Alibaba, Nio, Baidu Stocks Decline Amid China's Rate Cuts: What's Going On?

Chinese stocks listed in the U.S. are experiencing a downturn as Beijing implements a reduction in its primary lending rates.

What Happened: On Monday’s pre-market, the shares of Chinese companies listed in the U.S. saw a decline during Monday’s pre-market session, according to Benzinga Pro. This follows Beijing’s decision to reduce its primary benchmark lending rates by 25 basis points.

At the time of reporting, Alibaba Group Holding Ltd – ADR BABA experienced a 1.99% drop, while rival PDD Holdings Inc. PDD, parent company of Temu, fell by 1.96%. Electric vehicle manufacturers Li Auto Inc. NASDAQ: LI) and NIO Inc. NIO saw declines of 1.98% and 2.30%, respectively. Additionally, Baidu, Inc. BIDU decreased by 1.28%, and JD.com, Inc. JD was down by 0.78%.

Bloomberg reported that investors are assessing the impact of commercial bank rate cuts amid discussions that only government spending might revive the economy. The People’s Bank of China (PBOC) announced the one-year loan prime rate (LPR) is now 3.1%, and the five-year LPR is 3.6%.

See Also: Why Are Alibaba, Nio, JD.Com And Other US-Listed Chinese Stocks Surging Today?

CNBC reported that despite these monetary measures, experts have emphasized the necessity for fiscal stimulus, noting that the real challenge is the lack of demand in China.

Why It Matters: The reduction in China’s lending rates is part of a broader strategy to stimulate economic growth amid ongoing challenges. The economic recovery in China has been sluggish, with a noticeable decline in consumer demand and industrial output. In recent months, the Chinese government has been under pressure to implement measures that could boost economic activity. However, the effectiveness of monetary policy alone has been questioned, with experts like Shane Oliver advocating for increased fiscal measures to address the demand shortfall.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Outlook For Vicor

Vicor VICR is preparing to release its quarterly earnings on Tuesday, 2024-10-22. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Vicor to report an earnings per share (EPS) of $0.14.

Anticipation surrounds Vicor’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

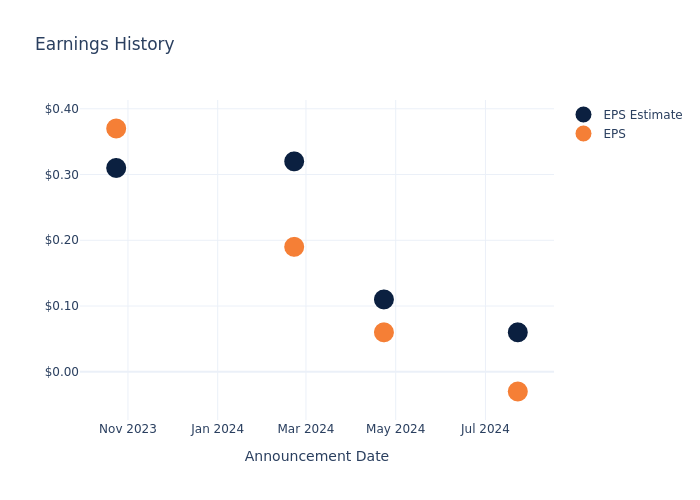

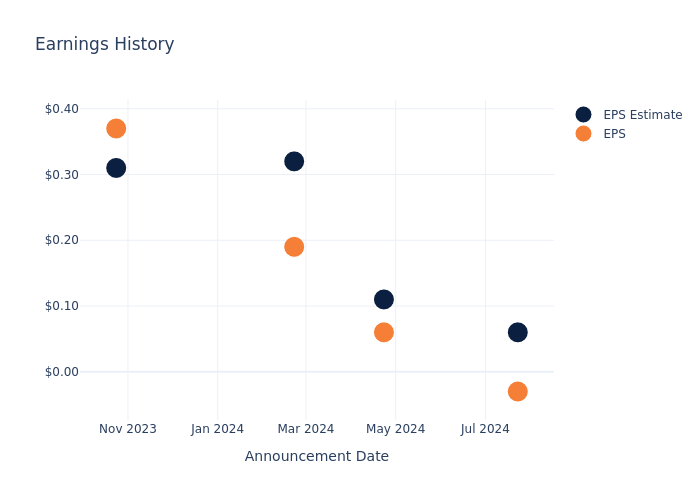

Earnings Track Record

During the last quarter, the company reported an EPS missed by $0.09, leading to a 0.05% increase in the share price on the subsequent day.

Here’s a look at Vicor’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.06 | 0.11 | 0.32 | 0.31 |

| EPS Actual | -0.03 | 0.06 | 0.19 | 0.37 |

| Price Change % | 0.0% | -9.0% | -24.0% | -27.0% |

Market Performance of Vicor’s Stock

Shares of Vicor were trading at $41.04 as of October 18. Over the last 52-week period, shares are down 22.6%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

To track all earnings releases for Vicor visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Closer Look at Moderna's Options Market Dynamics

Investors with a lot of money to spend have taken a bullish stance on Moderna MRNA.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MRNA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 19 uncommon options trades for Moderna.

This isn’t normal.

The overall sentiment of these big-money traders is split between 68% bullish and 31%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $150,092, and 15 are calls, for a total amount of $756,558.

Predicted Price Range

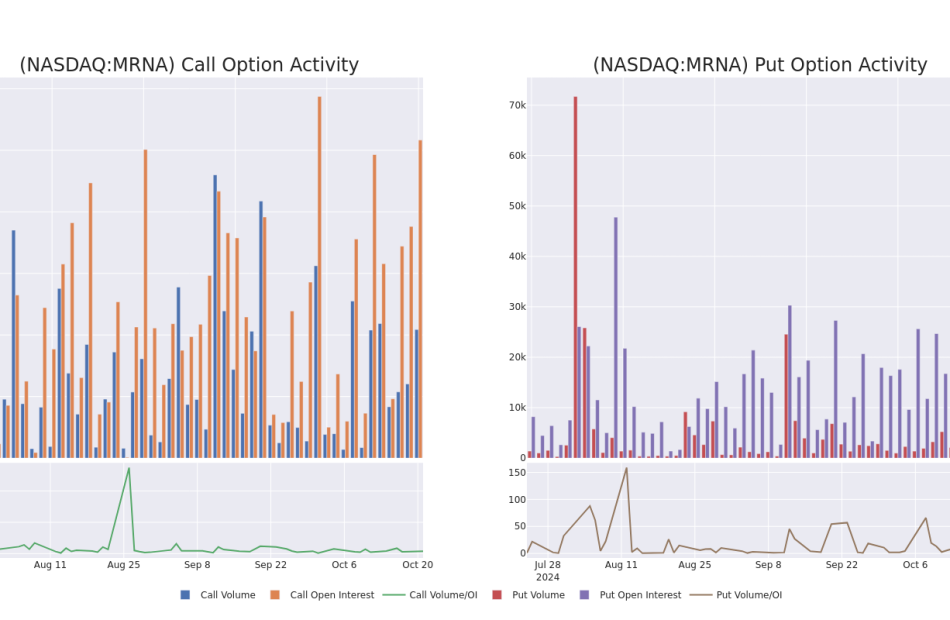

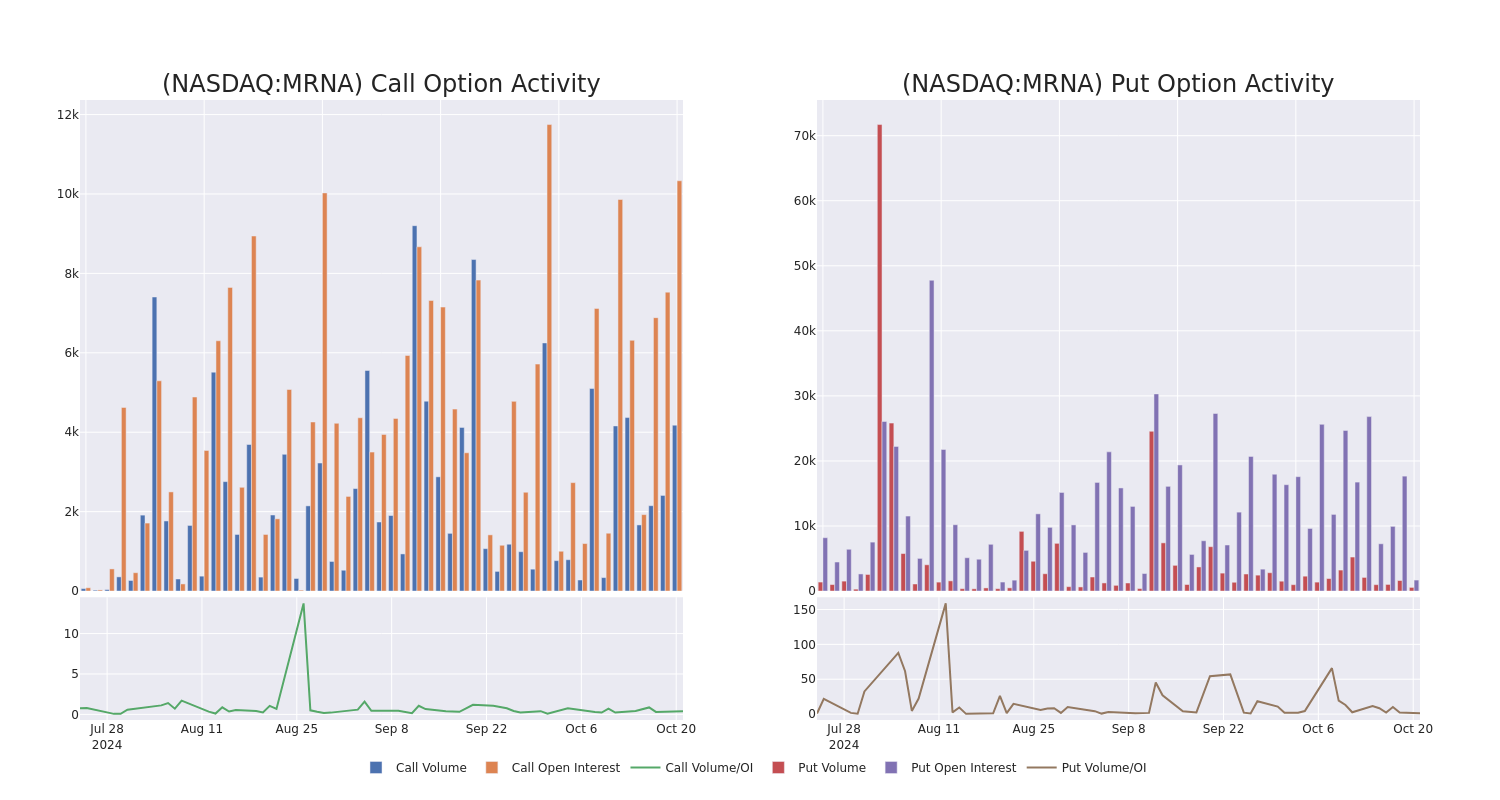

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $120.0 for Moderna during the past quarter.

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Moderna’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Moderna’s significant trades, within a strike price range of $40.0 to $120.0, over the past month.

Moderna Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | CALL | SWEEP | BULLISH | 09/19/25 | $4.25 | $4.1 | $4.25 | $95.00 | $135.0K | 548 | 319 |

| MRNA | CALL | SWEEP | BEARISH | 12/20/24 | $4.1 | $4.0 | $4.05 | $60.00 | $101.2K | 1.4K | 291 |

| MRNA | CALL | SWEEP | BULLISH | 11/15/24 | $4.05 | $4.0 | $4.0 | $55.00 | $83.6K | 856 | 351 |

| MRNA | PUT | SWEEP | BEARISH | 12/20/24 | $1.22 | $1.17 | $1.21 | $40.00 | $60.2K | 774 | 503 |

| MRNA | CALL | SWEEP | BULLISH | 09/19/25 | $4.2 | $4.05 | $4.2 | $95.00 | $60.0K | 548 | 463 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm’s mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

In light of the recent options history for Moderna, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Moderna Standing Right Now?

- With a trading volume of 1,969,412, the price of MRNA is down by -1.22%, reaching $53.44.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 17 days from now.

What The Experts Say On Moderna

In the last month, 2 experts released ratings on this stock with an average target price of $55.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Bernstein downgraded its action to Market Perform with a price target of $55.

* Maintaining their stance, an analyst from Jefferies continues to hold a Hold rating for Moderna, targeting a price of $55.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Moderna with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lumen stock jumps on Meta AI partnership

Investing.com — Lumen Technologies shares surged 17.8% in premarket trading on Monday following the announcement of a strategic partnership with Meta Platforms (NASDAQ:META) aimed at significantly increasing network capacity to support Meta’s growing artificial intelligence (AI) infrastructure.

The new collaboration will leverage Lumen’s Private Connectivity Fabric to provide Meta with enhanced interconnection and bandwidth flexibility, enabling the tech giant to meet the increasing demand for AI-driven services.

The partnership aligns with Meta’s vision to advance AI capabilities for a more connected world. Meta’s director of Network Investments, Alex-Handrah Aimé, said: “We are excited to work with Lumen to use this advanced network to provide scale and reliability for seamless experiences.”

Ashley Haynes-Gaspar, Lumen’s executive vice president and chief revenue officer, said the company is “enabling one of the biggest expansions of network capacity in our lifetime.”

“We’ve transformed our company to meet this demand.” She added that the expanded network will provide seamless and flexible connectivity as Meta’s platforms integrate more AI tools and services.

The partnership highlights the growing need for infrastructure as AI technology evolves to handle complex tasks like real-time language translation and image generation.

The initiative will offer access to both existing and new fiber routes between data centers, allowing Meta to continue to meet the needs of billions of users globally.

Lumen’s network solutions aim to prepare both companies for future developments in AI by supporting increasingly complex computing tasks.

The partnership comes as AI technologies take center stage across industries, underscoring the need for scalable and reliable networks.

Investors have responded positively, driving Lumen’s stock higher to levels last seen in October 2022.

Related Articles

Lumen stock jumps on Meta AI partnership

Disney names Morgan Stanley’s James Gorman as chair, plans to announce new CEO in 2026

Italian tech company Bending Spoons has eye on US for potential IPO

Stilwell Will Vote in Favor of Proposal to Sell IF Bancorp – UPDATE

NEW YORK, Oct. 21, 2024 (GLOBE NEWSWIRE) — Stilwell Activist Investments, L.P. (together with its affiliates, “Stilwell”), one of the largest stockholders of IF Bancorp, Inc. (“IROQ” or the “Company”) IROQ, today issued the following statement in connection with the Company’s upcoming annual meeting of stockholders scheduled to be held on November 25, 2024 (the “Annual Meeting”), at which stockholders will vote on a number of matters, including Stilwell’s non-binding proposal requesting a sale of the Company (the “Proposal”), submitted pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended:

IF Bancorp – Chronically Disappointing.

Based on chronic underperformance and the likelihood of continued underperformance, we intend to vote FOR the Proposal, copied directly below, at the upcoming Annual Meeting.

Proposal: RESOLVED, that the stockholders of IF Bancorp, Inc. (the “Company” or “IROQ“) hereby recommend that the Board of Directors take all necessary steps to promptly effectuate a sale of the Company.

As set forth in our Supporting Statement included in IROQ’s proxy statement filed with the Securities and Exchange Commission on October 16, 2024, we believe that the returns on the Company’s assets have been subpar for many years and that IROQ stockholders would be best served if the Company and its assets were sold at the earliest opportunity for the highest price available.

Although our proposal is non-binding, we believe it provides a referendum for IROQ stockholders to express their views on the status quo and that it would be incumbent upon the Board of Directors to seriously consider such views if a majority of stockholders support this Proposal at the Annual Meeting.

Investor Contact:

Megan Parisi

(787) 985-2194

mparisi@stilwellgroup.com

PLEASE NOTE: THIS IS NOT A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. DO NOT SEND US YOUR PROXY CARD. STILWELL IS NOT ASKING FOR YOUR PROXY CARD AND CANNOT AND WILL NOT ACCEPT PROXY CARDS IF SENT. STILWELL IS NOT ABLE TO VOTE YOUR PROXY, NOR DOES THIS COMMUNICATION CONTEMPLATE SUCH AN EVENT.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Speedy US corn and soy harvests strain farmers, storage capacity

By Julie Ingwersen and Heather Schlitz

CHICAGO (Reuters) – U.S. farmers are harvesting two of the largest corn and soybean crops in history at the fastest pace in years, straining their physical capabilities and their grain storage capacity.

The massive influx of crops is testing growers who are already grappling with grain prices near four-year lows, stiff competition for global export sales and farm incomes that are down 23% from a record high just two years ago.

Many Midwestern farmers still have grain left in storage from 2023, after they refused to sell a record corn crop due to low prices. Now, dry weather is accelerating this year’s harvests and forcing grain handlers in some areas to store corn outside, rather than in storage bins.

“It has been fast and furious,” Brent Johnson, a corn and soybean farmer in Ashland, Illinois, said of harvesting.

Weeks of warm and dry weather across the Corn Belt this autumn sped up crop maturity and enabled combines to keep rolling. As a result, farmers harvested 47% of the country’s second biggest corn crop in history by Oct. 13, topping the five-year average of 39%, according to U.S. data.

The harvest of the record-large soybean crop was 67% complete by Oct. 13, the fastest pace since 2012, when a major drought limited production.

Jeff O’Connor, who grows corn and soybeans near Kankakee, Illinois, said his employees only had a couple of half-days off to rest in the past month due to rapid harvesting.

“My people and equipment would like a break,” he said.

As soy harvesting winds down, farmers are moving on to corn, which typically yields more than three times as much grain per acre than soybeans. At some Midwest elevators, the flow of corn from the fields has been filling up storage, causing long lines of trucks waiting to dump their loads.

In Shell Rock, Iowa, ethanol producer POET is storing corn on the ground, local farmer Caleb Hamer said, adding that he dumped some of his harvest on a pile that looked like it held 1.5 million bushels.

“We are harvesting a crop too fast for our storage infrastructure. That’s the biggest thing,” said Chad Henderson, founder of Wisconsin-based Prime Agricultural Consultants.

Quick harvesting and localized storage squeezes are forcing farmers to consider selling some crops for less than it cost to produce them. Yet corn futures prices are signaling they should hold the grain for a few months, if possible.

On the Chicago Board of Trade, benchmark December corn futures were trading at a roughly 22-cent discount to the May 2025 contract. That means farmers could earn 22 cents a bushel by selling their corn for deferred delivery in May.

Still, growers should not store their harvest without booking any sales and risk a deeper market downturn, CoBank economist Tanner Ehmke said.

Chris Gibbs, who grows corn and soybeans in Ohio, said he has not made any advance deals to sell his autumn harvests for the first time in 48 years of farming.

“My marketing plan is to keep my head down and wait for an opportunity to come along, which is a very poor plan,” Gibbs said.

(Reporting by Julie Ingwersen and Heather Schlitz in Chicago. Editing by Tom Polansek and Marguerita Choy)

GM, Ford brace for investor scrutiny over pricing power, EV losses

By Nathan Gomes and Nora Eckert

(Reuters) – General Motors (GM) and Ford Motor (F) will likely have a tough time convincing investors when they report results that Detroit’s pricing power for gasoline cars is still strong and losses from their EV ventures are dwindling.

GM is set to release its results for the July to September period on Oct. 22, while crosstown rival Ford will report on Oct. 28.

GM CEO Mary Barra said earlier this month that profit margins had not peaked on traditional gas-powered vehicles and EV sales were ramping up.

The automaker’s shares have risen by over a third this year as GM raised its annual profit forecast twice, bolstered by strong sales of gas-powered models.

In contrast, Ford has struggled with quality woes and billion-dollar EV losses that have sent its shares down 8% this year.

Analysts from Deutsche Bank have said the automaker could fall short of expectations for the quarter, hampered in particular during the period by bloated inventories.

Wall Street has for months questioned whether consumers will pay for trucks and SUVs at historically high prices as steep interest rates and broader economic concerns loom.

Data is mixed. The average listing price for a new vehicle rose 2% month-on-month in October to $47,823, according to Cox Automotive’s latest report. That price is up only about 1% from a year ago, indicating that prices have touched a ceiling.

Automakers have had to lower prices of vehicles as cautious consumers shy away from heavier purchases – a stark contrast from the pricing power companies commanded a few years back when the production of newer models was constrained by supply chain issues.

“Concerns over peak pricing … as well as uncertainties around EV strategies and penetration, serve as mid- to longer-term overhangs,” Deutsche Bank Research said in a note.

“Moreover, we also have the November election next month that could influence EV policies one way or another.”

Both Ford and GM have focused on producing more higher margin gasoline-powered models such as Ford’s Maverick pickup and GM’s Chevrolet Trax compact SUV as EV sales growth has slowed.

Ford in August canceled its much-anticipated electric three-row SUV, saying it could not profitably launch the vehicle. GM has gone slow on its EV production goals.

The Detroit automakers have also grabbed significant market share from struggling rival Stellantis, whose sales in North America have been lagging.

Investors and analysts will also be looking for comments on how the economy is affecting consumers.

“Even with a larger-than-expected rate cut by the Fed in September, there hasn’t been a material improvement in auto loan rates or the overall affordability of new vehicles,” said Cox Automotive Chief Economist Jonathan Smoke.

Consumers’ preferences have shifted towards economical compact crossovers over traditionally preferred larger vehicles due to their lower upkeep costs and better gas mileage, U.S. automakers’ third-quarter sales data showed.

THE NUMBERS

GM:

** Analysts estimate Q3 revenue to grow about 1% to $44.5 billion when it reports results on Oct. 22

** Earnings per share (EPS) in the quarter estimated at $2.46

FORD:

** Analysts estimate Q3 revenue to grow about 2% to $42 billion when it reports results on Oct. 28

** Earnings per share (EPS) in the quarter estimated at $0.48

(Reporting by Nathan Gomes in Bengaluru, Nora Eckert in Detroit; Editing by Saumyadeb Chakrabarty)