Elon Musk Shuts Down Traditional Tesla $25K EV Rumors, Calls It 'Pointless' As Company Focuses On All-Autonomous Future: 'Yeah. It Would Be Silly'

Tesla Inc. TSLA CEO Elon Musk has definitively shut down speculation about the company’s long-rumored $25,000 traditional electric vehicle, marking a strategic pivot towards an all-autonomous future for the electric vehicle maker.

What Happened: During Tesla’s third-quarter earnings call, Musk explicitly rejected the idea of developing a conventional $25,000 car, calling it “pointless” and “silly” in light of the company’s autonomous vehicle strategy.

“I think having a regular $25,000 model is pointless. Yeah. It would be silly. Like, it’ll be completely at odds with what we believe,” Musk stated during the earnings call.

Instead, Tesla is focusing its efforts on the development of its robotaxi vehicle, dubbed the “Cybercab.” Unlike traditional vehicles, the Cybercab will be designed exclusively for autonomous operation, without a steering wheel or pedals.

“Autonomous, it’s fully considered cost per mile, is what matters,” Musk explained. “And if you try to make a car that is, essentially, a hybrid manual automatic car, it’s not going to be as good as a dedicated autonomous car.”

The company’s vision for the future is unambiguously autonomous. Tesla plans to begin volume production of the Cybercab in 2026, with ambitious targets of producing 2-4 million units annually across multiple factories.

“I think it’s going to be very obvious in retrospect… that the future is autonomous electric vehicles,” Musk emphasized. “Non-autonomous gasoline vehicles in the future will be like riding a horse and using a foot phone. It’s not that there are no horses… but they’re unusual. They’re niche.”

Tesla currently produces approximately 35,000 autonomous-capable vehicles per week, which Musk contrasted with competitors like Alphabet Inc GOOGLGOOG owned Waymo, noting that “Waymo’s entire fleet is less than – they have less than a 1,000 cars. We make 35,000 a week.”

Why It Matters: While abandoning the traditional $25,000 car concept, Tesla still plans to introduce a more affordable vehicle in the first half of 2025, which Musk indicated would be priced “sub-30k” with incentives. However, this vehicle will be designed with autonomous capabilities in mind, aligning with the company’s broader strategy.

The company also plans to launch its robotaxi service in Texas and California next year, pending regulatory approval, with Texas expected to move faster due to less stringent regulatory requirements.

The decision comes as Tesla maintains its position as one of the few profitable electric vehicle manufacturers globally. During the earnings call, Musk noted that “to the best of my knowledge, there was no EV division of any company, of any existing auto company that is profitable.”

This strategic pivot underscores Tesla’s confidence in its autonomous driving technology, with the company predicting that its Full Self-Driving system will surpass human safety levels by the second quarter of 2025.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

GE Vernova Earnings Miss On This Big Headwind

GE Vernova (GEV) reported worse-than-expected third-quarter profit but reaffirmed full 2024 guidance early Wednesday as the General Electric spinoff continues to see “incremental contract losses” from its offshore wind business. GEV shares angled higher early Wednesday.

The company saw third-quarter earnings of 10 cents per share and revenue coming in at $8.9 billion. Prior to Wednesday’s earnings release, analysts expected Q3 earnings of 17 cents per share with revenue totaling $8.77 billion, according to FactSet.

GE Vernova ended Q3 with $7.4 billion in cash, up from $5.8 billion at the end of Q2. The company said its sales total was due to growth in its equipment and services segment and positive pricing across all its segments. GE Vernova did see “incremental contract losses” in offshore wind. The outfit saw orders in its wind power segment decrease about 19% to $1.7 billion due to lower onshore wind equipment demand.

↑

X

Market Rally Resilient As Microsoft Leads Megacap Techs; GM, Duolingo Also In Focus

Wind power revenue came in flat at $2.9 billion. GEV predicted a considerable Q3 loss from its wind energy business ahead of earnings.

GE Vernova also reaffirmed 2024 revenue guidance of $34 billion-$35 billion. The company also continues to expect adjusted EBITDA margin of 5%-7% and free cash flow between $1.3 billion-$1.7 billion. In March, GE Vernova announced it is targeting 10% EBITDA by 2028. The company betting on the strong demand for grid equipment that its electrification backlog will triple to around $18 billion by the end of 2024.

Chief Financial Officer Ken Parks said in the earnings release Wednesday that GEV’s decision to maintain its guidance is the “strong performance in power and electrification offsetting additional losses in wind this quarter.”

Stock Performance: GE Vernova

GE Vernova edged up 0.4% to 277.40 during market trade on Wednesday. The stock closed at 276.42 on Tuesday and has gained 8.4% in October. Since booking a monthly decline in June, GEV has rallied for fourth straight months, including a nearly 27% advance in September.

The stock broke out of a seven-week base in mid-August. Shares are up more than 40% from that breakout.

Meanwhile, the 56 stocks in the IBD tracked Energy-Alternative/Other industry group have collectively gained more than 43% in 2024, according to MarketSurge.

GE Vernova emerged from General Electric’s big, long-term breakup earlier this year, with spinouts of GE Aerospace (GE) and GE HealthCare Technologies (GEHC). GE Aerospace kept the GE ticker symbol.

Before the spinouts, General Electric shed a number of assets and operations over a series of years, from lighting to locomotives. In November 2017, GE began signaling the breakup process amid financial troubles.

GE Vernova stock has a 93 Composite Rating out of a best-possible 99. The stock also has a 97 Relative Strength Rating and a 70 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Calumet Provides Preliminary Third Quarter 2024 Selected Financial Results

INDIANAPOLIS, Oct. 23, 2024 /PRNewswire/ — Calumet, Inc. CLMT (the “Company,” “Calumet,” “we,” “our” or “us”) announced today preliminary selected financial results for the third quarter ended September 30, 2024.

Based on preliminary data, the Company currently expects to report a net loss between $110 million and $90 million and Adjusted EBITDA between $45 million and $55 million for the third quarter 2024. For a reconciliation of the preliminary estimate of Adjusted EBITDA to preliminary estimated net loss, the most directly comparable GAAP measure, see “Non-GAAP Financial Measures” below. Further, as of September 30, 2024, the Company estimates total liquidity of approximately $290 million comprised of approximately $35 million of unrestricted cash and cash equivalents and approximately $255 million of availability under our credit facilities.

Calumet continued to demonstrate strong operations at Montana Renewables throughout the third quarter, processing approximately 12,000 barrels per day of renewable feedstock and producing over 2,500 barrels per day of sustainable aviation fuel (“SAF”). Further, a new SAF production record was achieved each month during the third quarter, culminating with approximately 3,200 barrels per day of SAF produced in September. Montana Renewables is expected to generate over $5 million of Adjusted EBITDA for the third quarter, despite experiencing a roughly $6 million impact to margins from feedstock price lag when the industry saw these prices abruptly drop approximately $0.40 per gallon in late July. Last, the Great Falls facility expects to conduct a planned turnaround in November to change catalyst. This timing is expected to allow completion prior to the winter season and to coincide with a period of margin uncertainty as the blender tax credit is expected to change to the production tax credit.

Our Specialties business operated well during the third quarter, with total production volume increasing versus the prior quarter despite experiencing unplanned downtime in July from Hurricane Beryl. As previously disclosed, this downtime resulted in a loss of approximately 500,000 barrels of production, resulting in a lost opportunity of roughly $8 million. Specialty margins continue to remain resilient, largely in line with the second quarter, and fuel margins tightened along with the broader industry.

Finally, the Company announced on October 16 that the U.S. Department of Energy (“DOE”) Loan Programs Office (“LPO”) has awarded a conditional commitment for a loan guarantee of up to $1.44 billion to fund the construction and expansion of a renewable fuels facility owned by Montana Renewables, LLC (“Montana Renewables” or “MRL”), an unrestricted subsidiary of Calumet. Further details on this announcement can be found in the Current Report on Form 8-K filed by the Company on October 22, 2024.

The Company has prepared the estimated preliminary financial data presented above based on the most current information available to management. The Company’s normal financial reporting processes with respect to the preliminary financial data have not been fully completed and the Company’s independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to the accompanying preliminary financial data. As a result, the Company’s actual financial results could vary materially from this preliminary financial data. Investors should not place undue reliance on these preliminary financial data. These estimates should not be viewed as a substitute for full interim financial statements prepared in accordance with U.S. GAAP.

About Calumet

Calumet, Inc. CLMT manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to customers across a broad range of consumer-facing and industrial markets. Calumet is headquartered in Indianapolis, Indiana and operates twelve facilities throughout North America.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements and information in this press release may constitute “forward-looking statements.” The words “will,” “may,” “intend,” “believe,” “expect,” “outlook,” “forecast,” “anticipate,” “estimate,” “continue,” “plan,” “should,” “could,” “would,” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. The statements discussed in this press release that are not purely historical data are forward-looking statements, including, but not limited to, the statements regarding (i) preliminary estimates of selected financial results for the most recent quarterly period, (ii) our expectations regarding the loan facility (the “DOE Facility”) that MRL expects to receive from the DOE LPO, including the timing, size and intended use of borrowings under such facility, (iii) our expectation that the DOE Facility will enable MRL to complete the MaxSAF™ construction and that such project will be completed on time and on budget, (iv) demand for finished products in markets we serve, (v) our expectation regarding our business outlook and cash flows, including with respect to the Montana Renewables business and our plans to de-leverage our balance sheet, (vi) our expectation regarding anticipated capital expenditures and strategic initiatives, and (vii) our ability to meet our financial commitments, debt service obligations, debt instrument covenants, contingencies and anticipated capital expenditures. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our current expectations for future sales and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisition or disposition transactions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause our actual results to differ materially from our historical experience and our present expectations or projections. Known material factors that could cause actual results to differ materially from those in the forward-looking statements include: the overall demand for specialty products, fuels, renewable fuels and other refined products; the level of foreign and domestic production of crude oil and refined products; our ability to produce specialty products, fuel products, and renewable fuel products that meet our customers’ unique and precise specifications; the marketing of alternative and competing products; the impact of fluctuations and rapid increases or decreases in crude oil and crack spread prices, including the resulting impact on our liquidity; the results of our hedging and other risk management activities; our ability to comply with financial covenants contained in our debt instruments; the availability of, and our ability to consummate, acquisition or combination opportunities and the impact of any completed acquisitions; labor relations; our access to capital to fund expansions, acquisitions and our working capital needs and our ability to obtain debt or equity financing on satisfactory terms; successful integration and future performance of acquired assets, businesses or third-party product supply and processing relationships; our ability to timely and effectively integrate the operations of acquired businesses or assets, particularly those in new geographic areas or in new lines of business; environmental liabilities or events that are not covered by an indemnity, insurance or existing reserves; maintenance of our credit ratings and ability to receive open credit lines from our suppliers; demand for various grades of crude oil and resulting changes in pricing conditions; fluctuations in refinery capacity; our ability to access sufficient crude oil supply through long-term or month-to-month evergreen contracts and on the spot market; the effects of competition; continued creditworthiness of, and performance by, counterparties; the impact of current and future laws, rulings and governmental regulations, including guidance related to the Dodd-Frank Wall Street Reform and Consumer Protection Act; the costs of complying with the Renewable Fuel Standard, including the prices paid for renewable identification numbers (“RINs”); shortages or cost increases of power supplies, natural gas, materials or labor; hurricane or other weather interference with business operations; our ability to access the debt and equity markets; accidents or other unscheduled shutdowns; and general economic, market, business or political conditions, including inflationary pressures, instability in financial institutions, general economic slowdown or a recession, political tensions, conflicts and war (such as the ongoing conflicts in Ukraine and the Middle East and their regional and global ramifications).

For additional information regarding factors that could cause our actual results to differ from our projected results, please see our filings with the Securities and Exchange Commission (“SEC”), including the risk factors and other cautionary statements in Calumet Specialty Products Partners, L.P.’s (the “Partnership”) latest Annual Report on Form 10-K and other filings made by the Partnership and the Company with the SEC.

We caution that these statements are not guarantees of future performance and you should not rely unduly on them, as they involve risks, uncertainties, and assumptions that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. While our management considers these assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Accordingly, our actual results may differ materially from the future performance that we have expressed or forecast in our forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent required by applicable law. Certain public statements made by us and our representatives on the date hereof may also contain forward-looking statements, which are qualified in their entirety by the cautionary statements contained above.

Non-GAAP Financial Measures

Our management uses certain non-GAAP performance measures to analyze operating segment performance and non-GAAP financial measures to evaluate past performance and prospects for the future to supplement our financial information presented in accordance with generally accepted accounting principles (“GAAP”). These financial and operational non-GAAP measures are important factors in assessing our operating results and profitability and include performance measures along with certain key operating metrics.

We use the following financial performance measures:

EBITDA: We define EBITDA for any period as net income (loss) plus interest expense (including amortization of debt issuance costs), income taxes and depreciation and amortization. We believe net income (loss) is the most directly comparable GAAP measure to EBITDA.

Adjusted EBITDA: We define Adjusted EBITDA for any period as: EBITDA adjusted for (a) impairment; (b) unrealized gains and losses from mark to market accounting for hedging activities; (c) realized gains and losses under derivative instruments excluded from the determination of net income (loss); (d) non-cash equity-based compensation expense and other non-cash items (excluding items such as accruals of cash expenses in a future period or amortization of a prepaid cash expense) that were deducted in computing net income (loss); (e) debt refinancing fees, extinguishment costs, premiums and penalties; (f) any net gain or loss realized in connection with an asset sale that was deducted in computing net income (loss); (g) amortization of turnaround costs; (h) lower of cost or market (“LCM”) inventory adjustments; (i) the impact of liquidation of inventory layers calculated using the last in, first-out (“LIFO”) method; (j) RINs mark-to-market adjustments; and (k) all extraordinary, unusual or non-recurring items of gain or loss, or revenue or expense.

The definition of Adjusted EBITDA that is presented in this press release is similar to the calculation of (i) “Consolidated Cash Flow” contained in the indentures governing our 11.00% Senior Notes due 2025 (the “2025 Notes”), our 8.125% Senior Notes due 2027 (the “2027 Notes”), our 9.75% Senior Notes due 2028 (the “2028 Notes”), and our 9.25% Senior Secured First Lien Notes due 2029 (the “2029 Secured Notes”) and (ii) “Consolidated EBITDA” contained in the credit agreement governing our revolving credit facility. We are required to report Consolidated Cash Flow to the holders of our 2025 Notes, 2027 Notes, 2028 Notes, and 2029 Secured Notes and Consolidated EBITDA to the lenders under our revolving credit facility, and these measures are used by them to determine our compliance with certain covenants governing those debt instruments. Please see our filings with the SEC, including the Partnership’s most recent Annual Report on Form 10-K and other filings made by the Partnership and the Company with the SEC, for additional details regarding the covenants governing our debt instruments.

These non-GAAP measures are used as supplemental financial measures by our management and by external users of our financial statements such as investors, commercial banks, research analysts and others, to assess:

- the financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

- the ability of our assets to generate cash sufficient to pay interest costs and support our indebtedness;

- our operating performance and return on capital as compared to those of other companies in our industry, without regard to financing or capital structure;

- the viability of acquisitions and capital expenditure projects and the overall rates of return on alternative investment opportunities; and

- our operating performance excluding the non-cash impact of LCM and LIFO inventory adjustments, RINs mark-to-market adjustments, and depreciation and amortization.

We believe that these non-GAAP measures are useful to analysts and investors, as they exclude transactions not related to our core cash operating activities and provide metrics to analyze our ability to fund our capital requirements and to pay interest on our debt obligations. We believe that excluding these transactions allows investors to meaningfully analyze trends and performance of our core cash operations.

EBITDA and Adjusted EBITDA should not be considered alternatives to Net income (loss) or any other measure of financial performance presented in accordance with GAAP. In evaluating our performance as measured by EBITDA or Adjusted EBITDA management recognizes and considers the limitations of these measurements. EBITDA and Adjusted EBITDA do not reflect our liabilities for the payment of income taxes, interest expense or other obligations such as capital expenditures. Accordingly, EBITDA and Adjusted EBITDA are only two of several measurements that management utilizes. Moreover, our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate EBITDA and Adjusted EBITDA in the same manner. Please see the section of this release entitled “Non-GAAP Reconciliations” for tables that present reconciliations of EBITDA and Adjusted EBITDA to Net income (loss), our most directly comparable GAAP financial performance measure.

Subject to the qualifications set forth above, our estimated range of Net loss and Adjusted EBITDA for the Company for the three months ended September 30, 2024 is (in millions):

|

Three Months Ended September 30, 2024 |

||||||

|

Low Estimate |

High Estimate |

|||||

|

(In millions) |

||||||

|

Reconciliation of Net loss to Adjusted EBITDA |

||||||

|

Net loss |

$ |

(110.0) |

$ |

(90.0) |

||

|

Add: |

||||||

|

Depreciation and amortization |

46.0 |

44.0 |

||||

|

LCM / LIFO loss |

10.0 |

9.0 |

||||

|

Loss on impairment and disposal of assets |

1.0 |

– |

||||

|

Interest expense |

60.0 |

55.0 |

||||

|

Unrealized gain on derivatives |

(14.0) |

(12.0) |

||||

|

RINs mark-to-market loss |

34.0 |

32.0 |

||||

|

Other non-recurring expenses |

13.0 |

11.0 |

||||

|

Equity-based compensation and other items |

4.0 |

7.0 |

||||

|

Income tax expense |

2.0 |

1.0 |

||||

|

Noncontrolling interest adjustments |

(1.0) |

(2.0) |

||||

|

Adjusted EBITDA |

$ |

45.0 |

$ |

55.0 |

||

![]() View original content:https://www.prnewswire.com/news-releases/calumet-provides-preliminary-third-quarter-2024-selected-financial-results-302285424.html

View original content:https://www.prnewswire.com/news-releases/calumet-provides-preliminary-third-quarter-2024-selected-financial-results-302285424.html

SOURCE Calumet, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

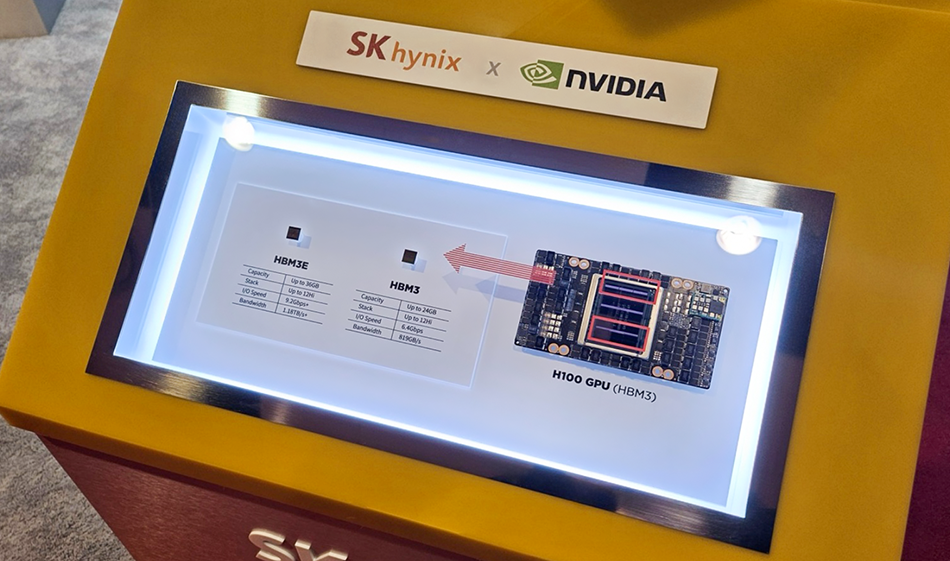

Nvidia Supplier SK Hynix Reports Record-Breaking Quarterly Profit As AI Demand Drives 7% Revenue Surge

SK Hynix HXSCF, a major memory chipmaker and a key supplier to Nvidia Corp. NVDA, has announced a record-breaking quarterly profit, driven by the rising demand for artificial intelligence technology.

What Happened: The South Korean semiconductor company posted revenues of 17.5731 trillion won ($12.65 billion), a 7% increase from the previous quarter. Operating profit surged to 7.03 trillion won ($5.06 billion), and net profit reached 5.7534 trillion won ($4.14 billion), marking significant gains from last year.

This marks SK Hynix’s highest-ever quarterly revenue, surpassing the previous record of 16.4233 trillion won set in the second quarter of 2024.

The company attributed this growth to increasing sales of premium memory products, such as high-bandwidth memory (HBM) and enterprise solid-state drives (eSSD), which cater to the booming demand for AI servers.

In the third quarter, HBM accounted for 30% of SK Hynix’s total DRAM revenue, with sales of the product jumping more than 70% quarter-over-quarter. The company expects HBM’s share to rise to 40% in the fourth quarter as it ramps up production of the newer 8-layer and 12-layer HBM3E models, reflecting strong demand from data centers and AI developers.

“SK Hynix has solidified its position as the world’s No.1 AI memory company by achieving the highest business performance ever in the third quarter of this year,” said Kim Woohyun, Vice President and Chief Financial Officer at SK Hynix. “We will continue to maximize profitability while securing stable revenues by taking flexible product and supply strategies in line with market demand.”

SK Hynix projects the demand for AI memory to remain robust in 2025, fueled by advancements in generative AI and artificial general intelligence. Additionally, the company expects steady growth in the PC and mobile markets, which have lagged behind the AI sector.

The company plans to enhance its NAND operations by expanding sales of high-capacity eSSDs and optimizing production efficiency. It will also continue transitioning to more advanced DRAM technologies, securing its leadership in the AI memory market.

Why It Matters: This announcement comes after a period of volatility for SK Hynix. In September, the company’s shares plummeted to their lowest level since February following a downgrade by Morgan Stanley. The investment bank warned that “memory conditions are beginning to deteriorate,” and that it would be challenging for SK Hynix to maintain revenue growth and margins.

However, the company’s fortunes quickly turned around when it announced the mass production of its latest high-bandwidth memory chips. This development, which positioned SK Hynix ahead in the competitive race to meet the growing demand driven by AI advancements, led to a 9% surge in the company’s shares.

Analysts have long been optimistic about SK Hynix’s future, with many predicting that the company will continue to benefit from the increasing demand for AI technology. In July, for example, Goldman Sachs and Citigroup both raised their stock-price targets for SK Hynix, citing the high potential for AI and the anticipation of a positive surprise in the company’s earnings.

Price Action: SK Hynix is currently trading at 1,98,300 won, with a surge of 1.17% on Thursday. The stock has gained 39.26% year-to-date, according to data from Benzinga Pro.

Read Next:

Image via SK Hynix

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: Tracy D Crandall Cashes Out $497K In RPM Intl Stock

Disclosed on October 22, Tracy D Crandall, VP at RPM Intl RPM, executed a substantial insider sell as per the latest SEC filing.

What Happened: Crandall opted to sell 3,718 shares of RPM Intl, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The transaction’s total worth stands at $497,140.

RPM Intl shares are trading down 0.0% at $130.58 at the time of this writing on Wednesday morning.

Unveiling the Story Behind RPM Intl

RPM International Inc manufactures and sells a variety of paints, coatings, and adhesives. The firm organizes itself into four segments based on product type. The construction products group sells coatings, roofing, insulation, and other products to distributors, contractors, and end consumers globally. The performance coatings group produces coatings that are used in construction and industrial applications like floorings and corrosion control. The consumer group sells paint, finishes, and similar products to individual consumers through hardware and craft stores. The specialty products group sells a line of products ranging from niche applications of the other groups to marine finishes, to edible food colorings. The majority of revenue comes from North America.

Financial Milestones: RPM Intl’s Journey

Revenue Growth: RPM Intl’s revenue growth over a period of 3 months has faced challenges. As of 31 August, 2024, the company experienced a revenue decline of approximately -2.14%. This indicates a decrease in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 42.5%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): RPM Intl’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 1.78.

Debt Management: RPM Intl’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.89.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 27.38 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 2.3 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): RPM Intl’s EV/EBITDA ratio stands at 17.32, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Transaction Codes To Focus On

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of RPM Intl’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I'm 62 With $1.6 Million in an IRA and a $2,800 per Month Social Security. What's My Retirement Budget?

A budget by definition includes both income and expenses. The two halves of a budget are interdependent, so that if expenses go up, income must also rise. Otherwise, the budget won’t balance. Someone ready to retire at 62 with $1.6 million in an IRA and $2,800 in monthly Social Security benefits could start with an income estimate of approximately $97,600, based on a popular retirement fund withdrawal rate. This would be enough to fund a comfortable retirement in many cases, based on surveys of retiree spending. If individual lifestyle choices or other needs call for more income, various strategies might be able to provide it. If you’re modeling various retirement financial scenarios, consider talking it over with a financial advisor.

One common rule of thumb suggests withdrawing 4% of the principal from a retirement account in the first year of retirement, adjusting that amount annually by the rate of inflation. For a $1.6 million IRA, that figure would be $64,000 in the first year. The next year, assuming a 2% inflation rate, the withdrawal would be $65,280 and so on. Barring the unexpected, a retiree with a conservatively invested portfolio could continue doing that for 30 years with little chance of exhausting their savings.

A $2,800 monthly Social Security benefit is equivalent to $33,600 annually. Along with the $64,000 IRA withdrawal, a retiree in this situation could likely expect a total of $97,600 the first year of retirement. Social Security is also adjusted for cost of living, so the retiree’s income, which comes to $8,133.33 monthly, would likely stay approximately the same in terms of purchasing power. Still, you’ll have to make sure this covers your expenses — including taxes.

There are a few different methods of estimating expenses in retirement. One is to estimate expenses as a percentage of retiree earnings the last year of working. The percentage used ranges from 55% to 90%, with lower-income retirees typically employing a higher percentage. A figure of 70% is one of the more widely used. Average salary for someone 55-64 in 2023 was $63,544, according to the Bureau of Labor Statistics. For an average 62-year-old retiree, then, using this approach suggests annual expenses of $63,544 times 70% or $44,480.80, well below the estimated annual retirement income of $97,600.

Another way to estimate expenses is to look at what retirees actually spend. According to surveys, median retiree budgets range from about $24,000 annually to about $34,000 annually. Average retiree budgets are significantly higher, most likely because averages can be skewed by a smaller number of bigger spenders. However, examinations of actual retiree spending again suggest that $97,600 annually could readily fund a comfortable retirement.

Harley-Davidson Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Harley-Davidson, Inc. HOG will release earnings results for its third quarter, before the opening bell on Thursday, Oct. 24.

Analysts expect the Milwaukee, Wisconsin-based company to report quarterly earnings at 79 cents per share, compared to $1.38 per share in the year-ago period. Harley-Davidson projects to report revenue of $965.78 million for the quarter, compared to $1.3 billion a year earlier, according to data from Benzinga Pro.

On Sept. 4, the company’s board approved a cash dividend of 17.25 cents per share for the third quarter.

Harley-Davidson shares fell 1.2% to close at $34.13 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- B of A Securities analyst Robert Ohmes maintained a Buy rating and cut the price target from $50 to $45 on Oct. 15. This analyst has an accuracy rate of 77%.

- Baird analyst Craig Kennison downgraded the stock from Outperform to Neutral and slashed the price target from $44 to $40 on Oct. 2. This analyst has an accuracy rate of 66%.

- Citigroup analyst James Hardiman maintained a Neutral rating and raised the price target from $37 to $39 on Sept. 19. This analyst has an accuracy rate of 68%.

- UBS analyst Robin Farley maintained a Neutral rating and raised the price target from $39 to $40 on Aug. 23. This analyst has an accuracy rate of 82%.

- Morgan Stanley analyst Adam Jonas maintained an Overweight rating and raised the price target from $50 to $51 on April 26. This analyst has an accuracy rate of 60%.

Considering buying HOG stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Nasdaq, S&P 500 sink as tech leads losses ahead of Tesla earnings

Sales of existing homes fell in September as house hunters remained on the fence about buying a home despite mortgage rates easing during the month.

Existing home sales slipped 1.0% from August’s tally to a seasonally adjusted annual rate of 3.84 million, the National Association of Realtors said Wednesday. That marked the lowest rate since October 2010. Economists polled by Bloomberg expected a pace of 3.88 million in September.

On a yearly basis, sales of previously owned homes were 3.5% lower in September. The median home price rose 3.0% from last September to $404,500, marking the 15th consecutive month of annual price increases.

“Home sales have been essentially stuck at around a 4 million-unit pace for the past 12 months,” NAR chief economist Lawrence Yun said in a press release.

There have been significant challenges that have weighed on sales activity, including a lack of inventory, escalating prices, and elevated mortgage rates. Last month, however, those factors turned around.

The Federal Reserve cut its benchmark rate by half a percentage point in September. While the central bank doesn’t set mortgage rates, its actions influence their direction of movement.

Mortgage rates hit the lowest level since February 2023 ahead of the Fed decision to ease, while listing inventory picked up.

But overall, that hasn’t been enough to entice buyers.

“Some consumers are hesitating about moving forward with a major expenditure like purchasing a home before the upcoming election,” Yun said.