% gain. Just behind was Utilities with a 16.1% gain. The growth leaders of 2023 participated in the 3Q advance, but Information Technology was at the back of the pack. The sector advanced less than 1% in 3Q24. Communication Services rose a rounded 6%, which was close to mid-pack. The other growth sector from 2023, Consumer Discretionary, surged 10% in 3Q24 after being up just 2% at mid-year. Plainly, sentiment toward the sector has improved on the belief that lower rates will help sales of homes and vehicles going forward. Financial was next in line, rallying 9% on hopes for continued progress in fee-based revenues. Two traditional defensive sectors, Consumer Staples and Healthcare, logged 3Q gains of 8% and 6%, respectively. Materials rose 7%, with much of the gain back-weighted to September following news of China’s stimulus plan. The lone negative sector in 3Q24 was Energy, which dropped 4%. Energy stocks rallied in the first half partly on expectations that the worsening situation in the Middle East, along with hurricanes in the Gulf of Mexico, would push up oil prices. But benchmark NYMEX crude finished 3Q24 at $67 per barrel, down from $81 at mid-year. Sector Performance for 2024 Year to Date As of 9/30/24, the S&P 500 was up 20.8% on a capital-appreciation basis and up 22.1% on a total-return basis (assuming reinvestment

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Steering Shaft Market Projected to Grow at 3.3% CAGR, Reaching $7.9 Billion by 2033 | Fact.MR report

Rockville, MD, Oct. 24, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global steering shaft market is estimated to be valued at US$ 5.7 Billion in 2023 and is expected to expand at a CAGR of 3.3% during the forecast period.

With the implementation of stricter safety regulations and standards, automakers are now required to install advanced safety features in their vehicles, including the steering system. This has led to an increased demand for high-quality steering shafts that can meet these new safety standards. In addition, the implementation of new safety regulations and standards has also led to increased competition among manufacturers, which has led to innovation and the development of new technologies.

On the back of continuous technological innovations coupled with rising awareness about environmental safety, rising consumer inclination towards electrical vehicles is observed over recent years. As the penetration of EVs continues to grow, the demand for these specialized steering shafts is expected to increase, subsequently creating numerous growth opportunities for players in the steering shaft market over the forecast period.

By region, Asia Pacific is expected to witness significant growth in the steering shaft market, due to increasing demand for commercial and passenger vehicles in countries such as China and India. The region is also home to some of the leading automotive component manufacturers, which has further fuelled the growth of the steering shaft market.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=5648

Key Takeaways from Market Study

- The global steering shaft market is projected to expand at a CAGR of 3% and be valued at US$ 7.9 Billion by 2033.

- The market sales declined at -3.5% CAGR for the historic period of 2018-2022.

- China is expected to dominate the market share in East Asia by likely accounting for 2% of its market share in 2023.

- Electronic Power Steering (EPS) by mechanism is likely to represent 6% market share in 2023.

- Splined steering shaft by steering shaft style is predicted to dominate the market and is estimated to be valued at US$ 7 Billion in 2023.

- Sales of steering shaft through OEMs is predicted to have a market valuation of US$ 7.4 Billion in 2023.

“Nearly 95% of Passenger Vehicles are Equipped with Electric Power Steering Systems leading to Higher Market Growth” says a Fact.MR analyst.

Leading Players Driving Innovation in the Steering Shaft Market:

Key industry participants like Changshu City Jinhua Machinery Co., Ltd, China Automotive Systems, Inc., Faw Koyo Steering Systems Co., Ltd., Global Steering Systems, JTEKT Corporation, KLM Performance, Nexteer Automotive, NSK Ltd., Pailton Engineering, Robert Bosch GmbH, Steering Shaft Factory and Zhejiang Shibao Co., Ltd., etc. are driving the steering shaft industry.

Market Development

- The steering shaft manufacturers are investing in the research and development of new technologies that can enhance the performance and durability of their products. They are looking for ways to improve the design and manufacturing processes to make the steering shafts more lightweight, durable, and efficient.

- For instance, in January 2023, Pailton Engineering, a steering system manufacturer announced that the company will design and build a new steering column for lightweight delivery vehicles. The development of the new steering column is attributed to the industry demand for lightweight vehicles, as manufacturers are attempting to reduce the load on delivery vehicles, especially electric vans made for last-mile deliveries.

Steering Shaft Industry News:

- For example, in October 2021, Nexteer Automotive expanded its Electric Power Steering (EPS) portfolio with the introduction of the Modular Column-Assist EPS System (mCEPS). This new system features a cost-effective, modular platform design that offers scalability for Nexteer and the flexibility to accommodate the needs of various OEMs.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=5648

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global steering shaft market, presenting historical market data (2018-2022) and forecast statistics for the period of 2023-2033.

The study reveals essential insights based on steering shaft style (splined, double D, smooth), mechanism (HPS -hydraulic power steering, EPS- electronic power steering, EPHS – electric power hydraulic steering), material (steel (polish stainless steel, stainless steel, steel), aluminium), sales channel (OEM, aftermarket), vehicle category (passenger vehicle (compact, mid-size, luxury SUVs), commercial vehicle (LCV, HCV, coaches & buses)) across major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and Middle East & Africa).

Check out More Related Studies Published by Fact.MR Research:

Automotive steering system market is expected to surpass a CAGR of 4% in the 2021-2031 assessment period, reaching nearly US$ 34 Billion.

Marine shaft power meter market increased at 3.7% CAGR and reached a value of US$ 491.17 million in 2022. The market is predicted to advance at a CAGR of 3.6% and reach US$ 724.75 million by the end of 2033.

Automotive whiplash protection system market is estimated at USD 2.6 Billion in 2022 and is forecast to surpass USD 5.2 Billion by 2032, growing at a CAGR of 7.2% from 2022 to 2032.

Automotive lighting market is set to enjoy a valuation of US$ 36.8 billion in 2022 and further expand at a CAGR of 6.4% to reach US$ 68.2 billion by the end of 2032.

Sales of automotive multifunction switches is estimated at US$ 3.94 billion in 2024 and has been analyzed by Fact.MR to increase at a CAGR of 4.2% and reach US$ 5.91 billion by 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.