Billionaire Ray Dalio Sold 27% of Bridgewater's Stake in Nvidia and Is Piling Into 2 Artificial Intelligence (AI) Stock-Split Stocks

Important data releases are a common occurrence on Wall Street. Between earnings season, which sees a vast majority of Wall Street’s largest and most-influential businesses report their quarterly operating results, and daily economic reports, it can be easy to miss something important.

For instance, you might have missed what can arguably be described as the most-important data dump of the fourth quarter last week. Nov. 14 marked the deadline for institutional investors with at least $100 million in assets under management (AUM) to file Form 13F with the Securities and Exchange Commission. This filing provides a snapshot that alerts investors to the stocks Wall Street’s most-prominent money managers bought and sold in the latest quarter (i.e., ended Sept. 30).

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Although investors tend to hone in on Warren Buffett’s trading activity at Berkshire Hathaway, the Oracle of Omaha is far from the only billionaire asset manager that’s been highly successful on Wall Street.

For example, Bridgewater Associates billionaire money manager Ray Dalio also has quite the following. Dalio, who runs a well-diversified fund that takes advantage of economic trends, closed out the third quarter with close to $17.7 billion in AUM.

Among the hundreds of trades executed by Dalio and his team during the September-ended quarter, perhaps none stand out more than the buying and selling activity associated with three of Wall Street’s hottest artificial intelligence (AI) stock-split stocks.

The first eye-popper is that Ray Dalio was a big-time seller of the market’s leading AI stock-split stock, Nvidia (NASDAQ: NVDA). Nvidia completed its largest forward stock split on record (10-for-1) following the close of trading on June 7.

Despite Nvidia’s AI-graphics processing units (GPUs) dominating in high-compute data centers, and the company possessing substantial pricing power on its H100 and Blackwell GPUs, Dalio’s Bridgewater shed 1,801,922 shares of Nvidia in the third quarter. This represents a 27% reduction from where things stood on June 30. Although profit-taking may be the key catalyst for Bridgewater, there’s potentially more to this story than just ringing the register.

For instance, Nvidia’s stock has enjoyed a near-parabolic increase on the heels of the AI revolution. However, history tells us that every game-changing technology since the advent of the internet has navigated its way through an early stage bubble. Investors frequently overestimate the speed at which new technologies are adopted by businesses and consumers, eventually leading to lofty expectations not being met.

TSMC's move to cut off Chinese chip firms weighs on annual Beijing semiconductor forum

Chinese chip industry experts and investors have congregated in Beijing for one of the largest annual chip forums to discuss the impact of Taiwan Semiconductor Manufacturing Company (TSMC) cutting advanced foundry services for some mainland clients and the outlook for the country’s chip sector under a new Donald Trump administration in the US.

Despite US threats of more sanctions, China should be bullish about developments in advanced semiconductors and generative artificial intelligence (AI) because of the potential of its huge market, according to industry insiders attending the 21st China International Semiconductor Expo.

The conference, which kicked off on Monday, gathered more than 500 firms from China’s semiconductor supply chain spanning design, foundry services and packaging in Beijing. Leading Chinese semiconductor equipment tool firms Naura Technology Group, 3D NAND flash memory chipmaker Yangtze Memory Technologies Corporation, DRAM chipmaker ChangXin Memory Technologies, and chip designer Huawei Technologies all took part in the three-day event.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Geopolitics has been one of the key concerns for many at the expo, as China braces for the uncertainty surrounding US policies when Trump returns to the White House for a second presidential term in January. Trump has vowed to increase tariffs on China-made goods by 60 per cent.

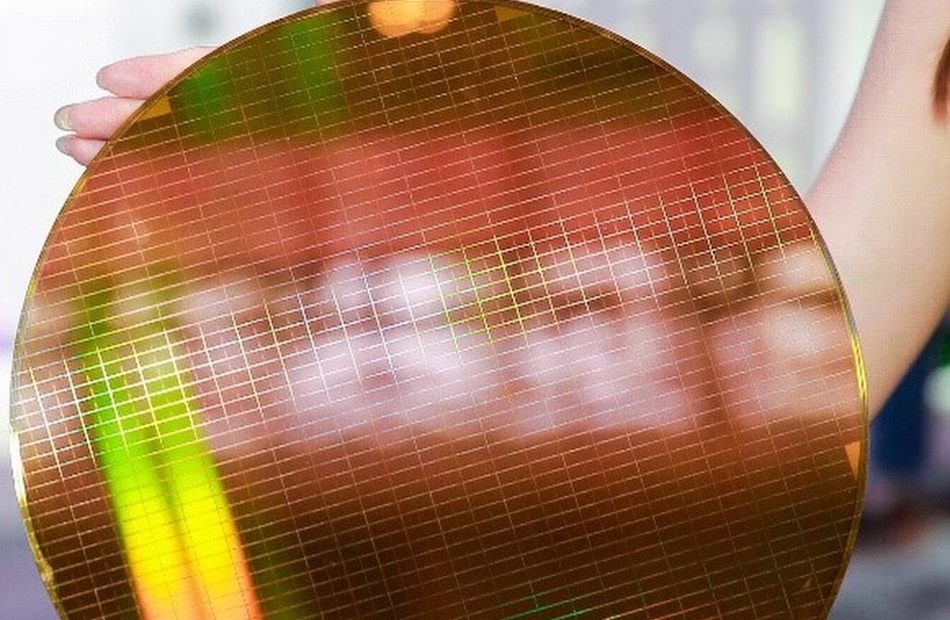

YMTC’s 64-layer 3D NAND flash memory wafer. Photo: YMTC alt=YMTC’s 64-layer 3D NAND flash memory wafer. Photo: YMTC>

He Weiwei, co-founder and general manager at BASiC Semiconductor, said during a panel at the Expo on Tuesday that the company has poured an extra 20 million yuan to 30 million yuan (US$2.8 million to US$4.1 million) into developing manufacturing facilities and materials in mainland China over fears that US sanctions could cut off supplies.

“This is a huge burden for a start-up like us,” He said. “We used to buy US materials and have the chips manufactured in Taiwan, and then ship them back to mainland China for packaging.”

When Trump started a trade war with China in 2018, BASiC feared it could be cut off from Taiwanese manufacturing, according to He. Technological decoupling in subsequent years also started to hurt expansion plans for Chinese companies.

“Some first-tier American carmakers made it very clear that they will not buy products made in China,” He said.

2 Potential Artificial Intelligence (AI) Stock-Splits Investors Could See in 2025

High-quality companies tend to create tremendous amounts of value, which sometimes drives their per-share price into the hundreds (or even thousands) of dollars. It can be too expensive for small investors to buy in at that price point (unless they use a broker that offers fractional shares), which leaves institutional investors and large funds holding a dominant piece of the pie.

A stock split can ease that problem by increasing the amount of shares in circulation while, at the same time, organically reducing the price per share. Stock splits are entirely cosmetic and don’t change the value of the underlying company, but they make the stock more accessible to smaller retail investors.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Several high-profile companies executed stock splits this year:

-

Nvidia completed a 10-for-1 stock split on June 10, which increased the number of shares in circulation tenfold and reduced its price per share from $1,200 to $120.

-

Chipotle completed a 50-for-1 stock split on June 26, which reduced its price per share from $3,283 to $66.

-

Broadcom completed a 10-for-1 stock split on July 12, which reduced its price per share from $1,700 to $170.

A new year is right around the corner and that has some analysts prognosticating on who might execute stock splits in 2025. I think Microsoft (NASDAQ: MSFT) and Meta Platforms (NASDAQ: META) could find their way onto the list. Out of the six technology companies with valuations of $1 trillion or more, those two have the highest per-share prices.

They could get even more pricey as they expand their presence in the artificial intelligence (AI) industry. Here’s why they could each benefit from a split.

Microsoft has completed nine splits since its stock came public in 1986. The company has created a staggering $3 trillion in value for investors over the last 38 years, and if it had completed no splits, its stock would be trading at $119,500 today!

Microsoft’s most recent split was more than two decades ago in 2003. The company’s stock is trading at $415 as of this writing, so it might be due for another in the near future — especially because of the potential value the company stands to create thanks to its investments in AI.

Microsoft is a key investor in ChatGPT creator OpenAI and has used the start-up’s technology to create the Copilot virtual assistant, which is embedded for free in its flagship software products like Windows, Bing, and Edge. However, users of 365 productivity applications — like Word, Excel, and PowerPoint — can also add Copilot to their plans for an additional monthly subscription fee.

"Big Short" Money Manager Michael Burry Is Piling Into 3 Industry-Leading Stocks That Share a Common Theme

In case you missed it, one of the most-anticipated data dumps of the fourth quarter occurred last week on Nov. 14 — and no, it has nothing to do with earnings season or the release of the October inflation report.

No later than 45 days following the end to a quarter, institutional investors with $100 million (or more) in assets under management are required to file Form 13F with the Securities and Exchange Commission. A 13F allows investors to look over the shoulders of Wall Street’s top money managers to see which stocks they purchased and sold in the most recent quarter (i.e., the third quarter).

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Although Berkshire Hathaway CEO Warren Buffett tends to garner a lot of attention, he’s far from the only asset manager who’s made their mark on Wall Street. Another 13F that’s of high interest to investors is that of Scion Asset Management’s Dr. Michael Burry.

It’s a well-known fact that Wall Street’s major stock indexes have increased in value over the long run. Even though stock corrections, bear markets, and crashes are a normal and inevitable aspect of the investing cycle, the long-term growth of the American economy and corporate profits eventually lifts Wall Street’s iconic indexes to new heights.

Nevertheless, there are opportunities for short-sellers to generate meaningful profits over shorter timelines. A short-seller makes money when the price of a security declines, and loses money when it rises. Whereas gains are capped at 100% for short-sellers (i.e., a publicly traded company’s share price can’t fall below $0), losses are, in theory, unlimited.

Burry gained notoriety for being in this contrarian camp during the financial crisis from 2007 through 2009. In fact, his story is documented in the 2015 film The Big Short, as well as the 2010 novel by Michael Lewis, The Big Short: Inside the Doomsday Machine.

Prior to the (in hindsight) collapse of the housing market, Burry questioned the health of mortgages that had been packaged into larger mortgage-backed securities (MBSs) by many of America’s biggest financial institutions. With his fund (Scion), Burry purchased credit-default swaps on these MBSs and effectively bet on their default. When the dust cleared, Scion walked away with a profit totaling around $725 million.

Since accurately calling this event, Burry has been known as Wall Street “Big Short” investor.

GameU Advances Inclusivity in Video Game Design with Autism In Entertainment Workgroup

GameU signs educational partnership with not-for-profit, Autism in Entertainment, highlighting career pathways in coding for the neurologically diverse

FLEMINGTON, N.J. and IRVINE, Calif., Nov. 20, 2024 /PRNewswire/ — GameU – the provider of premium online coding courses, with a social mission to promote inclusivity in video game design – has signed an educational partnership with California-based not-for-profit initiative, the Autism in Entertainment Workgroup.

Under the terms of the agreement with Orange County Asperger’s Support Group (OCASG), the governing body of Autism in Entertainment (AIE), GameU will both sponsor AIE programs as well as run a series of complimentary game design webinars for AIE members. Delivered by working professionals in the computer game industry, the GameU webinars will teach basics in game design, highlight the strong links between coding proficiency and autism, and provide pathways for future learning.

The first of those webinars, From Consumer to Creator: Becoming a Video Game Developer, will take place Thursday 21st November 2024, 3pm EST.

Register for the first GameU – AIE webinar here: https://us06web.zoom.us/meeting/register/tZwocOippzItHNTD1hlNZcsFtf4V6mwWC26E#/registration

“GameU is focused on equipping students, including those with special needs, with the skills to thrive in today’s and tomorrow’s digital economy,” said GameU President and CEO, Mike Kawas. “AIE’s belief that individuals on the autism spectrum can forge strong careers in entertainment-related fields, including game design, means our missions are well-aligned.

“We’re excited to work alongside AIE to help build career pathways in STEM-based fields for those in our community with high-functioning autism, including game design, coding and 3D modeling.”

OCASG President and Chair of the Autism In Entertainment Workgroup, Judi Uttal, said “Connecting AIE talent with industry-grade learning opportunities is an important aspect of enhancing employment prospects for neurodivergent individuals. We are thrilled to have GameU as our newest educational partner.

“Working hand-in-glove with an autism-friendly game design course provider, like GameU, enables AIE to better-help its members acquire skills and industry connections that pave the way to employment,” said Uttal. “The AIE – GameU Education Partnership is an example of tangible benefits that help drive inclusivity and diversity in the entertainment sector.”

For a free trial, of any one of GameU’s 1-to-1 All Abilities classes, sign-up here:

game-u.com/pages/free-trial-abilities

Register for the first GameU – AIE webinar here:

https://us06web.zoom.us/meeting/register/tZwocOippzItHNTD1hlNZcsFtf4V6mwWC26E#/registration

About GameU

GameU is a leading provider of premium online video game design courses, which teach students the skills they need to succeed in the video game industry. With curriculums crafted and taught by education experts and professional game developers, GameU virtually delivers a wide range of programs across three main avenues:

- All Abilities: Private one-to-one classes, tailored to each students’ needs, including neurologically diverse individuals

- For schools and districts: Built for specifically for K-12 school environments, GameU’s Hybrid+ Program transform students’ love of gaming into valuable STEAM skills with a blend of live instruction, on-demand learning and 1-to-1 training for in-classroom educators

- On-demand: Access to recorded classes, curriculum and game design software via Orbit, GameU’s Self-Guided Learning Platform

GameU provides a comprehensive learning experience that includes both live instruction and self-paced study. GameU is dedicated to empowering students and educators alike, helping them stay ahead of industry trends, to prepare them for the future of game development.

For more information, visit game-u.com

To keep up-to-date with GameU classes, programs, events and more, follow GameU on social media: LinkedIn (GameU), Facebook (@GameUSchool), YouTube (@Gameunj), Instagram (@gameuschool), TikTok (@gameuschool_), X (@GameUSchool)

For regular news and thought leadership regarding video game design, video game coding and more, subscribe to GameU’s blog here: www.game-u.com/pages/contact-us

About Autism in Entertainment

Autism in Entertainment (AIE) is the result of a strategic collaboration between the non-profit Orange County Asperger’s Support Group (OCASG), disability-focused staffing and consulting firm Zavikon, and generous grant funding from the California Department of Developmental Services (DDS). AIE seeks to connect entertainment top brass with work-ready job candidates who are on the spectrum. Established in May 2022, the Autism In Entertainment Workgroup includes educators, professionals, and family members who believe that individuals on the autism spectrum can contribute in entertainment-related fields, including film, television, social media, and game design. The goal of AIE is to drive employment efforts in entertainment-related careers.

For more information, visit autisminentertainment.org

About Orange County Asperger’s Support Group (OCASG)

The Orange County Asperger’s Support Group (OCASG) is the proud parent organization of Autism in Entertainment (AIE). OCASG is a nonprofit organization dedicated to improving the quality of life for autistic teens, adults, and their families in the community. We achieve this through providing support, organizing social activities, and education. Our goal is to empower the autism community by creating a safe and welcoming environment where individuals and families can connect with others who share similar experiences and challenges. We believe that through support and education, individuals with autism can achieve their full potential and become valued members of the community. For more information, visit www.ocaspergers.org or contact ocasupport@gmail.com

For further media information, interviews or images, please contact:

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/gameu-advances-inclusivity-in-video-game-design-with-autism-in-entertainment-workgroup-302311089.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/gameu-advances-inclusivity-in-video-game-design-with-autism-in-entertainment-workgroup-302311089.html

SOURCE GameU

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Thompson Thrift Hosts Ribbon Cutting for The Maddox, a Luxury Apartment Community Near Phoenix

PHOENIX, Nov. 19, 2024 /PRNewswire/ — Thompson Thrift, a full-service nationally recognized real estate company and one of the nation’s leading multifamily developers, hosted a ribbon cutting for The Maddox in the Phoenix suburb of Buckeye on Thursday, November 14, with Mayor Eric Orsborn in attendance. The first residents began moving into the 252-unit Class A multifamily community in the third quarter of 2024, and Thompson Thrift expects construction to be completed by January 2025.

“Thompson Thrift is well-versed in meeting the needs and desires of Arizona residents after delivering a variety of luxury multifamily communities throughout the Phoenix area,” said Tamera Greene, vice president of community management, west for Thompson Thrift. “When residents choose The Maddox for their home, they will enjoy distinct features and amenities carefully curated to maximize style, luxury and convenience.”

Located at 23683 W Yuma Rd. near Interstate 10, The Maddox consists of seven, three-story garden style structures with 80 detached garages. The one-, two- and three-bedroom layouts average nearly 1,000 square feet and feature luxury amenities including gourmet kitchens with elegant quartz countertops, timeless tile backsplash, stainless steel appliances, designer fixtures and finishes, Alexa-compatible smart hub to integrate all smart devices, smart thermostat and smart door locks, walk-in closets, full-size washers and dryers, as well as patio, balcony, and private yard options.

At the ribbon cutting, visitors were able to view model tours and preview community amenities such as a professionally decorated clubhouse, resort-style heated swimming pool, 24-hour fitness center, Amazon Package Hub, thoughtfully designed courtyards, grilling stations, outdoor game area, firepits with seating area, a dog park, pet spa with grooming station, pickleball court and more.

In support of Thompson Thrift’s commitment to community outreach, they presented a check to local non-profit Special Olympics Arizona. Special Olympics Arizona has been serving the people of Arizona since 1975, providing year-round sports training and athletic competition in a variety of Olympic-type sports for children and adults with intellectual disabilities. Today they work with more than 21,000 athletes and nearly 25,000 volunteers, striving to create a better world by fostering the acceptance and inclusion of all people.

Thompson Thrift is a full-service real estate development company focused on multifamily, ground-up commercial and mixed-use development across the Midwest, Southeast and Southwest. For nearly 40 years, Thompson Thrift has invested more than $6 billion into local communities and has become known as a trusted partner committed to developing high-quality, attractive multifamily, commercial and industrial projects.

About Thompson Thrift Real Estate Company

Thompson Thrift is an integrated full-service real estate company with offices in Indianapolis and Terre Haute, Indiana; Denver; Houston and Phoenix. Three business units drive Thompson Thrift’s success—Thompson Thrift Residential which is focused on upscale Class A multifamily communities and luxury leased homes, Thompson Thrift Commercial which is focused on ground-up commercial development, and Thompson Thrift Construction, a full-service construction company. Through these business units, Thompson Thrift is engaged in all aspects of development, construction, leasing, and management of quality commercial real estate projects across the country. The company earned national recognition as a winner of a 2024 Top Workplaces USA award, the latest accolade that reflects the company’s ongoing commitment to excellence in the community and workplace. For more information, please visit www.thompsonthrift.com

Contact:

Jennifer Franklin

Spotlight Marketing Communications

949.427.1385

jennifer@spotlightmarcom.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thompson-thrift-hosts-ribbon-cutting-for-the-maddox-a-luxury-apartment-community-near-phoenix-302310326.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thompson-thrift-hosts-ribbon-cutting-for-the-maddox-a-luxury-apartment-community-near-phoenix-302310326.html

SOURCE Thompson Thrift

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yatsen Announces Third Quarter 2024 Financial Results

Conference Call to Be Held at 7:30 A.M. U.S. Eastern Time on November 20, 2024

GUANGZHOU, China, Nov. 20, 2024 /PRNewswire/ — Yatsen Holding Limited (“Yatsen” or the “Company”) YSG, a leading China-based beauty group, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights

- Total net revenues for the third quarter of 2024 decreased by 5.7% to RMB677.0 million (US$96.5 million) from RMB718.1 million for the prior year period.

- Total net revenues from Skincare Brands[1] for the third quarter of 2024 increased by 3.6% to RMB267.9 million (US$38.2 million) from RMB258.5 million for the prior year period. As a percentage of total net revenues, total net revenues from Skincare Brands for the third quarter of 2024 were 39.6%, as compared with 36.0% for the prior year period.

- Gross margin for the third quarter of 2024 increased to 75.9% from 71.4% for the prior year period.

- Net loss for the third quarter of 2024 was RMB121.1 million (US$17.3 million), as compared with RMB197.9 million for the prior year period. Non-GAAP net loss[2] for the third quarter of 2024 was RMB76.6 million (US$10.9 million), as compared with RMB130.2 million for the prior year period.

Mr. Jinfeng Huang, Founder, Chairman and Chief Executive Officer of Yatsen, stated, “China’s beauty industry encountered significant challenges in the third quarter, with beauty sales declining year over year for four consecutive months from June to September. Against this backdrop, our three major clinical and premium skincare brands, including Galénic, DR.WU and Eve Lom, delivered another solid performance, bolstering our skincare segment overall. Going forward, we will continue to execute our development strategy, enhancing brand equity and product mix while further optimizing our cost structure to drive growth and profitability.”

Mr. Donghao Yang, Director and Chief Financial Officer of Yatsen, commented, “Our third quarter total net revenues declined by 5.7% year over year in line with our previous guidance. However, our three major skincare brands together continued to grow steadily, with combined net revenues increasing by 10.5% year over year. Furthermore, we improved our gross margin to 75.9% from 71.4% in the prior year period, while narrowing our net loss margin and non-GAAP net loss margin to 17.9% and 11.3%, respectively. We remain confident in our strategy and execution capabilities, and committed to propelling the Company’s sustainable development.”

Third Quarter 2024 Financial Results

Net Revenues

Total net revenues for the third quarter of 2024 decreased by 5.7% to RMB677.0 million (US$96.5 million) from RMB718.1 million for the prior year period. The decrease was primarily due to a 10.0% year-over-year decrease in net revenues from Color Cosmetics Brands,[3] partially offset by a 3.6% year-over-year increase in net revenues from Skincare Brands.

Gross Profit and Gross Margin

Gross profit for the third quarter of 2024 increased by 0.2% to RMB513.8 million (US$73.2 million) from RMB512.8 million for the prior year period. Gross margin for the third quarter of 2024 increased to 75.9% from 71.4% for the prior year period. The increase was primarily driven by an increase in sales of higher-gross-margin products.

Operating Expenses

Total operating expenses for the third quarter of 2024 decreased by 12.0% to RMB655.2 million (US$93.4 million) from RMB744.3 million for the prior year period. As a percentage of total net revenues, total operating expenses for the third quarter of 2024 were 96.8%, as compared with 103.6% for the prior year period.

- Fulfillment Expenses. Fulfillment expenses for the third quarter of 2024 were RMB50.4 million (US$7.2 million), as compared with RMB56.0 million for the prior year period. As a percentage of total net revenues, fulfillment expenses for the third quarter of 2024 decreased to 7.4% from 7.8% for the prior year period. The decrease was primarily due to an increase in the overall average selling price of the Company’s products, as well as further improvements in logistics efficiency.

- Selling and Marketing Expenses. Selling and marketing expenses for the third quarter of 2024 were RMB494.4 million (US$70.4 million), as compared with RMB511.7 million for the prior year period. As a percentage of total net revenues, selling and marketing expenses for the third quarter of 2024 increased to 73.0% from 71.3% for the prior year period. The increase was primarily due to increased investments in the Douyin platform, in line with the growing revenue contribution from Douyin, partially offset by lower marketing expenses as a result of the Company’s more strategic marketing spending.

- General and Administrative Expenses. General and administrative expenses for the third quarter of 2024 were RMB85.0 million (US$12.1 million), as compared with RMB151.8 million for the prior year period. As a percentage of total net revenues, general and administrative expenses for the third quarter of 2024 decreased to 12.6% from 21.1% for the prior year period. The decrease was primarily attributable to lower payroll expenses resulting from a reduction in general and administrative headcount and lower share-based compensation expenses.

- Research and Development Expenses. Research and development expenses for the third quarter of 2024 were RMB25.3 million (US$3.6 million), as compared with RMB24.7 million for the prior year period. As a percentage of total net revenues, research and development expenses for the third quarter of 2024 increased to 3.7% from 3.4% for the prior year period. The increase was primarily attributable to the deleveraging effect of lower total net revenues in the third quarter of 2024.

Loss from Operations

Loss from operations for the third quarter of 2024 was RMB141.3 million (US$20.1 million), as compared with RMB231.5 million for the prior year period. Operating loss margin was 20.9%, as compared with 32.2% for the prior year period.

Non-GAAP loss from operations[4] for the third quarter of 2024 was RMB98.5 million (US$14.0 million), as compared with RMB164.6 million for the prior year period. Non-GAAP operating loss margin was 14.5%, as compared with 22.9% for the prior year period.

Net Loss

Net loss for the third quarter of 2024 was RMB121.1 million (US$17.3 million), as compared with RMB197.9 million for the prior year period. Net loss margin was 17.9%, as compared with 27.6% for the prior year period. Net loss attributable to Yatsen’s ordinary shareholders per diluted ADS[5] for the third quarter of 2024 was RMB1.22 (US$0.17), as compared with RMB1.81 for the prior year period.

Non-GAAP net loss for the third quarter of 2024 was RMB76.6 million (US$10.9 million), as compared with RMB130.2 million for the prior year period. Non-GAAP net loss margin was 11.3%, as compared with 18.1% for the prior year period. Non-GAAP net loss attributable to Yatsen’s ordinary shareholders per diluted ADS[6] for the third quarter of 2024 was RMB0.77 (US$0.11), as compared with RMB1.19 for the prior year period.

Balance Sheet and Cash Flow

As of September 30, 2024, the Company had cash, restricted cash and short-term investments of RMB1.31 billion (US$186.5 million), as compared with RMB2.08 billion as of December 31, 2023.

Net cash used in operating activities for the third quarter of 2024 was RMB175.9 million (US$25.1 million), as compared with RMB163.4 million for the prior year period.

Business Outlook

For the fourth quarter of 2024, the Company expects its total net revenues to be between RMB1.07 billion and RMB1.18 billion, representing a year-over-year increase of approximately 0% to 10%. These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to change.

Exchange Rate

This announcement contains translations of certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to US$ were made at a rate of RMB7.0176 to US$1.00, the exchange rate in effect as of September 30, 2024, as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. The Company makes no representation that any RMB or US$ amounts could have been, or could be, converted into US$ or RMB, as the case may be, at any particular rate, or at all.

|

[1] Include net revenues from Galénic, DR.WU (its mainland China business), Eve Lom and other skincare brands of the Company. |

|

[2] Non-GAAP net loss is a non-GAAP financial measure. Effective from the fourth quarter of 2023, non-GAAP net loss is defined as net loss excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill and (v) tax effects on non-GAAP adjustments. Non-GAAP net loss for the prior year period presented in this document is also calculated in the same manner. |

|

[3] Include Perfect Diary, Little Ondine, Pink Bear and other color cosmetics brands of the Company. |

|

[4] Non-GAAP loss from operations is a non-GAAP financial measure. Effective from the fourth quarter of 2023, non-GAAP loss from operations is defined as loss from operations excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions and (iii) impairment of goodwill. Non-GAAP loss from operations for the prior year period presented in this document is also calculated in the same manner. |

|

[5] ADS refers to American depositary shares, each of which represents twenty Class A ordinary shares, effective from March 18, 2024. Prior to that date, each ADS represented four Class A ordinary shares. Unless otherwise stated, the current ADS ratio has been applied retrospectively to all periods presented in this document. |

|

[6] Non-GAAP net loss attributable to ordinary shareholders per diluted ADS is a non-GAAP financial measure. Non-GAAP net loss attributable to ordinary shareholders per diluted ADS is defined as non-GAAP net loss attributable to ordinary shareholders divided by the weighted average number of diluted ADS outstanding for computing diluted earnings per ADS. Effective from the fourth quarter of 2023, non-GAAP net loss attributable to ordinary shareholders is defined as net loss attributable to ordinary shareholders excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill, (v) tax effects on non-GAAP adjustments and (vi) accretion to redeemable non-controlling interests. Non-GAAP net loss attributable to ordinary shareholders per diluted ADS for the prior year period presented in this document is also calculated in the same manner. |

Conference Call Information

The Company’s management will hold a conference call on Wednesday, November 20, 2024, at 7:30 A.M. U.S. Eastern Time or 8:30 P.M. Beijing Time to discuss its financial results and operating performance for the third quarter 2024.

|

United States (toll free): |

+1-888-346-8982 |

|

International: |

+1-412-902-4272 |

|

Mainland China (toll free): |

400-120-1203 |

|

Hong Kong, SAR (toll free): |

800-905-945 |

|

Hong Kong, SAR: |

+852-3018-4992 |

|

Conference ID: |

6604822 |

The replay will be accessible through Wednesday, November 27, by dialing the following numbers:

|

United States: |

+1-877-344-7529 |

||||||

|

International: |

+1-412-317-0088 |

||||||

|

Replay Access Code: |

6604822 |

A live and archived webcast of the conference call will also be available on the Company’s investor relations website at http://ir.yatsenglobal.com.

About Yatsen Holding Limited

Yatsen Holding Limited YSG is a leading China-based beauty group with the mission of creating an exciting new journey of beauty discovery for consumers around the world. Founded in 2016, the Company has launched and acquired numerous color cosmetics and skincare brands including Perfect Diary, Little Ondine, Pink Bear, Galénic, DR.WU (its mainland China business), Eve Lom and EANTiM. The Company’s flagship brand, Perfect Diary, is one of the leading color cosmetics brands in China in terms of retail sales value. The Company primarily reaches and engages with customers directly both online and offline, with expansive presence across all major e-commerce, social and content platforms in China.

For more information, please visit http://ir.yatsenglobal.com.

Use of Non-GAAP Financial Measures

The Company uses non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders and non-GAAP net income (loss) attributable to ordinary shareholders per diluted ADS, each a non-GAAP financial measure, in reviewing and assessing its operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company presents these non-GAAP financial measures because they are used by the management to evaluate operating performance and formulate business plans. Non-GAAP financial measures help identify underlying trends in its business, provide further information about its results of operations, and enhance the overall understanding of its past performance and future prospects. The Company defines non-GAAP income (loss) from operations as income (loss) from operations excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions and (iii) impairment of goodwill. The Company defines non-GAAP net income (loss) as net income (loss) excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill and (v) tax effects on non-GAAP adjustments. The Company defines non-GAAP net income (loss) attributable to ordinary shareholders as net income (loss) attributable to ordinary shareholders excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill, (v) tax effects on non-GAAP adjustments and (vi) accretion to redeemable non-controlling interests. Non-GAAP net income (loss) attributable to ordinary shareholders per diluted ADS is computed using non-GAAP net income (loss) attributable to ordinary shareholders divided by weighted average number of diluted ADS outstanding for computing diluted earnings per ADS.

However, the non-GAAP financial measures have limitations as analytical tools as the non-GAAP financial measures are not presented in accordance with U.S. GAAP and may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating performance. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure. Reconciliations of Yatsen’s non-GAAP financial measure to the most comparable U.S. GAAP measure are included at the end of this press release.

Safe Harbor Statement

This announcement contains statements that may constitute “forward-looking” statements which are made pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to,” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the Securities and Exchange Commission (“SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs, plans, outlook and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s growth strategies; its future business development, results of operations and financial condition; its ability to continue to roll out popular products and maintain popularity of existing products; its ability to anticipate and respond to changes in industry trends and consumer preferences and behavior in a timely manner; its ability to attract and retain new customers and to increase revenues generated from repeat customers; its expectations regarding demand for and market acceptance of its products and services; its ability to integrate newly-acquired businesses and brands; trends and competition in and relevant government policies and regulations relating to China’s beauty market; changes in its revenues and certain cost or expense items; and general economic conditions globally and in China. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Yatsen Holding Limited

Investor Relations

E-mail: ir@yatsenglobal.com

Piacente Financial Communications

Hui Fan

Tel: +86-10-6508-0677

E-mail: yatsen@thepiacentegroup.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: yatsen@thepiacentegroup.com

|

YATSEN HOLDING LIMITED |

||||||||||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||||||

|

(All amounts in thousands, except for share, per share data or otherwise noted) |

||||||||||||

|

December 31, |

September 30, |

September 30, |

||||||||||

|

2023 |

2024 |

2024 |

||||||||||

|

RMB’000 |

RMB’000 |

USD’000 |

||||||||||

|

Assets |

||||||||||||

|

Current assets |

||||||||||||

|

Cash and cash equivalents |

836,888 |

503,075 |

71,688 |

|||||||||

|

Restricted Cash |

21,248 |

– |

– |

|||||||||

|

Short-term investments |

1,218,481 |

805,851 |

114,833 |

|||||||||

|

Accounts receivable, net |

198,851 |

208,285 |

29,680 |

|||||||||

|

Inventories, net |

352,090 |

438,419 |

62,474 |

|||||||||

|

Prepayments and other current assets |

303,841 |

431,583 |

61,500 |

|||||||||

|

Amounts due from related parties |

20,200 |

7,181 |

1,023 |

|||||||||

|

Total current assets |

2,951,599 |

2,394,394 |

341,198 |

|||||||||

|

Non-current assets |

||||||||||||

|

Investments |

618,752 |

628,355 |

89,540 |

|||||||||

|

Property and equipment, net |

64,878 |

72,315 |

10,305 |

|||||||||

|

Goodwill, net |

556,567 |

571,129 |

81,385 |

|||||||||

|

Intangible assets, net |

671,396 |

638,079 |

90,926 |

|||||||||

|

Deferred tax assets |

1,375 |

1,426 |

203 |

|||||||||

|

Right-of-use assets, net |

114,348 |

129,303 |

18,426 |

|||||||||

|

Other non-current assets |

27,100 |

25,728 |

3,666 |

|||||||||

|

Total non-current assets |

2,054,416 |

2,066,335 |

294,451 |

|||||||||

|

Total assets |

5,006,015 |

4,460,729 |

635,649 |

|||||||||

|

Liabilities, redeemable non-controlling interests and |

||||||||||||

|

Current liabilities |

||||||||||||

|

Accounts payable |

105,691 |

70,781 |

10,086 |

|||||||||

|

Advances from customers |

41,579 |

31,604 |

4,504 |

|||||||||

|

Accrued expenses and other liabilities |

391,217 |

392,448 |

55,923 |

|||||||||

|

Amounts due to related parties |

9,431 |

14,832 |

2,114 |

|||||||||

|

Income tax payables |

17,946 |

19,112 |

2,723 |

|||||||||

|

Lease liabilities due within one year |

45,464 |

47,484 |

6,766 |

|||||||||

|

Total current liabilities |

611,328 |

576,261 |

82,116 |

|||||||||

|

Non-current liabilities |

||||||||||||

|

Deferred tax liabilities |

111,591 |

111,972 |

15,956 |

|||||||||

|

Deferred income-non current |

30,556 |

18,401 |

2,622 |

|||||||||

|

Lease liabilities |

67,767 |

83,042 |

11,833 |

|||||||||

|

Total non-current liabilities |

209,914 |

213,415 |

30,411 |

|||||||||

|

Total liabilities |

821,242 |

789,676 |

112,527 |

|||||||||

|

Redeemable non-controlling interests |

51,466 |

49,737 |

7,087 |

|||||||||

|

Shareholders’ equity |

||||||||||||

|

Ordinary Shares (US$0.00001 par value; 10,000,000,000 ordinary |

173 |

173 |

25 |

|||||||||

|

Treasury shares |

(864,568) |

(1,066,199) |

(151,932) |

|||||||||

|

Additional paid-in capital |

12,260,208 |

12,263,026 |

1,747,467 |

|||||||||

|

Statutory reserve |

24,177 |

24,177 |

3,445 |

|||||||||

|

Accumulated deficit |

(7,345,153) |

(7,669,093) |

(1,092,837) |

|||||||||

|

Accumulated other comprehensive income |

60,200 |

76,710 |

10,933 |

|||||||||

|

Total Yatsen Holding Limited shareholders’ equity |

4,135,037 |

3,628,794 |

517,101 |

|||||||||

|

Non-controlling interests |

(1,730) |

(7,478) |

(1,066) |

|||||||||

|

Total shareholders’ equity |

4,133,307 |

3,621,316 |

516,035 |

|||||||||

|

Total liabilities, redeemable non-controlling interests and |

5,006,015 |

4,460,729 |

635,649 |

|||||||||

|

YATSEN HOLDING LIMITED |

|||||||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||

|

(All amounts in thousands, except for share, per share data or otherwise noted) |

|||||||||||||

|

For the Three Months Ended September 30, |

|||||||||||||

|

2023 |

2024 |

2024 |

|||||||||||

|

RMB’000 |

RMB’000 |

USD’000 |

|||||||||||

|

Total net revenues |

718,125 |

677,016 |

96,474 |

||||||||||

|

Total cost of revenues |

(205,325) |

(163,191) |

(23,255) |

||||||||||

|

Gross profit |

512,800 |

513,825 |

73,219 |

||||||||||

|

Operating expenses: |

|||||||||||||

|

Fulfilment expenses |

(56,025) |

(50,412) |

(7,184) |

||||||||||

|

Selling and marketing expenses |

(511,706) |

(494,357) |

(70,445) |

||||||||||

|

General and administrative expenses |

(151,830) |

(85,046) |

(12,119) |

||||||||||

|

Research and development expenses |

(24,739) |

(25,338) |

(3,611) |

||||||||||

|

Total operating expenses |

(744,300) |

(655,153) |

(93,359) |

||||||||||

|

Loss from operations |

(231,500) |

(141,328) |

(20,140) |

||||||||||

|

Financial income |

30,319 |

7,722 |

1,100 |

||||||||||

|

Foreign currency exchange gain |

1,800 |

12,825 |

1,828 |

||||||||||

|

Loss from equity method investments, net |

(6,655) |

(6,510) |

(928) |

||||||||||

|

Other income, net |

8,780 |

6,239 |

889 |

||||||||||

|

Loss before income tax expenses |

(197,256) |

(121,052) |

(17,251) |

||||||||||

|

Income tax expenses |

(654) |

(4) |

(1) |

||||||||||

|

Net loss |

(197,910) |

(121,056) |

(17,252) |

||||||||||

|

Net loss (income) attributable to non-controlling interests and |

1,371 |

(11) |

(2) |

||||||||||

|

Net loss attributable to Yatsen’s shareholders |

(196,539) |

(121,067) |

(17,254) |

||||||||||

|

Shares used in calculating loss per share (1): |

|||||||||||||

|

Weighted average number of Class A and Class B ordinary shares: |

|||||||||||||

|

Basic |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Diluted |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Net loss per Class A and Class B ordinary share |

|||||||||||||

|

Basic |

(0.09) |

(0.06) |

(0.01) |

||||||||||

|

Diluted |

(0.09) |

(0.06) |

(0.01) |

||||||||||

|

Net loss per ADS (20 ordinary shares equal to 1 ADS) (2) |

|||||||||||||

|

Basic |

(1.81) |

(1.22) |

(0.17) |

||||||||||

|

Diluted |

(1.81) |

(1.22) |

(0.17) |

||||||||||

|

For the Three Months Ended September 30, |

|||||||||||||

|

2023 |

2024 |

2024 |

|||||||||||

|

Share-based compensation expenses are included in the |

RMB’000 |

RMB’000 |

USD’000 |

||||||||||

|

Fulfilment expenses |

767 |

252 |

36 |

||||||||||

|

Selling and marketing expenses |

9,485 |

2,289 |

326 |

||||||||||

|

General and administrative expenses |

42,635 |

23,743 |

3,383 |

||||||||||

|

Research and development expenses |

24 |

763 |

109 |

||||||||||

|

Total |

52,911 |

27,047 |

3,854 |

||||||||||

|

(1) Authorized share capital is re-classified and re-designated into Class A ordinary shares and Class B ordinary shares, with each |

|||||||||||||

|

(2) Effective from March 18, 2024, the Company changed its ADS to Class A Ordinary Share ratio from one ADS representing |

|||||||||||||

|

YATSEN HOLDING LIMITED |

|||||||||||||

|

UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS |

|||||||||||||

|

(All amounts in thousands, except for share, per share data or otherwise noted) |

|||||||||||||

|

For the Three Months Ended September 30, |

|||||||||||||

|

2023 |

2024 |

2024 |

|||||||||||

|

RMB’000 |

RMB’000 |

USD’000 |

|||||||||||

|

Loss from operations |

(231,500) |

(141,328) |

(20,140) |

||||||||||

|

Share-based compensation expenses |

52,911 |

27,047 |

3,854 |

||||||||||

|

Amortization of intangible assets resulting from assets and |

13,956 |

15,779 |

2,248 |

||||||||||

|

Non-GAAP loss from operations |

(164,633) |

(98,502) |

(14,038) |

||||||||||

|

Net loss |

(197,910) |

(121,056) |

(17,252) |

||||||||||

|

Share-based compensation expenses |

52,911 |

27,047 |

3,854 |

||||||||||

|

Amortization of intangible assets resulting from assets and |

13,956 |

15,779 |

2,248 |

||||||||||

|

Revaluation of investments on the share of equity method |

3,227 |

3,266 |

465 |

||||||||||

|

Tax effects on non-GAAP adjustments |

(2,430) |

(1,586) |

(226) |

||||||||||

|

Non-GAAP net loss |

(130,246) |

(76,550) |

(10,911) |

||||||||||

|

Net loss attributable to Yatsen’s shareholders |

(196,539) |

(121,067) |

(17,254) |

||||||||||

|

Share-based compensation expenses |

52,911 |

27,047 |

3,854 |

||||||||||

|

Amortization of intangible assets resulting from assets and |

13,701 |

15,385 |

2,192 |

||||||||||

|

Revaluation of investments on the share of equity method |

3,227 |

3,266 |

465 |

||||||||||

|

Tax effects on non-GAAP adjustments |

(2,430) |

(1,559) |

(222) |

||||||||||

|

Non-GAAP net loss attributable to Yatsen’s shareholders |

(129,130) |

(76,928) |

(10,965) |

||||||||||

|

Shares used in calculating loss per share: |

|||||||||||||

|

Weighted average number of Class A and Class B ordinary shares: |

|||||||||||||

|

Basic |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Diluted |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Non-GAAP net loss attributable to ordinary shareholders per |

|||||||||||||

|

Basic |

(0.06) |

(0.04) |

(0.01) |

||||||||||

|

Diluted |

(0.06) |

(0.04) |

(0.01) |

||||||||||

|

Non-GAAP net loss attributable to ordinary shareholders per |

|||||||||||||

|

Basic |

(1.19) |

(0.77) |

(0.11) |

||||||||||

|

Diluted |

(1.19) |

(0.77) |

(0.11) |

||||||||||

|

(1) Effective from March 18, 2024, the Company changed its ADS to Class A Ordinary Share ratio from one ADS representing |

|||||||||||||

![]() View original content:https://www.prnewswire.com/news-releases/yatsen-announces-third-quarter-2024-financial-results-302311003.html

View original content:https://www.prnewswire.com/news-releases/yatsen-announces-third-quarter-2024-financial-results-302311003.html

SOURCE Yatsen Holding Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SpaceX's Starlink Enables Real Time Views Of Earth During Starship's 6th Test Flight: Could It Be The Future Of Space Connectivity?

SpaceX’s Starlink revealed that it enabled real-time views of Earth during the sixth flight test of Starship.

What Happened: Starlink, the satellite internet segment of SpaceX, announced via a tweet that it had enabled real-time views of Earth during the sixth flight test of Starship.

This comes as SpaceX continues to increase its launch cadence, with 17 launches in the last 31 days, including the launch of 24 Starlink satellites to low-Earth orbit from Florida.

“Starlink enabled real-time views of Earth during Starship’s sixth flight test earlier today,” the Elon Musk-owned satellite internet service provider said in a post on X.

Starlink operates a constellation of satellites around the world to offer internet connectivity to its more than four million subscribers. Musk recently said that Starlink is SpaceX’s primary source of funding for the Starship program, with contributions from NASA, too.

“Starlink is how we are paying for humanity to get to Mars. That’s why there is a Hohmann transfer orbit diagram on the Starlink router.”

With Starlink demonstrating the capability of live streaming during re-entry and landing, its capabilities could eventually be leveraged to offer connectivity on future space missions.

Starship, a rocket designed to transport astronauts to the moon and Mars, successfully launched from SpaceX’s Texas rocket development site, with the first stage booster, Super Heavy, detaching at an altitude of about 40 miles.

While SpaceX is currently a privately held company, investors can leverage Destiny Tech100 Inc. DXYZ to participate in the Musk-led space company’s growth. According to data from Benzinga Pro, DXYZ has gained over 198% in the past 6 months.

Why It Matters: The successful launch and the real-time views enabled by Starlink are significant milestones for SpaceX. The company’s CEO, Musk, has been vocal about his vision for space exploration and colonization, and Starship plays a crucial role in this vision.

Gwynne Shotwell, COO of SpaceX, recently stated that Starlink is expected to become profitable in 2024. With over 7,000 Starlink satellites launched to date, the company is building 50-60 satellites per week as it expands its network in low-earth orbit.

Moreover, NASA has endorsed the initial deployment of 400 Starlink satellites closer to Earth and is conducting a study to assess the impact of this deployment on travel to and from the International Space Station (ISS.)

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.