Options Exercise: Eric Venker At Roivant Sciences Realizes $782K

A large exercise of company stock options by Eric Venker, President & COO at Roivant Sciences ROIV was disclosed in a new SEC filing on October 23, as part of an insider exercise.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Venker, President & COO at Roivant Sciences, a company in the Health Care sector, just exercised stock options worth 100,000 shares of ROIV stock with an exercise price of $3.85.

The Wednesday morning market activity shows Roivant Sciences shares down by 0.51%, trading at $11.67. This implies a total value of $782,000 for Venker’s 100,000 shares.

Discovering Roivant Sciences: A Closer Look

Roivant Sciences Ltd is a commercial-stage biopharmaceutical company dedicated to improving the delivery of healthcare to patients. It also incubates discovery-stage companies and health technology startups complementary to its biopharmaceutical business. Its drug candidate VTAMA (tapinarof) is a treatment of plaque psoriasis in adult patients and is in its commercial stage. The other drug candidates in their different stages of development are; Batoclimab, IMVT-1402, Brepocitinib, Namilumab, and others.

Understanding the Numbers: Roivant Sciences’s Finances

Revenue Growth: Roivant Sciences displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 154.96%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company sets a benchmark with a high gross margin of 92.78%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Roivant Sciences exhibits below-average bottom-line performance with a current EPS of 0.13.

Debt Management: Roivant Sciences’s debt-to-equity ratio is below the industry average. With a ratio of 0.07, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 2.05, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 61.99 is above industry norms, reflecting an elevated valuation for Roivant Sciences’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 0.72 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Illuminating the Importance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

The Insider’s Guide to Important Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Roivant Sciences’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

At Roivant Sciences, Eric Venker Chooses To Exercise Options, Resulting In $782K

A substantial insider activity was disclosed on October 23, as Venker, President & COO at Roivant Sciences ROIV, reported the exercise of a large sell of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Venker, President & COO at Roivant Sciences, a company in the Health Care sector, just exercised stock options worth 100,000 shares of ROIV stock with an exercise price of $3.85.

Roivant Sciences shares are trading, exhibiting down of 0.51% and priced at $11.67 during Wednesday’s morning. This values Venker’s 100,000 shares at $782,000.

Discovering Roivant Sciences: A Closer Look

Roivant Sciences Ltd is a commercial-stage biopharmaceutical company dedicated to improving the delivery of healthcare to patients. It also incubates discovery-stage companies and health technology startups complementary to its biopharmaceutical business. Its drug candidate VTAMA (tapinarof) is a treatment of plaque psoriasis in adult patients and is in its commercial stage. The other drug candidates in their different stages of development are; Batoclimab, IMVT-1402, Brepocitinib, Namilumab, and others.

A Deep Dive into Roivant Sciences’s Financials

Revenue Growth: Roivant Sciences displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 154.96%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Analyzing Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 92.78%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Roivant Sciences’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.13.

Debt Management: With a below-average debt-to-equity ratio of 0.07, Roivant Sciences adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Roivant Sciences’s P/E ratio of 2.05 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 61.99 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 0.72, Roivant Sciences presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Deep Dive into Insider Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Roivant Sciences’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ryder System's Earnings Outlook

Ryder System R is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ryder System to report an earnings per share (EPS) of $3.42.

Ryder System bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

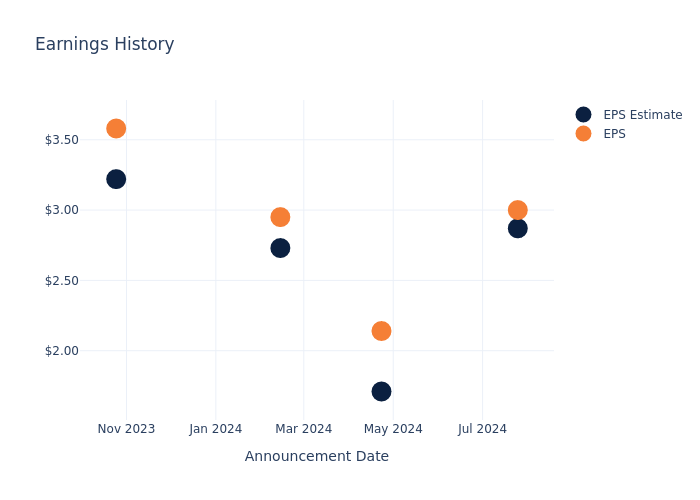

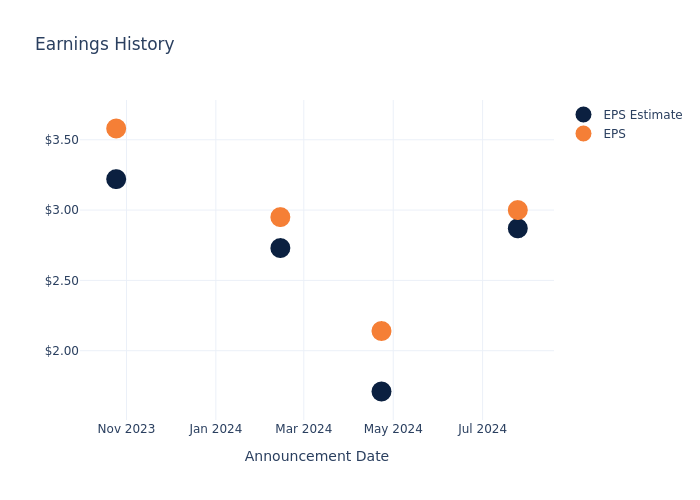

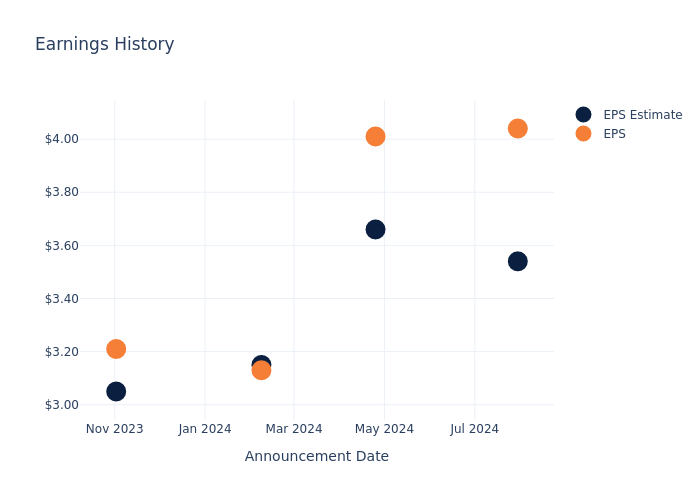

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.13, leading to a 0.13% increase in the share price on the subsequent day.

Here’s a look at Ryder System’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.87 | 1.71 | 2.73 | 3.22 |

| EPS Actual | 3 | 2.14 | 2.95 | 3.58 |

| Price Change % | 0.0% | 0.0% | -2.0% | -1.0% |

Market Performance of Ryder System’s Stock

Shares of Ryder System were trading at $145.73 as of October 22. Over the last 52-week period, shares are up 55.78%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Ryder System

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ryder System.

A total of 1 analyst ratings have been received for Ryder System, with the consensus rating being Outperform. The average one-year price target stands at $155.0, suggesting a potential 6.36% upside.

Comparing Ratings with Competitors

In this comparison, we explore the analyst ratings and average 1-year price targets of Landstar System, Schneider National and RXO, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Landstar System received a Neutral consensus from analysts, with an average 1-year price target of $172.43, implying a potential 18.32% upside.

- Schneider National is maintaining an Neutral status according to analysts, with an average 1-year price target of $27.78, indicating a potential 80.94% downside.

- RXO is maintaining an Neutral status according to analysts, with an average 1-year price target of $27.3, indicating a potential 81.27% downside.

Analysis Summary for Peers

The peer analysis summary provides a snapshot of key metrics for Landstar System, Schneider National and RXO, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ryder System | Outperform | 8.91% | $648M | 4.13% |

| Landstar System | Neutral | -10.83% | $160.64M | 5.21% |

| Schneider National | Neutral | -2.21% | $110.70M | 1.20% |

| RXO | Neutral | -3.43% | $163M | -1.21% |

Key Takeaway:

Ryder System ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity compared to its peers.

Unveiling the Story Behind Ryder System

Ryder System Inc operates in three business segments: (1) Fleet Management Solutions which provides full-service leasing and leasing with flexible maintenance options, commercial rental and maintenance services of trucks, tractors and trailers to customers; (2) Supply Chain Solutions (SCS), which provides integrated logistics solutions, including distribution management, dedicated transportation, transportation management, brokerage, e-commerce, last mile, and professional services; and (3) Dedicated Transportation Solutions (DTS), which provides turnkey transportation solutions in the U.S., including dedicated vehicles, professional drivers, management, and administrative support.

Ryder System: A Financial Overview

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Ryder System’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 8.91%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Ryder System’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.97%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ryder System’s ROE stands out, surpassing industry averages. With an impressive ROE of 4.13%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Ryder System’s ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.77%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Ryder System’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.83, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Ryder System visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Moves Lower; AT&T Earnings Top Views

U.S. stocks traded lower midway through trading, with the Nasdaq Composite falling more than 1% on Wednesday.

The Dow traded down 0.90% to 42,540.14 while the NASDAQ fell 1.38% to 18,317.40. The S&P 500 also fell, dropping, 0.83% to 5,802.43.

Check This Out: How To Earn $500 A Month From IBM Stock Ahead Of Q3 Earnings

Leading and Lagging Sectors

Real estate shares rose by 0.4% on Wednesday.

In trading on Wednesday, consumer discretionary shares fell by 0.9%.

Top Headline

AT&T Inc T reported better-than-expected earnings for the third quarter.

The company posted operating revenues of $30.21 billion, down 0.5% year over year. It marginally missed the analyst consensus estimate of $30.44 billion. Adjusted EPS of $0.60 beat the estimate of $0.57. The stock gained after the print.

Equities Trading UP

- La Rosa Holdings Corp. LRHC shares shot up 165% to $1.2950 after the company reported preliminary 9-moth revenue growth of 120% year over year.

- Shares of CNS Pharmaceuticals, Inc. CNSP got a boost, surging 91% to $0.2996. The company requested a panel hearing for November 5, 2024, and will be subject to a halt in the suspension or delisting decision until then.

- Virax Biolabs Group Limited VRAX shares were also up, gaining 60% to $2.6759 after the company announced a distribution agreement with Europa Biosite to commercialize the ImmuneSelect research-use portfolio in the United Kingdom and Ireland.

Equities Trading DOWN

- Alto Neuroscience, Inc. ANRO shares dropped 66% to $4.9550 after the company announced topline results from a Phase 2b trial evaluating ALTO-100 as a treatment for major depressed disorder did not meet its primary endpoint.

- Shares of Constellium SE CSTM were down 23% to $11.51 after the company reported third-quarter EPS and sales that missed estimates, citing macroeconomic and geopolitical uncertainties, and expressed caution heading into 2025.

- Enphase Energy, Inc. ENPH was down, falling 14% to $79.56 after the company reported worse-than-expected third-quarter financial results.

Commodities

In commodity news, oil traded down 0.6% to $71.32 while gold traded down 0.8% at $2,737.90.

Silver traded down 3.5% to $33.800 on Wednesday, while copper fell 0.7% to $4.3490.

Euro zone

European shares were mostly lower today. The eurozone’s STOXX 600 fell 0.17%, Germany’s DAX fell 0.08% and France’s CAC 40 fell 0.25%. Spain’s IBEX 35 Index rose 0.25%, while London’s FTSE 100 fell 0.47%.

Consumer confidence in the Eurozone rose by 0.4 points to a reading of -12.5 in October.

Asia Pacific Markets

Asian markets closed mixed on Wednesday, with Japan’s Nikkei 225 falling 0.80%, Hong Kong’s Hang Seng Index gaining 1.27%, China’s Shanghai Composite Index gaining 0.52% and India’s BSE Sensex falling 0.17%.

Singapore’s annual inflation rate eased to 2.0% in September versus 2.2% in the previous month.

Economics

- U.S. mortgage applications declined by 6.7% from the previous week during the third week of October, following a 17% dip in the earlier period.

- U.S. existing home sales declined 1% from the previous month to an annualized rate of 3.84 million in September.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

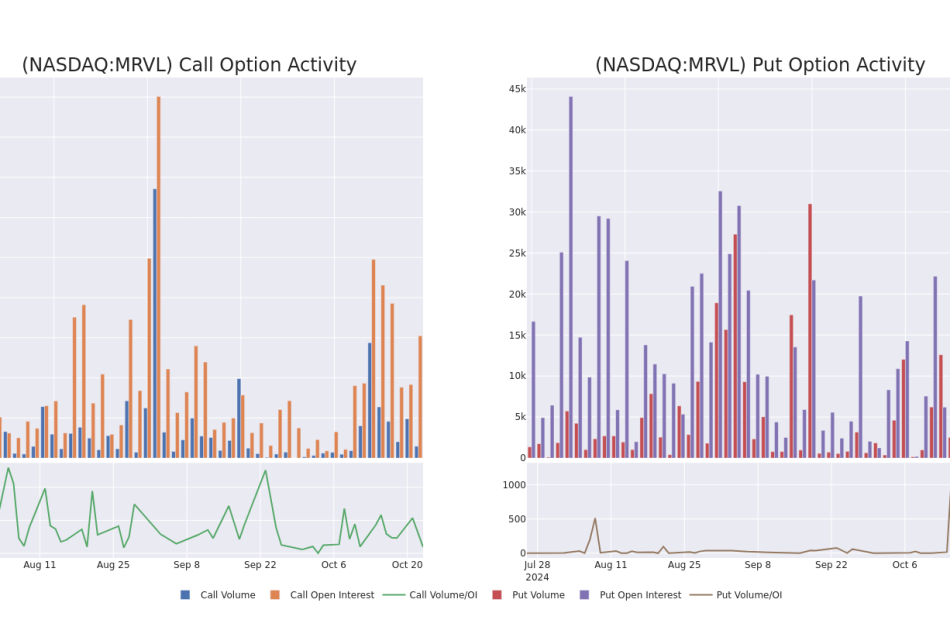

Smart Money Is Betting Big In MRVL Options

Deep-pocketed investors have adopted a bearish approach towards Marvell Tech MRVL, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MRVL usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 23 extraordinary options activities for Marvell Tech. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 60% bearish. Among these notable options, 10 are puts, totaling $1,041,041, and 13 are calls, amounting to $792,116.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $100.0 for Marvell Tech during the past quarter.

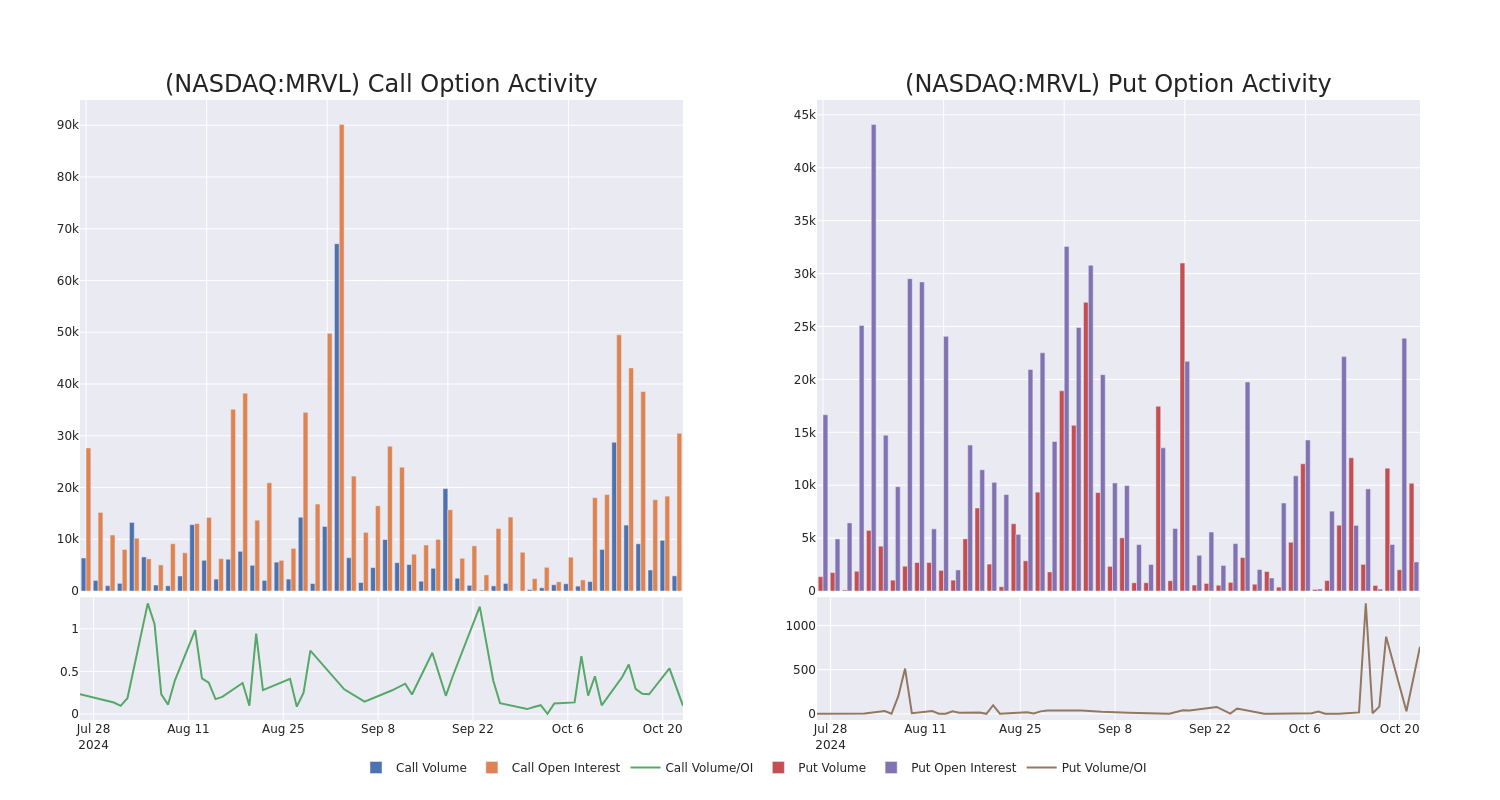

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Marvell Tech options trades today is 1661.25 with a total volume of 13,124.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Marvell Tech’s big money trades within a strike price range of $40.0 to $100.0 over the last 30 days.

Marvell Tech Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | PUT | SWEEP | BEARISH | 11/29/24 | $0.75 | $0.53 | $0.68 | $68.00 | $561.0K | 11 | 8.3K |

| MRVL | PUT | TRADE | BEARISH | 02/21/25 | $9.5 | $9.4 | $9.5 | $85.00 | $131.1K | 256 | 237 |

| MRVL | CALL | SWEEP | BULLISH | 03/21/25 | $16.3 | $16.15 | $16.3 | $72.50 | $125.5K | 698 | 93 |

| MRVL | PUT | TRADE | BEARISH | 02/21/25 | $9.75 | $9.7 | $9.75 | $85.00 | $96.5K | 256 | 0 |

| MRVL | CALL | SWEEP | BEARISH | 01/17/25 | $6.75 | $6.7 | $6.7 | $85.00 | $93.8K | 4.1K | 233 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Following our analysis of the options activities associated with Marvell Tech, we pivot to a closer look at the company’s own performance.

Present Market Standing of Marvell Tech

- Trading volume stands at 4,689,325, with MRVL’s price down by -4.12%, positioned at $79.92.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 37 days.

What Analysts Are Saying About Marvell Tech

1 market experts have recently issued ratings for this stock, with a consensus target price of $91.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Citigroup persists with their Buy rating on Marvell Tech, maintaining a target price of $91.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Marvell Tech options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

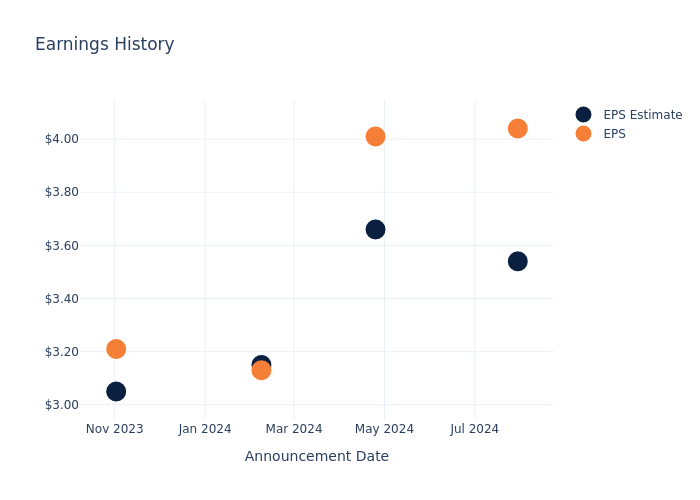

Earnings Preview: S&P Global

S&P Global SPGI is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect S&P Global to report an earnings per share (EPS) of $3.64.

The announcement from S&P Global is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.50, leading to a 0.77% drop in the share price the following trading session.

Here’s a look at S&P Global’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 3.54 | 3.66 | 3.15 | 3.05 |

| EPS Actual | 4.04 | 4.01 | 3.13 | 3.21 |

| Price Change % | -1.0% | 0.0% | 0.0% | 2.0% |

Market Performance of S&P Global’s Stock

Shares of S&P Global were trading at $513.52 as of October 22. Over the last 52-week period, shares are up 46.84%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

To track all earnings releases for S&P Global visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's the Only Stock Billionaires Warren Buffett and David Tepper Both Own

Do billionaires of a feather flock together? Not necessarily. Warren Buffett and David Tepper serve as good examples.

Both men rank among the wealthiest people in the world, with Buffett’s net worth around $146 billion and Tepper’s net worth topping $21 billion. Both are long-term investors who sometimes take contrarian positions.

But these two billionaires aren’t attracted to the same stocks very often. Buffett’s Berkshire Hathaway portfolio includes 41 holdings. Tepper’s Appaloosa Management hedge fund has 37 holdings. However, Buffett and Tepper own only one stock in common.

Before I reveal which lone stock is in both Berkshire Hathaway’s and Appaloosa Management’s portfolios, I must acknowledge something that isn’t readily apparent. Technically, Buffett and Tepper own three of the same stocks. However, two of those stocks come with an asterisk beside their names.

To explain the situation, let’s review some corporate history. In 1995, General Re acquired New England Asset Management (NEAM). Around three years later, Berkshire Hathaway acquired General Re. Why is this important? Because NEAM still has its own investment portfolio that’s separate from Berkshire’s.

NEAM’s holdings include Microsoft and Qualcomm. Both tech stocks are also in Tepper’s Appaloosa portfolio. Buffett doesn’t manage NEAM’s investments but indirectly owns shares of Microsoft and Qualcomm.

While these two stocks warrant an asterisk beside their names, another stock deserves two asterisks. NEAM owns Google parent Alphabet‘s Class A shares. Tepper doesn’t own the Class A shares but does own Alphabet‘s Class C shares, which trade under a different ticker. In this case, Buffett, indirectly, and Tepper, directly, are invested in the same company, although not the same stock.

What’s the one stock that’s a common denominator in Buffett’s and Tepper’s holdings that doesn’t require a special explanation? Amazon (NASDAQ: AMZN).

Berkshire Hathaway first bought Amazon stock in the first quarter of 2019. Buffett subsequently revealed that the decision to buy Amazon was made by one of his two investment managers. However, Buffett has liked Amazon and its founder Jeff Bezos for years.

He no doubt approved of the purchase. The legendary investor has even expressed regret in the past for not buying Amazon stock sooner.

Interestingly, Tepper also initiated a new position in Amazon in the first quarter of 2019. Unlike Buffett, he has never been hesitant about buying high-flying growth stocks.

2024 Fisher Service Award for Military Community Service Recipients Announced

Washington, D.C., Oct. 23, 2024 (GLOBE NEWSWIRE) — Fisher House Foundation and Military Times Foundation have awarded grants to five non-profit organizations supporting military service members and their families. The Fisher Service Award for Military Community Service provides funding toward innovative programs created to improve the quality of life of veterans.

The Fisher Service Award began in 1999 as the Newman’s Own Awards and have now awarded more than $3.4 million across 210 non-profit programs.

“Congratulations to the 2024 Fisher Service Award recipients,” said Chairman and CEO of Fisher House Foundation Ken Fisher. “These exceptional programs are making a meaningful difference for the military and veteran community we hold close. We deeply appreciate our partners at Military Times and our esteemed judges for their unwavering support and commitment.”

“Military Times is proud to support military-connected families and organizations that strive to improve the lives of those in this community. Our support of the Fisher Service Award is just one of the many ways we underscore the Military Times mission of service to the community we serve” said Kelly Facer, SVP Sightline Media Group / Military Times. ”As is the case every year, our honorees exemplify the power of community, cooperation, and innovation in tackling the most important issues for our nation’s heroes and their families.”

After receiving over 515 entries for the 2024 program, 11 judges evaluated each entry based on the organization’s creativity, innovation, and impact on the respective communities. Fisher House Foundation and Military Times Foundation are proud to announce that the five winning organizations are:

Children’s Museum at Joint Base Lewis-McChord, Greentrike; HillVets Fellowship Program, HillVets Foundation; Musicians on Call Veteran’s Bedside Program, Musicians on Call; Mobile Service Units (MSU) Serving Isolated Veterans in Mendocino and Lake Counties CA, Nation’s Finest; and Stronghold Ambassador Program, Stronghold Food Pantry (Organization information below.)

The leading 2024 Fisher Service Award-winning organization received a $100,000 grant, with the remaining top organizations receiving $75,000. All recipients will also receive an advertising package from Military Times valued at $50,000. The 2024 recipients were honored in a ceremony hosted by Fisher House Foundation and Military Times in Washington, D.C., on October 23, 2024. Photos from the ceremony can be viewed at https://www.flickr.com/photos/fisherhousefoundation/sets.

Founded in service of military families in 2021, Greentrike’s Children’s Museum at Joint Base Lewis-McChord is the only children’s museum on a US military base in the world. The Children’s Museum at JBLM provides an array of innovative playscapes that invite self-directed play to empower children’s imaginations. The Children’s Museum at JBLM is the home for Play to Learn, a weekly play-based learning program for children six and under and their caregivers. Admission to the Museum is always Pay As You Will, a donation-only admission model designed to eliminate financial barriers and provide access for all.

“We are deeply honored to have the Children’s Museum at Joint Base Lewis-McChord selected as a Fisher Service Award recipient,” said Greentrike CEO Tanya Durand. “Fisher House Foundation’s support of the Museum will help ensure all military families connected to JBLM have an opportunity to experience the power of play together. We share this honor with all who have been instrumental in securing our vision to establish the first and only children’s museum on a U.S. military installation so that families navigating the challenges of military life have their own indoor play and gathering space, rich learning environment, art studio, and a place to make friends, build community, and experience joy. We are truly grateful to Fisher House Foundation and the Military Times Foundation for recognizing that our work can help ensure optimal childhood development and support the families who are serving our country.”

Applications for the 2025 Fisher Service Awards are currently open. Learn more at https://fisherhouse.org/programs/fisher-service-award/.

###

About Military Times

The Military Times digital platforms and print products are the trusted source for independent news and information for service members and their families. The military community relies on the Army Times, Marine Corps Times, Navy Times, and Air Force Times for reporting on everything important to their lives, including: pay, benefits, finance, education, health care, recreational resources, retirement, promotions, product reviews, and entertainment. Military Times is published by Sightline Media Group. To learn more, visit www.militarytimes.com.

About Fisher House Foundation

Fisher House Foundation is best known for its network of 98 comfort homes where military and veteran families can stay at no cost while a loved one is receiving treatment. These homes are located at major military and VA medical centers nationwide and in Europe, close to the medical center or hospital they serve. Fisher Houses have up to 21 suites with private bedrooms and baths. Families share a common kitchen, laundry facilities, a warm dining room, and an inviting living room. Fisher House Foundation ensures that there is never a lodging fee. Since inception, the program has saved military and veteran families an estimated $610 million in out-of-pocket costs for lodging and transportation. www.fisherhouse.org.

Winning Entries

Children’s Museum at Joint Base Lewis-McChord

Greentrike – Tacoma, Washington

Greentrike’s Children’s Museum at Joint Base Lewis-McChord (the Museum) is a robust, relevant, and pioneering resource for military families. Like the Children’s Museum of Tacoma, the idea for a children’s museum at JBLM was inspired to fill a gap in meaningful activities for military children that could also involve the adults who care for them. In 2021, Greentrike combined over 30 years of museum program management, with several years of research and discussions, to design and open the first and only children’s museum on a US military base in the world. greentrike.org

HillVets Fellowship Program

HillVets Foundation – Washington D.C

HillVets is a nonprofit organization dedicated to empowering veterans, service members, and military families through leadership development, mentorship, and policy advocacy. HillVets connects veterans with leaders, enhancing their advocacy on key issues. Programs include fellowships on Capitol Hill, networking opportunities, and educational initiatives that help veterans transition into influential roles in government, policy, and beyond. hillvets.org

Musicians on Call Veteran’s Bedside Program

Musicians on Call – Nashville, Tennessee

Hospitalized veterans face particular challenges, which is why Musicians On Call prioritizes delivering music to the VA community. MOC Bedside brings live music directly to veterans, their families and caregivers so they can access the healing power of music when they need it most. MOC volunteers have proudly performed for over 100,000 veterans, in person and virtually, in VA hospitals nationwide. musiciansoncall.org

Mobile Service Units (MSU) Serving Isolated Veterans in Mendocino and Lake Counties, CA

Nation‘s Finest – Santa Rosa, California

Nation’s Finest Mobile Service Unit (MSU) delivers essential services like case management and telehealth to veterans in rural and underserved areas, bridging gaps in access to VA resources. By bringing care directly to them, the MSU ensures veterans receive timely medical, mental health, and support services, fostering stability, community, and access to benefits and employment programs. nationsfinest.org

Stronghold Ambassador Program

Stronghold Food Pantry – Leavenworth, Kansas

Stronghold’s Ambassador Program leverages technology and innovation to deliver fresh and nonperishable groceries to military and veteran families worldwide. By activating Ambassadors globally, the traditional food pantry model is transformed into a movement for new service delivery. The program bridges cutting-edge solutions with genuine human connection, prioritizing compassion and integrity while fostering empowerment and a cycle of positivity for all. strongholdfoodpantry.org

Judges for the 2024 competition were:

Ms. Gina Allvin, Spouse of General David W. Allvin, Vice Chief of Staff of the United States Air Force

Ms. Kelly Facer, Sr. Vice President, Military Times, a Sightline Media Group Company

Mrs. Tammy Fisher, Trustee, Fisher House Foundation

Ms. Patty George, Spouse of General Randy A. George, Chief of Staff of the Army

Ms. Christine Grady, Spouse of Admiral Christopher W. Grady, Vice Chairman of the Joint Chiefs of Staff

Mrs. Kelly Hokanson, Spouse of General Daniel Hokanson, Chief of the National Guard Bureau

Ms. LyndaLee Lunday, Spouse of Admiral Kevin E. Lunday, Vice Commandant of the Coast Guard Ms. Ann Morrison, Spouse of LTG John B. Morrison, United States Army Chief of Staff G-6

Mrs. Lynne Pace, Trustee, Fisher House Foundation

Ms. Jennifer Saltzman, Spouse of General B. Chance Saltzman, Chief of Space Operations, United States Space Force

Mrs. Suzie Schwartz, Trustee, Fisher House Foundation

Michelle Horn Fisher House Foundation 2405992478 mhorn@fisherhouse.org

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.