Can I Retire at 62 with $500k in My Roth and $2,000 from Social Security and Pension?

Ultimately, whether you have enough to retire depends on your costs and your income.

If you can live on a tight budget with the right circumstances, $2,000 a month from a pension and Social Security, combined with the right strategy with $500,000 in your Roth IRA may be enough to sustain you throughout your retirement. But it’s important to consider the opportunity cost between retiring now and working and investing for a few more years, as it may determine your quality of life in retirement.

Your retirement plan depends on your specific circumstances. Talk to a financial advisor about your goals today.

Weighing the Opportunity Cost of the Next Few Years

Steve Davis, CEO of Total Wealth Academy recommends waiting a few years to shore up your retirement portfolio at this point, in order to let your Roth IRA and Social Security benefit grow.

“The average female lives 18.5 years in retirement. That is less than $2,000 a month from the IRA or $4,000 a month total. That is not enough for the basics let alone romance, travel, and fun… [Instead] I would pull the money out of the IRA, leaving maybe $400,000. Get it invested in income producing assets.”

“I would also keep working until 70 at least, to buy additional assets before retiring to get that up to about $10,000 a month [because] $12,000 a month would be a pretty high quality of lifestyle in retirement,” he told SmartAsset.

There are three important issues here:

-

By retiring early you are giving your portfolio less time to grow and will spend more time making withdrawals.

-

A $500,000 Roth IRA is a small portfolio. Using the 4% rule, it can only generate $20,000 per year/$1,667 per month. This is tight for an individual and probably unworkable for a couple.

-

You are not maximizing your Social Security. At age 62, you will receive 70% of your total potential benefits each month, cutting your lifetime income significantly.

Remember, you may need to finance a long life, and you may incur unexpected expenses during retirement. A $1,667 monthly rate of withdrawal will last 25 years, taking you to age 87. That leaves you less than $4,000 per month in total, with the realistic possibility of that portfolio running out.

For many people, this is not a good plan.

A financial advisor can help you develop a sustainable retirement plan.

How To Fix A Small Portfolio

As Davis suggested, you actually are in a good position to retire, just not to retire early. With a few more years, you can have a very comfortable retirement.

Maximize Your Social Security

We don’t know how your monthly income is distributed between pension and benefits, but on average a retiree collects $1,793 per month in full Social Security benefits. Retiring at 62 would reduce that by 30% to $1,255. So we assume a $1,255 Social Security payment and a $745 pension.

If you wait until age 70 to retire, your benefits will increase to 124%. That would boost an average payment to $2,223. Add your pension, and you have a $2,968 monthly income. That alone is almost as much your entire income at 62, without even considering your Roth IRA.

Grow Your Portfolio

Your Roth IRA has two key advantages. First, by not paying taxes on your withdrawals you functionally increase the value of this account by 6% to 11% on average. Second, right now it has hit its era of peak growth. Maximize that.

Let’s assume you contribute nothing extra to this portfolio and leave it in an S&P 500 index fund, with the market’s average annual return of 10%. If you wait until age 70 to retire, this portfolio could be worth as much as $1.07 million. If you take a slightly more conservative approach, investing in 60% stocks and 40% bonds, you might expect an 8.7% rate of return and a final portfolio of $974,555.

These numbers can fuel a very comfortable retirement. For example, say you took that entire $974,555 and bought a lifetime annuity on your 70th birthday. That could generate a $7,321 monthly income. Add in your benefits and pension and you can retire on $10,289 per month.

Yes, eight more years is a long time to work and wait. But your retirement will be even longer. With just a little more patience, you can make it a great one. Discuss your plan with a financial advisor to find the most efficient path to retirement.

Bottom Line

You have half a million dollars in a Roth IRA and $2,000 in a pension and benefits. You are close to a fantastic retirement, but at age 62 you likely aren’t quite there yet.

Retirement Income Tips

-

Annuities are an interesting product. On the one hand, they can cost you some potential gains. You’ll get less from an annuity than you might from the market. On the other hand, they guarantee you an income for life, which is a promise you can’t get from any other investment class. So… are they right for you?

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Morsa Images

The post I Have $500k in a Roth IRA, and Will Receive a Combined $2,000 a Month From a Pension and Social Security. Can I Retire at 62? appeared first on SmartReads by SmartAsset.

Warren Buffett Says He Wouldn't Be Successful Today If He Didn't Take This $100 College Class: 'I Was That Terrified'

It’s well known that legendary investor Warren Buffett answers investor questions for hours every year at Berkshire Hathaway Inc’s (NYSE: BRK-A) (NYSE: BRK-B) annual meeting of shareholders. But most don’t know that such wouldn’t have been possible in Buffett’s early days.

If it weren’t for a $100 college course he took when he was 20 years old, the “Oracle of Omaha” might have shorted his own success.

Don’t Miss:

What To Know: Buffett had an extreme fear of public speaking up until the age of 20, according to a report from CNBC.

“Just the thought of it made me physically ill. I would literally throw up,” Buffett told CNBC contributor and “Getting There” author Gillian Zoe Segal.

In his early college days, Buffett would select certain classes to avoid having to present in front of his classmates. Furthermore, he designed his schedule so he wouldn’t have to be in front of crowds.

He told Segal that he could barely even introduce himself whenever he found himself in a situation that required him to speak in front of others.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Buffett set out to change that when he saw an ad for a Dale Carnegie public speaking course at Columbia’s Business School. He signed up and even wrote a check to cover the costs, but shortly after, he reneged on his intentions.

“I just couldn’t do it. I was that terrified,” the Berkshire CEO said.

Not long after Buffett graduated, he came across the exact same ad in the paper and set out to sign himself up again, with one key difference in his approach.

“This time, I handed the instructor $100 in cash. I knew if I gave him the cash I’d show up,” Buffett said.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

He did show up, and he discovered that about 30 other people had the same problem he did, he said: “We all had trouble saying our own names.”

By the time he finished the 12-week course, he was ready to put his skills to the test. He applied for a teaching position at the University of Omaha right away, knowing that if he didn’t keep at it, he would risk giving up the progress he had made in the public speaking class.

“I just kept doing it, and now you can’t stop me from talking,” Buffett told Segal with a laugh.

The report indicates that the Berkshire CEO credits much of his success to the public speaking class, which is a lot of praise for someone as successful as the Oracle himself.

According to Bloomberg, Buffett is the eighth-richest person in the world, with an estimated net worth of $145 billion at the time of writing. His fund has historically outperformed the S&P 500, delivering nearly 20% compounded annual returns since Buffett took control of Berkshire in 1965.

Read Next:

Photo: Fortune Live Media from Flickr.

Some elements of this story were previously reported by Benzinga and it has been updated.

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Warren Buffett Says He Wouldn’t Be Successful Today If He Didn’t Take This $100 College Class: ‘I Was That Terrified’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NBA Icon Shaquille O'Neal Says An Accidental Babysitting Gig Led To His Early Investment In Google – 'You're Good With Kids. I Like You.'

Shaquille O’Neal, the former NBA superstar, has seen his fair share of investments. Still, one of his most notable financial decisions came through babysitting – something he didn’t expect to be doing. In an interview with Ellen DeGeneres, O’Neal detailed how this casual encounter led to one of his most lucrative opportunities. However, not all of his investments began as favorably.

Don’t Miss

Discussing his ventures, O’Neal recounted what he considers his “worst investment ever.” He had a chance to partner with Starbucks when its CEO, Howard Schultz, proposed expanding into African American communities. O’Neal explained his initial skepticism: “So, me growing up, I’d never seen Black people drink coffee. So I look to the owner of Starbucks and say, ‘it’s not going to work. Black people don’t drink coffee.’” This decision, he admits, did not age well, humorously noting, “So now, every time I go to Starbucks, I see Black people drinking coffee, I’m like–”

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Passing on Starbucks may have been a huge mistake, but he still got in early on one of the most powerful tech companies ever. While at the Four Seasons Hotel in Los Angeles around 1993 or 1994, he babysat a couple of children whose father was in a meeting. After the meeting, the father, impressed with Shaq’s rapport with his children, offered him an investment opportunity in a then-little-known startup named Google. “You’re good with kids. I like you. I’m going to bring you in on this investment,” the father said. He described the future of Google, envisioning a world where “you’re going to be able to type on your phone, search engine, this, do this, boom, boom, boom. You should invest.”

Shaq took the advice and the rest is history. “I invested. And then, a couple of years later, I got a really big return,” he shared with DeGeneres. The exact amount Shaq invested in Google was never disclosed.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for just $1,000

In Zack O’Malley Greenburg’s book, “A-List Angels: How a Band of Actors, Artists and Athletes Hacked Silicon Valley,” Shaq reflects on his successful investment in Google. He recounts how he stumbled into the opportunity simply by being at the right place at the right time and engaging with the right people. Despite the success, O’Neal expressed one significant regret: “My only regret is that I wish I would have bought more.”

With a massive net worth of $500 million, his career is legendary. “I always wanted to be a business owner and now I am,” Shaq once remarked, according to a Marca article. His business ventures and endorsements are as iconic as his athletic achievements, showcasing his versatility and acumen in both arenas.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article NBA Icon Shaquille O’Neal Says An Accidental Babysitting Gig Led To His Early Investment In Google – ‘You’re Good With Kids. I Like You.’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Dell Technologies's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bearish stance on Dell Technologies.

Looking at options history for Dell Technologies DELL we detected 21 trades.

If we consider the specifics of each trade, it is accurate to state that 47% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $522,999 and 14, calls, for a total amount of $1,086,671.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $190.0 for Dell Technologies during the past quarter.

Volume & Open Interest Trends

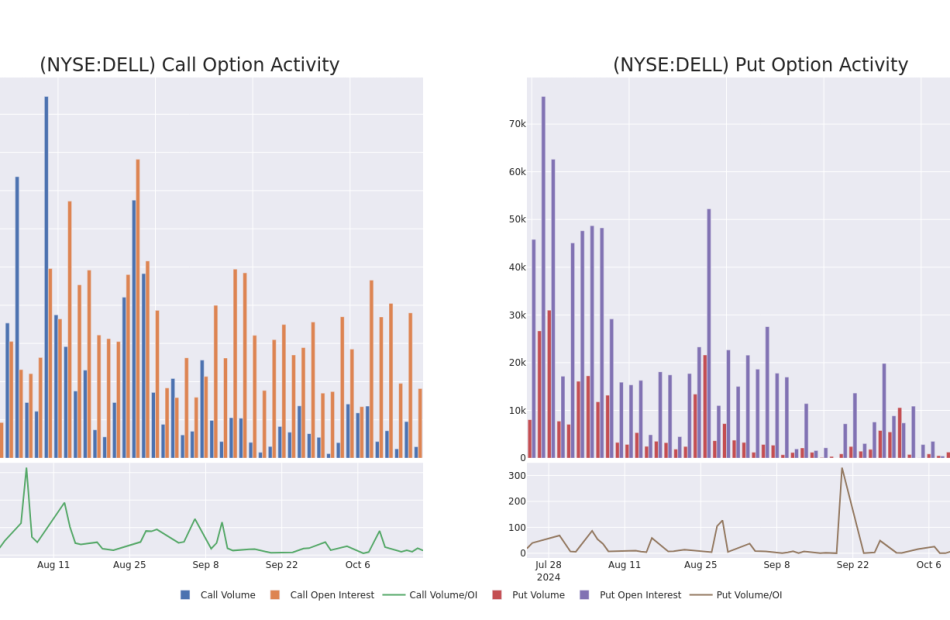

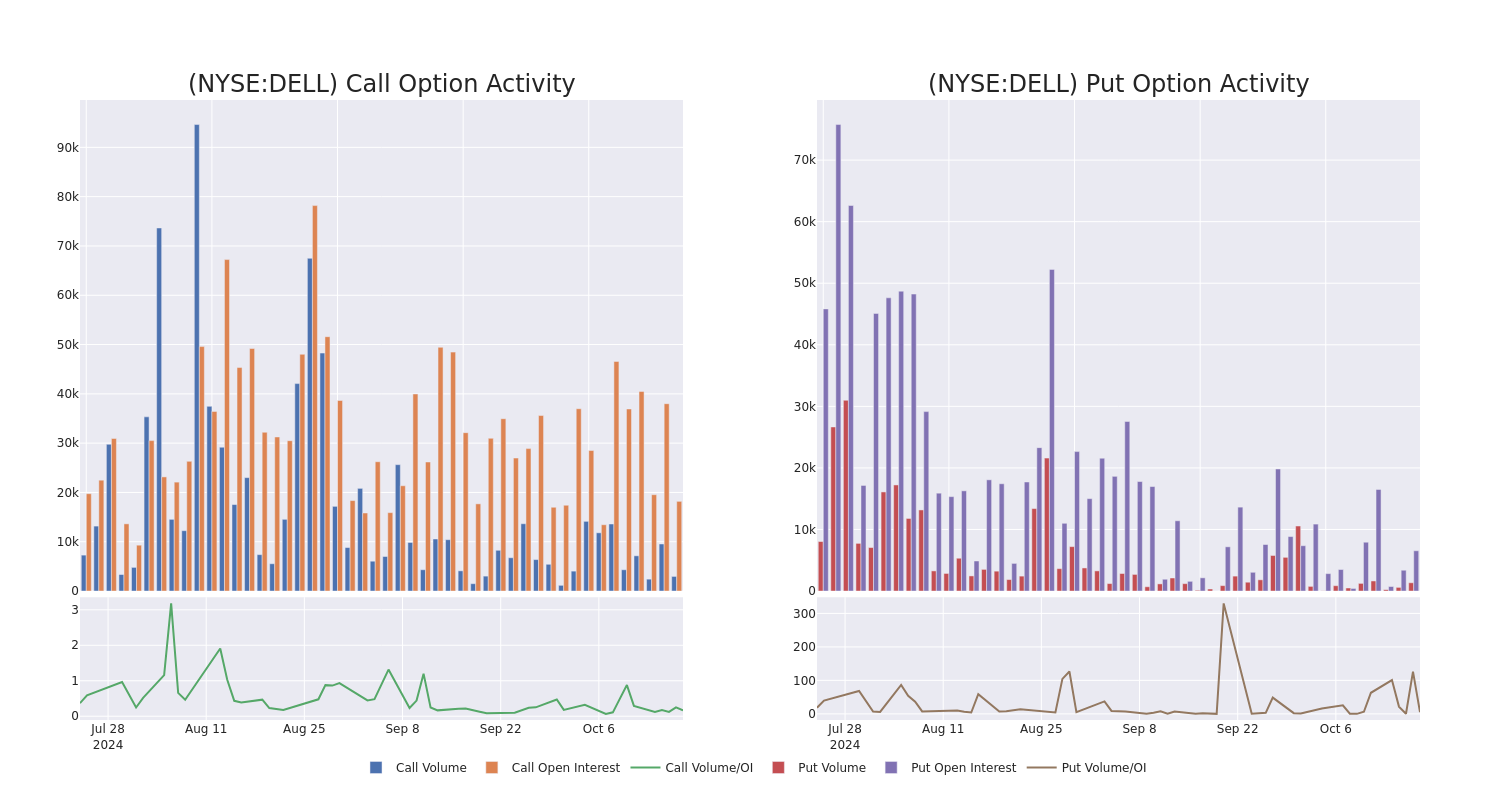

In today’s trading context, the average open interest for options of Dell Technologies stands at 1832.57, with a total volume reaching 2,199.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dell Technologies, situated within the strike price corridor from $85.0 to $190.0, throughout the last 30 days.

Dell Technologies Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | SWEEP | BULLISH | 06/20/25 | $46.15 | $45.95 | $46.0 | $85.00 | $317.4K | 406 | 180 |

| DELL | PUT | TRADE | BEARISH | 01/17/25 | $5.9 | $5.75 | $5.9 | $115.00 | $224.2K | 3.3K | 384 |

| DELL | CALL | SWEEP | BULLISH | 06/20/25 | $46.75 | $45.5 | $45.7 | $85.00 | $114.2K | 406 | 50 |

| DELL | CALL | TRADE | BULLISH | 06/20/25 | $45.7 | $45.5 | $45.7 | $85.00 | $114.2K | 406 | 0 |

| DELL | PUT | TRADE | BEARISH | 11/15/24 | $5.65 | $5.5 | $5.6 | $126.00 | $112.0K | 0 | 226 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium and commercial personal computers and enterprise on-premises data center hardware. It holds top-three market shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

After a thorough review of the options trading surrounding Dell Technologies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Dell Technologies’s Current Market Status

- With a trading volume of 1,692,355, the price of DELL is down by -0.23%, reaching $126.17.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 36 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dell Technologies, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold extends record, silver jumps to 12-year high as precious metals outperform stock market

Gold and silver showed no sign of slowing their rise on Monday as investors continue to pour into precious metals.

Gold futures (GC=F) touched fresh records, rising as much as 0.8% to hover near highs of $2,750 per ounce. Silver futures (SI=F) gained more than 3% before paring gains, briefly topping $34 per ounce, the highest level in 12 years.

The two precious metals have outperformed the broader markets, with bullion rising 26% year to date and silver gaining 35% during the same period, compared to the S&P 500’s (^GSPC) gain of 19% since the start of 2024.

Gold purchases by central banks, which hit a record in the first quarter of 2024, have been one of the biggest drivers of the precious metal’s rise this year. BofA analysts estimate gold has surpassed the euro to become the world’s largest reserve asset, second only to the US dollar.

Investors have also flocked to physically backed gold exchange-traded funds, with inflow up three months in a row, according to the World Gold Council.

“I think it’s the declining inflation expectation and also the rotation of assets that tend to perform well with a more dovish Fed,” Phil Streible, Blue Line Futures chief market strategist, told Yahoo Finance on Monday morning.

The strategist sees gold reaching $2,850 by the end of the year.

Meanwhile, silver surged higher after gaining more than 6% on Friday. JPMorgan analysts cited sentiment at the recent London Bullion Market Association/London Platinum and Palladium Market conference, with attendees forecasting an average year-ahead price of $45 per ounce for the grey metal.

“This bullish view is driven by a sense that silver is undervalued vs gold, less crowded, and supported by multifaceted, versatile demand applications,” wrote JPMorgan analysts on Friday.

Silver is used across different industries, from electronics to fuel cells in automobile components and solar panels. The analysts see uncertainty ahead for the metal if former President Donald Trump were to win the presidential election.

“We are bullish silver ourselves, though for this strong silver outperformance to eventuate, we likely need to see industrial metals prices continue to rally in 2025, something that could get complicated under a Trump presidency and a hard line on tariffs early next year, despite Chinese stimulus,” said the note.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Earnings Outlook For Trustmark

Trustmark TRMK will release its quarterly earnings report on Tuesday, 2024-10-22. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Trustmark to report an earnings per share (EPS) of $0.82.

The announcement from Trustmark is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

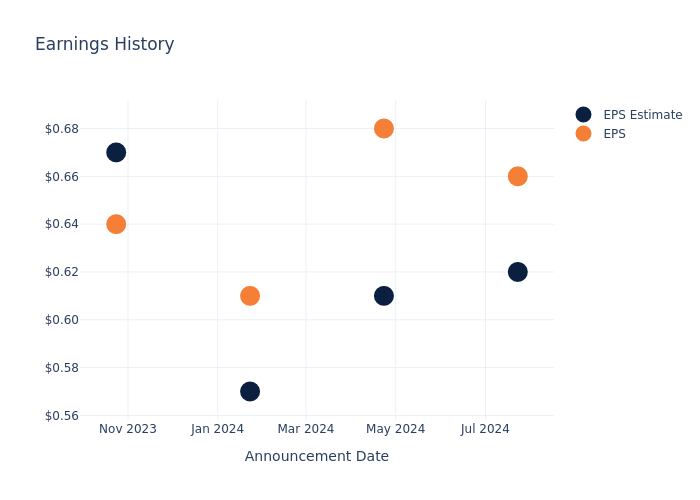

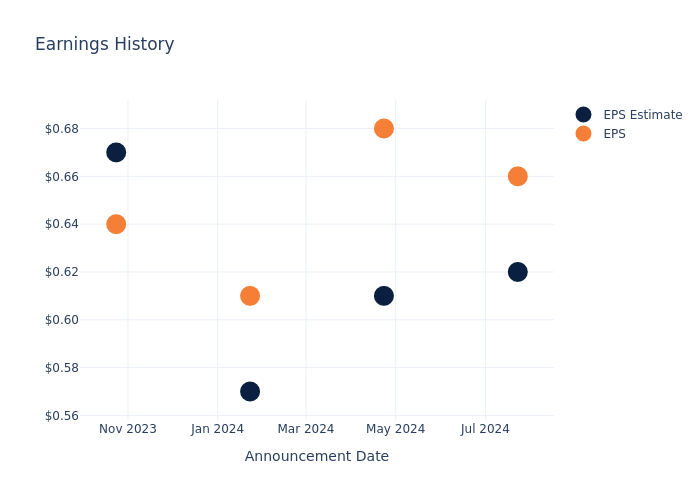

Overview of Past Earnings

Last quarter the company beat EPS by $0.04, which was followed by a 2.44% drop in the share price the next day.

Here’s a look at Trustmark’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.62 | 0.61 | 0.57 | 0.67 |

| EPS Actual | 0.66 | 0.68 | 0.61 | 0.64 |

| Price Change % | -2.0% | 7.000000000000001% | -1.0% | -6.0% |

Market Performance of Trustmark’s Stock

Shares of Trustmark were trading at $34.68 as of October 18. Over the last 52-week period, shares are up 66.26%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Trustmark visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BHP trying to avoid responsibility over Brazilian dam collapse, UK court told

By Sam Tobin

LONDON (Reuters) -BHP is cynically trying to avoid its responsibility for Brazil’s worst environmental disaster, lawyers representing thousands of victims told London’s High Court on Monday, as a lawsuit worth up to 36 billion pounds ($47 billion) began.

More than 600,000 Brazilians, 46 local governments and around 2,000 businesses are suing BHP over the 2015 collapse of the Mariana dam in southeastern Brazil, which was owned and operated by BHP and Vale’s Samarco joint venture.

The dam’s collapse unleashed a wave of toxic sludge that killed 19 people, left thousands homeless, flooded forests and polluted the length of the Doce River.

BHP, the world’s biggest miner by market value, is contesting liability and says the London lawsuit duplicates legal proceedings and reparation and repair programmes in Brazil and should be thrown out.

It also says nearly $8 billion has already been paid to those affected through the Renova Foundation, with around $1.7 billion going to claimants involved in the English case.

The lawsuit, one of the largest in English legal history, entered a decisive stage on Monday with the beginning of a 12-week trial to determine whether BHP is liable.

The claimants’ lawyer Alain Choo Choy said in court filings made public on Monday that “there is a chasm between what BHP regards as ‘acceptable’ and the compensation to which the claimants consider themselves legally and morally entitled”.

He argued that BHP’s actions in fighting the case and funding separate litigation in Brazil showed the miner was “cynically and doggedly trying to avoid” responsibility.

“Although that is BHP’s choice, it cannot properly now claim to be a company ‘doing the right thing’ by the victims of the disaster,” Choo Choy added.

‘EXAGGERATED’

BHP argues it did not own or operate the dam, which held minings waste known as tailings. It said a Brazilian subsidiary of its Australian holding company was a 50% shareholder in Samarco, which operated independently.

The miner also said it had no knowledge the dam’s stability was compromised before it collapsed.

Lawyers representing the miner said in court filings: “There is no law or contract which imposed any duty of safety on the ultimate parent company of a non-controlling shareholder and the other parent company in the same corporate group.

“Nor was there any breach of such duty of safety. And nor did BHP’s acts or omissions cause the collapse.”

BHP also said that parts of the lawsuit were “implausible or exaggerated”.

I’m 63, retired and getting $45,000 per year. But I only have about $200,000 in my IRA and still have a mortgage. What’s my move?

MarketWatch Picks highlights items we think you’ll find useful; we are independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn more

Question: “At 63 years old, I am concerned over my retirement income. I retired at 60, with a passive income of about $45,000 per year, and started receiving $1,500 per month in Social Security at 62. My income is from rental properties with long-term leases that should extend through my 70s. I managed to put about $200,000 into an IRA. My mortgage is about $450 a month, plus taxes and insurance, with 10 years remaining. What options do I have to increase my portfolio and ensure my financial security for the next 15 years?”

Answer: You have a lot to consider here — and you may want to have a financial adviser help you make a plan to help your money grow and last throughout retirement, pros say. But before we go into whether to get a financial planner or not, let’s look at your situation and see what risks you might be facing that you should think about.

Some of your biggest risks are general inflation, renter risk — the potential for a tenant to have a negative impact — and long-term care costs, says Mark Struthers, a certified financial planner and founder of Sona Wealth Advisors.

Inflation risk: To outpace inflation, you’ll want to be sure your money is hard at work. Look at how that IRA is invested and whether that aligns with your long-term goals, suggests Ryan Haiss, a certified financial planner and co-founder of Flynn Zito Capital Management. “I often see DIY investors overexposed to certain sectors, such as technology, or taking on more risk than they realize,” Haiss says. “While that may work well in strong markets, it can be detrimental during downturns. An adviser can help review your investment strategy to ensure it aligns with your long-term goals.”