The , Ayre Group and Nikki Beach Hospitality Group Partner to Bring a Resort & Spa, Beach Club and Residences to Antigua

JOLLY BEACH, Antigua, Oct. 21, 2024 /PRNewswire/ — Today the Ayre Group and Nikki Beach Hospitality Group, the global luxury lifestyle hospitality company, announced their partnership to open Nikki Beach Resort & Spa Antigua, which will also feature a beach club – Nikki Beach Antigua – as well as branded, private Nikki Beach Residences.

The details of the resort were unveiled at a groundbreaking ceremony on Jolly Beach, the location for the new development. The mile long Jolly Beach is located on the island’s beautiful west coast, an immaculate example of one of Antigua’s 365 powdery-white sand beaches. The US $400m+ development will be an immediate neighbour to the Jolly Harbour community.

Nikki Beach Hospitality Group prides itself on providing guests with an unrivalled and distinctive barefoot luxury lifestyle experience. The properties feature cutting-edge architecture, contemporary dining, indulgent Nikki Spa services and signature entertainment, creating an atmosphere that caters to those seeking both high and low energy offerings.

“We look forward to introducing the Nikki Beach experience to the stunning island of Antigua, marking our first resort and residences in the Caribbean and our second beach club after Saint Barth. We look forward to expanding in the region and providing our guests with an exciting new destination where they can Celebrate Life with us, all while enjoying Antigua’s natural beauty, rich culture, and vibrant community,” said Lucia Penrod, Cofounder, CEO and Owner of Nikki Beach Hospitality Group.

Calvin Ayre, Chairman of the Ayre Group, explained, “This soon-to-be-developed 5-star hotel on the beachfront of Antigua is poised to become an unforgettable destination in the region, combining luxury, convenience, and modern living. As guests enter the property, they will be immediately immersed in its idyllic atmosphere and breathtaking ocean views.”

Nikki Beach Resort & Spa Antigua will become a marketing anchor for the broader tourism destination of Antigua and catalyse local private investment.

The property will boast state of the art facilities including 82 hotel rooms and suites, 181 luxury branded residences of up to four bedrooms, comprising studios, apartments, and beach-front villas of varying sizes, with a total of 263 resort keys reflecting 876 guest beds on-site. Additionally, owners of the branded residences will be able to participate in a rental program.

Besides the iconic beach club with its own boat drop-off point, there will be five additional food and beverage outlets on-site as well as extensive health and wellness areas including Tone Gym and Nikki Spa. This will also include cryo, hyperbaric, hydrothermal, red-light, and IV therapy rooms, an aquatic centre, and an exclusive residence owner’s lounge with a private gym.

The combination of world-class facilities nestled in breathtaking natural beauty will make Nikki Beach Resort & Spa Antigua and the Nikki Beach Residences a high-end destination for guests and residence owners alike.

The Antigua resort has been designed by HKS Architects and ROAM Interior Design (formerly HKS Hospitality Interiors), two of the world’s leading design firms for the hospitality, leisure, and entertainment industries. A hallmark of HKS’s award-winning work is their attention and sensitivity to the influences of local culture, natural resources, local communities, and the spirit of the location.

A significant investment will be made in the resort’s development and the expectation is that around 300 long term jobs will be created on the island along with a similar number of shorter-term construction jobs. During construction, a diverse workforce will be required for the project and once operational the resort will create significant full-time employment, resulting from the expected high levels of occupancy. Local suppliers will expand to cater for the resort’s operational needs, as well as to independently service a higher volume of tourists throughout the region. The construction workforce will as far as possible be sourced locally, where the appropriate skills are available, and the development team will be looking to utilise as much of the Antiguan supply chain as possible in terms of workforce, subcontractors, and suppliers.

The Honourable Charles “Max” Fernandez, Minister of Tourism, stated that, “The project will create significant local employment, both directly and indirectly, which is particularly welcome post the global pandemic wreaking havoc on the hospitality industry.”

The Honourable Gaston Browne Prime Minister – Antigua and Barbuda added, “I welcome Nikki Beach Hospitality Group’s 5-Star tourism development project to the shores of Antigua. Nikki Beach is a luxury brand that is celebrated for its cutting-edge architecture, contemporary dining, and amenities. The construction of this hotel will accelerate the transformation of Antigua and Barbuda as a luxury destination here in the Caribbean. I am sure many inquisitive travellers will want to enjoy the Nikki Beach experience here in Antigua. Nikki Beach ranks so highly among travellers with exquisite taste, that the outcome of its presence here will be mutually beneficial to all stakeholders.”

The team are due to break ground later this month, with an estimated build phase of approximately 36 months and an opening scheduled for 2028. The sales launch of the residences will be in Fall 2025 with Blueprint Global leading the sales and marketing. Interested parties can pre-register at Nikkibeachresidencesantigua

About The Ayre Group:

Led by Chairman Calvin Ayre, the Ayre Group are a global investment group that funds ground-breaking businesses in blockchain technology, media, publishing, health & wellness, and travel & leisure. Ayre Group builds and supports technology and businesses that break down barriers to entry, democratize opportunity, and positively enhance people’s lives.

The Group’s real estate arm Ayre Developments is the largest real estate developer in Antigua today, with projects including the Canada Place high-tech office complex—described by Antigua and Barbuda Prime Minister Gaston Browne as “the most impressive building on the island, hands down”—as well as the US $400m+ five-star Nikki Beach Antigua project scheduled for completion in 2028, plus business retreats, nightlife, and dining.

About Nikki Beach Hospitality Group:

Established by entrepreneurs Jack and Lucia Penrod, Nikki Beach Hospitality Group epitomizes barefoot luxury hospitality, curating transformative lifestyle experiences through its collection of Nikki Beach properties including 11 iconic beach clubs, five resorts, residences, dining concepts, and pop-ups as well as the group’s new restaurant concept, Lucia. Located in some of the world’s most sought-after travel destinations worldwide, Nikki Beach is recognized among the world’s best beach clubs and resorts. Nikki Beach stands as a global haven for unforgettable moments, seamlessly blending music, dining, entertainment, fashion, film, and art to create unparalleled celebrations. Beyond travel experiences, Nikki Beach extends its reach with a lifestyle division, featuring boutiques and an e-commerce shop. In 2024, the brand introduced Lucia Cannes, a groundbreaking restaurant and beach concept within the Nikki Beach Hospitality Group portfolio. Lucia promises to redefine culinary excellence and immersive dining, blending Cuisine du Soleil with vibrant, seasonally changing decor. Across the brand’s expanding endeavours, Nikki Beach Hospitality Group continues to set new benchmarks in crafting luxury travel and lifestyle experiences.

Photo – https://stockburger.news/wp-content/uploads/2024/10/Ayre_Group.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/the–ayre-group-and-nikki-beach-hospitality-group-partner-to-bring-a-resort–spa-beach-club-and-residences-to-antigua-302281991.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/the–ayre-group-and-nikki-beach-hospitality-group-partner-to-bring-a-resort–spa-beach-club-and-residences-to-antigua-302281991.html

SOURCE Ayre Group

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

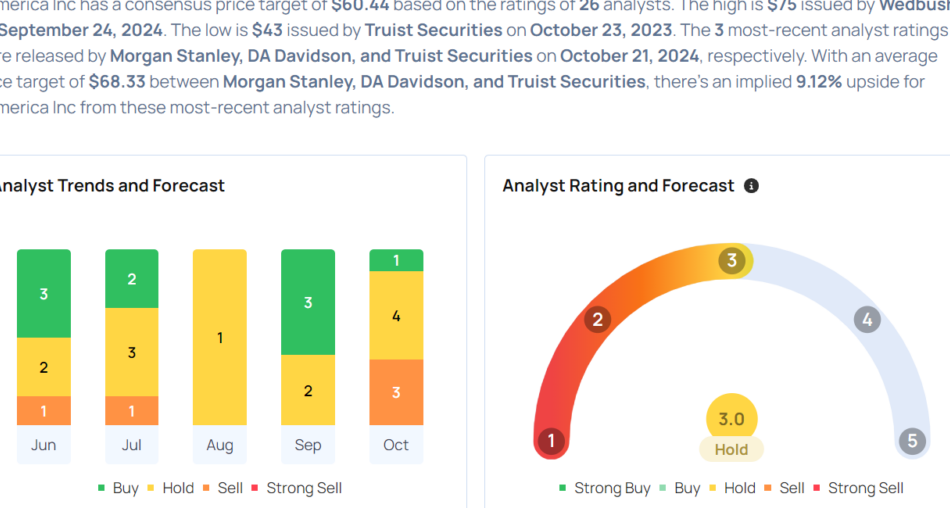

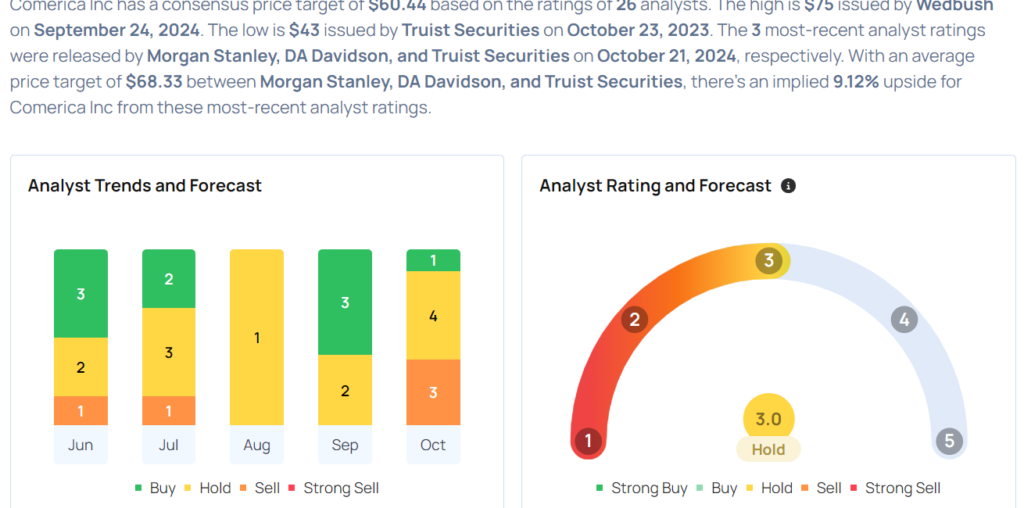

Comerica Analysts Boost Their Forecasts After Better-Than-Expected Earnings

Comerica CMA reported better-than-expected earnings for its third quarter on Friday.

The company posted adjusted earnings of $1.37 per share, beating market estimates of $1.16 per share. The company’s quarterly sales came in at $811.000 million versus expectations of $811.617 million.

Comerica shares fell 3.9% to trade at $62.41 on Monday.

These analysts made changes to their price targets on Comerica following earnings announcement.

- Barclays analyst Jason Goldberg maintained Comerica with an Underweight and raised the price target from $56 to $66.

- JP Morgan analyst Anthony Elian maintained the stock with a Neutral and raised the price target from $65 to $70.

- Stephens & Co. analyst Terry McEvoy maintained the stock with an Overweight and boosted the price target from $64 to $70.

- Wells Fargo analyst Mike Mayo maintained Comerica with an Underweight and raised the price target from $43 to $51.

- Truist Securities analyst Brandon King maintained the stock with a Hold and lifted the price target from $66 to $70.

- DA Davidson analyst Peter Winter maintained Comerica with a Neutral and raised the price target from $64 to $68.

- Morgan Stanley analyst Manan Gosalia maintained the stock with an Equal-Weight and increased the price target from $63 to $67.

Considering buying CMA stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

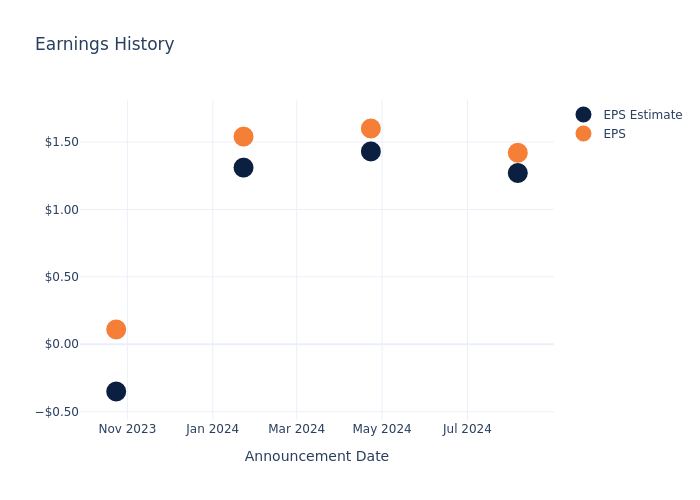

Stride's Earnings: A Preview

Stride LRN will release its quarterly earnings report on Tuesday, 2024-10-22. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Stride to report an earnings per share (EPS) of $0.22.

The announcement from Stride is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

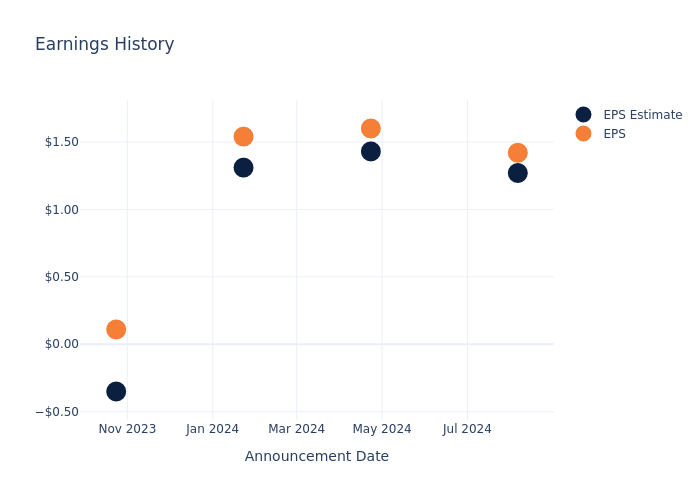

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.15, leading to a 9.26% increase in the share price the following trading session.

Here’s a look at Stride’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.27 | 1.43 | 1.31 | -0.35 |

| EPS Actual | 1.42 | 1.60 | 1.54 | 0.11 |

| Price Change % | 9.0% | 9.0% | -2.0% | 18.0% |

Stride Share Price Analysis

Shares of Stride were trading at $64.52 as of October 18. Over the last 52-week period, shares are up 45.71%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Stride

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Stride.

With 7 analyst ratings, Stride has a consensus rating of Outperform. The average one-year price target is $88.71, indicating a potential 37.49% upside.

Analyzing Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Adtalem Glb Education, Laureate Education and Strategic Education, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for Adtalem Glb Education, with an average 1-year price target of $88.5, indicating a potential 37.17% upside.

- The consensus outlook from analysts is an Neutral trajectory for Laureate Education, with an average 1-year price target of $17.0, indicating a potential 73.65% downside.

- The consensus outlook from analysts is an Outperform trajectory for Strategic Education, with an average 1-year price target of $126.67, indicating a potential 96.33% upside.

Analysis Summary for Peers

The peer analysis summary outlines pivotal metrics for Adtalem Glb Education, Laureate Education and Strategic Education, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Stride | Outperform | 10.48% | $188.21M | 5.51% |

| Adtalem Glb Education | Outperform | 12.41% | $227.37M | 3.67% |

| Laureate Education | Neutral | 8.05% | $180.25M | 13.84% |

| Strategic Education | Outperform | 8.55% | $149.03M | 1.80% |

Key Takeaway:

In terms of consensus rating, Stride is performing better than its peers. Stride has the highest revenue growth among its peers. Stride’s gross profit is lower than some peers. Stride’s return on equity is lower compared to its peers. Overall, Stride is positioned in the middle compared to its peers.

Get to Know Stride Better

Stride Inc is an American online educational company. It offers alternative programs to traditional on-campus schooling. It also operates state-funded virtual charter schools around the United States. The educational programs for K-12 students are usually monitored by parents and provide virtual classroom environments where teachers meet with students online, by phone, or in-person. The company’s contractual agreements with various school districts to offer its curriculum programs provide a majority of the company’s revenue. The company lines of business are Managed Public School Programs, Institutional, and Private Pay Schools and Other.

Unraveling the Financial Story of Stride

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Stride’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 10.48%. This signifies a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Stride’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 11.75%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Stride’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 5.51%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Stride’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.29%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.45, Stride adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Stride visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Futures dip ahead of earnings-packed week; Boeing surges

By Lisa Pauline Mattackal, Purvi Agarwal and Carolina Mandl

(Reuters) -The Dow Jones Industrial Average and S&P 500 closed lower on Monday, retreating from Friday’s record high closes and six straight weekly gains as Treasury yields rose and investors wary of high valuations awaited earnings from major companies.

“It’s not at all unusual for the market to want to take a little bit of a breather after six weeks of continually record highs,” said Carol Schleif, chief investment officer at BMO Family Office.

According to preliminary data, the S&P 500 lost 9.89 points, or 0.17%, to end at 5,854.78 points, while the Nasdaq Composite gained 50.45 points, or 0.27%, to 18,539.37. The Dow Jones Industrial Average fell 338.80 points, or 0.78%, to 42,932.84.

The yield on the benchmark 10-year Treasury jumped as high as 4.17%, a 12-week high.

“The rise in the 10-year yield is causing confusion that maybe the economy is growing too rapidly and that employment remains too resilient,” said Sam Stovall, chief investment strategist at CFRA Research. “As a result, the Fed might end up being slower to lower interest rates.”

On Friday, the Dow and the S&P 500 both closed at record highs as all three major indexes closed out a sixth consecutive week of gains, their longest winning streak this year.

Many rate-sensitive megacap technology stocks slipped, such as Tesla.

After a fairly upbeat start to earnings season, the focus was on the 114 S&P 500 companies scheduled to report this week. These include Tesla, Coca-Cola and Texas Instruments.

Ahead of a busy week for earnings, some investors likely took some profits, according to analysts. David Laut, chief investment officer at Abound Financial, said the market was looking at how stretched valuations are.

Of companies that have reported so far, 83.1% beat earnings estimates, according to data compiled by LSEG on Friday.

Monday’s declines were broad, with almost all 11 major S&P 500 sectors in the red.

The rate-sensitive Real Estate sector dropped as yields rose, while the technology sector was lifted by a jump in chip heavyweight Nvidia, which touched a fresh record high.

The economically sensitive small-cap Russell 2000 dropped.

Investors also looked ahead to the U.S. presidential election, with polls showing chances improving for former President Donald Trump, the Republican candidate. [MKTS/GLOB]

“As the election date approaches, even small changes in tight polls could drive seemingly erratic swings in market sentiment,” Danske Bank analysts said.

Meanwhile, Boeing jumped after news that workers could vote on a new deal to end a costly five-week strike.

Spirit Airlines skyrocketed 51.7% after the company reached an agreement to extend a debt refinancing deadline by two months.

Humana slipped after a report said Cigna had resumed merger talks with the health insurer. Cigna’s shares also fell.

Home sales, flash PMI and durable goods reports are on the data docket through the week, as is the Fed’s Beige Book.

(Reporting by Lisa Mattackal and Purvi Agarwal in Bengaluru, and Carolina Mandl in New York; Editing by Pooja Desai and David Gregorio)

Verizon Vs. AT&T: Wireless Giants Brace For Q3 Earnings Face-Off

As Verizon Communications Inc VZ and AT&T Inc T prepare to release their third quarter earnings, the stage is set for a head-to-head clash between the two telecom giants.

Verizon reports Tuesday with analysts expecting $1.18 EPS and $33.43 billion in revenue, while AT&T follows up on Wednesday with consensus estimates of 57 cents EPS and $30.44 billion in revenue.

Both companies have seen significant year-to-date stock recoveries, but who’s leading the charge as they head into their respective earnings calls?

Verizon: Spectrum Play Meets Bullish Sentiment

Verizon’s year-to-date gains of 12.67% may pale in comparison to AT&T, but the technical signals surrounding Verizon stock are flashing green.

Chart created using Benzinga Pro

Verizon stock, currently trading at $43.81, is supported by its eight-day simple moving average (SMA) of $43.55. Its 50-day SMA of $42.96 and 200-day SMA of $41.05 indicate a bullish trend in the near term.

Chart created using Benzinga Pro

The Moving Average Convergence/Divergence (MACD) sits at 0.12, indicating bullish momentum, although the Relative Strength Index (RSI) of 51.77 suggests a slightly overbought status. While Verizon’s technical outlook remains positive, its recent acquisition of spectrum licenses from United States Cellular Corp USM for $1 billion is likely to boost future growth, keeping the company in a strong competitive stance.

But the stock is teetering on its 20-day SMA of $44.12, giving some analysts pause ahead of earnings. Verizon will need to deliver solid financials on Tuesday to maintain its upward trend, particularly with its recent $3.3 billion deal to lease wireless towers across the U.S., adding long-term operational strength.

Read Also: How To Earn $500 A Month From Verizon Stock Ahead Of Q3 Earnings Results

AT&T: Strikes Behind, Stock Surge Ahead?

AT&T has rebounded in a big way, with its stock up 26.23% year-to-date.

Chart created using Benzinga Pro

At a current price of $21.78, AT&T has firmly planted itself above its eight-day SMA ($21.55), 20-day SMA ($21.73) and 50-day SMA ($20.98), indicating solid buying momentum.

Chart created using Benzinga Pro

Like Verizon, AT&T is also benefiting from bullish technical signals, including a MACD of 0.16. The stock is trading in the upper range of its Bollinger Bands, signaling strong bullish momentum that aligns with the positive outlook from many analysts.

Additionally, AT&T recently ratified agreements with the CWA, covering over 23,000 employees, and ensuring long-term labor peace. With a 19% wage increase locked in for Southeast employees, the carrier is laying the groundwork for steady operations—key as it gears up for its earnings.

However, the long-term question remains: can AT&T maintain its stock surge in the face of rising competition and slower 5G growth?

Who Takes The Earnings Crown?

With both companies positioned in bullish territory, the deciding factor may ultimately hinge on their upcoming earnings performance.

Verizon’s spectrum deals and wireless tower agreements may offer longer-term strategic advantages, but AT&T’s strong labor agreements and impressive stock performance show it’s not backing down from the fight.

As both telecom giants report earnings this week, investors will be watching closely to see who will come out on top. Will Verizon’s strategic moves win out, or will AT&T’s stock momentum carry it to new heights?

Read Next:

Photo: Jason Taylor AG and refrina/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

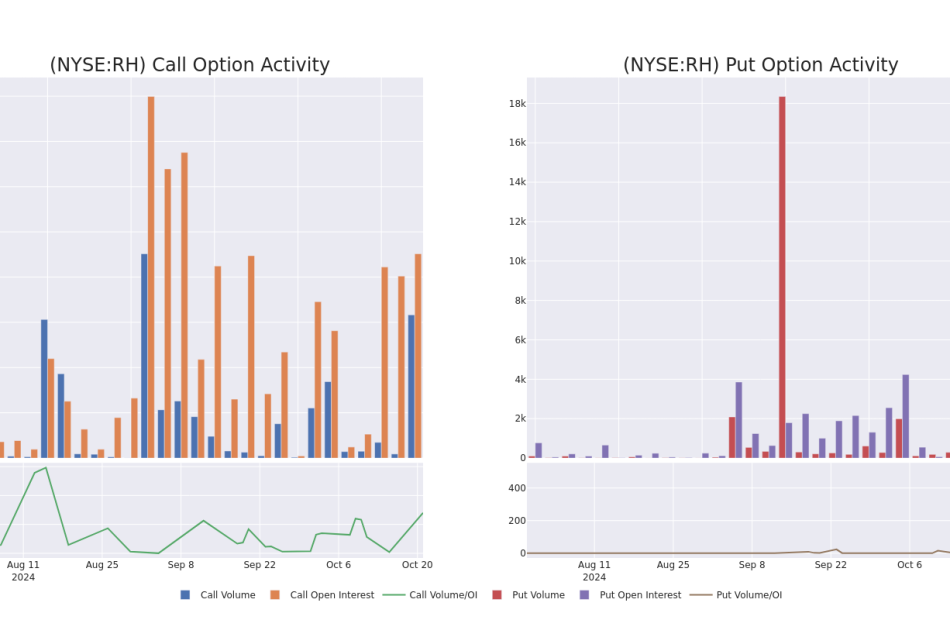

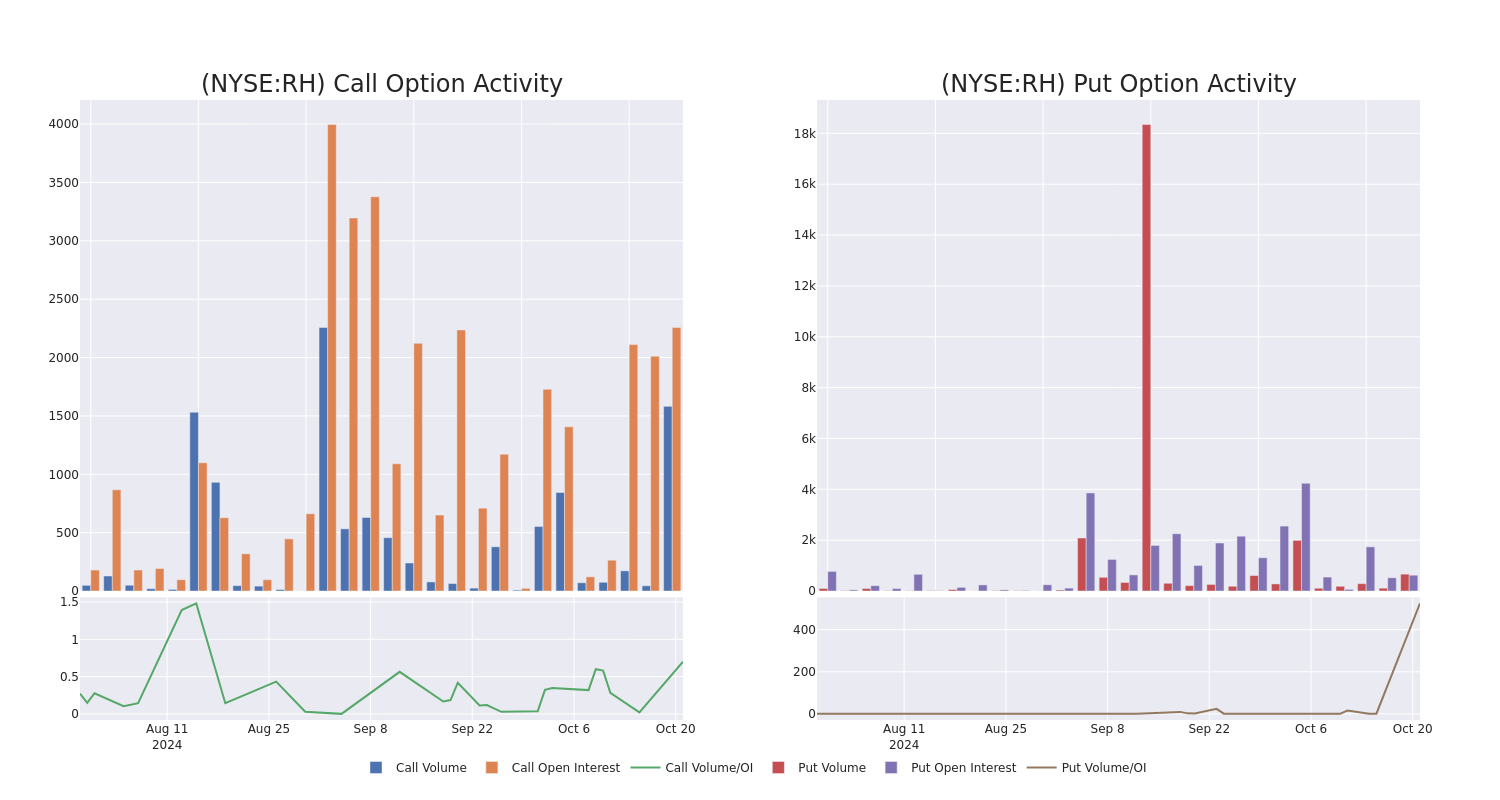

A Closer Look at RH's Options Market Dynamics

Financial giants have made a conspicuous bearish move on RH. Our analysis of options history for RH RH revealed 14 unusual trades.

Delving into the details, we found 35% of traders were bullish, while 42% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $213,413, and 8 were calls, valued at $836,480.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $280.0 to $400.0 for RH over the recent three months.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in RH’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to RH’s substantial trades, within a strike price spectrum from $280.0 to $400.0 over the preceding 30 days.

RH 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $51.7 | $50.5 | $50.5 | $330.00 | $429.2K | 630 | 201 |

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $46.6 | $46.1 | $46.6 | $330.00 | $129.3K | 630 | 403 |

| RH | CALL | SWEEP | BEARISH | 01/17/25 | $47.7 | $44.0 | $44.0 | $350.00 | $110.0K | 1.3K | 347 |

| RH | PUT | TRADE | BULLISH | 11/08/24 | $9.2 | $8.5 | $8.7 | $335.00 | $64.3K | 1 | 268 |

| RH | CALL | TRADE | BULLISH | 11/15/24 | $12.1 | $11.5 | $11.9 | $365.00 | $41.6K | 0 | 109 |

About RH

RH is a luxury furniture and lifestyle retailer operating in the $134 billion domestic furniture and home furnishing industry. The firm offers merchandise across many categories including furniture, lighting, textiles, bath, decor, and children and is growing the presence of its hospitality business with 18 restaurant locations. RH innovates, curates, and integrates products, categories, services, and businesses across channels and brand extensions (RH Modern and Waterworks, for example). RH is fully integrated across channels and is positioned to broaden its addressable market over the next decade by expanding abroad, with its World of RH digital platform (highlighting offerings outside of home furnishings), and with offerings in color, bespoke furniture, architecture, media, and more.

In light of the recent options history for RH, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is RH Standing Right Now?

- Currently trading with a volume of 641,527, the RH’s price is down by -1.77%, now at $348.25.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 45 days.

Professional Analyst Ratings for RH

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $430.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wedbush has elevated its stance to Outperform, setting a new price target at $430.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for RH, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

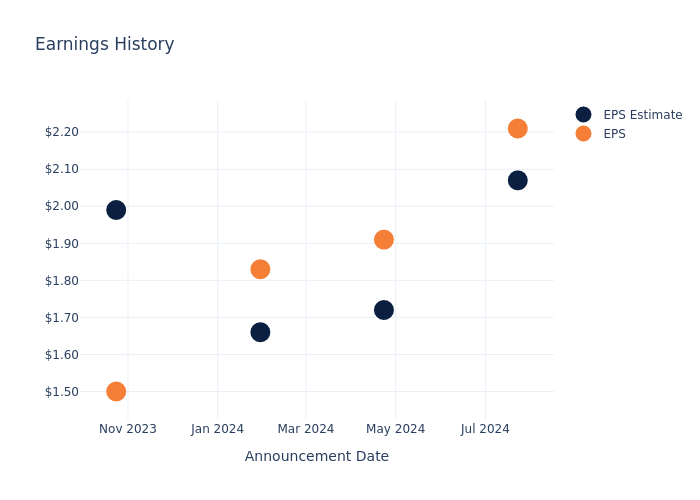

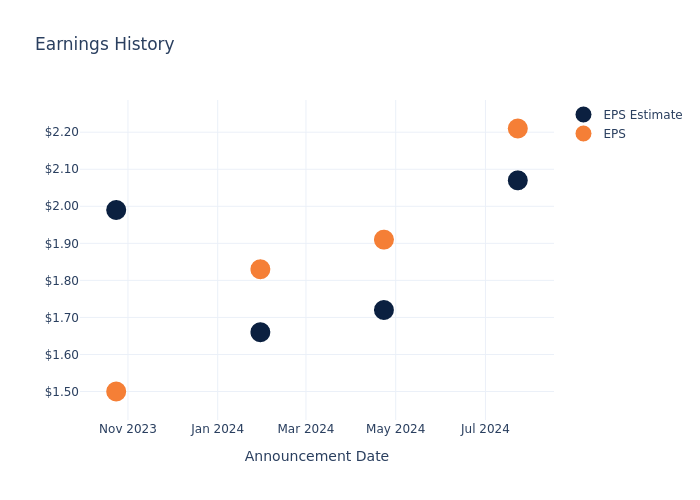

A Glimpse of Enova International's Earnings Potential

Enova International ENVA will release its quarterly earnings report on Tuesday, 2024-10-22. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Enova International to report an earnings per share (EPS) of $2.32.

Investors in Enova International are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Earnings Track Record

During the last quarter, the company reported an EPS beat by $0.14, leading to a 4.08% increase in the share price on the subsequent day.

Here’s a look at Enova International’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.07 | 1.72 | 1.66 | 1.99 |

| EPS Actual | 2.21 | 1.91 | 1.83 | 1.50 |

| Price Change % | 4.0% | -1.0% | -7.000000000000001% | -18.0% |

Enova International Share Price Analysis

Shares of Enova International were trading at $86.84 as of October 18. Over the last 52-week period, shares are up 94.35%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Enova International

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Enova International.

Analysts have provided Enova International with 4 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $90.5, suggesting a potential 4.21% upside.

Comparing Ratings Among Industry Peers

This comparison focuses on the analyst ratings and average 1-year price targets of and Enova International, three major players in the industry, shedding light on their relative performance expectations and market positioning.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for and Enova International, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Enova International | Outperform | 25.83% | $299.24M | 4.69% |

Key Takeaway:

Enova International ranks at the bottom for Revenue Growth among its peers. It is also at the bottom for Gross Profit. However, it is in the middle for Return on Equity.

All You Need to Know About Enova International

Enova International Inc provides online financial services, including short-term consumer loans, line of credit accounts, and installment loans to customers mainly in the United States and the United Kingdom. Consumers apply for credit online, receive a decision almost immediately, and can receive funds within one day. Enova acts as either the lender or a third-party facilitator between borrowers and other lenders. The company earns revenue from interest income, finance charges, and other fees, including fees on the transactions between borrowers and third-party lenders. The majority of revenue comes from the United States. The company realizes similar amounts of revenue from each of its three different products: short-term loans, lines of credit, and installment loans.

Enova International: A Financial Overview

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Enova International showcased positive performance, achieving a revenue growth rate of 25.83% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Enova International’s net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 8.58%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company’s ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.69%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.14%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 2.81, Enova International faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Enova International visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Magnificent Dividend Stocks Down 33% and 39% to Buy Right Now While Their Dividend Yields Are Near Once-in-a-Decade Highs

One of my favorite pairings when looking for passive income on the stock market is to find companies with safe, steady operations with dividend yields that are near 10-year highs. While finding this combination isn’t exactly common, chocolatier The Hershey Company (NYSE: HSY) and quick-service food franchisor MTY Food Group (OTC: MTYF.F) currently meet these requirements.

With Hershey and MTY down 12% and 20% from their 52-week highs — and 33% and 39% below their all-time highs — investors would be wise to consider these two magnificent dividend stocks at discounted prices.

Here’s why buying Hershey and MTY makes for a compelling investment proposition, with their 2.9% and 2.3% dividend yields near a decade-long high.

Hershey: Safety and stability in chocolates and snacks

Perhaps the most persuasive reason to consider buying The Hershey Company is its stability. Operating in the recession-resistant industries of chocolates and sweet and salty snacks, Hershey is undeniably steady, as evidenced by its 0.37 five-year beta.

Beta measures a stock’s volatility compared to the broader market, and a beta below 1 implies that a stock is less likely to plunge during bear markets. Stocks with a beta as low as Hershey’s are what I would consider “bedrock” types of holdings that you can use as a foundational piece in any of your portfolios — which is why it is one of my daughter’s nine core portfolio positions.

With that said, the company’s current 33% drawdown from its all-time high is its third-largest of the last three decades, only smaller than its 50% and 40% drops during the 2008 and 2000 crashes.

So, does this drop show that Hershey is damaged goods since the broader market is still up?

Not so much. First, prior to this decline, the company’s ratio of enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) was at an all-time high of 24. For perspective, Hershey’s current EV/EBITDA ratio is 15, and its historical average as a publicly traded stock is 18, which shows just how stretched its valuation had become.

Furthermore, the company is facing an array of short-term headwinds ranging from implementing a new enterprise resource planning system, cocoa prices briefly quadrupling in less than two years, and a cost-conscious consumer. Ultimately, however, when investors look back at these challenges 10 years from now, I’m confident that they will have proven to be temporary and that Hershey’s market-leading brands will have endured.

Anchored by the three most recognizable chocolate brands in the United States, according to Statista (Hershey, Kit Kat, and Reese’s), the company remains the leader of its niche. In addition to being the top banana in the chocolate world, Hershey’s recent acquisitions of Skinny Pop Popcorn and Dot’s Homestyle Pretzels are paying immediate dividends, with the new units growing sales by 13% and 65% annually since 2019.

And speaking of dividends, despite Hershey’s challenges since early 2023, it’s hiked its dividend payments twice in three quarters, raising its payout by a hefty 32%. Even after this giant increase, the dividend only uses 55% of Hershey’s net income, leaving plenty of wiggle room to continue raising a dividend that is already at a decade-long high.

Make no mistake, Hershey won’t be a multibagger anytime soon. However, its 2.9% yield, leadership position, success with recent acquisitions, and steady results in the face of a multitude of short-term issues make it a magnificent bedrock holding to buy and hold for decades.

MTY Food Group’s diversification throughout all seasons and varieties

Whereas Hershey’s safety stems from focusing on the resilient chocolate and snacking niche, MTY Food Group’s stability is thanks to its wide-ranging diversification. MTY’s portfolio of roughly 90 quick-service food brands is incredibly well diversified across all four seasons and almost every imaginable cuisine.

Dramatically oversimplifying its well-rounded portfolio, MTY’s litany of frozen treats and smoothies brands lead the way in the summer, while labels like its Wetzel’s Pretzels and Papa Murphy’s do more of the heavy lifting in colder months.

In addition to this diversification, MTY’s focus on being a franchisor — with all but about 200 of its roughly 7,000 locations franchisee-operated — makes it a uniquely safe investment proposition. Offloading the bulk of the risk and capital requirements to its franchisees, MTY is an asset-light operator with stable free-cash-flow (FCF) margins.

Even during the middle of the pandemic, MTY maintained a 20% FCF margin, which is actually higher than its current 15% mark. While lower consumer confidence has continued to weigh on the company’s FCF margins somewhat, MTY’s FCF growth over the last decade borders on art.

Making 27 acquisitions worth more than $1.7 billion in just the last decade, MTY has proven masterful at redeploying its rising FCF totals in new ventures that create even more — a beautiful flywheel effect in motion.

However, MTY doesn’t spend all of its FCF on mergers and acquisitions. Currently, the company’s 2.3% dividend yield is at its highest level of the last decade outside of the 2020 crash. What makes this yield even more exciting is that it only uses 14% of MTY’s FCF, meaning that the company could triple its yield to 7% and still have cash left over.

But, with shares trading with an EV/FCF ratio of only 10, management has leaned into buying back shares at a deep discount to the market. With management displaying an appetite for buying back shares after sell-offs over the last five years, MTY’s current 39% drop from its all-time highs should keep it repurchasing shares hand over fist.

Since 2019, MTY has lowered its share count by 1.2% annually — a nice addition to the cash returned to shareholders with dividends.

Altogether, MTY’s steady FCF generation and serially acquisitive ways combine for a powerful compounding machine that should continue to reward investors with growing dividends for decades to come.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Josh Kohn-Lindquist has positions in Hershey and MTY Food Group. The Motley Fool has positions in and recommends Hershey and MTY Food Group. The Motley Fool has a disclosure policy.

2 Magnificent Dividend Stocks Down 33% and 39% to Buy Right Now While Their Dividend Yields Are Near Once-in-a-Decade Highs was originally published by The Motley Fool