Textile Chemicals Market Expected to Grow at a CAGR of 4.7% by 2031 | SkyQuest Technology

Westford, US, Oct. 21, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Global Textile Chemicals Market will attain a value of USD 37.81 billion by 2031, with a CAGR of 4.7% over the forecast period (2024-2031). Rapid surge in demand for textiles around the world on the back of the growing world population and rising disposable income is slated to drive the demand for textile chemicals going forward. Rapidly evolving consumer preferences and growing awareness regarding aesthetic appearance are also expected to indirectly bolster market growth in the future.

Download Sample for detailed overview: https://www.skyquestt.com/sample-request/textile-chemicals-market

Browse in-depth TOC on “Textile Chemicals Market” Pages – 197, Tables – 95, Figures – 76

Textile Chemicals Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $26.19 billion |

| Estimated Value by 2031 | $37.81 billion |

| Growth Rate | Poised to grow at a CAGR of 4.7% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the world |

| Report Highlights | Updated financial information/product portfolio of players |

| Key Market Opportunities | Use of textile chemicals to develop smart textile products |

| Key Market Drivers | Rising disposable income and growing world population |

Coating and Sizing Textile Chemicals to Bring in the Most Revenue for Market Players

Use of coating and sizing chemicals in the textile industry is projected to surpass any other type of chemical going forward. Use of coatings and sizing chemicals to provide textiles with specific characteristics such as stain resistance, wrinkle-free properties, and enhanced comfort. Improvement of the physical properties of textiles through the use of these chemicals is what allows them to hold a dominant stance.

Demand for Textile Chemicals is Slated to Rise at a Rapid Pace for Technical Textile Applications in the Future

Growing emphasis on safety and advancements in the development of novel technical textile materials are projected to make the technical textile segment a highly opportune one. Extensive use of advanced textile chemicals to enhance the properties of technical textiles such as durability, water and fire resistance, antimicrobial characteristics, etc. is slated to present new opportunities for textile chemicals companies over the coming years.

Presence of Key Textile Manufacturers Allows Asia Pacific Region to Hold Sway Over Global Textile Chemical Demand

The Asia Pacific region is forecasted to spearhead sales of textile chemicals on a global level owing to the massive population base, evolving consumer preferences, and the presence of major textile manufacturing industries and companies. Growing disposable income of people in this region will also help bolster the demand for textile chemicals in the future. China and India are estimated to emerge as the most opportune markets for textile chemicals companies operating in this region.

Request Free Customization of this report: https://www.skyquestt.com/speak-with-analyst/textile-chemicals-market

Textile Chemicals Market Insights:

Drivers

- Rapidly increasing global population

- Evolving consumer preferences and rising disposable income

- Increasing aesthetic awareness among people

Restraints

- Ban on use of toxic chemicals

- Lack of sustainable chemical alternatives

Prominent Players in Textile Chemicals Market

- Archroma

- BASF SE

- Huntsman Corporation

- Lubrizol Corporation

- DyStar Group

- Kemin Industries

- Solvay SA

- The Dow Chemical Company

- Evonik Industries AG

- Clariant International AG

Key Questions Answered in Textile Chemicals Market Report

- What drives the global Textile Chemicals market growth?

- Who are the leading Textile Chemicals providers in the world?

- Which region leads the demand for Textile Chemicals in the world?

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/textile-chemicals-market

This report provides the following insights:

Analysis of key drivers (growing global population, evolving consumer preferences, rising disposable income), restraints (bans on use of toxic textile chemicals, lack of sustainable chemical alternatives), and opportunities (development of sustainable Textile Chemicals, use of textile chemicals for the development of smart textiles) influencing the growth of Textile Chemicals market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Textile Chemicals market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Related Reports:

Specialty Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Construction Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Aroma Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Crop Protection Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

Water Treatment Chemicals Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization has expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is Super Micro Computer a Millionaire-Maker Stock?

Super Micro Computer (NASDAQ: SMCI) has been through an interesting 2024. It started the year as one of the hottest stocks to own, tripling its share price in less than three months. Then, it slowly declined after investors took profits, and Supermicro (as the company is often called) reported a bad earnings report. To make matters worse, Hindenburg Research, a famed short-selling firm, reported that Supermicro was involved in accounting fraud, triggering a Department of Justice (DOJ) probe into the claims.

That’s quite the roller-coaster ride for Supermicro investors, and it has left the stock significantly down from its all-time high. So, could this be a million-dollar investing idea? After all, Supermicro’s business is booming.

Demand for Supermicro’s products has been off the charts

Super Micro Computer’s rise is tied to the incredible demand for artificial intelligence (AI) computing power. Supermicro makes components for servers and also sells complete server systems. The company’s products are set apart from the competition by their superior cooling technology: Its most efficient servers are liquid-cooled, which eliminates the need to place these servers in large rooms to be cooled by expensive air conditioning.

According to Supermicro, this provides up to 40% energy savings and 80% space savings, as the racks can be placed closer together because airflow isn’t as critical. This combo allows its customers to pack more servers in a room, and that’s a key selling point.

The massive demand for its products has rapidly accelerated Supermicro’s business. In Q4 FY 2024 (ending June 30), Supermicro’s revenue rose 143% year over year to $5.3 billion. The company also gave strong guidance for FY 2025, with management expecting between $26 billion and $30 billion in revenue — about 74% to 101% growth.

But management has a larger vision than that. It believes it can grow its business to $50 billion in annual revenue. While this may seem like a lofty goal, this projection was $20 billion during last year’s Q4 results, and Supermicro’s 2025 guidance has already exceeded that level.

If that were the only piece of information investors had, Supermicro would probably still be one of the most popular stocks on the market, but there’s far more to this story.

Supermicro isn’t without its problems

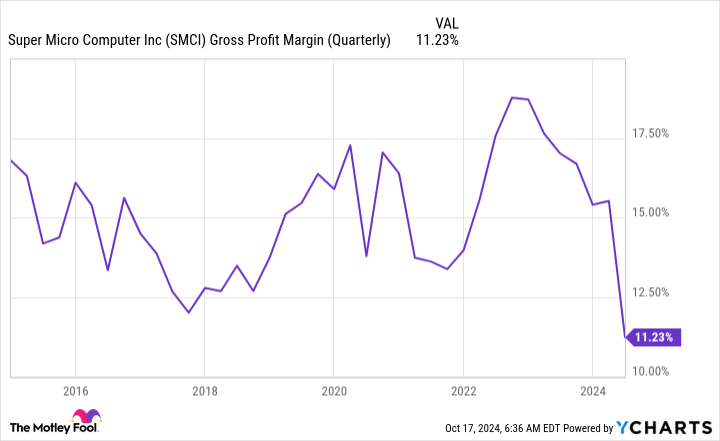

One huge red flag in Supermicro’s results is its declining gross margin. This value has leached to a decade-long low despite rising revenues. That’s never a good sign.

Management claims that its gross margin should tick up throughout FY 2025 due to a more profitable product mix, manufacturing efficiencies in its liquid-cooled product line (its factories in Malaysia and Taiwan are still scaling up production), and new products. This will be a key point for investors to watch, as Supermicro’s profits could boom if its gross margin improves throughout the year.

However, with accounting malpractice claims in the air, some investors are worried that they cannot trust anything management says. Noted short-selling firm Hindenburg Research called out Supermicro’s past mistakes, as the company paid a $17.5 million fine for accounting errors it made in 2018. To make matters worse, Supermicro also delayed its end-of-year form 10-K filing this year because it was assessing the “design and operating effectiveness of its internal controls over financial reporting.”

That’s another potential weakness, and with the DOJ looking into it, the potential scandal may cause investors to stay far away from Supermicro. I wouldn’t blame anyone, as there’s a lot of risk in the stock. But there’s also a lot of reward if management’s projections come true and the DOJ probe finds nothing wrong.

Supermicro may be one of the cheapest stocks associated with the AI investment trend, trading for a mere 15 times forward earnings estimates.

If it gets through these choppy waters unscathed, it’s not unrealistic to think that it could fetch a premium equal to that of the S&P 500 (SNPINDEX: ^GSPC), which trades at 23.8 times forward earnings on average.

Supermicro stock involves a lot of risk, but the possible upside is also there. So, will this stock make you a millionaire? Likely not. I’m talking about the stock doubling or tripling in the next few years, so unless you have a massive pile of cash to put into it, it won’t do it.

However, if you’re interested in taking a small position that’s adjusted for risk (Supermicro makes up about 1% of my portfolio), it has the potential to boost your long-term returns. This way, the stock could accelerate your path to becoming a millionaire.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Super Micro Computer a Millionaire-Maker Stock? was originally published by The Motley Fool

Oil rises as Israel plans next Iran move after weekend attack

(Bloomberg) — Oil gained — after losing almost 8% last week — as traders tracked the risk to supplies from tensions in the Middle East and China again moved to bolster its the economy.

Most Read from Bloomberg

Global benchmark Brent rose above $74 a barrel, while West Texas Intermediate topped $70. On Saturday, a Hezbollah drone exploded next to Prime Minister Benjamin Netanyahu’s private home. The following day, Israel opened a fresh military assault on the group’s strongholds in Lebanon. Israel has already vowed to retaliate against Iran for a missile attack at the start of October.

Meanwhile, China — the world’s largest oil importer — cut its benchmark lending rates on Monday, after the central bank lowered interest rates at the end of September as part a series of measures to revive growth. Speaking in Singapore, Saudi Aramco Chief Executive Officer Amin H. Nasser said he is bullish about the nation’s consumption.

Crude has had a volatile month, with traders balancing risks to flows from the Middle East against signs of soft demand in China. At the same time, the International Energy Agency has said rising global supplies could lead to a surplus next year, with OPEC+ set to restore some shuttered capacity in stages from December.

“If we don’t see a major escalation of the situation in the Middle East, I still expect that oil prices will be further under pressure because we are entering a period, including next year, of more comfortable markets,” Fatih Birol, head of the IEA, told Bloomberg Television on Monday. He cited factors including the rapid growth of output in the Americas.

Still, traders remain on edge. Bullish call options continue to trade at a premium to bearish puts, while weekly call option volumes on the global Brent benchmark were the second-largest on record last week.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Gas Pressure Regulator Market is Projected to Reach a Valuation of US$ 4.09 Billion at a CAGR of 3.7% by 2034 | Fact.MR Report

Rockville, MD , Oct. 21, 2024 (GLOBE NEWSWIRE) — According to a newly published study by Fact.MR, a market research and competitive intelligence provider, the global Gas Pressure Regulator Market is analyzed to reach a size of US$ 2.84 billion in 2024 and further increase at a CAGR of 3.7% from 2024 to 2034.

The oil and gas industry’s ongoing production and exploration efforts are driving the expansion of the gas pressure regulator market growth. Reliable pressure management systems are becoming pivotal as companies in this sector spend more on advanced extraction technology and infrastructure. Gas pressure regulators are crucial to the efficiency of operations because they ensure that gas flow and pressure levels are kept within safe and useful ranges.

This is vital for maintaining stringent safety standards, which decreases the possibility of accidents and assures regulatory compliance, in addition to optimizing production. Consequently, the demand for effective gas pressure regulating systems is rising.

East Asia’s growing manufacturing sector and the increasing reliance on natural gas for electricity and heating are contributing to the market expansion in the region. The market in North America is expanding due to increased consumption of natural gas in industrial, commercial, and residential settings. Effective gas distribution systems are becoming more necessary as shale gas output rises.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10422

Key Takeaways from Market Study:

- The global market for gas pressure regulators is approximated to reach a valuation of US$ 4.09 billion by the end of 2034.

- The East Asia region is analyzed to lead with a 26.9% worldwide market share in 2024.

- The North American market is projected to touch a value of US$ 960.7 million by 2034-end.

- Demand for single-stage gas pressure regulators in Japan is forecasted to increase at 3.9% CAGR between 2024 to 2034.

- China is estimated to hold 47.9% portion of the East Asia market in 2024.

- By gas type, the fuel gases segment is evaluated to expand at a CAGR of 3.8% through 2034.

“Leading gas pressure regulator manufacturing companies are focusing on R&D projects to offer end users high-value solutions that increase their safety and productivity,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Gas Pressure Regulator Market:

Emerson Electric Co.; Rotarex SA; Matheson Tri-Gas, Inc.; Essex Industries, Inc.; Linda plc.; Watts Water Technologies, Inc.; Honeywell International; Itron Inc.; Xylem; Tewelding Engineers; Shenzen Wofly Technology Co., Ltd.; GMR Gas S.R.O.

Single-stage Gas Pressure Regulators Becoming Ideal Choice in Several Settings:

The popularity of single-stage gas pressure regulators is increasing due to their low cost, simplicity of operation, and efficiency. Because these regulators are designed to drop high inlet pressure to lower exit pressure in a single step, they are ideal for applications requiring only slight pressure reductions. Its simple design has fewer components than multi-stage regulators, which lowers manufacturing costs and makes installation and maintenance easier.

For people and businesses searching for dependable and efficient solutions to manage gas pressure in a variety of applications, from industrial operations to residential heating, single-stage gas pressure regulators are a budget-friendly choice. The increasing need for trustworthy, low-maintenance, and effective solutions from customers is driving an expansion in the requirement for single-stage gas pressure regulators across several industries.

Gas Pressure Regulator Industry News:

- GCE Healthcare introduced a new design for their most recent high-pressure gas regulator in June 2021. MediTec is a high-pressure regulator with a distinctive and cutting-edge design that combines extensive manufacturing expertise with professional medical knowledge.

- In March 2021, Colfax Corporation unveiled a new gas regulator solution that was more capable than its previous offers. Once the company makes its debut, its global market share should rise.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10422

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the gas pressure regulator market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (single-stage, double-stage), gas capacity (toxic gases, corrosive gases, inert gases, fuel gases, others), and application (oil & gas, medical, automotive, manufacturing, residential & commercial, mining, water treatment), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Segmentation of Gas Pressure Regulator Market Research:

- By Product Type :

- By Gas Capacity :

- Toxic Gases

- Corrosive Gases

- Inert Gases

- Fuel Gases

- Others

- By Application :

- Oil & Gas

- Medical

- Automotive

- Manufacturing

- Residential & Commercial

- Mining

- Water Treatment

Checkout More Related Studies Published by Fact.MR Research:

Fire Protection System Market: is estimated to achieve a size of US$ 70.48 billion in 2024, according to a revised research report published by Fact.MR. Demand is projected to expand at a notable CAGR of 9.1% to touch a valuation of US$ 168.4 billion by 2034-end.

Flexographic Printing Technology Market: is projected at US$ 2.86 billion in 2024. The market has been evaluated to advance at a CAGR of 6.5% and reach a valuation of US$ 5.38 billion by the end of 2034.

Blow Moulding Machine Market: was valued at US$ 2,443.4 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 3.7% to end up at US$ 3,604.0 Million by 2034.

Land Survey Equipment System Market: is expected to reach a valuation of US$ 8,523.2 million in 2024 and is projected to climb to US$ 13,363.4 million by 2034, expanding at a CAGR of 4.6% during the forecast period of 2024 to 2034.

Portable Inverter Generator Market: was valued at US$ 3,404.1 million in 2023 and has been forecasted to expand at a noteworthy CAGR of 9.4% to end up at US$ 8,959.8 Million by 2034. The portable inverter generator market accounts for around 19% in overall generator market.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cryogenic Ethylene Market Share Expand at a CAGR of 9.2%, Reaching US$ 13,760.3 Million by 2034 | Fact.MR Report

Rockville, MD , Oct. 21, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the Global Cryogenic Ethylene Market is estimated to reach a valuation of US$ 5,706.9 million in 2024 and is expected to grow at a CAGR of 9.2% during the forecast period of (2024 to 2034).

The cryogenic ethylene market is a dynamic and ever-evolving industry that is driven by several causes. First and foremost, the driving force affects to the increase in demand for polyethylene. It is a multi-application plastic used across packaging, building, and construction, and consumer goods. Technological advancement has also been a key determinant in the market.

Innovations in cryogenic storage and transportation have so far enabled ethylene to be efficiently and safely handled, thus making it more accessible to industries worldwide. More stress is being laid on research and development, too, in finding new applications for cryogenic ethylene in the manufacture of speciality chemicals and materials.

As would be expected from the established chemical companies and special gases suppliers, the competitive landscape of cryogenic ethylene is shared between just a few big names. Competition among the companies exists concerning product quality, pricing, distribution networks, and many other aspects. There is even variation within products on the basis of their capabilities to deliver supplies of cryogenic ethylene credibly and regularly.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=7232

Key Takeaways from Market Study:

- The global Cryogenic Ethylene market is projected to grow at 2% CAGR and reach US$ 13,760.3 million by 2034

- The market created an opportunity of US$ 8,053.4 million between 2024 to 2034

- North America is a prominent region that is estimated to hold a market share of 5 % in 2024

- Polymer production under application segment is estimated to grow at a CAGR of 2% creating an absolute $ opportunity of US$ 8,053.4 million between 2024 and 2034

- North America and East Asia are expected to create an absolute $ opportunity of US$ 4,633.0 million collectively

“The cryogenic ethylene market is poised for continued growth, driven by increasing demand for polyethylene, advancements in cryogenic technology, and expanding industrial applications. However, challenges such as volatility in raw material prices and regulatory pressures could impact market dynamics.” says a Fact.MR analyst.

Leading Players Driving Innovation in the Cryogenic Ethylene Market:

Air Liquide ; Borealis; Chevron Philips; DOW; Eastman; Exxon Mobil; Indorama; Lotte; LyondellBasell; BASF; Reliance Industries Limited; Shell Global; SABIC; INEOS Group AG; Other Prominent Players.

Market Development:

Recent innovations include, LanzaTech partnered with Danone to concentrate on monoethylene glycol-a main feedstock for polyethylene terephthalate applied to resins, fibers, and bottles in May 2022.

In March 2024, New Energy Blue reached another critical milestone in its Decarbonizing America initiative by forming New Energy Chemicals, a game-changing biochemical subsidiary. The subsidiary will focus on producing, during this first phase of the project, bio-based ethylene that is sourced and manufactured in the US.

In Dec 2023, EFC Gases & Advanced Materials introduced an innovative neon gas cycling system designed to provide consistent and stable pricing for neon to end users over the long term.

Cryogenic Ethylene Industry News:

- In December 2021, Butler Gas received formal recognition as the designated industrial gas supplier for the Pittsburgh Penguins. This partnership involves Butler Gas supplying propane for the Zambonis and industrial forklifts used at the Penguins’ facilities, namely PPG Arena and UPMC Lemieux.

- In May 2022, LanzaTech partnered with Danone to concentrate on monoethylene glycol-a main feedstock for polyethylene terephthalate applied to resins, fibers, and bottles.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=7232

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the global Cryogenic Ethylene market, presenting historical data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on Grade (Polymer Grade, Chemical Grade), Application (Chemical Production, Polymer Production, Alkylation and Refining, Solvent and Specialty Chemicals, Automotive, Construction, Medical and Pharmaceuticals, Textile and Fiber Production), Transport Mode (Tank Cars (Rail Cars), Cargo Tanks (Tank Trucks), ISO Containers, High-Pressure Cylinders), across major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and Pacific, Middle East & Africa).

Segmentation of Cryogenic Ethylene Industry Research:

- By Grade :

- Polymer Grade

- Chemical Grade

- By Application :

- Chemical Production

- Ethylene Oxide (EO)

- Ethylene Glycol (EG)

- Ethylene Benzene (EB)

- Polymer Production

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene (PE)

- Solvent and Specialty Chemicals

- Agricultural Intermediates

- Polyethylene Wax

- Refrigerant

- LNG Liquifaction

- Coolant Systems

- Other Applications

- Chemical Production

- By Transport Mode :

- Tank Cars (Rail Cars)

- Cargo Tanks (Tank Trucks)

- ISO Containers

- High-Pressure Cylinders

Checkout More Related Studies Published by Fact.MR Research:

The global high purity boron market is valued at US$ 1.21 billion in 2024 and is forecasted to expand at a CAGR of 8.5% to reach US$ 2.72 billion by the end of the assessment period in 2034.

The global EVA foam market is approximated to touch a valuation of US$ 18.99 billion in 2024. The market has been forecasted to increase at 5.4% CAGR to achieve a value of US$ 32.2 billion by the end of 2034.

Revenue from the global seismic rubber bearing and isolator market is estimated to reach US$ 461.91 million in 2024. The market is analyzed to rise at a CAGR of 3.2% to reach US$ 630.69 million by the end of 2034.

The global electroplating chemicals market is currently valued at around US$ 49.23 billion in 2024 and is forecasted to expand at a CAGR of 6.8% to reach US$ 94.69 billion by 2034.

The global container glass coating market is estimated to reach a valuation of US$ 3.91 billion in 2024 and further expand at a CAGR of 5.6% to end up at US$ 6.77 billion by the year 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nearly Half of Americans Are Absolutely Wrong About This All-Important Social Security Rule

Social Security is the foundation for many Americans’ retirement plans. However, not everyone knows all of the details of how the government program works. There are a few foundational rules everyone should know, but many Americans’ knowledge falls short for even the most basic and important rules governing the program.

If you don’t know the basics of how Social Security works, making an informed decision about when to claim your retirement benefits becomes impossible. Applying for benefits too early (or too late) can have serious long-term ramifications on your retirement goals. Unfortunately, almost half of Americans maintain an incorrect belief about how claiming benefits early will impact their monthly benefit, according to a recent survey from Nationwide.

A costly mistaken belief

In the survey, 48% of Americans incorrectly identified the following statement as true: “If I claim benefits early, my benefits will go up automatically when reaching full retirement age.”

Most readers will reach full retirement age at 67 despite becoming eligible to claim Social Security benefits at age 62. But there’s no free lunch when it comes to these benefits. The truth is claiming your benefits before you reach full retirement age will permanently reduce your monthly benefit.

The following table shows just how much less you can expect to receive relative to your full retirement age if you claim early.

Claiming Age% of Full Benefit6270%6375%6480%6586.7%6693.3%67100%

For Americans with a full retirement age of 67 (born in 1960 or later).

Table source: Author. Data source: Social Security Administration.

Why is this misunderstanding so prevalent?

There’s a reason why many people may maintain the mistaken belief that you’ll see a bump in benefits upon reaching full retirement age. That’s because sometimes you actually do. But that’s only due to another commonly misunderstood rule: the Social Security earnings test.

The Social Security earnings test says if you earn over a certain amount while collecting retirement benefits before your full retirement age, the Social Security Administration will withhold some of your monthly benefits. The amount withheld is factored back into your monthly benefit once you reach full retirement age. At that point, the earnings test no longer applies, and the SSA no longer withholds any of your benefit.

In this context, the ultimate size of your check is primarily determined by the age at which you initially apply for Social Security. If you never exceed the earnings test threshold in a given year, you’ll never see a change in the amount you collect besides the annual COLA.

Many Americans are unaware of how the Social Security earnings test works as well. Just 56% of survey respondents correctly answered a question about it in Nationwide’s survey.

The earnings test is the exception to the rule, not the rule itself. It’s important to make that distinction to avoid confusion when making a decision about when to claim benefits.

It pays to delay

All things being equal, it’s typically beneficial to wait to claim your benefits, possibly even beyond your full retirement age.

If you opt to wait to claim your benefits, the Social Security Administration will increase your monthly benefit by 2/3 of a percentage point for each month you delay beyond full retirement age. Those delayed retirement credits max out at age 70, which means someone with a full retirement age of 67 can receive a 24% boost to their monthly checks.

A 2019 study from United Income found the majority of seniors (57%) would be better off by waiting until age 70 to claim their retirement benefits. Just 8% would benefit from claiming before age 65.

There are plenty of good reasons to claim early, though.

For one, if the quality of your life with the supplemental income is significantly higher than without, then it probably makes sense to claim it when you need it. There are steps you can take later if your situation improves to mitigate the impact of claiming early.

Another situation is when you have a reasonable expectation that you’ll pass away earlier than your peers. Social Security is designed to pay out roughly the same amount in lifetime benefits for someone living an average life expectancy regardless of when they claim. But if you suffer from a condition that curbs your life expectancy, it might make sense to claim your benefits earlier.

No matter when you decide to claim, be sure you do it with a complete understanding of how your claiming age impacts your monthly benefit and whether or not you should actually expect your benefit to increase in the future.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Nearly Half of Americans Are Absolutely Wrong About This All-Important Social Security Rule was originally published by The Motley Fool

The Rise of Metaverse Market: A $1,303.4 billion Industry Dominated by Microsoft, Sony, Meta, HTC | MarketsandMarkets™

Delray Beach, FL, Oct. 21, 2024 (GLOBE NEWSWIRE) — The global Metaverse Market size is expected to grow from USD 83.9 Billion in 2023 to USD 1,303.4 Billion by 2030 at a CAGR of 48.0% during the forecast period, according to new research report by MarketsandMarkets™

Browse in-depth TOC on “Metaverse Market”

291 – Tables

67 – Figures

359 – Pages

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=166893905

Metaverse Market Dynamics:

Drivers

- Increase in demand from entertainment and gaming industries

- Emerging opportunities from adjacent markets

- Virtualization in fashion, art, and retail industries

Restraints

- High installation and maintenance costs of high-end metaverse components

- Regulations pertaining to cybersecurity, privacy, and usage standards

Opportunities

- Incorporation of metaverse and adjacent technologies in aerospace & defense sector

- Continuous developments in 5G technology

- Emergence of virtual experiences in corporate and hospitality sectors

List of Key Players in Metaverse Market:

- Microsoft (US)

- Sony (Japan)

- Meta (US)

- HTC (Taiwan)

- Google (US)

- Apple (US)

- Qualcomm (US)

- Samsung (South Korea)

- Activision Blizzard (US)

- NetEase (China)

- Electronic Arts (US)

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=166893905

Metaverse is an online experience of shared 3D virtual worlds created by combining physical and digital worlds. These virtual worlds are created by leveraging AR, VR, real-time 3D, and interactive video. The Metaverse has gained wide popularity in social networking, online video gaming, and live entertainment. With investments towering up for real-time 3D technology development, the market players from the social media industry, online gaming market space, and other technology fields are already foreseeing a vast potential in the metaverse market. Online game makers, such as Activision Blizzard (US), Electronic Arts (US), Microsoft (US), NetEase (China), Nexon (Japan), Roblox (US), Take-Two (US), and Tencent (China), support the metaverse market growth through the in-game 3D virtual worlds. The opportunities in adjacent markets, such as VR, AR, extended reality, cloud gaming, AI in social media, and AR/VR hardware and peripherals, open new revenue prospects for the metaverse market.

The software segment holds the largest market size during the forecast period. The software includes gaming engines, 3D modeling & reconstruction tools, volumetric video tools, geospatial mapping software, metaverse platforms, and financial platforms. A game engine is a software framework or platform that developers use to create and develop video games. It provides a set of tools, libraries, and systems for various aspects of game development, such as rendering graphics, handling physics, managing game assets, and implementing gameplay logic. Game engines help streamline the game development process and enable developers to focus on creating the actual content and gameplay rather than building the underlying technology from scratch.

Game engines play a significant role in the development of the metaverse, which is a virtual, interconnected, and immersive digital universe where users can interact, socialize, work, and play. The few usage of game engine in metaverse are, creating virtual worlds, increasing user interaction, avatar creation and animation, multiplayer networking and many more. In 2023, the software segment held the highest share in the metaverse market during the forecast period as it helps to o create and design the virtual worlds and environments within the metaverse. This includes 3D modeling software, world-building tools, and terrain generation software, it enable users to navigate, interact, and control their experience within the metaverse. This includes menus, HUDs (Heads-Up Displays), and gesture recognition interfaces, it helps to implement networking protocols and multiplayer functionality to enable users to interact with each other in real-time within the metaverse. This would support market growth in the coming years.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=166893905

The geographic analysis of the metaverse market includes five regions: North America, Asia Pacific, Europe, Middle East & Africa, and Latin America. As a technology adopter, North America holds the largest market size during the forecast period. Being technologically advanced and developed, North America is the leading market in developing cutting-edge display technology. Further, the rising expenditure of companies and individuals on digital solutions and advanced technologies also boosts market growth. North America has emerged as the largest market for metaverse technology. It accounted for a significant share of the global market in 2023. The use of AR technology in consumer electronics propels the growth of the AR market in the region. Industries such as aerospace and defense, healthcare, consumer, and commercial applications for education and training also use AR. Several global companies providing AR devices and solutions have their presence in the US, including Microsoft, Apple, Meta, and Google. Additionally, enterprises’ increased acceptance of metaverse technologies to market their products in a modern way has been the key factor driving the growth of the metaverse market in North America.

VR and AR technologies are crucial for creating immersive metaverse experiences. VR provides fully immersive digital environments, while AR overlays digital content onto the real world, blending the physical and digital realms. Advances in hardware have made VR and AR more accessible and compelling; this includes better headsets, more powerful GPUs, and more affordable components, making the technology available to a broader range of consumers and industries. The availability of engaging content boosts AR and VR growth. As more developers and creators produce high-quality VR and AR experiences, it encourages user adoption. This content spans from games and entertainment to educational and professional applications. The gaming industry has been a significant driver for VR adoption. Games like “Beat Saber,” “Half-Life: Alyx,” and “Superhot VR” have demonstrated the potential for immersive gaming experiences.

Additionally, businesses use AR for interactive marketing campaigns and location-based entertainment, like the success of Pokémon GO. MR is finding significant traction in the enterprise and industrial sectors. Businesses are adopting MR for remote assistance, training, maintenance and repair, 3D modeling, and data visualization; MR helps improve efficiency, reduce errors, and enhance collaboration in these industries.

Get access to the latest updates on Metaverse Companies and Metaverse Industry

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.