Wintrust Financial Corporation Reports Third Quarter and Year-to-Date Results

ROSEMONT, Ill, Oct. 21, 2024 (GLOBE NEWSWIRE) — Wintrust Financial Corporation (“Wintrust”, “the Company”, “we” or “our”) WTFC announced net income of $509.7 million or $7.67 per diluted common share for the first nine months of 2024 compared to net income of $499.1 million or $7.71 per diluted common share for the same period of 2023. Pre-tax, pre-provision income (non-GAAP) for the first nine months of 2024 totaled a record $778.1 million, compared to $751.3 million in the first nine months of 2023.

The Company recorded quarterly net income of $170.0 million or $2.47 per diluted common share for the third quarter of 2024 compared to net income of $152.4 million or $2.32 per diluted common share for the second quarter of 2024. Pre-tax, pre-provision income (non-GAAP) totaled $255.0 million as compared to $251.4 million for the second quarter of 2024.

Results of operations include those of Macatawa Bank Corporation (“Macatawa”), since the acquisition date of August 1, 2024.

Timothy S. Crane, President and Chief Executive Officer, commented, “Our net income for both the third quarter and year-to-date 2024 were driven by robust organic loan and deposit growth as well as a stable net interest margin. We believe we are well-positioned for strong financial performance as we continue our momentum in the fourth quarter of 2024 and into 2025.”

Additionally, Mr. Crane emphasized, “Net interest margin in the third quarter remained stable, decreasing one basis point as compared to the second quarter of 2024. We expect net interest margin to remain in the 3.50% range in the fourth quarter of 2024 and into 2025. Stable net interest margin coupled with continued balance sheet growth should result in net interest income growth. Focusing on growth of net interest income, disciplined expense control and maintaining our consistent credit standards should drive strong financial performance.”

Mr. Crane continued, “I want to recognize the efforts of our new Macatawa teammates and committed Wintrust team members on the seamless transaction and a solid beginning to integration activities. Macatawa offers a unique opportunity for Wintrust to expand into the desirable west Michigan market with a compatible management team and reputable brand. The quality core deposit franchise, excess liquidity and pristine credit quality coupled with aligned values make the acquisition an ideal fit for the Company. We are thrilled to bring our product offerings to Michigan and continue Macatawa’s commitment to customer service and community involvement.”

Highlights of the third quarter of 2024:

Comparative information to the second quarter of 2024, unless otherwise noted

- Total loans increased by approximately $2.4 billion, which includes approximately $1.3 billion of acquired balances relating to Macatawa. Excluding Macatawa, total loans increased $1.1 billion or 10% annualized.

- Total deposits increased by approximately $3.4 billion, which includes approximately $2.3 billion of acquired balances relating to Macatawa. Excluding Macatawa, total deposits increased $1.1 billion or 9% annualized.

- Total assets increased by $4.0 billion, which includes approximately $2.9 billion of acquired assets relating to Macatawa. Excluding Macatawa, total assets increased $1.1 billion or 8% annualized.

- Net interest income increased to $502.6 million in the third quarter of 2024 compared to $470.6 million in the second quarter of 2024, primarily due to average earning asset growth and the addition of Macatawa for the last two months of the third quarter.

- Net interest margin decreased by one basis point to 3.49% (3.51% on a fully taxable-equivalent basis, non-GAAP) during the third quarter of 2024.

- Non-interest income was impacted by the following:

- Net gains on investment securities totaling $3.2 million in the third quarter of 2024 related to changes in the value of equity securities as compared to net losses of $4.3 million in the second quarter of 2024.

- Unfavorable mortgage servicing rights (“MSRs”) related revenue totaled $11.4 million in the third quarter of 2024 compared to favorable MSRs related revenue of $2.8 million in the second quarter of 2024.

- Non-interest expense was impacted by the following:

- Macatawa added approximately $10.1 million of total operating expenses, including $3.0 million of core deposit intangible asset amortization.

- Incurred acquisition related costs of $1.6 million in the third quarter of 2024 as compared to $542,000 in the second quarter of 2024.

- Provision for credit losses totaled $22.3 million in the third quarter of 2024, including a one-time acquisition-related Day 1 provision of approximately $15.5 million, as compared to a provision for credit losses of $40.1 million in the second quarter of 2024.

- Tangible book value per common share (non-GAAP) increased to $76.15 as of September 30, 2024 as compared to $72.01 as of June 30, 2024. See Table 18 for reconciliation of non-GAAP measures.

Mr. Crane noted, “We are very pleased with our organic loan and deposit growth rates. Excess liquidity acquired in the Macatawa transaction was deployed by funding quality loan growth and reducing exposure to wholesale and brokered funding sources. Non-interest bearing deposits remained at 21% of total deposits at the end of the third quarter of 2024 and increased $708 million compared to the second quarter of 2024. We continue to leverage our customer relationships and market positioning to generate deposits, grow loans and build long term franchise value.”

Commenting on credit quality, Mr. Crane stated, “Our credit metrics were stable. Net charge-offs totaled $26.7 million, or 23 basis points of average total loans on an annualized basis, in the third quarter of 2024 and were spread primarily across the commercial and property and casualty premium finance receivables portfolios. This compared to net charge-offs totaling $30.0 million, or 28 basis points of average total loans on an annualized basis, in the second quarter of 2024. Approximately $18.3 million of charge-offs in the current quarter were previously reserved for in the second quarter of 2024. Non-performing loans totaled $179.7 million, or 0.38% of total loans, at the end of the third quarter of 2024 compared to $174.3 million, or 0.39% of total loans, at the end of the second quarter of 2024. Total non-performing assets comprised 0.30% of total assets as of September 30, 2024, a two basis point decline compared to June 30, 2024. We continue to be conservative and proactive in reviewing credit and maintaining our consistently strong credit standards. We believe that the Company’s reserves remain appropriate and we remain diligent in our review of credit.”

In summary, Mr. Crane noted, “Our record year continued as we built upon our strong momentum with the acquisition of Macatawa. Substantial loan growth in the third quarter and inclusion of Macatawa for all three months in the fourth quarter create positive revenue momentum. We have reduced our asset sensitivity to interest rates and therefore we believe that we are well positioned for the current interest rate environment and consensus forecast for additional interest rate cuts by the Federal Reserve. Steadfast commitment to credit quality, growing net interest income and increasing our long term franchise value remain our priority.”

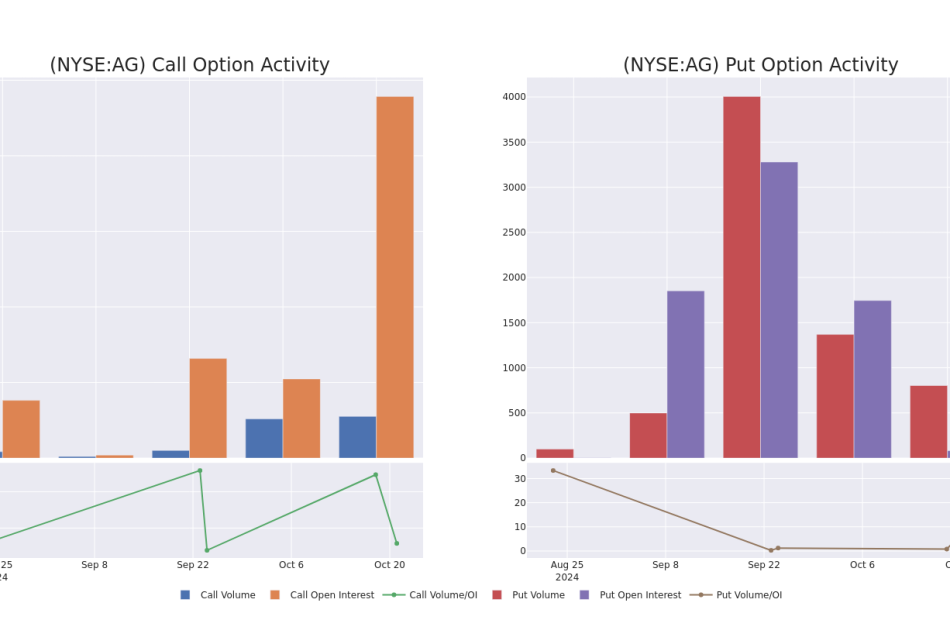

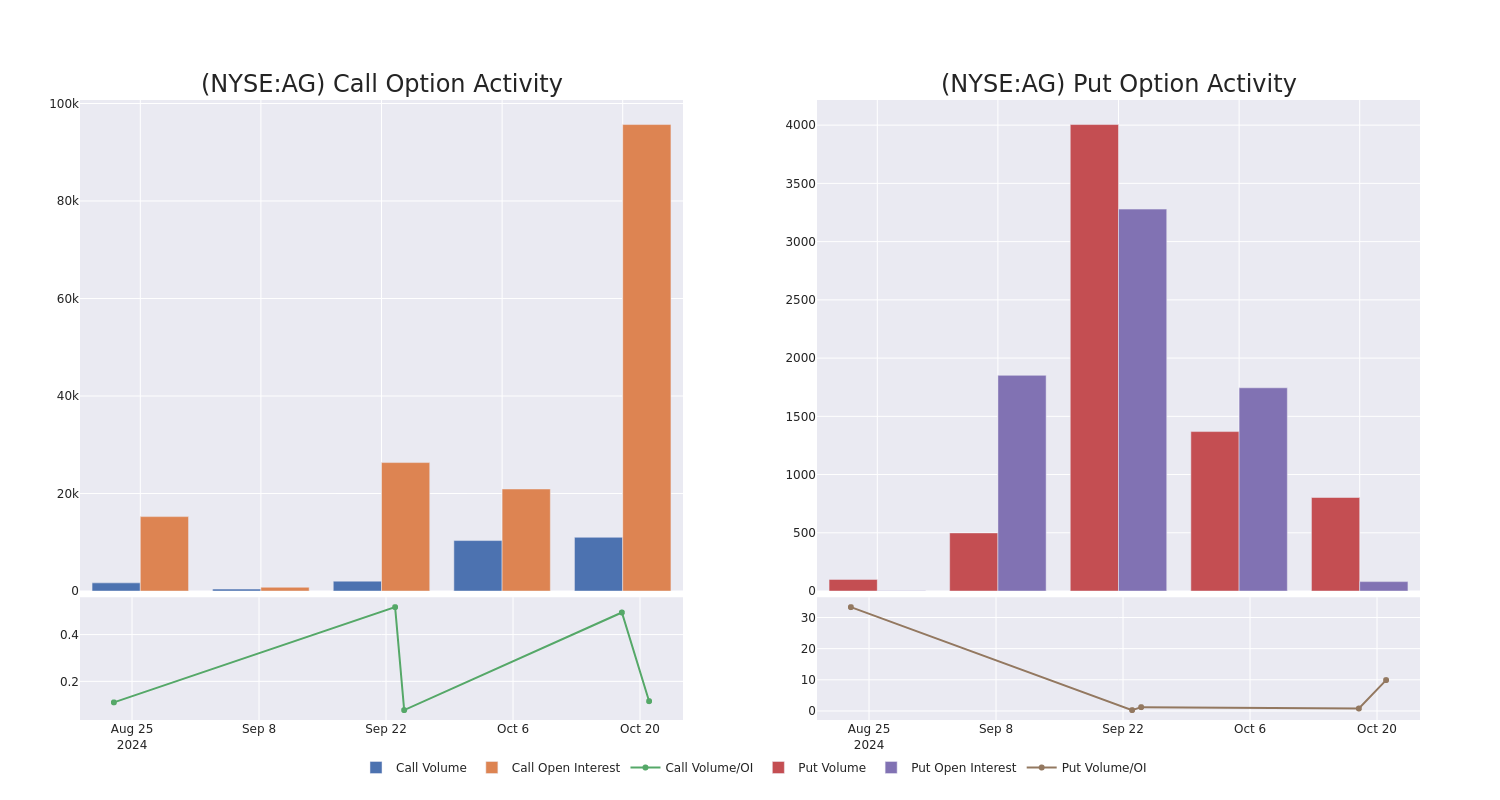

The graphs below illustrate certain financial highlights of the third quarter of 2024 as well as historical financial performance. See “Supplemental Non-GAAP Financial Measures/Ratios” at Table 18 for additional information with respect to non-GAAP financial measures/ratios, including the reconciliations to the corresponding GAAP financial measures/ratios.

Graphs available at the following link: http://ml.globenewswire.com/Resource/Download/bc11950c-ec29-45c6-902d-8e0709edd6de

SUMMARY OF RESULTS:

BALANCE SHEET

Total assets increased $4.0 billion in the third quarter of 2024 as compared to the second quarter of 2024. Total loans increased by $2.4 billion as compared to the second quarter of 2024. The increase in total loans included approximately $1.3 billion of loans related to the Macatawa acquisition. The increase in loans was diversified across nearly all loan portfolios.

Total liabilities increased by $3.1 billion in the third quarter of 2024 as compared to the second quarter of 2024 primarily due to a $3.4 billion increase in total deposits. The increase in total deposits included approximately $2.3 billion related to the Macatawa acquisition. Excess liquidity acquired in the Macatawa transaction enabled the Company to reduce brokered funding reliance by $858 million. Non-interest bearing deposits increased $708 million in the third quarter of 2024 as compared to the second quarter of 2024. Non-interest bearing deposits as a percentage of total deposits was 21% at September 30, 2024, June 30, 2024 and March 31, 2024. The Company’s loans to deposits ratio was 91.6% on September 30, 2024 as compared to 93.0% as of June 30, 2024.

For more information regarding changes in the Company’s balance sheet, see Consolidated Statements of Condition and Table 1 through Table 3 in this report.

NET INTEREST INCOME

For the third quarter of 2024, net interest income totaled $502.6 million, an increase of $32.0 million as compared to the second quarter of 2024. The $32.0 million increase in net interest income in the third quarter of 2024 compared to the second quarter of 2024 was primarily due to a $3.1 billion increase in average earning assets, which included the addition of Macatawa in the third quarter. These benefits were partially offset by a one basis point decrease in the net interest margin.

Net interest margin was 3.49% (3.51% on a fully taxable-equivalent basis, non-GAAP) during the third quarter of 2024 compared to 3.50% (3.52% on a fully taxable-equivalent basis, non-GAAP) during the second quarter of 2024. The net interest margin decrease as compared to the second quarter of 2024 was primarily due to a one basis point decrease in the yield on earning assets and one basis point decrease in the net free funds contribution. These declines were partially offset by a one basis point decrease in rate paid on interest-bearing liabilities. The one basis point decrease in yield on earnings assets in the third quarter of 2024 as compared to the second quarter of 2024 was primarily due to an increase in average interest-bearing cash as a percentage of average quarterly earning assets associated with the Macatawa acquisition. The one basis point decrease in the rate paid on interest-bearing liabilities in the third quarter of 2024 as compared to the second quarter of 2024 was primarily due to a one basis point decrease in rate paid on interest-bearing deposits.

For more information regarding net interest income, see Table 4 through Table 8 in this report.

ASSET QUALITY

The allowance for credit losses totaled $436.2 million as of September 30, 2024, relatively unchanged compared to $437.6 million as of June 30, 2024. A provision for credit losses totaling $22.3 million was recorded for the third quarter of 2024 as compared to $40.1 million recorded in the second quarter of 2024. Provision for credit losses in the third quarter of 2024 included Day 1 provision for credit losses of approximately $15.5 million related to the Macatawa acquisition. The lower provision for credit losses recognized in the third quarter of 2024 compared to the second quarter of 2024 was primarily attributable to lower required specific reserves on nonaccrual loans, improved forecasted macroeconomic conditions, and, to a lesser extent, portfolio changes related to improved risk rating mix and shorter life of loan. For more information regarding the allowance for credit losses and provision for credit losses, see Table 11 in this report.

Management believes the allowance for credit losses is appropriate to account for expected credit losses. The Current Expected Credit Losses accounting standard requires the Company to estimate expected credit losses over the life of the Company’s financial assets as of the reporting date. There can be no assurances, however, that future losses will not significantly exceed the amounts provided for, thereby affecting future results of operations. A summary of the allowance for credit losses calculated for the loan components in each portfolio as of September 30, 2024, June 30, 2024, and March 31, 2024 is shown on Table 12 of this report.

Net charge-offs totaled $26.7 million in the third quarter of 2024, a decrease of $3.3 million as compared to $30.0 million of net charge-offs in the second quarter of 2024. Approximately $18.3 million of charge-offs in the current quarter were previously reserved for in the second quarter of 2024. Net charge-offs as a percentage of average total loans were 23 basis points in the third quarter of 2024 on an annualized basis compared to 28 basis points on an annualized basis in the second quarter of 2024. For more information regarding net charge-offs, see Table 10 in this report.

The Company’s delinquency rates remain low and manageable. For more information regarding past due loans, see Table 13 in this report.

Non-performing assets totaled $193.4 million and comprised 0.30% of total assets as of September 30, 2024, as compared to $194.0 million, or 0.32% of total assets, as of June 30, 2024. Non-performing loans totaled $179.7 million and comprised 0.38% of total loans at September 30, 2024, as compared to $174.3 million and 0.39% of total loans at June 30, 2024. The increase in the third quarter of 2024 was primarily due to an increase in certain credits within the commercial portfolios becoming nonaccrual. For more information regarding non-performing assets, see Table 14 in this report.

Credit metrics remained stable and at relatively low levels in the third quarter of 2024.

NON-INTEREST INCOME

Wealth management revenue increased by $1.8 million in the third quarter of 2024 as compared to the second quarter of 2024 primarily due to the Macatawa acquisition and increased asset management fees from higher assets under management during the period. Wealth management revenue is comprised of the trust and asset management revenue of Wintrust Private Trust Company and Great Lakes Advisors, the brokerage commissions, managed money fees and insurance product commissions at Wintrust Investments and fees from tax-deferred like-kind exchange services provided by the Chicago Deferred Exchange Company.

Mortgage banking revenue decreased by $13.2 million in the third quarter of 2024 as compared to the second quarter of 2024 primarily due to $11.4 million unfavorable MSR related revenues, net of servicing hedge, in the third quarter of 2024 compared to $2.8 million favorable MSR related revenues in the second quarter of 2024 and slightly decreased production revenue due to reduced production margin. This was partially offset by a favorable adjustment to the Company’s held-for-sale portfolio of early buy-out exercised loans guaranteed by U.S. government agencies, which are held at fair value, of $3.5 million in the third quarter of 2024 compared to a $642,000 favorable adjustment in the second quarter of 2024. The Company monitors the relationship of these assets and seeks to minimize the earnings impact of fair value changes. For more information regarding mortgage banking revenue, see Table 16 in this report.

The Company recognized $3.2 million in net gains on investment securities in the third quarter of 2024 as compared to $4.3 million in net losses in the second quarter of 2024. The net gains in the third quarter of 2024 were primarily the result of unrealized gains on the Company’s equity investment securities with a readily determinable fair value.

Fees from covered call options decreased by $1.1 million in the third quarter of 2024 as compared to the second quarter of 2024. The Company has typically written call options with terms of less than three months against certain U.S. Treasury and agency securities held in its portfolio for liquidity and other purposes. Management has entered into these transactions with the goal of economically hedging security positions and enhancing its overall return on its investment portfolio. These option transactions are designed to mitigate overall interest rate risk and do not qualify as hedges pursuant to accounting guidance.

Other income decreased by $5.1 million in the third quarter of 2024 compared to the second quarter of 2024 primarily due to a gain recognized in the second quarter of 2024 associated with our property and casualty insurance premium finance receivable loan sale transaction.

For more information regarding non-interest income, see Table 15 in this report.

NON-INTEREST EXPENSE

Non-interest expenses totaled $360.7 million in the third quarter of 2024, increasing $20.3 million as compared to $340.4 million in the second quarter of 2024. The Macatawa acquisition impacted this increase by approximately $10.1 million of non-interest expense associated with Macatawa, which included $3.0 million in amortization of other acquisition-related intangible assets in the third quarter of 2024.

Salaries and employee benefits expense increased by $12.7 million in the third quarter of 2024 as compared to the second quarter of 2024. The $12.7 million increase is primarily related to higher incentive compensation expense due to elevated bonus accruals in the third quarter of 2024 as well as increased salaries expense due to the Macatawa acquisition and additional staffing to support the Company’s growth.

Software and equipment expense increased $2.3 million in the third quarter of 2024 as compared to the second quarter of 2024 primarily due to software expense relating to upgrading and maintenance of information technology and security infrastructure as well as the Macatawa acquisition.

Advertising and marketing expenses in the third quarter of 2024 totaled $18.2 million, which is a $803,000 increase as compared to the second quarter of 2024. Marketing costs are incurred to promote the Company’s brand, commercial banking capabilities and the Company’s various products, to attract loans and deposits and to announce new branch openings as well as the expansion of the Company’s non-bank businesses. The level of marketing expenditures depends on the timing of sponsorship programs utilized which are determined based on the market area, targeted audience, competition and various other factors. Generally, these expenses are elevated in the second and third quarters of each year.

For more information regarding non-interest expense, see Table 17 in this report.

INCOME TAXES

The Company recorded income tax expense of $62.7 million in the third quarter compared to $59.0 million in the second quarter of 2024. The effective tax rates were 26.95% in the third quarter of 2024 compared to 27.90% in the second quarter of 2024. The effective tax rates were impacted by an overall lower level of provision for state income tax expense in the comparable periods.

BUSINESS UNIT SUMMARY

Community Banking

Through its community banking unit, the Company provides banking and financial services primarily to individuals, small to mid-sized businesses, local governmental units and institutional clients residing primarily in the local areas the Company services. In the third quarter of 2024, the community banking unit expanded its commercial, commercial real estate and residential real estate loan portfolios.

Mortgage banking revenue was $16.0 million for the third quarter of 2024, a decrease of $13.2 million as compared to the second quarter of 2024, primarily due to $11.4 million unfavorable MSR related revenues, net of servicing hedge, in the third quarter of 2024 compared to $2.8 million favorable MSR related revenues in the second quarter of 2024 and slightly decreased production revenue due to reduced production margin. This was partially offset by a favorable adjustment to the Company’s held-for-sale portfolio of early buy-out exercised loans guaranteed by U.S. government agencies, which are held at fair value, of $3.5 million in the third quarter of 2024 compared to a $642,000 favorable adjustment in the second quarter of 2024. Service charges on deposit accounts totaled $16.4 million in the third quarter of 2024, which was relatively stable compared to the second quarter of 2024. The Company’s gross commercial and commercial real estate loan pipelines remained solid as of September 30, 2024 indicating momentum for expected continued loan growth in the fourth quarter of 2024.

Specialty Finance

Through its specialty finance unit, the Company offers financing of insurance premiums for businesses and individuals, equipment financing through structured loans and lease products to customers in a variety of industries, accounts receivable financing and value-added, out-sourced administrative services and other services. Originations within the insurance premium financing receivables portfolios were $4.8 billion during the third quarter of 2024. Average balances increased by $259.8 million, as compared to the second quarter of 2024. The Company’s leasing portfolio balance remained stable in the third quarter of 2024, with its portfolio of assets, including capital leases, loans and equipment on operating leases, totaling $3.7 billion as of September 30, 2024 and June 30, 2024. Revenues from the Company’s out-sourced administrative services business were $1.5 million in the third quarter of 2024, which was relatively stable compared to the second quarter of 2024.

Wealth Management

Through four separate subsidiaries within its wealth management unit, the Company offers a full range of wealth management services, including trust and investment services, tax-deferred like-kind exchange services, asset management, and securities brokerage services. See “Items Impacting Comparative Results,” regarding the sale of the Company’s Retirement Benefits Advisors (“RBA”) division during the first quarter of 2024. Wealth management revenue totaled $37.2 million in the third quarter of 2024, relatively stable as compared to the second quarter of 2024. At September 30, 2024, the Company’s wealth management subsidiaries had approximately $51.1 billion of assets under administration, which included $8.0 billion of assets owned by the Company and its subsidiary banks.

ITEMS IMPACTING COMPARATIVE FINANCIAL RESULTS

Business Combination

On August 1, 2024, the Company completed its previously announced acquisition of Macatawa, the parent company of Macatawa Bank. In conjunction with the completed acquisition, the Company issued approximately 4.7 million shares of common stock. Macatawa operates 26 full-service branches located throughout communities in Kent, Ottawa and northern Allegan counties in the state of Michigan. Macatawa offers a full range of banking, retail and commercial lending, wealth management and ecommerce services to individuals, businesses and governmental entities. As of August 1, 2024, Macatawa had approximately $2.9 billion in assets, $2.3 billion in deposits and $1.3 billion in loans. The Company preliminarily recorded goodwill of approximately $144.6 million on the purchase.

Division Sale

In the first quarter of 2024, the Company sold its RBA division and recorded a gain of approximately $20.0 million in other non-interest income from the sale.

Business Combination

On April 3, 2023, the Company completed its acquisition of Rothschild & Co Asset Management US Inc. and Rothschild & Co Risk Based Investments LLC from Rothschild & Co North America Inc. As the transaction was determined to be a business combination, the Company recorded goodwill of approximately $2.6 million on the purchase.

WINTRUST FINANCIAL CORPORATION

Key Operating Measures

Wintrust’s key operating measures and growth rates for the third quarter of 2024, as compared to the second quarter of 2024 (sequential quarter) and third quarter of 2023 (linked quarter), are shown in the table below:

| % or(1) basis point (bp) change from 2nd Quarter 2024 |

% or basis point (bp) change from 3rd Quarter 2023 |

||||||||||||||||||

| Three Months Ended | |||||||||||||||||||

| (Dollars in thousands, except per share data) | Sep 30, 2024 | Jun 30, 2024 | Sep 30, 2023 | ||||||||||||||||

| Net income | $ | 170,001 | $ | 152,388 | $ | 164,198 | 12 | % | 4 | % | |||||||||

| Pre-tax income, excluding provision for credit losses (non-GAAP) (2) | 255,043 | 251,404 | 244,781 | 1 | 4 | ||||||||||||||

| Net income per common share – Diluted | 2.47 | 2.32 | 2.53 | 6 | (2) | ||||||||||||||

| Cash dividends declared per common share | 0.45 | 0.45 | 0.40 | — | 13 | ||||||||||||||

| Net revenue (3) | 615,730 | 591,757 | 574,836 | 4 | 7 | ||||||||||||||

| Net interest income | 502,583 | 470,610 | 462,358 | 7 | 9 | ||||||||||||||

| Net interest margin | 3.49 | % | 3.50 | % | 3.60 | % | (1) | bps | (11) | bps | |||||||||

| Net interest margin – fully taxable-equivalent (non-GAAP) (2) | 3.51 | 3.52 | 3.62 | (1) | (11) | ||||||||||||||

| Net overhead ratio (4) | 1.62 | 1.53 | 1.59 | 9 | 3 | ||||||||||||||

| Return on average assets | 1.11 | 1.07 | 1.20 | 4 | (9) | ||||||||||||||

| Return on average common equity | 11.63 | 11.61 | 13.35 | 2 | (172) | ||||||||||||||

| Return on average tangible common equity (non-GAAP) (2) | 13.92 | 13.49 | 15.73 | 43 | (181) | ||||||||||||||

| At end of period | |||||||||||||||||||

| Total assets | $ | 63,788,424 | $ | 59,781,516 | $ | 55,555,246 | 27 | % | 15 | % | |||||||||

| Total loans (5) | 47,067,447 | 44,675,531 | 41,446,032 | 21 | 14 | ||||||||||||||

| Total deposits | 51,404,966 | 48,049,026 | 44,992,686 | 28 | 14 | ||||||||||||||

| Total shareholders’ equity | 6,399,714 | 5,536,628 | 5,015,613 | 62 | 28 | ||||||||||||||

(1) Period-end balance sheet percentage changes are annualized.

(2) See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(3) Net revenue is net interest income plus non-interest income.

(4) The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency.

(5) Excludes mortgage loans held-for-sale.

Certain returns, yields, performance ratios, or quarterly growth rates are “annualized” in this presentation to represent an annual time period. This is done for analytical purposes to better discern, for decision-making purposes, underlying performance trends when compared to full-year or year-over-year amounts. For example, a 5% growth rate for a quarter would represent an annualized 20% growth rate. Additional supplemental financial information showing quarterly trends can be found on the Company’s website at www.wintrust.com by choosing “Financial Reports” under the “Investor Relations” heading, and then choosing “Financial Highlights.”

WINTRUST FINANCIAL CORPORATION

Selected Financial Highlights

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Sep 30, 2024 | Jun 30, 2024 | Mar 31, 2024 | Dec 31, 2023 | Sep 30, 2023 | Sep 30, 2024 | Sep 30, 2023 | ||||||||||||||||||||

| Selected Financial Condition Data (at end of period): | |||||||||||||||||||||||||||

| Total assets | $ | 63,788,424 | $ | 59,781,516 | $ | 57,576,933 | $ | 56,259,934 | $ | 55,555,246 | |||||||||||||||||

| Total loans(1) | 47,067,447 | 44,675,531 | 43,230,706 | 42,131,831 | 41,446,032 | ||||||||||||||||||||||

| Total deposits | 51,404,966 | 48,049,026 | 46,448,858 | 45,397,170 | 44,992,686 | ||||||||||||||||||||||

| Total shareholders’ equity | 6,399,714 | 5,536,628 | 5,436,400 | 5,399,526 | 5,015,613 | ||||||||||||||||||||||

| Selected Statements of Income Data: | |||||||||||||||||||||||||||

| Net interest income | $ | 502,583 | $ | 470,610 | $ | 464,194 | $ | 469,974 | $ | 462,358 | $ | 1,437,387 | $ | 1,367,890 | |||||||||||||

| Net revenue(2) | 615,730 | 591,757 | 604,774 | 570,803 | 574,836 | 1,812,261 | 1,701,167 | ||||||||||||||||||||

| Net income | 170,001 | 152,388 | 187,294 | 123,480 | 164,198 | 509,683 | 499,146 | ||||||||||||||||||||

| Pre-tax income, excluding provision for credit losses (non-GAAP)(3) | 255,043 | 251,404 | 271,629 | 208,151 | 244,781 | 778,076 | 751,320 | ||||||||||||||||||||

| Net income per common share – Basic | 2.51 | 2.35 | 2.93 | 1.90 | 2.57 | 7.79 | 7.82 | ||||||||||||||||||||

| Net income per common share – Diluted | 2.47 | 2.32 | 2.89 | 1.87 | 2.53 | 7.67 | 7.71 | ||||||||||||||||||||

| Cash dividends declared per common share | 0.45 | 0.45 | 0.45 | 0.40 | 0.40 | 1.35 | 1.20 | ||||||||||||||||||||

| Selected Financial Ratios and Other Data: | |||||||||||||||||||||||||||

| Performance Ratios: | |||||||||||||||||||||||||||

| Net interest margin | 3.49 | % | 3.50 | % | 3.57 | % | 3.62 | % | 3.60 | % | 3.52 | % | 3.68 | % | |||||||||||||

| Net interest margin – fully taxable-equivalent (non-GAAP)(3) | 3.51 | 3.52 | 3.59 | 3.64 | 3.62 | 3.54 | 3.70 | ||||||||||||||||||||

| Non-interest income to average assets | 0.74 | 0.85 | 1.02 | 0.73 | 0.82 | 0.86 | 0.84 | ||||||||||||||||||||

| Non-interest expense to average assets | 2.36 | 2.38 | 2.41 | 2.62 | 2.41 | 2.38 | 2.39 | ||||||||||||||||||||

| Net overhead ratio(4) | 1.62 | 1.53 | 1.39 | 1.89 | 1.59 | 1.52 | 1.55 | ||||||||||||||||||||

| Return on average assets | 1.11 | 1.07 | 1.35 | 0.89 | 1.20 | 1.17 | 1.26 | ||||||||||||||||||||

| Return on average common equity | 11.63 | 11.61 | 14.42 | 9.93 | 13.35 | 12.52 | 13.91 | ||||||||||||||||||||

| Return on average tangible common equity (non-GAAP)(3) | 13.92 | 13.49 | 16.75 | 11.73 | 15.73 | 14.69 | 16.43 | ||||||||||||||||||||

| Average total assets | $ | 60,915,283 | $ | 57,493,184 | $ | 55,602,695 | $ | 55,017,075 | $ | 54,381,981 | $ | 58,014,347 | $ | 53,028,199 | |||||||||||||

| Average total shareholders’ equity | 5,990,429 | 5,450,173 | 5,440,457 | 5,066,196 | 5,083,883 | 5,628,346 | 5,008,648 | ||||||||||||||||||||

| Average loans to average deposits ratio | 93.8 | % | 95.1 | % | 94.5 | % | 92.9 | % | 92.4 | % | 94.5 | % | 93.2 | % | |||||||||||||

| Period-end loans to deposits ratio | 91.6 | 93.0 | 93.1 | 92.8 | 92.1 | ||||||||||||||||||||||

| Common Share Data at end of period: | |||||||||||||||||||||||||||

| Market price per common share | $ | 108.53 | $ | 98.56 | $ | 104.39 | $ | 92.75 | $ | 75.50 | |||||||||||||||||

| Book value per common share | 90.06 | 82.97 | 81.38 | 81.43 | 75.19 | ||||||||||||||||||||||

| Tangible book value per common share (non-GAAP)(3) | 76.15 | 72.01 | 70.40 | 70.33 | 64.07 | ||||||||||||||||||||||

| Common shares outstanding | 66,481,543 | 61,760,139 | 61,736,715 | 61,243,626 | 61,222,058 | ||||||||||||||||||||||

| Other Data at end of period: | |||||||||||||||||||||||||||

| Common equity to assets ratio | 9.4 | % | 8.6 | % | 8.7 | % | 8.9 | % | 8.3 | % | |||||||||||||||||

| Tangible common equity ratio (non-GAAP)(3) | 8.1 | 7.5 | 7.6 | 7.7 | 7.1 | ||||||||||||||||||||||

| Tier 1 leverage ratio(5) | 9.4 | 9.3 | 9.4 | 9.3 | 9.2 | ||||||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||

| Tier 1 capital ratio(5) | 10.5 | 10.3 | 10.3 | 10.3 | 10.2 | ||||||||||||||||||||||

| Common equity tier 1 capital ratio(5) | 9.8 | 9.5 | 9.5 | 9.4 | 9.3 | ||||||||||||||||||||||

| Total capital ratio(5) | 12.2 | 12.1 | 12.2 | 12.1 | 12.0 | ||||||||||||||||||||||

| Allowance for credit losses(6) | $ | 436,193 | $ | 437,560 | $ | 427,504 | $ | 427,612 | $ | 399,531 | |||||||||||||||||

| Allowance for loan and unfunded lending-related commitment losses to total loans | 0.93 | % | 0.98 | % | 0.99 | % | 1.01 | % | 0.96 | % | |||||||||||||||||

| Number of: | |||||||||||||||||||||||||||

| Bank subsidiaries | 16 | 15 | 15 | 15 | 15 | ||||||||||||||||||||||

| Banking offices | 203 | 177 | 176 | 174 | 174 | ||||||||||||||||||||||

(1) Excludes mortgage loans held-for-sale.

(2) Net revenue is net interest income plus non-interest income.

(3) See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(4) The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency.

(5) Capital ratios for current quarter-end are estimated.

(6) The allowance for credit losses includes the allowance for loan losses, the allowance for unfunded lending-related commitments and the allowance for held-to-maturity securities losses.

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CONDITION

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||||

| Sep 30, | Jun 30, | Mar 31, | Dec 31, | Sep 30, | ||||||||||||||||

| (In thousands) | 2024 | 2024 | 2024 | 2023 | 2023 | |||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and due from banks | $ | 725,465 | $ | 415,462 | $ | 379,825 | $ | 423,404 | $ | 418,088 | ||||||||||

| Federal funds sold and securities purchased under resale agreements | 5,663 | 62 | 61 | 60 | 60 | |||||||||||||||

| Interest-bearing deposits with banks | 3,648,117 | 2,824,314 | 2,131,077 | 2,084,323 | 2,448,570 | |||||||||||||||

| Available-for-sale securities, at fair value | 3,912,232 | 4,329,957 | 4,387,598 | 3,502,915 | 3,611,835 | |||||||||||||||

| Held-to-maturity securities, at amortized cost | 3,677,420 | 3,755,924 | 3,810,015 | 3,856,916 | 3,909,150 | |||||||||||||||

| Trading account securities | 3,472 | 4,134 | 2,184 | 4,707 | 1,663 | |||||||||||||||

| Equity securities with readily determinable fair value | 125,310 | 112,173 | 119,777 | 139,268 | 134,310 | |||||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stock | 266,908 | 256,495 | 224,657 | 205,003 | 204,040 | |||||||||||||||

| Brokerage customer receivables | 16,662 | 13,682 | 13,382 | 10,592 | 14,042 | |||||||||||||||

| Mortgage loans held-for-sale, at fair value | 461,067 | 411,851 | 339,884 | 292,722 | 304,808 | |||||||||||||||

| Loans, net of unearned income | 47,067,447 | 44,675,531 | 43,230,706 | 42,131,831 | 41,446,032 | |||||||||||||||

| Allowance for loan losses | (360,279 | ) | (363,719 | ) | (348,612 | ) | (344,235 | ) | (315,039 | ) | ||||||||||

| Net loans | 46,707,168 | 44,311,812 | 42,882,094 | 41,787,596 | 41,130,993 | |||||||||||||||

| Premises, software and equipment, net | 772,002 | 722,295 | 744,769 | 748,966 | 747,501 | |||||||||||||||

| Lease investments, net | 270,171 | 275,459 | 283,557 | 281,280 | 275,152 | |||||||||||||||

| Accrued interest receivable and other assets | 1,721,090 | 1,671,334 | 1,580,142 | 1,551,899 | 1,674,681 | |||||||||||||||

| Trade date securities receivable | 551,031 | — | — | 690,722 | — | |||||||||||||||

| Goodwill | 800,780 | 655,955 | 656,181 | 656,672 | 656,109 | |||||||||||||||

| Other acquisition-related intangible assets | 123,866 | 20,607 | 21,730 | 22,889 | 24,244 | |||||||||||||||

| Total assets | $ | 63,788,424 | $ | 59,781,516 | $ | 57,576,933 | $ | 56,259,934 | $ | 55,555,246 | ||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Non-interest-bearing | $ | 10,739,132 | $ | 10,031,440 | $ | 9,908,183 | $ | 10,420,401 | $ | 10,347,006 | ||||||||||

| Interest-bearing | 40,665,834 | 38,017,586 | 36,540,675 | 34,976,769 | 34,645,680 | |||||||||||||||

| Total deposits | 51,404,966 | 48,049,026 | 46,448,858 | 45,397,170 | 44,992,686 | |||||||||||||||

| Federal Home Loan Bank advances | 3,171,309 | 3,176,309 | 2,676,751 | 2,326,071 | 2,326,071 | |||||||||||||||

| Other borrowings | 647,043 | 606,579 | 575,408 | 645,813 | 643,999 | |||||||||||||||

| Subordinated notes | 298,188 | 298,113 | 437,965 | 437,866 | 437,731 | |||||||||||||||

| Junior subordinated debentures | 253,566 | 253,566 | 253,566 | 253,566 | 253,566 | |||||||||||||||

| Accrued interest payable and other liabilities | 1,613,638 | 1,861,295 | 1,747,985 | 1,799,922 | 1,885,580 | |||||||||||||||

| Total liabilities | 57,388,710 | 54,244,888 | 52,140,533 | 50,860,408 | 50,539,633 | |||||||||||||||

| Shareholders’ Equity: | ||||||||||||||||||||

| Preferred stock | 412,500 | 412,500 | 412,500 | 412,500 | 412,500 | |||||||||||||||

| Common stock | 66,546 | 61,825 | 61,798 | 61,269 | 61,244 | |||||||||||||||

| Surplus | 2,470,228 | 1,964,645 | 1,954,532 | 1,943,806 | 1,933,226 | |||||||||||||||

| Treasury stock | (6,098 | ) | (5,760 | ) | (5,757 | ) | (2,217 | ) | (1,966 | ) | ||||||||||

| Retained earnings | 3,748,715 | 3,615,616 | 3,498,475 | 3,345,399 | 3,253,332 | |||||||||||||||

| Accumulated other comprehensive loss | (292,177 | ) | (512,198 | ) | (485,148 | ) | (361,231 | ) | (642,723 | ) | ||||||||||

| Total shareholders’ equity | 6,399,714 | 5,536,628 | 5,436,400 | 5,399,526 | 5,015,613 | |||||||||||||||

| Total liabilities and shareholders’ equity | $ | 63,788,424 | $ | 59,781,516 | $ | 57,576,933 | $ | 56,259,934 | $ | 55,555,246 | ||||||||||

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Sep 30, 2024 | Sep 30, 2023 | ||||||||||||||||||

| Interest income | |||||||||||||||||||||||||

| Interest and fees on loans | $ | 794,163 | $ | 749,812 | $ | 710,341 | $ | 694,943 | $ | 666,260 | $ | 2,254,316 | $ | 1,846,009 | |||||||||||

| Mortgage loans held-for-sale | 6,233 | 5,434 | 4,146 | 4,318 | 4,767 | 15,813 | 12,473 | ||||||||||||||||||

| Interest-bearing deposits with banks | 32,608 | 19,731 | 16,658 | 21,762 | 26,866 | 68,997 | 57,216 | ||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 277 | 17 | 19 | 578 | 1,157 | 313 | 1,228 | ||||||||||||||||||

| Investment securities | 69,592 | 69,779 | 69,678 | 68,237 | 59,164 | 209,049 | 170,350 | ||||||||||||||||||

| Trading account securities | 11 | 13 | 18 | 15 | 6 | 42 | 26 | ||||||||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stock | 5,451 | 4,974 | 4,478 | 3,792 | 3,896 | 14,903 | 11,120 | ||||||||||||||||||

| Brokerage customer receivables | 269 | 219 | 175 | 203 | 284 | 663 | 844 | ||||||||||||||||||

| Total interest income | 908,604 | 849,979 | 805,513 | 793,848 | 762,400 | 2,564,096 | 2,099,266 | ||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||

| Interest on deposits | 362,019 | 335,703 | 299,532 | 285,390 | 262,783 | 997,254 | 621,080 | ||||||||||||||||||

| Interest on Federal Home Loan Bank advances | 26,254 | 24,797 | 22,048 | 18,316 | 17,436 | 73,099 | 53,970 | ||||||||||||||||||

| Interest on other borrowings | 9,013 | 8,700 | 9,248 | 9,557 | 9,384 | 26,961 | 25,723 | ||||||||||||||||||

| Interest on subordinated notes | 3,712 | 5,185 | 5,487 | 5,522 | 5,491 | 14,384 | 16,502 | ||||||||||||||||||

| Interest on junior subordinated debentures | 5,023 | 4,984 | 5,004 | 5,089 | 4,948 | 15,011 | 14,101 | ||||||||||||||||||

| Total interest expense | 406,021 | 379,369 | 341,319 | 323,874 | 300,042 | 1,126,709 | 731,376 | ||||||||||||||||||

| Net interest income | 502,583 | 470,610 | 464,194 | 469,974 | 462,358 | 1,437,387 | 1,367,890 | ||||||||||||||||||

| Provision for credit losses | 22,334 | 40,061 | 21,673 | 42,908 | 19,923 | 84,068 | 71,482 | ||||||||||||||||||

| Net interest income after provision for credit losses | 480,249 | 430,549 | 442,521 | 427,066 | 442,435 | 1,353,319 | 1,296,408 | ||||||||||||||||||

| Non-interest income | |||||||||||||||||||||||||

| Wealth management | 37,224 | 35,413 | 34,815 | 33,275 | 33,529 | 107,452 | 97,332 | ||||||||||||||||||

| Mortgage banking | 15,974 | 29,124 | 27,663 | 7,433 | 27,395 | 72,761 | 75,640 | ||||||||||||||||||

| Service charges on deposit accounts | 16,430 | 15,546 | 14,811 | 14,522 | 14,217 | 46,787 | 40,728 | ||||||||||||||||||

| Gains (losses) on investment securities, net | 3,189 | (4,282 | ) | 1,326 | 2,484 | (2,357 | ) | 233 | (959 | ) | |||||||||||||||

| Fees from covered call options | 988 | 2,056 | 4,847 | 4,679 | 4,215 | 7,891 | 17,184 | ||||||||||||||||||

| Trading (losses) gains, net | (130 | ) | 70 | 677 | (505 | ) | 728 | 617 | 1,647 | ||||||||||||||||

| Operating lease income, net | 15,335 | 13,938 | 14,110 | 14,162 | 13,863 | 43,383 | 39,136 | ||||||||||||||||||

| Other | 24,137 | 29,282 | 42,331 | 24,779 | 20,888 | 95,750 | 62,569 | ||||||||||||||||||

| Total non-interest income | 113,147 | 121,147 | 140,580 | 100,829 | 112,478 | 374,874 | 333,277 | ||||||||||||||||||

| Non-interest expense | |||||||||||||||||||||||||

| Salaries and employee benefits | 211,261 | 198,541 | 195,173 | 193,971 | 192,338 | 604,975 | 554,042 | ||||||||||||||||||

| Software and equipment | 31,574 | 29,231 | 27,731 | 27,779 | 25,951 | 88,536 | 76,853 | ||||||||||||||||||

| Operating lease equipment | 10,518 | 10,834 | 10,683 | 10,694 | 12,020 | 32,035 | 31,669 | ||||||||||||||||||

| Occupancy, net | 19,945 | 19,585 | 19,086 | 18,102 | 21,304 | 58,616 | 58,966 | ||||||||||||||||||

| Data processing | 9,984 | 9,503 | 9,292 | 8,892 | 10,773 | 28,779 | 29,908 | ||||||||||||||||||

| Advertising and marketing | 18,239 | 17,436 | 13,040 | 17,166 | 18,169 | 48,715 | 47,909 | ||||||||||||||||||

| Professional fees | 9,783 | 9,967 | 9,553 | 8,768 | 8,887 | 29,303 | 25,990 | ||||||||||||||||||

| Amortization of other acquisition-related intangible assets | 4,042 | 1,122 | 1,158 | 1,356 | 1,408 | 6,322 | 4,142 | ||||||||||||||||||

| FDIC insurance | 10,512 | 10,429 | 14,537 | 43,677 | 9,748 | 35,478 | 27,425 | ||||||||||||||||||

| OREO expenses, net | (938 | ) | (259 | ) | 392 | (1,559 | ) | 120 | (805 | ) | 31 | ||||||||||||||

| Other | 35,767 | 33,964 | 32,500 | 33,806 | 29,337 | 102,231 | 92,912 | ||||||||||||||||||

| Total non-interest expense | 360,687 | 340,353 | 333,145 | 362,652 | 330,055 | 1,034,185 | 949,847 | ||||||||||||||||||

| Income before taxes | 232,709 | 211,343 | 249,956 | 165,243 | 224,858 | 694,008 | 679,838 | ||||||||||||||||||

| Income tax expense | 62,708 | 58,955 | 62,662 | 41,763 | 60,660 | 184,325 | 180,692 | ||||||||||||||||||

| Net income | $ | 170,001 | $ | 152,388 | $ | 187,294 | $ | 123,480 | $ | 164,198 | $ | 509,683 | $ | 499,146 | |||||||||||

| Preferred stock dividends | 6,991 | 6,991 | 6,991 | 6,991 | 6,991 | 20,973 | 20,973 | ||||||||||||||||||

| Net income applicable to common shares | $ | 163,010 | $ | 145,397 | $ | 180,303 | $ | 116,489 | $ | 157,207 | $ | 488,710 | $ | 478,173 | |||||||||||

| Net income per common share – Basic | $ | 2.51 | $ | 2.35 | $ | 2.93 | $ | 1.90 | $ | 2.57 | $ | 7.79 | $ | 7.82 | |||||||||||

| Net income per common share – Diluted | $ | 2.47 | $ | 2.32 | $ | 2.89 | $ | 1.87 | $ | 2.53 | $ | 7.67 | $ | 7.71 | |||||||||||

| Cash dividends declared per common share | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 0.40 | $ | 0.40 | $ | 1.35 | $ | 1.20 | |||||||||||

| Weighted average common shares outstanding | 64,888 | 61,839 | 61,481 | 61,236 | 61,213 | 62,743 | 61,119 | ||||||||||||||||||

| Dilutive potential common shares | 1,053 | 926 | 928 | 1,166 | 964 | 934 | 888 | ||||||||||||||||||

| Average common shares and dilutive common shares | 65,941 | 62,765 | 62,409 | 62,402 | 62,177 | 63,677 | 62,007 | ||||||||||||||||||

TABLE 1: LOAN PORTFOLIO MIX AND GROWTH RATES

| % Growth From | |||||||||||||||||||

| (Dollars in thousands) | Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Dec 31, 2023(1) |

Sep 30, 2023 |

||||||||||||

| Balance: | |||||||||||||||||||

| Mortgage loans held-for-sale, excluding early buy-out exercised loans guaranteed by U.S. government agencies | $ | 314,693 | $ | 281,103 | $ | 193,064 | $ | 155,529 | $ | 190,511 | NM | 65 | % | ||||||

| Mortgage loans held-for-sale, early buy-out exercised loans guaranteed by U.S. government agencies | 146,374 | 130,748 | 146,820 | 137,193 | 114,297 | 9 | 28 | ||||||||||||

| Total mortgage loans held-for-sale | $ | 461,067 | $ | 411,851 | $ | 339,884 | $ | 292,722 | $ | 304,808 | 77 | % | 51 | % | |||||

| Core loans: | |||||||||||||||||||

| Commercial | |||||||||||||||||||

| Commercial and industrial | $ | 6,768,382 | $ | 6,226,336 | $ | 6,105,968 | $ | 5,804,629 | $ | 5,894,732 | 22 | % | 15 | % | |||||

| Asset-based lending | 1,709,685 | 1,465,867 | 1,355,255 | 1,433,250 | 1,396,591 | 26 | 22 | ||||||||||||

| Municipal | 827,125 | 747,357 | 721,526 | 677,143 | 676,915 | 30 | 22 | ||||||||||||

| Leases | 2,443,721 | 2,439,128 | 2,344,295 | 2,208,368 | 2,109,628 | 14 | 16 | ||||||||||||

| PPP loans | 6,301 | 9,954 | 11,036 | 11,533 | 13,744 | (61 | ) | (54 | ) | ||||||||||

| Commercial real estate | |||||||||||||||||||

| Residential construction | 73,088 | 55,019 | 57,558 | 58,642 | 51,550 | 33 | 42 | ||||||||||||

| Commercial construction | 1,984,240 | 1,866,701 | 1,748,607 | 1,729,937 | 1,547,322 | 20 | 28 | ||||||||||||

| Land | 346,362 | 338,831 | 344,149 | 295,462 | 294,901 | 23 | 17 | ||||||||||||

| Office | 1,675,286 | 1,585,312 | 1,566,748 | 1,455,417 | 1,422,748 | 20 | 18 | ||||||||||||

| Industrial | 2,527,932 | 2,307,455 | 2,190,200 | 2,135,876 | 2,057,957 | 25 | 23 | ||||||||||||

| Retail | 1,404,586 | 1,365,753 | 1,366,415 | 1,337,517 | 1,341,451 | 7 | 5 | ||||||||||||

| Multi-family | 3,193,339 | 2,988,940 | 2,922,432 | 2,815,911 | 2,710,829 | 18 | 18 | ||||||||||||

| Mixed use and other | 1,588,584 | 1,439,186 | 1,437,328 | 1,515,402 | 1,519,422 | 6 | 5 | ||||||||||||

| Home equity | 427,043 | 356,313 | 340,349 | 343,976 | 343,258 | 32 | 24 | ||||||||||||

| Residential real estate | |||||||||||||||||||

| Residential real estate loans for investment | 3,252,649 | 2,933,157 | 2,746,916 | 2,619,083 | 2,538,630 | 32 | 28 | ||||||||||||

| Residential mortgage loans, early buy-out eligible loans guaranteed by U.S. government agencies | 92,355 | 88,503 | 90,911 | 92,780 | 97,911 | (1 | ) | (6 | ) | ||||||||||

| Residential mortgage loans, early buy-out exercised loans guaranteed by U.S. government agencies | 43,034 | 45,675 | 52,439 | 57,803 | 71,062 | (34 | ) | (39 | ) | ||||||||||

| Total core loans | $ | 28,363,712 | $ | 26,259,487 | $ | 25,402,132 | $ | 24,592,729 | $ | 24,088,651 | 20 | % | 18 | % | |||||

| Niche loans: | |||||||||||||||||||

| Commercial | |||||||||||||||||||

| Franchise | $ | 1,191,686 | $ | 1,150,460 | $ | 1,122,302 | $ | 1,092,532 | $ | 1,074,162 | 12 | % | 11 | % | |||||

| Mortgage warehouse lines of credit | 750,462 | 593,519 | 403,245 | 230,211 | 245,450 | 302 | 206 | ||||||||||||

| Community Advantage – homeowners association | 501,645 | 491,722 | 475,832 | 452,734 | 424,054 | 14 | 18 | ||||||||||||

| Insurance agency lending | 1,048,686 | 1,030,119 | 964,022 | 921,653 | 890,197 | 18 | 18 | ||||||||||||

| Premium Finance receivables | |||||||||||||||||||

| U.S. property & casualty insurance | 6,253,271 | 6,142,654 | 6,113,993 | 5,983,103 | 5,815,346 | 6 | 8 | ||||||||||||

| Canada property & casualty insurance | 878,410 | 958,099 | 826,026 | 920,426 | 907,401 | (6 | ) | (3 | ) | ||||||||||

| Life insurance | 7,996,899 | 7,962,115 | 7,872,033 | 7,877,943 | 7,931,808 | 2 | 1 | ||||||||||||

| Consumer and other | 82,676 | 87,356 | 51,121 | 60,500 | 68,963 | 49 | 20 | ||||||||||||

| Total niche loans | $ | 18,703,735 | $ | 18,416,044 | $ | 17,828,574 | $ | 17,539,102 | $ | 17,357,381 | 9 | % | 8 | % | |||||

| Total loans, net of unearned income | $ | 47,067,447 | $ | 44,675,531 | $ | 43,230,706 | $ | 42,131,831 | $ | 41,446,032 | 16 | % | 14 | % | |||||

(1) Annualized.

TABLE 2: DEPOSIT PORTFOLIO MIX AND GROWTH RATES

| % Growth From | ||||||||||||||||||||||||

| (Dollars in thousands) | Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

Jun 30, 2024(1) |

Sep 30, 2023 |

|||||||||||||||||

| Balance: | ||||||||||||||||||||||||

| Non-interest-bearing | $ | 10,739,132 | $ | 10,031,440 | $ | 9,908,183 | $ | 10,420,401 | $ | 10,347,006 | 28 | % | 4 | % | ||||||||||

| NOW and interest-bearing demand deposits | 5,466,932 | 5,053,909 | 5,720,947 | 5,797,649 | 6,006,114 | 33 | (9 | ) | ||||||||||||||||

| Wealth management deposits(2) | 1,303,354 | 1,490,711 | 1,347,817 | 1,614,499 | 1,788,099 | (50 | ) | (27 | ) | |||||||||||||||

| Money market | 17,713,726 | 16,320,017 | 15,617,717 | 15,149,215 | 14,478,504 | 34 | 22 | |||||||||||||||||

| Savings | 6,183,249 | 5,882,179 | 5,959,774 | 5,790,334 | 5,584,294 | 20 | 11 | |||||||||||||||||

| Time certificates of deposit | 9,998,573 | 9,270,770 | 7,894,420 | 6,625,072 | 6,788,669 | 31 | 47 | |||||||||||||||||

| Total deposits | $ | 51,404,966 | $ | 48,049,026 | $ | 46,448,858 | $ | 45,397,170 | $ | 44,992,686 | 28 | % | 14 | % | ||||||||||

| Mix: | ||||||||||||||||||||||||

| Non-interest-bearing | 21 | % | 21 | % | 21 | % | 23 | % | 23 | % | ||||||||||||||

| NOW and interest-bearing demand deposits | 11 | 11 | 12 | 13 | 13 | |||||||||||||||||||

| Wealth management deposits(2) | 3 | 3 | 3 | 4 | 4 | |||||||||||||||||||

| Money market | 34 | 34 | 34 | 33 | 32 | |||||||||||||||||||

| Savings | 12 | 12 | 13 | 13 | 13 | |||||||||||||||||||

| Time certificates of deposit | 19 | 19 | 17 | 14 | 15 | |||||||||||||||||||

| Total deposits | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||

(1) Annualized.

(2) Represents deposit balances of the Company’s subsidiary banks from brokerage customers of Wintrust Investments, Chicago Deferred Exchange Company, LLC (“CDEC”), and trust and asset management customers of the Company.

TABLE 3: TIME CERTIFICATES OF DEPOSIT MATURITY/RE-PRICING ANALYSIS

As of September 30, 2024

| (Dollars in thousands) | Total Time Certificates of Deposit |

Weighted-Average Rate of Maturing Time Certificates of Deposit |

||||

| 1-3 months | $ | 3,125,473 | 4.71 | % | ||

| 4-6 months | 3,238,465 | 4.55 | ||||

| 7-9 months | 2,624,913 | 4.39 | ||||

| 10-12 months | 619,340 | 4.05 | ||||

| 13-18 months | 239,018 | 3.48 | ||||

| 19-24 months | 89,361 | 2.82 | ||||

| 24+ months | 62,003 | 2.29 | ||||

| Total | $ | 9,998,573 | 4.47 | % | ||

TABLE 4: QUARTERLY AVERAGE BALANCES

| Average Balance for three months ended, | ||||||||||||||||||||

| Sep 30, | Jun 30, | Mar 31, | Dec 31, | Sep 30, | ||||||||||||||||

| (In thousands) | 2024 | 2024 | 2024 | 2023 | 2023 | |||||||||||||||

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents(1) | $ | 2,413,728 | $ | 1,485,481 | $ | 1,254,332 | $ | 1,682,176 | $ | 2,053,568 | ||||||||||

| Investment securities(2) | 8,276,576 | 8,203,764 | 8,349,796 | 7,971,068 | 7,706,285 | |||||||||||||||

| FHLB and FRB stock | 263,707 | 253,614 | 230,648 | 204,593 | 201,252 | |||||||||||||||

| Liquidity management assets(3) | $ | 10,954,011 | $ | 9,942,859 | $ | 9,834,776 | $ | 9,857,837 | $ | 9,961,105 | ||||||||||

| Other earning assets(3)(4) | 17,542 | 15,257 | 15,081 | 14,821 | 17,879 | |||||||||||||||

| Mortgage loans held-for-sale | 376,251 | 347,236 | 290,275 | 279,569 | 319,099 | |||||||||||||||

| Loans, net of unearned income(3)(5) | 45,920,586 | 43,819,354 | 42,129,893 | 41,361,952 | 40,707,042 | |||||||||||||||

| Total earning assets(3) | $ | 57,268,390 | $ | 54,124,706 | $ | 52,270,025 | $ | 51,514,179 | $ | 51,005,125 | ||||||||||

| Allowance for loan and investment security losses | (383,736 | ) | (360,504 | ) | (361,734 | ) | (329,441 | ) | (319,491 | ) | ||||||||||

| Cash and due from banks | 467,333 | 434,916 | 450,267 | 443,989 | 459,819 | |||||||||||||||

| Other assets | 3,563,296 | 3,294,066 | 3,244,137 | 3,388,348 | 3,236,528 | |||||||||||||||

| Total assets | $ | 60,915,283 | $ | 57,493,184 | $ | 55,602,695 | $ | 55,017,075 | $ | 54,381,981 | ||||||||||

| NOW and interest-bearing demand deposits | $ | 5,174,673 | $ | 4,985,306 | $ | 5,680,265 | $ | 5,868,976 | $ | 5,815,155 | ||||||||||

| Wealth management deposits | 1,362,747 | 1,531,865 | 1,510,203 | 1,704,099 | 1,512,765 | |||||||||||||||

| Money market accounts | 16,436,111 | 15,272,126 | 14,474,492 | 14,212,320 | 14,155,446 | |||||||||||||||

| Savings accounts | 6,096,746 | 5,878,844 | 5,792,118 | 5,676,155 | 5,472,535 | |||||||||||||||

| Time deposits | 9,598,109 | 8,546,172 | 7,148,456 | 6,645,980 | 6,495,906 | |||||||||||||||

| Interest-bearing deposits | $ | 38,668,386 | $ | 36,214,313 | $ | 34,605,534 | $ | 34,107,530 | $ | 33,451,807 | ||||||||||

| Federal Home Loan Bank advances | 3,178,973 | 3,096,920 | 2,728,849 | 2,326,073 | 2,241,292 | |||||||||||||||

| Other borrowings | 622,792 | 587,262 | 627,711 | 633,673 | 657,454 | |||||||||||||||

| Subordinated notes | 298,135 | 410,331 | 437,893 | 437,785 | 437,658 | |||||||||||||||

| Junior subordinated debentures | 253,566 | 253,566 | 253,566 | 253,566 | 253,566 | |||||||||||||||

| Total interest-bearing liabilities | $ | 43,021,852 | $ | 40,562,392 | $ | 38,653,553 | $ | 37,758,627 | $ | 37,041,777 | ||||||||||

| Non-interest-bearing deposits | 10,271,613 | 9,879,134 | 9,972,646 | 10,406,585 | 10,612,009 | |||||||||||||||

| Other liabilities | 1,631,389 | 1,601,485 | 1,536,039 | 1,785,667 | 1,644,312 | |||||||||||||||

| Equity | 5,990,429 | 5,450,173 | 5,440,457 | 5,066,196 | 5,083,883 | |||||||||||||||

| Total liabilities and shareholders’ equity | $ | 60,915,283 | $ | 57,493,184 | $ | 55,602,695 | $ | 55,017,075 | $ | 54,381,981 | ||||||||||

| Net free funds/contribution(6) | $ | 14,246,538 | $ | 13,562,314 | $ | 13,616,472 | $ | 13,755,552 | $ | 13,963,348 | ||||||||||

(1) Includes interest-bearing deposits from banks and securities purchased under resale agreements with original maturities of greater than three months. Cash equivalents include federal funds sold and securities purchased under resale agreements with original maturities of three months or less.

(2) Investment securities includes investment securities classified as available-for-sale and held-to-maturity, and equity securities with readily determinable fair values. Equity securities without readily determinable fair values are included within other assets.

(3) See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(4) Other earning assets include brokerage customer receivables and trading account securities.

(5) Loans, net of unearned income, include non-accrual loans.

(6) Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

TABLE 5: QUARTERLY NET INTEREST INCOME

| Net Interest Income for three months ended, | ||||||||||||||||||||

| Sep 30, | Jun 30, | Mar 31, | Dec 31, | Sep 30, | ||||||||||||||||

| (In thousands) | 2024 | 2024 | 2024 | 2023 | 2023 | |||||||||||||||

| Interest income: | ||||||||||||||||||||

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents | $ | 32,885 | $ | 19,748 | $ | 16,677 | $ | 22,340 | $ | 28,022 | ||||||||||

| Investment securities | 70,260 | 70,346 | 70,228 | 68,812 | 59,737 | |||||||||||||||

| FHLB and FRB stock | 5,451 | 4,974 | 4,478 | 3,792 | 3,896 | |||||||||||||||

| Liquidity management assets(1) | $ | 108,596 | $ | 95,068 | $ | 91,383 | $ | 94,944 | $ | 91,655 | ||||||||||

| Other earning assets(1) | 282 | 235 | 198 | 222 | 291 | |||||||||||||||

| Mortgage loans held-for-sale | 6,233 | 5,434 | 4,146 | 4,318 | 4,767 | |||||||||||||||

| Loans, net of unearned income(1) | 796,637 | 752,117 | 712,587 | 697,093 | 668,183 | |||||||||||||||

| Total interest income | $ | 911,748 | $ | 852,854 | $ | 808,314 | $ | 796,577 | $ | 764,896 | ||||||||||

| Interest expense: | ||||||||||||||||||||

| NOW and interest-bearing demand deposits | $ | 30,971 | $ | 32,719 | $ | 34,896 | $ | 38,124 | $ | 36,001 | ||||||||||

| Wealth management deposits | 10,158 | 10,294 | 10,461 | 12,076 | 9,350 | |||||||||||||||

| Money market accounts | 167,382 | 155,100 | 137,984 | 130,252 | 124,742 | |||||||||||||||

| Savings accounts | 42,892 | 41,063 | 39,071 | 36,463 | 31,784 | |||||||||||||||

| Time deposits | 110,616 | 96,527 | 77,120 | 68,475 | 60,906 | |||||||||||||||

| Interest-bearing deposits | $ | 362,019 | $ | 335,703 | $ | 299,532 | $ | 285,390 | $ | 262,783 | ||||||||||

| Federal Home Loan Bank advances | 26,254 | 24,797 | 22,048 | 18,316 | 17,436 | |||||||||||||||

| Other borrowings | 9,013 | 8,700 | 9,248 | 9,557 | 9,384 | |||||||||||||||

| Subordinated notes | 3,712 | 5,185 | 5,487 | 5,522 | 5,491 | |||||||||||||||

| Junior subordinated debentures | 5,023 | 4,984 | 5,004 | 5,089 | 4,948 | |||||||||||||||

| Total interest expense | $ | 406,021 | $ | 379,369 | $ | 341,319 | $ | 323,874 | $ | 300,042 | ||||||||||

| Less: Fully taxable-equivalent adjustment | (3,144 | ) | (2,875 | ) | (2,801 | ) | (2,729 | ) | (2,496 | ) | ||||||||||

| Net interest income (GAAP)(2) | 502,583 | 470,610 | 464,194 | 469,974 | 462,358 | |||||||||||||||

| Fully taxable-equivalent adjustment | 3,144 | 2,875 | 2,801 | 2,729 | 2,496 | |||||||||||||||

| Net interest income, fully taxable-equivalent (non-GAAP)(2) | $ | 505,727 | $ | 473,485 | $ | 466,995 | $ | 472,703 | $ | 464,854 | ||||||||||

(1) Interest income on tax-advantaged loans, trading securities and investment securities reflects a taxable-equivalent adjustment based on the marginal federal corporate tax rate in effect as of the applicable period.

(2) See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

TABLE 6: QUARTERLY NET INTEREST MARGIN

| Net Interest Margin for three months ended, | |||||||||||||||

| Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2024 |

Dec 31, 2023 |

Sep 30, 2023 |

|||||||||||

| Yield earned on: | |||||||||||||||

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents | 5.42 | % | 5.35 | % | 5.35 | % | 5.27 | % | 5.41 | % | |||||

| Investment securities | 3.38 | 3.45 | 3.38 | 3.42 | 3.08 | ||||||||||

| FHLB and FRB stock | 8.22 | 7.89 | 7.81 | 7.35 | 7.68 | ||||||||||

| Liquidity management assets | 3.94 | % | 3.85 | % | 3.74 | % | 3.82 | % | 3.65 | % | |||||

| Other earning assets | 6.38 | 6.23 | 5.25 | 5.92 | 6.47 | ||||||||||

| Mortgage loans held-for-sale | 6.59 | 6.29 | 5.74 | 6.13 | 5.93 | ||||||||||

| Loans, net of unearned income | 6.90 | 6.90 | 6.80 | 6.69 | 6.51 | ||||||||||

| Total earning assets | 6.33 | % | 6.34 | % | 6.22 | % | 6.13 | % | 5.95 | % | |||||

| Rate paid on: | |||||||||||||||

| NOW and interest-bearing demand deposits | 2.38 | % | 2.64 | % | 2.47 | % | 2.58 | % | 2.46 | % | |||||

| Wealth management deposits | 2.97 | 2.70 | 2.79 | 2.81 | 2.45 | ||||||||||

| Money market accounts | 4.05 | 4.08 | 3.83 | 3.64 | 3.50 | ||||||||||

| Savings accounts | 2.80 | 2.81 | 2.71 | 2.55 | 2.30 | ||||||||||

| Time deposits | 4.58 | 4.54 | 4.34 | 4.09 | 3.72 | ||||||||||

| Interest-bearing deposits | 3.72 | % | 3.73 | % | 3.48 | % | 3.32 | % | 3.12 | % | |||||

| Federal Home Loan Bank advances | 3.29 | 3.22 | 3.25 | 3.12 | 3.09 | ||||||||||

| Other borrowings | 5.76 | 5.96 | 5.92 | 5.98 | 5.66 | ||||||||||

| Subordinated notes | 4.95 | 5.08 | 5.04 | 5.00 | 4.98 | ||||||||||

| Junior subordinated debentures | 7.88 | 7.91 | 7.94 | 7.96 | 7.74 | ||||||||||

| Total interest-bearing liabilities | 3.75 | % | 3.76 | % | 3.55 | % | 3.40 | % | 3.21 | % | |||||

| Interest rate spread(1)(2) | 2.58 | % | 2.58 | % | 2.67 | % | 2.73 | % | 2.74 | % | |||||

| Less: Fully taxable-equivalent adjustment | (0.02 | ) | (0.02 | ) | (0.02 | ) | (0.02 | ) | (0.02 | ) | |||||

| Net free funds/contribution(3) | 0.93 | 0.94 | 0.92 | 0.91 | 0.88 | ||||||||||

| Net interest margin (GAAP)(2) | 3.49 | % | 3.50 | % | 3.57 | % | 3.62 | % | 3.60 | % | |||||

| Fully taxable-equivalent adjustment | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | ||||||||||

| Net interest margin, fully taxable-equivalent (non-GAAP)(2) | 3.51 | % | 3.52 | % | 3.59 | % | 3.64 | % | 3.62 | % | |||||

(1) Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities.

(2) See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(3) Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

TABLE 7: YEAR-TO-DATE AVERAGE BALANCES, AND NET INTEREST INCOME AND MARGIN

| Average Balance fornine months ended, |

Interest fornine months ended, |

Yield/Rate fornine months ended, |

|||||||||||||||||

| (Dollars in thousands) | Sep 30, 2024 |

Sep 30, 2023 |

Sep 30, 2024 |

Sep 30, 2023 |

Sep 30, 2024 |

Sep 30, 2023 |

|||||||||||||

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents(1) | $ | 1,720,387 | $ | 1,584,120 | $ | 69,310 | $ | 58,443 | 5.38 | % | 4.93 | % | |||||||

| Investment securities(2) | 8,276,711 | 7,637,612 | 210,834 | 172,025 | 3.40 | 3.01 | |||||||||||||

| FHLB and FRB stock | 249,375 | 219,442 | 14,903 | 11,120 | 7.98 | 6.77 | |||||||||||||

| Liquidity management assets(3)(4) | $ | 10,246,473 | $ | 9,441,174 | $ | 295,047 | $ | 241,588 | 3.85 | % | 3.42 | % | |||||||

| Other earning assets(3)(4)(5) | 15,966 | 17,906 | 715 | 876 | 5.98 | 6.54 | |||||||||||||

| Mortgage loans held-for-sale | 338,061 | 299,426 | 15,813 | 12,473 | 6.25 | 5.57 | |||||||||||||

| Loans, net of unearned income(3)(4)(6) | 43,963,779 | 39,974,840 | 2,261,341 | 1,851,686 | 6.87 | 6.19 | |||||||||||||

| Total earning assets(4) | $ | 54,564,279 | $ | 49,733,346 | $ | 2,572,916 | $ | 2,106,623 | 6.30 | % | 5.66 | % | |||||||

| Allowance for loan and investment security losses | (368,713 | ) | (301,742 | ) | |||||||||||||||

| Cash and due from banks | 450,899 | 476,490 | |||||||||||||||||

| Other assets | 3,367,882 | 3,120,105 | |||||||||||||||||

| Total assets | $ | 58,014,347 | $ | 53,028,199 | |||||||||||||||

| NOW and interest-bearing demand deposits | $ | 5,279,697 | $ | 5,544,488 | $ | 98,586 | $ | 83,949 | 2.49 | % | 2.02 | % | |||||||

| Wealth management deposits | 1,467,886 | 1,739,427 | 30,913 | 30,705 | 2.81 | 2.36 | |||||||||||||

| Money market accounts | 15,398,045 | 13,480,887 | 460,466 | 299,649 | 3.99 | 2.97 | |||||||||||||

| Savings accounts | 5,923,205 | 5,172,174 | 123,026 | 73,203 | 2.77 | 1.89 | |||||||||||||

| Time deposits | 8,435,172 | 5,718,850 | 284,263 | 133,574 | 4.50 | 3.12 | |||||||||||||

| Interest-bearing deposits | $ | 36,504,005 | $ | 31,655,826 | $ | 997,254 | $ | 621,080 | 3.65 | % | 2.62 | % | |||||||

| Federal Home Loan Bank advances | 3,002,228 | 2,313,571 | 73,099 | 53,970 | 3.25 | 3.12 | |||||||||||||

| Other borrowings | 612,627 | 628,915 | 26,961 | 25,723 | 5.88 | 5.47 | |||||||||||||

| Subordinated notes | 381,813 | 437,543 | 14,384 | 16,502 | 5.03 | 5.04 | |||||||||||||

| Junior subordinated debentures | 253,566 | 253,566 | 15,011 | 14,101 | 7.91 | 7.44 | |||||||||||||

| Total interest-bearing liabilities | $ | 40,754,239 | $ | 35,289,421 | $ | 1,126,709 | $ | 731,376 | 3.69 | % | 2.77 | % | |||||||

| Non-interest-bearing deposits | 10,041,972 | 11,224,841 | |||||||||||||||||

| Other liabilities | 1,589,790 | 1,505,289 | |||||||||||||||||

| Equity | 5,628,346 | 5,008,648 | |||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 58,014,347 | $ | 53,028,199 | |||||||||||||||

| Interest rate spread(4)(7) | 2.61 | % | 2.89 | % | |||||||||||||||

| Less: Fully taxable-equivalent adjustment | (8,820 | ) | (7,357 | ) | (0.02 | ) | (0.02 | ) | |||||||||||

| Net free funds/contribution(8) | $ | 13,810,040 | $ | 14,443,925 | 0.93 | 0.81 | |||||||||||||

| Net interest income/margin (GAAP)(4) | $ | 1,437,387 | $ | 1,367,890 | 3.52 | % | 3.68 | % | |||||||||||

| Fully taxable-equivalent adjustment | 8,820 | 7,357 | 0.02 | 0.02 | |||||||||||||||

| Net interest income/margin, fully taxable-equivalent (non-GAAP)(4) | $ | 1,446,207 | $ | 1,375,247 | 3.54 | % | 3.70 | % | |||||||||||

(1) Includes interest-bearing deposits from banks and securities purchased under resale agreements with original maturities of greater than three months. Cash equivalents include federal funds sold and securities purchased under resale agreements with original maturities of three months or less.

(2) Investment securities includes investment securities classified as available-for-sale and held-to-maturity, and equity securities with readily determinable fair values. Equity securities without readily determinable fair values are included within other assets.

(3) Interest income on tax-advantaged loans, trading securities and investment securities reflects a taxable-equivalent adjustment based on the marginal federal corporate tax rate in effect as of the applicable period.

(4) See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(5) Other earning assets include brokerage customer receivables and trading account securities.

(6) Loans, net of unearned income, include non-accrual loans.

(7) Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities.

(8) Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

TABLE 8: INTEREST RATE SENSITIVITY

As an ongoing part of its financial strategy, the Company attempts to manage the impact of fluctuations in market interest rates on net interest income. Management measures its exposure to changes in interest rates by modeling many different interest rate scenarios.

The following interest rate scenarios display the percentage change in net interest income over a one-year time horizon assuming increases and decreases of 100 and 200 basis points. The Static Shock Scenario results incorporate actual cash flows and repricing characteristics for balance sheet instruments following an instantaneous, parallel change in market rates based upon a static (i.e. no growth or constant) balance sheet. Conversely, the Ramp Scenario results incorporate management’s projections of future volume and pricing of each of the product lines following a gradual, parallel change in market rates over twelve months. Actual results may differ from these simulated results due to timing, magnitude, and frequency of interest rate changes as well as changes in market conditions and management strategies. The interest rate sensitivity for both the Static Shock and Ramp Scenario is as follows:

| Static Shock Scenario | +200 Basis Points | +100 Basis Points | -100 Basis Points | -200 Basis Points | ||||||||

| Sep 30, 2024 | 1.2 | % | 1.1 | % | 0.4 | % | (0.9 | )% | ||||

| Jun 30, 2024 | 1.5 | 1.0 | 0.6 | (0.0 | ) | |||||||

| Mar 31, 2024 | 1.9 | 1.4 | 1.5 | 1.6 | ||||||||

| Dec 31, 2023 | 2.6 | 1.8 | 0.4 | (0.7 | ) | |||||||

| Sep 30, 2023 | 3.3 | 1.9 | (2.0 | ) | (5.2 | ) | ||||||

| Ramp Scenario | +200 Basis Points | +100 Basis Points | -100 Basis Points | -200 Basis Points | |||||||

| Sep 30, 2024 | 1.6 | % | 1.2 | % | 0.7 | % | 0.5 | % | |||

| Jun 30, 2024 | 1.2 | 1.0 | 0.9 | 1.0 | |||||||

| Mar 31, 2024 | 0.8 | 0.6 | 1.3 | 2.0 | |||||||

| Dec 31, 2023 | 1.6 | 1.2 | (0.3 | ) | (1.5 | ) | |||||

| Sep 30, 2023 | 1.7 | 1.2 | (0.5 | ) | (2.4 | ) | |||||

As shown above, the magnitude of potential changes in net interest income in various interest rate scenarios has continued to remain relatively neutral. Given the recent unprecedented rise in interest rates, the Company has made a conscious effort to reposition its exposure to changing interest rates given the uncertainty of the future interest rate environment. To this end, management has executed various derivative instruments including collars and receive fixed swaps to hedge variable rate loan exposures and originated a higher percentage of its loan originations in longer term fixed rate loans. The Company will continue to monitor current and projected interest rates and may execute additional derivatives to mitigate potential fluctuations in the net interest margin in future periods.

TABLE 9: MATURITIES AND SENSITIVITIES TO CHANGES IN INTEREST RATES

| Loans repricing or contractual maturity period | |||||||||||||||

| As of September 30, 2024 | One year or less |

From one to five years |

From five to fifteen years | After fifteen years | Total | ||||||||||

| (In thousands) | |||||||||||||||

| Commercial | |||||||||||||||

| Fixed rate | $ | 442,214 | $ | 3,352,273 | $ | 1,914,643 | $ | 23,532 | $ | 5,732,662 | |||||

| Variable rate | 9,513,446 | 1,585 | — | — | 9,515,031 | ||||||||||

| Total commercial | $ | 9,955,660 | $ | 3,353,858 | $ | 1,914,643 | $ | 23,532 | $ | 15,247,693 | |||||

| Commercial real estate | |||||||||||||||

| Fixed rate | $ | 570,054 | $ | 2,866,473 | $ | 420,951 | $ | 55,521 | $ | 3,912,999 | |||||

| Variable rate | 8,868,451 | 11,899 | 68 | — | 8,880,418 | ||||||||||

| Total commercial real estate | $ | 9,438,505 | $ | 2,878,372 | $ | 421,019 | $ | 55,521 | $ | 12,793,417 | |||||

| Home equity | |||||||||||||||

| Fixed rate | $ | 8,588 | $ | 1,593 | $ | — | $ | 22 | $ | 10,203 | |||||

| Variable rate | 416,840 | — | — | — | 416,840 | ||||||||||

| Total home equity | $ | 425,428 | $ | 1,593 | $ | — | $ | 22 | $ | 427,043 | |||||

| Residential real estate | |||||||||||||||

| Fixed rate | $ | 7,088 | $ | 5,468 | $ | 75,934 | $ | 1,086,008 | $ | 1,174,498 | |||||

| Variable rate | 92,075 | 512,374 | 1,609,091 | — | 2,213,540 | ||||||||||

| Total residential real estate | $ | 99,163 | $ | 517,842 | $ | 1,685,025 | $ | 1,086,008 | $ | 3,388,038 | |||||

| Premium finance receivables – property & casualty | |||||||||||||||

| Fixed rate | $ | 7,049,022 | $ | 82,659 | $ | — | $ | — | $ | 7,131,681 | |||||

| Variable rate | — | — | — | — | — | ||||||||||

| Total premium finance receivables – property & casualty | $ | 7,049,022 | $ | 82,659 | $ | — | $ | — | $ | 7,131,681 | |||||

| Premium finance receivables – life insurance | |||||||||||||||

| Fixed rate | $ | 160,090 | $ | 444,534 | $ | 4,000 | $ | 4,654 | $ | 613,278 | |||||

| Variable rate | 7,383,621 | — | — | — | 7,383,621 | ||||||||||

| Total premium finance receivables – life insurance | $ | 7,543,711 | $ | 444,534 | $ | 4,000 | $ | 4,654 | $ | 7,996,899 | |||||

| Consumer and other | |||||||||||||||

| Fixed rate | $ | 17,226 | $ | 7,218 | $ | 841 | $ | 998 | $ | 26,283 | |||||

| Variable rate | 56,393 | — | — | — | 56,393 | ||||||||||

| Total consumer and other | $ | 73,619 | $ | 7,218 | $ | 841 | $ | 998 | $ | 82,676 | |||||

| Total per category | |||||||||||||||

| Fixed rate | $ | 8,254,282 | $ | 6,760,218 | $ | 2,416,369 | $ | 1,170,735 | $ | 18,601,604 | |||||

| Variable rate | 26,330,826 | 525,858 | 1,609,159 | — | 28,465,843 | ||||||||||

| Total loans, net of unearned income | $ | 34,585,108 | $ | 7,286,076 | $ | 4,025,528 | $ | 1,170,735 | $ | 47,067,447 | |||||

| Less: Existing cash flow hedging derivatives | (6,000,000 | ) | |||||||||||||

| Less: Cash flow hedging derivatives effective in Q4 2024 | (700,000 | ) | |||||||||||||

| Total loans repricing or maturing in one year or less, adjusted for cash flow hedging activity | $ | 27,885,108 | |||||||||||||

| Variable Rate Loan Pricing by Index: | |||||||||||||||

| SOFR tenors | $ | 17,155,288 | |||||||||||||

| 12- month CMT | 6,242,461 | ||||||||||||||

| Prime | 3,545,047 | ||||||||||||||

| Fed Funds | 951,119 | ||||||||||||||

| Ameribor tenors | 237,486 | ||||||||||||||

| Other U.S. Treasury tenors | 196,990 | ||||||||||||||

| Other | 137,452 | ||||||||||||||

| Total variable rate | $ | 28,465,843 | |||||||||||||

SOFR – Secured Overnight Financing Rate.

CMT – Constant Maturity Treasury Rate.

Ameribor – American Interbank Offered Rate.

Graph available at the following link: http://ml.globenewswire.com/Resource/Download/9d3dafaf-55b5-40b8-9717-0f757fa58f36

Source: Bloomberg

As noted in the table on the previous page, the majority of the Company’s portfolio is tied to SOFR and CMT indices which, as shown in the table above, do not mirror the same changes as the Prime rate which has historically moved when the Federal Reserve raises or lowers interest rates. Specifically, the Company has variable rate loans of $13.7 billion tied to one-month SOFR and $6.2 billion tied to twelve-month CMT. The above chart shows:

| Basis Point (bp) Change in | ||||||||||

| 1-month SOFR |

12- month CMT |

Prime | ||||||||

| Third Quarter 2024 | (49 | ) | bps | (111 | ) | bps | (50 | ) | bps | |

| Second Quarter 2024 | 1 | 6 | 0 | |||||||

| First Quarter 2024 | (2 | ) | 24 | 0 | ||||||

| Fourth Quarter 2023 | 3 | (67 | ) | 0 | ||||||

| Third Quarter 2023 | 18 | 6 | 25 | |||||||

TABLE 10: ALLOWANCE FOR CREDIT LOSSES

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||

| Sep 30, | Jun 30, | Mar 31, | Dec 31, | Sep 30, | Sep 30, | Sep 30, | |||||||||||||||||||||

| (Dollars in thousands) | 2024 | 2024 | 2024 | 2023 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Allowance for credit losses at beginning of period | $ | 437,560 | $ | 427,504 | $ | 427,612 | $ | 399,531 | $ | 387,786 | $ | 427,612 | $ | 357,936 | |||||||||||||

| Cumulative effect adjustment from the adoption of ASU 2022-02 | — | — | — | — | — | — | 741 | ||||||||||||||||||||

| Provision for credit losses – Other | 6,787 | 40,061 | 21,673 | 42,908 | 19,923 | 68,521 | 71,482 | ||||||||||||||||||||

| Provision for credit losses – Day 1 on non-PCD assets acquired during the period | 15,547 | — | — | — | — | 15,547 | — | ||||||||||||||||||||

| Initial allowance for credit losses recognized on PCD assets acquired during the period | 3,004 | — | — | — | — | 3,004 | — | ||||||||||||||||||||

| Other adjustments | 30 | (19 | ) | (31 | ) | 62 | (60 | ) | (20 | ) | (15 | ) | |||||||||||||||

| Charge-offs: | |||||||||||||||||||||||||||

| Commercial | 22,975 | 9,584 | 11,215 | 5,114 | 2,427 | 43,774 | 10,599 | ||||||||||||||||||||

| Commercial real estate | 95 | 15,526 | 5,469 | 5,386 | 1,713 | 21,090 | 9,842 | ||||||||||||||||||||

| Home equity | — | — | 74 | — | 227 | 74 | 227 | ||||||||||||||||||||

| Residential real estate | — | 23 | 38 | 114 | 78 | 61 | 78 | ||||||||||||||||||||

| Premium finance receivables – property & casualty | 7,790 | 9,486 | 6,938 | 6,706 | 5,830 | 24,214 | 14,978 | ||||||||||||||||||||

| Premium finance receivables – life insurance | 4 | — | — | — | 18 | 4 | 173 | ||||||||||||||||||||

| Consumer and other | 154 | 137 | 107 | 148 | 184 | 398 | 447 | ||||||||||||||||||||

| Total charge-offs | 31,018 | 34,756 | 23,841 | 17,468 | 10,477 | 89,615 | 36,344 | ||||||||||||||||||||

| Recoveries: | |||||||||||||||||||||||||||

| Commercial | 649 | 950 | 479 | 592 | 1,162 | 2,078 | 2,059 | ||||||||||||||||||||

| Commercial real estate | 30 | 90 | 31 | 92 | 243 | 151 | 368 | ||||||||||||||||||||

| Home equity | 101 | 35 | 29 | 34 | 33 | 165 | 105 | ||||||||||||||||||||

| Residential real estate | 5 | 8 | 2 | 10 | 1 | 15 | 11 | ||||||||||||||||||||

| Premium finance receivables – property & casualty | 3,436 | 3,658 | 1,519 | 1,820 | 906 | 8,613 | 3,110 | ||||||||||||||||||||

| Premium finance receivables – life insurance | 41 | 5 | 8 | 7 | — | 54 | 9 | ||||||||||||||||||||

| Consumer and other | 21 | 24 | 23 | 24 | 14 | 68 | 69 | ||||||||||||||||||||

| Total recoveries | 4,283 | 4,770 | 2,091 | 2,579 | 2,359 | 11,144 | 5,731 | ||||||||||||||||||||

| Net charge-offs | (26,735 | ) | (29,986 | ) | (21,750 | ) | (14,889 | ) | (8,118 | ) | (78,471 | ) | (30,613 | ) | |||||||||||||

| Allowance for credit losses at period end | $ | 436,193 | $ | 437,560 | $ | 427,504 | $ | 427,612 | $ | 399,531 | $ | 436,193 | $ | 399,531 | |||||||||||||