A Preview Of First Busey's Earnings

First Busey BUSE is gearing up to announce its quarterly earnings on Tuesday, 2024-10-22. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that First Busey will report an earnings per share (EPS) of $0.54.

The market awaits First Busey’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

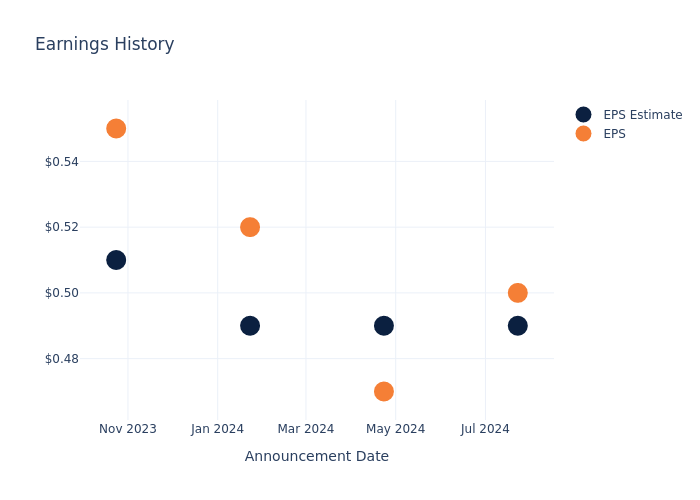

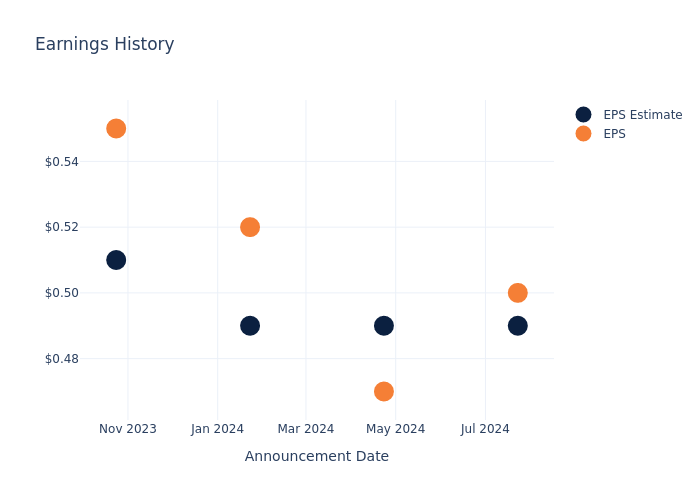

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.01, leading to a 3.18% drop in the share price the following trading session.

Here’s a look at First Busey’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.49 | 0.49 | 0.49 | 0.51 |

| EPS Actual | 0.50 | 0.47 | 0.52 | 0.55 |

| Price Change % | -3.0% | -1.0% | 2.0% | -1.0% |

Performance of First Busey Shares

Shares of First Busey were trading at $26.0 as of October 18. Over the last 52-week period, shares are up 34.48%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for First Busey visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NEXT EDGE CAPITAL CORP. ANNOUNCES CHANGES TO RISK RATING

TORONTO, Oct. 21, 2024 /CNW/ – Next Edge Capital Corp. (“Next Edge“) announced today an update to the investment risk rating of the mutual fund listed below (the “Fund“).

|

Fund |

Previous Risk Rating |

Updated Risk Rating |

|

Next Edge Strategic Metals and |

Medium to High |

High |

Such change is a result of the risk rating methodology mandated by the Canadian Securities Administrators and an annual review by Next Edge to determine the risk level of its publicly-offered mutual funds.

No material changes have been made to the investment objectives, strategies or management of the Fund. The change in the risk rating will be reflected in the Fund’s offering documents which will be completed in accordance with applicable securities laws.

About Next Edge Capital Corp.

Next Edge Capital Corp. is an investment fund manager and a leader in the structuring and distribution of alternative, private credit and value-added fund products in Canada. The firm is led by an experienced management team that has launched numerous investment solutions in a variety of product structures and has been responsible for raising over $3 billion of alternative assets since 2000.1 Next Edge specializes and focuses on providing unique, non-correlated pooled investment vehicles to the Canadian marketplace. www.nextedgecapital.com.

|

1 |

Please note that over CAD $2 billion of the CAD $3 billion of alternative assets raised relates to assets that were raised at a previous firm(s). |

This press release is for information purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. This press release is not for dissemination in the United States or for distribution to U.S. news wire services.

SOURCE Next Edge Capital Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/21/c6039.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/21/c6039.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Controladora Vuela's Earnings: A Preview

Controladora Vuela VLRS will release its quarterly earnings report on Tuesday, 2024-10-22. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Controladora Vuela to report an earnings per share (EPS) of $0.15.

The announcement from Controladora Vuela is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

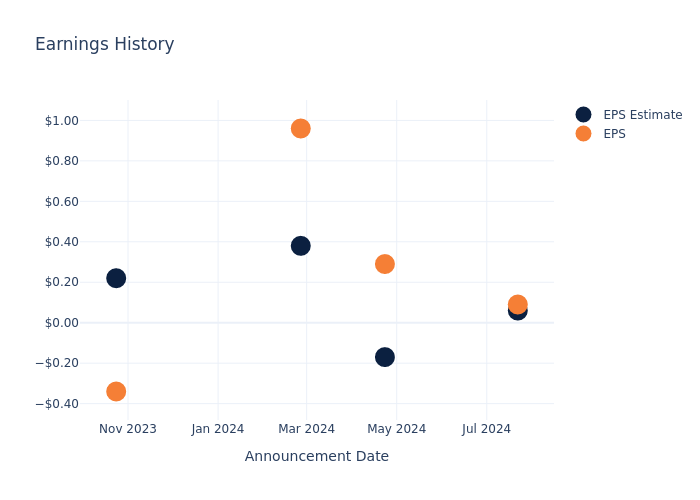

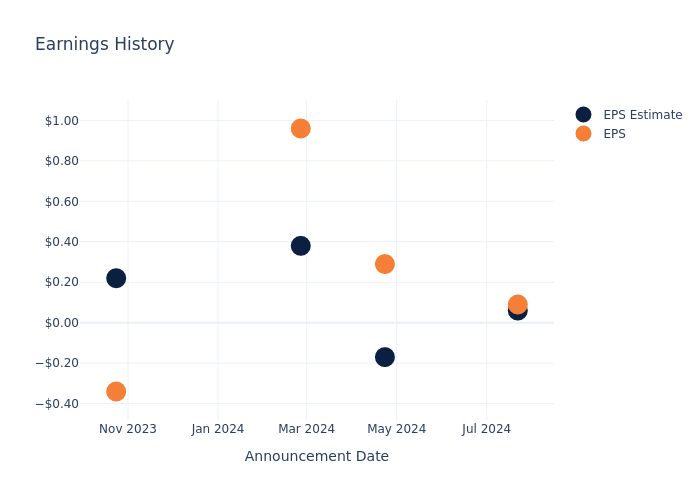

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.03, leading to a 3.03% increase in the share price the following trading session.

Here’s a look at Controladora Vuela’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.06 | -0.17 | 0.38 | 0.22 |

| EPS Actual | 0.09 | 0.29 | 0.96 | -0.34 |

| Price Change % | 3.0% | 2.0% | 0.0% | 1.0% |

Market Performance of Controladora Vuela’s Stock

Shares of Controladora Vuela were trading at $7.15 as of October 18. Over the last 52-week period, shares are up 17.84%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Controladora Vuela visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insights Ahead: Pentair's Quarterly Earnings

Pentair PNR is set to give its latest quarterly earnings report on Tuesday, 2024-10-22. Here’s what investors need to know before the announcement.

Analysts estimate that Pentair will report an earnings per share (EPS) of $1.07.

The announcement from Pentair is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

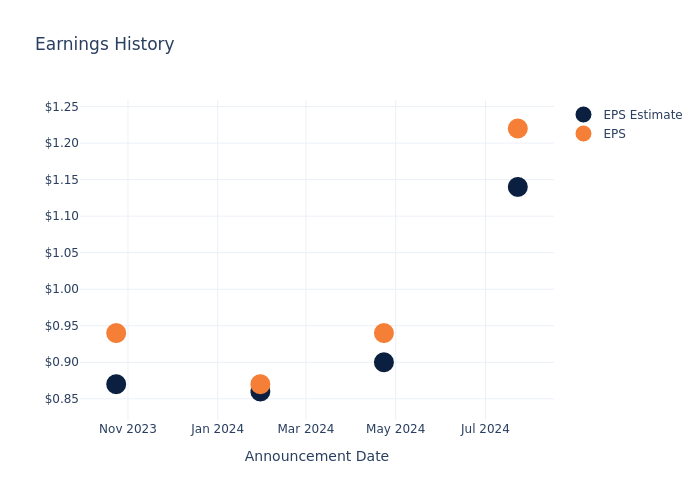

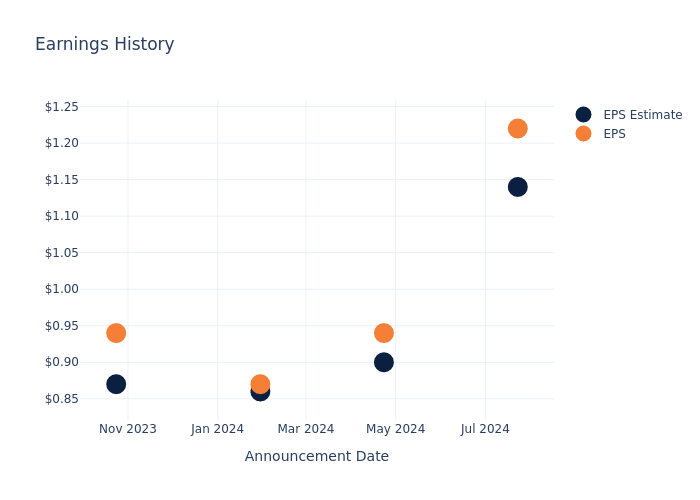

Earnings History Snapshot

During the last quarter, the company reported an EPS beat by $0.08, leading to a 3.89% drop in the share price on the subsequent day.

Here’s a look at Pentair’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.14 | 0.90 | 0.86 | 0.87 |

| EPS Actual | 1.22 | 0.94 | 0.87 | 0.94 |

| Price Change % | -4.0% | 1.0% | 0.0% | -4.0% |

Performance of Pentair Shares

Shares of Pentair were trading at $99.04 as of October 18. Over the last 52-week period, shares are up 65.72%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Views on Pentair

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Pentair.

The consensus rating for Pentair is Outperform, based on 11 analyst ratings. With an average one-year price target of $102.18, there’s a potential 3.17% upside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Stanley Black & Decker, IDEX and Snap-on, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Stanley Black & Decker is maintaining an Neutral status according to analysts, with an average 1-year price target of $102.27, indicating a potential 3.26% upside.

- IDEX is maintaining an Outperform status according to analysts, with an average 1-year price target of $233.17, indicating a potential 135.43% upside.

- The consensus outlook from analysts is an Outperform trajectory for Snap-on, with an average 1-year price target of $327.6, indicating a potential 230.78% upside.

Peer Metrics Summary

The peer analysis summary provides a snapshot of key metrics for Stanley Black & Decker, IDEX and Snap-on, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Pentair | Outperform | 1.55% | $437.90M | 5.51% |

| Stanley Black & Decker | Neutral | -3.23% | $1.14B | -0.13% |

| IDEX | Outperform | -4.61% | $366.80M | 3.89% |

| Snap-on | Outperform | -1.06% | $587.80M | 4.67% |

Key Takeaway:

Pentair ranks highest in revenue growth among its peers. It also leads in gross profit margin. However, it has the lowest return on equity compared to its peers.

All You Need to Know About Pentair

Pentair is a global leader in the water treatment industry, with 10,000 employees and a presence in 25 countries. Pentair’s business is organized into three segments: pool, water technologies, and flow. The company offers a wide range of water solutions, including energy-efficient swimming pool equipment, filtration solutions, and commercial and industrial pumps. Pentair generated approximately $4.1 billion in revenue in 2023.

Unraveling the Financial Story of Pentair

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Pentair’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 1.55%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Pentair’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 16.93%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Pentair’s ROE stands out, surpassing industry averages. With an impressive ROE of 5.51%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Pentair’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.8%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.55, Pentair adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Pentair visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At Newmont's Recent Unusual Options Activity

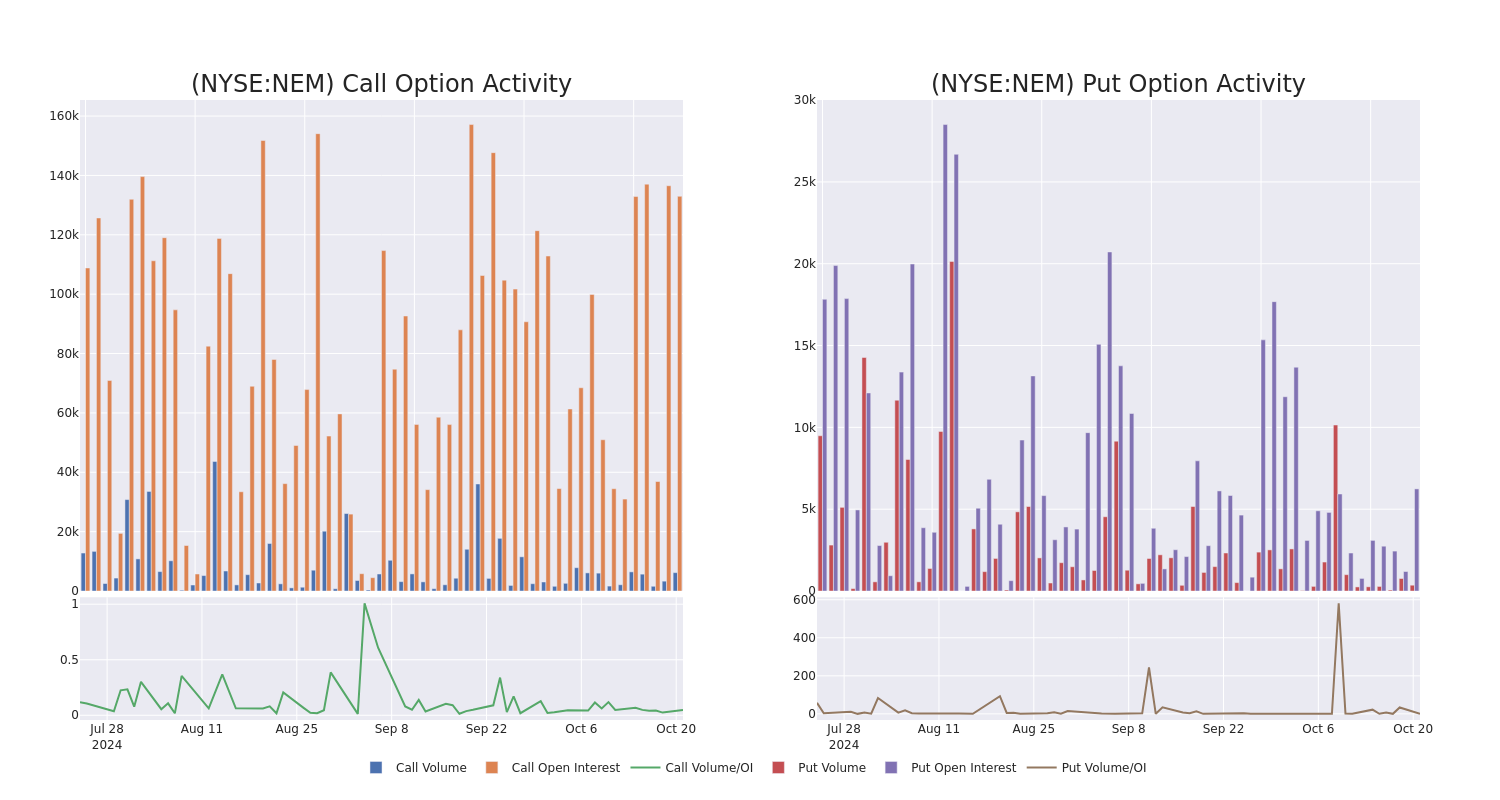

Whales with a lot of money to spend have taken a noticeably bullish stance on Newmont.

Looking at options history for Newmont NEM we detected 27 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $140,066 and 23, calls, for a total amount of $1,365,528.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $25.0 and $75.0 for Newmont, spanning the last three months.

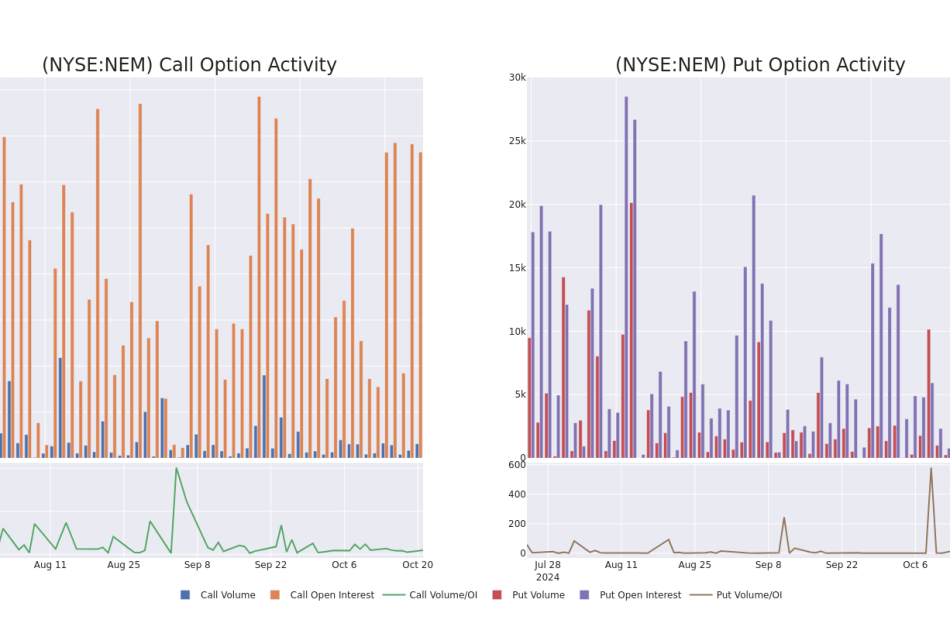

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Newmont options trades today is 6327.86 with a total volume of 6,563.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Newmont’s big money trades within a strike price range of $25.0 to $75.0 over the last 30 days.

Newmont Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | TRADE | BULLISH | 01/16/26 | $18.45 | $18.15 | $18.37 | $42.50 | $183.7K | 1.6K | 118 |

| NEM | CALL | TRADE | BEARISH | 01/16/26 | $13.45 | $13.35 | $13.35 | $50.00 | $132.1K | 4.6K | 333 |

| NEM | CALL | TRADE | BEARISH | 01/16/26 | $13.4 | $13.35 | $13.35 | $50.00 | $132.1K | 4.6K | 134 |

| NEM | CALL | TRADE | NEUTRAL | 03/21/25 | $19.05 | $18.75 | $18.9 | $40.00 | $94.4K | 368 | 50 |

| NEM | CALL | TRADE | BULLISH | 03/21/25 | $4.2 | $4.15 | $4.2 | $60.00 | $84.0K | 2.2K | 433 |

About Newmont

Newmont is the world’s largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 6.9 million ounces of gold in 2024. However, after buying Newcrest, Newmont is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2023.

Having examined the options trading patterns of Newmont, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Newmont Standing Right Now?

- With a volume of 4,291,434, the price of NEM is up 0.35% at $57.82.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

What Analysts Are Saying About Newmont

2 market experts have recently issued ratings for this stock, with a consensus target price of $65.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Jefferies has decided to maintain their Buy rating on Newmont, which currently sits at a price target of $63.

* An analyst from UBS persists with their Buy rating on Newmont, maintaining a target price of $67.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Newmont options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Flirts With $70,000 After $2.4 Billion Inflow Into ETFs

(Bloomberg) — Bitcoin came close to $70,000 on Monday as a spurt of inflows into exchange-traded funds for the largest digital asset as well as optimism about the outlook for US regulations supported sentiment.

Most Read from Bloomberg

The cryptocurrency rose 1% before paring some of the gains to trade at $68,252 as of 8:32 a.m. in New York. Smaller tokens such as second-ranked Ether and top-10 coin Solana oscillated in narrow ranges.

US spot-Bitcoin ETFs lured almost $2.4 billion of net inflows in the six days through Oct. 18, data compiled by Bloomberg show, partly on bets that US crypto rules will become friendlier after the Nov. 5 presidential election.

Republican candidate Donald Trump is avowedly pro-crypto, so much so that Bitcoin is viewed as a so-called Trump trade. Democratic rival Vice President Kamala Harris has vowed to support a regulatory framework for the industry. That contrasts with a crackdown on the sector under the Biden administration.

The two key market trends are the elections and the global macroeconomic environment, according to David Lawant, head of research at crypto prime broker FalconX. The Bitcoin options market indicates that “forward implied volatility is heavily clustered around the election day and somewhat subdued leading to it and some time after it,” he wrote in a note.

Bitcoin climbed nearly 10% in the seven days through Sunday, the original cryptocurrency’s best weekly performance in more than a month. ETF demand helped the token reach a record high of $73,798 in March. The rally cooled and Bitcoin last traded above $70,000 back in June.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

BETTER HOMES AND GARDENS® REAL ESTATE ANNOUNCES BRAND REFRESH, EMPHASIZING ITS LIFESTYLE EXPERTISE AND REPUTABLE BRAND ROOTS

The real estate brand from the magazine you trust for all things home unveils “Nobody Knows Homes BetterSM” tagline

MADISON, N.J., Oct. 21, 2024 /PRNewswire/ — Better Homes and Gardens Real Estate LLC, a subsidiary of Anywhere Real Estate Inc. HOUS, has helped buyers find homes that uniquely fit their lifestyle with a curated approach that has led to a 99% client satisfaction rate. The real estate brand has earned a reputation of quality and trust, built on the rich legacy of the Better Homes & Gardens media brand, a century-long trusted source for all things home. The Better Homes and Gardens Real Estate (BHGRE) brand plans to further lean into that deep understanding of home with the launch of its latest positioning, “Nobody Knows Homes Better.”

The refreshed campaign embodies the brand’s commitment to providing exceptional boutique-level service and lifestyle expertise. As “personal property curators,” affiliated agents and brokers offer a personalized approach to help ensure buyers find not just a house but the perfect home for their lifestyle.

With the evolution of Better Homes and Gardens Real Estate comes even greater commitment to ensuring affiliated agents and brokers have the tools, training and resources to stay on top of home design and industry trends. Specifically, the BHGRE® brand is creating opportunities for agents to expand their lifestyle skillset, leaning into knowledge within the brand network to further learn from other top professionals.

“True icons are consistently evolving to stay fresh and align with changing consumer interests and demands and this brand is no different,” said Ginger Wilcox, President of Better Homes and Gardens Real Estate. “People want to work with an agent and brand that is reliable and trustworthy during one of the biggest decisions of their life – and we do just that.”

Along with the new tagline, the brand is releasing the “We Know” campaign ad, which showcases how BHGRE® affiliated agents are uniquely positioned to meet consumers where they are and pay special attention to their clients’ wants and needs. Whether it’s a fixer-upper with tons of charm and potential, or a fully remodeled estate, the BHGRE brand understands all the big and small details that make a future home a source of joy and pride and promises to deliver better living.

As the brand looks ahead to 2025, BHGRE has produced the Home Trends Report based on Better Homes & Gardens audience research. This highlights key trends in the lifestyle space to inform consumers’ everyday lives, but also how these insights can be examined from both a homebuying and selling lens.

The Better Homes and Gardens® Real Estate brand continues to cement itself as a lifestyle leader in the real estate industry. With the resource of brand trust for both homebuying and lifestyle knowledge, the brand continues to prove that “Nobody Knows Homes BetterSM.”

About Better Homes and Gardens Real Estate LLC

The Better Homes and Gardens® Real Estate network is a dynamic real estate brand that offers a full range of services to brokers, sales associates and home buyers and sellers. Using innovative technology, sophisticated business systems and the broad appeal of a lifestyle brand, the Better Homes and Gardens Real Estate network embodies the future of the real estate industry while remaining grounded in the tradition of home. Better Homes and Gardens Real Estate LLC is a subsidiary of Anywhere Real Estate Inc. HOUS, a global leader in real estate franchising and provider of real estate brokerage, relocation, and settlement services.

The growing Better Homes and Gardens® Real Estate network includes approximately 11,700 independent sales associates in approximately 400 offices serving homebuyers and sellers across the United States, Canada, Jamaica, The Bahamas, Australia and Türkiye.

Better Homes and Gardens®, BHGRE® and the Better Homes and Gardens Real Estate Logo are registered service marks owned by Meredith Operations Corporation and licensed to Better Homes and Gardens Real Estate LLC. Better Homes and Gardens Real Estate LLC fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Each office is independently owned and operated.

Media Contact

Misty.Beard@bhgre.com

Misty Beard

973-407-2331

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/better-homes-and-gardens-real-estate-announces-brand-refresh-emphasizing-its-lifestyle-expertise-and-reputable-brand-roots-302281886.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/better-homes-and-gardens-real-estate-announces-brand-refresh-emphasizing-its-lifestyle-expertise-and-reputable-brand-roots-302281886.html

SOURCE Better Homes and Gardens Real Estate LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microwave Power Transmission Market Size & Share to Surpass USD 939.5 million by 2031 | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 21, 2024 (GLOBE NEWSWIRE) — The microwave power transmission industry (마이크로파 전력 전송 산업) was worth US$ 167.0 million in 2022. The market is projected to increase at a CAGR of 24.1% from 2023 to 2031, reaching US$ 939.5 million by 2031. The increasing interest in space-based solar power generation, which involves capturing solar energy in space and transmitting it to Earth via microwave beams, has driven the development of microwave power transmission systems that can effectively beam energy from space-based solar arrays to ground-based receivers.

Unlike traditional grid-based electricity supply, microwave transmission systems provide a reliable alternative that makes it possible to access power in remote areas. Remote, rural, military, and emergency response applications drive this demand for off-grid power solutions. The need for dependable and effective microwave power transmission solutions to power satellite ground stations and remote communication facilities is driven by the growth of the telecommunications infrastructure, including the rollout of 5G networks and the rising demand for satellite communication systems.

Technology in microwave power transmission continues to advance continuously, and cost-cutting initiatives continue to be taken in the field, such as developing lightweight, affordable rectenna arrays and solid-state microwave amplifiers. The market can expand by reducing installation and operating costs, enhancing system performance, and providing new applications and industry opportunities.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85410

Key Findings of the Market Report

- Based on technology, a near-field segment is likely to increase demand for microwave power transmission in the market.

- The space solar power station segment was the largest application segment in 2022.

- A signal generator is expected to drive market demand for microwave power transmission.

- From 2023 to 2031, Asia Pacific is expected to hold the largest share.

- North America held a share of 23.0% in 2022.

Global Microwave Power Transmission Market: Competitive Landscape

Researchers and developers in the industry are heavily investing in innovation and new technologies to boost efficiency, extend transmission distances, and enhance reliability. The company is also investing in marketing and brand-building activities to expand its microwave power transmission market share.

Key Players Profiled

- Infineon Technologies

- WiTricity

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- ALE International

- NEC Corporation

- Aviat Networks, Inc.

- Intracom Telecom

- Ceragon

- DragonWave-X

- Anritsu

- Energous Corporation

- Powercast Corporation

- TDK Corporation

- Ossia Inc.

- Others

Key Developments

- In August 2023, Aviat Networks, Inc., an innovative wireless transport and access company, selected Aviat to upgrade and modernize Hoosier Energy’s existing microwave transmission network, an Indiana-based transmission and generation cooperative.

- In March 2024, Huawei’s SuperHub solution was awarded the GSMA GLOMO “Best Mobile Innovation for Emerging Markets” award in recognition of its ability to improve microwave spectrum efficiency. In SuperHub, microwave spectrum can be reused across several links and separated by as little as 15 degrees, resulting in better spectrum utilization and higher link speeds.

Global Microwave Power Transmission Market: Growth Drivers

- A number of technological developments have led to an increase in the efficiency, range, and reliability of microwave power transmission technology, which has led to the growth of this market. Long-distance power transmission can now be achieved using microwave-based systems thanks to these advances.

- Renewable energy sources, such as solar and wind power, are becoming increasingly popular to efficiently transport energy from remote or offshore regions to metropolitan centers. As a result, microwave power transmission has become a necessity.

- Microwave power transmission technologies have become a promising source of effective and high-power wireless charging solutions due to their widespread applications in consumer electronics, electric cars, and medical devices. This will boost market growth across several industries.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85410

Global Microwave Power Transmission Market: Regional Landscape

- Asia Pacific is expected to drive demand for the microwave power transmission market. China and India are experiencing rapid industrialization and urbanization, making efficient energy transmission systems essential. As part of government initiatives in South Korea and Japan, renewable energy is being encouraged to increase market potential.

- As telecommunications infrastructure in Southeast Asian countries expands, microwave power transmission systems will become more prevalent. A rising level of funding for solar power projects in China is helping to expand the market.

- A growing demand for off-grid power options in rural and isolated areas has led to the development of microwave power transmission technology in the Asia Pacific region. Technological innovations and cost-reduction initiatives in countries such as South Korea and Japan are driving the growth and adoption of the market.

- The use of microwave power transmission for reliable energy distribution has become increasingly popular because of increased concerns about energy security and resilience in natural disaster-prone countries like Japan.

- The governments of countries such as India subsidize and encourage clean energy technology to create an adequate market environment for microwave power transmission solutions.

Global Microwave Power Transmission Market: Segmentation

By Technology

By Component

- Signal Generator

- Power Amplifier

- Transceiver Antenna

- Rectifier Circuit

- Others

By Application

- Space Solar Power Station

- Payload Spacecraft Module

- High Power Weapon

- EV Battery

- Medical Device

- Others

By End User

- Aerospace

- Automotive

- Defense

- Healthcare

- Consumer Electronics

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Buy this Premium Research Report @ https://www.transparencymarketresearch.com/checkout.php?rep_id=85410<ype=S

More Trending Reports by Transparency Market Research –

Biomass Boiler Market (バイオマスボイラー市場) – The market was valued at US$ 4.7 Bn in 2021 and it is estimated to grow at a CAGR of 18.1 % from 2022 to 2031 and reach US$ 24.9 Bn by the end of 2031

Microturbines Market (سوق التوربينات الدقيقة) – The industry was valued at US$ 91.8 Mn in 2021 and it is estimated to advance at a CAGR of 8.6 % from 2022 to 2031 and reach US$ 209.6 Mn by the end of 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.