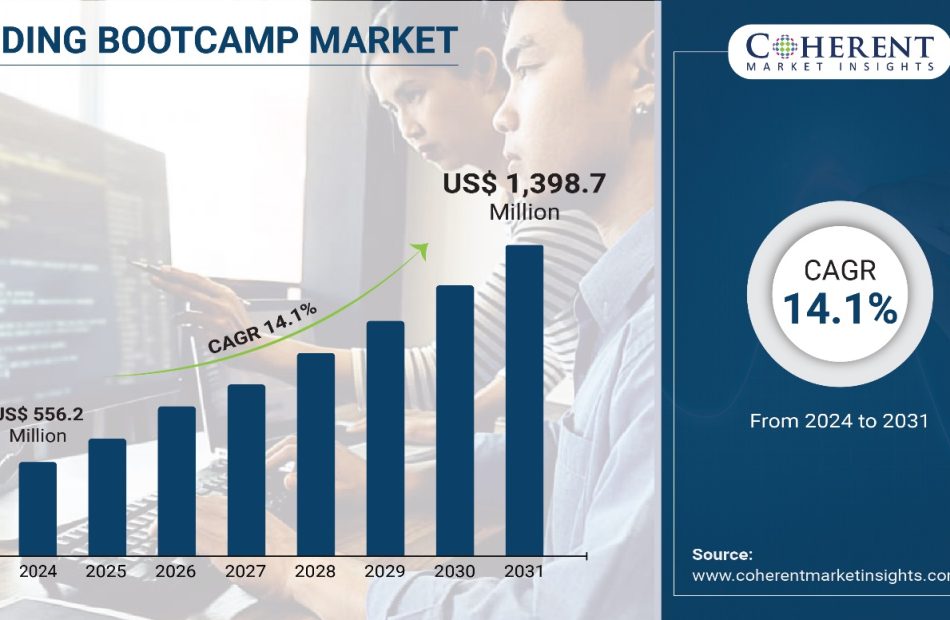

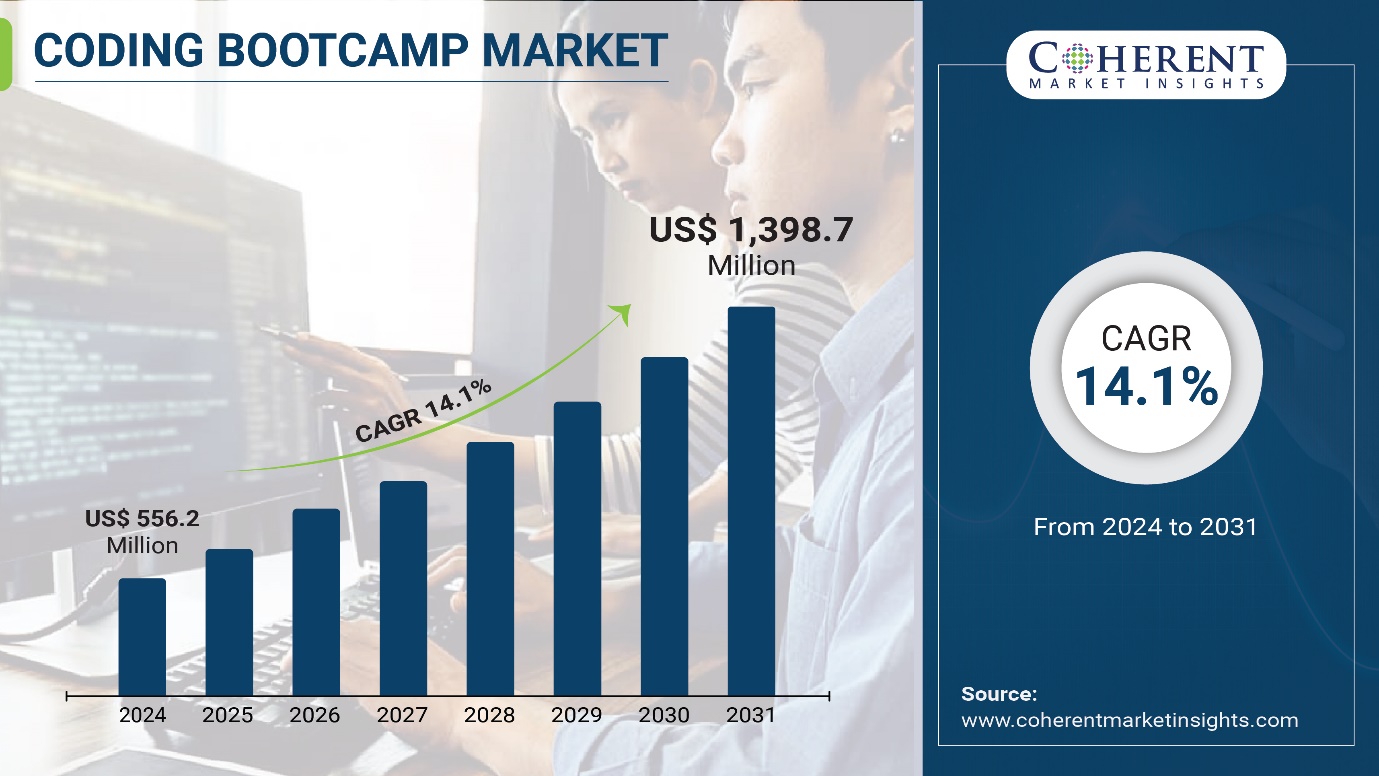

Coding Bootcamp Market Forecast to Expand at a 14.1% CAGR, to reach US$ 1,398.7 Million by 2031, says Coherent Market Insights

Burlingame, Oct. 21, 2024 (GLOBE NEWSWIRE) — The global Coding Bootcamp Market Size to Grow from US$ 556.2 Million in 2024 to US$ 1,398.7 Million by 2031, at a Compound Annual Growth Rate (CAGR) of 14.1% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Rising adoption of online learning and demand for technical skills. Online coding bootcamps have gained immense popularity as they provide flexibility to students to learn technical skills as per their own schedule and are more cost-effective compared to traditional degree programs.

Request Sample Copy of this Report: https://www.coherentmarketinsights.com/insight/request-sample/7261

Market Dynamics

Rising demand for programmers and developers in the IT sector drives the market growth. There is a huge shortage of skilled programmers globally. This due to growing digital transformation of businesses. Coding bootcamp helps to bridge this skill gap by offering intensive courses. It helps to learn programming and web development skills in a very short time span. Coding bootcamp create job-ready candidates within 3-6 months. It helps industries to fulfil their talent requirements.

The other driver for the market growth is increasing investment by venture capital firms in coding bootcamp startups. Many new players are entering the market with cutting-edge learning models and technologies. This innovation is drawing large investment.

Coding Bootcamp Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $556.2 million |

| Estimated Value by 2031 | $1,398.7 million |

| Growth Rate | Poised to grow at a CAGR of 14.1% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Program Type, By Delivery Mode, By Subject Focus |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Flexible learning formats and affordable costs • Strong industry connections and guaranteed jobs |

| Restraints & Challenges | • Lack of accreditation from colleges and universities • High dropout rates from intensive programs |

Market Trends

Hands-on learning and full-time immersive bootcamps are gaining popularity in the coding bootcamp market. These bootcamps offer in-person instructions, group projects, portfolio building, and one-on-one mentorship to students. These help participants to gain actual experience of real-life software development projects.

Many top bootcamps are also partnering with companies to provide job placements and internships to students. Furthermore, new bootcamp specializations are introduced in various fields. It includes Data Science, UI/UX Design, Cloud & DevOps. This is a key trend witnessed in the market. As these technologies open new career avenues, these bootcamps are attracting more enrollments.

Coding bootcamps produce job-ready candidates within 3-6 months which is helping industries to fulfill their talent requirements. The other driver for the market growth is increasing investment by venture capital firms in coding bootcamp startups.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7261

Market Opportunities

Full-time immersive programs account for the largest share of coding bootcamp market. These programs are intense, usually lasting anywhere between 3-6 months. Students attend classes for 20-40 hours a week to learn coding skills intensively. These programs have a high time commitment. However, students learn skills at an accelerated pace.

Online and distance learning programs are gaining popularity due to their flexible structure. These programs allow students to learn coding from the convenience of their home or anywhere with an internet connection. These programs offer maximum flexibility to juggle learning with work or family commitments. The self-paced nature also appeals to many students.

Key Market Takeaways

The global coding bootcamp market is anticipated to witness a CAGR of 14.1% during the forecast period 2024-2031. This is owing to rapid digitalization across industries and growing demand for coding skills.

On the basis of program type, full-time immersive programs segment is expected to hold 42.6% shares in 2024. This owing to intensive hands-on learning and faster skill acquisition.

On the basis of delivery mode, in-person bootcamps are expected to be the most popular. This is owing to live instructor interactions and peer support. However, online bootcamps are growing rapidly.

On the basis of subject focus, full-stack web development programs dominate due to their versatility.

North America is expected to hold the largest share due to early adoption of bootcamp programs in the region.

Competitors Insights:

Key players operating in the coding bootcamp market include:

- Bloc

- Coding Dojo

- Flatiron School

- General Assembly

- Thinkful

- Hack Reactors

- Ironhack

- Le Wagon

- Tech Elevator

- The Tech Academy

Coding Bootcamp Industry News

In February 2023, HyperionDev, announced its partnership with Imperial Colllege London. HyperionDev is a leading online coding bootcamp provider. The partnership aims to deliver its portfolio of high-impact, outcomes-oriented online learning programs in web development and data science.

In May 2022, Galvanize announced its acquisition of Hack Reactor for its rigorous software engineering programs.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7261

Detailed Segmentation-

Program Type Insights (Revenue, US$ Mn, 2019 – 2031)

- Full-Time Immersive Programs

- Part-Time Programs

- Online/Distance Learning Programs

Delivery Mode Insights (Revenue, US$ Mn, 2019 – 2031)

- In-Person Bootcamps

- Online Bootcamps

Subject Focus Insights (Revenue, US$ Mn, 2019 – 2031)

- Full-Stack Web Development

- Data Science and Analytics

- Mobile App Development

- Cybersecurity

- Other Specialized Programs (e.g. UX/UI, DevOps)

Regional Insights (Revenue, USD Mn, 2019 – 2031)

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Information and Communication Technology Domain:

The global Advanced Video Coding (AVC) Market size was valued at USD 3.46 Billion in 2023 and is expected to reach USD 4.79 Billion by 2030, growing at a CAGR of 4.8%.

The global geospatial analytics market size was valued at US$ 59.46 Billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030.

The global Video Transcoding Market Size, Share, Outlook, and Opportunity Analysis, 2024-2031

The global video streaming market is expected to reach a value of US$ 36.29 Bn by 2030 at a CAGR of 19.3% between 2023 and 2030.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Don't Get Caught Holding 7 Stocks About To Shrink 30% Or More

Earnings season for most S&P 500 companies is a time to post impressive growth. But a cohort of companies is about to shrink instead — something to watch out for if you’re a growth investor.

↑

X

Beating The Market: How To Find Outperforming Stocks

Seven stocks in the index, including Microchip Technology (MCHP), American International Group (AIG) and General Electric (GE), are expected to post a revenue drop of at least 30% for the third quarter, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge.

Such a big fall in revenue by these stocks stands out in a bad way. The S&P 500 itself is seen reporting 4.7% revenue growth in the third quarter, says John Butters of FactSet.

S&P 500 Sectors Trailing In Growth

Most S&P 500 sectors will post growth in the quarter. But not all.

Few investors will be surprised to find that information technology stocks will post the strongest growth: 11.7%, says FactSet. But it’s easy to overlook the fact two sectors, industrials and energy, are forecast to shrink. Analysts think industrial companies’ revenue will shrink 0.1%. And energy companies’ revenue are expected to contract 4.9%.

Given tech’s strong growth, Microchip Technology is an outlier — in a bad way. Analysts expect the company to post quarterly revenue of $1.2 billion. That’s down nearly 49% from the same year-ago period. Such a poor outlook helps explain the stock’s 14.4% drop this year, manifesting in a 17 RS Rating. The 41 EPS Rating is low, too, as earnings are seen coming in down 18% this year.

Falling Revenue In S&P 500

Financials in the S&P 500 are expected to have a decent third quarter for growth. Analysts think the sector will show 4.9% top-line growth. But that’s even with AIG as an anchor.

The insurance giant is seen posting revenue of $6.8 billion in the quarter. That’s down 47% from the same year-ago period. Investors, though, don’t seem overly concerned yet. Shares are still up nearly 16% this year so far. AIG, as a result, sports an RS Rating of 61. Holding up the stock, somewhat, is decent profit growth despite contracting revenue. Analysts think the company’s bottom line will shrink just 6% in 2024 before growing 34% in 2025.

And sometimes shrinking is desirable. Shares of General Electric are up 51% this year. That’s even as analysts think the company’s revenue in the third quarter will contract 46%. The company has unlocked shareholder value by splitting itself up into several companies. That forces each unit of the old GE to be competitive and also allocate its resources efficiently. GE carries an impressive RS Rating of 95 and EPS Rating of 85. Earnings are seen rising 30% this year and 23% next year.

Shrinking isn’t always bad, as GE shows. But it’s not ideal if you’re looking for growth opportunities.

S&P 500 Companies Expected To Shrink Most

Based on third-quarter revenue forecasts

| Company | Ticker | Revenue decline (est.) | Sector |

|---|---|---|---|

| Microchip Technology | MCHP | -48.9% | Information Technology |

| American International Group | AIG | -47.0% | Financials |

| General Electric | GE | -45.9% | Industrials |

| Albemarle | ALB | -40.9% | Materials |

| Moderna | MRNA | -32.8% | Health Care |

| Deere | DE | -32.7% | Industrials |

| Fidelity National Information Services | FIS | -30.6% | Financials |

Sources: IBD, S&P Global Market Intelligence

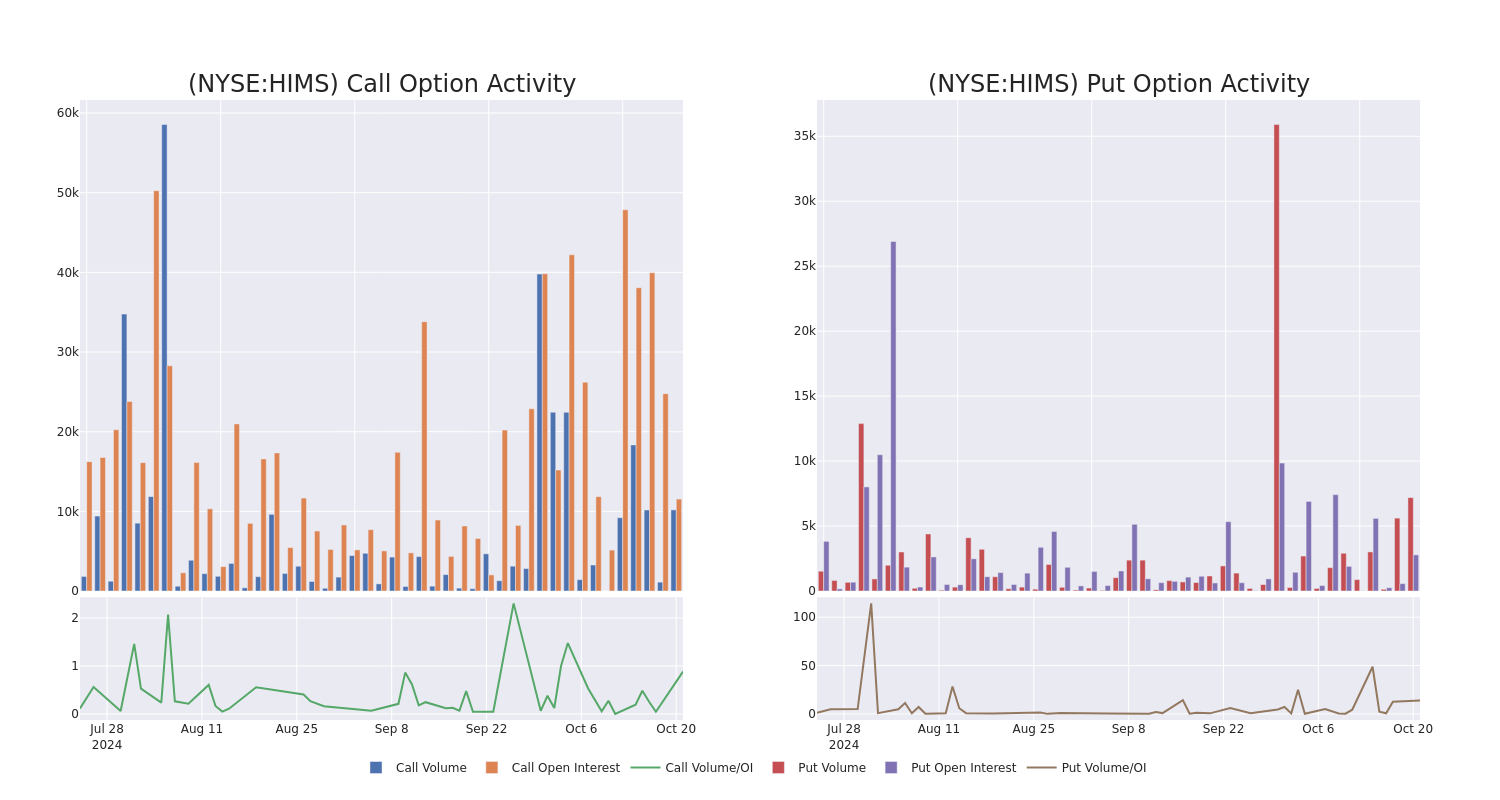

This Is What Whales Are Betting On Hims & Hers Health

Investors with a lot of money to spend have taken a bullish stance on Hims & Hers Health HIMS.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with HIMS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

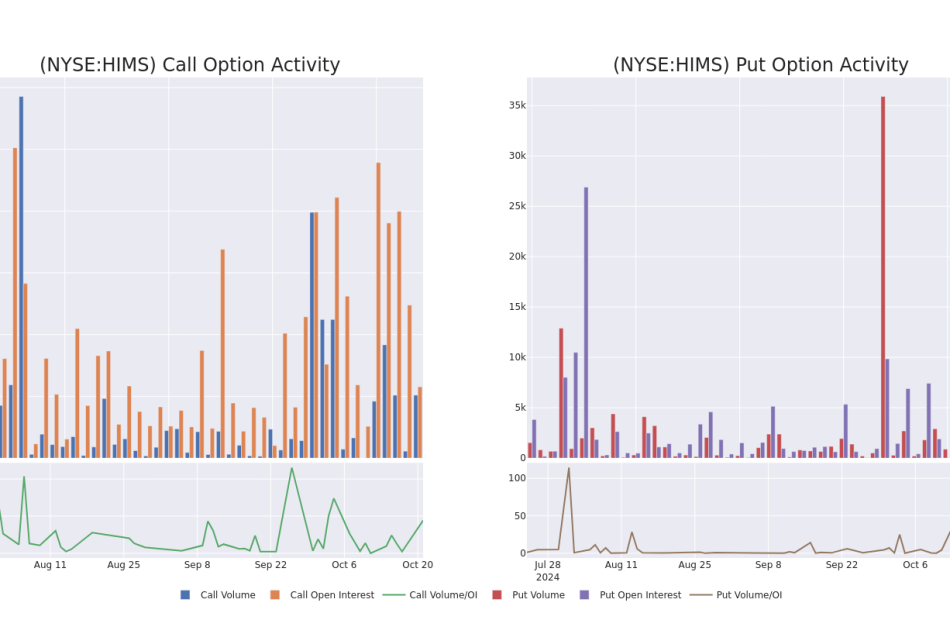

Today, Benzinga‘s options scanner spotted 34 uncommon options trades for Hims & Hers Health.

This isn’t normal.

The overall sentiment of these big-money traders is split between 38% bullish and 26%, bearish.

Out of all of the special options we uncovered, 12 are puts, for a total amount of $742,170, and 22 are calls, for a total amount of $1,554,886.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $7.0 and $30.0 for Hims & Hers Health, spanning the last three months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Hims & Hers Health options trades today is 1432.7 with a total volume of 17,328.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Hims & Hers Health’s big money trades within a strike price range of $7.0 to $30.0 over the last 30 days.

Hims & Hers Health Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HIMS | PUT | SWEEP | BULLISH | 01/16/26 | $5.2 | $5.1 | $5.1 | $20.00 | $255.0K | 354 | 1.0K |

| HIMS | CALL | TRADE | BEARISH | 01/16/26 | $5.9 | $5.8 | $5.8 | $30.00 | $173.4K | 2.1K | 700 |

| HIMS | CALL | SWEEP | BULLISH | 11/08/24 | $2.05 | $1.95 | $2.05 | $23.50 | $102.5K | 0 | 526 |

| HIMS | PUT | SWEEP | BULLISH | 01/16/26 | $5.3 | $5.1 | $5.1 | $20.00 | $87.7K | 354 | 1.2K |

| HIMS | CALL | SWEEP | BULLISH | 01/17/25 | $8.2 | $8.2 | $8.2 | $15.00 | $85.2K | 5.0K | 1.2K |

About Hims & Hers Health

Hims & Hers Health Inc is a multi-specialty telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more.

In light of the recent options history for Hims & Hers Health, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Hims & Hers Health Standing Right Now?

- With a trading volume of 4,792,748, the price of HIMS is up by 4.27%, reaching $23.09.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 14 days from now.

What The Experts Say On Hims & Hers Health

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $24.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from B of A Securities has decided to maintain their Buy rating on Hims & Hers Health, which currently sits at a price target of $25.

* An analyst from B of A Securities has decided to maintain their Buy rating on Hims & Hers Health, which currently sits at a price target of $23.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Hims & Hers Health options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alcoholic Beverages Market Size Forecasted to Hit USD 3.1 Trillion by 2032 at a CAGR of 6.8%, Driven by Growing Consumer Demand | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Oct. 21, 2024 (GLOBE NEWSWIRE) — The global alcoholic beverages market is estimated to flourish at a CAGR of 6.8% from 2024 to 2032. Transparency Market Research projects that the overall sales revenue for alcoholic beverages is estimated to reach US$ 3.1 trillion by the end of 2032.

A prominent driver is the influence of experiential marketing and immersive brand experiences. Companies are increasingly investing in creating unique and memorable experiences for consumers through events, tastings, and interactive pop-up activations. By engaging with consumers on a deeper level and forging emotional connections with their brands, companies can foster brand loyalty and differentiate themselves in the competitive market landscape.

The rise of cannabis-infused beverages presents a novel opportunity for the alcoholic beverages market. With the legalization of cannabis in many regions, companies are exploring the integration of cannabis extracts into beverages, offering consumers a new category of products with unique flavor profiles and potential health benefits. This convergence of the alcoholic beverages and cannabis industries opens up new avenues for innovation and market growth.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=33

Key Findings of the Market Report

- Beer remains the leading product type segment in the alcoholic beverages market, capturing the largest share of global consumption and sales.

- Glass bottles maintain dominance in the alcoholic beverages market, valued for their premium image, recyclability, and ability to preserve taste and quality.

- Online retailers emerge as the leading sales channel in the alcoholic beverages market, offering convenience, wide product selections, and personalized shopping experiences.

Alcoholic Beverages Market Growth Drivers & Trends

- Rising demand for high-quality, premium beverages driven by affluent consumers seeking unique flavors, craftsmanship, and luxury experiences.

- Increasing interest in low-alcohol and non-alcoholic alternatives as consumers prioritize wellness and moderation in their drinking habits.

- Growing popularity of craft beer, spirits, and artisanal cocktails as consumers seek authenticity, innovation, and local flavors.

- The digitalization of alcohol sales, offering convenience, variety, and personalized recommendations to consumers through online platforms and delivery services.

- Growing consumer awareness and demand for eco-friendly packaging, organic ingredients, and sustainable production practices in the alcoholic beverages industry.

Global Alcoholic Beverages Market: Regional Profile

- North America boasts a mature market, driven by a rich tradition of beer and spirits consumption. While beer remains popular, there’s a growing interest in craft spirits and premium wine. The region’s diverse demographics and sophisticated tastes contribute to a dynamic market landscape.

- Western Europe is synonymous with wine culture, with countries like France, Italy, and Spain leading global production. Beer also holds a significant share, especially in Germany and the UK. Premiumization trends drive demand for high-quality products, while sustainability concerns fuel interest in organic and artisanal offerings.

- In East Asia, a rapidly growing market reflects changing lifestyles and rising incomes. China and Japan lead consumption, with a preference for spirits like Baijiu and Shochu, alongside beer and wine. Urbanization and westernization influence consumer choices, with younger generations embracing international brands and cocktail culture.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=33

Alcoholic Beverages Market: Competitive Landscape

In the competitive landscape of the alcoholic beverages market, global giants such as Diageo, Anheuser-Busch InBev, and Pernod Ricard dominate with diverse portfolios spanning spirits, beer, and wine. Craft breweries and distilleries, like BrewDog and Suntory, challenge traditional players with innovative flavors and small-batch production.

Regional players, such as Asahi Group in Asia and Constellation Brands in North America, cater to local tastes while expanding their global footprint. The rise of low-alcohol and non-alcoholic alternatives, along with increasing consumer demand for premiumization and sustainability, further intensifies competition, driving innovation and shaping the future of the industry. Some prominent players are as follows:

- Carlsberg A/S

- Heineken Holding N.V.

- Diageo Plc.

- ASAHI GROUP HOLDINGS, LTD.

- SUNTORY HOLDINGS LIMITED

- Halewood Sales

- Brown-Forman

- Bacardi Limited

- Anheuser-Busch Companies, LLC.

- Bundaberg Brewed Drinks

- Constellation Brands, Inc.

- United Breweries Ltd.

Product Portfolio

- Halewood Sales is a renowned producer and distributor of premium spirits, wines, and craft beers. With a rich heritage and commitment to quality, Halewood offers a diverse portfolio of brands that captivate discerning consumers around the globe, delivering exceptional taste and memorable experiences.

- Brown-Forman, a leading spirits company, boasts an illustrious portfolio featuring iconic brands such as Jack Daniel’s, Woodford Reserve, and Finlandia. With a legacy of craftsmanship and innovation, Brown-Forman sets the standard for excellence in the spirits industry, delighting consumers worldwide.

Alcoholic Beverages Market: Key Segments

By Product Type

By Packaging

- Glass Bottles

- Tins

- Plastic Bottles

- Others

By Sales Channel

- Modern Trade

- Specialty Stores

- Convenience Stores

- Commercial

- Hotels/Restaurants/Bars

- Online Retailers

- Other Retailing Formats

By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- East Asia

- South Asia

- Oceania

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=33<ype=S

More Trending Reports by Transparency Market Research –

- Tea & Tea Based Beverages Market – The global tea & tea based beverages market (Markt für Tee und Teegetränke) is projected to advance at a CAGR of 4.9% from 2024 to 2028.

- Ready-to-Drink Beverages Market – The global ready-to-drink beverages market (Markt für Fertiggetränke) is projected to expand at a CAGR of 6.6% during the forecast period from 2022 to 2032.

- Arak Market – The global arak market (Arak-Markt) is projected to rise at a CAGR of 3.6% from 2024 to 2028.

- Brazil Flavored and Functional Water Market – The Brazil flavored and functional water market is expected to rise at a 7.3% CAGR from 2024 to 2028.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart's relocation mandate just sent a Sam’s Club executive rushing for the exit

It’s been months since Walmart (WMT) said it would require corporate employees to relocate to its headquarters in Arkansas or risk losing their jobs — but that decision is now pushing some executives to resign.

That’s been the case for Cheryl Ainoa, the chief technology officer at Walmart-owned Sam’s Club, who said she is leaving her position after almost five years because she doesn’t want to relocate to the retail giant’s home base in Bentonville, the retail giant confirmed to Quartz in an email.

In May, Walmart announced plans to eliminate thousands of corporate roles in Texas and California, requiring remote workers to relocate to one of its three main hubs in Arkansas, New Jersey, or Northern California. This decision sent shockwaves through the workforce, particularly for the 300 employees who learned during a Zoom call — where they were not permitted to speak — that they would need to move or face potential job termination.

Aiona, who helped oversee innovations such as the exit technology that allows customers to leave the warehouses without receipt checks, will remain in her position until February. She will be succeeded by Sanjay Radhakrishnan, Walmart’s senior vice president of global technology.

Walmart and Sam’s Club did not immediately respond to Quartz’s request for comment.

Earlier this year, Walmart said it would allow certain employees to work remotely, but only part-time. In an employee memo, chief people officer Donna Morris emphasized that in-person collaboration would enhance workforce effectiveness, foster innovation, and strengthen company culture.

Layoffs for employees who hadn’t yet relocated began on Aug. 9.

Since then, the retail giant has aimed to address its worker shortage with a pipeline program designed to funnel hourly employees into higher-level positions. As part of the three-year initiative, the company hopes it can train and certify workers to fill roles as pharmacy technicians, opticians, and software engineers.

ARC Capital Venture LLC Highlights Growing Investor Confidence in U.S. Fixed Income Market

CHICAGO, Oct. 21, 2024 (GLOBE NEWSWIRE) — ARC Capital Venture LLC has highlighted a renewed wave of investor optimism in the U.S. fixed income market, driven by positive economic indicators and a growing belief in the Federal Reserve’s ability to guide the economy toward a “soft landing.” With inflows into fixed-income assets reaching record highs, this revival underscores the strength and stability of bonds as a viable investment strategy.

The latest data shows that leading financial institutions, including BlackRock, JPMorgan Chase, and Pimco, have experienced unprecedented growth in their bond portfolios. In the third quarter alone, U.S. bond funds saw an impressive $123 billion in inflows, with $93 billion directed towards exchange-traded funds (ETFs). These figures reflect the renewed confidence of investors who are seeking reliable returns and a hedge against potential stock market volatility.

ARC Capital has observed similar trends among it’s clients, many of whom are shifting from cash savings to fixed income, recognizing bonds as a key component of their portfolios. This trend is largely fuelled by the Federal Reserve’s recent easing of interest rates and the broader realization that high-quality bonds provide essential diversification in periods of economic stress.

“The current bond market is demonstrating remarkable resilience and appeal,” said Nicos Kezarides, Chief Executive Officer at ARC Capital Venture LLC. “We’re seeing more investors re-enter the fixed-income space as interest rates decline, with bonds offering competitive yields that are particularly attractive compared to traditional savings products. This environment is creating an ideal opportunity for investors to benefit from the stability and potential returns offered by bonds.”

The market’s positive momentum is further supported by the fact that, despite global uncertainties, major financial institutions have continued to report strong inflows. Pimco, for instance, recently reached $2 trillion in assets under management for the first time since 2022, marking a significant milestone for the bond giant.

As the Federal Reserve continues to adjust its policies, ARC Capital anticipates that the fixed-income market will see sustained growth, particularly for longer-duration bonds that offer attractive yields in a normalized rate environment. The broad appeal of both active and passive bond strategies underscores the democratization of fixed-income investing, making it accessible to a wider range of investors.

“Bonds are increasingly being seen as a crucial tool for portfolio diversification, and we expect this trend to accelerate as the economy stabilizes,” added Nicos Kezarides. “At ARC Capital, we are committed to helping our clients navigate this evolving landscape, providing them with the insights and investment opportunities needed to succeed in the fixed income space.”

For more information on ARC Capital services and market insights, please visit www.arc-capital.com or contact our team at info@arc-capital.com.

This press release does not provide general or personal financial product advice, nor does it constitute a recommendation to engage in transactions or invest in fixed income securities. It should not be considered as a solicitation. Before making any investment decisions related to fixed-income securities, investors are advised to consult with their financial adviser and seek independent tax advice, considering their individual needs and financial circumstances.

Media Relations

ARC Capital Venture LLC

Max Harrington, Head of Marketing

max.harrington@arc-capital.com

+1 (312) 820-1040

10 South Riverside Plaza

Suite 875

Chicago, IL 60606

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

V INVESTOR NEWS: Visa Inc. Investors that Suffered Losses are Encouraged to Contact RLF About Ongoing Investigation into the Company (NYSE: V)

NEW YORK, Oct. 21, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, continues to investigate potential securities claims on behalf of shareholders of Visa Inc. V resulting from allegations that Visa may have issued materially misleading business information to the investing public.

So What: If you purchased Visa securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=29131 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On September 24, 2024, during market hours, The United States Department of Justice issued a release entitled “Justice Department Sues Visa for Monopolizing Debit Markets.” In this release, the DOJ announced it “filed a civil antitrust lawsuit today against Visa for monopolization and other unlawful conduct in debit network markets[.]” The release further stated the “complaint alleges that Visa illegally maintains a monopoly over debit network markets by using its dominance to thwart the growth of its existing competitors and prevent others from developing new and innovative alternatives.”

The release quoted Attorney General Merrick Garland as stating “[w]e allege that Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market[.] Merchants and banks pass along those costs to consumers, either by raising prices or reducing quality or service. As a result, Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.”

On this news, Visa’s stock fell 5.4% on September 24, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

THE MILESTONE GROUP ACQUIRES TWO APARTMENT COMMUNITIES TOTALING 676 UNITS IN FREDERICKSBURG, VA

FREDERICKSBURG, Va., Oct. 21, 2024 /PRNewswire/ — The Milestone Group (“Milestone”) announces the acquisition of two Fredericksburg, VA apartment communities, Kensington Crossing with 476 units, and Magnolia Falls with 200 units. The purchase prices were not disclosed.

“These two assets are very well positioned in a highly sought-after submarket near abundant retail and dining options, and their proximate locations allow for meaningful operating efficiencies,” said Milestone Vice President of Acquisitions, Jason Wise. “Our plans for the assets include enhancement of all common areas and amenities that will immediately boost the resident experience. Furthermore, Milestone assumed the existing loans on both, allowing for a quick and seamless transaction.”

About the Properties

The properties, located in rapidly growing Stafford County, are conveniently located on US-17 near the I-95 interchange. Immediate retail options include Target, Walmart, Giant Food, Lowe’s, Starbucks, and Chick-fil-A. A myriad of options located at nearby Central Park, Spotsylvania Town Centre, and Downtown Fredericksburg are all within 15 minutes.

Kensington Crossing has 476 fully-renovated one-, two- and three-bedroom units that feature stainless steel appliances, granite countertops, and faux-wood flooring throughout the units. Residents enjoy amenities including two swimming pools, tennis and sports courts, two fitness centers, a cabana lounge, and covered parking.

Magnolia Falls features 200 fully-renovated one- and two-bedroom units also including stainless appliances, granite countertops, and faux-wood flooring throughout. Residents have access to a swimming pool with sundeck, playground, dog park, sport court, and fitness center.

About Milestone

The Milestone Group is a leading, privately held real estate investment management firm with strong expertise and focus on value-add multifamily assets in major metropolitan markets of the United States. Founded in 2003, Milestone has created trust and confidence with its investors through successfully navigating multiple economic cycles across over $9 billion of multifamily investments totaling more than 90,000 units. Milestone invests through a series of discretionary equity funds and has corporate offices in Dallas, TX, Boca Raton, FL, and Atlanta, GA. For more information, please visit www.milestonegp.com or contact investorrelations@milestonegp.com.

![]() View original content:https://www.prnewswire.com/news-releases/the-milestone-group-acquires-two-apartment-communities-totaling-676-units-in-fredericksburg-va-302281871.html

View original content:https://www.prnewswire.com/news-releases/the-milestone-group-acquires-two-apartment-communities-totaling-676-units-in-fredericksburg-va-302281871.html

SOURCE The Milestone Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.