Richmond American Announces Community Grand Opening in DeLand

Seasons at Grandview Gardens offers beautiful homes with designer-curated finishes

DELAND, Fla., Oct. 21, 2024 /PRNewswire/ — Richmond American Homes of Florida, LP, a subsidiary of M.D.C. Holdings, Inc., is pleased to announce the Grand Opening of Seasons at Grandview Gardens (RichmondAmerican.com/SeasonsAtGrandviewGardens), an exciting new DeLand community. This notable neighborhood offers an impressive array of single- and two-story floor plans from the builder’s sought-after Seasons™ Collection (RichmondAmerican.com/Seasons), designed to maximize space and put homeownership within reach for a variety of buyers.

Grand Opening Event (RichmondAmerican.com/GrandviewGardensGO)

Prospective homebuyers and area agents are encouraged to stop by Seasons at Grandview Gardens for a special Grand Opening event on Saturday, October 26, from 12 to 3 p.m. Attendees can enjoy complimentary tacos and enter a prize drawing.

Community highlights:

- New single- and two-story homes from the upper $300s

- Five Seasons™ Collection floor plans with open layouts

- 3 to 6 bedrooms and approx. 1,880 to 3,030 sq. ft.

- Professionally curated fixtures and finishes

- 3-car and RV garages available

- Near beaches, notable schools, recreation, shopping & dining

- Close proximity to Blue Spring State Park

- Slate model home open for tours

- Select homes ready for quick move-in

Seasons at Grandview Gardens is located at 343 Alexandrite Street in DeLand. Call 407.287.6285 or visit RichmondAmerican.com to learn more and RSVP for the community’s Grand Opening event.

About M.D.C. Holdings, Inc.

M.D.C. Holdings, Inc. was founded in 1972. MDC’s homebuilding subsidiaries, which operate under the name Richmond American Homes, have helped more than 240,000 homebuyers achieve the American Dream since 1977. One of the largest homebuilders in the nation, MDC is committed to quality and value that is reflected in each home its subsidiaries build. The Richmond American companies have operations in Alabama, Arizona, California, Colorado, Florida, Idaho, Maryland, Nevada, New Mexico, Oregon, Tennessee, Texas, Utah, Virginia and Washington. Mortgage lending, insurance and title services are offered by the following MDC subsidiaries, respectively: HomeAmerican Mortgage Corporation, American Home Insurance Agency, Inc. and American Home Title and Escrow Company. For more information, visit MDCHoldings.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-announces-community-grand-opening-in-deland-302282340.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/richmond-american-announces-community-grand-opening-in-deland-302282340.html

SOURCE M.D.C. Holdings, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Vanguard ETFs That Can Provide Lifetime Passive Income

Generating passive income is a cornerstone of financial independence. It creates steady cash flows without requiring active involvement, allowing investors to focus on other aspects of their lives or pursue additional opportunities. For many, the ultimate goal is to build a portfolio that generates enough passive income to cover living expenses indefinitely.

Enter Vanguard exchange-traded funds (ETFs), the brainchild of investing legend John Bogle. These ETFs offer a powerful combination of broad diversification and rock-bottom fees, making them ideal vehicles for long-term wealth-building and income generation. Vanguard’s approach to investing, pioneered by Bogle, emphasizes low-cost, passive strategies that have revolutionized the investment landscape.

Vanguard ETFs distinguish themselves in the investment landscape through a unique blend of features. These funds typically boast lower turnover rates compared to actively managed alternatives, a characteristic that substantially reduces investors’ tax liabilities. This tax efficiency, combined with the impressive dividend growth rates many Vanguard ETFs have demonstrated since their inception, underscores the premium quality of their underlying holdings.

Moreover, Vanguard’s approach to passive management ensures that these ETFs closely track their underlying indexes. This methodology maximizes efficiency while maintaining the simplicity that individual investors appreciate. The result is a powerful investment vehicle that combines the benefits of broad market exposure with the cost-effectiveness of passive investing.

Another critical advantage of Vanguard’s low-cost ETFs is their reliability. Thanks to their highly diversified portfolios and high-quality holdings, these ETFs are unlikely to suspend their cash distributions, even during economic downturns. This reliability is a significant benefit over individual stocks, which may cut or eliminate dividends during challenging times.

Let’s explore three Vanguard ETFs that have the potential to provide lifetime passive income, each offering a unique approach to dividend investing.

A low-cost core holding

The Vanguard S&P 500 ETF (NYSEMKT: VOO) mirrors the performance of the benchmark S&P 500 index, encompassing 500 of the largest U.S. companies. With an ultra-low expense ratio of 0.03%, this ETF allows investors to retain more of their returns. While its 30-day SEC yield of 1.23% might appear modest initially, the fund’s true strength lies in its growth potential.

Since its inception in 2010, the fund has achieved an impressive 13.4% compound annual growth rate (CAGR) of distributions. This remarkable figure illustrates the power of investing in high-quality, dividend-growing companies over time. To put this into perspective, a $10,000 investment at the fund’s launch, with dividends reinvested and assuming no tax liabilities, would have burgeoned to $69,250 today.

Comprehensive U.S. market exposure

The Vanguard Total Stock Market Index Fund ETF Shares (NYSEMKT: VTI) offers investors broad exposure to the entire U.S. stock market, encompassing small-, mid-, and large-cap stocks. Matching its S&P 500 counterpart, it sports a minimal expense ratio of 0.03%, maximizing investor returns.

While its 30-day SEC yield of 1.22% closely mirrors the S&P 500 ETF, this fund’s true value lies in its long-term performance and diversification across the entire U.S. market. Since its inception in 2001, the fund’s distributions have grown at an annual rate of 5.05%.

This steady growth translates to significant returns over time. A $10,000 investment at the fund’s launch, with dividends reinvested and assuming no tax liabilities, would have blossomed to $76,590 today.

The fund’s performance has outpaced the aforementioned S&P 500 ETF due to its longer track record. Its comprehensive coverage provides investors with a simple way to capture the performance of the entire U.S. stock market in a single fund.

Focus on high-yield stocks

For investors prioritizing current income, the Vanguard High Dividend Yield Index Fund ETF Shares (NYSEMKT: VYM) presents a compelling option. This ETF targets stocks with above-average dividend yields, resulting in a higher 30-day SEC yield of 2.65%.

While its expense ratio is slightly higher at 0.06%, it remains remarkably low compared to actively managed funds. The fund’s strength lies in its income generation and growth potential.

Since its 2006 inception, the ETF’s distributions have grown at an annual rate of 9.18%. Although its earnings growth rate of 10.6% is lower than the broader market ETFs, it compensates with a higher current yield.

To illustrate its performance, a $10,000 investment at the fund’s launch, with dividends reinvested and assuming no tax liabilities, would have grown to $45,750 today. This growth showcases the fund’s potential for both income and capital appreciation over time.

The power of passive management

All three ETFs benefit from Vanguard’s passive management approach, which closely tracks their respective indexes. This hands-off approach simplifies investing for individuals seeking passive income. The low turnover rates of these ETFs (2.2% for the Vanguard S&P 500 ETF and Vanguard Total Stock Market ETF, 5.7% for the Vanguard High Dividend Yield ETF) further enhance their tax efficiency.

These Vanguard ETFs showcase the potential for growing passive income over time. Their broad diversification, ultra-low fees, and passive management approach set them apart in the ETF landscape.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

George Budwell has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF, Vanguard Total Stock Market ETF, and Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool has a disclosure policy.

3 Vanguard ETFs That Can Provide Lifetime Passive Income was originally published by The Motley Fool

UNDER ARMOUR ANNOUNCES SECOND QUARTER FISCAL 2025 EARNINGS CONFERENCE CALL DATE

BALTIMORE, Oct. 21, 2024 /PRNewswire/ — Under Armour, Inc. UA UAA))) plans to release its second quarter fiscal 2025 (ended September 30, 2024) results on November 7, 2024. Following the news release at approximately 6:55 a.m. Eastern Time (ET), Under Armour management will host a conference call at approximately 8:30 a.m. ET to review results.

This call will be webcast live and archived at https://about.underarmour.com/investor-relations/financials.

About Under Armour, Inc.

Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer, and distributor of branded athletic performance apparel, footwear, and accessories. Designed to empower human performance, Under Armour’s innovative products and experiences are engineered to make athletes better. For further information, please visit http://about.underarmour.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/under-armour-announces-second-quarter-fiscal-2025-earnings-conference-call-date-302282204.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/under-armour-announces-second-quarter-fiscal-2025-earnings-conference-call-date-302282204.html

SOURCE Under Armour, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

North American Construction Group Ltd. Third Quarter Results Conference Call and Webcast Notification

ACHESON, Alberta, Oct. 21, 2024 (GLOBE NEWSWIRE) — North American Construction Group Ltd. (“NACG” or “the Company”) NOANOA announced today that it will release its financial results for the third quarter ended September 30, 2024 on Wednesday, October 30, 2024 after markets close. Following the release of its financial results, NACG will hold a conference call and webcast on Thursday, October 31, 2024, at 7:00 a.m. Mountain Time (9:00 a.m. Eastern Time).

The call can be accessed by dialing:

Toll free: 1-800-717-1738

Conference ID: 86919

A replay will be available through November 29, 2024, by dialing:

Toll Free: 1-888-660-6264

Conference ID: 86919

Playback Passcode: 86919

A slide deck for the webcast will be available for download the evening prior to the call and will be found on the company’s website at www.nacg.ca/presentations/

The live presentation and webcast can be accessed at: North American Construction Group Ltd. Third Quarter Results Conference Call Registration (onlinexperiences.com)

A replay will be available until November 29, 2024, using the link provided.

About the Company

North American Construction Group Ltd. is a premier provider of heavy civil construction and mining services in Canada, the U.S. and Australia. For over 70 years, NACG has provided services to the mining, resource and infrastructure construction markets.

For further information, please contact:

Jason Veenstra, CPA, CA

Chief Financial Officer

North American Construction Group Ltd.

Phone: (780) 960-7171

Email: ir@nacg.ca

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NVIDIA's Options Frenzy: What You Need to Know

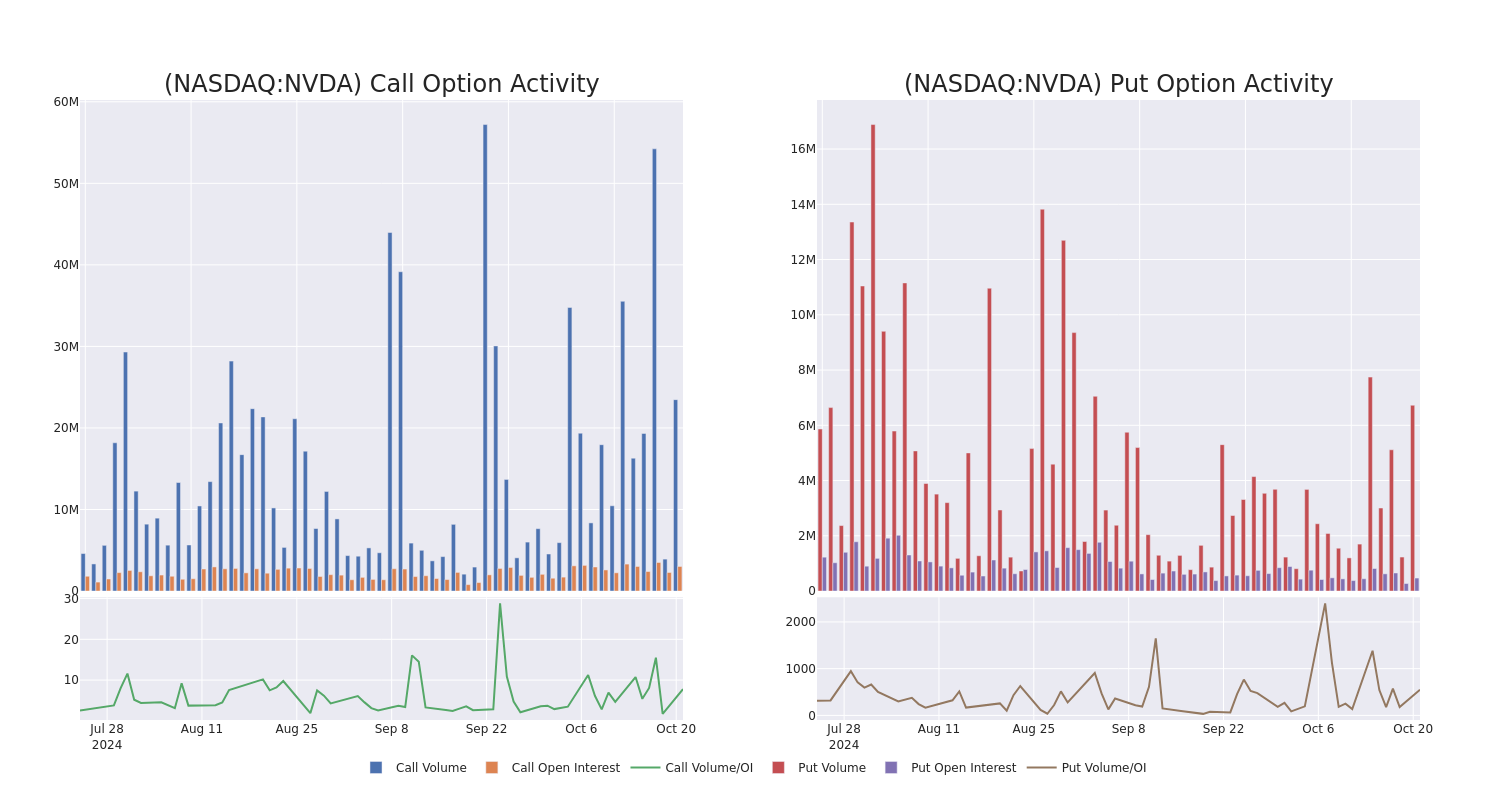

Deep-pocketed investors have adopted a bullish approach towards NVIDIA NVDA, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NVDA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 941 extraordinary options activities for NVIDIA. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 48% leaning bullish and 39% bearish. Among these notable options, 227 are puts, totaling $13,267,202, and 714 are calls, amounting to $62,348,419.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $260.0 for NVIDIA over the last 3 months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of NVIDIA stands at 17951.37, with a total volume reaching 30,182,383.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in NVIDIA, situated within the strike price corridor from $0.5 to $260.0, throughout the last 30 days.

NVIDIA Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVDA | CALL | SWEEP | BULLISH | 01/17/25 | $9.05 | $9.0 | $9.04 | $160.00 | $543.0K | 34.9K | 5.9K |

| NVDA | PUT | SWEEP | NEUTRAL | 12/19/25 | $13.0 | $12.85 | $12.9 | $111.00 | $239.9K | 1.6K | 202 |

| NVDA | CALL | SWEEP | BULLISH | 10/25/24 | $2.08 | $2.03 | $2.03 | $145.00 | $215.8K | 49.1K | 144.1K |

| NVDA | CALL | SWEEP | BULLISH | 01/17/25 | $12.6 | $12.55 | $12.6 | $150.00 | $199.0K | 97.6K | 9.7K |

| NVDA | CALL | SWEEP | BULLISH | 10/25/24 | $5.05 | $5.0 | $5.0 | $140.00 | $196.0K | 71.2K | 151.7K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Having examined the options trading patterns of NVIDIA, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is NVIDIA Standing Right Now?

- Currently trading with a volume of 259,972,551, the NVDA’s price is up by 4.33%, now at $143.97.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 29 days.

What The Experts Say On NVIDIA

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $163.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for NVIDIA, targeting a price of $190.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on NVIDIA with a target price of $150.

* An analyst from UBS has revised its rating downward to Buy, adjusting the price target to $150.

* Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Overweight with a new price target of $150.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $175.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NVIDIA options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Simpson Manufacturing Co., Inc. Announces 2024 Third Quarter Financial Results

- Net sales of $587.2 million, increased 1.2% year-over-year

- Income from operations of $124.9 million, resulting in operating income margin of 21.3%

- Net income per diluted share of $2.21

- Revising full year 2024 outlook based on reduced housing start expectations

PLEASANTON, Calif., Oct. 21, 2024 /PRNewswire/ — Simpson Manufacturing Co., Inc. (the “Company”) SSD, an industry leader in engineered structural connectors and building solutions, today announced its financial results for the third quarter of 2024. All comparisons below (which are generally indicated by words such as “increased,” “decreased,” “remained,” or “compared to”), unless otherwise noted, are comparing the quarter ended September 30, 2024, with the quarter ended September 30, 2023.

Consolidated 2024 Third Quarter Highlights

|

Three Months Ended, |

Year-Over- |

||||

|

September 30, |

Year |

||||

|

2024 |

2023 |

Change |

|||

|

(In thousands, except per share data and percentages) |

|||||

|

Net sales |

$ 587,153 |

$ 580,084 |

1.2 % |

||

|

Gross profit |

275,057 |

282,917 |

(2.8) % |

||

|

Gross profit margin |

46.8 % |

48.8 % |

|||

|

Total operating expenses |

148,872 |

141,935 |

4.9 % |

||

|

Income from operations |

124,854 |

140,213 |

(11.0) % |

||

|

Operating income margin |

21.3 % |

24.2 % |

|||

|

Net income |

$ 93,519 |

$ 104,021 |

(10.1) % |

||

|

Net income per diluted common share |

$ 2.21 |

$ 2.43 |

(9.1) % |

||

|

Adjusted EBITDA1 |

$ 148,278 |

$ 158,792 |

(6.6) % |

||

|

Trailing Twelve Months Ended |

Year-Over- |

||||

|

September 30, |

Year |

||||

|

2024 |

2023 |

Change |

|||

|

(In thousands, except percentages) |

|||||

|

Total U.S. Housing starts2 |

1,384 |

1,407 |

(1.6) % |

||

|

__________________ |

|

1 Adjusted EBITDA is a non-GAAP financial measure and it is defined in the Non-GAAP Financial Measures section of the press release. For a reconciliation of Adjusted EBITDA to U.S. GAAP (“GAAP”) net income see the schedule titled “Reconciliation of Net Income to Adjusted EBITDA”. |

|

2 Source: United States Census Bureau |

Management Commentary

“Our third quarter net sales of $587.2 million were up modestly year-over-year despite the housing markets in both the U.S. and Europe remaining under pressure,” commented Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co., Inc. “In North America, our volumes were relatively flat year-over-year with strength in the national retail, component manufacturer and OEM markets offsetting weakness in residential and commercial. While product mix drove a higher average sales price per pound in the quarter, our customer mix resulted in greater volume discounts applied. In Europe, sales increased modestly year-over-year, outperforming the market as we’ve continued to benefit from new customer wins and product applications.”

Mr. Olosky continued, “Despite near-term challenges, we grew our North America volume by 500 basis points ahead of U.S. housing starts over the trailing twelve months. Even though our overall profitability is good, it is below our expectations and we are working to align costs with market conditions to improve profitability. For 2024, we now expect U.S. housing starts to be down in the low single-digit range from 2023 with low single-digit growth to come in 2025. In Europe, 2024 housing starts are expected to be down in the high single-digit range compared to the prior year with meaningful growth to be pushed out further into 2026 and beyond.”

North America Segment 2024 Third Quarter Financial Highlights

- Net sales of $461.4 million increased 1.0% from $456.8 million due to slightly higher average sales prices resulting from a favorable sales mix on relatively flat sales volumes, in addition to incremental sales from the Company’s 2024 acquisitions.

- Gross margin decreased to 49.5% from 51.8%, primarily due to higher factory and overhead and warehouse costs, as a percentage of net sales, partly offset by efficiency gains.

- Income from operations of $123.3 million decreased 9.1% from $135.6 million. The decrease was primarily due to a decrease in gross profit, as well as increases in operating expenses of $4.1 million from 22.1% of net sales to 22.7%. Increased operating expenses include personnel costs (including engineering support services) and advertising and tradeshow costs, which were partly offset by a decrease in variable incentive compensation.

Europe Segment 2024 Third Quarter Financial Highlights

- Net sales of $121.2 million increased 1.8% from $119.0 million, due to increased sales volumes, partly offset by price decreases in some regions. Net sales benefited from the positive effect of approximately $1.5 million in foreign currency translation.

- Gross margin decreased to 36.6% from 37.9%, primarily due to higher labor, factory and overhead, and warehouse and freight costs as a percentage of net sales, partly offset by lower material costs.

- Income from operations of $12.6 million decreased 18.2% from $15.5 million. The decrease was primarily due to increases in operating expenses of $2.4 million from 24.3% of net sales to 25.8% as well as a decrease in gross profit. Increased operating expenses included higher personnel and depreciation costs, which were partly offset by a decrease in variable incentive compensation.

Refer to the “Segment and Product Group Information” table below for additional segment information (including information about the Company’s Asia/Pacific and Administrative and All Other segments).

Corporate Developments

During the third quarter, the Company completed the acquisition of all of the operating assets and assumed liabilities of Monet DeSauw Inc. and certain properties of Callaway Properties, LLC (together with its subsidiaries, “Monet”) for a total purchase consideration of approximately $48.5 million, net of cash received. Monet specializes in the production of large-scale saws and material handling equipment for the truss industry in the United States.

During the third quarter, the Company completed the acquisition of QuickFrames USA, a manufacturer of pre-engineered structural support systems for commercial construction with sales in North America.

Balance Sheet & 2024 Third Quarter Cash Flow Highlights

- As of September 30, 2024, cash and cash equivalents totaled $339.4 million with total debt outstanding of $465.4 million, of which $75.0 million remained outstanding under its $450.0 million revolving credit facility.

- Cash flow provided by operating activities of $102.5 million decreased from $200.9 million, primarily due to increases in working capital.

- Cash flow used in investing activities of $106.6 million increased from $18.5 million due to increases of $61.5 million in acquisitions and $25.6 million in capital expenditures.

Business Outlook

The Company has updated its 2024 financial outlook based on three quarters of financial information to reflect its latest expectations regarding demand trends, cost of sales, and operating expenses. Based on business trends and conditions as of today, October 21, 2024, the Company’s outlook for the full fiscal year ending December 31, 2024 is as follows:

- Based on current expectations that U.S. housing starts will be down from the prior year, operating margin is estimated to be in the range of 19.0% to 19.5%.

- The effective tax rate is estimated to be in the range of 25.3% to 25.8%, including both federal and state income tax rates as well as international income tax rates, and assuming no tax law changes are enacted.

- Capital expenditures are estimated to be in the range of $175.0 million to $185.0 million, which includes $90.0 million to $100.0 million for the Columbus, Ohio facility expansion and the new Gallatin, Tennessee fastener facility construction with the remaining spend carrying over into 2025.

Conference Call Details

Investors, analysts and other interested parties are invited to join the Company’s third quarter 2024 financial results conference call on Monday, October 21, 2024, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). To participate, callers may dial (877) 407-0792 (U.S. and Canada) or (201) 689-8263 (International) approximately 10 minutes prior to the start time. The call will be webcast simultaneously and can be accessed through ir.simpsonmfg.com. For those unable to participate during the live broadcast, a replay of the call will also be available beginning that same day at 8:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on Monday, November 4, 2024 by dialing (844) 512–2921 (U.S. and Canada) or (412) 317–6671 (International) and entering the conference ID: 13749013. The webcast will remain posted on the Investor Relations section of Simpson’s website at ir.simpsonmfg.com for 90 days.

About Simpson Manufacturing Co., Inc.

Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiary, Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing carbon & glass fiber materials. The Company primarily supplies its building product solutions to both the residential and commercial markets in North America and Europe. The Company’s common stock trades on the New York Stock Exchange under the symbol “SSD.”

Copies of Simpson Manufacturing’s Annual Report to Stockholders and its proxy statements and other SEC filings, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, are made available free of charge on the company’s website on the same day they are filed with the SEC. To view these filings, visit the Investor Relations section of the Company’s website.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “outlook,” “target,” “continue,” “predict,” “project,” “change,” “result,” “future,” “will,” “could,” “can,” “may,” “likely,” “potentially,” or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our ongoing integration of ETANCO and recently acquired companies, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing.

Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of global pandemics such as the COVID-19 pandemic or other widespread public health crisis and their effects on the global economy, the effects of inflation and labor and supply shortages, on our operations, and the operations of our customers, suppliers and business partners, and our ongoing integration of ETANCO, as well as those discussed in the “Risk Factors” and ” Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC.

We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

Non-GAAP Financial Measures

This press release includes certain financial information not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”). Since not all companies calculate non-GAAP financial information identically (or at all), the presentations herein may not be comparable to other similarly titled measures used by other companies. Further, these measures should not be considered substitutes for the financial measures calculated in accordance with GAAP. The Company uses Adjusted EBITDA as an additional financial measure in evaluating the ongoing operating performance of its business. The Company believes Adjusted EBITDA allows it to readily view operating trends, perform analytical comparisons, and identify strategies to improve operating performance. Adjusted EBITDA should not be considered in isolation or as a substitute for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. See the Reconciliation of Non-GAAP Financial Measures below.

The Company defines Adjusted EBITDA as net income (loss) before income taxes, adjusted to exclude depreciation and amortization, integration, acquisition and restructuring costs, goodwill impairment, gain on bargain purchase, net loss or gain on disposal of assets, interest income or expense, and foreign exchange and other expense (income).

|

Simpson Manufacturing Co., Inc. and Subsidiaries UNAUDITED Condensed Consolidated Statements of Operations (In thousands, except per share data)

|

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Net sales |

$ 587,153 |

$ 580,084 |

$ 1,714,710 |

$ 1,712,093 |

|||

|

Cost of sales |

312,096 |

297,167 |

916,562 |

888,835 |

|||

|

Gross profit |

275,057 |

282,917 |

798,148 |

823,258 |

|||

|

Research and development and engineering expense |

23,678 |

24,751 |

68,303 |

67,035 |

|||

|

Selling expense |

54,590 |

52,391 |

165,007 |

151,497 |

|||

|

General and administrative expense |

70,604 |

64,793 |

207,181 |

197,267 |

|||

|

Total operating expenses |

148,872 |

141,935 |

440,491 |

415,799 |

|||

|

Acquisition and integration related costs |

1,356 |

785 |

4,992 |

4,086 |

|||

|

Gain on disposal of assets |

(25) |

(16) |

(460) |

(223) |

|||

|

Income from operations |

124,854 |

140,213 |

353,125 |

403,596 |

|||

|

Interest income and other, net |

1,668 |

1,292 |

4,111 |

18 |

|||

|

Other & foreign exchange gain (loss), net |

(29) |

(1,429) |

352 |

(1,471) |

|||

|

Income before taxes |

126,493 |

140,076 |

357,588 |

402,143 |

|||

|

Provision for income taxes |

32,974 |

36,055 |

90,821 |

102,958 |

|||

|

Net income |

$ 93,519 |

$ 104,021 |

$ 266,767 |

$ 299,185 |

|||

|

Earnings per common share: |

|||||||

|

Basic |

$ 2.22 |

$ 2.44 |

$ 6.31 |

$ 7.01 |

|||

|

Diluted |

$ 2.21 |

$ 2.43 |

$ 6.28 |

$ 6.98 |

|||

|

Weighted average shares outstanding: |

|||||||

|

Basic |

42,151 |

42,673 |

42,254 |

42,651 |

|||

|

Diluted |

42,335 |

42,882 |

42,464 |

42,893 |

|||

|

Cash dividend declared per common share |

$ 0.28 |

$ 0.27 |

$ 0.83 |

$ 0.80 |

|||

|

Other data: |

|||||||

|

Depreciation and amortization |

$ 21,276 |

$ 18,180 |

$ 59,835 |

$ 54,224 |

|||

|

Pre-tax equity-based compensation expense |

$ 4,662 |

$ 6,625 |

$ 15,089 |

$ 17,789 |

|||

|

Simpson Manufacturing Co., Inc. and Subsidiaries UNAUDITED Condensed Consolidated Balance Sheets (In thousands) |

||||||

|

September 30, |

December 31, |

|||||

|

2024 |

2023 |

2023 |

||||

|

Cash and cash equivalents |

$ 339,427 |

$ 571,006 |

$ 429,822 |

|||

|

Trade accounts receivable, net |

360,350 |

351,164 |

283,975 |

|||

|

Inventories |

583,380 |

504,446 |

551,575 |

|||

|

Other current assets |

51,609 |

51,583 |

47,069 |

|||

|

Total current assets |

1,334,766 |

1,478,199 |

1,312,441 |

|||

|

Property, plant and equipment, net |

495,822 |

382,508 |

418,612 |

|||

|

Operating lease right-of-use assets |

87,097 |

66,144 |

68,792 |

|||

|

Goodwill |

550,946 |

483,413 |

502,550 |

|||

|

Intangible assets, net |

395,517 |

356,450 |

365,339 |

|||

|

Other noncurrent assets |

33,311 |

48,773 |

36,990 |

|||

|

Total assets |

$ 2,897,459 |

$ 2,815,487 |

$ 2,704,724 |

|||

|

Trade accounts payable |

$ 110,321 |

$ 95,267 |

$ 107,524 |

|||

|

Long-term debt, current portion |

22,500 |

22,500 |

22,500 |

|||

|

Accrued liabilities and other current liabilities |

245,129 |

309,802 |

231,233 |

|||

|

Total current liabilities |

377,950 |

427,569 |

361,257 |

|||

|

Operating lease liabilities, net of current portion |

70,496 |

53,808 |

55,324 |

|||

|

Long-term debt, net of current portion and issuance costs |

442,886 |

539,073 |

458,791 |

|||

|

Deferred income tax |

89,226 |

97,298 |

98,170 |

|||

|

Other long-term liabilities |

53,680 |

28,248 |

51,436 |

|||

|

Stockholders’ equity |

1,863,221 |

1,669,491 |

1,679,746 |

|||

|

Total liabilities and stockholders’ equity |

$ 2,897,459 |

$ 2,815,487 |

$ 2,704,724 |

|||

|

Simpson Manufacturing Co., Inc. and Subsidiaries UNAUDITED Segment and Product Group Information (In thousands) |

||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 30, |

% |

September 30, |

% |

|||||||||

|

2024 |

2023 |

change* |

2024 |

2023 |

change* |

|||||||

|

Net Sales by Reporting Segment |

||||||||||||

|

North America |

$ 461,356 |

$ 456,820 |

1.0 % |

$ 1,331,126 |

$ 1,328,615 |

0.2 % |

||||||

|

Percentage of total net sales |

78.6 % |

78.8 % |

77.6 % |

77.6 % |

||||||||

|

Europe |

121,170 |

119,043 |

1.8 % |

370,985 |

371,074 |

N/M |

||||||

|

Percentage of total net sales |

20.6 % |

20.5 % |

21.6 % |

21.7 % |

||||||||

|

Asia/Pacific |

4,627 |

4,221 |

9.6 % |

12,599 |

12,404 |

1.6 % |

||||||

|

$ 587,153 |

$ 580,084 |

1.2 % |

$ 1,714,710 |

$ 1,712,093 |

0.2 % |

|||||||

|

Net Sales by Product Group** |

||||||||||||

|

Wood Construction |

$ 494,379 |

$ 491,308 |

0.6 % |

$ 1,450,972 |

$ 1,461,442 |

(0.7) % |

||||||

|

Percentage of total net sales |

84.2 % |

84.7 % |

84.6 % |

85.4 % |

||||||||

|

Concrete Construction |

86,715 |

84,141 |

3.1 % |

251,893 |

242,133 |

4.0 % |

||||||

|

Percentage of total net sales |

14.8 % |

14.5 % |

14.7 % |

14.1 % |

||||||||

|

Other |

6,059 |

4,635 |

N/M |

11,845 |

8,518 |

39.1 % |

||||||

|

$ 587,153 |

$ 580,084 |

1.2 % |

$ 1,714,710 |

$ 1,712,093 |

0.2 % |

|||||||

|

Gross Profit (Loss) by Reporting Segment |

||||||||||||

|

North America |

$ 228,169 |

$ 236,451 |

(3.5) % |

$ 660,287 |

$ 680,218 |

(2.9) % |

||||||

|

North America gross margin |

49.5 % |

51.8 % |

49.6 % |

51.2 % |

||||||||

|

Europe |

44,327 |

45,115 |

(1.7) % |

134,088 |

139,538 |

(3.9) % |

||||||

|

Europe gross margin |

36.6 % |

37.9 % |

36.1 % |

37.6 % |

||||||||

|

Asia/Pacific |

1,619 |

1,771 |

N/M |

3,781 |

4,515 |

N/M |

||||||

|

Administrative and all other |

942 |

(420) |

N/M |

(8) |

(1,013) |

N/M |

||||||

|

$ 275,057 |

$ 282,917 |

(2.8) % |

$ 798,148 |

$ 823,258 |

(3.1) % |

|||||||

|

Income (Loss) from Operations |

||||||||||||

|

North America |

$ 123,253 |

$ 135,633 |

(9.1) % |

$ 354,212 |

$ 393,456 |

(10.0) % |

||||||

|

North America operating margin |

26.7 % |

29.7 % |

26.6 % |

29.6 % |

||||||||

|

Europe |

12,635 |

15,450 |

(18.2) % |

33,037 |

42,894 |

(23.0) % |

||||||

|

Europe operating margin |

10.4 % |

13.0 % |

8.9 % |

11.6 % |

||||||||

|

Asia/Pacific |

260 |

477 |

N/M |

(617) |

718 |

N/M |

||||||

|

Administrative and all other |

(11,294) |

(11,347) |

N/M |

(33,507) |

(33,472) |

N/M |

||||||

|

$ 124,854 |

$ 140,213 |

(11.0) % |

$ 353,125 |

$ 403,596 |

(12.5) % |

|||||||

|

*Unfavorable percentage changes are presented in parentheses, if any. |

||

|

**The Company manages its business by geographic segment but presents sales by product group as additional information. |

||

|

N/M Statistic is not material or not meaningful. |

|

Simpson Manufacturing Co., Inc. and Subsidiaries Reconciliation of Non-GAAP Financial Measures (In thousands) (Unaudited) A reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below.

|

|||

|

Three Months Ended September 30, |

|||

|

2024 |

2023 |

||

|

Net Income |

$ 93,519 |

$ 104,021 |

|

|

Provision for income taxes |

32,974 |

36,055 |

|

|

Interest (income) expense, net and other financing costs |

(1,668) |

(1,292) |

|

|

Depreciation and amortization |

21,276 |

18,180 |

|

|

Other* |

2,177 |

1,828 |

|

|

Adjusted EBITDA |

$ 148,278 |

$ 158,792 |

|

|

*Other: Includes acquisition, integration, and restructuring related expenses, other & foreign exchange loss net, and net loss or gain on disposal of assets. |

CONTACT:

Addo Investor Relations

investor.relations@strongtie.com

(310) 829-5400

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/simpson-manufacturing-co-inc-announces-2024-third-quarter-financial-results-302282244.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/simpson-manufacturing-co-inc-announces-2024-third-quarter-financial-results-302282244.html

SOURCE Simpson Manufacturing Co., Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Goulston & Storrs Directors Cecilia Gordon and Christine Roddy Earn Connect Commercial Real Estate's 2024 Women in Real Estate Awards

BOSTON, Oct. 21, 2024 /PRNewswire/ — Goulston & Storrs, an Am Law 200 firm, is pleased to announce that directors Cecilia Gordon and Christine Roddy have been recognized as recipients of the 2024 Connect Commercial Real Estate (CRE) Women in Real Estate Awards for their professional excellence and inspirational leadership within commercial real estate.

Cecilia Gordon, an honoree from Boston and New England, is Co-Chair of both the firm’s Real Estate Group and Hospitality and Recreation Industry Group, where she helps lead a team of more than 100 attorneys. Her practice is centered on advising national and regional developers, investment funds, REITs, and property owners on complex real estate matters. She also focuses on helping clients in the hospitality industry with hotel and resort investments, branding, and management, as well as handling equity investments across various real estate asset classes through joint ventures and preferred equity structures. Gordon serves on the firm’s Newer Director Committee and the D.C. Committee. She earned her J.D. from New York University School of Law, and her B.A., magna cum laude, from Harvard University.

Christine Roddy, an honoree from Washington, DC, focuses her practice on zoning and land use, historic preservation, municipal law, and urban renewal. She counsels clients in the development of mixed-use, office, retail, institutional, industrial and residential projects. Her clients include developers, colleges and universities, private schools, institutional and non-profit organizations, as well as foreign governments. Roddy is a work allocator for the Real Estate Group and serves on the firm’s Wellbeing Advisory Group. She earned her J.D. from Vanderbilt Law School, and her B.A., cum laude, from Duke University.

About Goulston & Storrs

Collaboration is not just a pillar of our strategy; it is the key to our competitive advantage and approach to clients, community, and each other. At Goulston & Storrs, we practice law with excellence and integrity. We are a place where mutual respect and collaboration drive open discussion, transparency, creativity and optimal results for our clients. We are committed to being a diverse and inclusive workplace where sophisticated business is conducted with genuine camaraderie. To learn more about us, visit www.goulstonstorrs.com.

Contact:

Leigh Herzog

Goulston & Storrs PC

(617) 574-2259

lherzog@goulstonstorrs.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/goulston–storrs-directors-cecilia-gordon-and-christine-roddy-earn-connect-commercial-real-estates-2024-women-in-real-estate-awards-302281949.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/goulston–storrs-directors-cecilia-gordon-and-christine-roddy-earn-connect-commercial-real-estates-2024-women-in-real-estate-awards-302281949.html

SOURCE Goulston & Storrs PC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lockheed Martin Reports Q3 Results Tuesday: Here's What To Watch

Lockheed Martin Corp LMT is set to report its third-quarter financial results before Tuesday’s opening bell. Here’s a look at what investors will be watching.

The Details: According to data from Benzinga Pro, analysts expect the company to report earnings of $6.50 per share and quarterly revenue of $17.351 billion. Lockheed Martin has beat analyst expectations on the top and bottom lines for the past seven consecutive quarters.

Investors are anticipating an update on the planned acquisition of satellite manufacturer Terran Orbital Corp. LLAP and updates on the defense contractor’s $5.1 billion in recently secured contracts.

Read Next: Nuclear Energy Stocks Are Hot: Here’s A List Of Tickers To Watch

What Else: Last week, Reuters reported the Biden administration plans to soften export restrictions on U.S. space companies to ship satellites and spacecraft-related items to allies.

People familiar with the matter reportedly said the move is aimed at boosting sales for the commercial space industry in the U.S. while protecting national security. Lockheed Martin stands to benefit from the new policies due to the company’s space segment.

Susquehanna analyst Charles Minervino maintained Lockheed Martin with a Positive rating and raised the price target from $565 to $705 ahead of the company’s third-quarter report.

LMT Price Action: According to Benzinga Pro, Lockheed Martin shares ended Monday’s session up 0.46% at $614.61.

Read Also:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.