Pentair Analysts Increase Their Forecasts Following Better-Than-Expected Q3 Results

Pentair plc PNR reported better-than-expected results for its third quarter on Tuesday.

The company reported that third-quarter 2024 net sales fell 2% year over year to $993 million, beating the consensus of $988.8 million. Adjusted EPS rose 16% Y/Y to $1.09, surpassing the consensus of $1.07.

For FY24 Outlook, Pentair raised adjusted EPS to $4.27 (from $4.25) vs. consensus of $4.25. Meanwhile, the company continues to see sales growth of roughly flat to down 1% on a reported basis.

Pentair sees fourth-quarter adjusted EPS of $1.02 versus a consensus of $1.02 and sales of around $965 million-$975 million vs. a consensus of $989.2 million.

CEO John L. Stauch said, “Our relentless dedication to strong execution, Transformation, and delivering value to our customers has driven yet another quarter of significant free cash flow and outstanding results, surpassing our expectations. Our balanced approach across our water portfolio continues to validate the effectiveness of our strategy. We have made substantial progress on 80/20 with the completion of training on a majority of our total revenue.”

Pentair shares fell 1.3% to trade at $97.04 on Wednesday.

These analysts made changes to their price targets on Pentair following earnings announcement.

- Barclays analyst Julian Mitchell maintained Pentair with an Overweight and raised the price target from $105 to $108.

- Keybanc analyst Jeffrey Hammond maintained the stock with an Overweight and raised the price target from $110 to $115.

- Goldman Sachs analyst Brian Lee maintained Pentair with a Neutral and raised the price target from $93 to $103.

- UBS analyst Damian Karas maintained the stock with a Buy and raised the price target from $100 to $115.

- JP Morgan analyst Stephen Tusa maintained Pentair with a Neutral and raised the price target from $106 to $110.

- TD Cowen analyst Joseph Giordano maintained the stock with a Buy and boosted the price target from $95 to $110.

Considering buying PNR stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Look Ahead: Western Digital's Earnings Forecast

Western Digital WDC is gearing up to announce its quarterly earnings on Thursday, 2024-10-24. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Western Digital will report an earnings per share (EPS) of $1.72.

The market awaits Western Digital’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

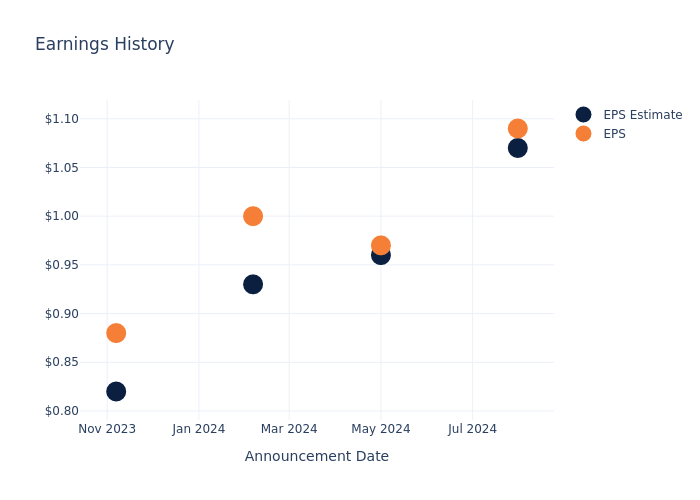

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.29, leading to a 9.72% drop in the share price on the subsequent day.

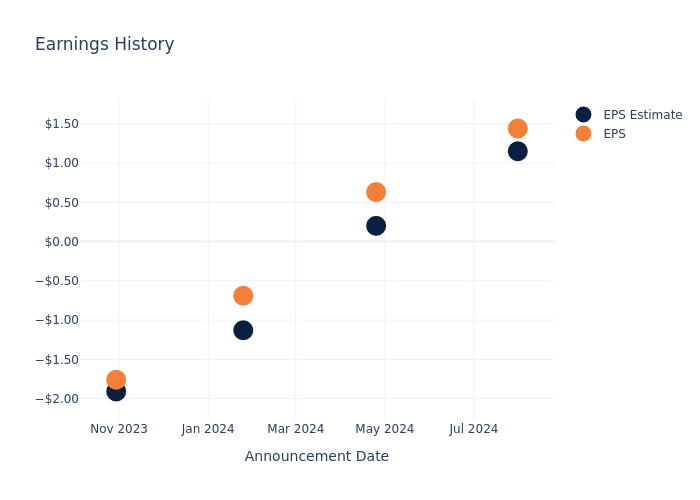

Here’s a look at Western Digital’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.15 | 0.20 | -1.13 | -1.91 |

| EPS Actual | 1.44 | 0.63 | -0.69 | -1.76 |

| Price Change % | -10.0% | 3.0% | -3.0% | -4.0% |

Tracking Western Digital’s Stock Performance

Shares of Western Digital were trading at $67.76 as of October 22. Over the last 52-week period, shares are up 74.96%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Western Digital

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Western Digital.

A total of 9 analyst ratings have been received for Western Digital, with the consensus rating being Buy. The average one-year price target stands at $89.33, suggesting a potential 31.83% upside.

Comparing Ratings Among Industry Peers

The analysis below examines the analyst ratings and average 1-year price targets of NetApp, Hewlett Packard and Super Micro Computer, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- NetApp received a Neutral consensus from analysts, with an average 1-year price target of $133.5, implying a potential 97.02% upside.

- Analysts currently favor an Neutral trajectory for Hewlett Packard, with an average 1-year price target of $20.89, suggesting a potential 69.17% downside.

- For Super Micro Computer, analysts project an Neutral trajectory, with an average 1-year price target of $641.8, indicating a potential 847.17% upside.

Snapshot: Peer Analysis

In the peer analysis summary, key metrics for NetApp, Hewlett Packard and Super Micro Computer are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Western Digital | Buy | 40.87% | $1.35B | 0.28% |

| NetApp | Neutral | 7.61% | $1.10B | 23.90% |

| Hewlett Packard | Neutral | 10.11% | $2.44B | 2.34% |

| Super Micro Computer | Neutral | 37.87% | $597.37M | 6.68% |

Key Takeaway:

Western Digital ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is at the top for Return on Equity.

All You Need to Know About Western Digital

Western Digital is a leading vertically integrated supplier of data storage solutions, spanning both hard disk drives and solid-state drives. In the HDD market it forms a practical duopoly with Seagate, and it is the largest global producer of NAND flash chips for SSDs in a joint venture with competitor Kioxia.

Unraveling the Financial Story of Western Digital

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Western Digital showcased positive performance, achieving a revenue growth rate of 40.87% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Western Digital’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 0.77%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Western Digital’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 0.28%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Western Digital’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.12% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Western Digital’s debt-to-equity ratio is below the industry average. With a ratio of 0.69, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for Western Digital visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Examining the Future: KKR & Co's Earnings Outlook

KKR & Co KKR is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect KKR & Co to report an earnings per share (EPS) of $1.22.

The announcement from KKR & Co is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

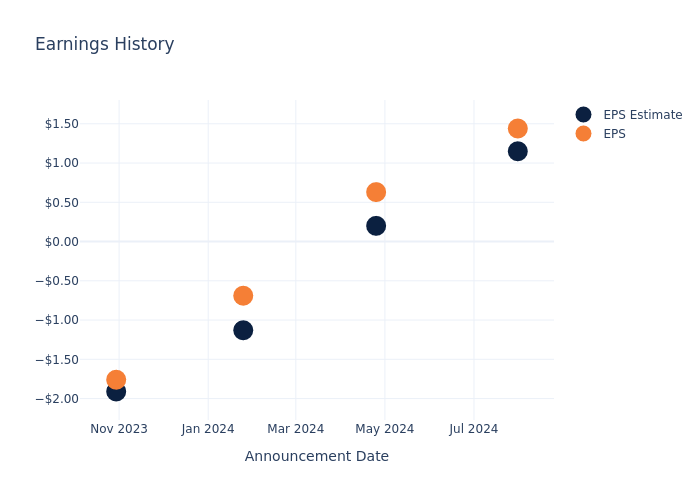

Past Earnings Performance

In the previous earnings release, the company beat EPS by $0.02, leading to a 3.0% drop in the share price the following trading session.

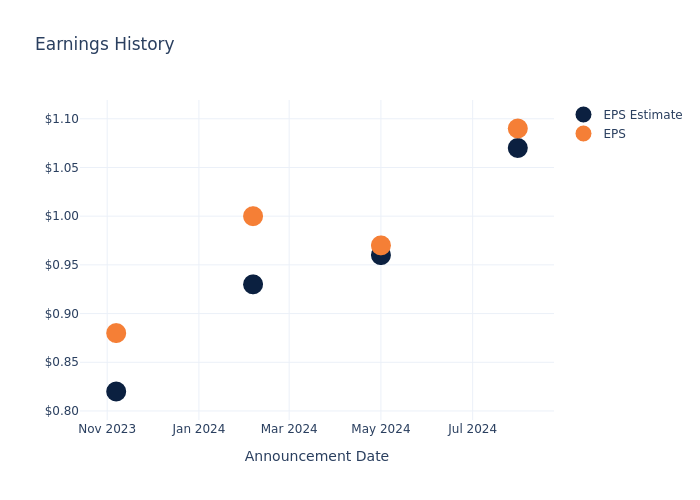

Here’s a look at KKR & Co’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.07 | 0.96 | 0.93 | 0.82 |

| EPS Actual | 1.09 | 0.97 | 1 | 0.88 |

| Price Change % | -3.0% | 2.0% | 1.0% | 0.0% |

KKR & Co Share Price Analysis

Shares of KKR & Co were trading at $140.17 as of October 22. Over the last 52-week period, shares are up 155.55%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on KKR & Co

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on KKR & Co.

KKR & Co has received a total of 18 ratings from analysts, with the consensus rating as Outperform. With an average one-year price target of $143.61, the consensus suggests a potential 2.45% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of BlackRock, Brookfield and Ares Management, three key industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for BlackRock, with an average 1-year price target of $1023.88, indicating a potential 630.46% upside.

- For Brookfield, analysts project an Outperform trajectory, with an average 1-year price target of $50.96, indicating a potential 63.64% downside.

- For Ares Management, analysts project an Neutral trajectory, with an average 1-year price target of $161.31, indicating a potential 15.08% upside.

Peer Metrics Summary

The peer analysis summary provides a snapshot of key metrics for BlackRock, Brookfield and Ares Management, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| KKR | Outperform | 14.54% | $980.89M | 3.10% |

| BlackRock | Outperform | 7.66% | $2.31B | 3.75% |

| Brookfield | Outperform | -2.61% | $3.90B | 0.00% |

| Ares Management | Neutral | -20.67% | $718.06M | 5.04% |

Key Takeaway:

KKR & Co ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity. Overall, KKR & Co is positioned in the top tier compared to its peers in this analysis.

Get to Know KKR & Co Better

KKR is one of the world’s largest alternative asset managers, with $601.3 billion in total managed assets, including $487.3 billion in fee-earning AUM, at the end of June 2024. The company has two core segments: asset management (which includes private markets-private equity, credit, infrastructure, energy, and real estate-and public markets-primarily credit and hedge/investment fund platforms) and insurance (following the firm’s initial investment in, and then ultimate purchase of, Global Atlantic Financial Group, which is engaged in retirement/annuity and life insurance lines as well as reinsurance).

KKR & Co: Delving into Financials

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: KKR & Co’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 14.54%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: The company’s net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 16.26%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): KKR & Co’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 3.1%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.19%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: KKR & Co’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.32, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for KKR & Co visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lido Staked Ether Decreases More Than 5% Within 24 hours

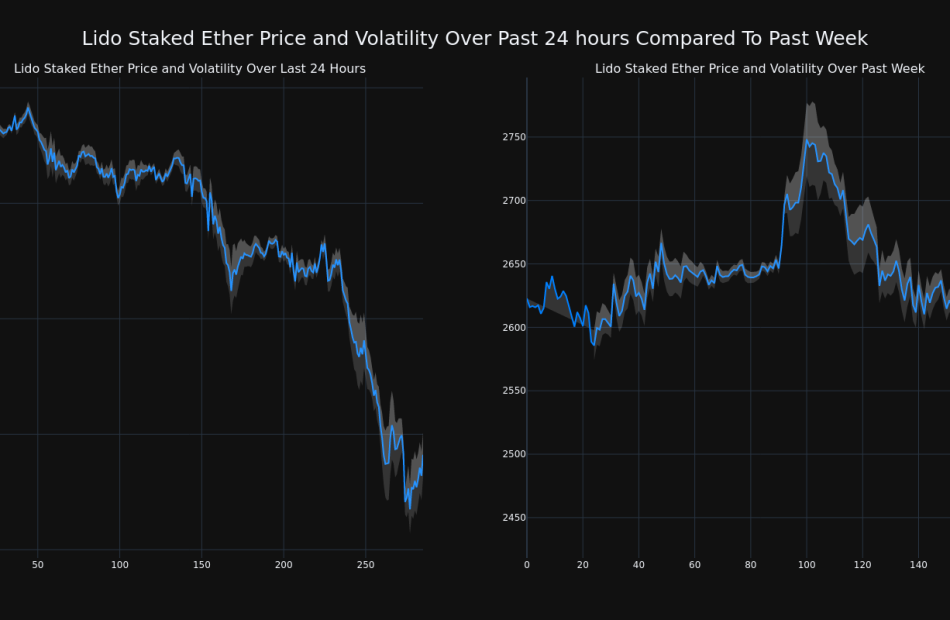

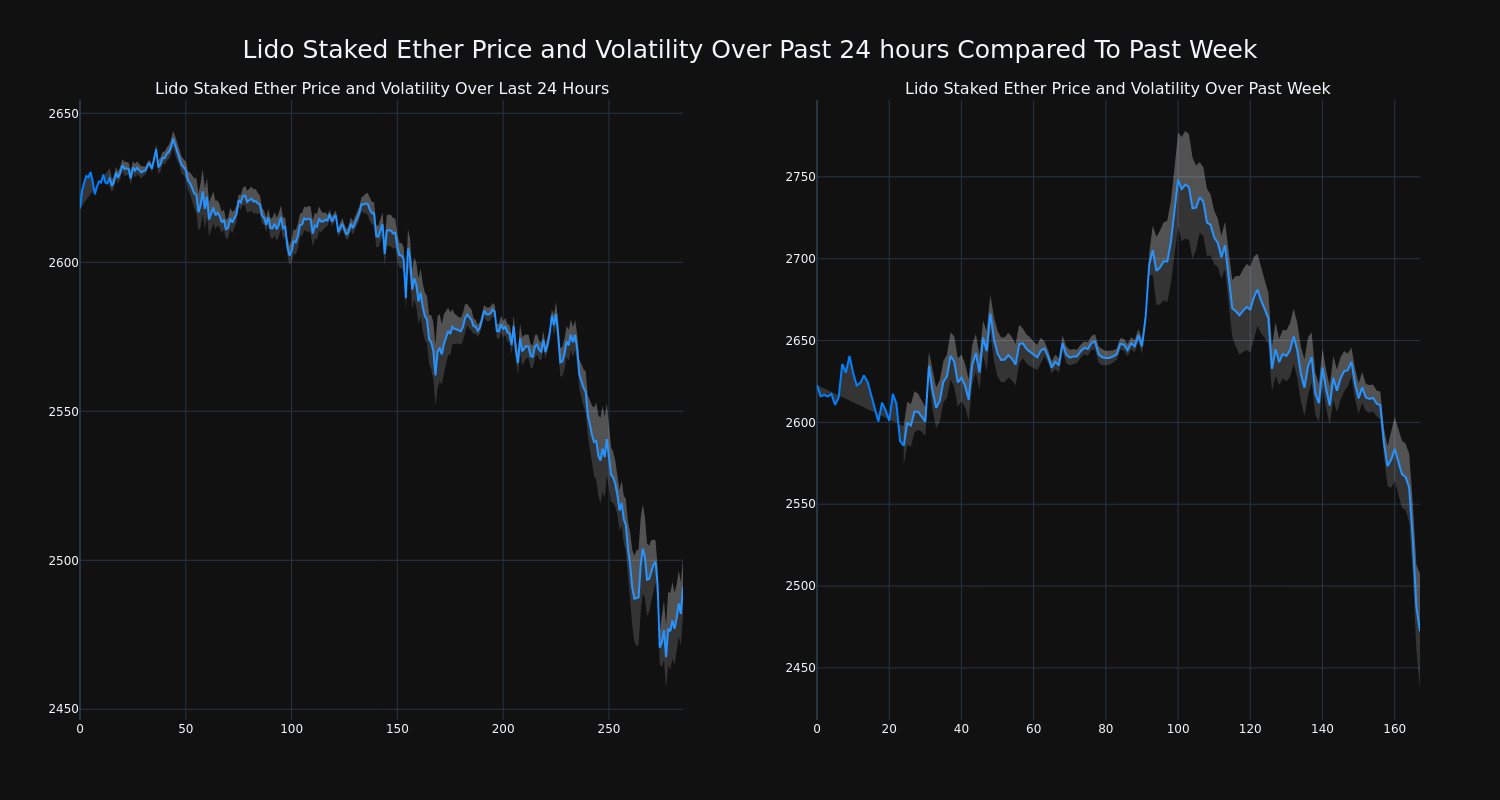

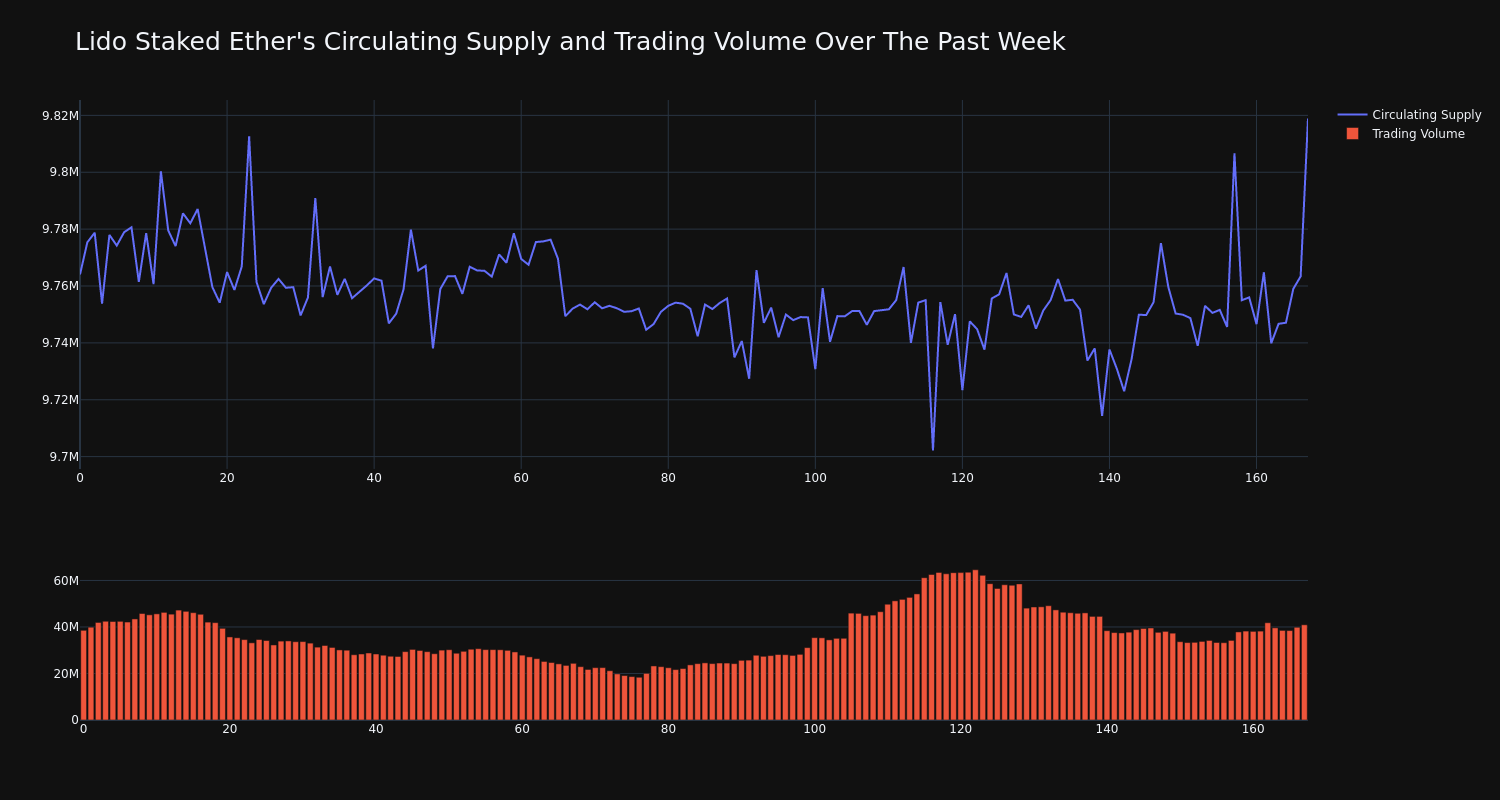

Lido Staked Ether’s STETH/USD price has decreased 5.08% over the past 24 hours to $2,486.35, continuing its downward trend over the past week of -6.0%, moving from $2,622.75 to its current price.

The chart below compares the price movement and volatility for Lido Staked Ether over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has increased 6.0% over the past week while the overall circulating supply of the coin has increased 0.56% to over 9.75 million. The current market cap ranking for STETH is #8 at $24.20 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's CEO says a design flaw in its new AI chip was '100% Nvidia's fault'

Nvidia (NVDA) says it has fixed a design flaw in its latest artificial intelligence chips that led to production and shipping delays.

The chipmaker worked with its partner, Taiwan Semiconductor Manufacturing Company (TSM), to resolve the engineering setback in its highly anticipated Blackwell AI platform.

“It was functional, but the design flaw caused the yield to be low,” Nvidia chief executive Jensen Huang said, according to Reuters. “It was 100% Nvidia’s fault.”

The complexity of the project contributed to the setback. The Blackwell computer involved seven new chip designs that needed to be developed and put into production simultaneously, according to Huang.

The problems first surfaced in August, when Nvidia’s stock fell around 8% after a report that Blackwell’s production was delayed due to a design flaw, possibly setting deliveries back by three or so months and impacting major customers such as Google (GOOGL) and Microsoft (MSFT).

During the company’s second-quarter earnings that month, Huang said Nvidia shipped samples of Blackwell to customers and that the AI platform’s production would ramp up in the fourth quarter into the next fiscal year. To “improve production yield,” Nvidia made a change to Blackwell’s GPU mask, the chipmaker said during earnings. However, “there were no functional changes necessary,” Huang said on a call with analysts. The company said it expects to “ship several billion dollars in Blackwell revenue” in the fourth quarter.

“What TSMC did, was to help us recover from that yield difficulty and resume the manufacturing of Blackwell at an incredible pace,” Huang said during an appearance in Denmark to unveil the country’s first AI supercomputer, Gefion.

The recovery appears successful. In October, Nvidia shares got a boost after Huang said Blackwell was in full production and demand for the chip was “insane.”

“Everybody wants to have the most, and everybody wants to be first,” Huang said during an appearance on CNBC.

Nvidia stock closed at a record high of $143.71 per share earlier this week ahead of major technology companies’ earnings. The chipmaker’s shares were down 3.3% during mid-day trading on Wednesday but are up around 189% so far this year.

AdTech Stock Magnite Gains as Disney Renews Key Deal, Expands ESPN and Podcast Offerings

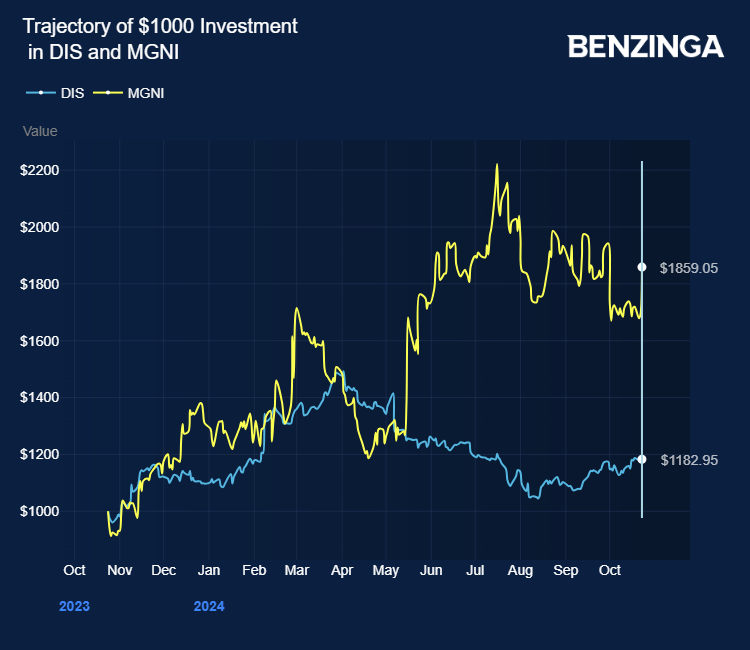

Magnite, Inc MGNI stock got a boost from a deal renewal with Walt Disney Co DIS Wednesday.

The two companies extended their deal for another two years, marking six years of collaboration.

Magnite remains Disney’s preferred supply-side technology partner, enabling the monetization of ad-supported content across its entire portfolio.

Also Read: Disney’s Leadership Shift: James Gorman Named As Chairman, CEO Search Underway

Magnite facilitates transactions with over 30 demand-side platforms (DSPs) for Disney and plans to expand globally.

Jamie Power, SVP of Addressable Sales at Disney. “Magnite plays a critical role in allowing buyers to access Disney’s inventory by connecting to more than 30 demand-side platforms in the US and starting to expand globally.”

As part of the renewed partnership, Disney will use Magnite to execute one-to-one deals through its ClearLine offering, monetize College Football live streams on ESPN, expand into Latin America, and offer podcast inventory for ESPN and ABC News.

Sean Buckley, Chief Revenue Officer at Magnite: “In addition to our role in enabling Disney’s programmatic transactions, we’re actively innovating in new areas like live streaming to bring added value to our partnership.”

Disney remains committed to its streaming ambitions, raising the prices of its Disney+ and Hulu services.

It also prompted subscribers to bypass Apple Inc’s AAPL App Store while subscribing to its streaming services to avoid the hefty charges.

Disney’s streaming division reported an operating profit of $47 million in the third quarter, marking its first profitable quarter versus a $(512) million loss a year ago.

Magnite stock surged over 86% in the last 12 months. DIS is up over 16%.

Price Actions: MGNI stock is up 2.11% at $12.33 at the last check on Wednesday. DIS stock is down 0.17% at $96.58.

Also Read:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Statement by Minister Sean Fraser on Status of Negotiations with Provinces and Territories to Address Encampments

OTTAWA, ON, Oct. 22, 2024 /CNW/ – As much progress as Canada makes to solve the housing crisis, it will not be over as long as there are people living in tents.

On September 18, 2024, I sent a letter to each province and territory asking them to partner with the federal government to urgently find shelter for those experiencing homelessness or living in encampments. In the letter, we offered millions of dollars in additional funding in exchange for partnering with us and matching our contributions.

The funding on offer is the $250 million we announced to address the urgent issue of encampments and unsheltered homelessness in Budget 2024. This is in addition to federal investments through the:

- Reaching Home program to prevent and reduce homelessness;

- Affordable Housing Fund and bilateral agreements under the National Housing Strategy to build affordable and supportive housing;

- Co-operative Housing Development Program to support growth in the co-op sector;

- Apartment Construction Loan Program to build more rental homes in the market for middle-class Canadians; and

- Housing Accelerator Fund to help cities make it easier to build more homes, faster.

One month has passed since we made the offer. To date, the following provinces have not formally responded to us to help find homes for those in need, and end encampments in their respective jurisdictions:

- Alberta

- Ontario

- Saskatchewan

While some have since entered election periods, there was ample engagement before the letter was sent, and there is no longer time to wait as the weather gets colder. In these cases – along with any others who do not take quick action – we are now approaching municipalities directly to work with them, urgently.

If a province or territory partners with us, they will be able to select the communities that will get funding from us. Should they wish to forego a partnership with us, we will rely on the best available data to inform our decisions.

We will approach five cities first given their readiness to quickly adopt cost-matched responses. They are: Calgary, Edmonton, Toronto, Regina, and Saskatoon. This list is not exhaustive, as we will be approaching more communities that have demonstrated an ability to quickly respond to encampments.

No one level of government can tackle the housing crisis, or support those in need, alone. I am disappointed that these provincial governments are not willing to partner with us, as it means we cannot support as many communities as we would have been able to had they come to the table with funding and solutions. But, let me be clear: we will no longer wait for them to muster the political will to act as winter gets closer and lives are put at risk.

Sofia Ouslis

Communications Advisor

Office of the Minister of Housing, Infrastructure and Communities

Sofia.ouslis@infc.gc.ca

SOURCE Department of Housing, Infrastructure and Communities

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/22/c7270.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/22/c7270.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ADT's Earnings: A Preview

ADT ADT is preparing to release its quarterly earnings on Thursday, 2024-10-24. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect ADT to report an earnings per share (EPS) of $0.14.

Investors in ADT are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

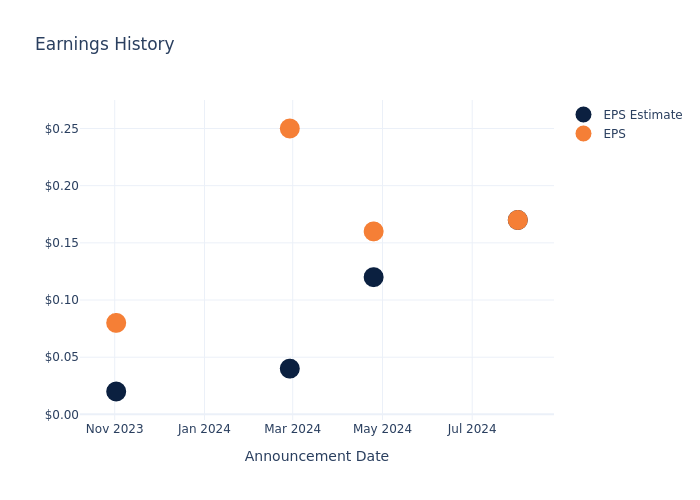

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.00, leading to a 2.26% drop in the share price on the subsequent day.

Here’s a look at ADT’s past performance and the resulting price change:

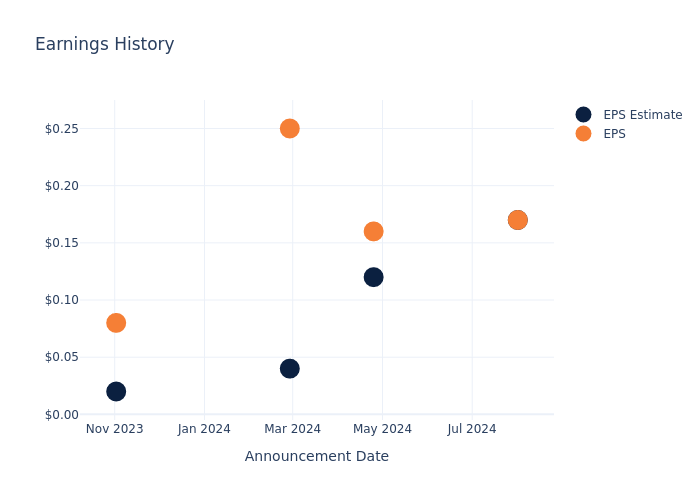

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.17 | 0.12 | 0.04 | 0.02 |

| EPS Actual | 0.17 | 0.16 | 0.25 | 0.08 |

| Price Change % | -2.0% | 2.0% | 1.0% | -6.0% |

Tracking ADT’s Stock Performance

Shares of ADT were trading at $6.96 as of October 22. Over the last 52-week period, shares are up 17.81%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for ADT visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.