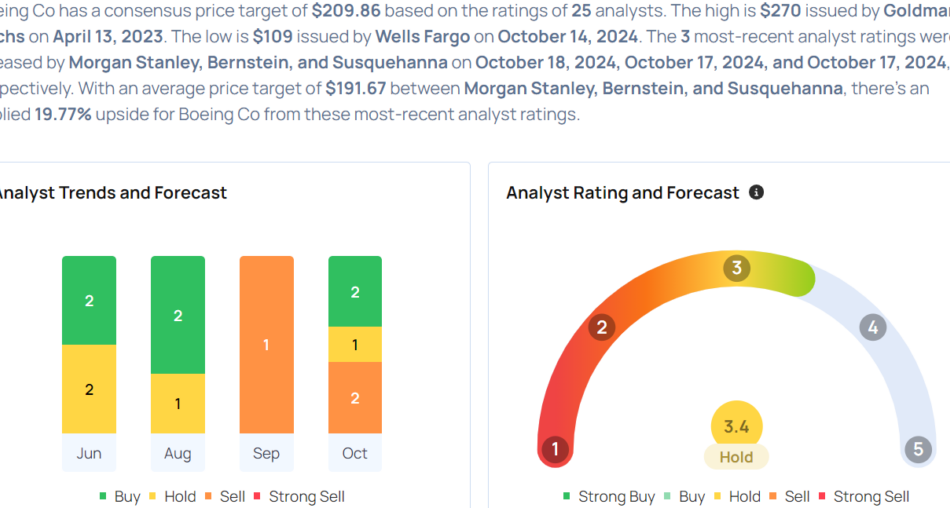

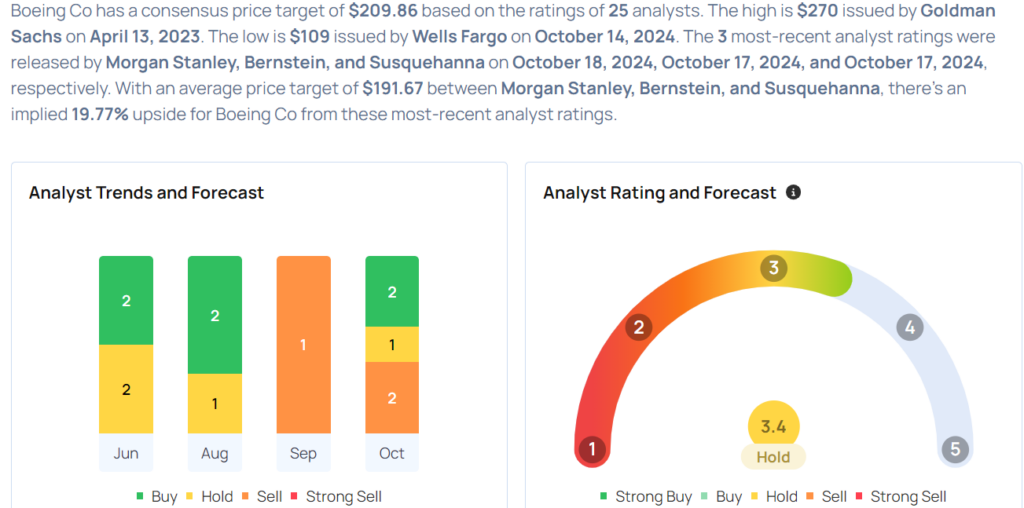

Boeing Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

The Boeing Company BA will release earnings results for its third quarter, before the opening bell on Wednesday, Oct. 23.

Analysts expect the Arlington, Virginia-based company to report a quarterly loss at $10.52 per share, versus a year-ago loss of $10.48 per share. Boeing projects to report revenue of $6.06 billion for the quarter, compared to $17.82 billion, compared to $16.51 billion a year earlier, according to data from Benzinga Pro.

According to Reuters, Boeing plans to issue around $10 billion in new shares and $5 billion in mandatory convertible bonds, a hybrid bond that converts into equity at a predetermined date. The plane maker also filed regulatory documents indicating it could raise up to $25 billion in stock and debt.

Boeing shares rose slightly to close at $159.88 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Kristine Liwag maintained an Equal-Weight rating and cut the price target from $195 to $170 on Oct. 18. This analyst has an accuracy rate of 71%.

- Citigroup analyst Jason Gursky maintained a Buy rating and slashed the price target from $224 to $209 on Oct. 15. This analyst has an accuracy rate of 83%.

- TD Cowen analyst Cai Rumohr maintained a Buy rating and cut the price target from $200 to $190 on Oct. 14. This analyst has an accuracy rate of 77%.

- JP Morgan analyst Seth Seifman maintained an Overweight rating and lowered the price target from $235 to $195 on Oct. 14. This analyst has an accuracy rate of 85%.

- Wells Fargo analyst Matthew Akers maintained an Underweight rating and cut the price target from $110 to $109 on Oct. 14. This analyst has an accuracy rate of 78%.

Considering buying BA stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Bitcoin Wallet Activity A Rotation, Not A Sell-Off, Says Analytics Firm As Elon Musk-Headed EV Giant Expected To Reveal Q3 Numbers

Elon Musk’s EV juggernaut Tesla Inc. TSLA was reportedly still in possession of its Bitcoin BTC/USD holdings, and the recent transfers were nothing but reallocation.

What Happened: On-chain analytics firm Arkham Intelligence posted an update on X on Tuesday, saying, “We believe that the Tesla wallet movements that we reported on last week were wallet rotations with the Bitcoin still owned by Tesla.”

About 11,509 BTCs, worth $771.8 million as of this writing, were moved by a wallet linked to Tesla to several wallets last week, sparking speculation in the market.

As per the latest update, the holdings were distributed across seven wallets that hold between 1100 and 2200 BTC.

“Some have speculated that this is movement to a custodian, for example, to secure a loan against the BTC,” Arkham added.

Tesla didn’t immediately return Benzinga’s request for comment on the transfers.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Kintara Therapeutics Announces Correction to Prior Announcement Regarding CVR Issuance in Connection with the Proposed Merger with TuHURA Biosciences Expected to Close on October 18, 2024

SAN DIEGO, Oct. 15, 2024 /PRNewswire/ — Kintara Therapeutics, Inc. (“Kintara”) KTRA, a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced a correction to the press release previously issued by Kintara on October 14, 2024, regarding a record date for the issuance of the Contingent Value Rights (“CVRs”) to stockholders of Kintara pursuant to the definitive merger agreement (the “Merger Agreement”) with TuHURA Biosciences, Inc. (“TuHURA”). Kintara announced today that the CVRs will not be issued to stockholders of record of Kintara based on a record date of October 17, 2024, but rather will be issued stockholders of record of Kintara immediately prior to the planned reverse stock split that will be consummated immediately prior to the proposed Merger. Accordingly, the announcement of a record date for the CVRs made by Kintara on October 14, 2024 is hereby retracted. Kintara does not anticipate that this correction and retraction will affect the stockholders of record who will receive the CVRs or the number of CVRs to be received by them.

As previously announced, Kintara’s stockholders approved a reverse stock split of Kintara’s common stock in a range of 1-for-20 to 1-for-40 at Kintara’s special meeting of stockholders held on October 4, 2024. Kintara expects to effect a reverse stock split at a ratio of 1-for-35 immediately prior to the consummation of the proposed Merger.

Also as previously announced, the proposed Merger is expected to close on October 18, 2024 (the “Closing Date”), subject to regulatory approval and the satisfaction of the remaining closing conditions under the Merger Agreement.

In connection with the proposed Merger and pursuant to the Contingent Value Rights Agreement (the “CVR Agreement”) to be entered into prior to the Closing Date, Kintara will issue a number of CVRs to Kintara stockholders entitling the holders thereof to an aggregate of 53,897,125 shares of Kintara’s common stock, which number is subject to adjustment as a result of Kintara’s proposed reverse stock split described above upon the achievement of certain milestones as set forth in the CVR Agreement. Kintara stockholders of record immediately prior to the reverse stock split will receive one CVR per share of Kintara common stock (or in the case of warrants to purchase shares of Kintara common stock, each share of Kintara common stock for which such warrant to purchase shares of Kintara stock is exercisable) each respectively owned. The CVRs will be issued immediately prior to the proposed reverse stock split and closing of the proposed Merger.

Equiniti Trust Company, LLC is acting as the rights agent for CVRs. Stockholders holding their shares in book-entry form or in brokerage accounts need not take any action in connection with the issuance of CVRs. Beneficial holders are encouraged to contact their bank, broker or custodian with any procedural questions.

About TuHURA Biosciences, Inc.

TuHURA Biosciences is a Phase 3 registration-stage immuno-oncology company developing novel technologies to overcome resistance to cancer immunotherapy. TuHURA’s lead personalized cancer vaccine candidate, IFx-2.0, is designed to overcome primary resistance to checkpoint inhibitors. TuHURA is preparing to initiate a single randomized placebo-controlled Phase 3 registration trial of IFx-2.0 administered as an adjunctive therapy to Keytruda® (pembrolizumab) in first line treatment for advanced Merkel Cell Carcinoma.

In addition, TuHURA is leveraging its Delta receptor technology to develop novel bi-specific antibody drug or peptide drug conjugates (ADCs and PDCs), targeting Myeloid Derived Suppressor Cells to inhibit their immune suppressing effects on the tumor microenvironment to prevent T cell exhaustion and acquired resistance to checkpoint inhibitors and cellular therapies.

For more information, please visit tuhurabio.com and connect with TuHURA on Facebook, X, and LinkedIn.

About Kintara Therapeutics, Inc.

Located in San Diego, California, Kintara is dedicated to the development of novel cancer therapies for patients with unmet medical needs. Kintara is developing therapeutics for clear unmet medical needs with reduced risk development programs. Kintara’s lead program is REM-001 Therapy for cutaneous metastatic breast cancer (CMBC).

Kintara has a proprietary, late-stage photodynamic therapy platform that holds promise as a localized cutaneous, or visceral, tumor treatment as well as in other potential indications. REM-001 Therapy, which consists of the laser light source, the light delivery device, and the REM-001 drug product, has been previously studied in four Phase 2/3 clinical trials in patients with CMBC who had previously received chemotherapy and/or failed radiation therapy. In CMBC, REM-001 has a clinical efficacy to date of 80% complete responses of CMBC evaluable lesions and an existing robust safety database of approximately 1,100 patients across multiple indications.

Kintara Therapeutics, Inc. is headquartered in San Diego, California. For more information, please visit www.kintara.com or follow us on X at @Kintara_Thera, Facebook and LinkedIn.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based upon Kintara’s and TuHURA’s current expectations. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. Examples of such forward-looking statements include but are not limited to express or implied statements regarding Kintara’s or TuHURA’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding the proposed Merger and the expected effects, perceived benefits or opportunities and related timing with respect thereto. These statements are only predictions. Kintara and TuHURA have based these forward-looking statements largely on their then-current expectations and projections about future events, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of Kintara’s and TuHURA’s control, and actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: (i) the risk that the conditions to the closing or consummation of the proposed Merger are not satisfied; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the proposed Merger; (iii) risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the proposed Merger, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the proposed Merger by either Kintara or TuHURA; (v) the effect of the announcement or pendency of the proposed Merger on Kintara’s or TuHURA’s business relationships, operating results and business generally; (vi) costs related to the proposed Merger; (vii) the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; (vii) the ability of Kintara or TuHURA to protect their respective intellectual property rights; (viii) competitive responses to the proposed Merger; (ix) unexpected costs, charges or expenses resulting from the proposed Merger; (x) whether the combined business of TuHURA and Kintara will be successful; (xi) legislative, regulatory, political and economic developments; and (xii) additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024, and the Registration Statement on Form S-4 related to the proposed Merger filed with the SEC. Additional assumptions, risks and uncertainties are described in detail in Kintara’s registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither Kintara nor TuHURA can assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law or regulation, Kintara and TuHURA undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

INVESTOR INQUIRIES:

Robert E. Hoffman

Kintara Therapeutics

rhoffman@kintara.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/kintara-therapeutics-announces-correction-to-prior-announcement-regarding-cvr-issuance-in-connection-with-the-proposed-merger-with-tuhura-biosciences-expected-to-close-on-october-18-2024-302276973.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/kintara-therapeutics-announces-correction-to-prior-announcement-regarding-cvr-issuance-in-connection-with-the-proposed-merger-with-tuhura-biosciences-expected-to-close-on-october-18-2024-302276973.html

SOURCE Kintara Therapeutics

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon boss to unhappy remote workers: Go find a new job

Amazon (AMZN) Web Services CEO Matt Garman has a message for the scores of workers unhappy about the return-to-work mandate: find another job.

Speaking at The Wall Street Journal’s (NWS) Tech Live event, Garman said Monday evening that requiring workers to be in the office five days a week starting in January is necessary for the company.

“Particularly as we really think about how do we want to disrupt and we want to invent on behalf of our customers, we find that there is no substitution for doing that in person,” Garman said, according to Business Insider.

The CEO believes innovation is best executed with speed in person. “Just the creative energy and how fast you’re able to iterate when you’re sitting there writing on a whiteboard or you’re talking to people in the cubicle next to you or you’re running into people that are in a different department, but you see them at the coffee line or whatever it is,” he said.

That’s why he happily told his employees: “If it’s not for you, then that’s okay — you can go and find another company if you want to.”

Garman said the three-day-a-week policy didn’t work because people came on different days. He also claimed that most employees were excited to be working in person.

He made a similar statement in a company-wide meeting last week, telling workers if they “just don’t work well in that environment and don’t want to, that’s okay, there are other companies around.”

“At Amazon, we want to be in an environment where we are working together, and we feel that collaborative environment is incredibly important for our innovation and for our culture,” he said.

When the new policy was announced, many employees took to internal forums to post their dissatisfaction. Some even publicly said they were quitting over the change.

Abcourt Announces its Results for the Fourth Quarter and annuals ended June 30, 2024

ROUYN-NORANDA, Quebec, Oct. 22, 2024 (GLOBE NEWSWIRE) — Abcourt Mines Inc. (“Abcourt” or the “Corporation”) ABI (OTCQB : ABMBF) announces its results for the fourth quarter and the year ended June 30, 2024. All monetary values in this press release are expressed in Canadian dollars, unless otherwise indicated. The financial statements and management report are available on SEDAR+.

Highlights for the year ended June 30, 2024

- In July 2023, the Company published the technical report and preliminary economic assessment for the Sleeping Giant project in compliance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects;

- In July 2023, Robert Gagnon, geologist, was appointed Vice-President Exploration of the Corporation;

- In November 2023, Abcourt completed a drilling campaign on the Flordin property. A total of 1,512 metres of drilling was completed (8 holes) in the Fall of 2023 in the eastern sector of the property, 1 km east of the area worked by Cambior in 1988. Hole FL-23-265 intersected two gold mineralized zones in an interval of 36 to 52 m. The first mineralized zone returned 3.58 g/t gold over 4 m from 36 to 40 m, and the second returned 14.79 g/t gold over 4 m from 48 to 52 m. This drilling campaign confirmed the presence of new high-grade gold zones located near surface;

- Exploration work totalled $4,682,986 for the year, with mainly prospecting and evaluation expenses incurred on the Sleeping Giant property for the underground drilling campaign in the amount of approximately $3,827,538 and for the processing of the 5,000-tonne bulk sample from the Courville property (Pershing Manitou);

- The Corporation has completed the processing of a 5,000 tonnes bulk sample from the Pershing-Manitou project in April 2024;

- The Corporation completed approximately 3,143 metres of definition and exploration drilling at the Sleeping Giant mine on the upper 4 levels of the mine to refine the geological model on these levels and support engineering planning towards a pre-feasibility economic study;

- Recovered 327 ounces of gold from 1,428 tonnes from the Sleeping Giant mine at a feed grade of 7.4 g/t, with a mill recovery of 95.7%;

- Recovery of 269.6 ounces of gold from 5,361 tonnes of the Pershing-Manitou project at a feed grade of 1.7 g/t, with a mill recovery of 89.9%;

- Sales of approximately 345 ounces of gold at an average realized price of $2,674 (US$1,992) per ounce, compared with 5,545 ounces of gold at an average realized price of $2,439 (US$1,832) in 2023. Gold sales are derived from gold recoveries during bulk sampling at the Courville (Pershing Manitou) and Sleeping Giant properties;

- On June 17, 2024, the Company entered into an option agreement with Québec Lafleur Minerals Inc. (formerly Québec Pegmatite Holdings Corp.) (« LaFleur »), under which Abcourt granted LaFleur the right to acquire a 100% interest in 141 mining claims held by the Company and covering approximately 5,579 hectares. The optioned property includes portions of the Courville and Abcourt Barvue projects, namely the Jolin (Courville) and Bartec (Abcourt-Barvue) sectors, and adjoins the Swanson property. LaFleur was required to pay $500,000 in cash within 10 days of signing the agreement to acquire 25% of the property (conditions met by June 30, 2024);

- On July 8, 2024, LaFleur chosed to accelerate the exercise of the remaining conditions of the agreement by making payment through the issuance of shares from its share capital for an amount totalling $1,500,000 to acquire the remaining 75% interest in the property. LaFleur issued 4,299,211 shares to Abcourt at a deemed price of $0.3489 per share;

- In August 2023, the Company granted 19,000,000 stock options to directors and officers, and certain employees and consultants of the Company;

- On April 30, 2024, at a special meeting of the Corporation’s shareholders, the disinterested shareholders approved a resolution permitting the creation of a controlling shareholder of the Company (as this term is defined in the policies of the Exchange), namely Francois Mestrallet, director, directly and through SARL MF;

- Between September 6th and December 15th, 2023, the Company closed four tranches of a private placement of 64,503,750 units at a price of $0.04 per unit for total gross proceeds of $2,580,150;

- Between March 26th and June 27th, 2024, the Company closed five tranches of a private placement of 88,434,400 units at a price of $0.05 per unit for total gross proceeds of $4,421,720;

- Cash of $757,753 at June 30, 2024, compared with $963,974 at June 30, 2023. Company’s negative working capital of $4,947,411 compared with $(4,476,223) at June 30, 2023.

About Abcourt Mines Inc.

Abcourt Mines Inc. is a Canadian gold exploration company with properties strategically located in northwestern Quebec, Canada. Abcourt owns the 100% owned Sleeping Giant Mine and Mill, where it focuses its operations. The Sleeping Giant Mine has a mining lease and environmental certificates of authorization to extract up to 800 tonnes per day from its underground mine.

For more information about Abcourt Mines Inc., please visit our website and view our filings under Abcourt’s profile on www.sedarplus.ca

FORWARD-LOOKING STATEMENTS

Certain information contained in this news release may constitute “forward-looking information” within the meaning of Canadian securities legislation. Generally, forward-looking information can be identified by forward-looking terminology, such as “plans”, “aims”, “expects”, “projects”, “intends”, “anticipates”, “estimates”, “could”, “should”, “likely”, or variations of these words and phrases or statements specifying that certain acts, events or results “may”, “would”, “would”, “would”, “would”, “would”, “occur” or “be achieved” or other expressions Similar. Forward-looking statements are based on Abcourt’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause Abcourt’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements or information. Forward-looking statements are subject to business, economic and uncertainties and other factors that could cause actual results to differ materially from these forward-looking statements, including the relevant assumptions and risk factors set out in Abcourt’s public filings, are available on SEDAR+ at www.sedarplus.ca. There can be no assurance that these statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Although Abcourt believes that the assumptions and factors used in preparing forward-looking statements are reasonable, undue reliance should not be placed on such statements. Except as required by applicable securities laws, Abcourt disclaims any intention or obligation to update or revise any of these forward-looking statements or information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spirit Airlines Stock Jumps Over 16% In After-Hours Trading Amid Frontier's Renewed Merger Interest: Report

Frontier Group Holdings Inc. ULCC is reportedly considering the possibility of a renewed acquisition of Spirit Airlines Inc. SAVE amid the latter’s ongoing discussions with bondholders over a potential bankruptcy filing.

What Happened: The two low-cost carriers have recently engaged in preliminary merger discussions. However, the talks are still in their early stages and may not result in a deal, The Wall Street Journal reported, citing people familiar with the matter.

If a merger is agreed upon, it is likely to occur as part of Spirit’s debt and liability restructuring during bankruptcy proceedings. Spirit is currently negotiating with bondholders over potential bankruptcy terms while also exploring out-of-court options to restructure its balance sheet.

Spirit has been under significant financial strain, particularly after a failed merger with JetBlue Airways Corporation JBLU and years of losses.

Frontier Group Holdings Inc. and Spirit Airlines Inc. did not immediately respond to Benzinga‘s request for comment.

Why It Matters: The news of the potential merger comes in the wake of Spirit’s recent stock performance. The airline’s shares dropped by 6.22% on Tuesday, likely due to profit-taking after a Monday rally. This rally followed the announcement of an extension of the company’s debt refinancing deadline.

Earlier in October, Spirit modified its card processing agreement, extending the deadline for its 2025 notes and the early maturity date. This followed ongoing negotiations with the U.S. National Bank Association regarding Visa and MasterCard payments.

Price Action: Spirit Airlines stock closed at $2.11 on Tuesday, down 6.22% for the day. In after-hours trading, the stock rose 16.59%. Year-to-date, Spirit Airlines has seen a significant decline of 87.09%.

Meanwhile, Frontier Group Holdings Inc. closed at $6.72 on Tuesday, down 2.75%. After hours, the stock dipped 0.45%. Year-to-date, Frontier Group has experienced an increase of 26.55%, according to data from Benzinga Pro.

Read Next:

Image via Wikimedia Commons

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I'm Earning $275k This Year. Can I Use a Backdoor Roth Strategy to Reduce Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

If you’re making $275,000 a year, you can’t contribute to a Roth IRA due to income limits. However, a backdoor conversion can allow a high earner to sock away unlimited sums in a Roth account, enabling tax-free requirement withdrawals and a way past pesky required minimum distribution rules (RMDs) that many pretax retirement account require. But this will likely require sufficient after-tax funds – such as from a non-retirement bank account or brokerage account – to pay the upfront tax bill that a backdoor conversion strategy generates.

Conversions are most advisable for savers who will be in a higher tax bracket after retirement. Assuming these conditions are met, a backdoor conversion can be a useful method of avoiding Required Minimum Distributions (RMDs) and enjoying tax-free withdrawals in retirement. Consider discussing a Roth backdoor conversion with a financial advisor to make sure you understand the ins and outs of this strategy.

Roth retirement accounts allow savers to use after-tax money to fund accounts where investments accumulate earnings tax-free and, in most circumstances, withdrawals are also tax-free. Another appealing feature of Roth accounts is that they are exempt from RMD rules requiring savers to begin withdrawing from pre-tax savings accounts such as IRAs and 401(k)s after age 73, which can expose retirees to unwelcome tax bills.

Roth IRAs also have income limits that make them inaccessible to some high earners. For 2024, individuals earning $161,000, married couples filing jointly earning $240,000 and married couples filing separately earning $10,000 are all prohibited from contributing to Roth retirement accounts at all.

However, since 2010 it’s been possible for a saver to convert unlimited funds from a pre-tax retirement account to a Roth account. This backdoor conversion, as it’s known, has become a popular way for people who earn and lot and have saved a lot to get the advantages of Roth accounts.

To perform a backdoor conversion, a saver can transfer funds from a pre-tax retirement account such as a 401(k). 401(k)s and other qualified accounts may not limit an investor based on his or her income, and its annual contribution limits are also much higher than Roth IRA contribution caps. Next, they transfer funds from their other retirement account to a new Roth IRA account. Because the funds from the 401(k) are pre-tax, the saver will have to pay income taxes on the converted amounts in that tax year, as if they were withdrawals treated as ordinary income. A large transfer can generate a large tax bill if the entire amount is converted at once. Sometimes conversions of large IRAs are done gradually over several years to manage the tax bill and keep the person in lower tax brackets.

Susan Kreh's Recent Buy: Acquires $239K In Oil-Dri Corp of America Stock

Susan Kreh, Chief Financial Officer at Oil-Dri Corp of America ODC, reported an insider buy on October 21, according to a new SEC filing.

What Happened: Kreh’s recent purchase of 3,500 shares of Oil-Dri Corp of America, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday, reflects confidence in the company’s potential. The total transaction value is $239,505.

As of Tuesday morning, Oil-Dri Corp of America shares are down by 1.27%, currently priced at $67.56.

Unveiling the Story Behind Oil-Dri Corp of America

Oil-Dri Corp of America develops, manufactures, and markets sorbent products made predominantly from clay. Its absorbent offerings, which draw liquid up, include cat litter, floor products, toxin control substances for livestock, and agricultural chemical carriers. The company has two segments based on the different characteristics of two primary customer groups namely Retail and Wholesale Products Group and Business to Business Products Group. The company’s products are sold under various brands such as Cat’s Pride, Jonny Cat, Amlan, Agsorb, Verge, Pure-Flo, and Ultra-Clear.

Oil-Dri Corp of America’s Financial Performance

Revenue Growth: Oil-Dri Corp of America’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 5.88%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Insights into Profitability:

-

Gross Margin: The company shows a low gross margin of 29.04%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.26, Oil-Dri Corp of America showcases strong earnings per share.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.34.

Market Valuation:

-

Price to Earnings (P/E) Ratio: Oil-Dri Corp of America’s P/E ratio of 12.6 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.38, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 7.72, Oil-Dri Corp of America could be considered undervalued.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Cracking Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Oil-Dri Corp of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.