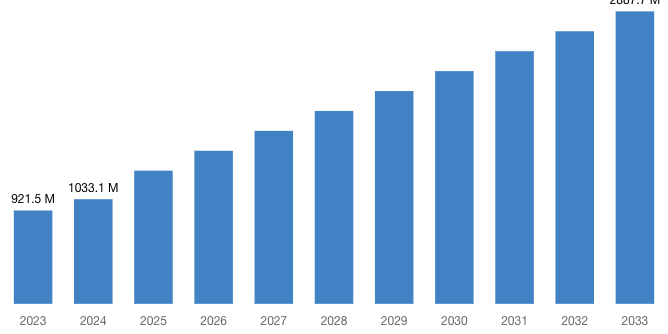

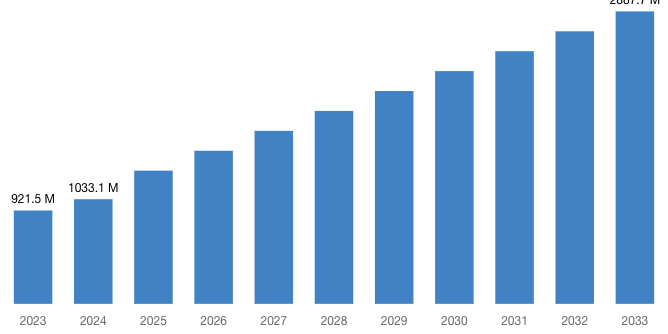

[Latest] Global Ready to Drink Cocktail Market Size/Share Worth USD 2,887.7 Million by 2033 at a 12.1% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

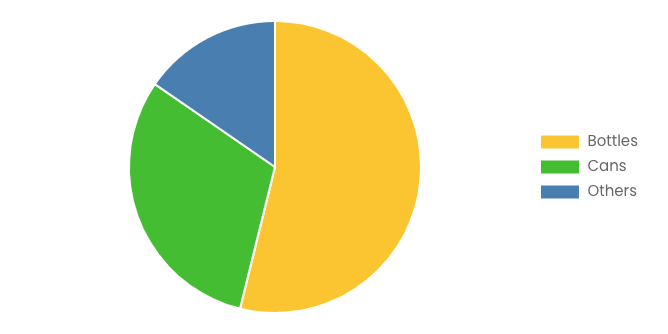

Austin, TX, USA, Oct. 22, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Ready-To-Drink Cocktail Market Size, Trends and Insights By Alcohol Base (Malt-based, Spirit-based, Wine-based, Others), By Packaging (Bottles, Cans, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online, Liquor Stores, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Ready to Drink Cocktail Market size & share was valued at approximately USD 921.5 Million in 2023 and is expected to reach USD 1,033.1 Million in 2024 and is expected to reach a value of around USD 2,887.7 Million by 2033, at a compound annual growth rate (CAGR) of about 12.1% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Ready-To-Drink Cocktail Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52945

Ready to Drink Cocktail Market: Growth Factors and Dynamics

- Convenience and Accessibility: Ready-to-drink cocktails offer consumers convenience by eliminating the need for cocktail preparation, making them an attractive option for busy lifestyles and on-the-go consumption.

- Expanding Millennial and Gen Z Demographics: Younger generations, particularly Millennials and Gen Z, seek convenience without compromising on taste or quality. Ready-to-drink cocktails cater to their preferences for convenience, variety, and social experiences.

- Rise of Home Entertaining: The trend of socializing and entertaining at home has surged, especially post-pandemic. Ready-to-drink cocktails provide an easy solution for hosting gatherings, offering bar-quality drinks without needing bartending skills or extensive ingredients.

- Innovative Flavors and Packaging: Manufacturers are continuously innovating with new and unique flavors and eye-catching packaging designs to capture consumer attention and differentiate their products in a crowded market.

- Health-Conscious Choices: With increasing health awareness, there’s a growing demand for low-sugar, low-calorie, and natural ingredient-based ready-to-drink cocktails. Manufacturers are responding by introducing healthier options to cater to health-conscious consumers.

- Globalization and Market Expansion: Ready-to-drink cocktails are gaining popularity not only in traditional markets but also in emerging markets worldwide. As consumer tastes become more globalized, there’s a growing opportunity for market expansion and product diversification on a global scale.

- Marketing and Branding: Effective marketing campaigns and branding strategies are crucial in driving growth in the Ready to Drink Cocktail market. Companies invest in innovative marketing tactics, influencer collaborations, and experiential events to build brand awareness and engage consumers, driving sales and market expansion.

- E-commerce and Digitalization: The rapid growth of e-commerce platforms and digitalization has significantly impacted the Ready to Drink Cocktail market. Consumers increasingly prefer the convenience of online shopping, leading to the proliferation of online liquor stores and delivery services. This shift towards digital channels gives manufacturers new opportunities to reach consumers directly and expand their market presence.

- Seasonal and Occasional Demand: Ready-to-drink cocktails experience surges in demand during peak seasons and occasions such as holidays, festivals, and summer months. Manufacturers capitalize on these trends by offering seasonal flavors and limited-edition releases, creating excitement and driving sales during specific times of the year.

Request a Customized Copy of the Ready-To-Drink Cocktail Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52945

Ready to Drink Cocktail Market: Partnership and Acquisitions

- In 2023, Jennifer Lopez unveiled ‘The House of Delola,’ featuring a premium lineup of spirit-based and organic RTD cocktails. Available in Bella Berry Spritz (10.5% ABV), L’Orange Spritz (10.5% ABV), and Paloma Rosa Spritz (11.5% ABV), these low-calorie drinks boast fruit-infused flavors, offering a sophisticated drinking experience.

- In 2022, Diageo plc unveiled Crown Royal RTD cocktails, catering to whisky and cocktail enthusiasts. The range offers three classic Crown Royal serves infused with apple, cranberry, cola, and peach tea flavors, providing a convenient and flavorful option for discerning drinkers.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 1,033.1 Million |

| Projected Market Size in 2033 | USD 2,887.7 Million |

| Market Size in 2023 | USD 921.5 Million |

| CAGR Growth Rate | 12.1% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Alcohol Base, Packaging, Distribution Channel and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your research requirements. |

(A free sample of the Ready-To-Drink Cocktail report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Ready-To-Drink Cocktail report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Ready-To-Drink Cocktail Market Report @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

Ready to Drink Cocktail Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Ready-To-Drink Cocktail Market, with the industry experiencing positive and negative effects. Here are some of the key impacts:

- Disruption in Supply Chain: The COVID-19 pandemic disrupted global supply chains, leading to shortages of key ingredients and packaging materials for ready-to-drink cocktails, impacting production and distribution capabilities.

- Closure of On-Premise Channels: The closure of bars, restaurants, and other on-premise channels during lockdowns significantly reduced the consumption of ready-to-drink cocktails, decreasing sales and revenue for manufacturers.

- Focus on Home Consumption: With consumers spending more time at home, manufacturers shifted their focus towards promoting ready-to-drink cocktails for home consumption through marketing campaigns, online promotions, and partnerships with online retailers.

- Introduction of New Products and Flavors: To reignite consumer interest and stimulate demand, companies introduced new products and flavors, focusing on innovative and trending options to capture market attention.

- Expansion of E-commerce Channels: Manufacturers accelerated their e-commerce strategies, enhancing online platforms, and partnering with third-party delivery services to make ready-to-drink cocktails more accessible to consumers through online channels.

- Health and Wellness Positioning: Capitalizing on the growing health-conscious trend, companies introduced healthier ready-to-drink cocktail options, such as low-sugar, low-calorie, and natural ingredient-based beverages, to cater to health-conscious consumers.

- Reopening of On Consumer Engagement and Education: Manufacturers invested in consumer engagement and education initiatives to rebuild trust and confidence in the safety and quality of ready-to-drink cocktails. Through virtual tastings, interactive workshops, and educational content, companies aimed to reconnect with consumers, communicate product benefits and foster brand loyalty in a post-pandemic landscape.

- Premise Channels: As restrictions eased and on-premise channels reopened, manufacturers focused on rebuilding partnerships with bars, restaurants, and hospitality venues, providing support through promotional activities, training programs, and tailored product offerings to revitalize sales in these channels.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Ready to Drink Cocktail Market, with some challenges and opportunities arising from it.

Request a Customized Copy of the Ready-To-Drink Cocktail Market Report @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

Key questions answered in this report:

- What is the size of the Ready-To-Drink Cocktail market and what is its expected growth rate?

- What are the primary driving factors that push the Ready-To-Drink Cocktail market forward?

- What are the Ready-To-Drink Cocktail Industry’s top companies?

- What are the different categories that the Ready-To-Drink Cocktail Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Ready-To-Drink Cocktail market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Ready-To-Drink Cocktail Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

Ready-To-Drink Cocktail Market – Regional Analysis

The Ready-To-Drink Cocktail Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: Premiumization is a notable trend in North America’s ready-to-drink cocktail market, where consumers prioritize high-quality ingredients and sophisticated packaging. Innovation in flavors is also prominent, with brands constantly introducing new and adventurous combinations to captivate diverse tastes. Moreover, health-conscious choices like low-sugar and natural ingredient-based cocktails align with the region’s wellness trends, while convenient single-serve options cater to on-the-go lifestyles.

- Europe: Europe’s ready-to-drink cocktail market is characterized by a reverence for cultural heritage, emphasizing traditional recipes and locally sourced ingredients. Sustainability is a key trend, with consumers seeking eco-friendly packaging and responsibly sourced materials. Additionally, premiumization is evident, reflecting a willingness to invest in higher-quality products. The region’s preference for artisanal producers underscores a growing demand for small-batch and craft offerings.

- Asia-Pacific: In Asia-Pacific, the influence of Western cocktail culture is on the rise, driving interest in ready-to-drink cocktails inspired by classic and innovative Western recipes. Fusion flavors, blending traditional Asian ingredients with modern mixology techniques, are gaining popularity, offering unique and exciting taste experiences. Convenience and accessibility are paramount, with ready-to-drink cocktails catering to busy urban lifestyles and e-commerce platforms facilitating easy access to a diverse range of products.

- LAMEA: LAMEA’s ready-to-drink cocktail market embraces cultural diversity, showcasing regional flavors and ingredients from Latin America, Africa, and the Middle East. Tropical flavors like mango and coconut dominate, capturing the region’s vibrant culinary heritage. The hospitality sector drives demand, with bars, restaurants, and hotels offering a variety of options for both locals and tourists. The emerging middle class fuels interest in premium and imported cocktails, reflecting a growing appetite for quality and sophistication.

Request a Customized Copy of the Ready-To-Drink Cocktail Market Report @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Ready-To-Drink Cocktail Market Size, Trends and Insights By Alcohol Base (Malt-based, Spirit-based, Wine-based, Others), By Packaging (Bottles, Cans, Others), By Distribution Channel (Hypermarkets/Supermarkets, Online, Liquor Stores, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

List of the prominent players in the Ready to Drink Cocktail Market:

- Bacardi Limited

- Diageo plc

- Brown-Forman Corporation

- Pernod Ricard SA

- Beam Suntory Inc.

- Campari Group

- The Coca-Cola Company

- Anheuser-Busch InBev

- Constellation Brands Inc.

- Sazerac Company Inc.

- Asahi Group Holdings Ltd.

- & J. Gallo Winery

- Halewood Wines & Spirits

- Cutwater Spirits

- Mark Anthony Brands International

- Others

Click Here to Access a Free Sample Report of the Global Ready-To-Drink Cocktail Market @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Luxury Food Market: Luxury Food Market Size, Trends and Insights By Type (Vegetarian Food, Poultry, Pork, Meat, Seafood, Others), By Distribution Channel (Online Retailers, Specialty Stores, Supermarkets and Hypermarkets, Gourmet Food Stores, Hotel and Restaurant Supply, Duty-Free Shops, Direct Sales), By End-User (Small Food Chains, High-End Restaurants), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Coffee Capsule Market: Europe Coffee Capsule Market Size, Trends and Insights By Product Type (Traditional Coffee Capsules, Compostable Coffee Capsules, Recyclable Coffee Capsules), By Material Type (Plastic Capsules, Aluminum Capsules, Paper-Based Capsules), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Convenience Stores), By Coffee Type (Regular Coffee, Decaffeinated Coffee, Flavored Coffee, Specialty Coffee), By End-User (Residential, Commercial), By Compatibility (Original Line, Vertuo Line, Other Compatible Machines), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Tamarind Extract Market: Tamarind Extract Market Size, Trends and Insights By Form (Liquid, Powder, Paste), By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Others), By Distribution Channel (Direct Sales, Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Mushroom Market: US Mushroom Market Size, Trends and Insights By Type of Mushroom (Button Mushrooms, Shiitake Mushrooms, Oyster Mushrooms, Portobello Mushrooms, Others), By Form (Fresh Mushrooms, Processed Mushrooms), By End Use (Household Consumption, Food Processing Industry, Pharmaceuticals, Cosmetics and Personal Care Products, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Food Service Providers, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Dietary Supplements Market: Europe Dietary Supplements Market Size, Trends and Insights By Ingredient (Vitamins, Botanicals, Minerals, Protein & Amino Acids, Fibers & Specialty Carbohydrates, Omega Fatty Acids, Probiotics, Prebiotics & Postbiotics, Others), By Form (Tablets, Capsules, Soft gels, Powders, Gummies, Liquids, Others), By Type (Gluten-Free, Non-GMO, Organic, Natural, Vegan, Others), By Application (Energy & Weight Management, General Health, Bone & Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti-cancer, Lungs Detox/Cleanse, Skin/ Hair/ Nails, Sexual Health, Brain/Mental Health, Insomnia, Menopause, Anti-aging, Prenatal Health, Others), By End User (Infants, Children, Adults, Pregnant Women, Geriatric, Others), By Distribution Channel (Online, Offline), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Bovine Gelatin Market: Bovine Gelatin Market Size, Trends and Insights By Form (Powder, Capsule & Tablets, Liquid), By Type (Type A, Type B), By Nature (Organic, Conventional), By Application (Food and beverages, Cosmetics & personal care, Pharmaceuticals, Others), By Distribution Channel (B2B, B2C, Supermarket/hypermarket, Specialty supplement stores, Drugstore & Pharmacies, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Non-Alcoholic Beverages Market: US Non-Alcoholic Beverages Market Size, Trends and Insights By Type (Carbonated Soft Drinks (CSD), Bottled Water, Fruit Juices, Energy Drinks, Sports Drinks, Ready-to-Drink (RTD) Tea and Coffee, Functional Beverages, Dairy Alternatives, Others), By Packaging (Cans, Bottles (Plastic/Glass), Cartons, Pouches, Others), By Flavor (Regular/Original, Flavored, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Food Service, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India Monosodium Glutamate Market: India Monosodium Glutamate Market Size, Trends and Insights By Application (Food Processing, Restaurant, Household, Animal Feed, Others), By Form (Powder, Granules, Crystal), By Sales Channel (Business to Business, Business to Consumers), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Ready to Drink Cocktail Market is segmented as follows:

By Alcohol Base

- Malt-based

- Spirit-based

- Wine-based

- Others

By Packaging

By Distribution Channel

- Hypermarkets/Supermarkets

- Online

- Liquor Stores

- Others

Click Here to Get a Free Sample Report of the Global Ready-To-Drink Cocktail Market @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Ready-To-Drink Cocktail Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Ready-To-Drink Cocktail Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Ready-To-Drink Cocktail Market? What Was the Capacity, Production Value, Cost and PROFIT of the Ready-To-Drink Cocktail Market?

- What Is the Current Market Status of the Ready-To-Drink Cocktail Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Ready-To-Drink Cocktail Market by Considering Applications and Types?

- What Are Projections of the Global Ready-To-Drink Cocktail Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Ready-To-Drink Cocktail Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Ready-To-Drink Cocktail Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Ready-To-Drink Cocktail Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Ready-To-Drink Cocktail Industry?

Click Here to Access a Free Sample Report of the Global Ready-To-Drink Cocktail Market @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

Reasons to Purchase Ready-To-Drink Cocktail Market Report

- Ready-To-Drink Cocktail Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Ready-To-Drink Cocktail Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Ready-To-Drink Cocktail Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Ready-To-Drink Cocktail Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Ready-To-Drink Cocktail market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Ready-To-Drink Cocktail Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Ready-To-Drink Cocktail market analysis.

- The competitive environment of current and potential participants in the Ready-To-Drink Cocktail market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Ready-To-Drink Cocktail market should find this report useful. The research will be useful to all market participants in the Ready-To-Drink Cocktail industry.

- Managers in the Ready-To-Drink Cocktail sector are interested in publishing up-to-date and projected data about the worldwide Ready-To-Drink Cocktail market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Ready-To-Drink Cocktail products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Ready-To-Drink Cocktail Market Report @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Ready-To-Drink Cocktail Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/ready-to-drink-cocktail-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cadence Bank Announces Third Quarter 2024 Financial Results

HOUSTON and TUPELO, Miss., Oct. 21, 2024 /PRNewswire/ — Cadence Bank CADE (the Company), today announced financial results for the quarter ended September 30, 2024.

Highlights for the third quarter of 2024 included:

- Reported quarterly net income available to common shareholders of $134.1 million, or $0.72 per diluted common share, and adjusted net income from continuing operations available to common shareholders,(1) which excludes non-routine income and expenses,(2) of $135.6 million, or $0.73 per diluted common share, which represents an increase of $0.04 per share, or 5.8%, compared to the second quarter of 2024 adjusted net income from continuing operations available to common shareholders.(1)

- Achieved quarterly adjusted pre-tax pre-provision net revenue from continuing operations (PPNR)(1) of $189.9 million, which is flat compared to the second quarter of 2024 and up $44.7 million from the third quarter of 2023. Year-to-date, adjusted PPNR(1) is $555.0 million, up $80.6 million or 17.0%, from the same period in 2023.

- Period-end loans were flat for the quarter at $33.3 billion as higher levels of payoffs and paydowns offset new origination activity. Year-to-date, net loan growth is $807.0 million or 3.3% annualized.

- Grew period-end total deposits by $985.7 million, or 10.4% on an annualized basis. Customer deposits, which exclude brokered deposits and public funds, increased $1.4 billion including approximately $435.0 million in customer overnight sweep activity. Excluding the sweep activity, customer deposits increased approximately $945.0 million in the quarter, or 11.4% annualized.

- Continued improvement in net interest margin by 4 basis points to 3.31%, benefiting from improvement in average earning asset mix, stabilized deposit costs and higher loan yields.

- Credit metrics reflected 0.26% in annualized net charge-offs, slightly improved from the linked quarter, and a $12.0 million provision for credit losses resulting in a 1.38% allowance for credit losses as a percent of loans.

- Repurchased 323,395 shares of Company common stock during the third quarter at a weighted average price of $28.79 per share; regulatory capital remained strong with Common Equity Tier 1 Capital of 12.3% and Total Capital of 14.5%.

- Tangible book value per common share(1) increased to $21.68 per share at September 30, 2024, up $1.60 per share compared to the second quarter of 2024, while tangible common shareholders’ equity to tangible assets(1) increased to 8.28% at September 30, 2024.

“Our third quarter results reflect another good quarter with strong operating performance, highlighted by favorable deposit trends, improvement in our net interest margin, and continued disciplined expense management,” remarked Dan Rollins, Chairman and Chief Executive Officer of Cadence Bank. “From a balance sheet standpoint, we were very pleased with our team’s continued success in growing deposits across the franchise, while keeping the increase in total cost of deposits to just two basis points. Our loan pipelines continue to be robust, reflecting the strong economies in our footprint; however, elevated payoffs and paydowns resulted in total loans being flat linked quarter. Importantly, our net interest income and net interest margin continued to exhibit growth, and our expenses and credit quality results remained in line with expectations.”

Earnings Summary

All adjusted financial results discussed herein are adjusted results from continuing operations.(3)

For the third quarter of 2024, the Company reported net income available to common shareholders of $134.1 million, or $0.72 per diluted common share, compared to $90.2 million, or $0.49 per diluted common share, for the third quarter of 2023 and $135.1 million, or $0.73 per diluted common share, for the second quarter of 2024. Adjusted net income available to common shareholders from continuing operations(1) increased to $135.6 million, or $0.73 per diluted common share, for the third quarter of 2024, compared with $97.6 million, or $0.53 per diluted common share, for the third quarter of 2023 and $127.9 million, or $0.69 per diluted common share, for the second quarter of 2024.

Additionally, the Company reported adjusted PPNR from continuing operations(1) of $189.9 million, or 1.58% of average assets on an annualized basis, for the third quarter of 2024, which is consistent with the second quarter of 2024, and an increase of $44.7 million or 30.7% compared to the same quarter of 2023. These notable increases in financial performance were driven by net interest margin expansion, fee revenue growth, and continued disciplined expense management.

Net Interest Revenue

Net interest revenue increased to $361.5 million for the third quarter of 2024, compared to $329.0 million for the third quarter of 2023 and $356.3 million for the second quarter of 2024. The net interest margin (fully taxable equivalent) improved to 3.31% for the third quarter of 2024, compared with 2.98% for the third quarter of 2023 and 3.27% for the second quarter of 2024.

Net interest revenue increased $5.1 million, or 1.4%, compared to the second quarter of 2024 as the Company continues to benefit from improved average earning asset mix, upward repricing in the loan portfolio and slowed pressure on deposit costs. Purchase accounting accretion revenue was $3.0 million for both the third quarter of 2024 and the second quarter of 2024, respectively. Average earning assets declined slightly to $43.5 billion, as growth in average loans of $334.3 million was offset by lower excess cash.

Yield on net loans, loans held for sale and leases, excluding accretion, was 6.61% for the third quarter of 2024, up 5 basis points from 6.56% for the second quarter of 2024. Investment securities yielded 3.04% in the third quarter of 2024, down 15 basis points from 3.19% in the second quarter of 2024 due to both increased fair values of the portfolio as well as maturing higher yielding securities in the quarter. The yield on total interest earning assets increased to 5.92% for the third quarter of 2024, up 2 basis points from 5.90% for the second quarter of 2024.

The average cost of total deposits was relatively stable at 2.55% for the third quarter of 2024, compared to 2.53% for the second quarter of 2024. While there was some mix shift between deposit product types, interest bearing demand and money market as well as savings costs were flat linked quarter and time deposit costs declined slightly. Total interest-bearing liabilities cost was 3.47% for the third quarter of 2024 compared to 3.45% for the second quarter of 2024.

Balance Sheet Activity

Loans and leases, net of unearned income, were flat at $33.3 billion compared to the second quarter of 2024. A decline in non-real estate C&I loans was offset by growth in owner occupied C&I, income producing CRE and residential mortgage loans.

Total deposits were $38.8 billion as of September 30, 2024, an increase of $985.7 million from the prior quarter. The third quarter’s increase included a decline of $568.0 million in public funds to $3.7 billion, and a $174.0 million increase in brokered deposits to $626.0 million at September 30, 2024. Core customer deposits, which excludes brokered deposits and public funds, reflected organic growth of approximately $1.4 billion compared to June 30, 2024. However, approximately $435 million of this increase in non-interest bearing deposits was temporary in nature at quarter end driven by timing of overnight customer sweep activity.

The September 30, 2024 loan to deposit ratio was 85.7% and securities to total assets was 15.9%, reflecting continued strong liquidity. Noninterest bearing deposits increased to 23.8% of total deposits at the end of the third quarter of 2024 from 22.7% at June 30, 2024. Excluding the aforementioned approximately $435 million in overnight customer sweep activity, noninterest bearing deposits to total deposits were flat compared to the prior quarter. Stabilization in this mix has positively impacted both the net interest margin and cost of deposits trends.

Total investment securities declined $0.1 billion during the third quarter of 2024 to $7.8 billion at September 30, 2024. Cash, due from balances and deposits at the Federal Reserve increased $1.4 billion to $4.0 billion at September 30, 2024. However, from an average balance perspective, cash, due from balances and deposits at the Federal Reserve declined $0.6 billion linked quarter as the Company continues to use excess liquidity to fund loan growth and reduce reliance on higher cost funding.

In June 2024, the Company called $138.9 million in fixed-to-floating subordinated debt at par. This debt was yielding 5.65%; however, was set to reprice to a weighted-average rate of SOFR+3.76% after the June call date. In November 2024, the Company anticipates calling $215.2 million in fixed-to-floating subordinated debt at par. This debt is currently yielding 4.125% and is set to reprice at SOFR+2.73% after the November call date.

Credit Results, Provision for Credit Losses and Allowance for Credit Losses

Net charge-offs for the third quarter of 2024 were $22.2 million, or 0.26% of average net loans and leases on an annualized basis, compared with net charge-offs of $34.2 million, or 0.42% of average net loans and leases on an annualized basis, for the third quarter of 2023 and net charge-offs of $22.6 million, or 0.28% of average net loans and leases on an annualized basis, for the second quarter of 2024. Net charge-offs for the third quarter of 2024 were primarily in the C&I portfolio and a significant portion of the credits were specifically reserved for in prior quarters. The provision for credit losses for the third quarter of 2024 was $12.0 million, compared with $17.0 million for the third quarter of 2023 and $22.0 million for the second quarter of 2024. The allowance for credit losses of $460.9 million at September 30, 2024 declined slightly to 1.38% of total loans and leases compared to 1.41% of total loans and leases at June 30, 2024.

Total nonperforming assets as a percent of total assets were 0.57% at September 30, 2024 compared to 0.32% at September 30, 2023 and 0.46% at June 30, 2024. Total nonperforming loans and leases as a percent of loans and leases, net were 0.82% at September 30, 2024, compared to 0.46% at September 30, 2023 and 0.65% at June 30, 2024. The linked quarter increase in nonperforming loans represents migration of a limited number of credits that were previously identified as criticized. Other real estate owned and other repossessed assets was $5.4 million at September 30, 2024 compared to the September 30, 2023 balance of $2.9 million and the June 30, 2024 balance of $4.8 million. Criticized loans represented 2.64% of loans at September 30, 2024 compared to 2.71% at September 30, 2023 and 2.51% at June 30, 2024, while classified loans were 2.09% at September 30, 2024 compared to 2.10% at September 30, 2023 and 2.09% at June 30, 2024. Criticized and classified loan totals continue to remain below the most recent peak levels at March 31, 2023.

Noninterest Revenue

Noninterest revenue was $85.9 million for the third quarter of 2024 compared with $74.0 million for the third quarter of 2023 and $100.7 million for the second quarter of 2024. Adjusted noninterest revenue(1) for the third quarter of 2024 was $88.8 million, compared with $80.6 million for the third quarter of 2023 and $85.7 million for the second quarter of 2024. Adjusted noninterest revenue(1) for the third quarter of 2024 excludes $2.9 million in securities losses while adjusted noninterest revenue(1) for the third quarter of 2023 excludes $6.7 million of facility and signage write-downs associated with branch closures and adjusted noninterest revenue(1) for the second quarter of 2024 excludes a gain of $15.0 million associated with the sale of businesses, primarily related to the sale of Cadence Business Solutions, LLC during the second quarter of 2024 (see Key Transactions below).

Wealth management revenue was $24.1 million for the third quarter of 2024, compared with $24.0 million for the second quarter of 2024 as seasonal declines in trust revenue were offset by growth in advisory and brokerage fees. Credit card, debit card and merchant fee revenue was $12.6 million for the third quarter of 2024, relatively consistent with $12.8 million for the second quarter of 2024. Deposit service charge revenue was $18.8 million for the third quarter of 2024, which represents an increase compared to $17.7 million for the second quarter of 2024 including an increase in account analysis revenue.

Mortgage production and servicing revenue totaled $8.2 million for the third quarter of 2024, compared with $9.9 million for the second quarter of 2024 due to slower originations. Mortgage origination volume for the third quarter of 2024 was $732.3 million, compared with $758.4 million for the second quarter of 2024. The net MSR valuation adjustment, net of the related hedge, was a negative $7.0 million for the third quarter of 2024, compared with a negative $3.7 million for the second quarter of 2024.

Other noninterest revenue was $32.1 million for the third quarter of 2024, compared to $40.1 million for the second quarter of 2024. Other noninterest revenue for the second quarter of 2024 included the $15.0 million gain on sale of businesses. Excluding this gain, other noninterest revenue increased $7.1 million linked quarter including increases in credit related fees, SBA income and other miscellaneous revenue.

Noninterest Expense

Noninterest expense for the third quarter of 2024 was $259.4 million, compared with $274.4 million for the third quarter of 2023 and $256.7 million for the second quarter of 2024. Adjusted noninterest expense(1) for the third quarter of 2024 was $260.4 million, compared with $264.2 million for the third quarter of 2023 and $251.1 million for the second quarter of 2024. Adjusted noninterest expense for the third quarter of 2024 excludes a benefit of $1.2 million associated with an adjustment to the estimated FDIC deposit insurance special assessment. The adjusted efficiency ratio(1) was 57.7% for the third quarter of 2024, compared to 56.7% for the second quarter of 2024 and 64.4% for the third quarter of 2023.

The $9.2 million, or 3.7%, linked quarter increases in adjusted noninterest expense(1) was driven by increases in salaries and employee benefits expense as well as other noninterest expense. Salaries and employee benefits expense increased $4.2 million compared to the second quarter of 2024 primarily as a result of the Company’s annual merit increases being effective on July 1, 2024. Other noninterest expense increased $7.6 million compared to the second quarter of 2024. This increase was driven partially by an increase of $2.9 million in legal expense as second quarter of 2024 included higher recoveries of legal costs. The remainder of the increase was the result of small increases in various miscellaneous expenses combined with second quarter 2024 results including benefits associated with certain items including operational loss recoveries.

Capital Management

Total shareholders’ equity was $5.6 billion at September 30, 2024 compared with $4.4 billion at September 30, 2023 and $5.3 billion at June 30, 2024. Estimated regulatory capital ratios at September 30, 2024 included Common Equity Tier 1 capital of 12.3%, Tier 1 capital of 12.7%, Total risk-based capital of 14.5%, and Tier 1 leverage capital of 10.1%. During the third quarter of 2024, the Company repurchased 323,395 shares of Company common stock at an average price of $28.79 per share. The company has 8.8 million shares remaining on its current share repurchase authorization, which expires on December 31, 2024. Outstanding common shares were 182.3 million as of September 30, 2024.

Summary

Rollins concluded, “Our results for the third quarter as well as year-to-date 2024 reflect steady improvement in our financial performance through disciplined balance sheet growth and strong core deposit retention, expansion in our net interest margin, stable credit quality, and enhanced operating efficiency. As always, it is rewarding to see all of our teammates’ hard work and focus on serving our customers and communities continue to produce positive results.”

Key Transactions

Effective May 17, 2024, the Company completed the sale of Cadence Business Solutions, its payroll processing business unit, resulting in a net gain on sale of approximately $12 million. The impact on both revenues and expenses is not material. The payroll processing unit had previously been part of Cadence Insurance, Inc., prior to its sale in November 2023.

Effective November 30, 2023, the Company completed the sale of its insurance subsidiary, Cadence Insurance, to Arthur J. Gallagher & Co. for approximately $904 million. The Transaction resulted in net capital creation of approximately $625 million, including a net gain on sale of approximately $525 million. The gain along with Cadence Insurance’s historical financial results for periods prior to the divestiture have been reflected in the consolidated financial statements as discontinued operations. Additionally, current and prior period adjusted earnings exclude the impact of discontinued operations.

Conference Call and Webcast

The Company will conduct a conference call to discuss its third quarter 2024 financial results on October 22, 2024, at 10:00 a.m. (Central Time). This conference call will be an interactive session between management and analysts. Interested parties may listen to this live conference call via Internet webcast by accessing http://ir.cadencebank.com/events. The webcast will also be available in archived format at the same address.

About Cadence Bank

Cadence Bank CADE is a leading regional banking franchise with approximately $50 billion in assets and more than 350 branch locations across the South and Texas. Cadence provides consumers, businesses and corporations with a full range of innovative banking and financial solutions. Services and products include consumer banking, consumer loans, mortgages, home equity lines and loans, credit cards, commercial and business banking, treasury management, specialized lending, asset-based lending, commercial real estate, equipment financing, correspondent banking, SBA lending, foreign exchange, wealth management, investment and trust services, financial planning, and retirement plan management. Cadence is committed to a culture of respect, diversity and inclusion in both its workplace and communities. Cadence Bank, Member FDIC. Equal Housing Lender.

|

(1) Considered a non-GAAP financial measure. A discussion regarding these non-GAAP measures and ratios, including reconciliations of non-GAAP measures to the most directly comparable GAAP measures and definitions for non-GAAP ratios, appears in Table 14 “Reconciliation of Non-GAAP Measures and Other Non-GAAP Ratio Definitions” beginning on page 22 of this news release. |

|

(2) See Table 14 for detail on non-routine income and expenses. |

|

(3) Given the sale of Cadence Insurance, Inc. (“Cadence Insurance”) in the fourth quarter of 2023, the financial results presented consist of both continuing operations and discontinued operations. The discontinued operations include the financial results of Cadence Insurance prior to the sale, as well as the associated gain on sale in the fourth quarter of 2023. The discontinued operations are presented as a single line item below income from continuing operations and as separate lines in the balance sheet in the accompanying tables for all periods presented. |

Forward-Looking Statements

Certain statements made in this news release constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor under the Private Securities Litigation Reform Act of 1995 as well as the “bespeaks caution” doctrine. These statements are often, but not exclusively, made through the use of words or phrases like “assume,” “believe,” “budget,” “contemplate,” “continue,” “could,” “foresee,” “indicate,” “may,” “might,” “outlook,” “prospect,” “potential,” “roadmap,” “should,” “target,” “will,” “would,” the negative versions of such words, or comparable words of a future or forward-looking nature. These forward-looking statements may include, without limitation, discussions regarding general economic, interest rate, real estate market, competitive, employment, and credit market conditions, or any of the Company’s comments related to topics in its risk disclosures or results of operations as well as the impact of the Cadence Insurance sale on the Company’s financial condition and future net income and earnings per share, and the Company’s ability to deploy capital into strategic and growth initiatives. Forward-looking statements are based upon management’s expectations as well as certain assumptions and estimates made by, and information available to, the Company’s management at the time such statements were made. Forward-looking statements are not guarantees of future results or performance and are subject to certain known and unknown risks, uncertainties and other factors that are beyond the Company’s control and that may cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements.

Risks, uncertainties and other factors the Company may face include, without limitation: general economic, unemployment, credit market and real estate market conditions, including inflation, and the effect of such conditions on customers, potential customers, assets, investments and liquidity; risks arising from market and consumer reactions to the general banking environment, or to conditions or situations at specific banks; risks arising from media coverage of the banking industry; risks arising from perceived instability in the banking sector; the risks of changes in interest rates and their effects on the level, cost, and composition of, and competition for, deposits, loan demand and timing of payments, the values of loan collateral, securities, and interest sensitive assets and liabilities; the ability to attract new or retain existing deposits, to retain or grow loans or additional interest and fee income, or to control noninterest expense; the effect of pricing pressures on the Company’s net interest margin; the failure of assumptions underlying the establishment of reserves for possible credit losses, fair value for loans and other real estate owned; changes in real estate values; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, or uncertainties surrounding the debt ceiling and the federal budget; uncertainties surrounding the functionality of the federal government; potential delays or other problems in implementing and executing the Company’s growth, expansion, acquisition, or divestment strategies, including delays in obtaining regulatory or other necessary approvals, or the failure to realize any anticipated benefits or synergies from any acquisitions, growth, or divestment strategies; the ability to pay dividends or coupons on the Company’s 5.5% Series A Non-Cumulative Perpetual Preferred Stock, par value $0.01 per share, or the 4.125% Fixed-to-Floating Rate Subordinated Notes due November 20, 2029; possible downgrades in the Company’s credit ratings or outlook which could increase the costs or availability of funding from capital markets; changes in legal, financial, accounting, and/or regulatory requirements; the costs and expenses to comply with such changes; the enforcement efforts of federal and state bank regulators; the ability to keep pace with technological changes, including changes regarding maintaining cybersecurity and the impact of generative artificial intelligence; increased competition in the financial services industry, particularly from regional and national institutions; the impact of a failure in, or breach of, the Company’s operational or security systems or infrastructure, or those of third parties with whom the Company does business, including as a result of cyber-attacks or an increase in the incidence or severity of fraud, illegal payments, security breaches or other illegal acts impacting the Company or the Company’s customers. The Company also faces risks from natural disasters or acts of war or terrorism; international or political instability, including the impacts related to or resulting from Russia’s military action in Ukraine, the escalating conflicts in the Middle East, and additional sanctions and export controls, as well as the broader impacts to financial markets and the global macroeconomic and geopolitical environments.

The Company also faces risks from: possible adverse rulings, judgments, settlements or other outcomes of pending, ongoing and future litigation, as well as governmental, administrative and investigatory matters; the impairment of the Company’s goodwill or other intangible assets; losses of key employees and personnel; the diversion of management’s attention from ongoing business operations and opportunities; and the company’s success in executing its business plans and strategies, and managing the risks involved in all of the foregoing.

The foregoing factors should not be construed as exhaustive and should be read in conjunction with those factors that are set forth from time to time in the Company’s periodic and current reports filed with the FDIC, including those factors included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, particularly those under the heading “Item 1A. Risk Factors,” in the Company’s Quarterly Reports on Form 10-Q under the heading “Part II-Item 1A. Risk Factors,” and in the Company’s Current Reports on Form 8-K.

Although the Company believes that the expectations reflected in these forward-looking statements are reasonable as of the date of this news release, if one or more events related to these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Accordingly, undue reliance should not be placed on any forward-looking statements. The forward-looking statements speak only as of the date of this news release, and the Company does not undertake any obligation to publicly update or review any forward-looking statement, except as required by applicable law. All written or oral forward-looking statements attributable to the Company are expressly qualified in their entirety by this section.

|

Table 1 Selected Financial Data (Unaudited)

|

||||||||

|

Quarter Ended |

Year-to-date |

|||||||

|

(In thousands) |

Sep 2024 |

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sep 2023 |

Sep 2024 |

Sep 2023 |

|

|

Earnings Summary: |

||||||||

|

Interest revenue |

$ 647,713 |

$ 642,210 |

$ 637,113 |

$ 615,187 |

$ 595,459 |

$ 1,927,036 |

$ 1,694,980 |

|

|

Interest expense |

286,255 |

285,892 |

283,205 |

280,582 |

266,499 |

855,352 |

678,229 |

|

|

Net interest revenue |

361,458 |

356,318 |

353,908 |

334,605 |

328,960 |

1,071,684 |

1,016,751 |

|

|

Provision for credit losses |

12,000 |

22,000 |

22,000 |

38,000 |

17,000 |

56,000 |

42,000 |

|

|

Net interest revenue, after provision for credit losses |

349,458 |

334,318 |

331,908 |

296,605 |

311,960 |

1,015,684 |

974,751 |

|

|

Noninterest revenue |

85,901 |

100,658 |

83,786 |

(311,460) |

73,989 |

270,345 |

195,116 |

|

|

Noninterest expense |

259,438 |

256,697 |

263,207 |

329,367 |

274,442 |

779,343 |

826,555 |

|

|

Income (loss) from continuing operations before income taxes |

175,921 |

178,279 |

152,487 |

(344,222) |

111,507 |

506,686 |

343,312 |

|

|

Income tax expense (benefit) |

39,482 |

40,807 |

35,509 |

(80,485) |

24,355 |

115,797 |

75,891 |

|

|

Income (loss) from continuing operations |

136,439 |

137,472 |

116,978 |

(263,737) |

87,152 |

390,889 |

267,421 |

|

|

Income from discontinued operations, net of taxes |

— |

— |

— |

522,801 |

5,431 |

— |

15,819 |

|

|

Net income |

136,439 |

137,472 |

116,978 |

259,064 |

92,583 |

390,889 |

283,240 |

|

|

Less: Preferred dividends |

2,372 |

2,372 |

2,372 |

2,372 |

2,372 |

7,116 |

7,116 |

|

|

Net income available to common shareholders |

$ 134,067 |

$ 135,100 |

$ 114,606 |

$ 256,692 |

$ 90,211 |

$ 383,773 |

$ 276,124 |

|

|

Balance Sheet – Period End Balances |

||||||||

|

Total assets |

$ 49,204,933 |

$ 47,984,078 |

$ 48,313,863 |

$ 48,934,510 |

$ 48,523,010 |

$ 49,204,933 |

$ 48,523,010 |

|

|

Total earning assets |

44,834,897 |

43,525,688 |

43,968,692 |

44,192,887 |

43,727,058 |

44,834,897 |

43,727,058 |

|

|

Available for sale securities |

7,841,685 |

7,921,422 |

8,306,589 |

8,075,476 |

9,643,231 |

7,841,685 |

9,643,231 |

|

|

Loans and leases, net of unearned income |

33,303,972 |

33,312,773 |

32,882,616 |

32,497,022 |

32,520,593 |

33,303,972 |

32,520,593 |

|

|

Allowance for credit losses (ACL) |

460,859 |

470,022 |

472,575 |

468,034 |

446,859 |

460,859 |

446,859 |

|

|

Net book value of acquired loans |

5,521,000 |

5,543,419 |

6,011,007 |

6,353,344 |

6,895,487 |

5,521,000 |

6,895,487 |

|

|

Unamortized net discount on acquired loans |

17,988 |

20,874 |

23,715 |

26,928 |

30,761 |

17,988 |

30,761 |

|

|

Total deposits |

38,844,360 |

37,858,659 |

38,120,226 |

38,497,137 |

38,344,885 |

38,844,360 |

38,344,885 |

|

|

Total deposits and repurchase agreements |

38,861,324 |

37,913,693 |

38,214,616 |

38,948,653 |

39,207,474 |

38,861,324 |

39,207,474 |

|

|

Other short-term borrowings |

3,500,000 |

3,500,000 |

3,500,000 |

3,500,000 |

3,500,223 |

3,500,000 |

3,500,223 |

|

|

Subordinated and long-term debt |

225,823 |

269,353 |

430,123 |

438,460 |

449,323 |

225,823 |

449,323 |

|

|

Total shareholders’ equity |

5,572,863 |

5,287,758 |

5,189,932 |

5,167,843 |

4,395,257 |

5,572,863 |

4,395,257 |

|

|

Total shareholders’ equity, excluding AOCI (1) |

6,163,205 |

6,070,220 |

5,981,265 |

5,929,672 |

5,705,178 |

6,163,205 |

5,705,178 |

|

|

Common shareholders’ equity |

5,405,870 |

5,120,765 |

5,022,939 |

5,000,850 |

4,228,264 |

5,405,870 |

4,228,264 |

|

|

Common shareholders’ equity, excluding AOCI (1) |

$ 5,996,212 |

$ 5,903,227 |

$ 5,814,272 |

$ 5,762,679 |

$ 5,538,185 |

$ 5,996,212 |

$ 5,538,185 |

|

|

Balance Sheet – Average Balances |

||||||||

|

Total assets |

$ 47,803,977 |

$ 48,192,719 |

$ 48,642,540 |

$ 48,444,176 |

$ 48,655,138 |

$ 48,211,586 |

$ 48,791,497 |

|

|

Total earning assets |

43,540,045 |

43,851,822 |

44,226,077 |

43,754,664 |

44,003,639 |

43,871,434 |

44,017,508 |

|

|

Available for sale securities |

7,915,636 |

8,033,552 |

8,269,708 |

9,300,714 |

10,004,441 |

8,072,391 |

10,666,618 |

|

|

Loans and leases, net of unearned income |

33,279,819 |

32,945,526 |

32,737,574 |

32,529,030 |

32,311,572 |

32,988,706 |

31,706,637 |

|

|

Total deposits |

37,634,453 |

38,100,087 |

38,421,272 |

38,215,379 |

38,468,912 |

38,050,413 |

38,767,657 |

|

|

Total deposits and repurchase agreements |

37,666,828 |

38,165,908 |

38,630,620 |

38,968,397 |

39,295,967 |

38,152,672 |

39,544,419 |

|

|

Other short-term borrowings |

3,512,218 |

3,500,000 |

3,500,000 |

3,503,320 |

3,510,942 |

3,504,102 |

3,460,386 |

|

|

Subordinated and long-term debt |

265,790 |

404,231 |

434,579 |

443,251 |

449,568 |

367,826 |

455,810 |

|

|

Total shareholders’ equity |

5,420,826 |

5,207,254 |

5,194,048 |

4,507,343 |

4,505,162 |

5,274,579 |

4,480,723 |

|

|

Common shareholders’ equity |

$ 5,253,833 |

$ 5,040,261 |

$ 5,027,055 |

$ 4,340,350 |

$ 4,338,169 |

$ 5,107,586 |

$ 4,313,730 |

|

|

Nonperforming Assets: |

||||||||

|

Nonperforming loans and leases (NPL) (2) (3) |

272,954 |

216,746 |

241,007 |

216,141 |

150,038 |

272,954 |

150,038 |

|

|

Other real estate owned and other assets |

5,354 |

4,793 |

5,280 |

6,246 |

2,927 |

5,354 |

2,927 |

|

|

Nonperforming assets (NPA) |

$ 278,308 |

$ 221,539 |

$ 246,287 |

$ 222,387 |

$ 152,965 |

$ 278,308 |

$ 152,965 |

|

|

(1) |

Denotes non-GAAP financial measure. Refer to related disclosure and reconciliation on pages 23 – 27. |

|

(2) |

At September 30, 2024, $81.6 million of NPL is covered by government guarantees from the SBA, FHA, VA or USDA. Refer to Table 7 on page 13 for related information. |

|

(3) |

At June 30, 2024, NPL does not include nonperforming loans held for sale of $2.7 million. |

|

Table 2 Selected Financial Ratios |

||||||||

|

Quarter Ended |

Year-to-date |

|||||||

|

Sep 2024 |

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sep 2023 |

Sep 2024 |

Sep 2023 |

||

|

Financial Ratios and Other Data: |

||||||||

|

Return on average assets from continuing operations (2) |

1.14 % |

1.15 % |

0.97 % |

(2.16) % |

0.71 % |

1.08 % |

0.73 % |

|

|

Return on average assets (2) |

1.14 |

1.15 |

0.97 |

2.12 |

0.75 |

1.08 |

0.78 |

|

|

Adjusted return on average assets from continuing operations (1)(2) |

1.15 |

1.09 |

0.97 |

0.62 |

0.82 |

1.07 |

0.92 |

|

|

Return on average common shareholders’ equity from continuing operations (2) |

10.15 |

10.78 |

9.17 |

(24.32) |

7.75 |

10.04 |

8.07 |

|

|

Return on average common shareholders’ equity (2) |

10.15 |

10.78 |

9.17 |

23.46 |

8.25 |

10.04 |

8.56 |

|

|

Adjusted return on average common shareholders’ equity from continuing operations (1)(2) |

10.27 |

10.21 |

9.15 |

6.65 |

8.93 |

9.88 |

10.18 |

|

|

Return on average tangible common equity from continuing operations (1)(2) |

14.04 |

15.18 |

12.94 |

(36.79) |

11.75 |

14.06 |

12.28 |

|

|

Return on average tangible common equity (1)(2) |

14.04 |

15.18 |

12.94 |

35.49 |

12.50 |

14.06 |

13.03 |

|

|

Adjusted return on average tangible common equity from continuing operations (1)(2) |

14.21 |

14.37 |

12.92 |

10.06 |

13.53 |

13.84 |

15.50 |

|

|

Pre-tax pre-provision net revenue from continuing operation to total average assets (1)(2) |

1.56 |

1.67 |

1.44 |

(2.51) |

1.05 |

1.56 |

1.06 |

|

|

Adjusted pre-tax pre-provision net revenue from continuing operations to total average assets (1)(2) |

1.58 |

1.59 |

1.44 |

1.13 |

1.18 |

1.54 |

1.30 |

|

|

Net interest margin-fully taxable equivalent |

3.31 |

3.27 |

3.22 |

3.04 |

2.98 |

3.27 |

3.10 |

|

|

Net interest rate spread-fully taxable equivalent |

2.45 |

2.45 |

2.40 |

2.25 |

2.21 |

2.43 |

2.37 |

|

|

Efficiency ratio fully tax equivalent (1) |

57.90 |

56.09 |

60.05 |

NM |

67.93 |

57.99 |

68.03 |

|

|

Adjusted efficiency ratio fully tax equivalent (1) |

57.73 |

56.73 |

60.12 |

66.01 |

64.35 |

58.18 |

62.48 |

|

|

Loan/deposit ratio |

85.74 % |

87.99 % |

86.26 % |

84.41 % |

84.81 % |

85.74 % |

84.81 % |

|

|

Full time equivalent employees |

5,327 |

5,290 |

5,322 |

5,333 |

6,160 |

5,327 |

6,160 |

|

|

Credit Quality Ratios: |

||||||||

|

Net charge-offs to average loans and leases (2) |

0.26 % |

0.28 % |

0.24 % |

0.29 % |

0.42 % |

0.26 % |

0.20 % |

|

|

Provision for credit losses to average loans and leases (2) |

0.14 |

0.27 |

0.27 |

0.46 |

0.21 |

0.23 |

0.18 |

|

|

ACL to loans and leases, net |

1.38 |

1.41 |

1.44 |

1.44 |

1.37 |

1.38 |

1.37 |

|

|

ACL to NPL |

168.84 |

216.85 |

196.08 |

216.54 |

297.83 |

168.84 |

297.83 |

|

|

NPL to loans and leases, net |

0.82 |

0.65 |

0.73 |

0.67 |

0.46 |

0.82 |

0.46 |

|

|

NPA to total assets |

0.57 |

0.46 |

0.51 |

0.45 |

0.32 |

0.57 |

0.32 |

|

|

Equity Ratios: |

||||||||

|

Total shareholders’ equity to total assets |

11.33 % |

11.02 % |

10.74 % |

10.56 % |

9.06 % |

11.33 % |

9.06 % |

|

|

Total common shareholders’ equity to total assets |

10.99 |

10.67 |

10.40 |

10.22 |

8.71 |

10.99 |

8.71 |

|

|

Tangible common shareholders’ equity to tangible assets (1) |

8.28 |

7.87 |

7.60 |

7.44 |

5.86 |

8.28 |

5.86 |

|

|

Tangible common shareholders’ equity, excluding AOCI, to tangible assets, excluding AOCI (1) |

9.40 |

9.40 |

9.13 |

8.90 |

8.41 |

9.40 |

8.41 |

|

|

Capital Adequacy (3): |

||||||||

|

Common Equity Tier 1 capital |

12.3 % |

11.9 % |

11.7 % |

11.6 % |

10.3 % |

12.3 % |

10.3 % |

|

|

Tier 1 capital |

12.7 |

12.3 |

12.2 |

12.1 |

10.8 |

12.7 |

10.8 |

|

|

Total capital |

14.5 |

14.2 |

14.5 |

14.3 |

12.9 |

14.5 |

12.9 |

|

|

Tier 1 leverage capital |

10.1 |

9.7 |

9.5 |

9.3 |

8.6 |

10.1 |

8.6 |

|

|

(1) Denotes non-GAAP financial measure. Refer to related disclosure and reconciliation on pages 23 – 27. |

|

(2) Annualized. |

|

(3) Current quarter regulatory capital ratios are estimated. |

|

NM – Not meaningful |

|

Table 3 Selected Financial Information

|

||||||||

|

Quarter Ended |

Year-to-date |

|||||||

|

Sep 2024 |

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sep 2023 |

Sep 2024 |

Sep 2023 |

||

|

Common Share Data: |

||||||||

|

Diluted earnings (losses) per share from continuing operations |

$ 0.72 |

$ 0.73 |

$ 0.62 |

$ (1.46) |

$ 0.46 |

$ 2.07 |

$ 1.41 |

|

|

Adjusted earnings per share from continuing operations (1) |

0.73 |

0.69 |

0.62 |

0.40 |

0.53 |

2.04 |

1.78 |

|

|

Diluted earnings per share |

0.72 |

0.73 |

0.62 |

1.41 |

0.49 |

2.07 |

1.50 |

|

|

Cash dividends per share |

0.250 |

0.250 |

0.250 |

0.235 |

0.235 |

0.750 |

0.705 |

|

|

Book value per share |

29.65 |

28.07 |

27.50 |

27.35 |

23.15 |

29.65 |

23.15 |

|

|

Tangible book value per share (1) |

21.68 |

20.08 |

19.48 |

19.32 |

15.09 |

21.68 |

15.09 |

|

|

Market value per share (last) |

31.28 |

28.28 |

29.00 |

29.59 |

21.22 |

31.28 |

21.22 |

|

|

Market value per share (high) |

34.13 |

29.95 |

30.03 |

31.45 |

25.87 |

34.13 |

28.18 |

|

|

Market value per share (low) |

27.46 |

26.16 |

24.99 |

19.67 |

19.00 |

24.99 |

16.95 |

|

|

Market value per share (average) |

30.96 |

28.14 |

27.80 |

24.40 |

22.56 |

28.98 |

22.41 |

|

|

Dividend payout ratio from continuing operations |

34.72 % |

34.25 % |

40.48 % |

(16.13) % |

51.09 % |

36.23 % |

50.00 % |

|

|

Adjusted dividend payout ratio from continuing operations (1) |

34.25 % |

36.23 % |

40.32 % |

58.75 % |

44.34 % |

36.76 % |

39.61 % |

|

|

Total shares outstanding |

182,315,142 |

182,430,427 |

182,681,325 |

182,871,775 |

182,611,075 |

182,315,142 |

182,611,075 |

|

|

Average shares outstanding – diluted |

185,496,110 |

185,260,963 |

185,574,130 |

182,688,190 |

184,645,004 |

185,443,201 |

184,062,368 |

|

|

Yield/Rate: |

||||||||

|

(Taxable equivalent basis) |

||||||||

|

Loans, loans held for sale, and leases |

6.64 % |

6.59 % |

6.50 % |

6.48 % |

6.39 % |

6.58 % |

6.22 % |

|

|

Loans, loans held for sale, and leases excluding net accretion on |

6.61 |

6.56 |

6.46 |

6.43 |

6.31 |

6.54 |

6.12 |

|

|

Available for sale securities: |

||||||||

|

Taxable |

3.03 |

3.18 |

3.11 |

2.45 |

2.07 |

3.11 |

1.98 |

|

|

Tax-exempt |

3.97 |

4.12 |

4.25 |

3.78 |

3.23 |

4.11 |

3.22 |

|

|

Other investments |

5.37 |

5.45 |

5.48 |

5.41 |

5.36 |

5.44 |

5.02 |

|

|

Total interest earning assets and revenue |

5.92 |

5.90 |

5.80 |

5.59 |

5.38 |

5.87 |

5.16 |

|

|

Deposits |

2.55 |

2.53 |

2.45 |

2.32 |

2.14 |

2.51 |

1.76 |

|

|

Interest bearing demand and money market |

3.13 |

3.13 |

3.11 |

3.02 |

2.79 |

3.13 |

2.43 |

|

|

Savings |

0.57 |

0.57 |

0.57 |

0.56 |

0.56 |

0.57 |

0.47 |

|

|

Time |

4.50 |

4.53 |

4.42 |

4.22 |

3.98 |

4.48 |

3.48 |

|

|

Total interest bearing deposits |

3.30 |

3.28 |

3.21 |

3.10 |

2.88 |

3.26 |

2.46 |

|

|

Fed funds purchased, securities sold under agreement to repurchase |

5.10 |

4.47 |

4.86 |

4.33 |

4.27 |

4.81 |

3.99 |

|

|

Short-term FHLB borrowings |

— |

— |

— |

— |

3.54 |

— |

4.91 |

|

|

Short-term BTFP borrowings |

4.77 |

4.77 |

4.84 |

5.04 |

5.15 |

4.79 |

5.15 |

|

|

Total interest bearing deposits and short-term borrowings |

3.46 |

3.44 |

3.39 |

3.33 |

3.16 |

3.43 |

2.77 |

|

|

Subordinated and long-term borrowings |

4.30 |

4.41 |

4.35 |

4.18 |

4.22 |

4.36 |

4.24 |

|

|

Total interest bearing liabilities |

3.47 |

3.45 |

3.40 |

3.34 |

3.17 |

3.44 |

2.79 |

|

|

Interest bearing liabilities to interest earning assets |

75.40 % |

75.97 % |

75.73 % |

76.08 % |

75.74 % |

75.70 % |

73.88 % |

|

|

Net interest income tax equivalent adjustment (in thousands) |

$ 694 |

$ 644 |

$ 636 |

$ 987 |

$ 1,081 |

$ 1,974 |

$ 3,197 |

|

|

(1) Denotes non-GAAP financial measure. Refer to related disclosure and reconciliation on pages 23 – 27. |

|

Table 4 Consolidated Balance Sheets (Unaudited)

|

|||||

|

As of |

|||||

|

(In thousands) |

Sep 2024 |

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sep 2023 |

|

ASSETS |

|||||

|

Cash and due from banks |

$ 504,827 |

$ 516,715 |

$ 427,543 |

$ 798,177 |

$ 594,787 |

|

Interest bearing deposits with other banks and Federal funds sold |

3,483,299 |

2,093,820 |

2,609,931 |

3,434,088 |

1,400,858 |

|

Available for sale securities, at fair value |

7,841,685 |

7,921,422 |

8,306,589 |

8,075,476 |

9,643,231 |

|

Loans and leases, net of unearned income |

33,303,972 |

33,312,773 |

32,882,616 |

32,497,022 |

32,520,593 |

|

Allowance for credit losses |

460,859 |

470,022 |

472,575 |

468,034 |

446,859 |

|

Net loans and leases |

32,843,113 |

32,842,751 |

32,410,041 |

32,028,988 |

32,073,734 |

|

Loans held for sale, at fair value |

205,941 |

197,673 |

169,556 |

186,301 |

162,376 |

|

Premises and equipment, net |

797,556 |

808,705 |

822,666 |

802,133 |

789,698 |

|

Goodwill |

1,366,923 |

1,366,923 |

1,367,785 |

1,367,785 |

1,367,785 |

|

Other intangible assets, net |

87,094 |

91,027 |

96,126 |

100,191 |

104,596 |

|

Bank-owned life insurance |

652,057 |

648,970 |

645,167 |

642,840 |

639,073 |

|

Other assets |

1,422,438 |

1,496,072 |

1,458,459 |

1,498,531 |

1,590,769 |

|

Assets of discontinued operations |

— |

— |

— |

— |

156,103 |

|

Total Assets |

$ 49,204,933 |

$ 47,984,078 |

$ 48,313,863 |

$ 48,934,510 |

$ 48,523,010 |

|

LIABILITIES |

|||||

|

Deposits: |

|||||

|

Demand: Noninterest bearing |

$ 9,242,693 |

$ 8,586,265 |

$ 8,820,468 |

$ 9,232,068 |

$ 9,657,198 |

|

Interest bearing |

18,125,553 |

18,514,015 |

18,945,982 |

19,276,596 |

18,334,551 |

|

Savings |

2,560,803 |

2,613,950 |

2,694,777 |

2,720,913 |

2,837,348 |

|

Time deposits |

8,915,311 |

8,144,429 |

7,658,999 |

7,267,560 |

7,515,788 |

|

Total deposits |

38,844,360 |

37,858,659 |

38,120,226 |

38,497,137 |

38,344,885 |

|

Securities sold under agreement to repurchase |

16,964 |

55,034 |

94,390 |

451,516 |

862,589 |

|

Other short-term borrowings |

3,500,000 |

3,500,000 |

3,500,000 |

3,500,000 |

3,500,223 |

|

Subordinated and long-term debt |

225,823 |

269,353 |

430,123 |

438,460 |

449,323 |

|

Other liabilities |

1,044,923 |

1,013,274 |

979,192 |

879,554 |

876,195 |

|

Liabilities of discontinued operations |

— |

— |

— |

— |

94,538 |

|

Total Liabilities |

43,632,070 |

42,696,320 |

43,123,931 |

43,766,667 |

44,127,753 |

|

SHAREHOLDERS’ EQUITY |

|||||

|

Preferred stock |

166,993 |

166,993 |

166,993 |

166,993 |

166,993 |

|

Common stock |

455,788 |

456,076 |

456,703 |

457,179 |

456,528 |

|

Capital surplus |

2,729,440 |

2,724,656 |

2,724,587 |

2,743,066 |

2,733,003 |

|

Accumulated other comprehensive loss |

(590,342) |