Lockheed Martin Reports Q3 Results Tuesday: Here's What To Watch

Lockheed Martin Corp LMT is set to report its third-quarter financial results before Tuesday’s opening bell. Here’s a look at what investors will be watching.

The Details: According to data from Benzinga Pro, analysts expect the company to report earnings of $6.50 per share and quarterly revenue of $17.351 billion. Lockheed Martin has beat analyst expectations on the top and bottom lines for the past seven consecutive quarters.

Investors are anticipating an update on the planned acquisition of satellite manufacturer Terran Orbital Corp. LLAP and updates on the defense contractor’s $5.1 billion in recently secured contracts.

Read Next: Nuclear Energy Stocks Are Hot: Here’s A List Of Tickers To Watch

What Else: Last week, Reuters reported the Biden administration plans to soften export restrictions on U.S. space companies to ship satellites and spacecraft-related items to allies.

People familiar with the matter reportedly said the move is aimed at boosting sales for the commercial space industry in the U.S. while protecting national security. Lockheed Martin stands to benefit from the new policies due to the company’s space segment.

Susquehanna analyst Charles Minervino maintained Lockheed Martin with a Positive rating and raised the price target from $565 to $705 ahead of the company’s third-quarter report.

LMT Price Action: According to Benzinga Pro, Lockheed Martin shares ended Monday’s session up 0.46% at $614.61.

Read Also:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medical Marijuana Dispensaries Near Preschools In Arizona? Court of Appeals Says Yes

The Arizona Court of Appeals decided recently that medical marijuana dispensaries can operate close to preschools.

This decision stems from a legal challenge against the Arizona Department of Health Services (ADHS) regarding the state’s medical marijuana law, specifically the 500-foot buffer zone requirement concerning schools, AZ Mirror reported.

See Also: Drivers Cannot Be Penalized For Cannabis Use If They’re Not Impaired, Arizona Court Rules

The case involved 3SL Family, LLC, which applied for a dispensary license in Ahwatukee in 2016. After the ADHS awarded the license to a competitor located near two preschools, 3SL argued that this placement violated the Arizona Medical Marijuana Act (AMMA).

Approved by voters in 2010, the AMMA legalized medical marijuana in the state and set strict rules about the proximity of dispensaries to “public or private schools.”

Distinction Between Schools And Preschools

In the majority opinion, Chief Judge David Gass stated: “Because statutes mean what they say, we conclude the two phrases do not have the same meaning and the two preschools at issue here are not ‘a public or private school’ under the Act.” The court recognized that Arizona law typically sees schools as institutions for school-aged children, effectively separating them from the preschool demographic.

Judge Andrew Jacobs, dissenting, argued that the AMMA’s language clearly categorizes preschools as schools. He said: “It would make no sense for the same drafting hand to separate preschoolers, grade schoolers, and high schoolers from marijuana in (one law) — only to allow the placement of dispensaries next to preschoolers in (another law) while separating them only from older schoolchildren.”

Implications For The Medical Marijuana Industry

This ruling could lead to increased accessibility for patients and greater competition among dispensaries in Arizona. However, it raises valid concerns about the proximity of marijuana businesses to young children. Judge Jacobs pointed out that allowing dispensaries near preschools might expose very young children to marijuana.

“Separating schoolchildren from medical marijuana growing, sale, and use is one means the voters chose to protect marijuana growers, sellers, and users from prosecution,” Jacobs said.

Continuing Legal Battles Ahead

For 3SL Family, LLC, this ruling isn’t the end of the legal journey. Attorney Jesse Callahan confirmed that an appeal to the Arizona Supreme Court will be forthcoming. “We believe that the language of the law clearly protects all schoolchildren, including those in preschool.”

This ruling comes at a time when Arizona’s medical marijuana market is experiencing significant shifts. After the legalization of recreational marijuana sales in January 2021, the number of qualifying medical marijuana patients in Arizona dropped from nearly 300,000 to under 95,000 by July 2024. This decline has put pressure on the state’s medical marijuana industry, which thrived in its early years.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Silicon Carbide Semiconductor Market Size/Share Worth USD 11,783.1 Million by 2033 at a 18.5% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

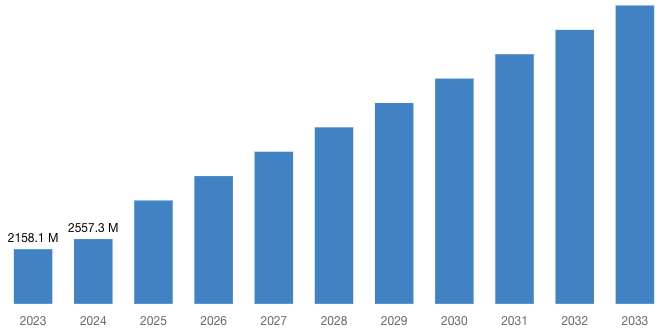

Austin, TX, USA, Oct. 21, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Silicon Carbide Semiconductor Market Size, Trends and Insights By Component (Schottky Diodes, FET/MOSFET Transistors, Integrated Circuits, Rectifiers/Diodes, Power Modules, Others), By Product (Optoelectronic Devices, Power Semiconductors, Frequency Devices, Others), By Wafer Size (1 inch to 4 inches, 6 inches, 8 inches, 10 inches & above), By End-User (Automotive, Consumer Electronics, Aerospace & Defense, Medical Devices, Data & Communication Devices, Energy & Power, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

“According to the latest research study, the demand of global Silicon Carbide Semiconductor Market size & share was valued at approximately USD 2,158.1 Million in 2023 and is expected to reach USD 2,557.3 Million in 2024 and is expected to reach a value of around USD 11,783.1 Million by 2033, at a compound annual growth rate (CAGR) of about 18.5% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Silicon Carbide Semiconductor Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52995

Silicon Carbide Semiconductor Market: Growth Factors and Dynamics

- Rising Demand for Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs): The increasing adoption of EVs and HEVs globally drives the demand for Silicon Carbide Semiconductors in power electronics, owing to their ability to improve energy efficiency and extend driving range.

- Expansion of Renewable Energy Sector: The growth of renewable energy sources such as solar and wind power necessitates efficient power conversion technologies, spurring the demand for Silicon Carbide Semiconductors in inverters and converters for grid integration.

- Advancements in Power Electronics: Silicon Carbide Semiconductors offer higher power density, lower switching losses, and improved thermal conductivity compared to traditional silicon-based semiconductors, driving their adoption in power electronic applications such as inverters, converters, and motor drives.

- Increased Focus on Energy Efficiency: With a growing emphasis on energy conservation and sustainability, industries are adopting Silicon Carbide Semiconductors to reduce energy losses and improve system efficiency in various applications, including industrial motor drives and power supplies.

- Emerging Applications in Aerospace and Defense: Silicon Carbide Semiconductors are increasingly utilized in aerospace and defense applications for their ability to withstand high temperatures, radiation, and harsh environments, driving market growth in this sector.

- Technological Advancements and Cost Reductions: Continuous advancements in manufacturing processes and economies of scale contribute to cost reductions in Silicon Carbide Semiconductor production, making them more competitive and accessible for a wider range of applications, fueling market growth.

- Growing Demand for High-Frequency and High-Temperature Applications: Silicon Carbide Semiconductors are preferred for high-frequency and high-temperature applications due to their superior performance characteristics, including high breakdown voltage and thermal conductivity. This drives their adoption in industries such as telecommunications, RF devices, and automotive power electronics.

- Expansion of 5G Infrastructure: The deployment of 5G networks requires high-performance semiconductor components capable of handling increased data traffic and operating at high frequencies. Silicon Carbide Semiconductors play a crucial role in 5G infrastructure, enabling efficient power amplification and signal processing, thus contributing to market growth.

Request a Customized Copy of the Silicon Carbide Semiconductor Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52995

Silicon Carbide Semiconductor Market: Partnership and Acquisitions

- In 2023, WOLFSPEED, INC. revealed a wafer supply agreement valued at USD 2 billion with Renesas Electronics Corporation, a provider of advanced semiconductor solutions. Renesas will secure a 10-year supply commitment for silicon carbide bare and epitaxial wafers from Wolfspeed, enabling Renesas to scale production of silicon carbide power semiconductors starting in 2025.

- In 2021, ON Semiconductor Corporation (ON Semi) announced an agreement to acquire SiC and sapphire materials manufacturer GT Advanced Technologies Inc. This strategic move aims to bolster ON Semi’s SiC supply chain, enabling it to meet growing customer demand for Silicon Carbide-based solutions.

- In 2022, ON Semiconductor Corporation (ON Semi) expanded its presence in the Czech Republic by launching an extended silicon carbide fabrication facility. This strategic expansion enhances ON Semi’s manufacturing capabilities, allowing it to meet the increasing demand for silicon carbide-based semiconductor solutions.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 2,557.3 Million |

| Projected Market Size in 2033 | USD 11,783.1 Million |

| Market Size in 2023 | USD 2,158.1 Million |

| CAGR Growth Rate | 18.5% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Component, Product, Wafer Size, End-User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Silicon Carbide Semiconductor report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Silicon Carbide Semiconductor report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Silicon Carbide Semiconductor Market Report @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

Silicon Carbide Semiconductor Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Silicon Carbide Semiconductor Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Supply Chain Disruptions: The COVID-19 pandemic led to disruptions in global supply chains, affecting the availability of raw materials, components, and semiconductor manufacturing equipment, thereby impacting the production of Silicon Carbide Semiconductors.

- Delayed Investments and Project Deployments: Economic uncertainties and lockdown measures resulted in delayed investments and project deployments across various industries, affecting the demand for Silicon Carbide Semiconductors in applications such as electric vehicles, renewable energy, and telecommunications.

- Resumption of Production and Supply Chain Operations: As economic activities gradually resume, semiconductor manufacturers focus on ramping up production and restoring supply chain operations to meet the pent-up demand for Silicon Carbide Semiconductors.

- Accelerated Adoption of Electric Vehicles (EVs) and Renewable Energy: Governments worldwide prioritize investments in EV infrastructure and renewable energy projects as part of economic recovery plans, driving the demand for Silicon Carbide Semiconductors in power electronics and energy conversion systems.

- Technological Advancements and Innovation: Semiconductor companies continue to invest in research and development to enhance the performance and efficiency of Silicon Carbide Semiconductors, driving innovation in areas such as material science, device design, and manufacturing processes.

- Strategic Partnerships and Collaborations: Collaboration between semiconductor manufacturers, technology providers, and industry stakeholders fosters innovation and accelerates the adoption of Silicon Carbide Semiconductors in emerging applications such as 5G networks, electric vehicles, and industrial automation.

- Diversification of End-Use Applications: Semiconductor companies explore new markets and applications for Silicon Carbide Semiconductors beyond traditional sectors such as automotive and power electronics, tapping into opportunities in sectors like aerospace, healthcare, and consumer electronics to diversify revenue streams and mitigate risks.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Silicon Carbide Semiconductor Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Silicon Carbide Semiconductor Market Report @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

Key questions answered in this report:

- What is the size of the Silicon Carbide Semiconductor market and what is its expected growth rate?

- What are the primary driving factors that push the Silicon Carbide Semiconductor market forward?

- What are the Silicon Carbide Semiconductor Industry’s top companies?

- What are the different categories that the Silicon Carbide Semiconductor Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Silicon Carbide Semiconductor market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Silicon Carbide Semiconductor Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

Silicon Carbide Semiconductor Market – Regional Analysis

The Silicon Carbide Semiconductor Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, the Silicon Carbide Semiconductor market is driven by the increasing adoption of electric vehicles (EVs) and renewable energy solutions. Trends include the integration of Silicon Carbide technology in EV charging infrastructure, grid modernization projects, and data center applications. Additionally, partnerships between semiconductor manufacturers and automotive companies drive innovation in Silicon Carbide-based power electronics for EVs, contributing to market growth in the region.

- Europe: In Europe, the Silicon Carbide Semiconductor market is influenced by initiatives to achieve carbon neutrality and promote sustainable energy solutions. Trends include the deployment of Silicon Carbide-based power electronics in renewable energy projects, smart grid systems, and industrial automation applications. Moreover, collaborations between semiconductor firms and government agencies drive research and development efforts to accelerate the adoption of Silicon Carbide technology in key sectors such as automotive and aerospace.

- Asia-Pacific: In the Asia-Pacific region, the Silicon Carbide Semiconductor market experiences significant growth due to the region’s dominance in semiconductor manufacturing and rapid technological advancements. Trends include the expansion of Silicon Carbide production capacity, the emergence of innovative applications in consumer electronics and telecommunications, and the adoption of Silicon Carbide technology in electric vehicle production and energy infrastructure projects. Additionally, strategic partnerships between semiconductor companies and government entities drive market development initiatives in the region.

- LAMEA (Latin America, Middle East, and Africa): In the LAMEA region, the Silicon Carbide Semiconductor market is characterized by a focus on industrial automation, energy efficiency, and infrastructure development. Trends include the utilization of Silicon Carbide technology in oil and gas exploration, renewable energy projects, and smart city initiatives. Furthermore, collaborations between Silicon Carbide manufacturers and local governments drive investments in sustainable energy solutions and digital transformation, fostering market growth opportunities in the region.

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Silicon Carbide Semiconductor Market Size, Trends and Insights By Component (Schottky Diodes, FET/MOSFET Transistors, Integrated Circuits, Rectifiers/Diodes, Power Modules, Others), By Product (Optoelectronic Devices, Power Semiconductors, Frequency Devices, Others), By Wafer Size (1 inch to 4 inches, 6 inches, 8 inches, 10 inches & above), By End-User (Automotive, Consumer Electronics, Aerospace & Defense, Medical Devices, Data & Communication Devices, Energy & Power, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

List of the prominent players in the Silicon Carbide Semiconductor Market:

- Cree Inc.

- Infineon Technologies AG

- ROHM Co. Ltd.

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Microchip Technology Inc.

- Norstel AB

- Toshiba Corporation

- General Electric Company

- Fairchild Semiconductor International Inc.

- Renesas Electronics Corporation

- Alpha & Omega Semiconductor Inc.

- United Silicon Carbide Inc.

- Ascatron AB

- GeneSiC Semiconductor Inc.

- Others

Click Here to Access a Free Sample Report of the Global Silicon Carbide Semiconductor Market @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Smart Speaker Market: Smart Speaker Market Size, Trends and Insights By Type (Virtual Assistants, Wireless Speakers, Others), By Application (Residential, Commercial), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

MEMS Gas Sensor Market: MEMS Gas Sensor Market Size, Trends and Insights By Type (Inflammable Gas, Toxic Gas, Others), By Application (Air Quality Monitoring, Industrial Safety, Emission Control, Research Application, Storage Monitoring, Others), By End-user Industry (Automotive, Healthcare, Water & Water Treatment, Metal Industry, Building Automation, Food & Beverage, Mining Industry, Power Stations, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Smart Speaker Market: US Smart Speaker Market Size, Trends and Insights By Intelligent Virtual Assistance (Alexa, Google Assistance, Siri, Others), By Component (Hardware, Software), By Price (Low, Mid, Premium), By Application (Smart Home, Consumer, Smart Office, Others), By End Use Industry (Residential, Commercial), By Distribution Channel (Online, Offline), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe Commercial Refrigeration Equipment Market: Europe Commercial Refrigeration Equipment Market Size, Trends and Insights By Product Type (Refrigerators and Freezers, Refrigerated Display Cases, Beverage Refrigeration, Ice Machines, Others), By Application (Food Service, Food and Beverage Retail, Healthcare, Hotels and Hospitality, Other), By Capacity (Small Capacity, Medium Capacity, Large Capacity), By Technology (Self-contained Refrigeration Units, Remote Condensing Units, Smart Refrigeration), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Multimeter Market: Digital Multimeter Market Size, Trends and Insights By Product Type (Handheld, Desktop, Mounted), By Ranging Type (Auto-ranging, Manual), By Application (Automotive, Energy & Utility, Consumer electronics, Medical, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Digital Panel Meter Market: Digital Panel Meter Market Size, Trends and Insights By Type (Temperature Meters, Voltage Meters, Current Meters, Power Meters, Multifunction Meters), By Display Type (LED Display, LCD Display, OLED Display), By Application (Industrial Automation, Energy Management, Process Control, Environmental Monitoring), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Data Center CPU Market: Data Center CPU Market Size, Trends and Insights By Chip Type (Central Processing Unit (CPU), Graphics Processing Unit (GPU), Field-Programmable Gate Array (FPGA), Application Specific Integrated Circuit (ASIC), Others), By Data Center Size (Small and medium size, Large size), By Vertical Industry (BFSI, Government, IT and telecom, Transportation, Energy & utilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Non-Volatile Memory Market: Non-Volatile Memory Market Size, Trends and Insights By Type (Electrically Addressed, Mechanically Addressed), By Application (Consumer Electronics, Healthcare Monitoring, Automotive Application, Enterprise Storage, Industrial), By End-User (Automotive, Healthcare, Telecom and IT, Energy and Power, Manufacturing Industries), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Silicon Carbide Semiconductor Market is segmented as follows:

By Component

- Schottky Diodes

- FET/MOSFET Transistors

- Integrated Circuits

- Rectifiers/Diodes

- Power Modules

- Others

By Product

- Optoelectronic Devices

- Power Semiconductors

- Frequency Devices

- Others

By Wafer Size

- 1 inch to 4 inches

- 6 inches

- 8 inches

- 10 inches & above

By End-User

- Automotive

- Consumer Electronics

- Aerospace & Defense

- Medical Devices

- Data & Communication Devices

- Energy & Power

- Others

Click Here to Get a Free Sample Report of the Global Silicon Carbide Semiconductor Market @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Silicon Carbide Semiconductor Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Silicon Carbide Semiconductor Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Silicon Carbide Semiconductor Market? What Was the Capacity, Production Value, Cost and PROFIT of the Silicon Carbide Semiconductor Market?

- What Is the Current Market Status of the Silicon Carbide Semiconductor Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Silicon Carbide Semiconductor Market by Considering Applications and Types?

- What Are Projections of the Global Silicon Carbide Semiconductor Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Silicon Carbide Semiconductor Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Silicon Carbide Semiconductor Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Silicon Carbide Semiconductor Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Silicon Carbide Semiconductor Industry?

Click Here to Access a Free Sample Report of the Global Silicon Carbide Semiconductor Market @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

Reasons to Purchase Silicon Carbide Semiconductor Market Report

- Silicon Carbide Semiconductor Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Silicon Carbide Semiconductor Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Silicon Carbide Semiconductor Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Silicon Carbide Semiconductor Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Silicon Carbide Semiconductor market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Silicon Carbide Semiconductor Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Silicon Carbide Semiconductor market analysis.

- The competitive environment of current and potential participants in the Silicon Carbide Semiconductor market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Silicon Carbide Semiconductor market should find this report useful. The research will be useful to all market participants in the Silicon Carbide Semiconductor industry.

- Managers in the Silicon Carbide Semiconductor sector are interested in publishing up-to-date and projected data about the worldwide Silicon Carbide Semiconductor market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Silicon Carbide Semiconductor products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Silicon Carbide Semiconductor Market Report @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Silicon Carbide Semiconductor Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/silicon-carbide-semiconductor-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Grupo Aeroportuario del Pacifico Announces Results for the Third Quarter of 2024

GUADALAJARA, Mexico, Oct. 21, 2024 (GLOBE NEWSWIRE) — Grupo Aeroportuario del Pacífico, S.A.B. de C.V. PACGAP (“the Company” or “GAP”) reports its consolidated results for the third quarter ended September 30, 2024 (3Q24). Figures are unaudited and prepared following International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Summary of Results 3Q24 vs. 3Q23

- The sum of aeronautical and non-aeronautical services revenues increased by Ps. 402.8 million, or 6.4%. Total revenues increased by Ps. 839.7 million, or 11.4%.

- Cost of services increased by Ps. 251.9 million, or 21.3%.

- Income from operations increased by Ps. 70.2 million, or 1.9%.

- EBITDA increased by Ps. 237.8 million, or 5.6%, from Ps. 4,629.9 million in 3Q23 to Ps. 4,507.6 million in 3Q24. EBITDA margin (excluding the effects of IFRIC-12) went from 67.5% in 3Q23 to 67.0% in 3Q24.

- Comprehensive income increased by Ps. 69.1 million, or 2.7%, from Ps. 2,551.4 million in 3Q23 to Ps. 2,620.6 million in 3Q24.

Company’s Financial Position:

During 3Q24, there was a decrease in the Company’s aeronautical revenues compared to 3Q23, mainly due to the decline in passenger traffic, as a result of preventive reviews of Pratt & Whitney A320neo and A321neo engines, which affected the fleet operated by Volaris and VivaAerobus and that started in the third quarter of 2023 reaching its highest volume in the 3Q24. This decrease was offset by an increase in non-aeronautical revenues of 38.7%, generated mainly by the consolidation of the cargo and free trade zone business at the Guadalajara airport starting in July 2024. The Company reports a financial position of cash and cash equivalents as of September 30, 2024, of Ps. 15,828.0 million. During 3Q24, the Company refinanced the credit facilities with Citibanamex for Ps. 1,000.0 million and for USD$40.0 million, additionally, on September 5, 2024, the Company issued long-term bond certificates for an amount of Ps. 5,648.1 million, for capital investments and debt refinancing.

Passenger Traffic

During 3Q24, total passengers at the Company’s 14 airports decreased by 923.2 thousand passengers, a decrease of 5.7%, compared to 3Q23.

During 3Q23, the following new routes were opened:

Domestic:

| Airline | Departure | Arrival | Opening date | Frequencies |

| Aeromexico | Guadalajara | Tijuana | July 1, 2024 | 1 daily |

Note: Frequencies can vary without prior notice.

International:

| Airline | Departure | Arrival | Opening date | Frequencies |

| Hainan | Tijuana | Beijing | July 12, 2024 | 2 weekly |

| Flair | Guadalajara | Toronto | September 13, 2024 | 2 weekly |

Note: Frequencies can vary without prior notice.

Domestic Terminal Passengers – 14 airports (in thousands):

| Airport | 3Q23 | 3Q24 | Change | 9M23 | 9M24 | Change |

| Guadalajara | 3,261.8 | 3,113.0 | (4.6%) | 9,395.0 | 8,779.4 | (6.6%) |

| Tijuana * | 2,448.3 | 2,204.9 | (9.9%) | 6,751.6 | 6,288.3 | (6.9%) |

| Los Cabos | 832.5 | 791.4 | (4.9%) | 2,244.2 | 2,119.7 | (5.5%) |

| Puerto Vallarta | 799.5 | 804.2 | 0.6% | 2,197.1 | 2,121.6 | (3.4%) |

| Montego Bay | 0.0 | 0.0 | 0.0% | 0.0 | 0.0 | 0.0% |

| Guanajuato | 662.9 | 547.0 | (17.5%) | 1,729.5 | 1,545.3 | (10.7%) |

| Hermosillo | 556.8 | 524.2 | (5.9%) | 1,552.4 | 1,512.7 | (2.6%) |

| Kingston | 0.7 | 1.3 | 69.8% | 1.3 | 2.4 | 80.5% |

| Mexicali | 447.6 | 250.5 | (44.0%) | 1,174.8 | 765.1 | (34.9%) |

| Morelia | 221.1 | 165.0 | (25.3%) | 609.1 | 464.5 | (23.7%) |

| La Paz | 303.6 | 320.5 | 5.6% | 814.2 | 879.9 | 8.1% |

| Aguascalientes | 171.6 | 158.5 | (7.6%) | 478.6 | 467.0 | (2.4%) |

| Los Mochis | 123.1 | 144.0 | 16.9% | 336.2 | 412.0 | 22.5% |

| Manzanillo | 27.3 | 28.1 | 3.1% | 80.1 | 94.4 | 17.8% |

| Total | 9,856.8 | 9,052.5 | (8.2%) | 27,364.0 | 25,452.3 | (7.0%) |

*Cross Border Xpress (CBX) users are classified as international passengers.

International Terminal Passengers – 14 airports (in thousands):

| Airport | 3Q23 | 3Q24 | Change | 9M23 | 9M24 | Change |

| Guadalajara | 1,342.2 | 1,493.1 | 11.2% | 3,848.9 | 4,353.1 | 13.1% |

| Tijuana * | 1,093.9 | 1,067.9 | (2.4%) | 3,254.5 | 3,001.9 | (7.8%) |

| Los Cabos | 999.4 | 881.2 | (11.8%) | 3,603.1 | 3,489.0 | (3.2%) |

| Puerto Vallarta | 599.0 | 529.0 | (11.7%) | 2,863.8 | 2,970.5 | 3.7% |

| Montego Bay | 1,306.4 | 1,154.9 | (11.6%) | 3,963.2 | 3,897.2 | (1.7%) |

| Guanajuato | 227.4 | 284.2 | 25.0% | 645.5 | 773.5 | 19.8% |

| Hermosillo | 18.3 | 19.0 | 3.9% | 55.0 | 62.6 | 13.8% |

| Kingston | 509.4 | 514.3 | 1.0% | 1,338.9 | 1,324.9 | (1.0%) |

| Mexicali | 1.8 | 1.8 | 0.1% | 5.3 | 5.6 | 4.8% |

| Morelia | 149.2 | 169.9 | 13.9% | 444.0 | 483.9 | 9.0% |

| La Paz | 2.6 | 2.6 | (2.4%) | 10.3 | 8.7 | (15.9%) |

| Aguascalientes | 81.5 | 90.9 | 11.5% | 214.3 | 242.1 | 13.0% |

| Los Mochis | 1.9 | 2.1 | 13.9% | 5.4 | 6.1 | 14.3% |

| Manzanillo | 6.5 | 9.6 | 47.7% | 49.1 | 65.7 | 33.7% |

| Total | 6,339.5 | 6,220.3 | (1.9%) | 20,301.6 | 20,684.7 | 1.9% |

*CBX users are classified as international passengers.

Total Terminal Passengers – 14 airports (in thousands):

| Airport | 3Q23 | 3Q24 | Change | 9M23 | 9M24 | Change |

| Guadalajara | 4,604.0 | 4,606.0 | 0.0% | 13,243.9 | 13,132.5 | (0.8%) |

| Tijuana * | 3,542.2 | 3,272.7 | (7.6%) | 10,006.1 | 9,290.2 | (7.2%) |

| Los Cabos | 1,831.9 | 1,672.6 | (8.7%) | 5,847.3 | 5,608.7 | (4.1%) |

| Puerto Vallarta | 1,398.5 | 1,333.2 | (4.7%) | 5,060.9 | 5,092.1 | 0.6% |

| Montego Bay | 1,306.4 | 1,154.9 | (11.6%) | 3,963.2 | 3,897.2 | (1.7%) |

| Guanajuato | 890.2 | 831.2 | (6.6%) | 2,375.0 | 2,318.7 | (2.4%) |

| Hermosillo | 575.2 | 543.3 | (5.5%) | 1,607.5 | 1,575.3 | (2.0%) |

| Kingston | 510.1 | 515.5 | 1.1% | 1,340.3 | 1,327.3 | (1.0%) |

| Mexicali | 449.4 | 252.3 | (43.9%) | 1,180.1 | 770.7 | (34.7%) |

| Morelia | 370.2 | 335.0 | (9.5%) | 1,053.1 | 948.4 | (9.9%) |

| La Paz | 306.2 | 323.0 | 5.5% | 824.5 | 888.6 | 7.8% |

| Aguascalientes | 253.1 | 249.3 | (1.5%) | 692.9 | 709.1 | 2.3% |

| Los Mochis | 125.0 | 146.1 | 16.9% | 341.6 | 418.1 | 22.4% |

| Manzanillo | 33.8 | 37.7 | 11.6% | 129.2 | 160.1 | 23.9% |

| Total | 16,196.1 | 15,272.8 | (5.7%) | 47,665.4 | 46,137.0 | (3.2%) |

*CBX users are classified as international passengers.

CBX Users (in thousands):

| Airport | 3Q23 | 3Q24 | Change | 9M23 | 9M24 | Change |

| Tijuana | 1,084.2 | 1,048.7 | (3.3%) | 3,226.9 | 2,956.3 | (8.4%) |

Consolidated Results for the Third Quarter of 2024 (in thousands of pesos):

| 3Q23 | 3Q24 | Change | |

| Revenues | |||

| Aeronautical services | 4,812,288 | 4,627,601 | (3.8%) |

| Non-aeronautical services | 1,516,381 | 2,103,878 | 38.7% |

| Improvements to concession assets (IFRIC-12) | 1,064,286 | 1,501,188 | 41.1% |

| Total revenues | 7,392,955 | 8,232,667 | 11.4% |

| Operating costs | |||

| Costs of services: | 1,183,268 | 1,435,204 | 21.3% |

| Employee costs | 440,836 | 573,117 | 30.0% |

| Maintenance | 171,063 | 213,360 | 24.7% |

| Safety, security & insurance | 180,066 | 220,486 | 22.4% |

| Utilities | 141,334 | 160,803 | 13.8% |

| Business operated directly by us | 63,147 | 72,858 | 15.4% |

| Other operating expenses | 186,822 | 194,580 | 4.2% |

| Technical assistance fees | 209,109 | 200,635 | (4.1%) |

| Concession taxes | 671,398 | 598,091 | (10.9%) |

| Depreciation and amortization | 619,755 | 787,295 | 27.0% |

| Cost of improvements to concession assets (IFRIC-12) | 1,064,286 | 1,501,188 | 41.1% |

| Other (income) | (4,959) | (10,082) | 103.3% |

| Total operating costs | 3,742,857 | 4,512,331 | 20.6% |

| Income from operations | 3,650,098 | 3,720,336 | 1.9% |

| Financial Result | (544,187) | (1,059,983) | 94.8% |

| Income before income taxes | 3,105,911 | 2,660,353 | (14.3%) |

| Income taxes | (727,051) | (677,524) | (6.8%) |

| Net income | 2,378,860 | 1,982,829 | (16.6%) |

| Currency translation effect | 158,864 | 651,897 | 310.3% |

| Cash flow hedges, net of income tax | 13,398 | (12,124) | (190.5%) |

| Remeasurements of employee benefit – net income tax | 318 | (2,052) | (745.3%) |

| Comprehensive income | 2,551,440 | 2,620,550 | 2.7% |

| Non-controlling interest | (52,302) | (140,692) | 169.0% |

| Comprehensive income attributable to controlling interest | 2,499,138 | 2,479,858 | (0.8%) |

| 3Q23 | 3Q24 | Change | |

| EBITDA | 4,269,853 | 4,507,631 | 5.6% |

| Comprehensive income | 2,551,440 | 2,620,550 | 2.7% |

| Comprehensive income per share (pesos) | 5.0175 | 5.1864 | 3.4% |

| Comprehensive income per ADS (US dollars) | 3.0304 | 3.1324 | 3.4% |

| Operating income margin | 49.4% | 45.2% | (8.5%) |

| Operating income margin (excluding IFRIC-12) | 57.7% | 55.3% | (4.2%) |

| EBITDA margin | 57.8% | 54.8% | (5.2%) |

| EBITDA margin (excluding IFRIC-12) | 67.5% | 67.0% | (0.7%) |

| Costs of services and improvements / total revenues | 30.4% | 35.7% | 17.3% |

| Cost of services / total revenues (excluding IFRIC-12) | 18.7% | 21.3% | 14.0% |

– Net income and comprehensive income per share for 3Q24 and 3Q23 were calculated based on 505,277,464 shares outstanding as of September 30, 2024, and September 30, 2023, respectively. U.S. dollar figures presented were converted from pesos to U.S. dollars at a rate of Ps. 19.6303 per U.S. dollar (the noon buying rate on September 30, 2024, as published by the U.S. Federal Reserve Board).

For purposes of consolidating our Jamaican airports, the average three-month exchange rate of Ps. 18.9229 per U.S. dollar for the three months ended September 30, 2024, was used.

Revenues (3Q24 vs. 3Q23)

- Aeronautical services revenues decreased by Ps. 184.7 million, or 3.8%.

- Non-aeronautical services revenues increased by Ps. 587.5 million, or 38.7%.

- Revenues from improvements to concession assets increased by Ps. 436.9 million, or 41.1%.

- Total revenues increased by Ps. 839.7 million, or 11.4%.

- The change in aeronautical services revenues was primarily due to the following factors:

- Revenues at our Mexican airports decreased by Ps. 251.2 million or 6.1% compared to 3Q23, mainly due to the 5.4% decrease in passenger traffic.

- Revenues from Jamaican airports increased by Ps. 66.5 million, or 9.4%, compared to 3Q23. This was mainly due to the peso depreciation versus the U.S. dollar by 10.9%, compared to 3Q23, which went from an average exchange rate of Ps. 17.0621 in 3Q23 to Ps. 18.9229 in 3Q24. Passenger traffic decreased by 8.0%.

- The change in non-aeronautical services revenues was primarily driven by the following factors:

- Revenues at our Mexican airports increased by Ps. 573.4 million, or 45.5%, compared to 3Q23. Revenues from businesses operated directly by us increased by Ps. 444.5 million, or 100.3%, mainly due to the consolidation of a cargo and free trade zone business starting in July 2024 with revenues of Ps. 354.1 million. Revenues from businesses operated by third parties increased by Ps. 124.5 million, or 16.1%, mainly due to the opening of new commercial spaces, and the renegotiation of contract conditions. The business lines that grew the most were car rentals, food and beverages, time shares, and retail, all of which increased by Ps. 122.9 million, or 23.4%, offset by a decrease of Ps. 6.3 million in duty-free stores.

- Revenues from the Jamaican airports increased by Ps. 14.1 million, or 5.6%, compared to 3Q23, mainly due to the peso depreciation versus the U.S. dollar by 10.9%, compared to 3Q23. Revenues in U.S. dollars decreased by US$ 0.7 million, or 4.9%.

| 3Q23 | 3Q24 | Change | |

| Businesses operated by third parties: | |||

| Food and beverage | 249,671 | 291,059 | 16.6% |

| Car rental | 144,939 | 209,871 | 44.8% |

| Duty-free | 193,804 | 184,931 | (4.6%) |

| Retail | 175,933 | 174,816 | (0.6%) |

| Leasing of space | 97,178 | 111,224 | 14.5% |

| Times shares | 33,902 | 63,608 | 87.6% |

| Ground transportation | 24,526 | 41,301 | 68.4% |

| Other commercial revenues | 50,202 | 30,260 | (39.7%) |

| Communications and financial services | 28,734 | 26,446 | (8.0%) |

| Total | 998,889 | 1,133,516 | 13.5% |

| Businesses operated directly by us: | |||

| Cargo operation and free trade zone | – | 390,385 | 100.0% |

| Car parking | 186,944 | 171,497 | (8.3%) |

| Convenience stores | 128,147 | 137,122 | 7.0% |

| VIP Lounges | 105,870 | 130,000 | 22.8% |

| Advertising | 41,696 | 52,977 | 27.1% |

| Hotel operation | – | 28,189 | 100.0% |

| Total | 462,657 | 910,169 | 96.7% |

| Recovery of costs | 54,836 | 60,193 | 9.8% |

| Total Non-aeronautical Revenues | 1,516,381 | 2,103,878 | 38.7% |

Figures are expressed in thousands of Mexican pesos.

- Revenues from improvements to concession assets 1

Revenues from improvements to concession assets (IFRIC-12) increased by Ps. 436.9 million, or 41.1%, compared to 3Q23. The change was composed of :- Improvements to concession assets at the Company’s Mexican airports increased by Ps. 299.7 million, or 28.9%, following investments under the Master Development Program for the 2020-2024 period.

- Improvements to concession assets at the Company’s Jamaican airports increased Ps. 137.2 million, or 504.1%.

________________________

1 Revenues from improvements to concession assets are recognized in accordance with International Financial Reporting Interpretation Committee 12 “Service Concession Arrangements” (IFRIC 12). However, this recognition does not have a cash impact or impact on the Company’s operating results. Amounts included as a result of the recognition of IFRIC 12 are related to construction of infrastructure in each quarter to which the Company has committed. This is in accordance with the Company’s Master Development Programs in Mexico and Capital Development Programs in Jamaica. All margins and ratios calculated using “Total Revenues” include revenues from improvements to concession assets (IFRIC 12), and, consequently, such margins and ratios may not be comparable to other ratios and margins, such as EBITDA margin, operating margin or other similar ratios that are calculated based on those results of the Company that do have a cash impact.

Total operating costs increased by Ps. 769.5 million, or 20.6%, compared to 3Q23, mainly due to the increase in the cost of improvements to concession assets (IFRIC-12) by Ps. 436.9 million and the cargo and free trade zone business consolidation.

The cost of services increased by Ps. 251.9 million, or 21.3%, while the depreciation and amortization increased by Ps. 167.5 million, or 27.0%. This was offset by a combined decrease of Ps. 81.8 million, or 5.0%, in concession taxes and technical assistance fees (excluding the cost of improvements to concession assets (IFRIC-12), operating costs increased Ps. 332.5 million, or 12.4%).

This increase in total operating costs was primarily due to the following factors:

Mexican airports:

- Operating costs increased by Ps. 694.8 million, or 23.4%, compared to 3Q23, primarily due to an increase in the cost of improvements to the concession assets (IFRIC-12) by Ps. 299.7 million, or 28.9%, an increase in the cost of services by Ps. 223.2 million, or 22.9%, an increase in depreciation and amortization by Ps. 152.7 million, or 30.6%, and a combined increase in technical assistance fees and concession taxes by Ps. 22.9 million, or 5.0% (excluding the cost of improvements to the concession assets (IFRIC-12), operating costs increased by Ps. 395.0 million or 20.5%).

The change in the cost of services at our Mexican airports during 3Q24 was mainly due to:

- Employee costs increased Ps. 125.0 million, or 32.2%, compared to 3Q23, mainly due to the consolidation of the cargo and free trade zone business of Ps. 86.5 million, as well as the hiring of 175 additional personnel during the last quarter of 2023 and 9M24, as well as the adjustments in salaries and cost related to changes in Labor Law.

- Maintenance expenses increased by Ps. 41.3 million, or 31.7%, compared to 3Q23, mainly due to the opening of new operational areas and the consolidation of the cargo and free trade zone business with maintenance expenses of Ps. 8.4 million.

- Safety, security, and insurance increased by Ps. 29.4 million, or 22.1%, compared to 3Q23, mainly due to the increase in the security headcount, minimum wages, and changes in Labor Law, the opening of new operational areas and the consolidation of the cargo and free trade zone business by Ps.4.8 million.

- Other operating expenses increased by Ps. 15.7 million, or 7.1%, compared to 3Q23, mainly due to a combined increase in services, professional fees, and travel expenses by Ps. 11.7 million, the consolidation of the cargo and free trade zone business with other operating expenses of Ps. 12.4 million. This was offset by the decrease in the allowance for expected credit losses by Ps. 4.8 million.

Jamaican Airport:

- Operating costs increased by Ps. 74.7 million, or 9.6%, compared to 3Q23, mainly due to a Ps. 137.2 million, or 504.1%, increase in the cost of improvements to concession assets (IFRIC-12), an increase in the cost of services by Ps. 28.7 million, or 13.8%, offset by the decrease in the concession taxes by Ps. 104.7 million, or 24.8%.

Operating income margin went from 49.4% in 3Q23 to 45.2% in 3Q24. Excluding the effects of IFRIC-12, the operating income margin went from 57.7% in 3Q23 to 55.3% in 3Q24. Income from operations increased by Ps. 70.2 million, or 1.9%, compared to 3Q23.

EBITDA margin went from 57.8% in 3Q23 to 54.8% in 3Q24. Excluding the effects of IFRIC-12, EBITDA margin went from 67.5% in 3Q23 to 67.0% in 3Q24. The nominal value of EBITDA increased by Ps. 237.8 million, or 5.6%, compared to 3Q23.

Financial results increased by Ps. 515.8 million, or 94.8%, from a net expense of Ps. 544.1 million in 3Q23 to a net expense of Ps. 1,060.0 million in 3Q24. This change was mainly the result of:

- Foreign exchange rate fluctuations, which went from an income of Ps. 170.2 million in 3Q23 to an expense of Ps. 313.4 million in 3Q24. This generated a foreign exchange loss of Ps. 483.7 million. This was mainly due to the depreciation of the peso. Currency translation effect gain increased Ps. 493.0 million, compared to 3Q23.

- Interest expenses increased by Ps. 25.2 million, or 2.2%, compared to 3Q23, mainly due to higher debt as a result of the issuance of long-term debt securities and the drawdown of credit lines, as well as the substantial increase in the interest rates.

- Interest income decreased by Ps. 6.9 million, or 2.1%, compared to 3Q23, mainly due to a decrease in the cash and cash equivalents average balance and the reference rates.

In 3Q24, comprehensive income increased by Ps. 69.1 million, or 2.7%, compared to 3Q23. Income before income taxes decreased by Ps. 445.6 million, mainly due to the decrease in passenger traffic and partially offset by the revenues generated by the commercial strategy and the consolidation of the cargo and free trade zone business. This decrease generated a decrease in the tax income of Ps. 49.5 million. Net and comprehensive income increased mainly due to the increase of the effect of foreign currency translation by Ps. 493.0 million.

During 3Q24, net income decreased by Ps. 396.0 million, or 16.6%, compared to 3Q23. Taxes for the period decreased by Ps. 49.5 million, tax income increased by Ps. 67.0 million and the benefit for deferred taxes increased by Ps. 116.5 million, mainly due to the application of fiscal losses for Ps. 97.9 million, and other deferred taxes by Ps. 20.7 million, offset by a decrease in the inflationary effects, that went from an inflation rate of 1.5% in 3Q23 to 1.4% in 3Q24.

Consolidated Results for the Nine Months of 2024 (in thousands of pesos):

| 9M23 | 9M24 | Change | |

| Revenues | |||

| Aeronautical services | 14,780,643 | 14,150,663 | (4.3%) |

| Non-aeronautical services | 4,544,249 | 5,521,018 | 21.5% |

| Improvements to concession assets (IFRIC-12) | 4,767,624 | 4,314,977 | (9.5%) |

| Total revenues | 24,092,516 | 23,986,658 | (0.4%) |

| Operating costs | |||

| Costs of services: | 3,184,434 | 3,720,973 | 16.8% |

| Employee costs | 1,273,009 | 1,522,994 | 19.6% |

| Maintenance | 478,061 | 555,642 | 16.2% |

| Safety, security & insurance | 503,020 | 602,508 | 19.8% |

| Utilities | 363,997 | 396,811 | 9.0% |

| Business operated directly by us | 175,242 | 219,017 | 25.0% |

| Other operating expenses | 391,105 | 424,000 | 8.4% |

| Technical assistance fees | 651,826 | 627,172 | (3.8%) |

| Concession taxes | 1,938,019 | 1,991,302 | 2.7% |

| Depreciation and amortization | 1,858,980 | 2,137,595 | 15.0% |

| Cost of improvements to concession assets (IFRIC-12) | 4,767,624 | 4,314,977 | (9.5%) |

| Other (income) | 7,837 | (22,474) | (386.7%) |

| Total operating costs | 12,408,721 | 12,769,544 | 2.9% |

| Income from operations | 11,683,794 | 11,217,114 | (4.0%) |

| Financial Result | (1,726,623) | (2,316,875) | 34.2% |

| Income before income taxes | 9,957,170 | 8,900,239 | (10.6%) |

| Income taxes | (2,524,654) | (2,193,977) | (13.1%) |

| Net income | 7,432,516 | 6,706,263 | (9.8%) |

| Currency translation effect | (655,718) | 1,019,679 | (255.5%) |

| Cash flow hedges, net of income tax | (24,353) | (47,527) | 95.2% |

| Remeasurements of employee benefit – net income tax | 917 | 177 | (80.7%) |

| Comprehensive income | 6,753,363 | 7,678,591 | 13.7% |

| Non-controlling interest | (60,519) | (268,334) | 343.4% |

| Comprehensive income attributable to controlling interest | 6,692,844 | 7,410,259 | 10.7% |

| 9M23 | 9M24 | Change | |

| EBITDA | 13,542,775 | 13,354,710 | (1.4%) |

| Comprehensive income | 6,753,363 | 7,678,591 | 13.7% |

| Comprehensive income per share (pesos) | 13.2807 | 15.1968 | 14.4% |

| Comprehensive income per ADS (US dollars) | 8.0210 | 9.1782 | 14.4% |

| Operating income margin | 48.5% | 46.8% | (3.6%) |

| Operating income margin (excluding IFRIC-12) | 60.5% | 57.0% | (5.7%) |

| EBITDA margin | 56.2% | 55.7% | (1.0%) |

| EBITDA margin (excluding IFRIC-12) | 70.1% | 67.9% | (3.1%) |

| Costs of services and improvements / total revenues | 33.0% | 33.5% | 1.5% |

| Cost of services / total revenues (excluding IFRIC-12) | 16.5% | 18.9% | 14.8% |

– Net income and comprehensive income per share for 9M24 and 9M23 were calculated based on 505,277,464 shares outstanding as of September 30, 2024, and September 30, 2023. U.S. dollar figures presented were converted from pesos to U.S. dollars at a rate of Ps. 19.6903 per U.S. dollar (the noon buying rate on September 30, 2024, as published by the U.S. Federal Reserve Board).

– For purposes of the consolidation of the airports in Jamaica, the average nine-month exchange rate of Ps. 17.7104 per U.S. dollar for the nine months ended September 30, 2024, was used.

Revenues (9M24 vs. 9M23)

- Aeronautical services revenues decreased by Ps. 630.0 million, or 4.3%.

- Non-aeronautical services revenues increased by Ps. 976.8 million, or 21.5%.

- Revenues from improvements to concession assets decreased by Ps. 452.6 million, or 9.5%.

- Total revenues decreased by Ps. 105.9 million, or 0.4%.

- The change in aeronautical services revenues was composed primarily of the following factors:

- Revenues at our Mexican airports decreased by Ps. 700.4 million, or 5.5%, compared to 9M23, mainly due to the 3.4% decrease in passenger traffic, as well as 93.4% compliance with the maximum tariffs.

- Revenues from Jamaican airports increased by Ps. 70.4 million, or 3.3%, compared to 9M23. This was mainly due to the increase in revenues in U.S. dollars by US$4.8 million, or 4.0%. This was offset by an appreciation of the peso against the dollar compared to 9M23 of 0.7%, which went from an average exchange rate of Ps. 17.8282 in 9M23 to Ps. 17.7104 in 9M24, which represented a decrease in revenues in pesos. Passenger traffic decreased by 1.5%.

- The change in non-aeronautical services revenues was composed primarily of the following factors :

- Revenues at our Mexican airports increased by Ps. 968.4 million, or 25.6%, compared to 9M23. Revenues from businesses operated directly by us increased by Ps. 612.9 million, or 48.5%, mainly due to the consolidation of the cargo and free trade zone business starting in July 2024 with revenues of Ps. 354.1 million, while the recovery of costs increased by Ps. 4.5 million, or 3.5%. Revenues from businesses operated by third parties increased by Ps. 350.9 million, or 14.7%. This was mainly due to the opening of new commercial spaces, and the renegotiation of existing contracts. The business lines that increased the most were car rentals, food and beverage, other commercial revenues, and retail, which jointly increased by Ps. 357.8 million, or 18.2%.

- Revenues from the Jamaican airports increased by Ps. 8.4 million, or 1.1%, compared to 9M23, mainly due to the increase in revenues in USD dollars by US$0.7 million or 1.8%, this was offset by an appreciation of the peso against the dollar compared to 9M23 of 0.7%.

| 9M23 | 9M24 | Change | |

| Businesses operated by third parties: | |||

| Food and beverage | 748,361 | 879,140 | 17.5% |

| Duty-free | 583,824 | 552,968 | (5.3%) |

| Car rentals | 427,802 | 613,048 | 43.3% |

| Retail | 531,703 | 516,596 | (2.8%) |

| Leasing of space | 270,513 | 318,494 | 17.7% |

| Time share | 166,585 | 174,355 | 4.7% |

| Other commercial revenues | 112,188 | 144,093 | 28.4% |

| Ground transportation | 132,307 | 134,823 | 1.9% |

| Communications and financial services | 88,240 | 80,524 | (8.7%) |

| Total | 3,061,523 | 3,414,040 | 11.5% |

| Businesses operated directly by us: | |||

| Car parking | 528,005 | 518,229 | (1.9%) |

| Cargo operation and free trade zone | – | 453,379 | 100.0% |

| Convenience stores | 359,901 | 420,499 | 16.8% |

| VIP Lounges | 319,848 | 361,941 | 13.2% |

| Advertising | 105,815 | 130,785 | 23.6% |

| Hotel operation | – | 46,804 | 100.0% |

| Total | 1,313,568 | 1,931,636 | 47.1% |

| Recovery of costs | 169,158 | 175,341 | 3.7% |

| Total Non-aeronautical Revenues | 4,544,248 | 5,521,018 | 21.5% |

Figures are expressed in thousands of Mexican pesos.

- Revenues from improvements to concession assets2

Revenues from improvements to concession assets (IFRIC12) decreased by Ps. 452.6 million, or 9.5%, compared to 9M23. The change was composed primarily of:- The Company’s Mexican airports decreased by Ps. 672.3 million, or 14.4%, following the investments under the Master Development Program for the 2020-2024 period.

- Improvements to concession assets at the Company’s Jamaican airports increased by Ps. 219.7 million, or 258.7%.

________________________

[2] Revenues from improvements to concession assets are recognized in accordance with International Financial Reporting Interpretation Committee 12 “Service Concession Arrangements” (IFRIC 12), but this recognition does not have a cash impact or an impact on the Company’s operating results. Amounts included as a result of the recognition of IFRIC 12 are related to construction of infrastructure in each quarter to which the Company has committed in accordance with the Company’s Master Development Programs in Mexico and Capital Development Program in Jamaica. All margins and ratios calculated using “Total Revenues” include revenues from improvements to concession assets (IFRIC 12), and, consequently, such margins and ratios may not be comparable to other ratios and margins, such as EBITDA margin, operating margin or other similar ratios that are calculated based on those results of the Company that do have a cash impact.

Total operating costs increased by Ps. 360.8 million, or 2.9%, compared to 9M23, mainly due to a Ps. 536.5 million, or 16.8%, increase in the cost of services, a Ps. 278.6 million, or 15.0%, increase in depreciation and amortization, and a combined increase in concession taxes and technical assistance fees by Ps. 28.6 million, or 1.1%. This was offset by the decrease in improvements to concession assets (IFRIC12) by Ps. 452.6 million, or 9.5% (excluding the cost of improvements to concession assets, operating costs increased Ps. 813.5 million, or 10.6%).

This increase in total operating costs was composed primarily of the following factors:

Mexican Airports:

- Operating costs increased by Ps. 102.9 million, or 1.0%, compared to 9M23, primarily due to a Ps.454.5, or 17.2%, increase in the cost of services, a combined Ps. 279.7 million, or 18.9%, increase in depreciation and amortization, and a combined Ps. 68.5 million, or 4.8%, increase in technical assistance fees and concession taxes. This was offset by a Ps. 672.4 million, or 14.4%, decrease in the cost of improvements to the concession assets (IFRIC-12). (excluding the cost of improvements to the concession assets, operating costs increased by Ps. 775.3 million or 14.0%).

The change in the cost of services during 9M24 was mainly due to:

- Employee costs increased by Ps. 237.7 million, or 21.2%, compared to 9M23, mainly due to the adjustments in salaries and changes in Labor Law and the consolidation of the cargo and free trade zone business with employee costs of Ps. 86.5 million.

- Other operating expenses increased by Ps. 72.4 million, or 14.4%, compared to 9M23, mainly due to a combined increase in services, professional fees, and travel expenses by Ps. 41.0 million and the consolidation of the cargo and free trade zone business with other operating expenses of Ps. 12.4 million.

- Maintenance increased by Ps. 61.0 million, or 16.1%, compared to 9M23.

- Safety, security, and insurance costs increased Ps. 60.4 million, or 15.6%, compared to 9M23, mainly due to an increase in the number of security staff, an increase in minimum wages, changes in Labor Law, the opening of additional operational areas and the consolidation of the cargo and free trade zone business by Ps.4.8 million.

Jamaican Airports:

- Operating costs increased by Ps. 257.9 million, or 11.8%, compared to 9M23, mainly due to a Ps. 219.7 million, or 258.7%, increase in the cost of improvements to concession assets (IFRIC-12), a Ps. 82.0 million, or 15.0% increase in the cost of services, offset by the decrease in concession taxes by Ps. 39.9 million, or 3.4%, and Ps. 1.1 million or 0.3% in depreciation and amortization.

Operating margin went from 48.5% in 9M23 to 46.8% in 9M24. Excluding the effects of IFRIC-12, the operating margin went from 60.5% in 9M23 to 57.0% in 9M24. Operating income decreased Ps. 466.7 million, or 4.0%, compared to 9M23.

EBITDA margin went from 56.2% in 9M23 to 55.7% in 9M24. Excluding the effects of IFRIC-12, EBITDA margin went from 70.1% in 9M23 to 67.9% in 9M24. The nominal value of EBITDA decreased Ps. 188.1 million, or 1.4%, compared to 9M23.

Financial cost increased by Ps. 590.3 million, or 34.2%, from a net expense of Ps. 1,726.6 million in 9M23 to a net expense of Ps. 2,316.9 million in 9M24. This change was mainly the result of:

- Foreign exchange rate fluctuations, which went from a loss of Ps. 186.3 million in 9M23 to a loss of Ps.203.6 million in 9M24. This generated an increase in the foreign exchange loss of Ps. 17.3 million, due to the peso depreciation. Currency translation effect gain increased Ps. 1,675.4 million, compared to 9M23.

- Interest expenses increased by Ps. 364.4 million, or 13.8%, compared to 9M23, mainly due to the increase in debt due to the issuance of bond certificates and the contracting of bank loans.

- Interest income decreased by Ps. 208.4 million, or 18.9%, compared to 9M23, mainly due to a decrease in the cash and cash equivalent average balance and the increase in the reference interest rates.

In 9M24, comprehensive income increased by Ps. 925.2 million, or 13.7%, compared to 9M23. Income before taxes decreased by Ps. 1,056.9 million, mainly due to the decrease in passenger traffic and increase in operating costs, offset by the increase in non-aeronautical revenues resulting from the commercial strategy and the consolidation of the cargo and free trade zone business. Income taxes decreased by Ps. 330.7 million. However, net and comprehensive income increased mainly due to the increase of the effect of foreign currency translation in Ps. 1,675.4 million.

During 9M24, net income decreased by Ps. 726.3 million, or 9.8%, compared to 9M23. Taxes for the period decreased by Ps. 330.7 million, mainly due to the increase in the benefit for deferred taxes by Ps. 431.3 million, mainly due to the application of fiscal losses by Ps. 445.0 million, offset by the increase in the income taxes by Ps. 100.6 million.

Statement of Financial Position

Total assets as of September 30, 2024, increased by Ps. 10,630.1 million compared to September 30, 2023, primarily due to the following items: (i) a Ps.6,157.0 million increase in net improvements to concession assets, (ii) a Ps. 1,373.9 increase in cash and cash equivalents, (iii) Ps. 881.0 million increase in deferred taxes, (iii) a Ps. 727.4 million increase in net machinery, equipment, and leasehold improvements, and (v) a Ps. 308.0 million increase in account receivables.

Total liabilities as of September 30, 2024, increased by Ps. 8,192.6 million compared to September 30, 2023. This increase was primarily due to the following items: (i) Ps. 6,148.1 million in long-term bond certificates, (ii) Ps. 915.1 million in bank loans, and (iii) Ps. 446.6 million increase in income taxes.

Recent events

The financial information presented in 3Q24 consolidates, as of July 1, 2024, the figures of the cargo and free trade zone business at the Guadalajara airport that increases non-aeronautical revenues by Ps. 354.1 million, with an EBITDA margin of 58.1% and a treasury of Ps. 254.6 million, without financial debt.

Company Description

Grupo Aeroportuario del Pacífico, S.A.B. de C.V. (GAP) operates 12 airports throughout Mexico’s Pacific region, including the major cities of Guadalajara and Tijuana, the four tourist destinations of Puerto Vallarta, Los Cabos, La Paz and Manzanillo, and six other mid-sized cities: Hermosillo, Guanajuato, Morelia, Aguascalientes, Mexicali and Los Mochis. In February 2006, GAP’s shares were listed on the New York Stock Exchange under the ticker symbol “PAC” and on the Mexican Stock Exchange under the ticker symbol “GAP”. In April 2015, GAP acquired 100% of Desarrollo de Concesiones Aeroportuarias, S.L., which owns a majority stake in MBJ Airports Limited, a company operating Sangster International Airport in Montego Bay, Jamaica. In October 2018, GAP entered into a concession agreement for the operation of Norman Manley International Airport in Kingston, Jamaica, and took control of the operation in October 2019.

| This press release contains references to EBITDA, a financial performance measure not recognized under IFRS and which does not purport to be an alternative to IFRS measures of operating performance or liquidity. We caution investors not to place undue reliance on non-GAAP financial measures such as EBITDA, as these have limitations as analytical tools and should be considered as a supplement to, not a substitute for, the corresponding measures calculated in accordance with IFRS. | ||

| This press release may contain forward-looking statements. These statements are statements that are not historical facts and are based on management’s current view and estimates of future economic circumstances, industry conditions, company performance, and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations, and the factors or trends affecting financial condition, liquidity, or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to several risks and uncertainties. There is no guarantee that the expected events, trends, or results will occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. | ||

In accordance with Section 806 of the Sarbanes-Oxley Act of 2002 and Article 42 of the “Ley del Mercado de Valores”, GAP has implemented a “whistleblower” program, which allows complainants to anonymously and confidentially report suspected activities that involve criminal conduct or violations. The telephone number in Mexico, facilitated by a third party responsible for collecting these complaints, is 800 04 ETICA (38422) or WhatsApp +52 55 6538 5504. The website is www.lineadedenunciagap.com or by email at denuncia@lineadedenunciagap.com. GAP’s Audit Committee will be notified of all complaints for immediate investigation.

Exhibit A: Operating results by airport (in thousands of pesos):

| Airport | 3Q23 | 3Q24 | Change | 9M23 | 9M24 | Change |

| Guadalajara | ||||||

| Aeronautical services | 1,384,710 | 1,417,532 | 2.4% | 4,044,710 | 3,982,181 | (1.5%) |

| Non-aeronautical services | 263,082 | 352,935 | 34.2% | 760,360 | 980,667 | 29.0% |

| Improvements to concession assets (IFRIC 12) | 42,989 | 603,457 | 1303.7% | 1,700,457 | 1,810,371 | 6.5% |

| Total Revenues | 1,690,782 | 2,373,924 | 40.4% | 6,505,526 | 6,773,219 | 4.1% |

| Operating income | 1,250,818 | 1,015,291 | (18.8%) | 3,503,297 | 3,372,720 | (3.7%) |

| EBITDA | 1,365,126 | 1,200,463 | (12.1%) | 3,844,399 | 3,815,547 | (0.8%) |

| Tijuana | ||||||

| Aeronautical services | 784,504 | 706,053 | (10.0%) | 2,203,798 | 2,036,395 | (7.6%) |

| Non-aeronautical services | 166,714 | 116,154 | (30.3%) | 469,318 | 406,706 | (13.3%) |

| Improvements to concession assets (IFRIC 12) | 140,836 | 83,488 | (40.7%) | 422,509 | 250,464 | (40.7%) |

| Total Revenues | 1,092,055 | 905,696 | (17.1%) | 3,095,626 | 2,693,565 | (13.0%) |

| Operating income | 634,623 | 427,131 | (32.7%) | 1,718,782 | 1,337,424 | (22.2%) |

| EBITDA | 735,933 | 549,019 | (25.4%) | 2,017,211 | 1,688,143 | (16.3%) |

| Los Cabos | ||||||

| Aeronautical services | 680,673 | 579,520 | (14.9%) | 2,287,815 | 2,040,450 | (10.8%) |

| Non-aeronautical services | 261,808 | 303,020 | 15.7% | 867,887 | 954,709 | 10.0% |

| Improvements to concession assets (IFRIC 12) | 249,608 | 149,281 | (40.2%) | 748,823 | 447,844 | (40.2%) |

| Total Revenues | 1,192,089 | 1,031,821 | (13.4%) | 3,904,525 | 3,443,002 | (11.8%) |

| Operating income | 635,646 | 452,723 | (28.8%) | 2,200,249 | 1,880,936 | (14.5%) |

| EBITDA | 717,482 | 544,826 | (24.1%) | 2,444,388 | 2,152,122 | (12.0%) |

| Puerto Vallarta | ||||||

| Aeronautical services | 463,874 | 417,191 | (10.1%) | 1,921,180 | 1,803,364 | (6.1%) |

| Non-aeronautical services | 119,673 | 125,653 | 5.0% | 432,069 | 449,813 | 4.1% |

| Improvements to concession assets (IFRIC 12) | 403,557 | 371,727 | (7.9%) | 1,210,671 | 1,115,182 | (7.9%) |

| Total Revenues | 987,104 | 914,572 | (7.3%) | 3,563,921 | 3,368,359 | (5.5%) |

| Operating income | 409,131 | 277,151 | (32.3%) | 1,651,577 | 1,461,358 | (11.5%) |

| EBITDA | 463,400 | 331,539 | (28.5%) | 1,815,864 | 1,624,594 | (10.5%) |

| Montego Bay | ||||||

| Aeronautical services | 433,702 | 449,879 | 3.7% | 1,390,696 | 1,415,149 | 1.8% |

| Non-aeronautical services | 199,151 | 211,571 | 6.2% | 597,734 | 610,416 | 2.1% |

| Improvements to concession assets (IFRIC 12) | 23,988 | 47,058 | 96.2% | 79,029 | 127,739 | 61.6% |

| Total Revenues | 656,842 | 708,507 | 7.9% | 2,067,460 | 2,153,303 | 4.2% |

| Operating income | 176,139 | 241,419 | 37.1% | 712,829 | 782,524 | 9.8% |

| EBITDA | 289,301 | 320,937 | 10.9% | 1,065,396 | 1,002,645 | (5.9%) |

Exhibit A: Operating results by airport (in thousands of pesos):

| Airport | 3Q23 | 3Q24 | Change | 9M23 | 9M24 | Change |

| Guanajuato | ||||||

| Aeronautical services | 263,732 | 250,429 | (5.0%) | 706,740 | 678,494 | (4.0%) |

| Non-aeronautical services | 46,316 | 50,164 | 8.3% | 135,793 | 142,768 | 5.1% |

| Improvements to concession assets (IFRIC 12) | 70,722 | 55,538 | (21.5%) | 212,167 | 166,613 | (21.5%) |

| Total Revenues | 380,771 | 356,130 | (6.5%) | 1,054,699 | 987,875 | (6.3%) |

| Operating income | 221,187 | 188,197 | (14.9%) | 580,177 | 527,958 | (9.0%) |

| EBITDA | 243,150 | 210,608 | (13.4%) | 646,402 | 593,613 | (8.2%) |

| Hermosillo | ||||||

| Aeronautical services | 139,364 | 127,518 | (8.5%) | 382,873 | 377,662 | (1.4%) |

| Non-aeronautical services | 25,324 | 29,928 | 18.2% | 68,093 | 86,895 | 27.6% |

| Improvements to concession assets (IFRIC 12) | 14,439 | 16,079 | 11.4% | 43,318 | 48,238 | 11.4% |

| Total Revenues | 179,127 | 173,525 | (3.1%) | 494,285 | 512,795 | 3.7% |

| Operating income | 84,897 | 66,727 | (21.4%) | 230,718 | 217,425 | (5.8%) |

| EBITDA | 109,893 | 91,963 | (16.3%) | 304,785 | 293,241 | (3.8%) |

| Others (1) | ||||||

| Aeronautical services | 661,729 | 679,158 | 2.6% | 1,842,831 | 1,816,968 | (1.4%) |

| Non-aeronautical services | 112,098 | 108,815 | (2.9%) | 327,381 | 318,032 | (2.9%) |

| Improvements to concession assets (IFRIC 12) | 118,145 | 174,560 | 47.8% | 350,648 | 348,526 | (0.6%) |

| Total Revenues | 891,974 | 962,533 | 7.9% | 2,520,861 | 2,483,527 | (1.5%) |

| Operating income | 235,321 | 550,978 | 134.1% | 612,501 | 562,107 | (8.2%) |

| EBITDA | 317,323 | 518,843 | 63.5% | 858,561 | 828,427 | (3.5%) |

| Total | ||||||

| Aeronautical services | 4,812,288 | 4,627,280 | (3.8%) | 14,780,643 | 14,150,662 | (4.3%) |

| Non-aeronautical services | 1,194,167 | 1,298,239 | 8.7% | 3,658,636 | 3,950,006 | 8.0% |

| Improvements to concession assets (IFRIC 12) | 1,064,286 | 1,501,188 | 41.1% | 4,767,624 | 4,314,977 | (9.5%) |

| Total Revenues | 7,070,740 | 7,426,707 | 5.0% | 23,206,903 | 22,415,645 | (3.4%) |

| Operating income | 3,647,758 | 3,219,618 | (11.7%) | 11,210,130 | 10,142,452 | (9.5%) |

| EBITDA | 4,241,607 | 3,768,198 | (11.2%) | 12,997,005 | 11,998,332 | (7.7%) |

(1) Others include the operating results of the Aguascalientes, La Paz, Los Mochis, Manzanillo, Mexicali, Morelia, and Kingston airports.

Exhibit B: Consolidated statement of financial position as of September 30 (in thousands of pesos):

| 2023 | 2024 | Change | % | |

| Assets | ||||

| Current assets | ||||

| Cash and cash equivalents | 14,454,072 | 15,828,015 | 1,373,943 | 9.5% |

| Trade accounts receivable – Net | 2,062,286 | 2,370,326 | 308,040 | 14.9% |

| Other current assets | 1,328,135 | 1,325,663 | (2,472) | (0.2%) |

| Total current assets | 17,844,493 | 19,524,004 | 1,679,511 | 9.4% |

| Advanced payments to suppliers | 2,058,763 | 1,391,549 | (667,214) | (32.4%) |

| Machinery, equipment and improvements to leased buildings – Net | 3,798,780 | 4,526,156 | 727,376 | 19.1% |

| Improvements to concession assets – Net | 27,144,891 | 33,301,904 | 6,157,013 | 22.7% |

| Airport concessions – Net | 9,023,473 | 9,443,181 | 419,708 | 4.7% |

| Rights to use airport facilities – Net | 1,079,962 | 1,008,491 | (71,471) | (6.6%) |

| Deferred income taxes – Net | 7,053,371 | 7,934,352 | 880,981 | 12.5% |

| Other non-current assets | 601,549 | 2,105,723 | 1,504,175 | 250.1% |

| Total assets | 68,605,283 | 79,235,361 | 10,630,078 | 15.5% |

| Liabilities | ||||

| Current liabilities | 14,617,581 | 13,049,798 | (1,567,783) | (10.7%) |

| Long-term liabilities | 34,904,611 | 44,664,952 | 9,760,341 | 28.0% |

| Total liabilities | 49,522,193 | 57,714,751 | 8,192,558 | 16.5% |

| Stockholders’ Equity | ||||

| Common stock | 8,197,536 | 1,194,390 | (7,003,146) | (85.4%) |

| Legal reserve | 478,185 | 920,187 | 442,002 | 92.4% |

| Net income | 7,317,424 | 6,535,681 | (781,743) | (10.7%) |

| Retained earnings | 244,656 | 8,345,564 | 8,100,908 | 3311.1% |

| Reserve for share repurchase | 1,500,000 | 2,500,000 | 1,000,000 | 66.7% |

| Foreign currency translation reserve | (25,610) | 681,626 | 707,236 | (2761.6%) |

| Remeasurements of employee benefit – Net | 14,931 | (1,741) | (16,672) | (111.7%) |

| Cash flow hedges- Net | 106,269 | 13,191 | (93,078) | (87.6%) |

| Total controlling interest | 17,833,391 | 20,188,898 | 2,355,507 | 13.2% |