Jiayin Group Inc. Reports Third Quarter 2024 Unaudited Financial Results

SHANGHAI, Nov. 20, 2024 (GLOBE NEWSWIRE) — Jiayin Group Inc. (“Jiayin” or the “Company”) JFIN, a leading fintech platform in China, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Operational and Financial Highlights:

- Loan facilitation volume1 was RMB26.7 billion (US$3.8 billion), representing an increase of 10.3% from the same period of 2023.

- Average borrowing amount per borrowing was RMB7,629 (US$1,087), representing a decrease of 30.5% from the same period of 2023.

- Repeat borrowing rate2 was 67.8% compared with 71.5% in the same period of 2023.

- Net revenue was RMB1,444.9 million (US$205.9 million), representing a decrease of 1.5% from the same period of 2023.

- Income from operation was RMB311.9 million (US$44.4 million), representing a decrease of 18.3% from the same period of 2023.

- Net income was RMB269.6 million (US$38.4 million), representing a decrease of 16.8% from the same period of 2023.

Mr. Yan Dinggui, the Company’s Founder, Director and Chief Executive Officer, commented: “As we close out the third quarter of 2024, I’m proud to report continued strong performance, with a significant year-over-year increase in both loan facilitation volume and related revenue. Our loan facilitation volume reached RMB26.7 billion in the third quarter, a 10.3% increase compared with the same period last year. Loan facilitation service revenue grew 18.1% to RMB1,105.7 million. This growth reflects our strategic focus on innovation, risk management, and market diversification. We’ve successfully leveraged technology to enhance operational efficiency and borrower experience, while maintaining a sharp eye on risk resilience. We are confident that our adaptable business model and commitment to sustainable growth will enable us to capture new opportunities and deliver long-term value to our shareholders.”

___________________________

1 “Loan facilitation volume” refers the loan facilitation volume facilitated in Mainland China during the period presented.

2 “Repeat borrowing rate” refers to the repeat borrowers as a percentage of all of our borrowers in Mainland China.

“Repeat borrowers” during a certain period refers to borrowers who have borrowed in such period and have borrowed at least twice since such borrowers’ registration on our platform until the end of such period.

Third Quarter 2024 Financial Results

Net revenue was RMB1,444.9 million (US$205.9 million), representing a decrease of 1.5% from the same period of 2023.

Revenue from loan facilitation services was RMB1,105.7 million (US$157.6 million), representing an increase of 18.1% from the same period of 2023. The increase was primarily driven by service fee optimization within our loan facilitation operations and increased loan facilitation volume from the Company’s institutional funding partners.

Revenue from releasing of guarantee liabilities was RMB251.7 million (US$35.9 million) compared with RMB397.9 million in the same period of 2023.The year-over-year decrease was primarily due to the decrease in average outstanding loan balances for which the Company provided guarantee services.

Other revenue was RMB87.5 million (US$12.4 million), compared with RMB131.9 million for the same period of 2023. The decrease was mainly due to the decrease in revenue from individual investor referral services.

Facilitation and servicing expense was RMB419.1 million (US$59.7 million) compared with RMB544.3 million for the same period of 2023. This was primarily due to decreased expenses related to financial guarantee services, which was partially offset by the effect of increased loan facilitation volume.

Allowance for uncollectible receivables, contract assets, loans receivable and others was RMB11.6 million (US$1.7 million), representing an increase of 36.5% from the same period of 2023, primarily due to increased balances of receivables arising from loan facilitation.

Sales and marketing expense was RMB550.3 million (US$78.4 million), representing an increase of 34.9% from the same period of 2023, primarily due to an increase in borrower acquisition expenses.

General and administrative expense was RMB56.1 million (US$8.0 million), representing an increase of 5.5% from the same period of 2023, primarily driven by an increase in expenditures for employee compensation and related benefits.

Research and development expense was RMB95.9 million (US$13.7 million), representing an increase of 36.0% from the same period of 2023, primarily driven by an increase in expenditures for employee compensation and related benefits.

Income from operation was RMB311.9 million (US$44.4 million), representing a decrease of 18.3% from the same period of 2023.

Net income was RMB269.6 million (US$38.4 million), representing a decrease of 16.8% from RMB323.9 million in the same period of 2023.

Basic and diluted net income per share were both RMB1.27 (US$0.18) compared with RMB1.51 in the third quarter of 2023. Basic and diluted net income per ADS were both RMB5.08 (US$0.72) compared with RMB6.04 in the third quarter of 2023. Each ADS represents four Class A ordinary shares of the Company.

Cash and cash equivalents were RMB741.2 million (US$105.6 million) as of September 30, 2024, compared with RMB880.2 million as of June 30, 2024.

The following table provides the delinquency rates of all outstanding loans on the Company’s platform in Mainland China as of the respective dates indicated.

| Delinquent for | ||||||

| As of | 1-30 days |

31-60 days |

61-90 days |

91 -180 days |

More than 180 days | |

| (%) | ||||||

| December 31, 2021 | 1.31 | 0.90 | 0.72 | 1.78 | 2.12 | |

| December 31, 2022 | 1.01 | 0.67 | 0.51 | 1.18 | 2.02 | |

| December 31, 2023 | 1.13 | 0.90 | 0.68 | 1.48 | 2.07 | |

| March 31, 2024 | 0.99 | 0.85 | 0.68 | 1.63 | 2.62 | |

| June 30, 2024 | 0.96 | 0.83 | 0.67 | 1.61 | 2.60 | |

| September 30, 2024 | 0.93 | 0.76 | 0.55 | 1.32 | 2.49 | |

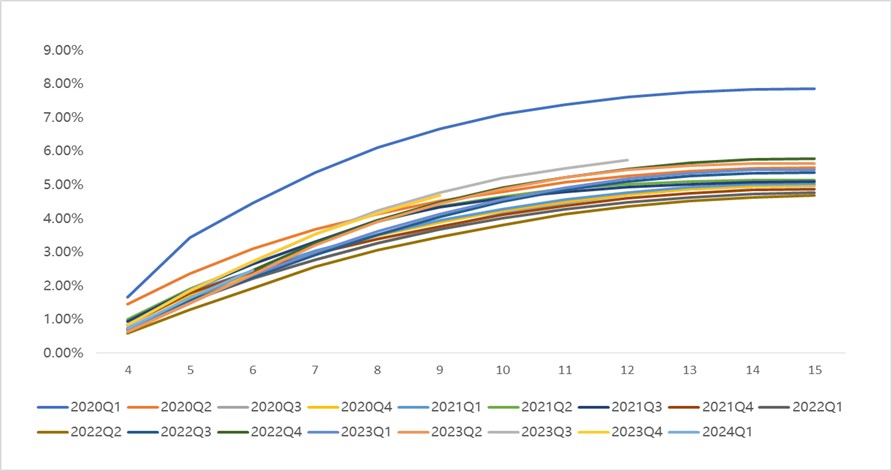

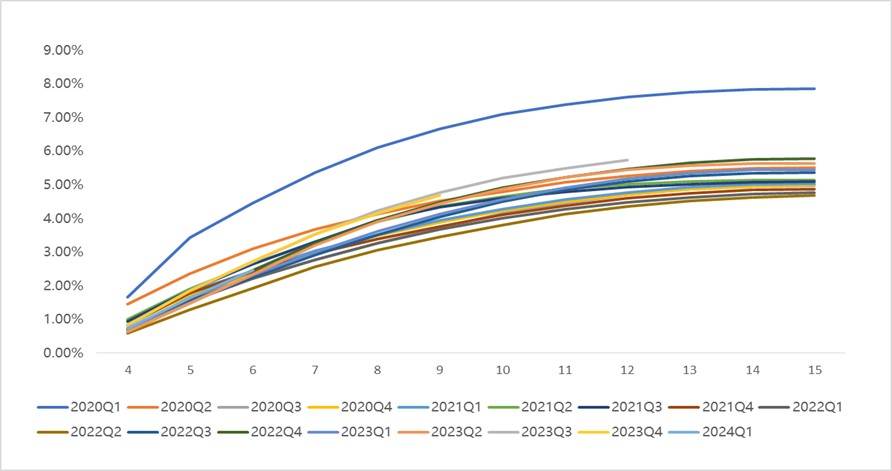

The following chart and table display the historical cumulative M3+ Delinquency Rate by Vintage for loan products facilitated through the Company’s platform in Mainland China.

Business Outlook

The Company expects its loan facilitation volume for the fourth quarter of 2024 to reach no less than RMB25 billion. This forecast reflects the Company’s current and preliminary views on the market and operational conditions, which are subject to change.

Recent Development

Dividend Policy

The board of directors of the Company (the “Board”) previously approved and adopted a dividend policy on March 28, 2023, (the “Existing Dividend Policy”) under which the Company may choose to declare and distribute a cash dividend twice each fiscal year, starting from 2023, at an aggregate amount of no less than 15% of the net income after tax of the Company in the previous fiscal year.

On November 19, 2024, the Board approved and adopted an amended dividend policy (the “Amended Dividend Policy”) to replace the Company’s Existing Dividend Policy in its entirety, with immediate effect. Under the Amended Dividend Policy, the Company may choose to declare and distribute a cash dividend once each fiscal year, starting from 2025, at an aggregate amount of no less than 15% of the net income after tax of the Company in the previous fiscal year. The determination to make dividend distributions in any particular fiscal year will be made at the discretion of the Board based upon factors such as the Company’s results of operations, cash flow, general financial condition, capital requirements, contractual restrictions and other factors as the Board may deem relevant.

Share Repurchase Plan Update

In March 2024, the Company’s Board of Directors approved an adjustment to the existing share repurchase plan, pursuant to which the aggregate value of ordinary shares authorized for repurchase under the plan shall not exceed US$30 million.

On June 4, 2024, the Company’s Board of Directors approved to extend the share repurchase plan for a period of 12 months, commencing on June 13, 2024, and ending on June 12, 2025. Pursuant to the extended share repurchase plan, the Company may repurchase its ordinary shares through June 12, 2025, with an aggregate value not exceeding the remaining balance under the share repurchase plan. As of November 20, 2024, the Company had repurchased approximately 3.5 million of its ADSs for approximately US$15.0 million.

Conference Call

The Company will conduct a conference call to discuss its financial results on November 20, 2024, at 8:00 AM U.S. Eastern Time (9:00 PM Beijing/Hong Kong Time on the same day).

To join the conference call, all participants must use the following link to complete the online registration process in advance. Upon registering, each participant will receive access details for this event including the dial-in numbers, a PIN number, and an e-mail with detailed instructions to join the conference call.

Participant Online Registration:

https://register.vevent.com/register/BIc807864fea404df38423af62dcb33615

A live and archived webcast of the conference call will be available on the Company’s investors relations website at http://ir.jiayintech.cn/.

About Jiayin Group Inc.

Jiayin Group Inc. is a leading fintech platform in China committed to facilitating effective, transparent, secure and fast connections between underserved individual borrowers and financial institutions. The origin of the business of the Company can be traced back to 2011. The Company operates a highly secure and open platform with a comprehensive risk management system and a proprietary and effective risk assessment model which employs advanced big data analytics and sophisticated algorithms to accurately assess the risk profiles of potential borrowers. For more information, please visit http://ir.jiayintech.cn/.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at a specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.0176 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System as of September 30, 2024. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor / Forward-Looking Statements

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements in this announcement include, but are not limited to, statements in the section entitled, “Business Outlook,” such as forecast of loan facilitation volume, and statements made by the Company’s Founder, Director and Chief Executive Officer, such as the Company’s future growth. Forward-looking statements involve inherent risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry. Potential risks and uncertainties include, but are not limited to, those relating to the Company’s ability to retain existing investors and borrowers and attract new investors and borrowers in an effective and cost-efficient way, the Company’s ability to increase the investment volume and loan facilitation volume of loans facilitated through its marketplace, effectiveness of the Company’s credit assessment model and risk management system, PRC laws and regulations relating to the online individual finance industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the Nasdaq Stock Market or other stock exchange. All information provided in this press release is as of the date hereof, and the Company undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by the Company is included in the Company’s filings with the U.S. Securities and Exchange Commission, including its annual report on Form 20-F.

For investor and media inquiries, please contact:

Jiayin Group

Mr. Shawn Zhang

Email: ir@jiayinfintech.cn

| JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except for share and per share data) |

||||||||

| As of December 31, |

As of September 30, |

|||||||

| 2023 | 2024 | |||||||

| RMB | RMB | US$ | ||||||

| ASSETS | ||||||||

| Cash and cash equivalents | 370,193 | 741,206 | 105,621 | |||||

| Restricted cash | 2,435 | — | — | |||||

| Accounts receivable and contract assets, net | 2,103,545 | 2,820,024 | 401,850 | |||||

| Financial assets receivables, net | 991,628 | 514,263 | 73,282 | |||||

| Prepaid expenses and other current assets, net | 1,922,056 | 807,660 | 115,091 | |||||

| Deferred tax assets, net | 61,174 | 86,783 | 12,366 | |||||

| Property and equipment, net | 40,332 | 44,708 | 6,371 | |||||

| Right-of-use assets, net | 49,659 | 54,057 | 7,703 | |||||

| Long-term investment | 101,481 | 175,702 | 25,037 | |||||

| Other non-current assets | 2,263 | 2,983 | 425 | |||||

| TOTAL ASSETS | 5,644,766 | 5,247,386 | 747,746 | |||||

| LIABILITIES AND EQUITY | ||||||||

| Deferred guarantee income | 886,862 | 380,717 | 54,252 | |||||

| Contingent guarantee liabilities | 933,947 | 351,370 | 50,070 | |||||

| Payroll and welfare payable | 94,856 | 111,369 | 15,870 | |||||

| Tax payables | 568,819 | 605,076 | 86,223 | |||||

| Accrued expenses and other current liabilities | 731,863 | 895,795 | 127,650 | |||||

| Lease liabilities | 47,958 | 54,244 | 7,730 | |||||

| TOTAL LIABILITIES | 3,264,305 | 2,398,571 | 341,795 | |||||

| TOTAL SHAREHOLDERS’ EQUITY | 2,380,461 | 2,848,815 | 405,951 | |||||

| TOTAL LIABILITIES AND EQUITY | 5,644,766 | 5,247,386 | 747,746 | |||||

| JIAYIN GROUP INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Amounts in thousands, except for share and per share data) |

||||||||||||||||||

| For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||||

| 2023 | 2024 | 2023 | 2024 | |||||||||||||||

| RMB | RMB | US$ | RMB | RMB | US$ | |||||||||||||

| Net revenue | 1,466,344 | 1,444,872 | 205,893 | 3,866,330 | 4,396,539 | 626,502 | ||||||||||||

| Operating costs and expenses: | ||||||||||||||||||

| Facilitation and servicing | (544,251 | ) | (419,056 | ) | (59,715 | ) | (1,174,305 | ) | (1,694,188 | ) | (241,420 | ) | ||||||

| Allowance for uncollectible receivables, contract assets, loans receivable and others |

(8,491 | ) | (11,638 | ) | (1,658 | ) | (29,011 | ) | (10,993 | ) | (1,566 | ) | ||||||

| Sales and marketing | (407,940 | ) | (550,289 | ) | (78,416 | ) | (1,209,461 | ) | (1,396,660 | ) | (199,022 | ) | ||||||

| General and administrative | (53,209 | ) | (56,099 | ) | (7,994 | ) | (149,673 | ) | (167,310 | ) | (23,841 | ) | ||||||

| Research and development | (70,532 | ) | (95,925 | ) | (13,669 | ) | (203,400 | ) | (272,014 | ) | (38,762 | ) | ||||||

| Total operating costs and expenses | (1,084,423 | ) | (1,133,007 | ) | (161,452 | ) | (2,765,850 | ) | (3,541,165 | ) | (504,611 | ) | ||||||

| Income from operation | 381,921 | 311,865 | 44,441 | 1,100,480 | 855,374 | 121,891 | ||||||||||||

| Interest income, net | 2,957 | 2,934 | 418 | 4,940 | 9,168 | 1,306 | ||||||||||||

| Other income, net | 2,567 | 8,742 | 1,246 | 13,579 | 74,966 | 10,683 | ||||||||||||

| Income before income taxes and loss from investment in affiliates |

387,445 | 323,541 | 46,105 | 1,118,999 | 939,508 | 133,880 | ||||||||||||

| Income tax expense | (61,806 | ) | (53,927 | ) | (7,685 | ) | (185,055 | ) | (158,559 | ) | (22,594 | ) | ||||||

| Loss from investment in affiliates | (1,738 | ) | — | — | (4,002 | ) | — | — | ||||||||||

| Net income | 323,901 | 269,614 | 38,420 | 929,942 | 780,949 | 111,286 | ||||||||||||

| Less: net income (loss) attributable to non-controlling interest |

108 | 2 | — | 85 | (4 | ) | (1 | ) | ||||||||||

| Net income attributable to Jiayin Group Inc. |

323,793 | 269,612 | 38,420 | 929,857 | 780,953 | 111,287 | ||||||||||||

| Weighted average shares used in calculating net income per share: |

||||||||||||||||||

| – Basic and diluted | 214,740,208 | 212,672,997 | 212,672,997 | 214,168,317 | 212,380,527 | 212,380,527 | ||||||||||||

| Net income per share: | ||||||||||||||||||

| – Basic and diluted | 1.51 | 1.27 | 0.18 | 4.34 | 3.68 | 0.52 | ||||||||||||

| Net income per ADS: | ||||||||||||||||||

| – Basic and diluted | 6.04 | 5.08 | 0.72 | 17.36 | 14.72 | 2.08 | ||||||||||||

| Net income | 323,901 | 269,614 | 38,420 | 929,942 | 780,949 | 111,286 | ||||||||||||

| Other comprehensive income (loss), net of tax of nil: |

||||||||||||||||||

| Foreign currency translation adjustments | 2,044 | (7,008 | ) | (999 | ) | 8,014 | (9,891 | ) | (1,409 | ) | ||||||||

| Comprehensive income | 325,945 | 262,606 | 37,421 | 937,956 | 771,058 | 109,877 | ||||||||||||

| Comprehensive income (loss) attributable to non-controlling interest |

147 | (69 | ) | (10 | ) | (4 | ) | (13 | ) | (2 | ) | |||||||

| Total comprehensive income attributable to Jiayin Group Inc. |

325,798 | 262,675 | 37,431 | 937,960 | 771,071 | 109,879 | ||||||||||||

A chart accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/8192de01-1462-4730-9c79-d7659198df5d

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Stares At Multi-Billion Dollar Hit Amid Google's Antitrust Ruling: Here's What Investors Should Know

Alphabet Inc.’s GOOG GOOGL lucrative agreement to pay Apple Inc. AAPL over $20 billion a year to make its search engine the default on iPhones is now under threat.

What Happened: In May earlier this year, an antitrust lawsuit against Google’s parent company revealed that Apple received a massive $20 billion in 2022 to make Google the default search engine on Apple’s Safari browser on iPhones.

The documents also underscore the importance of these payments to Apple’s financial performance, with Google’s contributions in 2020 accounting for 17.5% of the company’s operating income.

Following this, in August, a U.S. federal judge ruled that Alphabet’s Google holds an illegal monopoly in the search engine market.

The U.S. Department of Justice (DOJ) now plans to propose measures to prevent these types of payments, arguing that they reinforce Google’s dominant position in the market, according to the Wall Street Journal.

See Also: Alphabet’s Life Sciences Firm Verily To Become A Standalone Entity, Disconnect From Google

If the judge grants the DOJ’s request, this long-standing arrangement between the two tech giants could end.

If Google is barred from making these payments, Apple might need to find new partners to fill the gap. Microsoft Corporation’s MSFT Bing or other search providers could step in, but whether they will offer similar terms remains uncertain.

While Bing was the default search engine for Siri and Spotlight from 2013 to 2017, Apple later switched back to Google.

Microsoft launched Bing in 2009 to directly compete with Google. However, despite its efforts, Google remains the dominant player.

A previous Bloomberg report has also suggested that the DOJ’s plan highlighted the proposal to force Google to divest its Chrome browser.

Why It Matters: Though the ruling could be a setback for Google, it’s far from final.

Google has already indicated that it will appeal the decision, and the outcome could change depending on future legal developments.

Earlier, Google’s vice president of regulatory affairs, Lee-Anne Mulholland told Benzinga, “The government putting its thumb on the scale in these ways would harm consumers, developers, and American technological leadership at precisely the moment it is most needed.”

Previously, Alphabet CEO Sundar Pichai also stated during the company’s third-quarter earnings call that the DOJ’s proposals could result in “unintended consequences.”

As the DOJ’s final proposed remedies draw nearer on Nov. 20, JPMorgan analyst Doug Anmuth anticipates potential headline risk but believes it could provide much-needed clarity.

He continues to have an Overweight rating on GOOGL stock, with a price target of $212, indicating a 20% upside from its current price.

Price Action: On Tuesday, Alphabet’s Class A shares rose by 1.61%, closing at $178.12, while Class C shares increased by 1.57%, finishing at $179.58. In Wednesday’s pre-market session, Class A shares gained 0.06% to $178.22, and Class C shares edged up by 0.03% to $179.63, as of the latest update, according to data from Benzinga Pro.

Apple shares rose by 0.11% on Tuesday, ending the day at $228.28. However, in Wednesday’s pre-market session, the stock declined by 0.21%, reaching $227.79 at the time of writing.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Unstoppable Multibaggers Up Between 965% and 3,450% Since 2014 to Buy After a Recent Pullback

One of my favorite opportunities when investing is finding long-term multibaggers that have recently experienced short-term pullbacks in their share prices.

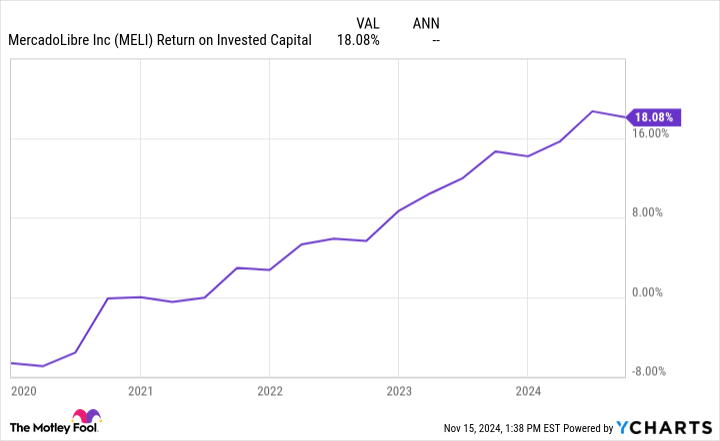

Three high-growth businesses currently meeting these requirements are Celsius (NASDAQ: CELH), MercadoLibre (NASDAQ: MELI), and Wingstop (NASDAQ: WING). After delivering share price increases ranging from 965% to 3,450% over the last decade, these multibaggers have pulled back between 11% and 73% from their 52-week highs.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Here’s why I believe these short-term drops in price could prove to be an opportunity for investors thinking a decade ahead.

In the third quarter of 2023, better-for-you energy drink maker Celsius more than doubled its sales compared to the previous year’s quarter. Fast-forward to Q3 2024, and Celsius saw sales drop 31%. This dramatic slowdown (and eventual shrinking) has caused the market to send the company’s shares down 73% from its recent highs.

So why am I highlighting a stock with declining sales as one of my favorite growth stock opportunities right now?

First, most of this slowdown results from how the company recognizes revenue upfront when it sells drinks through its largest distributor, Pepsi. The two companies signed a distribution deal in 2022, and Pepsi loaded up on Celsius drinks, prompting incredible growth from Celsius. Now, Pepsi is rightsizing its inventory with smaller orders from Celsius as the two businesses continue to learn how to work together.

However, despite this alarming-looking slowdown in sales via Pepsi’s distribution channels, Celsius’ underlying demand (what it actually sells to customers at retail locations) remains robust. During Q3, Celsius grew retail dollar and unit volume sales by 7%. The ready-to-drink energy market as a whole has only eked out 1% growth so far in 2024.

This relative retail sales strength helped Celsius maintain its No. 3 market share at 11.6% of its niche, compared to 11.5% a year ago. These results stand in stark contrast to what might otherwise look like an awful Q3 at first glance.

Second, sales to Amazon and Costco were up 21% and 15%, respectively, while international revenue jumped 37%. Thanks to this global growth potential and strong retail demand for Celsius drinks, it seems far too early to give up the promising growth stock which has risen 3,450% over the last 10 years.

Celsius currently trades at a price-to-sales (P/S) ratio of 4.4 — which compares nicely to its peer Monster‘s ratio of 7.4 — making it a reasonable time to buy into the company’s growth prospects.

Canaan Inc. Reports Unaudited Third Quarter 2024 Financial Results

– Total Revenue Increased to US$73.6 Million, up 120.9% YoY –

– Total Computing Power Sold Achieved 7.3 Million Thash/s, up 93.8% YoY –

SINGAPORE, Nov. 20, 2024 /PRNewswire/ — Canaan Inc. CAN (“Canaan” or the “Company”), a leading high-performance computing solutions provider, today announced its unaudited financial results for the three months ended September 30, 2024.

Third Quarter 2024 Operating and Financial Highlights

Revenues were US$73.6 million, which beat the previous guidance of US$73 million and increased 120.9% year-over-year.

Total computing power sold was 7.3 million Thash/s, representing a year-over-year increase of 93.8%.

Mining revenue was US$9.0 million, with 147 Bitcoins mined with an average revenue per Bitcoin mined of US$61,034.

Loss from operations was US$56.8 million, narrowing 49.6% year-over-year.

Nangeng Zhang, chairman, and chief executive officer of Canaan, commented, “Despite a challenging third quarter for the industry, we delivered a solid US$73.6 million in total revenue, exceeding our expectations. While Bitcoin prices remained soft in the quarter, the global network hash rate surged over 10%. Through strategic planning and effective execution, we made further strides in our operations. Primarily driven by the A14’s continued large-scale deliveries proceeding as scheduled, we recorded 7.3 million Thash/s of computing power sold, marking our highest sales volume in the past 11 quarters. Our mining operation matrix also continued to be optimized. Despite unfavorable Bitcoin prices, we mined 147 Bitcoins this quarter, a 5% sequential increase.”

“Building on the success of the A14, our new A15 series, which features outstanding performance parameters, began small-scale deliveries this quarter. We are working to optimize the A15’s yield rate and power efficiency, and anticipate ramping up to large-scale deliveries in the fourth quarter. Meanwhile, we remained diligent in strengthening our presence in the North American market. We recently made good progress with our Avalon A15 series, both air-cooled and liquid-cooled versions, including orders from public companies such as CleanSpark and HIVE, which we announced in November. We are also moving steadily towards our 2025 mid-year 10EH/s self-mining target. By delivering high-quality products and efficient alternative solutions, we are committed to empowering our global mining clients to navigate both challenges and opportunities ahead.”

Jin “James” Cheng, chief financial officer of Canaan, stated, “Although the Bitcoin prices remained under pressure in Q3, we overcame significant challenges to beat our expected targets this quarter. Our mining machine sales reached their highest level in nearly two years, driven by our dedicated efforts in delivering both the A14 and A15 models. This accomplishment is a testament to our strengthened production and delivery capabilities. Mining revenue reached US$9 million in the quarter, holding steady compared to the second quarter, despite a 7.5% decrease in the average prices of Bitcoins mined during the same periods. We also increased our balance sheet Bitcoin holdings to a record high of 1,231 Bitcoins, reinforcing our confidence in the long-term value of our cryptocurrency assets.”

“Benefiting from the successful bulk delivery of the A14 products, continued presales of the A15 series, and the completion of the third tranche of Series A preferred shares as we expected, our cash reserves increased to US$72 million by the end of the quarter. The bolstered cash level has enabled us to accelerate the mass production ramp-up of the A15 model. As we approach a critical period of opportunity with the market poised for improvement, we are dedicated to leveraging our high-quality products and enhanced delivery capabilities to meet the diverse needs of our global mining customers. We believe our strategic investments in R&D, supply chain, and mining deployment position us well to capitalize on the anticipated market upturn.”

Third Quarter 2024 Financial Results

Revenues in the third quarter of 2024 were US$73.6 million, as compared to US$71.9 million in the second quarter of 2024 and US$33.3 million in the same period of 2023. Total revenues consisted of US$64.6 million in products revenue, US$9.0 million in mining revenue and US$65,000 in other revenues.

Products revenue in the third quarter of 2024 was US$64.6 million, compared to US$61.8 million in the second quarter of 2024 and US$29.9 million in the same period of 2023. The sequential increase was driven by the increased computing power sold. The year-over-year increase was driven by the increased computing power sold and increased average selling price.

Mining revenue in the third quarter of 2024 was US$9.0 million, compared to US$9.3 million in the second quarter of 2024 and US$3.3 million in the same period of 2023. The year-over-year increase was mainly attributable to the increased computing power energized for mining.

Cost of revenues in the third quarter of 2024 was US$95.1 million, compared to US$91.0 million in the second quarter of 2024 and US$102.4 million in the same period of 2023.

Product cost in the third quarter of 2024 was US$81.6 million, compared to US$79.7 million in the second quarter of 2024 and US$83.7 million in the same period of 2023. The sequential increase was in line with revenue growth. The inventory write-down and prepayment write-down recorded for this quarter was US$22.9 million, compared to US$17.3 million for the second quarter of 2024 and US$53.9 million for the same period of 2023. Product cost consists of direct production costs of mining machines and AI products and indirect costs related to production, as well as inventory write-down and prepayment write-down.

Mining cost in the third quarter of 2024 was US$13.5 million, compared to US$11.0 million in the second quarter of 2024 and US$18.7 million in the same period of 2023. Mining costs herein consist of direct production costs of mining operations, including electricity and hosting, as well as depreciation of deployed mining machines. The sequential increase was mainly due to the increased depreciation driven by the increased deployed mining machines. The year-over-year decreases were mainly due to the decreased depreciation which was driven by the end of the depreciation period of early deployed mining machines and the impairment of the currently deployed mining machines. The depreciation in this quarter for deployed mining machines was US$6.5 million, compared to US$4.8 million in the second quarter of 2024 and US$15.0 million in the same period of 2023.

Gross loss in the third quarter of 2024 was US$21.5 million, compared to US$19.1 million in the second quarter of 2024 and US$69.1 million in the same period of 2023.

Total operating expenses in the third quarter of 2024 were US$35.3 million, compared to US$27.5 million in the second quarter of 2024 and US$43.8 million in the same period of 2023.

Research and development expenses in the third quarter of 2024 were US$14.8 million, compared to US$14.6 million in the second quarter of 2024 and US$17.2 million in the same period of 2023. The year-over-year decrease was mainly due to a decrease of US$1.7 million in staff costs and a decrease of US$0.5 million in share-based compensation expenses. Research and development expenses in the third quarter of 2024 also included share-based compensation expenses of US$1.9 million.

Sales and marketing expenses in the third quarter of 2024 were US$1.7 million, compared to US$1.6 million in the second quarter of 2024 and US$2.5 million in the same period of 2023. The year-over-year decrease was mainly due to a decrease of US$0.8 million in the advertising expenses. Sales and marketing expenses in the third quarter of 2024 also included share-based compensation expenses of US$54 thousand.

General and administrative expenses in the third quarter of 2024 were US$12.4 million, compared to US$10.4 million in the second quarter of 2024 and US$16.2 million in the same period of 2023. The sequential increase was mainly due to a decrease in the realized gain on asset disposals. The year-over-year decrease was mainly due to a decrease of US$2.5 million in share-based compensation expenses and an increase of US$0.5 million in the realized gain on asset disposals. General and administrative expenses in the third quarter of 2024 also included share-based compensation expenses of US$4.7 million.

Impairment on property, equipment and software in the third quarter of 2024 was US$6.5 million, compared to US$0.8 million in the second quarter of 2024 and US$5.7 million in the same period of 2023. The sequential and year-over-year increases were mainly due to the increased impairment for some A13 series of mining rigs deployed as a result of increased Bitcoin mining difficulty post-halving.

Loss from operations in the third quarter of 2024 was US$56.8 million, compared to US$46.6 million in the second quarter of 2024 and US$112.8 million in the same period of 2023.

Excess of fair value of Series A Convertible Preferred Shares in the third quarter of 2024 was US$28.3 million, compared to nil in the second quarter of 2024 and nil in the same period of 2023. For further information, please refer to “Preferred Shares Financing” in this press release.

Foreign exchange losses, net in the third quarter of 2024 were US$1.0 million, compared with a gain of US$11.4 million in the second quarter of 2024 and a gain of US$10.9 million in the same period of 2023, respectively. The foreign exchange losses were due to the U.S. dollar depreciation against the Renminbi during the third quarter of 2024.

Net loss in the third quarter of 2024 was US$75.6 million, compared to US$41.9 million in the second quarter of 2024 and US$80.1 million in the same period of 2023.

Non-GAAP adjusted EBITDA in the third quarter of 2024 was a loss of US$34.1 million, as compared to a loss of US$30.6 million in the second quarter of 2024 and a loss of US$68.0 million in the same period of 2023. For further information, please refer to “Use of Non-GAAP Financial Measures” in this press release.

Foreign currency translation adjustment, net of nil tax, in the third quarter of 2024 was a gain of US$5.1 million, compared with a loss of US$4.0 million in the second quarter of 2024 and a gain of US$7.7 million in the same period of 2023, respectively.

Basic and diluted net loss per American depositary share (“ADS”) in the third quarter of 2024 were US$0.27. In comparison, basic and diluted net loss per ADS in the second quarter of 2024 were US$0.15, while basic and diluted net loss per ADS in the same period of 2023 were US$0.47. Each ADS represents 15 of the Company’s Class A ordinary shares.

As of September 30, 2024, the Company held Cryptocurrency assets with a fair value of US$32.6 million and Cryptocurrency receivable with a fair value of US$46.4 million. Cryptocurrency assets primarily consist of 482 bitcoins owned by the Company and 19.3 bitcoins received as customer deposits. Cryptocurrency receivable consists of 600 bitcoins pledged for secured term loans, 100 bitcoins transferred to fixed term product, and 30 bitcoins prepaid for professional services. As of September 30, 2024, the Company held a total of 1,231.3 bitcoins.

Total change in fair value of cryptocurrency assets and cryptocurrency receivable in the third quarter of 2024 was an unrealized gain of US$2.5 million, compared to an unrealized loss of US$9.8 million in the second quarter of 2024. The change in fair value of cryptocurrency assets was recorded in Change in fair value of cryptocurrency as a loss of US$1.7 million, and the change in fair value of cryptocurrency receivable was recorded in Other income (net) as a gain of US$4.2 million.

As of September 30, 2024, the Company had cash of US$71.8 million, compared to US$96.2 million as of December 31, 2023.

Accounts receivable, net as of September 30, 2024, was US$1.4 million, compared to US$3.0 million as of December 31, 2023. Accounts receivable was mainly due to an installment policy implemented for some major customers who meet certain conditions.

Contract liabilities as of September 30, 2024, were US$16.2 million, compared to US$19.6 million as of December 31, 2023.

Shares Outstanding

As of September 30, 2024, the Company had a total of 273,741,843 ADSs outstanding, each representing 15 of the Company’s Class A ordinary shares.

Recent Developments

Expanded Mining Operation Footprint in Texas and Pennsylvania

On November 15, 2024, the Company’s wholly-owned subsidiary, Beet Digital LLC., entered into a strategic joint mining agreement with Luna Squares Texas LLC (“LS Texas”), a West Texas Bitcoin mining firm, to collaborate on mining activities at LS Texas’ mining site. Based on current estimated configurations, Canaan will install approximately 3,480 Avalon A14 series mining machines with an average hash rate of 150 Thash/s and 5,664 Avalon A15 series mining machines with an average hash rate of 194 Thash/s at LS Texas’ 30 MW site located in Willow Wells, Texas. The site is expected to be energized by the first quarter of 2025. After the site is fully energized, this project will provide approximately 1.62 EH/s of computing power.

Additionally, Cantaloupe Digital LLC (“Cantaloupe”), a wholly owned subsidiary of Canaan, recently amended its hosting agreement with Stronghold Digital Mining Hosting, LLC, an affiliate of Stronghold Digital Mining, Inc. (“Stronghold”) and will deliver 4,000 Avalon A14 series mining machines, each with an average hash rate of 150 Thash/s, to replace older Avalon models at Stronghold’s Panther Creek facility. In October, Cantaloupe completed the replacement of 2,000 older-generation units with A14 series machines. The Company anticipates that these 4,000 A14 units will be fully operational by December 31, 2024, resulting in a total of 6,000 A14 series machines at Panther Creek, Pennsylvania, with a combined computing power of 0.9 Exahash/s.

Secured Order from New Customer CleanSpark for 3,800 Avalon A1566I Miners

On November 1, 2024, Canaan U.S. Inc., a wholly owned subsidiary of the Company, entered into a purchase agreement with a new customer, CleanSpark Inc., for its Avalon A1566I miners.

According to the purchase agreement, Canaan U.S. Inc. will provide CleanSpark with 3,800 Avalon A1566I Immersion Cooling Miners. The miners, with an average computing power of 249 Thash/s without overclocking, are scheduled to be delivered in the fourth quarter of 2024.

Secured Large Orders from HIVE for 11,500 units of Avalon A1566 Miners

On November 11, 2024, Canaan Creative Global Pte. Ltd. (“CCG”), a wholly owned Singapore subsidiary of the Company, entered into a purchase agreement with HIVE Digital Technologies Ltd (“HIVE”).

According to the purchase agreement, CCG will provide HIVE with 6,500 Avalon A1566 miners, with an average computing power of 185 Thash/s. Of the 6,500 A1566 miners, 500 miners have been immediately delivered and are scheduled for installation. The remaining 6,000 machines will be delivered in four monthly shipments of 1,500 units, from December 2024 through March 2025.

On November 20, 2024, CCG entered into a follow-on order purchase agreement with HIVE.

According to the follow-on purchase agreement, CCG will provide HIVE with 5,000 Avalon A15 series miners, with an average computing power of 194 Thash/s, expected to be delivered in the first quarter of 2025.

Preferred Shares Financing

On November 27, 2023, the Company entered into a Securities Purchase Agreement with an institutional investor (the “Buyer”), pursuant to which the Company agreed to issue and sell to the Buyer up to 125,000 Series A Convertible Preferred Shares (the “Series A Preferred Shares”) at the price of US$1,000.00 for each Series A Preferred Share.

On December 11, 2023, the Company closed the first tranche of the preferred shares financing (the “First Tranche Preferred Shares Financing”) and was obligated to issue the second tranche of the preferred shares financing (the “Forward Purchase Liabilities”), raising total net proceeds of US$25.4 million. Pursuant to the First Tranches Preferred Shares Financing, the Company issued 25,000 Preferred Shares in total at the price of US$1,000.00 per Preferred Share.

In connection with the issuance of the Preferred Shares, the Company caused The Bank of New York Mellon to deliver 8,000,000 ADSs collectively as pre-delivery shares (the “Pre-delivery Shares”), each representing fifteen Class A ordinary shares of the Company, at the price of US$0.00000075 for each ADS. The Pre-delivery Shares shall be returned to the Company at the end of the arrangement and the Company shall pay such Buyer US$0.00000075 for each such Pre-delivery Share. The Pre-delivery Shares are considered a form of stock borrowing facility and were accounted as a share lending arrangement.

On January 22, 2024, the Company closed the second tranche of the preferred shares financing (the “Second Tranche Preferred Shares Financing”), raising total net proceeds of US$49.9 million. Pursuant to the Second Tranche Preferred Shares Financing, the Company issued 50,000 Preferred Shares in total at the price of US$1,000.00 per Preferred Share and caused The Bank of New York Mellon to deliver an additional 2,800,000 ADSs collectively as pre-delivery shares (the “Pre-delivery Shares”), each representing fifteen Class A ordinary shares of the Company, at the price of US$0.00000075 for each ADS.

The Company intends to use the net proceeds from the First Tranche and Second Tranche Preferred Shares for the expansion of wafer procurement, R&D activities, and other general corporate purposes.

On September 27, 2024, the Company closed the third and final tranche of Series A preferred shares financing (the “Third Tranche Closing”), raising total net proceeds of US$50.0 million. Pursuant to the Third Tranche Closing, the Company issued 50,000 Series A Preferred Shares in total at the price of US$1,000.00 per Series A Preferred Share.

The Company will use the proceeds from the Third Tranche Closing to manufacture or invest in digital mining sites and equipment to be deployed or sold in North America, including any acquisition or disposition of assets from or between subsidiaries.

Pursuant to the Global Amendment in connection with the Third Tranche Closing, the Buyer agreed to return to the Company 2,800,000 ADSs of the Pre-Delivery Shares delivered to the Buyer in the first tranche and the second tranche Series A preferred shares financing. The Company acknowledged that 1,345,203 ADSs of 2,800,000 ADSs of the Pre-Delivery Shares being returned to the Company would be returned in the form of 20,178,045 restricted class A ordinary shares. The Company will have no obligation to issue any Pre-Delivery Shares to the Buyer in connection with the Third Tranche Closing. As of the date of the Company’s third quarter 2024 earnings release, the Company has paid to the Buyer repurchase price of US$2.10 and cancelled 20,178,045 restricted class A ordinary shares repurchased.

As of the date of the Company’s earnings release for the third quarter of 2024, the Company has 4,223,697,753 Class A ordinary shares, 311,624,444 Class B ordinary shares, and 50,000 Series A Preferred Shares issued and outstanding. The increase in the outstanding Class A ordinary shares compared to the end of 2023 was due to the conversion from part of the Series A Preferred Shares to Class A ordinary shares by the Buyer and the issuance of the Pre-delivery Shares.

Execution of a Securities Purchase Agreement for Series A-1 Convertible Preferred Shares

On November 19, 2024, the Company entered into a securities purchase agreement (the “Series A-1 Securities Purchase Agreement”) with an institutional investor (the “Buyer”), pursuant to which the Company shall issue and sell to the Buyer up to 30,000 Convertible Series A-1 Preferred Shares (the “Series A-1 Preferred Shares”) at the price of US$1,000.00 for each Series A-1 Preferred Share. The closing of the sale of the Series A-1 Preferred Shares under the Series A-1 Securities Purchase Agreement is conditioned upon general customary closing conditions.

The Company agreed that the proceeds from the sale of the Series A-1 Preferred Shares will be used by the Company and/or its subsidiaries to manufacture or invest in digital mining sites and equipment to be deployed or sold in North America, including any acquisition or disposition of assets from or between subsidiaries.

Bitcoin Fixed Term Product

During the third quarter of 2024, the Company transferred 100 Bitcoins for fixed term product with an annual percentage rate of return (the “APR”) of 1.5% for 30 calendar days. As of the date of this earnings release, the fixed term product has matured, and total principal and interest of 100.12 Bitcoins have been transferred for open term product with an APR of 1% per annum.

Secured Term Loans

During the third quarter of 2024, the Company pledged 70 Bitcoins for secured term loans with an aggregate carrying value of US$2.0 million for 18 months. The secured term loans enable additional liquidity for the production expansion and operations of the Company.

Business Outlook

For the fourth quarter of 2024, the Company expects total revenues to be approximately US$80 million. This forecast reflects the Company’s current and preliminary views on the market and operational conditions, which are subject to change.

Conference Call Information

The Company’s management team will hold a conference call at 8:00 A.M. U.S. Eastern Time on November 20, 2024 (or 9:00 P.M. Singapore Time on the same day) to discuss the financial results. Details for the conference call are as follows:

Event Title: Canaan Inc. Third Quarter 2024 Earnings Conference Call

Registration Link: https://register.vevent.com/register/BI93fff71a1b6d462d915c62d639a733cf

All participants must use the link provided above to complete the online registration process in advance of the conference call. Upon registering, each participant will receive a set of participant dial-in numbers and a unique access PIN, which can be used to join the conference call.

A live and archived webcast of the conference call will be available at the Company’s investor relations website at investor.canaan-creative.com.

About Canaan Inc.

Established in 2013, Canaan Inc. CAN, is a technology company focusing on ASIC high-performance computing chip design, chip research and development, computing equipment production, and software services. Canaan has extensive experience in chip design and streamlined production in the ASIC field. In 2013, Canaan’s founding team shipped to its customers the world’s first batch of mining machines incorporating ASIC technology in bitcoin‘s history under the brand name Avalon. In 2019, Canaan completed its initial public offering on the Nasdaq Global Market. To learn more about Canaan, please visit https://www.canaan.io/.

Safe Harbor Statement

This announcement contains forward−looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward−looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Canaan Inc.’s strategic and operational plans, contain forward−looking statements. Canaan Inc. may also make written or oral forward−looking statements in its periodic reports to the U.S. Securities and Exchange Commission (“SEC”) on Forms 20−F and 6−K, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Canaan Inc.’s beliefs and expectations, are forward−looking statements. Forward−looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward−looking statement, including but not limited to the following: the Company’s goals and strategies; the Company’s future business development, financial condition and results of operations; the expected growth of the bitcoin industry and the price of bitcoin; the Company’s expectations regarding demand for and market acceptance of its products, especially its bitcoin mining machines; the Company’s expectations regarding maintaining and strengthening its relationships with production partners and customers; the Company’s investment plans and strategies, fluctuations in the Company’s quarterly operating results; competition in its industry; and relevant government policies and regulations relating to the Company and cryptocurrency. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Canaan Inc. does not undertake any obligation to update any forward−looking statement, except as required under applicable law.

Use of Non-GAAP Financial Measures

In evaluating Canaan’s business, the Company uses non-GAAP measures, such as adjusted EBITDA, as supplemental measures to review and assess its operating performance. The Company defines adjusted EBITDA as net loss excluding income tax expenses (benefit), interest income, depreciation and amortization expenses, share-based compensation expenses, impairment on property, equipment and software, change in fair value of financial instruments and excess of fair value of Series A Convertible Preferred Shares. The Company believes that the non-GAAP financial measures provide useful information about the Company’s results of operations, enhance the overall understanding of the Company’s past performance and future prospects and allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools and investors should not consider them in isolation, or as a substitute for net loss, cash flows provided by operating activities or other consolidated statements of operations and cash flows data prepared in accordance with U.S. GAAP. One of the key limitations of using adjusted EBITDA is that it does not reflect all of the items of income and expense that affect the Company’s operations. Further, the non-GAAP financial measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s performance.

Investor Relations Contact

Canaan Inc.

Xi Zhang

Email: IR@canaan-creative.com

ICR, LLC.

Robin Yang

Tel: +1 (347) 396-3281

Email: canaan.ir@icrinc.com

|

CANAAN INC. |

||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

||

|

(all amounts in thousands, except share and per share data, or as otherwise noted) |

||

|

As of December 31, |

As of September 30, |

|

|

2023 |

2024 |

|

|

USD |

USD |

|

|

ASSETS |

||

|

Current assets: |

||

|

Cash |

96,154 |

71,782 |

|

Accounts receivable, net |

2,997 |

1,375 |

|

Cryptocurrency receivable, current |

– |

8,261 |

|

Inventories |

142,287 |

87,802 |

|

Prepayments and other current assets |

122,242 |

138,273 |

|

Total current assets |

363,680 |

307,493 |

|

Non-current assets: |

||

|

Cryptocurrency |

28,342 |

32,632 |

|

Cryptocurrency receivable, non-current |

– |

38,127 |

|

Property, equipment and software, net |

29,466 |

40,153 |

|

Intangible asset |

– |

954 |

|

Operating lease right-of-use assets |

1,690 |

3,363 |

|

Deferred tax assets |

66,809 |

76,088 |

|

Other non-current assets |

486 |

472 |

|

Non-current financial investment |

2,824 |

2,854 |

|

Total non-current assets |

129,617 |

194,643 |

|

Total assets |

493,297 |

502,136 |

|

LIABILITIES, AND |

||

|

Current liabilities |

||

|

Accounts payable |

6,245 |

16,735 |

|

Contract liabilities |

19,614 |

16,238 |

|

Income tax payable |

3,534 |

3,535 |

|

Accrued liabilities and other current liabilities |

64,240 |

36,178 |

|

Operating lease liabilities, current |

1,216 |

1,407 |

|

Preferred Shares forward contract |

40,344 |

– |

|

Series A Convertible Preferred Shares |

– |

77,104 |

|

Total current liabilities |

135,193 |

151,197 |

|

Non-current liabilities: |

||

|

Long-term loans |

– |

23,963 |

|

Lease liabilities, non-current |

210 |

1,636 |

|

Deferred tax liability |

– |

162 |

|

Other non-current liabilities |

9,707 |

9,372 |

|

Total liabilities |

145,110 |

186,330 |

|

Shareholders’ equity: |

||

|

Ordinary shares (US$0.00000005 par |

– |

– |

|

Treasury stocks (US$0.00000005 par |

(57,055) |

(57,055) |

|

Additional paid-in capital |

653,860 |

763,293 |

|

Statutory reserves |

14,892 |

14,892 |

|

Accumulated other comprehensive loss |

(43,879) |

(47,736) |

|

Accumulated deficit |

(219,631) |

(357,588) |

|

Total shareholders’ equity |

348,187 |

315,806 |

|

Total liabilities and shareholders’ equity |

493,297 |

502,136 |

|

CANAAN INC. |

|||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF |

|||

|

(all amounts in thousands of USD, except share and per share data, or as otherwise noted) |

|||

|

For the Three Months Ended |

|||

|

September 30, 2023 |

June 30, 2024 |

September 30, 2024 |

|

|

USD |

USD |

USD |

|

|

Revenues |

|||

|

Products revenue |

29,937 |

61,751 |

64,584 |

|

Mining revenue |

3,264 |

9,308 |

8,959 |

|

Other revenues |

118 |

799 |

65 |

|

Total revenues |

33,319 |

71,858 |

73,608 |

|

Cost of revenues |

|||

|

Product cost |

(83,668) |

(79,661) |

(81,625) |

|

Mining cost |

(17,908) |

(11,037) |

(13,476) |

|

Other cost |

(833) |

(290) |

(18) |

|

Total cost of revenues |

(102,409) |

(90,988) |

(95,119) |

|

Gross loss |

(69,090) |

(19,130) |

(21,511) |

|

Operating expenses: |

|||

|

Research and development expenses |

(17,152) |

(14,648) |

(14,761) |

|

Sales and marketing expenses |

(2,491) |

(1,578) |

(1,719) |

|

General and administrative expenses |

(16,223) |

(10,445) |

(12,392) |

|

Impairment on property, equipment |

(5,691) |

(798) |

(6,462) |

|

Impairment on cryptocurrency |

(2,199) |

– |

– |

|

Total operating expenses |

(43,756) |

(27,469) |

(35,334) |

|

Loss from operations |

(112,846) |

(46,599) |

(56,845) |

|

Interest income |

61 |

66 |

158 |

|

Interest expense |

– |

(14) |

(247) |

|

Change in fair value of |

– |

(5,125) |

(1,672) |

|

Change in fair value of financial |

– |

(225) |

1,243 |

|

Excess of fair value of Series A |

– |

– |

(28,297) |

|

Foreign exchange gains (losses), net |

10,890 |

11,364 |

(1,036) |

|

Other income (expense), net |

1,349 |

(3,257) |

4,408 |

|

Loss before income tax expenses |

(100,546) |

(43,790) |

(82,288) |

|

Income tax benefit |

20,443 |

1,910 |

6,710 |

|

Net loss |

(80,103) |

(41,880) |

(75,578) |

|

Foreign currency translation adjustment, net of nil tax |

7,662 |

(3,999) |

5,129 |

|

Total comprehensive loss |

(72,441) |

(45,879) |

(70,449) |

|

Weighted average number of |

|||

|

— Basic |

2,562,542,847 |

4,117,791,601 |

4,163,053,834 |

|

— Diluted |

2,562,542,847 |

4,117,791,601 |

4,163,053,834 |

|

Net loss per class A and Class B |

|||

|

— Basic |

(3.13) |

(1.02) |

(1.82) |

|

— Diluted |

(3.13) |

(1.02) |

(1.82) |

|

Share-based compensation expenses were included in: |

|||

|

Cost of revenues |

67 |

59 |

53 |

|

Research and development expenses |

2,411 |

1,702 |

1,882 |

|

Sales and marketing expenses |

86 |

13 |

55 |

|

General and administrative expenses |

7,176 |

4,750 |

4,694 |

The table below sets forth a reconciliation of net loss to Non-GAAP adjusted EBITDA for the period indicated:

|

For the Three Months Ended |

|||

|

September 30, 2023 |

June 30, |

September 30, 2024 |

|

|

USD |

USD |

USD |

|

|

Net loss |

(80,103) |

(41,880) |

(75,578) |

|

Income tax benefit |

(20,443) |

(1,910) |

(6,710) |

|

Interest income |

(61) |

(66) |

(158) |

|

Interest expense |

14 |

247 |

|

|

EBIT |

(100,607) |

(43,842) |

(82,199) |

|

Depreciation and amortization expenses |

17,166 |

5,650 |

7,855 |

|

EBITDA |

(83,441) |

(38,192) |

(74,344) |

|

Share-based compensation expenses |

9,740 |

6,524 |

6,684 |

|

Impairment on property, equipment and |

5,691 |

798 |

6,462 |

|

Change in fair value of financial |

– |

225 |

(1,243) |

|

Excess of fair value of Series A |

– |

– |

28,297 |

|

Non-GAAP adjusted EBITDA |

(68,010) |

(30,645) |

(34,144) |

![]() View original content:https://www.prnewswire.com/news-releases/canaan-inc-reports-unaudited-third-quarter-2024-financial-results-302311234.html

View original content:https://www.prnewswire.com/news-releases/canaan-inc-reports-unaudited-third-quarter-2024-financial-results-302311234.html

SOURCE Canaan Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MSTR Rises 3% In Wednesday Pre-Market: Michael Saylor's Company Is Now Worth More Than The Combined Market Caps Of World's Two Largest Gold Mining Companies

MicroStrategy Inc. MSTR is making headlines as its stock climbs in pre-market trading, driven by Bitcoin’s impressive rally. The company’s market value has now outstripped the combined worth of the world’s two largest gold mining companies.

MicroStrategy saw its shares rise by 3.36% as Bitcoin’s price exceeded $93,000. According to Benzinga Pro, the company has now surpassed the market value of the two largest gold mining firms globally, Newmont Corporation NEM and Barrick Gold GOLD.

The market capitalization of MicroStrategy stands at $96.732 billion, significantly higher than Newmont’s $49.16 billion and Barrick Gold’s $31.11 billion. This valuation boost follows the company’s recent acquisition of 51,780 Bitcoin, valued at $4.6 billion, completed between Nov. 11 and Nov.17.

Peter Schiff commented on the feat by MicroStrategy on Wednesday, “I wonder how much longer it will take before MSTR’s market cap exceeds the capitalization of the entire gold mining industry!”

Led by co-founder and chairman Michael Saylor, MicroStrategy has pivoted its strategy towards Bitcoin since 2020, viewing it as a hedge against inflation.

Meanwhile, Goldman Sachs has given a “go for gold” as a leading commodity trade for 2025, with prices expected to reach $3,000 per ounce by December 2025.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo by JOCA_PH on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Durable Dividend Stocks That Have Delivered Decades of Stability and Growth

We’ve endured quite a number of economic shocks over the past few decades. The dot.com crash, financial crisis, and pandemic have severely affected many companies, forcing several to cut their dividends due to falling profits.

However, some companies have built resilient businesses that can endure even the deepest economic shocks. Enbridge (NYSE: ENB) and Oneok (NYSE: OKE) are two of those stalwarts. They have grown their earnings nearly every year for more than a decade while delivering dividend durability for even longer periods. That makes them great income stocks to buy for those seeking payouts that can deal with difficult times.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Enbridge is a remarkably consistent company. The Canadian pipeline and utility operator has paid dividends for over 69 years and has increased its payment for 29 years in a row.

A big factor in the durability of Enbridge’s dividend is its extremely predictable earnings profile. The company currently gets 98% of its earnings before interest, taxes, depreciation, and amortization (EBITDA) from cost-of-service or contracted assets, which provides a lot of visibility into its future earnings.

The company has achieved its annual financial guidance for 18 straight years and is on track to hit it again this year. Its earnings have only declined once during that period, due to the expected impact of collapsing commodity prices and wildfires in Canada.

Enbridge has worked to enhance the durability of its earnings profile by selling assets whose earnings are exposed to commodity price volatility, and then recycling that capital into stable assets. For example, last year it sold its stake in Aux Sable — which operates natural gas liquids (NGL) extraction and separation facilities — to help fund the purchase of three stable natural gas utilities this year.

The company is investing heavily in expanding its portfolio of assets with stable earnings profiles. It has billions of dollars in commercially secured capital projects currently under construction that should come on line through the end of the decade.

They support Enbridge’s view that it will be able to grow its EBITDA by around the mid-single digits annually. That should give it plenty of fuel to continue increasing its dividend.

Oneok has been very durable over the years. The pipeline company has grown its adjusted EBITDA for 10 straight years, increasing it at an impressive 15% compound annual rate despite two major periods of turbulence in the oil market. Meanwhile, it has delivered more than a quarter-century of dividend stability and growth.

1 Vanguard Index Fund May Beat the S&P 500 by 100% in the Next Few Years, According to a Wall Street Analyst

In general, the S&P 500 (SNPINDEX: ^GSPC) is the preferred stock market barometer for large-cap companies, while the Russell 2000 is the preferred stock market barometer for small-cap companies. Specific details are provided below:

-

S&P 500: Includes 500 large-cap companies that cover about 80% of U.S. equities by market value. The median market capitalization is $37 billion.

-

Russell 2000: Includes nearly 2,000 small-cap companies that cover about 5% of U.S. equities by market value. The median market capitalization is about $1 billion.

Tom Lee, head of research at Fundstrat Global Advisors, told CNBC during a recent interview that small-cap stocks may outpeform large-cap stocks by a wide margin in the near term. “I think small caps, in the next couple of years, could outperform by more than 100%,” he said, citing interest rate cuts and historically cheap valuations.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Should that prediction prove accurate, the Russell 2000 would run circles around the S&P 500 in the next few years, perhaps even doubling its return as Lee suggests. Investors can position themselves to benefit by purchasing shares of the Vanguard Russell 2000 ETF (NASDAQ: VTWO).

Read on for the important details.

Tom Lee highlighted two reasons small-cap stocks could outperform in the coming years. First, the Federal Reserve recently started cutting interest rates, and small-cap companies usually benefit from rate cuts more than large cap companies because the former usually have more floating-rate debt. Second, small-cap stocks currently have historically cheap valuations relative to large-cap stocks.

Importantly, Lee is not the only Wall Street pundit to make those points. In July, JPMorgan Chase strategist Michael Cembalest wrote, “Small-cap stocks are at their cheapest levels in the 21st century with potential market and political catalysts in their favor.” The catalysts he referenced include falling interest rates, as well as the tariffs proposed by President-elect Donald Trump. Tariffs usually hurt large-cap stocks more, according to Cembalest.

Likewise, Goldman Sachs strategists Hania Schmidt and Jen Nusser addressed interest rate cuts and small-cap valuations in a recent blog headlined: Time to Shine? A Small Cap Reversal of Fortune. The key points are detailed below:

-

The Russell 2000 has historically outperformed the S&P 500 by an average of 12 percentage points during the 12-month period following the end of a rate-cutting cycle.

-

Since 1985, the P/E ratio of the median Russell 2000 stock has been (on average) 2% below the P/E ratio of the median S&P 500 stock. But the discrepancy is currently 28%.

Yiren Digital Reports Third Quarter 2024 Financial Results

BEIJING, Nov. 20, 2024 /PRNewswire/ — Yiren Digital Ltd. YRD (“Yiren Digital” or the “Company”), an AI-powered platform providing a comprehensive suite of financial and lifestyle services in China, today announced its unaudited financial results for the quarter ended September 30, 2024.

Third Quarter 2024 Operational Highlights

Financial Services Business

- Total loans facilitated in the third quarter of 2024 reached RMB13.4 billion (US$1.9 billion), representing an increase of 3.5% from RMB12.9 billion in the second quarter of 2024 and compared to RMB9.8 billion in the same period of 2023.

- Cumulative number of borrowers served reached 11,611,899 as of September 30, 2024, representing an increase of 7.4% from 10,807,497 as of June 30, 2024, and compared to 8,595,780 as of September 30, 2023.

- Number of borrowers served in the third quarter of 2024 was 1,498,020, representing an increase of 0.4% from 1,491,756 in the second quarter of 2024 and compared to 1,204,012 in the same period of 2023. As our efforts to upgrade the customer mix reach a milestone success, we are now shifting our focus to increasing the repeat rate of existing high-quality borrowers.

- Outstanding balance of performing loans facilitated reached RMB22.8 billion (US$3.2 billion) as of September 30, 2024, representing an increase of 4.3% from RMB21.8 billion as of June 30, 2024 and compared to RMB15.1 billion as of September 30, 2023.

Insurance Brokerage Business

- Cumulative number of insurance clients served reached 1,470,738 as of September 30, 2024, representing an increase of 4.3% from 1,410,158 as of June 30, 2024, and compared to 1,256,762 as of September 30, 2023.

- Number of insurance clients served in the third quarter of 2024 was 82,291, representing a decrease of 7.3% from 88,766 in the second quarter of 2024, and compared to 123,693 in the same period of 2023.

- Gross written premiums in the third quarter of 2024 were RMB1,351.3 million (US$192.6 million), representing an increase of 27.4% from RMB1,060.9 million in the second quarter of 2024 and compared to RMB1,428.5 million in the same period of 2023. The quarterly increase was attributed to the gradual recovery of our life insurance business following product changes made in response to new regulations, along with the continued rise in renewed life insurance premiums.

Consumption and Lifestyle Business

- Total gross merchandise volume generated through our e-commerce platform and “Yiren Select” channel reached RMB507.6 million (US$72.3 million) in the third quarter of 2024, representing a decrease of 8.5% from RMB554.6 million in the second quarter of 2024, and compared to RMB563.2 million in the same period of 2023. The decrease was mainly due to the already high penetration of our products and services within the existing customer pool, along with our strategic scale-back of product offerings as we shift our focus to upgrading customer segmentation.

“I’m pleased to report a stable and healthy quarter with concrete business development and strategic exploration, driven by our ‘quality over quantity’ strategy, which underscores our consistent focus on sustainable, high-quality growth.” said Mr. Ning Tang, Chairman and Chief Executive Officer.

“Our financial services business has improved asset quality through strong risk management and borrower optimization. We’ve also made progress in exploring new online business models for our insurance division. As a tech-powered platform, Yiren Digital prioritizes the use of technology and digital capabilities to enhance our business model. Furthermore, our AI investments are driving operational efficiency and enhancing the customer experience. These efforts lay the foundation for higher-quality growth and long-term value for our stakeholders.”

“In the third quarter of this year, our total revenue reached RMB 1.5 billion, up 13% year-over-year.” Mr.Yuning Feng, Chief Financial Officer commented. “On the balance sheet side, as we continued to make strategic long-term investments this quarter, cash and cash equivalents decreased compared to the end of the previous quarter, bringing the total to RMB3.7 billion. Despite this, our cash position remains strong and competitive within the industry. Meanwhile, we are continuing share buybacks and executing cash dividends to enhance returns for our shareholders.”

Third Quarter 2024 Financial Results

Total net revenue in the third quarter of 2024 was RMB1,479.1 million (US$210.8 million), representing an increase of 12.8% from RMB1,310.8 million in the third quarter of 2023. Particularly, in the third quarter of 2024, revenue from financial services business was RMB836.2 million (US$119.2 million), representing an increase of 25.2% from RMB668.0 million in the same period of 2023.The increase was attributed to the persistent and growing demand for our small revolving loan products. Revenue from insurance brokerage business was RMB85.5 million (US$12.2 million), representing a decrease of 67.7% from RMB264.6 million in the third quarter of 2023. The decrease was primarily driven by a decline in life insurance sales, resulting from product modifications mandated by new regulations, along with an industry-wide reduction in commission fee rates due to the implementation of more stringent regulatory standards on rates and terms. Revenue from consumption and lifestyle business and others was RMB557.4 million (US$79.4 million), representing an increase of 47.4% from RMB378.2 million in the third quarter of 2023. The annual increase was primarily attributed to the continuous growth of the service and product penetration in the expanding base of paying customers. As the penetration rate reached a substantial level in the third quarter of 2024, the growth rate is expected to moderate.

Sales and marketing expenses in the third quarter of 2024 were RMB335.6 million (US$47.8 million), compared to RMB195.7 million in the same period of 2023. The increase was primarily driven by the swift growth of our financial services segment and enhanced marketing endeavors aimed at attracting new, high-caliber customers while optimizing our customer composition.

Origination, servicing and other operating costs in the third quarter of 2024 were RMB205.9million (US$29.3 million), compared to RMB245.4 million in the same period of 2023. The decrease was mainly due to the decline in insurance brokerage services.

Research and development expenses in the third quarter of 2024 were RMB150.8 million (US$21.5 million), compared to RMB39.0 million in the same period of 2023. The increase was mainly attributed to our ongoing investment in AI upgrades and technological innovations.

General and administrative expenses in the third quarter of 2024 were RMB80.1 million (US$11.4 million), compared to RMB53.5 million in the same period of 2023. The increase was primarily due to increasing incentive bonus and employee benefits.

Allowance for contract assets, receivables and others in the third quarter of 2024 was RMB94.9 million (US$13.5 million), compared to RMB72.7 million in the same period of 2023. The increase reflects the growing volume of loans facilitated on our platform and the stringent risk estimates in response to the evolving external credit environment.

Provision for contingent liabilities in the third quarter of 2024 was RMB272.4 million (US$38.8 million), compared to RMB11.1 million in the same period of 2023. The increase was mainly attributed to a higher volume of loans facilitated under our risk-taking model[1].

Income tax expense in the third quarter of 2024 was RMB44.7 million (US$6.4 million).

Net income in the third quarter of 2024 was RMB355.4 million (US$50.7 million), as compared to RMB554.4 million in the same period in 2023. The decrease was primarily due to the growing loan volume facilitated under our risk-taking model, resulting in substantial upfront provisions required by the current accounting principles.

Adjusted EBITDA[2] (non-GAAP) in the third quarter of 2024 was RMB393.9 million (US$56.1 million), compared to RMB692.7 million in the same period of 2023.

Basic and diluted income per ADS in the third quarter of 2024 were RMB4.1 (US$0.6) and RMB4.0 (US$0.6) respectively, compared to a basic income per ADS of RMB6.3 and a diluted income per ADS of RMB6.2 in the same period of 2023.

Net cash generated from operating activities in the third quarter of 2024 was RMB50.4 million (US$7.2 million), compared to RMB645.4 million in the same period of 2023.

Net cash used in investing activities in the third quarter of 2024 was RMB1,859.6 million (US$265.0 million), compared to RMB393.9 million in the same period of 2023.

Net cash used in financing activities in the third quarter of 2024 was RMB22.2 million (US$3.2 million), compared to RMB502.6 million in the same period of 2023.