A Closer Look at DoorDash's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on DoorDash DASH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DASH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 27 uncommon options trades for DoorDash.

This isn’t normal.

The overall sentiment of these big-money traders is split between 62% bullish and 22%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $69,725, and 25 are calls, for a total amount of $1,832,170.

What’s The Price Target?

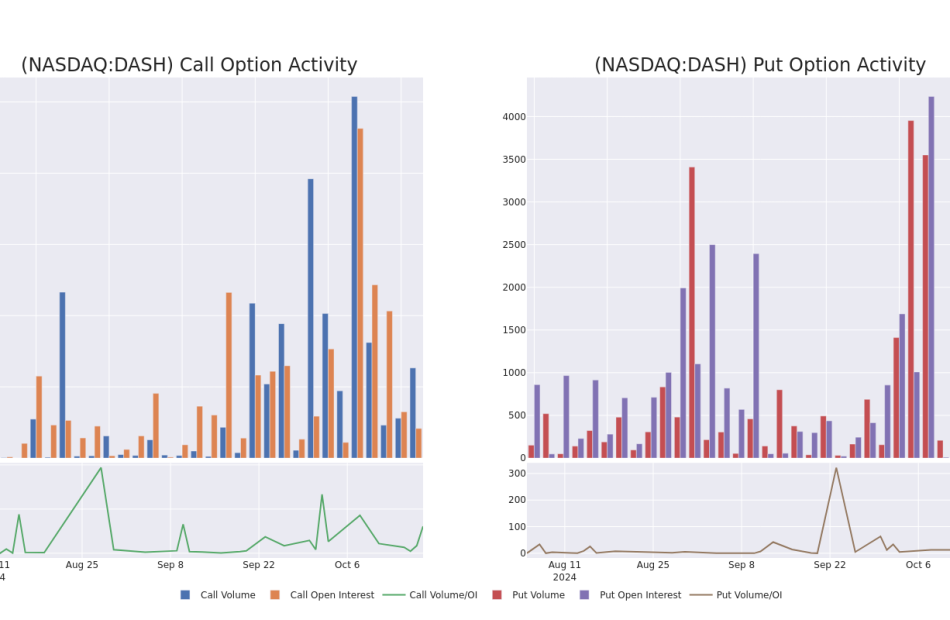

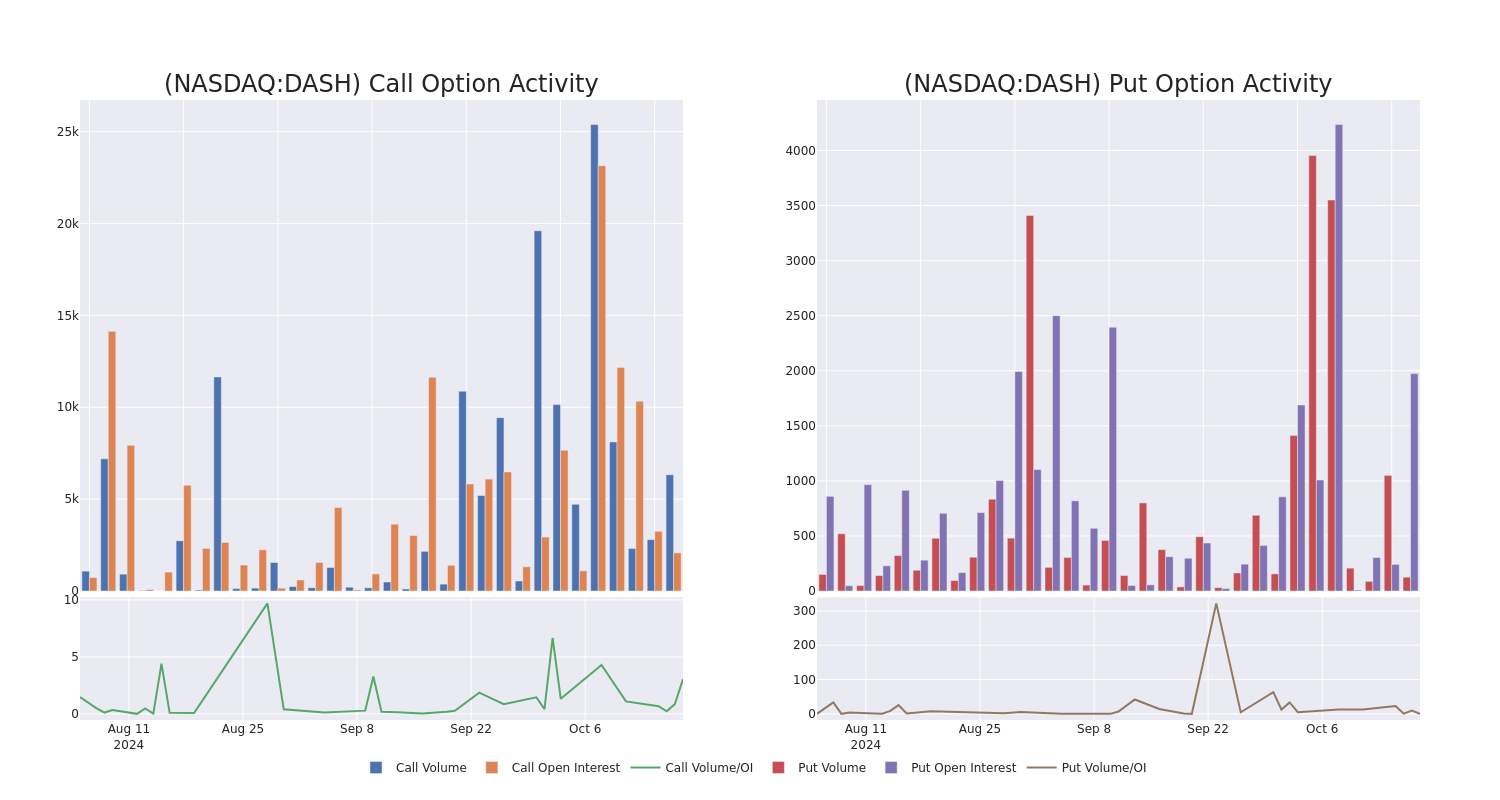

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $125.0 to $210.0 for DoorDash over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for DoorDash’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of DoorDash’s whale trades within a strike price range from $125.0 to $210.0 in the last 30 days.

DoorDash Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.9 | $23.9 | $23.9 | $130.00 | $423.0K | 1.6K | 177 |

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.5 | $23.5 | $23.5 | $130.00 | $279.6K | 1.6K | 470 |

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.8 | $23.8 | $23.8 | $130.00 | $211.8K | 1.6K | 224 |

| DASH | CALL | SWEEP | BULLISH | 11/15/24 | $23.9 | $23.4 | $23.4 | $130.00 | $65.5K | 1.6K | 500 |

| DASH | CALL | TRADE | BULLISH | 01/17/25 | $30.25 | $30.15 | $30.25 | $125.00 | $60.5K | 1.3K | 182 |

About DoorDash

Founded in 2013 and headquartered in San Francisco, DoorDash is an online food order demand aggregator. Consumers can use its app to order food on-demand for pickup or delivery from merchants mainly in the US. Through the acquisition of Wolt in 2022, the firm also provides this service in Europe. DoorDash provides a marketplace for the merchants to create a presence online, market their offerings, and meet demand by making the offerings available for pickup or delivery. The firm provides similar service to businesses in addition to restaurants, such as grocery, retail, pet supplies, and flowers.

Following our analysis of the options activities associated with DoorDash, we pivot to a closer look at the company’s own performance.

Present Market Standing of DoorDash

- Trading volume stands at 991,640, with DASH’s price up by 0.25%, positioned at $152.36.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 9 days.

What Analysts Are Saying About DoorDash

5 market experts have recently issued ratings for this stock, with a consensus target price of $155.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160.

* In a cautious move, an analyst from Raymond James downgraded its rating to Outperform, setting a price target of $155.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on DoorDash with a target price of $160.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $160.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Equal-Weight rating on DoorDash with a target price of $142.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest DoorDash options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The post-'stretch' home stretch for Roth IRA conversions

The days of the individual retirement account “stretch” are long gone. But the appeal of Roth conversions is enduring — especially under the current tax rates.

Expiring provisions of the Tax Cuts and Jobs Act at the end of 2025 that mean lower taxes on the conversion, the fact that Roth IRAs carry no required minimum distributions and, of course, the duty-free withdrawals for the owner or their heirs add up to a compelling case, according to Sarah Brenner, the director of retirement education with consulting firm Ed Slott & Company. The first Secure Act was a “game-changer for IRAs and Roth IRAs” due to the new obligation for beneficiaries to empty the accounts within a decade of inheritance, and Secure 2.0 “made some changes around the edges,” she said in an interview.

The situation for traditional IRA owners is “kind of like ripping off a Band-Aid,” in which they should just “get the pain over with,” Brenner said, pointing out that clients often have a misconception that “you’ve got to do it all” even though “it’s not all-or-nothing” because they could simply do a partial conversion as well.

“The Secure Act changed the game, and it has definitely led to, I would say, an even stronger case for Roth conversions,” she added. “You work with the rules you have, and you have a 10-year rule.”

READ MORE: Final IRS rules to IRA beneficiaries: Get going on those RMDs already

After four straight years of pushing back the implementation of that rule, the IRS has indicated that it will be going into effect at the beginning of 2025. Next year was already going to turn into one of the most consequential for tax policy in recent decades because of the possible sunset of the lower tax brackets and many other parts of the Tax Cuts and Jobs Act that will be high on the agenda for the next occupant of the White House and lawmakers in control of Congress.

Tax experts have been extolling the continued virtues of Roth conversions since passage of the first Secure Act in 2019.

“Though considerations around Roth IRA conversions have changed as a result of the Secure Act, Roth IRAs still offer advantages to account owners and beneficiaries,” certified public accountant and planner Joseph Doerrer wrote the following year in the Journal of Accountancy. “Roth IRAs are tax advantaged, and owners of Roth IRAs aren’t required to take RMDs. This can prove helpful in retirement, as it allows a larger amount of assets to remain in the account. Not having to take RMDs can also help account owners avoid creating unwanted taxable income, giving them more flexibility in retirement. Beneficiaries will enjoy a simpler tax situation, versus beneficiaries of traditional IRAs, due to the tax-free nature of their distributions from the account.”

The Lesser-Known Reason Costco Installed New Membership Card Scanners in Stores

It’s not unusual for stores to make changes to policies and practices over time. And Costco is no exception.

Earn up to $845 cash back this year just by changing how you pay at Costco! Learn more here.

In recent months, Costco has taken to installing membership card scanners at the front of its stores. And the general consensus is that Costco’s goal in doing so is to put an end to membership sharing.

Indeed, Costco has been cracking down on non-members by banning them from its food courts. This change seems to fall in line with that strategy.

But actually, there’s another big reason Costco opted to install membership card scanners. And it’s one that could benefit you a lot as a regular shopper.

If you’ve ever shopped at a Costco store before, you most likely encountered a lot of people. Costco stores tend to see a lot of foot traffic in general. But sometimes, that traffic can be inconsistent, making it harder to ensure an adequate supply of inventory.

During the company’s most recent earnings call, President and CEO Ron Vachris explained that the purpose of the new scanners isn’t just to make sure that non-members aren’t sneaking in. It’s also to track inventory based on the number of customers who are coming into the store at different times.

As he said, “It gives our operators real-time traffic counts throughout the day. So, we’re able to adjust front-end lines that we need to open and close lines based on the fluctuations of business. We can monitor our fresh foods a little better because we know what the traffic counts look like and so forth.”

Another reason behind the decision to install scanners is to see if memberships are up for renewal. If so, Costco can direct members who need to renew to customer service so they don’t hold up the checkout lines. And given the store’s notoriously long lines, that’s a good thing.

As Vachris said, the scanners have “taken the friction of membership verification away from the front-end registers and moved that to the front door, where we’re able to look at people’s membership status. We let them know if their renewal is due before they get to the front end.”

It’s clear that Costco has been making changes in recent months, including implementing a fee hike that raised the cost of a Gold Star membership from $60 to $65 per year and the cost of an Executive membership from $120 to $130 per year. But ultimately, even that change has the potential to lead to a better customer experience.

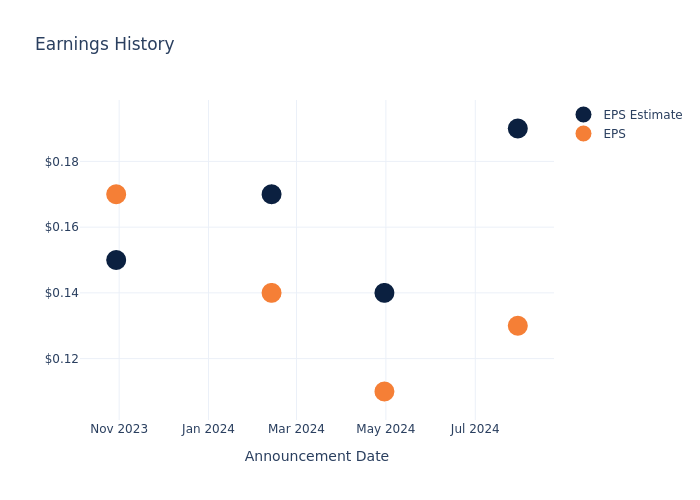

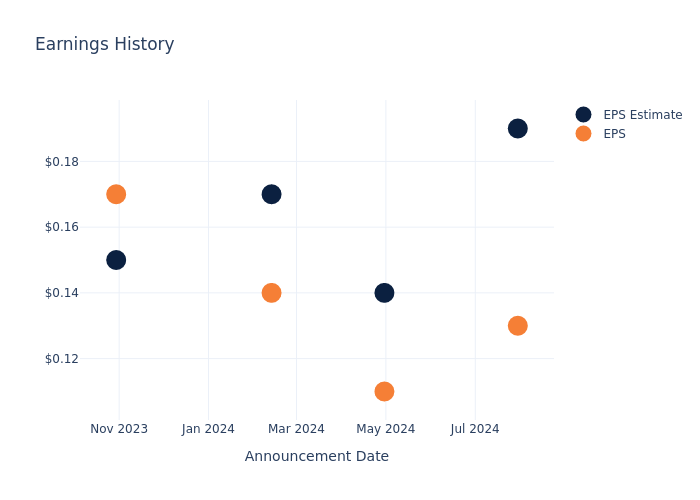

An Overview of Denny's's Earnings

Denny’s DENN is set to give its latest quarterly earnings report on Tuesday, 2024-10-22. Here’s what investors need to know before the announcement.

Analysts estimate that Denny’s will report an earnings per share (EPS) of $0.15.

The market awaits Denny’s’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.06, leading to a 3.79% drop in the share price the following trading session.

Here’s a look at Denny’s’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.19 | 0.14 | 0.17 | 0.15 |

| EPS Actual | 0.13 | 0.11 | 0.14 | 0.17 |

| Price Change % | -4.0% | 0.0% | -6.0% | -0.0% |

Stock Performance

Shares of Denny’s were trading at $6.65 as of October 18. Over the last 52-week period, shares are down 24.44%. Given that these returns are generally negative, long-term shareholders are likely a little upset going into this earnings release.

To track all earnings releases for Denny’s visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here’s one economic message from the Costco gold bar craze

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

It’s all about trust.

The nation may have left the gold standard behind in 1933, but Costco (COST) shoppers have proven that gold is a red-hot buy.

Sure, it’s an investment, but it’s also “reflecting this yearning for real money,” economist and senior fellow at the Independent Institute Judy Shelton told Yahoo Finance executive editor Brian Sozzi on Yahoo Finance’s Opening Bid podcast (video above; listen below). “Gold is kind of a surrogate for the real economy, and it represents commodities but also that traditional role of money you can trust.”

The wildly popular Costco bullion was introduced to warehouse club members last year via 24-karat 1 oz bars. The product has flown off the shelves, with Costco raking in a reported $200 million per month in gold bar sales. Demand has been so great that the retailer has begun to offer platinum bars.

According to Shelton, the gold rush at Costco likely has personal meaning to the financially skittish consumer. Over the past few years, consumers have become accustomed to watching inflation spike as high as 9% while the US dollar lost 20% of its purchasing power. This hasn’t exactly stoked Americans’ confidence.

Judy Shelton will be at Yahoo Finance’s Invest conference in November. Register to attend here!

The sudden rise in gold’s popularity could also relate to consumers’ overall trust in the precious metal and what it represents. “It’s a meaningful unit of account. It works across borders,” she said. “It has universal value, and it’s highly recognized.”

Precious metals such as gold are currently having a solid ride. Year to date, gold prices are up 31.72% to $2,750 an ounce. Silver and platinum prices are up 41% and 3%, respectively.

UBS chief investment officer of the Americas, Solita Marcelli, said the gold price rally has further room to run, citing the potential for more interest rate cuts and worsening geopolitical tensions.

“Despite the rally, we think gold’s hedging properties remain attractive. Alongside physical gold, investors may consider exposure through structured strategies, ETFs, or via gold miner equities. Investors unaccustomed to the volatility of individual commodities may also consider exposure via an actively managed strategy that seeks to deliver alpha over comparable passive indices,” Marcelli wrote in a note to clients.

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

Ask an Advisor: At 65, Should I Be Rebalancing My 401(k) from Stocks to Bonds?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

In my 401(k) retirement plan, I’m 82% stocks. I’m 65 and still working. Should I be moving my stocks to bonds?

-Bob

While it’s not a satisfying answer, the real answer is that “it depends.” The decision of whether to shift your 401(k) to a more conservative asset allocation will depend primarily on your longer-term goals, personal drivers of your risk/return profile and the asset allocation in your other accounts, if applicable. (And if you need help picking a suitable mix of stocks and bonds, consider speaking with a financial advisor.)

Before making any asset allocation decisions, I suggest you start by reflecting on your long-term goals for these savings. What do you intend to use the money for? Gaining a clear understanding of your longer-term goals will largely inform your time horizon, risk tolerance and return objective, the three inputs which collectively drive asset allocation decisions.

If your goal is to use the entirety of these savings for income when you eventually retire, then your time horizon will be your remaining time working plus your retirement years. With this goal and time horizon, you’ll need to evaluate your retirement readiness in the context of all sources of retirement income, including your 401(k) plan, other investment and savings accounts and Social Security, among others.

If you feel that you are behind in saving the amount required to support your desired level of spending in retirement, you will likely have a higher return objective since you need to achieve additional growth in your portfolio to advance your retirement goals. A higher return objective is generally associated with taking on more risk. Prioritizing capital appreciation by maintaining more exposure to stocks could be necessary in this situation. However, if you are confident that the various sources of retirement income can support this spending, you might have a lower return goal that emphasizes capital preservation rather than growth. Shifting to a more conservative allocation in the retirement plan could be prudent.

Perhaps you have built up more than enough savings to support your retirement and wish to pass on some of your assets to future generations. Multigenerational goals will require a different outlook. In this case, maintaining a more aggressive, equity-oriented asset allocation could make sense since the time horizon will extend beyond your retirement period into the next generation(s). (And if you need help setting financial goals, like retiring by a certain age, a financial advisor can help.)

Stock market today: Dow drops 300 points, Nvidia, Apple close at fresh records

Stocks closed mixed on Monday as the 10-year Treasury yield rose and investors braced for a packed week of top-tier earnings that could drive or drag on a record-setting rally.

The S&P 500 (^GSPC) dropped almost 0.2%, coming off a fresh all-time closing high and a sixth weekly win in a row. The Dow Jones Industrial Average (^DJI) dropped more than 300 points, closing about 0.8% lower, while the tech-heavy Nasdaq Composite (^IXIC) closed up 0.2%.

AI chip heavyweight Nvidia (NVDA) gained more than 4% to close at a fresh all-time high, while iPhone maker Apple (AAPL) also eked out a closing record.

Meanwhile, the 10-year Treasury yield (^TNX) climbed 10 basis points to 4.18%, the highest level since July.

Whether records keep rolling in rides in large part on corporate results in the coming days. Earnings season ramps up this week, as over 100 S&P 500 companies are lined up to report. So far, 80% of third quarter updates from those on the benchmark have topped the mark.

Investors are on edge for Tesla’s (TSLA) report on Wednesday, after its robotaxi unveiling fell short of expectations. The EV maker is the highlight of the week amid questions about Big Tech performance, even after Netflix’s (NFLX) strong kickoff to the megacap season.

General Motors (GM), Coca-Cola (KO), American Airlines (AAL), and UPS (UPS) are among several other big hitters on the earnings docket this week.

Boeing (BA) faces a double-whammy on Wednesday, when it’s expected to release earnings at the same time workers vote on whether to accept a tentative deal agreed with the union to end a five-week strike. Shares of the plane maker rose over 3%.

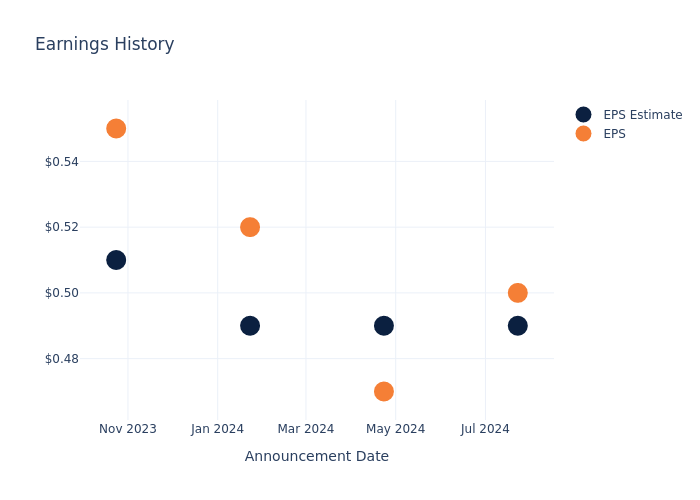

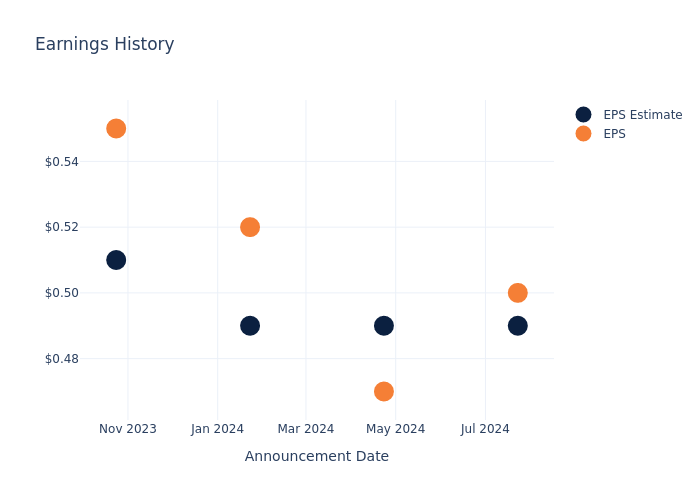

LIVE COVERAGE IS OVER 14 updatesA Preview Of First Busey's Earnings

First Busey BUSE is gearing up to announce its quarterly earnings on Tuesday, 2024-10-22. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that First Busey will report an earnings per share (EPS) of $0.54.

The market awaits First Busey’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.01, leading to a 3.18% drop in the share price the following trading session.

Here’s a look at First Busey’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.49 | 0.49 | 0.49 | 0.51 |

| EPS Actual | 0.50 | 0.47 | 0.52 | 0.55 |

| Price Change % | -3.0% | -1.0% | 2.0% | -1.0% |

Performance of First Busey Shares

Shares of First Busey were trading at $26.0 as of October 18. Over the last 52-week period, shares are up 34.48%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for First Busey visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.