A Look Into Goldman Sachs Gr Inc's Price Over Earnings

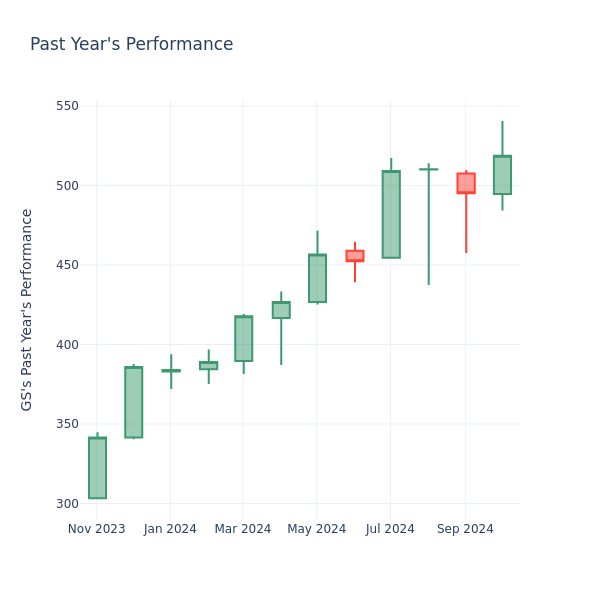

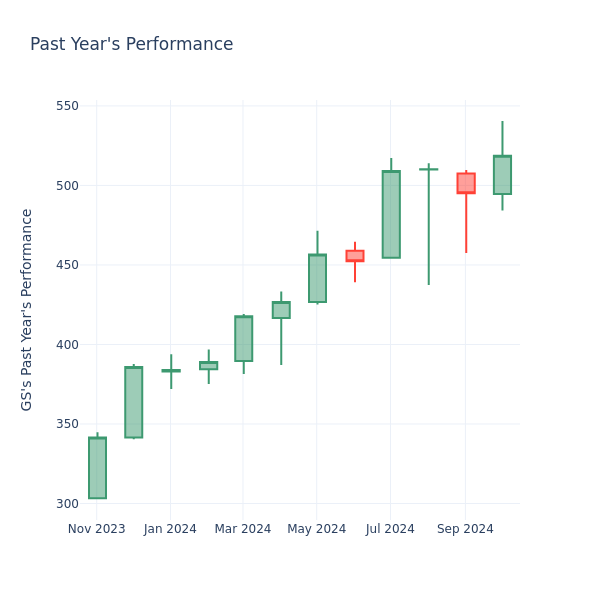

In the current session, the stock is trading at $518.68, after a 0.17% increase. Over the past month, Goldman Sachs Gr Inc. GS stock increased by 4.15%, and in the past year, by 74.78%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Goldman Sachs Gr P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Goldman Sachs Gr has a lower P/E than the aggregate P/E of 48.25 of the Capital Markets industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company’s market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company’s stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bullish Move: Aaron Christiansen Shows Confidence, Acquires $239K In Oil-Dri Corp of America Stock

It was revealed in a recent SEC filing that Aaron Christiansen, Vice President Operations at Oil-Dri Corp of America ODC made a noteworthy insider purchase on October 21,.

What Happened: Christiansen’s recent move, as outlined in a Form 4 filing with the U.S. Securities and Exchange Commission on Monday, involves purchasing 3,500 shares of Oil-Dri Corp of America. The total transaction value is $239,505.

At Tuesday morning, Oil-Dri Corp of America shares are up by 1.56%, trading at $69.5.

Unveiling the Story Behind Oil-Dri Corp of America

Oil-Dri Corp of America develops, manufactures, and markets sorbent products made predominantly from clay. Its absorbent offerings, which draw liquid up, include cat litter, floor products, toxin control substances for livestock, and agricultural chemical carriers. The company has two segments based on the different characteristics of two primary customer groups namely Retail and Wholesale Products Group and Business to Business Products Group. The company’s products are sold under various brands such as Cat’s Pride, Jonny Cat, Amlan, Agsorb, Verge, Pure-Flo, and Ultra-Clear.

Oil-Dri Corp of America’s Financial Performance

Positive Revenue Trend: Examining Oil-Dri Corp of America’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.88% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Staples sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 29.04%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Oil-Dri Corp of America’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 1.26.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.34.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 12.6 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 1.38, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry benchmarks at 7.72, Oil-Dri Corp of America presents an attractive value opportunity.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Oil-Dri Corp of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kimberly-Clark's Growth Potential 'Underestimated,' Analyst Sees Attractive Entry Point

Goldman Sachs analyst Bonnie Herzog reiterated the Buy rating on Kimberly-Clark Corporation KMB stock, with a price forecast of $152.

The company reported third quarter adjusted earnings per share of $1.83, beating the street view of $1.70. Quarterly revenues of $4.952 billion missed the analyst consensus of $5.048 billion.

According to Herzog, Kimberly-Clark’s management efforts on productivity and the current environment are conducive to margin expansion.

The analyst projects that the market underestimates the company’s potential for gross margin growth, which should lead to healthy EPS growth despite increased reinvestments.

Also Read: Retail Inventory Pressures Hit Kimberly-Clark’s Annual Outlook, Stock Slides

Herzog also forecasts that Kimberly-Clark’s segment reorganization will enhance execution moving forward.

As a result, the analyst sees a favorable risk/reward scenario, with Kimberly-Clark’s improving fundamentals contrasting sharply with its deep valuation discount compared to its HPC peers, offering an attractive entry point for investors.

The analyst indicated that adjusted EBIT is expected to grow in the mid-to-high teens on a constant currency basis, with adjusted EPS also projected to rise similarly.

For the fourth quarter of 2024, organic sales growth is expected to be about 4% at the mid-point, versus Goldman Sachs’ estimate of 5.0%.

The projected all-in EPS is $1.46, ranging from $1.33 to $1.60, reflecting a constant currency growth of 15% – 19%, compared to Goldman Sachs’ estimate of $1.60.

Price Action: KMB shares are trading lower by 4.30% to $138.01 at last check Tuesday.

Photo via Shutterstock

Read Also:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon boss to unhappy remote workers: Go find a new job

Amazon (AMZN) Web Services CEO Matt Garman has a message for the scores of workers unhappy about the return-to-work mandate: find another job.

Speaking at The Wall Street Journal’s (NWS) Tech Live event, Garman said Monday evening that requiring workers to be in the office five days a week starting in January is necessary for the company.

“Particularly as we really think about how do we want to disrupt and we want to invent on behalf of our customers, we find that there is no substitution for doing that in person,” Garman said, according to Business Insider.

The CEO believes innovation is best executed with speed in person. “Just the creative energy and how fast you’re able to iterate when you’re sitting there writing on a whiteboard or you’re talking to people in the cubicle next to you or you’re running into people that are in a different department, but you see them at the coffee line or whatever it is,” he said.

That’s why he happily told his employees: “If it’s not for you, then that’s okay — you can go and find another company if you want to.”

Garman said the three-day-a-week policy didn’t work because people came on different days. He also claimed that most employees were excited to be working in person.

He made a similar statement in a company-wide meeting last week, telling workers if they “just don’t work well in that environment and don’t want to, that’s okay, there are other companies around.”

“At Amazon, we want to be in an environment where we are working together, and we feel that collaborative environment is incredibly important for our innovation and for our culture,” he said.

When the new policy was announced, many employees took to internal forums to post their dissatisfaction. Some even publicly said they were quitting over the change.

BEV Market Growth Hinges On Closing the Gender Gap

LIVONIA, Mich., Oct. 22, 2024 (GLOBE NEWSWIRE) — Battery electric vehicle (BEV) ownership, shopping and awareness are largely male-dominated, with men making up 71% of owners and 74% of shoppers and typically conducting more exploratory research throughout the purchasing process. Women start with lower familiarity of BEVs—only 30% are familiar compared with 55% of men—and report engaging in fewer research activities during their car-buying process. However, the research conducted by women carries greater weight in their final purchase decisions. This dynamic presents an opportunity for automakers, and especially dealerships, to close the gender confidence gap by serving as a trusted source of clear, reliable information for women throughout the BEV buying process.

This is according to new data from EVForward® by Escalent, the largest, most comprehensive study of the next generation of electric vehicle (EV) buyers, which reveals unprecedented insights into the attitudes, behaviors, demands and opinions of BEV shoppers.

Men and women report researching BEVs differently. Men are significantly more inclined to explore their options via online research (71% compared with 64% of women), videos (34% versus 27%), online forums (22% versus 15%) and vehicle-building tools on manufacturer websites (22% versus 17%). Women rely more heavily on in-person experiences, with 65% conducting test drives compared with 60% of men. However, women report having worse dealership experiences than men and not getting all the information they need from the dealership while shopping for a BEV. Women are also less adventurous with new technology and largely rely on what they are familiar with. With men largely ready to adopt BEVs, dealerships need to consider strategies to fill these gender gaps and better engage women to overcome these barriers to BEV adoption.

“A combination of factors is limiting BEV adoption for women,” said Nikki Stern, senior insights manager with Escalent’s Automotive & Mobility team. “Women are not only less familiar with BEVs and complete fewer research activities, but they are also less likely to know someone who owns a BEV. This limits their ability to hear about positive experiences, further slowing their consideration of BEV powertrains.”

Educational messages about BEVs resonate with shoppers. When evaluating different message types—such as technology, environmental, practicality and emotional messages—38% of new-car buyers favor educational content, which is nearly 20 percentage points higher than the second most preferred message group. This highlights the importance of clear, informative communication in helping new-car buyers better understand the benefits of BEVs and navigate their purchase decisions.

“Dealerships hold the key to effectively engaging female buyers and it’s critical they acknowledge the existing gaps. Women generally have a broader set of EV barriers than men, so they need additional and more nuanced information to feel comfortable and confident in buying one,” said K.C. Boyce, vice president with the Automotive & Mobility and Energy teams at Escalent. “Alongside the opportunity to enhance the dealership experience for female buyers—a recognized challenge—dealers must recognize that women generally approach EV purchases differently than men and tailor their strategies accordingly.”

To learn more about Escalent’s EVForward research on future EV buyers, visit escalent.co.

About EVForward®

The results reported come from Escalent’s EVForward database, a global sample of more than 50,000 new-vehicle buyers aged 18 to 80, weighted by age, gender and location to match the demographics of the new-vehicle buyer population and by vehicle segment to match current vehicle sales. The sample for this research comes from an opt-in, online panel. As such, any reported margins of error or significance tests are estimated and rely on the same statistical assumptions as data collected from a random probability sample. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 1,800 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE, and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT: Kim Eberhardt

248.417.2460

keberhardt@identitypr.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e9b9e81d-fd36-4d23-a142-f6df5a20ec83

https://www.globenewswire.com/NewsRoom/AttachmentNg/fdc85718-5bba-4245-9a12-e498b9465a88

https://www.globenewswire.com/NewsRoom/AttachmentNg/70bafde8-3fc2-4fee-a8f2-74c37dd9f800

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of Viking Therapeutics's Earnings

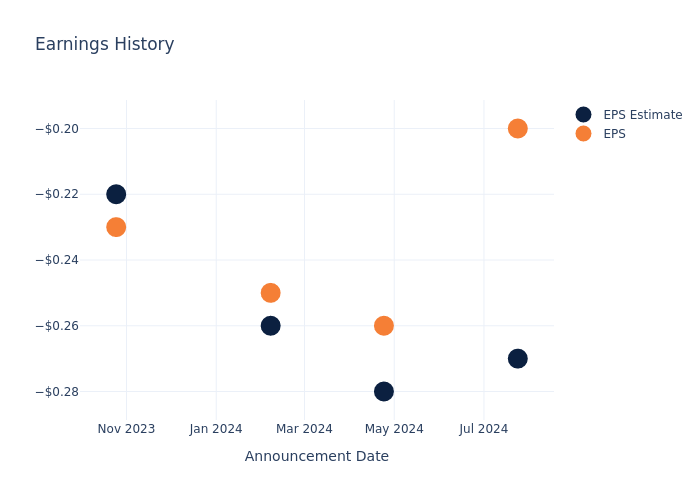

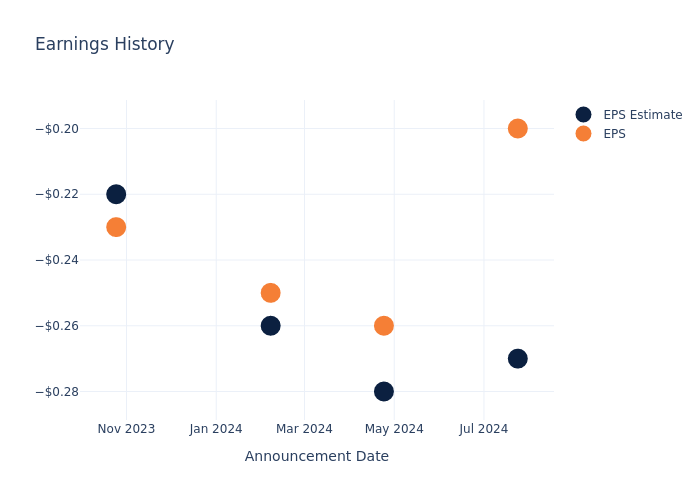

Viking Therapeutics VKTX is preparing to release its quarterly earnings on Wednesday, 2024-10-23. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Viking Therapeutics to report an earnings per share (EPS) of $-0.25.

Anticipation surrounds Viking Therapeutics’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

Earnings Track Record

Last quarter the company beat EPS by $0.07, which was followed by a 28.31% increase in the share price the next day.

Here’s a look at Viking Therapeutics’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.27 | -0.28 | -0.26 | -0.22 |

| EPS Actual | -0.20 | -0.26 | -0.25 | -0.23 |

| Price Change % | 28.000000000000004% | 6.0% | 18.0% | -9.0% |

Market Performance of Viking Therapeutics’s Stock

Shares of Viking Therapeutics were trading at $64.34 as of October 21. Over the last 52-week period, shares are up 484.35%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Viking Therapeutics visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

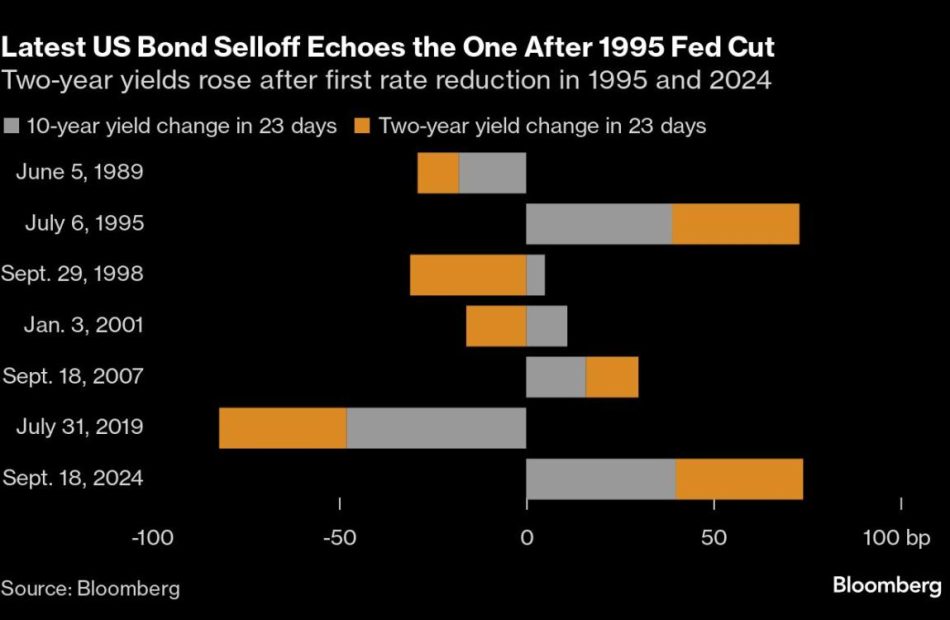

Treasuries Plunge Like It’s 1995 as Traders See Soft Landing

(Bloomberg) — The last time US government bonds sold off this much as the Federal Reserve started cutting interest rates, Alan Greenspan was orchestrating a rare soft landing.

Most Read from Bloomberg

Two-year yields have climbed 34 basis points since the Fed reduced rates on Sept. 18 for the first time since 2020. Yields rose similarly in 1995, when the Fed — led by Greenspan — managed to cool the economy without causing a recession. In prior rate cutting cycles going back to 1989, two-year yields on average fell 15 basis points one month after the Fed started slashing rates.

Rising yields “reflect the reduced probability of recession risks,” said Steven Zeng, an interest rate strategist at Deutsche Bank AG. “Data has come in pretty strong. The Fed may slow the pace of rate cuts.”

The latest backup in yields shows how a resilient US economy and buoyant financial markets limit the options for Fed Chair Jerome Powell to aggressively lower rates. Interest swaps show traders are expecting the Fed to lower rates by 128 basis points through September 2025, compared with 195 basis points priced in about a month ago.

Global bonds have been sliding this week as investors weigh the potential of slower rate reductions, leaving a gauge of total return in Treasuries up just 1.7% this year through Monday. That trails the 4.3% gain in T-bills over that period.

The selloff extended slightly on Tuesday, pushing the 10-year yield up about one basis point after an increase of 11 basis points on Monday. The recent rise has brought the yield on the benchmark to around 4.2%, up from a 15-month low of 3.6% on Sept. 17 — one day before the Fed lowered borrowing costs by half a point.

On Tuesday, trading activities suggested that sentiment remains bearish, with a series of sales of block trades in 10-year note futures. In the options market, one trade targets the 10-year yields rising to about 4.75% by the option expiry on Nov. 22.

In 1995, the Fed slashed interest rates just three times — from 6% to 5.25% — in six months, after lifting them sharply. Yields on 10-year notes jumped more than 100 basis points 12 months later after the first cut that year, while two-year yields rose 90 basis points.

This time, rising yields also reflect growing concern that the Republican Party could take control of both the White House and Congress in the Nov. 5 election, potentially boosting the federal deficit and inflation.

General Motors' Strong Q3 Earnings Impress Analysts, Highlights Turnaround And EV Profitability Focus

General Motors Company GM reported third-quarter adjusted earnings per share of $2.96, surpassing expectations, and sales of $48.757 billion, which was up 10.5%.

The company’s adjusted EBIT rose 15.5% to $4.115 billion, with a cash balance of $23.7 billion at quarter-end.

Analysts covering the auto behemoth provided their takes:

- Wedbush analyst Daniel Ives reiterated the Outperform rating on the stock, with a price forecast of $55.

- Goldman Sachs analyst Mark Delaney maintained the Buy rating on the stock, with a price forecast of $61.

Wedbush: According to the analyst, General Motors’ quarterly performance represents a significant step in the right direction as management navigates challenging conditions. The company remains laser-focused on achieving its 200,000 production target for the year, while anticipating a positive variable run rate by the end of 2024, benefiting from its investments.

This “long-awaited turnaround” for General Motors showcases its commitment to balancing production and profitability, Ives adds.

Goldman Sachs: The analyst notes that the transition from the third quarter to the fourth quarter will be a crucial focus for the firm.

In addition, the analyst writes that the state of the underlying auto business, particularly pricing trends as some competitors address high inventory levels in the U.S., General Motors’ performance in China and profit outlook, free cash flow and capital allocation, and Cruise’s progress may be focus areas.

However, given the company’s positive remarks about 2025 EBIT during its recent investor day, Delaney highlights that the underlying business remains strong.

The analyst emphasizes that the company reiterated key points from its October investor day, including expectations for its EV business to achieve variable profit in the fourth quarter of 2024, plans to produce and wholesale around 200,000 EVs in 2024, and an anticipated profitability boost of $2 billion to $4 billion from EVs in 2025.

Price Action: GM shares are trading higher by 9.25% to $53.46 at last check Tuesday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.