Market Whales and Their Recent Bets on Fiserv Options

Deep-pocketed investors have adopted a bearish approach towards Fiserv FI, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in FI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 8 extraordinary options activities for Fiserv. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 12% leaning bullish and 75% bearish. Among these notable options, 5 are puts, totaling $246,464, and 3 are calls, amounting to $101,810.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $200.0 for Fiserv over the recent three months.

Analyzing Volume & Open Interest

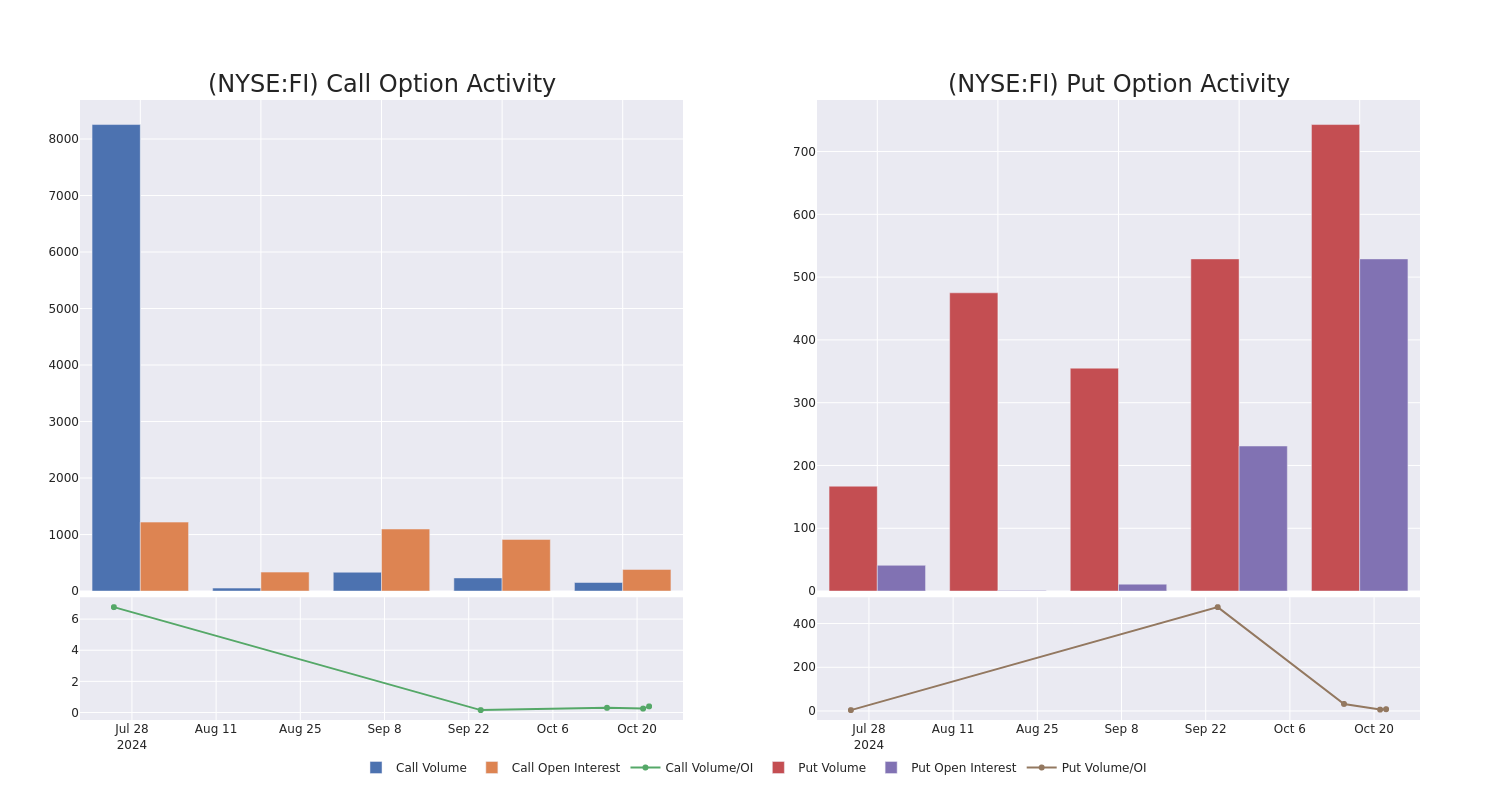

In today’s trading context, the average open interest for options of Fiserv stands at 152.0, with a total volume reaching 894.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Fiserv, situated within the strike price corridor from $150.0 to $200.0, throughout the last 30 days.

Fiserv 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FI | PUT | TRADE | BEARISH | 11/15/24 | $10.5 | $9.1 | $10.5 | $200.00 | $105.0K | 192 | 100 |

| FI | CALL | TRADE | BEARISH | 03/21/25 | $11.9 | $11.6 | $11.7 | $200.00 | $50.3K | 162 | 43 |

| FI | PUT | SWEEP | BEARISH | 10/25/24 | $5.9 | $5.5 | $5.72 | $197.50 | $43.4K | 324 | 182 |

| FI | PUT | SWEEP | BEARISH | 10/25/24 | $5.0 | $4.7 | $5.0 | $197.50 | $38.0K | 324 | 80 |

| FI | PUT | SWEEP | BULLISH | 10/25/24 | $5.0 | $4.4 | $4.59 | $197.50 | $34.5K | 324 | 305 |

About Fiserv

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for us banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company’s revenue is generated internationally.

After a thorough review of the options trading surrounding Fiserv, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Fiserv Standing Right Now?

- With a trading volume of 2,012,516, the price of FI is up by 0.52%, reaching $198.19.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 0 days from now.

What The Experts Say On Fiserv

5 market experts have recently issued ratings for this stock, with a consensus target price of $209.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Oppenheimer downgraded its rating to Outperform, setting a price target of $203.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Fiserv, which currently sits at a price target of $220.

* Consistent in their evaluation, an analyst from Jefferies keeps a Hold rating on Fiserv with a target price of $195.

* Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Fiserv with a target price of $230.

* Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for Fiserv, targeting a price of $200.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Fiserv with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Says Buy The AmEx Dip Citing Love From Millennial And Gen Z Members — Younger Customers Will Stick With The 'Company For Decades'

CNBC host Jim Cramer has urged investors to consider buying American Express Co AXP shares despite the recent dip in the stock price.

What Happened: Cramer, on his show “Mad Money,” highlighted the potential of American Express in the long term, especially in attracting younger customers. He emphasized the company’s strong earnings and credit quality, which he believes will only improve with the Federal Reserve’s ongoing interest rate cuts, reported CNBC.

“American Express had tremendous success at winning over lots of younger customers, who will likely stick with the company for decades to come,” Cramer said. “That’s the big story here, not a line or two on the call about a softer spending environment right now, which management is handling with aplomb.”

Despite a slight revenue miss and a downward revision of its full-year forecast, American Express reported a significant earnings beat. The company’s stock price fell by over 2% following the earnings report. Cramer believes that Wall Street is underestimating the company’s earnings strength and the potential for long-term growth.

He also lauded American Express for its success in attracting younger cardholders, a demographic he believes has a higher lifetime value than older customers. The company’s CFO, Christophe Le Caillec, noted on the earnings call that they are seeing strong loyalty from Millennial and Gen Z members.

Why It Matters: The recent dip in American Express’ stock price follows a mixed third-quarter earnings report. The company’s revenue (net of interest expenses) grew by 8% year-on-year to $16.64 billion, slightly missing the analyst consensus estimate of $16.67 billion. However, the adjusted EPS of $3.49 beat the analyst consensus estimate of $3.28.

Despite the revenue miss, the company’s Card Member spending or Billed Business grew by 6% (or 6% forex adjusted) year-over-year to $387.3 billion. This performance led analysts to increase their forecasts for the company’s future.

Earlier in October, American Express announced that it would become the sole owner of Swisscard after UBS Group AG UBS sold its 50% stake.

Despite the mixed results, analysts noted that the company’s higher loan volumes, stable growth in Card Member spending, and accelerated card fee revenue growth triggered the topline growth.

Price Action: American Express stock closed at $270.74 on Monday, down 2.19% for the day. In after-hours trading, the stock slightly recovered, rising 0.28%. Year to date, American Express has gained 43.77%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

UV Booster Market is Projected to Rise at a CAGR of 5.2%, Reach US$ 211.8 Million by 2034 | Fact.MR Report

Rockville, MD , Oct. 22, 2024 (GLOBE NEWSWIRE) — The UV Booster Market is expected to grow from US$ 127.6 million in 2024 to US$ 211.8 million in 2034. Fact. MR’s extensive study shows that the market will expand at a growth rate of 5.2% from 2024 to 2034.

The UV Booster market develops in the cosmetic industry under high awareness of the consumer about sun protection and skincare. There is a growing demand for products that can perform well on the side of protection against UV rays while boasting other benefits-such as moisturizing, anti-aging, and anti-inflammatory effects. The UV Booster market is increasingly attributed to popular skincare and hair care with potential benefits related to sun protection and anti-aging. Natural and organic products are in great demand due to a developing desire among consumers for alternatives to traditionally available chemical-based products.

The Benzotriazole segment is anticipated to grow at the highest rate owing to its increasing demand in lipsticks and lip balms. The Lipsticks & Lip Balms segment will see the highest CAGR, due to the fact that this ingredient will be increasingly used for popular cosmetic products. Overall, with more awareness amongst consumers about the benefits accruing from sun and skin care, the UV Booster market is expected to continue growing rapidly. Key players in the market are focusing on innovative product development, offering UV protection along with other benefits like moisturizing, anti-aging, and anti-inflammatory benefits.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8081

Key Takeaways from Market Study:

- Global UV Booster market will grow at a CAGR of 5.2%, reaching US$ 211.8 million by the end of 2034.

- North America will expand at a CAGR of 5.6% from 2024 to 2034, capturing 21.6% of the market share in 2024 and offering an absolute opportunity of US$ 15.5 million.

- East Asia will account for 30.2% of market share in 2024, generating an absolute dollar opportunity of US$ 27.0 million between 2024 and 2034.

- Between 2024 and 2034, the benzophenone by product classification is expected to produce an absolute dollar opportunity US$ 33.2 million.

- With a 53.9% market share, the UV Booster skin care cosmetics product type is estimated to be worth US$ 68.8 million in 2024.

“UV Booster market, where analysis highlight trends, growth drivers, and opportunities cosmetics companies can leverage in this emerging trend” says a Fact.MR analyst.

Market Development:

Key companies like Allnex, Perma Chink Systems Inc., BASF SE, Clariant AG, Solvay SA, Huntsman Corporation, Milliken Chemical, Spectrum Chemical, Adeka Corporation, Croda International PLC. are propelling the market growth.

As these important companies took advantage of a variety of primary strategies to improve their position in the electronic chemicals and materials market, they released new products, acquired companies, expanded, and made deals. As an instance-

- In April 2023, Allnex reached a milestone when it mechanically completed the new manufacturing hub in Jiaxing, China – another critical step forward in its strategic expansion into greener resins. Operations are expected to start in phases during the second half of 2023.

- In October 2022, Clariant introduced AddWorks® AGC 970, a novel light stabilizer for agricultural polyethylene films to improve resistance to UV exposure and agrochemicals with innovation spirit in agricultural fields.

- In April 2022, Allnex launched a new UV Booster product under the name of Allnex UV-101, which is used in hair care and skin care.

- In March 2022, Perma Chink Systems Inc. announced a new line of UV-stable water-repellent coatings for furniture and equipment used outdoors.

- In May 2022, BASF SE acquired the company Perstorp’s UV Booster business, this widened its product portfolio within the cosmetic and personal care industry.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=8081

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global UV Booster Market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on product (benzamidine, benzophenone, triazine, benzotriazole, others), application (skin care cosmetics, hair care cosmetics, make-up cosmetics) and across major seven regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa).

Segmentation of UV Booster Market:

- By Product :

- Benzamidine

- Benzophenone

- Triazine

- Benzotriazole

- Others

- By Application :

- Skin Care Cosmetics

- Hair Care Cosmetics

- Make-up Cosmetics

- Lipsticks & Lip Balms

- Foundation

- Others (Concealers, etc.)

- By Region :

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Check out More Related Studies Published by Fact.MR:

Ultraviolet Stabilizers Market: Size is US$ 1.4 billion for 2023. Global demand for ultraviolet stabilizers is expected to reach an industry value of US$ 2.4 billion by 2033-end, increasing at a CAGR of 5.3% over the next ten years.

Sun Protection Active Ingredient Market: Size is set to reach a valuation of US$ 816.3 million in 2023 and further expand at a CAGR of 5.3% to reach US$ 1,370.3 million by the end of 2033.

High Purity Boron Market: Size is valued at US$ 1.21 billion in 2024 and is forecasted to expand at a CAGR of 8.5% to reach US$ 2.72 billion by the end of the assessment period in 2034.

EVA Foam Market: Size is approximated to touch a valuation of US$ 18.99 billion in 2024. The market has been forecasted to increase at 5.4% CAGR to achieve a value of US$ 32.2 billion by the end of 2034.

Seismic Rubber Bearing and Isolator Market: Size is estimated to reach US$ 461.91 million in 2024. The market is analyzed to rise at a CAGR of 3.2% to reach US$ 630.69 million by the end of 2034.

Electroplating Chemicals Market: Size is currently valued at around US$ 49.23 billion in 2024 and is forecasted to expand at a CAGR of 6.8% to reach US$ 94.69 billion by 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gas Engine Market Size Projected to Grow $6.3 billion by 2029 | MarketsandMarkets™

Delray Beach, FL, Oct. 22, 2024 (GLOBE NEWSWIRE) — The global Gas Engine Market size is expected to grow from USD 5.1 billion in 2024 to USD 6.3 billion by 2029, at a CAGR of 4.5% according to a new report by MarketsandMarkets™. The gas engines market is experiencing robust growth driven by increasing demand for cleaner energy solutions and the transition towards sustainable power generation. As industries and governments worldwide prioritize environmental sustainability, gas engines have emerged as a viable alternative to traditional fossil fuel-based power generation systems. This shift is further fueled by advancements in gas engine technology, enhancing efficiency and reliability while reducing emissions.

The growth in gas engine market can be attributed to various factors stimulating demand. A prominent driver is the escalating focus on cleaner energy sources and sustainability initiatives, prompting a surge in the adoption of gas-powered engines as a viable alternative to conventional fossil fuel-based options. Furthermore, technological advancements, including enhanced efficiency and reliability of gas engines, are significantly contributing to market expansion. These advancements not only improve the performance of gas engines but also make them more competitive and appealing to consumers seeking reliable and environmentally friendly power solutions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=54641802

Gas Engine Market Scope:

| Report Coverage | Details |

| Market Size | USD 6.3 billion by 2029 |

| Growth Rate | 4.5% of CAGR |

| Largest Market | Asia Pacific |

| Market Dynamics | Drivers, Restraints, Opportunities & Challenges |

| Forecast Period | 2024-2029 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Gas Engine Market by fuel type, power output, application, and region. |

| Geographies Covered | Asia Pacific, Europe, North America, South America, Middle East & Africa. |

| Report Highlights | Updated financial information / product portfolio of players |

| Key Market Opportunities | Adoption of Natural Gas as Transition Fuel |

| Key Market Drivers | Advance Gas Engine Technology |

Utilities segment to have highest gas engine market share from 2024 to 2029

The utilities segment, categorized by end-use industry, is expected to hold the highest gas engine market share from 2024 to 2029 due to several driving factors contributing to its dominance. Utilities, including electricity, gas, and water providers, are increasingly turning to gas engines for power generation and cogeneration applications to meet the escalating energy demands of modern societies. Gas engines offer utilities a reliable and efficient solution for electricity generation, enabling them to balance supply and demand while enhancing grid stability. Furthermore, the versatility of gas engines allows utilities to deploy them in various applications, such as peak shaving, grid support, and distributed energy generation, contributing to their widespread adoption across the sector. Additionally, the growing focus on renewable and cleaner energy sources is driving utilities to transition from traditional fossil fuel-based power generation to gas engines, which offer lower emissions and greater fuel flexibility. Moreover, supportive government policies and incentives aimed at promoting renewable energy and improving energy efficiency further accelerate the adoption of gas engines by utilities. With their proven reliability, efficiency, and environmental benefits, gas engines are poised to play a pivotal role in powering the utilities sector, driving significant market share within the segment during the forecast period.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=54641802

Gas Engine Market Dynamics:

Drivers:

- Trend toward clean and efficient power generation

- Stringent emission regulations

- Adoption of industrial automation and robotics and shift toward smart manufacturing

- Advancements in gas engine technology

- Integration of renewable energy sources

Restraints:

- Policy and regulatory uncertainty

- Fluctuating gas prices

Opportunities:

- Evolving landscape of coal, gas, and nuclear energy

- Adoption of natural gas as transition fuel

- Leveraging potential of biogas and landfill gas

Challenges:

- Infrastructural shortcomings

- Ensuring long-term sustainability

Asia Pacific is expected to be the second fastest region in the Gas Engine Industry

Asia Pacific is poised to emerge as the largest gas engine market due to several compelling factors propelling its growth and dominance in the industry. Firstly, the region’s rapid industrialization, urbanization, and population growth are driving significant demand for energy across various sectors such as manufacturing, construction, and transportation. Gas engines offer a reliable and efficient solution to meet this escalating energy demand while addressing environmental concerns, as they produce lower emissions compared to conventional fossil fuel-based alternatives. Furthermore, supportive government policies and initiatives aimed at promoting cleaner energy sources and reducing greenhouse gas emissions are accelerating the adoption of gas engines in the Asia Pacific region. These policies create a conducive environment for investment in gas engine infrastructure and deployment, further stimulating market growth. Additionally, the abundant availability of natural gas resources in countries like China, India, and Australia enhances the attractiveness of gas engines as a cost-effective and sustainable power generation solution. Moreover, ongoing investments in infrastructure development, including power plants, cogeneration facilities, and distributed energy systems, contribute to the widespread deployment of gas engines across the region. With favorable market dynamics, supportive regulatory frameworks, and increasing environmental awareness, Asia Pacific is poised to lead the global gas engine market, offering lucrative opportunities for industry players and driving innovation and sustainable development in the energy sector.

Key Market Players:

Some of the major players in the Gas Engine Companies are Caterpillar (US), Rolls-royce Holdings (UK), Siemens Energy (Germany), Wartsila (Finland), and Cummins (US).

Browse Adjacent Markets: Energy and Power Market Research Reports & Consulting

Browse Related Reports:

High-Speed Engine Market – Global Forecast to 2028

Marine Engines Market – Global Forecast to 2029

Small Gas Engines Market – Global Forecast to 2028

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Smartest Dividend Stocks to Buy With $1,000 Right Now

Dividends are the unsung heroes when it comes to making money and building wealth in the stock market. They may not be as sexy or draw the attention that high-flying growth stocks do, but they can be just as rewarding, especially over time.

If you’re looking for dividend stocks to add to your portfolio, you might want to consider the following two companies. Each has a high dividend yield and each is a leader in industries that are likely to be around for the long haul. Investing $500 into each could net you about $65 in annual income at their current yields.

Tobacco giant Altria Group (NYSE: MO) has been one of the highest-yielding dividend stocks in the S&P 500 for quite a while. Its quarterly dividend is $1.02 per share and it offers a forward yield of over 8%. For perspective, the average dividend yield of the S&P 500 stands just above 1.3%.

When Altria announced a dividend increase in August, it marked the 55th straight year the company has raised its payout. It is one of only 54 companies on the stock market that has reached the Dividend King status, putting it in elite company when considering the thousands of companies on U.S. stock exchanges.

It’s one thing to have an attractive dividend. But it’s even more impressive when you manage to keep increasing an attractive dividend, which Altria has done — almost doubling it in the past decade.

Altria has maintained a stronghold in the cigarette industry for a while. Smoking rates have been steadily declining in the U.S., affecting volume, but the pricing power that it can exert has allowed it to offset this decline and keep its financials healthy.

The company has to find viable smoke-free options to maintain its leadership position in the long term. It failed with its $12.8 billion Juul investment (putting it lightly), but its recent vaping venture, NJOY, has been making positive strides. In the second quarter, NJOY consumables shipment volumes increased by 14.7% to 12.5 million units, and NJOY devices’ shipment volume jumped by 80% to 1.8 million units. This brought the totals to 23.4 million and 2.8 million, respectively, in the first half of 2024.

Cigarettes will be the mainstay of Altria’s business for the foreseeable future. However, it’s encouraging to see it making the investments needed for long-term success. In the meantime, investors can enjoy the company’s lucrative dividend, which should continue increasing for several years to come.

AT&T (NYSE: T) is getting accolades from investors for its improved financial picture after some turbulent years caused by a misguided decision to get involved in the media and entertainment industry. The company took its lumps, sold off its underperforming assets, and returned to its telecom roots, and the results have been paying off. The stock is up over 26% this year (as of Oct. 21), marking its best stretch in a while.

Market 'Very Convinced' Of A Trump Win, Says Stanley Druckenmiller: Why Billionaire Investor Thinks Blue Sweep Is 'Highly Unlikely'

While opinion polls predict a close race between Democratic nominee Kamala Harris and Republican nominee Donald Trump, billionaire investor and former hedge fund manager Stanley Druckenmiller, the chairman and CEO of Duquesne Family Office, on Thursday weighed in with his thoughts on the 2024 presidential election.

Don’t Miss:

What Markets Say: While stating that things are still fluid, Druckenmiller said he liked the market indicators for the elections. In an interview with Bloomberg, the billionaire said in 1980, the market was right on former President Ronald Reagan despite what the pundits said.

“And I must say in the last 12 days, the market and the inside of the market is very convinced Trump is going to win. You can see it in the bank stocks, you can see it in crypto, you can even see it in Trump Media & Technology Group Corp. (NYSE:DJT), his social media company,” he said.

Industries that benefit from deregulation will benefit from a Trump victory and outperform others, Druckenmiller said.

Trump is the favorite to win the election now, the billionaire said, adding that the polls do not mean much nowadays as no one even responds to them anymore.

See Also: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

The Scenarios: Druckenmiller weighed in four scenarios, namely a blue sweep, a red sweep, the Trump administration with a blue branch of Congress, and a Harris administration with a red branch of Congress.

A blue sweep is extremely unlikely, the billionaire said, adding that even if Harris wins the presidency looking at state-by-state polls, it looks like the Republicans are going to win the Senate.

Where you got a blue sweep, you would have a rough time for equities for three to six months, Druckenmiller said. This will translate into the economy because equity ownership is 25% of financial assets, an all-time high, he added.

“So that’s a blue sweep. But the good news or the bad news, depending on how you view life is, I think it’s highly unlikely,” the ex-hedge fund manager said.

A red sweep is probably more likely than a Trump presidency with a blue Congress, he said. This is because anybody who votes for Trump is probably not going to switch their allegiance, he added.

Fiserv Earnings Enjoy 24% Boost, Raises 2024 Outlook On Heels Of DoorDash Partnership

Fiserv, Inc FI reported fiscal third-quarter results, with revenue increasing by 7% year-over-year to $5.22 billion, beating the analyst consensus estimate of $4.91 billion. Adjusted revenue increased 7% year-over-year to $4.88 billion.

The financial technology and services provider’s adjusted EPS of $2.30 beat the analyst consensus estimate of $2.26.

Also Read: Apple Pay Expands Buy Now, Pay Later With Affirm, Adds Support For Third-Party Browsers And More

The adjusted EPS marked a 17% increase over last year’s period. The stock price slid after the print.

Organic revenue grew 15%, led by 24% growth in Merchant Solutions and 6% in Financial Solutions.

The adjusted operating margin increased by 170 bps Y/Y to 40.2%. Adjusted operating margin increased 290 basis points Y/Y to 37.7% in the Merchant Solutions segment and by 40 bps Y/Y to 47.4% in the Financial Solutions segment.

“We are pleased with our third quarter performance, which showcases strength across both our Merchant and Financial Solutions segments and several significant new wins,” Chair and CEO Frank Bisignano said.

FY24 Outlook: Fiserv raised organic revenue growth outlook to 16%-17% (prior 15%-17%) and raised adjusted EPS outlook to $8.73-$8.80 (prior $8.65 – $8.80), representing growth of 16%-17% Y/Y versus the $8.75 consensus.

Fiserv announced a partnership with DoorDash Inc DASH to integrate financial services into the online delivery platform.

Through this partnership, DoorDash is leveraging Fiserv’s expertise in merchant acquiring, account processing, and card issuing to streamline financial services for Dashers. Starion Bank, a long-standing Fiserv client, will act as the Sponsor Bank for the Crimson accounts.

Fiserv stock gained 80% in the last 12 months.

Price Action: FI stock is down 0.85% at $195.50 premarket at the last check on Tuesday.

Also Read:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DOJ Sues Rocket Mortgage, Appraisal Companies For Alleged Racial Discrimination — Rocket Responds: 'Massive Overreach'

The U.S. Department of Justice (DOJ) announced Monday afternoon that it’s going after a group of companies for alleged racial discrimination in mortgage refinancing applications.

What To Know: The DOJ filed a lawsuit against Rocket Companies Inc.’s RKT Rocket Mortgage; as well as Solidifi US; Maverick Appraisal Group and Maverick CEO Maksym Mykhailyna, alleging that the parties discriminated against a Black homeowner by “undervaluing her home based on her race” in an appraisal that takes place when a homeowner files to refinance their mortgage.

The DOJ also alleged Rocket Mortgage further interfered with the homeowner’s rights by canceling her mortgage refinance application after she reported the discrimination.

Benzinga reached out to Rocket Companies, Solidifi US and Mykhailyna’s company Maverick Appraisal Group for comment on the allegations.

Rocket Mortgage issued the following statement to Benzinga in response to the DOJ’s lawsuit:

“Under federal law, mortgage lenders are required to work at arm’s length during the appraisal process, partnering with independent appraisal management companies who assign the work to state-licensed professional appraisers. The law’s intent is to determine the home’s value without any input or bias from the lender or any other party with interest in the transaction,” the company said.

“It is clear the government isn’t interested in their own rules, or facts, and are simply including us in this case to score headlines based on our strong brand and prominent position in the industry. We look forward to exposing the government’s massive overreach in this matter.”

According to the DOJ, the homeowner applied for a mortgage refinancing loan from Rocket Mortgage in early 2021. Rocket Mortgage contracted Solidifi to appraise the home and Solidifi retained Mykhailyna and his company for the appraisal.

The home was located in a predominantly white neighborhood in Denver, but the complaint alleged Mykhailyna used sales data from neighborhoods that were further away and had larger Black populations. Mykhailyna also allegedly used homes in the same neighborhood to support an appraisal for a white homeowner in the same neighborhood a few months earlier.

“The complaint alleges that these and other errors demonstrate Mykhailyna undervalued the property because of race and color,” the press release states.

Mykhailyna sent his appraisal to Solidifi, which reviewed the appraisal and forwarded it to Rocket Mortgage. When Rocket Mortgage presented it to the homeowner, she contacted the company and explained why she believed there was racial discrimination involved. The DOJ claimed Rocket Mortgage canceled her refinance application in response.

The homeowner then filed a complaint with the Department of Housing and Urban Development (HUD), which conducted an investigation before referring the matter to the DOJ.

“HUD applauds today’s action and remains committed to working with DOJ to ensure appraisal companies and mortgage providers are held accountable when they violate our nation’s fair housing laws,” said principal deputy assistant secretary Diane Shelley of HUD’s Office of Fair Housing and Equal Opportunity.

“It has been over 56 years since the passage of the Fair Housing Act, and it is unconscionable that Black and Brown families still face discrimination during housing transactions.”

Rocket Companies shares closed Monday down 9.33% at $16.33, according to pricing data from Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.