Billionaire Philippe Laffont Just Increased His Position by 139% in This Data Center Opportunity (Hint: It's Not Nvidia)

Philippe Laffont is a billionaire investor best known for founding the hedge fund Coatue Management. While hedge funds are widely known for their sophisticated trading prowess and secretive natures, retail investors can get a glimpse into the stocks that financial institutions are buying and selling once per quarter by looking at a form 13F.

Coatue’s latest 13F contained a number of trades across major technology stocks, particularly those looking to disrupt artificial intelligence (AI). However, the fund also made a massive purchase in a data center opportunity that has largely been flying under the radar. That’s right! There are other opportunities in data centers besides Nvidia.

Below, I’m going to analyze the data center opportunity on Coatue’s radar and assess if now is a good opportunity to buy the stock.

What data center stock did Coatue Management just buy?

According to its most recent 13F, Coatue purchased 2.9 million shares of Constellation Energy (NASDAQ: CEG) during the second quarter — increasing its position by 139%.

I don’t blame you if you’re confused as to how a power utility could be seen as a data center opportunity. Here’s the thing: Data centers consume a ton of power. With AI becoming more of a tailwind for businesses across all industry sectors, companies are going to need to invest in more energy-efficient infrastructure.

This is where Constellation Energy comes into focus. The company specializes in nuclear power, which is widely seen as a superior alternative to traditional sources of powering data centers.

Some recent big-ticket moves in nuclear power

Several names in big tech have been quietly making moves at the intersection of nuclear power and data centers this year. In March, Amazon‘s cloud unit, Amazon Web Services (AWS), acquired a nuclear-powered data center from Talen Energy. And just this week, the company signed agreements with a state utility called Energy Northwest and Dominion Energy, both of which will be helping Amazon develop and explore how small modular reactors (SMR) can facilitate its nuclear power projects.

These deals by Amazon follow a similar one by Alphabet, which will be relying on Kairos Power to develop SMRs.

While the subject matter of Amazon’s and Alphabet’s recent moves have dominated headlines lately, Constellation Energy is by no means late to the party. The company has been working closely with Microsoft for quite some time, and several weeks ago, the two industry leaders announced plans to reopen a nuclear power facility on Three Mile Island in Pennsylvania.

Is Constellation Energy stock a buy right now?

The obvious takeaway here is that Constellation has experienced outsized valuation expansion recently. Following the announcement of the Three Mile Island deal on Sept. 20, shares of Constellation have risen as much as 12% — a pretty sharp move based on one press release.

While I don’t encourage trying to time your buying activity, I think investors need to approach Constellation with some caution right now. It’s no coincidence that Amazon and Alphabet have made some moves with nuclear power companies on the heels of Microsoft’s deal with Constellation.

I suspect more companies will be exploring nuclear power solutions for their data center needs. As such, shares of Constellation could experience some momentum based on any future news — whether the company is directly involved or not.

The positive thing here is that the AI story is in its early chapters. For this reason, demand for data center services and adjacent opportunities, such as nuclear power, should continue to materialize in the long run.

While Constellation Energy stock may appear a little pricey right now, Coatue’s investment is a savvy move. Investors with long-term horizons may want to keep this name on their radars.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Constellation Energy, Microsoft, and Nvidia. The Motley Fool recommends Dominion Energy and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Philippe Laffont Just Increased His Position by 139% in This Data Center Opportunity (Hint: It’s Not Nvidia) was originally published by The Motley Fool

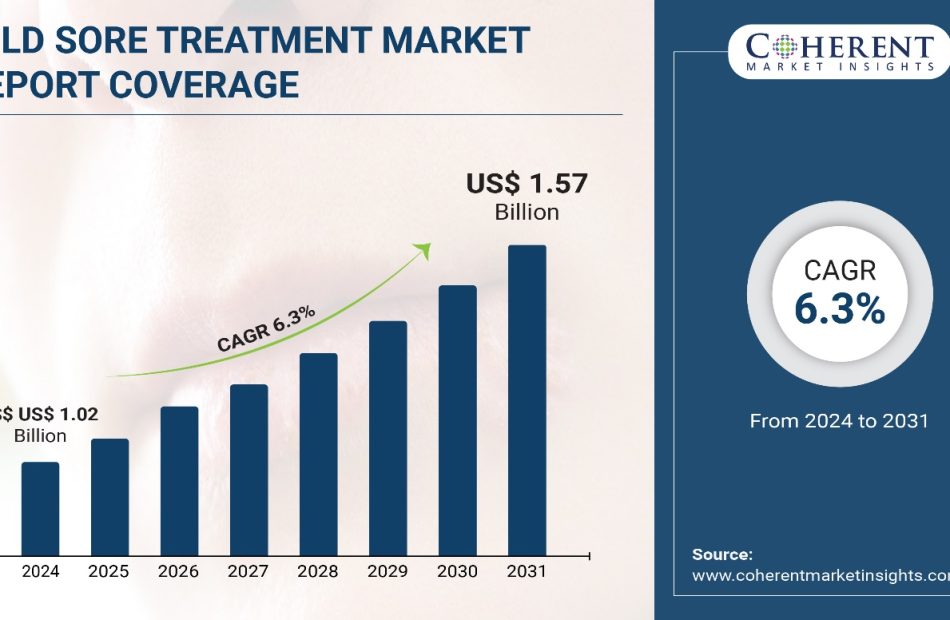

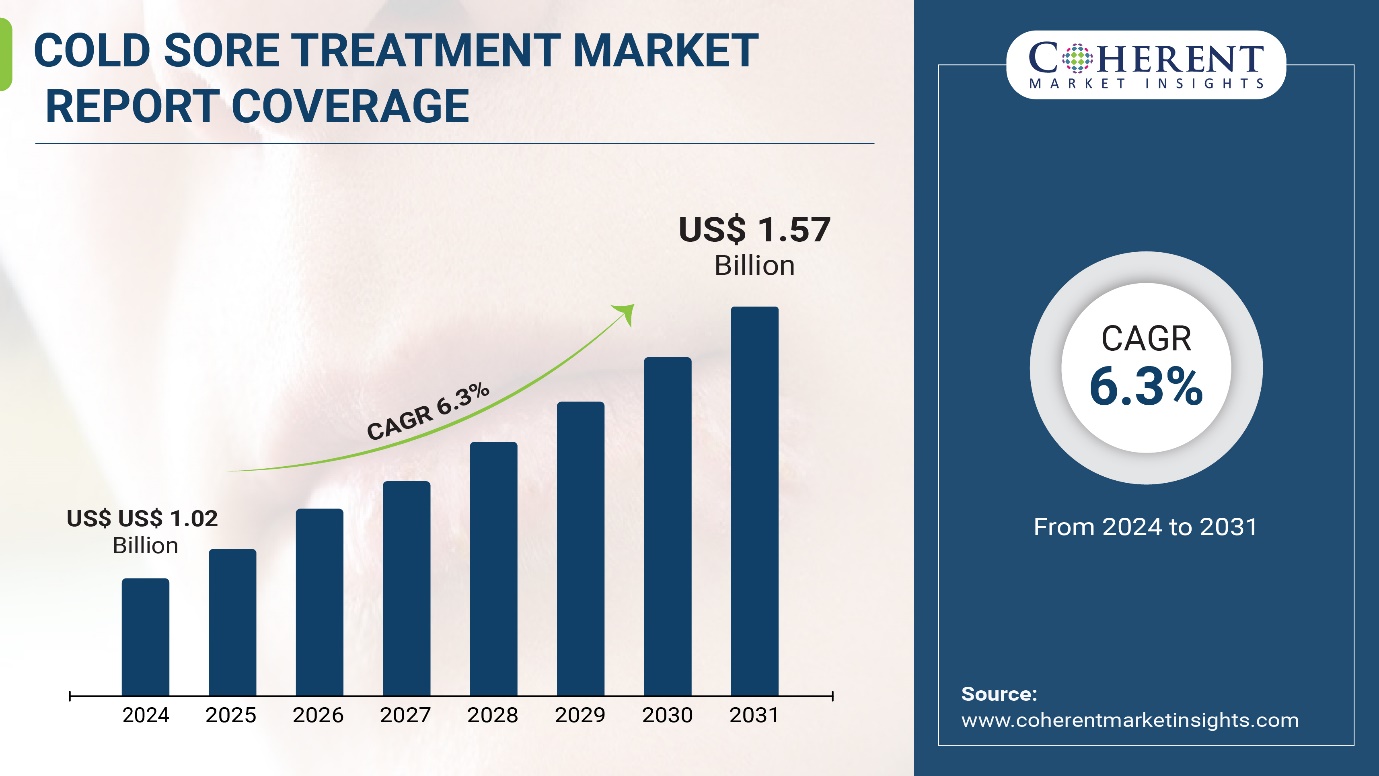

Cold Sore Treatment Market Size to Reach $1.57 Billion by 2031, Globally, at a 6.3% CAGR: Report by Coherent Market Insights

Burlingame, Oct. 21, 2024 (GLOBE NEWSWIRE) — The global Cold Sore Treatment Market Size to Grow from US$ 1.02 Billion in 2024 to US$ 1.57 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 6.3% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Rising awareness regarding available treatment options is also fueling the demand for cold sore treatments. The market is witnessing numerous product launches catering to wide-ranging consumer requirements in terms of formulation, dosage, and application methods, which is further supporting market growth over the forecast period.

Request Sample Copy of this Report: https://www.coherentmarketinsights.com/insight/request-sample/7257

Market Dynamics

The cold sore treatment market growth is majorly driven by the rising incidences of herpes labialis infections globally. According to the World Health Organization (WHO), around 3.7 billion people under the age of 50 years or 67% of the population have HSV-1 infection globally. Moreover, increasing adoption of over-the-counter medication for cold sores is also contributing to the market growth. However, lack of awareness about treatment and symptoms of cold sores in low and middle-income countries is expected to hinder the market growth.

Market Trends

The cold sore treatment market is witnessing a growing demand for topical antiviral drugs for preventing and treating cold sores. Topical antiviral drugs like penciclovir and acyclovir are widely used as they have fewer side effects as compared to oral antiviral drugs. Furthermore, the market is also expected to gain traction from increasing research and development activities for developing novel drug formulations such as combination therapies and long-acting formulations to effectively treat cold sores. For instance, in June 2022, Chugai Pharmaceutical announced results from a Phase III study evaluating the efficacy and safety of long-acting formulation of penciclovir cream for the treatment of herpes labialis.

Cold Sore Treatment Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $1.02 billion |

| Estimated Value by 2031 | $1.57 billion |

| Growth Rate | Poised to grow at a CAGR of 6.3% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Product Type, By Cold Sore Type, By Age Group, By Distribution Channel: |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Increasing incidence of cold sores • Growing demand for over-the-counter drugs |

| Restraints & Challenges | • Social stigma associated with cold sores • Self-limiting nature of outbreaks |

Topical treatments segment accounted for the largest market share of 35% in 2024 owing to the rising adoption of creams and ointments for quick relief from symptoms. Creams containing acyclovir are widely used as they are effective in reducing healing time when applied at the first signs of a cold sore outbreak. Oral antiviral medications help shorten outbreak duration and reduce symptoms severity by defending cells from virus replication if taken at the initial signs of a cold sore. However, their market share is lower at 25% due to fewer patients opting for pills over creams.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7257

The primary outbreaks segment held the dominant position in 2024 with a share of 60% due to most adults experiencing their first cold sore by age 20. Children and adolescents are highly susceptible to primary herpes simplex virus type 1 infections through oral contact.

Children formed the largest age group in 2024 with a 35% share as their immune system is not equipped to deal with the virus initially. Safety profiles of treatments targeting children are continuously improving to prevent serious complications.

Key Market Takeaways

The cold sore treatment market is anticipated to witness a CAGR of 6.3% during the forecast period 2024-2031, owing to increasing awareness initiatives by key players.

On the basis of product type, topical treatment segment is expected to hold a dominant position, owing to advantages like immediate relief and localized action. On the basis of cold sore type, primary outbreaks segment is expected to hold a dominant position over the forecast period, due to large patient population affected during initial exposures.

On the basis of age group, children segment is expected to hold a dominant position, due to underdeveloped immune defenses in pediatric patients. On the basis of distribution channel, hospital pharmacy segment is expected to hold a dominant position, owing to availability of prescription-only medications and regular check-ups.

By region, North America is expected to hold a dominant position over the forecast period, due to developed healthcare infrastructure and growing disease prevalence in the US and Canada.

Key players operating in the cold sore treatment market include GSK Plc, Novartis AG, Teva Pharmaceutical US, Inc., AbbVie Inc, Merck & Co., Inc., Pfizer Inc., Sanofi, Mylan N.V., Aurobindo Pharma, Dr. Reddy’s Pharmaceuticals, HRA Pharma, Quantum Health, Church & Dwight Co., Inc., Perrigo Company plc, Biofrontera AG, Bausch Health Companies Inc., Meda Pharmaceuticals among others.

Recent Developments

In February 2024, Abreva promoted confidence among cold store suffers by introducing a distinctive, diamond-studded lip design.

In December 2022, BioNTech initiated a Phase 1 clinical trial for BNT163, an Mrna vaccine aimed at preventing genital lesions caused by HSV-2 and potentially HSV-1.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7257

Detailed Segmentation

By Product Type Insights (Revenue, USD Bn, 2019 – 2031)

- Topical Treatments

- Creams and Ointments

- Acyclovir

- Penciclovir

- Docosanol

- Other Topical Treatments

- Medicated Lip Balms and Patches

- Oral Treatments

- Antiviral Medications

- Valacyclovir

- Famciclovir

- Acyclovir

- Over-the-Counter Medications

- Light-Based Treatments

- Laser Therapy

- Photodynamic Therapy

By Cold Sore Type Insights (Revenue, USD Bn, 2019 – 2031)

- Primary Outbreaks

- Recurrent Outbreaks

By Age Group Insights (Revenue, USD Bn, 2019 – 2031)

- Children and Adolescents

- Adults

By Distribution Channel Insights (Revenue, USD Bn, 2019 – 2031)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Regional Insights (Revenue, USD Bn, 2019 – 2031)

- North America

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Pharmaceutical Domain:

The Global Camylofin Market is estimated to be valued at USD 185.1 Mn in 2024 and is expected to reach USD 261.2 Mn by 2031, growing at a compound annual growth rate (CAGR) of 5% from 2024 to 2031.

Global chronic disease management market is estimated to be valued at USD 5.71 Bn in 2024 and is expected to reach USD 13.80 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 13.4% from 2024 to 2031.

Global donor egg IVF (in-vitro fertilization) market is estimated to be valued at USD 2.85 Bn in 2024 and is expected to reach USD 5.30 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 9.3% from 2024 to 2031.

Cold, Cough, and Sore Throat Remedies Market, Size, Share, Outlook, and Opportunity Analysis, 2024 – 2031

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing's new proposal may lead to $1 billion in wage-related costs over four years

By Abhijith Ganapavaram and Allison Lampert

(Reuters) -Boeing’s shares rose 4% on Monday on hopes of an end to a crippling strike, although analysts expressed doubts that the proposed labor contract unveiled over the weekend would muster enough support from workers.

About 33,000 workers will vote on the contract proposal on Wednesday after a more than month-long work stoppage, which has halted production of models including its best-selling 737 MAX narrowbody jets.

The vote also coincides with Boeing’s third-quarter results, in which it is expected to report a hefty loss.

“We view the proposal as a positive step,” Ben Tsocanos, aerospace director at ratings agency S&P Global, told Reuters. “Resolving the strike quickly is key to improving the company’s financial position and supporting the rating.”

Moody’s declined to comment on the new proposal. Ratings agencies have warned of a downgrade if the strike drags on.

The new contract proposal announced on Saturday includes a 35% pay hike over four years, a $7,000 ratification bonus, a reinstated incentive plan and enhanced contributions to workers’ 401(k) retirement plans, including a one-time $5,000 contribution plus up to 12% in employer contributions.

The new wage increase and the ratification bonus are an improvement over the previous offer, which was rebuffed by the striking workers, but the salary hikes still fall short of a 40% pay rise over four years demanded by the Machinists’ union.

Wells Fargo’s Matthew Akers, who has a bearish view on Boeing stock, said the offer may not be ratified.

“Our analysis of over 1,000 online comments implies a more constructive view but still not enough to pass,” Akers said in a note.

He estimated 20% were constructive on the latest offer vs 3% on the prior offer after reviewing comments on IAM 751 Reddit forum, though he cautioned the forum maybe negatively biased.

J.P.Morgan’s Seth Seifman estimated the wage hikes might increase Boeing’s costs by more than $1 billion, while Jefferies analyst Sheila Kahyaoglu expects wage-related expenses at about $1.3 billion.

The latest proposal follows weeks of sometimes acrimonious discussions between Boeing and the International Association of Machinists and Aerospace Workers (IAM) union, whose leadership faced fury from some members after endorsing the first offer from Boeing that most workers opposed.

The IAM did not explicitly endorse the latest offer but told workers on Saturday “it is worthy of your consideration”.

However, even if the new contract is accepted by members, the planemaker still faces the challenge of quickly restoring production to pre-strike levels once workers return.

“Based on our analysis of prior Boeing strikes, it has taken an average of 6-12 months after the conclusion of the strike for production rates to return to pre-strike levels. Moreover, the impact the strike has had on the already fragile supply chain is uncertain,” RBC Capital Markets analysts said.

The work stoppage has halted production of Boeing’s cash-cow 737 MAX, and 767 and 777 widebodies.

Boeing shares were trading at $161.

In a separate labor action, about 5,000 workers were set to return to work at business jet maker Textron’s facilities in Wichita, Kansas, after voting to accept a five-year contract providing wage increases of 31%.

“Boeing’s latest offer more likely to win approval, particularly following Textron’s IAM contract approval; but negative Reddit posts suggest it may not be a shoo-in,” TD Cowen analyst Cai von Rumohr said.

In a boost to Boeing, Dubai’s Emirates Airlines ordered five Boeing 777F freighters on Monday and will make a decision this year on a purchase of further Boeing or Airbus models.

(Reporting By Allison Lampert in Montreal and Abhijith Ganapavaram in Bengaluru; Editing by Anil D’Silva and Shounak Dasgupta)

Coinbase CEO Brian Armstrong Supports Republican Dave Mccormick For Pennsylvania Senate Seat: 'He Is The Better Candidate On Crypto'

Brian Armstrong, CEO of cryptocurrency exchange Coinbase, has publicly endorsed GOP nominee David McCormick for the Pennsylvania senate seat, citing his friendlier stance on cryptocurrency.

What Happened: Armstrong took to X Sunday to back the Senate hopeful. “If you live in Pennsylvania, you should vote for Dave McCormick. He is the better candidate on crypto (among many other credentials),” Armstrong wrote.

See Also: Riding Dogecoin’s Wave: Indicators Point To What Could Happen Next

The former CEO of Bridgewater Associates announced his candidacy last year, aiming to unseat three-time incumbent Democratic Sen. Bob Casey Jr.

A U.S. Army veteran and former Treasury Department official, McCormick has publicly expressed his pro-cryptocurrency stance. He stated that American leadership in blockchain and cryptocurrency is important to the country’s economic and national security.

Interestingly, in May earlier this year, his rival Casey crossed the party line to support a resolution against the SEC’s anti-cryptocurrency SAB121. On the other hand, he cosponsored the Digital Asset Anti-Money Laundering Act of 2023, brought forward by anti-cryptocurrency crusader Sen. Elizabeth Warren (D-Mass.)

According to the cryptocurrency-based prediction market Polymarket, Donald Trump had a 57% chance, against Kamala Harris’ 43%, of winning the popular vote in the key swing state.

Why It Matters: Armstrong’s endorsement of McCormick was significant, given his position as the head of one of the world’s largest digital asset trading platforms.

The cryptocurrency mogul had previously said that cryptocurrency is a non-partisan issue, with advocates from both sides of the political spectrum championing its cause.

The company revealed earlier this year it was engaging with both the Trump campaign and the Harris campaign to push for regulatory clarity for the industry.

Did You Know?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Set To Open On A Mixed Note As Investors Await Earnings From Tesla, Boeing, GM And Others: Strategist Predicts Significant Gains In This Bull Market

U.S. stocks could get off to a mixed start on Monday after the averages posted weekly gains for a sixth straight week.

Earning news flow will pick up momentum in the coming days, potentially cushioning any downside, with Tesla Inc. TSLA, Boeing Co. BA, General Motors Co. GM and several others set to post their results through Friday.

Nearly a fifth of S&P 500 companies are set to report their earnings this week. Cumulative earnings of S&P 500 companies are set to rise for a fifth straight quarter, FactSet said. According to the analytics firm, 79% of the 14% of S&P 500 companies that have reported so far have exceeded Street expectations.

On Monday, traders could focus on earnings from over 100 S&P 500 companies, and some focus could also be on the housing market.

| Futures | Performance (+/-) |

| Nasdaq 100 | -0.23% |

| S&P 500 | -0.08% |

| Dow Jones | 0.03% |

| R2K | 0.17% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY fell 0.21% to $583.38 and the Invesco QQQ ETF QQQ declined 0.38% to $492.60, according to Benzinga Pro data.

Cues From Last Week:

Despite simmering tensions in the Middle East, Energy was the worst-performing sector in the market due to multiple factors. Slower economic growth in China and a surge in U.S. oil production resulted in a fall of over 8% in WTI crude prices.

The Dow Jones Industrial Average and the S&P 500 Index jumped to fresh highs in intraday trading on Friday.

| Index | Week’s Performance (+/-) | Value |

| Nasdaq Composite | -0.07% | 18,489.55 |

| S&P 500 | 0.08% | 5,864.67 |

| Dow Jones | 0.49% | 43,275.91 |

| Russell 2000 | 1.87% | 2,276.09 |

Insights From Analysts:

Ryan Detrick, Chief Market Strategist at Carson Group, recently highlighted positive trends for the S&P 500, noting that the index has risen in 10 of the last 11 months.

Detrick emphasized the significance of sustained bull markets, remarking, “Once a bull market gets past its second birthday, they tend to last for many more years.” This insight suggests a robust outlook for investors as the current bull market matures.

Detrick underscored that the S&P 500 has registered a six-week streak of gains for the first time this year. Referencing data from 51 similar instances in the past, Detrick concluded that stocks surged 86.3% of the time when this happened, registering an average increase of 11.1%.

“Both are better than any-time returns,” he noted, reinforcing his bullish sentiment.

Nathan Peterson, Director of Derivatives Analysis at the Schwab Center for Financial Research, noted that the focus will be on earnings next week.

“At this point in time, I don’t see enough to suggest that we may be setting up for a mean reversion pullback, so the path of least resistance still seems to be higher in my view.”

He underscored that his view on equities this week is “slightly bullish.”

However, in case earnings momentum reverses, investors could book profits, Peterson added.

See Also: How To Trade Futures

Upcoming Economic Data

This week’s economic calendar is light, but housing market data could influence investor sentiment – September’s existing home sales data is scheduled to be released on Wednesday, while new home sales data will be out on Thursday.

- On Monday, Dallas Fed President Lorie Logan will speak at 8:55 a.m. ET.

- On Tuesday, Philadelphia Fed President Patrick Harker has a speech scheduled at 10 a.m. ET.

- On Wednesday, Fed Governor Michelle Bowman is scheduled to speak at 9 a.m. ET.

- Initial jobless claims are scheduled to be released on Thursday at 8:30 a.m. ET.

Stocks In Focus:

- Boeing Co. BA surged 3.8% in premarket trading after the company landed a big win with Emirates SkyCargo ordering five more Boeing 777 freighters.

- Tesla, Inc. TSLA edged lower, down by 0.8% after Friday’s marginal decline of 0.1%.

- Nvidia Corp. NVDA rose 0.33%, building on gains of 0.8% on Friday.

- Bank of America Corp. BAC shares fell 0.3% in premarket trading after the company announced the extension of guaranteed exchange rates by up to a year.

Commodities, Bonds And Global Equity Markets:

Crude oil futures edged up in the early New York session, rising nearly 1.65% as China lowered its key lending rates to support the economy.

The 10-year Treasury note yield rose marginally to 4.126%.

Most major Asian markets ended lower on Monday, with Chinese markets edging lower amid economic growth concerns.

European stocks showed tentativeness and were mostly lower in early trading.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SHAREHOLDER INVESTIGATION: Halper Sadeh LLC Investigates USAP, CPTN, NBR, INSI on Behalf of Shareholders October 21, 2024

NEW YORK, Oct. 21, 2024 (GLOBE NEWSWIRE) — Halper Sadeh LLC, an investor rights law firm, is investigating the following companies for potential violations of the federal securities laws and/or breaches of fiduciary duties to shareholders relating to:

Universal Stainless & Alloy Products, Inc. USAP‘s sale to Aperam for $45.00 per share in cash. If you are a Universal shareholder, click here to learn more about your legal rights and options.

Cepton, Inc. CPTN‘s sale to KOITO MANUFACTURING CO., LTD. for $3.17 per share in cash. If you are a Cepton shareholder, click here to learn more about your legal rights and options.

Nabors Industries Ltd. NBR‘s merger with Parker Wellbore. Per the terms of the proposed transaction, Nabors would acquire all of Parker’s issued and outstanding common shares in exchange for 4.8 million shares of Nabors common stock, subject to a share price collar. If you are a Nabors shareholder, click here to learn more about your rights and options.

Insight Select Income Fund INSI‘s sale to KKR Income Opportunities Fund. Under the terms of the agreement, INSI shareholders will receive shares of KKR Income and may elect to receive up to 5% of the consideration in cash. If you are an INSI shareholder, click here to learn more about your rights and options.

Halper Sadeh LLC may seek increased consideration for shareholders, additional disclosures and information concerning the proposed transaction, or other relief and benefits on behalf of shareholders. We would handle the action on a contingent fee basis, whereby you would not be responsible for out-of-pocket payment of our legal fees or expenses.

Shareholders are encouraged to contact the firm free of charge to discuss their legal rights and options. Please call Daniel Sadeh or Zachary Halper at (212) 763-0060 or email sadeh@halpersadeh.com or zhalper@halpersadeh.com.

Halper Sadeh LLC represents investors all over the world who have fallen victim to securities fraud and corporate misconduct. Our attorneys have been instrumental in implementing corporate reforms and recovering millions of dollars on behalf of defrauded investors.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Halper Sadeh LLC

Daniel Sadeh, Esq.

Zachary Halper, Esq.

One World Trade Center

85th Floor

New York, NY 10007

(212) 763-0060

sadeh@halpersadeh.com

zhalper@halpersadeh.com

https://www.halpersadeh.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: Vanguard's Best-Performing ETF in 2024 Will Also Outperform the S&P 500 in 2025

Buying an S&P 500 index fund is an excellent way to achieve diversification and bet on the growth of the U.S. economy. However, some investors may prefer to mix in individual stocks and exchange-traded funds (ETFs) to invest in companies they believe can help them achieve their investment objectives — whether that is fueling their passive income stream, betting on a certain theme or sector, or trying to outperform the S&P 500.

Vanguard offers over 85 low-cost ETFs for stocks, fixed income, and blends. The best-performing of those ETFs year to date has been the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) — which is up 29.2% so far in 2024 vs. a 21.9% gain in the S&P 500. Here’s why the ETF could beat the market again in 2025, and why it is worth buying and holding over the long term.

Betting on the biggest and best growth stocks

Growth investing prioritizes the potential for future earnings and cash flows, whereas value investing focuses on what a company is producing today.

With 231 holdings, the Vanguard S&P 500 Growth ETF essentially splits the S&P 500 in half and targets those companies with the highest growth rates, regardless of valuation. The strategy works well if companies deliver on earnings growth, but can backfire if actual results don’t live up to expectations.

The Vanguard S&P 500 Growth ETF has a whopping 59.7% weighting in its top 10 names — Apple, Microsoft, Nvidia, Alphabet, Meta Platforms, Amazon, Eli Lilly, Broadcom, Tesla, and Netflix. Meanwhile, the Vanguard S&P 500 ETF has just a 34.3% weighting in those same 10 stocks. Given that many of these companies have been market-beating stocks in 2024, it makes sense that the Vanguard S&P 500 Growth ETF is outperforming the S&P 500.

To continue beating the market, these companies must prove that they can grow their earnings faster than the market average, justifying higher valuations.

Understanding growth stock valuations

The following chart shows the forward earnings multiplies for these 10 companies, which are based on analysts’ estimates for the next 12 months. With the exception of Alphabet, none of these stocks look particularly cheap. But context is key.

Take Meta Platforms, for example. Meta is spending a ton of money on research and development, from buying artificial intelligence (AI)-powered Nvidia chips to experimenting with virtual reality, the metaverse, and more. Meta could easily not make these investments and boost its short-term earnings, which would make the stock look dirt cheap.

The same could be said for Nvidia, which could have toned down its pace of innovation to inflate its profitability. Instead, it chose to invest in a new chip that could deliver unparalleled efficiency and cost savings for its customers.

Amazon is known for focusing more on sales growth than on earnings growth. It could easily be a high-margin, inexpensive company if it didn’t reinvest so much of its cash flow into the business.

One reason these companies sport expensive valuations is that investors have been bidding up their stock prices. But another, more important factor is that these companies are not focused on generating as much earnings as possible right now, but rather on charting a path toward future growth that often comes at the expense of near-term results.

For this strategy to work well over time, companies must allocate capital to projects that generate a return on investment. If a company begins spending money on bad ideas, it will fall apart quickly.

A reasonably balanced growth ETF

What separates the Vanguard S&P 500 Growth ETF from other growth funds is that it includes many traditional “value” stocks, like Procter & Gamble, Merck, Coca-Cola, PepsiCo, and McDonald’s, as well as faster-growing companies in non-tech focused sectors, like UnitedHealth and Costco Wholesale. These companies don’t have nearly the growth potential of an innovative tech stock like Nvidia, but they do have track records for steady earnings growth over time. Investors are willing to pay a higher multiple for a stock like P&G relative to its peers because P&G is a high-margin, well-run business that does a masterful job developing its top brands.

While roughly 60% of the Vanguard S&P 500 Growth ETF is in its top 10 holdings, the other 40% of the fund is fairly balanced across companies from various sectors. All told, the Vanguard S&P 500 Growth ETF has a price-to-earnings (P/E) ratio of 32.9 compared to 29.1 for the Vanguard S&P 500 ETF. So it’s not like it is that much more expensive, especially compared to ultra-growth-focused ETFs like the Vanguard Mega Cap Growth ETF, which has fewer holdings and higher weightings in a handful of companies.

Think long-term with the Vanguard S&P 500 Growth ETF

With an expense ratio of just 0.1%, the Vanguard S&P 500 Growth ETF offers investors a low-cost way to target hundreds of top growth stocks without racking up high fees.

Concentrating on high-quality businesses that grow their earnings is a recipe for outperforming other funds or indexes with fewer quality names. However, it’s important to understand that the stock market can do just about anything in the short term.

If near-term results disappoint or investor sentiment turns negative, companies whose valuations are based on future growth will likely sell off more than companies that are valued fairly based on what they are earning today.

Therefore, it’s important to approach the Vanguard S&P 500 Growth ETF with a long-term mindset and the understanding that even the best companies suffer brutal sell-offs.

Should you invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Merck, Meta Platforms, Microsoft, Netflix, Nvidia, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: Vanguard’s Best-Performing ETF in 2024 Will Also Outperform the S&P 500 in 2025 was originally published by The Motley Fool