Elizabeth Warren Challenger Joins Others In Opposing Michael Saylor's Bitcoin Storage Stance: Nothing More American Than The Right To Self Custody

A controversial take on Bitcoin BTC/USD self-custody by MicroStrategy CEO Michael Saylor has riled up privacy advocates, prompting disagreements and counter-arguments.

What happened: During a recent interview, Saylor called the narrative a “myth and trope” propagated by “paranoid crypto-anarchists.”

Taking a contrarian position, Saylor said that there was a higher risk of seizure if Bitcoin was held by unregulated entities that don’t have trust in the government and traditional economy.

Jameson Lopp, a popular technologist and Bitcoin advocate, took strong exception to Saylor’s stance. Citing the example of gold, Lopp stated that most seizures in history happened at financial institutions that held gold on behalf of clients, as opposed to those held in self-custody.

Lopp even reminded everyone of Bitcoin’s fundamentals, as outlined in the whitepaper, which was rooted in a lack of trust in the third party.

These positions were also backed by pro-cryptocurrency senate hopeful John Deaton.

“In today’s world, it is difficult to think of anything more American than a person’s inalienable right to self-custody custody his/her own assets, whether those assets be gold bars, silver coins, art, or Bitcoin,” Deaton, who is running against Sen. Elizabeth Warren (D-Mass.), said.

Why It Matters: While self-custody wallets offer several advantages, they do not provide a foolproof solution against the risks of hacking.

In December last year, crypto hardware wallet provider Ledger became the target of a sophisticated attack, which led to the theft of approximately $484,000 in assets.

While having ownership over one’s private keys provides a sense of security, it also requires greater responsibility.

Consider the bizarre case of James Howells, who accidentally put a hard drive containing 8,000 BTCs in the trash while cleaning his office. The discarded stash is worth hundreds of millions of dollars today.

Price Action: At the time of writing, Bitcoin was exchanging hands at $66,962.86, down 0.51% in the last 24 hours, according to data from Benzinga Pro.

Image via Michael

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Samsung Biologics reports third quarter 2024 financial results

- Recorded Q3’24 consolidated revenue of KRW 1.2 trillion

- Recorded Q3’24 consolidated operating profit of KRW 338.6 billion

- Continued business expansion through strong competitive edge in speed and execution

INCHEON, South Korea, Oct. 23, 2024 /PRNewswire/ — Samsung Biologics (KRX: 207940.KS), a global contract development and manufacturing organization (CDMO), today announced financial results for the third quarter of fiscal year 2024.

“We made steady progress this quarter, achieving consistent performance across all our plants while expanding our capabilities to better address the needs of our clients,” said John Rim, CEO and President of Samsung Biologics. “As we continue to enhance our CMO technologies and introduce new CDO platforms, we remain committed to providing high-quality, innovative solutions that are essential for development and manufacturing success maximized through our unique operational excellence initiatives. This will reinforce our efforts to deepen our global partnerships and enhance the value we offer to our clients.”

THIRD QUARTER 2024 RESULTS

In the third quarter, consolidated revenue reached KRW 1.2 trillion, marking a 15% increase compared to the previous year, while operating profit stood at KRW 338.6 billion. On a standalone basis, the company achieved revenue of KRW 1.1 trillion, while operating profit reached KRW 444.7 billion. The quarter’s results were buoyed by the contribution of the newest Plant 4 and the full utilization of Plants 1 through 3.

|

[Consolidated Earnings, KRW billion] |

|||

|

Q3’24 |

Q3’23 |

YoY |

|

|

Revenue |

1,187.1 |

1,034.0 |

+153.1 (+14.8%) |

|

Operating |

338.6 |

318.5 |

+20.1 (+6.3%) |

|

EBITDA |

495.4 |

457.1 |

+38.3 (+8.4%) |

Samsung Biologics has strengthened its partnerships with global pharmaceutical companies, now collaborating with 17 of the top 20 pharma clients. The total contract volume for 2024 has exceeded USD 3.3 billion, with a cumulative contract volume of USD 15.4 billion. The company has achieved over 335 regulatory approvals since its founding in 2011, demonstrating its commitment to high standards of quality and compliance.

FISCAL YEAR 2024 OUTLOOK

Samsung Biologics has raised its annual revenue growth guidance to 15-20%, driven by the successful ramp-up of Plant 4 operations and favorable foreign exchange rates. The company continues to make steady progress on key strategic initiatives, including the construction of its dedicated, standalone ADC facility by the year’s end, along with Plant 5, scheduled to be operational in April 2025.

The company is also poised to delivering solutions that better cater clients’ needs for complex and high-concentration biopharmaceuticals. Recent development platform launches — S-AfuCHO™, S-OptiCharge™, and S-HiCon™ — provide advanced capabilities, from generating afucosylated antibodies with enhanced ADCC activity to optimizing charge variant distribution for improved safety and efficacy. These technologies are designed to support the growing demand for complex biopharmaceuticals and enable clients to achieve their therapeutic goals.

Looking ahead, Samsung Biologics expects to gain further momentum through enhanced capabilities and the expansion of manufacturing partnerships with leading pharmaceutical and biotech companies. The company continues to invest in innovative companies with promising technologies to accelerate the delivery of advanced solutions through the Samsung Life Science Fund.

Samsung Biologics is committed to further integrating sustainable practices throughout its operations. In August, the company joined the Pharmaceutical Supply Chain Initiative as a Supplier Partner. This partnership complements Samsung Biologics’ role within the Sustainable Market Initiative’s Health Systems Task Force to decarbonize supply chains. Moving forward, the company will prioritize responsible business practices and build resilient supply chains that contribute to a sustainable healthcare ecosystem.

For more details on performance and financials, please refer to the Earnings Release.

About Samsung Biologics Co., Ltd.

Samsung Biologics (KRX: 207940.KS) is a fully integrated, end-to-end CDMO service provider, offering seamless development and manufacturing solutions from cell line development to final aseptic fill/finish as well as laboratory testing support for the biopharmaceutical products we manufacture. Our state-of-the-art facilities are CGMP compliant with bioreactors ranging from small to large scales to serve varying client needs. To maximize our operational efficiency and expand our capabilities in response to growing biomanufacturing demand, Samsung Biologics completed Bio Campus I with Plant 4, offering a combined 604 kL total capacity, and launched Bio Campus II with the construction of Plant 5, which will be operational in April 2025, adding 180 kL biomanufacturing capacity. Additionally, Samsung Biologics America enables the company to work in closer proximity to clients based in the U.S. and Europe. We continue to upgrade our capabilities to accommodate our clients by investing in technologies such as an antibody-drug conjugate (ADC) facility, a dedicated mRNA manufacturing facility, and additional aseptic filling capacity. As a sustainable CDMO partner of choice, we are committed to on-time, in-full delivery of the products we manufacture with our flexible manufacturing solutions, operational excellence, and proven expertise.

Samsung Biologics Media Contact

Claire Kim, Head of Global Marketing & Communications

cair.kim@samsung.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/samsung-biologics-reports-third-quarter-2024-financial-results-302284227.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/samsung-biologics-reports-third-quarter-2024-financial-results-302284227.html

SOURCE Samsung Biologics

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meet the 17 people in the $100 billion club — who are jointly worth more than Amazon or Google

-

The elite group worth more than $100 billion includes Elon Musk, Jeff Bezos, and Bill Gates.

-

The 17 members have grown about $500 billion richer this year and are jointly worth $2.5 trillion.

-

Walmart heirs Jim, Rob, and Alice Walton joined the club for the first time in September.

Elon Musk, Jeff Bezos, and Mark Zuckerberg are among the handful of people on the planet with a net worth above $100 billion.

Members of this elite group have amassed 12-digit fortunes by owning huge amounts of stock in some of the world’s most valuable companies. Most are founders and either current or former CEOs, and some, such as Warren Buffett, would be much richer if they didn’t give billions to charity.

There may be only 17 centibillionaires, but their combined wealth is around $2.5 trillion, according to the Bloomberg Billionaires Index. They’re worth more than Amazon or Google-parent Alphabet, which command market values of around $2 trillion each.

All but one of them have grown richer this year, adding a net $504 billion to their collective fortunes. Oracle ($481 billion), Mastercard ($476 billion), and Home Depot ($404 billion) are all worth less than that.

Walmart heirs Jim, Rob, and Alice Walton joined the exclusive group in September, thanks to their net worths surging by over $30 billion this year.

Here’s the list of individuals worth at least $100 billion, showing Bloomberg’s estimate of their net worth at the time of publication, how much it’s changed this calendar year, and the source of their wealth.

All figures are correct as of October 21, 2024.

1. Elon Musk

Net worth: $241 billion

YTD change in wealth: +$11.5 billion

Source of wealth: Tesla and SpaceX stock

Elon Musk is the CEO of the electric-vehicle maker Tesla and the spacecraft manufacturer SpaceX. He’s also the owner of X, the social network formerly known as Twitter.

His other businesses include The Boring Company, Neuralink, and xAI.

2. Jeff Bezos

Net worth: $212 billion

YTD change in wealth: +$35 billion

Source of wealth: Amazon stock

Jeff Bezos is the founder, executive chairman, and former CEO of Amazon, the e-commerce and cloud-computing giant.

He also founded the space company Blue Origin and owns The Washington Post.

3. Mark Zuckerberg

Net worth: $204 billion

YTD change in wealth: +$75.6 billion

Source of wealth: Meta stock

Mark Zuckerberg is the cofounder, chairman, and CEO of Meta Platforms, the social-media titan behind Facebook, Instagram, WhatsApp, and Threads.

Meta’s Reality Labs division makes virtual-reality and augmented-reality headsets and experiences.

Spirit Airlines Stock Jumps Over 16% In After-Hours Trading Amid Frontier's Renewed Merger Interest: Report

Frontier Group Holdings Inc. ULCC is reportedly considering the possibility of a renewed acquisition of Spirit Airlines Inc. SAVE amid the latter’s ongoing discussions with bondholders over a potential bankruptcy filing.

What Happened: The two low-cost carriers have recently engaged in preliminary merger discussions. However, the talks are still in their early stages and may not result in a deal, The Wall Street Journal reported, citing people familiar with the matter.

If a merger is agreed upon, it is likely to occur as part of Spirit’s debt and liability restructuring during bankruptcy proceedings. Spirit is currently negotiating with bondholders over potential bankruptcy terms while also exploring out-of-court options to restructure its balance sheet.

Spirit has been under significant financial strain, particularly after a failed merger with JetBlue Airways Corporation JBLU and years of losses.

Frontier Group Holdings Inc. and Spirit Airlines Inc. did not immediately respond to Benzinga‘s request for comment.

Why It Matters: The news of the potential merger comes in the wake of Spirit’s recent stock performance. The airline’s shares dropped by 6.22% on Tuesday, likely due to profit-taking after a Monday rally. This rally followed the announcement of an extension of the company’s debt refinancing deadline.

Earlier in October, Spirit modified its card processing agreement, extending the deadline for its 2025 notes and the early maturity date. This followed ongoing negotiations with the U.S. National Bank Association regarding Visa and MasterCard payments.

Price Action: Spirit Airlines stock closed at $2.11 on Tuesday, down 6.22% for the day. In after-hours trading, the stock rose 16.59%. Year-to-date, Spirit Airlines has seen a significant decline of 87.09%.

Meanwhile, Frontier Group Holdings Inc. closed at $6.72 on Tuesday, down 2.75%. After hours, the stock dipped 0.45%. Year-to-date, Frontier Group has experienced an increase of 26.55%, according to data from Benzinga Pro.

Read Next:

Image via Wikimedia Commons

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mattel, Hasbro Ahead Of Earnings, Holiday Season: JPMorgan Says Consumers 'Remain Soft'

JPMorgan offered a preview of third-quarter earnings for Mattel, Inc. MAT and Hasbro, Inc. HAS before the toymakers report later this week.

Mattel: JPMorgan analyst Christopher Horvers highlighted Mattel’s success in expanding shelf space at major retail partners which coincides with Barbie’s 65th Anniversary and the release of Mini Barbie Land and Barbie Dreamworld.

Read Next: Nuclear Energy Stocks Are Hot: Here’s A List Of Tickers To Watch

While the analyst said the stock’s setup is starting to improve, he also warned consumers remain soft and “very choiceful in how they spend money.”

Horvers also pointed to a shorter holiday season with five fewer days between Thanksgiving and Christmas as well as the presidential election as potential drags on Mattel’s stock.

The JPMorgan analyst maintained a Neutral rating on Mattel, but raised its price target from $22 to $23.

Mattel is set to report on Wednesday after the market close, followed by a conference call to discuss the results at 5 p.m. ET. According to data from Benzinga Pro, the Street estimates Mattel will report earnings of 95 cents per share on revenue of $1.858 billion.

Hasbro: Horvers pointed to Hasbro’s recent Transformers release and new products across its Beyblade, Play Doh and Peppa Pig lines as the “start of a stronger holiday setup after several years of more glacial innovation.” The analyst also expects any weakness in the stock to be bought given Hasbro’s improving innovation and a strong year ahead for the company’s Magic and Go! brands.

JPMorgan maintained its Overweight rating on Hasbro and raised its price target from $76 to $82 heading into the company’s third-quarter report.

Hasbro is set to report its results on Thursday before the opening bell, followed by a conference call at 8:30 a.m. ET. According to data from Benzinga Pro, the Street estimates Hasbro will report earnings of $1.28 per share on revenue of $1.295 billion.

MAT, HAS Price Action: According to Benzinga Pro, Mattel shares ended Tuesday’s session down 1.68% at $18.11 and Hasbro shares closed 1.25% lower at $71.04.

Read Also:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Peter Schiff Predicts A 'Bloodbath' For MicroStrategy Stock, Calls It The Most Overvalued On MSCI World Index

Influential economist Peter Schiff predicted a crash for Bitcoin BTC/USD development company MicroStrategy Inc. MSTR, terming it the most overvalued stock in the MSCI World Index.

What Happened: In an X post on Tuesday, Schiff wrote, “$MSTR has got to be the most overvalued stock in the MSCI World Index. When it finally crashes, that’s gonna be the real bloodbath!”

The MSCI World is a widely watched global stock market index that tracks the performance of about 1500 large and mid-cap companies from 23 developed nations. Added to the index earlier in March, MicroStrategy stock has a weightage of 0.039380% as of June 3, 2024 data.

The MSCI World Index gained nearly 24% in 2023, and so far in 2024, it has returned an average of 18.86%. The MicroStrategy stock has surged 220.64% year-to-date.

The stock’s Relative Strength Index, or RSI, was just above 70 as of this writing, as per Trading View, suggesting overvaluation. Interestingly, Wells Fargo & Co. WFC, which is also part of the index, had a higher RSI of 76.13.

This prediction comes in the wake of Schiff’s earlier suggestion to MicroStrategy’s founder, Michael Saylor, to purchase the large quantity of Bitcoin that the U.S. government planned to sell. Schiff’s recommendation was made in jest, following the U.S. government’s decision to liquidate 69,370 BTC it had seized from the dark web marketplace, Silk Road.

Why It Matters: Schiff is well-known to be critical of all things Bitcoin, and MicroStrategy, which sits on huge stashes of the cryptocurrency, is no exception.

Earlier this month, Schiff encouraged Michael Saylor, MicroStrategy’s founder, to borrow billions to buy the seized Bitcoin that the U.S. government would potentially sell, in what was a veiled jibe at the company’s Bitcoin strategy.

He has previously questioned the ‘never sell your Bitcoin’ strategy advocated by Saylor, also backed by presidential hopeful Donald Trump on the campaign trail.

Price Action: At the time of writing, Bitcoin was exchanging hands at $67,078.87, down 0.51% in the last 24 hours, according to data from Benzinga Pro. Shares of MicroStrategy closed 0.30% higher at $219.70 during Tuesday’s regular trading session.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biogas Compression Market Set to Hit USD 319.2 million by 2031, with 21.2% CAGR: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 22, 2024 (GLOBE NEWSWIRE) — The global biogas compression market (바이오가스 압축 시장) is estimated to flourish at a CAGR of 21.2% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for biogas compression is estimated to reach US$ 319.2 million by the end of 2031.

Evolving financing models are playing a crucial role in market growth. Innovative financing mechanisms such as green bonds, crowd funding, and public-private partnerships are providing funding avenues for biogas projects, particularly in emerging economies where traditional financing may be limited.

Regulatory harmonization efforts are streamlining biogas project development across borders. Standardization of regulations and permitting processes facilitates cross-border investment and project deployment, fostering market expansion and global collaboration in the biogas compression sector.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85452

Advancements in biogas upgrading technologies are enhancing the quality of biogas for injection into natural gas pipelines. This trend opens up new opportunities for biogas utilization in sectors such as transportation and heating, driving demand for biogas compression systems tailored for pipeline injection applications.

Key Findings of the Market Report

- Screw compressors lead the biogas compression market, offering efficient and reliable compression solutions tailored to the specific requirements of biogas applications.

- Biomethane emerges as the leading application segment in the biogas compression market, driven by its versatility and potential as a renewable fuel source.

- Europe emerges as the leading region in the biogas compression market, driven by robust regulatory support and significant investments in renewable energy infrastructure.

Biogas Compression Market Growth Drivers & Trends

- Increasing adoption of renewable energy sources, driven by government mandates and environmental concerns, boosts demand for biogas compression solutions.

- Continuous innovation in compression technology enhances efficiency and reliability, making biogas compression more viable and cost-effective.

- Growing emphasis on waste-to-energy solutions promotes biogas production, driving the need for efficient compression infrastructure.

- Biogas offers a decentralized energy source, reducing dependence on traditional fossil fuels and enhancing energy security in various sectors.

- Emerging applications of biogas, such as transportation fuel and power generation, open new avenues for market growth and diversification.

Global Biogas Compression Market: Regional Profile

- In North America, stringent environmental regulations and increasing focus on renewable energy solutions propel the demand for biogas compression technologies. The United States, in particular, witnesses significant investments in biogas infrastructure, driven by government incentives and growing awareness of sustainable energy practices.

- Europe stands as a frontrunner in the global biogas compression market, buoyed by ambitious renewable energy targets and robust regulatory support. Countries like Germany, Sweden, and the Netherlands lead in biogas production and utilization, fostering a thriving market ecosystem with a strong emphasis on technology development and deployment.

- Asia Pacific showcases immense growth potential in the biogas compression market, driven by rapid industrialization and urbanization. Countries such as China, India, and Japan are investing in biogas infrastructure to address energy security concerns and mitigate environmental pollution. Government initiatives promoting clean energy adoption further catalyze market expansion across the region.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85452

Biogas Compression Market: Competitive Landscape

The biogas compression market features a competitive landscape marked by a blend of established players and emerging entrants striving to meet the rising demand for biogas compression solutions. Leading companies such as Atlas Copco, EnviTec Biogas, and Xebec Adsorption dominate with their extensive product portfolios and global presence.

Innovative startups like Greenlane Renewables and Unison Solutions are disrupting the market with cutting-edge technologies and tailored solutions. Strategic partnerships, mergers, and acquisitions are common strategies among key players to enhance market foothold and expand product offerings, intensifying competition and fostering innovation in the biogas compression sector. Some prominent players are as follows:

- Tetra Tech

- Aerzen

- Gardner Denver

- Biokomp Srl

- Hindustan Petroleum Corporation Limited,

- HAUG Sauer Kompressoren AG

- Bauer Compressors Inc.

- Enea Mattei S.p.A.

- Mehrer Compression GmbH

- Tecno Project Industriale Srl

- Avelair

- Fornovo Gas S.p.A.

- Chicago Pneumatic

- Swamatics

- DBS Engineering Services

Product Portfolio

- Tetra Tech offers comprehensive consulting, engineering, and technical services to address complex environmental, infrastructure, and natural resource challenges worldwide. With a focus on sustainability and innovation, Tetra Tech delivers tailored solutions to clients across various sectors, ensuring resilience and long-term success.

- Aerzen specializes in providing high-performance rotary lobe blowers, screw compressors, and gas meters for diverse industrial applications. With a commitment to innovation and reliability, Aerzen delivers energy-efficient solutions that meet the rigorous demands of customers worldwide, ensuring optimal performance and operational excellence.

- Gardner Denver offers a wide range of industrial equipment, including air compressors, blowers, and vacuum pumps, designed to enhance productivity and efficiency across various industries. With a legacy of engineering excellence and customer-focused solutions, Gardner Denver remains a trusted partner for reliable and innovative equipment solutions.

Biogas Compression Market: Key Segments

By Compressor Type

- Piston

- Screw

- Vane

- Liquid Ring

- Diaphragm

- Others

By Application

- Biomethane

- Transportation

- Combined Heat and Power

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=85452<ype=S

More Trending Reports by Transparency Market Research –

Hydrogen Compressor Market (水素圧縮機市場) – The global hydrogen compressor market is projected to advance at a CAGR of 5.8% from 2023 to 2031

Geophysical Exploration Equipment Market (سوق معدات الاستكشاف الجيوفيزيائية) – The global geophysical exploration equipment market is projected to expand at a CAGR of 4.1% during the forecast period from 2023 to 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

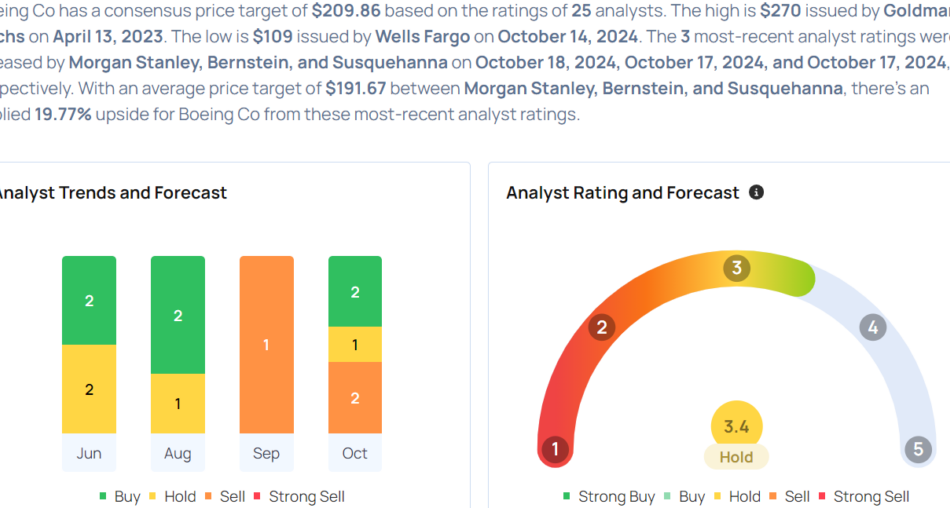

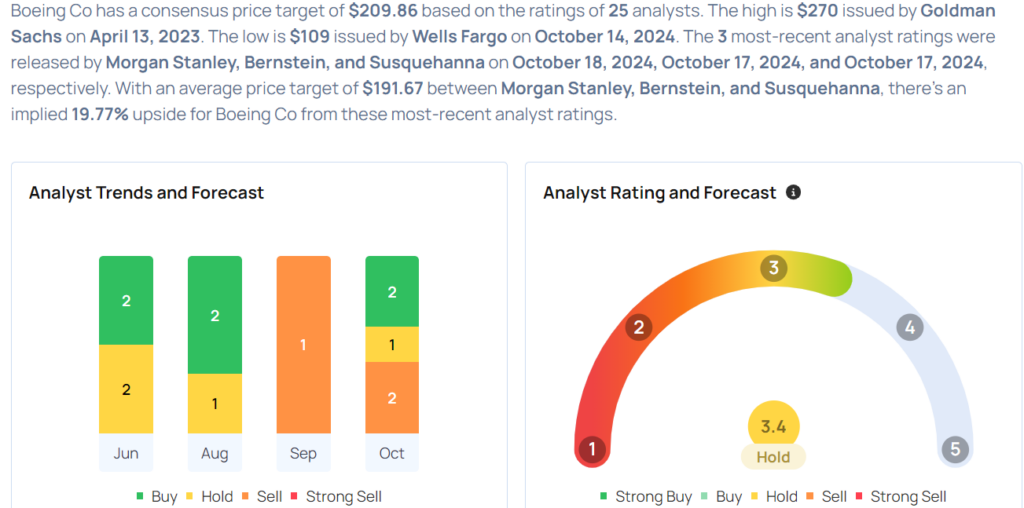

Boeing Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

The Boeing Company BA will release earnings results for its third quarter, before the opening bell on Wednesday, Oct. 23.

Analysts expect the Arlington, Virginia-based company to report a quarterly loss at $10.52 per share, versus a year-ago loss of $10.48 per share. Boeing projects to report revenue of $6.06 billion for the quarter, compared to $17.82 billion, compared to $16.51 billion a year earlier, according to data from Benzinga Pro.

According to Reuters, Boeing plans to issue around $10 billion in new shares and $5 billion in mandatory convertible bonds, a hybrid bond that converts into equity at a predetermined date. The plane maker also filed regulatory documents indicating it could raise up to $25 billion in stock and debt.

Boeing shares rose slightly to close at $159.88 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Kristine Liwag maintained an Equal-Weight rating and cut the price target from $195 to $170 on Oct. 18. This analyst has an accuracy rate of 71%.

- Citigroup analyst Jason Gursky maintained a Buy rating and slashed the price target from $224 to $209 on Oct. 15. This analyst has an accuracy rate of 83%.

- TD Cowen analyst Cai Rumohr maintained a Buy rating and cut the price target from $200 to $190 on Oct. 14. This analyst has an accuracy rate of 77%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and lowered the price target from $235 to $195 on Oct. 14. This analyst has an accuracy rate of 85%.

- Wells Fargo analyst Matthew Akers maintained an Underweight rating and cut the price target from $110 to $109 on Oct. 14. This analyst has an accuracy rate of 78%.

Considering buying BA stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.