Tesla, Dow And 3 Stocks To Watch Heading Into Thursday

With U.S. stock futures trading mixed this morning on Thursday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Dow Inc. DOW to report quarterly earnings at 57 cents per share on revenue of $30.44 billion before the opening bell, according to data from Benzinga Pro. Dow shares gained 0.5% to $51.72 in after-hours trading.

- Lam Research Corporation LRCX reported better-than-expected earnings for its first quarter. The company said it sees second-quarter adjusted earnings of 87 cents per share, plus or minus 10 cents, and quarterly revenue of $4.3 billion, plus or minus $300 million. Lam Research shares gained 5.6% to $76.91 in the after-hours trading session.

- Analysts expect Honeywell International Inc. HON to post quarterly earnings at $2.50 per share on revenue of $9.90 billion. The company will release earnings before the markets open. Honeywell shares fell 0.6% to $219.00 in after-hours trading.

Check out our premarket coverage here

- Tesla Inc. TSLA reported stronger-than-expected earnings for its third quarter, while sales missed estimates. The automaker reported third-quarter earnings per share of 72 cents, beating a Street consensus estimate of 58 cents per share. Tesla shares jumped 12.1% to $239.50 in the after-hours trading session.

- Analysts expect American Airlines Group Inc. AAL to report quarterly earnings at 15 cents per share on revenue of $13.47 billion before the opening bell. American Airlines shares gained 1% to $12.96 in after-hours trading.

Check This Out:

Photo courtesy: Unsplash

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hex Bolts Market Size Forecasted to Hit USD 2.0 Billion by 2031 at 3.0% CAGR Growth: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 23, 2024 (GLOBE NEWSWIRE) — The global hex bolts market is estimated to surge at a CAGR of 3.0% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for hex bolts is estimated to reach US$ 2.0 billion by the end of 2031.

A significant trend is the rise of modular construction techniques. As demand for rapid and cost-effective building solutions grows, modular construction offers an efficient alternative. Hex bolts play a crucial role in assembling prefabricated modules, driving demand for specialized fasteners designed for modular construction applications.

The emergence of advanced material sciences introduces new possibilities for hex bolt design and performance. Lightweight yet durable materials, such as titanium alloys and composite materials, offer superior strength-to-weight ratios and corrosion resistance, addressing specific application requirements across industries.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=71196

The trend towards miniaturization in electronics and consumer appliances drives demand for miniature hex bolts. As devices become smaller and more compact, the need for precise and reliable fastening solutions grows, fueling demand for miniature hex bolts in manufacturing processes.

Key Players –

Some prominent players are as follows:

- Oglaend System Group

- Trifast plc

- Vikrant Fasteners

- Ningbo XinXing Fasteners Manufacture Co. Ltd.

- Dokka Fasteners

- Canco Fasteners

- IGC Fastners

- Alloy Fasteners

- OneMonroe

- RS Components Pte. Ltd.

- United Fasteners

Key Findings of the Market Report

- Fully threaded segment leads the hex bolts market, offering versatility and uniform fastening across applications, ensuring secure connections in various industries.

- Stainless steel material segment leads the hex bolts market due to its corrosion resistance, durability, and wide application across various industries.

- The construction application segment leads the hex bolts market due to demand for fasteners in building infrastructure and commercial projects.

Hex Bolts Market Growth Drivers & Trends

- Increasing investments in construction and infrastructure projects worldwide drive demand for hex bolts, essential for structural stability and assembly.

- Expanding automotive production fuels demand for hex bolts used in vehicle assembly, supported by rising consumer demand.

- Growing manufacturing activities across various sectors spur demand for hex bolts, essential components in machinery, equipment, and industrial applications.

- Continuous innovations in materials, coatings, and manufacturing processes enhance hex bolt performance, durability, and corrosion resistance, driving market growth.

- Increasing emphasis on sustainability prompts the adoption of eco-friendly and recyclable materials in hex bolt production, aligning with environmental regulations and corporate responsibility initiatives.

Global Hex Bolts Market: Regional Profile

- In North America, particularly in the United States and Canada, the hex bolts market thrives due to robust construction and automotive sectors. Demand is driven by infrastructure development projects and the flourishing manufacturing industry.

- Key players like Fastenal Company and Portland Bolt & Manufacturing Company dominate the market, offering a wide range of hex bolts tailored to diverse industrial applications.

- In Europe, countries like Germany and France lead the hex bolts market, buoyed by stringent quality standards and advanced manufacturing capabilities.

- The region’s robust automotive and aerospace industries fuel demand for high-performance fastening solutions. Established players such as Stanley Black & Decker and Hilti Corporation maintain market dominance through innovative product offerings and strategic partnerships.

- In the Asia Pacific region, rapid industrialization and infrastructure investments drive market growth. Countries like China, Japan, and India witness significant demand for hex bolts, fueled by construction activities and the burgeoning manufacturing sector.

- Local players alongside global giants like Würth Group and ITW Construction Asia Pacific compete by offering cost-effective solutions and expanding their distribution networks across the region.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=71196

Hex Bolts Market: Competitive Landscape

The hex bolts market boasts a competitive landscape characterized by the presence of key players like Fastenal Company, Stanley Black & Decker, and Hilti Corporation.

These companies dominate with extensive product portfolios, global distribution networks, and robust R&D capabilities. Regional players such as Portland Bolt & Manufacturing Company cater to niche markets with specialized offerings.

Market competition is fueled by factors like product quality, pricing strategies, and customer service. Mergers, acquisitions, and partnerships are common strategies employed by companies to strengthen their market position and expand their geographical presence in the hex bolts market. Product Portfolio

- Oglaend System Group offers a comprehensive range of multidiscipline support systems for the offshore, marine, and industrial sectors, including cable management solutions, support systems, and fire protection products.

- Trifast plc specializes in the design, manufacturing, and distribution of industrial fasteners and components, serving diverse sectors including automotive, electronics, and construction.

- Vikrant Fasteners provides high-quality fastening solutions for industrial applications, offering a wide range of bolts, nuts, screws, and washers catering to diverse industries worldwide.

Hex Bolts Market: Key Segments

By Threaded Type

- Fully Threaded

- Partially Threaded

By Material

- Stainless Steel

- Carbon Steel

- Alloy

- Others

By Application

- Automotive

- Construction

- Aerospace

- Others (Industrial Machinery, Home Appliances, etc.)

By Price

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=71196<ype=S

More Trending Reports by Transparency Market Research –

- Water Softening Systems Market – The global water softening systems market is projected to flourish at a CAGR of 6.2% from 2023 to 2031. As per the report published by TMR, a valuation of US$ 10.9 Bn is anticipated for the market in 2031.

- Vertical Lift Module Market – The global vertical lift module market is projected to grow at a CAGR of 9.1% from 2023 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Expected To Open In Red As Investors Eye Tesla Earnings: Gold Surges, Crude Slips As Analysts Predict A Stall In Risk Rally

A risk-off mood persists on Wall Street as the index futures point to a marginally lower start on Wednesday after the tech-led rebound witnessed in the previous session. Nvidia Corp. NVDA fell in premarket, followed by Apple Inc. AAPL and Tesla Inc. TSLA.

Chipmakers and chip designers will also be in focus today. While Taiwan Semiconductor Manufacturing Co. Ltd. TSM alerted the U.S. about a potential violation of expert rules, Qualcomm Inc. QCOM faces the threat of its chip designing license being canceled by Arm Holdings Plc. ARM.

On Wednesday, investors will have Tesla, Boeing Co. BA, AT&T Inc. T, Starbucks Corp. SBUX, Spirit Airlines Inc. SAVE, and McDonald’s Corp. MCD on their radar.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.30% |

| S&P 500 | -0.18% |

| Dow Jones | -0.40% |

| R2K | -0.30% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY fell 0.21% to $582.10 and the Invesco QQQ ETF QQQ declined 0.22% to $494.34, according to Benzinga Pro data.

Cues From Last Session:

Investors remained cautious, with most sectors on the S&P 500 index closing the day in the red. However, consumer staples and communication services stocks beat the overall trend to rise.

Tech stocks helped the Nasdaq Composite index close the day in the green, bucking a wider decline in the markets.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.18% | 18,573.13 |

| S&P 500 | -0.05% | 5,851.20 |

| Dow Jones | -0.02% | 42,924.89 |

| Russell 2000 | -0.37% | 2,231.53 |

Insights From Analysts:

Following six consecutive weeks of gains, the markets have remained gloomy this week, with tech stocks offering some respite amid sideways movements in most other sectors.

One of the factors playing on investors’ minds is the rise in benchmark US 10-year treasury yields, which rose to their highest mark since July.

On the economic data front, the composite manufacturing index in the US Fifth District came in at -14 for October compared to a reading of -21 in the prior month.

“We now recommend moving to the sidelines. We think investors are likely to as well; the risk rally should stall for the next few weeks,” said analysts at Barclays in a note according to CNBC, commenting on the gloomy performance in equity markets this week.

The International Monetary Fund, though, expects U.S. growth to remain strong. According to its latest World Economic Outlook report, the IMF revised its projected U.S. GDP growth rate to 2.8%, up from its previous projection of 2.6%.

For 2025, IMF revised U.S. GDP growth projections upwards from 1.9% to 2.2%.

Charlie Bilello, Chief Market Strategist at Creative Planning, highlighted a continued surge in gold prices, which rose to a new all-time high of $2,772.55 an ounce.

See Also: Best Futures Trading Software

Upcoming Economic Data:

- Fed Governor Michelle Bowman is scheduled to deliver a speech at 9 a.m. ET.

- Existing home sales data is scheduled to be released at 10 a.m. ET.

- Federal Reserve Bank of Richmond President Thomas Barkin will speak at noon ET.

- The Federal Reserve will also publish its latest ‘Beige Book’ at 2 p.m. ET.

Stocks In Focus:

- Tesla will release its third-quarter earnings after market hours. Analysts expect EPS to fall below estimates.

- McDonald’s hamburgers have been linked to an E-coli outbreak.

- Frontier Airlines ULCC is reportedly considering renewing its bid for Spirit Airlines.

- Starbucks reported weak preliminary results and suspended guidance for the full fiscal year 2025.

- Telecom major AT&T is scheduled to report its earnings before markets open.

Commodities, Bonds And Global Equity Markets:

Crude oil futures fell in the early New York session, falling nearly 1.8% as data showed a rise in U.S. inventory, exceeding expectations.

The 10-year Treasury note yield rose marginally to 4.222%.

Asian markets were mixed on Wednesday, with Chinese markets edging up while Japan’s Nikkei 225 declined.

European stocks continued to remain tentative and were mostly lower in early trading.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'I Splatted. It Hurt,' Says Dave Ramsey, Referring To The Sudden Call On His $1.2 Million Loans That Turned His World Upside Down

Dave Ramsey is renowned for his no-nonsense money management approach and clear-cut financial advice. However, Ramsey experienced a financial disaster that destroyed him utterly before he rose to fame as the personal finance expert we know today. He summed it up in an honest reflection: “I splatted. It hurt.”

In the late 1980s, Dave Ramsey was riding high. At just 28 years old, he had amassed a $4 million real estate portfolio, had a successful business and appeared on a straight path to even greater wealth. But things took a sudden turn for the worse.

Don’t Miss:

The Banking Act of 1986 changed the rules for bank ownership, triggering a wave of buyouts and consolidations. The local bank where Ramsey had obtained his loans was bought out and the new owners, who didn’t know him or care about his past success, called in his loans and lines of credit. Dave suddenly found himself needing to repay $1.2 million fast.

Ramsey was forced to declare bankruptcy without enough time to sell his properties or come up with the cash. He lost everything he had worked so hard to build. “When I hit rock bottom, it wasn’t a bounce back,” Ramsey recalled. “It was a splat and it hurt bad.”

See Also: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Ramsey had to dig himself and his family out of that financial disaster, but it was anything but easy. Suddenly, he had just 90 days to unload $1.2 million worth of real estate, but he couldn’t do it fast enough. Defaults, numerous foreclosures and lawsuits followed and it took three years for everything to fully unwind.

He and his wife Sharon had to take a long, hard look at their financial habits. They had to admit that their choices had led them to that point – there were no villains to blame, just their own missteps. They decided then and there that things had to change.

In his interview on The Street, Ramsey said they had to ask themselves, “OK, what about us personally and what about our behaviors, our habits, our decisions and our values was wrong that brought us to this moment?” It was a moment of brutal honesty, but it was also the start of a transformation.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

The pair resolved to take serious measures. They completely gave up trying to borrow money. Ramsey promised himself never to take on debt again and canceled his credit cards. From then on, they lived on a strict budget, drove an old, beat-up car and worked hard to save up. “It was so bad that I was highly motivated to get out of that car as fast as I could,” Ramsey said.

Stocks usually see double-digit gains under U.S. presidents — with two exceptions since 1933

With the U.S. presidential election just two weeks away, Deutsche Bank Research found the S&P 500 has seen a long stretch of annualized double-digit returns under different White House administrations — with two exceptions since 1933.

“As we approach the big day, markets are bracing themselves for a vote that will likely lead to very different policies, depending who wins and with what congressional configuration,” said Jim Reid, global head of macro and thematic research at Deutsche Bank, in a note emailed Tuesday.

Yet it may be “better to be lucky than good,” said Reid, explaining that events might be more likely “to dictate big-picture market performance under the next president, with policy probably playing a smaller role.”

Deutsche Bank Research broke out the S&P 500’s SPX annualized total return under each U.S. president dating back to Theodore Roosevelt in 1901. The chart below shows the S&P 500 fell on an annualized basis under Herbert Hoover and Richard Nixon — declines that stood out against an otherwise long period of double-digit total returns no matter who was in the White House. The S&P 500 also fell on an annualized basis under President George W. Bush’s administration, the chart shows.

“From 1933 onwards, most presidents have benefited from a long period of U.S. exceptionalism and double-digit annual equity returns with just two very unlucky exceptions,” said Reid. “The problem is these exceptions have tended to be pretty savage relative to the norm.”

But in Reid’s view, “the big outliers were driven by events that were arguably mostly outside of the control of the sitting president.” Those events include the Great Depression, “the 1973 oil shock, and the double whammy of the post-2000 bubble unwind” and the early global financial crisis seen under George W. Bush, according to the note.

“Academics have argued that Hoover’s policies exacerbated the Depression,” said Reid, referring to the president who served from 1929 to 1933. “But you only have to look at the returns under” the preceding administration of Calvin Coolidge “to see that he likely presided over a bubble that contributed to the subsequent 1929 crash, even if he had left office earlier that year.”

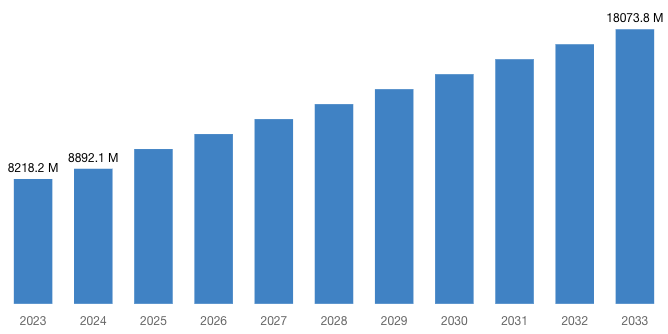

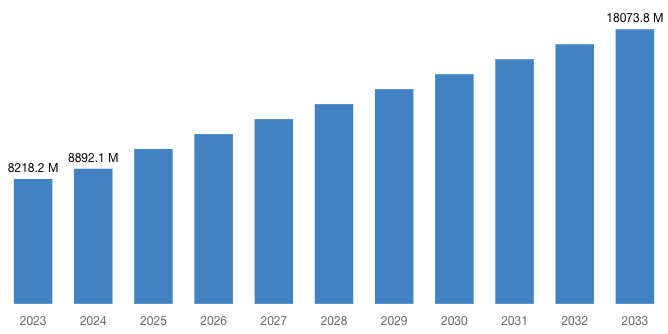

[Latest] Global Cocktail Mixers Market Size/Share Worth USD 18,073.8 Million by 2033 at a 8.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 23, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Cocktail Mixers Market Size, Trends and Insights By Product Type (Alcoholic Mixers, Non-Alcoholic Mixers), By Flavor (Fruit Flavored Mixers, Herbal/Spiced Mixers, Savory Mixers, Others), By Application (Home Use, Commercial/Bar Use), By Packaging Type (Bottles, Cans, Pouches), By Distribution Channel (Retail Stores, Online Retail, Bars and Restaurants, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Cocktail Mixers Market size & share was valued at approximately USD 8,218.2 Million in 2023 and is expected to reach USD 8,892.1 Million in 2024 and is expected to reach a value of around USD 18,073.8 Million by 2033, at a compound annual growth rate (CAGR) of about 8.2% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Cocktail Mixers Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52930

Cocktail Mixers Market: Growth Factors and Dynamics

- Rising Demand for Craft Cocktails: The growing popularity of craft cocktails has fueled demand for high-quality cocktail mixers. Consumers are increasingly seeking unique and premium mixer options to create sophisticated drinks at home or enjoy at bars and restaurants.

- Shift Towards Home Entertainment: The trend of entertaining at home has surged, especially post-pandemic, leading to increased consumption of cocktails made at home. This has driven the demand for convenient and diverse cocktail mixer options that replicate the bar experience.

- Expanding Beverage Culture: There’s a broader cultural shift towards diverse beverage consumption, including cocktails, driven by millennials and younger demographics. This demographic is more adventurous in trying new flavors and experimenting with mixology, stimulating demand for innovative cocktail mixers.

- Health and Wellness Trends: Consumers are increasingly conscious of their health and wellness, leading to a demand for healthier cocktail mixer options. This has resulted in the introduction of low-sugar, natural ingredient-based, and functional cocktail mixers to cater to health-conscious consumers.

- Innovations and Flavor Trends: Continuous innovations in flavors and ingredients are driving the market growth. Manufacturers are introducing novel flavors, botanical infusions, and exotic ingredients to cater to changing consumer preferences and to differentiate their products in the market.

- E-commerce and Online Retailing: The rise of e-commerce platforms has significantly expanded the accessibility of cocktail mixers to consumers. Online retailing provides a convenient channel for purchasing a wide variety of mixers, contributing to market growth by reaching a broader consumer base.

- Globalization and Cultural Exchange: Increased globalization and cultural exchange have led to the adoption of cocktail culture in various regions worldwide. This has resulted in the proliferation of cocktail bars and restaurants, driving demand for cocktail mixers across different markets and contributing to market growth.

- Sustainability and Environmental Concerns: With growing awareness of environmental issues, there’s a rising demand for sustainable and eco-friendly packaging options in the cocktail mixers market. Manufacturers are increasingly adopting recyclable materials and sustainable production practices to meet consumer expectations and reduce environmental impact, driving growth through responsible consumption initiatives.

Request a Customized Copy of the Cocktail Mixers Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52930

Cocktail Mixers Market: Partnership and Acquisitions

- In 2024, India’s leading Cocktail Mixer brand, Jimmy’s, unveiled a new line of Martini Cocktail mixers, featuring enticing flavors like Green Apple, Popstar, and Espresso Martini. This launch diversifies their product offering, catering to varied tastes and preferences in the market.

- In 2023, Fever-Tree introduced its inaugural cocktail mixers lineup, including Margarita, Mojito, and Espresso Martini variants, priced at £4.50 per 500ml. Crafted with premium, naturally sourced ingredients like Mexican limes, Italian blood oranges, and Kenyan coffee beans, the mixers aim to simplify home cocktail preparation while ensuring exceptional taste.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 8,892.1 Million |

| Projected Market Size in 2033 | USD 18,073.8 Million |

| Market Size in 2023 | USD 8,218.2 Million |

| CAGR Growth Rate | 8.2% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product Type, Flavor, Application, Packaging Type, Distribution Channel and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Cocktail Mixers report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Cocktail Mixers report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Cocktail Mixers Market Report @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

Cocktail Mixers Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Cocktail Mixers Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Disruption in Supply Chain: The pandemic disrupted global supply chains, leading to shortages of key ingredients and packaging materials for cocktail mixers. This affected production capacities and led to fluctuations in product availability and pricing.

- Closure of Bars and Restaurants: The closure of bars, restaurants, and hospitality venues during lockdowns significantly reduced on-premise consumption of cocktails, impacting sales of cocktail mixers that were primarily used in commercial settings.

- Focus on Home Consumption: Manufacturers pivoted towards promoting at-home cocktail experiences, encouraging consumers to experiment with cocktail-making using their products through online tutorials, recipes, and social media campaigns.

- Introduction of Ready-to-Drink Cocktails: To cater to changing consumer behavior and preferences for convenience, many brands introduced ready-to-drink cocktail options that required minimal preparation, capitalizing on the trend of home entertaining.

- Expansion of Online Distribution: Companies expanded their online presence and distribution networks to reach consumers directly through e-commerce platforms, ensuring continued accessibility of cocktail mixers during periods of restricted movement and beyond.

- Innovations in Packaging and Formats: Manufacturers innovated in packaging and formats to meet evolving consumer needs, such as single-serve pouches, eco-friendly packaging, and multi-pack options, enhancing convenience and sustainability.

- Adoption of Health-Conscious Formulations: With increased focus on health and wellness during the pandemic, companies introduced healthier formulations of cocktail mixers, including low-sugar, natural ingredient-based, and functional options, appealing to health-conscious consumers.

- Collaborations and Partnerships: Companies in the cocktail mixers market collaborated with bars, restaurants, and influencers to promote their products and create unique experiences. These partnerships helped drive brand visibility, foster consumer engagement, and stimulate demand as the market recovered from the pandemic’s impact.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Cocktail Mixers Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Cocktail Mixers Market Report @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

Key questions answered in this report:

- What is the size of the Cocktail Mixers market and what is its expected growth rate?

- What are the primary driving factors that push the Cocktail Mixers market forward?

- What are the Cocktail Mixers Industry’s top companies?

- What are the different categories that the Cocktail Mixers Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Cocktail Mixers market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Cocktail Mixers Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

Cocktail Mixers Market – Regional Analysis

The Cocktail Mixers Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: With a thriving craft cocktail scene, North America sees a surge in demand for premium and artisanal cocktail mixers. Health-conscious consumers drive the popularity of low-sugar and natural ingredient-based options, while constant flavor innovation caters to diverse palates. Convenience remains key, leading to the rise of ready-to-drink and single-serve mixer options, catering to on-the-go lifestyles.

- Europe: Europe’s cocktail culture is deeply rooted in tradition, with an emphasis on heritage recipes and ingredients. Sustainability is a growing concern, prompting the adoption of eco-friendly packaging and production practices. Premiumization is on the rise, as consumers seek sophisticated drinking experiences, often with locally-sourced and seasonal ingredients.

- Asia-Pacific: As Western cocktail trends gain traction, urban Asia-Pacific markets see a fusion of traditional Asian flavors with modern mixology techniques. E-commerce platforms witness rapid growth, providing convenient access to cocktail mixers, especially in tech-savvy regions like China and South Korea. Health-conscious choices, such as low-calorie and functional mixers, appeal to a younger demographic seeking healthier options.

- LAMEA: In LAMEA regions, a rich tapestry of cultural diversity influences cocktail mixer trends, with flavors and ingredients reflecting the culinary heritage of Latin America, Africa, and the Middle East. Traditional recipes are cherished, and passed down through generations. With the emergence of a middle class, there’s a growing appetite for premium and imported mixers, particularly in urban hubs, where the hospitality sector experiences notable growth, driving consumption in tourist destinations and bustling city centers.

Request a Customized Copy of the Cocktail Mixers Market Report @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Cocktail Mixers Market Size, Trends and Insights By Product Type (Alcoholic Mixers, Non-Alcoholic Mixers), By Flavor (Fruit Flavored Mixers, Herbal/Spiced Mixers, Savory Mixers, Others), By Application (Home Use, Commercial/Bar Use), By Packaging Type (Bottles, Cans, Pouches), By Distribution Channel (Retail Stores, Online Retail, Bars and Restaurants, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/cocktail-mixers-market/

List of the prominent players in the Cocktail Mixers Market:

- The Coca-Cola Company

- PepsiCo Inc.

- Fever-Tree

- Monin

- Stirrings

- Finest Call

- Master of Mixes

- Powell & Mahoney

- Q Mixers

- Tropicana Products Inc.

- Collins Brothers

- Real Syrups

- Jordan’s Skinny Mixes

- Scrappy’s Bitters

- Cocktail Artist

- Others

Click Here to Access a Free Sample Report of the Global Cocktail Mixers Market @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Luxury Food Market: Luxury Food Market Size, Trends and Insights By Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Others), By Distribution Channel (Online Retailers, Specialty Stores, Supermarkets and Hypermarkets, Gourmet Food Stores, Hotel and Restaurant Supply, Duty-Free Shops, Direct Sales), By End-User (Small Food Chains, High-End Restaurants), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Coffee Capsule Market: Europe Coffee Capsule Market Size, Trends and Insights By Product Type (Traditional Coffee Capsules, Compostable Coffee Capsules, Recyclable Coffee Capsules), By Material Type (Plastic Capsules, Aluminum Capsules, Paper-Based Capsules), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Convenience Stores), By Coffee Type (Regular Coffee, Decaffeinated Coffee, Flavored Coffee, Specialty Coffee), By End-User (Residential, Commercial), By Compatibility (Original Line, Vertuo Line, Other Compatible Machines), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Tamarind Extract Market: Tamarind Extract Market Size, Trends and Insights By Form (Liquid, Powder, Paste), By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Others), By Distribution Channel (Direct Sales, Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Mushroom Market: US Mushroom Market Size, Trends and Insights By Type of Mushroom (Button Mushrooms, Shiitake Mushrooms, Oyster Mushrooms, Portobello Mushrooms, Others), By Form (Fresh Mushrooms, Processed Mushrooms), By End Use (Household Consumption, Food Processing Industry, Pharmaceuticals, Cosmetics and Personal Care Products, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Food Service Providers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Dietary Supplements Market: Europe Dietary Supplements Market Size, Trends and Insights By Ingredient (Vitamins, Botanicals, Minerals, Protein & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Prebiotics & Postbiotics, Others), By Form (Tablets, Capsules, Soft gels, Powders, Gummies, Liquids, Others), By Type (Gluten-Free, Non-GMO, Organic, Natural, Vegan, Others), By Application (Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Others), By End User (Infants, Children, Adults, Pregnant Women, Geriatric, Others), By Distribution Channel (Online, Offline), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Starter Cultures Market: US Starter Cultures Market Size, Trends and Insights By Type (Bacterial Starter Cultures, Yeast Starter Cultures, Mold Starter Cultures, Others), By Application (Dairy Products, Meat Products, Beverages, Bakery Products, Confectionery, Others), By Form (Freeze-Dried Starter Cultures, Directly Inoculated Starter Cultures, Lyophilized Starter Cultures, Others), By End-Use Industry (Food & Beverage Industry, Pharmaceutical Industry, Agriculture, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Non-Alcoholic Beverages Market: US Non-Alcoholic Beverages Market Size, Trends and Insights By Type (Carbonated Soft Drinks (CSD), Bottled Water, Fruit Juices, Energy Drinks, Sports Drinks, Ready-to-Drink (RTD) Tea and Coffee, Functional Beverages, Dairy Alternatives, Others), By Packaging (Cans, Bottles (Plastic/Glass), Cartons, Pouches, Others), By Flavor (Regular/Original, Flavored, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Food Service, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India Monosodium Glutamate Market: India Monosodium Glutamate Market Size, Trends and Insights By Application (Food Processing, Restaurant, Household, Animal Feed, Others), By Form (Powder, Granules, Crystal), By Sales Channel (Business to Business, Business to Consumers), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Cocktail Mixers Market is segmented as follows:

By Product Type

- Alcoholic Mixers

- Non-Alcoholic Mixers

By Flavor

- Fruit Flavored Mixers

- Herbal/Spiced Mixers

- Savory Mixers

- Others

By Application

- Home Use

- Commercial/Bar Use

By Packaging Type

By Distribution Channel

- Retail Stores

- Online Retail

- Bars and Restaurants

- Others

Click Here to Get a Free Sample Report of the Global Cocktail Mixers Market @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Cocktail Mixers Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Cocktail Mixers Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Cocktail Mixers Market? What Was the Capacity, Production Value, Cost and PROFIT of the Cocktail Mixers Market?

- What Is the Current Market Status of the Cocktail Mixers Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Cocktail Mixers Market by Considering Applications and Types?

- What Are Projections of the Global Cocktail Mixers Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Cocktail Mixers Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Cocktail Mixers Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Cocktail Mixers Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Cocktail Mixers Industry?

Click Here to Access a Free Sample Report of the Global Cocktail Mixers Market @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

Reasons to Purchase Cocktail Mixers Market Report

- Cocktail Mixers Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Cocktail Mixers Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Cocktail Mixers Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Cocktail Mixers Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Cocktail Mixers market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Cocktail Mixers Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Cocktail Mixers market analysis.

- The competitive environment of current and potential participants in the Cocktail Mixers market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Cocktail Mixers market should find this report useful. The research will be useful to all market participants in the Cocktail Mixers industry.

- Managers in the Cocktail Mixers sector are interested in publishing up-to-date and projected data about the worldwide Cocktail Mixers market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Cocktail Mixers products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Cocktail Mixers Market Report @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Cocktail Mixers Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/cocktail-mixers-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing Machinists Reject 35% Wage Hike Deal, Extending 5-Week Strike Amid $6B Loss And Cash Burn Warnings

Boeing Co BA machinists rejected a new labor deal with 64% voting against the proposal, their union announced Wednesday, extending a strike that has halted most of the company’s Seattle-area production for over five weeks.

What Happened: The deal offered 35% wage increases over four years, increased 401(k) contributions, and a $7,000 bonus. However, workers were dissatisfied with the absence of a pension plan and sought higher pay to offset rising living costs, reported CNBC.

The strike is Boeing’s first since 2008 and adds to the company’s challenges, including a $6 billion quarterly loss and continued cash burn. CEO Kelly Ortberg emphasized resolving the labor dispute as a priority.

Price Action: Boeing stock closed at $157.06 on Wednesday, down 1.76% for the day. In after-hours trading, the stock saw a modest recovery, rising 0.55%. Year to date, Boeing’s stock has declined 37.62%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stewart Reports Third Quarter 2024 Results

- Total revenues of $667.9 million ($663.2 million on an adjusted basis) compared to $601.7 million ($603.7 million on an adjusted basis) in the prior year quarter

- Net income of $30.1 million ($33.1 million on an adjusted basis) compared to $14.0 million ($23.9 million on an adjusted basis) in the prior year quarter

- Diluted earnings per share of $1.07 ($1.17 on an adjusted basis) compared to prior year diluted EPS of $0.51 ($0.86 on an adjusted basis)

HOUSTON, Oct. 23, 2024 /PRNewswire/ — Stewart Information Services Corporation STC today reported net income attributable to Stewart of $30.1 million ($1.07 per diluted share) for the third quarter 2024, compared to $14.0 million ($0.51 per diluted share) for the third quarter 2023. On an adjusted basis, third quarter 2024 net income was $33.1 million ($1.17 per diluted share) compared to $23.9 million ($0.86 per diluted share) in the third quarter 2023. Pretax income before noncontrolling interests for the third quarter 2024 was $42.8 million ($46.8 million on an adjusted basis) compared to $27.1 million ($40.0 million on an adjusted basis) for the third quarter 2023.

Third quarter 2024 results included $4.7 million of pretax net realized and unrealized gains, while third quarter 2023 results included $1.9 million of pretax net realized and unrealized losses, both of which were primarily driven by net unrealized gains and losses, respectively, from fair value changes of equity securities investments in the title segment.

“We are proud of our third quarter results as they reflect continued progress on our journey. Strong topline performance in several lines of business resulted in improved third quarter results when compared to the same quarter last year, even as residential purchase market conditions remain difficult given macro-economic impacts,” commented Fred Eppinger, chief executive officer. “We remain focused on investing in ourselves to better the company and our customers and remain dedicated to prioritizing our pursuit of growth and margin improvement across all lines of business.”

Selected Financial Information

Summary results of operations are as follows (dollars in millions, except per share amounts, pretax margin and adjusted pretax margin, and amounts may not add as presented due to rounding):

|

Quarter Ended September 30, |

Nine Months Ended September 30, |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Total revenues |

667.9 |

601.7 |

1,824.5 |

1,675.2 |

|

|

Pretax income before noncontrolling interests |

42.8 |

27.1 |

78.9 |

42.1 |

|

|

Income tax expense |

(9.1) |

(9.1) |

(18.0) |

(9.6) |

|

|

Net income attributable to noncontrolling interests |

(3.6) |

(3.9) |

(10.4) |

(10.9) |

|

|

Net income attributable to Stewart |

30.1 |

14.0 |

50.6 |

21.6 |

|

|

Non-GAAP adjustments, after taxes* |

3.0 |

9.9 |

12.3 |

27.7 |

|

|

Adjusted net income attributable to Stewart* |

33.1 |

23.9 |

62.8 |

49.4 |

|

|

Pretax margin |

6.4 % |

4.5 % |

4.3 % |

2.5 % |

|

|

Adjusted pretax margin* |

7.1 % |

6.6 % |

5.3 % |

4.7 % |

|

|

Net income per diluted Stewart share |

1.07 |

0.51 |

1.80 |

0.79 |

|

|

Adjusted net income per diluted Stewart share* |

1.17 |

0.86 |

2.24 |

1.80 |

|

|

* Adjusted net income, adjusted pretax margin and adjusted net income per diluted share are non-GAAP measures. See Appendix A for explanation and reconciliation of non-GAAP adjustments. |

Title Segment

Summary results of the title segment are as follows (dollars in millions, except pretax margin and adjusted pretax margin):

|

Quarter Ended September 30, |

||||||

|

2024 |

2023 |

% Change |

||||

|

Operating revenues |

553.3 |

522.1 |

6 % |

|||

|

Investment income |

13.6 |

13.4 |

2 % |

|||

|

Net realized and unrealized gains (losses) |

4.8 |

(1.8) |

361 % |

|||

|

Pretax income |

45.0 |

35.4 |

27 % |

|||

|

Non-GAAP adjustments to pretax income* |

(1.6) |

6.6 |

||||

|

Adjusted pretax income* |

43.4 |

42.0 |

3 % |

|||

|

Pretax margin |

7.9 % |

6.6 % |

||||

|

Adjusted pretax margin* |

7.7 % |

7.8 % |

||||

|

* Adjusted pretax income and adjusted pretax margin are non-GAAP financial measures. See Appendix A for explanation and reconciliation of non-GAAP adjustments. |

||||||

Title segment operating revenues in the third quarter 2024 increased $31.2 million, or 6 percent, primarily driven by higher revenues from our domestic commercial and agency title operations, while total segment operating expenses increased $28.4 million, or 6 percent, compared to the third quarter 2023. Agency retention expenses in the third quarter 2024 increased $15.0 million, or 7 percent, primarily resulting from $16.8 million (6 percent) higher gross agency revenues compared to the third quarter 2023.

Total title segment employee costs and other operating expenses increased by $14.6 million, or 6 percent, in the third quarter 2024 compared to the prior year quarter, primarily due to higher outside search and incentive compensation expenses related to higher commercial revenues. As a percentage of operating revenues, these expenses were 47.4 percent in both third quarters of 2024 and 2023. Title loss expense in the third quarter 2024 decreased $1.0 million, or 4 percent, primarily due to an overall favorable claim experience compared to the prior year quarter. As a percentage of title revenues, title loss expense was 3.8 percent for the third quarter 2024 compared to 4.3 percent in the third quarter 2023.

In addition to the net realized and unrealized losses and gains presented above, non-GAAP adjustments to the title segment’s pretax income for the third quarters 2024 and 2023 included $3.2 million and $4.8 million, respectively, of total acquisition intangible asset amortization and other expenses (refer to Appendix A).

Direct title revenues information is presented below (dollars in millions):

|

Quarter Ended September 30, |

||||

|

2024 |

2023 |

% Change |

||

|

Non-commercial: |

||||

|

Domestic |

168.2 |

167.6 |

0 % |

|

|

International |

29.0 |

29.1 |

0 % |

|

|

197.2 |

196.7 |

0 % |

||

|

Commercial: |

||||

|

Domestic |

67.4 |

51.9 |

30 % |

|

|

International |

6.1 |

7.8 |

(22 %) |

|

|

73.5 |

59.7 |

23 % |

||

|

Total direct title revenues |

270.7 |

256.4 |

6 % |

|

Total non-commercial domestic revenues in the third quarter 2024 were comparable to the prior year quarter, primarily due to the higher average fee per file offsetting the slightly lower total non-commercial domestic transactions in the third quarter 2024. Domestic commercial revenues in the third quarter 2024 increased $15.5 million, or 30 percent, due to a higher average transaction size and a 4 percent improvement in commercial transactions closed compared to the third quarter 2023. Third quarter 2024 average domestic commercial fee per file was $17,700, which was 25 percent higher compared to $14,200 from the prior year quarter, while average residential fee per file was $3,000, a 2 percent improvement compared to the prior year quarter.

Real Estate Solutions Segment

Summary results of the real estate solutions segment are as follows (dollars in millions, except pretax margin and adjusted pretax margin):

|

Quarter Ended September 30, |

||||

|

2024 |

2023 |

% Change |

||

|

Operating revenues |

96.3 |

68.2 |

41 % |

|

|

Pretax income |

7.4 |

2.6 |

181 % |

|

|

Non-GAAP adjustments to pretax income* |

5.5 |

6.3 |

||

|

Adjusted pretax income* |

12.9 |

8.9 |

45 % |

|

|

Pretax margin |

7.7 % |

3.8 % |

||

|

Adjusted pretax margin* |

13.4 % |

13.0 % |

||

|

* Adjusted pretax income and adjusted pretax margin are non-GAAP financial measures. See Appendix A for an explanation and reconciliation of non-GAAP adjustments. |

||||

Segment operating revenues in the third quarter 2024 increased $28.2 million, or 41 percent, compared to the prior year quarter, primarily due to improved revenues from our credit information and valuation services. On a combined basis, segment employee costs and other operating expenses in the third quarter 2024 increased $24.2 million, or 41 percent, in line with the higher operating revenues. Non-GAAP adjustments to pretax income shown in the schedule above were related to acquisition intangible asset amortization expenses.

Corporate and Other Segment

The segment’s results were primarily driven by net expenses attributable to corporate operations, which decreased to $9.5 million in the third quarter 2024, compared to $10.8 million in the third quarter 2023, primarily due to a prior acquisition-related settlement expense in the third quarter 2023.

Expenses

Consolidated employee costs in the third quarter 2024 increased $12.4 million, or 7 percent, compared to the prior year quarter, primarily driven by increased incentive compensation on higher title and real estate solutions revenues. As a percentage of total operating revenues, employee costs improved to 29.8 percent in the third quarter 2024 compared to 30.7 percent in the third quarter 2023.

Consolidated other operating expenses in the third quarter 2024 increased $25.2 million, or 19 percent, primarily driven by higher service expenses and outside search fees related to higher revenues from real estate solutions and commercial title operations, respectively, compared to the third quarter 2023. As a percentage of total operating revenues, total other operating expenses for the third quarter 2024 increased to 24.0 percent compared to 22.1 percent in the prior year quarter, primarily due to increased real estate solutions service expenses.

Other

Net cash provided by operations in the third quarter 2024 was $76.1 million compared to $59.5 million in the third quarter 2023, primarily driven by increased consolidated net income in the third quarter 2024.

Third quarter Earnings Call

Stewart will hold a conference call to discuss the third quarter 2024 earnings at 8:30 a.m. Eastern Time on Thursday, October 24, 2024. To participate, dial (800) 343-5172 (USA) or (203) 518-9856 (International) – access code STCQ324. Additionally, participants can listen to the conference call through Stewart’s Investor Relations website at https://investors.stewart.com/news-and-events/events/default.aspx. The conference call replay will be available from 11:00 a.m. Eastern Time on October 24, 2024 until midnight on October 31, 2024 by dialing (800) 839-5634 (USA) or (402) 220-2560 (International).

About Stewart

Stewart (NYSE-STC) is a global real estate services company, offering products and services through our direct operations, network of Stewart Trusted Providers™ and family of companies. From residential and commercial title insurance and closing and settlement services to specialized offerings for the mortgage and real estate industries, we offer the comprehensive service, deep expertise and solutions our customers need for any real estate transaction. At Stewart, we are dedicated to becoming the premier title services company and we are committed to doing so by partnering with our customers to create mutual success. Learn more at stewart.com.

Cautionary statement regarding forward-looking statements. Certain statements in this earnings release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements relate to future, not past, events and often address our expected future business and financial performance. These statements often contain words such as “may,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “will,” “foresee” or other similar words. Forward-looking statements by their nature are subject to various risks and uncertainties that could cause our actual results to be materially different than those expressed in the forward-looking statements. These risks and uncertainties include, among other things, the volatility of economic conditions; adverse changes in the level of real estate activity; changes in mortgage interest rates, existing and new home sales, and availability of mortgage financing; our ability to respond to and implement technology changes, including the completion of the implementation of our enterprise systems; the impact of unanticipated title losses or the need to strengthen our policy loss reserves; any effect of title losses on our cash flows and financial condition; the ability to attract and retain highly productive sales associates; the impact of vetting our agency operations for quality and profitability; independent agency remittance rates; changes to the participants in the secondary mortgage market and the rate of refinancing that affects the demand for title insurance products; regulatory non-compliance, fraud or defalcations by our title insurance agencies or employees; our ability to timely and cost-effectively respond to significant industry changes and introduce new products and services; the outcome of pending litigation; our ability to manage risks associated with potential cybersecurity or other privacy or data security breaches; the impact of changes in governmental and insurance regulations, including any future reductions in the pricing of title insurance products and services; our dependence on our operating subsidiaries as a source of cash flow; our ability to access the equity and debt financing markets when and if needed; our ability to grow our international operations; seasonality and weather; and our ability to respond to the actions of our competitors. These risks and uncertainties, as well as others, are discussed in more detail in our documents filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023, and if applicable, as supplemented by any risk factors contained in our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K filed subsequently. All forward-looking statements included in this earnings release are expressly qualified in their entirety by such cautionary statements. We expressly disclaim any obligation to update, amend or clarify any forward-looking statements contained in this earnings release to reflect events or circumstances that may arise after the date hereof, except as may be required by applicable law.

ST-IR

|

STEWART INFORMATION SERVICES CORPORATION CONDENSED STATEMENTS OF INCOME (In thousands of dollars, except per share amounts and except where noted) |

|||||

|

Quarter Ended September 30, |

Nine Months Ended |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Revenues: |

|||||

|

Title revenues: |

|||||

|

Direct operations |

270,706 |

256,377 |

736,774 |

722,242 |

|

|

Agency operations |

282,549 |

265,700 |

764,081 |

723,476 |

|

|

Real estate solutions |

96,346 |

68,190 |

271,561 |

202,169 |

|

|

Total operating revenues |

649,601 |

590,267 |

1,772,416 |

1,647,887 |

|

|

Investment income |

13,626 |

13,393 |

40,833 |

32,114 |

|

|

Net realized and unrealized gains (losses) |

4,714 |

(1,946) |

11,238 |

(4,829) |

|

|

667,941 |

601,714 |

1,824,487 |

1,675,172 |

||

|

Expenses: |

|||||

|

Amounts retained by agencies |

233,980 |

218,983 |

634,083 |

596,498 |

|

|

Employee costs |

193,862 |

181,493 |

545,987 |

534,710 |

|

|

Other operating expenses |

155,646 |

130,455 |

444,890 |

380,530 |

|

|

Title losses and related claims |

21,282 |

22,251 |

59,754 |

59,727 |

|

|

Depreciation and amortization |

15,480 |

16,414 |

46,062 |

46,848 |

|

|

Interest |

4,899 |

5,054 |

14,768 |

14,777 |

|

|

625,149 |

574,650 |

1,745,544 |

1,633,090 |

||

|

Income before taxes and noncontrolling interests |

42,792 |

27,064 |

78,943 |

42,082 |

|

|

Income tax expense |

(9,123) |

(9,134) |

(17,999) |

(9,588) |

|

|

Net income |

33,669 |

17,930 |

60,944 |

32,494 |

|

|

Less net income attributable to noncontrolling interests |

3,573 |

3,931 |

10,375 |

10,870 |

|

|

Net income attributable to Stewart |

30,096 |

13,999 |

50,569 |

21,624 |

|

|

Net earnings per diluted share attributable to Stewart |

1.07 |

0.51 |

1.80 |

0.79 |

|

|

Diluted average shares outstanding (000) |

28,200 |

27,650 |

28,069 |

27,445 |

|

|

Selected financial information: |

|||||

|

Net cash provided by operations |

76,121 |

59,533 |

67,656 |

43,578 |

|

|

Other comprehensive income (loss) |

18,259 |

(13,295) |

10,911 |

(7,278) |

|

|

Third Quarter Domestic Order Counts: |

||||||||||||

|

Opened Orders 2024: |

July |

August |

Sept |

Total |

Closed Orders 2024: |

July |

August |

Sept |

Total |

|||

|

Commercial |

1,111 |

1,273 |

1,281 |

3,665 |

Commercial |

1,140 |

1,318 |

1,336 |

3,794 |

|||

|

Purchase |

17,796 |

16,403 |

15,259 |

49,458 |

Purchase |

12,382 |

12,217 |

10,991 |

35,590 |

|||

|

Refinancing |

6,017 |

7,077 |

7,826 |

20,920 |

Refinancing |

3,617 |

4,016 |

4,133 |

11,766 |

|||

|

Other |

3,621 |

3,129 |

6,671 |

13,421 |

Other |

4,304 |

2,142 |

1,779 |

8,225 |

|||

|

Total |

28,545 |

27,882 |

31,037 |

87,464 |

Total |

21,443 |

19,693 |

18,239 |

59,375 |

|||

|

Opened Orders 2023: |

July |

August |

Sept |

Total |

Closed Orders 2023: |

July |

August |

Sept |

Total |

|||

|

Commercial |

913 |

1,208 |

1,199 |

3,320 |

Commercial |

1,036 |

1,320 |

1,305 |

3,661 |

|||

|

Purchase |

17,446 |

19,674 |

16,386 |

53,506 |

Purchase |

13,006 |

14,200 |

12,697 |

39,903 |

|||

|

Refinancing |

5,077 |

5,807 |

5,148 |

16,032 |

Refinancing |

3,367 |

3,778 |

3,252 |

10,397 |

|||

|

Other |

2,976 |

3,161 |

2,493 |

8,630 |

Other |

2,891 |

1,187 |

2,269 |

6,347 |

|||

|

Total |

26,191 |

29,850 |

25,226 |

81,267 |

Total |

20,300 |

20,485 |

19,523 |

60,308 |

|||

|

STEWART INFORMATION SERVICES CORPORATION CONDENSED BALANCE SHEETS (In thousands of dollars) |

||

|

September 30, |

December 31, |

|

|

Assets: |

||

|

Cash and cash equivalents |

183,772 |

233,365 |

|

Short-term investments |

44,911 |

39,023 |

|

Investments in debt and equity securities, at fair value |

688,661 |

679,936 |

|

Receivables – premiums from agencies |

40,730 |

38,676 |

|

Receivables – other |

120,457 |

93,811 |

|

Allowance for uncollectible amounts |

(8,851) |

(7,583) |

|

Property and equipment, net |

90,036 |

82,335 |

|

Operating lease assets, net |

105,510 |

115,879 |

|

Title plants |

76,028 |

73,359 |

|

Goodwill |

1,080,681 |

1,072,129 |

|

Intangible assets, net of amortization |

175,166 |

193,196 |

|

Deferred tax assets |

3,749 |

3,776 |

|

Other assets |

128,720 |

84,959 |

|

2,729,570 |

2,702,861 |

|

|

Liabilities: |

||

|

Notes payable |

445,704 |

445,290 |

|

Accounts payable and accrued liabilities |

196,670 |

190,054 |

|

Operating lease liabilities |

122,788 |

135,654 |

|

Estimated title losses |

517,592 |

528,269 |

|

Deferred tax liabilities |

32,481 |

25,045 |

|

1,315,235 |

1,324,312 |

|

|

Stockholders’ equity: |

||

|

Common Stock and additional paid-in capital |

353,172 |

338,451 |

|

Retained earnings |

1,080,879 |

1,070,841 |

|

Accumulated other comprehensive loss |

(24,304) |

(35,215) |

|

Treasury stock |

(2,666) |

(2,666) |

|

Stockholders’ equity attributable to Stewart |

1,407,081 |

1,371,411 |

|

Noncontrolling interests |

7,254 |

7,138 |

|

Total stockholders’ equity |

1,414,335 |

1,378,549 |

|

2,729,570 |

2,702,861 |

|

|

Number of shares outstanding (000) |

27,714 |

27,370 |

|

Book value per share |

50.77 |

50.11 |

| STEWART INFORMATION SERVICES CORPORATION

SEGMENT INFORMATION (In thousands of dollars)

|

|||||||||

|

Quarter Ended: |

September 30, 2024 |

September 30, 2023 |

|||||||

|

Title |

Real |

Corporate |

Total |

Title |

Real |

Corporate |

Total |

||

|

Revenues: |

|||||||||

|

Operating revenues |

553,255 |

96,346 |

– |

649,601 |

522,077 |

68,190 |

– |

590,267 |

|

|

Investment income |

13,588 |

38 |

– |

13,626 |

13,368 |

25 |

– |

13,393 |

|

|

Net realized and unrealized gains (losses) |

4,757 |

– |

(43) |

4,714 |

(1,821) |

– |

(125) |

(1,946) |

|

|

571,600 |

96,384 |

(43) |

667,941 |

533,624 |

68,215 |

(125) |

601,714 |

||

|

Expenses: |

|||||||||

|

Amounts retained by agencies |

233,980 |

– |

– |

233,980 |

218,983 |

– |

– |

218,983 |

|

|

Employee costs |

176,225 |

14,104 |

3,533 |

193,862 |

165,829 |

12,361 |

3,303 |

181,493 |

|

|

Other operating expenses |

85,853 |

68,634 |

1,159 |

155,646 |

81,625 |

46,217 |

2,613 |

130,455 |

|

|

Title losses and related claims |

21,282 |

– |

– |

21,282 |

22,251 |

– |

– |

22,251 |

|

|

Depreciation and amortization |

8,860 |

6,264 |

356 |

15,480 |

9,196 |

6,820 |

398 |

16,414 |

|

|

Interest |

406 |

– |

4,493 |

4,899 |

355 |

191 |

4,508 |

5,054 |

|

|

526,606 |

89,002 |

9,541 |

625,149 |

498,239 |

65,589 |

10,822 |

574,650 |

||

|

Income (loss) before taxes |

44,994 |

7,382 |

(9,584) |

42,792 |

35,385 |

2,626 |

(10,947) |

27,064 |

|

|

Nine Months Ended: |

September 30, 2024 |

September 30, 2023 |

|||||||

|

Title |

Real |

Corporate |

Total |

Title |

Real |

Corporate |

Total |

||

|

Revenues: |

|||||||||

|

Operating revenues |

1,500,855 |

271,561 |

– |

1,772,416 |

1,445,718 |

202,169 |

– |

1,647,887 |

|

|

Investment income |

40,746 |

87 |

– |

40,833 |

32,033 |

81 |

– |

32,114 |

|

|

Net realized and unrealized gains (losses) |

11,387 |

– |

(149) |

11,238 |

(1,658) |

– |

(3,171) |

(4,829) |

|

|

1,552,988 |

271,648 |

(149) |

1,824,487 |

1,476,093 |

202,250 |

(3,171) |

1,675,172 |

||

|

Expenses: |

|||||||||

|

Amounts retained by agencies |

634,083 |

– |

– |

634,083 |

596,498 |

– |

– |

596,498 |

|

|

Employee costs |

495,943 |

39,904 |

10,140 |

545,987 |

485,690 |

37,333 |

11,687 |

534,710 |

|

|

Other operating expenses |

247,371 |

193,703 |

3,816 |

444,890 |

236,752 |

138,052 |

5,726 |

380,530 |

|

|

Title losses and related claims |

59,754 |

– |

– |

59,754 |

59,727 |

– |

– |

59,727 |

|

|

Depreciation and amortization |

26,126 |

18,803 |

1,133 |

46,062 |

26,182 |

19,401 |

1,265 |

46,848 |

|

|

Interest |

1,165 |

7 |

13,596 |

14,768 |

1,063 |

191 |

13,523 |

14,777 |

|

|

1,464,442 |

252,417 |

28,685 |

1,745,544 |

1,405,912 |

194,977 |

32,201 |

1,633,090 |

||

|

Income (loss) before taxes |

88,546 |

19,231 |

(28,834) |

78,943 |

70,181 |

7,273 |

(35,372) |

42,082 |

|

Appendix A

Non-GAAP Adjustments

Management uses a variety of financial and operational measurements other than its financial statements prepared in accordance with United States Generally Accepted Accounting Principles (GAAP) to analyze its performance. These include: (1) adjusted revenues, which are reported revenues adjusted for net realized and unrealized gains and losses and (2) adjusted pretax income and adjusted net income, which are reported pretax income and reported net income after earnings from noncontrolling interests, respectively, adjusted for net realized and unrealized gains and losses, acquired intangible asset amortization, office closure costs, executive severance expenses, and nonrecurring expenses. Adjusted diluted earnings per share (adjusted diluted EPS) is calculated using adjusted net income divided by the diluted average weighted outstanding shares. Adjusted pretax margin is calculated using adjusted pretax income divided by adjusted total revenues. Management views these measures as important performance measures of core profitability for its operations and as key components of its internal financial reporting. Management believes investors benefit from having access to the same financial measures that management uses.

Below are reconciliations of the non-GAAP financial measures used by management to the most directly comparable GAAP measures for the quarter and nine months ended September 30, 2024 and 2023 (dollars in millions, except shares, per share amounts and pretax margins, and amounts may not add as presented due to rounding).

|

Quarter Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

% Chg |

2024 |

2023 |

% Chg |

||

|

Total revenues |

667.9 |

601.7 |

11 % |

1,824.5 |

1,675.2 |

9 % |

|

|

Non-GAAP revenue adjustments: |

|||||||

|

Net realized and unrealized (gains) losses |

(4.7) |

1.9 |

(11.2) |

4.8 |

|||

|

Adjusted total revenues |

663.2 |

603.7 |

10 % |

1,813.2 |

1,680.0 |

8 % |

|

|

Pretax income |