Arkansas May Be Sitting On 19M Tons Of Lithium Amid Rising Demand For EV Batteries: How To Invest In What Elon Musk Calls 'The New Oil'

In a recent study, researchers have suggested that Arkansas could potentially hold a significant amount of lithium, a crucial component for electric car batteries and other high-tech products.

What Happened: The researchers, in a study published in the journal Science Advances, have estimated that there could be between 5.1 to 19 million tons of lithium in the Smackover Formation brines in southern Arkansas, reported The Hill. This amount could potentially make up 35 to 136% of the current U.S. lithium resource estimate.

The researchers used a machine-learning model trained on published and newly collected brine lithium concentration data to create a map of predicted lithium concentrations in Smackover Formation brines across southern Arkansas.

Lithium ETFs offer a way to diversify your investments across multiple companies poised to benefit from the growing demand for lithium.

Some of the top lithium ETFs to consider include the Global X Lithium & Battery Tech ETF LIT, Amplify Lithium and Battery Technology ETF BATT, First Trust NASDAQ Clean Edge Green Energy Index Fund QCLN, iShares Global Clean Energy ETF ICLN, and the VanEck Vectors Rare Earth/Strategic Metals ETF REMX.

Why It Matters: Automakers and tech companies are scrambling to secure their lithium supplies, with some even investing in mining projects, such as General Motors‘ joint venture with Lithium Americas LAC for the Thacker Pass lithium project in Nevada.

Meanwhile, in Europe, the Serbian parliament’s decision not to ban lithium exploration and exploitation has kept Rio Tinto‘s RIO major Jadar project alive.

In January, Microsoft Corp MSFT revealed its collaboration with a U.S. national laboratory to create an innovative battery material that decreases lithium consumption by 70%, attracting interest from Tesla Inc TSLA CEO Elon Musk.

Moreover, in July 2022 Musk tweeted that “lithium batteries are the new oil,” responding to Craft Ventures co-founder David Sacks‘ comments about the importance of energy independence amid oil challenges from Russia’s invasion of Ukraine.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NIO, LI, or TSLA: Which EV Stock Has the Highest Upside Potential?

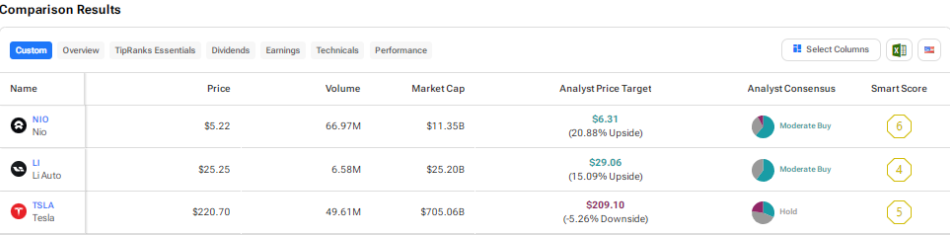

Electric vehicle makers are facing multiple headwinds, including slowing demand due to macro pressures, intense competition, and additional tariffs on imports by certain countries. Nonetheless, Wall Street is optimistic about certain EV stocks due to their resilient performance in a tough business backdrop and improving financials. We used TipRanks’ Stock Comparison Tool to place Nio (NIO), Li Auto (LI), and Tesla (TSLA) against each other to pick the EV stock with the highest upside potential, according to Wall Street analysts.

Nio (NYSE:NIO)

Shares of Chinese EV maker Nio are down more than 42% year-to-date even after witnessing a solid rally in September due to China’s stimulus measures and improving numbers. However, uncertainty about the Chinese government’s measures to support the EV sector and intense competition continue to drag down Nio stock.

Despite a tough business backdrop, Nio reported solid deliveries in September. The company delivered 21,181 vehicles, reflecting a 35.4% year-over-year increase. Its Q3 deliveries grew 11.6% to 61,855 vehicles. The September numbers included 832 units of the company’s first mass-market model Onvo L60, which was launched on September 19.

Recently, Nio announced that a group of Chinese investors will invest RMB3.3 billion in its subsidiary Nio China, while the company itself will invest an additional RMB10 billion. Reacting to the news, Daiwa analyst Kelvin Lau noted that Nio China is the core operational entity for the company and the cash injection by existing shareholders is a favorable development that supports the business operations. Lau has a Buy rating on Nio stock.

Is Nio Stock a Good Buy?

HSBC analyst Yuqian Ding lowered the price target for Nio stock to $7.20 from $7.90 but maintained a Buy rating. The analyst has a constructive outlook on Nio’s volumes and margin growth, supported by strong NIO brand sales, the potential for volume expansion for ONVO L60, supply chain cost optimization, and better economies of scale.

Overall, Wall Street has a Moderate Buy recommendation on Nio stock based on eight Buys, four Holds, and one Sell recommendation. The average Nio stock price target of $6.31 implies about 21% upside potential.

Li Auto (NASDAQ:LI)

Shares of Chinese new energy vehicles (NEV) maker Li Auto have rallied about 22% over the past month due to the news on China’s stimulus measures and the company’s solid September deliveries. However, LI stock is still down more than 32% year-to-date.

Recently, Li Auto reported about a 49% rise in September deliveries to 53,709 vehicles. Overall, the company’s Q3 deliveries increased 45.4% to 152,831. The company attributed the robust performance to solid order intake for Li L series and Li MEGA.

Despite the impressive numbers, Macquarie analyst Eugene Hsiao downgraded Li Auto stock from Buy to Hold but raised the price target to $33 from $25. The analyst thinks that LI stock is fully valued following the recent rally. He added that the stock lacks a catalyst with no new launches lined up in the second half of 2024.

What Is the Target Price for Li Auto Stock?

With six Buys and four Holds, Li Auto stock earns a Moderate Buy consensus rating. At $29.06, the average LI stock price target implies 15.1% upside potential.

Tesla (NASDAQ:TSLA)

Shares of Elon Musk-led Tesla are down over 11% so far this year. Investors are concerned about the company losing market share to emerging EV players and the decline in its margins due to discounts and other incentives.

Moreover, Tesla’s Q3 deliveries of 462,890 vehicles fell short of expectations and reflected the impact of macro challenges and intense rivalry in China. To make matters worse, the company’s much-awaited robotaxi event failed to impress investors. Analyst Dan Levy from Barclays thinks that the robotaxi event was light on the details and did not highlight any near-term opportunities for the EV giant. Levy reaffirmed a Hold rating on TSLA stock with a price target of $220.

All eyes are now on Tesla’s Q3 results, scheduled on October 23. Analysts expect the company’s EPS to decline nearly 11% year-over-year to $0.59. They project revenue to rise more than 9% to $25.47 billion. Price cuts and increased production costs are expected to offset the company’s top-line growth and weigh on the company’s Q3 margins and EPS.

Is Tesla a Buy, Sell, or Hold?

Meanwhile, Levy thinks that TSLA’s Q3 results could act as a positive near-term catalyst, with focus now on the company’s fundamentals. While the analyst is optimistic about TSLA’s long-term prospects due to its leading position in the global EV transition, he prefers to be on the sidelines due to near-term pressures.

Wall Street is sidelined on Tesla stock, with a Hold consensus rating based on 11 Buys, 16 Holds, and eight Sells. The average TSLA stock price target of $207.83 implies a possible downside of 5.8%.

Conclusion

Wall Street is cautiously optimistic about Nio and Li Auto but sidelined on Tesla. Analysts see a higher upside potential in Nio stock than in the other two EV stocks. Nio’s improving sales and its efforts to enhance its margins could drive the stock higher.

GM results exceed Wall Street targets; company is upbeat on full-year earnings

By Nora Eckert

DETROIT (Reuters) -General Motors continued to defy Wall Street’s expectations this year, posting third-quarter results ahead of analyst projections on the back of steady gasoline-engine truck and SUV sales and a focus on keeping inventories lean.

GM is targeting annual earnings at the top end of its previous forecast, and Chief Financial Officer Paul Jacobson brushed off economic concerns for customers.

“The consumer has held up remarkably well for us,” he told reporters, adding that interest rate cuts would further improve demand next year.

GM started the year expecting to make $12 billion to $14 billion in pretax profit and raised the forecast in mid-year to $13 billion to $15 billion, buoyed by strong pricing and consumer spending. On Tuesday, it said it was on track to deliver between $14 billion and $15 billion in pretax profit.

The company’s shares were up about 4% in pre-market trading Tuesday.

GM’s adjusted earnings per share were $2.96 for the quarter, outpacing analysts’ forecast of $2.43 per share. Revenue for the three-month period was $48.8 billion, beating Wall Street’s expectation of $44.6 billion.

CEO Mary Barra has been focusing on a message of stability, saying earlier this month that the automaker’s profit next year is expected to look similar to this year, a relief for investors who are worried about a potential decline in the auto industry’s earnings. GM has said pricing could be softer next year but it expects results to be supported by cost cuts on SUVs and electric vehicles and improvement in China.

A weak spot in otherwise strong earnings was China, where operations regressed from a powerhouse to a loss of $210 million in the first half of this year. GM lost another $137 million in the region during the third quarter, and it is planning a restructuring of operations there.

“We really haven’t instituted any of the real restructuring yet,” Jacobson said, adding that sales in the region are up and inventory down.

Investor concerns persist that historically high interest rates and economic fears will catch up with consumers and dampen sales of new cars, despite the resilience seen for much of the year. Shareholders are also queasy about automakers’ EV losses as Chinese rivals pump out affordable electric vehicles abroad and Tesla continues to dominate battery-powered vehicle sales in the United States.

While Chinese automakers have not yet penetrated the U.S. market, large automakers like GM see a threat from low-cost and high-tech vehicles, executives have said.

GM’s stock is up 36% year-to-date, outpacing rivals Stellantis and Ford Motor, whose share prices have both fallen over the same period. Ford has struggled with costly quality problems and Stellantis with decreasing sales and revenue in North America after it raised prices and held back on incentives.

INVESTORS SEEK CLARITY ON AUTONOMOUS CRUISE

GM’s profit engine, traditional gas-powered vehicles, including eight refreshed gas SUV models through the end of 2025, is luring many customers who are not yet ready for EVs.

The company’s EV sales have increased every quarter of this year as it increases production of models including the Silverado EV truck and Equinox electric SUV.

Still, EVs accounted for only about 4% of the company’s total U.S. deliveries through the third quarter.

Investors are also hoping for more clarity around the plans for GM’s autonomous Cruise unit, which has been under scrutiny since one of its robotaxis dragged a pedestrian last year. The unit recorded an operating loss of $400 million for the quarter, narrower than the $700 million loss in the prior-year period. At GM’s investor day earlier this month, Barra said the division would lose no more than $2 billion in 2025.

(Reporting by Nora Eckert in Detroit, additional reporting by Nathan Gomes in Bangalore; Editing by Peter Henderson, Matthew Lewis and Emelia Sithole-Matarise)

Nucor Stock Falls After Q3 Results, Weak Q4 EPS Guidance: Details

Nucor Corp NUE shares are trading lower after the company reported its third-quarter financial results and announced it expects its fourth-quarter earnings to decline to $1.05.

Here’s a look at the details from the report.

The Details: Nucor reported quarterly earnings of $1.49 per share, which beat the analyst consensus estimate of $1.47. Quarterly revenue came in at $7.44 billion, which beat the analyst consensus estimate of $7.28 and is a decrease from sales of $8.78 billion from the same period last year.

- Average sales price per ton in the third quarter decreased 6% compared with the second quarter of 2024 and decreased by 15% compared with the third quarter of 2023.

- A total of approximately 6.196 million tons were shipped to outside customers in the third quarter of 2024, a 1% decrease compared with both the second quarter of 2024 and the third quarter of 2023.

- Total steel mill shipments in the third quarter of 2024 decreased 3% compared with the second quarter of 2024 and were comparable to the third quarter of 2023.

- Steel mill shipments to internal customers represented 19% of total steel mill shipments in the third quarter of 2024, compared with 21% in the second quarter of 2024 and 20% in the third quarter of 2023.

- Downstream steel product shipments to outside customers in the third quarter of 2024 decreased 6% compared with the second quarter of 2024 and decreased 11% compared with the third quarter of 2023.

Read Next: Nuclear Energy Stocks Are Hot: Here’s A List Of Tickers To Watch

“Thank you to our Nucor teammates for continuing to set new records for safety performance while generating over $1.30 billion of cash from operations for the quarter,” said Leon Topalian, Nucor’s CEO.

“Nucor’s market leadership, product diversity, and strong balance sheet enable us to provide meaningful returns to shareholders and execute our growth strategy even in the face of market uncertainty,” Topalian added.

Outlook: Nucor said it expects its fourth-quarter earnings to decline to $1.05 per share amid decreased steel mill segment earnings caused by lower average selling prices and decreased volumes.

The company will host a conference call on Tuesday at 10 a.m. ET to discuss the results.

NUE Price Action: According to Benzinga Pro, Nucor shares are down 2.82% at $151.70 after hours, dipping 1.35% during Monday’s regular trading session.

Read Also:

Photo: Courtesy of Nucor Corporation

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

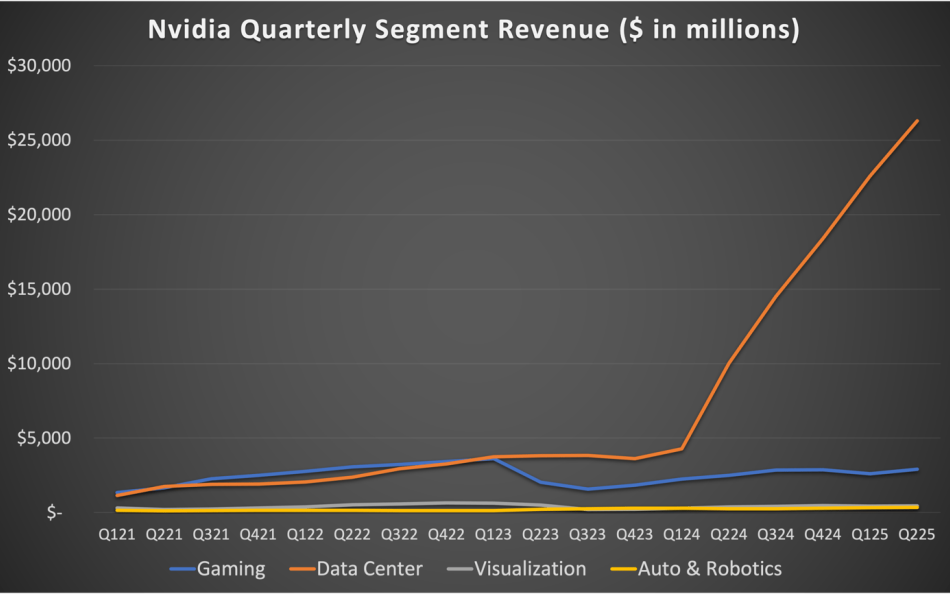

SAP Is Joining The AI Party As A 'Foundational Player' Alongside Leaders Nvidia And Microsoft, Says Wedbush's Dan Ives

SAP SE SAP exceeded earnings expectations in its latest quarter, with Wedbush Securities analyst Dan Ives highlighting the European tech giant’s emerging role in the artificial intelligence revolution alongside industry leaders NVIDIA Corp NVDA and Microsoft Corp MSFT.

What Happened: “SAP is going to be a foundational player,” Ives told CNBC. “I think it’s going to be a huge step in the right direction on cloud checks, actually very strong for SAP.”

The German software giant’s transformation to cloud-based services continues to accelerate, with Ives noting that cloud operations now represent approximately 45% of the company’s business. This figure is projected to reach 70% by the end of next year, signaling a significant shift in SAP’s business model.

The German software giant’s transformation to cloud-based services continues to accelerate, with Ives noting that cloud operations now represent approximately 45% of the company’s business. This figure is projected to reach 70% by the end of next year, signaling a significant shift in SAP’s business model.

“This speaks to the second derivative of the AI revolution,” Ives said. “It’s not just about NVIDIA and Microsoft, SAP is now joining that AI party.”

The results come as enterprise resource planning (ERP) and logistics software providers increasingly integrate AI capabilities into their offerings. Ives positioned SAP alongside Oracle Corp ORCL, Microsoft, and Amazon.com Inc AMZN as major beneficiaries of this trend, suggesting these companies will see “incremental string from enterprises accelerating AI cloud appointment.”

The growing emphasis on AI integration in enterprise software marks a significant shift in the industry, with traditional ERP providers like SAP adapting their offerings to meet the increasing demand for AI-powered solutions.

Why It Matters: SAP reported adjusted earnings of $1.33 per share, beating the consensus estimate of $1.32. Quarterly revenue came in at $9.16 billion, slightly below the consensus estimate of $9.17 billion.

On Monday, Ives also mentioned other companies like Palantir, IBM, AMD, and Apple making significant moves in artificial intelligence.

Despite the positive earnings, SAP has been under scrutiny due to a Department of Justice investigation into allegations of overcharging U.S. government agencies. This investigation has been ongoing since at least 2022 and focuses on potential price-fixing schemes involving $2 billion worth of SAP technology sold to U.S. military and government agencies since 2014.

Price Action: SAP SE stock closed at $229.48 on Monday, down 0.42% for the day. In after-hours trading, the stock saw a notable increase, rising 3.54%. Year to date, SAP has gained 52.77%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ELS Reports Third Quarter Results

Continued Strong Performance

Preliminary 2025 Rent Rate Growth Assumptions

CHICAGO, Oct. 21, 2024 /PRNewswire/ — Equity LifeStyle Properties, Inc. ELS (referred to herein as “we,” “us,” and “our”) today announced results for the quarter and nine months ended September 30, 2024. All per share results are reported on a fully diluted basis unless otherwise noted.

|

FINANCIAL RESULTS |

|||||||

|

($ in millions, except per share data) |

Quarters Ended September 30, |

||||||

|

2024 |

2023 |

$ Change |

% Change (1) |

||||

|

Net Income per Common Share |

$ 0.44 |

$ 0.41 |

$ 0.03 |

7.5 % |

|||

|

Funds from Operations (“FFO”) per Common Share and OP Unit |

$ 0.72 |

$ 0.68 |

$ 0.04 |

5.3 % |

|||

|

Normalized Funds from Operations (“Normalized FFO”) per Common Share and OP Unit |

$ 0.72 |

$ 0.68 |

$ 0.04 |

4.9 % |

|||

|

Nine Months Ended September 30, |

|||||||

|

2024 |

2023 |

$ Change |

% Change (1) |

||||

|

Net Income per Common Share |

$ 1.45 |

$ 1.19 |

$ 0.26 |

21.8 % |

|||

|

FFO per Common Share and OP Unit |

$ 2.27 |

$ 2.01 |

$ 0.26 |

12.8 % |

|||

|

Normalized FFO per Common Share and OP Unit |

$ 2.16 |

$ 2.04 |

$ 0.12 |

5.6 % |

|||

|

_____________________ |

|

1. Calculations prepared using actual results without rounding. |

Operations Update

Normalized FFO per Common Share and OP Unit for the quarter ended September 30, 2024 was $0.72, representing a 4.9% increase compared to the same period in 2023, performing at the midpoint of our guidance range of $0.72. Normalized FFO for the nine months ended September 30, 2024, was $2.16 per Common Share and OP Unit, representing a 5.6% increase compared to the same period in 2023. Core property operating revenues increased 4.4% and Core income from property operations, excluding property management increased 5.8% for the quarter ended September 30, 2024, compared to the same period in 2023. For the nine months ended September 30, 2024, Core property operating revenues increased 4.9% and Core income from property operations, excluding property management increased 6.2% compared to the same period in 2023.

MH

Core MH base rental income for the quarter ended September 30, 2024 increased 6.2% compared to the same period in 2023, which reflects 5.8% growth from rate increases and 0.4% from occupancy gains. Core MH homeowners increased by 111, and we sold 173 new homes during the quarter ended September 30, 2024. The average sales price of new homes sold was approximately $88,000. Core MH base rental income for the nine months ended September 30, 2024 increased 6.2% compared to the same period in 2023, which reflects 6.0% growth from rate increases and 0.2% from occupancy gains.

RV and Marina

Core RV and marina base rental income for the quarter ended September 30, 2024 increased 1.3% compared to the same period in 2023. Core RV and marina annual base rental income increased 6.2% for the quarter ended September 30, 2024, compared to the same period in 2023. Core RV and marina base rental income for the nine months ended September 30, 2024 increased 3.0% compared to the same period in 2023. Core RV and marina annual base rental income increased 6.9% for the nine months ended September 30, 2024, compared to the same period in 2023.

Property Operating Expenses

Core property operating expenses, excluding property management for the quarter ended September 30, 2024 increased 2.8% compared to the same period in 2023. For the nine months ended September 30, 2024, Core property operating expenses, excluding property management increased 3.4% compared to same period in 2023.

Balance Sheet Activity

In October 2024, we sold approximately 4.5 million shares of our common stock at a price of $70.00 from our at-the-market (“ATM”) offering program. The net proceeds of $314.2 million were used to repay our $300.0 million unsecured term loan (the “$300 million Term Loan”) and to terminate the interest rate swaps, which fixed the interest rate of the $300 million Term Loan at 6.05% until maturity in April 2026.

Storm Events

Following Hurricane Helene which made landfall on September 26, 2024 we accrued approximately $1.0 million of expenses related to debris removal and clean up, which is reflected in Casualty-related charges/(recoveries), net on the consolidated income statement, and we recorded a $1.8 million reduction to the carrying value of certain assets, which is included in Loss on sale of real estate and impairment, net in the Consolidated Statements of Income on page 3.

Following Hurricane Milton which made landfall on October 9, 2024, we have continued clean up efforts at impacted properties. We believe that we have adequate insurance, subject to deductibles, including business interruption coverage, and at this time, we do not believe that Hurricane Milton will have a significant adverse impact on our results of operations or our financial condition on a consolidated basis.

Guidance Update (1)

Consistent with our historical practice at this time of year, we have updated and narrowed the full year guidance range. The full year guidance range of $0.06 per share is the same as the fourth quarter guidance range.

The updated guidance does not include assumptions related to debris removal and restoration costs, and possible business interruption losses, asset impairments or insurance recoveries related to Hurricane Milton. We believe we have adequate insurance coverage, subject to deductibles, for losses related to Hurricane Milton, but we are unable to predict the timing or amount of recovery. Furthermore, in accordance with GAAP, insurance reimbursement for business interruption losses is to be recognized as revenue only upon receipt.

|

($ in millions, except per share data) |

2024 |

||||||

|

Fourth quarter |

Full Year |

||||||

|

Net Income per Common Share |

$0.44 to $0.50 |

$1.89 to $1.95 |

|||||

|

FFO per Common Share and OP Unit |

$0.70 to $0.76 |

$2.96 to $3.02 |

|||||

|

Normalized FFO per Common Share and OP Unit |

$0.73 to $0.79 |

$2.89 to $2.95 |

|||||

|

2023 Actual |

2024 Growth Rates |

||||||

|

Core Portfolio: |

Fourth quarter |

Full Year |

Fourth quarter |

Full Year |

|||

|

MH base rental income |

$ 170.1 |

$ 668.5 |

5.5% to 6.1% |

5.8% to 6.4% |

|||

|

RV and marina base rental income (2) |

$ 96.0 |

$ 413.5 |

2.7% to 3.3% |

2.7% to 3.3% |

|||

|

Property operating revenues |

$ 320.8 |

$ 1,297.7 |

4.2% to 4.8% |

4.5% to 5.1% |

|||

|

Property operating expenses, excluding property management |

$ 133.0 |

$ 562.3 |

1.1% to 1.7% |

2.6% to 3.2% |

|||

|

Income from property operations, excluding property management |

$ 187.8 |

$ 735.4 |

6.4% to 7.0% |

6.0% to 6.6% |

|||

|

Non-Core Portfolio: |

2024 Full Year |

||||||

|

Income from property operations, excluding property management |

$13.9 to $17.9 |

||||||

|

Other Guidance Assumptions: |

2024 Full Year |

||||||

|

Property management and general administrative |

$113.6 to $119.6 |

||||||

|

Debt assumptions: |

|||||||

|

Weighted average debt outstanding |

$3,350 to $3,550 |

||||||

|

Interest and related amortization |

$135.4 to $141.4 |

||||||

Preliminary 2025 Rent Rate Growth Assumptions (1)

- By October month-end, we anticipate sending 2025 rent increase notices to approximately 50% of our MH residents. The average expected rate increase of these notices is approximately 5.0%.

- We have set RV annual rates for 2025 for more than 95% of our annual sites. The average rate increase for these annual sites is approximately 5.5%.

|

______________________ |

|

|

1. |

Fourth quarter and full year 2024 guidance represent management’s estimate of a range of possible outcomes. The midpoint of the ranges and the preliminary 2025 rent rate growth assumptions reflect management’s estimate of the most likely outcome based on our current view of existing market conditions and assumptions. Actual results could vary materially from management’s estimates presented above if any of our assumptions, including occupancy and rate changes, our ability to manage expenses in an inflationary environment, our ability to integrate and operate recent acquisitions and costs to restore property operations and potential revenue losses following storms or other unplanned events, are incorrect. See Forward-Looking Statements in this press release for additional factors impacting our 2024 and 2025 guidance assumptions. See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for definitions of FFO and Normalized FFO and a reconciliation of Net income per Common Share – Fully Diluted to FFO per Common Share and OP Unit – Fully Diluted and Normalized FFO per Common Share and OP Unit – Fully Diluted. |

|

2. |

Core RV and marina annual revenue represents approximately 77.8% and 70.4% of fourth quarter 2024 and full year 2024 RV and marina base rental income guidance, respectively. Core RV and marina annual revenue fourth quarter 2024 growth rate range is 5.8% to 6.4% and the full year 2024 growth rate range is 6.4% to 7.0%. |

About Equity LifeStyle Properties

We are a self-administered, self-managed real estate investment trust (“REIT”) with headquarters in Chicago. As of October 21, 2024, we own or have an interest in 452 properties in 35 states and British Columbia consisting of 172,870 sites.

For additional information, please contact our Investor Relations Department at (800) 247-5279 or at investor_relations@equitylifestyle.com.

Conference Call

A live audio webcast of our conference call discussing these results will take place tomorrow, Tuesday, October 22, 2024, at 10:00 a.m. Central Time. Please visit the Investor Relations section at www.equitylifestyleproperties.com for the link. A replay of the webcast will be available for two weeks at this site.

Forward-Looking Statements

In addition to historical information, this press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used, words such as “anticipate,” “expect,” “believe,” “project,” “estimate,” “guidance,” “intend,” “may be” and “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements and may include, without limitation, information regarding our expectations, goals or intentions regarding the future, and the expected effect of our acquisitions. Forward-looking statements, including our guidance concerning Net Income, FFO and Normalized FFO per share data, and certain growth rates, by their nature, involve estimates, projections, goals, forecasts and assumptions and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in a forward-looking statement due to a number of factors, which include, but are not limited to the following: (i) the mix of site usage within the portfolio; (ii) yield management on our short-term resort and marina sites; (iii) scheduled or implemented rate increases on community, resort and marina sites; (iv) scheduled or implemented rate increases in annual payments under membership subscriptions; (v) occupancy changes; (vi) our ability to attract and retain membership customers; (vii) change in customer demand regarding travel and outdoor vacation destinations; (viii) our ability to manage expenses in an inflationary environment; (ix) changes in debt service and interest rates; (x) our ability to integrate and operate recent acquisitions in accordance with our estimates; (xi) our ability to execute expansion/development opportunities in the face of supply chain delays/shortages; (xii) completion of pending transactions in their entirety and on assumed schedule; (xiii) our ability to attract and retain property employees, particularly seasonal employees; (xiv) ongoing legal matters and related fees; (xv) costs to clean up and restore property operations and potential revenue losses following storms or other unplanned events; and (xvi) the potential impact of, and our ability to remediate, material weaknesses in our internal control over financial reporting. For further information on these and other factors that could impact us and the statements contained herein, refer to our filings with the Securities and Exchange Commission, including the “Risk Factors” and “Forward-Looking Statements” sections in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

Supplemental Financial Information

|

Financial Highlights (1)(2) |

|||||

|

(In millions, except Common Shares and OP Units outstanding and per share data, unaudited) |

|||||

|

As of and for the Quarters Ended |

|||||

|

Sep 30, |

June 30, |

Mar 31, |

Dec 31, |

Sep 30, |

|

|

Operating Information |

|||||

|

Total revenues |

$ 387.3 |

$ 380.0 |

$ 386.6 |

$ 360.6 |

$ 388.8 |

|

Consolidated net income |

$ 86.9 |

$ 82.1 |

$ 115.3 |

$ 96.4 |

$ 80.7 |

|

Net income available for Common Stockholders |

$ 82.8 |

$ 78.3 |

$ 109.9 |

$ 91.9 |

$ 77.0 |

|

Adjusted EBITDAre |

$ 176.8 |

$ 164.3 |

$ 186.3 |

$ 171.1 |

$ 167.0 |

|

FFO available for Common Stock and OP Unit holders |

$ 140.9 |

$ 134.7 |

$ 167.4 |

$ 148.5 |

$ 133.8 |

|

Normalized FFO available for Common Stock and OP Unit holders |

$ 140.5 |

$ 128.5 |

$ 152.7 |

$ 138.2 |

$ 133.9 |

|

Funds Available for Distribution (“FAD”) for Common Stock and OP Unit holders |

$ 120.7 |

$ 108.3 |

$ 136.9 |

$ 109.2 |

$ 107.8 |

|

Common Shares and OP Units Outstanding (In thousands) and Per Share Data |

|||||

|

Common Shares and OP Units, end of the period |

195,617 |

195,621 |

195,598 |

195,531 |

195,525 |

|

Weighted average Common Shares and OP Units outstanding – Fully Diluted |

195,510 |

195,465 |

195,545 |

195,475 |

195,440 |

|

Net income per Common Share – Fully Diluted (3) |

$ 0.44 |

$ 0.42 |

$ 0.59 |

$ 0.49 |

$ 0.41 |

|

FFO per Common Share and OP Unit – Fully Diluted |

$ 0.72 |

$ 0.69 |

$ 0.86 |

$ 0.76 |

$ 0.68 |

|

Normalized FFO per Common Share and OP Unit – Fully Diluted |

$ 0.72 |

$ 0.66 |

$ 0.78 |

$ 0.71 |

$ 0.68 |

|

Dividends per Common Share |

$ 0.4775 |

$ 0.4775 |

$ 0.4775 |

$ 0.4475 |

$ 0.4475 |

|

Balance Sheet |

|||||

|

Total assets |

$ 5,644 |

$ 5,645 |

$ 5,630 |

$ 5,614 |

$ 5,626 |

|

Total liabilities |

$ 4,149 |

$ 4,135 |

$ 4,110 |

$ 4,115 |

$ 4,129 |

|

Market Capitalization |

|||||

|

Total debt (4) |

$ 3,502 |

$ 3,499 |

$ 3,507 |

$ 3,548 |

$ 3,533 |

|

Total market capitalization (5) |

$ 17,457 |

$ 16,240 |

$ 16,104 |

$ 17,341 |

$ 15,990 |

|

Ratios |

|||||

|

Total debt / total market capitalization |

20.1 % |

21.5 % |

21.8 % |

20.5 % |

22.1 % |

|

Total debt / Adjusted EBITDAre (6) |

5.0 |

5.1 |

5.1 |

5.3 |

5.4 |

|

Interest coverage (7) |

5.1 |

5.1 |

5.2 |

5.2 |

5.3 |

|

Fixed charges (8) |

5.0 |

5.1 |

5.1 |

5.1 |

5.1 |

|

______________________ |

|

|

1. |

See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for definitions of Adjusted EBITDAre, FFO, Normalized FFO and FAD and a reconciliation of Consolidated net income to Adjusted EBITDAre. |

|

2. |

See page 6 for a reconciliation of Net income available for Common Stockholders to Non-GAAP financial measures FFO available for Common Stock and OP Unit holders, Normalized FFO available for Common Stock and OP Unit holders and FAD for Common Stock and OP Unit holders. |

|

3. |

Net income per Common Share – Fully Diluted is calculated before Income allocated to non-controlling interest – Common OP Units. |

|

4. |

Excludes deferred financing costs of approximately $27.2 million as of September 30, 2024. |

|

5. |

See page 14 for the calculation of market capitalization as of September 30, 2024. |

|

6. |

Calculated using trailing twelve months Adjusted EBITDAre. |

|

7. |

Calculated by dividing trailing twelve months Adjusted EBITDAre by the interest expense incurred during the same period. |

|

8. |

See Non-GAAP Financial Measures Definitions and Reconciliations at the end of the supplemental financial information for a definition of fixed charges. This ratio is calculated by dividing trailing twelve months Adjusted EBITDAre by the sum of fixed charges and preferred stock dividends, if any, during the same period. |

|

Consolidated Balance Sheets |

|||

|

(In thousands, except share and per share data) |

|||

|

September 30, 2024 |

December 31, 2023 |

||

|

(unaudited) |

|||

|

Assets |

|||

|

Investment in real estate: |

|||

|

Land |

$ 2,088,682 |

$ 2,088,657 |

|

|

Land improvements |

4,536,573 |

4,380,649 |

|

|

Buildings and other depreciable property |

1,230,614 |

1,236,985 |

|

|

7,855,869 |

7,706,291 |

||

|

Accumulated depreciation |

(2,592,258) |

(2,448,876) |

|

|

Net investment in real estate |

5,263,611 |

5,257,415 |

|

|

Cash and restricted cash |

40,398 |

29,937 |

|

|

Notes receivable, net |

55,037 |

49,937 |

|

|

Investment in unconsolidated joint ventures |

84,834 |

85,304 |

|

|

Deferred commission expense |

56,050 |

53,641 |

|

|

Other assets, net |

144,189 |

137,499 |

|

|

Total Assets |

$ 5,644,119 |

$ 5,613,733 |

|

|

Liabilities and Equity |

|||

|

Liabilities: |

|||

|

Mortgage notes payable, net |

$ 2,943,999 |

$ 2,989,959 |

|

|

Term loans, net |

497,873 |

497,648 |

|

|

Unsecured line of credit |

32,500 |

31,000 |

|

|

Accounts payable and other liabilities |

207,603 |

151,567 |

|

|

Deferred membership revenue |

232,862 |

218,337 |

|

|

Accrued interest payable |

11,991 |

12,657 |

|

|

Rents and other customer payments received in advance and security deposits |

128,345 |

126,451 |

|

|

Distributions payable |

93,407 |

87,493 |

|

|

Total Liabilities |

$ 4,148,580 |

$ 4,115,112 |

|

|

Equity: |

|||

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized as of September 30, 2024 and December 31, 2023; none issued and outstanding |

— |

— |

|

|

Common stock, $0.01 par value, 600,000,000 shares authorized as of September 30, 2024 and December 31, 2023; 186,512,609 and 186,426,281 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively |

1,917 |

1,917 |

|

|

Paid-in capital |

1,648,384 |

1,644,319 |

|

|

Distributions in excess of accumulated earnings |

(219,724) |

(223,576) |

|

|

Accumulated other comprehensive income |

(4,764) |

6,061 |

|

|

Total Stockholders’ Equity |

1,425,813 |

1,428,721 |

|

|

Non-controlling interests – Common OP Units |

69,726 |

69,900 |

|

|

Total Equity |

1,495,539 |

1,498,621 |

|

|

Total Liabilities and Equity |

$ 5,644,119 |

$ 5,613,733 |

|

|

Consolidated Statements of Income |

|||||||

|

(In thousands, unaudited) |

|||||||

|

Quarters Ended |

Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenues: |

|||||||

|

Rental income |

$ 314,468 |

$ 303,334 |

$ 931,854 |

$ 888,440 |

|||

|

Annual membership subscriptions |

16,714 |

16,673 |

49,298 |

48,832 |

|||

|

Membership upgrade sales (1) |

4,173 |

3,744 |

12,170 |

10,863 |

|||

|

Other income |

16,440 |

15,658 |

48,186 |

51,283 |

|||

|

Gross revenues from home sales, brokered resales and ancillary services |

30,839 |

44,795 |

98,457 |

115,841 |

|||

|

Interest income |

2,430 |

2,276 |

7,018 |

6,623 |

|||

|

Income from other investments, net |

2,192 |

2,333 |

6,860 |

6,897 |

|||

|

Total revenues |

387,256 |

388,813 |

1,153,843 |

1,128,779 |

|||

|

Expenses: |

|||||||

|

Property operating and maintenance |

129,010 |

126,846 |

369,898 |

361,543 |

|||

|

Real estate taxes |

20,731 |

19,017 |

61,617 |

56,165 |

|||

|

Membership sales and marketing (2) |

6,448 |

5,696 |

17,871 |

16,055 |

|||

|

Property management |

20,165 |

19,887 |

59,311 |

58,710 |

|||

|

Depreciation and amortization |

50,934 |

50,968 |

153,386 |

152,934 |

|||

|

Cost of home sales, brokered resales and ancillary services |

22,051 |

33,471 |

71,668 |

85,880 |

|||

|

Home selling expenses and ancillary operating expenses |

7,336 |

7,164 |

20,955 |

21,258 |

|||

|

General and administrative |

9,274 |

9,895 |

30,248 |

38,163 |

|||

|

Casualty-related charges/(recoveries), net (3) |

591 |

— |

(20,422) |

— |

|||

|

Other expenses |

1,402 |

1,338 |

4,120 |

4,187 |

|||

|

Early debt retirement |

30 |

68 |

30 |

68 |

|||

|

Interest and related amortization |

36,497 |

33,434 |

106,077 |

99,144 |

|||

|

Total expenses |

304,469 |

307,784 |

874,759 |

894,107 |

|||

|

Income before income taxes and other items |

82,787 |

81,029 |

279,084 |

234,672 |

|||

|

Gain/(Loss) on sale of real estate and impairment, net (4) |

(1,798) |

(949) |

(1,798) |

(3,581) |

|||

|

Income tax benefit |

— |

— |

239 |

— |

|||

|

Equity in income of unconsolidated joint ventures |

5,874 |

661 |

6,736 |

2,158 |

|||

|

Consolidated net income |

86,863 |

80,741 |

284,261 |

233,249 |

|||

|

Income allocated to non-controlling interests – Common OP Units |

(4,042) |

(3,772) |

(13,230) |

(10,981) |

|||

|

Redeemable perpetual preferred stock dividends |

— |

— |

(8) |

(8) |

|||

|

Net income available for Common Stockholders |

$ 82,821 |

$ 76,969 |

$ 271,023 |

$ 222,2602 |

|||

|

_____________________ |

|

|

1. |

Membership upgrade sales revenue is net of deferrals of $5.9 million and $7.0 million for the quarters ended September 30, 2024 and September 30, 2023, respectively. See page 13 for details of membership sales activity. |

|

2. |

Membership sales and marketing expense is net of sales commission deferrals of $1.2 million for both quarters ended September 30, 2024 and September 30, 2023. See page 13 for details of membership sales activity. |

|

3. |

Casualty-related charges/(recoveries), net for the quarter ended September 30, 2024 includes debris removal and cleanup costs related to Hurricane Ian of $1.3 million and Hurricane Helene of $1.0 million and insurance recovery revenue related to Hurricane Ian of $1.7 million, including $0.5 million for reimbursement of capital expenditures related to Hurricane Ian. Casualty-related charges/(recoveries), net for the nine months ended September 30, 2024 includes debris removal and cleanup costs related to Hurricane Ian of $2.5 million and Hurricane Helene of $1.0 million and insurance recovery revenue for Hurricane Ian of $24.0 million, including $21.5 million for reimbursement of capital expenditures related to Hurricane Ian. |

|

4. |

Reflects a $1.8 million reduction to the carrying value of certain assets as a result of Hurricane Helene for both the quarter ended and nine months ended September 30, 2024. |

Non-GAAP Financial Measures

This document contains certain Non-GAAP measures used by management that we believe are helpful to understand our business. We believe investors should review these Non-GAAP measures along with GAAP net income and cash flows from operating activities, investing activities and financing activities, when evaluating an equity REIT’s operating performance. Our definitions and calculations of these Non-GAAP financial and operating measures and other terms may differ from the definitions and methodologies used by other REITs and, accordingly, may not be comparable. These Non-GAAP financial and operating measures do not represent cash generated from operating activities in accordance with GAAP, nor do they represent cash available to pay distributions and should not be considered as an alternative to net income, determined in accordance with GAAP, as an indication of our financial performance, or to cash flows from operating activities, determined in accordance with GAAP, as a measure of our liquidity, nor are they indicative of funds available to fund our cash needs, including our ability to make cash distributions. For definitions and reconciliations of Non-GAAP measures to our financial statements as prepared under GAAP, refer to both Reconciliation of Net Income to Non-GAAP Financial Measures on page 6 and Non-GAAP Financial Measures Definitions and Reconciliations on pages 16-19.

|

Selected Non-GAAP Financial Measures (1) |

|

|

(In millions, except per share data, unaudited) |

|

|

Quarter Ended |

|

|

September 30, 2024 |

|

|

Income from property operations, excluding property management – Core (2) |

$ 193.5 |

|

Income from property operations, excluding property management – Non-Core (2) |

2.1 |

|

Property management and general and administrative |

(29.4) |

|

Other income and expenses |

10.8 |

|

Interest and related amortization |

(36.5) |

|

Normalized FFO available for Common Stock and OP Unit holders |

$ 140.5 |

|

Insurance proceeds due to catastrophic weather event (3) |

0.5 |

|

FFO available for Common Stock and OP Unit holders (4) |

$ 140.9 |

|

FFO per Common Share and OP Unit |

$ 0.72 |

|

Normalized FFO per Common Share and OP Unit |

$ 0.72 |

|

Normalized FFO available for Common Stock and OP Unit holders |

$ 140.5 |

|

Non-revenue producing improvements to real estate |

(19.8) |

|

FAD for Common Stock and OP Unit holders |

$ 120.7 |

|

Weighted average Common Shares and OP Units – Fully Diluted |

195.5 |

|

______________________ |

|

|

1. |

See page 6 for a reconciliation of Net income available for Common Stockholders to FFO available for Common Stock and OP Unit holders, Normalized FFO available for Common Stock and OP Unit holders and FAD for Common Stock and OP Unit holders. |

|

2. |

See pages 8-9 for details of the Core Income from Property Operations, excluding property management. See page 10 for details of the Non-Core Income from Property Operations, excluding property management. |

|

3. |

Represents insurance recovery revenue for reimbursement of capital expenditures related to Hurricane Ian. |

|

4. |

Amounts may not foot due to rounding. |

|

Reconciliation of Net Income to Non-GAAP Financial Measures |

|||||||

|

(In thousands, except per share data, unaudited) |

|||||||

|

Quarters Ended |

Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Net income available for Common Stockholders |

$ 82,821 |

$ 76,969 |

$ 271,023 |

$ 222,260 |

|||

|

Income allocated to non-controlling interests – Common OP Units |

4,042 |

3,772 |

13,230 |

10,981 |

|||

|

Depreciation and amortization |

50,934 |

50,968 |

153,386 |

152,934 |

|||

|

Depreciation on unconsolidated joint ventures |

1,309 |

1,141 |

3,560 |

3,357 |

|||

|

(Gain)/Loss on unconsolidated joint ventures |

— |

— |

— |

(416) |

|||

|

(Gain)/Loss on sale of real estate and impairment, net |

1,798 |

949 |

1,798 |

3,581 |

|||

|

FFO available for Common Stock and OP Unit holders |

140,904 |

133,799 |

442,997 |

392,697 |

|||

|

Deferred income tax benefit |

— |

— |

(239) |

— |

|||

|

Accelerated vesting of stock-based compensation expense |

— |

— |

— |

6,320 |

|||

|

Early debt retirement |

30 |

68 |

30 |

68 |

|||

|

Transaction/pursuit costs and other (1) |

— |

— |

383 |

207 |

|||

|

Insurance proceeds due to catastrophic weather event (2) |

(451) |

— |

(21,464) |

— |

|||

|

Normalized FFO available for Common Stock and OP Unit holders |

140,483 |

133,867 |

421,707 |

399,292 |

|||

|

Non-revenue producing improvements to real estate |

(19,771) |

(26,065) |

(55,814) |

(70,751) |

|||

|

FAD for Common Stock and OP Unit holders |

$ 120,712 |

$ 107,802 |

$ 365,893 |

$ 328,541 |

|||

|

Net income per Common Share – Basic |

$ 0.44 |

$ 0.41 |

$ 1.45 |

$ 1.19 |

|||

|

Net income per Common Share – Fully Diluted (3) |

$ 0.44 |

$ 0.41 |

$ 1.45 |

$ 1.19 |

|||

|

FFO per Common Share and OP Unit – Basic |

$ 0.72 |

$ 0.68 |

$ 2.27 |

$ 2.01 |

|||

|

FFO per Common Share and OP Unit – Fully Diluted |

$ 0.72 |

$ 0.68 |

$ 2.27 |

$ 2.01 |

|||

|

Normalized FFO per Common Share and OP Unit – Basic |

$ 0.72 |

$ 0.69 |

$ 2.16 |

$ 2.04 |

|||

|

Normalized FFO per Common Share and OP Unit – Fully Diluted |

$ 0.72 |

$ 0.68 |

$ 2.16 |

$ 2.04 |

|||

|

Weighted average Common Shares outstanding – Basic |

186,327 |

186,100 |

186,311 |

186,008 |

|||

|

Weighted average Common Shares and OP Units outstanding – Basic |

195,432 |

195,335 |

195,416 |

195,254 |

|||

|

Weighted average Common Shares and OP Units outstanding – Fully Diluted |

195,510 |

195,440 |

195,507 |

195,414 |

|||

|

____________________ |

|

|

1. |

Prior period amounts have been reclassified to conform to the current period presentation. |

|

2. |

Represents insurance recovery revenue for reimbursement of capital expenditures related to Hurricane Ian. |

|

3. |

Net income per Common Share – Fully Diluted is calculated before Income allocated to non-controlling interest – Common OP Units. |

|

Consolidated Income from Property Operations (1) |

|||||||

|

(In millions, except home site and occupancy figures, unaudited) |

|||||||

|

Quarters Ended |

Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

MH base rental income (2) |

$ 178.3 |

$ 167.9 |

$ 530.1 |

$ 498.9 |

|||

|

Rental home income (2) |

3.4 |

3.6 |

10.3 |

11.1 |

|||

|

RV and marina base rental income (2) |

113.4 |

112.8 |

336.9 |

326.3 |

|||

|

Annual membership subscriptions |

16.7 |

16.7 |

49.3 |

48.8 |

|||

|

Membership upgrade sales (3) |

4.2 |

3.7 |

12.2 |

10.9 |

|||

|

Utility and other income (2)(4) |

36.9 |

35.9 |

106.4 |

107.1 |

|||

|

Property operating revenues |

352.9 |

340.6 |

1,045.2 |

1,003.1 |

|||

|

Property operating, maintenance and real estate taxes (2) |

150.8 |

147.0 |

435.2 |

421.3 |

|||

|

Membership sales and marketing (3) |

6.4 |

5.7 |

17.9 |

16.1 |

|||

|

Property operating expenses, excluding property management (1) |

157.2 |

152.7 |

453.1 |

437.4 |

|||

|

Income from property operations, excluding property management (1) |

$ 195.7 |

$ 187.9 |

$ 592.1 |

$ 565.7 |

|||

|

Manufactured home site figures and occupancy averages: |

|||||||

|

Total sites (5) |

73,002 |

72,736 |

73,006 |

72,727 |

|||

|

Occupied sites |

69,037 |

68,818 |

68,960 |

68,819 |

|||

|

Occupancy % |

94.6 % |

94.6 % |

94.5 % |

94.6 % |

|||

|

Monthly base rent per site |

$ 861 |

$ 813 |

$ 854 |

$ 806 |

|||

|

RV and marina base rental income: |

|||||||

|

Annual |

$ 77.5 |

$ 74.1 |

$ 229.6 |

$ 216.2 |

|||

|

Seasonal |

7.4 |

8.5 |

44.9 |

45.9 |

|||

|

Transient |

28.5 |

30.2 |

62.4 |

64.2 |

|||

|

Total RV and marina base rental income |

$ 113.4 |

$ 112.8 |

$ 336.9 |

$ 326.3 |

|||

|

______________________ |

|

|

1. |

Excludes property management expenses. |

|

2. |

MH base rental income, Rental home income, RV and marina base rental income and Utility income, net of bad debt expense, are presented in Rental income in the Consolidated Statements of Income on page 3. Bad debt expense is presented in Property operating, maintenance and real estate taxes in this table. |

|

3. |

See page 13 for details of membership sales activity. |

|

4. |

Includes approximately $2.1 million and $1.6 million of business interruption income from Hurricane Ian during the quarters ended September 30, 2024 and September 30, 2023, respectively and $5.9 million and $9.6 million for the nine months ended September 30, 2024 and September 30, 2023, respectively. |

|

5. |

For September 30, 2024, includes 273 MH expansion sites added during the quarter ended December 31, 2023. |

|

Core Income from Property Operations (1) |

|||||||||||

|

(In millions, except occupancy figures, unaudited) |

|||||||||||

|

Quarters Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2024 |

2023 |

Change (2) |

2024 |

2023 |

Change (2) |

||||||

|

MH base rental income |

$ 178.1 |

$ 167.8 |

6.2 % |

$ 529.6 |

$ 498.4 |

6.2 % |

|||||

|

Rental home income |

3.4 |

3.5 |

(4.5) % |

10.3 |

11.1 |

(7.5) % |

|||||

|

RV and marina base rental income |

110.9 |

109.5 |

1.3 % |

327.1 |

317.4 |

3.0 % |

|||||

|

Annual membership subscriptions |

16.6 |

16.7 |

(0.7) % |

49.2 |

48.7 |

1.1 % |

|||||

|

Membership upgrade sales (3) |

4.2 |

3.8 |

11.3 % |

12.1 |

10.8 |

12.3 % |

|||||

|

Utility and other income |

34.3 |

31.6 |

8.8 % |

96.9 |

90.5 |

7.1 % |

|||||

|

Property operating revenues |

347.5 |

332.9 |

4.4 % |

1,025.2 |

976.9 |

4.9 % |

|||||

|

Utility expense |

42.4 |

41.7 |

1.7 % |

119.1 |

116.6 |

2.2 % |

|||||

|

Payroll |

31.5 |

31.7 |

(0.7) % |

90.1 |

90.9 |

(0.9) % |

|||||

|

Repair & maintenance |

25.4 |

25.2 |

0.7 % |

72.8 |

73.5 |

(0.9) % |

|||||

|

Insurance and other (4) |

27.9 |

26.9 |

3.8 % |

83.4 |

77.4 |

7.8 % |

|||||

|

Real estate taxes |

20.4 |

18.7 |

9.4 % |

60.5 |

54.9 |

10.1 % |

|||||

|

Membership sales and marketing (3) |

6.4 |

5.7 |

12.9 % |

17.8 |

16.0 |

11.3 % |

|||||

|

Property operating expenses, excluding property management (1) |

154.0 |

149.9 |

2.8 % |

443.7 |

429.3 |

3.4 % |

|||||

|

Income from property operations, excluding property management (1) |

$ 193.5 |

$ 183.0 |

5.8 % |

$ 581.5 |

$ 547.6 |

6.2 % |

|||||

|

Occupied sites (5) |

69,040 |

68,820 |

|||||||||

|

_____________________ |

|

|

1. |

Excludes property management expenses. |

|

2. |

Calculations prepared using actual results without rounding. |

|

3. |

See page 13 for details of membership sales activity. |

|

4. |

Includes bad debt expense for the periods presented. |

|

5. |

Occupied sites are presented as of the end of the period. |

|

Core Income from Property Operations (continued) |

|||||||||||

|

(In millions, except home site and occupancy figures, unaudited) |

|||||||||||

|

Quarters Ended |

Nine Months Ended |

||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||

|

Core manufactured home site figures and occupancy averages: |

|||||||||||

|

Total sites |

72,590 |

72,475 |

72,592 |

72,466 |

|||||||

|

Occupied sites |

68,977 |

68,760 |

68,902 |

68,761 |

|||||||

|

Occupancy % |

95.0 % |

94.9 % |

94.9 % |

94.9 % |

|||||||

|

Monthly base rent per site |

$ 861 |

$ 813 |

$ 854 |

$ 805 |

|||||||

|

Quarters Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2024 |

2023 |

Change (1) |

2024 |

2023 |

Change (1) |

||||||

|

Core RV and marina base rental income: |

|||||||||||

|

Annual (2) |

$ 75.4 |

$ 71.0 |

6.2 % |

$ 222.8 |

$ 208.4 |

6.9 % |

|||||

|

Seasonal |

7.2 |

8.3 |

(13.3) % |

43.1 |

45.1 |

(4.4) % |

|||||

|

Transient |

28.3 |

30.2 |

(6.1) % |

61.2 |

63.9 |

(4.3) % |

|||||

|

Total Seasonal and Transient |

$ 35.5 |

$ 38.5 |

(7.7) % |

$ 104.3 |

$ 109.0 |

(4.3) % |

|||||

|

Total RV and marina base rental income |

$ 110.9 |

$ 109.5 |

1.3 % |

$ 327.1 |

$ 317.4 |

3.0 % |

|||||

|

Quarters Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2024 |

2023 |

Change (1) |

2024 |

2023 |

Change (1) |

||||||

|

Core utility information: |

|||||||||||

|

Income |

$ 20.0 |

$ 18.1 |

10.8 % |

$ 55.6 |

$ 52.0 |

6.9 % |

|||||

|

Expense |

42.4 |

41.7 |

1.7 % |

119.1 |

116.6 |

2.1 % |

|||||

|

Expense, net |

$ 22.4 |

$ 23.6 |

(5.1) % |

$ 63.5 |

$ 64.6 |

(1.7) % |

|||||

|

Utility recovery rate (3) |

47.2 % |

43.4 % |

46.7 % |

44.6 % |

|||||||

|

_____________________ |

|

|

1. |

Calculations prepared using actual results without rounding. |

|

2. |

Core Annual marina base rental income represents approximately 99% of the total Core marina base rental income for all periods presented. |

|

3. |

Calculated by dividing the utility income by utility expense. |

|

Non-Core Income from Property Operations (1) |

|||

|

(In millions, unaudited) |

|||

|

Quarter Ended |

Nine Months Ended |

||

|

September 30, 2024 |

September 30, 2024 |

||

|

MH base rental income |

$ 0.2 |

$ 0.5 |

|

|

RV and marina base rental income |

2.4 |

9.8 |

|

|

Annual membership subscriptions |

0.1 |

0.1 |

|

|

Utility and other income |

2.6 |

9.5 |

|

|

Property operating revenues |

5.3 |

19.9 |

|

|

Property operating expenses, excluding property management (1)(2) |

3.2 |

9.2 |

|

|

Income from property operations, excluding property management (1) |

$ 2.1 |

$ 10.7 |

|

|

______________________ |

|

|

1. |

Excludes property management expenses. |

|

2. |

Includes bad debt expense for the periods presented. |

|

Home Sales and Rental Home Operations |

|||||||

|

(In thousands, except home sale volumes and occupied rentals, unaudited) |

|||||||

|

Home Sales – Select Data |

Quarters Ended |

Nine Months Ended |

|||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Total new home sales volume |

174 |

285 |

620 |

687 |

|||

|

New home sales gross revenues |

$ 15,500 |

$ 27,684 |

$ 55,906 |

$ 69,036 |

|||

|

Total used home sales volume |

60 |

84 |

173 |

252 |

|||

|

Used home sales gross revenues |

$ 883 |

$ 1,020 |

$ 2,961 |

$ 3,229 |

|||

|

Brokered home resales volume |

135 |

160 |

396 |

495 |

|||

|

Brokered home resales gross revenues |

$ 551 |

$ 704 |

$ 1,772 |

$ 2,255 |

|||

|

Rental Homes – Select Data |

Quarters Ended |

Nine Months Ended |

|||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Rental operations revenues (1) |

$ 8,515 |

$ 9,406 |

$ 26,170 |

$ 29,491 |

|||

|

Rental home operations expense (2) |

1,387 |

1,762 |

4,313 |

3,879 |

|||

|

Depreciation on rental homes (3) |

2,390 |

2,727 |

7,450 |

8,275 |

|||

|

Occupied rentals: (4) |

|||||||

|

New |

1,795 |

2,086 |

|||||

|

Used |

217 |

259 |

|||||

|

Total occupied rental sites |

2,012 |

2,345 |

|||||

|

As of September 30, 2024 |

As of September 30, 2023 |

||||||

|

Cost basis in rental homes: (5) |

Gross |

Net of |

Gross |

Net of |

|||

|

New |

$ 220,134 |

$ 180,787 |

$ 249,568 |

$ 218,955 |

|||

|

Used |

11,197 |

6,972 |

12,606 |

8,906 |

|||

|

Total rental homes |

$ 231,331 |

$ 187,759 |

$ 262,174 |

$ 227,861 |

|||

|

______________________ |

|

|

1. |

For the quarters ended September 30, 2024 and 2023, approximately $5.1 million and $5.9 million, respectively, of the rental operations revenue is included in the MH base rental income in the Core Income from Property Operations on pages 8-9. The remainder of the rental operations revenue for the quarters ended September 30, 2024 and 2023 is included in Rental home income in the Core Income from Property Operations on pages 8-9. |

|

2. |

Rental home operations expense is included in Property operating, maintenance and real estate taxes in the Consolidated Income from Property Operations on page 7. Rental home operations expense is included in Insurance and other in the Core Income from Property Operations on pages 8-9. |

|

3. |

Depreciation on rental homes in our Core portfolio is presented in Depreciation and amortization in the Consolidated Statements of Income on page 3. |

|

4. |

Includes occupied rental sites as of the end of the period in our Core portfolio. |

|

5. |

Includes both occupied and unoccupied rental homes in our Core portfolio. |

|

Total Sites |

|

|

(Unaudited) |

|

|

Summary of Total Sites as of September 30, 2024 |

|

|

Sites (1) |

|

|

MH sites |

73,000 |

|

RV sites: |

|

|

Annual |

34,400 |

|

Seasonal |

11,800 |

|

Transient |

17,000 |

|

Marina slips |

6,900 |

|

Membership (2) |

26,000 |

|

Joint Ventures (3) |

3,800 |

|

Total |

172,900 |

|

______________________ |

|

|

1. |

MH sites are generally leased on an annual basis to residents who own or lease factory-built homes, including manufactured homes. Annual RV and marina sites are leased on an annual basis to customers who generally have an RV, factory-built cottage, boat or other unit placed on the site, including those Northern properties that are open for the summer season. Seasonal RV and marina sites are leased to customers generally for one to six months. Transient RV and marina sites are leased to customers on a short-term basis. |

|

2. |

Sites primarily utilized by approximately 117,400 members. Includes approximately 5,900 sites rented on an annual basis. |

|

3. |

Joint ventures have approximately 2,000 annual sites and 1,800 transient sites. |

|

Membership Campgrounds – Select Data |

|||||||||

|

Years Ended December 31, |

Nine Months |

||||||||

|

Campground and Membership Revenue ($ in thousands, unaudited) |

2020 |

2021 |

2022 |

2023 |

2024 |

||||

|

Annual membership subscriptions |

$ 53,085 |

$ 58,251 |

$ 63,215 |

$ 65,379 |

$ 49,298 |

||||

|

Annual RV base rental income |

$ 20,761 |

$ 23,127 |

$ 25,945 |

$ 27,842 |

$ 21,771 |

||||

|

Seasonal/Transient RV base rental income |

$ 18,126 |

$ 25,562 |

$ 24,316 |

$ 20,996 |

$ 17,956 |

||||

|

Membership upgrade sales |

$ 9,677 |

$ 11,191 |

$ 12,958 |

$ 14,719 |

$ 12,170 |

||||

|

Utility and other income |

$ 2,426 |

$ 2,735 |

$ 2,626 |

$ 2,544 |

$ 1,848 |

||||

|

Membership Count |

|||||||||

|

Total Memberships (1) |

116,169 |

125,149 |

128,439 |

121,002 |

117,426 |

||||

|

Paid Membership Origination |

20,587 |

23,923 |

23,237 |

20,758 |

16,109 |

||||

|

Promotional Membership Origination |

23,542 |

26,600 |

28,178 |

25,232 |

18,921 |

||||

|

Membership Upgrade Sales Volume (2) |

3,373 |

4,863 |

4,068 |

3,858 |

2,920 |

||||

|

Campground Metrics |

|||||||||

|

Membership Campground Count |

81 |

81 |

82 |

82 |

82 |

||||

|

Membership Campground RV Site Count |

24,800 |

25,100 |

25,800 |

26,000 |

26,000 |

||||

|

Annual Site Count (3) |

5,986 |

6,320 |

6,390 |

6,154 |

5,933 |

||||

|

Membership Sales Activity ($ in thousands, unaudited) |

Quarters Ended September 30, |

||

|

2024 |

2023 |

||

|

Membership upgrade sales current period, gross |

$ 10,076 |

$ 10,788 |

|

|

Membership upgrade sales upfront payments, deferred, net |

(5,903) |

(7,044) |

|

|

Membership upgrade sales |

$ 4,173 |

$ 3,744 |

|

|

Membership sales and marketing, gross |

$ (7,615) |

$ (6,874) |

|

|

Membership sales commissions, deferred, net |

1,167 |

1,178 |

|

|

Membership sales and marketing |

$ (6,448) |

$ (5,696) |

|

|

______________________ |

|

|

1. |

Members who have entered into annual subscriptions with us that entitle them to use certain properties on a continuous basis for up to 21 days. |

|

2. |

Existing members who have upgraded memberships are eligible for enhanced benefits, including but not limited to longer stays, the ability to make earlier reservations, potential discounts on rental units, and potential access to additional properties. Upgrades require a non-refundable upfront payment. |

|

3. |

Sites that have been rented by members for an entire year. |

|

Market Capitalization |

|||||||||

|

(In millions, except share and OP Unit data, unaudited) |

|||||||||

|

Capital Structure as of September 30, 2024 |

|||||||||

|

Total |

% of Total |

Total |

% of Total |

% of Total |

|||||

|

Secured Debt |

$ 2,969 |

84.8 % |

|||||||

|

Unsecured Debt |

533 |

15.2 % |

|||||||

|

Total Debt (1) |

$ 3,502 |

100.0 % |

20.1 % |

||||||

|

Common Shares (2) |

186,512,609 |

95.3 % |

|||||||

|

OP Units |

9,104,654 |

4.7 % |

|||||||

|

Total Common Shares and OP Units |

195,617,263 |

100.0 % |

|||||||

|

Common Stock price at September 30, 2024 |

$ 71.34 |

||||||||

|

Fair Value of Common Shares and OP Units |

$ 13,955 |

100.0 % |

|||||||

|

Total Equity |

$ 13,955 |

100.0 % |

79.9 % |

||||||

|

Total Market Capitalization |

$ 17,457 |

100.0 % |

|||||||

|

______________________ |

|

|

1. |

Excludes deferred financing costs of approximately $27.2 million. |

|

2. |

Refer to the Balance Sheet activity section on page ii for details regarding a subsequent issuance of common shares in October 2024. |

|

Debt Maturity Schedule |

|||||||

|

Debt Maturity Schedule as of September 30, 2024 |

|||||||

|

(In thousands, unaudited) |

|||||||

|

Year |

Outstanding |

Weighted |

% of Total |

Weighted |

|||

|

Secured Debt |

|||||||

|

2024 |

$ — |

— % |

— % |

— |

|||

|

2025 |

88,349 |

3.45 % |

2.52 % |

0.5 |

|||

|

2026 |

— |

— % |

— % |

— |

|||

|

2027 |

— |

— % |

— % |

— |

|||

|

2028 |

197,720 |

4.19 % |

5.65 % |

3.9 |

|||

|

2029 |

271,829 |

4.92 % |

7.76 % |

4.9 |

|||

|

2030 |

275,385 |

2.69 % |

7.86 % |

5.5 |

|||

|

2031 |

244,389 |

2.46 % |

6.98 % |

6.6 |

|||

|

2032 |

202,000 |

2.47 % |

5.77 % |

8.0 |

|||

|

2033 |

344,391 |

4.83 % |

9.84 % |

9.0 |

|||

|

Thereafter |

1,345,029 |

3.88 % |

38.41 % |

15.5 |

|||

|

Total |

$ 2,969,092 |

3.77 % |

84.79 % |

9.3 |

|||

|

Unsecured Term Loans |

|||||||

|

2024 |

$ — |

— % |

— % |

— |

|||

|

2025 |

— |

— % |

— % |

— |

|||

|

2026 |

300,000 |

6.05 % |

8.57 % |

1.6 |

|||

|

2027 |

200,000 |

4.88 % |

5.71 % |

2.3 |

|||

|

2028 |

— |

— % |

— % |

— |

|||

|

Thereafter |

— |

— % |

— % |

— |

|||

|

Total |

$ 500,000 |

5.58 % |

14.28 % |

2.0 |

|||

|

Total Secured and Unsecured (1) |

$ 3,469,092 |

4.03 % |

99.07 % |

8.2 |

|||

|

Line of Credit Borrowing (2) |

32,500 |

6.66 % |

0.93 % |

— |

|||

|

Note Premiums and Unamortized loan costs |

(27,221) |

||||||

|

Total Debt, Net |

$ 3,474,371 |

4.22% (3) |

100.00 % |

||||

|

_____________________ |

|

|

1. |

In October 2024 we repaid the $300.0 million Term Loan scheduled to mature in 2026. Excluding the $300.0 million Term Loan, our total secured and unsecured debt weighted average interest rate and years to maturity would have been approximately 3.85% and 9.0 years, respectively as of September 30, 2024. |

|

2. |

The floating interest rate on the line of credit is SOFR plus 0.10% plus 1.25% to 1.65%. During the quarter ended September 30, 2024, the effective interest rate on the line of credit borrowings was 6.66%. |

|

3. |

Reflects effective interest rate for the quarter ended September 30, 2024, including interest associated with the line of credit and amortization of deferred financing costs. Excluding the $300.0 million Term Loan and the associated unamortized loan costs repaid in October 2024, our total debt weighted average interest rate would have been approximately 4.05% as of September 30, 2024. |

Non-GAAP Financial Measures Definitions and Reconciliations

The following Non-GAAP financial measures definitions have been revised and do not include adjustments in respect to membership upgrade sales: (i) FFO; (ii) Normalized FFO; (iii) EBITDAre; (iv) Adjusted EBITDAre; (v) Property operating revenues; (vi) Property operating expenses, excluding property management; and (vii) Income from property operations, excluding property management. For comparability, prior periods’ non-GAAP financial measures have also been updated.

FUNDS FROM OPERATIONS (FFO). We define FFO as net income, computed in accordance with GAAP, excluding gains or losses from sales of properties, depreciation and amortization related to real estate, impairment charges and adjustments to reflect our share of FFO of unconsolidated joint ventures. Adjustments for unconsolidated joint ventures are calculated to reflect FFO on the same basis. We compute FFO in accordance with our interpretation of standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), which may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do.