Smart Money Is Betting Big In ISRG Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Intuitive Surgical.

Looking at options history for Intuitive Surgical ISRG we detected 21 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 66% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $884,979 and 10, calls, for a total amount of $2,075,713.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $250.0 to $620.0 for Intuitive Surgical over the recent three months.

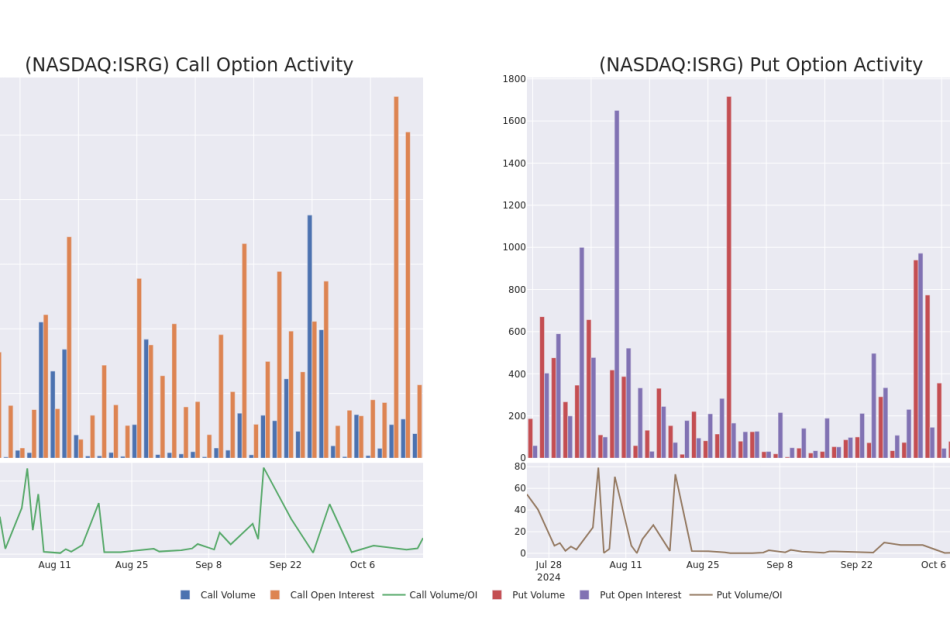

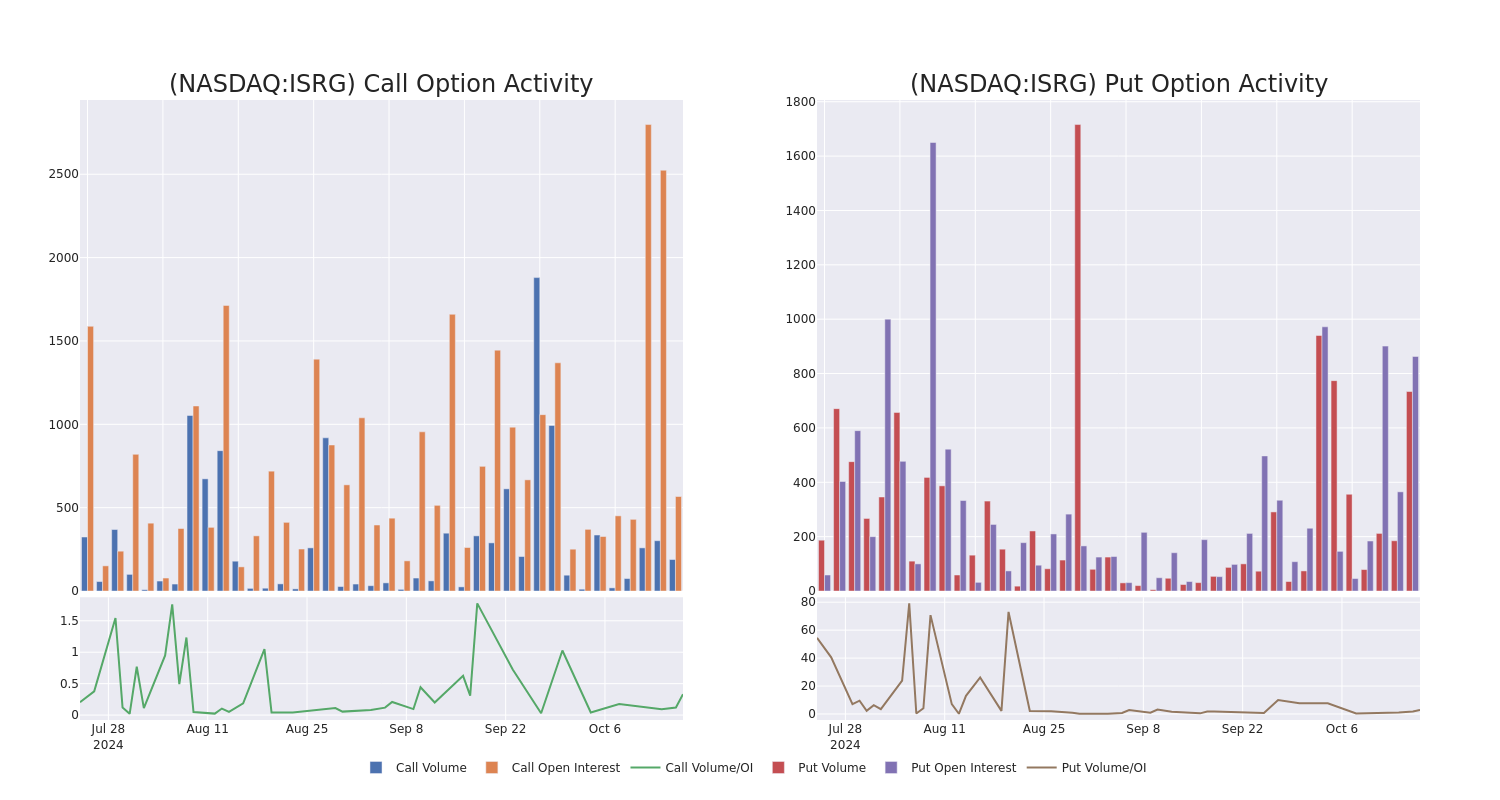

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Intuitive Surgical’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Intuitive Surgical’s whale activity within a strike price range from $250.0 to $620.0 in the last 30 days.

Intuitive Surgical Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | TRADE | BEARISH | 01/17/25 | $63.9 | $63.2 | $63.2 | $470.00 | $1.2M | 313 | 270 |

| ISRG | CALL | TRADE | BEARISH | 01/17/25 | $64.0 | $63.2 | $63.2 | $470.00 | $316.0K | 313 | 70 |

| ISRG | PUT | SWEEP | BEARISH | 01/15/27 | $97.1 | $94.0 | $97.1 | $570.00 | $184.4K | 0 | 21 |

| ISRG | PUT | SWEEP | BEARISH | 01/15/27 | $101.9 | $97.4 | $101.9 | $580.00 | $142.6K | 0 | 21 |

| ISRG | PUT | SWEEP | BULLISH | 01/16/26 | $44.4 | $44.3 | $44.32 | $500.00 | $132.9K | 9 | 54 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

After a thorough review of the options trading surrounding Intuitive Surgical, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Intuitive Surgical

- With a volume of 682,367, the price of ISRG is down -0.47% at $518.69.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 92 days.

What Analysts Are Saying About Intuitive Surgical

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $540.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Wells Fargo persists with their Overweight rating on Intuitive Surgical, maintaining a target price of $549.

* An analyst from BTIG has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $535.

* An analyst from Piper Sandler downgraded its action to Overweight with a price target of $538.

* An analyst from RBC Capital persists with their Outperform rating on Intuitive Surgical, maintaining a target price of $555.

* An analyst from Stifel has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $525.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuitive Surgical with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Decade of big S&P 500 gains is over, Goldman strategists say

(Bloomberg) — US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, Goldman Sachs Group Inc. strategists said.

Most Read from Bloomberg

The S&P 500 Index is expected to post an annualized nominal total return of just 3% over the next 10 years, according to an analysis by strategists including David Kostin. That compares with 13% in the last decade, and a long-term average of 11%.

They also see a roughly 72% chance that the benchmark index will trail Treasury bonds, and a 33% likelihood they’ll lag inflation through 2034.

“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the team wrote in a note dated Oct. 18.

US equities have rallied following the global financial crisis, first driven by near-zero interest rates and later by bets on resilient economic growth. The S&P 500 is on track to outperform the rest of the world in eight of the last 10 years, according to data compiled by Bloomberg.

Still, this year’s 23% bounce has been concentrated in a handful of the biggest technology stocks. The Goldman strategists said they expect returns to broaden out and the equal-weighted S&P 500 to outperform the market cap-weighted benchmark in the next decade.

Even if the rally were to remain concentrated, the S&P 500 would post below-average returns of about 7%, they said.

The latest Bloomberg Markets Live Pulse survey showed investors expect the US equity rally to extend into the final stretch of 2024. The strength of Corporate America’s results are seen as more crucial for the stock market’s performance than who wins the US presidential election or even the Federal Reserve’s policy path.

(Updates with MLIV Pulse survey findings in the last paragraph of story.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

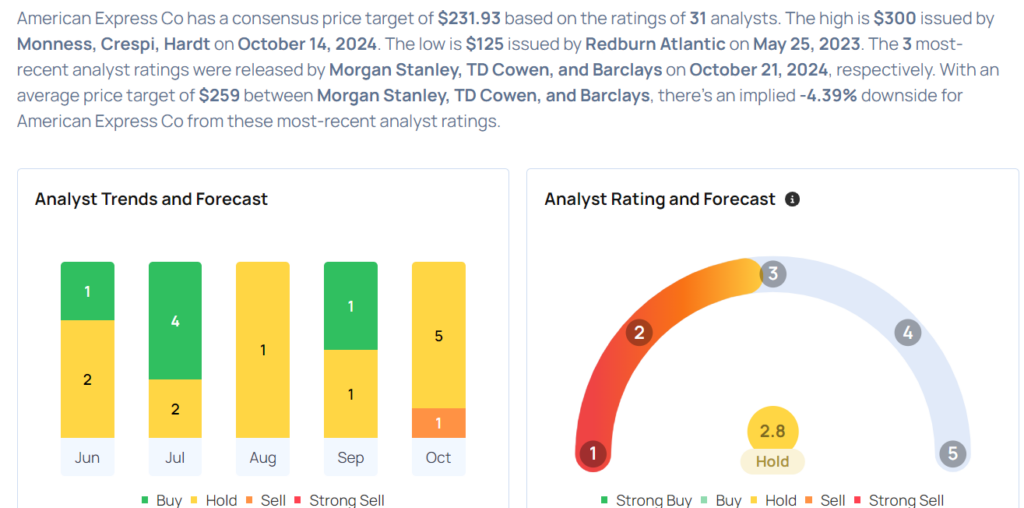

American Express Analysts Increase Their Forecasts After Q3 Earnings

American Express Co AXP company reported mixed results for the third quarter on Friday.

The company said quarterly revenue (net of interest expenses) grew 8% year-on-year to $16.64 billion, marginally missing the analyst consensus estimate of $16.67 billion. Adjusted EPS of $3.49 beat the analyst consensus estimate of $3.28.

Card Member spending or Billed Business grew 6% (or 6% forex adjusted) year-over-year to $387.3 billion.

U.S. Consumer Services revenue was $7.944 billion, up 10% year over year. Commercial Services revenue was $3.998 billion, up 7% year over year. International Card Services revenue was $2.936 billion, up 11% year over year, and Global Merchant and Network Services revenue was $1.847 billion, flat year over year.

American Express shares fell 2.2% to trade at $270.58 on Monday.

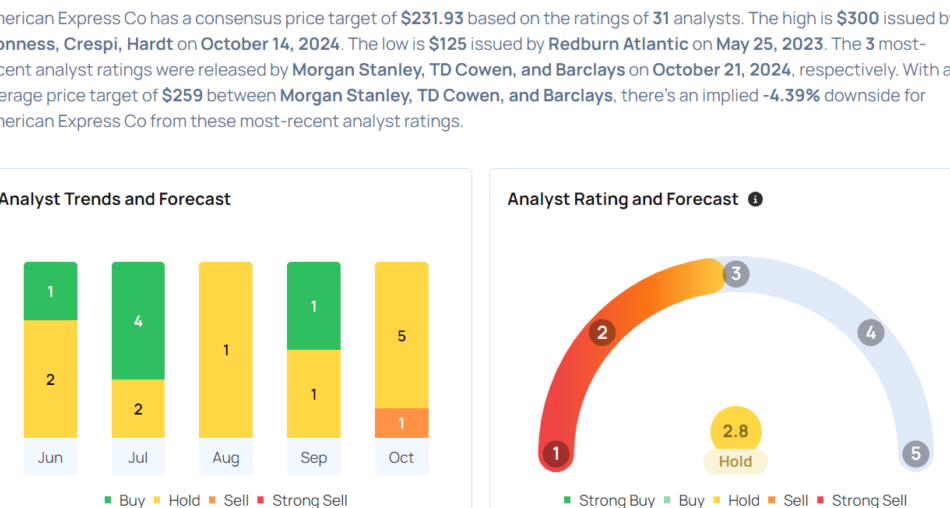

These analysts made changes to their price targets on American Express following earnings announcement.

- Barclays analyst Terry Ma maintained American Express with an Equal-Weight and raised the price target from $250 to $257.

- TD Cowen analyst Moshe Orenbuch maintained the stock with a Hold and raised the price target from $260 to $268.

- Morgan Stanley analyst Betsy Graseck maintained the stock with an Equal-Weight rating and boosted the price target from $248 to $252.

Considering buying AXP stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can You Put Your RMDs Into a Roth IRA? Here's What to Know

If you’re taking a required minimum distribution from an IRA, 401(k) or other tax-deferred account and don’t need the money to cover living expenses, where should you stash that unneeded cash?

Investors now need to start taking RMDs at age 73 or, if they were born after 1960, at age 75. Depending on the balances of your accounts, that distribution can be a sizable amount of money, perhaps more than you need to live on. One option is to reinvest that money, and a Roth IRA would seem to be a perfect choice: withdrawals from Roth accounts are tax-free – including all gains on your investments – and you’ll never need to take any of those pesky RMDs during your lifetime.

There’s just one catch: You can’t directly convert your RMDs to a Roth. But for some people, there is a potential workaround. For 2024, you can contribute up to $7,000 plus another $1,000 if you’re at least 50 years old – if you have enough earned income.

Get matched with a financial advisor to discuss your own retirement strategy.

What is – and isn’t – ‘earned income’

The IRS defines earned income as money you get for working, such as wages, commissions, bonuses, tips and honorariums for speaking, writing or taking part in a conference or convention. Income generated by self-employment also counts. Income that doesn’t qualify includes taxable pension payments, interest income, dividends, rental income, alimony and withdrawals from Roth IRAs or other nontaxable retirement accounts, along with annuities, welfare benefits, unemployment compensation, worker’s compensation payments and your Social Security income.

Another restriction on Roth contributions is the income limit. Once your modified adjusted gross income (MAGI) hits $146,000 for a single filer or $230,000 for joint filers, your maximum Roth contribution starts phasing out up to $161,000 (single filers) or $240,000 (joint filers). After that, you’re no longer eligible to contribute.

You also need to remember that you need to wait five tax years after your first contribution to any Roth account before you can make withdrawals. Heirs who inherit your Roth will need to withdraw the entire balance within 10 years.

Consider speaking with a financial advisor to develop a tax-efficient retirement strategy.

Other options on RMDs

If you don’t qualify to make a Roth contribution, you still have options to eliminate, reduce or delay your RMDs.

Roth conversion: You can convert your IRA to a Roth account, once you’ve taken your RMD for the year. You’ll pay taxes on the amount you convert, so one tactic is to convert the maximum amount available without pushing yourself into a higher tax bracket. Each Roth conversion carries its own five-year rule.

Charitable contribution: You can use a Qualified Charitable Distribution to donate some or all of your RMD to a charity recognized by the IRS and you won’t be taxed on the donated amount. To qualify, the money must be transferred directly from your IRA to the charity.

Keep working: Your 401(k) account with your current employer isn’t subject to RMDs if you’re still on the payroll. One tactic is to roll 401(k)s from previous employers into your current plan so that they won’t be subject to RMDs. Once you stop working, however, RMDs are required.

Be careful: The punishment for failing to take an RMD during the required time period is a hefty one – up to 50% of the missed RMD amount.

A financial advisor can help you navigate the particular risks and tradeoffs in your situation.

Pay attention to all your taxes

Structuring your retirement withdrawals to reduce your tax bite means looking at all your sources of income, including retirement accounts, RMDs, Social Security benefits, pensions and taxable investment income. For some people, withdrawing money from an IRA early in retirement can reduce the size of their eventual RMDs. If they also delay collecting their Social Security benefits, their benefit amount to increase by 8% each year until they reach 70 years old. Also, be sure to coordinate taxes, withdrawals and RMDs between spouses, and remember that a younger spouse’s RMDs won’t need to be taken until they reach age 73 or 75.

Other common retirement tax moves include investing in tax-free bonds, moving to a state with no income tax or estate tax, harvesting tax losses in taxable investment accounts and holding any taxable assets long enough to qualify for lower long-term capital gains tax rates.

To learn more about retirement planning and how to work toward your goals, talk to a financial advisor for free.

Bottom line

How to manage your RMDs – and all the other many tax questions that can arise in retirement – can be complicated. Take the time to estimate your retirement taxes before you start collecting pensions, Social Security and taking withdrawals from retirement accounts.

Tips

-

Balancing taxes and retirement income – and figuring out how to minimize taxes in retirement – is a crucial issue. A knowledgeable financial advisor can help you decide how to structure and coordinate these payments over the span of your retirement.

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

-

Make sure you’re protecting your cash reserves from inflation by securing them in an account that generates a competitive interest rate. Leaving cash in a checking account or low-yield savings account can stifle your purchasing power over time.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/skynesher

The post Can I Use My RMDs to Transfer Money Into My Roth IRA? appeared first on SmartReads by SmartAsset.

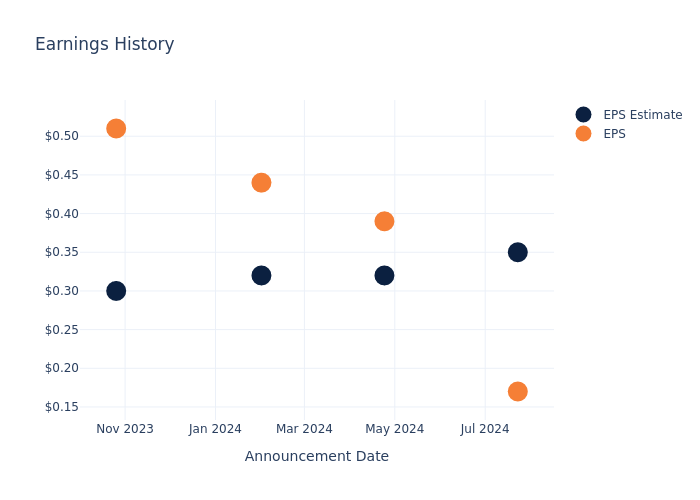

An Overview of PennyMac Mortgage's Earnings

PennyMac Mortgage PMT is preparing to release its quarterly earnings on Tuesday, 2024-10-22. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect PennyMac Mortgage to report an earnings per share (EPS) of $0.34.

Anticipation surrounds PennyMac Mortgage’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

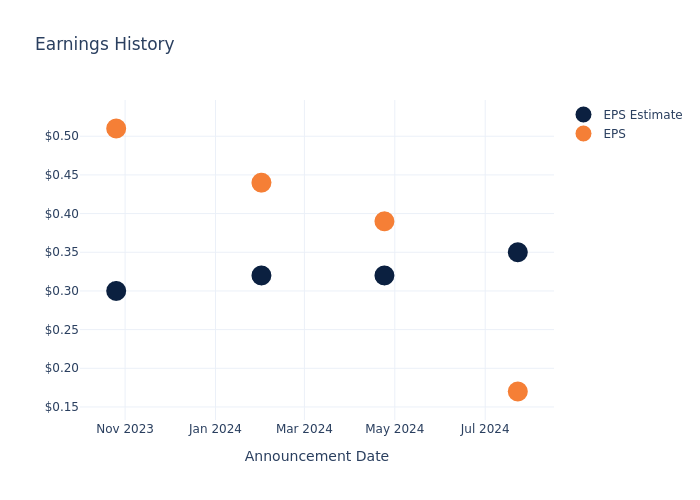

Historical Earnings Performance

Last quarter the company missed EPS by $0.18, which was followed by a 7.95% drop in the share price the next day.

Here’s a look at PennyMac Mortgage’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.35 | 0.32 | 0.32 | 0.30 |

| EPS Actual | 0.17 | 0.39 | 0.44 | 0.51 |

| Price Change % | -8.0% | 3.0% | -3.0% | 15.0% |

Market Performance of PennyMac Mortgage’s Stock

Shares of PennyMac Mortgage were trading at $14.06 as of October 18. Over the last 52-week period, shares are up 29.15%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for PennyMac Mortgage visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

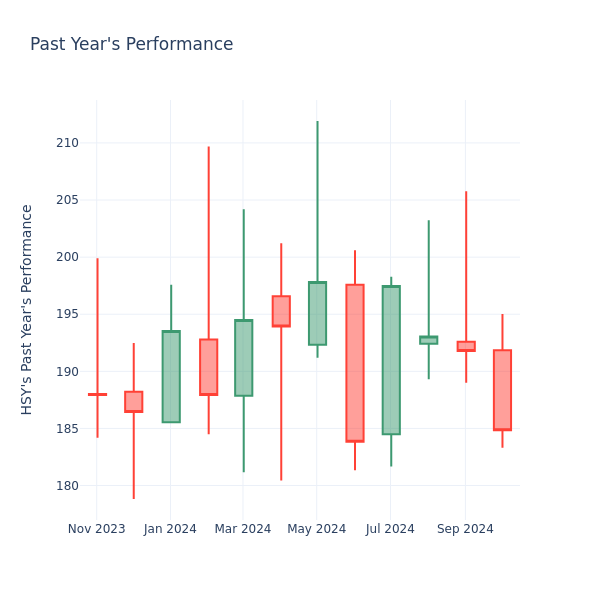

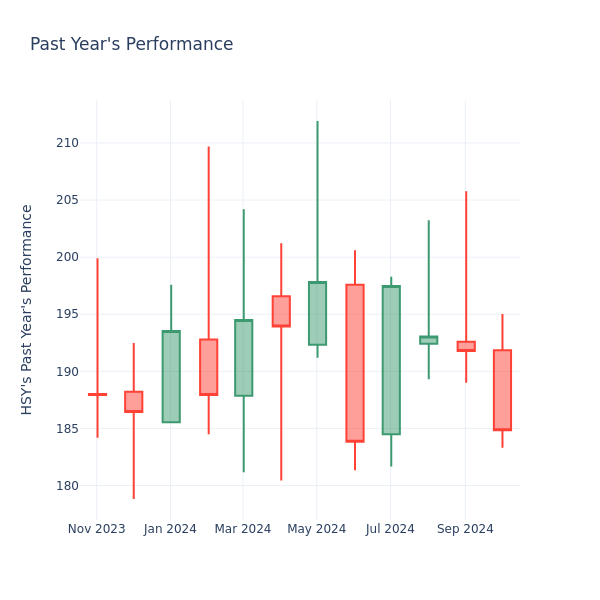

Price Over Earnings Overview: Hershey

In the current session, Hershey Inc. HSY is trading at $184.85, after a 0.44% drop. Over the past month, the stock fell by 4.39%, and in the past year, by 2.86%. With performance like this, long-term shareholders are more likely to start looking into the company’s price-to-earnings ratio.

How Does Hershey P/E Compare to Other Companies?

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 34.02 in the Food Products industry, Hershey Inc. has a lower P/E ratio of 20.56. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EXCLUSIVE: What It Takes To Thrive In Cannabis Vape Space – Lessons Learned From Industry Trailblazers (CORRECTED)

Editor’s note: This article has been updated to reflect the correct spelling of one of the panelist’s surnames. Benzinga apologizes for the misspelling.

“Cannabis vaping is very different from nicotine vaping; it should be subject to different rules and restrictions.” That’s according to Steven Przybyla, chief legal officer at Ispire Technology Inc. ISPR, who joined three other experts on the stage in Chicago at the Benzinga Cannabis Capital Conference. Yet, Przybyla says applying nicotine industry technologies to cannabis for enhanced safety measures, including age-gating technology, is a viable option.

During the conference panel, moderated by Shauntel Ludwig, CEO of Synergy Innovation, experts provided an overview of trends and innovations in the cannabis vaporization space. Tim Conder, CEO of TILT Holdings Inc. TLLTF, Alex Kwon, CEO and founder of ACTIVE, formerly Advanced Vapor Devices and Nicholas Kovacevich, strategic advisor at CCELL also joined the panel titled “Vape Innovation Masterclass: Cost-Effective, Quality Tech for a Global Market.”

Panelists highlighted the importance of consumer focus, investment in research and development (R&D) sector and the integration of safety measures, positioning these elements as foundational for sustainable growth in the industry.

The Importance Of Consumer Safety

Przybyla shed light on age-gating technology illustrating the growing emphasis on safety within the industry.

He spoke about the development of a Bluetooth-enabled age-gating system that biometrically verifies user age before allowing device activation. Przybyla highlighted the potential of this technology for public health, linking it to regulatory challenges in the nicotine market and demonstrating how similar strategies can be adapted for cannabis.

“This is a technology that we’re using from the nicotine space that we think has a lot of application from a safety, from a public health perspective in the cannabis space,” Przybyla said. “If you want to sell lawfully, in the U.S, you need to show that youth access is restricted.”

Przybyla also touched on the vaping industry association called VapeSAFER. The initiative focuses on self-regulation and establishing quality standards within the vapor industry to combat low-quality products entering the market and advocate for tailored regulations.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

“We want to promulgate our own standards,” he said. “We want to self-police ourselves. We want to actively engage with trade groups, associations Regulators and the FDA.”

That said, ACTIVE’s Kwon highlighted the importance of standardized testing and understanding product ingredients to ensure safety and quality. He added that the cannabis vaping industry should not be overshadowed by regulations designed for nicotine products.

“We probably don’t want e-cigarettes, big tobacco blanketing the regulations around cannabis,” Kwon said.

The cannabis vapor industry needs to ensure to be “at the seated table when a regulatory change is there because the sensible policy is going to be super important to make sure that there is a constant sustainable future for all the hard work that all the companies..because it’s a massive category that I think it’s just too important of a topic where we just kind of let Others kind of dictate,” Kwon said.

Innovation As Competitive Edge

All panelists agreed that continuous innovation is a key to success in the rapidly evolving cannabis industry.

TILT’s Konder said brands must leverage unique product features to attract consumers’ interest and loyalty.

“Innovation for us is paramount and it’s become paramount for brands not just over the past several years, but right now today to differentiate in the market,” he said. “Innovation is how a brand can stand apart from its competitors on the Shelf and really sort of earn a place in consumer’s hearts.”

CCELL’s Kovacevich emphasized CCELL’s commitment to research, adding that it’s necessary to invest in R&D substantially to push the boundaries of what’s possible in vaporization technology.

He also recalled navigating the vape crisis of 2019, where he faced challenges in an attempt to raise funds due to public health concerns.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The , Ayre Group and Nikki Beach Hospitality Group Partner to Bring a Resort & Spa, Beach Club and Residences to Antigua

JOLLY BEACH, Antigua, Oct. 21, 2024 /PRNewswire/ — Today the Ayre Group and Nikki Beach Hospitality Group, the global luxury lifestyle hospitality company, announced their partnership to open Nikki Beach Resort & Spa Antigua, which will also feature a beach club – Nikki Beach Antigua – as well as branded, private Nikki Beach Residences.

The details of the resort were unveiled at a groundbreaking ceremony on Jolly Beach, the location for the new development. The mile long Jolly Beach is located on the island’s beautiful west coast, an immaculate example of one of Antigua’s 365 powdery-white sand beaches. The US $400m+ development will be an immediate neighbour to the Jolly Harbour community.

Nikki Beach Hospitality Group prides itself on providing guests with an unrivalled and distinctive barefoot luxury lifestyle experience. The properties feature cutting-edge architecture, contemporary dining, indulgent Nikki Spa services and signature entertainment, creating an atmosphere that caters to those seeking both high and low energy offerings.

“We look forward to introducing the Nikki Beach experience to the stunning island of Antigua, marking our first resort and residences in the Caribbean and our second beach club after Saint Barth. We look forward to expanding in the region and providing our guests with an exciting new destination where they can Celebrate Life with us, all while enjoying Antigua’s natural beauty, rich culture, and vibrant community,” said Lucia Penrod, Cofounder, CEO and Owner of Nikki Beach Hospitality Group.

Calvin Ayre, Chairman of the Ayre Group, explained, “This soon-to-be-developed 5-star hotel on the beachfront of Antigua is poised to become an unforgettable destination in the region, combining luxury, convenience, and modern living. As guests enter the property, they will be immediately immersed in its idyllic atmosphere and breathtaking ocean views.”

Nikki Beach Resort & Spa Antigua will become a marketing anchor for the broader tourism destination of Antigua and catalyse local private investment.

The property will boast state of the art facilities including 82 hotel rooms and suites, 181 luxury branded residences of up to four bedrooms, comprising studios, apartments, and beach-front villas of varying sizes, with a total of 263 resort keys reflecting 876 guest beds on-site. Additionally, owners of the branded residences will be able to participate in a rental program.

Besides the iconic beach club with its own boat drop-off point, there will be five additional food and beverage outlets on-site as well as extensive health and wellness areas including Tone Gym and Nikki Spa. This will also include cryo, hyperbaric, hydrothermal, red-light, and IV therapy rooms, an aquatic centre, and an exclusive residence owner’s lounge with a private gym.

The combination of world-class facilities nestled in breathtaking natural beauty will make Nikki Beach Resort & Spa Antigua and the Nikki Beach Residences a high-end destination for guests and residence owners alike.

The Antigua resort has been designed by HKS Architects and ROAM Interior Design (formerly HKS Hospitality Interiors), two of the world’s leading design firms for the hospitality, leisure, and entertainment industries. A hallmark of HKS’s award-winning work is their attention and sensitivity to the influences of local culture, natural resources, local communities, and the spirit of the location.

A significant investment will be made in the resort’s development and the expectation is that around 300 long term jobs will be created on the island along with a similar number of shorter-term construction jobs. During construction, a diverse workforce will be required for the project and once operational the resort will create significant full-time employment, resulting from the expected high levels of occupancy. Local suppliers will expand to cater for the resort’s operational needs, as well as to independently service a higher volume of tourists throughout the region. The construction workforce will as far as possible be sourced locally, where the appropriate skills are available, and the development team will be looking to utilise as much of the Antiguan supply chain as possible in terms of workforce, subcontractors, and suppliers.

The Honourable Charles “Max” Fernandez, Minister of Tourism, stated that, “The project will create significant local employment, both directly and indirectly, which is particularly welcome post the global pandemic wreaking havoc on the hospitality industry.”

The Honourable Gaston Browne Prime Minister – Antigua and Barbuda added, “I welcome Nikki Beach Hospitality Group’s 5-Star tourism development project to the shores of Antigua. Nikki Beach is a luxury brand that is celebrated for its cutting-edge architecture, contemporary dining, and amenities. The construction of this hotel will accelerate the transformation of Antigua and Barbuda as a luxury destination here in the Caribbean. I am sure many inquisitive travellers will want to enjoy the Nikki Beach experience here in Antigua. Nikki Beach ranks so highly among travellers with exquisite taste, that the outcome of its presence here will be mutually beneficial to all stakeholders.”

The team are due to break ground later this month, with an estimated build phase of approximately 36 months and an opening scheduled for 2028. The sales launch of the residences will be in Fall 2025 with Blueprint Global leading the sales and marketing. Interested parties can pre-register at Nikkibeachresidencesantigua

About The Ayre Group:

Led by Chairman Calvin Ayre, the Ayre Group are a global investment group that funds ground-breaking businesses in blockchain technology, media, publishing, health & wellness, and travel & leisure. Ayre Group builds and supports technology and businesses that break down barriers to entry, democratize opportunity, and positively enhance people’s lives.

The Group’s real estate arm Ayre Developments is the largest real estate developer in Antigua today, with projects including the Canada Place high-tech office complex—described by Antigua and Barbuda Prime Minister Gaston Browne as “the most impressive building on the island, hands down”—as well as the US $400m+ five-star Nikki Beach Antigua project scheduled for completion in 2028, plus business retreats, nightlife, and dining.

About Nikki Beach Hospitality Group:

Established by entrepreneurs Jack and Lucia Penrod, Nikki Beach Hospitality Group epitomizes barefoot luxury hospitality, curating transformative lifestyle experiences through its collection of Nikki Beach properties including 11 iconic beach clubs, five resorts, residences, dining concepts, and pop-ups as well as the group’s new restaurant concept, Lucia. Located in some of the world’s most sought-after travel destinations worldwide, Nikki Beach is recognized among the world’s best beach clubs and resorts. Nikki Beach stands as a global haven for unforgettable moments, seamlessly blending music, dining, entertainment, fashion, film, and art to create unparalleled celebrations. Beyond travel experiences, Nikki Beach extends its reach with a lifestyle division, featuring boutiques and an e-commerce shop. In 2024, the brand introduced Lucia Cannes, a groundbreaking restaurant and beach concept within the Nikki Beach Hospitality Group portfolio. Lucia promises to redefine culinary excellence and immersive dining, blending Cuisine du Soleil with vibrant, seasonally changing decor. Across the brand’s expanding endeavours, Nikki Beach Hospitality Group continues to set new benchmarks in crafting luxury travel and lifestyle experiences.

Photo – https://stockburger.news/wp-content/uploads/2024/10/Ayre_Group.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the–ayre-group-and-nikki-beach-hospitality-group-partner-to-bring-a-resort–spa-beach-club-and-residences-to-antigua-302281991.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the–ayre-group-and-nikki-beach-hospitality-group-partner-to-bring-a-resort–spa-beach-club-and-residences-to-antigua-302281991.html

SOURCE Ayre Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.